Minnesota Auto Insurance | Cheap MN Auto Insurance Quotes

Cheap MN auto insurance quotes are available. A married 35-year-old pays $251.91/month or $3,023/year for Minnesota full coverage auto insurance. Liberty Mutual only charges drivers in Albert Lea $331 a month, while coverage from the same provider costs up to $1,745 monthly in Minneapolis. State Farm is the largest and cheapest car insurance provider in Minnesota, making up nearly 25 percent of the market. The company with the lowest ratio of complaints to policyholders for Minnesota auto insurance is Travelers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Minnesota Statistics Summary | Details |

|---|---|

| Road Miles in Minnesota | Vehicle Miles: 57,395 millions Miles of Roadway: 138,767 |

| Vehicles | Registered Vehicles: 4,985,782 Motor Vehicle Thefts: 8,367 |

| Population | 5,611,179 |

| Most Popular Vehicle in Minnesota | Ford F150 |

| Uninsured%/Underinsured% | 11.50% |

| Total Driving Related Deaths | Speeding Fatalities: 89 DUI Fatalities: 85 |

| Full Coverage Average Premiums | Liability: $439.58 Collision: $214.02 Comprehensive: $173.04 Full Coverage: $826.64 |

| Cheapest Provider | State Farm |

Whether you are driving to the Voyageurs National Park this summer or looking to spend time in The North Star State, you need the best Minnesota auto insurance coverage for complete peace of mind. The state also has more than 850 domestic and foreign insurance companies in the state.

With so many choices, you are bound to feel overwhelmed when choosing the best insurance product. Our guide will help you make an informed decision for the insurance product that best suits your need.

Comparing auto insurance companies can also help you start to figure out which company suits your insurance and financial needs the best. In truth, the best cheap MN auto insurance quotes and Minnesota auto insurance plans are just a click away.

You can start by entering your ZIP code into our free online quote comparison tool. It’ll give you rates for your specific demographic information and location.

What are the Minnesota auto insurance rates and coverage?

The best auto insurance policy is the one tailored to your needs. But, how to figure out if the coverage is relevant for your needs? Answer: You should know the insurance fundamentals.

Don’t worry as cover the fundamentals in easy to understand manner. In the guide, we will help you understand different types of coverages, required minimum insurance requirements, add-on coverage options, rates, and much more. After all, no one should be paying for a product that they don’t know why they need it in the first place!

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What is Minnesota’s car culture?

The perception that the rest of the nation has is that Minnesotans drive with their famous ‘Minnesota nice’ attitude. You get rarely honked or see drivers swerving around you at an intersection.

However, sometimes you see excessive speeds on the freeways and dangerous driving during the brutal winter weather. Consequently, you may see a lot of accidents, spinouts, and rollovers during winter weather. Pick-up trucks, primarily the Ford F-150, are liked in the North Star state.

Minnesotans prefer to drive for everything. In the city of Minneapolis, around 90 percent of trips are done using a car.

The city is preparing a 2040 Comprehensive Plan in which it wants residents to drive less for errands such as grocery shopping by bringing shops closer to homes. But, till that happens, the residents have to drive, and therefore an adequate auto insurance coverage is vital.

What is the Minnesota minimum coverage?

The next obvious question you may have is: ‘But what is adequate coverage?’ Well, it depends on how much you are driving, your track record, where you stay, and much more. But, what is not negotiable is the minimum auto liability insurance that you must purchase.

The state requires you to carry the proof of coverage and enacted a law in 2016 that mandates that residents must prove insurance coverage while registering a vehicle in the state. The State of Minnesota mandates that you must have the following minimum coverage:

Liability coverage

- $30,000 for injury or death of one person/ $60,000 for injury per accident

- $10,000 for property damage

Personal Injury Protection (PIP)

- $40,000 per person per accident ($20,000 for hospital and medical expenses and $20,000 for non-medical costs such as lost wages)

Underinsured and Uninsured coverage

- $25,000 for injury per person for underinsured and uninsured

- $50,000 for injury per accident for underinsured and uninsured

Minnesota is one of the only five states in the country that requires residents to purchase liability coverage, personal liability protection, and uninsured/underinsured coverage. However, this is the minimum amount that is required by the state. In case of an accident, the cost can be much higher.

It is always prudent to carry higher coverage than the state-mandated minimum. But, what is the use of these coverages? Let us discuss each to understand why is it required.

What’s liability insurance?

Liability insurance pays for injuries and damages to the third party in case of an accident where you are at fault. In case you rear-ended a car and held at fault, and your insurer may cover the damage to the third-party up to your coverage limit.

In case the damage is above your coverage limit, you may need to compensate the third party out of pocket. That is why it is imperative that you have adequate coverage to protect yourself against financial implications.

Watch this video from Allstate to learn more about liability insurance:

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What’s personal injury protection (PIP)?

While liability covers the third party, PIP is designed to protect you and your co-passengers in case of an accident. Since Minnesota is a no-fault state, you are required to purchase PIP coverage.

In case of an accident, PIP will cover your or other covered person’s medical bills, lost wages, child care, and funeral expenses. The PIP system is expected to help you get back on the feet after an accident by paying for medical bills and other expenses without assessing who was at fault.

It also reduces the burden at courts for small damages. However, if you want to step out of the no-fault system to sue a third party for damages, you must meet the following conditions:

- incurred more than $4,000 in medical expenses

- suffered more than 60 days of disability, or permanent injury

Remember: The compensation against your claim will be only the additional amount not already covered by your PIP.

Take a look at this Geico video to understand more about PIP:

What’s underinsured and uninsured coverage?

As the name suggests, uninsured/underinsured coverage is meant to pay for damages in case an uninsured/underinsured driver hits you. Minnesota has a considerable number of uninsured drivers, and therefore, it is vital that you are adequately covered against potential loses.

What are the required forms of financial responsibility in Minnesota?

It is mandatory to purchase the state-mandated liability coverage in Minnesota. If you caused an accident and did not have an insurance policy, you would need to file a form SR-22 financial responsibility form.

You will also require an SR-22 form for a suspended license, or previously reported lapses of coverage. You are expected to show proof of insurance when requested by a law enforcement officer. If you fail to show the evidence, you are to appear in court and prove you were covered.

Driving without insurance is considered a misdemeanor offense that carries a fine up to $1,000 and 90 days of jail time.

Do not make the mistake of driving without insurance!

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What percentage of income are insurance premiums in Minnesota?

How to get a discount? One fundamental way is to know what are other paying in your state on average. Knowing about the average premium paid by other Minnesotans might help you in analyzing the quote that you may receive from an insurer.

The average annual disposable income in Minnesota is $42,500, while the average premium for full coverage is $856.

| Percentage of Income | 2014 | 2013 | 2012 |

|---|---|---|---|

| Minnesota | 2.01% | 2.01% | 1.93% |

| National Average | 2.40% | 2.43% | 2.34% |

On average, Minnesotans spend around $130 less than the national average. Which means more savings and more disposable income! However, the average numbers may not apply in your case.

What is the core auto insurance coverage in Minnesota?

According to the National Association of Insurance Commissioners (NAIC), the average full coverage auto insurance in Minnesota was $826.04 against the national median of $954.99. Besides liability insurance, full coverage auto insurance includes collision and comprehensive coverage.

Although auto insurance is cheaper than the national average, it won’t hurt to look for additional insurance discounts! You can do the following things to save on premiums:

- Optimize the Deductible: A higher deductible will reduce the premium

- Multiple Vehicles: Have multiple vehicles on the same policy

- Certified Driving Course: Complete a DMV certified driving course for premium discounts

- Safety Equipment: Safety equipment such as ABS and anti-theft alarm can save on discount

- Reduce your mileage: Some insurers may provide a premium discount for low annual mileage

Can you get additional liability coverage in Minnesota?

| Loss Ratio (%) | 2014 | 2013 | 2012 | |||

|---|---|---|---|---|---|---|

| MN | US | MN | US | MN | US | |

| PIP | 66.54 | 69.41 | 69.85 | 74.69 | 72.19 | 82.31 |

| Med Pay | 47.73 | 74.05 | 72.16 | 76.85 | 420.51 | 79.05 |

| Uninsured/Underinsured | 55.81 | 67.33 | 54.42 | 67.22 | 55.57 | 67.55 |

Minnesota is one of the five states in the country that requires you to buy PIP and uninsured/underinsured coverage. With more than 11.5 percent of drivers in the state are either uninsured or carry less than required insurance, it is vital to have adequate coverage in case of an accident.

Uninsured/underinsured coverage helps if an uninsured driver hits you, and they are unable to pay for damages.

Question: How do I know if my provider would cover me?

Answer: Look at the loss ratio.

Okay, so what is the loss ratio?

Loss ratio is the ratio between the total payout made by the company against the total premiums earned.

A higher than average loss ratio would mean that the company is sustaining losses and paying more than it earned. It would also indicate that the premiums might increase in the near future.

A less than average loss ratio may indicate that a company is not paying claims regularly. It may indicate that you may experience difficulty in claim processing.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Are there any add-ons, endorsements, and riders?

In addition to options like collision and comprehensive insurance, there are other add-on coverages to consider in creating your insurance policy, such as:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Rental Reimbursement

- Modified Auto Insurance Coverage

- Classic Auto Insurance

- Non-Owner Auto Insurance

- Pay-As-You-Drive or Usage-Based Insurance

What are the premium rates by demographics in Minnesota?

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate Indemnity | $3,023.30 | $3,023.30 | $2,908.43 | $2,908.43 | $6,885.00 | $9,968.67 | $3,677.99 | $3,860.95 |

| American Family Mutual | $2,233.79 | $2,233.79 | $2,025.26 | $2,025.26 | $6,086.73 | $8,812.61 | $2,233.79 | $2,519.05 |

| Illinois Farmers Ins | $2,041.64 | $2,038.65 | $1,965.24 | $2,076.17 | $5,820.43 | $5,872.48 | $2,672.81 | $2,612.21 |

| Geico General | $2,661.52 | $2,641.10 | $2,544.82 | $2,473.72 | $5,545.67 | $7,047.50 | $2,494.27 | $2,579.67 |

| Liberty Mutual Fire | $9,604.65 | $9,604.65 | $9,510.34 | $9,510.34 | $18,911.44 | $28,385.86 | $9,604.65 | $13,376.94 |

| AMCO Insurance | $1,970.26 | $1,978.45 | $1,753.51 | $1,860.69 | $5,026.90 | $6,105.97 | $2,312.50 | $2,403.62 |

| State Farm Mutual Auto | $1,542.45 | $1,542.45 | $1,374.37 | $1,374.37 | $3,334.79 | $4,106.75 | $1,786.56 | $1,474.15 |

| USAA CIC | $1,895.96 | $1,879.44 | $1,726.56 | $1,724.94 | $5,042.84 | $5,519.17 | $2,473.98 | $2,629.95 |

Insurers generally charge a higher premium for teen drivers due to the higher risk involved with a new driver. Some insurers also charge varying rates based on gender. However, with age insurance premiums generally, tend to reduce to a market average.

The table clearly shows why comparison buying is important if you want to save on premiums. If you are a teen male driver, you can save a whopping $24,000 in average annual premiums if they move from Liberty Mutual to State Farm.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Liberty Mutual Fire | Single 17-year old male | $28,385.86 |

| Liberty Mutual Fire | Single 17-year old female | $18,911.44 |

| Liberty Mutual Fire | Single 25-year old male | $13,376.94 |

| Allstate Indemnity | Single 17-year old male | $9,968.67 |

| Liberty Mutual Fire | Married 35-year old female | $9,604.65 |

| Liberty Mutual Fire | Married 35-year old male | $9,604.65 |

| Liberty Mutual Fire | Single 25-year old female | $9,604.65 |

| Liberty Mutual Fire | Married 60-year old female | $9,510.34 |

| Liberty Mutual Fire | Married 60-year old male | $9,510.34 |

| American Family Mutual | Single 17-year old male | $8,812.61 |

| Geico General | Single 17-year old male | $7,047.50 |

| Allstate Indemnity | Single 17-year old female | $6,885.00 |

| AMCO Insurance | Single 17-year old male | $6,105.97 |

| American Family Mutual | Single 17-year old female | $6,086.73 |

| Illinois Farmers Ins | Single 17-year old male | $5,872.48 |

| Illinois Farmers Ins | Single 17-year old female | $5,820.43 |

| Geico General | Single 17-year old female | $5,545.67 |

| USAA CIC | Single 17-year old male | $5,519.17 |

| USAA CIC | Single 17-year old female | $5,042.84 |

| AMCO Insurance | Single 17-year old female | $5,026.90 |

| State Farm Mutual Auto | Single 17-year old male | $4,106.75 |

| Allstate Indemnity | Single 25-year old male | $3,860.95 |

| Allstate Indemnity | Single 25-year old female | $3,677.99 |

| State Farm Mutual Auto | Single 17-year old female | $3,334.79 |

| Allstate Indemnity | Married 35-year old female | $3,023.30 |

| Allstate Indemnity | Married 35-year old male | $3,023.30 |

| Allstate Indemnity | Married 60-year old female | $2,908.43 |

| Allstate Indemnity | Married 60-year old male | $2,908.43 |

| Illinois Farmers Ins | Single 25-year old female | $2,672.81 |

| Geico General | Married 35-year old female | $2,661.52 |

| Geico General | Married 35-year old male | $2,641.10 |

| USAA CIC | Single 25-year old male | $2,629.95 |

| Illinois Farmers Ins | Single 25-year old male | $2,612.21 |

| Geico General | Single 25-year old male | $2,579.67 |

| Geico General | Married 60-year old female | $2,544.82 |

| American Family Mutual | Single 25-year old male | $2,519.05 |

| Geico General | Single 25-year old female | $2,494.27 |

| USAA CIC | Single 25-year old female | $2,473.98 |

| Geico General | Married 60-year old male | $2,473.72 |

| AMCO Insurance | Single 25-year old male | $2,403.62 |

| AMCO Insurance | Single 25-year old female | $2,312.50 |

| American Family Mutual | Married 35-year old female | $2,233.79 |

| American Family Mutual | Married 35-year old male | $2,233.79 |

| American Family Mutual | Single 25-year old female | $2,233.79 |

| Illinois Farmers Ins | Married 60-year old male | $2,076.17 |

| Illinois Farmers Ins | Married 35-year old female | $2,041.64 |

| Illinois Farmers Ins | Married 35-year old male | $2,038.65 |

| American Family Mutual | Married 60-year old female | $2,025.26 |

| American Family Mutual | Married 60-year old male | $2,025.26 |

| AMCO Insurance | Married 35-year old male | $1,978.45 |

| AMCO Insurance | Married 35-year old female | $1,970.26 |

| Illinois Farmers Ins | Married 60-year old female | $1,965.24 |

| USAA CIC | Married 35-year old female | $1,895.96 |

| USAA CIC | Married 35-year old male | $1,879.44 |

| AMCO Insurance | Married 60-year old male | $1,860.69 |

| State Farm Mutual Auto | Single 25-year old female | $1,786.56 |

| AMCO Insurance | Married 60-year old female | $1,753.51 |

| USAA CIC | Married 60-year old female | $1,726.56 |

| USAA CIC | Married 60-year old male | $1,724.94 |

What are the cheapest MN auto insurance rates by ZIP code?

Depending on where you live, you can find the insurer that provides the cheapest insurance rates.

| Cheapest ZIP Codes in Minnesota | City | Average by ZIP Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 56007 | ALBERT LEA | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| 56088 | TRUMAN | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| 56120 | BUTTERFIELD | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| 55912 | AUSTIN | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| 56159 | MOUNTAIN LAKE | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| 55987 | WINONA | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| 56039 | GRANADA | $4,018.94 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| 56027 | ELMORE | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| 56073 | NEW ULM | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| 56181 | WELCOME | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| 56062 | MADELIA | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| 56031 | FAIRMONT | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| 56127 | DUNNELL | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| 56087 | SPRINGFIELD | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| 56054 | LAFAYETTE | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| 56081 | SAINT JAMES | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| 56075 | NORTHROP | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| 56098 | WINNEBAGO | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| 56019 | COMFREY | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| 56041 | HANSKA | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| 56001 | MANKATO | $4,043.78 | Liberty Mutual | $11,927.85 | Allstate | $4,376.76 | State Farm | $2,014.61 | Nationwide | $2,615.86 |

| 56085 | SLEEPY EYE | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| 56036 | GLENVILLE | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| 56171 | SHERBURN | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| 56162 | ORMSBY | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

E.g., across many ZIP codes, State Farm provides the cheapest premium rates. You should get a quote from State Farm.

| Most Expensive ZIP Codes in Minnesota | City | Average by ZIP Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 55411 | MINNEAPOLIS | $6,620.56 | Liberty Mutual | $20,934.87 | Allstate | $6,404.25 | State Farm | $3,337.51 | USAA | $3,688.43 |

| 55106 | SAINT PAUL | $6,563.33 | Liberty Mutual | $20,971.66 | Allstate | $6,567.98 | State Farm | $3,568.79 | USAA | $3,711.58 |

| 55101 | SAINT PAUL | $6,547.31 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,460.84 | USAA | $3,504.15 |

| 55103 | SAINT PAUL | $6,520.89 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,315.39 | USAA | $3,504.15 |

| 55404 | MINNEAPOLIS | $6,491.18 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,895.66 | USAA | $3,328.08 |

| 55412 | MINNEAPOLIS | $6,434.63 | Liberty Mutual | $20,934.87 | Allstate | $6,465.92 | State Farm | $3,297.21 | USAA | $3,688.43 |

| 55107 | SAINT PAUL | $6,404.50 | Liberty Mutual | $20,971.66 | Allstate | $6,136.19 | State Farm | $3,003.66 | USAA | $3,261.85 |

| 55454 | MINNEAPOLIS | $6,394.17 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,770.93 | USAA | $3,328.08 |

| 55415 | MINNEAPOLIS | $6,385.64 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,861.81 | USAA | $3,328.08 |

| 55407 | MINNEAPOLIS | $6,382.20 | Liberty Mutual | $20,346.17 | Allstate | $6,595.26 | State Farm | $2,988.98 | USAA | $3,582.41 |

| 55408 | MINNEAPOLIS | $6,370.83 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,894.22 | USAA | $3,183.53 |

| 55402 | MINNEAPOLIS | $6,353.00 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,824.38 | USAA | $3,328.08 |

| 55455 | MINNEAPOLIS | $6,349.43 | Liberty Mutual | $20,934.87 | Allstate | $6,531.88 | State Farm | $2,935.21 | USAA | $3,328.08 |

| 55104 | SAINT PAUL | $6,339.29 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $3,032.21 | USAA | $3,328.08 |

| 55405 | MINNEAPOLIS | $6,320.72 | Liberty Mutual | $20,934.87 | Allstate | $6,601.34 | State Farm | $2,824.38 | USAA | $3,688.43 |

| 55406 | MINNEAPOLIS | $6,257.62 | Liberty Mutual | $20,346.17 | Allstate | $6,568.73 | State Farm | $2,777.97 | USAA | $3,222.20 |

| 55414 | MINNEAPOLIS | $6,254.15 | Liberty Mutual | $20,346.17 | Allstate | $6,531.88 | State Farm | $2,681.89 | USAA | $3,328.08 |

| 55403 | MINNEAPOLIS | $6,252.05 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,800.79 | USAA | $3,328.08 |

| 55413 | MINNEAPOLIS | $6,248.33 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,907.36 | USAA | $3,271.06 |

| 55401 | MINNEAPOLIS | $6,221.83 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,859.24 | USAA | $3,328.08 |

| 55114 | SAINT PAUL | $6,200.17 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $2,503.54 | USAA | $3,328.08 |

| 55102 | SAINT PAUL | $6,187.71 | Liberty Mutual | $20,346.17 | Allstate | $5,927.14 | State Farm | $2,977.73 | USAA | $3,261.85 |

| 55409 | MINNEAPOLIS | $6,109.20 | Liberty Mutual | $20,346.17 | Allstate | $6,509.73 | State Farm | $2,954.03 | USAA | $3,183.53 |

| 55130 | SAINT PAUL | $5,798.28 | Liberty Mutual | $14,314.34 | Allstate | $6,462.88 | State Farm | $3,582.91 | USAA | $3,711.58 |

| 55450 | MINNEAPOLIS | $5,758.23 | Liberty Mutual | $20,934.87 | Allstate | $5,069.73 | USAA | $2,531.82 | State Farm | $2,935.21 |

Since ZIP codes aren’t representative of a whole city, next we want to look at rates by city.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the Minnesota auto insurance rates by city?

The tables below show the cheapest and most expensive auto insurance rates by cities.

| Cheapest Cities in Minnesota | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Albert Lea | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| Truman | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| Butterfield | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| Austin | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| Mountain Lake | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| Goodview | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| Granada | $4,018.95 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| Elmore | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| New Ulm | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| Welcome | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| Madelia | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| Fairmont | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| Dunnell | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| Springfield | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| Lafayette | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| St. James | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| Northrop | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Winnebago | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| Comfrey | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| Hanska | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| Sleepy Eye | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| Glenville | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| Sherburn | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| Ormsby | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Lewisville | $4,051.00 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,712.06 | USAA | $2,438.90 |

Albert Lea has the cheapest rates in all of Minnesota.

| Most Expensive Cities in Minnesota | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Minneapolis | $6,106.69 | Liberty Mutual | $19,767.41 | Allstate | $6,275.74 | State Farm | $2,860.94 | USAA | $3,270.39 |

| St. Paul | $5,972.08 | Liberty Mutual | $18,511.98 | Allstate | $6,141.30 | State Farm | $3,006.99 | USAA | $3,309.17 |

| Little Canada | $5,397.29 | Liberty Mutual | $14,314.34 | Allstate | $5,939.60 | USAA | $3,246.25 | State Farm | $3,375.84 |

| Brooklyn Center | $5,250.46 | Liberty Mutual | $13,733.42 | Allstate | $5,517.75 | State Farm | $2,657.84 | USAA | $3,027.14 |

| Falcon Heights | $5,110.86 | Liberty Mutual | $14,384.20 | Allstate | $5,605.47 | State Farm | $2,445.02 | USAA | $3,000.34 |

| Columbia Heights | $5,103.52 | Liberty Mutual | $13,733.42 | Allstate | $5,453.46 | State Farm | $2,631.03 | USAA | $2,963.85 |

| Maplewood | $5,061.15 | Liberty Mutual | $14,314.34 | Allstate | $5,382.25 | State Farm | $2,720.57 | USAA | $2,960.39 |

| Waskish | $5,023.66 | Liberty Mutual | $15,228.53 | Farmers | $4,564.50 | State Farm | $2,148.12 | Nationwide | $2,950.86 |

| St. Francis | $5,003.38 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,460.88 | USAA | $3,193.94 |

| Martin Lake | $5,003.33 | Liberty Mutual | $15,094.54 | Allstate | $4,712.34 | State Farm | $2,459.40 | USAA | $3,193.94 |

| Richfield | $5,002.58 | Liberty Mutual | $14,343.36 | Allstate | $5,308.16 | State Farm | $2,566.97 | USAA | $2,790.97 |

| Lake George | $4,999.75 | Liberty Mutual | $15,228.53 | Farmers | $4,491.44 | State Farm | $2,185.55 | USAA | $3,008.87 |

| South St. Paul | $4,994.42 | Liberty Mutual | $14,314.34 | Allstate | $5,331.35 | State Farm | $2,667.84 | USAA | $2,987.88 |

| Columbus | $4,992.05 | Liberty Mutual | $15,094.54 | Allstate | $4,758.69 | State Farm | $2,382.94 | Nationwide | $3,130.44 |

| Bethel | $4,984.06 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,424.09 | USAA | $3,193.94 |

| East Bethel | $4,978.05 | Liberty Mutual | $15,094.54 | Allstate | $4,712.66 | State Farm | $2,477.33 | USAA | $3,193.94 |

| Fridley | $4,971.65 | Liberty Mutual | $13,733.42 | Allstate | $5,492.04 | State Farm | $2,618.39 | USAA | $2,807.34 |

| Almelund | $4,966.16 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Isanti | $4,955.17 | Liberty Mutual | $15,094.54 | Allstate | $4,790.79 | State Farm | $2,422.96 | Nationwide | $3,215.12 |

| Garrison | $4,948.90 | Liberty Mutual | $15,228.53 | Allstate | $4,537.69 | State Farm | $2,148.12 | USAA | $2,902.05 |

| Andover | $4,946.23 | Liberty Mutual | $15,094.54 | Allstate | $5,081.81 | State Farm | $2,396.83 | USAA | $2,982.27 |

| Grandy | $4,945.76 | Liberty Mutual | $15,094.54 | Allstate | $4,770.32 | State Farm | $2,406.80 | Nationwide | $3,215.12 |

| Swatara | $4,945.15 | Liberty Mutual | $15,228.53 | Allstate | $4,489.01 | State Farm | $2,148.12 | Nationwide | $2,993.69 |

| Taylors Falls | $4,943.22 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Centerville | $4,940.45 | Liberty Mutual | $15,094.54 | Allstate | $4,928.00 | State Farm | $2,248.59 | USAA | $2,780.77 |

Discover Affordable Insurance Options Across Minnesota

Explore the most cost-effective insurance policies tailored for residents in Bloomington, Duluth, Rochester, and Saint Paul, MN. Our comprehensive guide helps you navigate through various options to find the best coverage that suits your needs and budget.

| Find the Cheapest Insurance in Your City |

|---|

| Bloomington, MN |

| Duluth, MN |

| Rochester, MN |

| Saint Paul, MN |

What are the best Minnesota auto insurance companies?

If you have used our FREE tool to a get quote, you might be wondering: ‘How to analyze a quote and choose my insurer?‘ The first thing to note is that you should not necessarily go with the cheapest provider.

You should analyze an insurer based on its financial strength, credit rating, customer reviews, etc. In this guide, we will help choose an insurer based on relevant metrics that provide you the best coverage.

What are the financial ratings of MN auto insurance companies?

Financial strength is one of the most important factors to consider while finalizing an insurer. We are using A.M. Credit Rating data, one of the most reputed credit rating agency for the insurance industry, to help analyze the financial strength of an insurer.

A good credit rating for an insurer would mean that the company is in good financial standing would be in a position to settle future claim obligations.

Let us look at the credit rating for the top ten auto insurance providers. The top ten insurance companies have around 80 percent market share in Minnesota.

| Company | Market Share | Credit Rating |

|---|---|---|

| State Farm Group | 24.73% | A |

| Progressive Group | 16.27% | A+ |

| American Family Insurance Group | 11.62% | A |

| Farmers Insurance Group | 5.91% | A |

| Allstate Insurance Group | 5.56% | A+ |

| Geico | 3.61% | A++ |

| USAA Group | 3.08% | A++ |

| Liberty Mutual Group | 3.07% | A |

| Travelers Group | 2.95% | A++ |

| Auto-Owners Group | 2.88% | A++ |

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

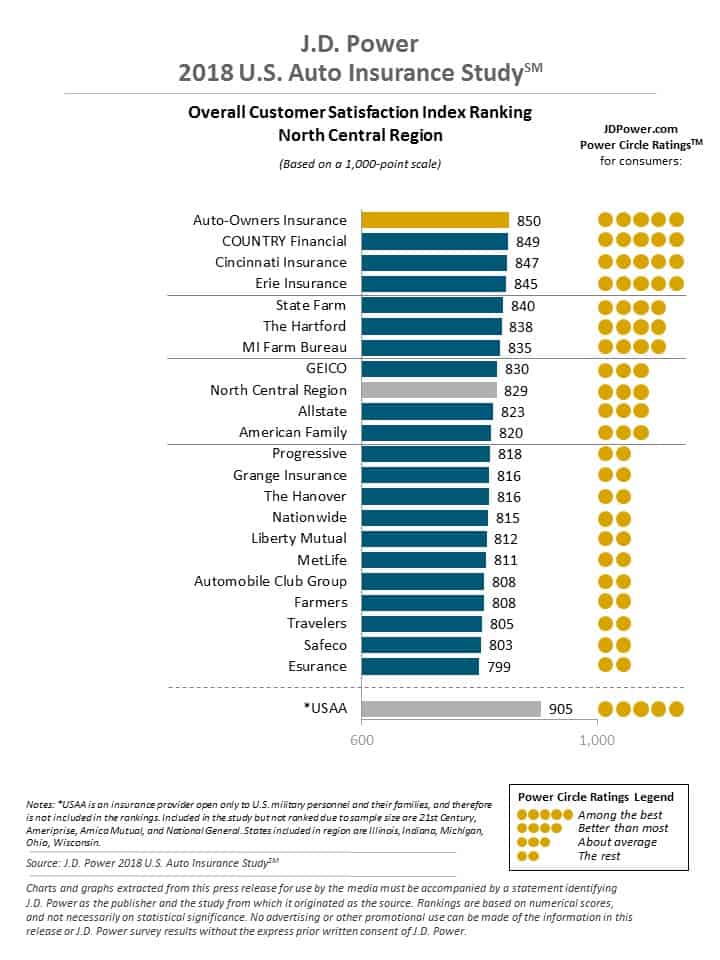

What are the customer satisfaction ratings of auto insurance companies in Minnesota?

Another important factor is to look at what the current customers are saying about an insurance company. Customer reviews provide us insights into the quality of service offered by an insurer.

E.g., we would know how quickly the insurer responds after filing a claim and how efficient is the claim settlement process.

Since it may not be possible to review the customer comments manually, we would be using the J.D. Power Customer Satisfaction Ratings. J.D. Power is one of the most trusted sources for automotive information.

According to J.D. Power, Auto-Owners Insurance is the highest-rated insurer in the North-Central Region.

What are the Minnesota auto insurance companies with the most customer complaints?

Another important aspect while analyzing an insurer is to look at the complaints filed against the company. Complaints ratio is one metric that gives you an idea about the quality of service provided by a company.

If the ratio is worse than the industry average, you might want to steer clear of the company.

The top insurers in Minnesota generally provide quality service and coverage. The table below provides complaints data for the top ten auto insurance provides in Minnesota:

| Company | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| State Farm Group | 0.44 | 1482 |

| Progressive Group | 0.75 | 120 |

| American Family Insurance Group | 0.79 | 73 |

| Farmers Insurance Group | 0 | 0 |

| Allstate Insurance Group | 0.5 | 163 |

| Geico | 0.68 | 333 |

| USAA Group | 0.74 | 296 |

| Liberty Mutual Group | 5.95 | 222 |

| Travelers Group | 0.09 | 2 |

| Auto-Owners Group | 0.53 | 31 |

You can file an online complaint with the Minnesota Department of Commerce.

What are the cheapest MN auto insurance companies?

| Company | Average | Compared to State Average ($4,513.50) |

|---|---|---|

| Allstate Indemnity | $4,532.01 | $18.51 |

| American Family Mutual | $3,521.29 | -$992.21 |

| Illinois Farmers Ins | $3,137.45 | -$1,376.04 |

| Geico General | $3,498.53 | -$1,014.96 |

| Liberty Mutual Fire | $13,563.61 | $9,050.11 |

| AMCO Insurance | $2,926.49 | -$1,587.01 |

| State Farm Mutual Auto | $2,066.99 | -$2,446.51 |

| USAA CIC | $2,861.60 | -$1,651.89 |

State Farm, USAA, and AMCO Insurance are the three cheapest car insurance providers in Minnesota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the premium rates by annual commute in Minnesota?

| Companies | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | 4532.01 | 4532.01 |

| American Family | 3480.06 | 3562.51 |

| Farmers | 3137.45 | 3137.45 |

| Geico | 3452.2 | 3544.87 |

| Liberty Mutual | 13165.37 | 13961.85 |

| Nationwide | 2926.49 | 2926.49 |

| State Farm | 2011.15 | 2122.82 |

| USAA | 2824.14 | 2899.06 |

Most of the top insurers in Minnesota do not increase the premium for a reasonable increase in annual mileage.

What are the premium rates by coverage level in Minnesota?

| Company | High | Medium | Low |

|---|---|---|---|

| Allstate | $4,600.41 | $4,528.59 | $4,467.02 |

| American Family | $3,432.86 | $3,618.33 | $3,512.68 |

| Farmers | $3,239.56 | $3,150.22 | $3,022.58 |

| Geico | $3,603.48 | $3,497.28 | $3,394.84 |

| Liberty Mutual | $13,874.92 | $13,574.70 | $13,241.20 |

| Nationwide | $3,064.92 | $2,947.12 | $2,767.43 |

| State Farm | $2,141.38 | $2,074.23 | $1,985.35 |

| USAA | $2,945.57 | $2,859.57 | $2,779.67 |

State Farm and USAA are the cheapest providers for both high and low coverage requirements.

What are the premium rates by credit history in Minnesota?

| Company | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $3,344.12 | $3,603.11 | $6,648.80 |

| American Family | $2,564.44 | $3,190.11 | $4,809.31 |

| Farmers | $2,654.85 | $2,840.59 | $3,916.92 |

| Geico | $2,861.19 | $3,433.78 | $4,200.64 |

| Liberty Mutual | $9,555.18 | $12,227.54 | $18,908.11 |

| Nationwide | $2,490.14 | $2,807.41 | $3,481.91 |

| State Farm | $1,344.22 | $1,842.99 | $3,013.76 |

| USAA | $1,905.46 | $2,192.66 | $4,486.70 |

Many people don’t realize that your credit score can affect so many aspects of your life. For instance, credit scores affect auto insurance rates.

Good news for Minnesotans: they have the highest average credit scores of any state.

If you have poor credit, you can consider State Farm or Nationwide for affordable coverage. If you have a good credit score, you can get a cheap quote from State Farm, USAA, or Nationwide.

As per the State of Credit Report by Experian, Minnesota has the highest average credit score in the country at 709 (v national average 675).

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the premium rates by driving record in Minnesota?

| Company | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $3,292.72 | $4,316.11 | $4,780.23 | $5,738.97 |

| American Family | $2,367.00 | $2,682.98 | $4,259.41 | $4,775.76 |

| Farmers | $2,686.69 | $3,053.56 | $3,381.83 | $3,427.73 |

| Geico | $2,318.73 | $2,484.09 | $3,691.11 | $5,500.20 |

| Liberty Mutual | $9,956.63 | $10,738.20 | $13,646.49 | $19,913.12 |

| Nationwide | $2,322.48 | $2,753.24 | $3,083.13 | $3,547.09 |

| State Farm | $1,900.45 | $2,066.98 | $2,233.53 | $2,066.98 |

| USAA | $2,126.06 | $2,531.74 | $2,706.41 | $4,082.21 |

Auto insurers tend to increase the premium considerably if you have a DUI charge or an accident on your file. E.g., see below to check how a DUI conviction can increase your premium.

| Company | Premium increase with DUI charge | Premium increase with an at-fault accident |

|---|---|---|

| State Farm | $166.53 | $333.08 |

| Farmers | $741.04 | $695.14 |

| Nationwide | $1,224.61 | $760.65 |

| USAA | $1,956.15 | $580.35 |

| American Family | $2,408.76 | $1,892.41 |

| Geico | $3,181.47 | $1,372.38 |

| Allstate | $2,446.25 | $1,487.51 |

| Liberty Mutual | $9,956.49 | $3,689.86 |

In case of an accident or DUI conviction, you should consider State Farm for affordable coverage.

What are the largest auto insurance companies in Minnesota?

Here’s a handy list of top ten insurance companies in Minnesota:

| Company | Market Share |

|---|---|

| State Farm Group | 24.73% |

| Progressive Group | 16.27% |

| American Family Insurance Group | 11.62% |

| Farmers Insurance Group | 5.91% |

| Allstate Insurance Group | 5.56% |

| Geico | 3.61% |

| USAA Group | 3.08% |

| Liberty Mutual Group | 3.07% |

| Travelers Group | 2.95% |

| Auto-Owners Group | 2.88% |

What is the number of auto insurers in Minnesota?

| Type of Insurer | Count |

|---|---|

| Domestic | 39 |

| Foreign | 816 |

As per the data from the National Association of Insurance Commissioners, there are 39 domestic and 816 foreign insurance providers in Minnesota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the state laws in Minnesota?

To save more on the insurance premium and to keep a clean record, you should be aware of state laws. We understand that you must have gone through the driving laws when applying for your driver’s license.

However, other automotive laws are also equally important if you are looking to save on insurance premiums. We have developed a quick refresher of relevant rules and regulations for your reference.

What are the auto insurance laws in Minnesota?

According to the National Association Of Insurance Commissioners, state laws define the type of tort law applicable, the minimum liability insurance required, and the system used for approval of insurer rates.

Minnesota follows the no-fault system and ‘File and Use’ rate filing law. File and Use law means that insurer can file auto forms, rules, and rates without review. Let us now look at the specific laws and rules applicable in the North Star State.

Want to learn more? Check out our guide on Fault vs. No Fault Auto Insurance Laws.

What are the windshield coverage laws in Minnesota?

Auto insurance companies in Minnesota are required to offer optional full glass coverage with zero deductible. If you opt for the coverage, you can get your damaged windshield repaired or replaced at no cost.

However, the insurer is free to use aftermarket parts of equal quality to repair or replace a windshield. You can opt for an OEM part, but you may need to pay the difference in cost.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What is MN high-risk insurance?

Insurers can deny you coverage in the voluntary market if you have a poor driving record. E.g., a poor driving record may include multiple DUI convictions or multiple at-fault accidents.

In this case, an insurer will find it too risky to cover you in the voluntary market. In such a scenario, the state laws expect that you search for coverage in the voluntary market for at least 60 days.

If you are unable to find coverage in 60 days, you can opt for the Minnesota Automobile Insurance Plan (MAIP).

How it works: MAIP will assign you to an auto insurer based on a quota.

The coverage level and conditions will remain the same as in the voluntary market. However, the premium rates might be higher.

All auto insurance providers in the state of Minnesota are expected to provide coverage under MAIP. The MAIP coverage is for three years after which you are expected to improve your driving record and move out to the voluntary market.

To qualify for the MAIP, you need to meet the following criteria:

- You should have a valid driver’s license

- You should have a vehicle registered in Minnesota

- You should be able to prove that you searched for auto insurance in the voluntary market for at least 60 days

- You should not have missed premium payment in the last 12 months

If your driver’s license is suspended or revoked due to multiple traffic offenses, DUI violations, or uninsured auto accident, your insurer would need to file a form with the Department of Public Safety certifying that you have the necessary insurance coverage.

What is low-cost insurance in Minnesota?

Minnesota does not have an affordable coverage plan for auto insurance. The state recommends that you shop around to get the maximum discount for auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What is automobile insurance fraud in Minnesota?

Auto insurance fraud impacts all of us. Fraud can increase the loses for the companies while subsequently increasing the premium rates for the rest of us. Therefore, auto insurance fraud is a crime in Minnesota.

Typical auto insurance frauds include inflation of claim value, misrepresentation of facts on the insurance application, staging an accident or injury for a claim, or services never rendered against premium payment.

The quantum of penalty is contingent on either the value of the fraud committed or the economic harm suffered by the victim. Minnesota state law awards the following penalties for insurance fraud:

| Fraud value | Imprisonment | Fine |

|---|---|---|

| More than $35,000 | Up to 20 years | Up to $100,000 |

| $5,000-$35,000 | Up to ten years | Up to $20,000 |

| $1,000-$5,000 | Up to five years | Up to $10,000 |

| $500-$1,000 | Up to 365 days | Up to 3,000 |

| Less than $500 | Up to 90 days | Up to $1,000 |

For more info on insurance fraud laws , click here.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What is the statute of limitations in Minnesota?

Statute of Limitations is the time until which you can bring a lawsuit against a third party. In Minnesota, you have two years for personal injury and six years for property damage until which time you can step out of the no-fault system and sue the third party for damages.

What are the vehicle licensing laws in Minnesota?

If your license is due for renewal soon, you might be wondering: ‘Can I renew my driver’s license online?’ or ‘how do I get my first driver’s license?’ Remember, it is illegal to drive without a valid driver’s license in Minnesota.

Driving without a driver’s license will result in a fine. In this guide, we will help you answer these questions along with other relevant information on the license renewal procedures in Minnesota.

What is REAL ID Implementation in Minnesota?

The Federal Government started enforcing the REAL ID Act passed by Congress in 2005 that established minimum security standards for license issuance.

The Act is scheduled to come into effect in October 2020, after which you will be expected to carry a REAL ID-compliant document to enter federal buildings or board a domestic flight.

Minnesota started issuing REAL ID-compliant driver licenses from October 2018.

If you have any of the following document, you may not need another REAL ID:

- US Passport

- Foreign Passport

- U.S. Military ID

- Permanent Resident Card (Green Card)

You can also use the Driver and Vehicle Services tool to check if you need a REAL ID-compliant driver’s license. To get a REAL ID-compliant driver’s license, you need to bring the following documents to a nearby Driver and Vehicle Services office:

- One identification document

- Document proving social security number

- Two documents proving your residency in Minnesota

You can check the full list of documents required on the Driver and Vehicle Services’ website.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the penalties for driving without insurance in Minnesota?

It is illegal to drive in Minnesota without valid insurance. If you are not able to furnish valid proof of insurance during a traffic stop, you can produce it in court before a specified date. If you are unable to furnish valid proof even after the court date, you can face harsh penalties and jail time.

If it’s your first or second offense, you can be fined up to $1,000 with a minimum fine of $200. Your driving privilege, including driver’s license, car registration, and license plates, can be suspended for up to 30 days.

To reinstate your driving privileges, you will have to pay a $30 reinstatement fee and submit an SR-22 financial responsibility form.

However, if it is your third offense, the penalties are harsher. You may have to pay a fine up to $3,000 and lose your driving privileges for up to a year.

You will also face jail time up to 90 days along with reinstatement fee and SR-22 documentation.

Remember, if you show the behavior of repeated offense, your insurer might deny you coverage in the voluntary market. A bad driving record can increase your premium rate considerably.

Driving without insurance not only attracts fines and penalties, but it can also prove catastrophic to your financial health in case of an accident. Do not make the mistake of driving without insurance! Get a quote with our FREE tool. Just enter your zip code to get started.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

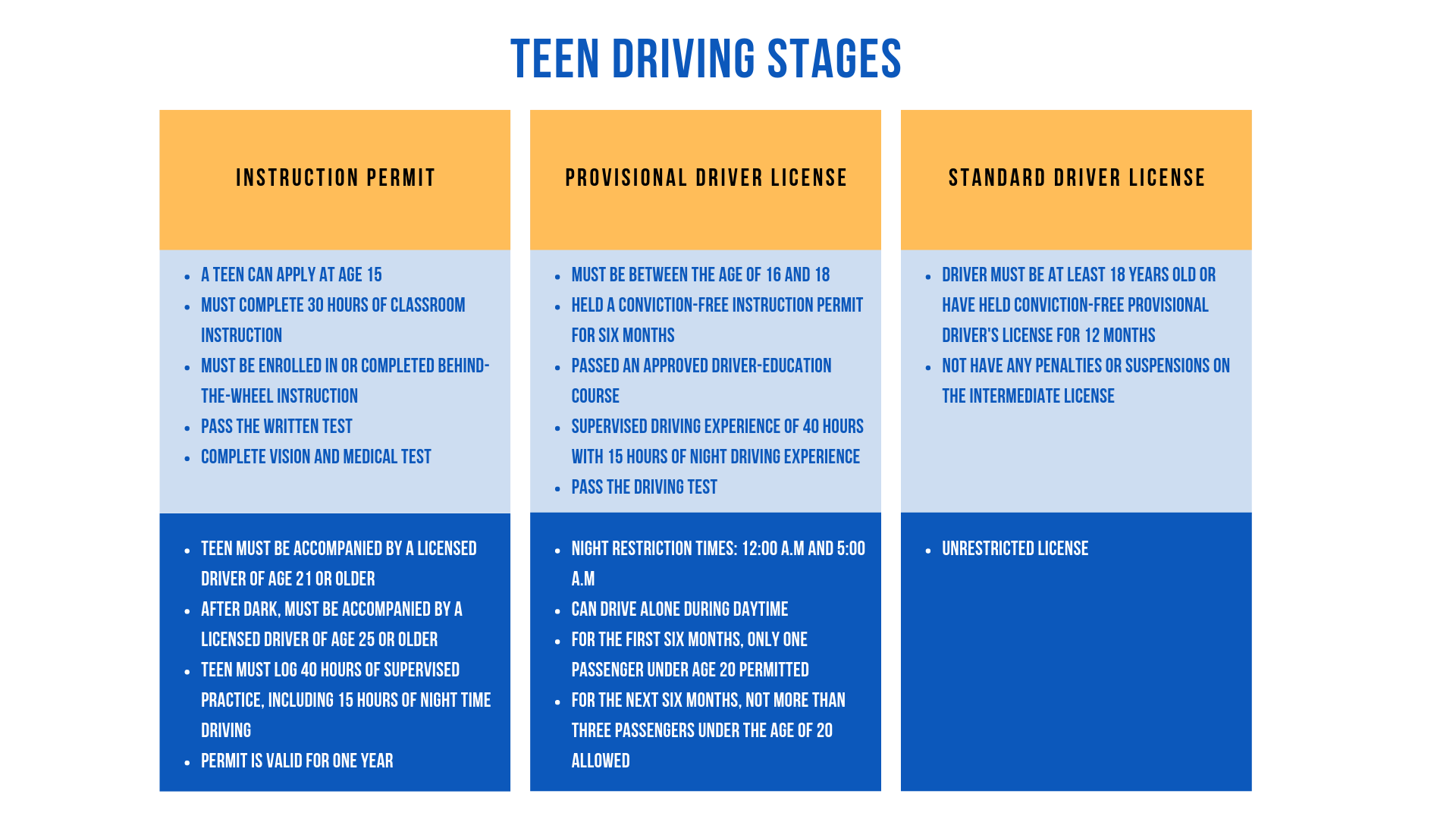

What are the teen driving laws in Minnesota?

If you are above age 15 and have completed 30 hours of classroom instruction, you can write the knowledge test and get your instruction permit. The instruction permit allows you to practice driving under the supervision of either a certified instructor or a licensed driver of age 21 or older.

To qualify for the next stage, the provisional driver’s license, you must be at least 16 and have logged 40 hours of supervised driving, including 15 hours of nighttime driving.

To successfully obtain a provisional driver’s license, you must have held a conviction-free instruction permit for at least six months and passed an approved driver education course.

Finally, you would need to pass the driving test undertaken at the nearest Driver and Vehicle Services Office. If you have held the provisional driver’s license for a minimum of 12 months or are 18 years and older, you can apply for the standard driver’s license.

To successfully obtain the standard license, you must not have a conviction on the provisional license. If you are applying for a new driver’s license, remember to ask for REAL ID-compliant driver’s license.

What is the license renewal procedure in Minnesota?

The standard-driver license in Minnesota has a validity of four years. You need to undergo a vision test every time you renew your driver’s license. However, unlike many other states, Driver and Vehicle Services in Minnesota do not allow the online renewal of driver’s license. You have to visit one of the offices of DVS to renew your driver’s license.

New Residents

If you are moving to Minnesota from another U.S. state or Canada and have a valid driver’s license, you can obtain a Minnesota driver’s license by passing a knowledge and vision test.

Remember: If your license expired more than a year ago, you would also have to undertake the driving test.

If you are moving to Minnesota from another country, you will have to pass the vision, knowledge, and driving tests to get a driver’s license. To find the documents required to get a license, visit the Driver and Vehicle Services website.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the rules of the road in Minnesota?

It is critical that you are aware of the road rules and regulations. It not only keeps you and your family safe, but it can also lead to a discount on your insurance premium on account of a clean driving record. In this section, we want to do a quick recap of the essential rules and regulations that you must remember while driving in Minnesota.

Is Minnesota at fault or no-fault state?

Minnesota follows a no-fault tort system of auto insurance. As we mentioned earlier, the no-fault system is designed to help you get on your feet faster in case of an accident.

However, to protect yourself from financial harm, you need to purchase Personal Injury Protection along with uninsured/underinsured coverage.

You can step out of the no-fault system to sue a third party in court if you have sustained an injury that resulted in expenses more considerable than a threshold value we discussed earlier.

What are the seat belt and car seat laws in Minnesota?

Click it or ticket! Seat belts coupled with air bags are one of the most critical safety features in your car.

In 2018, there were 2,792 motor vehicle deaths in Minnesota.

According to the CDC, the rate of traffic death is lower in Minnesota compared to the national average.

Ninety-four percent Minnesotans wear seat belts whereas only 86 percent of the rest of the country wear seat belts. Minnesota wants its drivers to remain safe on the road. That’s why the state has penalties for not wearing a seat belt.

In Minnesota, not wearing a seat belt is considered a primary offense, which means a law enforcement officer can stop and fine you. The fine is $25 for the first offense and can rise to $100.

You should use a restraint system for children under the age of 8 or shorter than 57 inches. Infants must be in rear-facing safety seats.

Remember: The driver is responsible for the child restraint violation and will have to pay a penalty of $50.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the keep right and move over laws in Minnesota?

You should keep right in Minnesota unless passing a slower vehicle traveling in the same direction (the vehicle must be going under the posted speed limit).

Minnesota updated its keep right law on August 1st, 2019 to make sure slow drivers keep right.

If officers see a slow vehicle in the left lane that is holding up traffic, they may pull that vehicle over. State law also requires you to reduce speed or vacate the lane closest to stationary emergency vehicles using flashing lights.

What are the speed limits in Minnesota?

| TYPE OF ROAD | MPH |

|---|---|

| Rural Interstates | 70 |

| Urban Interstates | 60 |

| Other limited access road | 60 |

| Other roads | 60 |

What are the ridesharing laws in Minnesota?

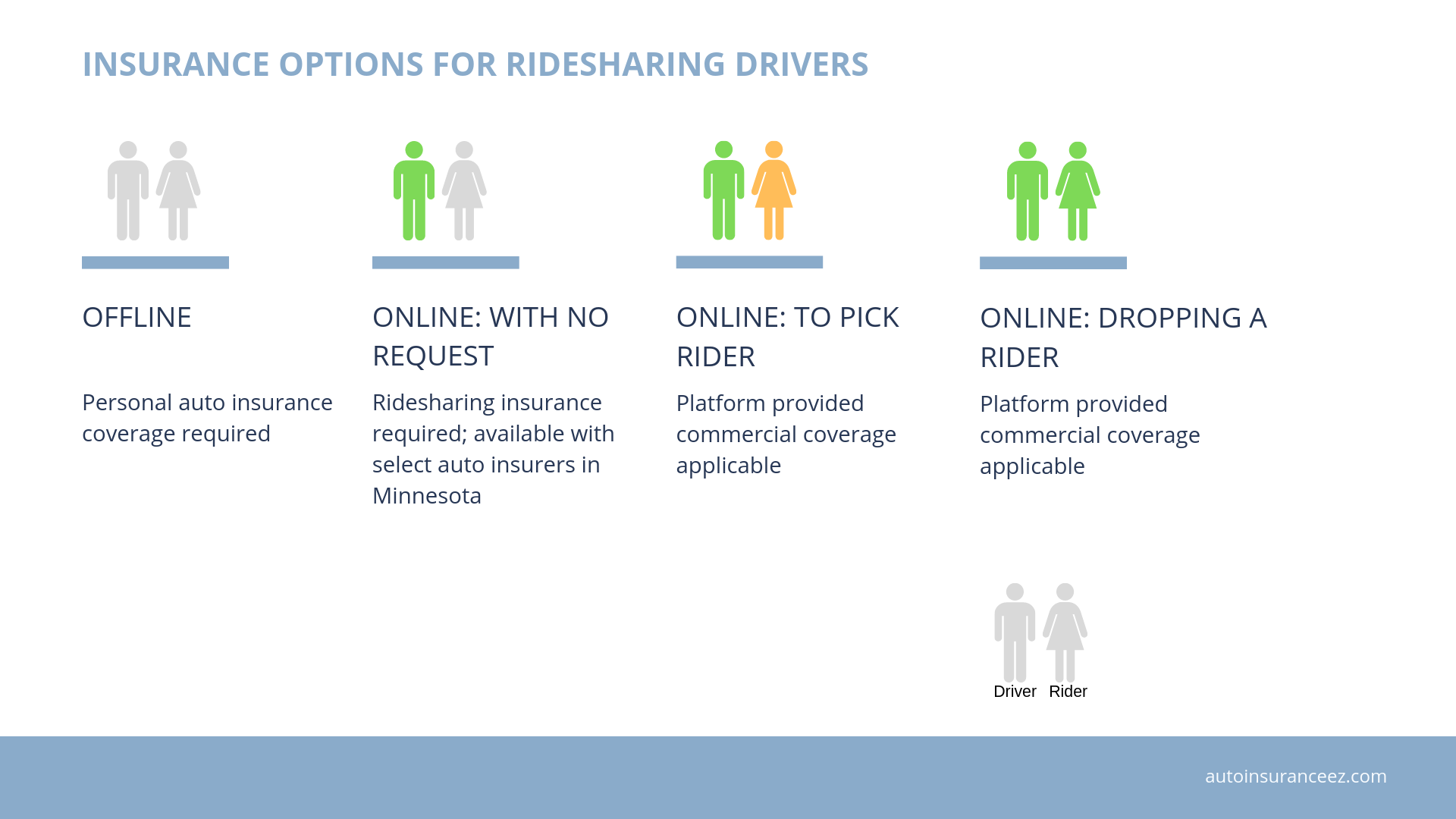

If you have ever used Uber or Lyft lately, you have already availed coverage under the commercial insurance plan offered by these platform providers. If you drive for Uber, Lyft, or any other ridesharing application, it is vital for you to know the different kinds of coverage available to you.

There are numerous scenarios when you are driving for ridesharing companies such as Uber and Lyft.

Offline: When you are driving for personal use, you are expected to use your auto insurance policy

Online with no ride request: The most tricky scenario is when you are online and yet to receive a pick-up request. In this case, you are not covered under your policy as you are driving for the ridesharing company. In this case, you need a ‘gap insurance’ – called Ridesharing Insurance.

In Minnesota, Allstate, Farmers, and Geico will be able to provide you Ridesharing Insurance plan. Online with ride request or active ride: In this scenario, the commercial policy of the ridesharing company will provide insurance coverage.

E.g., in case of Uber, it provides $1,000,000 liability coverage, $1,000,000 bodily injury protection, and contingent collision & comprehensive coverage with $1,000 deductible. The deductible portion can vary between platforms.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Is there automation on the road in Minnesota?

Self-driving cars not allowed on public or private roads. A task force constituted by Minnesota has recommended steps towards opening the roads to self-driving cars.

The State Legislators and the Minnesota Department of Transportation are still wary of allowing self-driving cars on public roads. However, these cars may be allowed on private roads if the lawmakers pass the current bills.

What are Minnesota safety laws?

No one wants a reckless or impaired driver on the road endangering other drivers or pedestrians. Minnesota has strict law to stop people from making such mistakes. Let us review the safety laws applicable in the state.

What are the DUI Laws in Minnesota?

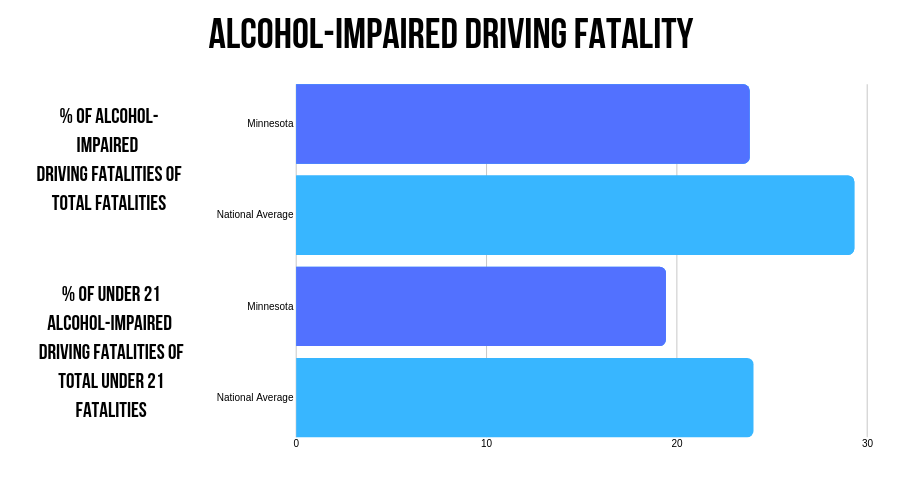

In 2017, a total of 85 people in Minnesota died because of alcohol-impaired driving, of which, seven were under 21 years old.

Minnesota fares better than the national average in terms of alcohol-impaired fatalities partly due to the strict penalties for the offense.

Let us review the fines and penalties related to the offense:

| OFFENSE | LICENSE SUSPENSION OR REVOCATION | IMPRISONMENT | FINE | OTHER |

|---|---|---|---|---|

| First | 90 days (180 days if the driver is under 21) | Up to 90 days | $1,000 | |

| Second | Revoked for one year | 30 days to one year | $3,000 | |

| Third | if thirdoffense on record: DL revoked for one year; if third offense in ten years: DL revoked and denied for three years | 90 days to one year | Minimum $3,000 | To avoid jail time, driver has to agree with electronic alcohol monitoring with at least daily breath-alcohol test |

| Fourth | if fourth on record: cancelled and revoked for three years if fourth in ten years: cancelled and revoked for four years | 90 days to seven years | $14,000 | Impoundment of registration plates, weekly meeting with probation officer, random substance testing; the cost for all the tests to be paid by the driver |

| Fifth | Driver's license cancelled and revoked for six years | Minimum one year in jail | Same |

Remember, the lookback period in Minnesota is 10 years.

The lookback period is the time until which any new offense will be counted as a subsequent offense and will result in harsher fines and penalties.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the marijuana-impaired driving laws in Minnesota?

Although no legislation prohibits marijuana-impaired drivers from plying on the road, it is advisable to avoid driving in the intoxicated condition. You would not only be endangering your life but also some other person’s life.

What are the distracted driving laws in Minnesota?

It is illegal to use handheld devices and to text while driving in Minnesota for all drivers. It is also unlawful for permit holders and provisional license drivers to use cellphones while driving.

Minnesota has been hands-free since August 1st, 2019. Drivers may only use voice commands to perform tasks, such as making a call.

The distracted driving laws allow law enforcement for primary enforcement. This means that a law enforcement officer can stop you and fine you for text messaging.

What’s driving in Minnesota like?

Another important factor that insurers use is to consider data on vehicle theft, crashes, speeding violations, etc., of your local area. Let us now look at the relevant data across Minnesota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What is the number of vehicle theft in Minnesota?

| Make and Model | Model Year | Total Number of Thefts |

|---|---|---|

| Honda Accord | 1997 | 620 |

| Honda Civic | 1998 | 534 |

| Chevrolet Pickup (Full Size) | 1999 | 421 |

| Ford Pickup (Full Size) | 2001 | 248 |

| Toyota Camry | 1999 | 235 |

| Honda CR-V | 2000 | 229 |

| Chevrolet Impala | 2005 | 190 |

| Dodge Caravan | 2005 | 142 |

| Toyota Corolla | 2005 | 125 |

| Chevrolet Malibu | 2005 | 123 |

The 1997 Honda Accord and the 1998 Honda Civic are the two most stolen cars in Minnesota. To check the number of cars stolen in your city, you can use the data provided by the FBI:

| City | Motor vehicle theft |

|---|---|

| Aitkin | 5 |

| Akeley | 0 |

| Albany | 1 |

| Albert Lea | 14 |

| Alexandria | 37 |

| Annandale | 5 |

| Anoka | 33 |

| Appleton | 0 |

| Apple Valley | 37 |

| Arlington | 0 |

| Ashby | 0 |

| Atwater | 0 |

| Austin | 27 |

| Avon | 0 |

| Babbitt | 0 |

| Barnesville | 0 |

| Baudette | 0 |

| Baxter | 7 |

| Bayport | 3 |

| Becker | 3 |

| Belgrade/Brooten | 0 |

| Belle Plaine | 3 |

| Bemidji | 42 |

| Benson | 1 |

| Big Lake | 6 |

| Blackduck | 0 |

| Blaine | 41 |

| Blooming Prairie | 2 |

| Bloomington | 115 |

| Blue Earth | 4 |

| Bovey | 0 |

| Braham | 0 |

| Brainerd | 32 |

| Breckenridge | 3 |

| Breezy Point | 0 |

| Breitung Township | 0 |

| Brooklyn Center | 114 |

| Brooklyn Park | 170 |

| Brownton | 1 |

| Buffalo | 6 |

| Buffalo Lake | 0 |

| Burnsville | 77 |

| Caledonia | 0 |

| Cambridge | 13 |

| Canby | 0 |

| Cannon Falls | 6 |

| Centennial Lakes | 7 |

| Champlin | 9 |

| Chaska | 12 |

| Chisholm | 1 |

| Clara City | 0 |

| Cloquet | 21 |

| Cold Spring/Richmond | 2 |

| Coleraine | 0 |

| Columbia Heights | 37 |

| Coon Rapids | 50 |

| Corcoran | 1 |

| Cottage Grove | 21 |

| Crookston | 7 |

| Crosby | 0 |

| Crosslake | 0 |

| Crystal | 31 |

| Danube | 2 |

| Dawson/Boyd | 0 |

| Dayton | 5 |

| Deephaven | 0 |

| Deer River | 0 |

| Detroit Lakes | 9 |

| Dilworth | 12 |

| Duluth | 136 |

| Eagan | 43 |

| Eagle Lake | 3 |

| East Grand Forks | 6 |

| East Range | 0 |

| Eden Prairie | 27 |

| Eden Valley | 0 |

| Edina | 17 |

| Elbow Lake | 0 |

| Elko New Market | 1 |

| Elk River | 19 |

| Elmore | 2 |

| Ely | 0 |

| Eveleth | 8 |

| Fairfax | 0 |

| Fairmont | 9 |

| Falcon Heights | 4 |

| Faribault | 44 |

| Farmington | 16 |

| Fergus Falls | 9 |

| Floodwood | 0 |

| Forest Lake | 35 |

| Fountain | 0 |

| Franklin | 0 |

| Fridley | 74 |

| Fulda | 0 |

| Gaylord | 0 |

| Gilbert | 2 |

| Glencoe | 1 |

| Glenwood | 0 |

| Golden Valley | 31 |

| Goodview | 7 |

| Grand Rapids | 1 |

| Granite Falls | 1 |

| Hallock | 0 |

| Hancock | 0 |

| Hastings | 30 |

| Hawley | 0 |

| Hector | 0 |

| Hermantown | 13 |

| Hibbing | 10 |

| Hill City | 0 |

| Hilltop | 5 |

| Hokah | 0 |

| Hopkins | 15 |

| Houston | 0 |

| Howard Lake | 1 |

| Hutchinson | 4 |

| Inver Grove Heights | 73 |

| Isanti | 2 |

| Isle | 1 |

| Janesville | 1 |

| Jordan | 1 |

| Kasson | 6 |

| Keewatin | 1 |

| Kimball | 0 |

| La Crescent | 1 |

| Lake City | 7 |

| Lake Crystal | 2 |

| Lakefield | 0 |

| Lakes Area | 8 |

| Lake Shore | 0 |

| Lakeville | 30 |

| Lamberton | 0 |

| Lauderdale | 3 |

| Lester Prairie | 1 |

| Le Sueur | 5 |

| Lewiston | 0 |

| Lino Lakes | 5 |

| Litchfield | 6 |

| Little Falls | 9 |

| Long Prairie | 1 |

| Lonsdale | 4 |

| Madelia | 1 |

| Madison Lake | 1 |

| Mankato | 49 |

| Maple Grove | 35 |

| Mapleton | 2 |

| Maplewood | 141 |

| Marshall | 9 |

| Medina | 2 |

| Melrose | 1 |

| Menahga | 0 |

| Mendota Heights | 6 |

| Milaca | 0 |

| Minneapolis | 1,987 |

| Minneota | 0 |

| Minnesota Lake | 1 |

| Minnetonka | 16 |

| Minnetrista | 5 |

| Montevideo | 8 |

| Montgomery | 8 |

| Moorhead | 91 |

| Moose Lake | 2 |

| Morris | 5 |

| Morristown | 0 |

| Mounds View | 27 |

| Mountain Lake | 0 |

| Nashwauk | 3 |

| New Brighton | 27 |

| New Hope | 15 |

| New Prague | 1 |

| New Richland | 0 |

| North Branch | 12 |

| Northfield | 5 |

| North Mankato | 3 |

| North St. Paul | 22 |

| Oakdale | 56 |

| Oak Park Heights | 5 |

| Olivia | 1 |

| Onamia | 1 |

| Orono | 8 |

| Ortonville | 0 |

| Osakis | 0 |

| Osseo | 1 |

| Ostrander | 0 |

| Owatonna | 36 |

| Park Rapids | 12 |

| Paynesville | 0 |

| Pequot Lakes | 0 |

| Pike Bay | 0 |

| Pillager | 0 |

| Pine River | 1 |

| Plainview | 1 |

| Plymouth | 35 |

| Preston | 0 |

| Princeton | 8 |

| Proctor | 6 |

| Ramsey | 18 |

| Red Wing | 29 |

| Redwood Falls | 13 |

| Renville | 0 |

| Richfield | 62 |

| Rochester | 132 |

| Rogers | 9 |

| Roseau | 1 |

| Rosemount | 4 |

| Roseville | 77 |

| Rushford | 0 |

| Sacred Heart | 0 |

| Sartell | 7 |

| Sauk Centre | 4 |

| Sauk Rapids | 12 |

| Shakopee | 42 |

| Silver Bay | 0 |

| Silver Lake | 2 |

| Slayton | 1 |

| Sleepy Eye | 0 |

| South Lake Minnetonka | 4 |

| South St. Paul | 63 |

| Springfield | 0 |

| Spring Grove | 1 |

| Spring Lake Park | 20 |

| St. Anthony | 6 |

| Staples | 2 |

| Starbuck | 0 |

| St. Charles | 2 |

| St. Cloud | 124 |

| St. Francis | 5 |

| Stillwater | 18 |

| St. James | 1 |

| St. Joseph | 5 |

| St. Louis Park | 44 |

| St. Paul | 1,874 |

| St. Paul Park | 17 |

| St. Peter | 8 |

| Thief River Falls | 5 |

| Tracy | 2 |

| Tri-City | 1 |

| Two Harbors | 3 |

| Virginia | 25 |

| Wabasha | 1 |

| Waite Park | 15 |

| Walker | 4 |

| Warroad | 2 |

| Waseca | 9 |

| Wayzata | 3 |

| Wells | 0 |

| West Concord | 1 |

| West Hennepin | 1 |

| West St. Paul | 65 |

| Wheaton | 0 |

| White Bear Lake | 27 |

| Willmar | 18 |

| Windom | 5 |

| Winnebago | 0 |

| Winona | 8 |

| Winsted | 0 |

| Woodbury | 47 |

| Worthington | 9 |

| Wyoming | 11 |

| Zumbrota | 6 |

Vehicle theft can also impact disproportionately minority communities when it comes to auto insurance rates. One of the key problems is that often vehicle theft is more predominant in neighborhoods of persons of color.

Insurance companies will then charge higher rates to people who live in those areas because a higher vehicle theft rate can lead to more people filing claims. This costs the insurance companies money, so rates get increased for that neighborhood.

You can read more about auto insurance impacting negatively minority groups as well as issues of police brutality in our Biggest Police Budgets by City [+Defunding and Black Imprisoment] article.

What is the number of road fatalities in Minnesota?

Let us review the fatality data in the state to understand the possible reasons causing these accidents.

What is the number of fatal crashes by weather condition and light condition?

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 182 | 40 | 50 | 9 | 3 | 284 |

| Rain | 12 | 9 | 4 | 0 | 0 | 25 |

| Snow/Sleet | 14 | 4 | 5 | 0 | 0 | 23 |

| Other | 0 | 1 | 3 | 0 | 0 | 4 |

| Unknown | 0 | 0 | 3 | 0 | 1 | 4 |

| TOTAL | 208 | 54 | 65 | 9 | 4 | 340 |

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What is the number of fatalities by county for all crashes in Minnesota?

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Aitkin County | 2 | 4 | 6 | 6 | 3 |

| Anoka County | 12 | 16 | 11 | 20 | 17 |

| Becker County | 3 | 3 | 1 | 9 | 5 |

| Beltrami County | 6 | 6 | 6 | 3 | 4 |

| Benton County | 8 | 1 | 7 | 2 | 9 |

| Big Stone County | 2 | 0 | 1 | 0 | 1 |

| Blue Earth County | 4 | 3 | 12 | 6 | 7 |

| Brown County | 2 | 7 | 2 | 0 | 2 |

| Carlton County | 3 | 1 | 9 | 3 | 6 |

| Carver County | 6 | 10 | 5 | 3 | 1 |

| Cass County | 5 | 6 | 4 | 10 | 6 |

| Chippewa County | 4 | 5 | 4 | 1 | 0 |

| Chisago County | 6 | 8 | 4 | 6 | 8 |

| Clay County | 6 | 4 | 3 | 1 | 4 |

| Clearwater County | 1 | 1 | 2 | 2 | 2 |

| Cook County | 1 | 1 | 0 | 0 | 0 |

| Cottonwood County | 4 | 1 | 6 | 0 | 2 |

| Crow Wing County | 9 | 10 | 5 | 8 | 3 |

| Dakota County | 19 | 10 | 11 | 28 | 11 |

| Dodge County | 0 | 3 | 2 | 1 | 1 |

| Douglas County | 1 | 6 | 2 | 6 | 7 |

| Faribault County | 3 | 2 | 4 | 4 | 1 |

| Fillmore County | 1 | 2 | 2 | 3 | 1 |

| Freeborn County | 2 | 3 | 2 | 4 | 3 |

| Goodhue County | 7 | 10 | 8 | 4 | 5 |

| Grant County | 0 | 3 | 0 | 0 | 3 |

| Hennepin County | 42 | 34 | 33 | 45 | 45 |

| Houston County | 2 | 0 | 5 | 0 | 3 |

| Hubbard County | 4 | 4 | 3 | 5 | 1 |

| Isanti County | 5 | 8 | 15 | 7 | 3 |

| Itasca County | 6 | 2 | 6 | 3 | 5 |

| Jackson County | 5 | 0 | 6 | 1 | 0 |

| Kanabec County | 0 | 1 | 2 | 2 | 2 |

| Kandiyohi County | 2 | 12 | 8 | 4 | 1 |

| Kittson County | 2 | 0 | 0 | 0 | 0 |

| Koochiching County | 1 | 0 | 1 | 4 | 1 |

| Lac Qui Parle County | 0 | 1 | 2 | 0 | 0 |

| Lake County | 4 | 0 | 3 | 1 | 4 |

| Lake of The Woods County | 0 | 1 | 0 | 2 | 1 |

| Le Sueur County | 6 | 1 | 6 | 4 | 3 |

| Lincoln County | 2 | 1 | 0 | 0 | 0 |

| Lyon County | 2 | 4 | 3 | 2 | 3 |

| Mahnomen County | 1 | 1 | 1 | 1 | 0 |

| Marshall County | 1 | 1 | 1 | 3 | 0 |

| Martin County | 3 | 0 | 1 | 1 | 3 |

| Mcleod County | 4 | 2 | 4 | 1 | 3 |

| Meeker County | 5 | 2 | 4 | 5 | 2 |

| Mille Lacs County | 4 | 8 | 4 | 7 | 3 |

| Morrison County | 5 | 8 | 9 | 6 | 4 |

| Mower County | 3 | 1 | 2 | 2 | 1 |

| Murray County | 0 | 2 | 1 | 2 | 0 |

| Nicollet County | 2 | 6 | 2 | 2 | 0 |

| Nobles County | 5 | 2 | 3 | 3 | 0 |

| Norman County | 3 | 0 | 3 | 2 | 0 |

| Olmsted County | 12 | 8 | 14 | 12 | 6 |

| Otter Trail County | 8 | 3 | 9 | 2 | 7 |

| Pennington County | 0 | 1 | 3 | 5 | 2 |

| Pine County | 7 | 4 | 9 | 10 | 9 |

| Pipestone County | 1 | 0 | 2 | 3 | 1 |

| Polk County | 5 | 3 | 4 | 6 | 4 |

| Pope County | 2 | 0 | 0 | 1 | 0 |

| Ramsey County | 12 | 12 | 18 | 15 | 19 |

| Red Lake County | 0 | 0 | 0 | 0 | 0 |

| Redwood County | 3 | 1 | 2 | 3 | 8 |

| Renville County | 4 | 4 | 2 | 1 | 2 |

| Rice County | 5 | 6 | 5 | 6 | 4 |

| Rock County | 1 | 5 | 0 | 3 | 1 |

| Roseau County | 1 | 6 | 0 | 1 | 2 |

| Scott County | 11 | 5 | 7 | 8 | 8 |

| Sherburne County | 4 | 2 | 11 | 5 | 11 |

| Sibley County | 2 | 2 | 6 | 0 | 4 |

| St. Louis County | 19 | 8 | 16 | 19 | 16 |

| Stearns County | 6 | 9 | 12 | 5 | 13 |

| Steele County | 1 | 6 | 4 | 5 | 1 |

| Stevens County | 1 | 0 | 1 | 1 | 1 |

| Swift County | 1 | 2 | 3 | 2 | 5 |

| Todd County | 6 | 3 | 2 | 3 | 2 |

| Traverse County | 1 | 0 | 0 | 0 | 0 |

| Wabasha County | 4 | 4 | 3 | 4 | 2 |

| Wadena County | 1 | 3 | 4 | 1 | 2 |

| Waseca County | 2 | 2 | 1 | 1 | 2 |

| Washington County | 10 | 8 | 12 | 13 | 7 |

| Watonwan County | 1 | 2 | 1 | 0 | 1 |

| Wilkin County | 0 | 0 | 0 | 0 | 0 |

| Winona County | 2 | 6 | 1 | 5 | 6 |

| Wright County | 16 | 16 | 8 | 7 | 8 |

| Yellow Medicine County | 2 | 2 | 4 | 0 | 3 |

What is the number of traffic fatalities in Minnesota?

| Traffic Fatalities | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 317 | 282 | 287 | 247 | 269 | 256 | 262 | 274 | 232 | 209 |

| Urban | 138 | 139 | 124 | 121 | 126 | 131 | 99 | 135 | 159 | 147 |

Fatalities by person type in Minnesota

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 156 | 154 | 159 | 144 | 124 |

| Light Truck - Pickup | 40 | 45 | 66 | 41 | 40 | |

| Light Truck - Utility | 40 | 45 | 40 | 52 | 51 | |

| Light Truck - Van | 23 | 26 | 14 | 13 | 20 | |

| Light Truck - Other | 0 | 0 | 1 | 1 | 0 | |

| Large Truck | 10 | 8 | 5 | 9 | 6 | |

| Bus | 0 | 1 | 1 | 0 | 1 | |

| Other/Unknown Occupants | 16 | 14 | 13 | 8 | 12 | |

| Total Occupants | 285 | 293 | 299 | 268 | 254 | |

| Motorcyclists | Total Motorcyclists | 61 | 46 | 61 | 56 | 55 |

| Nonoccupants | Pedestrian | 32 | 15 | 39 | 58 | 38 |

| Bicyclist and Other Cyclist | 6 | 5 | 10 | 7 | 6 | |

| Other/Unknown Nonoccupants | 3 | 2 | 2 | 3 | 4 | |

| Total Nonoccupants | 41 | 22 | 51 | 68 | 48 | |

| Total | Total | 387 | 361 | 411 | 392 | 357 |

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Fatalities by crash type in Minnesota

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 387 | 361 | 411 | 392 | 357 |

| Single Vehicle | 190 | 156 | 196 | 176 | 179 |

| Involving a Large Truck | 75 | 66 | 64 | 61 | 61 |

| Involving Speeding | 84 | 111 | 84 | 92 | 89 |

| Involving a Rollover | 105 | 94 | 104 | 88 | 89 |

| Involving a Roadway Departure | 181 | 205 | 216 | 199 | 181 |

| Involving an Intersection (or Intersection Related) | 112 | 97 | 124 | 128 | 126 |

Fatalities trend for the counties in Minnesota

| Minnesota Counties by 2017 Ranking | Fatalities | |||||

|---|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | ||

| 1 | Hennepin County | 42 | 34 | 33 | 45 | 45 |

| 2 | Ramsey County | 12 | 12 | 18 | 15 | 19 |

| 3 | Anoka County | 12 | 16 | 11 | 20 | 17 |

| 4 | St. Louis County | 19 | 8 | 16 | 19 | 16 |

| 5 | Stearns County | 6 | 9 | 12 | 5 | 13 |

| 6 | Dakota County | 19 | 10 | 11 | 28 | 11 |

| 7 | Sherburne County | 4 | 2 | 11 | 5 | 11 |

| 8 | Benton County | 8 | 1 | 7 | 2 | 9 |

| 9 | Pine County | 7 | 4 | 9 | 10 | 9 |

| 10 | Chisago County | 6 | 8 | 4 | 6 | 8 |

| Sub Total 1 | Top Ten Counties | 162 | 139 | 154 | 181 | 158 |

| Sub Total 2 | All Other Counties | 225 | 222 | 257 | 211 | 199 |

| Total | All Counties | 387 | 361 | 411 | 392 | 357 |

Fatalities involving speeding by county in Minnesota

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Aitkin County | 1 | 2 | 4 | 2 | 0 |

| Anoka County | 2 | 6 | 2 | 7 | 6 |

| Becker County | 1 | 1 | 1 | 2 | 1 |

| Beltrami County | 1 | 2 | 0 | 1 | 1 |

| Benton County | 1 | 0 | 1 | 0 | 1 |

| Big Stone County | 0 | 0 | 0 | 0 | 0 |

| Blue Earth County | 2 | 1 | 1 | 1 | 0 |

| Brown County | 1 | 5 | 2 | 0 | 0 |

| Carlton County | 0 | 0 | 1 | 1 | 1 |

| Carver County | 0 | 5 | 1 | 1 | 0 |

| Cass County | 4 | 3 | 2 | 1 | 2 |

| Chippewa County | 0 | 0 | 1 | 0 | 0 |

| Chisago County | 1 | 0 | 2 | 1 | 2 |

| Clay County | 5 | 2 | 0 | 0 | 2 |

| Clearwater County | 0 | 1 | 1 | 0 | 0 |

| Cook County | 1 | 0 | 0 | 0 | 0 |