Best Plano, TX Auto Insurance in 2025 (Compare the top 10 Companies)

State Farm, Allstate, and AAA provide the best Plano, TX auto insurance, with rates starting from $43 a month. These companies offer low rates, particular claims, and tailored policies, giving Plano, Texas drivers good coverage, sound finances, and great assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Plano TX

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Plano TX

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Plano TX

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsState Farm is the top choice for the best Plano, TX auto insurance, offering competitive rates, excellent financial stability, and a smooth claims process. Allstate and AAA also provide affordable options, starting at $43 per month, and discounts for safe drivers and bundled policies.

With Texas’ high insurance costs, it is necessary to choose the right auto insurance coverage options by comparing top providers based on customer service, coverage choices, and local claims satisfaction to see the best price.

Our Top 10 Company Picks: Best Plano, TX Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | A++ | Many Discounts | State Farm | |

| #2 | 25% | A+ | Add-on Coverages | Allstate | |

| #3 | 15% | A | Online App | AAA |

| #4 | 13% | A++ | Accident Forgiveness | Travelers | |

| #5 | 25% | A+ | 24/7 Support | Erie |

| #6 | 10% | A++ | Military Savings | USAA | |

| #7 | 20% | A+ | Usage Discount | Nationwide |

| #8 | 20% | A | Local Agents | Farmers | |

| #9 | 25% | A | Customizable Polices | Liberty Mutual |

| #10 | 25% | A++ | Custom Plan | Geico |

Enter your ZIP code and get the best rates on auto insurance for Plano, Texas, with our free comparison tool.

- Safe driver and bundling discounts help lower Plano insurance costs

- Plano, Texas, car insurance rates start at $43 per month

- Comparing multiple insurers ensures the best policy for Plano drivers

In this article, we’ll cover the best auto insurance companies in Plano, TX, whether your insurance provider offers minimum coverage, full coverage, or special discounts. You’ll learn how to compare rates, evaluate coverage options, and choose the right policy for your needs.

#1 – State Farm: Top Overall Pick

Pros

- Multiple Discounts: Drivers in Plano can save on insurance through bundling, good driving, and multi-vehicle discounts.

- Competitive Rates: State Farm offers some of the lowest insurance rates in Plano, TX, making it an affordable choice. Read our “State Farm Auto Insurance Review” to learn more.

- Strong Financial Stability: State Farm’s good reputation ensures reliable insurance claims processing in Plano, Texas.

Cons

- Limited Digital Tools: State Farm’s online and mobile insurance tools in Plano are less advanced than those of competitors.

- Higher Rates for High-Risk Drivers: Insurance premiums in Plano, Texas, can be expensive for those with accidents or violations.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Add-on Coverages

Pros

- Diverse Add-Ons: Allstate provides numerous insurance add-ons in Plano, Texas, including accident forgiveness and new car replacement.

- Strong Mobile App: Plano drivers can manage their insurance policies efficiently with Allstate’s robust app.

- Superior Bundling Discounts: With up to 25% savings, Allstate offers substantial insurance bundling benefits in Plano, TX.

Cons

- Higher Base Premiums: Check out “Allstate Auto Insurance Review,” which explains why rates in Plano are typically higher before discounts, so understanding the details can help you find better coverage value.

- Mixed Customer Satisfaction: Some Plano policyholders report insurance claims and time issues with customer service responses.

#3 – AAA: Best for Online App

Pros

- Member Perks: Plano residents benefit from AAA insurance extras, including travel discounts and identity theft monitoring.

- Reliable Roadside Assistance: AAA’s insurance coverage in Plano, TX, includes industry-leading roadside services.

- User-Friendly Online Experience: Explore further details in our “AAA Auto Insurance Review,” as its website and app make managing policies in Plano easy.

Cons

- Membership Requirement: Plano, Texas, drivers must purchase an AAA membership before accessing auto insurance options.

- Average Claims Processing Speed: Some customers in Plano, Texas, report delays in resolving auto insurance claims.

#4 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers auto insurance plans in Plano that prevent rate hikes after the first accident.

- Superior Financial Strength: Travelers’ high rating provides dependable insurance coverage in Plano. Explore our “Travelers Auto Insurance Review” to gain deeper insights.

- IntelliDrive Discount: Plano drivers can save on auto insurance using the IntelliDrive tracking program.

Cons

- Limited Local Agents: Travelers has fewer in-person insurance representatives in Plano than their competitors.

- High Premiums for High-Risk Drivers: Insurance rates in Plano can be costly for drivers with previous claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Erie: Best for 24/7 Support

Pros

- Top-Tier Customer Service: It is known for responsive and helpful auto insurance support for Plano residents.

- Comprehensive Coverage Options: It provides different insurance plans for Plano drivers, including complete replacement cost coverage.

- Lock-In Rate Feature: Auto insurance premiums in Plano, Texas, won’t increase unless coverage changes.

Cons

- Availability Issues: The “Erie Auto Insurance Review” discusses why this provider is not as widely available in Plano, Texas, as larger national insurers.

- Limited Online Tools: Digital insurance management options for Plano customers are not as advanced as those of competitors.

#6 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA offers some of the best insurance savings for military members in Plano, TX.

- Exceptional Customer Satisfaction: For expanded insights, see our “USAA Auto Insurance Reviews,” where you will find that Plano policyholders frequently rate USAA insurance service highly.

- Highly Competitive Rates: USAA auto insurance in Plano, Texas, is known for being affordable, especially for safe drivers.

Cons

- Restricted Eligibility: Only military members and their families in Plano, Texas, can access its coverage.

- Limited Local Presence: The company lacks in-person offices in Plano, TX, unlike other insurance providers.

#7 – Nationwide: Best for Usage-Based Discounts

Pros

- Usage-Based Discount: Plano drivers using SmartRide can lower their insurance costs based on driving habits. Obtain further insights from our “Nationwide Auto Insurance Review.”

- Multi-Policy Savings: Nationwide offers substantial insurance discounts for Plano residents and bundles home and auto coverage.

- Vanishing Deductible: Safe drivers in Plano, TX, can reduce their insurance deductible over time with Nationwide.

Cons

- Higher Premiums for High-Risk Drivers: Nationwide insurance in Plano, Texas, may be costly for those with poor driving records.

- Fewer Local Agents: Some Plano drivers prefer more in-person auto insurance support.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Strong Local Agent Network: Farmers has numerous auto insurance agents in Plano, TX, for personalized service.

- Signal App Discount: Read our “Farmers Auto Insurance Review ” to find out how safe drivers in Plano can save on auto insurance with the Signal telematics program.

- Comprehensive Coverage Options: It offers extensive insurance plans in Plano, Texas, including rideshare coverage.

Cons

- Higher Minimum Premiums: Farmers auto insurance in Plano, Texas, tends to be more expensive than competitors.

- Discount Availability Varies: Some Plano, Texas drivers may not qualify for all auto insurance discounts.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers highly personalized auto insurance coverage in Plano, Texas.

- RightTrack Discount: Plano drivers can use RightTrack to save on auto insurance through monitored driving habits.

- New Vehicle Discount: Plano residents with new cars can access Liberty Mutual auto insurance savings.

Cons

- Higher Rates for Certain Demographics: Young and high-risk drivers in Plano, TX, may face expensive insurance rates.

- Mixed Customer Reviews: Some policyholders in Plano report inconsistent insurance claims handling.

- Discover more in our “Liberty Mutual Auto Insurance Review“

#10 – Geico: Best for Custom Plans

Pros

- Competitive Rates: Geico offers some of the most affordable insurance plans in Plano. For additional insights, refer to our “Geico Auto Insurance Review.”

- Strong Digital Tools: Plano drivers can manage auto insurance policies easily with Geico’s app and website.

- Diverse Discount Options: Geico auto insurance in Plano, TX, includes military, multi-policy, and defensive driving discounts.

Cons

- Limited Personalized Support: Geico lacks as many local auto insurance agents as other providers in Plano, Texas.

- Discounts May Vary: Some auto insurance discounts in Plano, Texas, may not be available depending on eligibility.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Importance of Auto Insurance in Plano, Texas

Auto insurance is essential for drivers in Plano, TX, providing financial protection and legal compliance. With the city’s growing population and busy roads, having the right coverage ensures peace of mind in case of accidents, theft, or unexpected damage.

Plano, TX Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $43 | $144 |

| $45 | $114 | |

| $89 | $135 |

| $52 | $171 | |

| $72 | $187 | |

| $56 | $155 |

| $59 | $110 |

| $66 | $138 | |

| $52 | $102 | |

| $46 | $163 |

According to the table, insurance rates in Plano vary by provider and coverage, starting at $ 43 a month for minimum coverage (AAA) and $187 for full coverage (Geico). Travelers offers full coverage at $102, while Farmers and USAA have higher costs based on policy details.

Analyzing these rates shows that affordability and coverage benefits differ across insurers, making comparison shopping crucial. Drivers must weigh the trade-offs between cost and protection, ensuring they choose a plan that fits their financial situation while providing adequate coverage for potential risks.

Texas law requires drivers to meet minimum car insurance requirements, carrying at least liability insurance to cover damages they cause to others. Without adequate coverage, drivers may face fines, license suspension, or higher out-of-pocket costs after an accident.

Plano Auto Insurance Discounts

Auto insurance in Plano, TX, can be expensive, but discounts offer a practical way to lower monthly premiums. By taking advantage of available savings, drivers can reduce costs while maintaining high-quality coverage that meets their needs.

Auto Insurance Discounts From the Top Providers in Plano, TX

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Homeowner, Defensive Driving Discounts |

| Drivewise, Multi-Policy, Anti-Theft, Good Student, Early Signing, Claim-Free Discounts | |

| Multi-Policy, Safe Driver, Young Driver, Defensive Driving, Paid in Full Discounts |

| Signal App, Good Student, Multi-Policy, Vehicle Safety, Claims-Free Discounts | |

| DriveEasy, Military, Good Student, Multi-Policy, Vehicle Safety, Anti-Theft Discounts | |

| RightTrack, New Vehicle, Multi-Policy, Good Student, Claims-Free, Vehicle Safety Discounts |

| SmartRide, Multi-Policy, Defensive Driving, Claims-Free, Paid in Full Discounts |

| Drive Safe & Save, Good Student, Multi-Policy, Defensive Driving, Claims-Free Discounts | |

| IntelliDrive, Multi-Policy, Safe Driver, Vehicle Safety, Claims-Free Discounts | |

| SafePilot, Military, Good Student, Multi-Policy, Claims-Free, Safe Driver Discounts |

As you can see in the table, key discounts include multi-policy savings from AAA and USAA, defensive driving discounts from State Farm and Nationwide, and anti-theft savings from Geico and Allstate. Claims-free discounts from Liberty Mutual and Travelers also reward safe drivers with lower rates.

If you're looking to improve your driving record, consider State Farm’s Drive Safe & Save discount in Plano, TX. It encourages safer driving and can save you up to 30%.

Scott W. Johnson Licensed Insurance Agent

Utilizing these discounts can lead to significant savings on auto insurance. By comparing providers and selecting the best discounts, Plano drivers can reduce costs while maintaining strong coverage.

Auto Insurance Coverage Requirements in Texas

Your Plano, TX auto insurance policy must meet Texas auto insurance law. Driving legally in Plano requires:

Auto Insurance Minimum Coverage Requirements in Texas

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $25,000 per accident |

Do you know the difference between all the different types of coverage that auto insurance offers? There’s liability coverage, which is the bare minimum you need to drive legally.

There’s comprehensive coverage, which is what newer and more expensive vehicles need if you don’t want to pay 100 percent of the cost associated with a crash that wasn’t your fault.

There’s also collision coverage for the bumps and scrapes that tend to happen the longer you own your vehicle.

If you buy all of these, it’s known as full coverage. Read on for how to get cheap full coverage auto insurance in Plano, TX.

They say that everything is bigger in Texas, and auto insurance prices are no exception. What is the average cost of car insurance in Texas? The average driver could be paying $194 or more each month just to stay covered! But you don’t have to be one of those people.

Who has the cheapest auto insurance in Texas? We’ll help you find out. And remember, who has the cheapest auto insurance in Houston won’t be the same as who offers the cheapest auto insurance in Plano, TX.

In fact, shopping around for a new auto insurance policy in Plano may get you even better discounts than anywhere else in the state.

Plano, TX Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $180 |

| $299 | |

| $145 |

| $175 | |

| $114 | |

| $190 |

| $134 |

| $136 | |

| $160 | |

| $140 |

Because Texas is such a big and highly populated state, you can imagine that there are many car insurance companies vying for your business. Some of them are major providers like Encompass, Mercury, and State Farm, just to name a few.

Other local companies, such as the Texas Farm Bureau, want to offer specially tailored policies and rates that address Texans’ unique needs.

Regardless of who you purchase a policy from, their customer service and their claims process can be just as important – if not more – than how much they charge you for your policy. So keep that in mind while you’re shopping around.

Do you know how Texas auto insurance companies determine how much each driver should pay for their policy? Well, it’s a much more complicated process than you may think.

There are a multitude of factors – such as your age, marital status, home ownership, and more – that may change how expensive or affordable your rate is.

And the more you know about them, the easier it will be for you to “steer” things in your favor.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Major Factors That Affect Car Insurance Rates in Plano

For better or worse, there are only so many things you can control when it comes to helping yourself lower your monthly car insurance premiums. The important thing is to become an informed consumer and figure out what the most important factors are.

With that information, you can go on to figure out which ones you can change in order to get yourself the cheapest rate possible.

Your Zip Code

The most important thing your auto insurance agent will ask for is your zip code when it comes time to underwrite your policy. Why is this so important? They use that information to gather statistical data about how safe or unsafe it is to drive in your area.

Living in Plano, where there are 286,047 residents, means that you will be sharing the road with a lot of people, increasing your likelihood of an accident.

Furthermore, the median household income of $88,398 means your insurance provider may assume you can pay top-tier prices—even if you can’t.

Plano, TX Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 75094 | $176 |

| 75093 | $160 |

| 75024 | $154 |

| 75023 | $147 |

| 75025 | $143 |

| 75075 | $143 |

| 75074 | $138 |

| 75098 | $89 |

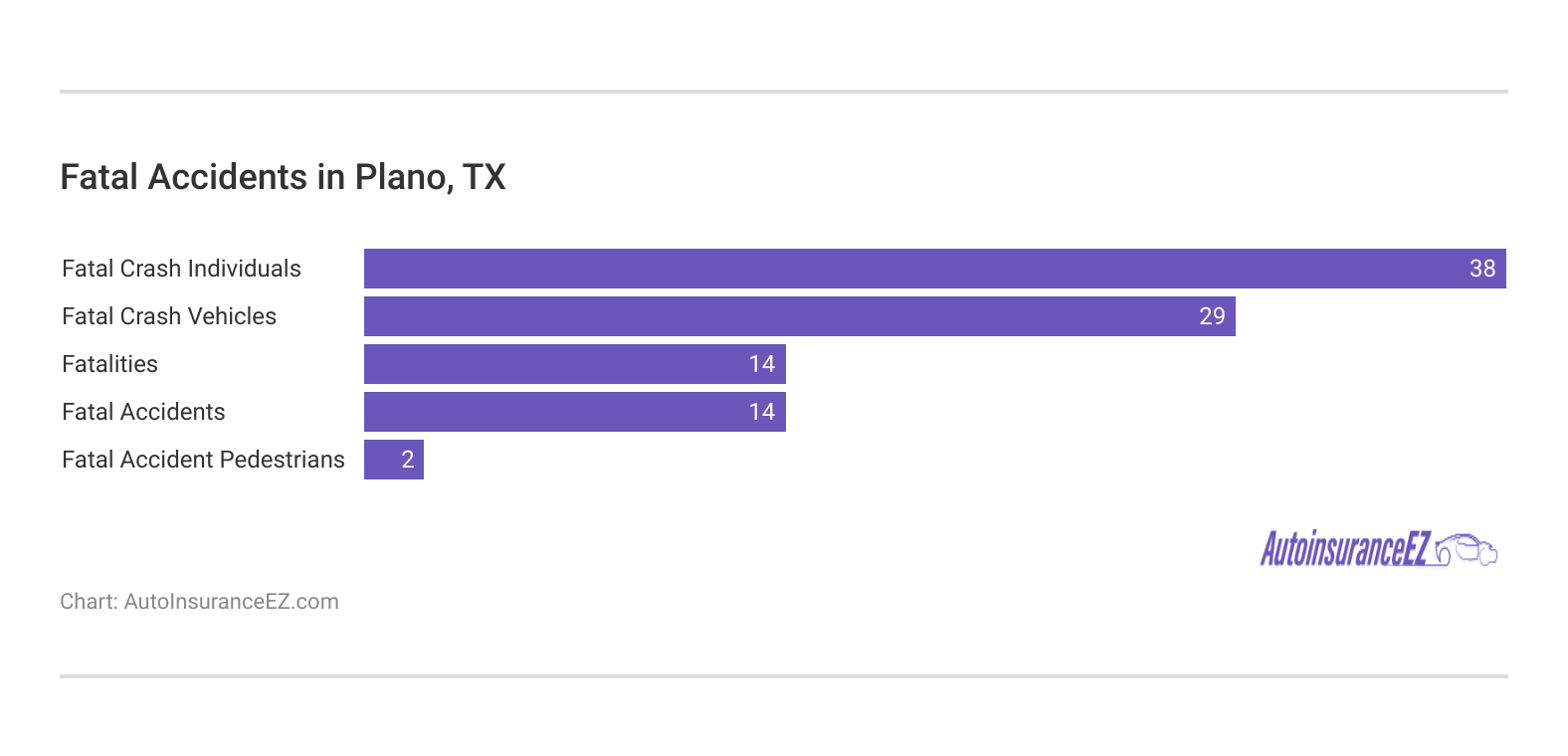

Automotive Accidents

Surprisingly, compared to other cities of similar size in Texas, there are very few fatal accidents experienced in Plano each year. You can use this information to your advantage when negotiating your insurance prices.

After all, if your likelihood of a serious crash is so low, why not try asking for a better rate? As they say, it doesn’t hurt to ask

Auto Thefts in Plano

If you want to live in a safe city, if you want to rub elbows with the job creators of major corporations, or if you just want to live in a pleasant, quiet suburb within reasonable driving distance of downtown Dallas, then Plano, Texas, is the place for you. Then again, if you’re already living there, you probably don’t need to be told all that!

- Fun fact: Plano isn’t considered one of the safest cities for some arbitrary reason—Forbes Magazine awarded it this coveted distinction.

The most recent data from Neighborhood Scout shows that there were only 395 auto thefts in Plano within the last year. Just like serious accidents, that is a remarkably low rate for such a large city. This may help get you a lower premium, or your insurance company may ignore it.

However, you can be proactive and try to lower your monthly costs even further by installing anti-theft devices on your vehicle for more security.

Plano, TX Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Liability | Comprehensive |

|---|---|---|

| $125 | $175 |

| $145 | $195 | |

| $110 | $160 |

| $135 | $185 | |

| $114 | $164 | |

| $155 | $205 |

| $134 | $184 |

| $95 | $145 | |

| $140 | $190 | |

| $115 | $165 |

Your Credit Score

Many auto insurance companies believe that the higher your credit score, the lower the premium you should be charged for your policy. Many people in unfortunate financial situations may have an issue with this.

However, at the end of the day, there may be very little you can do about it other than work hard to improve your credit score. This isn’t an impossible thing to change, but it will take time and effort on your part.

Plano, TX Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $120 | $145 | $190 |

| $135 | $160 | $210 | |

| $110 | $135 | $180 |

| $125 | $150 | $200 | |

| $100 | $125 | $170 | |

| $140 | $165 | $220 |

| $115 | $140 | $185 |

| $95 | $120 | $160 | |

| $130 | $155 | $205 | |

| $85 | $110 | $150 |

Your Age

Did you know that teenage drivers are charged some of the highest auto insurance rates out of any other demographic? There are many reasons for this. Lack of experience behind the wheel, poor decision-making, and a higher likelihood of distracted driving are among them.

So if you’re under the age of 25, it’s important to do as much as you can to prove to your insurance provider that you are a responsible driver who will not get into an accident. Affordable auto insurance in Plano, TX for teens can be hard to find.

Plano, TX Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 34 Female | Age: 34 Male |

|---|---|---|---|---|

| $350 | $380 | $120 | $125 |

| $370 | $400 | $130 | $135 | |

| $340 | $370 | $115 | $120 |

| $360 | $390 | $125 | $130 | |

| $330 | $360 | $110 | $115 | |

| $380 | $410 | $135 | $140 |

| $355 | $385 | $120 | $125 |

| $345 | $375 | $115 | $120 | |

| $365 | $395 | $125 | $130 | |

| $320 | $350 | $105 | $110 |

Your Driving Record

Your insurance provider will look into your driving history and see how unsafe of a motorist do you have been within the last three to five years. If you don’t have even so much as a speeding ticket, then you have nothing to worry about!

It will be infinitely easier for you to find the lowest possible rate. However, multiple speeding tickets, multiple moving violations, or even something as serious as a DUI will send your monthly premiums shooting through the roof.

Plano, TX Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $165 | $190 | $210 | $250 |

| $196 | $225 | $245 | $290 | |

| $150 | $175 | $195 | $230 |

| $180 | $210 | $230 | $275 | |

| $111 | $130 | $145 | $180 | |

| $170 | $195 | $215 | $260 |

| $125 | $145 | $160 | $200 |

| $103 | $120 | $135 | $165 | |

| $140 | $165 | $185 | $220 | |

| $101 | $115 | $130 | $160 |

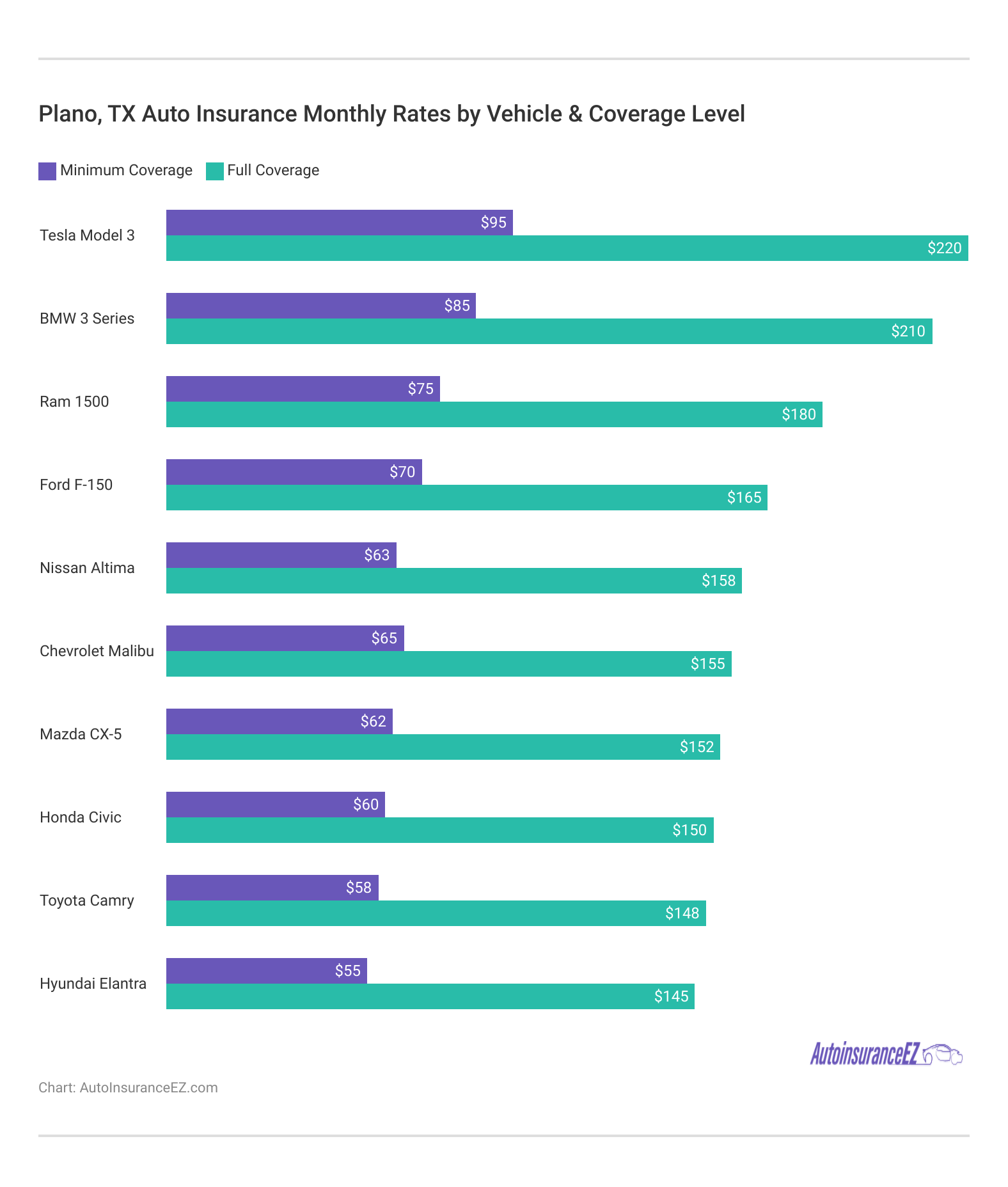

Your Vehicle

All Things Considered, the odds are pretty high that living in Plano means you can afford to drive a very nice, shiny new vehicle. But guess what? Those types of vehicles tend to come with a pretty expensive auto insurance price tag.

You’re going to need a fair amount of comprehensive coverage to replace or repair damages if your luxury vehicle gets into an accident. Unless you are extremely risky or extremely confident, you can’t exactly get away with purchasing the bare minimum coverage.

Minor Factors That Affect Car Insurance Costs in Plano

Of course, tweaking some of the factors below can add up to some extra savings over time:

Your Marital Status

Getting married, despite how expensive it may be, has its rewards. One of those rewards is getting a better deal on your monthly insurance premiums. And this isn’t just for car insurance, either; you can get better homeowners insurance discounts and cheaper rates on other financial products.

Just make sure you try and bundle as much as you can in order to maximize your savings.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Your Gender

Lots of different statistical models suggest that the fairer sex is the safer one behind the wheel. People attribute this to women typically being more cautious, level-headed, and less likely to engage in road rage.

While some insurance companies are moving away from adjusting premiums based on gender, there are still providers out there who may alter your premiums by anywhere from 2 to 3 percent based on whether you are male or female.

Your Driving Distance to Work

Plano is a very big residential area equidistant from many commercial sectors. So, depending on where your job is located, you may have a relatively short or an annoyingly long daily commute.

There is a wide range of workers in Plano who may spend as little as 15 minutes on average getting to the office or as much as 35 minutes trying to get where they need to go.

Of course, this gridlock isn’t going to look good when your insurance company is evaluating your risk and adjusting your monthly premiums.

If you’re in the unlucky majority of people who have a longer commute time, then you’re probably driving more miles each year, too. Some companies care a lot about your annual mileage, and they give you up to a 33 percent discount if you can prove your low mileage with a plug-in device.

But if you drive a lot each year, it may be wise to let your insurance company estimate your annual mileage and hope that they low-ball it in your favor.

Your Coverage and Deductibles

Changing your deductible can be a blessing or a curse, depending on your luck. On the one hand, raising your deductible can save you a decent amount of money each month on your car insurance premiums. On the other hand, you may be in for a very rude awakening if you find yourself in a position where you have to pay that deductible.

You have to balance your desire to save money with your ability to pay a significant amount of money if you need to make a claim.

Education in Plano, TX

Many Plano residents have successfully pursued higher education degrees. The largest number, 37 percent of the city’s population, has a bachelor’s degree. Another 18 percent have a master’s degree of some sort.

In fact, it is extremely rare to find an adult Plano resident who has not completed at least one year of college.

As far as the city limits of Plano are concerned, aspiring estheticians can take courses at the Regency Beauty Institute-Plano. However, there are many prestigious institutions of higher learning a short commute away in Dallas. The University of Texas has a Dallas campus in the city.

There’s also Richland College, Collin County Community College, Brookhaven, and Southern Methodist University, just to name a few. With so many choices, it’s easy to see why there are so many highly educated people living in Plano.

Some people believe that they only have one of two choices: they can purchase a low-quality auto insurance policy on the cheap, or they can shell out the big bucks for comprehensive coverage and stellar customer service. But the truth is that you can have both.

We want to help you find that perfect combination of the two – an affordable price with a reputable company – and we have exactly what you need to make that dream a reality.

How We Conducted Our Car Insurance Analysis in Plano, TX

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and who owns his own home. Miles driven annually were based on the national average.

The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device, which qualifies for an anti-theft device discount.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Essential Insights for Choosing Auto Insurance in Plano

Finding cheap auto insurance companies in Plano, TX, requires comparing rates, coverage options, and available discounts to find the best deal. As Plano, Texas, becomes more populated and traffic density is high, selecting a good insurer provides financial coverage against accidents and unforeseen damage.

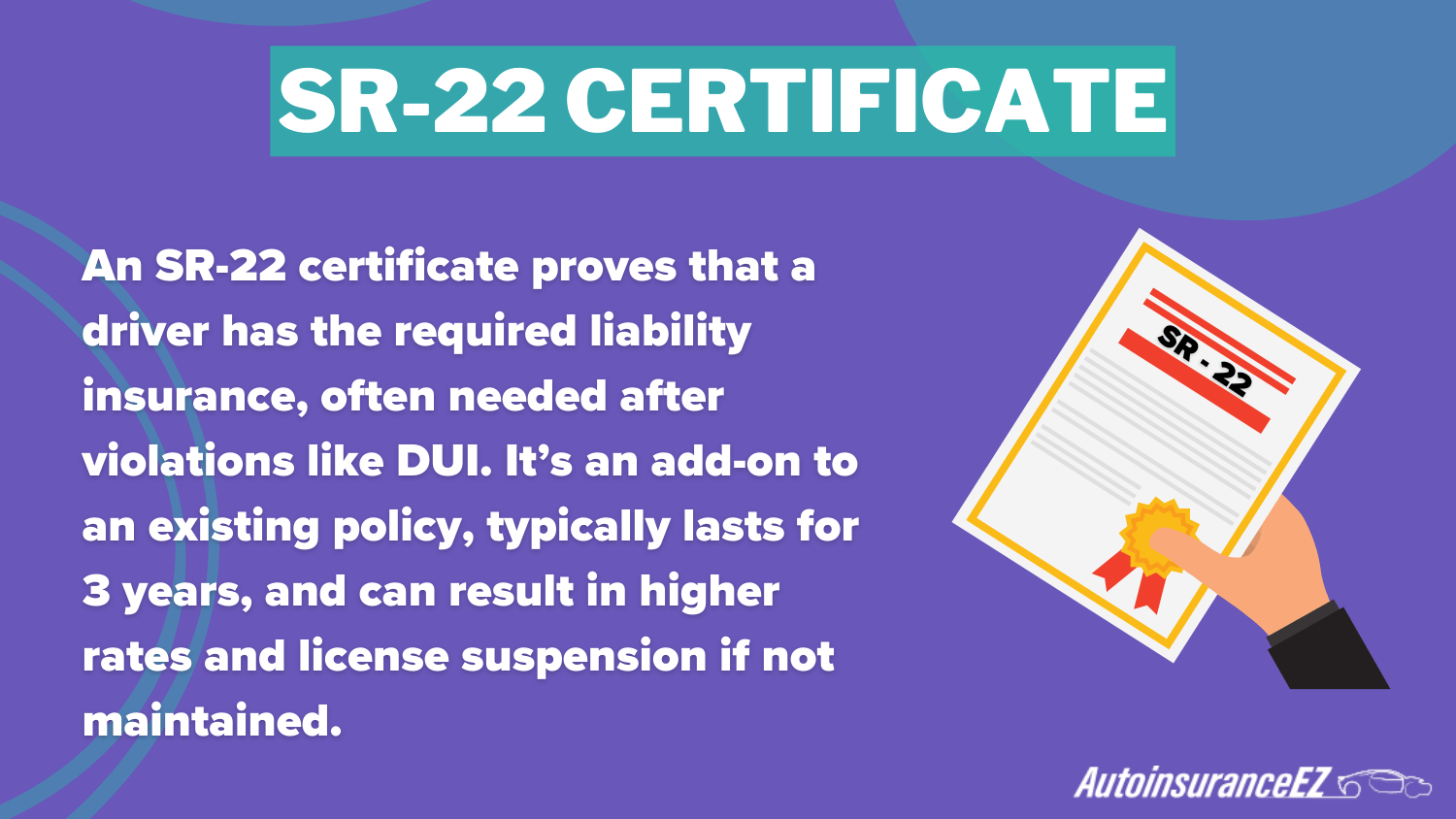

Drivers with past offenses may need an SR-22 certificate to meet Texas legal insurance requirements, making it essential to select a provider that offers this filing. Knowing factors such as credit scores, driving records, and discounts available can help Plano residents decrease their premiums while maintaining sufficient coverage.

Just enter your zip code to start shopping around for free quotes on Plano, TX auto insurance right now.

Frequently Asked Questions

How does the low accident rate affect car insurance in Plano, TX?

The low accident rate in Plano helps keep insurance premiums lower since insurers consider the city’s safer driving conditions when calculating risk. This contributes to more competitive pricing from top car insurance companies near Plano, Texas.

What are the coverage options for Plano car insurance?

Plano car insurance coverage options include liability, comprehensive, collision, uninsured motorist, and personal injury protection. Car insurance agents in Plano can help customize policies based on individual needs and budgets.

Compare auto insurance quotes for Plano, Texas by simply entering your ZIP code into our free comparison tool.

How does a DUI record affect your ability to get cheap renters insurance in Plano, TX?

A DUI record makes it hard to get cheap renters insurance in Plano because providers see DUI offenders as high-risk. This may lead to higher premiums or limited coverage options, and the same applies to car insurance after a DUI, which often comes with significantly increased rates.

How does a City of Plano’s speeding ticket impact your insurance rates?

A Plano speeding ticket cost can lead to higher insurance rates, as insurers view traffic violations as an increased risk. The more severe the violation, the greater the potential rate hike.

Where can you find cheap car insurance in Plano, TX?

You can find cheap car insurance in Plano by comparing quotes from multiple car insurance companies in Plano, taking advantage of discounts, and maintaining a clean driving record. Both local and national insurers offer various budget-friendly options.

Does Plano’s low auto theft rate help lower car insurance quotes in Plano?

Plano’s low auto theft rate contributes to lower best car insurance rates in Plano, as insurers see a reduced likelihood of theft-related claims. Additionally, installing an anti-theft device can qualify drivers for an anti-theft device discount, reducing comprehensive coverage costs.

Which companies provide top car insurance in Plano, Texas?

Top Plano, Texas car insurance providers include State Farm, Geico, Progressive, and regional insurers offering competitive rates. These companies provide strong coverage, good customer service, and various discounts.

How do you compare auto insurance in Plano, TX, for the best rates?

To compare auto insurance quotes in Plano for the best rates, get quotes from multiple providers, review coverage options, and consider available discounts. Using online tools or working with an independent agent can streamline the process.

Which factors determine the best auto insurance companies in Plano, TX?

The best auto insurance in Plano, Texas, is determined by affordability, customer service, claims handling, available coverage options, and discount programs. These factors affect your auto insurance rates, customer reviews, and financial stability ratings, which also play a key role.

Which providers offer the cheapest car insurance in Plano, TX?

Companies like GEICO, State Farm, and Progressive often offer the cheapest Plano, Texas, auto insurance. Rates vary based on driving history, vehicle type, and coverage level. Comparing multiple providers is the best way to secure the lowest rate.