Cheap Auto Insurance in Ohio for 2025 (Find Savings With These 10 Companies)

USAA, Geico, and American Family offer cheap auto insurance in Ohio from $16 per month, meeting Ohio's 25/50/25 liability coverage requirement. USAA gives 10% off for military vehicles on base only. Geico includes accident forgiveness after five clean years, and American Family provides savings for loyal customers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: May 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsThe top providers for cheap auto insurance in Ohio are USAA, Geico, and American Family, each offering smart, data-backed savings.

USAA gives 10% off when you garage your vehicle on base and rewards accident-free drivers with increasing discounts. Geico cuts costs with a 25% multi-vehicle discount and offers mechanical breakdown coverage that extends up to 7 years or 100,000 miles.

Our Top 10 Company Picks: Cheap Auto Insurance in Ohio

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $16 | A++ | Military Focus | USAA | |

| #2 | $23 | A++ | Affordable Rates | Geico | |

| #3 | $24 | A | Strong Coverage | American Family | |

| #4 | $25 | A++ | Extensive Options | Travelers | |

| #5 | $27 | A++ | Nationwide Presence | State Farm | |

| #6 | $33 | A+ | Competitive Pricing | Progressive | |

| #7 | $37 | A+ | Customizable Policies | Farmers | |

| #8 | $41 | A | Discounts Available | Liberty Mutual |

| #9 | $44 | A+ | Reliable Service | Nationwide |

| #10 | $46 | A+ | Well-Established Brand | Allstate |

American Family adds value through a $100 loyalty discount and lowers your deductible by $50 each year you stay claim-free. These features make them solid picks for Ohio drivers focused on long-term savings.

- USAA leads with military discounts and long-term driver savings

- Safe driving and usage tracking lower Ohio insurance costs fast

- Loyalty, bundling, and claim-free perks cut Ohio premiums sharply

To lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

#1 – USAA: Top Overall Pick

Pros

- Exclusive Discounts: USAA offers up to 30% off in Ohio with SafePilot for consistent safe driving habits. See how USAA stands out in Ohio in our USAA auto insurance review.

- Base-Specific Savings: Ohio drivers who garage their vehicles on military bases receive a 10% premium reduction.

- Top Financial Stability: With an A.M. Best rating of A++, USAA provides unmatched claims reliability in Ohio.

Cons

- Eligibility Limits: Only military-affiliated individuals in Ohio can access USAA’s policies.

- Limited Agent Access: In-person agent support for Ohio members is minimal compared to larger carriers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Discount Stackability: Ohio drivers can combine up to 25% in multi-vehicle and federal employee discounts with Geico.

- Mechanical Breakdown Add-On: Ohio policyholders can extend repair coverage up to 7 years or 100,000 miles.

- Digital Efficiency: Geico’s mobile app offers full claims and ID management, helping Ohio users file faster. Discover Ohio policy options in our Geico auto insurance review.

Cons

- Sparse Local Agents: Some Ohio regions lack nearby agents, making in-person support harder to access.

- Credit Score Sensitivity: Drivers with lower credit scores in Ohio may see notably higher premiums despite discounts.

#3 – American Family: Best for Strong Coverage

Pros

- Deductible Diminishing Benefit: Ohio drivers earn $50 off annually for staying claim-free, up to $500. Explore further details on our American Family auto insurance review.

- Teen Safe Driver Program: Ohio families can reduce risk and premiums with monitored teen driving tools.

- Loyalty Cash Back: Returning policyholders in Ohio may qualify for a $100 renewal reward after one full term.

Cons

- Higher Starting Rates: Entry premiums in Ohio tend to be steeper before applying discounts.

- Limited Availability: Some rural areas in Ohio may have restricted access to policy options and in-person services.

#4 – Travelers: Best for Extensive Options

Pros

- IntelliDrive Savings: Ohio drivers using Travelers’ telematics can save up to 30% based on driving behavior.

- Package Discounts: Ohio residents can bundle home and auto to secure up to 13% off auto premiums. Explore Ohio bundling options in our Travelers auto insurance review.

- Strong Claims Reputation: Travelers maintains low complaint ratios in Ohio and ranks well in J.D. Power surveys.

Cons

- Rate Adjustment Risk: Aggressive braking or speeding tracked via IntelliDrive may raise rates in Ohio.

- Upfront Costs: Some customized coverages in Ohio require higher upfront payments than standard plans.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – State Farm: Best for Nationwide Presence

Pros

- Drive Safe & Save: Ohio users can save up to 30% with consistent low-risk driving via telematics. Find more Ohio driver discounts in our State Farm auto insurance review.

- Massive Agent Network: With hundreds of agents across Ohio, policyholders get quick, local assistance.

- Strong Financials: An A++ A.M. Best rating ensures State Farm remains reliable for Ohio claims handling.

Cons

- Few Specialized Add-ons: Ohio drivers may find limited choices for niche coverage like rideshare or OEM parts.

- SR-22 Price Impact: For high-risk drivers in Ohio, SR-22 filings with State Farm often trigger steeper rate hikes.

#6 – Progressive: Best for Competitive Pricing

Pros

- Snapshot Program: Progressive’s Snapshot program can lower Ohio premiums by up to 30% for low-risk driving behavior tracked via telematics.

- Broad SR-22 Support in Ohio: Offers fast digital filing for Ohio SR-22 drivers with DUI or major violations, helping them stay legally covered. Explore Ohio rate options in our Progressive auto insurance review.

- Name Your Price Tool for Ohio Drivers: This tool lets Ohio policyholders adjust coverages to match budgets, showing real-time rate impact.

Cons

- Rate Fluctuations: Progressive’s base rates in Ohio can rise significantly without consistent Snapshot data reporting.

- Limited Accident Forgiveness: Not all Ohio drivers qualify for accident forgiveness, especially after a recent claim.

#7 – Farmers Insurance: Best for Customizable Policies

Pros

- Signal App Incentives: The Farmers’ Signal app rewards Ohio drivers with up to 15% off for safe driving habits.

- Bundling Deals: Ohio customers save an average of 20% when combining auto and home policies under Farmers.

- OEM Coverage Option: Farmers in Ohio offers optional OEM replacement coverage for newer vehicles. Read more in our article, “Farmers Insurance Review.”

Cons

- Price Variability: Ohio premiums fluctuate widely by ZIP code, making consistency a challenge.

- Discount Limits: Some Ohio drivers may not qualify for preferred discounts like the mature driver credit.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Discounts Available

Pros

- RightTrack Savings: Liberty Mutual’s RightTrack offers up to 30% off in Ohio for safe drivers.

- Rental Car Reimbursement: According to our Liberty Mutual auto insurance review, Ohio policies include optional rental coverage up to $50/day with no mileage caps.

- 24/7 Claims Service: Liberty Mutual provides round-the-clock claims support for Ohio customers.

Cons

- Expensive Full Coverage: Ohio drivers report that Liberty Mutual’s full coverage policies can be costlier than regional insurers.

- Claim Satisfaction Gap: Ohio customer satisfaction ratings lag slightly behind national averages in claim resolution.

#9 – Nationwide: Reliable Service

Pros

- Vanishing Deductible: Ohio drivers earn $100 off their deductible for each year without an accident, up to $500.

- Multi-Policy Discount: Up to 25% off for Ohio residents bundling auto with renters or homeowners insurance.

- A+ Financial Strength: Nationwide’s A.M. Best rating ensures claim reliability for Ohio drivers. Read our Nationwide auto insurance review for more details.

Cons

- Higher Base Rates: Even with discounts, base premiums in Ohio may exceed some low-cost competitors.

- Telematics Delays: Some Ohio users report delays in SmartRide data updates, affecting timely discounts.

#10 – Allstate: Best for Well-Established Brand

Pros

- Drivewise Program: Ohio drivers can save up to 40% with Allstate’s Drivewise based on real-time driving behavior.

- Accident Forgiveness: Ohio customers get one accident waived from affecting rates after being accident-free for 3 years.

- New Car Replacement: Allstate offers Ohio drivers new car replacement for vehicles under two model years old. Explore further details on our Allstate auto insurance review.

Cons

- Costly Add-Ons: Add-on features like roadside or rental reimbursement in Ohio can drive up policy costs.

- Limited SR-22 Flexibility: Allstate’s SR-22 filing options are less competitive for high-risk Ohio drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Cheap Auto Insurance Coverage Rates in Ohio

USAA has the lowest rates, with $16 for minimum coverage and $41 for full coverage. Geico, Travelers, and American Family also offer cheap options, all under $65.

Ohio Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $120 | |

| $24 | $62 | |

| $37 | $96 | |

| $23 | $59 | |

| $41 | $106 |

| $44 | $114 |

| $33 | $85 | |

| $27 | $70 | |

| $25 | $63 | |

| $16 | $41 |

On the higher side, Allstate and Liberty Mutual go above $100. Each company shows how costs change based on the level of coverage a driver selects.

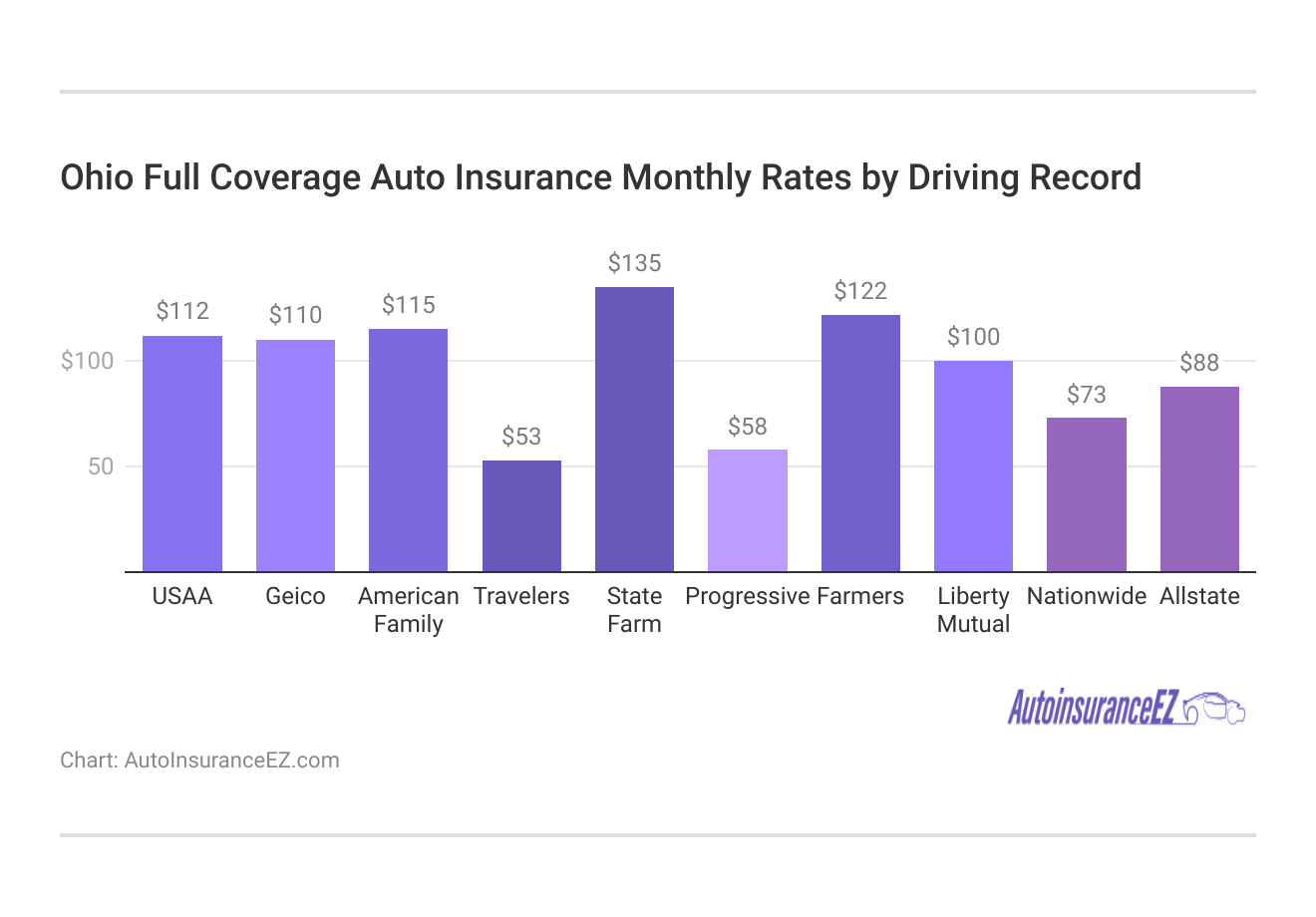

Full coverage auto insurance rates in Ohio change a lot depending on driving history. If you have a clean record, you pay the least for premiums. But if there are violations like tickets, accidents, or DUIs, the costs go up slowly but surely.

USAA and Geico often remain the most lenient of all insurance companies. At the same time, some other insurance companies make bigger price jumps after mistakes. These changes show how driving behavior affects the cost of insurance with different companies.

Read more: Cheap Car Insurance Rates

Cheap Auto Insurance Discounts in Ohio

Discount programs with Ohio insurers show how driving habits, combining policies, and even student grades can affect monthly costs. Tools like SmartRide and Snapshot reward safe driving behaviors.

Auto Insurance Discounts in Ohio by Savings Potential

| Company | Discount Type | Maximum Percentage |

|---|---|---|

| Vehicle Storage | 60% | |

| Multi-Policy | 25% | |

| Multi-Vehicle | 29% |

| IntelliDrive | 30% | |

| Drive Safe & Save | 30% | |

| Snapshot | 30% | |

| Good Student | 20% | |

| RightTrack | 30% |

| SmartRide | 40% | |

| Drivewise | 40% |

Companies such as USAA focus on special eligibility benefits. Each insurance company has its own ways to lower costs, whether by keeping a safe driving record or bundling different services. These variations can greatly affect the amount that drivers in Ohio end up paying.

Ohio’s insurance premiums are influenced by many moderate-risk factors. The weather can be unpredictable, and there is a lot of traffic in the cities and on highways. Because of this, insurance companies have to consider seasonal dangers and busy city roads when setting their rates.

Ohio Auto Insurance Premiums Report Card

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risk | B | Ohio experiences a variety of weather conditions, including snow, ice, and rain, which increase the risk of accidents. |

| Traffic Density | B | Ohio's traffic density is moderate, with major cities like Cleveland and Columbus seeing higher accident rates during peak hours. |

| Average Claim Size | C | The average claim size is impacted by the state's weather and traffic conditions, leading to a moderate increase in premiums. |

| Vehicle Theft Rate | C | Ohio has a moderate vehicle theft rate, particularly in urban areas, which contributes to the cost of insurance. |

| Uninsured Drivers Rate | D | Ohio has a relatively higher rate of uninsured drivers, which can result in more claims and higher premiums. |

The existence of drivers without insurance and constant vehicle thefts creates more unpredictability. Even though not very severe, these combined factors keep the pressure on premiums high. This makes a situation where rates seldom go low and risk is always nearby.

How to Save on Ohio Auto Insurance Discounts

Ohio drivers find savings through multiple discounts that reward more than just good driving records. Combining home and auto insurance, joining telematics programs, or storing a vehicle during the off-season all affect the final price.

Even good student grades can lower insurance costs. These discounts vary depending on the provider, but it is important to know which combination fits your life before your next renewal starts anew.

Read more: Automobile Liability Coverage

Car Insurance Coverage Options for Ohio Drivers

Ohio drivers deal with more than just basic liability. From fixing collision damages to covering theft, storm damage, and medical expenses, the different coverage choices change how protection works when needed. Here are the main options:

- Liability Insurance (Required): Covers bodily injury and property damage you cause to others in an accident. Ohio’s minimum limits are $2,083 per person, $4,166 per accident, and $2,083 for property damage.

- Collision Coverage: Pays for damage to your vehicle in a collision, regardless of who is at fault.

- Comprehensive Coverage: Covers damage from non-collision events like theft, vandalism, hail, or fire.

- Uninsured/Underinsured Motorist: Protects you if you’re hit by a driver with no insurance or too little insurance.

- Medical Payments (MedPay): Covers medical costs for you and your passengers after an accident, no matter who caused it.

- Optional Add-Ons: Includes roadside assistance, rental car reimbursement, and coverage for custom parts and equipment.

Add-ons like roadside assistance or rental reimbursement make each policy more tailored. Choosing wisely means following the rules and being prepared for unexpected troubles.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Ohio Minimum Auto Insurance Coverage Requirements

Ohio establishes its minimum liability requirement to cover only basic damages. Bodily injury liability insurance coverage helps both individuals and totals per accident, while property damage protection matches the same limit.

Ohio Minimum Liability Insurance Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

These numbers show only the legal minimum amount, no extra safety. Drivers who want to be financially secure usually look for more coverage because they know one bad accident could quickly exceed what the state allows as the minimum.

Since Ohio is an at-fault state, if you cause an accident, you are responsible for filing a claim with your insurance and covering any damages incurred by others.

Driving in Ohio Without Insurance

Auto insurance claims in Ohio cover many common problems. Rear-end crashes and fender benders happen most often, while side-swipes and single-car accidents increase repair expenses.

5 Most Common Auto Insurance Claims in Ohio

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collision | 29% | $3,500 |

| Fender Bender | 25% | $2,000 |

| Single Vehicle Accident | 20% | $4,000 |

| Side-Impact Collision | 15% | $3,800 |

| Theft Claim | 11% | $6,500 |

Theft, even though it does not happen often, brings a high financial cost. These events show how varied and expensive the risks can be. This makes both insurers and drivers need to manage amounts with unpredictability in their coverage plans. Multiple offenses can result in harsher penalties, including longer suspensions, higher fines, and significantly higher insurance premiums.

Read more: Factors That Affect Your Car Insurance Premium

High Risk Coverage Insurance

In Ohio, all drivers are required to have car insurance. Failing to do so may result in fines, license suspension, or the requirement to obtain an SR-22 insurance. SR-22 is classified as high-risk coverage, and motorists in Ohio are required to maintain it for a minimum of three years.

Premiums for high-risk drivers can double due to claim history. In particular, a reckless driving conviction can spike rates for five years or longer.

Daniel Walker Licensed Insurance Agent

SR-22 insurance may also be mandatory for drivers who have a DUI conviction, a history of reckless driving, a high number of points on their driving record, or who own a high-performance car. Enter your ZIP code to discover more.

Frequently Asked Questions

What is the cheapest car insurance in Ohio?

USAA car insurance is the cheapest company in Ohio, starting at $16 a month. Geico and American Family follow close behind with cheap car insurance in Ohio. Explore your options in how to cancel your USAA auto insurance policy.

How can you benefit from Erie car insurance in Ohio?

You can benefit from Erie car insurance in Ohio through low monthly rates, accident forgiveness, and a Rate Lock® feature that keeps your premium stable unless you make specific changes.

Where can you find car insurance quotes in Ohio for full coverage?

You can compare car insurance quotes in Ohio for full coverage online to find rates as low as $48 a month, with added protection like collision and comprehensive options. Get cheap auto insurance in Ohio when you use our online quote tool today.

Why should you consider Central Insurance for auto coverage?

You should consider Central Insurance for personalized service, flexible monthly billing, and solid coverage options that suit a wide range of Ohio drivers.

What makes State Farm car insurance in Ohio a strong choice?

State Farm car insurance in Ohio offers reliable agent support, safe driver discounts, and Drive Safe & Save™ rewards that can cut monthly rates by up to 30%. Explore telematics options now in the State Farm Drive Safe and Save or OnStar program review.

How can you get cheap car insurance in Ohio with an SR-22?

You can get cheap car insurance in Ohio with an SR-22 by comparing high-risk providers. Rates start under $60 a month from companies that specialize in nonstandard policies.

Is The General car insurance right for your needs in Ohio?

General car insurance is ideal if you need fast SR-22 filings or have a less-than-perfect record. It offers flexible monthly payments and quick online quote options in Ohio.

Who is cheaper, Geico or Progressive in Ohio?

Geico is generally cheaper than Progressive in Ohio, with monthly rates often starting under $50 for minimum coverage, depending on your ZIP code and driving record.

Is AAA insurance good in Ohio?

Yes, AAA auto insurance is a good option in Ohio if you want membership perks, roadside assistance, and competitive monthly rates with safe driver and loyalty discounts.

What is the lowest liability coverage in Ohio?

The lowest liability coverage in Ohio includes $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage, with monthly premiums starting around $30.

Can you get low-income car insurance in Ohio?

Yes, you can get low-income car insurance in Ohio by comparing state-minimum policies, usage-based programs, and providers offering monthly rates as low as $25. Enter your ZIP code to start discovering cheap auto insurance in Ohio.