Geico DriveEasy App Review (2025 Ratings)

Our Geico DriveEasy app review reveals that this telematics-based program tracks behaviors like speeding, phone use, and hard braking to determine insurance rates. Geico DriveEasy rewards safe driving habits with potential discounts of up to 25%. However, a poor DriveEasy score may result in higher rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

Usage-based insurance and telematics-driven insurance programs are increasingly popular among drivers who want more control over their insurance costs. The Geico DriveEasy app plays a significant role in this trend, offering a behavior-based, pay-as-you-drive approach to car insurance.

How Geico DriveEasy Program Works

As you can see in this Geico DriveEasy program review, the system monitors your activity on the road in a variety of circumstances. This is a usage-based insurance program where, once enrolled, you will receive a safe driving score based on your performance in each situation. This score will be higher if your driving habits meet certain criteria.

How Insurers Determine DriveEasy Score

Leave your phone alone. Even though the DriveEasy system uses your phone, the algorithm doesn’t want you to use your phone while driving. The app will run in the background, so avoid tapping or picking up your phone while driving to keep your score up. Note that other passengers using your phone while you are driving will count as active phone use as well.

Don’t slam on the brakes. This seems obvious, and if someone cuts you off or stops short in front of you there may be nothing you can do. Still, paying attention to your surroundings and fellow drivers can limit the need to brake hard, and Geico likes that.

General control and uniform speeds are desirable and considered safe. When cornering, slow down first so you are not racing through the turn. Don’t hit the gas hard after a stop and try to maintain a consistent speed throughout your trip.

Pay attention to the weather and avoid driving in dangerous conditions. This applies to the time of day as well. Driving in low light or late at night is considered riskier than daytime driving, and your score will reflect that.

What Happens After Each Trip

Each time you drive, your score will be updated, and you will be able to see the details in the Geico Mobile app. The specific habits you exhibited will be included in your score. Geico will track and store this information, so if you’re squeamish about your data being sold, keep that in mind. Geico will then use that information to determine your insurance rates, as well as to further establish safe driving criteria.

GEICO DriveEasy Tracked Risky Behaviors and Definition

| Risky Behavior | Definition |

|---|---|

| Speeding | Driving above the legal speed limit, which increases the risk of accidents. |

| Hard Braking | Sudden and forceful braking, indicating aggressive or inattentive driving. |

| Phone Usage | Using your phone while driving, leading to distracted driving and higher crash risks. |

| Rapid Acceleration | Quickly accelerating, which can be a sign of aggressive driving. |

| Cornering | Taking turns too quickly or sharply, which can lead to loss of control. |

| Time of Day | Driving during times that are statistically more dangerous, such as late at night. |

| Frequent Trips | Making many short trips in a short period, which can lead to driver fatigue. |

| Distance Driven | Longer distances can increase the risk of accidents due to extended time on the road. |

A benefit of this program is that each time you drive you can review your performance. You may find that the instant feedback enables you to get a better grasp on just how safely you are driving. We can all get distracted too easily or use our phones too often while driving. Knowing just how much we are engaged in these risky behaviors might just help make the roads safer for all of us.

Read More: Driving Tips for Road Safety

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How to Enroll in DriveEasy With the Geico App

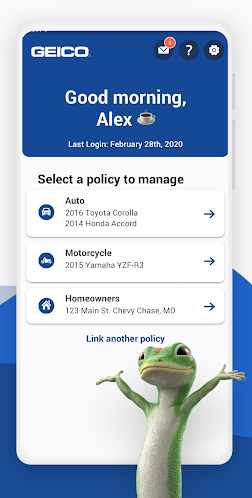

Originally, Geico offered a dedicated app for the DriveEasy program. This has recently changed. The Geico DriveEasy app is now integrated into the Geico mobile app itself. When you download the Geico app, you will be asked a series of questions to determine your interest in enrolling in the DriveEasy program. You can now decide whether or not you wish to participate in the program.

If at a later date, you wish to take part in Geico DriveEasy, you have a few options. You can call Geico customer service or your agent directly. You can chat with an assistant online, or you can email customer service via Geico’s website. In these cases, you will receive an invitation to enroll. Once accepted, you will follow the same procedure as a first-time user of the mobile app.

There are some advantages to participating in DriveEasy. Perhaps the most alluring is the possibility of lowering your car insurance rates.

The Geico DriveEasy App Discount

At the end of the day, saving money on car insurance is a goal many of us share. If you would like to get a discount on your Geico auto insurance rates based on your habits, then Geico DriveEasy may be right for you. The Geico Mobile app integrates the data it receives from your drives into the insurance rates you receive. Safe drivers receive lower car insurance rates. Riskier drivers get higher rate offers. It’s as simple as that, sort of.

You will want to pay attention to the specific driving habits of Geico DriveEasy tracks, and how they are rated. In particular notice those aspects outside of your control, like someone else using your phone or a car abruptly stopping in front of you. Each case is unique, so you will need to maintain close monitoring of your score and its effects on your insurance rates.

GEICO DriveEasy Compared to Other Telematics Programs

| Feature | GEICO DriveEasy | Progressive Snapshot | State Farm Drive Safe & Save | Allstate Drivewise |

|---|---|---|---|---|

| Monitoring Method | Mobile App | Mobile App/Plug-in Device | Mobile App/Bluetooth Beacon | Mobile App/Plug-in Device |

| Driving Behaviors Tracked | Speed, Braking, Phone Use, Time of Day | Speed, Braking, Acceleration, Time of Day | Speed, Braking, Acceleration, Mileage | Speed, Braking, Acceleration, Time of Day |

| Discount Potential | Up to 25% | Up to 30% | Up to 30% | Up to 40% |

| Availability | Nationwide | Nationwide | Nationwide | Nationwide |

| Feedback Provided | Driving Score, Tips for Improvement | Driving Score, Weekly Summaries | Driving Score, Monthly Feedback | Driving Score, Tips for Improvement |

| Impact on Rates | Immediate, based on driving score | Immediate, based on driving score | Immediate, based on driving score | Immediate, based on driving score |

| Privacy Considerations | GPS data collected | GPS data collected | GPS data collected | GPS data collected |

| Additional Features | None | Option to switch off monitoring during certain trips | Tracks mileage for potential savings | Accident detection and response |

There are other situations in which the Geico DriveEasy program may not be a good fit. If your car is frequently driven by other people, their habits could negatively impact your score. Driving in heavy stop-and-go traffic in the early morning hours is difficult to manage safely on the best of days. This type of driving condition does not score well in the DriveEasy app.

In addition, Geico requires everyone on your policy to be active, so if any family member wishes not to participate, you will not be eligible. You may decide the Geico DriveEasy app discount isn’t worth your data being tracked, or you might even see your rates raised because your score isn’t high enough. If any of these scenarios sound familiar, you may want to opt out of the program.

Read More:

- Geico Safe Driver Discount: How Much Can You Save?

- How Your Credit Score Affects Your Car Insurance Premiums

- High Risk Drivers

Geico DriveEasy App Ratings

The DriveEasy Geico apps for iPhone and Google do not have excellent ratings. In fact, the DriveEasy app only scores a 2.8 out of 5 in the Apple App Store and a 3.4 out of 5 in the Google Play Store.

Many of the bad reviews about the DriveEasy app involve log in issues and the app not allowing a navigation app to run smoothly.

There are also driver complaints that the app does not track your driving accurately, or let you change from a driver to a passenger in some cases.

For example, if you drive but have your passenger use your phone to make a call or change navigation, you will be dinged for distracted driving.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How to Turn Off Geico DriveEasy

Once you have activated DriveEasy, there is no way to directly stop the app from monitoring your driving. You will need to contact Geico directly to unenroll. Visit the FAQ page from the DriveEasy app’s home on your phone, and you will see instructions to call Geico at 800-841-3000. You can find this number online as well.

Telematics programs like Geico DriveEasy let drivers lower premiums through safe driving, with potential discounts of up to 25%, but risky behaviors like distracted driving can raise rates, making real-time feedback essential for savings.

Chris Abrams Licensed Insurance Agent

An agent will guide you through the unsubscribe process over the phone. You may wonder “What happens if I turn off Geico DriveEasy?” If you have been active with the DriveEasy program long enough to establish a score, that data will not be erased.

Geico will continue to use that information to determine what coverage and rate amounts are offered to you. Keep this in mind before you call to unenroll.

The Value of Geico DriveEasy

Geico DriveEasy can save you money if you are a safe driver. However, if you are not sure about your driving behaviors, you can wind up with higher rates. For more information, read our “Driving Tips for Road Safety“.

The DriveEasy program is good for low mileage drivers who do not play with their phones while driving and do not drive late at night. DriveEasy can also be a good way for drivers to improve their safe driving skills like hard braking since the app gives them immediate feedback.

Remember: how much you save with the DriveEasy app is up to you. Drivers who monitor their scores and make driving adjustments will save the most.

However, the DriveEasy app leaves a lot to be desired. It has low ratings in both the Apple App Store and the Google Play Store. It also runs continually on your phone, leading to privacy and battery life concerns.

We hope you have learned all you need to know about the DriveEasy App and if it is right for you. Before you go, enter your ZIP code to compare free quotes from auto insurance companies in your area.

Frequently Asked Questions

What is DriveEasy?

DriveEasy is Geico’s app that tracks your driving habits to help you save on different types of auto insurance through discounts based on your driving behavior.

What is the highest score on DriveEasy?

What is the highest driving score? The highest score on DriveEasy is 100, indicating perfect driving habits according to the app’s metrics.

What is the highest Geico DriveEasy score?

The highest Geico DriveEasy score is 100, reflecting exemplary driving performance.

What is a good driving score?

How does Geico DriveEasy know you’re driving?

DriveEasy uses your phone’s GPS and motion sensors to detect when you are driving and monitor your driving patterns.

Does Geico DriveEasy use data?

Yes, Geico DriveEasy uses data from your phone’s sensors and GPS to track your driving habits and calculate your score.

Does DriveEasy track your speed?

Yes, DriveEasy tracks your speed as part of its evaluation of your driving habits.

How often does Geico DriveEasy update?

DriveEasy updates your driving score and feedback regularly, typically every time you complete a trip.

Why is my DriveEasy score low?

Why is my DriveEasy score low? It may be due to hard braking, rapid acceleration, or speeding. To understand how these behaviors impact your insurance rates, check out our “Reckless Driving and Auto Insurance Rates” article.

How do I improve my driving score?

To improve your driving score, drive smoothly, avoid hard braking and rapid acceleration, and adhere to speed limits.

How to increase your DriveEasy score?

Boost your DriveEasy score by adopting safe driving habits, minimizing aggressive behaviors, and staying within speed limits to qualify for a safe driver discount.

How to activate the DriveEasy app?

To activate the DriveEasy app, download it from your app store, sign in with your GEICO account, and follow the setup instructions.

Can I turn off Geico DriveEasy?

Yes, you can turn off the DriveEasy app through your phone’s settings or by disabling it within the app.

Can Geico really save you?

Yes, Geico may offer savings based on your driving behavior tracked by the DriveEasy app, potentially lowering your insurance premium.

Is Geico DriveEasy a separate app?

Yes, Geico DriveEasy is a dedicated app for tracking driving behavior and providing discounts, as part of their usage-based insurance program.

Is DriveEasy safe?

Yes, DriveEasy is designed with security in mind to protect your data while tracking your driving habits.

Does Drivewise use cellular data?

Yes, Drivewise, like DriveEasy, uses cellular data to track and analyze your driving habits.

What is the purpose of DriveEasy?

The purpose of DriveEasy is to monitor driving behavior to help you earn car insurance discounts by promoting safer driving.

How does Drivewise know if I’m a passenger?

Drivewise detects whether you are driving or a passenger through movement patterns and GPS data.

What speed should you always drive?

You should always drive within the posted speed limits and adjust your speed based on road conditions for safety.

What is the safest speed to drive?

The safest speed is typically the posted speed limit, but it should be adjusted according to traffic, weather, and road conditions, considering the different levels of driving automation.

How to calculate your driving score?

DriveEasy calculates your driving score using metrics like speed, braking, and acceleration collected during your trips.

What does the Geico mobile app do?

The Geico mobile app provides access to your insurance policy, allows you to manage claims, and offers features like DriveEasy for tracking driving habits.

Does Geico refund if you cancel?

Geico might provide a refund if you cancel your policy, depending on your coverage terms and the timing of the cancellation. For guidance on changing providers, see our tips on “How to Switch Auto Insurance Companies“.

Can my driving score go up?

Yes, your driving score can improve with better driving habits over time, leading to potentially higher discounts.

How to improve my driving score?

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.