The Ultimate Louisiana Car Insurance Guide (Costs + Coverage)

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Louisiana Stats Summary | Details |

|---|---|

| Miles of Roadway | Miles in State: 61,419 Miles Driven: 48,180 million |

| Vehicles | Registered: 3,787,356 Thefts: 9,741 |

| State Population | 4,671,211 |

| Most Popular Vehicle in State | Ford F150 |

| Percent of Uninsured Motorists | 13% State Rank: 20th |

| Driving Related Deaths | Speeding Fatalities: 177 Drunk Driving Fatalities: 212 |

| Average Annual Premiums | Liability: $775 Collision: $414 Comprehensive: $215 |

| Cheapest Provider | State Farm and USAA |

From New Orleans to Baton Rouge, Louisiana is a cultural melting pot of fun, food, and music that charms people from all over the country.

As per a recent report, nearly 18 million people visited New Orleans in 2017 to absorb the flavors of the city’s unique French heritage, southern hospitality, and Mardi Gras.

Experiencing the eclectic vibe of Louisiana is everyone’s dream with so much to explore and eat, but between all this, do not forget to buy the right car insurance coverage for yourself to protect you on those overcrowded roads.

For some people, buying car insurance is an errand that they would like to delay for as long as possible, however, researching about the right coverage options for your needs and finding the best car insurer would help you in the long run.

In the market for cheap Louisiana car insurance? If you are living in New Orleans, Baton Rouge, Shreveport, Lafayette, or Lake Charles, you can acquire up to eight rate quotes from first rate insurers in the area through AutoInsuranceEZ.com. Price ranges fluctuate by provider and you should compare rates carefully before you purchase a policy. We’ll enable you to acquire the coverage to suit your needs.

You can dive right into our car insurance guide for Louisiana or start comparison shopping today using our FREE online tool. Enter your zip code above to get started.

Car Insurance Coverage and Rates in Louisiana

Do you know what kind of car insurance coverage do you need?

Though buying liability coverage is mandatory in almost every other state, there are many other types of coverage options that you may require depending on your personal situation.

There’s no ‘one size fits all policy’ in car insurance, no matter how much your insurance agent tries to convince you.

So, let’s understand what options are there and how you should select coverage.

Car Culture in Louisiana

Not only is Ford F150 the most popular vehicle in the state, around eight full-size SUV’s have twice the market share in Louisiana than their overall share in America.

The fascination of residents with trucks and SUVs is quite evident from these numbers. Car enthusiasts in Louisiana regularly put up regular events and shows featuring car racing shows and antique cars.

The urban roads in your state, even some rural highways, are heavily traveled by motorists especially during the weekends when there are festivals.

– Minimum Auto Insurance Coverage in Louisiana

Before we get into the details of what is the minimum auto insurance you need to buy in Louisiana, you should understand the basic law that governs coverage in your state.

Louisiana follows the at-fault system when it comes to injuries from car accidents which means that the motorist who is at fault is liable to pay the damages from the accident.

Now that you know who’s liable to pay for damages in an accident, let’s look at how much you’re required to buy as per the law.

| Type of Coverage | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $15,000 per person/$30,000 per accident |

| Property Damage Liability | $25,000 |

The mandatory coverage requirement for motorists is 15/30/25 in Louisiana or $15,000 per person for personal injury liability with an overall limit of $30,000 per accident and $25,000 for property damage liability.

This is how it works – If you were to get involved in an accident and you happen to be the at-fault party, your state-mandated coverage would only pay for the medical injuries of the passengers in the other car subjected to a cap of $15,000 per person and $30,000 overall for everyone injured in that accident.

In addition, the policy would also cover damages of $25,000 to the third-party’ car.

Here’s a short one-minute video that will make it simpler for you to understand auto liability coverage.

Do remember, however, that this basic liability insurance wouldn’t cover any damages that you or your co-passengers may sustain in a car accident.

That’s why you should consider other coverage options to protect yourself and your family in an accident.

| Types of Coverage | What it Covers |

|---|---|

| Collision | Collision helps to recover the cost of repair or replacement if your car is damaged due to a collision with another object, such as tree, fence, or another car. |

| Comprehensive | Comprehensive covers damages to your car that happen due to causes out of your control, such as storms, theft, fire, etc. |

| Medical Payments | Med Pay helps to cover the medical expenses from injury to you or your passengers in an accident irrespective of the fault. |

| Personal Injury Protection (PIP) | PIP, as the name suggests, kicks in to cover your personal injury expenses in an accident irrespective of fault. Along with medical expenses, PIP also covers lost wages. |

And, while it’s important to add some of these coverage options to your policy, do not forget to buy the right policy limit for your auto liability.

Now the question is, how much liability coverage should you have?

Imagine a scenario where you rear-end a high-end luxurious car which ends up injuring the people inside quite severely.

The car damage and medical expenses in itself would cost a lot. But, if you’re unlucky, the third-party may choose to file a lawsuit against you.

What will happen next?

Multiple court hearings and lawyer fees. If you’re carrying just the state-mandated limits, you would have to use your personal assets to settle the damages, and even then it may not be enough to cover all the piling expenses.

That’s why experts recommend minimum liability coverage of $500,000 to cover bodily injury and property damage.

– Premiums as a Percentage of Income in Louisiana

| Details | 2012 | 2013 | 2014 |

|---|---|---|---|

| Disposable Income | $36,448 | $36,244 | $37,787 |

| Average Annual Premiums | $1,275.10 | $1,307.72 | $1,364.17 |

| Percentage of Income | 3.50% | 3.61% | 3.61% |

Motorists in Louisiana spend almost 3.61 percent of their disposable income on car insurance premiums as per data from the National Association of Insurance Commissioners.

If you look at the neighboring states of Mississippi and Texas, the percentage of premium to income was 3.05 percent and 2.59 percent in 2014, respectively.

Disposable income is the amount left for households after paying off income taxes and social security charges.

The car insurance cost to income ratio of Louisiana is one of the highest in America. Therefore, budgeting for this expense in advance would help you to account for other household expenses better.

– Core Coverage Auto Premiums in Louisiana

| Types of Coverage | Average Annual Premiums |

|---|---|

| Liability | $775.83 |

| Collision | $414.36 |

| Comprehensive | $215.17 |

| Full Coverage | $1,405.36 |

Before buying any auto policy, you should have an idea about the average costs in your state so that you will know why you’re paying more or less.

Being aware also helps you to negotiate better with your agent and get add-ons or optional coverages with your main coverage.

Average annual premiums for liability coverage, which is always more expensive than other types of coverage, is $775 while the national average liability premium is $538.

Additional Liability Coverage in Louisiana

We have already talked about the types of coverage that you should consider with your basic liability insurance.

To cover your personal injuries in an accident, you have two options to consider – Medical Payments and Personal Injury Protection (PIP) while Collision and Comprehensive cover damages to your car.

But, what should you choose for personal injury – Medical Pay or PIP?

As you’re aware by now that both these coverage options would pay for your medical expenses in the event of an accident.

Medical Pay is specifically designed to cover all your medical expenses, but PIP also covers any lost income that you wouldn’t be able to earn because you’re injured and can’t work for the time being.

By definition, PIP would be a better option, however, if you have a passive income source then choosing PIP doesn’t make any sense.

Moreover, Medical Pay follows the policyholder, so whether you’re walking, sitting as a passenger or driving, Medical Pay would cover your injuries.

In the end, what you choose would depend on your specific needs. Doing a cost comparison can also help you in making a decision – since both these options cover medical expenses by and large.

| Loss Ratio Table | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments | 86.66% | 85.62% | 85.88% |

| Uninsured/Underinsured Motorist Coverage | 99.68% | 100.11% | 92.10% |

If you want to see whether insurance carriers are paying off specific claims, you can check their loss ratio.

Loss ratio is the ratio of total claims settled to premiums earned by an insurer. When the loss ratio of an insurer is 60 percent, it means that out of $100 earned in premiums, $60 was paid out in claims.

For uninsured/underinsured motorist coverage, the loss ratio of insurers in Louisiana is unusually high. Anything above 100 percent means that insurance carriers are losing money.

Around 13 percent of motorists in Louisiana are uninsured and almost 40 percent of the motorists buy only the state-mandated minimum coverage. This is a major reason behind the high loss ratio of carriers and also the rising premiums costs in Louisiana.

So, what happens when you are hit by an uninsured/underinsured driver?

If the at-fault driver isn’t adequately covered, you would have to either ask the other party for an out-of-pocket settlement or use your personal assets to pay for any damages. Both of these options are stressful and expensive.

Therefore, you would be better off by investing in an uninsured/underinsured motorist coverage that would pay for your damages if you’re hit by an uninsured driver.

Here’s a superhero explaining uninsured coverage for you.

Add-ons, Endorsements, and Riders in Louisiana

If you’re a car enthusiast, you would know that a classic car needs a different kind of insurance coverage because it holds special value, right?

Auto insurers are aware of the varied needs that car owners have and offer many add-ons and riders to cover those needs.

Have a look below at the available options:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

We know that insurance coverage costs a lot of money in Louisiana, and if you get add-ons or endorsements, costs would rise further.

Like other motorists in Louisiana, the consistently rising auto premium costs makes you uneasy about buying anything extra.

Though you can’t do anything to change the driving behavior of others on the road, that’s causing rates to rise, you can definitely get rewarded for being a safe driver.

Do you know how? – By enrolling in a usage-based insurance program.

Usage-based insurance, also known as pay-as-you-drive, uses telematics technology to track your driving behavior. If you follow the speed limits everywhere or don’t slam your brakes too often, you might be eligible for discounts.

The telematics technology uses a pre-installed device or a mobile app to collect data about your driving behaviour – such as, miles driven, how you’re braking, acceleration, when do you drive, etc.

Each insurer has its own metric to track driving and offers discounts once you have successfully completed a pre-defined time under the program.

– Male vs Female Auto Insurance Rates in Louisiana

| Insurance Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $9,256.33 | $11,657.16 | $4,694.46 | $5,083.73 | $4,254.40 | $4,254.40 | $4,394.91 | $4,394.91 |

| Geico Cas | $12,767.36 | $13,458.88 | $3,309.53 | $3,204.45 | $3,430.68 | $3,952.72 | $4,103.66 | $5,009.51 |

| Progressive Security Ins. | $16,529.91 | $18,373.77 | $4,746.19 | $4,834.20 | $4,158.02 | $3,880.90 | $3,483.46 | $3,762.32 |

| State Farm Mutual Auto | $8,404.12 | $10,538.72 | $3,180.57 | $3,569.11 | $2,851.05 | $2,851.05 | $2,619.17 | $2,619.17 |

| USAA | $8,021.04 | $9,403.41 | $3,286.33 | $3,597.39 | $2,678.38 | $2,634.64 | $2,612.63 | $2,591.11 |

Insurance rates also vary by gender among other factors as you can see in the table above. Teenagers usually have the highest rates for auto insurance, because of their inexperience, with males being charged much more than their female counterparts.

For those above 25, the rates are more or less the same between men and women with slight differences here and there which might be on account of some other factors.

You can also see the rankings of different carriers based on their insurance rates.

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Progressive Security Ins. | Single 17-year old male | $18,373.77 | 1 |

| Progressive Security Ins. | Single 17-year old female | $16,529.91 | 2 |

| Geico Cas | Single 17-year old male | $13,458.88 | 3 |

| Geico Cas | Single 17-year old female | $12,767.36 | 4 |

| Allstate P&C | Single 17-year old male | $11,657.16 | 5 |

| State Farm Mutual Auto | Single 17-year old male | $10,538.72 | 6 |

| USAA | Single 17-year old male | $9,403.41 | 7 |

| Allstate P&C | Single 17-year old female | $9,256.33 | 8 |

| State Farm Mutual Auto | Single 17-year old female | $8,404.12 | 9 |

| USAA | Single 17-year old female | $8,021.04 | 10 |

| Allstate P&C | Single 25-year old male | $5,083.73 | 11 |

| Geico Cas | Married 60-year old male | $5,009.51 | 12 |

| Progressive Security Ins. | Single 25-year old male | $4,834.20 | 13 |

| Progressive Security Ins. | Single 25-year old female | $4,746.19 | 14 |

| Allstate P&C | Single 25-year old female | $4,694.46 | 15 |

| Allstate P&C | Married 60-year old female | $4,394.91 | 16 |

| Allstate P&C | Married 60-year old male | $4,394.91 | 16 |

| Allstate P&C | Married 35-year old female | $4,254.40 | 18 |

| Allstate P&C | Married 35-year old male | $4,254.40 | 18 |

| Progressive Security Ins. | Married 35-year old female | $4,158.02 | 20 |

| Geico Cas | Married 60-year old female | $4,103.66 | 21 |

| Geico Cas | Married 35-year old male | $3,952.72 | 22 |

| Progressive Security Ins. | Married 35-year old male | $3,880.90 | 23 |

| Progressive Security Ins. | Married 60-year old male | $3,762.32 | 24 |

| USAA | Single 25-year old male | $3,597.39 | 25 |

| State Farm Mutual Auto | Single 25-year old male | $3,569.11 | 26 |

| Progressive Security Ins. | Married 60-year old female | $3,483.46 | 27 |

| Geico Cas | Married 35-year old female | $3,430.68 | 28 |

| Geico Cas | Single 25-year old female | $3,309.53 | 29 |

| USAA | Single 25-year old female | $3,286.33 | 30 |

| Geico Cas | Single 25-year old male | $3,204.45 | 31 |

| State Farm Mutual Auto | Single 25-year old female | $3,180.57 | 32 |

| State Farm Mutual Auto | Married 35-year old female | $2,851.05 | 33 |

| State Farm Mutual Auto | Married 35-year old male | $2,851.05 | 33 |

| USAA | Married 35-year old female | $2,678.38 | 35 |

| USAA | Married 35-year old male | $2,634.64 | 36 |

| State Farm Mutual Auto | Married 60-year old female | $2,619.17 | 37 |

| State Farm Mutual Auto | Married 60-year old male | $2,619.17 | 37 |

| USAA | Married 60-year old female | $2,612.63 | 39 |

| USAA | Married 60-year old male | $2,591.11 | 40 |

Auto Insurance Rates by ZIP Code in Louisiana

When you start your research for car insurance rates, you would notice that what you are being asked is different from your friend’s rate who lives in another ZIP code.

Since the risk factors that insurance carriers take into account vary by ZIP code, the rates also differ.

| Cheapest ZIP Codes in Louisiana | City | Average by ZIP Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 71439 | HORNBECK | $4,332.48 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,187.12 | State Farm | $3,544.31 |

| 71443 | KURTHWOOD | $4,355.93 | Allstate | $5,413.73 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,857.06 |

| 71459 | FORT POLK | $4,397.96 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,926.59 |

| 71446 | LEESVILLE | $4,408.37 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,978.60 |

| 71403 | ANACOCO | $4,430.85 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,418.09 | State Farm | $3,805.20 |

| 71474 | SIMPSON | $4,435.33 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,173.59 | State Farm | $3,921.03 |

| 71461 | NEWLLANO | $4,440.21 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,172.35 | State Farm | $3,946.65 |

| 71475 | SLAGLE | $4,471.44 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,418.09 | State Farm | $3,857.06 |

| 71075 | SPRINGHILL | $4,474.44 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,419.17 | USAA | $3,645.13 |

| 71429 | FLORIEN | $4,476.94 | Allstate | $5,413.73 | Progressive | $5,177.85 | State Farm | $3,406.01 | USAA | $3,555.97 |

| 71071 | SAREPTA | $4,477.36 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,433.73 | USAA | $3,645.13 |

| 71449 | MANY | $4,546.33 | Allstate | $5,413.73 | Progressive | $5,387.48 | State Farm | $3,543.35 | USAA | $3,555.97 |

| 71426 | FISHER | $4,568.59 | Allstate | $5,413.73 | Progressive | $5,177.85 | USAA | $3,555.97 | State Farm | $3,864.26 |

| 71486 | ZWOLLE | $4,580.26 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,499.60 | USAA | $3,555.97 |

| 71462 | NOBLE | $4,587.34 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,534.99 | USAA | $3,555.97 |

| 71468 | PROVENCAL | $4,591.96 | Allstate | $5,413.73 | Progressive | $5,170.17 | USAA | $3,580.55 | State Farm | $3,785.75 |

| 71016 | CASTOR | $4,592.82 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,553.73 | USAA | $3,843.04 |

| 71072 | SHONGALOO | $4,595.44 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,403.32 | USAA | $3,645.13 |

| 71048 | LISBON | $4,601.27 | Allstate | $5,413.73 | Progressive | $5,298.84 | State Farm | $3,624.07 | USAA | $3,645.13 |

| 71001 | ARCADIA | $4,604.07 | Allstate | $5,413.73 | Progressive | $5,206.83 | State Farm | $3,594.95 | USAA | $3,758.45 |

| 71045 | JAMESTOWN | $4,608.94 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,634.33 | USAA | $3,843.04 |

| 71460 | NEGREET | $4,610.52 | Allstate | $5,413.73 | Progressive | $5,387.48 | USAA | $3,555.97 | State Farm | $3,864.26 |

| 71406 | BELMONT | $4,610.84 | Progressive | $5,614.41 | Allstate | $5,413.73 | USAA | $3,555.97 | State Farm | $3,577.97 |

| 71068 | RINGGOLD | $4,613.19 | Allstate | $5,413.73 | Progressive | $5,216.23 | State Farm | $3,709.97 | USAA | $3,843.04 |

| 71038 | HAYNESVILLE | $4,630.28 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,577.56 | USAA | $3,645.13 |

New Orleans’ ZIP codes are the most expensive.

| Most Expensive ZIP Codes in Louisiana | City | Average by ZIP Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 70117 | NEW ORLEANS | $9,303.50 | Progressive | $11,349.19 | Geico | $10,722.66 | USAA | $6,335.87 | State Farm | $7,915.53 |

| 70127 | NEW ORLEANS | $9,249.24 | Progressive | $11,400.32 | Geico | $10,518.81 | USAA | $6,555.17 | State Farm | $7,577.65 |

| 70128 | NEW ORLEANS | $9,203.05 | Progressive | $11,483.77 | Geico | $10,518.81 | USAA | $6,562.78 | State Farm | $7,255.65 |

| 70126 | NEW ORLEANS | $9,155.49 | Progressive | $11,193.79 | Geico | $10,418.61 | USAA | $6,628.66 | State Farm | $7,342.14 |

| 70129 | NEW ORLEANS | $9,123.75 | Progressive | $11,277.24 | Geico | $10,565.56 | USAA | $6,562.78 | State Farm | $7,018.93 |

| 70113 | NEW ORLEANS | $9,085.51 | Progressive | $11,349.19 | Geico | $10,470.09 | USAA | $6,205.63 | State Farm | $7,208.41 |

| 70145 | NEW ORLEANS | $9,034.55 | Progressive | $11,349.19 | Geico | $10,722.66 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70146 | NEW ORLEANS | $9,034.55 | Progressive | $11,349.19 | Geico | $10,722.66 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70116 | NEW ORLEANS | $9,013.80 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $6,225.89 | State Farm | $7,667.52 |

| 70122 | NEW ORLEANS | $8,940.09 | Progressive | $11,349.19 | Geico | $10,626.87 | USAA | $5,798.83 | State Farm | $6,731.32 |

| 70148 | NEW ORLEANS | $8,877.47 | Progressive | $11,349.19 | Geico | $10,626.87 | USAA | $5,708.44 | State Farm | $6,508.60 |

| 70119 | NEW ORLEANS | $8,860.81 | Progressive | $11,297.04 | Allstate | $10,194.23 | USAA | $6,016.67 | State Farm | $7,081.33 |

| 70139 | NEW ORLEANS | $8,675.04 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70163 | NEW ORLEANS | $8,547.15 | Progressive | $11,349.19 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70130 | NEW ORLEANS | $8,542.14 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,235.76 |

| 70112 | NEW ORLEANS | $8,540.11 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,428.67 |

| 70170 | NEW ORLEANS | $8,521.57 | Progressive | $11,286.61 | Allstate | $10,194.23 | USAA | $5,708.44 | State Farm | $7,198.23 |

| 70125 | NEW ORLEANS | $8,459.50 | Progressive | $11,116.86 | Allstate | $10,194.23 | USAA | $6,004.41 | State Farm | $6,878.72 |

| 70114 | NEW ORLEANS | $8,180.81 | Progressive | $11,286.61 | Geico | $9,623.03 | USAA | $5,846.50 | State Farm | $6,330.33 |

| 70032 | ARABI | $8,001.83 | Progressive | $11,220.15 | Geico | $8,646.01 | USAA | $5,601.65 | State Farm | $7,180.78 |

| 70058 | HARVEY | $7,919.05 | Progressive | $11,116.86 | Geico | $9,080.79 | USAA | $5,410.50 | State Farm | $6,169.49 |

| 70131 | NEW ORLEANS | $7,899.82 | Progressive | $11,411.76 | Geico | $8,621.16 | USAA | $5,502.31 | State Farm | $6,146.30 |

| 70053 | GRETNA | $7,895.98 | Progressive | $11,054.29 | Geico | $9,043.51 | USAA | $5,455.88 | State Farm | $6,108.63 |

| 70072 | MARRERO | $7,857.95 | Progressive | $10,759.92 | Geico | $8,816.72 | USAA | $5,929.56 | State Farm | $5,965.95 |

| 70043 | CHALMETTE | $7,852.33 | Progressive | $11,251.46 | Geico | $8,284.43 | USAA | $5,601.65 | State Farm | $6,763.55 |

Auto Insurance Rates by City in Louisiana

Next, take a look at the tables below to see which cities have the best rates.

| Cheapest Cities in Louisiana | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Hornbeck | $4,332.48 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,187.12 | State Farm | $3,544.31 |

| Kurthwood | $4,355.93 | Allstate | $5,413.73 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,857.06 |

| Fort Polk | $4,397.96 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,926.59 |

| Leesville | $4,408.37 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $2,981.19 | State Farm | $3,978.60 |

| Anacoco | $4,430.85 | Allstate | $5,413.73 | Progressive | $5,142.31 | USAA | $3,418.09 | State Farm | $3,805.20 |

| Simpson | $4,435.33 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,173.59 | State Farm | $3,921.03 |

| New Llano | $4,440.21 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,172.35 | State Farm | $3,946.65 |

| Slagle | $4,471.44 | Allstate | $5,579.18 | Progressive | $5,152.75 | USAA | $3,418.09 | State Farm | $3,857.06 |

| Cullen | $4,474.44 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,419.17 | USAA | $3,645.13 |

| Florien | $4,476.94 | Allstate | $5,413.73 | Progressive | $5,177.85 | State Farm | $3,406.01 | USAA | $3,555.97 |

| Sarepta | $4,477.35 | Allstate | $5,413.73 | Geico | $5,046.39 | State Farm | $3,433.73 | USAA | $3,645.13 |

| Many | $4,546.33 | Allstate | $5,413.73 | Progressive | $5,387.48 | State Farm | $3,543.35 | USAA | $3,555.97 |

| Fisher | $4,568.59 | Allstate | $5,413.73 | Progressive | $5,177.85 | USAA | $3,555.97 | State Farm | $3,864.26 |

| Zwolle | $4,580.26 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,499.60 | USAA | $3,555.97 |

| Noble | $4,587.34 | Progressive | $5,600.85 | Allstate | $5,413.73 | State Farm | $3,534.99 | USAA | $3,555.97 |

| Provencal | $4,591.96 | Allstate | $5,413.73 | Progressive | $5,170.17 | USAA | $3,580.55 | State Farm | $3,785.75 |

| Castor | $4,592.82 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,553.73 | USAA | $3,843.04 |

| Shongaloo | $4,595.44 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,403.32 | USAA | $3,645.13 |

| Lisbon | $4,601.27 | Allstate | $5,413.73 | Progressive | $5,298.84 | State Farm | $3,624.07 | USAA | $3,645.13 |

| Arcadia | $4,604.07 | Allstate | $5,413.73 | Progressive | $5,206.83 | State Farm | $3,594.95 | USAA | $3,758.45 |

| Jamestown | $4,608.94 | Allstate | $5,413.73 | Progressive | $5,270.63 | State Farm | $3,634.33 | USAA | $3,843.04 |

| Negreet | $4,610.51 | Allstate | $5,413.73 | Progressive | $5,387.48 | USAA | $3,555.97 | State Farm | $3,864.26 |

| Belmont | $4,610.84 | Progressive | $5,614.41 | Allstate | $5,413.73 | USAA | $3,555.97 | State Farm | $3,577.97 |

| Ringgold | $4,613.19 | Allstate | $5,413.73 | Progressive | $5,216.23 | State Farm | $3,709.97 | USAA | $3,843.04 |

| Haynesville | $4,630.28 | Progressive | $5,439.25 | Allstate | $5,413.73 | State Farm | $3,577.56 | USAA | $3,645.13 |

The average annual premium in Louisiana is $5,711 and the rates in New Orleans are almost $3,000 over that.

| Most Expensive Cities in Louisiana | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| New Orleans | $8,649.31 | Progressive | $11,225.41 | Allstate | $9,603.97 | USAA | $5,944.69 | State Farm | $6,997.47 |

| Arabi | $8,001.83 | Progressive | $11,220.15 | Geico | $8,646.01 | USAA | $5,601.65 | State Farm | $7,180.78 |

| Harvey | $7,919.05 | Progressive | $11,116.86 | Geico | $9,080.79 | USAA | $5,410.50 | State Farm | $6,169.49 |

| Gretna | $7,860.34 | Progressive | $10,956.51 | Geico | $8,939.46 | USAA | $5,455.88 | State Farm | $6,132.24 |

| Estelle | $7,857.95 | Progressive | $10,759.92 | Geico | $8,816.72 | USAA | $5,929.56 | State Farm | $5,965.95 |

| Chalmette | $7,852.33 | Progressive | $11,251.46 | Geico | $8,284.43 | USAA | $5,601.65 | State Farm | $6,763.55 |

| Meraux | $7,789.28 | Progressive | $11,282.73 | Geico | $8,452.79 | USAA | $5,601.65 | State Farm | $6,248.68 |

| Poydras | $7,346.93 | Progressive | $11,312.43 | Allstate | $7,360.57 | USAA | $4,869.75 | State Farm | $6,208.18 |

| Lafitte | $7,282.71 | Progressive | $11,379.45 | Allstate | $7,817.59 | State Farm | $4,851.62 | USAA | $5,264.66 |

| Barataria | $7,257.44 | Progressive | $11,379.45 | Allstate | $7,817.59 | State Farm | $4,725.25 | USAA | $5,264.66 |

| Pointe A La Hache | $7,254.34 | Progressive | $11,312.43 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $4,879.19 |

| Kenner | $7,250.98 | Progressive | $10,866.48 | Geico | $7,913.35 | USAA | $5,527.33 | State Farm | $5,756.15 |

| Avondale | $7,150.36 | Progressive | $10,423.27 | Geico | $8,215.55 | Allstate | $5,175.46 | USAA | $5,929.56 |

| Belle Chasse | $7,147.88 | Progressive | $9,986.77 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $5,430.25 |

| Braithwaite | $7,070.65 | Progressive | $11,312.43 | Allstate | $7,360.57 | State Farm | $4,710.25 | USAA | $4,869.75 |

| Metairie | $7,028.30 | Progressive | $10,954.16 | Geico | $7,457.85 | USAA | $5,202.82 | State Farm | $5,401.80 |

| Uncle Sam | $7,025.29 | Progressive | $11,546.32 | Geico | $6,829.86 | USAA | $4,890.31 | State Farm | $5,056.99 |

| Burnside | $7,011.06 | Progressive | $11,546.32 | Geico | $6,829.86 | USAA | $4,819.16 | State Farm | $5,056.99 |

| Port Sulphur | $6,988.27 | Progressive | $9,986.77 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $4,874.50 |

| Elmwood | $6,943.52 | Progressive | $10,878.87 | Geico | $7,590.53 | USAA | $5,006.83 | State Farm | $5,116.54 |

| Baton Rouge | $6,786.59 | Progressive | $9,301.30 | Geico | $7,607.46 | USAA | $4,869.88 | State Farm | $5,317.05 |

| Pilottown | $6,775.22 | Progressive | $8,916.82 | Allstate | $8,110.10 | USAA | $4,869.75 | State Farm | $4,879.19 |

| Boothville | $6,756.68 | Progressive | $8,916.82 | Allstate | $8,110.10 | State Farm | $4,786.49 | USAA | $4,869.75 |

| Venice | $6,749.62 | Progressive | $8,916.82 | Allstate | $8,110.10 | State Farm | $4,751.19 | USAA | $4,869.75 |

| Baker | $6,694.24 | Progressive | $9,061.48 | Geico | $7,592.92 | USAA | $4,737.73 | State Farm | $5,276.11 |

The high number of uninsured drivers and distracted driving are some of the reasons that rates are so high in Louisiana but the situation gets worse when you step into the state’s most populated city, New Orleans.

As per Louisiana Insurance Commissioner, Jim Donelon, rates are 25 percent higher on an average for those living in the metro areas of New Orleans or Baton Rouge which gets a large share of auto litigation cases.

Moreover, many motorists carry only the minimum coverage and when these people hit someone on the road, they usually end up getting sued which in turn raises the premium rates for everyone.

Find the Cheapest Insurance in Your City: Louisiana Rates Comparison

Looking for the most affordable insurance rates in Louisiana? Our table provides a quick comparison of insurance costs across major cities in the state. Whether you’re in Baton Rouge, Lafayette, Lake Charles, New Orleans, or Shreveport, finding the cheapest insurance option is just a click away. Start comparing rates now to secure the best deal for your needs.

| Find the Cheapest Insurance in Your City |

|---|

| Baton Rouge, LA |

| Lafayette, LA |

| Lake Charles, LA |

| New Orleans, LA |

| Shreveport, LA |

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Carriers in Louisiana

When it comes to selecting an insurance carrier, everyone has a different criterion. Some motorists look for ease of digital communication with agents while others look for insurers who offer the best add-ons.

Along with your personal preferences for the type of auto insurance carrier you want to buy a policy from, there are some basic things that you must look at such as – customer reviews, financial ratings, and complaint numbers.

Buying a policy from an insurer who’s financially secure and responds to customer requests promptly should be your first priority.

Let’s see how leading insurers in Louisiana fare on these parameters.

Financial Ratings of the Leading Car Insurers in Louisiana

| Leading Insurance Company | AM Best Rating |

|---|---|

| State Farm Group | A++ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| Geico | A++ |

| Liberty Mutual Group | A |

| USAA Group | A++ |

| Southern Farm Bureau Casualty Group | A+ |

| Goauto Insurance Co | NR |

| Amtrust NGH Group | A- |

| Safeway Insurance Group | A |

Read more: GoAuto Auto Insurance Review

To give you an idea of how the leading insurance companies are rated on their financial strength, we have used data from AM Best.

AM Best, with its unique focus on the insurance sector, offers an independent opinion on the financial strength and long-term contractual obligations of insurance carriers.

To make it simple for everyone to understand, AM Best assigns a rating to all insurance carriers from A++ to D that signifies a superior to poor ability, respectively, in meeting their obligations.

Whenever you’re planning to buy a policy, make sure that it’s rated somewhere between A++ to B+, anything beyond that would mean a certain level of uncertainty about the provider’s financial condition.

Car Insurance Companies with Best Customer Reviews in Louisiana

Financial strength rating would help you to know whether an insurer is capable of meeting its obligations, however, customer reviews can actually tell you whether they do so or not.

Apart from settling claims, you also expect your insurance carrier to answer your queries timely, respond to the first notice of loss promptly, and share your premium payment receipts regularly through a medium of your choice.

That’s why it’s important to check customer reviews thoroughly before buying a policy so that you know whether an insurer offers everything that you need.

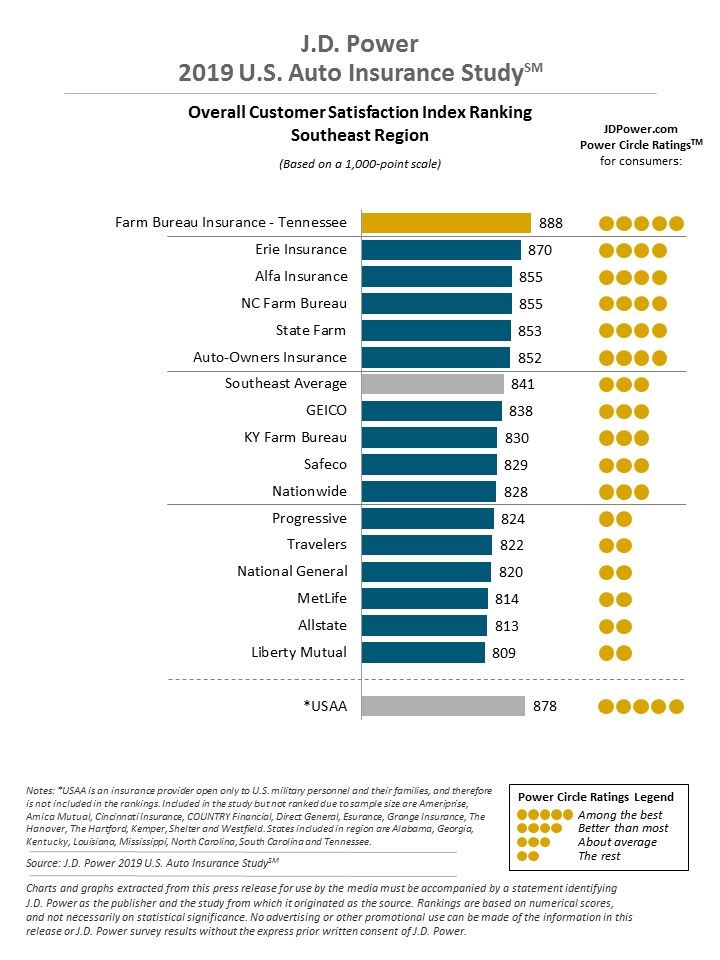

As per the J.D. Power 2019 U.S. Auto Insurance Study, customer satisfaction levels with auto insurance carriers has reached a new level of high with the availability of do-it-yourself tools that bypass agents and allow customers to buy policies online.

Senior consultant at J.D. Power, Robert Lajdziak, noted that “Auto insurance customers have more access, control, and visibility into the details of their policies, and that is translating into record-high levels of customer satisfaction.”

If digital access to your policy details is important to you, buying from an insurer who sends all documentation by mail only can make your life difficult.

Here’s the overall satisfaction index from the J.D. Power study.

The 2019 study by J.D. Power that allows customers to rate insurance companies which helps others in making a choice assesses customer satisfaction on five factors:

- Interaction

- Policy offerings

- Price

- Billing process and policy information

- Claims

In the southeast region, Farm Bureau Insurance was rated the highest among all insurers. The responses of this study were solicited from 42,759 auto insurance customers.

Complaint Numbers of Leading Car Insurance Companies in Louisiana

| Insurance Company | Complaint Numbers |

|---|---|

| State Farm Group | 1482 |

| Progressive Group | 120 |

| Allstate Insurance Group | 163 |

| Geico | 333 |

| Liberty Mutual Group | 222 |

| USAA Group | 296 |

| Southern Farm Bureau Casualty Group | 3 |

| Goauto Insurance Co | 25 |

| Amtrust NGH Group | 2 |

| Safeway Insurance Group | 30 |

You should also look at the complaints registered against the auto insurers in your state because that also would tell you how satisfied customers are with their services.

Average Annual Premiums by Insurance Carrier in Louisiana

| Insurance Company | Average Annual Premiums | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allstate P&C | $5,998.79 | $287.44 | 4.79% |

| Geico Cas | $6,154.60 | $443.25 | 7.20% |

| Progressive Security Ins. | $7,471.10 | $1,759.75 | 23.55% |

| State Farm Mutual Auto | $4,579.12 | -$1,132.22 | -24.73% |

| USAA | $4,353.12 | -$1,358.23 | -31.20% |

The average annual premiums in Louisiana is $5,711 so you can compare rates across insurance carriers in the table above.

Average Annual Premiums by Commute Rate in Louisiana

| Insurance Company | 10 miles commute/ 6000 annual mileage | 25 miles commute/ 12000 annual mileage |

|---|---|---|

| Allstate | $5,998.79 | $5,998.79 |

| Geico | $6,034.79 | $6,274.40 |

| Progressive | $7,471.10 | $7,471.10 |

| State Farm | $4,461.13 | $4,697.11 |

| USAA | $4,218.32 | $4,487.91 |

If you drive less on a regular basis, you might be eligible for low mileage discounts.

As you can see in the table, Geico, State Farm, and USAA offer low-mileage discounts i.e. if you clock around 10 miles/day you would have to pay lower premiums.

Though not every insurer in your state offers this discount, you should always ask before buying a policy if you plan to use public transport or work from home mostly.

Average Annual Premiums by Coverage Level in Louisiana

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $5,185.16 | $6,109.21 | $6,702.00 |

| Geico | $5,086.66 | $6,176.92 | $7,200.21 |

| Progressive | $6,193.86 | $7,406.27 | $8,813.16 |

| State Farm | $3,962.47 | $4,568.03 | $5,206.86 |

| USAA | $3,776.25 | $4,420.47 | $4,862.64 |

Insurance premiums vary by the level of coverage you choose, if your coverage level is high, your premiums would be considerably higher.

You might lower your coverage to pay low premiums, but if you were to get involved in a major accident, your coverage might not be enough to pay off the medical expenses or property damage costs.

And, Louisiana is famous for its staggering number of auto liability litigations which might put you in a difficult situation if you carry the minimum coverage as required by the law.

In April 2019, legislators passed a bill to curb the rising insurance premiums in Louisiana due to the high number of auto liability lawsuits in the state.

Average Annual Premiums by Credit History in Louisiana

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $7,859.57 | $5,410.52 | $4,726.27 |

| Geico | $7,322.08 | $6,353.32 | $4,788.40 |

| Progressive | $8,444.80 | $7,236.85 | $6,731.64 |

| State Farm | $6,350.34 | $4,086.69 | $3,300.33 |

| USAA | $6,010.39 | $3,841.14 | $3,207.81 |

If you have defaulted on your payments earlier or have a poor credit rating, insurance carriers would charge a much higher premium from you than others.

Almost all insurance carriers, as per data in the table, charge an exorbitantly high premium from motorists with a poor or fair credit rating.

As per data from Consumer Reports, adult single drivers can expect to pay $1,649 over the base premium rate if they have a poor credit rating in Louisiana.

What’s the average credit score in Louisiana?

As per Experian’s State of Credit Survey 2017, the average vantage score of Louisiana was 650 while the national average was 675.

Vantage score, developed by Experian, Equifax, and TransUnion, is a credit rating model that assigns scores to individuals in the range of 300-850.

Louisiana is amongst the top ten states with the lowest vantage scores which means that motorists usually are charged much higher rates because of their credit scores.

Average Annual Premiums by Driving Record in Louisiana

| Insurance Company | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $4,753.81 | $7,221.89 | $6,443.95 | $5,575.49 |

| Geico | $4,180.19 | $6,755.09 | $8,315.63 | $5,367.48 |

| Progressive | $6,223.20 | $8,352.66 | $8,027.23 | $7,281.29 |

| State Farm | $4,196.97 | $4,961.27 | $4,579.12 | $4,579.12 |

| USAA | $3,321.63 | $4,611.20 | $5,514.32 | $3,965.32 |

Driving carelessly and accumulating points on your driving record isn’t just unsafe, it also leads to an increase in your premium rates.

How much your premiums rise depends on your insurer and type of violation – some carriers take accidents more seriously while others penalize those with a DUI on their record.

Leading Car Insurance Companies in Louisiana

| Rank | Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|---|

| 1 | State Farm Group | $1,512,622 | 73.76% | 33.57% |

| 2 | Progressive Group | $602,564 | 65.32% | 13.37% |

| 3 | Allstate Insurance Group | $502,616 | 53.33% | 11.15% |

| 4 | Geico | $432,095 | 75.64% | 9.59% |

| 5 | Liberty Mutual Group | $253,836 | 68.10% | 5.63% |

| 6 | USAA Group | $248,894 | 86.36% | 5.52% |

| 7 | Southern Farm Bureau Casualty Group | $231,086 | 70.01% | 5.13% |

| 8 | Goauto Insurance Co | $144,626 | 74.36% | 3.21% |

| 9 | Amtrust NGH Group | $104,343 | 67.11% | 2.32% |

| 10 | Safeway Insurance Group | $72,940 | 67.02% | 1.62% |

Number of Insurers in Louisiana

| Type of Insurer | Number |

|---|---|

| Foreign | 819 |

| Domestic | 34 |

Enter your ZIP code below to compare auto insurance rates.Free Auto Insurance Comparison

Secured with SHA-256 Encryption

State Laws in Louisiana

While we have covered the basic information that you need to get auto insurance coverage in Louisiana in the previous sections, we would now explain the state laws that govern auto insurance in Louisiana.

Why is that important?

Though you wouldn’t need to know the state laws at the back of your mind always, you should still be aware of how auto insurance works and how rates are determined.

Also, we would highlight some laws related to high-risk insurance, drunk driving, insurance fraud, etc. that might be useful while driving or buying insurance.

Car Insurance Laws in Louisiana

We would first start with laws related to mainly car insurance – what is unique and what you may not know about.

How State Laws for Car Insurance are Determined

Auto insurance, like every other industry, is governed by state laws which determine the framework for day-to-day operations.

Tort law and its threshold, liability insurance requirements, and premium rates are all decided by your state’s legislators before becoming they can be put into practice.

Rate and Form Filing: In Louisiana, insurance companies need to file rates and forms for approval with the state insurance department before use.

This process has a 45-day deemer provision which means that rates or files get automatically approved if not denied within 45 days.

Financial Responsibility Laws: The financial responsibility laws in Louisiana require all motorists to either carry auto liability policy with limits stated by the state or a certificate of self-insurance or a cash deposit with the state treasurer or a motor vehicle liability bond.

Windshield Coverage Laws in Louisiana

There aren’t any specific windshield coverage laws in Louisiana but motorists aren’t allowed to drive with posters or signs on the windshield if it obstructs the view of the driver.

High-Risk Car Insurance in Louisiana

Motorists who have a poor credit record or were at-fault in an accident usually pay a higher premium rate than others.

But, what if someone has multiple violations on their driving record?

Motorists who have multiple violations on record can be refused insurance in the voluntary market if they are considered high-risk.

And, when you’re high-risk, you can either buy insurance from companies who specialize in high-risk insurance or apply to the Louisiana Automobile Insurance Plan.

What is the Louisiana Automobile Insurance Plan?

The Louisiana Automobile Insurance Plan allows high-risk motorists to buy coverage from an auto insurance company assigned to them.

This state-initiated plan, established in 1972, assigns high-risk drivers equitably amongst all insurers as per their market share in Louisiana.

As the probability of a claim is high, the plan makes it fair for all auto insurance companies by assigning them a percentage of these high-risk drivers.

How does the plan work?

If you were denied coverage in the voluntary market, you can apply to the Louisiana Automobile Insurance Plan, provided you’re eligible.

Once your application is accepted, you’re assigned to an auto insurer who would provide you coverage for a pre-defined time limit.

Though the plan enables high-risk drivers to get coverage, it tends to be expensive because of the risks involved in the transaction. Hence, you should try your best to become a safe driver.

Automobile Insurance Fraud in Louisiana

Auto insurance fraud is the act of misrepresenting or concealing information for the sake of personal financial gains.

Around 10 percent of the losses in the property and casualty insurance industry can be traced to insurance fraud as per estimates.

Whenever any fraudulent act is committed, it’s not only illegal but also leads to an increase in premium rates for everyone. Therefore, if you come across anything that seems unusual, do report it.

To combat auto insurance fraud, http://www.ldi.la.gov/consumers/boards-commissions/latifpa was established under the Department of Insurance.

You can report insurance fraud to the Louisiana Department of Insurance online or by phone at 225-342-4956 or mail to the Fraud Division, Louisiana Department of Insurance, Post Office Box 3096, Baton Rouge, LA 70821.

Statute of Limitations in Louisiana

If you’re severely injured in an accident or your car has been damaged beyond repair, you may want to pursue a lawsuit to get the right compensation.

But, did you know that there’s a time limit to bring a lawsuit after an accident?

According to the law in Louisiana, you have one year from the day of the accident to file a lawsuit for personal injury or property damage whether you’re a driver, passenger, motorcyclist, or pedestrian.

Vehicle Licensing Laws in Louisiana

New regulations regarding licensing or identification documents keep getting updated as and when a new requirement comes up in the legislation.

For instance, Real ID was introduced across all states to improve the existing security standards.

Let’s look at the laws related to your vehicle license.

Real ID in Louisiana

To improve the reliability of identification documents, Louisiana became compliant with the Real ID Act which enables federal agencies to accept driver’s licenses from the state for entry into certain federal facilities and fly by commercial airlines.

Real ID is an effort by the federal and state governments to enhance national security by ensuring authentication through state-issued identification documents.

If you haven’t applied for a Real Id compliant license, you can do so by visiting your local Office of Motor Vehicles with the required documentation.

By when can you use your driver’s license to enter federal facilities?

After October 2020, federal agencies wouldn’t accept any non-compliant state-issued documents for entry into federal facilities or nuclear power plants or for taking a commercial flight. You can still use your passport or any other federal ID to gain access.

What documents do you need to get a Real ID license?

You have to prove your identity, date of birth, lawful status in the country, residence in the state (two documents), and social security number. Common documents that you may need to bring are:

- Original or certified birth certificate (primary)

- U.S. passport (primary)

- Permanent resident card (primary)

- Social security card (secondary)

- Voter registration card (secondary)

If you aren’t a citizen, you have to bring your foreign passport with the arrival/departure records (I-94, CBP I-94A or I-797A).

How can you recognize a Real ID-compliant license?

A Real ID-compliant card has a start on the upper right corner while a non-compliant license would mention “not for federal identification.”

Penalties for Driving without Insurance In Louisiana

Laws in Louisiana require all motorists to carry the state-mandated minimum liability coverage at the least. If you fail to do so, you may have to face consequences, such as:

- Motorists who drive without insurance can be subjected to fines in the range of $500-$1,000. You can also face penalties for lack of proof of insurance or driving with a lapsed insurance policy.

- Along with the fines, driving without insurance could lead to registration revocation or license plate cancellation.

- If you happen to be involved in an accident without insurance, your driver’s license and registration may be revoked for a period of 180 days.

- Falsely claiming to have bought insurance can lead to license revocation for 12 to 18 months.

Those who think they can get by without insurance and also claim damages in an accident because of the other party’s fault, there’s a “No Pay, No Play” law in Louisiana for them.

The No Pay, No Play law prohibits motorists without any insurance to collect the first $15,000 in personal injuries and the first $25,000 in property damages irrespective of who was at fault in an accident.

How do the law enforcement officers check for auto insurance coverage?

In 2015, the Louisiana Office of Motor Vehicles had issued 1.2 million letters requesting people to pay their fines for lapsed insurance policies.

With the rising number of uninsured motorists in Louisiana, many of whom let their policy lapse, a new real-time monitoring system was launched in 2016 that enables police officers to check whether a motorist has coverage or not.

Teen Driver Laws in Louisiana

Teaching your children about safe driving from an early age can ensure everyone’s safety on the roads. And, the best way to do that is by practicing safe driving so that kids can learn while they are being driven around by you.

The state of Louisiana uses a Graduated Licensing Program to inculcate the habit of safe driving amongst kids before they can get a permanent unrestricted license.

Before we into the details of the program, you may watch this video for tips on safe driving.

All applicants under 17 get their driver’s license by progressing through the different stages of the Graduated Licensing Program.

Learner’s Permit: If you’re at least 15, you can get a learner’s permit after passing the knowledge and vision test. But, you must follow a few rules:

- Present a completion certificate of a 38-hour approved driver education course

- Must maintain the learner’s permit for at least 180 days and apply for the next stage only when you’re 16

- Should drive with a licensed adult driver who’s at least 21 or with a licensed sibling who’s at least 21 or a licensed parent/guardian

Intermediate License: When you’re 16, you can apply for an intermediate license but must follow a few rules:

- Complete supervised driving for 50 hours, including 15 hours of nighttime driving under the supervision of a parent/guardian or an adult who’s at least 21

- Pass the road test

- Can not drive between 11 p.m. and 5 a.m. except when accompanied by a licensed parent/guardian or an adult who’s at least 21 or a licensed sibling who’s at least 18

- Between 6 p.m. and 5 a.m., you can not drive with a passenger below 21, who isn’t an immediate family member, unless accompanied by a licensed adult who’s at least 21

Permanent License: As soon as you turn 17, you can apply for a permanent license provided:

- You haven’t been involved in an at-fault accident during the intermediate stage

- You haven’t been convicted for curfew, seat belt, or moving violations during the intermediate stage

License Renewal Procedure in Louisiana

Your Lousiana driver’s license is valid for only six years after which you must renew it by person or mail or online. If you don’t renew your license within 180 days before expiration, you would have to pay a fee of $15 if it has been expired for more than 10 days.

For a mail or online renewal, you would receive an invitation from the office otherwise you are required to renew it in person.

Please note that if you need any change of personal information in the license, you would have to visit the office.

New Residents in Louisiana

If you’re moving to Louisiana from another state, do note that you would be required to get a local license within 30 days of getting a residence.

Please visit your local OMV for a Louisiana license with documents such as valid out-of-state driver’s license, proof of residency, social security verification, and primary and secondary documents.

Rules of the Road in Louisiana

Abiding by the rules of the road is the best way to avoid accidents and in turn a spike in your premium rates.

While everyone tries to follow the speed limits, there aren’t many who completely understand laws related to seat belts or keeping right on highways.

Fault vs No-Fault Law

Louisiana follows the tort law where the at-fault party is responsible to settle damages sustained by the third-party in an accident through his/her auto liability insurance.

The tort law in Louisiana operates under comparative fault which means that the fault of everyone involved in an accident is assessed and if the victim is found partially responsible, he/she would have to share the cost of the claim.

Seat Belt and Car Seat Laws in Louisiana

The laws in Louisiana make it mandatory for front-seat passengers to wear seat belts and police officers can issue a citation if a motorist is caught without wearing one.

Violations are also subject to fines:

- First Offense: $25

- Second Offense: $50

- Third Offense: $50 plus court fees

Adults can wear their own seat belts but restraining a child properly in the car seat is a driver’s responsibility who should ensure that seats are fastened as per the instructions.

Until now, Louisiana followed the federal standards for child safety seats but from August 1, 2019, residents would have to abide by the new car seat law.

The general guidelines, which takes into consideration the child’s height and weight, are as follows:

- Below 2: Must ride in child safety seat which is rear-facing

- Age 2 to 4: When they outgrow their previous seat, they should be restrained in a forward-facing seat that has an internal harness

- Age 4 to 9: As children grow bigger, they should be put into booster seats

- Age 9 to 12: Children can now be allowed to drive without a booster seat if their back sticks to the car’s back seat, their knee bends over the edge, and the seat belt passes through their chest.

If you’re caught violating the seat belt law, you would have to pay fines:

- First Offense: $50

- Second Offense: $100

- Third or Subsequent Offenses: $100 plus court fee

In addition, your driving license would be confiscated and driving rights suspended until you prove that you have bought a car seat that meets the requirements under the law.

Keep Right and Move Over Laws in Louisiana

The law in Louisiana requires motorists to keep right while driving and use the left lane only to pass.

The move over laws of Louisiana require every motorist approaching a stationary vehicle with flashing lights to change the lane, farther from the parked vehicle, if it’s safe to do so.

If it’s unsafe to change lanes or when driving on a two-lane highway, motorists should slow down to maintain a safe speed.

Speed Limits in Louisiana

Although you should keep an eye on speed limits posted on the roads you’re driving, having an idea about the statutory limits can help.

- Interstate highways: 70mph

- Multi-lane divided highways: 65 mph

- Other roads: 55 mph

Ridesharing Laws in Louisiana

Until now, ridesharing companies, Uber and Lyft, were operating in a few locations of Louisiana i.e. Lafayette, the greater New Orleans area, and Baton Rouge.

Why was it not available across the state? Because of the lack of statewide regulations for ridesharing services although attempts have been made to pass a bill that would regulate such companies.

In June 2019, Gov. John Bel Edwards signed the house bill 575 that establishes statewide regulations for ridesharing companies and allows them to operate across the state.

The law took effect on July 1st and it would take Uber/Lyft a few months to spread their operations across the state.

Automation on the Road in Louisiana

Much like the rest of the country, Louisiana also wants to understand how autonomous vehicles can manage the traffic on roads and help everyone to get to their destination faster.

In 2017, the Louisiana Department of Transportation and Development signed a multi-year contract with Arcadis US to develop a strategic implementation plan for autonomous vehicles and study its impact on the future of transportation.

Not only that, Louisiana recently passed a bill, which takes effect from August 2019, to allow the operation of commercial motor vehicles in the state.

The requirements in the new bill state that these autonomous vehicles must meet the federal and state regulations as well as carry insurance coverage of at least $2 million.

Safety Laws in Louisiana

There can be many causes of accidents but if it’s driving under the influence of alcohol/drugs, law enforcement rarely shows any mercy.

That’s why you should refrain from driving after consuming anything that can slow down your ability to think.

Let’s look at what safety laws you need to follow in Louisiana.

DUI Laws in Louisiana

Known as OWI or operating under the influence (of alcohol/drugs) in the state’s statute, the DUI laws of Louisiana prohibit motorists from driving if their Blood Alcohol Content (BAC) level is above 0.08 percent.

Penalties for any violations are as follows:

| Offense | Prison | Fines | Ignition Interlock Device |

|---|---|---|---|

| First Offense | Up to 6 months | $300-$1,000 | Can be ordered to install |

| Second Offense | Up to 6 months | $750-$1,000 | Must install for a minimum of six months and during probation |

| Third Offense | 1 to 5 years | $2,000 | Must be installed during treatment and probation |

For motorists under the age of 21, the law tends to be stricter and prohibits the operation of a vehicle if the driver’s BAC level is above 0.02 percent.

Do remember that a DWI record for underage motorists can really mess up premium rates for a long period of time.

Penalties can include prison time, fines, and community work.

- For the first offense, you’re liable to pay a fine between $100 and $250 and complete substance abuse driver improvement program. In addition, your driving rights would be suspended for six months.

- For the second and subsequent offenses, you would have to pay a fine between $150 and $500 and spend up to three months in prison. This jail time could be suspended if the offender serves a minimum of 48 hours in prison, completes a substance abuse driver improvement program, and spends 80 hours on community service. In addition, the driver’s license would be suspended for a year.

Distracted Driving Laws in Louisiana

When you’re driving, it’s safer to delay watching a youtube video or responding to a text for later i.e. when you have killed your car’s ignition.

You might think that you’re good at multitasking, but it takes just a millisecond of distraction to lose control of your vehicle.

From 2011 to 2015, around 192 deaths and 26,977 injuries were reported in Louisiana from accidents due to distracted driving, mainly involving cell phone usage and texting.

Here’s an infographic from the Louisiana Highway Safety Commission highlighting the types of distraction while driving.

As per the law in Louisiana, texting is completely banned for everyone and cellphone usage isn’t allowed for drivers under 16.

In school zones, the usage of mobile devices is prohibited for any purpose during the posted hours, except for a few emergency situations.

If you violate the law, you would be fined $175 the first time and $500 every time for any subsequent offenses.

Driving in Louisiana

Your driving experience is a summation of many factors on the roads in your state which also influence premiums rates in your zip code.

How many people live in a city, what percentage of these people use public transportation, why are there fatal crashes in your zip code – these facts can help you understand the driving conditions in your state.

Vehicle Theft in Louisiana

| Rank | Make & Model | Year of Vehicle | Number of Thefts |

|---|---|---|---|

| 1 | Chevrolet Pickup (Full Size) | 2006 | 671 |

| 2 | Ford Pickup (Full Size) | 2006 | 584 |

| 3 | GMC Pickup (Full Size) | 2006 | 253 |

| 4 | Toyota Camry | 2007 | 224 |

| 5 | Dodge Pickup (Full Size) | 2003 | 222 |

| 6 | Nissan Altima | 2014 | 215 |

| 7 | Honda Accord | 2008 | 209 |

| 8 | Chevrolet Impala | 2008 | 177 |

| 9 | GMC Yukon | 2003 | 125 |

| 10 | Chevrolet Tahoe | 2007 | 114 |

From the data, the fascination of thieves for pickup trucks is quite evident much like the preference of residents for pickup trucks and SUVs.

You can also see the vehicle theft numbers in your city.

| City | Motor vehicle theft |

|---|---|

| Abbeville | 6 |

| Addis | 0 |

| Alexandria | 257 |

| Baker | 12 |

| Ball | 2 |

| Bastrop | 32 |

| Baton Rouge | 991 |

| Berwick | 0 |

| Blanchard | 4 |

| Bogalusa | 36 |

| Bossier City | 283 |

| Breaux Bridge | 4 |

| Broussard | 12 |

| Brusly | 0 |

| Carencro | 14 |

| Church Point | 8 |

| Clinton | 0 |

| Cottonport | 1 |

| Covington | 9 |

| Crowley | 28 |

| Cullen | 0 |

| Denham Springs | 4 |

| De Ridder | 10 |

| Epps | 0 |

| Erath | 3 |

| Eunice | 21 |

| Farmerville | 1 |

| Ferriday | 0 |

| Fisher | 0 |

| Florien | 0 |

| Folsom | 1 |

| Franklin | 6 |

| Franklinton | 9 |

| French Settlement | 0 |

| Georgetown | 0 |

| Golden Meadow | 0 |

| Gonzales | 37 |

| Gramercy3 | 8 |

| Greenwood | 7 |

| Gretna | 32 |

| Hammond | 79 |

| Harahan | 4 |

| Haughton | 4 |

| Houma | 50 |

| Ida | 0 |

| Independence | 8 |

| Iowa | 2 |

| Jena | 0 |

| Jennings | 1 |

| Kaplan | 1 |

| Kenner | 128 |

| Kentwood | 9 |

| Kinder | 2 |

| Krotz Springs | 3 |

| Lafayette | 297 |

| Lake Charles | 259 |

| Lake Providence | 0 |

| Leesville | 13 |

| Lutcher | 3 |

| Mandeville | 4 |

| Mansfield | 2 |

| Many | 5 |

| Marion | 2 |

| Marksville | 7 |

| Minden | 8 |

| Monroe3 | 204 |

| Montgomery | 0 |

| Moreauville | 2 |

| Morgan City | 29 |

| Natchitoches | 25 |

| New Orleans | 2,531 |

| Norwood | 0 |

| Oak Grove | 3 |

| Oil City | 1 |

| Olla | 1 |

| Opelousas | 42 |

| Patterson | 1 |

| Pearl River | 6 |

| Pineville | 42 |

| Plaquemine | 5 |

| Pollock | 0 |

| Ponchatoula | 20 |

| Port Allen | 8 |

| Port Vincent | 4 |

| Rayne | 9 |

| Ringgold | 0 |

| Ruston | 13 |

| Scott | 17 |

| Shreveport | 884 |

| Sibley | 1 |

| Slidell | 43 |

| Springhill | 1 |

| St. Gabriel | 6 |

| Sulphur | 69 |

| Tallulah | 1 |

| Thibodaux | 21 |

| Tickfaw | 0 |

| Vidalia | 3 |

| Ville Platte | 19 |

| Walker | 14 |

| Welsh | 3 |

| Westlake | 0 |

| West Monroe | 49 |

| Westwego | 7 |

| Wilson | 0 |

| Youngsville | 2 |

| Zachary | 24 |

| Zwolle | 0 |

New Orleans, Baton Rouge, and Shreveport had the highest number of motor vehicle thefts in 2017 as per data from FBI.

Road Fatalities in Louisiana

We would cover the fatality rates and reasons behind accidents in Louisiana in this section through data from the National Highway Traffic Safety Administration.

Fatal Crashes by Weather Condition and Light Condition in Louisiana

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 276 | 93 | 219 | 32 | 1 | 621 |

| Rain | 20 | 15 | 16 | 4 | 0 | 55 |

| Snow/Sleet | 1 | 0 | 0 | 0 | 0 | 1 |

| Other | 2 | 4 | 8 | 0 | 0 | 14 |

| Unknown | 0 | 1 | 1 | 0 | 3 | 5 |

| Total | 299 | 113 | 244 | 36 | 4 | 696 |

Fatalities (All Crashes) by County in Louisiana

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Acadia Parish | 12 | 18 | 17 | 12 | 12 |

| Allen Parish | 3 | 6 | 6 | 6 | 5 |

| Ascension Parish | 23 | 23 | 19 | 21 | 28 |

| Assumption Parish | 5 | 11 | 5 | 6 | 2 |

| Avoyelles Parish | 9 | 13 | 7 | 6 | 7 |

| Beauregard Parish | 5 | 6 | 5 | 5 | 8 |

| Bienville Parish | 4 | 3 | 1 | 6 | 2 |

| Bossier Parish | 9 | 14 | 12 | 11 | 15 |

| Caddo Parish | 29 | 40 | 36 | 27 | 36 |

| Calcasieu Parish | 24 | 24 | 36 | 47 | 38 |

| Caldwell Parish | 4 | 5 | 4 | 1 | 4 |

| Cameron Parish | 1 | 1 | 1 | 0 | 3 |

| Catahoula Parish | 1 | 0 | 3 | 2 | 1 |

| Claiborne Parish | 2 | 2 | 3 | 4 | 1 |

| Concordia Parish | 7 | 4 | 7 | 3 | 1 |

| De Soto Parish | 4 | 5 | 3 | 5 | 8 |

| East Baton Rouge Parish | 41 | 50 | 43 | 52 | 65 |

| East Carroll Parish | 1 | 1 | 4 | 0 | 0 |

| East Feliciana Parish | 2 | 6 | 8 | 16 | 8 |

| Evangeline Parish | 6 | 2 | 9 | 8 | 6 |

| Franklin Parish | 2 | 5 | 7 | 5 | 4 |

| Grant Parish | 1 | 6 | 5 | 2 | 6 |

| Iberia Parish | 16 | 15 | 24 | 15 | 8 |

| Iberville Parish | 6 | 16 | 13 | 18 | 6 |

| Jackson Parish | 3 | 2 | 4 | 2 | 3 |

| Jefferson Davis Parish | 7 | 4 | 10 | 12 | 12 |

| Jefferson Parish | 22 | 24 | 26 | 34 | 28 |

| La Salle Parish | 2 | 5 | 3 | 5 | 2 |

| Lafayette Parish | 38 | 31 | 29 | 24 | 18 |

| Lafourche Parish | 24 | 29 | 20 | 24 | 23 |

| Lincoln Parish | 8 | 8 | 2 | 4 | 5 |

| Livingston Parish | 25 | 24 | 18 | 25 | 23 |

| Madison Parish | 5 | 4 | 11 | 4 | 7 |

| Morehouse Parish | 9 | 3 | 7 | 4 | 5 |

| Natchitoches Parish | 10 | 6 | 8 | 10 | 6 |

| Orleans Parish | 53 | 50 | 50 | 55 | 44 |

| Ouachita Parish | 22 | 23 | 21 | 20 | 28 |

| Plaquemines Parish | 3 | 4 | 8 | 1 | 1 |

| Pointe Coupee Parish | 6 | 7 | 8 | 11 | 11 |

| Rapides Parish | 16 | 22 | 22 | 20 | 13 |

| Red River Parish | 4 | 4 | 3 | 4 | 5 |

| Richland Parish | 4 | 5 | 6 | 3 | 5 |

| Sabine Parish | 11 | 6 | 3 | 6 | 8 |

| St. Bernard Parish | 6 | 3 | 6 | 2 | 3 |

| St. Charles Parish | 13 | 6 | 7 | 8 | 8 |

| St. Helena Parish | 5 | 6 | 6 | 2 | 9 |

| St. James Parish | 7 | 6 | 5 | 4 | 4 |

| St. John The Baptist Parish | 15 | 8 | 8 | 10 | 8 |

| St. Landry Parish | 20 | 25 | 21 | 15 | 23 |

| St. Martin Parish | 14 | 16 | 10 | 13 | 17 |

| St. Mary Parish | 12 | 13 | 12 | 4 | 9 |

| St. Tammany Parish | 20 | 22 | 26 | 23 | 30 |

| Tangipahoa Parish | 26 | 22 | 36 | 40 | 31 |

| Tensas Parish | 1 | 2 | 1 | 1 | 1 |

| Terrebonne Parish | 22 | 19 | 16 | 20 | 29 |

| Union Parish | 7 | 6 | 7 | 7 | 1 |

| Vermilion Parish | 4 | 6 | 14 | 10 | 4 |

| Vernon Parish | 13 | 11 | 8 | 13 | 11 |

| Washington Parish | 10 | 10 | 10 | 12 | 15 |

| Webster Parish | 5 | 5 | 4 | 17 | 11 |

| West Baton Rouge Parish | 11 | 11 | 9 | 5 | 12 |

| West Carroll Parish | 1 | 1 | 3 | 1 | 3 |

| West Feliciana Parish | 2 | 3 | 3 | 1 | 3 |

| Winn Parish | 0 | 2 | 3 | 3 | 7 |

Traffic Fatalities in Louisiana

| Type of Road | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 502 | 442 | 391 | 348 | 345 | 342 | 389 | 368 | 368 | 369 |

| Urban | 414 | 382 | 330 | 332 | 378 | 361 | 351 | 377 | 385 | 390 |

Fatalities by Person Type in Louisiana

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 243 | 258 | 259 | 254 | 254 |

| Light Truck - Pickup | 137 | 150 | 145 | 138 | 144 |

| Light Truck - Utility | 86 | 87 | 72 | 74 | 76 |

| Light Truck - Van | 10 | 8 | 16 | 17 | 14 |

| Large Truck | 13 | 20 | 7 | 11 | 30 |

| Other/Unknown Occupants | 15 | 10 | 16 | 14 | 11 |

| Total Occupants | 504 | 533 | 519 | 512 | 529 |

| Light Truck - Other | 0 | 0 | 4 | 4 | 0 |

| Total Motorcyclists | 86 | 83 | 91 | 94 | 96 |

| Pedestrian | 97 | 105 | 106 | 127 | 111 |

| Bicyclist and Other Cyclist | 14 | 13 | 34 | 22 | 22 |

| Other/Unknown Nonoccupants | 2 | 6 | 2 | 2 | 2 |

| Total Nonoccupants | 113 | 124 | 142 | 151 | 135 |

| Total | 703 | 740 | 752 | 757 | 760 |

Fatalities by Crash Type in Louisiana

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 703 | 740 | 752 | 757 | 760 |

| Single Vehicle | 403 | 467 | 435 | 418 | 440 |

| Involving a Large Truck | 84 | 80 | 79 | 89 | 102 |

| Involving Speeding | 193 | 204 | 171 | 173 | 177 |

| Involving a Rollover | 197 | 227 | 204 | 177 | 204 |

| Involving a Roadway Departure | 435 | 467 | 411 | 415 | 421 |

| Involving an Intersection (or Intersection Related) | 119 | 153 | 151 | 138 | 141 |

Fatalities Trend for the Top 10 Counties in Louisiana

| Louisiana Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| East Baton Rouge Parish | 41 | 50 | 43 | 52 | 65 |

| Orleans Parish | 53 | 50 | 50 | 55 | 44 |

| Calcasieu Parish | 24 | 24 | 36 | 47 | 38 |

| Caddo Parish | 29 | 40 | 36 | 27 | 36 |

| Tangipahoa Parish | 26 | 22 | 36 | 40 | 31 |

| St. Tammany Parish | 20 | 22 | 26 | 23 | 30 |

| Terrebonne Parish | 22 | 19 | 16 | 20 | 29 |

| Ascension Parish | 23 | 23 | 19 | 21 | 28 |

| Jefferson Parish | 22 | 24 | 26 | 34 | 28 |

| Ouachita Parish | 22 | 23 | 21 | 20 | 28 |

| Top Ten Counties | 305 | 320 | 328 | 351 | 357 |

| All Other Counties | 398 | 420 | 424 | 406 | 403 |

| All Counties | 703 | 740 | 752 | 757 | 760 |

Fatalities Involving Speeding by County in Louisiana

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Acadia Parish | 4 | 8 | 5 | 0 | 2 |

| Allen Parish | 1 | 2 | 2 | 1 | 0 |

| Ascension Parish | 5 | 5 | 10 | 8 | 7 |

| Assumption Parish | 2 | 4 | 1 | 2 | 1 |

| Avoyelles Parish | 1 | 2 | 2 | 2 | 0 |

| Beauregard Parish | 2 | 2 | 0 | 1 | 0 |

| Bienville Parish | 0 | 0 | 1 | 0 | 0 |

| Bossier Parish | 3 | 3 | 1 | 0 | 4 |

| Caddo Parish | 13 | 17 | 12 | 5 | 9 |

| Calcasieu Parish | 8 | 10 | 8 | 10 | 6 |

| Caldwell Parish | 0 | 0 | 1 | 0 | 2 |

| Cameron Parish | 0 | 0 | 0 | 0 | 0 |

| Catahoula Parish | 0 | 0 | 0 | 0 | 0 |

| Claiborne Parish | 1 | 2 | 0 | 2 | 0 |

| Concordia Parish | 3 | 0 | 5 | 3 | 0 |

| De Soto Parish | 4 | 1 | 3 | 2 | 2 |

| East Baton Rouge Parish | 9 | 8 | 5 | 3 | 9 |

| East Carroll Parish | 0 | 0 | 0 | 0 | 0 |

| East Feliciana Parish | 0 | 1 | 1 | 4 | 3 |

| Evangeline Parish | 2 | 0 | 0 | 3 | 2 |

| Franklin Parish | 1 | 1 | 2 | 1 | 1 |

| Grant Parish | 0 | 2 | 4 | 1 | 1 |

| Iberia Parish | 3 | 2 | 4 | 3 | 2 |

| Iberville Parish | 1 | 10 | 3 | 4 | 1 |

| Jackson Parish | 0 | 1 | 0 | 0 | 0 |

| Jefferson Davis Parish | 1 | 1 | 1 | 2 | 1 |

| Jefferson Parish | 8 | 4 | 6 | 8 | 3 |

| La Salle Parish | 1 | 0 | 1 | 3 | 0 |

| Lafayette Parish | 9 | 8 | 4 | 2 | 5 |

| Lafourche Parish | 5 | 7 | 5 | 5 | 11 |

| Lincoln Parish | 0 | 3 | 0 | 1 | 2 |

| Livingston Parish | 5 | 8 | 4 | 3 | 8 |

| Madison Parish | 1 | 1 | 2 | 0 | 1 |

| Morehouse Parish | 3 | 3 | 0 | 1 | 0 |

| Natchitoches Parish | 2 | 1 | 3 | 2 | 0 |

| Orleans Parish | 8 | 6 | 9 | 12 | 7 |

| Ouachita Parish | 5 | 6 | 3 | 0 | 6 |

| Plaquemines Parish | 2 | 1 | 4 | 0 | 1 |

| Pointe Coupee Parish | 3 | 1 | 2 | 7 | 2 |

| Rapides Parish | 5 | 13 | 5 | 7 | 4 |

| Red River Parish | 3 | 2 | 1 | 1 | 2 |

| Richland Parish | 1 | 1 | 1 | 0 | 1 |

| Sabine Parish | 6 | 1 | 2 | 1 | 1 |

| St. Bernard Parish | 2 | 1 | 0 | 1 | 1 |

| St. Charles Parish | 8 | 4 | 2 | 3 | 4 |

| St. Helena Parish | 0 | 0 | 4 | 0 | 1 |

| St. James Parish | 0 | 2 | 0 | 0 | 0 |

| St. John The Baptist Parish | 6 | 3 | 2 | 5 | 1 |

| St. Landry Parish | 7 | 8 | 5 | 3 | 2 |

| St. Martin Parish | 2 | 7 | 2 | 3 | 7 |

| St. Mary Parish | 0 | 0 | 0 | 0 | 1 |

| St. Tammany Parish | 6 | 5 | 10 | 6 | 10 |

| Tangipahoa Parish | 4 | 6 | 8 | 14 | 14 |

| Tensas Parish | 0 | 0 | 0 | 1 | 0 |

| Terrebonne Parish | 9 | 9 | 4 | 7 | 11 |

| Union Parish | 3 | 2 | 1 | 1 | 0 |

| Vermilion Parish | 1 | 3 | 3 | 2 | 0 |

| Vernon Parish | 6 | 1 | 1 | 2 | 6 |

| Washington Parish | 0 | 2 | 2 | 4 | 4 |

| Webster Parish | 3 | 0 | 1 | 7 | 1 |

| West Baton Rouge Parish | 3 | 3 | 1 | 2 | 4 |

| West Carroll Parish | 1 | 0 | 0 | 0 | 1 |

| West Feliciana Parish | 1 | 0 | 1 | 0 | 0 |

| Winn Parish | 0 | 0 | 1 | 2 | 2 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County in Louisiana

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Acadia Parish | 2 | 5 | 3 | 2 | 4 |

| Allen Parish | 1 | 3 | 2 | 0 | 0 |

| Ascension Parish | 6 | 5 | 4 | 6 | 7 |

| Assumption Parish | 1 | 4 | 1 | 1 | 0 |

| Avoyelles Parish | 8 | 2 | 2 | 1 | 3 |

| Beauregard Parish | 4 | 4 | 1 | 0 | 1 |

| Bienville Parish | 0 | 0 | 0 | 0 | 0 |

| Bossier Parish | 1 | 4 | 3 | 0 | 3 |

| Caddo Parish | 6 | 16 | 17 | 7 | 14 |

| Calcasieu Parish | 8 | 8 | 13 | 17 | 12 |

| Caldwell Parish | 0 | 1 | 2 | 0 | 1 |

| Cameron Parish | 0 | 0 | 1 | 0 | 1 |

| Catahoula Parish | 1 | 0 | 1 | 0 | 0 |

| Claiborne Parish | 1 | 0 | 0 | 2 | 0 |

| Concordia Parish | 0 | 2 | 1 | 2 | 0 |

| De Soto Parish | 3 | 3 | 1 | 1 | 1 |

| East Baton Rouge Parish | 8 | 17 | 14 | 14 | 19 |

| East Carroll Parish | 0 | 1 | 1 | 0 | 0 |

| East Feliciana Parish | 1 | 2 | 1 | 8 | 2 |

| Evangeline Parish | 2 | 0 | 2 | 5 | 3 |

| Franklin Parish | 2 | 2 | 2 | 2 | 2 |

| Grant Parish | 0 | 5 | 1 | 1 | 2 |

| Iberia Parish | 9 | 3 | 14 | 6 | 2 |

| Iberville Parish | 4 | 7 | 1 | 5 | 2 |

| Jackson Parish | 0 | 1 | 1 | 0 | 1 |

| Jefferson Davis Parish | 2 | 3 | 4 | 2 | 2 |

| Jefferson Parish | 6 | 9 | 7 | 10 | 6 |

| La Salle Parish | 1 | 0 | 1 | 2 | 1 |

| Lafayette Parish | 20 | 12 | 10 | 5 | 5 |

| Lafourche Parish | 8 | 1 | 8 | 4 | 5 |

| Lincoln Parish | 2 | 2 | 0 | 1 | 2 |

| Livingston Parish | 6 | 11 | 6 | 9 | 4 |

| Madison Parish | 2 | 2 | 3 | 1 | 1 |

| Morehouse Parish | 1 | 1 | 3 | 1 | 1 |

| Natchitoches Parish | 3 | 2 | 2 | 3 | 0 |

| Orleans Parish | 22 | 13 | 18 | 21 | 16 |

| Ouachita Parish | 8 | 3 | 8 | 4 | 8 |

| Plaquemines Parish | 2 | 3 | 5 | 1 | 1 |

| Pointe Coupee Parish | 2 | 2 | 6 | 5 | 3 |