Cheap Auto Insurance in Minnesota 2025 (Save Big With These 10 Companies)

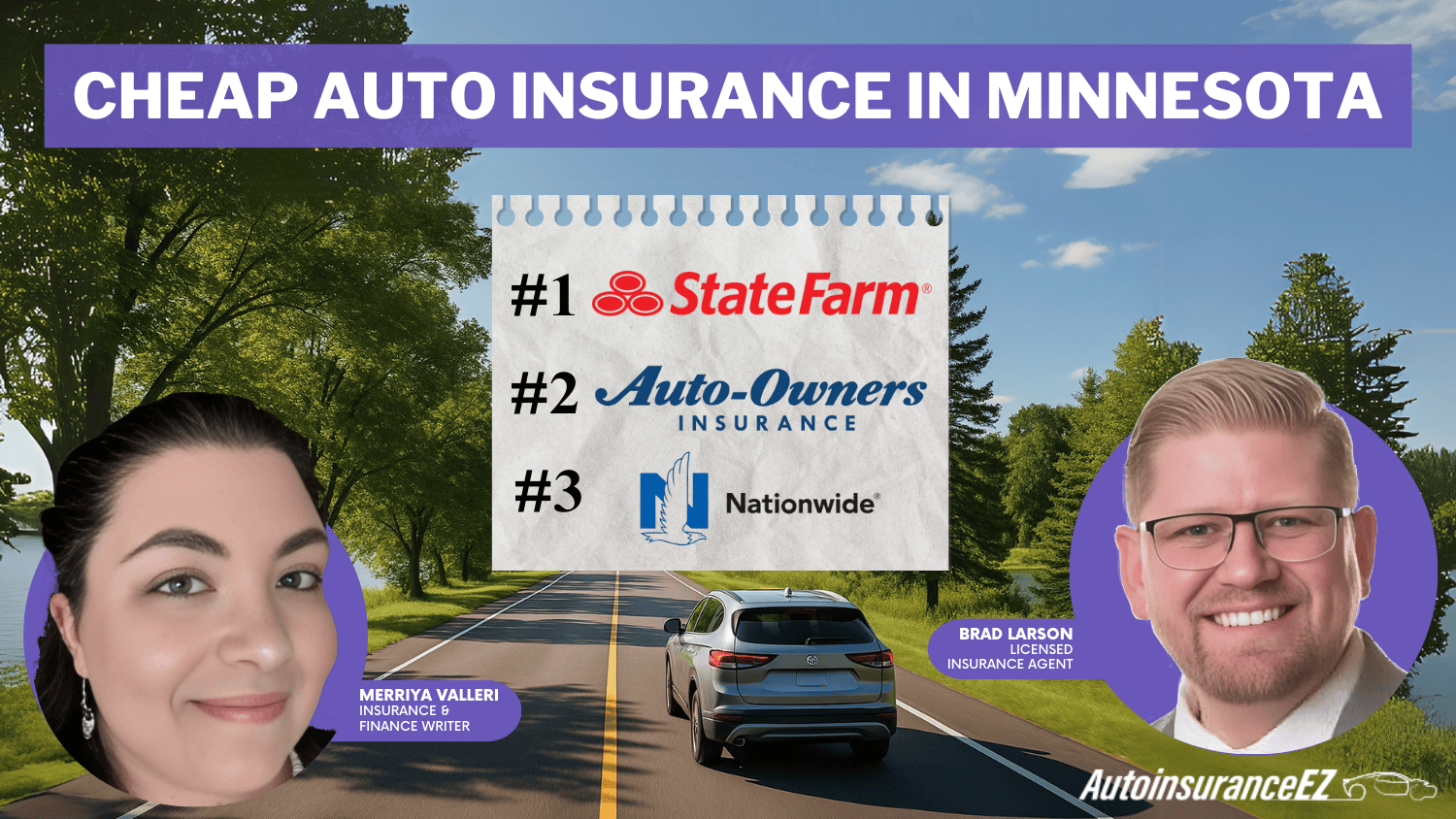

Get cheap auto insurance in Minnesota from top providers like State Farm, Auto-Owners, and Nationwide. State Farm offers the cheapest car insurance in Minnesota for as low as $27 per month. Auto-Owners stands out with its financial strength. Nationwide is known for its accident forgiveness program.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: May 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 563 reviews

563 reviewsCompany Facts

Min. Coverage in Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

563 reviews

563 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, Auto-Owners, and Nationwide are the top picks for cheap auto insurance in Minnesota. Minimum coverage rates start as low as $27 a month.

State Farm stands out with its Drive Safe & Save program that rewards low-mileage drivers, while Auto-Owners provides multiple discount opportunities, including multi-policy and good student discounts.

Our Top 10 Company Picks: Cheap Auto Insurance in Minnesota

| Company | Rank | A.M. Best | Monthly Rates | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | $27 | Personalized Service | State Farm | |

| #2 | A++ | $33 | Financial Strength | Auto-Owners | |

| #3 | A+ | $35 | Vanishing Deductible | Nationwide | |

| #4 | A++ | $37 | Online Tools | Geico | |

| #5 | A | $38 | Customer Service | American Family |

| #6 | A++ | $40 | Rural Drivers | Travelers | |

| #7 | A+ | $41 | Snapshot Program | Progressive | |

| #8 | A | $44 | Bundling Policies | Farmers | |

| #9 | A+ | $65 | Roadside Assistance | Allstate | |

| #10 | A | $152 | Multi-Policy Discounts | Liberty Mutual |

Nationwide delivers value through vanishing deductibles and accident forgiveness options. Minnesota drivers must meet the state’s minimum requirements of $30,000/$60,000 liability coverage, $10,000 property damage coverage, $40,000 PIP coverage, and uninsured/underinsured coverage.

- State Farm offers the cheapest auto insurance in Minnesota at just $27 a month

- Auto-Owners provides multi-policy and good student discounts

- Nationwide offers great features like vanishing deductibles and accident forgiveness

By comparing auto insurance companies, you can find the most affordable car insurance in Minnesota that fits both your budget and insurance needs. Enter your ZIP code in our free comparison tool to instantly get MN auto insurance quotes and start saving today.

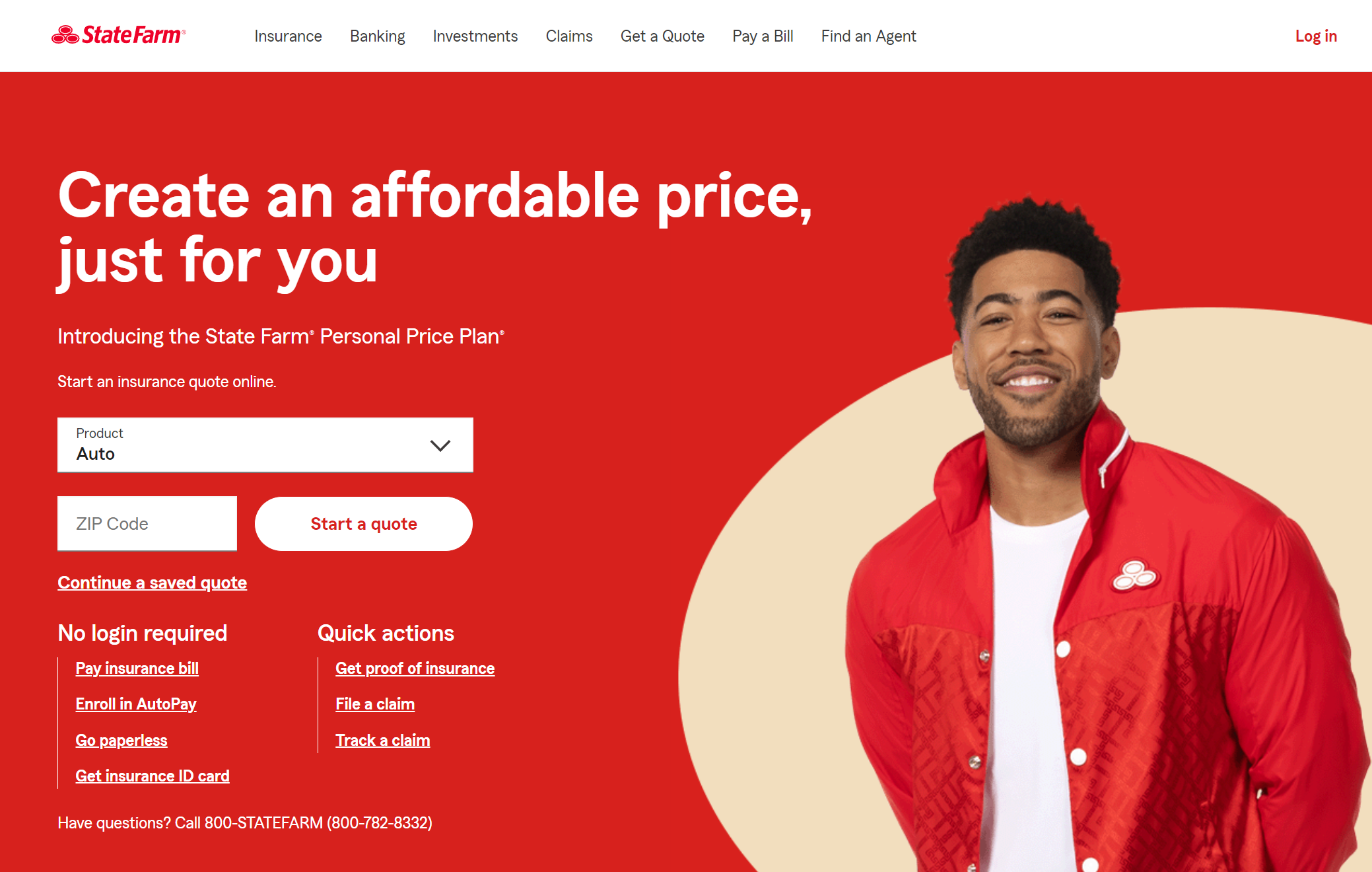

#1 – State Farm: Top Overall Pick

Pros

- Outstanding Customer Attention: State Farm is renowned for its robust local agent network and individualized service in Minnesota. Read more in our full review of State Farm’s auto insurance.

- Competitive Rates: State Farm offers cheap car insurance in MN, especially for low-mileage and safe drivers.

- Solid Financial Health: State Farm has a great A.M. Best rating and provides timely and consistent claims payments for Minnesota motorists.

Cons

- Limited Discounts: State Farm provides fewer discounts than other auto insurers in Minnesota, which could cap saving potential.

- Basic Digital Tools: The mobile app and website lack advanced features, making it less convenient for tech-savvy users in Minnesota seeking comprehensive online tools.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Auto-Owners: Best for Financial Strength

Pros

- Affordable: Auto-Owners offers one of the cheapest Minnesota car insurance policies, making it an affordable choice for many drivers. Read more in our Auto-Owners insurance review.

- Multiple Discount Opportunities: Auto-Owners offers various discounts for Minnesota drivers, including multi-policy, safe driver, and good student discounts.

- Financial Strength: With a high financial rating, Auto-Owners provides reliable claims payments and financial stability, giving Minnesota policyholders peace of mind.

Cons

- Limited Availability: Auto-Owners isn’t available in every state, which can restrict access for some drivers outside of Minnesota.

- Minimal Digital Tools: The company offers fewer mobile and online tools, lacking the robust digital experience many competitors provide in Minnesota.

#3 – Nationwide: Best for Vanishing Deductible

Pros

- Variety of Coverage: Provides various coverage choices, such as vanishing deductibles and accident forgiveness for Minnesota drivers. You can learn more in our Nationwide auto insurance review.

- On Your Side Review: Nationwide provides annual policy reviews for Minnesota drivers, ensuring they get the most competitive rates and coverage adjustments.

- Solid Financial Strength: With a strong financial foundation, Nationwide in Minnesota ensures reliable claims payments and long-term stability.

Cons

- Average Rates: While Nationwide offers competitive rates, they aren’t always the cheapest Minnesota auto insurance provider compared to other insurers.

- Limited Availability: Nationwide may not be available in every state, potentially restricting some drivers’ access to its services in Minnesota.

#4 – Geico: Best for Online Tools

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Pros

- Low Rates: Geico is renowned in Minnesota for providing some of the market’s lowest rates. Learn more about Geico’s rates in our Geico auto insurance review.

- Strong Online Tools: Geico’s user-friendly website and mobile app make managing policies and filing claims convenient for drivers seeking cheap auto insurance in Minnesota.

- Reliable Claims Process: Geico is known for its straightforward and efficient claims process, and Minnesota customers often give it positive feedback.

Cons

- Limited Agent Support: Geico relies heavily on digital resources, which might not provide the personalized assistance some Minnesota drivers prefer.

- Higher Premiums for Risky Drivers: Geico may charge significantly higher premiums for drivers in Minnesota with poor credit or accident histories.

#5 – American Family: Best For Customer Service

Pros

- Personalized Service: Well-known for providing excellent customer service in Minnesota via a network of local agents. Read our American Family auto insurance review to find out more about the company.

- Flexible Coverage Options: Offers customizable insurance plans, allowing MN drivers to tailor their policies to specific needs for cheap auto insurance.

- Safe Driving Discounts: American Family in Minnesota incentivizes safe driving behaviors with potential savings through its safe driving program.

Cons

- Limited Availability: The insurance provider isn’t available in every state, which can restrict access for certain drivers outside Minnesota.

- Average Claims Handling: Some customers in Minnesota have reported delays or issues during the claims process, which can be frustrating.

#6 – Travelers: Best for Rural Drivers

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Pros

- Competitive Rates: Provides reasonable prices, particularly for Minnesota drivers with spotless records. Learn more by reading our review of Travelers auto insurance.

- Homeowner Discounts: Attractive bundling options for those combining auto and home insurance, with flexible payment plans available for policyholders in Minnesota.

- Flexible Payment Plans: Minnesota customers can choose payment plans that suit their budget and needs.

Cons

- Below-Average Claims Satisfaction: Some customers in Minnesota have reported dissatisfaction with the claims process, citing delays or lack of transparency.

- Limited Local Agent Support: Heavily reliant on digital tools, offering less personalized service from local agents in Minnesota.

#7 – Progressive: Best for Snapshot Program

Pros

- Reasonably priced rates: Progressive is renowned for providing affordable rates, particularly for high-risk drivers in Minnesota. Our Progressive auto insurance review goes over this in more detail.

- Flexible Coverage Options: It offers a range of insurance coverage tailored to meet various driver needs, ideal for those looking for cheap auto insurance in Minnesota.

- Safe Driving Program: This program promotes safer driving by providing discounts and rewards for good driving habits, helping lower insurance costs for Minnesota drivers.

Cons

- Higher Premiums for Risky Drivers: Drivers in Minnesota with poor credit or those deemed high risk may experience significantly higher premiums.

- Average Claims Handling: Some customers in Minnesota have reported delays or issues with claims processing, indicating room for improvement.

#8 – Farmers: Best for Bundling Policies

Pros

- Outstanding Customer Service: Farmers in Minnesota offers outstanding customer service, including round-the-clock claims assistance. Check out our Farmers auto insurance review for more information.

- Accident Forgiveness: Provides accident forgiveness programs to prevent premium increases after the first at-fault accident, helping Minnesota drivers maintain affordable rates.

- Bundling Discounts: Offers substantial savings when bundling auto and home insurance, making it a cost-effective option for Minnesota policyholders.

Cons

- Limited Discount Opportunities: Offers fewer discount options than other major providers in Minnesota, reducing savings potential.

- State Availability: Not available in every state, limiting accessibility for certain drivers outside Minnesota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#9 – Allstate: Best for Roadside Assistance

Pros

- Large Discounts: Allstate in Minnesota provides several discounts, such as safe driver and excellent student discounts, as detailed in the Allstate Drivewise program review.

- Local Agents: Offers personalized service through a vast network of local agents, providing tailored support for Minnesota drivers seeking cheap auto insurance.

- Claim Satisfaction Guarantee: If Minnesota customers are dissatisfied with the claims process, they can receive a refund, ensuring peace of mind.

Cons

- Higher Premiums: It generally has higher rates compared to other companies in Minnesota, which may impact affordability.

- Average Customer Satisfaction: Some Minnesota customers have expressed mixed opinions about how claims are handled.

#10 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Large Discounts: Allstate provides several discounts, such as safe driver and excellent student discounts for Minnesota policyholders. Learn more about this provider in our thorough Liberty Mutual auto insurance review.

- Local Agents: A large network of agents offers personalized support, ensuring drivers in Minnesota can get the right auto insurance for their needs.

- Accident Forgiveness: Protects drivers in Minnesota from premium increases after their first at-fault accident, maintaining affordable coverage.

Cons

- Higher Premiums: Generally, more expensive than other companies in Minnesota, which may limit cost savings.

- Limited Digital Tools: The online platform and mobile app are less advanced, making policy management harder for Minnesota policyholders.

Minnesota Auto Insurance Rates and Coverage

Looking for cheap car insurance in Minnesota? This table highlights monthly rates from top providers across the state. State Farm leads with the most affordable minimum coverage at just $27 per month, while Auto-Owners and Nationwide follow closely behind at $33 and $35 monthly.

Compare these Minnesota auto insurance quotes to find the perfect balance between cost and protection for your vehicle.

Minnesota Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $160 | |

| $38 | $93 |

| $33 | $83 | |

| $44 | $108 | |

| $37 | $90 | |

| $152 | $375 |

| $35 | $87 | |

| $41 | $101 | |

| $27 | $67 | |

| $40 | $94 |

Before settling on an insurance provider, remember that rates can vary based on your driving record, credit score, and location within Minnesota. Taking a few minutes to compare could get you cheap car insurance rates in Minnesota every year.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minnesota’s Car Culture

The perception that the rest of the nation has is that Minnesotans drive with their famous ‘Minnesota nice’ attitude. You rarely get honked at or see drivers swerving around you at an intersection.

Minnesotans prefer to drive for everything. In Minneapolis, around 90% of trips are done using a car.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

However, you sometimes see excessive freeway speeds and dangerous driving during the brutal winter weather. Consequently, you may see a lot of accidents, spinouts, and rollovers during winter weather. Pick-up trucks, primarily the Ford F-150, are liked in the North Star state.

Minnesota Statistics Summary

| Minnesota Statistics Summary | Details |

|---|---|

| Road Miles in Minnesota | Vehicle Miles: 57,395 millions Miles of Roadway: 138,767 |

| Vehicles | Registered Vehicles: 4,985,782 Motor Vehicle Thefts: 8,367 |

| Population | 5,611,179 |

| Most Popular Vehicle in Minnesota | Ford F150 |

| Uninsured%/Underinsured% | 11.50% |

| Total Driving Related Deaths | Speeding Fatalities: 89 DUI Fatalities: 85 |

| Full Coverage Average Premiums | Liability: $439.58 Collision: $214.02 Comprehensive: $173.04 Full Coverage: $826.64 |

| Cheapest Provider | State Farm |

The city is preparing a 2040 Comprehensive Plan to reduce residents’ driving for errands such as grocery shopping by bringing shops closer to homes. But until that happens, residents will have to drive, so adequate auto insurance in Minnesota is vital.

Read More: 10 States With The Worst Weather-Related Fatal Crashes

To ensure you’re protected on the road, compare auto insurance companies to find the best coverage options at the most affordable rates.

Minimum Auto Insurance Coverage in Minnesota

The next obvious question you may have is: ‘But what is adequate coverage?’ Well, it depends on how much you are driving, your track record, where you stay, and much more. But what is not negotiable is the minimum auto liability insurance that you must purchase.

The state requires you to carry proof of coverage, and a law was enacted in 2016 that mandates that residents must prove insurance coverage when registering a vehicle in the state. The State of Minnesota mandates that you must have the following minimum coverage for cheap auto insurance in Minnesota:

Liability coverage

- $30,000 for injury or death of one person/ $60,000 for injury per accident

- $10,000 for property damage

Personal Injury Protection (PIP)

- $40,000 per person per accident ($20,000 for hospital and medical expenses and $20,000 for non-medical costs such as lost wages)

Underinsured and Uninsured coverage

- $25,000 for injury per person for underinsured and uninsured

- $50,000 for injury per accident for underinsured and uninsured

Minnesota is one of only five states in the country that requires residents to purchase liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. However, this is just the minimum amount required by the state.

The costs of an accident can be much higher, making it essential to explore cheap auto insurance in Minnesota for better coverage options.

It is always prudent to carry higher coverage than the state-mandated minimum. But what is the use of these coverages? Let us discuss each to understand why it is required.

Liability Insurance

Liability insurance pays for injuries and damages to the third party in case of an accident where you are at fault. If you rear-ended a car and are held at fault, your insurer may cover the damage to the third party up to your coverage limit.

If the damage exceeds your coverage limit, you may need to compensate the third party out of pocket. That is why you must have adequate coverage, such as cheap auto insurance in Minnesota, to protect yourself against financial implications.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Personal Injury Protection (PIP)

While liability covers the third party, bodily injury liability insurance helps protect you and your co-passengers in case of an accident. Additionally, Minnesota is a no-fault state, meaning you are required to purchase personal injury protection (PIP) coverage.

It also reduces the burden on courts for small damages. However, if you want to step out of the no-fault system to sue a third party for damages, you must meet the following conditions:

- Incurred more than $4,000 in medical expenses

- Suffered more than 60 days of disability or permanent injury

The compensation against your claim will be only the additional amount not already covered by your PIP. Take a look at this Geico video to understand more about PIP:

In case of an accident, PIP will cover your or another covered person’s medical bills, lost wages, child care, and funeral expenses. The PIP system is expected to help you get back on your feet after an accident by paying medical bills and other expenses without assessing who was at fault.

Underinsured and Uninsured Coverage

As the name suggests, uninsured/underinsured coverage is meant to pay for damages if an uninsured/underinsured driver hits you. With a considerable number of uninsured drivers, having cheap auto insurance in Minnesota is vital to ensure you are adequately covered against potential losses.

Read More: UM/UIM Auto Insurance Coverage

Forms of Financial Responsibility in Minnesota

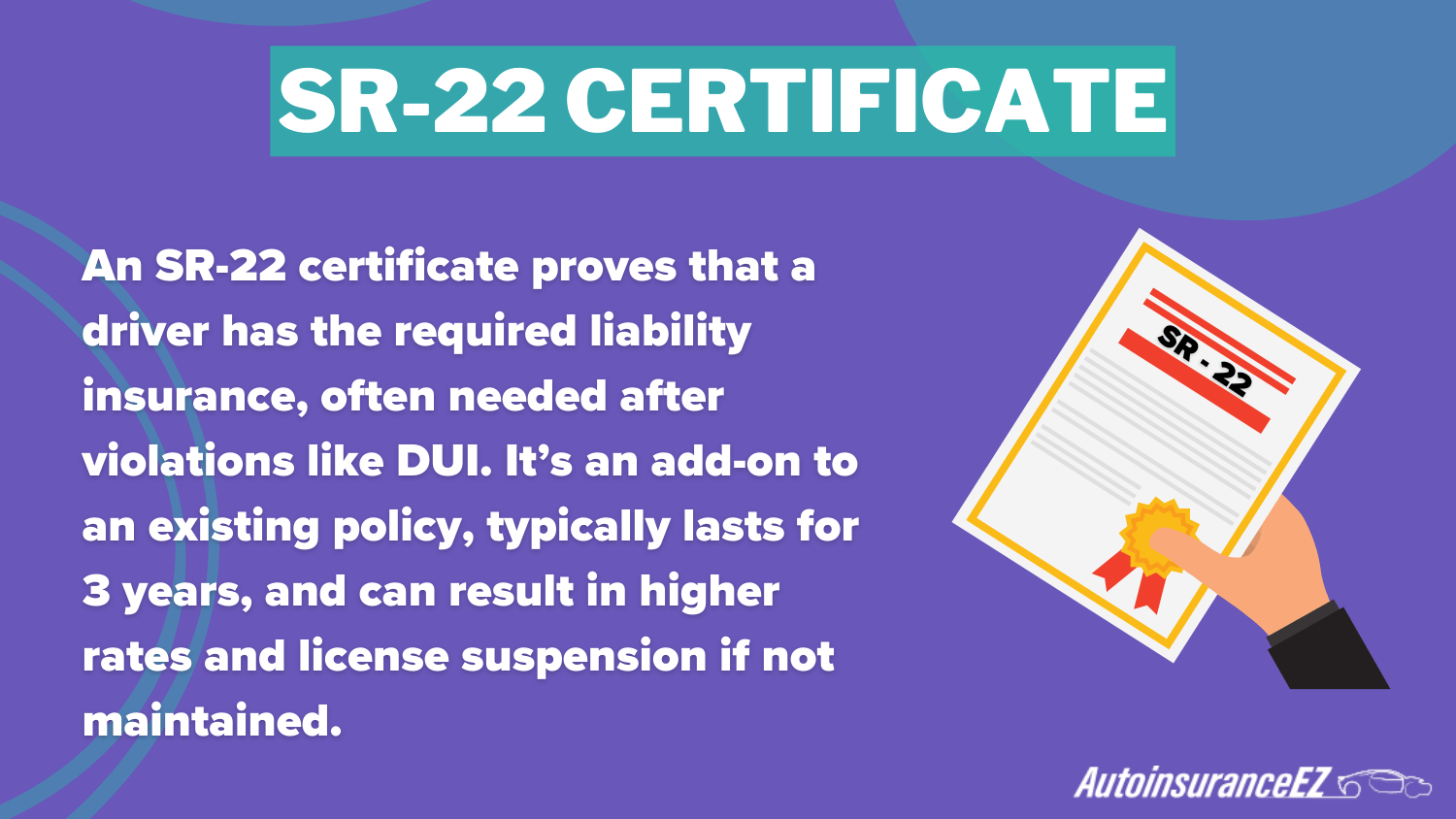

In Minnesota, it is mandatory to purchase state-mandated liability coverage. Minimum car insurance requirements must be met to legally drive in the state. If you caused an accident and did not have an insurance policy, you must file an SR-22 financial responsibility form.

You will also require an SR-22 form for a suspended license or previously reported coverage lapses.

Driving without insurance is considered a misdemeanor offense that carries a fine up to $1,000 and 90 days of jail time.

You are expected to show proof of insurance when requested by a law enforcement officer. If you fail to show the evidence, you must appear in court and prove you were covered.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How to Save on Insurance Premiums in Minnesota

Finding MN’s cheap car insurance starts with understanding available discounts. This table showcases potential savings from leading providers across the state. Liberty Mutual offers the highest anti-theft discount at 35%, while State Farm provides an impressive 35% good student discount.

Auto Insurance Discounts From Top Providers in Minnesota

| Company | Anti-Theft | Bundling | Good Student | Multi-Car | Safe Driver |

|---|---|---|---|---|---|

| 10% | 25% | 22% | 25% | 18% | |

| 25% | 25% | 20% | 20% | 18% |

| 12% | 16% | 20% | 10% | 8% | |

| 10% | 20% | 15% | 20% | 20% | |

| 25% | 25% | 15% | 25% | 15% | |

| 35% | 25% | 12% | 25% | 20% |

| 5% | 20% | 18% | 20% | 12% | |

| 25% | 10% | 10% | 12% | 10% | |

| 15% | 17% | 35% | 20% | 20% | |

| 15% | 13% | 8% | 8% | 17% |

Geico stands out with consistent 25% savings across multiple categories. When combined with already competitive base rates, these discounts can significantly reduce auto insurance premiums in Minnesota.

These discounts become even more valuable when you consider how affordable auto insurance is in Minnesota compared to the national average. As shown in the table below, Minnesotans spend a smaller percentage of their income on auto insurance than the national average.

Minnesota’s average annual disposable income is $42,500, while the average premium for full coverage is $856.

Premium as a Percentage of Income

| Percentage of Income | 2014 | 2013 | 2012 |

|---|---|---|---|

| Minnesota | 2.01% | 2.01% | 1.93% |

| National Average | 2.40% | 2.43% | 2.34% |

On average, Minnesotans spend around $130 less than the national average, which means more savings and more disposable income. However, the average numbers may not apply in your case.

Add-ons, Endorsements, and Riders

In addition to options like collision and comprehensive insurance, there are other add-on coverages to consider in creating your insurance policy, such as:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Rental Reimbursement

- Modified Auto Insurance Coverage

- Classic Auto Insurance

- Non-Owner Auto Insurance

- Pay-As-You-Drive or Usage-Based Insurance

While Minnesota requires minimum liability, PIP, and uninsured/underinsured motorist coverage, these optional add-ons can provide crucial extra protection for North Star State drivers.

Premium Rates by Demographics in Minnesota

The table clearly shows why comparison shopping is important if you want to save on premiums. As a teen male driver, you can save $24,000 in average annual premiums if you move from Liberty Mutual to State Farm.

Auto Insurance Full Coverage Monthly Rate in Minnesota by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $574 | $831 | $356 | $372 | $252 | $252 | $272 | $272 | |

| $507 | $734 | $170 | $196 | $186 | $186 | $149 | $149 |

| $595 | $895 | $245 | $260 | $225 | $230 | $220 | $225 | |

| $205 | $317 | $170 | $264 | $153 | $238 | $178 | $189 | |

| $462 | $587 | $200 | $216 | $222 | $220 | $155 | $147 | |

| $1,576 | $2,365 | $684 | $976 | $800 | $800 | $646 | $646 |

| $230 | $239 | $192 | $199 | $172 | $179 | $134 | $144 | |

| $288 | $300 | $240 | $250 | $216 | $225 | $157 | $163 | |

| $278 | $342 | $143 | $118 | $100 | $90 | $104 | $104 | |

| $215 | $234 | $179 | $195 | $161 | $175 | $150 | $152 |

Factors that affect your car insurance premium can include your age, driving record, location, and even gender. These variables all contribute to how much you will pay for coverage, making it essential to compare rates across different insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Cheap auto insurance in Minnesota rates by ZIP code

Depending on where you live, you can find an insurer that provides cheap auto insurance in Minnesota.

Minnesota 25 Cheapest Full Coverage Monthly Rates ZIP Codes

| ZIP | City | Rates | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|

| 56007 | Albert Lea | $331 | State Farm | $152 | Nationwide | $199 |

| 56088 | Truman | $332 | State Farm | $139 | Farmers | $204 |

| 56120 | Butterfield | $334 | State Farm | $141 | USAA | $203 |

| 55912 | Austin | $334 | State Farm | $155 | USAA | $209 |

| 56159 | Mountain Lake | $335 | State Farm | $145 | USAA | $203 |

| 55987 | Winona | $335 | State Farm | $159 | Nationwide | $207 |

| 56039 | Granada | $335 | State Farm | $137 | Nationwide | $211 |

| 56027 | Elmore | $335 | State Farm | $136 | Farmers | $199 |

| 56073 | New Ulm | $336 | State Farm | $139 | USAA | $203 |

| 56181 | Welcome | $336 | State Farm | $140 | Nationwide | $211 |

| 56062 | Madelia | $336 | State Farm | $142 | USAA | $203 |

| 56031 | Fairmont | $336 | State Farm | $137 | Nationwide | $211 |

| 56127 | Dunnell | $336 | State Farm | $147 | Farmers | $204 |

| 56087 | Springfield | $336 | State Farm | $142 | USAA | $203 |

| 56054 | Lafayette | $336 | State Farm | $148 | Farmers | $215 |

| 56081 | Saint James | $336 | State Farm | $142 | USAA | $203 |

| 56075 | Northrop | $336 | State Farm | $157 | Nationwide | $211 |

| 56098 | Winnebago | $336 | State Farm | $143 | Farmers | $203 |

| 56019 | Comfrey | $337 | State Farm | $139 | USAA | $203 |

| 56041 | Hanska | $337 | State Farm | $140 | USAA | $203 |

| 56001 | Mankato | $337 | State Farm | $168 | Nationwide | $218 |

| 56085 | Sleepy Eye | $337 | State Farm | $136 | USAA | $203 |

| 56036 | Glenville | $337 | State Farm | $153 | Farmers | $201 |

| 56171 | Sherburn | $337 | State Farm | $143 | Nationwide | $211 |

| 56162 | Ormsby | $337 | State Farm | $157 | Nationwide | $211 |

For example, State Farm provides the cheapest premium rates across many ZIP codes. You should get a quote from State Farm.

Minnesota 25 Most Expensive Full Coverage Monthly Rates by ZIP Codes

| ZIP | City | Rates | Most Expensive Company | Most Expensive Rate | 2nd Expensive Company | 2nd Expensive Rate |

|---|---|---|---|---|---|---|

| 55411 | Minneapolis | $552 | Liberty Mutual | $1,745 | Allstate | $534 |

| 55106 | Saint Paul | $547 | Liberty Mutual | $1,748 | Allstate | $547 |

| 55101 | Saint Paul | $546 | Liberty Mutual | $1,748 | Allstate | $544 |

| 55103 | Saint Paul | $543 | Liberty Mutual | $1,748 | Allstate | $544 |

| 55404 | Minneapolis | $541 | Liberty Mutual | $1,745 | Allstate | $549 |

| 55412 | Minneapolis | $536 | Liberty Mutual | $1,745 | Allstate | $539 |

| 55107 | Saint Paul | $534 | Liberty Mutual | $1,748 | Allstate | $511 |

| 55454 | Minneapolis | $533 | Liberty Mutual | $1,745 | Allstate | $547 |

| 55415 | Minneapolis | $532 | Liberty Mutual | $1,745 | Allstate | $547 |

| 55407 | Minneapolis | $532 | Liberty Mutual | $1,696 | Allstate | $550 |

| 55408 | Minneapolis | $531 | Liberty Mutual | $1,745 | Allstate | $549 |

| 55402 | Minneapolis | $529 | Liberty Mutual | $1,745 | Allstate | $547 |

| 55455 | Minneapolis | $529 | Liberty Mutual | $1,745 | Allstate | $544 |

| 55104 | Saint Paul | $528 | Liberty Mutual | $1,696 | Allstate | $544 |

| 55405 | Minneapolis | $527 | Liberty Mutual | $1,745 | Allstate | $550 |

| 55406 | Minneapolis | $521 | Liberty Mutual | $1,696 | Allstate | $547 |

| 55414 | Minneapolis | $521 | Liberty Mutual | $1,696 | Allstate | $544 |

| 55403 | Minneapolis | $521 | Liberty Mutual | $1,745 | Allstate | $547 |

| 55413 | Minneapolis | $521 | Liberty Mutual | $1,745 | Allstate | $531 |

| 55401 | Minneapolis | $518 | Liberty Mutual | $1,745 | Allstate | $531 |

| 55114 | Saint Paul | $517 | Liberty Mutual | $1,696 | Allstate | $544 |

| 55102 | Saint Paul | $516 | Liberty Mutual | $1,696 | Allstate | $494 |

| 55409 | Minneapolis | $509 | Liberty Mutual | $1,696 | Allstate | $542 |

| 55130 | Saint Paul | $483 | Liberty Mutual | $1,193 | Allstate | $539 |

| 55450 | Minneapolis | $480 | Liberty Mutual | $1,745 | Allstate | $422 |

Since ZIP codes don’t represent a whole city, we’ll next look at rates by city.

Cheap Auto Insurance in Minnesota Rates by City

The tables below show the cheapest and most expensive auto insurance rates by city.

https://docs.google.com/spreadsheets/d/1PyUQhZ5z1BNI-MkgSmD7as7CcmYjEQ3ne9kc24fyWxU/edit#gid=105355400

| Cheapest Cities in Minnesota | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Albert Lea | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| Truman | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| Butterfield | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| Austin | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| Mountain Lake | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| Goodview | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| Granada | $4,018.95 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| Elmore | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| New Ulm | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| Welcome | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| Madelia | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| Fairmont | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| Dunnell | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| Springfield | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| Lafayette | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| St. James | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| Northrop | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Winnebago | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| Comfrey | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| Hanska | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| Sleepy Eye | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| Glenville | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| Sherburn | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| Ormsby | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Lewisville | $4,051.00 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,712.06 | USAA | $2,438.90 |

Albert Lea has the cheapest rates in all of Minnesota.

https://docs.google.com/spreadsheets/d/1PyUQhZ5z1BNI-MkgSmD7as7CcmYjEQ3ne9kc24fyWxU/edit#gid=105355400

| Most Expensive Cities in Minnesota | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Minneapolis | $6,106.69 | Liberty Mutual | $19,767.41 | Allstate | $6,275.74 | State Farm | $2,860.94 | USAA | $3,270.39 |

| St. Paul | $5,972.08 | Liberty Mutual | $18,511.98 | Allstate | $6,141.30 | State Farm | $3,006.99 | USAA | $3,309.17 |

| Little Canada | $5,397.29 | Liberty Mutual | $14,314.34 | Allstate | $5,939.60 | USAA | $3,246.25 | State Farm | $3,375.84 |

| Brooklyn Center | $5,250.46 | Liberty Mutual | $13,733.42 | Allstate | $5,517.75 | State Farm | $2,657.84 | USAA | $3,027.14 |

| Falcon Heights | $5,110.86 | Liberty Mutual | $14,384.20 | Allstate | $5,605.47 | State Farm | $2,445.02 | USAA | $3,000.34 |

| Columbia Heights | $5,103.52 | Liberty Mutual | $13,733.42 | Allstate | $5,453.46 | State Farm | $2,631.03 | USAA | $2,963.85 |

| Maplewood | $5,061.15 | Liberty Mutual | $14,314.34 | Allstate | $5,382.25 | State Farm | $2,720.57 | USAA | $2,960.39 |

| Waskish | $5,023.66 | Liberty Mutual | $15,228.53 | Farmers | $4,564.50 | State Farm | $2,148.12 | Nationwide | $2,950.86 |

| St. Francis | $5,003.38 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,460.88 | USAA | $3,193.94 |

| Martin Lake | $5,003.33 | Liberty Mutual | $15,094.54 | Allstate | $4,712.34 | State Farm | $2,459.40 | USAA | $3,193.94 |

| Richfield | $5,002.58 | Liberty Mutual | $14,343.36 | Allstate | $5,308.16 | State Farm | $2,566.97 | USAA | $2,790.97 |

| Lake George | $4,999.75 | Liberty Mutual | $15,228.53 | Farmers | $4,491.44 | State Farm | $2,185.55 | USAA | $3,008.87 |

| South St. Paul | $4,994.42 | Liberty Mutual | $14,314.34 | Allstate | $5,331.35 | State Farm | $2,667.84 | USAA | $2,987.88 |

| Columbus | $4,992.05 | Liberty Mutual | $15,094.54 | Allstate | $4,758.69 | State Farm | $2,382.94 | Nationwide | $3,130.44 |

| Bethel | $4,984.06 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,424.09 | USAA | $3,193.94 |

| East Bethel | $4,978.05 | Liberty Mutual | $15,094.54 | Allstate | $4,712.66 | State Farm | $2,477.33 | USAA | $3,193.94 |

| Fridley | $4,971.65 | Liberty Mutual | $13,733.42 | Allstate | $5,492.04 | State Farm | $2,618.39 | USAA | $2,807.34 |

| Almelund | $4,966.16 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Isanti | $4,955.17 | Liberty Mutual | $15,094.54 | Allstate | $4,790.79 | State Farm | $2,422.96 | Nationwide | $3,215.12 |

| Garrison | $4,948.90 | Liberty Mutual | $15,228.53 | Allstate | $4,537.69 | State Farm | $2,148.12 | USAA | $2,902.05 |

| Andover | $4,946.23 | Liberty Mutual | $15,094.54 | Allstate | $5,081.81 | State Farm | $2,396.83 | USAA | $2,982.27 |

| Grandy | $4,945.76 | Liberty Mutual | $15,094.54 | Allstate | $4,770.32 | State Farm | $2,406.80 | Nationwide | $3,215.12 |

| Swatara | $4,945.15 | Liberty Mutual | $15,228.53 | Allstate | $4,489.01 | State Farm | $2,148.12 | Nationwide | $2,993.69 |

| Taylors Falls | $4,943.22 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Centerville | $4,940.45 | Liberty Mutual | $15,094.54 | Allstate | $4,928.00 | State Farm | $2,248.59 | USAA | $2,780.77 |

Financial Ratings of Auto Insurance Companies in Minnesota

Financial strength is a crucial factor to consider when choosing an insurer. We rely on data from A.M. Best, one of the most reputable credit rating agencies in the insurance industry, to help evaluate an insurer’s financial stability.

Minnesota Financial Ratings From Top Companies

| Company | Market Share | Credit Rating |

|---|---|---|

| 24.73% | A++ | |

| 16.27% | A+ | |

| 11.62% | A |

| 5.91% | A | |

| 5.56% | A+ | |

| 3.61% | A++ | |

| 3.08% | A+ | |

| 3.07% | A |

| 2.95% | A++ | |

| 2.88% | A++ |

A strong credit rating indicates that the company is financially sound and capable of fulfilling future claim obligations. Auto insurance coverage options also play a key role in determining the best provider for your needs.

Let’s examine the credit ratings of the top ten providers of cheap auto insurance in Minnesota. Together, these companies hold about 80 percent of the state’s market share.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

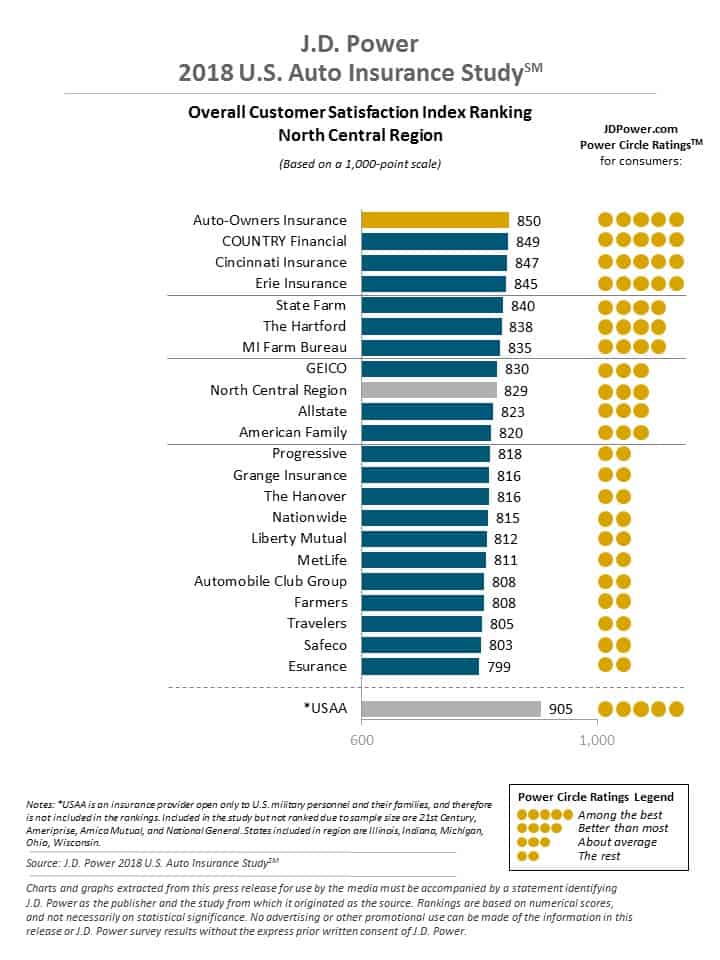

Customer Satisfaction Ratings of Auto Insurance Companies in Minnesota

Another key factor to consider is what current customers say about an insurance company. Customer reviews offer valuable insights into the quality of service provided by insurers, including how quickly they respond after a claim is filed and the efficiency of the claims settlement process.

Since manually reviewing all customer feedback can be overwhelming, we’ll rely on J.D. Power Customer Satisfaction Ratings, one of the most trusted sources for automotive information. These ratings help us assess which providers offer cheap auto insurance in Minnesota while delivering excellent customer service. Compare auto insurance companies to find the right fit for your needs.

According to J.D. Power, Auto-Owners Insurance is the highest-rated insurer in the North-Central Region.

Minnesota Auto Insurance Companies With the Most Customer Complaints

Another crucial aspect of evaluating an insurer is reviewing the complaints filed against the company. The complaints ratio is a key metric that gives you a clear idea of the quality of service provided by the insurer.

Complaints Data for Top 10 Insurers in Minnesota

| Company | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| 0.44 | 1482 | |

| 0.75 | 120 | |

| 0.79 | 73 |

| 0 | 0 | |

| 0.5 | 163 | |

| 0.68 | 333 | |

| 0.74 | 296 | |

| 5.95 | 222 |

| 0.09 | 2 | |

| 0.53 | 31 |

If a company’s complaints ratio is worse than the industry average, it may be a sign to reconsider. However, the top insurers in Minnesota typically deliver quality service and coverage. The table below highlights the complaints data for the leading providers of cheap auto insurance in Minnesota, helping you make an informed choice.

To file an auto insurance claim or report a concern about your insurer, you can file an online complaint with the Minnesota Department of Commerce.

Premium Rates by Annual Commute in Minnesota

For MN drivers, your annual mileage can make a big difference in your insurance rates. This table shows how much full coverage auto insurance costs per month for different commute distances with top providers. State Farm has the lowest rates for low and high-mileage drivers at $105 and $135 per month, respectively.

Minnesota Auto Insurance Full Coverage Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $120 | $150 | |

| $132 | $162 |

| $110 | $140 | |

| $128 | $158 | |

| $115 | $145 | |

| $122 | $152 |

| $130 | $160 | |

| $125 | $155 | |

| $105 | $135 | |

| $112 | $142 |

As you can see in the table, most MN insurance companies charge $20-30 more per month for longer commutes. But the good news is the increased rate for higher mileage isn’t as steep as you think, so MN’s cheap auto insurance is still available for commuters.

Read More: Is it bad to set your auto insurance miles too low?

If you want the cheapest auto insurance in MN, go with State Farm and Auto-Owners; they have the lowest rates regardless of mileage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Premium Rates by Credit History in Minnesota

Many people don’t realize that their credit score can affect many aspects of their lives. For instance, credit scores affect auto insurance rates.

Minnesota Auto Insurance Full Coverage Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $279 | $300 | $554 | |

| $214 | $266 | $401 |

| $250 | $280 | $420 | |

| $221 | $237 | $326 | |

| $238 | $286 | $350 | |

| $796 | $1,019 | $1,576 |

| $208 | $234 | $290 | |

| $190 | $230 | $330 | |

| $112 | $154 | $251 | |

| $230 | $270 | $370 |

The good news for Minnesotans is that they have the highest average credit scores in any state. If you have poor credit, State Farm or Nationwide are great options for affordable coverage.

Maintaining good credit can significantly lower your car insurance premiums in Minnesota, potentially saving you hundreds of dollars each year.

Daniel Walker LICENSED INSURANCE AGENT

On the other hand, if you have a good credit score, you can secure cheap auto insurance in Minnesota from providers like State Farm, USAA, or Nationwide. These companies offer competitive rates tailored to your credit situation.

According to the State of Credit Report by Experian, Minnesota has the highest average credit score in the country, at 709 (compared to the national average of 675).

Premium Rates by Driving Record in Minnesota

Your driving record significantly impacts your insurance premiums in Minnesota, as demonstrated in this comprehensive table. State Farm offers the most affordable rates across all categories, with clean record drivers paying just $118 monthly for full coverage while maintaining competitive rates even after incidents.

Minnesota Auto Insurance Full Coverage Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $283 | $369 | $409 | $484 | |

| $165 | $198 | $332 | $303 |

| $170 | $210 | $250 | $290 | |

| $191 | $221 | $265 | $269 | |

| $160 | $177 | $356 | $533 | |

| $664 | $698 | $968 | $1,730 |

| $153 | $212 | $259 | $322 | |

| $180 | $239 | $318 | $239 | |

| $118 | $129 | $139 | $129 | |

| $166 | $226 | $234 | $347 |

Auto insurers tend to increase the premium considerably if you have a DUI charge or an accident on your record. For example, see below to check how a DUI conviction can increase your premium.

Premium Rates Increase for DUI in Minnesota

| Company | Premium increase with DUI charge | Premium increase with an at-fault accident |

|---|---|---|

| $166 | $333 | |

| $741 | $695 | |

| $1,224 | $760 |

| $1,956 | $580 | |

| $2,408 | $1,892 | |

| $3,181 | $1,372 | |

| $2,446 | $1,487 | |

| $9,956 | $3,689 |

In case of an accident or DUI conviction, you should consider State Farm for affordable coverage. Additionally, following driving tips for road safety can help prevent accidents and maintain lower premiums over time.

Largest Auto Insurance Companies in Minnesota

Minnesota’s auto insurance market is dominated by just a few major players, with the top three companies controlling over half of all policies in the state. State Farm leads by a substantial margin, holding nearly a quarter (24.73%) of the market share, followed by Progressive at 16.27% and American Family at 11.62%.

Top 10 insurance companies in Minnesota

| Company | Market Share |

|---|---|

| 24.73% | |

| 16.27% | |

| 11.62% | |

| 5.91% | |

| 5.56% | |

| 3.61% | |

| 3.08% | |

| 3.07% |

| 2.95% | |

| 2.88% |

This concentration of market power demonstrates why these companies can offer competitive rates while maintaining strong financial stability in the region. When looking for coverage, it’s essential to compare auto insurance companies to ensure you’re getting the best rates and options in Minnesota. Understanding the different types of car insurance they offer can help you select the policy that best suits your needs.

Number of Car Insurers in Minnesota

| Type of Insurer | Count |

|---|---|

| Domestic | 39 |

| Foreign | 816 |

According to data from the National Association of Insurance Commissioners, Minnesota has 39 domestic and 816 foreign insurance providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

State Laws in Minnesota

Understanding state laws is crucial for saving on your insurance premiums and maintaining a clean driving record. While you may have reviewed driving laws when you obtained your license, it’s equally important to be aware of other automotive regulations that can impact your premiums.

To lower your auto insurance premiums in Minnesota, we’ve prepared a quick refresher on key rules and regulations, along with auto insurance coverage options, to ensure you’re informed and well-prepared to save more on your coverage.

Auto Insurance Laws in Minnesota

According to the National Association of Insurance Commissioners, state laws dictate the type of tort law, minimum liability insurance requirements, and the system for approving insurer rates.

In Minnesota, the no-fault system and the ‘File and Use’ rate filing law apply. Insurers can submit auto forms, rules, and rates without prior review. To help you better navigate the legal landscape and find cheap auto insurance in Minnesota, let’s explore the laws and regulations specific to the North Star State.

Want to learn more? Check out our guide on fault vs. no-fault auto insurance laws.

Windshield Coverage Laws in Minnesota

Minnesota car insurance companies must offer optional full-glass coverage with no deductible. This means you can have your damaged windshield repaired or replaced at no cost if you choose this coverage.

However, insurers can use aftermarket parts of equal quality for windshield repairs or replacements. If you prefer OEM parts, you may need to cover the difference in cost. To find the best cheap auto insurance in Minnesota that offers this option, it’s important to compare auto insurance coverage carefully.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

MN High-Risk Insurance

Insurers may deny you coverage in the voluntary market if you have a poor driving record, such as multiple DUI convictions or several at-fault accidents. This is because they consider it too risky to provide coverage.

In this situation, Minnesota state laws require that you search for coverage in the voluntary market for at least 60 days before exploring other options. To avoid high premiums, finding cheap auto insurance in Minnesota is still possible by comparing rates and considering alternative providers.

If you cannot find coverage in 60 days, opt for the Minnesota Automobile Insurance Plan (MAIP).

How it works: MAIP will assign you to an auto insurer based on a quota.

The coverage level and conditions will remain the same as in the voluntary market. However, the premium rates might be higher.

All auto insurance providers in Minnesota are expected to provide coverage under MAIP. The MAIP coverage is for three years, after which you are expected to improve your driving record and move out to the voluntary market.

To qualify for the MAIP, you need to meet the following criteria:

- You should have a valid driver’s license

- You should have a vehicle registered in Minnesota

- You should be able to prove that you searched for auto insurance in the voluntary market for at least 60 days

- You should not have missed premium payments in the last 12 months

If your driver’s license is suspended or revoked due to multiple traffic offenses, DUI violations, or uninsured auto accidents, your insurer must file a form with the Department of Public Safety certifying that you have the necessary insurance coverage.

Read More: When is high-risk auto insurance required?

Automobile Insurance Fraud in Minnesota

Auto insurance fraud affects everyone by raising company losses and increasing premium rates for all policyholders. In Minnesota, it is considered a crime.

The quantum of the penalty is contingent on either the value of the fraud committed or the economic harm suffered by the victim. Minnesota state law awards the following penalties for insurance fraud:

Insurance Fraud Penalties in Minnesota

| Fraud value | Imprisonment | Fine |

|---|---|---|

| More than $35,000 | Up to 20 years | Up to $100,000 |

| $5,000-$35,000 | Up to ten years | Up to $20,000 |

| $1,000-$5,000 | Up to five years | Up to $10,000 |

| $500-$1,000 | Up to 365 days | Up to 3,000 |

| Less than $500 | Up to 90 days | Up to $1,000 |

Common examples include inflating claim values, providing false information on applications, staging accidents or injuries for claims, and accepting payment for services never provided. To avoid inflated premiums and secure cheap auto insurance in Minnesota, it’s essential to be aware of such fraudulent activities and report any suspicious behavior.

Read More: Is it a bad idea to claim injury on auto insurance when you aren’t hurt?

Statute of Limitations in Minnesota

The statute of limitations is when you can file a lawsuit against a third party. In Minnesota, you have two years for personal injury and six years for property damage until you can leave the no-fault system and sue the third party for damages.

Read More: Auto Insurance Basics: Property Damage Liability

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Vehicle Licensing Laws in Minnesota

If your license is due for renewal soon, you might wonder: ‘Can I renew my driver’s license online?’ or ‘How do I get my first driver’s license?’ Remember, driving without a valid driver’s license in Minnesota is illegal.

Driving without a driver’s license can result in a fine. This guide will help you answer these questions and provide other relevant information like how to get insurance on your driver’s license in Minnesota.

REAL ID Implementation in Minnesota

The Federal Government started enforcing the REAL ID Act, passed by Congress in 2005, establishing minimum security standards for license issuance.

The Act is scheduled to take effect in October 2020, after which you will be expected to carry a REAL ID-compliant document to enter federal buildings or board a domestic flight. If you have any of the following documents, you may not need another REAL ID:

- US Passport

- Foreign Passport

- US Military ID

- Permanent Resident Card (Green Card)

To get a REAL ID-compliant driver’s license, you need to bring the following documents to a nearby Driver and Vehicle Services office:

- One identification document

- Document proving a Social Security number

- Two documents proving your residency in Minnesota

You can also use the Driver and Vehicle Services tool to check if you need a REAL ID-compliant driver’s license. You can check the full list of documents required on the Driver and Vehicle Services’ website.

Read More: Is it risky to provide your Social Security number when shopping for auto insurance?

Penalties for Driving Without Insurance in Minnesota

Driving without car insurance in MN is illegal and can result in penalties, fines, or even suspension of your driver’s license. Always ensure you have the required coverage to stay compliant with the law.

If you can’t provide proof during a traffic stop, you must present it in court by a set date. Failure to do so can lead to fines or jail time. Always maintain cheap auto insurance in Minnesota to avoid penalties.

If it’s your first or second offense, you can be fined up to $1,000 with a minimum fine of $200. Your driving privileges, including driver’s license, car registration, and license plates, can be suspended for up to 30 days.

You must pay a $30 reinstatement fee and submit an SR-22 financial responsibility form to reinstate your driving privileges.

However, if it is your third offense, the penalties are harsher. You may have to pay a fine of up to $3,000 and lose your driving privileges for up to a year. You will also face jail time of up to 90 days, a reinstatement fee, and SR-22 documentation.

Repeated offenses can lead your insurer to deny coverage in the voluntary market, and a poor driving record can significantly raise your premium. Driving without insurance results in fines and penalties and can also devastate your finances in case of an accident.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

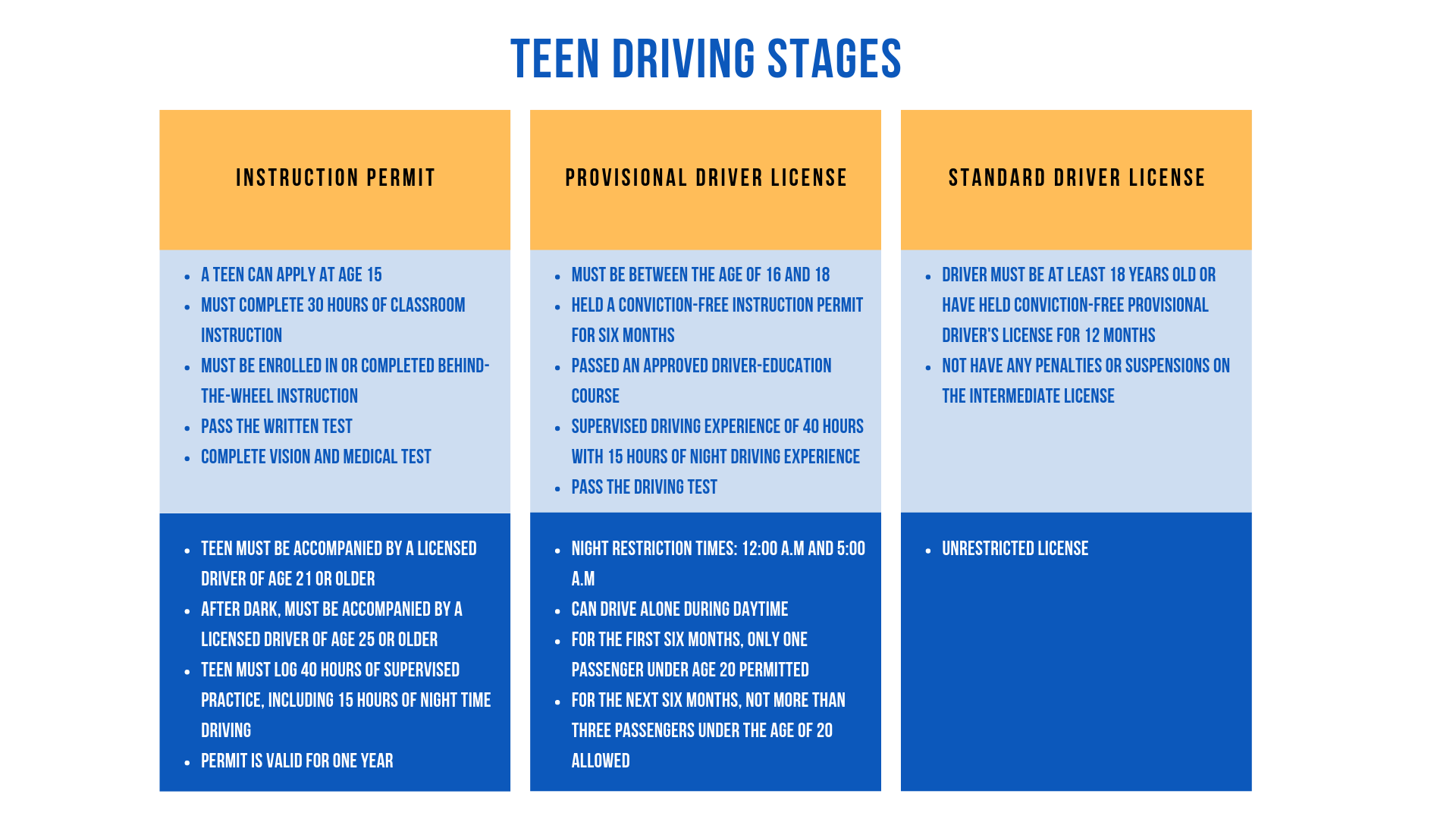

Teen Driving Laws in Minnesota

Minnesota’s licensing laws allow teens to use the multi-stage learning opportunity on how to teach your teen to drive. A teen can apply for an instruction permit at the age of 15.

If you are above age 15 and have completed 30 hours of classroom instruction, you can write the knowledge test and get your instruction permit. The instruction permit allows you to practice driving under the supervision of a certified instructor or a licensed driver of age 21 or older.

As you prepare to hit the road, don’t forget to explore cheap auto insurance in Minnesota to ensure you’re covered at the best possible rate. Finding the best auto insurance in Minnesota will give you peace of mind and protection.

License Renewal Procedure in Minnesota

The standard driver’s license in Minnesota has a validity of four years. You must undergo a vision test every time you renew your driver’s license. However, unlike many other states, Driver and Vehicle Services in Minnesota does not allow the online renewal of a driver’s license. You must visit a DVS office to renew your driver’s license.

Read More: Can you get auto insurance without a license?

New Residents

If you are moving to Minnesota from another U.S. state or Canada and have a valid driver’s license, you can obtain a Minnesota driver’s license by passing a knowledge and vision test.

Remember: If your license expired more than a year ago, you would also have to undertake the driving test.

If you are moving to Minnesota from another country, you must pass the vision, knowledge, and driving tests to get a driver’s license. To find the documents required to get a license, visit the Driver and Vehicle Services website.

Rules of the Road in Minnesota

Being aware of Minnesota’s road rules and regulations is vital not only for your safety and that of your family but can also help you qualify for car insurance discounts on your insurance premiums by maintaining a clean driving record.

In this section, we’ll provide a quick recap of the key rules and regulations you should keep in mind while driving in the state. Additionally, staying informed can help you find cheap auto insurance in Minnesota and enjoy better coverage at lower rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

At Fault and No-Fault

Minnesota follows a no-fault tort system of auto insurance. As we mentioned earlier, the no-fault system is designed to help you get on your feet faster in case of an accident.

However, you must purchase Personal Injury Protection and uninsured/underinsured coverage to protect yourself from financial harm.

You can step out of the no-fault system to sue a third party in court if you have sustained an injury resulting in more considerable expenses than the threshold value we discussed earlier.

Seatbelt and Car Seat Laws in Minnesota

Seatbelts and airbags are among your car’s most critical safety features. In 2018, there were 2,792 motor vehicle deaths in Minnesota.

According to the CDC, the rate of traffic deaths is lower in Minnesota compared to the national average.

Ninety-four percent of Minnesotans wear seat belts, whereas only 86 percent of the country does. Minnesota wants its drivers to remain safe on the road, so it has penalties for not wearing a seat belt.

In Minnesota, not wearing a seatbelt is considered a primary offense, which means a law enforcement officer can stop and fine you. The fine is $25 for the first offense and can rise to $100.

A restraint system should be used for children under 8 or shorter than 57 inches. Infants must be in rear-facing safety seats.

Remember that the driver is responsible for the child restraint violation and will have to pay a $50 penalty.

Speed Limits in Minnesota

Understanding Minnesota’s speed limits is essential for avoiding tickets that could increase your insurance premiums. As shown in the table below, Minnesota maintains consistent speed limits across most road types.

Minnesota Speed Limits

| TYPE | MPH |

|---|---|

| Rural Interstates | 70 |

| Urban Interstates | 60 |

| Other limited access road | 60 |

| Other roads | 60 |

Adhering to these posted speed limits not only keeps you safe on Minnesota roads but also helps you maintain lower insurance rates. Speeding tickets can significantly impact your premiums, as shown in earlier tables, where rates increase by 10-20% after just one ticket.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

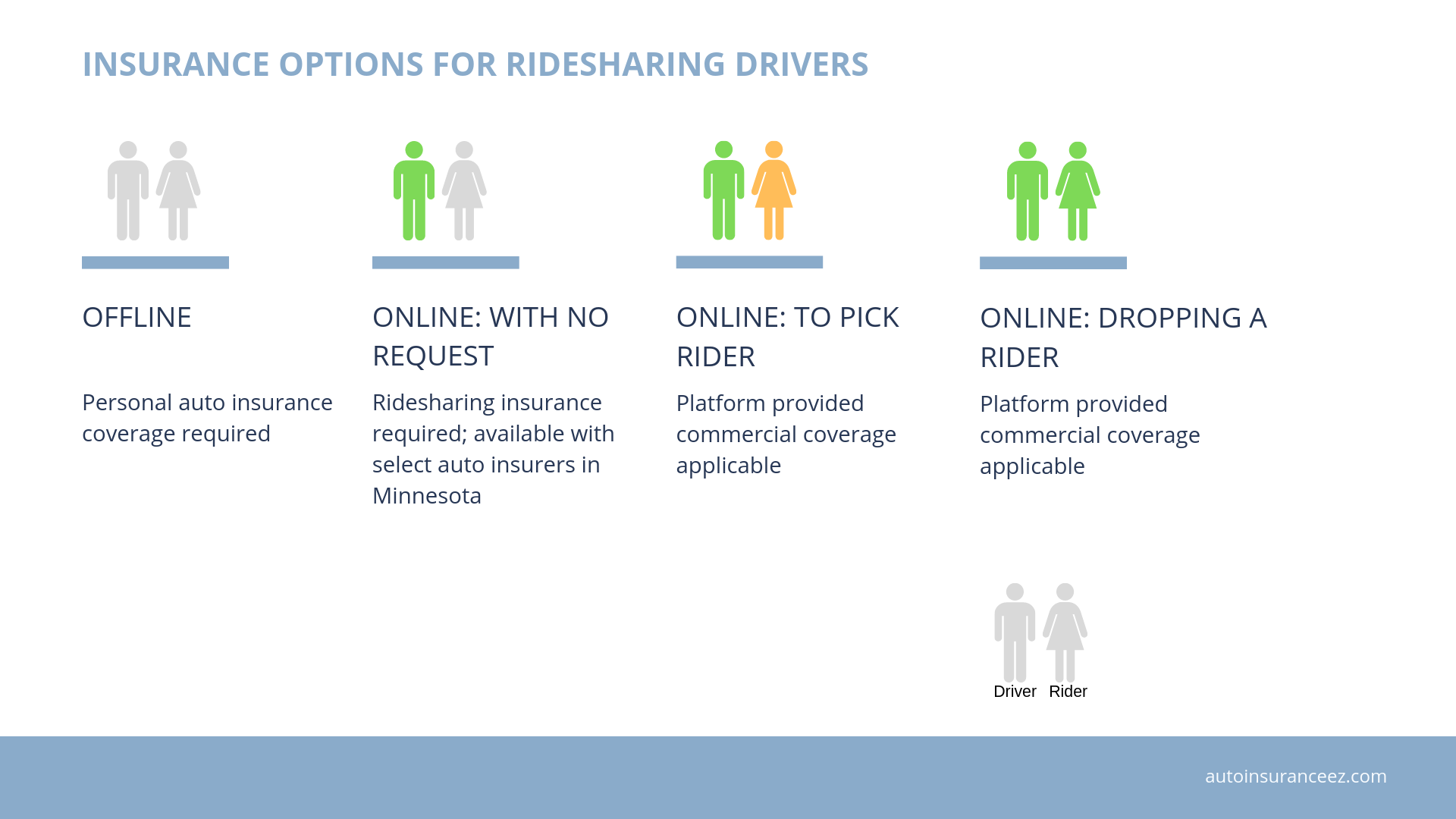

Ridesharing Laws in Minnesota

If you’ve recently used Uber or Lyft, you’ve already experienced coverage through these platforms’ commercial insurance plans. However, if you drive for Uber, Lyft, or any ridesharing service, it’s essential to understand the types of coverage available to protect yourself.

There are numerous scenarios when driving for ridesharing companies such as Uber and Lyft. In Minnesota, Allstate, Farmers, and Geico can provide you with a Ridesharing Insurance plan. Online with a ride request or an active ride: The ridesharing company’s commercial policy will provide insurance coverage in this scenario.

For example, in the case of Uber, it provides $1,000,000 liability coverage, $1,000,000 bodily injury protection, and contingent collision & comprehensive coverage with a $1,000 deductible. The deductible portion can vary between platforms.

Automation on the Road in Minnesota

Self-driving cars are not allowed on public or private roads. A Minnesota task force has recommended steps toward opening the roads to them.

Read More: Are Self-Driving Cars Safe?

State Legislators and the Minnesota Department of Transportation are still wary of allowing self-driving cars on public roads. However, if the lawmakers pass the current bills, these cars may be allowed on private roads.

DUI Laws in Minnesota

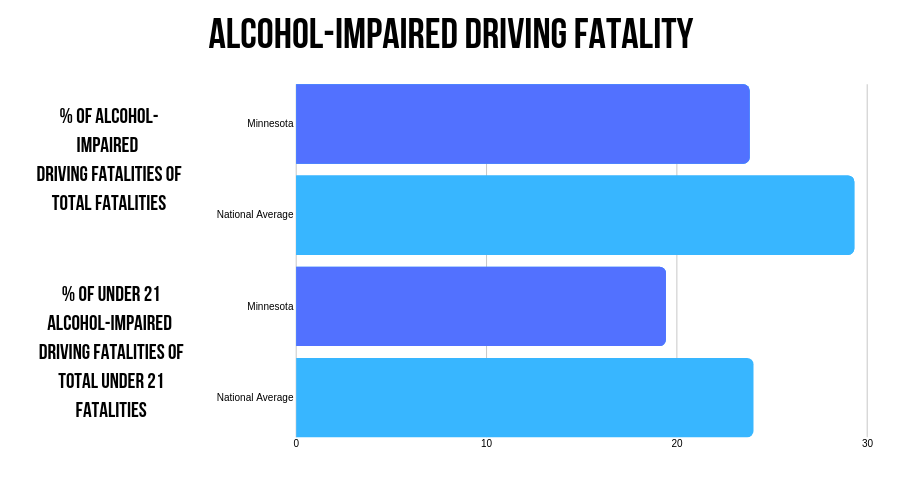

In 2017, a total of 85 people in Minnesota died because of alcohol-impaired driving, of which seven were under 21 years old.

Minnesota fares better than the national average in terms of alcohol-impaired fatalities, partly due to the strict penalties for the offense. Let us review the fines and penalties related to the offense:

Penalties for Alcohol-Impaired Driving in Minnesota

| Offense | Penalty Description | Fine & Fees | License Suspension | Possible Jail Time |

|---|---|---|---|---|

| DWI (Intoxicated Driving) | BAC over 0.08% | $1,000 | 90 days - 1 year | 90 days |

| Aggravated DWI (BAC > 0.16) | BAC > 0.16% or refusal | $3,000 | 1 - 3 years | 1 year |

| DUI (Under the Influence | Impaired Driving | $2,000 | 30 days - 1 year | 90 days |

| Underage DUI | Under 21 with alcohol | $500 | 30 days | 90 days |

| 2nd DWI Offense | 2nd DWI (10 yrs) | $3,000 | 1 - 3 years | 90 days |

| 3rd DWI Offense | 3rd DWI (10 years) | $5,000 | 3 - 7 years | 1 year |

| BAC Test Refusal | BAC Test Refusal | $700 | 1 year | 1 year |

Remember, the lookback period in Minnesota is 10 years. The lookback period is the time until which any new offense will be counted as a subsequent offense and will result in harsher fines and penalties.

Although no legislation prohibits marijuana-impaired drivers from driving on the road, it is advisable to avoid driving in an intoxicated condition. You would not only be endangering your life but also some other person’s life.

Read More: Reckless Driving and Auto Insurance Rates

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Distracted Driving Laws in Minnesota

In Minnesota, it is illegal for all drivers to use handheld devices and text while driving. Cellphone use is also unlawful for permit holders and provisional license drivers.

Minnesota has been hands-free since August 1st, 2019. Drivers may only use voice commands to perform tasks, such as making a call. The distracted driving laws allow law enforcement to act as the primary enforcer.

Read More: Will my auto insurance cover other cars?

Number of Vehicle Thefts in Minnesota

Vehicle theft can also disproportionately impact minority communities when it comes to auto insurance rates. One of the key problems is that vehicle theft is often more predominant in neighborhoods of people of color.

Vehicle Theft in Minnesota

| Make and Model | Model Year | Total Number of Thefts |

|---|---|---|

| Honda Accord | 1997 | 7,897 |

| Honda Civic | 2000 | 10,580 |

| Chevrolet Pickup (Full Size) | 2006 | 8,930 |

| Ford Pickup (Full Size) | 2006 | 8,930 |

| Toyota Camry | 2007 | 3,679 |

| Honda CR-V | 2001 | 3,896 |

| Chevrolet Impala | 2008 | 309 |

| Dodge Caravan | 2000 | 587 |

| Toyota Corolla | 2010 | 253 |

| Chevrolet Malibu | 2010 | 242 |

Minnesota’s two most stolen cars are the 1997 Honda Accord and the 1998 Honda Civic. To check the number of cars stolen in your city, you can use the data provided by the FBI:

Minnesota Vehicle Theft by City

| City | Motor vehicle theft |

|---|---|

| Aitkin | 5 |

| Akeley | 0 |

| Albany | 1 |

| Albert Lea | 14 |

| Alexandria | 37 |

| Annandale | 5 |

| Anoka | 33 |

| Appleton | 0 |

| Apple Valley | 37 |

| Arlington | 0 |

| Ashby | 0 |

| Atwater | 0 |

| Austin | 27 |

| Avon | 0 |

| Babbitt | 0 |

| Barnesville | 0 |

| Baudette | 0 |

| Baxter | 7 |

| Bayport | 3 |

| Becker | 3 |

| Belgrade/Brooten | 0 |

| Belle Plaine | 3 |

| Bemidji | 42 |

| Benson | 1 |

| Big Lake | 6 |

| Blackduck | 0 |

| Blaine | 41 |

| Blooming Prairie | 2 |

| Bloomington | 115 |

| Blue Earth | 4 |

| Bovey | 0 |

| Braham | 0 |

| Brainerd | 32 |

| Breckenridge | 3 |

| Breezy Point | 0 |

| Breitung Township | 0 |

| Brooklyn Center | 114 |

| Brooklyn Park | 170 |

| Brownton | 1 |

| Buffalo | 6 |

| Buffalo Lake | 0 |

| Burnsville | 77 |

| Caledonia | 0 |

| Cambridge | 13 |

| Canby | 0 |

| Cannon Falls | 6 |

| Centennial Lakes | 7 |

| Champlin | 9 |

| Chaska | 12 |

| Chisholm | 1 |

| Clara City | 0 |

| Cloquet | 21 |

| Cold Spring/Richmond | 2 |

| Coleraine | 0 |

| Columbia Heights | 37 |

| Coon Rapids | 50 |

| Corcoran | 1 |

| Cottage Grove | 21 |

| Crookston | 7 |

| Crosby | 0 |

| Crosslake | 0 |

| Crystal | 31 |

| Danube | 2 |

| Dawson/Boyd | 0 |

| Dayton | 5 |

| Deephaven | 0 |

| Deer River | 0 |

| Detroit Lakes | 9 |

| Dilworth | 12 |

| Duluth | 136 |

| Eagan | 43 |

| Eagle Lake | 3 |

| East Grand Forks | 6 |

| East Range | 0 |

| Eden Prairie | 27 |

| Eden Valley | 0 |

| Edina | 17 |

| Elbow Lake | 0 |

| Elko New Market | 1 |

| Elk River | 19 |

| Elmore | 2 |

| Ely | 0 |

| Eveleth | 8 |

| Fairfax | 0 |

| Fairmont | 9 |

| Falcon Heights | 4 |

| Faribault | 44 |

| Farmington | 16 |

| Fergus Falls | 9 |

| Floodwood | 0 |

| Forest Lake | 35 |

| Fountain | 0 |

| Franklin | 0 |

| Fridley | 74 |

| Fulda | 0 |

| Gaylord | 0 |

| Gilbert | 2 |

| Glencoe | 1 |

| Glenwood | 0 |

| Golden Valley | 31 |

| Goodview | 7 |

| Grand Rapids | 1 |

| Granite Falls | 1 |

| Hallock | 0 |

| Hancock | 0 |

| Hastings | 30 |

| Hawley | 0 |

| Hector | 0 |

| Hermantown | 13 |

| Hibbing | 10 |

| Hill City | 0 |

| Hilltop | 5 |

| Hokah | 0 |

| Hopkins | 15 |

| Houston | 0 |

| Howard Lake | 1 |

| Hutchinson | 4 |

| Inver Grove Heights | 73 |

| Isanti | 2 |

| Isle | 1 |

| Janesville | 1 |

| Jordan | 1 |

| Kasson | 6 |

| Keewatin | 1 |

| Kimball | 0 |

| La Crescent | 1 |

| Lake City | 7 |

| Lake Crystal | 2 |

| Lakefield | 0 |

| Lakes Area | 8 |

| Lake Shore | 0 |

| Lakeville | 30 |

| Lamberton | 0 |

| Lauderdale | 3 |

| Lester Prairie | 1 |

| Le Sueur | 5 |

| Lewiston | 0 |

| Lino Lakes | 5 |

| Litchfield | 6 |

| Little Falls | 9 |

| Long Prairie | 1 |

| Lonsdale | 4 |

| Madelia | 1 |

| Madison Lake | 1 |

| Mankato | 49 |

| Maple Grove | 35 |

| Mapleton | 2 |

| Maplewood | 141 |

| Marshall | 9 |

| Medina | 2 |

| Melrose | 1 |

| Menahga | 0 |

| Mendota Heights | 6 |

| Milaca | 0 |

| Minneapolis | 1,987 |

| Minneota | 0 |

| Minnesota Lake | 1 |

| Minnetonka | 16 |

| Minnetrista | 5 |

| Montevideo | 8 |

| Montgomery | 8 |

| Moorhead | 91 |

| Moose Lake | 2 |

| Morris | 5 |

| Morristown | 0 |

| Mounds View | 27 |

| Mountain Lake | 0 |

| Nashwauk | 3 |

| New Brighton | 27 |

| New Hope | 15 |

| New Prague | 1 |

| New Richland | 0 |

| North Branch | 12 |

| Northfield | 5 |

| North Mankato | 3 |

| North St. Paul | 22 |

| Oakdale | 56 |

| Oak Park Heights | 5 |

| Olivia | 1 |

| Onamia | 1 |

| Orono | 8 |

| Ortonville | 0 |

| Osakis | 0 |

| Osseo | 1 |

| Ostrander | 0 |

| Owatonna | 36 |

| Park Rapids | 12 |

| Paynesville | 0 |

| Pequot Lakes | 0 |

| Pike Bay | 0 |

| Pillager | 0 |

| Pine River | 1 |

| Plainview | 1 |

| Plymouth | 35 |

| Preston | 0 |

| Princeton | 8 |

| Proctor | 6 |

| Ramsey | 18 |

| Red Wing | 29 |

| Redwood Falls | 13 |

| Renville | 0 |

| Richfield | 62 |

| Rochester | 132 |

| Rogers | 9 |

| Roseau | 1 |

| Rosemount | 4 |

| Roseville | 77 |

| Rushford | 0 |

| Sacred Heart | 0 |

| Sartell | 7 |

| Sauk Centre | 4 |

| Sauk Rapids | 12 |

| Shakopee | 42 |

| Silver Bay | 0 |

| Silver Lake | 2 |

| Slayton | 1 |

| Sleepy Eye | 0 |

| South Lake Minnetonka | 4 |

| South St. Paul | 63 |

| Springfield | 0 |

| Spring Grove | 1 |

| Spring Lake Park | 20 |

| St. Anthony | 6 |

| Staples | 2 |

| Starbuck | 0 |

| St. Charles | 2 |

| St. Cloud | 124 |

| St. Francis | 5 |

| Stillwater | 18 |

| St. James | 1 |

| St. Joseph | 5 |

| St. Louis Park | 44 |

| St. Paul | 1,874 |

| St. Paul Park | 17 |

| St. Peter | 8 |

| Thief River Falls | 5 |

| Tracy | 2 |

| Tri-City | 1 |

| Two Harbors | 3 |

| Virginia | 25 |

| Wabasha | 1 |

| Waite Park | 15 |

| Walker | 4 |

| Warroad | 2 |

| Waseca | 9 |

| Wayzata | 3 |

| Wells | 0 |

| West Concord | 1 |

| West Hennepin | 1 |

| West St. Paul | 65 |

| Wheaton | 0 |

| White Bear Lake | 27 |

| Willmar | 18 |

| Windom | 5 |

| Winnebago | 0 |

| Winona | 8 |

| Winsted | 0 |

| Woodbury | 47 |

| Worthington | 9 |

| Wyoming | 11 |

| Zumbrota | 6 |

Insurance companies will then charge higher rates to those living in those areas because a higher vehicle theft rate can lead to more people filing claims. This costs the insurance companies money, so rates increase for that neighborhood.

You can read more about auto insurance negatively impacting minority groups, as well as issues of police brutality in our biggest police budgets by city article.

Road Fatalities in Minnesota

Examining Minnesota’s traffic fatality statistics reveals critical insights about road safety that directly impact your cheap auto insurance rates. Understanding these patterns can help you avoid high-risk behaviors that lead to premium increases. Here’s what the data shows about fatal crashes across the North Star State:

Minnesota Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 182 | 40 | 50 | 9 | 3 | 284 |

| Rain | 12 | 9 | 4 | 0 | 0 | 25 |

| Snow/Sleet | 14 | 4 | 5 | 0 | 0 | 23 |

| Other | 0 | 1 | 3 | 0 | 0 | 4 |

| Unknown | 0 | 0 | 3 | 0 | 1 | 4 |

| TOTAL | 208 | 54 | 65 | 9 | 4 | 340 |

Weather and lighting conditions play a significant role in Minnesota road safety. Poor visibility during snowstorms and the state’s long winter nights contribute to increased accident risks. Maintaining an appropriate following distance and reducing speed in adverse conditions helps prevent crashes that could lead to auto insurance claims and subsequent premium increases.

Fatal accident rates vary significantly by county, with urban areas like Hennepin showing higher total numbers while some rural counties have higher per capita rates.

Traffic Fatalities in Minnesota

| Category | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Rural | 310 | 315 | 320 | 325 | 300 |

| Urban | 510 | 520 | 530 | 540 | 500 |

These traffic fatality trends demonstrate why insurance companies factor location into their premium calculations. Areas with consistently high accident rates typically see higher base premiums, making it even more important to shop for affordable coverage options if you live in a high-risk zone.

Fatalities by Person Type in Minnesota

| Factors | Person Type | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 200 | 190 | 185 | 180 | 175 |

| Light Truck - Pickup | 50 | 48 | 45 | 42 | 40 | |

| Light Truck - Utility | 30 | 32 | 35 | 38 | 30 | |

| Light Truck - Van | 20 | 18 | 17 | 16 | 15 | |

| Light Truck - Other | 15 | 12 | 14 | 13 | 12 | |

| Large Truck | 10 | 8 | 9 | 8 | 7 | |

| Bus | 5 | 6 | 7 | 7 | 6 | |

| Other/Unknown Occupants | 25 | 22 | 20 | 18 | 20 | |

| Total Occupants | 355 | 340 | 335 | 325 | 300 | |

| Motorcyclists | Total Motorcyclists | 50 | 45 | 43 | 40 | 38 |

| Nonoccupants | Pedestrian | 60 | 55 | 52 | 50 | 45 |

| Bicyclist and Other Cyclist | 10 | 9 | 8 | 7 | 6 | |

| Other/Unknown Nonoccupants | 5 | 4 | 3 | 3 | 4 | |

| Total Nonoccupants | 80 | 75 | 73 | 70 | 70 | |

| Total | Total | 485 | 460 | 460 | 445 | 415 |

This breakdown by person type shows that while driver fatalities are most common, passenger and pedestrian deaths represent a significant portion of traffic incidents. Comprehensive road safety practices that protect all road users are essential for maintaining a clean driving record and qualifying for the lowest insurance rates.

Fatalities by Crash Type in Minnesota

| Crash Type | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 400 | 420 | 430 | 415 | 405 |

| Single Vehicle | 150 | 160 | 170 | 155 | 145 |

| Involving a Large Truck | 40 | 45 | 50 | 42 | 38 |

| Involving Speeding | 80 | 85 | 90 | 85 | 82 |

| Involving a Rollover | 100 | 110 | 120 | 115 | 110 |

| Involving a Roadway Departure | 120 | 125 | 130 | 120 | 115 |

| Involving an Intersection (or Intersection Related) | 60 | 65 | 70 | 67 | 62 |

Single-vehicle crashes account for a substantial percentage of Minnesota fatalities, often resulting from overcompensation on icy roads. These incidents can dramatically impact your insurance rates, as they’re typically considered at-fault accidents unless proven otherwise. Understanding proper winter driving techniques is crucial for maintaining affordable premiums.

Fatalities Trend for the Counties in Minnesota

| Ranking | County | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|

| #1 | Hennepin | 90 | 85 | 88 | 82 | 80 |

| #2 | Ramsey | 60 | 58 | 61 | 59 | 57 |

| #3 | Anoka | 55 | 52 | 53 | 51 | 50 |

| #4 | St. Louis | 45 | 43 | 44 | 42 | 40 |

| #5 | Stearns | 50 | 48 | 49 | 47 | 45 |

| #6 | Dakota | 75 | 72 | 70 | 68 | 66 |

| #7 | Sherburne | 35 | 34 | 36 | 33 | 32 |

| #8 | Benton | 25 | 23 | 24 | 22 | 21 |

| #9 | Pine | 15 | 14 | 16 | 13 | 12 |

| #10 | Chisago | 20 | 19 | 21 | 18 | 17 |

| Sub Total 1 | Top Ten Counties | 420 | 420 | 442 | 423 | 406 |

| Sub Total 2 | All Other Counties | 131 | 128 | 134 | 126 | 122 |

| Total | All Counties | 551 | 548 | 576 | 549 | 528 |

County-by-county fatality trends help insurers determine regional risk factors when calculating cheap auto insurance rates in Minnesota. If you’re relocating within the state, comparing quotes from multiple providers is essential, as different companies weigh these geographic factors differently in their pricing models.

Fatalities Involving Speeding by County in Minnesota

| County | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Aitkin | 5 | 6 | 7 | 6 | 5 |

| Anoka | 100 | 110 | 120 | 115 | 105 |

| Becker | 7 | 8 | 9 | 8 | 7 |

| Beltrami | 6 | 7 | 8 | 7 | 6 |

| Benton | 10 | 12 | 13 | 12 | 11 |

| Big Stone | 1 | 2 | 3 | 2 | 1 |

| Blue Earth | 12 | 14 | 15 | 13 | 11 |

| Brown | 8 | 9 | 10 | 9 | 8 |

| Carlton | 5 | 6 | 7 | 6 | 5 |

| Carver | 15 | 17 | 18 | 16 | 14 |

| Cass | 6 | 7 | 8 | 7 | 6 |

| Chippewa | 3 | 4 | 5 | 4 | 3 |

| Chisago | 12 | 13 | 14 | 13 | 11 |

| Clay | 18 | 20 | 22 | 21 | 19 |

| Clearwater | 6 | 7 | 8 | 7 | 6 |

| Cook | 1 | 2 | 3 | 2 | 1 |

| Cottonwood | 8 | 9 | 11 | 9 | 8 |

| Crow Wing | 13 | 14 | 15 | 14 | 12 |

| Dakota | 40 | 42 | 45 | 43 | 40 |

| Dodge | 10 | 12 | 13 | 11 | 10 |

| Douglas | 8 | 9 | 10 | 9 | 8 |

| Faribault | 5 | 6 | 7 | 6 | 5 |

| Fillmore | 6 | 7 | 8 | 7 | 6 |

| Freeborn | 4 | 5 | 6 | 5 | 4 |

| Goodhue | 10 | 12 | 13 | 11 | 9 |

| Grant | 3 | 4 | 5 | 4 | 3 |

| Hennepin | 100 | 110 | 120 | 105 | 95 |

| Houston | 3 | 4 | 5 | 4 | 3 |

| Hubbard | 6 | 7 | 8 | 7 | 6 |

| Isanti | 7 | 8 | 9 | 8 | 7 |

| Itasca | 9 | 10 | 11 | 10 | 9 |

| Jackson | 4 | 5 | 6 | 5 | 4 |

| Kanabec | 5 | 6 | 7 | 6 | 5 |

| Kandiyohi | 10 | 12 | 13 | 11 | 9 |

| Kittson | 1 | 2 | 3 | 2 | 1 |

| Koochiching | 3 | 4 | 5 | 4 | 3 |

| Lac Qui Parle | 2 | 3 | 4 | 3 | 2 |

| Lake | 6 | 7 | 8 | 7 | 6 |

| Lake of The Woods | 1 | 2 | 3 | 2 | 1 |

| Le Sueur | 8 | 9 | 10 | 8 | 7 |

| Lincoln | 4 | 5 | 6 | 5 | 4 |

| Lyon | 7 | 8 | 9 | 8 | 6 |

| Mahnomen | 2 | 3 | 4 | 3 | 2 |

| Marshall | 3 | 4 | 5 | 4 | 3 |

| Martin | 6 | 7 | 8 | 7 | 5 |

| McLeod | 5 | 6 | 7 | 6 | 5 |

| Meeker | 4 | 5 | 6 | 5 | 4 |

| Mille Lacs | 7 | 8 | 9 | 8 | 6 |

| Morrison | 10 | 11 | 12 | 11 | 9 |

| Mower | 3 | 4 | 5 | 4 | 3 |

| Murray | 2 | 3 | 4 | 3 | 2 |

| Nicollet | 12 | 14 | 13 | 12 | 11 |

| Nobles | 15 | 17 | 16 | 14 | 13 |

| Norman | 10 | 11 | 12 | 10 | 9 |

| Olmsted | 30 | 32 | 35 | 28 | 26 |

| Otter Tail | 6 | 7 | 8 | 6 | 5 |

| Pennington | 9 | 10 | 11 | 8 | 7 |

| Pine | 15 | 16 | 17 | 14 | 13 |

| Pipestone | 7 | 8 | 9 | 7 | 6 |

| Polk | 18 | 20 | 22 | 16 | 15 |

| Pope | 5 | 6 | 7 | 5 | 4 |

| Ramsey | 150 | 160 | 170 | 140 | 130 |

| Red Lake | 3 | 4 | 5 | 3 | 2 |

| Redwood | 11 | 12 | 13 | 10 | 9 |

| Renville | 13 | 15 | 14 | 12 | 11 |

| Rice | 16 | 18 | 19 | 15 | 14 |

| Rock | 8 | 9 | 10 | 8 | 7 |

| Roseau | 4 | 5 | 6 | 4 | 3 |

| Scott | 30 | 32 | 33 | 31 | 30 |

| Sherburne | 40 | 42 | 44 | 41 | 40 |

| Sibley | 10 | 12 | 13 | 11 | 10 |

| St. Louis | 50 | 52 | 54 | 51 | 50 |

| Stearns | 45 | 47 | 49 | 46 | 45 |

| Steele | 15 | 17 | 18 | 16 | 15 |

| Stevens | 20 | 22 | 23 | 21 | 20 |

| Swift | 5 | 6 | 7 | 6 | 5 |

| Todd | 10 | 12 | 13 | 11 | 10 |

| Traverse | 7 | 8 | 9 | 8 | 7 |