Farmers Auto Insurance Review for 2025

Farmers insurance has been in business for nearly a century, and its insurance ratings include an A from A.M. Best. It provides more coverage options than its competitors, including many discounts to offset sometimes higher-than-average rates. If you want to know if Farmers is a good choice for you, then check out our Farmers auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Farmers Insurance Group

Average monthly rate for good drivers

$139A.M. Best Rating:

AComplaint level:

N/APros

- Extensive Coverage

- Discount Options

- High Customer Service Ratings

- UBI Discount

Cons

- High Premiums

- Limited Discounts

- Slow Claims

Don’t miss this Farmers auto insurance review: Whether you’re a faithful customer or on the fence, here’s the essential information you need about financial ratings, policy premiums, claims process, and long-term outlook.

With so many insurance companies vying for your business, deciding who can provide you with the best coverage at the best price can be tough.

A company’s financial ratings, market share, loss ratio, and other key factors can help you understand which insurer is the right one for you. We have all of those details for Farmers.

And the best way to quickly and easily get a Farmers quote and compare it to other top providers in your area is to simply enter your ZIP code into our free online rate tool.

Farmers History Snapshot

Farmers Insurance was founded shortly before the Great Depression in 1928 by John C. Tyler and Thomas E. Leavey in a one-room office in downtown Los Angeles.

During the Depression, the insurer was one of a very few that continued to meet consumer claims with cash rather than forking over IOUs.

Farmers continued to expand and grow as the years progressed, and by the 1950s, the company acquired New World Life Company of Seattle and became the first company west of the Mississippi to utilize IBM 705 computers for the storage and retrieval of data.

In the 1960s, Farmers was the first big player in the insurance industry to offer consumers a monthly payment plan that wasn’t a finance plan to fulfill their insurance premiums, free of interest no less.

Fast forward nearly 50 years to the present day, in which Farmers Insurance serves consumers in all 50 states with almost 21,000 employees and more than 48,000 independent agents spread across the nation.

Farmers is also staying competitive by embracing non-standard car insurance, such as usage-based programs, with its Farmers Signal app. We go into details about the app later in this article but feel free to refer to our Farmers Signal app review.

Now, the group of companies that make up Farmers Insurance Group of Companies constitute one of the largest auto, small business, and home insurers in the country, offering customers an extensive variety of additional financial and insurance services.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Farmers Insurance Rating

Any time you’re on the hunt for auto insurance and trying to compare auto insurance companies, one of the first factors you need to evaluate is the financial strength rating awarded to the carrier you’re considering.

Why do financial strength ratings matter? These ratings tell you, the consumer, how likely a company is to have the ability to fulfill its financial obligations to consumers. Company credit ratings are another invaluable component, indicating the strength of its position to pay the claims of policyholders.

Top industry names like A.M. Best and Moody’s are widely respected by insurers and consumers, as a negative financial outlook by one of these ratings entities could make all the difference in an invidiaul’s decisio of what company to select.

One point to bear in mind before we delve into the following financial ratings next in our Farmers auto insurance review: an insurance company’s rating is based on numerous elements and is considered an opinion, rather than a hard fact, which is why a carrier’s insurance ratings often vary widely by the rating agency.

Let’s take a closer look at the ratings awarded to Farmers by the agency.

A.M. Best

A.M. Best awards companies financial strength ratings, issuer credit ratings, issue credit ratings, and national scale ratings based on an individualized process that considers the company’s ability to meet its ongoing insurance and financial obligations.

For this Farmers car insurance review, we’ll examine the company’s financial strength rating and issuer credit rating.

A.M. Best has awarded Farmers an Excellent “A” financial strength rating and a long-term issuer credit rating of “a.”

An “A” financial strength rating indicates the company has an excellent ability to continue to meet its financial obligations.

An “a” long-term issuer credit rating is only awarded by A.M. Best to companies that, in their opinion, possess an excellent ability to fulfill their senior financial obligations. Based on the data provided by A.M. Best, Farmers’ current financial position appears to be secure and projects continued solvency in the long term.

Better Business Bureau

The Better Business Bureau, or BBB, is a non-profit organization that issues rankings for various businesses per its in-house Accredited Business System. The BBB’s ratings differ from A.M. Best’s in that they are issued on a state-by-state basis, rather than to the company as a whole.

The Better Business Bureau, or BBB, is a non-profit organization that issues rankings for various businesses per its in-house Accredited Business System. The BBB’s ratings differ from A.M. Best’s in that they are issued on a state-by-state basis, rather than to the company as a whole.

In the state of California where Farmers is headquartered, the BBB has awarded Farmers the highest rating awarded to companies — an A+.

If you’re curious about the criterion the BBB uses to grade companies, there are more than a half-dozen rating elements it incorporates into each rating.

The elements are the type of business, the complaint history of the company, how long the company has been in business, any failure on the company’s part to honor its commitments made to the BBB, how transparent the company is in terms of its business practices, any advertising issues, and any licensing and government actions against the company (i.e. failure to acquire a specific license).

Moody’s Rating

Moody’s rating scale grades companies from Aaa down to C, appending number modifiers to ratings ranging from Aaa through Caa.

At the time of this Farmers auto insurance review, one of the company’s chief reciprocal insurers that comprises the Farmers Insurance Group of Companies — Farmers Insurance Exchange — has been awarded a Negative outlook and A2 long-term insurance financial strength rating by Moody’s.

An “A” rating indicates that the company’s financial obligations are upper-medium grade and subject to low credit risk. The “2” modifier reveals the company ranks at the mid-range of its generic rating category.

A negative outlook indicates the company’s credit rating could be lowered in the future, whereas in contrast, a stable outlook would indicate the rating would likely remain at the same level.

As it stands now, Farmers is still judged to be in a strong position to meet its financial obligations while presenting low credit risk. Farmers Insurance Exchange’s most recent ratings were issued in 2018.

However, it’s possible that Moody’s ratings could change in the near future, and they certainly bear watching over the next several years.

S&P Rating

Standard and Poor’s (S&P) also has a specific set of criteria it uses to assess the ratings for various companies, including the credit and risk factors presented. S&P ranks companies by a letter-grade system.

Farmers Insurance has an A Issuer Credit Rating and Financial Strength Rating with S&P, indicating that its current capacity to repay its financial obligations are strong.

As of its most recent CreditWatch released in May 2019, the company has been projected to have a stable outlook.

It is worth noting, however, that “A” long-term ratings reveal the company is somewhat more vulnerable to the adverse impact of economic and circumstantial shifts than obligations awarded a higher rating. Learn more about S&P Global’s rating definitions here.

NAIC Complaint Index

Now that we’ve looked at the financial strength and creditworthiness of Farmers as assessed by numerous independent rating agencies, we’re going to examine another important factor to consider when picking an insurer — consumer complaints.

Check out the table below, indicating the Farmers Insurance Exchange consumer complaint index released by the National Association of Insurance Commissioners (NAIC), which is the chief regulatory entity for insurers in the United States.

Farmers Auto Insurance NAIC Complaint Index by Year

| Year | Total Complaints | Complaint Index | vs. U.S. Average (1.00) |

|---|---|---|---|

| 2024 | 210 | 1.15 | 0.15 |

| 2023 | 201 | 1.11 | 0.11 |

| 2022 | 188 | 1.09 | 0.09 |

| 2021 | 166 | 1.02 | 0.02 |

| 2020 | 165 | 1.01 | 0.01 |

| 2019 | 162 | 0.97 | -0.03 |

| 2018 | 145 | 0.91 | -0.09 |

| 2017 | 137 | 0.69 | -0.31 |

If you examine the NAIC’s complaint data in the table above, you’ll notice that Farmers’ complaint amount elevated slightly in 2017 from 2016, then dropped in 2018 and to its lowest point in 2019, before elevating slightly each year after that.

The carrier’s complaint index ranked better than the national median in three of the years displayed in the table, while its market share has continued to grow annually.

Farmers Insurance Exchange’s written premiums have also grown annually. Considering the carrier’s history of decline in consumer complaints followed by only slight increases, as well as its steady growth of consumer premiums written, it would appear Farmers has worked hard and it’s paying off.

J.D. Power

J.D. Power’s annual insurance study is another invaluable resource to measure how well the top carriers in the nation are meeting the needs of their consumers.

J.D. Power Auto Insurance Study

| Insurance Company | Rating |

|---|---|

| USAA | 890 |

| State Farm | 877 |

| Armed Forces | 876 |

| Liberty Mutual | 865 |

| Nationwide | 861 |

| Allstate | 856 |

| Travelers | 852 |

| American Family | 850 |

| Progressive | 846 |

| Geico | 843 |

| Farmers | 840 |

The infographic above focuses on the Central Region of the U.S. only, including the following states: Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma, and South Dakota.

According to J.D. Power’s study, Farmers ranks the lowest in terms of customer satisfaction, along with carriers like Geico and Progressive. Farmers has been awarded a total of 840 out of a 1,000-point scale.

Consumer Reports

The table below reveals the most up-to-date customer ratings released by Consumer Reports for Farmers, featuring responses from over 23,000 customer surveys. Based on the feedback from respondents, Farmers Insurance Group was awarded an 89 out of 100 reader score.

Farmers Insurance Group Consumer Reports Customer Ratings

| Claims Process | Rating |

|---|---|

| Ease of Reaching an Agent | Excellent |

| Simplicity of the Process | Very Good |

| Promptness of Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Very Good |

| Freedom to Select Repair Shop | Very Good |

| Being Kept Informed of Claim Status | Very Good |

Respondents rated Farmer’s claims process as “Very Good” in all respects, except for Ease of Reaching an Agent, which was rated as “Excellent.”

Consumer Affairs

According to ConsumerAffairs.com, Farmers has a 2.4 out of five stars for overall satisfaction rating. However, ConsumerAffairs’ ratings are based on just 75 consumer ratings submitted in the year leading up to this Farmers auto insurance review, and therefore, do not reflect the full measure of ratings provided on the site.

Some of the top advantages noted by respondents include:

- More coverage options are offered than the competition

- Roadside assistance available

- Local agents and personalized service

- Add-on options available such as Accident Forgiveness and New Car Replacement coverage

- Discounts available for defensive driving, safe driving, and more

A few disadvantages recorded were an increase in rates from year to year and fees charged to customers in addition to their policy premiums.

Farmers Overview

Next in our Farmers auto insurance review, we’re going to take a deep dive into the company’s market share in recent years, its position for the future, marketing approach, community outreach, and so much more.

Farmers Market Share

An insurance carrier’s market share comprises the percentage of its membership or total sales during a specific period of time. A company’s market share is calculated by dividing its total sales over the period being measured by the total sales of the industry (in this case, the insurance industry) during the same period.

Naturally, the more significant a carrier’s share of the insurance market is, the stronger its position in comparison to the competition. Check out the table below, containing Farmers’ market share of the U.S. insurance market between 2015-2023.

Farmers U.S. Insurance Market Share

| Year | Market Share |

|---|---|

| 2015 | 5.09% |

| 2016 | 4.80% |

| 2017 | 4.48% |

| 2018 | 4.26% |

| 2019 | 4.14% |

| 2020 | 3.95% |

| 2021 | 3.83% |

| 2022 | 3.75% |

| 2023 | 3.69% |

Farmers’ share of the U.S. insurance market declined during the nine years for which data was taken, diminishing a total of 1.4% between 2015 – 2023.

While this decline isn’t in and of itself all that significant, when you note the relatively small percentage of the U.S. market that Farmers comprises, these figures become more noteworthy.

A company’s market share can easily shift upwards again.

However, if Farmers’ share of the insurance market continues to decline in 2024 and onward, that could be cause for concern.

Read more: Allstate vs. Farmers: Best Auto Insurance

Farmers’ Position for the Future

Farmers’ excellent overall financial and credit ratings spell good news for current and future customers of this insurer.

While the company has received some mixed reviews in terms of customer service, overall, the data reveals Farmer’s dedication to meeting the needs of its consumers.

Plus, the NAIC showed a decline in consumer complaints to Farmers for a few years and then only slight increases, revealing the company’s concerted efforts to continue to meet the needs of its insureds.

Farmers’ recent decline in market share isn’t necessarily a cause for alarm but does beg close watching over the next few years.

With an extensive array of coverage options (which we’ll delve into shortly), an efficient claims reporting process, and a secure financial position, Farmers’ position for the future would appear to be one of considerable strength.

Farmers’ Online Presence

Consumers can take care of a range of insurance needs and tasks with total ease through the Farmers website. It’s easy to contact customer service by submitting a message online, or you can give them a call at 1-888-327-6335 between the hours of 7:00 a.m. – 11:00 p.m. CST Monday – Friday and 8:00 a.m. – 8:00 p.m. CST Saturday – Sunday.

You can also report a claim, locate your claims representative, or simply learn more about the claims services offered by Farmers through the website. If you need to find an agent, it’s easy to search through Farmers online directly to locate a representative nearest to you.

You can also manage your online account, register for a new one, recover an old one, and handle billing and payments through the website.

Farmers’ Commercials

Farmers’ approach to marketing and branding is sharp and effective, weaving in elements of comedy in the company’s various campaigns without overlooking its clear message to consumers. As their slogan goes “At Farmers®, we’ve seen almost everything, so we know how to cover almost anything®.”

Check out the video below, featuring one of Farmers’ funniest insurance commercials to date. If you ever get into an auto accident with a car full of clowns — Farmers has still got you covered.

In honor of the 115th birthday of the illustrious Dr. Seuss, Farmers celebrated with a special commercial and animated reading by none other than our beloved Professor Burke.

Farmers Insurance has won several awards for its commercials, including a Golden Effie Award for Sustained Success for its University of Farmers Insurance commercial ad campaign, featuring Academy Award-winner J.K. Simmons as Professor Nathaniel Burke.

Farmers in the Community

Since its founding over 90 years ago, Farmers has maintained its commitment to corporate giving and serving in its local communities.

“The measure of our worth is not what we have done for ourselves, but what we have done for others.” ~ John C. Tyler, Co-Founder

Farmers’ work in its local communities focuses on education by investing in local youth, improving education access, and job readiness. The company’s involvement in disaster resilience also promotes response, preparedness, and recovery to help rebuild communities after a disaster.

Farmers also focuses on civic engagement to help those less fortunate in its communities by meeting essential needs, like providing shelter and food.

Farmers partners with SBP, the American Red Cross, Operation BBQ Relief, and Team Rubicon Disaster Response.

Farmers’ Employees

According to Great Place to Work, 81% of Farmers employees say the company is a great place to work. Of the Farmers employee populace, 42% are millennials, 40% are Gen Xers, and 18% are baby boomers.

In 2019, Farmers ranked number 26 in Best Workplaces in Financial Services & Insurance™ and number 91 in Fortune 100 Best Companies to Work For®. The company was also named number 55 in Best Workplaces for Diversity™ 2018.

According to Glassdoor, Farmers has a 3.4-star rating out of five possible stars, based on 3.2k respondent reviews at the time of our Farmer auto insurance review.

Of respondents, 54% said that they would recommend the company to a friend and 72% said that they approve of the CEO.

PayScale reported the average salary at Farmers Insurance Group is $57,000 per year.

If you’re curious to learn more about job opportunities with Farmers, check out the company’s careers page here.

Cheap Car Insurance Rates

Next, we’re going to take an in-depth look at Farmers’ rates compared to the competition by various factors such as gender, vehicle make and model, commute rates, coverage level rates, and more. Let’s get right down to business.

Farmers Availability & Rates by State

You may quickly notice in the data below that the rates you pay for coverage with Farmers could vary widely depending on the state that you live in. Farmers covers consumers in all 50 states.

Farmers Average Monthly Auto Insurance Rates by State

| State | Rates |

|---|---|

| Alabama | $108 |

| Alaska | $65 |

| Arizona | $81 |

| Arkansas | $80 |

| California | $108 |

| Colorado | $94 |

| Connecticut | $91 |

| Delaware | $116 |

| Florida | $99 |

| Georgia | $107 |

| Hawaii | $64 |

| Idaho | $53 |

| Illinois | $64 |

| Indiana | $71 |

| Iowa | $65 |

| Kansas | $81 |

| Kentucky | $98 |

| Louisiana | $124 |

| Maine | $59 |

| Maryland | $107 |

| Massachusetts | $78 |

| Michigan | $209 |

| Minnesota | $67 |

| Mississippi | $82 |

| Missouri | $85 |

| Montana | $70 |

| Nebraska | $69 |

| Nevada | $103 |

| New Hampshire | $59 |

| New Jersey | $113 |

| New Mexico | $69 |

| New York | $137 |

| North Carolina | $77 |

| North Dakota | $76 |

| Ohio | $70 |

| Oklahoma | $91 |

| Oregon | $75 |

| Pennsylvania | $76 |

| Rhode Island | $76 |

| South Carolina | $88 |

| South Dakota | $67 |

| Tennessee | $72 |

| Texas | $90 |

| Utah | $103 |

| Vermont | $87 |

| Virginia | $63 |

| Washington | $69 |

| Washington D.C. | $111 |

| West Virginia | $79 |

| Wisconsin | $58 |

| Wyoming | $82 |

Coverage with Farmers costs the most in Michigan, at $209 a month on average, and the least in Idaho, at $53 a month on average.

Next, we’re going to take a look at the top 10 insurers in the U.S. insurance market (including Farmers) to see how these rates compare.

Comparing the Top 10 Companies by Market Share

In several states, Farmers is on the higher end of the spectrum in terms of rates when compared to the competition.

In Arkansas and Florida, Farmers charges the highest rates of all the carriers for whom data was measured.

In both states, Farmers’ rates are anywhere from approximately $1,300-$1,400 higher annually than the state median cost of coverage.

Top 10 Companies Average Monthly Auto Insurance Rates by State

| State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| AK | $135 | $105 | $127 | $76 | $164 | $108 | $97 | $65 | $93 | $60 |

| AL | $108 | $105 | $133 | $89 | $162 | $96 | $112 | $108 | $79 | $56 |

| AR | $162 | $137 | $165 | $91 | $99 | $128 | $131 | $80 | $111 | $55 |

| AZ | $180 | $114 | $135 | $65 | $178 | $116 | $84 | $81 | $104 | $63 |

| CA | $199 | $138 | $167 | $101 | $216 | $142 | $132 | $108 | $122 | $74 |

| CO | $166 | $118 | $163 | $94 | $92 | $107 | $120 | $94 | $114 | $78 |

| CT | $196 | $125 | $151 | $62 | $201 | $112 | $133 | $91 | $83 | $77 |

| DC | $241 | $115 | $139 | $69 | $180 | $172 | $115 | $111 | $102 | $48 |

| DE | $207 | $130 | $157 | $101 | $494 | $144 | $90 | $116 | $82 | $43 |

| FL | $183 | $188 | $227 | $89 | $161 | $103 | $153 | $99 | $166 | $47 |

| GA | $165 | $124 | $149 | $61 | $263 | $152 | $115 | $107 | $110 | $71 |

| HI | $118 | $82 | $99 | $60 | $128 | $84 | $78 | $64 | $72 | $44 |

| IA | $126 | $95 | $82 | $81 | $116 | $73 | $75 | $65 | $92 | $55 |

| ID | $128 | $93 | $92 | $57 | $79 | $82 | $91 | $53 | $57 | $40 |

| IL | $176 | $114 | $117 | $47 | $76 | $93 | $89 | $64 | $87 | $62 |

| IN | $140 | $107 | $79 | $63 | $183 | $97 | $69 | $71 | $69 | $43 |

| KS | $160 | $114 | $144 | $75 | $174 | $92 | $127 | $81 | $87 | $56 |

| KY | $236 | $164 | $197 | $80 | $168 | $184 | $111 | $98 | $139 | $72 |

| LA | $206 | $176 | $212 | $141 | $274 | $181 | $161 | $124 | $156 | $98 |

| MA | $143 | $99 | $120 | $72 | $155 | $103 | $95 | $78 | $88 | $53 |

| MD | $201 | $116 | $140 | $135 | $181 | $106 | $121 | $107 | $103 | $80 |

| ME | $108 | $84 | $117 | $37 | $120 | $87 | $94 | $59 | $61 | $37 |

| MI | $406 | $204 | $335 | $99 | $424 | $257 | $152 | $209 | $183 | $107 |

| MN | $160 | $93 | $108 | $90 | $375 | $87 | $101 | $67 | $94 | $68 |

| MO | $148 | $106 | $135 | $90 | $129 | $66 | $98 | $85 | $114 | $50 |

| MS | $147 | $120 | $145 | $72 | $119 | $96 | $120 | $82 | $88 | $54 |

| MT | $154 | $125 | $164 | $82 | $59 | $88 | $171 | $70 | $111 | $50 |

| NC | $169 | $82 | $99 | $69 | $82 | $111 | $32 | $77 | $99 | $44 |

| ND | $136 | $145 | $107 | $61 | $398 | $77 | $110 | $76 | $88 | $44 |

| NE | $125 | $112 | $130 | $92 | $179 | $77 | $95 | $69 | $102 | $56 |

| NH | $128 | $77 | $93 | $50 | $198 | $77 | $63 | $59 | $69 | $41 |

| NJ | $157 | $115 | $231 | $74 | $279 | $119 | $93 | $113 | $136 | $61 |

| NM | $158 | $103 | $131 | $90 | $161 | $96 | $86 | $69 | $91 | $65 |

| NV | $165 | $140 | $155 | $110 | $111 | $112 | $82 | $103 | $91 | $69 |

| NY | $147 | $137 | $165 | $78 | $200 | $164 | $96 | $137 | $175 | $85 |

| OH | $120 | $62 | $96 | $59 | $106 | $114 | $85 | $70 | $63 | $41 |

| OK | $135 | $118 | $136 | $109 | $184 | $122 | $110 | $91 | $105 | $68 |

| OR | $153 | $106 | $111 | $93 | $141 | $111 | $78 | $75 | $97 | $58 |

| PA | $148 | $108 | $131 | $68 | $219 | $86 | $148 | $76 | $75 | $57 |

| RI | $189 | $151 | $183 | $125 | $235 | $190 | $116 | $76 | $103 | $65 |

| SC | $133 | $118 | $166 | $79 | $185 | $118 | $105 | $88 | $105 | $69 |

| SD | $136 | $151 | $113 | $57 | $230 | $76 | $105 | $67 | $97 | $58 |

| TN | $144 | $102 | $86 | $78 | $184 | $118 | $92 | $72 | $88 | $58 |

| TX | $201 | $176 | $137 | $105 | $178 | $154 | $121 | $90 | $101 | $62 |

| UT | $117 | $105 | $115 | $73 | $119 | $93 | $95 | $103 | $88 | $50 |

| VA | $103 | $83 | $100 | $69 | $129 | $86 | $61 | $63 | $73 | $43 |

| VT | $142 | $85 | $103 | $38 | $100 | $77 | $181 | $87 | $75 | $42 |

| WA | $114 | $91 | $102 | $75 | $92 | $70 | $60 | $69 | $81 | $46 |

| WI | $123 | $63 | $109 | $62 | $84 | $226 | $94 | $58 | $72 | $47 |

| WV | $162 | $115 | $139 | $83 | $196 | $104 | $110 | $79 | $102 | $67 |

| WY | $155 | $111 | $130 | $111 | $75 | $114 | $106 | $82 | $98 | $57 |

Not only is Farmers’ median annual rates about $250 more than the national median, but Farmers charges the second-highest average annual rates of all when compared to the average annual premiums charged by the other nine carriers.

Average Farmers Male vs. Female Car Insurance Rates

A growing number of states have made it illegal for insurers to utilize gender as a factor when setting rates. These states include Massachusetts, North Carolina, Montana, Hawaii, Pennsylvania, and parts of Michigan.

Many states still allow the practice of setting rates by gender, so be aware of the fact that depending on where you live, your gender could still impact how much you pay for auto insurance.

Check out the table below, indicating the various rates charged by the top 10 insurers in the U.S. insurance market based on age and gender alone.

Auto Insurance Average Monthly Rates by Gender

| Insurance Company | Female (Age 17) | Male (Age 17) | Female (Age 25) | Male (Age 25) | Female (Age 35) | Male (Age 35) | Female (Age 60) | Male (Age 60) |

|---|---|---|---|---|---|---|---|---|

| Allstate | $774 | $887 | $285 | $298 | $263 | $260 | $243 | $249 |

| American Family | $500 | $678 | $191 | $225 | $184 | $185 | $166 | $168 |

| Farmers | $710 | $762 | $246 | $253 | $213 | $213 | $195 | $204 |

| Geico | $471 | $523 | $198 | $189 | $192 | $193 | $187 | $190 |

| Liberty Mutual | $968 | $1,143 | $330 | $375 | $317 | $321 | $287 | $307 |

| Nationwide | $480 | $598 | $224 | $241 | $197 | $199 | $178 | $185 |

| Progressive | $724 | $802 | $225 | $230 | $191 | $181 | $166 | $171 |

| State Farm | $496 | $610 | $195 | $213 | $173 | $173 | $156 | $156 |

| Travelers | $776 | $1,071 | $194 | $208 | $182 | $183 | $171 | $173 |

| USAA | $401 | $449 | $166 | $177 | $129 | $128 | $121 | $121 |

If you compare the rates Farmers assess to insureds in each age and gender category against the competition, you’ll see their rates are on the mid to higher range of the rates charged by the top 10 carriers.

As an example, Farmers charges the third-highest rates to 35-year-old male motorists of the carriers listed. For teen male drivers, Farmers assess the sixth-most-expensive premiums of the top 10 insurers.

Similar to the other top insurers listed, Farmers charges its highest rates to teen drivers and its lowest to 60-year-old motorists.

Read more: American Family vs. Farmers: Best Auto Insurance

Average Farmers Rates by Make & Model

The car you drive could also affect how much you pay for insurance, as evidenced by the data our researchers collected here. Let’s look at a few different car makes and models to see how Farmers’ rates stack up against the competition.

Auto Insurance Average Monthly Rates by Make & Model

| Make and Model | Allstate | American Family | Farmers | Geico | Nationwide | Liberty Mutual | Progressive | State Farm | Travelers | USAA | Grand Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Chevrolet Equinox | $369 | $287 | $341 | $258 | $298 | $486 | $326 | $267 | $335 | $213 | $316 |

| Chevrolet Silverado | $412 | $291 | $314 | $278 | $277 | $520 | $311 | $285 | $392 | $211 | $327 |

| Ford F-150 | $458 | $291 | $366 | $278 | $281 | $499 | $330 | $291 | $368 | $238 | $340 |

| GMC Sierra | $396 | $265 | $367 | $258 | $296 | $489 | $369 | $252 | $368 | $201 | $324 |

| Honda Civic | $448 | $310 | $398 | $278 | $280 | $557 | $377 | $266 | $388 | $202 | $347 |

| Honda CR-V | $369 | $287 | $341 | $258 | $298 | $486 | $326 | $267 | $335 | $213 | $316 |

| Hyundai Elantra | $396 | $265 | $367 | $258 | $296 | $489 | $369 | $252 | $368 | $201 | $324 |

| Jeep Grand Cherokee | $360 | $277 | $311 | $258 | $293 | $485 | $304 | $269 | $365 | $205 | $310 |

| Nissan Rogue | $369 | $287 | $341 | $258 | $298 | $486 | $326 | $267 | $335 | $213 | $316 |

| Ram 1500 | $458 | $291 | $366 | $278 | $281 | $499 | $330 | $291 | $368 | $238 | $340 |

| Tesla Model Y | $412 | $291 | $314 | $278 | $277 | $520 | $311 | $285 | $392 | $211 | $327 |

| Toyota Camry | $448 | $310 | $398 | $278 | $280 | $557 | $377 | $266 | $388 | $202 | $347 |

| Toyota RAV4 | $360 | $277 | $311 | $258 | $293 | $485 | $304 | $269 | $365 | $205 | $310 |

For insureds with a Ford F-150, Farmers charges the fourth-most-expensive rates of the top 10 carriers. Take a look at what these carriers charge consumers who own a Honda Civic: Farmers charges the third-highest rates of all.

Read more: Farmers vs. Geico: Best Auto Insurance

Average Farmers Commute Rates

How far is your commute to work each day? Depending on the insurer you pick, you could end up paying higher rates if you have a longer commute to the office.

Average Monthly Commute Rates

| Insurance Company | 10 Miles Commute. 6000 Monthly Mileage | 25 Miles Commute. 12000 Monthly Mileage |

|---|---|---|

| Allstate | $34 | $34 |

| American Family | $24 | $24 |

| Farmers | $29 | $29 |

| Geico | $22 | $23 |

| Liberty Mutual | $42 | $43 |

| Nationwide | $24 | $24 |

| Progressive | $28 | $28 |

| State Farm | $22 | $23 |

| Travelers | $31 | $31 |

| USAA | $17 | $18 |

Those insured with Farmers will see little if any difference in their monthly rates if they have a 25-mile commute versus a 10-mile commute. That’s the same situation with Allstate, American Family, Nationwide, Progressive, and Travelers.

Compare that to companies like Geico, Liberty Mutual, State Farm, and USAA, which charge a slight increase in monthly rates to insureds with longer commutes.

Average Farmers Coverage Level Rates

The coverage levels you select for your policy can and will impact whether you notice lower or higher auto insurance rates. The higher the coverage level you select, the higher the level of risk the insurer is taking on in the event you file a covered claim.

As such, you can expect to see a notable difference in rates in most cases with any insurer you pick if you opt for high over low coverage levels.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $386 | $408 | $428 |

| American Family | $281 | $295 | $285 |

| Farmers | $327 | $347 | $375 |

| Geico | $250 | $268 | $286 |

| Liberty Mutual | $484 | $505 | $530 |

| Nationwide | $283 | $287 | $292 |

| Progressive | $311 | $335 | $363 |

| State Farm | $255 | $272 | $288 |

| Travelers | $352 | $372 | $385 |

| USAA | $200 | $212 | $222 |

Farmers charges insureds with high coverage levels roughly $48 more a month than individuals who opt for low levels of coverage. Let’s compare those rates again to the examples mentioned before of Liberty Mutual and State Farm.

Liberty Mutual charges insureds with high coverage levels about $46 more a month than individuals with low coverage levels. State Farm shows an approximate $33 a month rate difference for higher coverage.

If you look at the rates charged by each insurer in the far left column for “Low” coverage, you’ll note that Farmers assesses the fourth-highest rates of all the carriers listed.

In the far right column indicating the rates charged by the top 10 insurers for “High” coverage, Farmers ranks number four again for the highest rates.

To sum it up, Farmers comes in mid-range when compared to the competition for rates charged based on the chosen coverage level alone.

Read more: Farmers vs. Liberty Mutual: Best Auto Insurance

Average Farmers Credit History Rates

The state of your credit will impact how much you pay for coverage in most states, as insurers look at your credit history as a direct indicator of your likelihood to fulfill your policy premiums consistently and on time.

Apart from a few states like Hawaii, Massachusetts, and California that ban credit scoring as a factor when determining consumer rates, having healthy credit could make the difference between manageable rates and skyrocketing insurance premiums.

Auto Insurance Monthly Rates by Credit History

| Insurance Company | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $322 | $382 | $541 |

| American Family | $224 | $264 | $372 |

| Farmers | $306 | $325 | $405 |

| Geico | $203 | $249 | $355 |

| Liberty Mutual | $366 | $467 | $734 |

| Nationwide | $244 | $271 | $340 |

| Progressive | $302 | $330 | $395 |

| State Farm | $181 | $238 | $413 |

| Travelers | $338 | $362 | $430 |

| USAA | $152 | $185 | $308 |

According to a 2023 study by Experian, the average national credit score was 715. In addition, this study noted that more Americans have high credit scores than individuals with low credit scores, revealing that 42% of Americans have a super-prime credit score and 35% have a subprime credit score.

If you take a look at the data shown in the table above, you’ll see the significant disparity in rates that can occur if you have good versus poor credit.

In the case of Farmers, insureds with poor credit can expect to pay roughly $99 more a month year for coverage than consumers with good credit.

If you think that rate difference is steep, compare it to the change in rates assessed by Liberty Mutual, which charges roughly $368 more per month to individuals with poor credit than they do to consumers with good credit. With State Farm, the rate difference still comes to about $233 a month.

If you compare Farmers’ rate gap for insureds with poor versus good credit to the other nine insurers listed, the company comes in again near the mid-range.

Read more: Farmers vs. Nationwide: Best Auto Insurance

Average Farmers Driving Record Rates

It’s probably not shocking to you that your driving record will affect how much you pay for coverage, as an accident or violation on your record could indicate to a carrier that you present a higher risk to insure.

Let’s see how Farmers, and the other top insurers in the U.S. market, adjust consumer rates based on their driving record alone.

Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $318 | $416 | $374 | $522 |

| American Family | $224 | $310 | $252 | $361 |

| Farmers | $288 | $377 | $340 | $393 |

| Geico | $179 | $266 | $220 | $406 |

| Liberty Mutual | $398 | $517 | $475 | $634 |

| Nationwide | $229 | $283 | $259 | $379 |

| Progressive | $283 | $398 | $334 | $331 |

| State Farm | $235 | $283 | $266 | $303 |

| Travelers | $287 | $357 | $355 | $478 |

| USAA | $161 | $210 | $183 | $292 |

Farmers charges its highest rates (based on driving record) to drivers with one DUI in their driving history. Insureds with one DUI compared to a clean driving record could expect to see a roughly $105 monthly rate difference with Farmers.

With some insurers, the rate difference is even more significant. For instance, Liberty Mutual charges insureds with one DUI compared to a clean record of about $236 higher rates per month.

In the case of USAA, a company known for offering some of the most cost-effective rates of the top insurers in the industry, the rate difference for insureds with one DUI versus a clean record is still approximately $121 a month.

Read more: Farmers vs. USAA: Best Auto Insurance

Long story short — driving responsibly isn’t just about keeping you and other motorists safe. Safe driving habits could save you thousands of dollars per year in insurance premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Coverages Offered

If you’re considering coverage through Farmers, it’s important to understand the types of options you can include in your policy, including coverages that could be mandatory in your state, plus all those policy extras.

Types of Coverages Offered

Let’s take a closer look at the coverages available to you if you decide to purchase your auto insurance through Farmers.

Liability Coverage: Pays for any bodily injury and property damage incurred by others caused by a covered loss that you are responsible for.

Collision Coverage: Pays to help cover the costs of repairs to your vehicle if it incurs damage or to compensate you for the value of your vehicle in the event of a total loss.

Comprehensive Coverage: Pays to help cover the costs of damage to your vehicle caused by something other than a crash.

Uninsured/Underinsured Motorist Coverage: Pays for the costs of bodily injuries you incur when they stem from an at-fault driver who is uninsured. Uninsured motorist coverage would pay for your damages up to and until your policy limits are exhausted.

Underinsured motorist coverage helps to pay for the costs associated with your injuries caused by an at-fault driver who has some insurance, but not sufficient to pay for the full extent of your damages.

Medical Payments (MedPay) Coverage: Pays for medical expenses stemming from a covered accident, no matter who was at fault.

Personal Injury Protection (PIP) Coverage: When available, this type of coverage could help pay for rehabilitation and medical expenses, in addition to lost wages.

Personal Liability Umbrella Coverage: Provides additional liability coverage beyond the liability limits on your personal policy. You can purchase coverage in increments of $1 million all the way up to $10 million.

New Car Replacement Coverage®: If your car is ruled a total loss within the initial two years of model ownership and has less than 24,000 miles on it, this coverage would reimburse you for the costs of replacing your vehicle, minus any deductible. The replacement would be a new vehicle of the same make and model.

Customized Equipment Coverage: If you install aftermarket features in your vehicle, customized equipment coverage would help to pay if this add-on equipment gets damaged. Customized equipment coverage through Farmers is available for any car covered by collision and comprehensive coverage.

Towing and Roadside Service Coverage: If you get locked out of your vehicle or it breaks down, roadside assistance coverage would give you 24/7 access to services including flat tire change, locksmith services, dead or weak battery jump-starts, towing services to a nearby (qualified) repair shop, roadside winching, and emergency roadside connect to law enforcement, medical, or fire assistance.

Accident Forgiveness Coverage: For every three years you drive accident-free, Farmers would forgive one at-fault accident, which means the crash wouldn’t impact your premium.

Loss of Use Coverage: Under this add-on coverage, Farmers would offer a flat sum if your car has a qualified disablement for public transit, cabs, or a rental. The disablement must be covered by your collision or comprehensive coverage.

Glass Buy-Back Coverage: If your windshield gets cracked, Farmers will put you in touch with a vehicle glass company near you so you can get back on the open road.

Car Rental Reimbursement Coverage: If you get into an accident and require the use of a rental car, Farmers will help you locate a rental quickly. This coverage also includes an automatic deposit waiver, free pickup and delivery, and billing direct to Farmers. Car rental reimbursement would be available for up to 30 days for a covered loss under your comprehensive or collision insurance.

Original Equipment Manufacturer Coverage: When you sustain vehicle damage in a covered accident, this coverage would pay for the cost of repairs with original factory replacement parts (when available). You must have comprehensive and collision coverage to add original equipment manufacturer coverage to your policy, and your vehicle must be no more than 10 years older than the present calendar year.

Factors That Affect Your Rate

If you have more than one policy with Farmers, such as home insurance and auto insurance, bundling them together could earn you a discount on coverage. Check with your agent when purchasing coverage to see what insurance coverages make the most sense for your needs.

Getting the Best Rate with Farmers

Farmers sells its insurance products to over 90% of the country; odds are that there is a Farmers office located near you. However, because of different laws in every state, not all discounts may be available in all areas, or for the maximum amount listed here.

Note that some of your Farmers auto insurance discounts only apply to certain parts of your policy (such as comprehensive/collision or medical payments) as opposed to the entire policy as a whole.

Tracey L. Wells Licensed Insurance Agent & Farmers Insurance Agency Owner

Be sure to inquire with your agent about all discounts available to you when structuring your policy. You can help offset your Farmers insurance quote by taking full advantage of the range of discounts at your disposal. Here’s a look at some of Farmers’ many auto insurance discounts:

| Discount Type | Discount % |

| Multi-Policy (Auto + Home) | 17% |

| Multi-Policy (Auto + Renter) | 5% |

| Good Driver | 20% |

| Alternative Fuel Vehicle | 10% |

| Good Student | 10% |

| Student Away at School | 14% |

| Defensive Driver | 5% |

| Occupation Affinity Group | 5% |

| Anti-Lock Brake | 5% |

| Advance Purchase Credit | 3-10% |

Farmers offers some discounts that many of its competitors don’t. Read more about discounts in our articles Federal Employee Discount: How much can you save?, Occupation Discount: How much can you save?, and Senior Driver Discount: How much can you save?

Farmers’ Programs

You could save big on coverage with Farmers — just by being a safe driver. With the Signal® app, you could receive a 5% discount just for using it, and earn as much as 30% off your policy at your next renewal.

It’s possible to increase your discount if the drivers on your policy using Signal® are under 25. Upon enrolling in Signal®, if you complete 10 qualifying trips with the app, the initial 5% discount will be applied to your policy.

Signal® is only available in a limited number of states. The app isn’t available in Florida, Hawaii, New York, or South Carolina.

Canceling Your Policy

If you purchase coverage with Farmers and need to cancel your policy for any reason, here’s what you need to know to navigate the process smoothly and without stress.

Cancellation Fee

Farmers doesn’t indicate online whether there is a cancellation fee, so it’s vital to speak with your agent directly to confirm.

Refund Possibility

Most insurers will refund the unused amount of your policy premiums if you’ve paid it in full, so be sure to ask your agent when you call regarding your cancellation.

How to Cancel (Step-by-Step Guide)

Here’s how to cancel your policy with Farmers. Just remember — unless you don’t plan on driving, make sure you have a new policy lined up so you don’t experience a gap in coverage time.

Step #1 – Contact Farmers

You can either contact a local agent directly or get in touch with the customer service department to cancel your policy. Click through the Farmers Find an Agent page to locate an agent near you or if you’re unsure of your agent’s information.

You can also contact customer service directly at 1-888-327-6335. The customer service department is available Monday – Friday from 7:00 a.m. – 11:00 p.m. CST and Saturday – Sunday from 8:00 a.m. – 8:00 p.m. CST.

Step #2 – Be Ready to Provide a Reason For Cancellation

Your agent will almost certainly request a reason for the cancellation. Perhaps you’re switching to a different carrier with more affordable rates, you’ll be selling your car and don’t intend to drive, or you’re unhappy with Farmers.

If you’re looking for ways to reduce the cost of coverage, the agent could help you evaluate various discounts and other options that could decrease your premiums and keep your business as a valued customer.

Step #3 – Submit Any Required Documentation

You should never just stop making payments or let your coverage lapse instead of calling Farmers directly to cancel. If you have a lapse or gap in coverage, you could easily be subject to additional fines and fees.

Depending on the laws in your state, your agent could request you provide written notice of cancellation and other documentation, like a vehicle bill of sale, proof of license forfeiture, or a copy of your new policy.

Step #4 – Fulfill Any Requirements Under State Law

Be sure to get in touch with your state’s DMV to find out about any legal obligations regarding your auto policy cancellation. Some states require you to carry insurance for your vehicle to be plated or registered.

A number of states require you to provide proof of coverage to your insurer when canceling the policy.

Step #5 – Confirm Cancellation and Request Available Refunds

Request written confirmation of the cancellation of your policy, and if you are receiving a refund, ensure this is included in the confirmation. If, for some reason, you’re behind on your policy payments or added a new car to the policy, you’ll be required to pay the amount owed before Farmers can process your cancellation.

After you receive the confirmation notice, log into your online account to confirm the policy is officially canceled.

Upon receiving the final cancellation confirmation, be sure to contact the lienholder (if you’re making payments on your vehicle), as they might require you to carry specific coverages such as collision or comprehensive coverage.

Also, get in touch with your bank to cancel any automatic payments you had previously scheduled.

When You Can Cancel

You can cancel your policy at any time, but typically, the best time to switch insurers is before the renewal date of your policy and before the next monthly payment.

Read more: How can I cancel my auto insurance policy with Farmers Insurance?

How to Make a Claim

If you need to make a claim after an accident, Farmers makes the process efficient and straightforward. Keep reading our Farmers auto insurance review to learn more about the claims reporting process, as well as the company’s written premiums and loss ratio in recent years.

Ease of Making a Claim

You have multiple options to report a claim, depending on which is most convenient for you. Report a claim online through your account; text REPORTCLAIM to 29141, where you’ll receive a link to initiate the claims process; use the mobile app; or contact the Claim Contact Center directly at 1-800-435-7764. You could also contact your agent to file a claim.

Here’s a quick overview of the claims process with Farmers:

First, report your claim to Farmers, either online, to your agent, through the app, via text, or by contacting Claims Services. A claims representative will get in touch to explain how your claim will proceed and to:

- Get initial information about the loss

- Suggest options to prevent additional damage

- Go over your policy coverages and relevant endorsements

- Set up an in-person appointment, if needed, to adjust the claim

The claims representative would determine whether your loss is covered and collect information about your injuries and/or damages. The representative would investigate by:

- Interviewing witnesses and other individuals who were involved

- Studying documentation

- Taking pictures and samples

- Conducting a physical vehicle inspection, if required

The representative would examine your policy coverages, determine the damage amount, and make any necessary payouts. Farmers could also re-inspect your car if required and provide supplemental payment if additional damages are found by the repair facility or vendor.

Your representative would often issue payment in accordance with the repair estimate, but this could take longer, depending on the nature of your claim. Also, depending on your state’s laws and your coverages, payment for medical bills associated with your claim could be issued.

In the event your damages are not covered under your policy, Farmers would provide a letter explaining the denial. Once the claim is resolved under the terms of your auto policy, Farmers will close the claim.

Premiums Written & Loss Ratio

The table below shows the premiums written year-to-year and the loss ratio experienced by Farmers between 2015-2023. Not only did Farmers’ premiums written increase each year, but its loss ratio steadily declined.

Farmers Insurance Premiums Written & Loss Ratio

Year Premiums Written Loss Ratio

2015 $9,701,153,000 5.09%

2016 $10,304,622,000 4.80%

2017 $10,364,451,000 4.48%

2018 $10,496,476,000 4.26%

2019 $11,010,000,000 3.92%

2020 $11,250,000,000 3.89%

2021 $11,530,000,000 3.94%

2022 $12,020,000,000 4.10%

2023 $12,200,000,000 4.15%

Compare RatesStart Now →

| Year | Premiums Written | Loss Ratio |

|---|---|---|

| 2015 | $9,701,153,000 | 5.09% |

| 2016 | $10,304,622,000 | 4.80% |

| 2017 | $10,364,451,000 | 4.48% |

| 2018 | $10,496,476,000 | 4.26% |

| 2019 | $11,010,000,000 | 3.92% |

| 2020 | $11,250,000,000 | 3.89% |

| 2021 | $11,530,000,000 | 3.94% |

| 2022 | $12,020,000,000 | 4.10% |

| 2023 | $12,200,000,000 | 4.15% |

The smaller a company’s loss ratio, the fewer claims they are paying out in proportion to what they are earning back in earned premiums — which is great news for Farmers. Not only that, but Farmers’ steady increase in written premiums means increased revenue and a larger consumer base.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

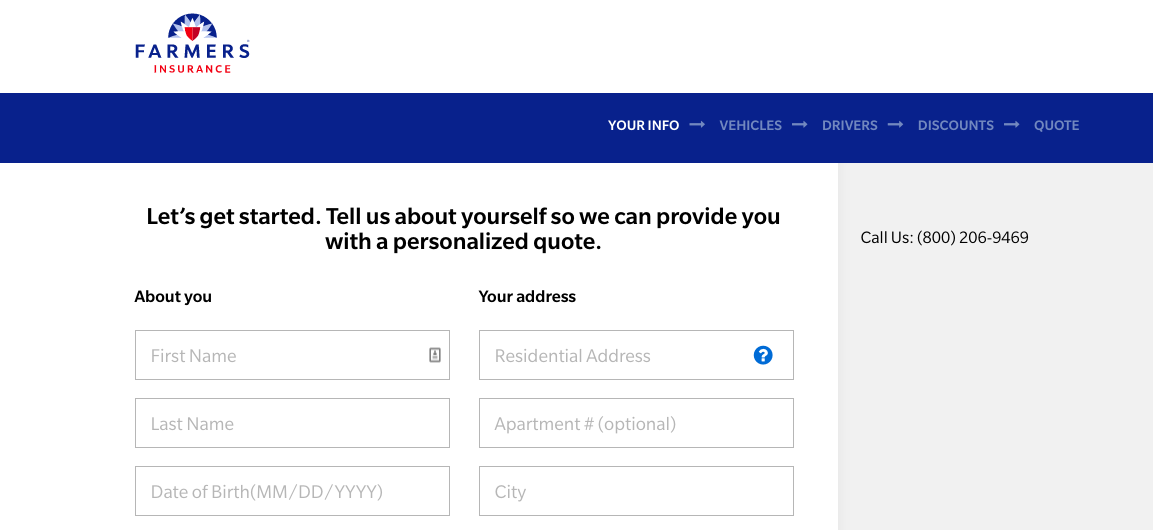

How to Get a Quote Online

Here’s your quick and easy guide to accessing your personalized quote from Farmers.

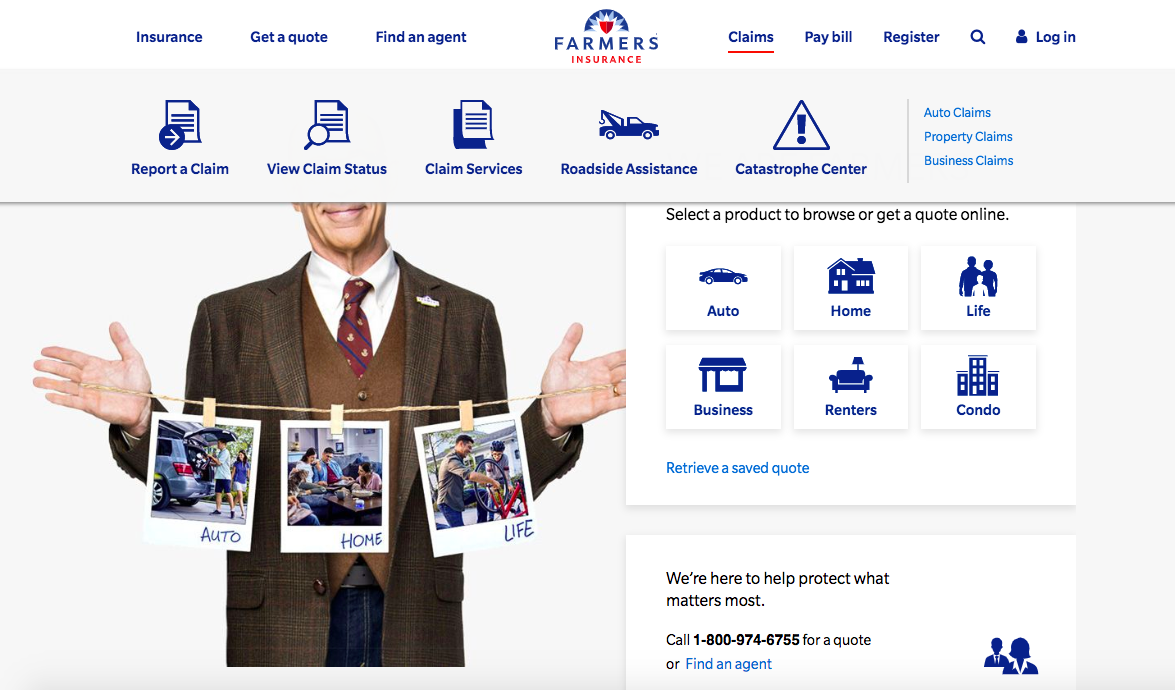

Step #1 – Go to the Farmers Website

Open a new tab or window on your computer and navigate to the Farmers website.

Click the auto product icon.

Step #2 – Enter Your ZIP Code

Enter your ZIP code and select “Get a Quote.”

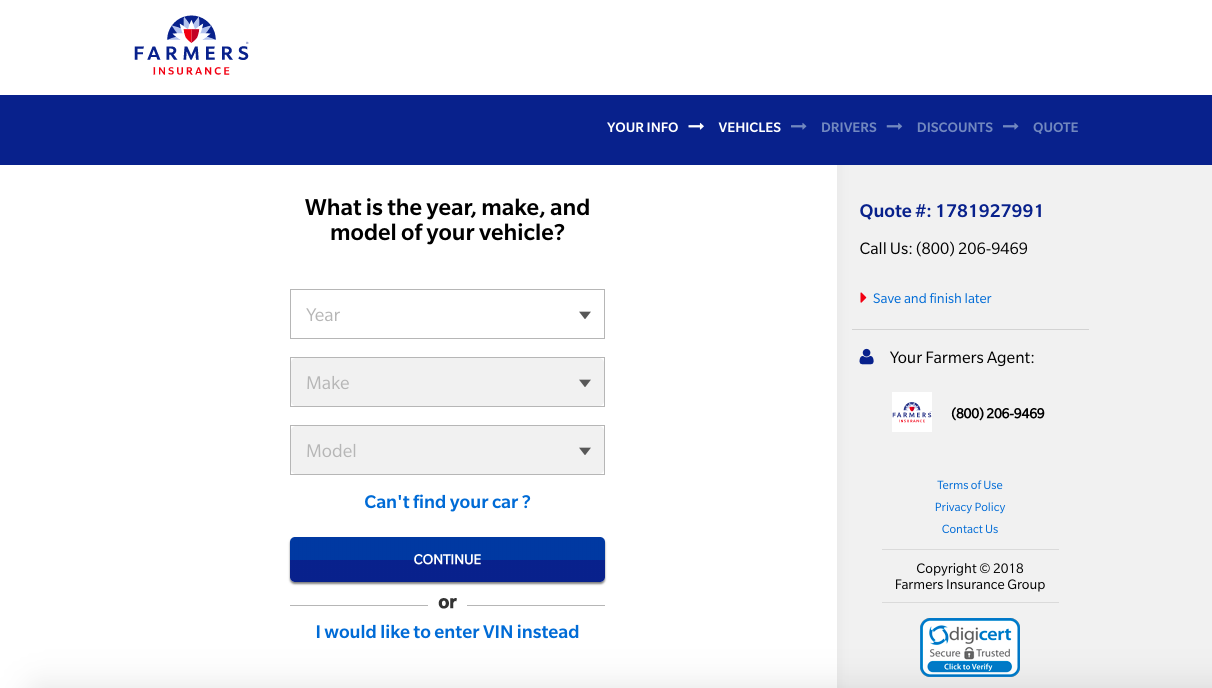

Step #3 – Enter Your Name, Address, and Date of Birth

On the next page, you’ll be prompted to enter personal information including your name, address, DOB.

Complete the boxes and select “Start Quote” to proceed.

Step #4 – Complete Vehicle and Driver Information

Now you’ll need to enter your vehicle information to proceed with your quote. Enter the year, make, and model of the vehicle, then select “Continue.”

You will also be prompted be submit additional information about your vehicle based on the initial details you provide, such as whether it is financed, leased, or owned, and your usage (i.e. commuting, business, pleasure).

You can add more than one vehicle as you need to.

After you complete the vehicle details for the cars you want to include in your quote, you’ll be prompted to fill in driver details.

Personal information requested includes your marital status, occupation, and social security number (optional).

Contact information requested includes your email and phone number.

And driving-related information includes your current insurance information (i.e. length of continuous coverage, policy limits, policy expiration date, etc.), the age at which you were first licensed, whether you require proof of financial responsibility (such as an SR-22), if you completed a driver safety course in the past three years, and your accident history.

Once finished, select “Add this Driver.” You can add more drivers if you like or proceed to the next section, where you’ll be required to select “Yes” or “No” regarding whether your vehicle will be used for rideshare purposes like Uber or Lyft.

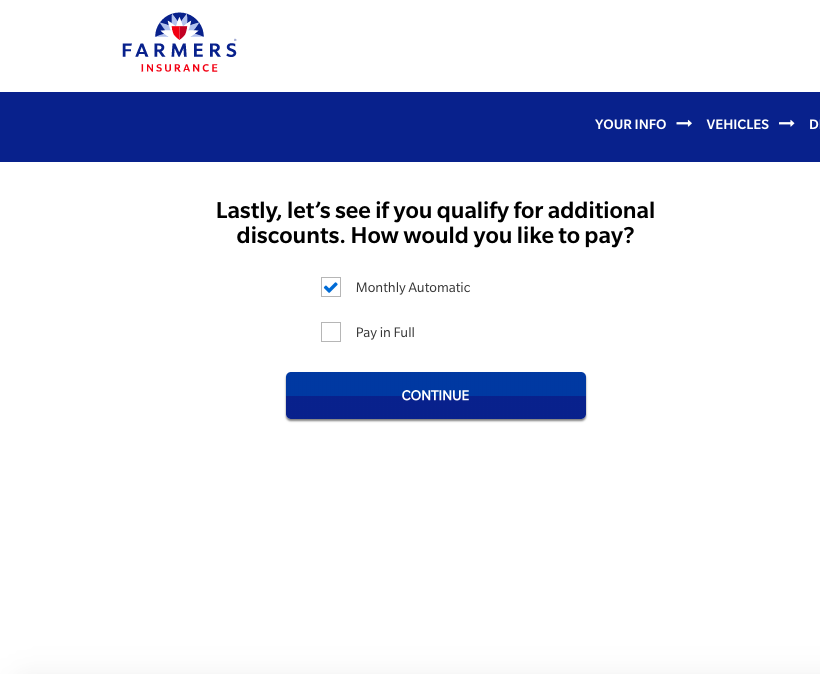

Step #5 – See If You Qualify For Discounts, Bundle, and Access Your Quote

As we detailed above, Farmers features a lot of great discounts. So why not see which ones are available to you?

Find out if you qualify for discounts depending on factors such as your payment preference and homeownership status.

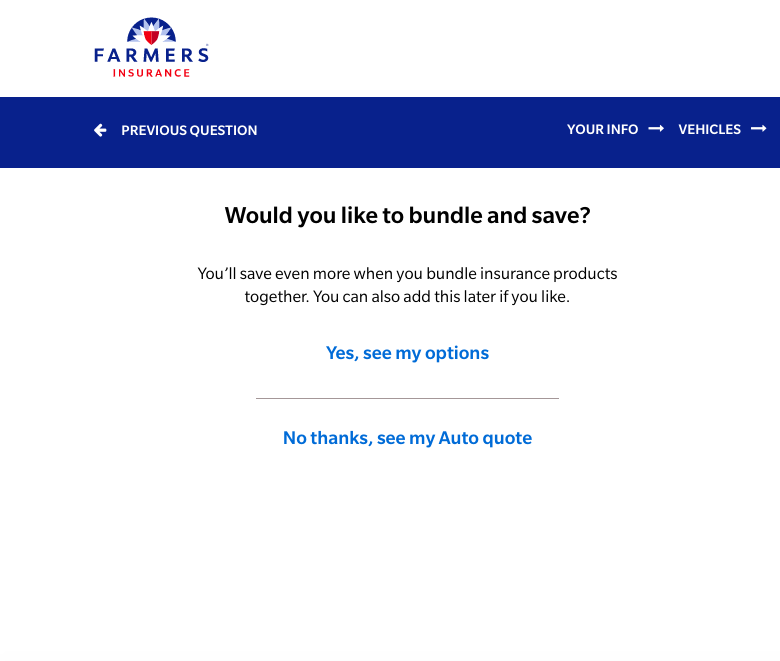

Finally, you can decide if you would like to see your options to bundle and save or proceed straight to your Auto quote.

Design of Website & App

We know that Farmers’ claims and quote retrieval process is fast and efficient — but how does the company’s online and tech presence measure up?

Keep reading our Farmers auto insurance review and you’ll find out.

Website

The Farmers website is well-laid-out and highly functional. You can easily find whatever answer or page you’re looking for in a few clicks.

Report a claim, view claims status, get your rate quote, and more.

If you scroll slightly down the homepage, you’ll see where you can enter your ZIP code to locate an agent near you.

How Easily You Can Find Answers

If you don’t find the answers you need via the dropdown menu at the top of the homepage, keep scrolling to locate a plethora of helpful articles for consumers.

Scroll to the very bottom of the home page for quick service links, resources, and company information.

If the Design Is a Plus or Minus

The site’s design is just as sleek as it is navigable. Plus, you won’t have to waste minutes sifting through various pages to find the answers you need, and customer service or an agent are only just a few clicks or a phone call away.

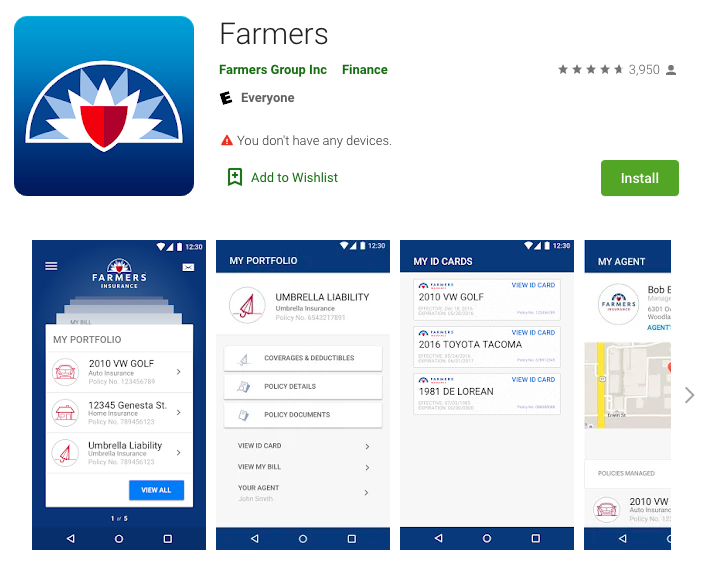

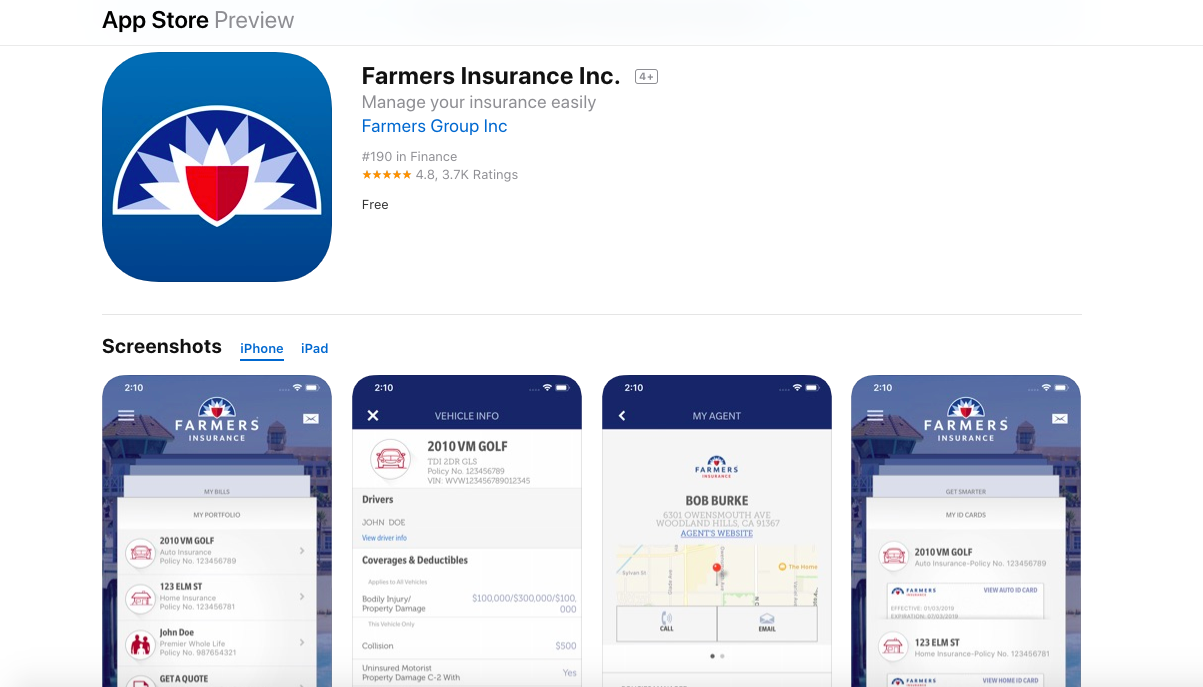

Mobile App

The Farmers mobile app has been redesigned to be faster and easier to manage your insurance policies.

It’s available on Google Play and in the App Store, giving you quick and easy access to take care of your account needs on the go.

How Easily You Can Manage Your Account Using Just the App

Through the app, you can view your insurance ID cards, policy documents, start and track a claim, view and pay bills, or request roadside assistance.

You can also get a personalized quote and locate contact information for your agent.

The Farmers App has a 4.7-star rating in the Google Play Store and a 4.8-star rating in the App Store.

If the Design Is a Plus or Minus

Consumers have reported the app to be fast, efficient, and seamless, with an intuitive and convenient design.

The Bottom Line: Farmers Auto Insurance Review

Is Farmers insurance good? Farmers insurance car insurance reviews, including ours, find that Farmers serves insureds in all 50 states, with a quality selection of coverage options and discounts, efficient claim reporting, and very good customer service. While certain rating factors could mean that consumers pay higher rates with Farmers, overall, its policy pricing is competitive.

Farmers’ excellent financial strength and creditworthiness, along with its lengthy history of corporate giving and community service, makes Farmers a worthwhile consideration if you’re in the market to purchase a new policy.

Scott W. Johnson Licensed Independent Insurance Agent (with Farmers Insurance experience)

Simplify your insurance search by accessing your Farmers insurance auto quote and comparing it with multiple carriers in minutes with our free online tool. Enter your ZIP code now to get started.

Frequently Asked Questions

What do people say about Farmers insurance?

Farmers insurance reviews are generally positive. Specifically, a 2024 survey found that among the 39% of Farmers’ policyholders that did file a claim, overall they were fairly happy with the company’s customer service during the claims process, giving the company a 4-star rating out of 5.

Why is Farmers auto insurance so expensive?

Farmers car insurance reviews find that Farmers vehicle insurance is slightly higher than the national average, but it isn’t the most expensive — although it does rank third or fifth in some categories when compared to its competitors’ rates. Farmers is more expensive than most companies because their insurance agents get commissions.

Also, insurance costs are rising in general across the board. Comparing at least three car insurance companies is a great way to save on your rate. Get multiple quotes to help compare Farmers car insurance quotes by entering your ZIP code into our free online quote comparison tool.

Are Progressive and Farmers the same?

According to Kelley Blue Book, the companies are similar as far as their standard car insurance coverage. Progressive gets higher marks for lower rates, while Farmers insurance quotes are higher but it gets higher marks for customer satisfaction regarding claims.

See details in our article, Farmers Insurance vs. Progressive: Best Auto Insurance.

What is full coverage?

Full coverage is a bit of a misnomer, in that it is often misconstrued as a type of all-encompassing policy coverage. Actually, it refers to a policy that has both coverages for property damage to your property and liability coverage.

Will Farmers cover me if I rent a car?

When you rent a car, the rental company would charge a daily fee for their insurance to cover damages. Your auto policy could include rental coverage, but it varies by state, so be sure to confirm with your agent directly. See more in our rental car insurance FAQ.

Does Farmers have accident forgiveness?

Yes, our Farmers insurance review finds that you could include accident forgiveness as an optional add-on to your policy. With accident forgiveness included in your coverages, Farmers would forgive one at-fault accident for every three accident-free years.

How do I pay my Farmers’ bill?

You can pay your bill through your online account, My Farmers. You can also contact your agent or Customer Service to pay your bill at 1-888-327-6335 Monday-Friday 7 a.m.-11 p.m. CST and Saturday – Sunday 8 a.m.-8 p.m. CST.

What is personal liability umbrella coverage?

Umbrella coverage protects you beyond your liability coverage, so if you are ever sued after an at-fault accident and the verdict exceeds your policy limits, the umbrella policy would cover the additional costs. That way, you can keep your savings, home, business, and other assets protected. Learn more in our article, Cheap Personal Umbrella Insurance.

Is Farmers homeowners insurance good or bad?

Farmers home insurance reviews (as well as Farmers renters insurance reviews) note that Farmers is a good choice for homeowners insurance, especially for its high marks for quality customer service.

Read about savings for bundling insurance in our article, Renter Discount: How much can you save?

What is the rating of Farmers life insurance?

Given that Farmers has an A (Excellent) rating from A.M. Best, it’s a reliable insurer for life insurance, as noted in Farmers life insurance reviews.

Farmers life insurance encompasses whole, term, universal, indexed universal and final expense insurance. It also offers numerous riders to further customize a policy.