Best Cambridge, MA Auto Insurance in 2025 (Check Out the Top 10 Companies)

Explore the best Cambridge, MA, auto insurance from Geico, Amica, and Travelers. Rates start at $38 per month, ideal for drivers meeting Massachusetts's 20/40/5 liability coverage limits. Save 22% with Geico’s Safe Driver discount. Get Amica’s ID fraud protection, and earn 30% off with Travelers IntelliDrive.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: May 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 768 reviews

768 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsThe top providers of the best Cambridge, MA, auto insurance are Geico, Amica, and Travelers, each offering distinct advantages beyond basic coverage.

Geico stands out with up to 22% savings for safe drivers and added perks for military members and federal employees. Explore key types of auto insurance coverage in Cambridge plans.

Our Top 10 Company Picks: Best Cambridge, MA Auto Insurance

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 25% | Cheap Rates | Geico | |

| #2 | A+ | 30% | Customer Service | Amica | |

| #3 | A++ | 13% | Discount Options | Travelers | |

| #4 | B | 17% | Good Student | State Farm | |

| #5 | A+ | 20% | Deductible Options | Nationwide |

| #6 | A+ | 10% | Budgeting Tools | Progressive | |

| #7 | A++ | 16% | Client Centric | Auto-Owners | |

| #8 | A | 20% | Policy Options | Farmers | |

| #9 | A | 25% | Unique Benefits | Liberty Mutual |

| #10 | A+ | 25% | Drivewise Program | Allstate |

Amica’s Platinum Choice package includes $1,000 lock replacement and full glass repair at no extra cost. Travelers use the IntelliDrive app to track driving habits, which can deliver up to 30% in savings after 90 days of consistent safe behavior.

- Geico offers added savings for government employees and clean records

- Cambridge drivers with glass coverage avoid full out-of-pocket costs

- Students in Cambridge can qualify for GPA-based premium discounts

Compare car insurance rates in Cambridge, Massachusetts, using our free comparison tool. Enter your ZIP code to view top offers.

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: In Cambridge, Geico drops monthly rates if you’ve got a clean driving record and enroll in their Safe Driver discount. Refer to our Geico auto insurance review to know more.

- Special Perks for Locals: Cambridge military families and federal employees can unlock extra policy perks not typically offered by other providers.

- App Efficiency: Managing claims, ID cards, and payments is seamless with Geico’s mobile app, especially convenient for busy Cambridge drivers.

Cons

- Few Local Agents: Geico has almost no in-person support in Cambridge, so you’ll need to rely on phone or digital tools to handle any policy changes.

- Optional Coverage Adds Up: Popular extras like rental car reimbursement or mechanical breakdown insurance can push up costs for Cambridge customers if added separately.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Amica: Best for Customer Service

Pros

- Platinum Package Extras: Cambridge drivers get full-glass coverage and a $1,000 lock replacement at no extra cost with Amica’s Platinum Choice Auto plan.

- Annual Cashback: Drivers in Cambridge can receive a portion of their premium back each year if they qualify for Amica’s dividend policies. Read our Amica auto insurance review for details.

- Built-In ID Protection: Identity theft monitoring is included, which is a great bonus for Cambridge residents juggling multiple digital accounts.

Cons

- Premiums Can Be Pricey: Amica’s monthly rates in Cambridge tend to run high unless you stack discounts or bundle other policies.

- Basic App Features: The mobile experience is pretty limited, and Cambridge users can’t make coverage edits or see detailed policy breakdowns directly in the app.

#3 – Travelers: Best for Discount Options

Pros

- Big Savings with IntelliDrive: If you’re a careful driver in Cambridge, Travelers could cut your rate by up to 30% after just 90 days of using their IntelliDrive app.

- Stackable Discounts: Pairing home and auto insurance with Travelers in Cambridge can quickly drop your overall costs. Have a look at our Travelers auto insurance review.

- Helpful Driving Feedback: The app provides Cambridge drivers with real-time behavior data, which can improve driving and influence future pricing.

Cons

- Savings Aren’t Immediate: You’ll need to complete the 90-day IntelliDrive period before any discount shows up, which delays benefits for Cambridge users.

- Not Ideal for Risky Drivers: If your record includes any violations, Travelers’ base rates in Cambridge might come in higher than competitors, even with the app.

#4 – State Farm: Best for Good Student

Pros

- Student-Friendly Savings: Cambridge college students with a 3.0 GPA or higher can qualify for State Farm’s Good Student program. Check out our State Farm auto insurance review to learn more.

- Easy Multi-Policy Bundling: If you combine auto and renters or homeowners insurance in Cambridge, you’ll likely see a sharp drop in total premium costs.

- App-Based Safe Driving: The Drive Safe & Save program works well for Cambridge drivers who want to track their habits and unlock new discounts as they go.

Cons

- Rates Vary a Lot: Cambridge drivers with accidents or no prior coverage could face inconsistent pricing, even if they qualify for other discounts.

- Limited DIY Tools: You can’t make all policy changes online, so some updates for Cambridge policies require a call or visit to an agent.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Deductible Options

Pros

- Flexible Deductibles: Cambridge drivers can adjust their deductibles to manage their monthly payments. Read our Nationwide auto insurance review for more information.

- Deductible Shrinks Over Time: Each year you don’t file a claim in Cambridge knocks $100 off your deductible, which can really add up with a clean record.

- Annual Coverage Checkups: Nationwide’s On Your Side Review is a nice touch, helping Cambridge customers keep their coverage aligned with life changes.

Cons

- Starting Costs Run High: Without bundling or loyalty discounts, Nationwide’s entry-level premiums in Cambridge are a bit steeper than other brands.

- App Isn’t Fully Flexible: Some features, like adding accident forgiveness, still require help from a Cambridge agent instead of self-service online.

#6 – Progressive: Best for Budgeting Tools

Pros

- Name Your Price Tool: Cambridge drivers can enter their monthly budget into Progressive’s Name Your Price tool to receive policy options aligned with how much they want to spend.

- Snapshot Program Savings: Safe Cambridge drivers can unlock dynamic discounts by sharing real-time driving data through Snapshot. Explore our Progressive auto insurance review for more details.

- Layered Discount System: Progressive rewards Cambridge policyholders who combine auto with home, renters, or motorcycle coverage through up to five separate discount tiers.

Cons

- High-Risk Premium Spike: Drivers in Cambridge with speeding tickets or prior claims may see significant rate hikes, even with usage-based discounts applied.

- Claim Handling Time: Some Cambridge customers report delays in complex claim resolutions, especially when multiple vehicles or parties are involved.

#7 – Auto-Owners: Best for Client Centric

Pros

- Agent-First Service: In Cambridge, Auto-Owners is praised for its responsive local agents who provide one-on-one help for claims and policy changes without relying on call centers.

- Multi-Policy Efficiency: Cambridge residents bundling auto with life or home coverage can trim their monthly premiums significantly through multi-line discounts.

- Stability Rating: Holding an A++ (Superior) A.M. Best rating, Auto-Owners brings Cambridge drivers dependable financial strength. Discover our Auto-Owners auto insurance review for details.

Cons

- Limited Online Features: Cambridge users looking to manage policies or file claims digitally may find Auto-Owners’ web and mobile tools lack modern functionality.

- Fewer Local Offices: While agent service is a plus, some areas of Cambridge have limited office presence, requiring longer travel for in-person help.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Policy Options

Pros

- Cambridge Coverage Variety: Farmers offers Cambridge drivers many optional coverages, such as new car replacement and rideshare insurance, which can be customized to fit each person’s specific risk situation.

- Signal App Benefits: By installing the Signal app, Cambridge policyholders can earn up to 15% off after 10 monitored trips, improving premiums with safe behavior.

- Declining Deductible: With every claim-free term, Farmers reduces your deductible by $50, which adds up fast for safe Cambridge drivers. Explore our Farmers auto insurance review to learn more.

Cons

- Above-Average Starting Rates: Cambridge newcomers to Farmers may notice higher base premiums until loyalty, bundling, or usage-based discounts are factored in.

- Coverage Complexity: With so many optional add-ons, Cambridge drivers must stay on top of what’s included—or risk overpaying for features they don’t need.

#9 – Liberty Mutual: Best for Unique Benefits

Pros

- Better Car Replacement: Liberty Mutual gives Cambridge drivers a new vehicle replacement upgrade, not just a payout for the depreciated value, after a total loss within the first year.

- Custom Add-Ons: From deductible fund contributions to accident forgiveness, Liberty’s customizable options offer Cambridge users rare flexibility in how they build protection.

- 24/7 Claims Assistance: Liberty’s round-the-clock support line is a huge asset for Cambridge drivers who may need roadside help. Learn more in our Liberty Mutual auto insurance review.

Cons

- Inconsistent Discount Application: Some Cambridge customers report difficulty accessing all available savings without speaking directly to an agent or using a promo-specific quote tool.

- Costlier Premiums: Even with perks, Liberty Mutual’s Cambridge pricing tends to land on the higher end unless paired with bundling or driving behavior programs.

#10 – Allstate: Best for Drivewise Program

Pros

- Drivewise Rewards: Cambridge drivers enrolled in Allstate’s Drivewise app can earn savings for braking gently. Visit our Allstate auto insurance review to get the full scoop.

- Claim Satisfaction Guarantee: If Cambridge users are unhappy with how a covered claim was handled, Allstate offers partial premium refunds through its customer guarantee.

- Deductible Rewards: Drivers in Cambridge automatically earn $100 off their deductible the day their policy begins, just for signing up, and this amount continues to grow each accident-free year.

Cons

- Rates Without Bundling: Standalone Cambridge auto insurance policies through Allstate are often expensive without pairing with home, renters, or life insurance.

- Driving Behavior Penalties: Cambridge Drivewise users may see reduced discounts or even rate hikes if tracked driving habits fall short of safe thresholds.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Coverage Rates in Cambridge, MA

The state’s minimum requirements for older and less expensive vehicles are perfectly adequate. However, when comparing auto insurance companies, it’s essential to consider that newer cars, especially if you’re still financing them, require more comprehensive policies to ensure adequate protection.

Cambridge, MA Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $51 | $153 | |

| $43 | $126 | |

| $48 | $145 | |

| $47 | $148 | |

| $38 | $115 | |

| $50 | $150 |

| $46 | $137 |

| $47 | $138 | |

| $45 | $134 | |

| $44 | $130 |

While the average motorist in Massachusetts pays around $134 per month for insurance, living in Cambridge could mean significant savings. Insurance companies in your area are currently offering good policies for as little as $60 per month, making it possible to reduce your insurance costs.

Encompass, National Grange Mutual, and Allstate are offering some of Cambridge’s best automobile insurance deals right now. But don’t just switch to the lower rate – make sure they give you a positive customer experience, too.

Cambridge, MA Auto Insurance Monthly Rates by Age

| Insurance Company | Age: 17 | Age: 34 |

|---|---|---|

| $716 | $184 | |

| $662 | $138 | |

| $630 | $145 | |

| $750 | $182 | |

| $525 | $125 | |

| $690 | $160 |

| $735 | $155 |

| $656 | $180 | |

| $680 | $130 | |

| $606 | $165 |

Teenagers living in Cambridge have to pay high insurance costs. A 17-year-old using Allstate pays $716 each month, but Geico offers the cheapest rate at $525. At age 34, insurance rates become much lower.

Senior drivers in Cambridge may see gradual increases due to slower reflexes and vision loss. That said, 70-year-olds typically pay around $130 a month.

Chris Abrams Licensed Insurance Agent

Geico is the cheapest at $125. Amica costs $138, and State Farm offers a rate of $130, which also helps older drivers save money.

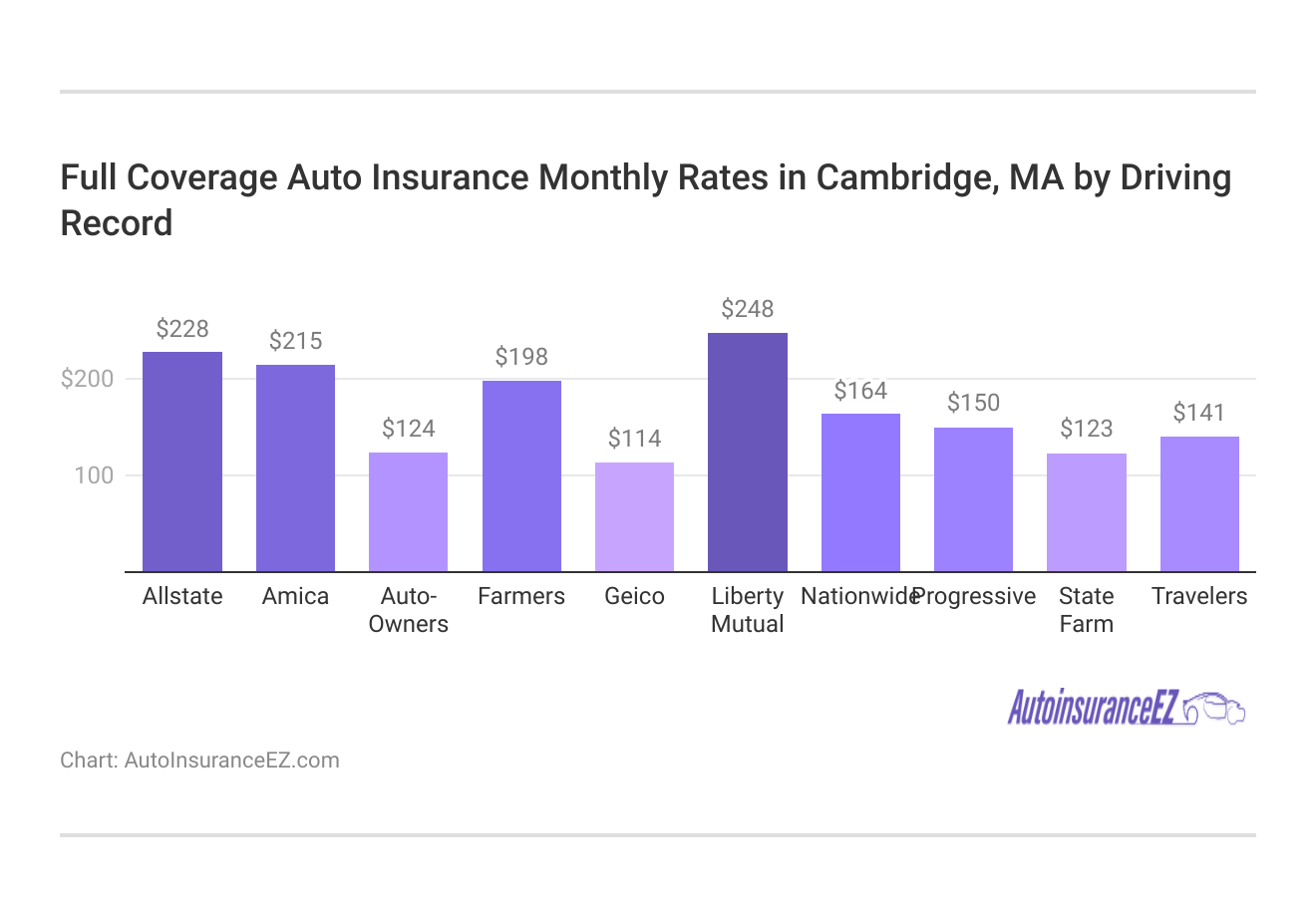

Cambridge, MA Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $113 | $145 | $180 | $220 | |

| $114 | $146 | $182 | $223 | |

| $115 | $150 | $185 | $225 | |

| $120 | $155 | $190 | $230 | |

| $80 | $100 | $130 | $150 | |

| $140 | $170 | $200 | $230 |

| $90 | $120 | $150 | $180 |

| $144 | $170 | $205 | $240 | |

| $53 | $64 | $71 | $84 | |

| $140 | $175 | $210 | $240 |

State Farm offers the lowest prices for all kinds of violations. The table shows how one ticket or DUI rapidly increases rates in Cambridge. Geico stays competitive for small violations, but Progressive and Travelers become very costly with a DUI. Amica and Auto-Owners remain consistent, though not inexpensive.

Your driving record greatly affects how much you need to pay. If you keep it clean, you are in a good position. But if you get a ticket or something worse, some companies increase your rate quickly. It depends not only on your actions but also on how the provider evaluates them.

Best Cambridge, MA Auto Insurance Discounts

Cambridge insurers give actual savings for clever actions. Nationwide offers a big 40% discount to drivers who don’t drive much and are safe, while Amica gives leading bundling discounts of 30%.

Auto Insurance Discounts From the Top Providers in Cambridge, MA

| Insurance Company | Bundling | Good Driver | Good Student | Loyalty | Low Mileage |

|---|---|---|---|---|---|

| 25% | 25% | 25% | 15% | 30% | |

| 30% | 25% | 20% | 13% | 10% | |

| 16% | 25% | 20% | 10% | 30% | |

| 20% | 30% | 15% | 12% | 10% | |

| 25% | 26% | 15% | 10% | 30% | |

| 25% | 20% | 12% | 10% | 30% |

| 20% | 40% | 18% | 8% | 40% |

| 10% | 30% | 10% | 13% | 30% | |

| 17% | 25% | 35% | 6% | 30% | |

| 13% | 10% | 8% | 9% | 20% |

State Farm gives students up to a 35% discount. Progressive offers a strong 30% discount for good drivers and low mileage, but Travelers has smaller discounts of under 20% in all areas.

Cambridge, MA Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A | High traffic congestion |

| Average Claim Size | B | Reasonable claim averages |

| Weather-Related Risks | B | Risk from snow and storms |

| Uninsured Drivers Rate | C | About 3.5% uninsured drivers |

| Vehicle Theft Rate | C | Moderate theft activity |

Cambridge’s car insurance report card explains important risk factors that insurers think about when setting policy prices. Traffic density got an A grade, meaning there is a lot of congestion, but the patterns are well-documented and predictable.

Claim sizes and weather risks are in the middle, getting B grades. But things like theft and drivers without insurance lower the score, with Cs showing more risk for insurers.

Factors Affecting Cambridge, MA Auto Insurance

There is a range of items that may factor into the rate quotes you are provided with. Even though several of these details aren’t something you can do something about, a few of them are things you can change for the better. Here are a few things that might alter how much car insurance in Cambridge might cost for you:

Your ZIP Code

The most affordable auto insurance is commonly found in cities with the lowest population density. Cities with fewer people on the roads often have lower accident rates, which directly affects how insurers calculate risk.

Cambridge, MA Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 2138 | $91 |

| 2139 | $92 |

| 2140 | $94 |

| 2141 | $96 |

Since fewer cars are traveling the road at any given time, it is less likely you will have an opportunity to become involved in a major traffic accident. The population of Cambridge is 107,289, and the median household income is $75,137.

Automotive Accidents

The chart below shows that Cambridge is a safe driving place, which is good news for your monthly premiums.

Fatal Accidents in Cambridge, MA

| Category | Count |

|---|---|

| Fatal accident count | 3 |

| Vehicles involved in fatal crashes | 3 |

| Fatal crashes involving drunk persons | 3 |

| Fatalities | 3 |

| Persons involved in fatal crashes | 3 |

| Pedestrians involved in fatal accidents | 2 |

The safer your city is, the more likely a company will offer lower rates to drivers living there. So if you live in a place like Cambridge with low crime, minimal severe crashes, and predictable traffic patterns, insurers are more confident.

Auto Thefts in Cambridge

Auto theft can still be an issue, even in smaller cities or non-urban towns. To make it less of a problem, consider investing in a passive anti-theft system for your car. Your auto insurance provider may compensate you with reduced rates. In Cambridge, there were 104 auto thefts in the year 2013.

Your Credit Score

Massachusetts is a particular case regarding automotive insurance and credit scores. There are three states where it is illegal for insurance companies to discriminate based on your credit, and Massachusetts is one of them. Although this can save you some serious cash if you have terrible credit, overall, Massachusetts insurance rates will cost more to offset the insurance company’s financial risk.

Your Age

Young drivers face a particularly harrowing burden when paying for their first auto insurance policy. Because of their inexperience, they are significantly more likely to get into a severe accident. That’s why some companies charge them 2x-3x higher premiums than someone twice their age.

Your Driving Record

For motorists with a few blemishes on their driving record, you can lower your monthly premiums by looking for a provider with an “Accident Forgiveness” program.

Such discounts can reduce your monthly Cambridge, MA, auto insurance rates for speeding tickets and minor accidents. But if you have a DUI or a Reckless Driving citation, be prepared to see your costs increase dramatically.

Your Vehicle

Some drivers, especially those with an older or less expensive vehicle, can get away with the bare minimum insurance coverage. However, before you rush out to purchase a luxury vehicle for yourself, consider that it will also come with a huge monthly insurance bill. After all, you wouldn’t insure a luxury vehicle with Liability only.

Your Marital Status

As an individual, being married won’t get you very significant discounts on automotive insurance. However, bundling multiple policies with your spouse will drastically lower your monthly rate.

This rule applies to home or boat insurance, too. If you combine many policies with one provider, they often offer big discounts. When you mix different types of coverage, such as car, home, and boat insurance, you usually save more money on your monthly costs. It is a good way to protect your things without spending too much money.

Your Gender

These days, fewer companies charge different rates based on gender. Many significant providers charge the same, all other attributes being equal. Even if your provider does alter premiums based on gender, they are unlikely to vary by more than 2-3%.

Your Driving Distance to Work

If you prefer to drive your own car, you may have some difficulty getting around in Cambridge. The general commute to work can last anywhere from 18 to 31 minutes. This likely explains why alternative forms of transportation are so popular in Cambridge; only about 35% of people drive their vehicles, 25% walk, 20% take the subway, and 7% take a bus or carpool.

Driving less in a city like Cambridge would save you a ton on monthly premiums, but you’d be off by quite a bit. Even infrequent drivers may only save 3-4% on their monthly costs. On the other hand, business vehicle owners can expect to pay 11% higher premiums.

Your Coverage and Deductibles

If you have a small budget for your insurance premiums, try raising your deductible. The higher your deductible, the lower your monthly premiums will be. This means you can get a basic auto policy for a significantly reduced rate or better coverage for relatively affordable Cambridge, MA, auto insurance.

Education in Cambridge, MA

It should come as no surprise that the residents of Cambridge are well-educated. Over one-quarter of citizens possess a bachelor’s degree, while nearly 20% possess a master’s.

And the higher your education, the lower your auto insurance costs because providers often give lower rates to well-educated drivers. It’s even more critical than where you work or how much you make yearly.

While Cambridge is essentially a college town, it is perhaps one of the country’s most famous and influential college towns. Everyone knows about Harvard and the Massachusetts Institute of Technology, but the city has lots to offer students looking to supplement their education in other ways.

For instance, there are two noteworthy culinary arts schools, Le Cordon Bleu and the Cambridge School of Culinary Arts. There is also the Longy School of Music and Hult International Business School.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Comparing the Best Cambridge, MA Auto Insurance

In Cambridge, the insurance scene favors drivers who know the city’s unique pace, from few cars to many walkers and cyclists. People living in this city prefer companies that consider how long you travel, when you use your vehicle, and the student population.

Always compare deductibles and claim service speed, not just price. For example, some insurers settle claims in under 48 hours for Cambridge drivers.Jeffrey Manola Licensed Insurance Agent

Features such as yearly coverage check-ups, policy dividends, and reduced deductibles give long-term benefits that usual quotes might miss. Get matched with top Cambridge, MA, auto coverage providers when you input your ZIP code into our free comparison quote tool.

Frequently Asked Questions

Which auto insurance provider offers the cheapest car insurance in Cambridge, MA?

Geico is known for cheap car insurance in Cambridge, with premiums starting at $38 per month for comprehensive coverage. Their competitive pricing makes them a popular choice for budget-conscious drivers.

What is the average monthly premium for auto insurance in Cambridge, MA?

The average monthly premium for car insurance in Cambridge, MA, is around $134. However, depending on the coverage options and provider, Cambridge residents may find affordable policies for as low as $60 per month. Enter your ZIP code now to begin comparing.

Which insurance company is best known for its customer service in Cambridge?

When considering Amica or any other provider, it’s important to consider the various factors affecting car insurance premiums, such as driving history, vehicle type, and coverage levels.

How can Cambridge drivers save on auto insurance with Progressive?

Progressive offers various budgeting tools and discounts, including usage-based insurance, which can help Cambridge drivers lower their premiums.

What discount opportunities are available for students in Cambridge, MA?

State Farm offers a good student discount, helping Cambridge’s college students save on their car insurance. This discount is based on maintaining good grades, which is an incentive for the area’s large student population.

How do auto insurance premiums differ based on your ZIP code in Cambridge?

Auto insurance premiums in Cambridge vary by ZIP code, with less populated areas typically having lower rates. This affects the type of car insurance that’s most affordable, as rural areas may offer better rates for comprehensive coverage, while urban areas may focus on liability due to higher accident risks.

Which provider offers the best deductible options for Cambridge residents?

Nationwide is known for offering flexible deductible options, which can help Cambridge residents adjust their premiums based on their budget. This flexibility allows drivers to customize their coverage to suit their needs.

What are the benefits of bundling home and auto insurance in Cambridge, MA?

Bundling home and auto insurance policies with providers like Farmers or Liberty Mutual can lead to significant discounts. It also streamlines the insurance process by consolidating multiple policies under one provider.

How does a driver’s credit score impact their insurance rates in Massachusetts?

In Massachusetts, insurers cannot base rates on a driver’s credit score. This ensures that drivers with lower credit scores aren’t penalized, making auto insurance more accessible and helping to maintain a more consistent average auto insurance cost across different credit score brackets.

Why might Cambridge drivers with older cars need more comprehensive insurance coverage?

Drivers with older cars may require more comprehensive insurance if their vehicle is still financed or if it holds significant value.

What can you expect from Garrity Insurance in Cambridge, MA?

You can expect Garrity Insurance in Cambridge, Massachusetts, to offer localized auto insurance with competitive monthly rates starting as low as $65, plus personalized service from agents familiar with Massachusetts requirements.

Is Gerrity Insurance right for your monthly auto coverage needs?

Yes, Gerrity Insurance provides flexible monthly auto insurance rates from around $58, with customizable policy options tailored to your driving habits and vehicle type. Learn the key factors that affect your car insurance premium in Cambridge.

How does Avanti car insurance meet your everyday driving needs?

Avanti Insurance offers basic liability and full coverage options at monthly rates starting near $52, making it a reliable choice if you’re looking for affordable plans that fit your lifestyle and budget.

Should you trust Garrity Insurance based on recent customer reviews?

Yes, most Garrity Insurance reviews highlight responsive agents and monthly rates below $70, especially for drivers with clean records or bundling multiple policies.

Where can you find the best car loan rates in Cambridge, MA?

You can find the best car loan rates in Cambridge, MA, starting as low as 4.9% APR with local credit unions and banks, which often offer lower monthly payments than national lenders. Compare providers in Cambridge to unlock cheap auto insurance rates.

How can you get SR-22 insurance near you in Cambridge?

You can get SR-22 insurance near you in Cambridge by contacting local insurers who specialize in high-risk drivers, with monthly premiums starting around $88, depending on your driving history.

Can a non-owner SR-22 insurance agent in Cambridge help you stay insured legally?

Yes, a non-owner SR-22 insurance agent in Cambridge can help you stay compliant if you don’t own a car but still need coverage, with monthly rates beginning at approximately $72.

What can you expect from Cambridge residential SR-22 insurance services?

Cambridge residential SR-22 insurance services will provide high-risk coverage options for local drivers, with monthly rates starting around $76 and support for maintaining license compliance. Get the best car loan rates in Cambridge as a high-risk driver.

How does Amica auto insurance compare to Geico for your needs?

If you’re comparing Amica auto insurance vs Geico, Amica offers strong customer service with monthly rates starting near $84, while Geico often provides lower premiums around $68, especially for good drivers and bundled policies. Unlock cheap Cambridge, MA, auto insurance offers by entering your ZIP code now.