Cheap Auto Insurance in Montana 2025 (Save Big With These 10 Companies!)

Liberty Mutual, State Farm, and Geico provide cheap auto insurance in Montana. These MT car insurers are recognized for their affordable rates starting as low as $16/mo, strong financial stability, and comprehensive discount programs. Learn more about Montana's 25/50/20 liability requirements here.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: May 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Company Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Pros & Cons

Liberty Mutual tops the list for cheap auto insurance in Montana, with minimum coverage starting at $16 a month. State Farm is next at $19 a month, followed by Geico at $23 a month.

Whether you’re driving through Glacier National Park or the Rocky Mountains, you need affordable insurance in Montana, the fourth-largest state. The tough terrain requires reliable coverage.

Our Top 10 Company Picks: Cheap Auto Insurance in Montana

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $16 A Multi-Policy Discounts Liberty Mutual

#2 $19 B Local Agent State Farm

#3 $23 A++ Low Premiums Geico

#4 $24 A+ Claims Handling Nationwide

#5 $28 A Customer Service Safeco

#6 $30 A++ Rural Drivers Travelers

#7 $34 A Customer Service American Family

#8 $42 A+ Safe-Driving Discounts Allstate

#9 $45 A Young Drivers Farmers

#10 $47 A+ Comprehensive Coverage Progressive

Each company has its own perks with Liberty Mutual has customizable plans with student and military discounts, State Farm has great financial strength with competitive rates, and Geico has strong digital tools with employee discounts.

- Liberty Mutual offers the cheapest auto insurance in Montana at just $16 a month

- State Farm is also Montana’s top pick with its Drive Safe & Save program

- Geico stands out for its Montana auto insurance digital platform

Montana’s auto insurance requirements are $25,000/$50,000/$20,000 liability auto insurance coverage, but increasing your coverage will give you better long-term protection. Enter your ZIP code above to start saving on your car insurance today.

#1 – Liberty Mutual: Top Overall Pick

Pros

- Customized Coverage: Liberty Mutual provides adaptable plans, such as new car replacement and accident forgiveness. Learn more in our thorough Liberty Mutual review.

- Robust Digital Tools: Offers an easy-to-use mobile app for managing policies and filing claims, helping Montana drivers find affordable coverage on the go.

- Financial Stability: Liberty Mutual’s solid financial strength ensures reliable claims payouts, crucial for Montana policyholders.

Cons

- Conflicting Claims Reviews: A few Montana policyholders have expressed dissatisfaction with the claims process.

- Limited Agent Support: Primarily relies on digital tools, which may not offer personalized agent support for Montana residents.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best For Financial Strength

Pros

- Outstanding Customer Attention: State Farm is renowned for its robust local agent network and individualized attention. Read more in our full review of State Farm’s auto insurance.

- Strong Financial Strength: State Farm’s excellent financial standing ensures reliable and timely claims handling for Montana drivers.

- Safe Driver Discounts: Provides significant savings for safe drivers in Montana through programs like Drive Safe & Save.

- Restricted Discounts: State Farm offers fewer discount options compared to other competitors in Montana.

- Average Digital Tools: The website and mobile apps could use improvements to better serve Montana drivers.

#3 – Geico: Employee Discounts

Pros

- Low Rates: Geico is renowned for providing some of the market’s lowest rates. Learn more about Geico’s rates in our Geico auto insurance review.

- Strong Web Presence: Geico provides an easy-to-use web platform and mobile app for managing policies, making it convenient for Montana drivers seeking cheap auto insurance.

- Reliable Claims Process: Geico’s claims process typically garners favorable reviews, making it a reliable choice for affordable auto insurance in Montana.

Cons

- Restricted Agent Network: Geico relies heavily on online resources, which may not offer personalized agent support for Montana drivers.

- Poor Customer Service: Some Montana policyholders have reported mixed experiences with Geico’s customer service.

#4 – Nationwide: Best For Accident Forgiveness

Pros

- Variety of Coverage: Provides a wide range of coverage choices for Montana drivers, such as accident forgiveness. You can learn more in our Nationwide auto insurance review.

- On Your Side Review offers yearly policy evaluations to ensure Montana clients receive the most competitive prices.

- Fantastic Bundling Discounts: Nationwide provides Montana citizens significant discounts when combining many plans, such as auto and home insurance.

Cons

- Average Rates: Nationwide offers reasonable rates, although they are not the cheapest in Montana.

- Claims Processing: A few Montana clients have complained about claims processing being slower than anticipated.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Safeco: Best For Budget-Conscious Drivers

Pros

- Affordable Rates: Safeco offers competitive pricing, making it a great choice for cheap auto insurance in Montana. Read more about this provider in our Safeco auto insurance review.

- Variety of Discounts: Safeco provides several discounts, including those for safe driving and bundling policies, which can further reduce costs for Montana drivers.

- Roadside Assistance: Safeco includes affordable add-ons like roadside assistance, offering extra value for budget-conscious policyholders.

Cons

- Mixed Claims Experience: Some Montana customers report delays in claims processing, affecting overall satisfaction.

- Limited Local Agent Support: Safeco relies heavily on digital tools, and local agent support may be limited in certain areas of Montana.

#6 – Travelers: Best For Unique Coverage

Pros

- Competitive prices: Provides reasonable prices, particularly for drivers with spotless records. Read more about Travelers’ ratings in our Travelers auto insurance review.

- Homeowner Discounts: Bundling auto insurance with homeowners insurance can help Montana residents save significantly, offering a flexible payment plan option that suits their needs.

- Flexible Payment Options: Travelers allows Montana drivers to choose from various payment plans, ensuring that premiums fit their budget.

Cons

- Claims Satisfaction Below Average: Some Montana customers report frustration with Travelers’ claims process, which may affect their satisfaction with the service.

- Limited Support for Local Agents: Travelers primarily rely on digital tools, which may lack the personal touch some Montana drivers prefer when dealing with their auto insurance.

#7 – American Family: Best For Loyalty Savings

Pros

- Personalized Service: Well-known for providing excellent customer service via a network of local agents. Find out more in our American Family auto insurance review.

- Flexible Coverage: Montana drivers can choose from a selection of coverage options tailored to meet their specific needs, ensuring affordable and customized auto insurance in Montana.

- Safe Driving Program: Montana drivers can save money through a safe driving program that rewards responsible driving with potential discounts.

Cons

- Restricted Availability: The insurer may not be available in all areas of Montana, limiting access to their coverage options.

- Average Claims Process: Some Montana customers have experienced delays or issues with the claims process, which may impact overall satisfaction

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Allstate: Best For Detailed Coverage

Pros

- Large Discounts: Allstate provides several discounts, such as safe driver and excellent student discounts. Read more about this provider in our Allstate auto insurance review.

- Local Agents: Montana residents benefit from tailored support provided by a vast network of local agents, ensuring personalized service for cheap auto insurance in Montana.

- Accident Forgiveness: Montana drivers are shielded from rate hikes following an accident, allowing them to maintain affordable premiums even after a claim.

Cons

#9 – Farmers: Best For Family Drivers

Pros

- Outstanding Customer Service: Farmers offers individualized local agent support and 24/7 claims assistance. Read our Farmers auto insurance review to learn more.

- Accident Forgiveness: Farmers offers accident forgiveness programs for Montana drivers, which helps keep your rates affordable.

- Bundling Discounts: Montana customers can enjoy significant discounts on auto and home insurance by bundling, providing savings on multiple policies.

Cons

- Limited Discounts: Farmers offer fewer discount opportunities than other providers, potentially reducing overall savings for Montana residents.

- State Availability: Farmers’ coverage may not be available in all states, limiting its availability for Montana drivers seeking this provider.

#10 – Progressive: Best For Coverage Options

Pros

- Reasonably priced rates: Progressive is renowned for providing affordable rates, particularly for high-risk drivers. Learn more in our Progressive auto insurance review.

- Discounts for Several Policies: Progressive offers substantial savings for Montana customers who bundle auto and home insurance, making it easier to find affordable coverage.

- Robust Digital Tools: Progressive offers convenient access to manage policies and submit claims, improving customer experience for Montana drivers.

Cons

- Claims Satisfaction: Some Montana drivers have expressed dissatisfaction with Progressive’s claims process, which could affect the overall experience.

- Limited Agent Support: Progressive relies heavily on digital tools, which may not provide the personalized service that some Montana customers seek.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How to Get Cheap Montana Car Insurance Rates

You might be wondering about what kind of coverage you need, and the answer to that question is sort of a complicated one. But let’s start with the basics: Montana requires every driver to have auto insurance, but how much insurance coverage do you need?

You might be looking for the cheapest auto insurance in Montana, and that’s okay, but we’re here to tell you that having more coverage will benefit you and your wallet in the long run. It’s important to strike a balance between affordable premiums and adequate protection.

Montana Auto Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

$42 $154

$34 $125

$45 $164

$23 $82

$16 $59

$24 $88

$47 $171

$28 $106

$19 $70

$30 $111

Before we discuss minimum liability insurance requirements, let’s examine Montana’s car culture. This will help you better understand the state’s laws and regulations and how cheap auto insurance affects the overall driving experience.

Montana’s harsh winters and rural roads make comprehensive coverage essential beyond state minimums.

Chris Abrams Licensed Insurance Agent

According to Hartford, the most common vehicles on Montana’s roads are big pickups like Chevy Silverado 1500s and beyond with the Z71 package, which fully equips the vehicle to go off-road.

After all, Montana residents are known for their jobs that involve farming, ranching, and anything related to the outdoors.

Montana Auto Insurance Requirements

Montana is one of 38 states classified as a traditional at-fault car accident state. This means the driver responsible for an accident is liable for covering the damages.

In at-fault car accident states like Montana, if you cause an accident, you are responsible for covering any incurred costs from that accident.

These costs could include damages to your vehicle as well as anyone else’s and medical bills.

The at-fault driver is also responsible for filing a claim with his or her insurance company. Ideally, the insurance company will inform the driver that the policy provides enough coverage to handle all costs, which is why considering cheap auto insurance in Montana with adequate coverage is crucial.

If the at-fault driver does not have enough insurance, he or she will have to cover these costs with personal assets. In short, the scenario above explains why it is a good idea to carry more insurance than the type of car insurance required.

Montana Code Annotated section 61-6-103 requires that any motor vehicle operated on public roads be insured by a liability insurance policy that meets the following Montana car insurance requirements:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $20,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle

Liability coverage pays the medical bills, property damage bills, and other costs of drivers, passengers, and pedestrians who are injured or have their vehicle damaged in a car accident you cause, up to coverage limits.

Forms of Financial Responsibility in Montana

A form of financial responsibility is just a fancy term for proof of insurance. Every driver in Montana is required to carry their proof of insurance (insurance card) on their person or in their car at all times, even when opting for cheap auto insurance in Montana to ensure compliance with state laws.

Types of auto insurance coverage include liability, collision, comprehensive, and more to protect drivers from various risks.

If a law enforcement officer pulls you over, you must be ready to show proof of insurance, registration and your license.

Here are some acceptable forms of proof of insurance:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Electronic insurance card (or picture proof of your insurance card)

If you’re pulled over and cannot show proof of insurance, you may be facing some serious penalties.

Even if you have cheap auto insurance in Montana, you must be able to show proof of your insurance policy. In this case, a police officer might give you a warning, or he or she may deem you a driver without insurance. Check Liberty Mutual’s site to learn more about providing your coverage.

Driving without insurance is a misdemeanor in Montana. A first-time offender could be punished with a fine between $250 and $500 or up to 10 days in jail.

It’s kind of silly to go to jail for a crime that could’ve easily been prevented. If you’ve opted for cheap auto insurance in Montana, make sure to take a photo of your insurance card if you’re bad with loose papers, and always have it with you or on your phone to avoid any issues.

Premiums as a Percentage of Income

Montana’s average per capita disposable income in 2014 was $36,041.

A person’s per capita income is the amount of money they take home after paying taxes. In 2014, Montana drivers paid $868.55 on average for a full coverage car insurance policy. This means drivers pay an average of 2.41 percent per year on car insurance alone.

From 2012-2014, Montana auto insurance increased by about $50 and the average per capita income increased by about $400.

When we look at the surrounding states’ averages, Idaho had a per capita income of $33,600 in 2014 and paid an average of $673.13 a year for a full coverage policy.

Wyoming had a much higher average per capita income of $49,918 and paid an average of $844.33 for a full coverage insurance policy.

Countrywide, Americans have an average per capita income of $40,859 and pay $981.77 a year for auto insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Core Car Insurance Coverage in Montana

The data in the table below is provided by the National Association of Insurance Commissioners (NAIC). Since this data is from 2015, rates are likely to be slightly higher today.

Core Auto Insurance Coverage in Montana

| Coverage Type | Monthly Cost |

|---|---|

| Liability | $32 |

| Collision | $22 |

| Comprehensive | $18 |

Keep in mind that these rates reflect cheap auto insurance in Montana based on the state’s minimum coverage laws, which may vary depending on individual factors.

Additional Liability Coverage in Montana

While the additional types of liability auto insurance coverage listed above aren’t required by the state of Montana, it still might be a good idea to carry them.

Because Montana is an at-fault state, a driver who causes an accident is required by law to pay for any damages associated with that accident; hopefully, the driver carries a big enough insurance policy so they don’t have to pay out of pocket to help cover damages.

9.90 percent of Montana drivers are uninsured. Montana is ranked 33rd in the U.S. for uninsured drivers.

If an uninsured driver hits you and you don’t have cheap auto insurance in Montana with underinsured/uninsured motorist coverage, you may be forced to cover the repair costs yourself. This coverage is crucial to avoid paying out of pocket in such scenarios. Check Geico’s website.

An easy way to save money? Customize with Liberty Mutual. Plus, 13 other tips for lowering your car insurance. https://t.co/Fi4LjmDXye pic.twitter.com/W8CifJuAVP

— Liberty Mutual (@LibertyMutual) July 19, 2023

More than likely, the uninsured driver will go bankrupt trying to pay for damages done to his vehicle, and you’ll never be paid. This is where uninsured motorist coverage steps in to help.

But what about the loss ratio?

When you’re looking for a new Montana auto insurance company, it’s important to consider its loss ratio percentage.

If the loss ratio is too high (over 100 percent), the company could be at risk of going bankrupt because it is paying too many claims.

When you get into a car accident, you need to file a claim with your insurance company stating what damage was done to your vehicle and what medical bills need to be paid.

On the other hand, if the loss ratio is too low (under 50 percent), the insurance company could be scamming its clients because it’s not paying enough for filed claims.

Add-ons, Endorsements, and Riders in Montana

With so many extra insurance coverage options, it can be difficult to understand which ones could work well with your lifestyle.

Your Montana auto insurance policy should be as unique as you are. Click on the links below to learn more about each policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

More coverage is always better coverage, even when searching for cheap auto insurance in Montana. Choose one add-on or choose them all to ensure you’re fully protected—the choice is completely up to you.

Male vs. Female Annual Car Insurance Rates in Montana

Did you know factors like gender, marital status, and age can affect your auto insurance rate?

In Montana, it is illegal to base an insurance rate on gender or marital status.

Montana Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $480 | $490 | $258 | $271 | $180 | $185 | $214 | $220 | |

| $400 | $420 | $178 | $210 | $140 | $145 | $148 | $150 |

| $460 | $475 | $246 | $256 | $160 | $165 | $171 | $183 | |

| $300 | $310 | $138 | $133 | $120 | $125 | $104 | $106 | |

| $530 | $550 | $267 | $306 | $190 | $195 | $211 | $227 |

| $420 | $440 | $194 | $213 | $130 | $135 | $141 | $149 | |

| $430 | $440 | $201 | $209 | $125 | $130 | $131 | $136 | |

| $270 | $280 | $118 | $122 | $105 | $110 | $90 | $91 | |

| $350 | $360 | $144 | $158 | $115 | $120 | $108 | $108 | |

| $375 | $385 | $152 | $165 | $115 | $120 | $127 | $129 |

Are you worried about your age affecting your rate? Car insurance companies know teenage drivers have little experience on the road, which is exactly why they hike their rates for young drivers.

Read More: Cheap Car Insurance for Young Drivers

If you keep a clean record, your rates are likely to decrease significantly once you turn 25.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

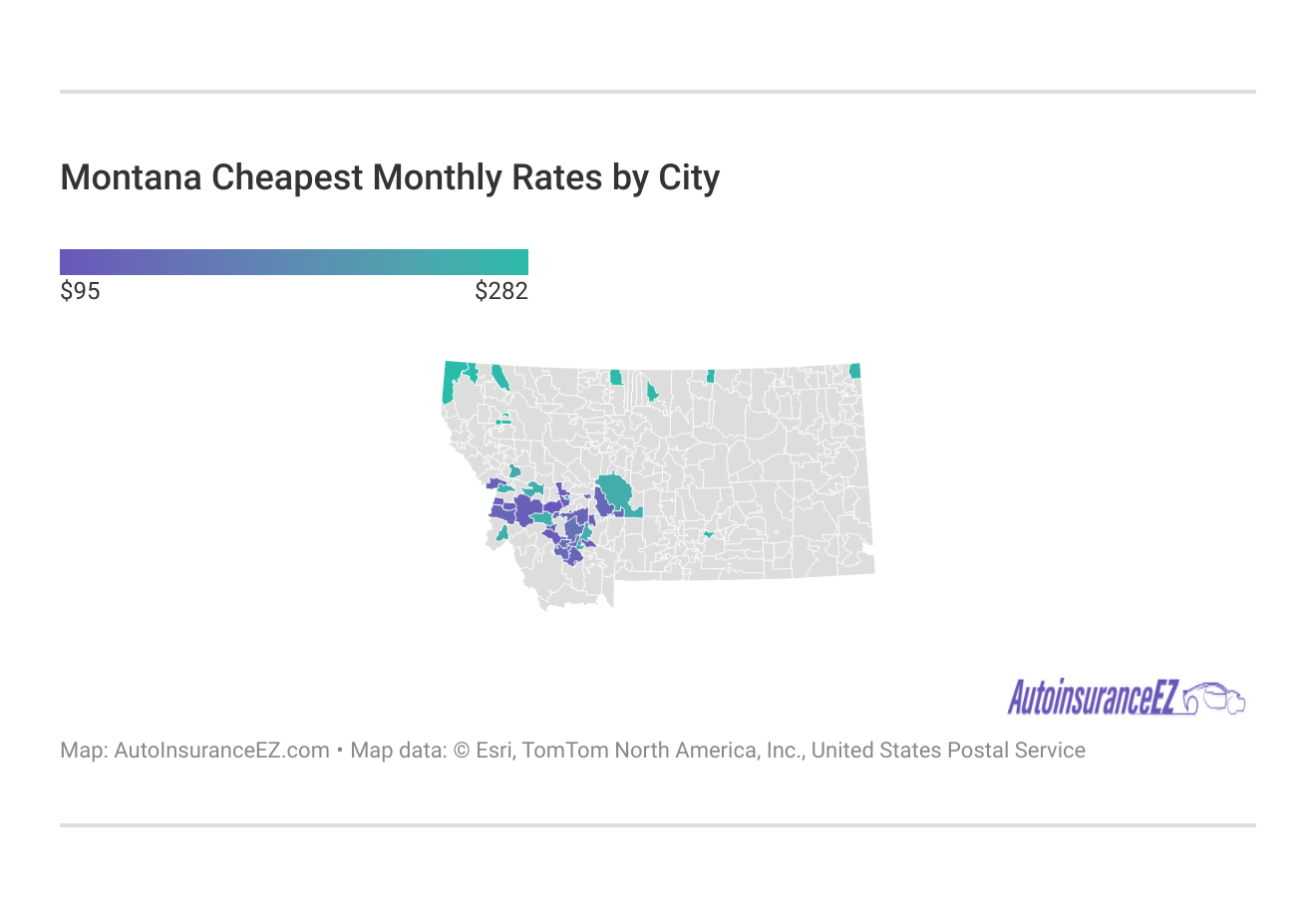

Cheapest Rates in Montana by City

Check out the table below for the average cost of car insurance in Montana by city.

Comparing rates by location can help you find the most affordable coverage tailored to your area.

Best Montana Car Insurance Companies

With literally hundreds of car insurance companies out there, it can be a tough choice to pick just one, especially when you don’t know what to look for in a company.

In this next section, we’ve answered all of the difficult questions and pulled valuable info on some of the very best car insurance companies in Montana for you.

Montana’s high teen DUI rate and dangerous rural roads require choosing insurers with strong claims handling, not just low prices.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Keep reading to learn more about AM Best ratings, customer service satisfaction rankings, company complaints, and more about cheap Montana auto insurance companies. By comparing auto insurance companies, you can choose the best provider and secure the most affordable coverage for your vehicle.

Montana’s Largest Car Insurance Companies

We can determine a company’s financial strength by studying its A.M. Best Rating. As we previously discussed, generally, a company should not have a loss ratio percentage over 100 percent or under 50 percent.

Financial Rating in Montana From Top Providers by Market Share

| Company | A.M. Best | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| A++ | $166,714 | 58.29% | 22.99% | |

| A | $93,428 | 56.54% | 12.88% |

| A+ | $92,619 | 60.42% | 12.77% | |

| A | $64,633 | 46.34% | 8.91% | |

| A | $50,954 | 70.92% | 7.03% | |

| A++ | $39,509 | 73.41% | 5.45% | |

| A | $38,879 | 58.37% | 5.36% |

| A+ | $29,149 | 47.79% | 4.02% | |

| A++ | $23,589 | 55.63% | 3.25% | |

| A+ | $22,480 | 62.39% | 3.10% |

As the table above shows, Allstate and Farmers both have loss ratios under 50 percent.

In both cases, the loss ratio is still in the 40 percent range, and both companies have a great AM Best rating, so it isn’t a huge deal that the loss ratio percentage is on the lower side. Cheap Car Insurance Rates: By comparing the ratings and financial strength of these companies, you can find the most affordable coverage with reliable providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Montana’s Best-Rated Car Insurance Companies

When you’re standing on the side of the road while trying to get hold of your car insurance company after you’ve just been in a car accident, the last thing you want to hear over the phone is a nasty voice.

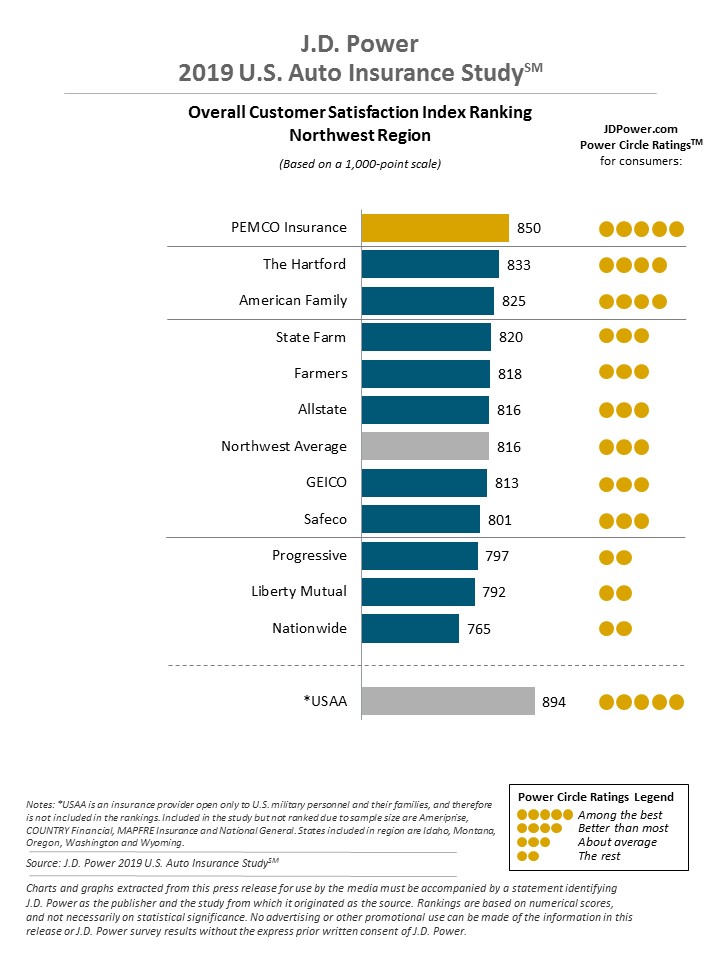

Customer service is very important, especially when it comes to your auto insurance provider. J.D. Power agrees, and that’s exactly why they rank auto insurance companies every year based on customer satisfaction.

The 2019 U.S. Auto Insurance Study, now in its 20th year, examines customer satisfaction in five factors (in order of importance): interaction; policy offerings; price; billing process and policy information; and claims.

Except USAA, (a company that only serves military members and their families) PEMCO Insurance was ranked number one for customer service in the Northwest region of the U.S.

The study is based on responses from 42,759 auto insurance customers and was fielded from February through April 2019.

Companies with the Most Complaints in Montana

All companies receive complaints. How a company handles a mistake is what matters.

Below are some numbers on company complaints in Montana.

Companies With the Most Complaints in Montana

| Company | National Median Complaint Ratio | Company Complaint Ratio | Total Complaints 2017 |

|---|---|---|---|

| 1 | 0.84 | 150 | |

| 1 | 4.28 | 140 |

| 1 | 1.11 | 120 | |

| 1 | 1.32 | 110 | |

| 1 | 0.90 | 130 | |

| 1 | 0.52 | 100 | |

| 1 | 0.26 | 140 |

| 1 | 1.02 | 110 | |

| 1 | 3.96 | 125 | |

| 1 | 0.90 | 95 |

Don’t let the numbers intimidate you—many cheap auto insurance options in Montana are available, even from top-rated providers on this list. It’s all about comparing quotes to find the best deal for your coverage needs. Compare Auto Insurance Companies to see how these providers measure up in terms of complaints, customer satisfaction, and pricing.

Cheapest Companies in Montana

Take a look at some of the companies offering cheap auto insurance in Montana to help you find the best and most affordable coverage. Comparing rates from these providers can save you money while ensuring you meet the state’s insurance requirements.

Cheapest Providers in Montana

Cheap car insurance rates are available from multiple providers, so it’s important to compare your options and select the best plan for your needs.

Commute Rates by Companies

Did you know that your rate can be affected by how many miles you drive per year?

Montana Monthly Commute Rates by Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $380 | $399 | |

| $310 | $320 |

| $326 | $326 | |

| $295 | $306 | |

| $111 | $111 |

| $290 | $290 | |

| $361 | $361 | |

| $167 | $171 | |

| $196 | $207 | |

| $350 | $370 |

According to the table above, whether you drive 6,000 miles per year or 12,000 miles per year, Liberty Mutual has the cheapest insurance in Montana.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Coverage Level Rates by Companies

Insurance can be costly, but opting for cheap auto insurance in Montana can still provide sufficient protection while saving you money in the long term.

A good insurance company might offer discounts or benefits when you choose to carry more coverage than Montana’s minimum requirements. Car insurance discounts can help you further reduce your premiums while ensuring comprehensive coverage.

To get a better picture of what we mean, take a look at the table below.

Montana Monthly Rates Coverage Level by Providers

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $371 | $389 | $409 | |

| $303 | $325 | $349 | |

| $288 | $298 | $314 | |

| $103 | $111 | $118 |

| $223 | $309 | $337 |

| $341 | $360 | $382 | |

| $191 | $201 | $213 | |

| $162 | $169 | $178 |

Liberty Mutual only charges about $200 more per year for high-coverage car insurance.

Credit History Rates by Companies

Your credit score can also affect your car insurance rate.

Montana Car Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $471 | $377 | $321 | |

| $420 | $230 | $180 |

| $384 | $305 | $288 | |

| $473 | $252 | $176 | |

| $111 | $111 | $111 |

| $366 | $264 | $239 | |

| $437 | $334 | $312 | |

| $420 | $220 | $170 | |

| $290 | $176 | $138 | |

| $460 | $250 | $190 |

According to Experian, Montana has an average credit score of 689.

The average American has a credit score of 675, so Montana residents often have a higher-than-average credit score.

A poor credit score can significantly raise your premiums, often by hundreds or even thousands of dollars. To find cheap auto insurance in Montana, maintain a high credit score and minimize your credit card usage to keep your rates affordable.

Driving Record Rates by Companies

Your driving record is the biggest factor affecting car insurance rates. Check out the table below to understand.

Montana Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $327 | $374 | $387 | $470 | |

| $250 | $290 | $335 | $395 |

| $286 | $286 | $370 | $361 | |

| $193 | $231 | $305 | $472 | |

| $75 | $105 | $131 | $131 |

| $211 | $254 | $303 | $391 | |

| $312 | $346 | $402 | $385 | |

| $270 | $320 | $355 | $410 | |

| $188 | $201 | $215 | $201 | |

| $285 | $330 | $365 | $420 |

If you’re involved in an accident, your annual premium could increase by over a thousand dollars. For those caught drinking and driving with a DUI, expect rates to rise by thousands of dollars. Maintaining a clean record is essential for securing cheap auto insurance in Montana.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Find the Cheapest Insurance in Montana Cities

This section is dedicated to helping residents of Montana cities, including Billings, Bozeman, Butte, and Great Falls, find the most affordable insurance options. Securing cost-effective insurance coverage is essential for residents seeking optimal protection.

By comparing rates, individuals in Montana can find cheap auto insurance and secure the most economical options in cities like Billings, Bozeman, Butte, and Great Falls.

Find the Cheapest Insurance in Your City

| Find the Cheapest Insurance in Your City |

|---|

| Billings, MT |

| Bozeman, MT |

| Butte, MT |

| Great Falls, MT |

This allows drivers to obtain the right coverage at competitive rates tailored to their specific needs and location. Cheap Car Insurance Rates can help you get the best deal for your coverage.

Number of Insurers in Montana

The primary difference between foreign and domestic insurers lies in their governing laws. Domestic insurers are regulated by the laws of Montana, whereas foreign insurers operate under U.S. federal insurance laws.

Number of Licensed Insurers in Montana

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 14 | 822 | 836 |

While Montana has its own insurance rules, foreign insurers typically provide more coverage options and flexibility for those seeking cheap auto insurance in Montana.

Montana State Laws

It’s important to know your state laws, but we don’t expect you to know every single one of them. However, being aware of Montana state driving laws can help keep you safe while on the road and help you avoid accidents and traffic fines.

In this section, we’ll cover topics such as teen driver laws, statutes of limitations, vehicle licensing, Real ID laws, and more.

Montana Car Insurance Laws

By now, you should know that Montana requires every driver to have car insurance. But have you ever wondered how state car insurance rate laws are formed?

According to the NAIC, car insurance rates must be filed before use with supporting data.

For more info on Montana state insurance laws, visit the Montana Motor Vehicle Division.

Windshield Coverage

Unfortunately for drivers in Montana, there aren’t any mandatory windshield coverage laws. This means that, unlike some states, Montana insurance companies are not obligated to pay for a broken or cracked windshield if it needs to be replaced.

Most likely, you’ll have to pay a hefty deductible first, before having your windshield repaired or replaced.

Not a fan of paying a deductible every single time you get a crack in your windshield?

Some insurance companies may offer deductible-free windshield coverage with a comprehensive plan. How do I know if I chose the right coverages?

High-Risk Insurance

Have you ever heard of high-risk insurance?

Montana SR-22 car insurance is one way the state of Montana can keep track of drivers who have not continuously proven financial responsibility by having car insurance. It is also required for “high-risk” drivers.

But what might qualify you as a high-risk driver?

- Conviction of DUI

- Driving while uninsured

- Having too many points on your license

- Causing a car accident

- Driving a high-risk car

- Being over a certain age

The cost of SR22 insurance is determined by your state’s minimum liability requirements. The SR22 insurance minimum in Montana is $25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage.

Keep in mind that an SR22 verifies your fulfillment of Montana’s minimum liability requirements for the next three years.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Low-Cost Insurance Program

Currently, Montana does not have a program to help families pay for car insurance if they have a low income.

Don’t be discouraged by this; learn more ways to save on your insurance policy.

Ask your insurance provider if you qualify for any of the following discounts:

- Homeowner’s discount

- Multi-Car discount

- Student Discount

- Military Discount

- Good driver discount

Car insurance for low-income families is available in states like California, New Jersey, and Hawaii, which offer government-assisted insurance programs.

Discounts for Cheap Auto Insurance in Montana

Looking for cheap auto insurance in Montana? You can save big by taking advantage of discounts from top providers like Liberty Mutual, State Farm, and Geico.

Whether it’s bundling policies, maintaining a good driving record, or using other discounts, these savings can help you lower your premiums and get affordable coverage.

Auto Insurance Discounts From the Top Providers in Montana

Company Anti-Theft Bundling Good Student Multi-Car Safe Driver

10% 25% 22% 25% 18%

25% 25% 20% 20% 18%

10% 20% 15% 20% 20%

25% 25% 15% 25% 15%

35% 25% 12% 25% 20%

5% 20% 18% 20% 12%

25% 10% 10% 12% 10%

20% 15% 10% 20% 10%

15% 17% 35% 20% 20%

15% 13% 8% 8% 17%

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Automobile Insurance Fraud in Montana

How can you get busted for insurance fraud?

According to the IIHS, insurance fraud can be “hard” or “soft.” Hard fraud occurs when someone deliberately fabricates claims or fakes an accident.

Soft insurance fraud, or opportunistic fraud, happens when individuals or businesses inflate legitimate claims to receive more money. For example, business owners might underreport the number of employees or misrepresent their roles to reduce worker’s compensation premiums, which can also impact overall costs, including cheap auto insurance in Montana.

The IIHS also says that the Insurance Research Council reported that “Auto insurance fraud and claim buildup added between $4.9 billion and $6.8 billion to closed auto injury claim payments in 2007.”

If you or someone you know would like to report a fraudulent insurance claim, please contact the Office of the Montana State Auditor, Commissioner of Securities and Insurance.

840 Helena Ave. Helena, Montana 59601

Phone: (800) 332-6148 or (406) 444-2040

Statute of Limitations

The statute of limitations law exists to protect both the insurance company as well as the claimant.

If you get into a car accident, you can’t wait 20 years to file a claim. If this were possible, insurance companies would go out of business. On the other hand, the statute of limitations law does give a driver ample time to file a claim for cheap auto insurance in Montana without rushing through the process.

According to Montana state law, a driver has three years to file a personal injury claim and two years to file a property damage claim, which is important when considering auto insurance coverage options for the right protection.

Montana State-Specific Laws

Did you know it’s illegal to drive in Montana with a sheep in the cab of your truck unless you have a chaperone?

As far as we know, this is one of the only weird driving laws in Montana. If you’d like to read up on more Montana car insurance laws, click here.

Vehicle Licensing Laws

In the state of Montana, every driver must be licensed. We will get into licensing laws further down, but first, we want to cover Real ID laws. What does a Montana Real ID look like?

After October 2020, drivers will not be able to board a domestic flight or enter a federally secured building without a Real ID.

Penalties for Driving Without Insurance

We get it – car insurance isn’t an exciting thing to pay for, but every driver must carry their car insurance policy. If a law enforcement officer pulls you over, you must be ready and willing to show proof of insurance, you license and registration.

What are some of the penalties for driving without insurance?

Penalties for Driving without insurance in Montana

| Offense | Penalties |

|---|---|

| First Offense | $250–$500 fine and/or up to 10 days in jail. |

| Second Offense (within 5 years) | $350 fine and/or up to 10 days in jail. License and registration suspended until you show proof of insurance and pay fees within 90 days. |

If you’re caught driving without insurance just one time, your license could be suspended. What happens if you drive without insurance? Even if you have insurance, you can still be penalized for driving without proof of insurance.

Let’s review acceptable forms of proof of insurance.

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- A picture of proof of insurance on your smartphone

- Electronic proof of insurance

If you’re not great at carrying around papers and insurance forms, take a photo of your insurance card as soon as you receive it, and that way (if you carry your phone with you all of the time), you should have it on you at all times.

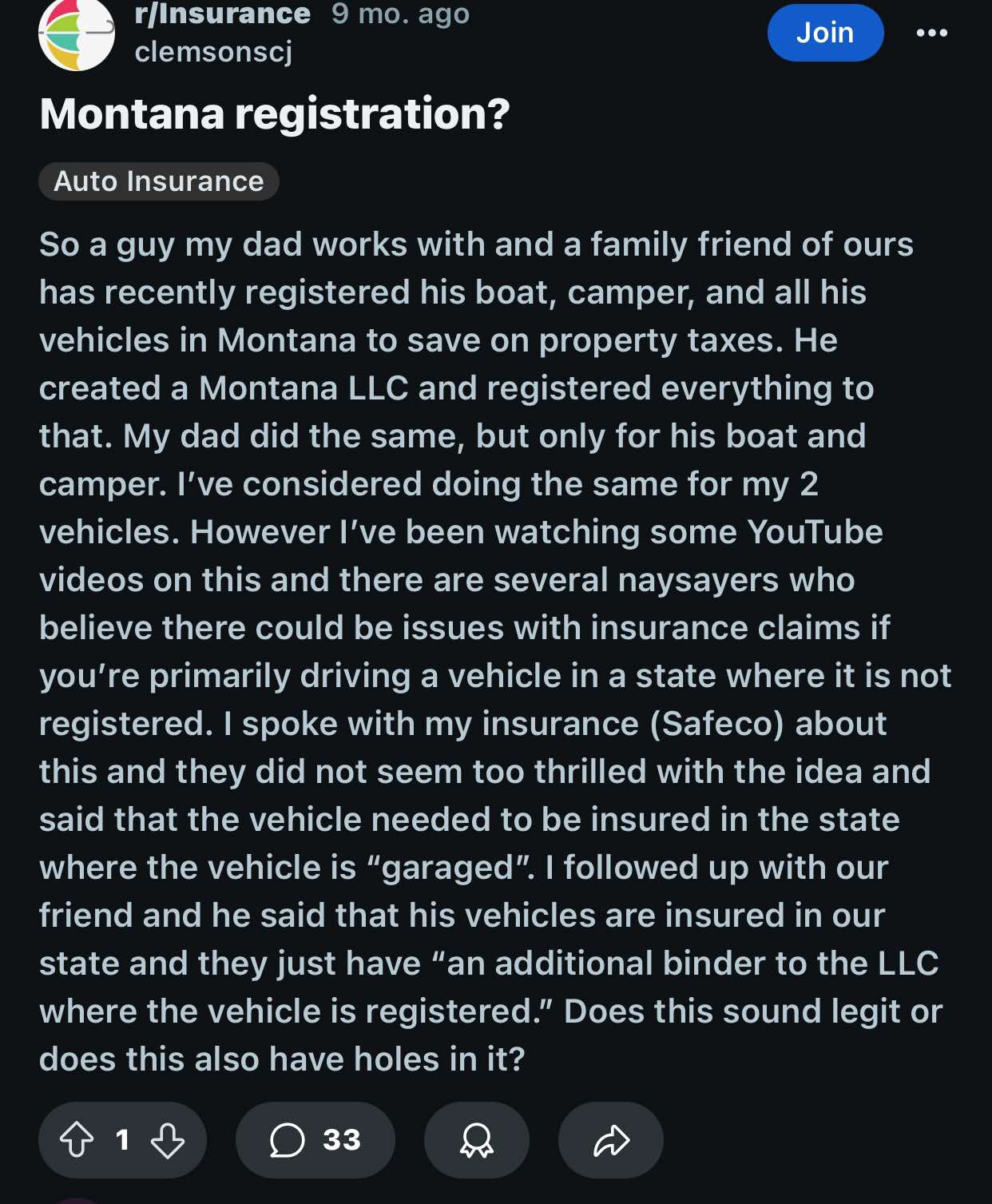

This Reddit post below raises concerns about registering vehicles in Montana for tax savings, as insurance companies like Safeco emphasize vehicles must be insured where they are garaged. While cheap auto insurance in Montana may appeal, it’s crucial to ensure coverage aligns with state regulations to avoid potential issues with claims.

Teen Driver Laws

In the state of Montana, teens can start driver’s education as early as 14 years and nine months old. Take a look at the table below for more info about how to get a license in the state of Montana.

Requirements for Getting a License in Montana

| License Requirements in Montana | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours, 10 of which must be at night |

| Minimum Age | 15 years old |

In Montana, license applicants younger than 16 must have completed driver’s education.

Montana Teen Driving Restrictions

| Restriction Type | Details |

|---|---|

| Night Driving | No driving 11 p.m.–5 a.m. |

| Passengers | 1 under-18 passenger (first 6 months); up to 3 (next 6 months); family excluded |

| Nighttime restrictions | End after 12 months or at age 18 (min. age 16) |

| Passenger restrictions | End after 12 months or at age 18 (min. age 16) |

| Passenger restrictions | 12 months or at age 18, whichever occurs first (min. age: 16) |

To ensure your teen driver is properly insured, check out car insurance for teenagers to learn more about affordable options and coverage tailored to young drivers.

License Renewal Procedures

If you are under 75, you must renew your license every eight years. If you are 75 or over, you must renew your license every four years.

IMPORTANT: If you are turning 75, you must renew your license even if you have previously renewed it within the last eight years.

Keep in mind that proof of adequate vision is required at every renewa,l and mail or online renewal is permitted by any driver regardless of age.

New Residents

Are you thinking about moving to Montana? New residents are required to transfer their out-of-state license to Montana within 60 days of living in the state. Do you remember Montana’s minimum liability insurance requirements?

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $20,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle

If you are getting ready to move, or have already moved to Montana, make sure you give your current insurance company a call so that they can switch your out-of-state insurance to meet Montana’s insurance requirements.

Some insurance companies do not provide insurance in every state.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Negligent Operator Treatment System

According to Driving Laws by Nolo, Montana has a law that prohibits negligent or “careless driving.” The law requires all motorists to drive “carefully and prudently, so as not to unduly or unreasonably endanger the life, limb, property, or other rights of a person.”

The difference between reckless and careless driving might be subtle in some cases. But generally, the distinction has to do with the driver’s level of culpability.

Unlike reckless driving—which requires proof that the driver intentionally or knowingly did something risky behind the wheel—a motorist can be convicted of careless driving without realizing the dangerousness of the driving.

Careless driving is a misdemeanor, but the consequences are less serious than those for reckless driving. The possible penalties for a careless driving conviction are:

- First offense: For a first careless driving violation, there’s a $10 to $100 fine.

- Second offense: For a second careless driving conviction within a year, the driver is looking at fines of $25 to $200.

- Third offense: For a third or subsequent offense within a year, the driver faces $50 to $500 in fines.

- Offenses involving death or injuries: A careless driving offender who causes death or “serious bodily injury” to another person faces up to six months in jail and/or a maximum of $5,000 in fines.

A careless driving conviction adds four points to the motorist’s driving record.

Montana Rules of the Road

In this next section, we’ll discuss Montana’s at-fault law and the important rules of the road. Understanding these guidelines can help you avoid accidents, fines, points on your license, or even suspension. If you’re looking to lower costs with cheap auto insurance in Montana, staying informed and following these rules will also help you maintain better insurance rates.

Fault vs No-Fault

As we previously discussed, Montana is an at-fault car accident state. This means that anyone who causes an accident is responsible for covering the costs of damages and/or medical bills incurred from that accident.

It’s a great thing to have more insurance than what is required because, with cheap auto insurance in Montana, you may run out of insurance funds quickly, leaving significant bills unpaid. Having additional coverage ensures better protection and financial security in the event of costly accidents.

Keep in mind that at-fault drivers are also responsible for filing a claim for other drivers if they were involved in the accident as well. For more clarity, let’s delve into the differences between fault vs. no-fault auto insurance laws to better understand how Montana’s at-fault system works.

Seat Belt and Car Seat Laws

Click it or ticket. Are you aware of Montana’s car seat and seat belt laws? Avoid a fine (and injuries) by following these Montana safety belt laws below.

Seat Belt Laws in Montana

| Seat Belt Laws in Montana | Details |

|---|---|

| Effective Since | October 1, 1987 |

| Primary Enforcement | no |

| Age/Seats Applicable | 6+ years in all seats |

| 1st Offense Max Fine | $20 |

If you break one of these laws, you’re looking at a $20 fine plus fees.

Help keep your little ones safe by making sure they are in the right type of car seat while traveling in a moving vehicle.

Car Seat laws for Montana

| Type of Car Seat Required | Age/Details |

|---|---|

| Must be in child safety seat | 5 years and younger and less than 60 pounds |

| Maximum base fine 1st offense, additional fees may apply | $100 |

| Preference for rear seat | law states no preference for rear seat |

| Adult Belt Permissible | not permissible |

Have you ever wondered if riding in the cargo area of a Pickup truck is illegal?

In Montana, there are no state laws about riding in the back of a Pickup truck, however, you should always use caution while riding in an area of a vehicle that does not have a seatbelt.

Keep Right or Move Over Laws

In Montana, drivers must keep right if they choose to drive slower than the average speed of traffic. Passing on the right is allowed under certain circumstances.

According to the Montana Code, the operator of a vehicle may overtake and pass on the right of another vehicle only under the following conditions:

- When the vehicle overtaken is making or about to make a left turn, or

- on a roadway with unobstructed pavement of sufficient width for two or more lanes of vehicles moving lawfully in the direction being traveled by the overtaking vehicle.

- The operator of a vehicle may overtake and pass another vehicle on the right only under conditions permitting safe movement. The movement may not be made by driving off the pavement or the main-traveled portion of the roadway.

AAA says Montana law requires drivers approaching a stationary emergency vehicle displaying flashing lights, including towing and recovery vehicles, traveling in the same direction, to vacate the lane closest if safe and possible to do so, or slow to a safe speed.

If on a highway with a speed limit of 50mph or greater, the driver must slow by at least 20mph below the posted speed limit.

Speed Limit Laws

The number one traffic violation in Montana is speeding. Knowing Montana’s speed limit laws can keep your wallet full and your driving record clean.

See the table below for the maximum speed limits in Montana.

Speed Limit Laws in Montana

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 80 mph trucks: 70 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | day: 70; night: 65 |

| Other Roads | day: 70; night: 65 |

Remember that these are the maximum limits allowed on the roads in Montana. To maintain safety and avoid accidents, always adhere to the posted limits and drive defensively.

Ridesharing

If you work for a company like Uber or Lyft, you must have ridesharing insurance. Insurance companies know that the more you drive, the more likely you are to get into an accident.

Are you looking for ridesharing insurance?

For affordable options that keep you protected, be sure to explore our cheap rideshare insurance section for additional coverage insights and savings tips.

Automation on the Road

Have you ever heard of vehicle automation? The IIHS says that in driving, automation involves using radar, cameras, and other sensors to perform parts or all of the driving task on a sustained basis instead of the driver.

One example is adaptive cruise control, which continually adjusts the vehicle’s speed to maintain a set minimum following distance.

Features such as automatic braking, which acts as a backup if the human driver fails to brake, or blind-spot detection, which provides additional information to the driver, aren’t considered automation under this definition.

At this time, Montana has not deployed or tested complete vehicle automation.

Safety Laws

In this next section, we will review three very important safety laws: DUI laws, impaired driving laws, and distracted driving laws.

If you’re unsure of these, review our driving tips for road safety to avoid penalties, fines, and accidents.

DUI Laws

From 2008-2017, there were 796 alcohol-impaired traffic deaths in the state of Montana. But if you’re going to spend a night out on the town, what are some important drinking and driving laws to follow?

DUI Laws in Montana

| Name for Offense | Driving under the influence (DUI) |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.16 |

| Criminal Status | 1st-3rd misdemeanors, 4th+ felonies |

| Look Back Period | 10 years for 2nd offense, unlimited/lifetime for 3rd+ |

What are some of the penalties involved with these DUI offenses?

DUI Penalties in Montana

| Offense | ALS/Revocation | Jail Time | Fine | Other Penalties |

|---|---|---|---|---|

| 1st Offense | 6-month suspension | 24 hrs – 6 months | $600–$1,000 + $200 fee | 10 points for life; ACT program; possible IID |

| 2nd Offense | 1-year suspension | 7 days – 1 year | $1,200–$2,000 | 10 points; possible 24/7 program |

| 3rd Offense | 1-year suspension | 30 days – 1 year | $2,500–$5,000 | 10 more points (30 total); license revoked |

In 2017, there were 56 alcohol-related fatalities in Montana. Please don’t drink and drive – it’s an action that can be easily avoided.

Marijuana-Impaired Driving Laws

According to Responsibility.org, if you are caught driving with more than THC per se (5 nanograms) of marijuana on your person, you will be charged with impaired driving.

If you are convicted of drugged-driving, you could be facing fines and/or jail time.

For states without a marijuana-specific per se drugged driving law, an impairment-based statute exists that requires law enforcement to prove the impairment of the driver. Successful prosecution depends on documented behavioral evidence and recent drug use.

Distracted Driving Laws

Technology has advanced greatly in the last few years, but like any other tool, texting has become both a convenience and a curse.

Studies have shown that the effects of texting and driving can be worse than drinking and driving. Look at the table below to find out more about distracted driving laws.

Distracted Driving Laws in MT

| Hand-held ban | Young drivers all cellphone ban | Texting ban | Enforcement |

|---|---|---|---|

| No | No | No | Not applicable |

While there aren’t any laws regarding cell phone use while driving in Montana, it might still be a good idea to exercise discretion if you choose to use your phone in a moving vehicle.

Driving in Montana

Now that we’ve covered Montana’s driving and safety laws, it’s time to discuss Montana’s must-know facts.

What are some of the risks of owning and operating a vehicle in Montana? What about vehicle theft? What causes traffic fatality rates in Montana?

Vehicle Theft in Montana

Is your vehicle on Montana’s most stolen list?

Vehicle Theft in Montana

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2023 | $150 |

| Ford Pickup (Full Size) | 2023 | $120 |

| Dodge Pickup (Full Size) | 2023 | $110 |

| GMC Pickup (Full Size) | 2023 | $90 |

| Honda Accord | 2023 | $80 |

| Chevrolet Impala | 2023 | $70 |

| Ford Explorer | 2023 | $85 |

| Chevrolet Pickup (Small Size) | 2023 | $130 |

| Toyota Camry | 2023 | $60 |

| Ford Pickup (Small Size) | 2023 | $100 |

The year of the vehicle is just the most popular model year stolen. The number listed as stolen for that make and model includes all model years of it. The Chevy Pickup truck is the most stolen vehicle in Montana.

Vehicle Theft by Cities in Montana

| City | Theft Count |

|---|---|

| Baker | 10 |

| Belgrade | 15 |

| Billings | 50 |

| Boulder | 5 |

| Bozeman | 25 |

| Bridger | 3 |

| Chinook | 6 |

| Colstrip | 12 |

| Columbia Falls | 8 |

| Columbus | 7 |

| Conrad | 4 |

| Cut Bank | 9 |

| Deer Lodge | 11 |

| Dillon | 14 |

| East Helena | 15 |

| Ennis | 10 |

| Eureka | 5 |

| Fort Benton | 20 |

| Fromberg | 8 |

| Glasgow | 18 |

| Glendive | 22 |

| Great Falls | 45 |

| Hamilton | 12 |

| Havre | 25 |

| Helena | 40 |

| Hot Springs | 6 |

| Kalispell | 30 |

| Laurel | 35 |

| Lewistown | 28 |

| Libby | 14 |

| Livingston | 19 |

| Manhattan | 15 |

| Miles City | 30 |

| Missoula | 50 |

| Plains | 5 |

| Polson | 25 |

| Red Lodge | 10 |

| Ronan City | 20 |

| Sidney | 40 |

| Stevensville | 12 |

| St. Ignatius | 8 |

| Thompson Falls | 18 |

| Troy | 6 |

| West Yellowstone | 50 |

| Whitefish | 20 |

| Wolf Point | 35 |

Did you know that some cities have more vehicle theft than others? The data from the list above is pulled directly from the FBI.

Read More: Auto Insurance Coverage: What events are and are not covered by your policy?

Road Fatalities in Montana

Accidents happen, and sometimes they result in death. Many of these traffic fatalities have resulted from specific scenarios. In this section, we want to discuss why they happen and what causes them, as well as how having cheap auto insurance in Montana can help protect you in such situations.

In 2017, there were 186 traffic fatalities in the state of Montana. Before we get into the causes of these fatal accidents, let’s first talk about the most dangerous roads in Montana and how cheap auto insurance in Montana can provide necessary coverage for drivers on risky roads.

Before exploring fatal accident causes, let’s review the most dangerous roads and how having the right coverage can help. How to file an auto insurance claim is key to a swift recovery when incidents occur.

Most Fatal Highway in Montana

According to Geotab.com, US-2 is the northernmost east-west US Route. Its Montana stretch has an average of 13 fatal crashes per year.

Over 30,000 people are killed every year in car accidents.

To determine the most dangerous highway in each US state, Geotab calculated a Fatal Crash Rate that is based on the annual number of road fatalities and fatal crashes according to the National Highway Traffic Safety Administration, adjusted for the average daily traffic counts provided by the Federal Highway Administration.

Fatal Crashes by Weather Condition and Light Condition

Do weather and light conditions cause frequent fatal car accidents in Montana?

Fatal Crashes by Weather Condition and Light Condition in MT

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 86 | 3 | 56 | 3 | 0 | 148 |

| Rain | 2 | 1 | 2 | 2 | 0 | 7 |

| Snow/Sleet | 5 | 1 | 2 | 0 | 0 | 8 |

| Other | 2 | 4 | 0 | 0 | 0 | 6 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 95 | 9 | 60 | 5 | 0 | 169 |

According to the table above, many of these accidents occurred either in broad daylight or in the dark under normal weather conditions, highlighting how car accidents and auto claims can be influenced by environmental factors.

Fatalities (All Crashes) by County

Below is a list showing fatal crashes by county in Montana. Can you find your county on this list?

Fatalities (All Crashes) by County in MT

| County | Fatalities 2024 | 2023 | 2022 | 2021 | 2020 | Fatalities/ 100K 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|

| Beaverhead | 5 | 6 | 5 | 4 | 6 | 25 | 30 | 28 | 27 | 32 |

| Big Horn | 4 | 5 | 4 | 3 | 5 | 35 | 40 | 38 | 37 | 42 |

| Blaine | 3 | 4 | 3 | 3 | 4 | 20 | 25 | 22 | 21 | 25 |

| Broadwater | 2 | 3 | 2 | 2 | 3 | 10 | 15 | 12 | 12 | 15 |

| Carbon | 6 | 5 | 4 | 3 | 6 | 50 | 45 | 42 | 40 | 47 |

| Carter | 1 | 2 | 1 | 1 | 1 | 5 | 10 | 7 | 8 | 9 |

| Cascade | 7 | 6 | 5 | 6 | 8 | 60 | 55 | 50 | 48 | 55 |

| Chouteau | 3 | 4 | 2 | 3 | 2 | 25 | 30 | 22 | 20 | 18 |

| Custer | 4 | 5 | 3 | 3 | 5 | 30 | 35 | 28 | 28 | 32 |

| Daniels | 2 | 3 | 2 | 2 | 2 | 15 | 18 | 13 | 14 | 12 |

| Dawson | 5 | 6 | 4 | 4 | 6 | 40 | 45 | 38 | 40 | 42 |

| Deer Lodge | 3 | 4 | 3 | 2 | 3 | 25 | 30 | 23 | 22 | 28 |

| Fallon | 5 | 4 | 6 | 5 | 7 | 15 | 14 | 16 | 15 | 18 |

| Fergus | 8 | 9 | 7 | 10 | 9 | 25 | 27 | 24 | 26 | 28 |

| Flathead | 12 | 11 | 13 | 14 | 15 | 30 | 28 | 32 | 34 | 36 |

| Gallatin | 15 | 14 | 16 | 18 | 20 | 40 | 38 | 42 | 44 | 48 |

| Garfield | 2 | 1 | 3 | 4 | 5 | 10 | 9 | 11 | 12 | 14 |

| Glacier | 3 | 2 | 3 | 3 | 4 | 15 | 14 | 16 | 15 | 17 |

| Golden Valley | 1 | 2 | 1 | 1 | 1 | 5 | 6 | 5 | 5 | 7 |

| Granite County | 4 | 3 | 4 | 4 | 3 | 20 | 19 | 21 | 20 | 22 |

| Hill County | 6 | 5 | 7 | 6 | 8 | 25 | 24 | 26 | 23 | 28 |

| Jefferson County | 7 | 6 | 5 | 7 | 9 | 30 | 28 | 27 | 32 | 35 |

| Judith Basin | 1 | 2 | 1 | 2 | 2 | 5 | 6 | 5 | 7 | 8 |

| Lake County | 10 | 9 | 8 | 7 | 11 | 18 | 17 | 16 | 19 | 20 |

| Lewis And Clark | 13 | 12 | 11 | 10 | 14 | 20 | 19 | 21 | 22 | 24 |

| Liberty County | 2 | 1 | 2 | 2 | 3 | 5 | 6 | 7 | 6 | 7 |

| Lincoln County | 9 | 8 | 10 | 8 | 12 | 22 | 21 | 23 | 22 | 25 |

| Madison | 7 | 6 | 8 | 9 | 10 | 12 | 11 | 13 | 14 | 15 |

| McCone | 2 | 3 | 4 | 3 | 4 | 5 | 6 | 7 | 7 | 8 |

| Meagher | 3 | 2 | 3 | 4 | 5 | 7 | 6 | 7 | 8 | 9 |

| Mineral | 4 | 3 | 4 | 5 | 6 | 8 | 7 | 8 | 9 | 10 |

| Missoula | 25 | 24 | 28 | 30 | 35 | 25 | 23 | 26 | 28 | 30 |

| Musselshell | 3 | 4 | 5 | 6 | 7 | 7 | 8 | 9 | 10 | 11 |

| Park | 9 | 8 | 10 | 11 | 13 | 15 | 14 | 16 | 18 | 20 |

| Petroleum | 1 | 1 | 2 | 2 | 3 | 4 | 5 | 6 | 5 | 6 |

| Phillips | 4 | 3 | 4 | 5 | 7 | 8 | 7 | 8 | 9 | 11 |

| Pondera | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 14 | 15 |

| Powder River | 3 | 2 | 3 | 4 | 5 | 6 | 5 | 6 | 7 | 8 |

| Powell | 4 | 3 | 4 | 5 | 6 | 7 | 6 | 7 | 8 | 9 |

| Prairie | 2 | 1 | 2 | 3 | 5 | 5 | 4 | 5 | 6 | 7 |

| Ravalli | 18 | 17 | 20 | 21 | 23 | 22 | 21 | 23 | 22 | 23 |

| Richland | 12 | 11 | 14 | 16 | 17 | 18 | 17 | 19 | 20 | 21 |

| Roosevelt | 9 | 8 | 10 | 12 | 13 | 14 | 13 | 15 | 16 | 18 |

| Rosebud | 10 | 9 | 11 | 12 | 15 | 16 | 15 | 17 | 18 | 19 |

| Sanders | 7 | 6 | 8 | 9 | 6 | 10 | 9 | 11 | 12 | 8 |

| Sheridan | 4 | 5 | 6 | 7 | 8 | 7 | 8 | 9 | 10 | 11 |

| Silver Bow | 10 | 9 | 11 | 12 | 10 | 15 | 14 | 16 | 17 | 15 |

| Stillwater | 3 | 4 | 5 | 6 | 5 | 5 | 6 | 7 | 8 | 7 |

| Sweet Grass | 5 | 4 | 7 | 8 | 6 | 8 | 7 | 10 | 11 | 9 |

| Teton | 6 | 5 | 6 | 7 | 5 | 9 | 8 | 9 | 10 | 8 |

| Toole | 4 | 3 | 5 | 4 | 5 | 7 | 6 | 8 | 7 | 6 |

| Treasure | 2 | 3 | 2 | 4 | 3 | 5 | 6 | 5 | 7 | 6 |

| Valley | 8 | 7 | 9 | 10 | 8 | 10 | 9 | 12 | 13 | 11 |

| Wheatland | 3 | 2 | 4 | 5 | 3 | 6 | 5 | 7 | 8 | 6 |

| Wibaux | 2 | 3 | 2 | 3 | 3 | 5 | 6 | 5 | 6 | 6 |

| Yellowstone | 12 | 11 | 10 | 13 | 15 | 25 | 24 | 23 | 26 | 28 |

| Yellowstone National Park (Dissolved As County Equivalent) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Understanding these figures is key to knowing how accidents change your car insurance rates.

Traffic Fatalities: Rural vs Urban

Are traffic fatalities in Montana more likely to happen in rural areas or urban areas? Normally, more fatalities happen in rural areas because it takes longer for an emergency response team to arrive at the crash site.

When considering cheap auto insurance in Montana, it’s important to account for the potential risks in rural areas, as coverage options may vary based on location and accident likelihood.

Traffic Fatalities: Rural vs Urban in MT

| Area | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Rural | 40 | 35 | 38 | 30 | 45 |

| Urban | 60 | 55 | 57 | 50 | 55 |

| Total | 100 | 90 | 95 | 80 | 100 |

On average, you are eight times more likely to get into a fatal accident in a rural area than in an urban environment.

Fatalities by Person Type

Did the person or vehicle type have anything to do with the fatal crash rate in Montana?

Fatalities by Person Type in MT

| Category | Person Type | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 50 | 48 | 52 | 47 | 55 |

| Light Truck - Pickup | 20 | 18 | 22 | 19 | 24 | |

| Light Truck - Utility | 25 | 24 | 27 | 26 | 28 | |

| Light Truck - Van | 15 | 14 | 16 | 14 | 18 | |

| Large Truck | 10 | 9 | 12 | 11 | 13 | |

| Other/Unknown Occupants | 30 | 28 | 32 | 29 | 35 | |

| Total Occupants | 150 | 145 | 155 | 150 | 160 | |

| Light Truck - Other | 5 | 4 | 6 | 5 | 7 | |

| Bus | 2 | 3 | 4 | 3 | 4 | |

| Motorcyclists | Total Motorcyclists | 35 | 33 | 37 | 34 | 40 |

| Nonoccupants | Pedestrian | 12 | 11 | 13 | 10 | 15 |

| Bicyclist and Other Cyclist | 10 | 9 | 11 | 8 | 12 | |

| Total Nonoccupants | 25 | 23 | 26 | 18 | 28 | |

| Other/Unknown Nonoccupants | 5 | 6 | 7 | 6 | 8 | |

| Total | Total | 200 | 190 | 200 | 190 | 210 |

Understanding these factors is essential for analyzing car accidents and auto claims and improving safety measures.

Fatalities by Crash Type

Does a certain type of crash cause more fatal accidents than other types of crashes?

Montana Fatalities by Crash Type

| Crash Type | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 200 | 190 | 210 | 180 | 220 |

| Single Vehicle | 50 | 48 | 52 | 45 | 55 |

| Involving a Large Truck | 30 | 28 | 32 | 25 | 35 |

| Involving Speeding | 60 | 58 | 65 | 55 | 70 |

| Involving a Rollover | 45 | 43 | 47 | 40 | 50 |

| Involving a Roadway Departure | 55 | 53 | 56 | 50 | 60 |

| Involving an Intersection (or Intersection Related) | 40 | 38 | 42 | 35 | 45 |

According to the table above, crashes involving a roadway departure were most likely to result in a fatality, demonstrating how accidents change your car insurance rates.

Five-Year Trend For The Top 10 Counties in Montana

Below is the five-year trend for the top ten largest counties in Montana.

Five-Year Trend For the Top 10 Counties in Montana

| County | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Big Horn | 20 | 18 | 22 | 19 | 24 |

| Broadwater | 15 | 14 | 16 | 17 | 18 |

| Cascade | 45 | 43 | 47 | 44 | 48 |

| Flathead | 50 | 48 | 52 | 45 | 55 |

| Gallatin | 55 | 52 | 57 | 51 | 59 |

| Glacier | 25 | 24 | 27 | 26 | 29 |

| Lake | 30 | 28 | 32 | 31 | 33 |

| Lewis And Clark | 40 | 38 | 42 | 39 | 44 |

| Missoula | 60 | 58 | 62 | 55 | 65 |

| Yellowstone | 75 | 70 | 80 | 72 | 85 |

Compare auto insurance companies to find the best coverage for these areas.

Fatalities Involving Speeding by County

Speeding is a huge cause of road fatalities in Montana. In 2017, there were 59 speeding-related road fatalities in Montana.

Fatalities Involving Speeding by County in MT

| County | Fatalities 2024 | 2023 | 2022 | 2021 | 2020 | Fatalities/ 100K 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|

| Beaverhead County | 5 | 4 | 3 | 4 | 5 | 20 | 19 | 18 | 19.5 | 20 |

| Big Horn County | 8 | 7 | 6 | 7 | 8 | 40 | 38 | 37 | 39 | 40 |

| Blaine County | 3 | 2 | 2 | 3 | 3 | 25 | 24 | 23 | 24 | 25 |

| Broadwater County | 4 | 3 | 4 | 5 | 4 | 30 | 28 | 29 | 31 | 30 |

| Carbon County | 6 | 5 | 4 | 5 | 6 | 27.5 | 26 | 25 | 26.5 | 27.5 |

| Carter County | 2 | 1 | 1 | 2 | 3 | 22.5 | 21 | 20.5 | 22 | 23 |

| Cascade County | 15 | 14 | 13 | 16 | 17 | 28 | 27 | 26 | 29 | 30 |

| Chouteau County | 3 | 2 | 3 | 4 | 3 | 26.5 | 25 | 26 | 28 | 26.5 |

| Custer County | 7 | 6 | 5 | 6 | 8 | 32 | 31 | 30 | 32 | 34 |

| Daniels County | 1 | 1 | 1 | 1 | 2 | 18 | 17 | 16.5 | 17.5 | 18.5 |

| Dawson County | 5 | 4 | 3 | 4 | 5 | 23 | 22 | 21 | 23 | 24 |

| Deer Lodge County | 3 | 2 | 2 | 3 | 3 | 25.5 | 24 | 23 | 24.5 | 25 |

| Fallon County | 2 | 2 | 2 | 3 | 2 | 22 | 21 | 20.5 | 21.5 | 21 |

| Fergus County | 6 | 5 | 4 | 6 | 7 | 29.5 | 28 | 27.5 | 28.5 | 29 |

| Flathead County | 12 | 11 | 10 | 11 | 13 | 35 | 34 | 33 | 33.5 | 36 |

| Gallatin County | 5 | 4 | 3 | 4 | 6 | 15 | 14 | 13 | 15 | 18 |

| Garfield County | 2 | 1 | 1 | 1 | 2 | 18.5 | 17 | 16 | 17.5 | 18 |

| Glacier County | 3 | 2 | 2 | 3 | 3 | 20 | 19 | 18 | 19.5 | 20 |

| Golden Valley County | 1 | 1 | 0 | 1 | 1 | 14 | 13.5 | 12 | 14 | 15 |

| Granite County | 2 | 1 | 2 | 3 | 2 | 19.5 | 18 | 17 | 19.5 | 18.5 |

| Hill County | 4 | 3 | 3 | 4 | 4 | 25 | 24 | 23.5 | 24 | 25 |

| Jefferson County | 3 | 2 | 2 | 3 | 4 | 22 | 21.5 | 20 | 21 | 23 |

| Judith Basin County | 1 | 1 | 1 | 1 | 1 | 16.5 | 16 | 15.5 | 16 | 17 |

| Lake County | 5 | 4 | 3 | 5 | 6 | 23 | 22 | 21 | 22.5 | 23.5 |

| Lewis And Clark County | 8 | 7 | 6 | 8 | 9 | 31 | 30 | 29 | 31 | 32 |

| Liberty County | 1 | 1 | 1 | 1 | 2 | 13 | 12.5 | 12 | 13 | 14 |

| Lincoln County | 2 | 2 | 2 | 3 | 3 | 20 | 19 | 18.5 | 20 | 21 |

| Madison County | 6 | 5 | 4 | 6 | 7 | 29 | 28 | 27 | 29 | 30 |

| Mccone County | 1 | 1 | 1 | 1 | 1 | 15.5 | 15 | 14.5 | 15 | 16 |

| Meagher County | 3 | 2 | 2 | 3 | 3 | 22 | 21 | 20.5 | 21.5 | 22 |

| Mineral County | 2 | 1 | 2 | 3 | 3 | 18.5 | 17 | 16 | 17.5 | 18.5 |

| Missoula County | 10 | 9 | 8 | 9 | 10 | 34 | 33 | 32 | 33 | 35 |

| Musselshell County | 3 | 2 | 2 | 3 | 4 | 22.5 | 21.5 | 21 | 22 | 23 |

| Park County | 4 | 3 | 2 | 3 | 4 | 25 | 24 | 23 | 24 | 25 |

| Petroleum County | 1 | 1 | 1 | 1 | 2 | 18 | 17 | 16.5 | 17.5 | 18.5 |

| Phillips County | 2 | 2 | 2 | 3 | 2 | 22 | 21 | 20.5 | 21.5 | 21 |

| Pondera County | 3 | 2 | 3 | 4 | 3 | 26 | 25 | 26 | 28 | 26.5 |

| Powder River County | 1 | 1 | 1 | 2 | 2 | 20 | 19 | 18.5 | 21 | 21 |

| Powell County | 2 | 2 | 2 | 2 | 3 | 22 | 21 | 20.5 | 21.5 | 22.5 |

| Prairie County | 1 | 1 | 1 | 1 | 1 | 19.5 | 18 | 17.5 | 18 | 19 |

| Ravalli County | 5 | 4 | 4 | 5 | 6 | 27 | 26 | 25 | 27.5 | 28 |

| Richland County | 3 | 3 | 3 | 4 | 3 | 25 | 24 | 23 | 24 | 25 |

| Roosevelt County | 2 | 1 | 2 | 2 | 3 | 22.5 | 21 | 20.5 | 21.5 | 22.5 |

| Rosebud County | 4 | 3 | 3 | 4 | 4 | 28 | 27 | 26 | 28 | 29 |

| Sanders County | 3 | 3 | 3 | 3 | 4 | 24 | 23 | 22.5 | 23 | 24.5 |

| Sheridan County | 2 | 1 | 2 | 2 | 3 | 22 | 21.5 | 21 | 21.5 | 22.5 |

| Silver Bow County | 6 | 5 | 6 | 7 | 8 | 30 | 29 | 30 | 32 | 33 |

| Stillwater County | 3 | 2 | 3 | 3 | 4 | 25.5 | 24 | 23.5 | 24 | 25 |

| Sweet Grass County | 1 | 1 | 1 | 1 | 2 | 19 | 18 | 17.5 | 18 | 19.5 |

| Teton County | 3 | 2 | 2 | 3 | 3 | 15 | 14 | 13.5 | 14 | 14.5 |

| Toole County | 4 | 3 | 3 | 4 | 4 | 20 | 18.5 | 18 | 19 | 19.5 |

| Treasure County | 2 | 2 | 1 | 2 | 2 | 18.5 | 18 | 17 | 17.5 | 18 |

| Valley County | 5 | 4 | 3 | 4 | 5 | 22 | 21.5 | 20.5 | 21 | 22 |

| Wheatland County | 1 | 1 | 1 | 2 | 1 | 10 | 9.5 | 9 | 10 | 9.5 |

| Wibaux County | 2 | 2 | 2 | 3 | 2 | 18 | 17.5 | 17 | 18.5 | 18 |

| Yellowstone County | 8 | 7 | 6 | 7 | 8 | 30 | 28 | 27 | 29 | 30 |

| Yellowstone National Park (Dissolved As County Equivalent) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Following driving tips for road safety can help you reduce these risks and stay safe on the road.

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County

In 2017, there were 56 alcohol-impaired road fatalities in Montana. Below is a list showing traffic fatalities that resulted from drunk driving by the counties in which they occurred and the year they occurred.

If you are seeking cheap auto insurance in Montana, consider how factors like drunk driving statistics may impact rates in certain counties, as insurers assess these risks when calculating premiums.

[table “2991responsivescroll” not found /]

Teen Drinking and Driving

For obvious reasons, teen drivers don’t have a lot of driving experience — but add some alcohol to the lack of experience and you’ve got yourself a deadly mix.

Montana is ranked fifth in the U.S. for teenage drinking and driving.

Teen Drinking & Driving in Montana

| Under 18 DUI Arrests | Teen DUI Rate | Rank |

|---|---|---|

| 120 | 350 | 5 |

According to Responsibility.org, in 26 states and D.C., under-21 alcohol-impaired driving fatalities per 100,000 population were at or below the national average of 1.2 deaths per 100,000 population.

Montana has the highest teenage drunk-driving fatality rate in the country, with an average of 3 deaths per 100,000 population.

EMS Response Time

Sometimes arriving seconds early to a crash site can mean the difference between saving someone’s life or sending them straight to the morgue.

Because there are fewer EMS services in rural areas than in cities, EMS response times are generally much faster in urban environments.

EMS Response Time in MT

| Area | Crash to EMS | EMS Response Time | Scene to Hospital | Crash to Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 10.01 mins | 12.27 mins | 38.66 mins | 52.85 mins | 150 |

| Urban | 1.19 mins | 5 mins | 22.86 mins | 28.14 mins | 19 |

This delay can impact accident outcomes, and for those seeking cheap auto insurance in Montana, it’s important to consider that rural areas might have higher risks due to longer emergency response times, which could influence insurance premiums.

Transportation

Insurance companies often base their rates on averages—the average number of cars owned per family, the average amount of time someone spends driving in traffic, and the average number of miles a person drives per year.

This next section will cover transportation averages, including car ownership, commuter transportation, traffic congestion, and the most commonly used types of transportation.

For those exploring cheap auto insurance in Montana, understanding these factors is key to assessing potential risks and insurance needs.

Car Ownership

How many cars do Montana drivers own on average?

According to Data USA, the following chart displays the households in Montana distributed between a series of car ownership buckets compared to the national averages for each bucket.

The largest share of households in Montana has two cars, followed by three cars.

The orange bars represent Montana’s average, while the gray bars indicate the country’s average. For those seeking cheap auto insurance in Montana, comparing local and national averages can provide insight into potential coverage needs based on state-specific trends in traffic, accidents, and commuting habits.

Commute Time

Using averages, Montana employees have a shorter commute time (16.9 minutes) than the normal US worker (25.5 minutes). Additionally, 1.66 percent of the workforce in Montana has “super commutes” over 90 minutes.

Commuter Transportation

In 2017, driving alone was the most common method of travel for workers in Montana, followed by carpooling and working from home. For those looking for cheap auto insurance in Montana, these commuting patterns could influence insurance rates based on driving frequency and risk factors.

Traffic Congestion in Montana

Good news for Montana drivers, Montana doesn’t have any cities on Inrix’s worst cities for traffic list.

Securing Affordable Auto Insurance in Montana

Liberty Mutual leads Montana’s cheapest auto insurance at $16 monthly due to extensive military and student discounts. State Farm ranks second at $19 monthly with its proven Drive Safe & Save usage-based insurance program, and Geico takes third at $23 monthly thanks to comprehensive employee discount offerings.

Those seeking affordable coverage should compare multiple Montana car insurance quotes online to find the best rates, as the average cost of auto insurance in Montana varies significantly by location and individual factors throughout the state.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices from various companies near you.

Frequently Asked Questions

How much does car insurance cost in Montana?

The average car insurance cost in Montana varies by provider. Liberty Mutual offers the cheapest rate at $16 per month, followed by State Farm, $19 per month, and Geico at $23 per month.

Who has cheap car insurance in Montana?

Liberty Mutual is the cheapest auto insurance carrier, offering rates as low as $16 per month. Compared to other companies, they provide cheap Montana car insurance. Use our free comparison tool to see what auto insurance quotes look like in your area.

What is the minimum auto insurance in Montana?

In Montana, the minimum auto insurance requirements are 25/50/20 liability coverage—$25,000 for bodily injury per person, $50,000 per accident, and $20,000 for property damage. Meeting these minimum car insurance requirements is crucial, and finding the cheapest liability car insurance in Montana can help you stay within your budget while complying with state law.

Which car insurance group is the cheapest?

Liberty Mutual offers the cheapest car insurance in Montana, with rates starting at $16 per month. State Farm is next at $19, followed by Geico at $23.

How much is car insurance in Montana per month?

The average Montana car insurance costs can range from $16 to $47 per month, depending on the provider. Liberty Mutual offers the most affordable rate, while Progressive is on the higher end of the spectrum.

Is State Farm a good option for cheap auto insurance in Montana?

Yes, State Farm offers affordable car insurance in Montana, with rates starting at $19 per month. It’s known for competitive rates, excellent customer service, and various discounts—compare auto insurance companies to see how it stacks up.

What factors influence car insurance rates in Montana?

Car insurance rates in Montana depend on factors such as your driving history, age, vehicle type, and location. By comparing car insurance quotes in Montana from companies like Liberty Mutual, State Farm, and Geico, you can find the most affordable coverage.

Can I get discounts on car insurance in Montana?

Yes, most insurance providers in Montana, including Liberty Mutual, Geico, and Nationwide, offer discounts for bundling policies, maintaining a safe driving record, and installing safety features in your vehicle. These discounts help reduce the cost of cheap auto insurance in Montana.

Does Montana require full coverage car insurance?