Cheap Auto Insurance in Alaska for 2025 (Save Big With These 10 Companies!)

USAA offers the cheapest liability rates for Alaska drivers looking to meet the state's minimum 50/100/25 liability limits. However, State Farm stands out with unparalleled agent support for a strong customer service, while Geico caters to tech-savvy drivers with competitive rates and comprehensive digital tools.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best providers of cheap auto insurance in Alaska are USAA, State Farm, and Geico, with rates starting as low as $20 per month—USAA is the cheapest overall.

These top picks offer competitive pricing and strong customer service for Alaskan drivers seeking a low-cost quote.

Our Top 10 Company Picks: Cheap Auto Insurance in Alaska

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $20 | A++ | Military Discounts | USAA | |

| #2 | $22 | A++ | Excellent Service | State Farm | |

| #3 | $26 | A++ | Competitive Rates | Geico | |

| #4 | $32 | A++ | Flexible Coverage | Travelers | |

| #5 | $33 | A+ | Innovative Discounts | Progressive | |

| #6 | $36 | A | Personalized Options | American Family | |

| #7 | $37 | A+ | Comprehensive Coverage | Nationwide |

| #8 | $44 | A | Customizable Policies | Farmers | |

| #9 | $46 | A+ | Multi-Policy Savings | Allstate | |

| #10 | $56 | A | Bundling Discounts | Liberty Mutual |

Knowing Alaska’s minimum car insurance requirements and the factors that influence your rate can help you choose wisely.

- Alaska drivers must carry 50/100/25 in liability coverage by law for auto insurance

- Full coverage is better for rural roads, wildlife risk, and vehicle protection

- USAA is the top pick for cheap auto insurance in Alaska at $20 per month

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

#1 – USAA: Top Overall Pick

Pros

- Lowest Monthly Rates: In Alaska, USAA has the cheapest auto insurance monthly rate, according to our USAA auto insurance review, with rates starting at $20.

- Military Discounts: USAA offers excellent discounts for military families and is thus the best auto insurance company in Alaska for those looking to get cheap car insurance.

- Financial Rating: With an A++ rating from A.M. Best, USAA is highly reliable when handling claims from Alaska drivers.

Cons

- Limited Eligibility: It only covers military personnel and their families, making it inaccessible to many Alaska drivers.

- Primarily Online Support: USAA conducts most of its business online, making it hard for Alaskan drivers to get in-person help.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Excellent Service

Pros

- Coverage Options: Indeed, auto insurance prices in Alaska start from just $22 a month. Review our State Farm auto insurance review for extra findings.

- High Level of Customer Service: They have a good reputation in customer service, which is an imperative consideration for all Alaskans.

- Discounts: Many discounts are available to Alaska drivers, including a good driver’s discount and a bundling discount.

Cons

- B Rating from A.M. Best: The B rating from A.M. Best raises some eyebrows about the financial strength of Alaska drivers.

- Higher Rates for Young Drivers: Younger drivers in Alaska, however, can expect to pay higher premiums, making it somewhat costly for them.

#3 – Geico: Best for Competitive Rates

Pros

- Competitive Monthly Rates: In Alaska, Geico has superior rates for auto insurance, with premiums from $26.

- Strong Financial Reliability: With an A++ rating from A.M. Best, a Geico auto insurance review shows they’re a financially solid choice for Alaska drivers.

- User-Friendly Online Platform: Their online tools make managing policies easy for tech-savvy Alaska residents.

Cons

- Limited Local Agent Support: You may miss personal service, as Geico doesn’t have as many local agents in Alaska.

- Mixed Customer Satisfaction: Reviews reflect a mixed bag when it comes to Geico, which may limit its appeal to drivers in Alaska.

#4 – Travelers: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Travelers lets you customize your coverage according to your needs, which is excellent for Alaska drivers.

- Monthly Rates: Their rates start at $32 monthly, making it a good option for auto insurance in Alaska.

- High Financial Stability: Travelers has an A++ rating from A.M. Best, so you can rest assured when filing claims in Alaska.

Cons

- Higher Costs for Customization: Customizing your coverage might lead to higher premiums for some Alaska drivers. Read our Travelers auto insurance review for more insights.

- Fewer Discounts Available: Compared to some other auto insurance companies, it offers fewer discounts. Therefore, it may limit your savings on low-cost auto insurance in Alaska.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Innovative Discounts

Pros

- Good Safe Driving Discounts: Progressive’s Snapshot program rewards you for being a good driver, and you will have discounts for Alaska drivers.

- Reasonable Pricing: Starting at $33, Progressive is relatively inexpensive for auto insurance in Alaska.

- Many Coverage Options: Our Progressive auto insurance review highlights many coverage options tailored for auto insurance Alaska residents.

Cons

- Customer Service Differs: Customers have varying experiences with customer service through Progressive, an aspect of concern for a driver like one from Alaska.

- Claims: If you file a claim, expect to pay more premiums. Alaska drivers should keep this in mind.

#6 – American Family: Best for Personalized Options

Pros

- Tailor-made Insurance Plans: American Family only has individualized auto insurance plans for Alaska.

- Starting Monthly Rate: The rates begin from $36 per month; hence, American Family is relatively cheap for auto insurance in Alaska.

- Community-minded Principles: They uphold the principles of the community, which satisfy the needs of Alaskans.

Cons

- B Rating from A.M. Best: The B rating from A.M. Best may raise concerns about financial stability for those exploring an American Family auto insurance review for Alaska car insurance.

- Fewer Discounts Available: They also offer fewer ways to get a discount than some other companies, which can limit your discounts on Alaska car insurance rates.

#7 – Nationwide: Best for Comprehensive Coverage

Pros

- All-inclusive Plans: Nationwide gets strong marks for its full coverage car insurance in Alaska that protects drivers from a wide variety of hazards on the road.

- Monthly Prices: Nationwide provides budget-friendly options for Alaska car insurance rates, starting at just $37 per month.

- Strong Financial Rating: Nationwide holds an A+ rating with A.M. Best, making it one of the safest bets for the people of Alaska.

Cons

- Higher Rates for Younger Drivers: Younger drivers could experience steeper premiums in our Nationwide auto insurance review. Comparing quotes may help you find the best rate in Alaska.

- Limited Local Agents: Low number of local agents complicates it for the drivers of the state to have one-on-one help with things like the average cost of car insurance in Alaska.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customizable Policies

Pros

- Customizable Insurance Policies: Farmers allow Alaskan drivers to customize their auto insurance to meet their needs, which is worth noting in a Farmer’s auto insurance review.

- Monthly Rates: With rates as low as $44 a month, Farmers is a good choice for affordable auto insurance in Alaska.

- Many Coverage Choices: They offer a choice that suits the different types of needs of Alaska motorists, including Alaska car insurance requirements.

Cons

- Higher Premiums: Farmers’ rates are possibly higher than those of some of its competitors, which may deter price-conscious Alaskan drivers.

- Customer Reviews: A few customers reported mixed service experiences with Farmers. This can be something to explore, particularly with respect to Alaska car insurance laws.

#9 – Allstate: Best Multi-Policy Savings

Pros

- Good Multi-Policy Discounts: Alaska drivers who combine auto insurance with other types of policies can get decent discounts from Allstate.

- Lowest Starting Rates: The lowest rates start at $46 a month, making it very competitive for auto insurance in Alaska.

- Strong Agent Network: Allstate has numerous local agents, making sure Alaska residents get excellent personal service.

Cons

- More Expensive Average Prices: Your Allstate premiums may be more expensive than those of other cheap auto insurance providers in Alaska.

- Mixed Claims Experiences: Some customers have noted issues with claims handling, so it’s good to check an Allstate auto insurance review and compare it to car insurance quotes in Alaska.

#10 – Liberty Mutual: Best for Bundling

Pros

- Affordable Bundling Discounts: Liberty Mutual offers good savings for Alaska drivers who bundle auto insurance coverage with other types of insurance coverage.

- Monthly Rates: Liberty Mutual offers Alaska drivers auto insurance for $56 per month with customizable coverage. It’s worth considering in your Liberty Mutual review.

- Flexibility in Payment Plans: There is flexibility in payment options for Alaska drivers to facilitate the cost management of auto insurance.

Cons

- Higher Premiums than Competitors: Liberty Mutual might not be the most budget-friendly choice for cheap auto insurance in Alaska.

- Limited Local Agent Network: Fewer local agents may result in less personalized support for drivers in Alaska, which is important when seeking cheap car insurance in Alaska.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Comparing Alaska Auto Insurance Rates

The average auto insurance cost in Alaska varies depending on the provider and the level of coverage chosen. Minimum coverage rates range from $20 with USAA (for eligible members) to $56 with Liberty Mutual, while complete coverage options range from $60 with USAA to $164 with Liberty Mutual.

Alaska Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $135 | |

| $36 | $105 | |

| $44 | $127 | |

| $26 | $76 | |

| $56 | $164 |

| $37 | $108 |

| $33 | $97 |

| $22 | $65 | |

| $32 | $93 | |

| $20 | $60 |

Other providers include State Farm, Geico, and Progressive, each offering low-price quotes to consumers who wish for affordable yet substantial coverage. Alaska’s wildlife risks demand the right kind of insurance. This guide covers minimum coverage requirements, financial responsibility, core coverage options, and additional liability protections.

Alaska Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $120 | $145 | $165 | $220 | |

| $110 | $135 | $155 | $210 | |

| $125 | $150 | $170 | $225 | |

| $95 | $115 | $140 | $190 | |

| $135 | $160 | $185 | $240 |

| $115 | $140 | $160 | $215 |

| $105 | $125 | $145 | $200 | |

| $100 | $120 | $140 | $180 | |

| $130 | $155 | $175 | $230 | |

| $85 | $105 | $125 | $170 |

It also covers the driving record rates in Alaska and other demographics like location and income, which will go on to affect the premiums. Auto insurance companies in Alaska use these factors to determine your rates, helping you find the best coverage for your budget.

Cheap auto insurance in Alaska may sound appealing, but accident volume by city can directly impact your monthly rates. Anchorage, with 3,500 accidents and 2,800 claims annually, tends to see higher monthly premiums than smaller cities like Bethel or Sitka. If you’re in Fairbanks or Juneau—both with over 700 claims per year—expect to pay more than someone in Kodiak or Palmer.

Alaska Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Anchorage | 3,500 | 2,800 |

| Bethel | 250 | 200 |

| Fairbanks | 1,200 | 960 |

| Juneau | 900 | 720 |

| Kenai | 500 | 400 |

| Ketchikan | 400 | 320 |

| Kodiak | 350 | 280 |

| Palmer | 450 | 360 |

| Sitka | 300 | 240 |

| Wasilla | 600 | 480 |

Providers like USAA and Geico may still offer rates starting at $20 a month, but drivers in high-claim cities often need full coverage, which can push rates closer to $100 per month. When comparing companies, consider not just price but how your location affects risk—and how each provider adjusts your monthly cost based on local claims.

Cheap auto insurance in Alaska tends to fall in the middle of the national pricing range, largely due to moderate risk factors reflected in the state’s report card. With monthly rates starting as low as $20, companies like USAA offer strong value, especially considering Alaska earned a “B” for claim size, traffic density, and theft rates.

Alaska Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B | Claims are generally average |

| Traffic Density | B | Medium levels; occasional congestion |

| Vehicle Theft Rate | B | Moderate theft rate |

| Weather-Related Risks | C | High winter risk |

These average scores help support cheap car insurance rates than those in states with higher accident or theft rates. Even so, Alaska’s “C” grade for weather, a byproduct of brutal winters, can make monthly bills for full coverage higher. However, drivers living in snowy or remote locations should expect to pay more for comprehensive protection.

Auto Insurance Discounts for Alaska Drivers

State Farm in Alaska stands out among the best insurance rates. Its average monthly premium is $186. Other affordable Alaskan car insurance companies include USAA and Geico, which, on average, offer rates of $205 and $240.

Auto Insurance Discounts From Top Providers in Alaska

| Insurance Company | Bundling | Claims-Free | Good Driver | Multi-Car |

|---|---|---|---|---|

| 25% | 10% | 25% | 25% | |

| 25% | 15% | 25% | 20% | |

| 20% | 9% | 30% | 20% | |

| 25% | 12% | 26% | 25% | |

| 25% | 8% | 20% | 25% |

| 20% | 14% | 40% | 20% |

| 10% | 10% | 30% | 12% | |

| 17% | 11% | 25% | 20% | |

| 13% | 13% | 10% | 8% | |

| 10% | 20% | 30% | 10% |

Progressive and Allstate are also available options in Alaska, though their rates are higher, averaging $255 and $262 monthly. Drivers can benefit from discounts offered by top Alaska car insurance companies to lower premiums. Common savings options include safe driver, multi-policy, good student discounts, and the popular anti-theft device discount.

Certain companies offer proprietary savings. Geico, for example, provides discounts for military members, while Liberty Mutual and Nationwide reward accident-free driving and cars with safety features. Progressive’s Snapshot program offers savings, too, for good coverage habits and paying in full.

Comparing car insurance quotes Alaska drivers receive helps them find the lowest rates and available discounts based on their driving history, location, and coverage needs.

Minimum Car Insurance Requirements in Alaska

In Alaska, drivers are required to meet minimum car insurance requirements to drive. This minimum coverage is called 50/100/25, or $50,000 in injuries to one person, $100,000 in injuries to several people, and $25,000 in property damage. Liability insurance covers expenses for others involved in an accident you cause.

However, the lowest level of insurance required by Alaska may max out quickly in a seriousaccident, leaving the responsible motorist on the hook for the rest. Alaska, with nearly 15% of drivers uninsured, comes in at 11th for uninsured motorists, having the importance of UM/UIM auto insurance coverage.

Uninsured/underinsured motorist (UM/UIM) coverage helps if you’re hit by a driver who has no insurance or low coverage limits.

Alaska’s insurance laws require strict minimums, but many drivers only carry the cheapest Alaska auto insurance that meets federal standards, which may fall short of state requirements. Here’s a quick breakdown of Alaska car insurance laws:

- Maintain Required Coverage: All drivers must carry the minimum automobile liability coverage of 50/100/25. You must also provide proof of insurance, which can be a valid insurance card, a copy of your policy, or an insurance binder.

- Provide Proof After an Accident: If you’re involved in an accident resulting in personal injury, death, or property damage exceeding $500, you must show proof of insurance.

- Avoid License Suspension: Failure to provide proof of insurance can lead to the suspension of your license for 90 days to a year. To avoid this, always carry proof of insurance when driving.

Alaska is an “at-fault” state, meaning the responsible driver must cover damages. To manage costs, many drivers choose full coverage or the cheapest option available based on their Alaska auto insurance quotes. UM/UIM coverage is another option that protects against uninsured or underinsured drivers.

Carrying the right policy and documents not only keeps you compliant with state laws but also helps you lock in cheap car insurance that Alaska drivers can legally rely on without risking fines.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

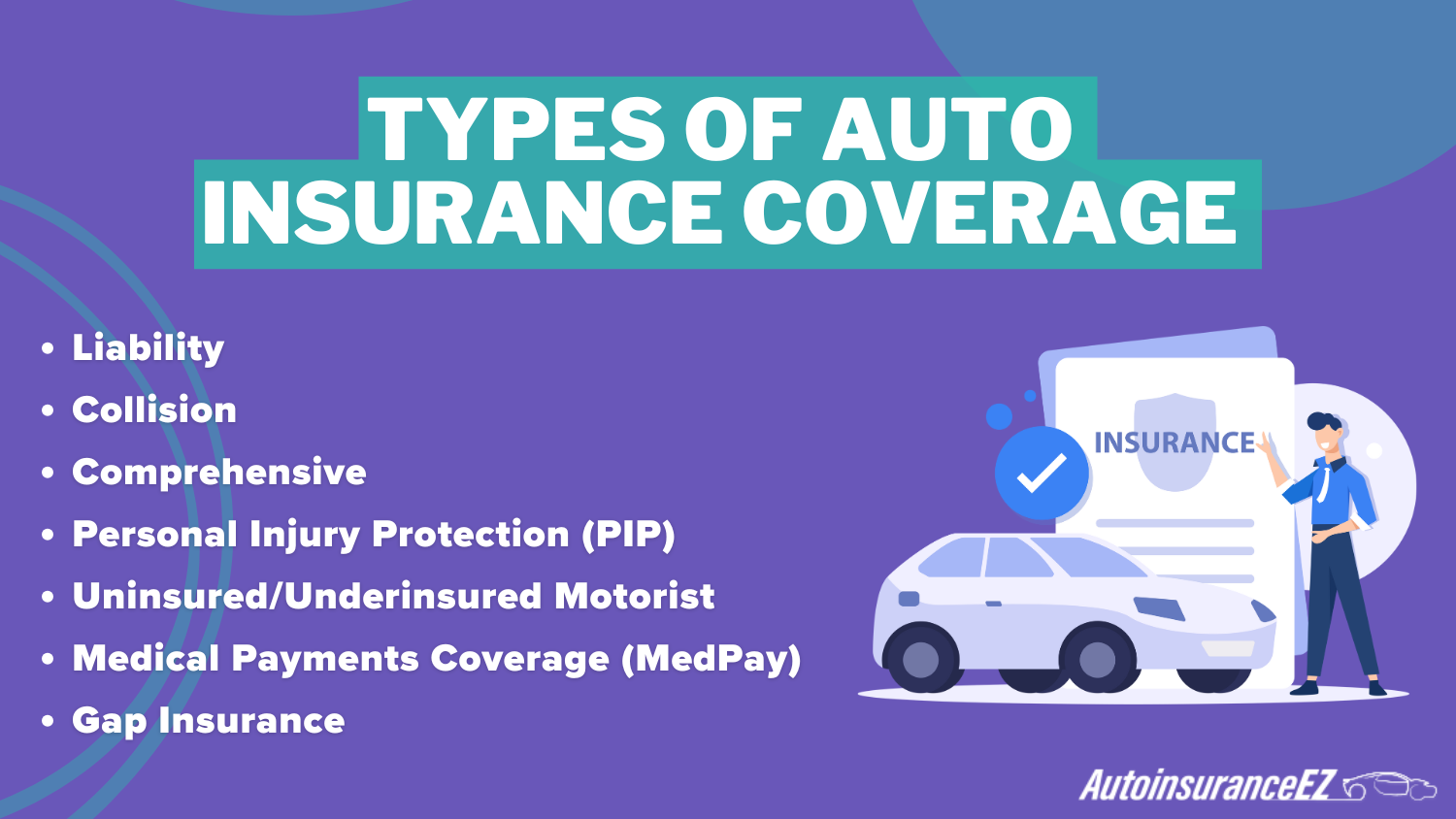

Auto Insurance Coverage Options

When you’re shopping for cheap auto insurance in Alaska, it’s important to know what your policy actually covers—and what it doesn’t. Minimum coverage is just the starting point and might fall short depending on your needs. Here’s a quick breakdown of the main types of auto insurance coverage available to Alaska drivers:

- Liability: Covers injuries and property damage you cause to others. Alaska law requires 50/100/25 limits to drive legally.

- Collision: Pays to fix or replace your vehicle if you hit another car or object. Useful on icy roads or if your vehicle is newer or financed.

- Comprehensive: Handles damage from things like wildlife collisions, theft, falling branches, or hail—common risks in Alaska.

- Uninsured/Underinsured Motorist: If you’re hit by a driver with little or no insurance. With 15% of Alaska drivers uninsured, it’s worth adding.

- Medical Payments (MedPay): Covers medical bills for you and your passengers after an accident, regardless of fault. A low-cost way to boost protection.

Depending on the company, you can add extras like roadside assistance, rental reimbursement, gap insurance for financed cars, or coverage for custom parts. These small upgrades can save you a lot of stress when things go wrong. While minimum coverage keeps you legal, it might not give you the protection you actually need.

If your budget allows, full coverage—or at least collision and comprehensive—is a wise way to go. In Alaska, where the weather and road conditions can shift rapidly, that extra layer of protection can make a difference when you need it more than ever.

Why Alaska Drivers Should Consider Full Coverage

Cheap auto insurance in Alaska may start at $20 monthly, but the claims data shows why it’s worth considering more than just minimum coverage. Collision makes up 55% of claims, with an average cost of $6,200 per claim. Property damage liability and comprehensive coverage follow closely behind.

5 Most Common Auto Insurance Claims in Alaska

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 55% | $6,200 |

| Property Damage Liability | 35% | $5,500 |

| Comprehensive | 25% | $3,800 |

| Bodily Injury Liability | 10% | $25,000 |

| Personal Injury Protection (PIP) | 8% | $10,500 |

While liability-only policies meet state requirements, they won’t cover the most common and expensive events drivers actually file for. A full coverage policy—offered by companies like USAA, State Farm, and Geico—helps cover high-cost claims like $25,000 for bodily injury or $10,500 for personal injury protection (PIP).

If you want cheap monthly rates without skipping real coverage, compare plans that include collision and comprehensive auto insurance coverage, not just liability.

Alaska Auto Insurance Premiums vs. Average Annual Income

A little over $4,146 is the average monthly disposable personal income (DPI) in Alaska. DPI is the cash someone has available to spend or save after taxes. The average price of car insurance in the state is approximately $88 per month, equal to about 2% of the average DPI.

With $4,146 available monthly for essentials, the auto insurance premium takes a significant portion of that income, around $100 a month, and potentially more for drivers with a poor driving history. Additionally, knowing how to deduct your car insurance from your taxes can help alleviate some of these expenses.

For Alaska drivers, start by choosing liability coverage to meet state requirements, then consider adding collision or comprehensive if your car has value or you drive often.

Daniel Walker Licensed Insurance Agent

Alaska has its own set of regulations, including the Alaska minimum car insurance requirement, which is required to drive legally. Saving for the future is also an important consideration, with American Consumer Credit Counseling advising that consumers save at least 20% of their income.

Choosing the Right Car Insurance in Alaska

Cheap auto insurance in Alaska typically comes with first-party liability coverage with bodily injury and property damage coverage. This kind of policy fulfills state minimum car insurance requirements but won’t cover your vehicle. It’s ideal for older cars or drivers who don’t drive very much.

If you want additional protection, such as collision or comprehensive coverage, you’ll have to pay extra. Always compare quotes, check for available discounts like safe driver or multi-policy, and review what’s actually covered before choosing a policy.

Start comparing total coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

How much does liability car insurance cost in Alaska?

Minimum liability coverage in Alaska starts at about $20 per month with USAA, but most drivers pay between $40 and $65 monthly, depending on their ZIP code, vehicle type, and driving history. These rates meet state-mandated limits but don’t include coverage for their own vehicles.

How do Alaska auto insurance rates vary by provider?

Average Alaska car insurance costs vary based on the provider. For example, USAA averages around $60–$90 monthly for full coverage, while Liberty Mutual may charge up to $160. Mutual and military-focused insurers tend to offer better rates than smaller regional providers.

How much does car insurance cost in Alaska for full coverage?

Full coverage in Alaska, which includes liability, collision, and comprehensive insurance, typically costs between $80 and $160 per month. If you choose optional coverages like uninsured motorist protection or roadside assistance, your monthly premium could be higher, depending on the provider and location.

What are the auto insurance requirements in Alaska?

Alaska requires drivers to carry a minimum of 50/100/25 liability coverage: $50,000 per person for bodily injury, $100,000 per accident, and $25,000 for property damage. Proof of insurance is mandatory in most areas, and additional coverage like UM/UIM is optional but often recommended.

What is the cheapest car insurance in Alaska for low-mileage drivers?

For drivers who don’t drive often, the cheapest car insurance in Alaska is typically available through Geico or USAA, with low-mileage discounts that can reduce monthly costs. Usage-based programs like Geico’s DriveEasy can further lower rates for safe, infrequent drivers.

What’s the typical monthly premium for auto insurance in Juneau, AK, with full coverage?

Full coverage auto insurance in Juneau, AK, typically costs between $75 and $115 per month. Rates may vary based on ZIP code, vehicle value, driving record, and provider, with Geico and Progressive often offering lower premiums in this region.

How does the driving environment affect auto insurance in Wasilla, AK?

Wasilla’s icy roads, rural stretches, and wildlife crossings make comprehensive and collision coverage more necessary. Auto insurance in Wasilla, AK, often costs slightly more than average, with monthly full coverage premiums ranging from $85 to $125, depending on provider and risk factors.

What factors affect the average car insurance in Alaska more—location or driving record?

A driving record has a greater impact on average car insurance in Alaska. A driver with a clean record might pay $60–$80 monthly, while someone with a DUI or multiple tickets may pay over $150. However, location matters too—urban ZIP codes often have higher rates due to more accidents.

How can I get accurate auto insurance quotes in Wasilla, AK?

To get accurate auto insurance quotes in Wasilla, AK, use a comparison site and enter consistent details, like desired coverage limits and driving history. Compare quotes from companies like State Farm, Geico, and Allstate, and check for local discounts or bundling options.

What should I consider when buying car insurance in Badger, Alaska?

Car insurance in Badger, Alaska, should include comprehensive coverage due to the high risk of wildlife collisions and harsh winter driving. Look for companies like USAA and Progressive that provide flexible claims processing and roadside assistance suited for rural areas.

Which car insurance companies in Alaska offer strong support for rural drivers?

Alaska auto insurance providers, such as State Farm, Progressive, and USAA, create coverage designed for rural areas, which often dictate higher laws for towing, wildlife collisions, and flexible claim processes. Such features are important in remote parts of Alaska, where access for repairs is restricted.

What are the best options for car insurance in Bethel, Alaska, if I have limited internet access?

In Bethel, Alaska, drivers who prefer working with local agents or phone-based services can turn to companies like State Farm and Allstate. Car insurance in Bethel, Alaska is available even with limited online access, and some providers allow policy management by phone or mail.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

How does student status affect car insurance in College, Alaska?

Student drivers in College, Alaska may qualify for discounts from companies like Geico and State Farm by maintaining good grades or being listed under a parent’s policy. Car insurance in College, Alaska for student drivers typically ranges from $90 to $140 per month with full coverage.

How do I compare auto insurance quotes in Alaska for bundled coverage?

To compare auto insurance quotes in Alaska for bundled coverage, request rates from insurers that offer multi-policy discounts. For example, State Farm and Allstate offer discounts when you combine home and auto insurance, which can reduce your total premium by 10% or more.