Types of Auto Insurance Coverage in 2025 (What You Need to Know)

Drivers should consider the types of auto insurance coverage like liability, collision, and comprehensive. Liability coverage averages $60 per month, protecting against damages to others. Comprehensive coverage, though costlier, protects your vehicle from theft, weather, and non-collision events.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Understanding the types of auto insurance coverage is crucial for finding the right protection for your vehicle. Drivers should evaluate options like liability, collision, and comprehensive coverage to ensure adequate safeguarding. In North Dakota, liability coverage averages $282.55 annually, while monthly rates can start as low as $60. Compare various coverage options to find the best rates and coverage for your needs.

Discovering the best car insurance coverage options can lead to the lowest rates. We’ll simplify the process of understanding comprehensive coverage auto insurance and other affordable auto insurance options. Learn how to buy cheap auto insurance online now and ensure you’re getting a fair rate.

We’ll teach you how to search for cheap auto insurance rates and tell you the pros and cons of cheap car insurance. How can I find cheap car insurance?

Use our free tool above by entering your ZIP code to find car insurance coverage types near you.

- Key types of auto insurance coverage: liability, collision, and comprehensive

- Liability coverage in North Dakota averages $282 annually

- Monthly rates start at $60—compare and find savings

The Different Automobile Insurance Coverage Types

Some states have what are known as “No-Fault” rules and regulations. Policies under these rules are required to insure policyholders regardless of fault in an accident. This is also referred to as personal injury protection or PIP. Be sure to ask your insurance agent if you live in a no-fault state and how it will affect your policy.

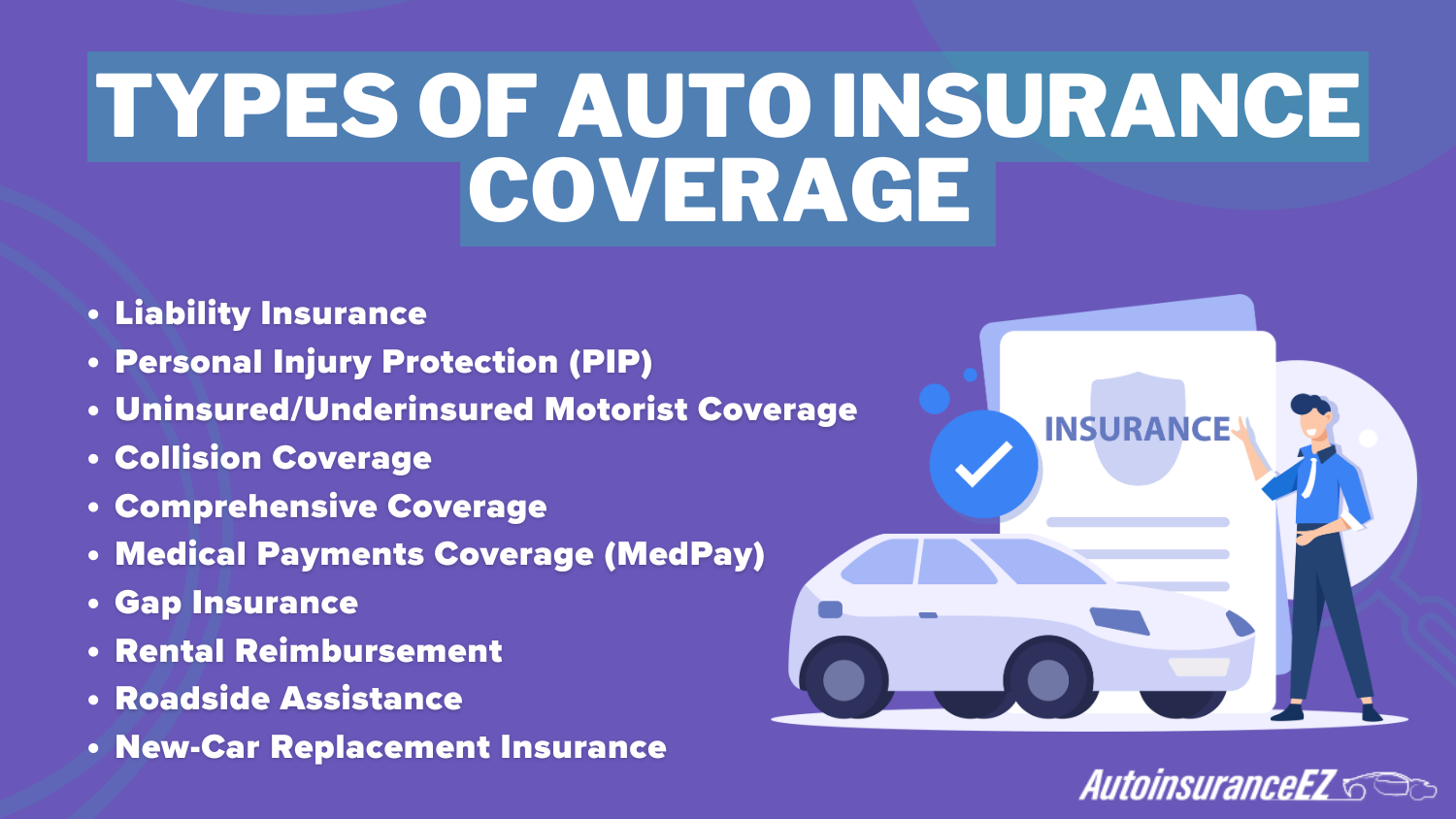

You may be asking, “What are the different kinds of car insurance I can buy?” There are many different types of auto insurance coverage that you can choose from, and some you must purchase no matter what to drive legally. Below are the standard types of coverage which you can choose from in most areas.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Liability Coverage

What is liability coverage? Liability covers any damages you are liable for, and it covers others if you are at fault in an accident. This insurance does not cover you and your car. This is required by all states, though exceptions can be made in certain states for individuals who can show that they can pay the state requirement out of pocket.

Did you know your credit score can affect your liability coverage? According to Experian, auto insurance companies issue lower rates to policyholders with good credit because they’re less likely to file a claim.

Let’s compare car insurance rates for liability coverage in each state in the data presented below.

U.S. Average Annual Liability Auto Insurance Rates by State

| States | Average Annual Liability Rates |

|---|---|

| North Dakota | $282.55 |

| South Dakota | $289.04 |

| Iowa | $293.34 |

| Wyoming | $323.38 |

| Maine | $333.92 |

| Idaho | $337.17 |

| Vermont | $340.98 |

| Kansas | $342.33 |

| Nebraska | $349.07 |

| North Carolina | $357.59 |

| Wisconsin | $359.84 |

| Indiana | $372.44 |

| Alabama | $372.57 |

| Ohio | $376.16 |

| Arkansas | $381.14 |

| Montana | $387.77 |

| New Hampshire | $393.24 |

| Tennessee | $397.73 |

| Missouri | $399.41 |

| Virginia | $413.12 |

| Illinois | $430.54 |

| Mississippi | $437.38 |

| Minnesota | $439.58 |

| Oklahoma | $441.57 |

| Hawaii | $458.49 |

| New Mexico | $462.21 |

| California | $462.95 |

| Utah | $471.26 |

| Colorado | $477.10 |

| Arizona | $488.59 |

| Georgia | $490.64 |

| Pennsylvania | $495.02 |

| South Carolina | $497.50 |

| Texas | $498.44 |

| West Virginia | $501.44 |

| Kentucky | $518.91 |

| Alaska | $547.34 |

| Oregon | $553.43 |

| Washington | $568.92 |

| Massachusetts | $587.75 |

| Maryland | $599.48 |

| District of Columbia | $628.09 |

| Connecticut | $633.95 |

| Nevada | $647.07 |

| Rhode Island | $720.06 |

| Michigan | $722.04 |

| Louisiana | $727.15 |

| Delaware | $776.50 |

| New York | $784.98 |

| Florida | $845.05 |

| New Jersey | $865.55 |

| U.S. Average | $516.39 |

As you can see, average liability auto insurance premiums escalate by a narrow margin year by year. How does your current rate compare to your state’s average? You see how some states have more expensive auto insurance rates than others, but those rates can change under the right circumstances.

Let’s move on to the next coverage type, personal injury protection (PIP).

Personal Injury Protection (PIP)

Personal injury protection covers you, passengers, and others listed in the policy. It does not safeguard your vehicle but does pay for your medical expenses.

In specific policies, it will also cover lost wages and other forms of damages. It is available to you regardless of who was at fault and is mandatory in individual states.

If you need more protection for medical bills, you should consider medical payments (MedPay). MedPay gives you a little more coverage for medical bills that PIP won’t pay.

This table details PIP averages in each state where information is available.

Average Annual Personal Injury Protection Auto Insurance Rates by State

| States | Average Annual PIP Rates |

|---|---|

| District of Columbia | $19.99 |

| Connecticut | $23.12 |

| Utah | $29.84 |

| Kansas | $31.75 |

| Massachusetts | $34.79 |

| North Dakota | $42.05 |

| Maryland | $54.86 |

| Pennsylvania | $55.75 |

| Hawaii | $56.69 |

| Washington | $70.53 |

| Oregon | $71.31 |

| Kentucky | $73.16 |

| Minnesota | $100.82 |

| Delaware | $143.42 |

| New York | $162.4 |

| Florida | $188.12 |

| New Jersey | $203.46 |

| Michigan | $391.56 |

| U.S. Average | $139.79 |

The annual rates are much cheaper than liability car insurance rates. Now that we’ve covered PIP, let’s move on to uninsured/underinsured coverage.

Uninsured/Underinsured Motorist Protection

Uninsured motorist and underinsured motorist insurance policies are frequently lumped together, as they perform a similar function. However, they must be purchased separately. Both of these cover you, passengers, and household members in the policy for bodily injury if the other driver is at fault.

Uninsured motorist coverage protects you if the other driver has no insurance, while underinsured motorist coverage safeguards you if the guilty party has inadequate insurance. You can learn more about underinsured motorist coverage here.

Let’s look at a breakdown of the percentage of uninsured and underinsured drivers by state.

Percentage of Uninsured Drivers by State

| States | Uninsured | Rank |

|---|---|---|

| Florida (3) | 26.70% | 1 |

| Mississippi | 23.70% | 2 |

| New Mexico | 20.80% | 3 |

| Michigan | 20.30% | 4 |

| Tennessee | 20% | 5 |

| Alabama | 18.40% | 6 |

| Washington | 17.40% | 7 |

| Indiana | 16.70% | 8 |

| Arkansas | 16.60% | 9 |

| D.C. | 15.60% | 10 |

| Alaska | 15.40% | 11 |

| California | 15.20% | 12 |

| Rhode Island | 15.20% | 13 |

| New Jersey | 14.90% | 14 |

| Wisconsin | 14.30% | 15 |

| Texas | 14.10% | 16 |

| Missouri | 14% | 17 |

| Illinois | 13.70% | 18 |

| Colorado | 13.30% | 19 |

| Louisiana | 13% | 20 |

| Oregon | 12.70% | 21 |

| Ohio | 12.40% | 22 |

| Maryland | 12.40% | 23 |

| Arizona | 12% | 24 |

| Georgia | 12% | 25 |

| Kentucky | 11.50% | 26 |

| Minnesota | 11.50% | 27 |

| Delaware | 11.40% | 28 |

| Nevada | 10.60% | 29 |

| Hawaii | 10.60% | 30 |

| Oklahoma | 10.50% | 31 |

| West Virginia | 10.10% | 32 |

| Montana | 9.90% | 33 |

| Virginia | 9.90% | 34 |

| New Hampshire | 9.90% | 35 |

| Connecticut | 9.40% | 36 |

| South Carolina | 9.40% | 37 |

| Iowa | 8.70% | 38 |

| Utah | 8.20% | 39 |

| Idaho | 8.20% | 40 |

| Wyoming | 7.80% | 41 |

| South Dakota | 7.70% | 42 |

| Pennsylvania | 7.60% | 43 |

| Kansas | 7.20% | 44 |

| North Dakota | 6.80% | 45 |

| Nebraska | 6.80% | 46 |

| Vermont | 6.80% | 47 |

| North Carolina | 6.50% | 48 |

| Massachusetts | 6.20% | 49 |

| New York | 6.10% | 50 |

| Maine | 4.50% | 51 |

The uninsured/underinsured percentage is part of why some states have higher than average car insurance.

Next, we’ll look at collision and comprehensive coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Collision and Comprehensive

Collision and comprehensive are also mainstays of many policies. These coverages target vehicle repair costs and compensate you for property damage regardless of fault.

Comprehensive auto insurance coverage, offering robust protection for various risks, typically costs around $60 per month, ensuring peace of mind on the road.

Chris Abrams Licensed Insurance Agent

Collision covers your car in the event of a car crash, be it with another vehicle, structure, or object. Regardless of who’s at fault, your car insurance company will pay for any damage caused by a collision.

The cost of collision auto insurance varies by state. Here is a table showing state averages for collision coverage.

U.S. Average Annual Collision Auto Insurance Rates by State

| States | Average Annual Collision Coverage Rates |

|---|---|

| Alabama | $299.10 |

| Alaska | $360.18 |

| Arizona | $259.31 |

| Arkansas | $304.87 |

| California | $364.56 |

| Colorado | $263.36 |

| Connecticut | $348.70 |

| Delaware | $296.60 |

| District of Columbia | $449.27 |

| Florida | $251.30 |

| Georgia | $320.45 |

| Hawaii | $297.75 |

| Idaho | $209.00 |

| Illinois | $284.92 |

| Indiana | $237.19 |

| Iowa | $207.10 |

| Kansas | $251.46 |

| Kentucky | $255.33 |

| Louisiana | $391.03 |

| Maine | $249.00 |

| Maryland | $331.72 |

| Massachusetts | $358.68 |

| Michigan | $383.21 |

| Minnesota | $214.02 |

| Mississippi | $302.96 |

| Missouri | $259.65 |

| Montana | $254.90 |

| Nebraska | $223.50 |

| Nevada | $293.78 |

| New Hampshire | $281.70 |

| New Jersey | $365.23 |

| New Mexico | $267.48 |

| New York | $358.45 |

| North Carolina | $264.58 |

| North Dakota | $227.44 |

| Ohio | $252.21 |

| Oklahoma | $298.21 |

| Oregon | $212.47 |

| Pennsylvania | $307.31 |

| Rhode Island | $377.06 |

| South Carolina | $247.62 |

| South Dakota | $200.10 |

| Tennessee | $290.39 |

| Texas | $340.51 |

| Utah | $254.41 |

| Vermont | $278.38 |

| Virginia | $264.70 |

| Washington | $250.13 |

| West Virginia | $319.10 |

| Wisconsin | $209.93 |

| Wyoming | $270.48 |

| U.S. Average | $299.73 |

Collision car insurance quotes are a little cheaper than liability car insurance quotes.

Comprehensive Coverage

Comprehensive covers you for damages resulting from vandalism, theft, or acts of God. These two are usually purchased together and include a deductible.

A deductible is the dollar amount you are willing to pay before the insurance covers you up to the fair market value of your car.

Are you currently paying too much in your state for these coverages? This table, meanwhile, details state averages for comprehensive coverage.

U.S. Average Annual Comprehensive Auto Insurance Rates by State

| States | Average Annual Comprehensive Coverae Rates |

|---|---|

| Oregon | $89.66 |

| Maine | $96.66 |

| California | $99.29 |

| Hawaii | $100.09 |

| New Hampshire | $103.03 |

| Washington | $104.11 |

| Utah | $106.57 |

| Florida | $110.12 |

| Idaho | $110.78 |

| Ohio | $112.74 |

| Delaware | $113.23 |

| Indiana | $115.02 |

| Nevada | $116.79 |

| Illinois | $117.98 |

| Vermont | $118.31 |

| Rhode Island | $122.17 |

| North Carolina | $123.00 |

| New Jersey | $123.18 |

| Connecticut | $126.02 |

| Wisconsin | $126.34 |

| Massachusetts | $128.92 |

| Virginia | $129.89 |

| Kentucky | $130.15 |

| Pennsylvania | $132.01 |

| Tennessee | $135.62 |

| Alaska | $141.08 |

| Alabama | $146.28 |

| Maryland | $146.77 |

| Michigan | $147.02 |

| Georgia | $153.61 |

| New York | $156.66 |

| Colorado | $158.34 |

| South Carolina | $165.38 |

| Missouri | $166.34 |

| New Mexico | $166.89 |

| Iowa | $171.58 |

| Minnesota | $173.04 |

| Arkansas | $183.36 |

| Arizona | $184.20 |

| Texas | $186.70 |

| Mississippi | $194.74 |

| West Virginia | $195.04 |

| Montana | $199.87 |

| Oklahoma | $201.56 |

| Nebraska | $206.24 |

| Louisiana | $208.59 |

| Wyoming | $222.86 |

| North Dakota | $227.64 |

| South Dakota | $228.59 |

| District of Columbia | $230.25 |

| Kansas | $230.65 |

| U.S. Average | $138.87 |

Compared to liability and collision, comprehensive auto insurance rates are much cheaper.

Find Affordable Auto Insurance for Your Automobile: Additional Coverages

You can get other types of coverage from an auto insurance company. Car insurance companies that sell insurance on a national level provide various other coverages, which are:

- Sound System Insurance

- Roadside Assistance

- Rental Car Reimbursement

- Classic Car Insurance

- Modified Car Insurance

- Usage-based Auto Insurance

- Accident-Forgiveness

- Disappearing Deductible

- Gap Insurance

Gap insurance is an excellent supplement to collision and comprehensive.

What is gap insurance? Sometimes, when your car is totaled, your lease or loan is more than the vehicle’s market value. This unexpected expense between what collision and comprehensive will pay, and your car’s market value is insured by gap coverage.

View this post on Instagram

It is also a good idea to have roadside assistance, as it may cover you in many unfortunate situations. If you locked yourself out of your car or need to be towed, this type of coverage will generally dispatch someone to come to your rescue.

Lastly, there is rental reimbursement. This is optional but helpful if your car is being repaired and you are renting a vehicle. This coverage helps reimburse or pay for your rental expenses. For additional details, please refer to this resource on Rental Coverage Auto Insurance.

Auto Insurance Coverage Options: The Bottom Line

However, bear in mind that there is usually a time and dollar amount limit imposed on how long and how much the automobile auto insurance will cover you for.

Hopefully, this covers every question you may have about car insurance. If not, we have some FAQs for you. First, though, you may be asking, “Can I easily compare rates on car insurance?” or, “Should I shop for insurance online?”

In short, yes, now that you know your auto insurance coverage options, enter your ZIP code in our FREE auto insurance comparison tool below.

This tool should help answer the questions, “How can I save money on car insurance?” and “What level of coverage is right for me?”

Frequently Asked Questions

Who offers the cheapest auto insurance and who has the cheapest auto insurance for seniors?

A Google search will show that USAA car insurance is generally the cheapest. For seniors, Geico auto insurance coverage options are usually the most affordable. Be sure to look up Progressive auto insurance coverage options, Allstate auto insurance coverage options, and other local companies near you.

USAA has cheap car insurance at an average of $444 for a six-month premium. Root auto insurance is also seen as a reputable option.

What is full coverage and how much should full coverage insurance cost?

Full coverage is the combination of at least collision, comprehensive, and liability coverages. The average for six-months of full coverage policy is about $750.

You should carry collision coverage that is slightly less than 10 percent of the value of your car. Less coverage than that puts you at risk.

Is 60 dollar auto insurance good?

It is best to check the reviews of insurers offering this rate in your area.

What will I need when buying insurance and what should I look for in a policy?

You will need your driver’s license, the vehicle you hope to insure, your registration, and a current declaration page. It would be best if you look for a reputable provider with reasonable rates.

What kind of auto insurance discounts are available?

Good student discounts are widely available, and safe driving discounts are even more prevalent.

How do I choose the right amount of auto insurance for me?

Speak with your insurer and don’t buy anything you don’t feel will be necessary for your needs.

How can I get an affordable deductible?

To get an affordable car insurance deductible, you must hold on to your policy without getting into an accident or filing a claim. Some companies will shrink your deductible cost each year you go without any incidents on the road. Be sure to discuss discounts with your insurer.

What is the difference between AAA and USAA roadside assistance?

AAA and USAA both offer roadside assistance, but they differ in eligibility and coverage. AAA provides services to its members, including towing, battery jump-starts, and lockout assistance. USAA, available exclusively to military members and their families, offers similar services but may have different coverage limits and benefits depending on the membership level.

Where can I find affordable auto insurance in Brockton?

To find affordable auto insurance in Brockton, consider comparing quotes from multiple insurance providers. Use online comparison tools or contact local brokers who can help you explore various policies and discounts tailored to your needs.

What is the Allstate disappearing deductible feature?

The Allstate disappearing deductible feature reduces your deductible amount each year you remain accident-free. This means that as you avoid claims, your deductible gradually decreases, potentially saving you money if you do need to file a claim.

What does EP mean in car insurance?

How can I get auto insurance quotes from Experian?

To get auto insurance quotes from Experian, visit their website and use their auto insurance quote tool. Enter your information to receive personalized quotes from various insurers. Experian’s service helps compare different insurance options based on your details.

What is the cheapest type of car insurance?

The cheapest type of car insurance is typically liability-only coverage, which meets the minimum legal requirements and covers damages to others in an accident. However, it may not cover damage to your own vehicle or personal injuries.

What services does Classic Collision in Eugene offer?

Classic Collision in Eugene provides auto body repair and collision repair services. Their offerings include paintless dent repair, collision repair, and auto body refinishing to restore vehicles to their pre-accident condition. Learn more about our Auto Insurance for Classic Cars.

What can I find on www.direct-autoinsurance.com?

On www.direct-autoinsurance.com, you can find information about various auto insurance policies, obtain quotes, and access resources for buying insurance directly online. The site helps you compare coverage options and pricing.

What are the reviews for EZ Insure?

EZ Insure reviews generally highlight their ability to provide competitive insurance quotes and a streamlined application process. Customer feedback may vary, so it’s useful to read multiple reviews to gauge overall satisfaction with their services.

What are the different auto insurance options available?

Different auto insurance options include liability coverage, collision coverage, comprehensive coverage, and additional endorsements like roadside assistance or rental car coverage. Each option offers varying levels of protection and cost.

Where can I find cheap auto insurance in Norfolk, VA?

To find cheap auto insurance in Norfolk, VA, compare quotes from multiple insurance companies. Utilize online comparison tools, check local insurance agencies, and inquire about available discounts to find the most affordable rates.

What are the options for cheap car insurance for people over 40?

For people over 40, options for cheap car insurance include maintaining a clean driving record, opting for higher deductibles, and seeking discounts for mature drivers or low mileage. Comparing quotes from various insurers can also help find the best rates.

What are the best car insurance options for a Dodge Journey?

The best car insurance options for a Dodge Journey include comprehensive coverage that protects against a wide range of risks, as well as collision coverage for damage from accidents. Consider adding roadside assistance and rental car coverage for additional protection.

How can I get auto insurance quotes in Parkersburg?

To get auto insurance quotes in Parkersburg, use online comparison tools or contact local insurance agents. Provide your vehicle and personal information to receive customized quotes from various insurers.

Where can I find auto insurance quotes in Cambridge?

Auto insurance quotes in Cambridge can be obtained through online comparison sites or by reaching out to local insurance agencies. Comparing quotes from multiple providers helps find the best rates and coverage options.

How can I obtain auto insurance quotes in Butte?

To obtain auto insurance quotes in Butte, use online insurance comparison tools or consult local insurance brokers. Providing detailed information about your vehicle and driving history will help you receive accurate quotes.

What resources are available for auto insurance?

Resources for auto insurance include online comparison tools, insurance company websites, local insurance agents, and customer reviews. These resources help you compare policies, understand coverage options, and find the best rates.

Is it possible to find auto insurance for $15?

Finding auto insurance for $15 per month is unlikely, as this is significantly below typical market rates. However, exploring low-cost insurance options and state minimum coverage requirements may offer more affordable choices.

How can I get car insurance quotes in Lake St. Louis?

To get car insurance quotes in Lake St. Louis, use online comparison tools or visit local insurance offices. Providing your vehicle details and driving history will help obtain accurate quotes from different insurers.

Where can I find cheap car insurance in Huntsville, AL?

For cheap car insurance in Huntsville, AL, compare quotes from various insurance companies using online tools or local agents. Look for discounts and low-cost policy options to find affordable rates.

What are the options for cheap car insurance in Oxnard?

Options for cheap car insurance in Oxnard include comparing quotes from multiple insurers and looking for discounts. Consider basic coverage options and inquire about affordable policy plans to find the best rates.

What options are available for auto insurance?

Available auto insurance options include liability, collision, comprehensive coverage, and various endorsements. Each type of coverage offers different levels of protection based on your needs and preferences.