Best & Worst Credit Scores by State in 2025 (See How Your State Ranks)

Curious about how your state ranks? Our guide on the best & worst credit scores by state reveals that Minnesota leads with an impressive average credit score of 721. Discover how the average credit card score by state impacts your financial health and explore ways to boost your credit.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

Curious about how your state stacks up in terms of credit scores? Our comprehensive guide on the best & worst credit scores by state reveals key datapoints, such as Minnesota’s leading average score of 721. Find out which states excel in credit and how it affects insurance rates. This guide also highlights top-rated companies for the best rates.

- Minnesota has the best credit score by state

- Credit scores affect auto insurance rates and coverage

- Use our tool to compare auto insurance quotes and save money

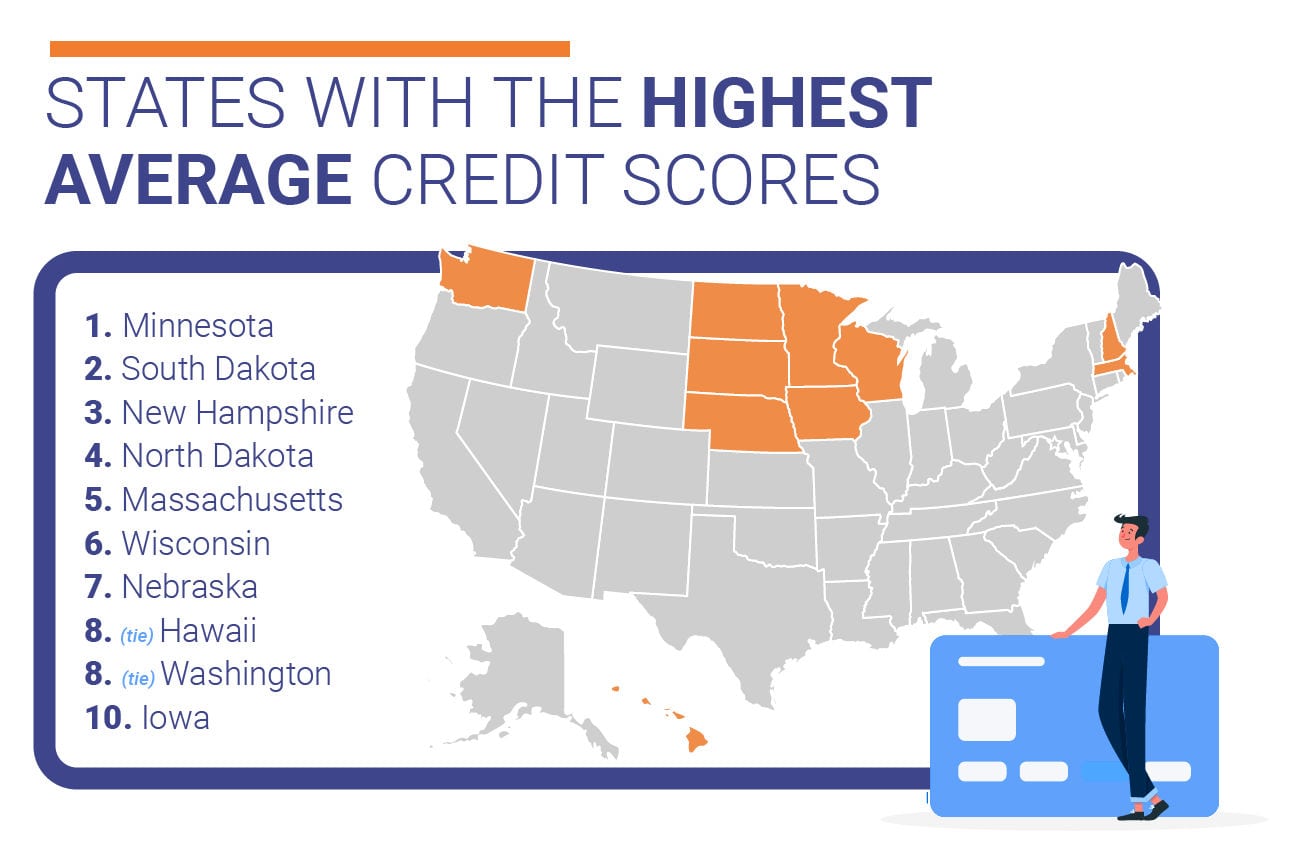

States with the Highest Average Credit Scores

For the most part, the highest credit scores in the United States are concentrated in the Midwest and Northeast, as well as along the West Coast.

In the table below, we’re providing the states with the highest average credit scores based on an average of their mean FICO scores and VantageScores.

Average FICO, VantageScore, and Overall Credit Scores: Best States

| State | FICO Score | VantageScore | Credit Score | Rank |

|---|---|---|---|---|

| Minnesota | 733 | 709 | 721 | 1 |

| South Dakota | 727 | 700 | 713.5 | 2 |

| New Hampshire | 724 | 701 | 712.5 | 3 |

| North Dakota | 727 | 697 | 712 | 4 |

| Massachusetts | 723 | 699 | 711 | 5 |

| Wisconsin | 725 | 696 | 710.5 | 6 |

| Nebraska | 723 | 695 | 709 | 7 |

| Hawaii | 723 | 693 | 708 | 8 (tie) |

| Washington | 723 | 693 | 708 | 8 (tie) |

| Iowa | 720 | 695 | 707.5 | 10 |

As you can see, six of the top 10 states for high credit scores can be found in the Midwest, which may surprise some people considering that salaries tend to be higher on the coasts.

But our research shows that people in the six states of the Midwest that make up the core of this list use less of their available credit and save more (a possibility given their lower cost of living).

Let’s take a closer look at each of these 10 states.

#10 – High Credit: Iowa

The Buckeye State starts off our list of the 10 states with the highest average credit score. Iowans have an average credit score of 707.5.

- FICO Score: 720

- VantageScore: 695

- Avg. Credit Score: 707.5

With such a good average credit score, that means Iowans from Davenport to Council Bluffs have quite a bit of purchasing power. As we already alluded to and will soon discuss further, credit histories can definitely affect your auto insurance rates.

Iowans with less-than-great credit should look to USAA, Geico, Farmers, or Progressive for their auto insurance. State Farm, is often not the cheapest auto insurance in Iowa for those with poor credit histories.

#8 (tie) – High Credit: Washington

With some of the nation’s highest average incomes in and around Seattle, it’s no surprise Washington state has some of the best average credit scores of any state.

- FICO Score: 723

- VantageScore: 693

- Avg. Credit Score: 708

The median household income in Washington is $74,073, which is well above the national median of $61,937. More good news for Washingtonians: They pay no state income tax.

With over 80,000 miles of roadways, many of them cascading through scenic areas, Washington state residents will want to have the best auto insurance in the Evergreen State.

What city has the lowest auto insurance rates in Washington? That honor goes to the coastal community of Port Townsend.

#8 (tie) – High Credit: Hawaii

We’re heading off the mainland for our next state with high credit scores: Hawaii. Hawaii residents see the same average credit scores across the board as Washingtonians.

- FICO Score: 723

- VantageScore: 693

- Avg. Credit Score: 708

Also like their West Coast neighbors, Hawaiians have a median household income—$80,212—that is well above the national average. This is good news, as Hawaii’s cost of living is 88 percent higher than the national average.

Thankfully, Hawaii has some reasonably cheap auto insurance rates for residents of all credit histories. State Farm tends to be the cheapest auto insurance company in Hawaii.

#7 – High Credit: Nebraska

Omaha’s hometown hero Warren Buffet isn’t the only guy around doing well. Nebraskans have the 7th highest average credit scores of any state, with an average credit score of 709.

- FICO Score: 723

- VantageScore: 695

- Avg. Credit Score: 709

With a low cost of living, Nebraskans’ access to credit can go a long way. Of course, Nebraska’s economy, like every state’s economy, has been hit hard by the coronavirus

Thankfully, Cornhuskers have some of the lowest average auto insurance rates across the country, as you can see in our guide to auto insurance in Nebraska.

#6 – High Credit: Wisconsin

The Badger State lands at the 6th spot in our countdown of the 10 states with the highest average credit scores.

- FICO Score: 725

- VantageScore: 696

- Avg. Credit Score: 710.5

Wisconsinites face a fairly average cost of living, 2 percent below the national average. And like their Iowa neighbors, residents of Wisconsin have below-average auto insurance rates.

#5 – High Credit: Massachusetts

Our 5th ranking takes us to the fairly wealthy New England state of Massachusetts. Residents in the Old Bay State have an average credit score of 711.

- FICO Score: 723

- VantageScore: 699

- Avg. Credit Score: 711

When the coronavirus hit, Governor Charlie Baker was one of the first governors across the nation to extend unemployment benefits to gig and contract workers.

Expanded unemployment insurance means that folks are better able to meet their financial obligations on time and thus protect their credit scores. That’s good news for drivers in Massachusetts, who have some of the highest auto insurance rates anywhere.

We can help you compare Massachusetts auto insurance, however, to find the best deal and coverage for you and your family at any credit level.

#4 – High Credit: North Dakota

It may surprise many people to see both Dakotas near the top of our list of states with the highest average credit scores. But with an average credit score of 712, North Dakota has certainly earned its position on this list.

- FICO Score: 727

- VantageScore: 697

- Avg. Credit Score: 712

North Dakotans have a cost of living that is more than 10 percent lower than the national average. This means that most North Dakotans are not overusing their credit on housing or other expenses that are more costly in other places across the nation.

What’s the cheapest auto insurance provider in North Dakota? For residents of the Peace Garden State who have a military connection, USAA will likely be the cheapest option; for those who don’t have a military connection, Allied will likely be the most affordable insurance option.

#3 – High Credit: New Hampshire

The largely rural New England state of New Hampshire lands in the 3rd spot on our list of the states with the highest average credit scores.

- FICO Score: 724

- VantageScore: 701

- Avg. Credit Score: 712.5

Like many of its New England neighbors, New Hampshire is taking a slow approach to reopening its economy during the coronavirus pandemic.

A slow reopen of the economy means residents need to pay particular attention to their financial obligations, from credit card payments to auto insurance rates, which can adversely affect their credit score.

Interesting fact: When it comes to mandatory minimum limits for forms of financial responsibility, New Hampshire is the only state that doesn’t require them. That means there are two primary ways to prove cheap auto insurance in New Hampshire:

- Simply buy coverage through an auto insurance company. Then keep a current insurance card or copy of the policy in your vehicle any time you drive.

- Deposit money or another form of financial security with the state treasurer’s office.

New Hampshire residents like their individuality, and that uniqueness extends to how they approach auto insurance.

#2 – High Credit: South Dakota

Like its northern neighbor, the state of South Dakota has some of the highest average credit scores anywhere in the United States.

- FICO Score: 727

- VantageScore: 700

- Avg. Credit Score: 713.5

From Sioux Falls in the east to Rapid City in the west, South Dakotans have a lot of financial prowess thanks to their high credit.

But that doesn’t mean South Dakotans want to spend more than necessary on auto insurance. That’s why we’ve gathered South Dakota auto insurance information and put it into a comprehensive guide.

#1 – State with the Best Credit: Minnesota

Topping our list of the 10 states with the highest average credit scores is the great state of Minnesota.

- FICO Score: 733

- VantageScore: 709

- Avg. Credit Score: 721

With an average credit score of 721—nearly 10 points higher than the next state—Minnesotans have a lot of spending power to visit their 10,000 lakes. Residents of the state also value saving money.

One perhaps surprising way for Minnesotans to save money on their tax bill? The Minnesota K-12 Education Credit.

Minnesota has 138,767 miles of roadway to get to all those lakes, and driving those beautiful roads will require you to have at least the minimum auto insurance required by the state.

Our research shows that Minnesotans travel primarily by car. In Minneapolis, 90 percent of trips are taken by vehicle, which means that even in a large city with public transit options, Minnesotans are choosing to drive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

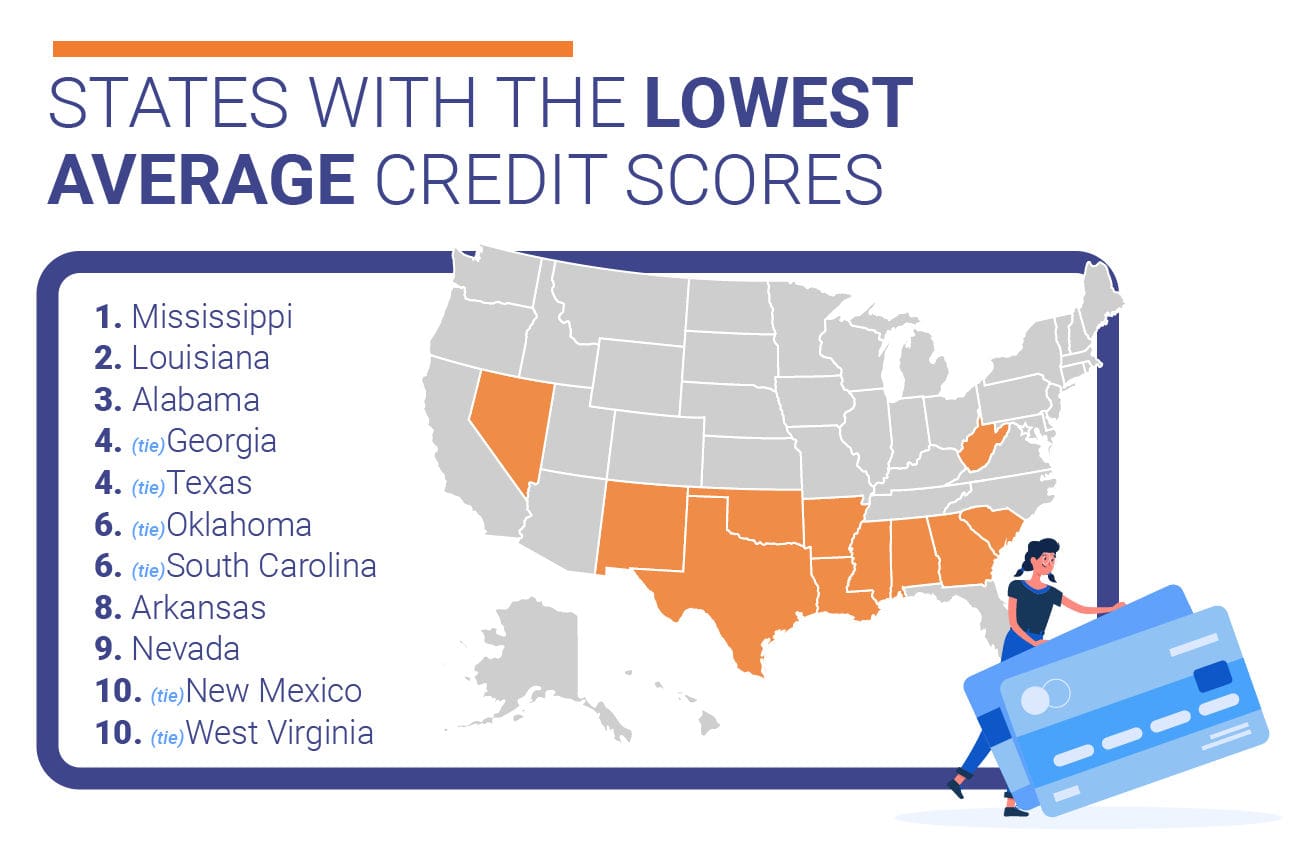

States with the Lowest Average Credit Scores

For the most part, the lowest credit scores in the United States are concentrated in the rural South. In the table below, we’re providing the states with the lowest average credit scores based on an average of their mean FICO scores and VantageScores.

Average FICO, VantageScore, and Overall Credit Scores: Worst States

| State | FICO Score | VantageScore | Credit Score | Rank |

|---|---|---|---|---|

| Mississippi | 667 | 647 | 657 | 1 |

| Louisiana | 677 | 650 | 663.5 | 2 |

| Alabama | 680 | 654 | 667 | 3 |

| Georgia | 682 | 654 | 668 | 4 (tie) |

| Texas | 680 | 656 | 668 | 4 (tie) |

| Oklahoma | 682 | 656 | 669 | 6 (tie) |

| South Carolina | 681 | 657 | 669 | 6 (tie) |

| Arkansas | 683 | 657 | 670 | 8 |

| Nevada | 686 | 655 | 670.5 | 9 |

| New Mexico | 686 | 659 | 672.5 | 10 (tie) |

| West Virginia | 687 | 658 | 672.5 | 10 (tie) |

As you can see, eight of these states with low credit scores can be found in the South. Many of these states face a large urban-rural divide that makes public support systems, especially during a time like the global COVID-19 pandemic, hard to facilitate.

Let’s take a closer look at each of these 10 states.

#10 (tie) – Low Credit: West Virginia

Beginning our list of the states with the lowest average credit scores is wild and wonderful West Virginia with an average credit score of 672.5.

- FICO Score: 687

- VantageScore: 658

- Avg. Credit Score: 672.5

With a median household income of just $45,392 and a poverty rate of 16.6 percent, West Virginians have a long history of problems securing credit. It’s also a mountainous state with a population that is largely rural.

Those mountain roads require certain standards of protection, which we cover in our guide to West Virginia auto insurance.

#10 (tie) – Low Credit: New Mexico

Tied with West Virginia for the 9th spot on our list is New Mexico, one of two Western states with some of the lowest average credit scores in the nation.

- FICO Score: 686

- VantageScore: 659

- Avg. Credit Score: 672.5

New Mexicans face a potentially devastating economic hardship under the global coronavirus pandemic.

As the coronavirus threatens to come back in full force this fall and winter, it’s important for New Mexicans to monitor and protect their credit scores.

We can also help residents of the Land of Enchantment find and save money on the right auto insurance for them and their families. In general, USAA and State Farm are the cheapest auto insurance companies in New Mexico.

#9 – Low Credit: Nevada

Moving north from New Mexico, we land in Nevada for the state with the 8th lowest credit scores.

- FICO Score: 686

- VantageScore: 655

- Avg. Credit Score: 670.5

The median household income in Nevada, $56,505, is below the national average and Nevadans face some of the highest home foreclosure rates in the United States, especially in the continuing wake of the 2008 housing crisis.

#8 – Low Credit: Arkansas

The Natural State holds the 7th spot in our list of the states with the lowest average credit scores.

- FICO Score: 683

- VantageScore: 657

- Avg. Credit Score: 670

Arkansas has a low median household income, $48,829, and a relatively high poverty rate at 15.6 percent. A largely rural state, Arkansas also struggles to keep up with population growth when it comes to important public services like medical infrastructure.

This is especially a problem when it comes to public health pandemics like COVID-19.

A relatively small state physically, Arkansas still has 102,595 miles of roadway. Our comprehensive Arkansas auto insurance guide can help Arkansans find the best coverage at a low price.

#6 (tie) – Low Credit: South Carolina

South Carolina ties for the 6th spot on our ranking of the states with the lowest average credit scores.

- FICO Score: 681

- VantageScore: 657

- Avg. Credit Score: 669

14.6 percent of South Carolinians live below the poverty line, nearly 3 percent more than the national average of 11.8 percent across the United States.

With so much of the state’s economy tied to the tourism industry, residents of the Palmetto State are especially at risk economically when pandemics like COVID-19 hit and keep travelers at home.

#6 (tie) – Low Credit: Oklahoma

Tying with South Carolina for the 6th spot on our ranking of the states with the lowest average credit scores, Oklahoma has not only low credit scores but also a 13.8 percent poverty rate.

- FICO Score: 682

- VantageScore: 656

- Avg. Credit Score: 669

Though Oklahoma is oil and natural resource-rich, the median household income there is still only $55,006. A resulting lack in public funding puts a strain on the state’s health care infrastructure. Oklahoma is also home to over 533,000 Native Americans.

Native American communities face a high risk of COVID-19, which exacerbates the economic issues the state already faces.

We’ve gathered the information Oklahomans need to make informed auto insurance decisions, beginning with Oklahoma’s auto insurance requirements.

With more than 3.5 million vehicles on Oklahoma’s roads, this information is essential for Sooners driving anywhere from Miami to Lawton.

#4 (tie) – Low Credit: Texas

With its growing cities and deep oil reserves, you might be surprised to see the Lone Star State tied for the 4th spot on our list of the states with the lowest average credit scores.

- FICO Score: 680

- VantageScore: 656

- Avg. Credit Score: 668

Though Texas does contain a lot of wealth, it is also a state divided. The Houston Chronicle reports that:

“Texas was one of just nine states in which the gap between rich and poor widened in 2018.”

Compounding this problem: Texas has some of the highest average auto insurance rates in the United States. As auto insurance experts, we’re here to help with our comprehensive guide, cheap auto insurance in Texas.

#4 (tie) – Low Credit: Georgia

Tying with Texas for the 4th spot on our ranking of the states with the lowest average credit scores, Georgia’s economic indicators are a mixed bag.

- FICO Score: 682

- VantageScore: 654

- Avg. Credit Score: 668

The state’s economy is quickly growing alongside the population, especially in the metro Atlanta area. But with a 14.3 percent poverty rate, the Peach State has a wide wealth gap, especially in rural areas of the state that lack access to regular medical care and other essential services.

Georgia was one of the first states to reopen its economy during the first wave of the COVID-19 crisis. But the question is, “Is the dollar more important than the lives of Americans, than the lives of our world?”

The coronavirus pandemic poses complicated questions when it comes to public health and the economy. But even if they are working from home or out of work, Georgians can find more affordable auto insurance.

So, who offers the cheapest auto insurance in Georgia? Most Georgians will find Geico to be their most affordable option.

#3 – Low Credit: Alabama

The three states with the lowest average credit scores are all located in the deep South, beginning with Alabama.

- FICO Score: 680

- VantageScore: 654

- Avg. Credit Score: 667

15.8 percent of Alabamans live below the poverty line, and the state’s median household income, $51,113, is well below the national average.

We know car insurance rates are affected by credit scores, and that’s one reason we created the guide cheap auto insurance in Alabama to help Alabamans explore their auto insurance options and to ultimately save money on coverage.

#2 – Low Credit: Louisiana

Louisiana lands in the 2nd spot on our ranking of the states with the lowest average credit scores.

- FICO Score: 677

- VantageScore: 650

- Avg. Credit Score: 663.5

The state was one of the hardest hit, both economically and health-wise, by the first wave of the coronavirus pandemic.

Since they took place before most places began restricting public movement, the state’s Mardi Gras celebrations are now believed to have been a breeding ground for COVID-19.

Another consideration compounding Louisianan’s financial wellbeing? The Pelican State is home to some of the highest auto insurance rates in the country. But don’t worry quite yet; we’re here to help you find more affordable coverage.

#1 – State with the Worst Credit: Mississippi

Topping our list of the states with the lowest credit scores among their residents is Mississippi.

- FICO Score: 667

- VantageScore: 647

- Avg. Credit Score: 657

In addition to topping our rankings based on low credit scores, Business Insider ranks Mississippi as the state with the lowest median household income of any state in the United States.

With a median household income of just $43,441, nearly 20 percent of Mississippians live below the poverty line. Low credit scores and incomes can make finding affordable auto insurance intimidating.

By this point, you might be wondering: How will my credit scores affect my car insurance rates? Let’s find out.

Understanding Credit Scores and Their Averages Across Different Demographics

Achieving the highest possible credit score can be a challenging but rewarding goal, as it opens doors to favorable interest rates and better financial opportunities. For many, striving for this perfect score contrasts sharply with those who struggle to build their credit. For example, a 467 credit score or a 500 credit score typically falls within the poor credit range, often limiting access to traditional financial products.

However, understanding how one’s credit score compares with the broader population can offer perspective. The average credit score by age varies significantly, with the average credit score at 21 being much lower than that of older individuals. Specifically, the average credit score by age 19 and the average credit score by age 21 often reflect the challenges of early financial management, as younger individuals have less experience with credit. In contrast, the average credit score by age 50 tends to be higher, reflecting decades of financial responsibility.

When analyzing the average credit card score by state or the average credit score by state, it becomes clear that regional differences play a significant role in credit health. For example, economic factors and access to financial education can influence the average credit score by income and even the average credit score by zip code.

States with stronger economies often see higher average scores, while areas with less financial stability may lag behind. Understanding these patterns can help individuals better navigate their credit journeys and work towards improving their scores over time.

How Credit Scores Affect Your Auto Insurance

We know that in most states, your credit scores are one of the factors that affect your insurance rates. But you might be surprised to see how much your credit score can affect your monthly auto insurance rate.

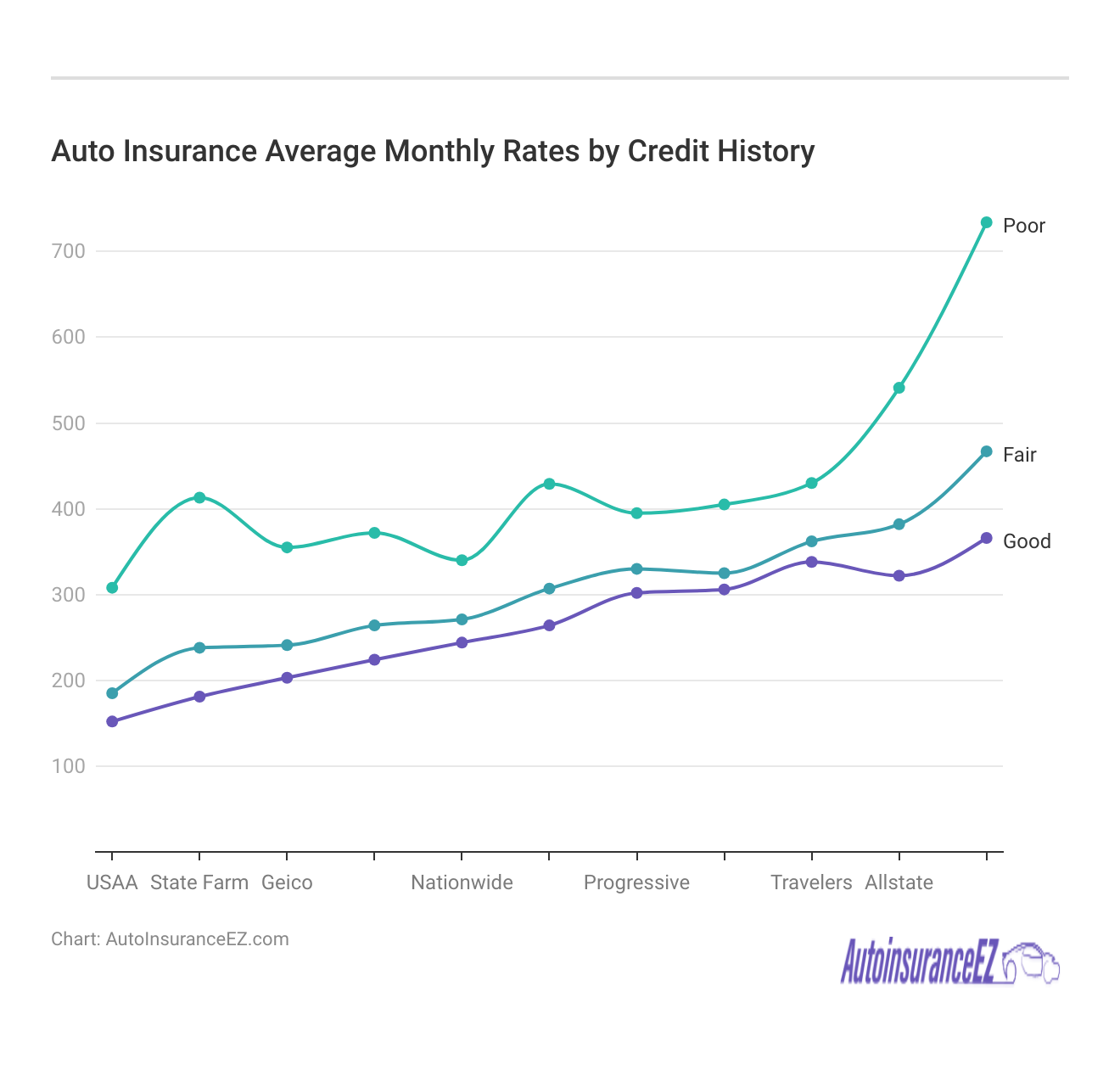

In the interactive graph below, you can explore how much more you can expect your auto insurance rate to be based on not only the insurance company but also your credit history.

As you can see, if you have poor credit, you end up paying a lot more for your auto insurance than if you have fair or good credit. In fact, the difference in auto insurance rates between someone with good credit and poor credit can be astronomical, oftentimes hundreds of dollars higher.

It’s why it literally pays to stay on top of your credit. Employing strategies like reducing credit card debt, working with credit repair companies, or financial advisors will not only mean the difference between higher and lower auto insurance rates, but it will also impact your financial stability as a whole.

Want to know more specifically what you can expect to pay for each auto insurer based on having a good, fair, or poor credit history?

In the table below, we provide the average monthly auto insurance rates for each of the 10 biggest insurers in the United States, as well as an overall average across all companies by credit history.

Bad Driving Record Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $152 | $185 | $308 | |

| $181 | $238 | $413 | |

| $203 | $241 | $355 | |

| $224 | $264 | $372 | |

| $244 | $271 | $340 |

| $302 | $330 | $395 | |

| $306 | $325 | $405 | |

| $322 | $382 | $541 | |

| $338 | $362 | $430 | |

| $366 | $467 | $734 |

| Average | $264 | $307 | $429 |

Our research shows that your credit history can actually determine which auto insurance provider is the most affordable for you.

For instance, if you have good or fair credit, State Farm or USAA (if you qualify for their insurance) will likely be your cheapest option. If you have a poor credit history, however, Geico will likely be more affordable.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

The Difference Between FICO Scores & VantageScores

Before we get to our rankings of the states with the highest and lowest overall credit scores, let’s take a brief look at the differences between the two credit reports we used to formulate these rankings: FICO scores and VantageScores.

The Fair Isaac Corporation debuted its FICO scoring system in 1989 and since then, it has dominated the credit scoring market. But as finance expert Barry Paperno explains, this may be changing:

“Over the last decade or so, FICO’s market dominance has been challenged by a newcomer called VantageScore. As the result of a collaboration between the three major credit reporting agencies (CRAs)—Experian, Equifax, and TransUnion—VantageScore uses similar scoring methods to FICO but with slightly different results.

Hitting the market in 2006, many economists and consumer advocates find the VantageScore to be fairer and a more accurate indicator of an individual’s financial prowess.

Both FICO and VantageScore use the same five criteria in determining your credit score:

- Payment history

- Length of credit

- Types of credit

- Credit usage

- Recent inquiries

Additionally, VantageScore uses a sixth criteria: Available credit. The main difference between FICO and VantageScores comes with how much weight each credit reporting system gives each of these five criteria.

In the table below, you can see how much weight is given to each criterion by the two systems.

Criteria for Credit Scores: FICO vs. VantageScore

| Criteria | FICO | VantageScore |

|---|---|---|

| Payment History | 35% | 40% |

| Length of Credit | 15% | 21% |

| Types of Credit | 10% | 11% |

| Credit Usage | 30% | 20% |

| Recent Inquiries | 10% | 5% |

| Available Credit | n/a | 3% |

One big difference in the two primary credit scores? FICO considers credit usage much more than VantageScore.

As you can see, the two credit reporting systems have only slight variations in their criteria for determining your credit score. And yet, these differences can lead to large differences in the scores you receive and the average credit scores of residents in each state.

Professionals Discuss Credit Scores & Financial Success

We asked a variety of relevant professionals such as financial advisors, investors, and auto industry insiders to weigh in on the issue of credit scores and financial literacy. Read on to find out some of the helpful advice they had to offer.

The scores are calculated by using a few different aspects of your credit history, including how responsibly you’ve paid borrowed money back. The scores are calculated by looking at:

- Payment history: This is the biggest chunk considered. They look to see that you always make payments on time.

- Credit utilization: Think of this as how much credit you use compared to how much is available. The lower the usage, the better.

- Length of history: This is how long you’ve been using credit.

- Recent applications: Submitting too many credit applications within a short period of time for new lines of credit could hurt your scores.

- Types of credit: They will look at what different types of credit you have, including credit cards, loans, and mortgages.

If you want to improve your credit scores, never spend money that you don’t have. In other words, if you can’t pay for something with a debit card at that moment, you shouldn’t pay it with a credit card.

To use a credit card most responsibly, pay your credit card in full each month.

Paying your balance in full each month helps you avoid interest, save money, and reduces the stress of missed payments. Credit builder loans can also improve your credit quickly. Remember, missed payments are the quickest way to hurt your credit score, so stay on top of monthly payments.

Post-pandemic, if your income or credit score has suffered, focus on building a budget that prioritizes paying off credit card balances and other loans. Include an emergency fund if possible, and avoid applying for too many credit cards, as this can lower your credit score.

Their goal is to empower people to use credit cards to their advantage, with confidence.

What are some ways people can monitor and protect their credit score, especially during the COVID-19 pandemic?

“Many businesses, from grocery stores to retail chains, have temporarily stopped accepting cash due to COVID-19 concerns. This means plastic becomes the payment norm for many Americans.

Anyone worried about the safety of constantly swiping at card terminals can consider setting up text or email alerts triggered after any transaction.

For example, anytime your card is used to make a purchase totaling more than $20, you receive a text from your bank. That text details the time of the transaction, the total amount, plus the location, whether in a physical store or online. This gives you instant visibility and 24/7 monitoring around card usage.”

Why are credit scores important? How are they used?

“Your credit score influences just about every major financial capability in life. This is because lenders use credit scores to assess the safety of giving you a loan.

According to lender models, your score indicates your likelihood and ability to pay them back on everything from car and student loans to home mortgages to your monthly credit card statements. Credit scores really do work like a game of dominos.

Understanding the best & worst credit scores by state is crucial; for instance, Minnesota's average score of 721 highlights the significant state-by-state differences in credit health.

Melanie Musson Published Insurance Expert

One move can positively or negatively trigger consequences down the line for years to come.”

How can people increase their credit score?

“The two foundations of building a credit score are having a credit usage history to begin with and making monthly credit payments on time.

- Start slow: You can boost your credit history by applying for a low-interest rate, cash-back credit card as soon as possible, ideally when you turn 18. Before then, ask to be an authorized user on a financially responsible family member’s credit card, which will help build your scores simultaneously.

- Pay on time: Second and just as important, ensure you’re making credit payments on time, in full, every single month. No carrying over balances or skimming by on credit card minimum payments. Paying on time and in full every month is age-old advice but it’s just essential right now for a solid credit score.”

What tips do you have for our readers about individual economic preparedness for a second wave of the COVID-19 virus outbreak?

“The best advice to prepare for financial hard times is to readjust your budget, spotting places you can lower non-essential or flexible expenses such as dining out, shopping, and even grocery bills.

The money you relocate away from disposable categories should go into one of two priorities: padding up your emergency fund or aggressively tackling debts. Both moves let you breathe a little if the second wave hits, causing economic trouble.

Remember that you’re only human. You can’t tackle every financial goal at once, from paying off student loans to building emergency funds to buying a new car to saving for a dream trip. More importantly, you shouldn’t be prioritizing these things equally.

We should all take a deep breath and be a little gentler with ourselves in these tricky times.”

His website provides policy quotes from independent life insurance providers.

“Are your credit card balances keeping you up at night? Do you feel like you’re drowning in debt? If so, know that you are not alone. A report from the Federal Reserve found that Americans have roughly $1.08 trillion in revolving debt—credit cards included.

Paying back your credit card debt isn’t nearly as easy as getting into it, but there are reliable strategies for paying down your debt.

All you need is a solid plan, some dedication, and discipline so that you can successfully work toward freeing your mind of financial stress once and for all.

The first step to paying off credit card debt is finding out just how much debt you are in. You can’t win the race if you don’t know where the starting line is.

How do you achieve this?

Make a list of all your credit cards, their interest rates, balance, and minimum payments. Now ask yourself, how important are quick wins to your motivation? Be honest with yourself. It’s okay to need a quick win to keep you going strong.

Once you’ve done this you have two options:

Option 1: Get the best bang for your buck and use the debt avalanche method.

Sort your credit cards from highest interest rate to lowest interest rate and pay off the high-interest rate cards first. To do this, pay the minimum payments on all of your cards and any extra money you have should go towards paying off the highest interest card.

Once you’ve paid that off, move down the list and focus on paying off the next highest interest rate card. Keep going until you are debt-free.

Option 2: Celebrate quicker wins to keep you motivated by using the debt snowball method.

Sort your credit cards from smallest balance to largest balance, regardless of interest rates, and pay off the card with the smallest balance first. To do this, pay the minimum payments on all of your cards and any extra money you have should go towards paying off the card with the smallest balance.

Once you’ve paid that off, celebrate your win (in a free way), move down the list, and focus on paying off the next smallest balance card. Keep going until you are debt-free. Both options will get you to where you want to go as long as you stick to the plan. You know yourself best—choose the one that fits your personality and get started.

If you want to reduce your interest payments to help you get debt free faster, find a new card that will allow you to do a balance transfer from a high-interest rate card on to a low-interest rate card.

Don’t forget about cards that have an interest free introductory period and make sure to read the fine print and see if there are any balance transfer fees.

You know yourself best. Choose the payoff method that best suits you and fits your personality and get started on the road to debt-free living.”

She is a certified financial educator who helps people earn financial freedom.

“An easy way for you to protect your credit score is to pay your debts on time. Paying the minimum payment is better than nothing because missed payments can impact your score negatively for some time. Only apply for the credit you need.

The fewer credit attempts you have on your file, the easier it will be for you to be accepted for credit in the future.

Your credit score is important because this score affects your eligibility for credit. Having a good score will show creditors that you are sensible with money and that you are not a high-risk debtor.

Credit scores can fluctuate month by month, so for those who are wanting to increase theirs, I would advise them to use their available credit regularly and pay off balances in full at the end of the month as this will boost their score.

FICO uses a 45-day span whereas VantageScore focuses on a 14-day span. FICO and VantageScore penalize all creditors for hard searches, but VantageScore will also judge you harder if you’re late paying your mortgage. FICO treats all payments the same.

I feel it does matter if you fall or miss a mortgage payment because you are at risk of losing your home, so I understand why VantageScore is harder on these types of missed payments.

My advice for all those who are affected by the COVID-19 virus outbreak: Keep up with your payments if you are able but as soon as you are aware of any potential financial difficulties, speak with your credit lenders.

They are there to help in these types of situations. Don’t apply for credit you don’t need right now; only apply when you need it.”

His company gives car repair lessons and reviews auto parts and products.

Why are credit scores important? How are they used?

“A credit score reflects the ability to repay debt. This is crucial as it provides lenders a quick, objective measurement of the credit risk.

Your credit score will affect how easily you can rent an apartment, get a mortgage, make big-ticket purchases, take out a loan, or even get hired in some industries.”

How can people increase their credit score?

“There are five main factors of your credit score:

- Payment history

- Credit indebtedness

- Time in file

- The pursuit of new credit

- Credit use

The biggest factor to achieve a perfect credit score is your track record of making your payments on time. However, you also need to ensure that your credit utilization rate does not exceed 30 percent.

Additionally, try to diversify your credit account as this will show that you can handle a reasonable mix of debt obligations.

Try not to apply for credit frequently, particularly if you get denied. Finally, don’t open too many accounts, as new accounts can negatively impact the average length of your credit history.”

What are the differences between FICO and VantageScores? Do they matter? “The three credit bureaus—Experian, TransUnion, and Equifax—have created a scoring model with the aim of competing with FICO and VantageScore.

Both of these use data obtained from consumer credit reports to generate a credit score, but the categories don’t have the same influence.

For example, payment history carries more weight on a Vantage score, but your current debt level is more significant with the FICO model.

Additionally, FICO requires at least one account reported and six months of credit history, VantageScore only requires one month of history, and one account reported in the past two years.

Unlike VantageScore, FICO also creates industry-specific scores that can help predict the ability to repay specific types of debt. For the average consumer, there is no big difference between the two.

However, differences can matter in specific situations. For example, if you’re trying to establish your credit, but don’t have a long history.”

What tips do you have for our readers about individual economic preparedness for a second wave of the COVID-19 virus outbreak?

“While everyone’s circumstances are different, there are few key tenets that people should adhere to in almost every situation. The first is the importance of having an emergency fund. This is money you set aside to use in an emergency.

If you lose your job, this will provide funds to live on for a period until your circumstances change. The next is to try to minimize your debt as much as you can.

This means paying off credit cards, car loans, and other debt. This will relieve some of the pressure if a second wave begins, and your paycheck starts to get squeezed.”

His site provides over 50,000 monthly readers with advice on investing and personal finance.

What are some ways people can monitor and protect their credit score, especially during the COVID-19 pandemic?

“Federal law ensures that you have free access to your credit report through AnnualCreditReport.com. Usually, this is limited to once per year, but during COVID-19, you can access free weekly reports through April 2021 on this site.

You won’t get a score here. To get a free score, first look to your bank. If you have a credit card, most major banks will give you your FICO score for free once each month, without signing up for other services.

You can also get a free score from many different consumer finance sites (although they will email you a lot) such as Credit Karma, Credit Sesame, and WalletHub.”

Why are credit scores important? How are they used?

“Credit scores are important because they are used whenever you take out a loan and for many other utility accounts. When you get pay TV or a new cell phone your score will be checked and if poor, a deposit may be required.

When applying for any type of loan, your score will impact whether you are approved, as well as the cost of the loan.

You might still be able to get a car loan with a lower score, but it will cost you a higher interest rate, making the total cost of the car higher.”

What is a good credit score?

“A good credit score is anything over 720 typically, with scores over 800 considered excellent.”

How can people increase their credit score?

“Increasing your score takes time, and there are no shortcuts. To increase your score you need to acquire some credit, make consistent on-time payments, and use your credit wisely.

In addition to ensuring you always make at least your minimum payment and pay on time, try to use less than 30 percent of your available credit card limits. The more on-time payments you make and the longer your credit history, the higher your score.

You should also review your report carefully. If you see anything inaccurate, file a dispute with the credit bureau right away—if you can remove negative items it will help.”

What are the differences between FICO and VantageScores? Do they matter? “FICO scores are the most used by lenders and are the most important score. FICO is calculated by a company called Fair Isaac using information from one of your reports from one of the three bureaus (TransUnion, Experian, or Equifax).

There is also more than one FICO scoring algorithm. Some top out at 850 and others at 900. If you apply for a car loan, mortgage, or credit score you will most likely have a FICO used. In addition, only a bank can give you your FICO.

The free score sites mentioned above all provide VantageScores. The VantageScore is a scoring model that is a joint venture between the three bureaus.

These also score up to 850, but Vantage Scores are usually a bit lower than FICO’s and also are more influenced by certain factors, such as credit utilization, than FICO. It’s good practice to look at both, some lenders are now using VantageScores.”

What tips do you have for our readers about individual economic preparedness for a second wave of the COVID-19 virus outbreak?

“The best way to prepare economically is to ensure you have a cash cushion. If you are having trouble paying your bills, find out what local programs exist for rent help or nationally for mortgage forbearance.

Don’t let a lender bully you. If you have a bit of cash on hand at all times (ideally one to two months, but at least $500) you can avoid missing payments or taking out a bad loan if things change suddenly. Now is the time to conserve cash until we see how things play out.”

Matthew Goldman is the founder of the credit card for wine lovers, the Grand Reserve.

Wine enthusiasts can earn points while they shop through their loyalty program.

What are some ways people can monitor and protect their credit score, especially during the COVID-19 pandemic?

“There are a few ways you can monitor your credit score for free. Through its Credit Scorecard website, for example, Discover lets you check your Experian FICO score at no cost. And certain banks and credit unions offer complimentary FICO scores to their customers.

You can also sign up with specialized services, such as MyFICO.com, that let you check your FICO scores from one to three bureaus.”

Why are credit scores important? How are they used?

“Your credit score is important because it’s a crucial factor lenders use when deciding whether to approve you. Basically, it indicates how responsibly you manage credit.

Lenders always want to be paid back, so they prefer to work with lower-risk applicants who have high credit scores.”

How can people increase their credit score?

“The most important things you can do to increase your credit score is make your bill payments on time and keep your credit utilization low. Together, these factors make up a significant 65 percent of your FICO score.

To keep your payment history on track, consider setting up automatic payments. This will ensure you never miss a due date. Beyond this, getting your payments right is a straightforward—even boring—process.

If you consistently pay on time over a long period, you’ll steadily see an increase in your credit score.

Credit utilization is a fancy phrase, but it’s very simple: It means how much of your total credit you’re using. If your credit limit is $1,000 and you’re using $500 of it, your credit utilization is 50 percent.

To protect your credit score, consider keeping your credit utilization under 30 percent. This isn’t a hard-and-fast rule, but rather a good guideline that will help you keep your finances on track.”

What are the differences between FICO and VantageScores? Do they matter? “Your FICO score is a three-digit number issued by the Fair Isaac Corporation. Meanwhile, your VantageScore is a three-digit number issued jointly by the three major credit bureaus. Both measure how responsibly you manage credit, but they’re not the same.

Most lenders use your FICO score when making approval decisions. Many fewer lenders use VantageScores, though this score has been gaining steam in part because of strong marketing to consumers.

The two scores don’t share identical contributing factors, but they have a few similarities. For example, payment history and credit utilization both carry significant weight. Before applying with a lender, it’s helpful to know which score it uses.

You can either ask your lender or search online to learn from the experiences of knowledgeable credit users.”

What tips do you have for our readers about individual economic preparedness for a second wave of the COVID-19 virus outbreak?

“The fundamentals of personal finance apply during COVID-19 as much as ever. Keep spending low, put money into savings, and protect your credit score—even if you’re not in dire need at the moment.

You never know when you’ll need to leverage your score to apply for credit cards or funding, and it’s always a good idea to have cash on hand to pay your bills during tough times.”

Finder helps users navigate complex insurance and financial decisions.

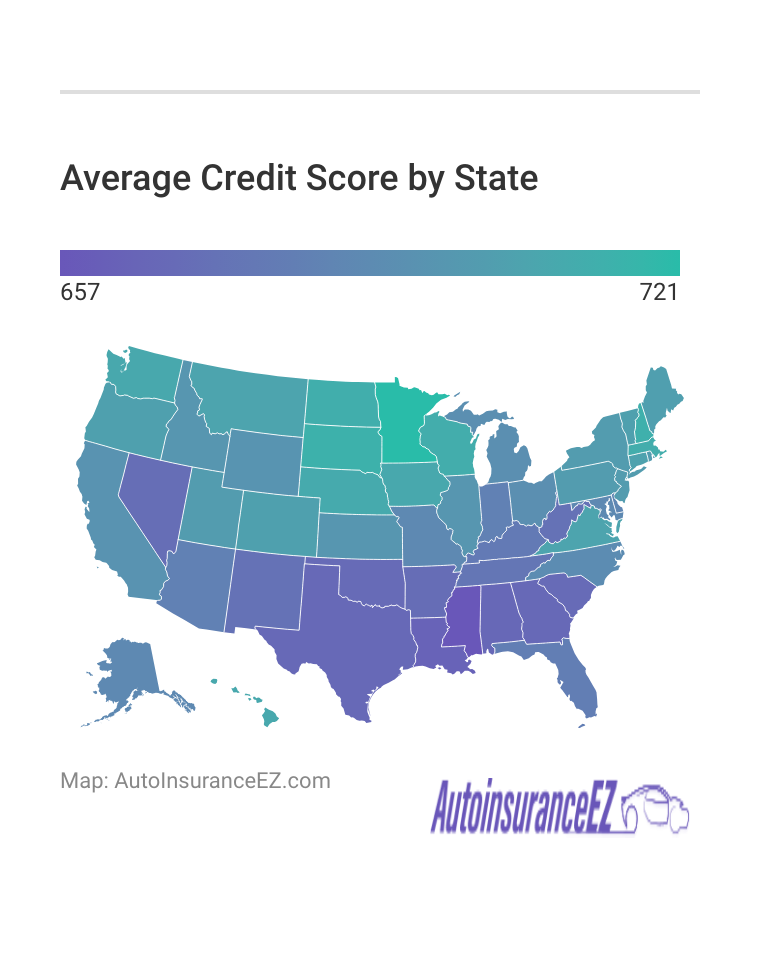

Complete Rankings: Average Credit Scores by State

In the table below, we’re providing the complete state rankings for average credit scores based on an average of mean FICO scores and VantageScores.

The list begins with Minnesota, the state with the highest average credit score, and ends with Mississippi, the state with the lowest average credit score.

Average FICO, VantageScore, and Overall Credit Scores: All 50 States + D.C.

| State | FICO Score | VantageScore | Credit Score | Rank |

|---|---|---|---|---|

| Minnesota | 733 | 709 | 721 | 1 |

| South Dakota | 727 | 700 | 713.5 | 2 |

| New Hampshire | 724 | 701 | 712.5 | 3 |

| North Dakota | 727 | 697 | 712 | 4 |

| Massachusetts | 723 | 699 | 711 | 5 |

| Wisconsin | 725 | 696 | 710.5 | 6 |

| Nebraska | 723 | 695 | 709 | 7 |

| Hawaii | 723 | 693 | 708 | 8 (tie) |

| Washington | 723 | 693 | 708 | 8 (tie) |

| Iowa | 720 | 695 | 707.5 | 10 |

| Virginia | 709 | 702 | 705.5 | 11 |

| Montana | 720 | 689 | 704.5 | 12 |

| Connecticut | 717 | 690 | 703.5 | 13 |

| Colorado | 718 | 688 | 703 | 14 (tie) |

| Oregon | 718 | 688 | 703 | 14 (tie) |

| Vermont | 726 | 680 | 703 | 14 (tie) |

| Maine | 715 | 689 | 702 | 17 |

| New Jersey | 714 | 686 | 700 | 18 (tie) |

| New York | 712 | 688 | 700 | 18 (tie) |

| Pennsylvania | 713 | 687 | 700 | 18 (tie) |

| Rhode Island | 713 | 687 | 700 | 18 (tie) |

| Utah | 716 | 683 | 699.5 | 22 |

| Idaho | 711 | 681 | 696 | 23 (tie) |

| Illinois | 709 | 683 | 696 | 23 (tie) |

| Kansas | 711 | 680 | 695.5 | 25 |

| Wyoming | 712 | 678 | 695 | 26 |

| California | 708 | 680 | 694 | 27 |

| Michigan | 706 | 677 | 691.5 | 28 (tie) |

| Ohio | 705 | 678 | 691.5 | 28 (tie) |

| North Carolina | 694 | 686 | 690 | 30 |

| Maryland | 704 | 672 | 688 | 31 (tie) |

| Missouri | 701 | 675 | 688 | 31 (tie) |

| Alaska | 707 | 668 | 687.5 | 33 (tie) |

| District Of Columbia | 703 | 672 | 687.5 | 33 (tie) |

| Delaware | 701 | 670 | 685.5 | 35 |

| Indiana | 699 | 667 | 683 | 36 |

| Arizona | 696 | 669 | 682.5 | 37 |

| Florida | 694 | 668 | 681 | 38 |

| Kentucky | 692 | 663 | 677.5 | 39 |

| Tennessee | 690 | 662 | 676 | 40 |

| New Mexico | 686 | 659 | 672.5 | 41 (tie) |

| West Virginia | 687 | 658 | 672.5 | 41 (tie) |

| Nevada | 686 | 655 | 670.5 | 43 |

| Arkansas | 683 | 657 | 670 | 44 |

| Oklahoma | 682 | 656 | 669 | 45 (tie) |

| South Carolina | 681 | 657 | 669 | 45 (tie) |

| Georgia | 682 | 654 | 668 | 47 (tie) |

| Texas | 680 | 656 | 668 | 47 (tie) |

| Alabama | 680 | 654 | 667 | 49 |

| Louisiana | 677 | 650 | 663.5 | 50 |

| Mississippi | 667 | 647 | 657 | 51 |

Though not all states could make our rankings here, every state has some important information to consider when it comes to the credit of its residents.

Virginia, for instance, has average credit scores for both FICO and VantageScore over 700. Only three other states, all of which made our top 10, can lay claim to such an honor.

We hope you enjoyed this article on the state of our credit scores across the United States and that the information we shared here arms you with the right information to make proactive financial decisions for you and your family.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Methodology: Ranking the States by Credit Score

We analyzed over 7,500 data points from all 50 states and the District of Columbia to determine the average credit score for each state, using data from FICO, VantageScore, the U.S. Consumer Financial Protection Bureau, and the Federal Reserve Board.

Given the economic impact of COVID-19, it’s crucial to protect and improve your credit score. Experts suggest monitoring your credit closely during this time. Credit scores can significantly impact your auto insurance rates, as insurers view lower scores as higher risk. Regardless of your credit score, you can save by using our free quote generator to find the best rates in your area.

Frequently Asked Questions

Can I get a copy of my credit report?

Yes, you are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. You can request it through AnnualCreditReport.com.

Do insurance quotes hurt your credit score?

No, getting insurance quotes does not hurt your credit score. Insurers perform a soft inquiry, which doesn’t affect your credit.

Do medical bills sent to collections affect your credit score?

Yes, medical bills that are sent to collections can negatively impact your credit score, especially if they remain unpaid.

Do you need good credit for car insurance?

While you don’t need good credit to get car insurance, your credit score can affect your premium rates, as many insurers use credit-based insurance scores to determine pricing.

Does Allstate use credit scores?

Yes, Allstate uses credit scores as part of their underwriting process to help determine insurance rates.

Does car insurance build credit?

No, paying car insurance does not build credit. Car insurance payments are not reported to credit bureaus unless you fail to pay and your account goes to collections.

Does credit score affect car insurance with Geico?

Yes, Geico uses credit-based insurance scores to help determine your premium rates.

Does credit score matter for car insurance?

Yes, your credit score can influence your car insurance rates, as many insurers consider it when calculating premiums.

Does Experian show your FICO score?

Yes, Experian offers access to your FICO score through various services, including free credit score tools and premium subscriptions.

Does getting an insurance quote hurt your credit score?

No, getting an insurance quote involves a soft inquiry, which does not affect your credit score.

Does Liberty Mutual check credit scores?

Yes, Liberty Mutual uses credit-based insurance scores as part of their pricing and underwriting process.

Does paying car insurance monthly affect your credit score?

Paying car insurance monthly does not directly affect your credit score unless you miss payments and your account goes into collections.

Does Progressive use credit scores?

Yes, Progressive uses credit-based insurance scores to help determine your premium rates.

Does your spouse’s credit score affect yours?

No, your spouse’s credit score does not directly affect your own credit score. However, joint accounts or loans can impact both of your credit scores.

Does State Farm use credit scores?

Yes, State Farm uses credit-based insurance scores as part of their underwriting process to determine premium rates.

Does USAA offer free credit score access?

Yes, USAA offers free access to your VantageScore through its CreditCheck service.

How often does the FICO score update?

Your FICO score updates whenever the credit bureaus receive new information, typically once a month.

How can I boost my TransUnion score quickly?

To boost your TransUnion score quickly, pay down credit card balances, avoid new credit inquiries, and ensure all payments are made on time.

How do I cancel my TransUnion membership online?

To cancel your TransUnion membership online, log into your account and follow the cancellation instructions under your account settings.

How do I check my Equifax business credit score?

You can check your Equifax business credit score by purchasing a business credit report directly from Equifax or through a business credit monitoring service.

How do I check my Experian credit score?

You can check your Experian credit score for free by signing up for Experian’s free credit score service or by purchasing a credit report through their website.

How long does it take for your credit score to go up after paying off debt?

It may take 1-2 billing cycles for your credit score to reflect improvements after paying off debt, though the exact timing can vary.

How low can your credit score go?

The lowest possible FICO credit score is 300.

What is a good credit score?

Before you learn the basics of the credit scoring industry, credit scores can be a mystery. But credit scores are not as hard to understand as you might initially think. According to credit reporting agency Equifax:

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What debt should I pay off first to raise my credit score?

In general, you want to pay off high-interest debts first. Credit cards generally carry the highest interest rates, followed by smaller loans such as personal loans or auto loans.

You might have heard the phrase “good debt” before and generally, good debt should be your last priority to pay off.

Why did my credit score drop after paying off debt?

Paying off debt is always a good thing, but sometimes it can actually lower your credit score a few points. Why? When you pay off a debt, it changes the account to an inactive status.

Fewer active accounts can often mean a lower credit score. Though remember, a bit lower credit score is better than continuing to pay high-interest payments.

Is it better to pay off your credit card or keep a balance?

Credit cards carry some of the highest interest rates of any type of credit out there, often in excess of 20 percent. Thus, it’s better to pay off your credit card than to keep a balance.

Paying off your credit card balances each month is also one of the best ways to increase your credit score.

How can I quickly raise my credit score?

Having a good credit score is a long game, not a short one. But there are ways you can quickly raise your credit score. Paying off collections, increasing your income to debt ratio, and even getting a secured credit card can all help raise your credit score quickly.

What financial resources are available during a pandemic?

Great question. During a pandemic like the current coronavirus, many people are furloughed or let go from employment while also facing increased medical and other incidental expenses.

Who had the highest average credit score by state for 2018?

In 2018, Minnesotans reigned supreme with an average Experian score of 713, followed by residents of South Dakota, Vermont, New Hampshire, and Massachusetts. The highest average credit score by state for 2019 also went to Minnesota, for the eighth year in a row, in fact.

What is the average credit score by state?

With all the states taken together, the average credit score is 703, which is a 14-point increase since 2010. This bodes well in a country where the residents have been accused of carrying too much debt, specifically credit card debt.

Which state has the best credit score?

The state with the best credit score is Minnesota, with residents having on average a credit score of 733. The 10 states with the best credit scores are spread out in-between the Northeast, Midwest, and West.

What is the average credit score for an American?

The average FICO score for Americans is 711, while the average VantageScore is 688. There are many ways Americans can improve their credit score, from paying down debt, receiving a debt consolidation loan, getting a secured credit card, and more.

What’s a good credit score for my age?

The credit scores of Americans tend to rise over time, signaling better and more responsible spending as people age, with also the possibility that as you grow older, your income streams become more secure. As an example, 30-39 year-olds have an average credit score of 673, while 60-year-olds and above have an average credit score of 749.

What is the average credit score in America?

The average credit score is a blend between the well-known FICO score and the VantageScore. In America, that score is 711 but varies a great deal with age. Younger people are more likely to have worse credit scores, whereas when people get older, their credit scores improve, possible due to better and more responsible spending habits but also due to better and more secure income streams.

How accurate is Credit Karma?

Credit Karma is considered accurate. However, it uses the VantageScore. Most companies are going to use the FICO score when looking at your credit.

What is the best credit score to buy a house?

Generally, to receive a conventional loan, you need to have a FICO credit score of at least 620. However, higher is better. The better your credit score is, the lower the interest rate you can receive on your loan or be approved for a larger amount. You can get a home loan with a credit score of less than 620 but you’ll need to go through government agencies to secure them.

What month is the best month to buy a home?

This depends a great deal on the area you are looking to buy a home in. In general, late summer or early fall is the bets time to buy a home as many people are looking to sell but prices are low.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.