Cheap Auto Insurance in Nebraska for 2025 (Find Savings With These 10 Companies)

USAA, State Farm, and Nationwide are some of the providers to consider for cheap auto insurance in Nebraska. USAA offers cheap Nebraska auto insurance rates at only $15 per month. These companies stand out not only for their low premiums but also for their exceptional coverage options and reliable customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,589 reviews

6,589 reviewsCompany Facts

Minimum Coverage in Nebraska

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Minimum Coverage in Nebraska

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,071 reviews

3,071 reviewsCompany Facts

Minimum Coverage in Nebraska

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsOur Top 10 Company Picks: Cheap Auto Insurance in Nebraska

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $15 | A++ | Customer Service | USAA | |

| #2 | $18 | B | Local Agent | State Farm | |

| #3 | $20 | A+ | Claims Handling | Nationwide |

| #4 | $25 | A++ | Low Premiums | Geico | |

| #5 | $26 | A+ | Comprehensive Coverage | Progressive | |

| #6 | $27 | A++ | Rural Drivers | Travelers | |

| #7 | $30 | A | Multi-Policy Savings | American Family | |

| #8 | $33 | A+ | Accident Forgiveness | Allstate | |

| #9 | $35 | A | Bundling Policies | Farmers | |

| #10 | $48 | A | Multi-Policy Discounts | Liberty Mutual |

Read on to learn more about how to secure the best auto insurance in Nebraska. Start comparing NE auto insurance rates by entering your ZIP code.

- USAA’s minimum coverage rates in NE are $15 per month

- Nebraska drivers can find affordable auto insurance with personalized coverage

- State Farm and Nationwide provide competitive prices and great customer service

#1 – USAA: Top Overall Pick

Pros

- Low-Cost Coverage: Our USAA auto insurance review shows that the company has competitive rates starting at $15 per month, making it the best low-cost auto insurance in Nebraska.

- Great Customer Service: USAA has excellent customer service representatives that make the process of its policyholders in Nebraska very smooth.

- Tailored Military Coverage: Nebraska offers special discounts and personalized coverage options to active and retired military members and their families.

Cons

- Eligibility Limited to Military Members: Auto insurance in Nebraska through USAA is available only to military personnel and their families.

- Limited Local Offices for Lincoln Residents: Nebraska drivers, particularly in Lincoln, may find in-person support lacking due to fewer physical locations.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agent Support

Pros

- Strong Local Presence: Our State Farm auto insurance review highlights the company’s strong network of local agents for customized car insurance services specifically targeted to Nebraska drivers.

- Low-Cost Rates: This company provides very cheap insurance coverage plans starting at just $18 per month to price-sensitive car owners in Nebraska.

- Savings Opportunities: Nebraska drivers can take advantage of discounts like Safe Driver and multi-policy discounts.

Cons

- Digital Tools Could Be Improved: State Farm’s digital tools may not be as advanced as those of its competitors in Nebraska.

- Rates May Rise Without Discounts: Without applying discounts, State Farm’s rates may be less competitive for Nebraska car insurance customers.

#3 – Nationwide: Best for Claims Handling

Pros

- Effortless Claims Management: Nationwide processes claims quickly and brings peace of mind to drivers in Nebraska whenever needed.

- Cheap Insurance Rates: The monthly coverage rates can go as low as $20, while it provides premium insurance for drivers in Nebraska.

- Customized Plans: From accident forgiveness to roadside assistance, Nationwide provides coverage tailored to Nebraska drivers’ unique needs.

Cons

- Limited In-Person Support: With fewer local agents, drivers may struggle to get face-to-face support, which can be troublesome for individuals who prefer direct interaction.

- Higher Rates for High-Risk Drivers: According to the Nationwide auto insurance review, drivers with a history of accidents may face higher premiums.

#4 – Geico: Best for Low Premiums

Pros

- Competitive Pricing: Geico has affordable auto insurance in Nebraska. The cheapest can start as low as $25 per month.

- Extensive Discounts: Geico has different discounts for Nebraska auto insurance for good drivers, multiple policyholders, and even safety features installed on your vehicle.

- User-Friendly Digital Tools: As per our Geico auto insurance review, their online platform and mobile app make managing your policy simple and easy.

Cons

- Limited Customization: Geico provides fewer alternatives for add-on coverage, which restricts how much you can customize your Nebraska auto insurance.

- Personalized Support is Minimized: Geico also does not maintain a local agent network, thus reducing the customized service to Nebraska auto insurance customers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Comprehensive Coverage

Pros

- Many Coverage Options: Progressive offers a broad range of coverage options, such as gap insurance, rideshare coverage, and custom parts replacement, among others, making it a great choice.

- Cheap Rates: Progressive offers affordable car insurance in Nebraska without compromising coverage quality, with premiums starting at $26 monthly.

- Personalized Policies: Progressive’s “Name Your Price” feature allows drivers to customize policies according to their budget. For more details, read our Progressive auto insurance review.

Cons

- Expensive for High-Risk Drivers: Drivers with past violations may face significantly higher premiums for auto insurance in Nebraska through Progressive.

- Complicated Discount System: Progressive’s numerous discount options can overwhelm drivers seeking cheap car insurance in Nebraska.

#6 – Travelers: Best for Rural Drivers

Pros

- Affordable Premiums in Rural Areas: Travelers provides auto insurance in Nebraska, with premiums starting at $27 per month, which is great for rural communities.

- Tailored Coverage for Local Drivers: With accident forgiveness and new car replacement options, our Travelers auto insurance review reveals that their focus is on the needs of NE drivers.

- Strong Financial Rating: Rated A++ by A.M. Best, Travelers ensures reliable long-term claims support through solid financial stability.

Cons

- Limited Urban Discounts in Larger Cities: Travelers may not offer as many discounts for those seeking car insurance in Nebraska in urban cities like Lincoln.

- Online Resources Could Be Improved: Travelers’ digital tools may not be as user-friendly or feature-rich as those offered by other insurers in the Nebraska auto insurance market.

#7 – American Family: Best for Multi-Policy Savings

Pros

- Significant Savings for Bundled Policies: The American Family offers substantial discounts on auto insurance for homeowners and drivers in Nebraska.

- Affordable Rates for Lincoln Drivers: American Family provides competitive Nebraska auto insurance rates starting at $30 monthly.

- Personalized Service With Local Agents: American Family’s network of local agents offers individualized service for Nebraska auto insurance customers.

Cons

- Not Available in Certain Regions: Although American Family provides excellent coverage, it does not offer its products in certain NE rural areas.

- Higher Premiums Without Bundling: Our American Family auto insurance review shows that rates may be less competitive for drivers who do not take advantage of bundling policies.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Allstate’s accident forgiveness program ensures that Nebraska drivers will never receive surprise increases in premiums following an initial at-fault accident.

- Comprehensive Add-ons: Allstate offers many informative add-ons, which can help customize the Nebraska auto insurance policy for your specific needs.

- Convenient Digital Tools: The Allstate app simplifies policy management and claims filing for customers seeking auto insurance in Nebraska.

Cons

- Higher Premiums for NE Drivers: Starting at $33 per month, Nebraska auto insurance quotes from Allstate are higher than those from some competitors.

- Strict Discount Eligibility: Our Allstate auto insurance review reveals that some discounts have strict eligibility requirements, limiting availability for specific NE drivers.

#9 – Farmers: Best for Bundling Policies

Pros

- Save Big With Bundled Policies: Bundling auto insurance in Nebraska with home coverage through Farmers leads to substantial discounts.

- Tailored Coverage for Every Driver: Farmers offers customizable options, including usage-based insurance, to meet individual needs, as noted in this Farmers auto insurance review.

- Budget-Friendly Rates: At just $35 per month, Farmers is one of the cheapest car insurance providers in Nebraska for personalized coverage.

Cons

- Standalone Policies Lack Savings Potential: Drivers who don’t bundle policies may miss out on the most significant discounts.

- Costs More for High-Risk Drivers: Those with violations could face steep premium hikes, limiting access to the cheapest car insurance in Nebraska.

#10 – Liberty Mutual: Best for Multi-Policy Discounts

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Nebraska Car Insurance Coverage & Rates

Finding cheap car insurance in Nebraska is a priority for every car owner. Price quotes differ with companies and different types of insurance. State Farm offers minimum insurance starting at $18 per month, while USAA offers military families exclusive cheap rates, with minimum insurance starting at $15 per month.

Nebraska Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $33 | $125 | |

| $30 | $112 | |

| $35 | $130 | |

| $25 | $92 | |

| $48 | $179 |

| $20 | $77 |

| $26 | $95 | |

| $18 | $69 | |

| $27 | $102 | |

| $15 | $56 |

Complete coverage plans are the most expensive, provided by Liberty Mutual, at $179 monthly. Compare quotes from service providers such as Geico, Progressive, and Nationwide to offer the best quotations.

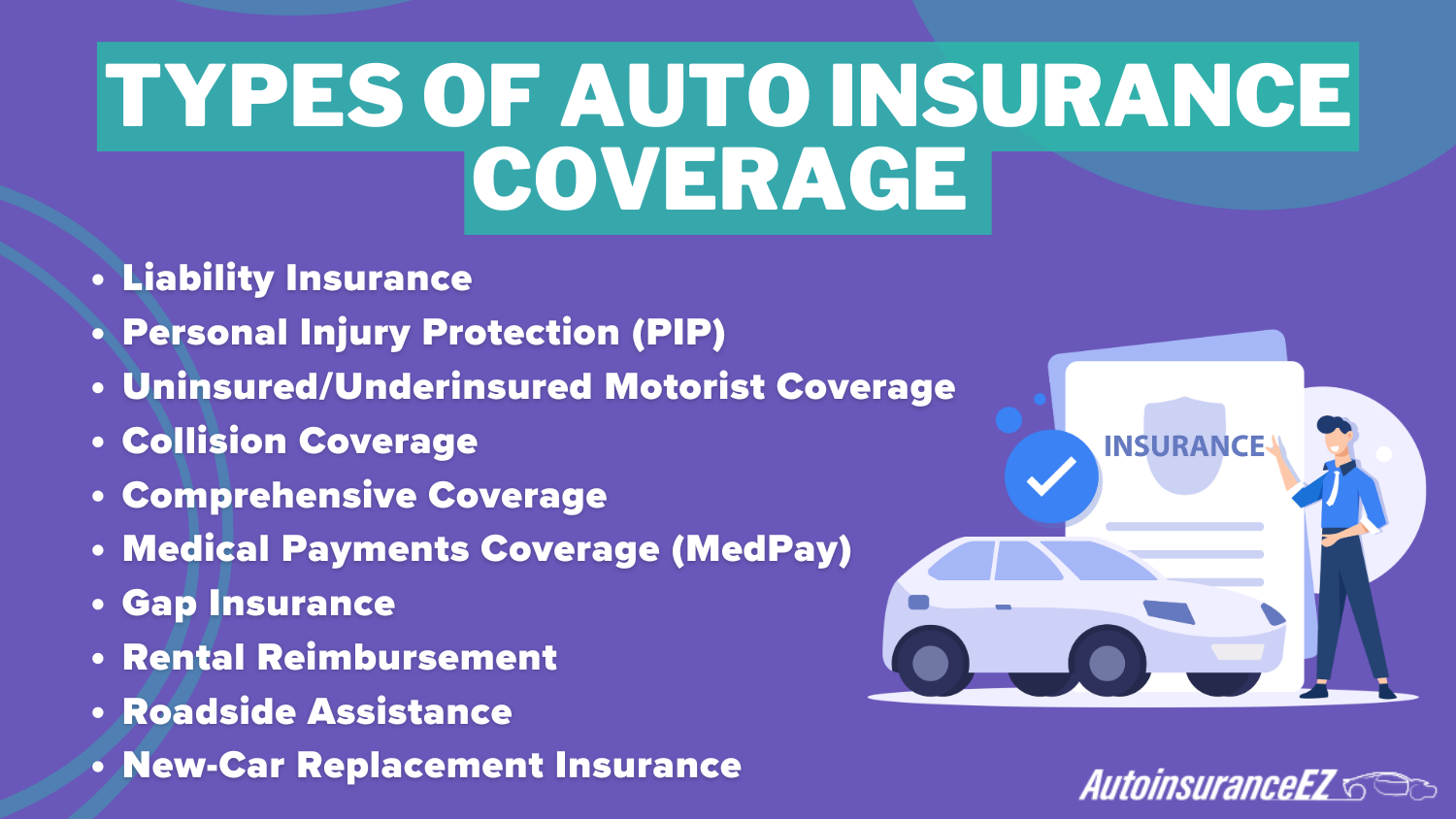

Knowing the different types of car insurance ensures you purchase enough coverage. Liability insurance covers damages you cause, while collision insurance provides comprehensive coverage against accidents or weather damage.

Other options, such as roadside assistance and medical payments, provide extra security. Roadside assistance and gap insurance add convenience factors. Comparing Nebraska car insurance rates with coverage types will help you make the right choice.

Driving Safely in Nebraska

Driving in Nebraska requires careful monitoring of the conditions of the roads and the weather prevailing in the state. The Omaha and Lincoln areas have the highest claims and accident records.

Nebraska Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Bellevue | 1,200 | 1,100 |

| Columbus | 400 | 380 |

| Fremont | 650 | 620 |

| Grand Island | 850 | 800 |

| Hastings | 580 | 550 |

| Kearney | 720 | 680 |

| Lincoln | 3,100 | 2,900 |

| Norfolk | 500 | 470 |

| North Platte | 450 | 430 |

| Omaha | 4,200 | 3,900 |

Driving in Nebraska requires careful monitoring of the conditions of the roads and the weather prevailing in the state. The Omaha and Lincoln areas have the highest claims and accident records.

Adopting safe driving practices might help you avoid expensive claims and even earn you a safe driver discount. Defensive driving is vital amid Nebraska’s moody weather.

5 Common Auto Insurance Claims in Nebraska

| Claim Type | Portion of Claims | Average Cost per Claim |

|---|---|---|

| Windshield Damage | 30% | $500 |

| Hail Damage | 25% | $3,000 |

| Rear-End Collisions | 20% | $4,721 |

| Single-Vehicle Accidents | 15% | $4,721 |

| Side-Impact Collisions | 10% | $4,721 |

Understanding the accident trends in your locality can help keep you safer on the road. You also find the cheapest auto insurance in Nebraska and save by guarding your car.

Best Nebraska Car Insurance Discounts

Finding the best auto insurance in Nebraska can be overwhelming, but discounts help reduce premiums. Many car insurance companies in Nebraska offer savings, such as a multi-car discount for insuring multiple vehicles.

Auto Insurance Discounts From the Top Providers in Nebraska

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Club Discount, Anti-Theft Discount, Multiple Policy Discount, TeenSMART Discount | |

| Multi-Car Discount, Safe Driving Discount, Low Mileage Discount, Early Signing Discount | |

| Bundling Discount, Safe Driver Discount, Signal App Discount, Distant Student Discount | |

| Multi-Policy Discount, Good Student Discount, Military Discount, Defensive Driving Discount | |

| RightTrack Discount, Multi-Policy Discount, New Graduate Discount, Paperless Billing Discount |

| SmartRide Discount, Accident-Free Discount, Multi-Policy Discount, Good Student Discount |

| Snapshot Discount, Multi-Car Discount, Good Student Discount, Continuous Insurance Discount | |

| Multi-Car Discount, Good Student Discount, Drive Safe & Save, Accident-Free Discount | |

| Multi-Policy Discount, Safe Driver Discount, Distant Student Discount, Green Vehicle Discount | |

| Multi-Vehicle Discount, Safe Driver Discount, Bundling Discount, Membership Discount |

In addition to the multi-car discount, other discounts are available for safe driving or maintaining a clean driving record. Savings are also available through programs like the snapshot discount based on driving habits.

Price is important, but it’s more important to be sure the coverage fits your needs. Liability and personal injury protection are among the coverage levels that different Nebraska auto insurance providers provide.

Nebraska Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Multi-Policy Discount | A | 20% | State Farm, Allstate, Geico |

| Good Student Discount | B+ | 10% | State Farm, Nationwide, Liberty Mutual |

| Vehicle Safety Features | B | 8% | Geico, American Family, Travelers |

| Paid-in-Full Discount | C+ | 5% | Progressive, Farmers, Liberty Mutual |

| Paperless Billing | C | 3% | Geico, State Farm, American Family |

Although they seem alluring, low prices aren’t always the most fantastic offer. Consider discounts, customer service, and coverage options to find the right balance of affordability and protection.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Nebraska’s Car Culture

In Nebraska, car culture is built around practicality and durability; trucks and SUVs like the Ford F-150 and Chevy Suburban are among the most popular options. These vehicles are best suited for Nebraska’s rural roads, which are often unpaved.

View this post on Instagram

With its vast plains, 70 percent of Nebraska’s motor vehicle deaths occur in the state’s rural areas. With long stretches between highways, drivers must be prepared with extra gas, food, paper maps, and reliable auto insurance in Nebraska.

USAA stands out for its military-specific benefits, offering tailored coverage options, highly-rated customer service and additional perks such as the SafePilot program.

Ty Stewart Licensed Insurance Agent

To save on premiums, many Nebraskans seek car insurance discounts. Understanding the average car insurance costs in Nebraska can also help drivers find the right coverage for their needs.

Nebraska Minimum Coverage

Nebraska auto insurance varies by coverage type and driver profile. The cheapest Nebraska auto insurance requires liability coverage at $381, with comprehensive and collision coverage at $234 and $248, respectively.

Nebraska Minimum Coverage Limits & Rates

| Coverage Type | Monthly Rates |

|---|---|

| Bodily Injury Liability | $80 |

| Property Damage | $30 |

| Uninsured Motorist | $50 |

| Personal Injury Protection (PIP) | $40 |

| Comprehensive | $70 |

| Collision | $100 |

Young drivers under 25 face the highest premiums due to inexperience, earning an “A” grade. Urban areas have higher premiums because of traffic and accident risks, resulting in a “B+” grade.

Traffic violations increase premiums, placing drivers in the “B” category. Adults between 25 and 65, with moderate risk, receive a “C+” grade. At the same time, rural areas enjoy lower rates, earning a “C.”

Nebraska Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Young Drivers (Under 25) | A | Highest premiums due to inexperience and higher risk. |

| Urban Areas | B+ | Higher rates due to more traffic and accident risks. |

| Traffic Violations | B | Increased premiums for higher-risk drivers. |

| Adults (25-65) | C+ | Moderate premiums reflecting balanced risk. |

| Rural Areas | C | Lower rates due to less traffic and accidents. |

| Senior Drivers (65+) | C- | Slightly higher rates due to age-related risks. |

| Clean Records | D | Lowest premiums for low-risk drivers. |

Senior drivers (65+) face higher premiums due to age-related risks, reflected in a “C-” grade. Clean drivers benefit from the cheapest Nebraska auto insurance, though they receive a “D” grade.

Find the Cheapest Insurance in Nebraska Cities

Finding affordable auto insurance in Nebraska is easy with research. By comparing options and considering local factors, you can get the best coverage at a competitive rate. Your location influences your premiums whether you live in one of Nebraska’s cities.

Follow these five easy steps to find the best rates for your city.

- Know Your City: Your location impacts auto insurance rates in Nebraska.

- Research Providers: Compare different auto insurance in Nebraska providers. Each offers unique coverage and pricing, so exploring multiple options is essential.

- Compare Rates: Local conditions such as traffic and weather might affect premiums. Areas with more car accidents and auto claims will have higher rates.

- Consider Local Factors: Local conditions like traffic and weather can influence premiums. Areas with higher car accidents and auto claims may have higher rates.

- Choose the Right Coverage: Evaluate auto insurance coverage options, compare premiums, consider local factors, and assess benefits to get the right coverage at the best price.

Adhere to the basic steps here to find cheaper auto insurance coverage that meets your requirements in Nebraska. Conduct further research and comparisons while considering regional considerations to source the correct coverage at the cheapest rate.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Securing Affordable Auto Insurance in Nebraska

Securing cheap auto insurance in Nebraska, it’s necessary to understand the factors that affect your car insurance premiums. Providers such as USAA, State Farm, and Nationwide offer competitive rates, with USAA starting at $15 per month. Such companies are recognized for affordable rates and strong customer service, providing benefits such as military perks and local agents.

Nebraska’s driving conditions, from rural roads to winter weather, impact premiums. To get the best deal, compare quotes based on your driving habits, vehicle type, and coverage needs. Get cheap auto insurance coverage with our quote comparison tool.

Frequently Asked Questions

What is the cheapest auto insurance provider in Nebraska?

USAA offers the lowest rates, starting at $15 per month, but it’s exclusive to military members and their families. Look at our USAA SafePilot program review for more insights.

Which Nebraska insurance company is best for customer service?

State Farm is known for exceptional local agent support and personalized service in Nebraska. Start comparing full coverage auto insurance rates by entering your ZIP code.

What factors influence auto insurance rates in Nebraska?

The average cost of auto insurance in NE depends on many factors, such as location, driving history, and the type of coverage. Most rural areas typically have lower premiums.

Can I use discounts for safe driving in Nebraska?

Yes, providers like Nationwide and Progressive offer safe driver discounts for clean records or participation in telematics programs. Learn more about the Tesla telematics program in our review.

What coverage is required for Nebraska drivers?

Nebraska auto insurance requirements mandate a minimum liability coverage of 25/50/25, including $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage.

How does Nebraska’s weather impact auto insurance claims?

Severe weather, such as hailstorms and tornadoes, leads to frequent claims for windshield and vehicle damage.

Are there insurance options for young drivers in Nebraska?

Providers like Geico and State Farm offer affordable rates and discounts for young or student drivers. Learn how you can qualify for a good student discount.

What makes USAA a top pick for Nebraska drivers?

USAA offers unbeatable rates, military-specific benefits, and excellent customer service tailored to military families. Use our free comparison tool to see what auto insurance quotes look like in your area.

How can rural drivers in Nebraska save on car insurance?

Rural drivers in Nebraska pay lower rates due to fewer cars and accidents. Nebraska car insurance companies like Travelers offer policies tailored to these areas. Bundling policies or choosing higher deductibles can also lead to savings.

Is it cheaper to bundle insurance policies in Nebraska?

American Family and Farmers offers notable discounts for bundling car and home insurance or other policies. Read how bundling car insurance and renters insurance can save you money.