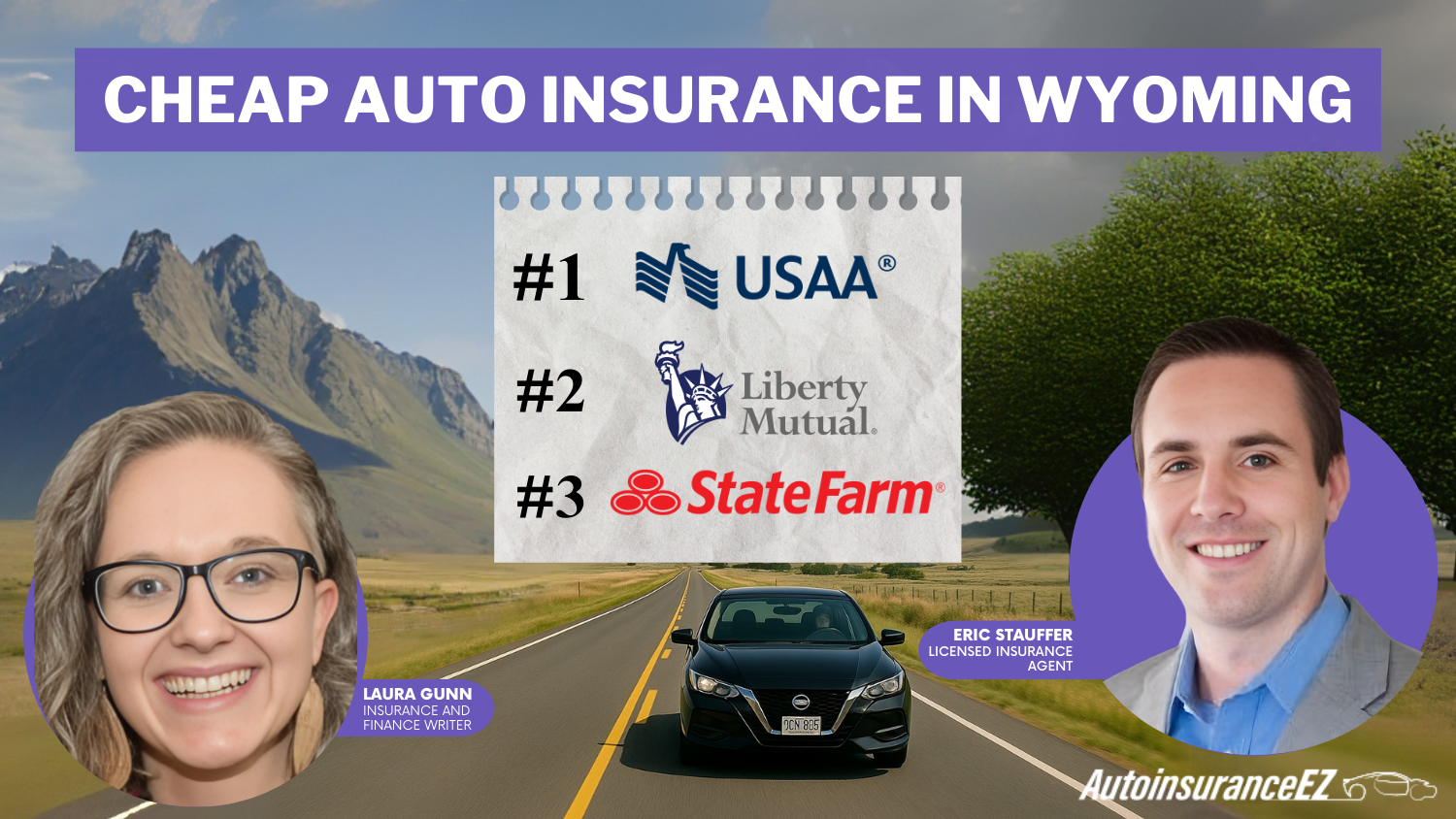

Cheap Auto Insurance in Wyoming for 2025 (Earn Savings With These 10 Companies)

For cheap auto insurance in Wyoming, USAA, Liberty Mutual, and State Farm are the best, with rates as low as $13 a month to meet 25/50/20 liability limits, USAA has strong claims satisfaction, while Liberty Mutual provides strong digital tools for easy policy management.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: May 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Liberty Mutual, and State Farm offer cheap auto insurance in Wyoming, with rates starting at $13 a month. USAA offers the cheapest and best car insurance in Wyoming, especially for military families, and has strong coverage across the state.

If you’re wondering, “How much is car insurance in Wyoming?” This article will help you understand your options by learning about the average car insurance costs in Wyoming and finding the best coverage for your needs.

Our Top 10 Company Picks: Cheap Auto Insurance in Wyoming

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $13 | A++ | Military Savings | USAA | |

| #2 | $17 | A | 24/7 Support | Liberty Mutual |

| #3 | $19 | A++ | Many Discounts | State Farm | |

| #4 | $25 | A++ | Accident Forgiveness | Travelers | |

| #5 | $26 | A+ | Innovative Programs | Progressive | |

| #6 | $27 | A++ | Custom Plan | Geico | |

| #7 | $28 | A | Student Savings | American Family |

| #8 | $23 | A+ | Usage Discount | Nationwide | |

| #9 | $30 | A | Local Agents | Farmers | |

| #10 | $36 | A+ | Add-on Coverages | Allstate |

Use this comprehensive Wyoming auto insurance guide to make informed decisions and save on your policy.

- USAA offers the cheapest rate for drivers with bad credit at $115 a month

- Progressive receives the highest total number of complaints from customers

- Wyoming drivers can get up to a 40% discount as good drivers

Just enter your ZIP code to compare up to 10 free auto insurance quotes from the leading providers in your area.

#1 – USAA: Top Overall Pick

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Pros

- Affordable Rates: USAA offers some of the cheapest auto insurance rates, especially for military members and their families. Learn more in our USAA auto insurance review.

- Military-Specific Coverage: Provides unique options like $75 a day vehicle storage discounts during deployment and coverage during international assignments.

- 97% Claims Satisfaction: Known for high customer satisfaction and quick claims processing, ensuring reliable coverage for Wyoming drivers.

Cons

- Eligibility: Access is limited to military members, veterans, and their families, restricting availability for other Wyoming residents.

- Availability: Fewer physical branch locations in Wyoming, which may make in-person service less convenient.

#2 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Customer Support: With Liberty Mutual, Wyoming drivers get round-the-clock help with claims and policy questions.

- Build-Your-Own Coverage: Offers 12 optional add-ons, including a $0 deductible glass repair and custom parts coverage up to $5,000. Learn more in our Liberty Mutual company review.

- Discount Variety: Features 17 different discounts, including 10% for the teaching profession and a 12% military discount for Wyoming residents.

Cons

- Conflicting Claims Reviews: A few policyholders have expressed dissatisfaction with the claims process.

- Limited Agent Support: This relies heavily on digital tools, which may not offer the personalized agent experience some drivers prefer.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#3 – State Farm: Best for Many Discounts

Pros

- Wyoming Agent Network: Maintains 37 local agents across the state, with at least one office within 30 miles of 92% of residents.

- Competitive Local Rates: Average premium of $105 per month in Wyoming, 5.4% below the state average.

- Financial Strength: Ensures reliable claims handling due to its solid financial foundation. Read more in our full review of State Farm’s auto insurance.

Cons

- Limited Discount Selection: Offers only 8 discount categories versus competitors’ average of 12-15 options.

- Dated Mobile Experience: App rated 3.2/5 stars, featuring fewer self-service options than competitors’ 4.5+ rated platforms.

#4 – Travelers: Cheapest for Accident Forgiveness

Pros

Pros

- Clean Record Pricing: Wyoming drivers with spotless records pay an average of $97 a month, 12.6% below the state average.

- Numerous Coverage Choices: Travelers offers a range of coverage choices, such as collision and comprehensive coverage. For more information, read our Travelers company review.

- Substantial Bundle Savings: Homeowners save an average of 22% when combining policies, the highest bundle discount in Wyoming.

Cons

- Claims Satisfaction Below Average: Some customers report dissatisfaction with the claims process.

- Limited Local Presence: Only 5 in-person agents serving Wyoming, with most customer service routed to out-of-state call centers.

#5 – Progressive: Cheapest for Innovative Programs

Pros

- Reasonably priced rates: Progressive is renowned for providing affordable rates, particularly for high-risk drivers. Our complete Progressive review goes over this in more detail.

- Snapshot Savings: Usage-based program provides average Wyoming discounts of $186 annually, with top safe drivers saving up to $325.

- Multi-Policy Discounts: Average 21% savings when bundling auto with home/renters insurance, with an additional 5% for adding RV coverage.

Cons

- Higher Rates for Clean Records: Safe Wyoming drivers pay approximately 12% more than the state average for similar coverage limits.

- Average Claims Experience: 73% satisfaction rate for Wyoming claims versus the industry average of 85%.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#6 – Geico: Cheapest Custom Plan

Pros

- Government Savings: Federal workers in Wyoming save an average of 18% on premiums versus standard rates. Learn more about its rates in our Geico auto insurance company review.

- Diverse Discount Programs: Offers 16 distinct discount categories, including 15% for military and 7% for federal employees common in Wyoming.

- Fast Claims Response: 87% of Wyoming claims receive an initial response within 24 hours, with settlements averaging 6.3 days.

Cons

- Limited In-Person Support: No dedicated Wyoming offices, with the nearest physical locations in neighboring Colorado and Utah.

- Inconsistent Customer Service: Wyoming customers report a 72% satisfaction rate versus an 85% industry average in recent surveys.

#7 – American Family: Best for Student Savings

Pros

Pros

- Safe Driver Incentives: Clean record discounts average 17% for Wyoming drivers, with a 5-year safe driving history earning up to 25% off.

- Discount Opportunities: Offers significant savings with discounts for bundling home and auto insurance, safe driving, and more, ideal for those seeking cheap coverage in Wyoming.

- Strong Local Agent Support: Wyoming drivers benefit from personalized support through the American Family’s local agent network.

Cons

- Limited Online Tools: Less advanced digital platforms may hinder online policy management for tech-savvy users.

- Restricted Discount Availability: Some discounts may not apply in Wyoming, limiting savings opportunities. Find out more about its discounts in our American Family review.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Usage Discount

Pros

- Variety of Coverage: Nationwide provides various coverage choices, such as vanishing deductibles and accident forgiveness. You can learn more in our Nationwide auto insurance review.

- Annual Policy Reviews: “On Your Side” assessments identify an average of $157 in potential savings for Wyoming customers each year.

- Superior Financial Security: $46.7 billion in assets and A+ ratings from all major agencies ensure claim payment capability regardless of circumstance.

Cons

- Mid-Range Pricing Structure: Wyoming rates average $118 a month, approximately 6% higher than the state median.

- Limited State Coverage: Available in only 12 of Wyoming’s 23 counties, excluding many rural drivers.

#9 – Farmers: Best for Local Agents

Pros

- 24/7 Wyoming Claims Team: Dedicated regional adjusters respond to claims within 4.3 hours on average. Read our Farmers Insurance company review to learn more.

- Numerous Coverage Options: Farmers offers a variety of coverage options, including unique add-ons like rideshare and new auto replacement insurance for Wyoming drivers.

- First Accident Waiver: The program prevents rate increases after initial accidents for Wyoming policyholders with 3+ years of clean driving history.

Cons

- Premium Price Point: Wyoming rates average $129 a month, approximately 16% above the state average.

- Limited Rural Coverage: Service is available in only 17 of Wyoming’s 23 counties, with restricted options in less populated areas.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Cheapest for Add-on Coverages

Pros

- Substantial Safe Driver Savings: Drivewise program participants in Wyoming save an average of $210 annually. Read more about this provider in our Allstate auto insurance review.

- Strong Agent Presence: 23 local offices throughout Wyoming with average appointment availability within 1.2 business days.

- Satisfaction Guarantee: Offers a $100 credit if customers are dissatisfied with the claims process, utilized by less than 2% of Wyoming claimants.

Cons

- Higher Premium Structure: Wyoming rates average $135/month, approximately 22% above the state median.

- Mixed Claims Feedback: 75% customer satisfaction rating versus 85% industry average according to recent J.D. Power studies.

Cheap Auto Insurance Companies in Wyoming

If you’re wondering, “How much does car insurance cost in Wyoming?” Prices vary; the higher coverage means higher premiums but better protection.

Wyoming Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $36 | $155 | |

| $27 | $112 |

| $30 | $130 | |

| $26 | $111 | |

| $17 | $75 |

| $28 | $114 | |

| $25 | $106 | |

| $19 | $82 | |

| $23 | $98 | |

| $13 | $57 |

Use the table above to compare monthly rates by provider and coverage level to find affordable, reliable auto insurance in Wyoming. To drive legally in the state, all drivers must carry at least the minimum Wyoming car insurance requirements:

- $25,000 for the injury or death of one person in an accident caused by the owner/driver

- $50,000 for total injuries or death in an accident caused by the owner/driver

- $20,000 for property damage in one accident caused by the owner/driver

These limits are designed to cover costs if you’re at fault in an accident, but drivers should consider higher coverage to avoid out-of-pocket expenses. Start comparing to get the cheapest auto insurance coverage option at the lowest price.

Basic Auto Insurance Coverage in Wyoming

Basic auto insurance coverage in Wyoming typically includes liability insurance, which pays for injuries and property damage you cause to others in an accident.

Many Wyoming drivers also opt for collision and comprehensive coverage, which protects your own vehicle from crashes, theft, or weather-related damage.

Daniel Walker Licensed Insurance Agent

While drivers often search for cheap auto insurance, it’s important to know what optional protections are available to enhance your policy. Common auto insurance add-ons in Wyoming include:

- Roadside Assistance: Roadside Assistance is a great addition to cheap auto insurance in Wyoming. This covers things like towing, jump-starts, and flat tire help when your car breaks down.

- Rental Car Reimbursement: Pays for a rental car while your car is being repaired after an accident, so you’re not out of commission.

- Gap Insurance: Especially useful if you have a loan or lease, gap insurance covers the difference between your car’s value and what you still owe if it’s totaled.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver with little or no insurance, a must-have when trying to have affordable yet full coverage in Wyoming.

- Medical Payments Coverage (MedPay): Pays for medical bills for you and your passengers after an accident, no matter who’s at fault, so you can have peace of mind.

With average Wyoming car insurance costs around $104 per month, evaluating both core coverage and add-ons can help you build a well-rounded, affordable policy.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting Auto Insurance Rates in Wyoming

When it comes to the average cost of car insurance in Wyoming, men and women typically pay similar rates, especially between the ages of 35 and 60. However, teenage drivers, particularly 17-year-old males, see significantly higher premiums due to their high-risk profile.

Wyoming Auto Insurance Monthly Rates by Provider, Age, & Gender

| Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $774 | $887 | $285 | $298 | $263 | $260 | $243 | $249 | |

| $500 | $678 | $191 | $225 | $184 | $185 | $166 | $168 |

| $710 | $762 | $246 | $253 | $213 | $213 | $195 | $204 | |

| $471 | $523 | $198 | $189 | $192 | $193 | $187 | $190 | |

| $968 | $1,143 | $330 | $375 | $317 | $321 | $287 | $307 |

| $480 | $598 | $224 | $241 | $197 | $199 | $178 | $185 | |

| $724 | $802 | $225 | $230 | $191 | $181 | $166 | $171 | |

| $496 | $610 | $195 | $213 | $173 | $173 | $156 | $156 | |

| $776 | $1,071 | $194 | $208 | $182 | $183 | $171 | $173 | |

| $401 | $449 | $166 | $177 | $129 | $128 | $121 | $121 |

In some states, women pay more. These figures highlight how age and gender are factors that affect auto insurance rates, which is especially important when shopping for cheap car insurance in Wyoming or comparing car insurance quotes in Wyoming.

Wyoming Car Insurance Rates by Driving Record

Your driving history plays a critical role in determining your rate. A clean record can help you qualify for cheap car insurance in Wyoming while speeding tickets, accidents, and DUIs often push drivers into high-risk insurance categories with elevated rates.

Wyoming Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $155 | $176 | $202 | $190 | |

| $111 | $125 | $142 | $135 |

| $135 | $153 | $174 | $165 | |

| $209 | $237 | $270 | $255 | |

| $175 | $195 | $220 | $210 |

| $140 | $160 | $185 | $175 | |

| $160 | $180 | $205 | $195 | |

| $127 | $144 | $164 | $155 | |

| $150 | $170 | $195 | $185 | |

| $103 | $117 | $133 | $125 |

Fewer accidents typically lead to lower rates, while speeding violations, DUIs, and accidents may increase your premiums. Maintaining a clean record could save you hundreds annually on your Wyoming car insurance.

Wyoming Auto Insurance Rates by Commute Distance

Wyoming’s expansive geography means many residents have long commutes, especially in areas prone to harsh weather. This can affect insurance costs based on your daily mileage.

Wyoming Commute Distances Auto Insurance Monthly Rates by Provider

| Insurance Company | 10 Miles Commute | 25 Miles Commute |

|---|---|---|

| $92 | $97 | |

| $83 | $89 |

| $100 | $105 | |

| $80 | $88 | |

| $110 | $115 |

| $90 | $95 | |

| $95 | $100 | |

| $85 | $90 | |

| $88 | $94 | |

| $75 | $82 |

Consider relocating closer to your workplace. Choosing to live closer to work or reducing your commute can be a smart way to lower your Wyoming car insurance premiums.

Read more: Is it a bad idea to set your auto insurance miles too low?

Wyoming Car Insurance Rates by Credit Score

In Wyoming, auto insurers can use your credit score to determine your rate. A higher score typically means lower premiums, while a lower score may result in higher rates.

We’ve created a chart to show how your credit score affects your car insurance premiums, specifically how full coverage insurance costs vary by company and credit score.

Wyoming Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $95 | $110 | $140 | |

| $85 | $100 | $130 |

| $98 | $115 | $145 | |

| $82 | $97 | $125 | |

| $115 | $130 | $165 |

| $90 | $105 | $135 | |

| $100 | $118 | $150 | |

| $88 | $103 | $128 | |

| $92 | $108 | $138 | |

| $78 | $90 | $115 |

Wyoming’s average credit score is 678, and residents hold 2.81 credit cards with an average balance of $6,245.

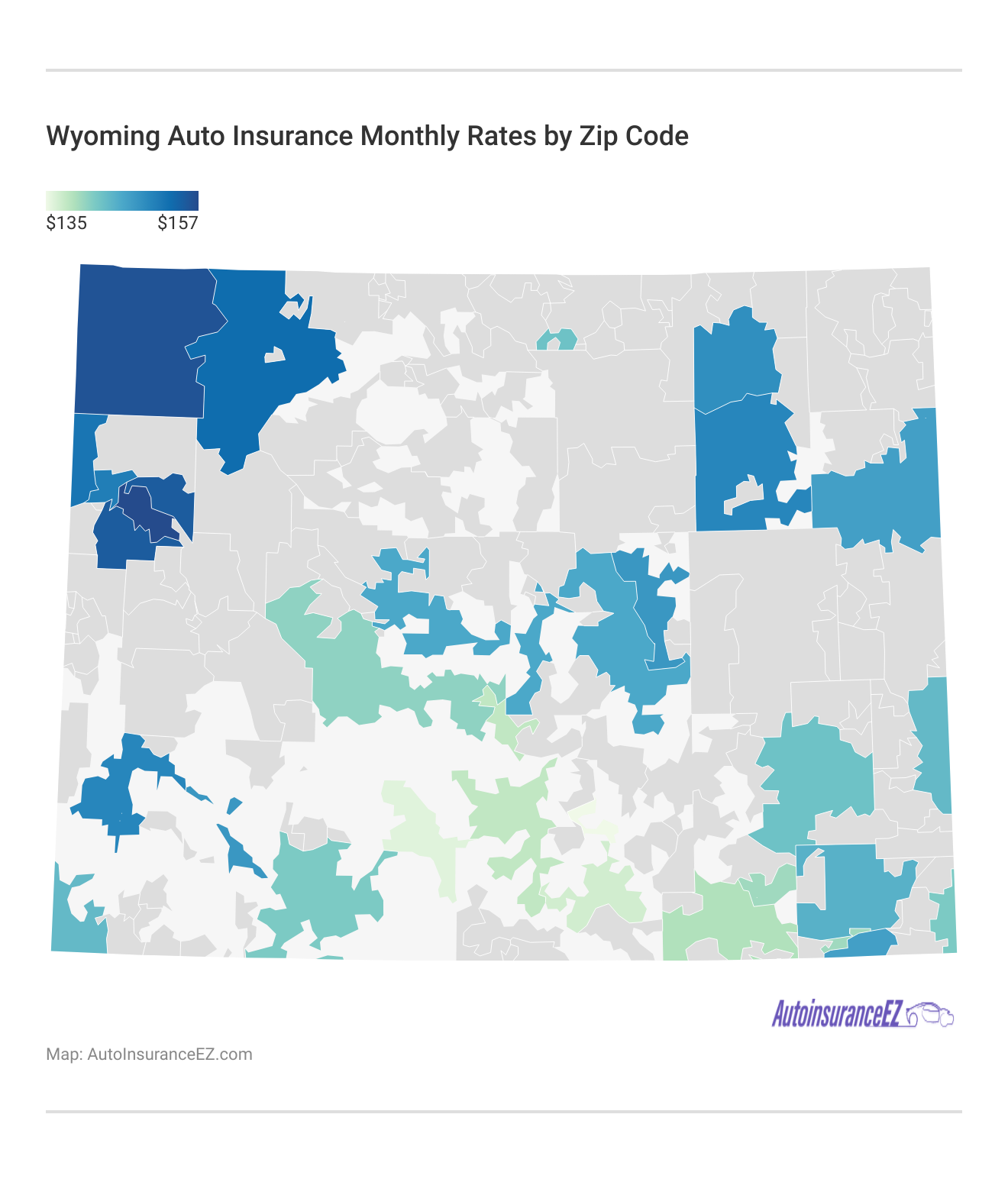

Auto Insurance in Wyoming by ZIP Code

Location affects auto insurance rates. The table below breaks down average rates by Wyoming ZIP codes so you can find your area’s average auto insurance costs.

These ZIP-code-based rates show where Wyoming’s cheapest car insurance is available. Check your location, compare quotes, and get the right coverage at the best price.

The Largest Companies’ Financial Rating

When shopping for cheap auto insurance in Wyoming, be sure to compare auto insurance companies and review each provider’s A.M. Best financial rating. These ratings indicate the insurer’s financial strength and overall reliability.

Wyoming Auto Insurance Providers by Market Share

| Insurance Company | Premiums Written | Market Share | Market Share |

|---|---|---|---|

| $39,210,020 | 5.4% | 24.09% | |

| $17,618,189,874 | 1.6% | 13.91% |

| $20,083,339 | 2.8% | 12.07% | |

| $46,358,896 | 6.4% | 9.72% | |

| $36,172,570 | 5% | 8.39% |

| $18,499,967 | 2.5% | 6.52% | |

| $41,737,283 | 5.7% | 6.44% | |

| $66,153,063 | 9.1% | 4.83% | |

| $28,786,741 | 4% | 3.16% | |

| $24,621,246 | 3.4% | 1.69% |

The table above lists A.M. Best scores for the ten largest auto insurers in Wyoming. The letter grades in financial ratings follow a traditional scale, with A being higher and B being lower.

Plus and minus signs reflect financial strength. The strongest providers have the highest grades and the most plus signs. Wyoming’s top insurers all hold strong ratings, ranging from A to A++.

Number of Insurers by State

Despite the small number of domestic insurers, Wyoming drivers still have access to a wide range of options through the 1,481 foreign companies operating statewide.

Number of Property & Casualty Insurance Companies in Wyoming

| Insurance Type | Number of Companies |

|---|---|

| Domestic | 4 |

| Foreign | 1,481 |

| Total | 1,485 |

These large national providers bring competitive pricing, advanced digital tools, and broader coverage options. Some even extend benefits across borders, making it possible for certain auto insurance to cover international rentals, a valuable perk for frequent travelers.

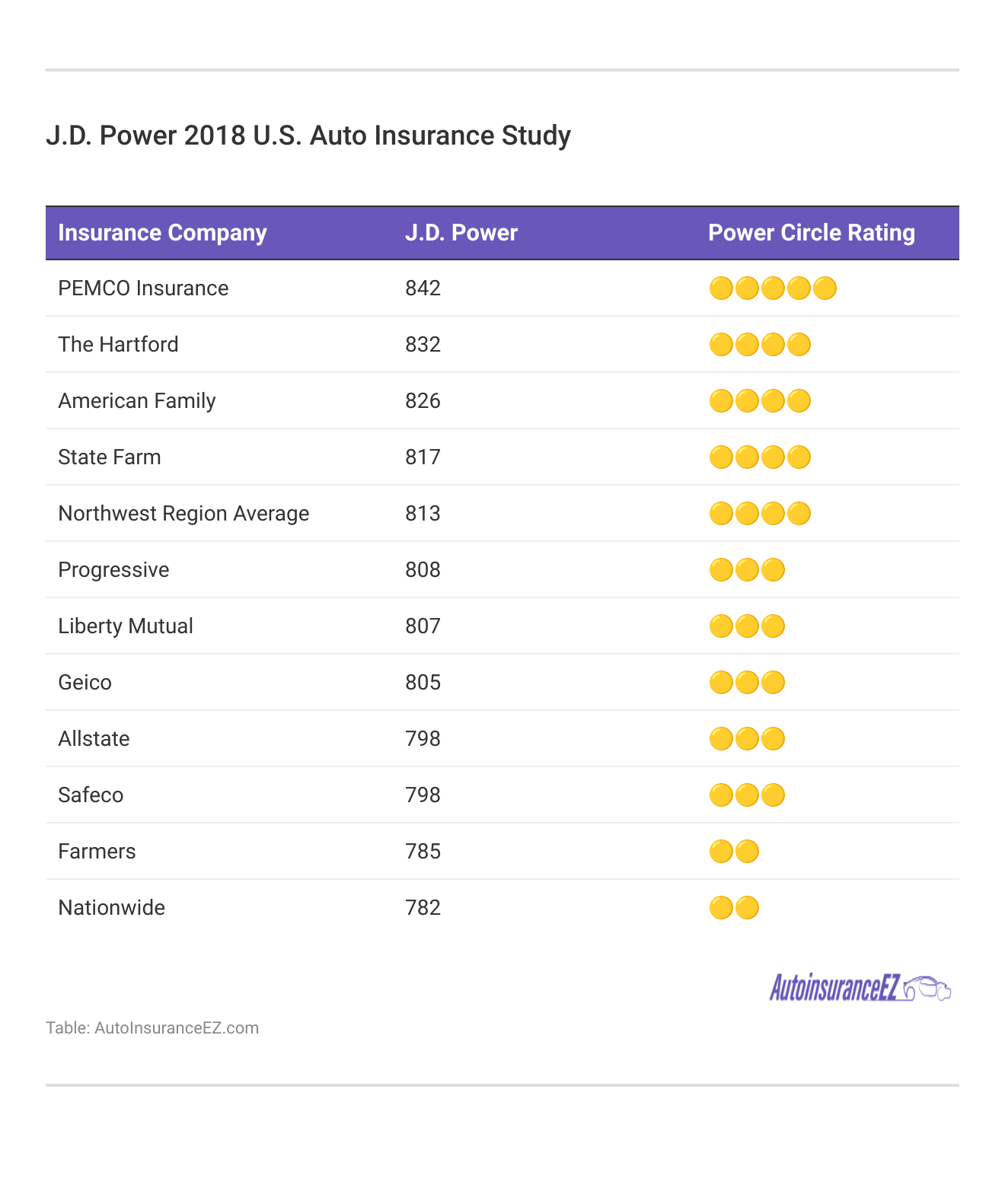

Companies With Best Customer Service Ratings

Financial strength helps assess a company’s reliability, but it’s not the only factor. Choose a provider with strong customer service and cheap auto insurance options.

According to findings by J.D. Power, some companies are better at customer service than others. In the Northwest region, which includes Wyoming, Washington, Idaho, Montana, and Oregon, PEMCO has the highest customer satisfaction ratings.

Read More: Cheap Auto Insurance in Washington

Companies With the Most Complaints in Wyoming

Customer satisfaction ratings help identify companies offering the cheapest auto insurance in Wyoming, and complaint rankings reveal which ones to avoid. Larger companies often receive more complaints. The table below shows complaint counts and ratios for Wyoming’s biggest auto insurers.

Company Complaint Ratios and Total Number of Complaints

| Company | Complaint Ratio | Total Number of Complaints |

|---|---|---|

| 0.15 | 57 | |

| 0.14 | 2 |

| 0.27 | 24 | |

| 0.61 | 25 | |

| 0.44 | 62 |

| 0 | 0 | |

| 0.20 | 284 | |

| 0.11 | 214 | |

| 0.09 | 1 | |

| 0.09 | 7 |

Auto insurance companies that customers recommend usually have fewer complaints and strong customer service, helping Wyoming drivers find a reliable, affordable auto insurance coverage. Complaints may not reflect every aspect of an insurer, but can indicate issues with staffing or company size.

Wyoming’s Premiums as a Percentage of Income

Per capita disposable personal income means the money individuals have after taxes. In 2014, Wyoming’s annual per capita disposable income was $49,918, and the average full auto coverage cost was $844.33. The table below shows premium percentages over three years.

Wyoming Auto Insurance Premiums as a Percentage of Income by Year

| Year | Full Coverage Premium | Median Household Income | Insurance as % of Income |

|---|---|---|---|

| 2021 | $1,548 | $76,536 | 2.02% |

| 2022 | $1,758 | $75,485 | 2.33% |

| 2023 | $1,540 | $74,815 | 2.06% |

| 2024 | $1,758 | $77,200 | 2.28% |

Auto insurance costs about 1.69% of income, which is within the typical 1–3% range across states. The percentage has gotten smaller year over year, which is good news for Wyoming residents.

Read More: How much insurance coverage do I need?

Low-Cost Insurance

Wyoming offers a program for high-risk drivers but does not offer a similar program for low-income families or individuals struggling to pay for car insurance.

While Wyoming does not support state-sponsored low-income insurance policies like New Jersey or California, motorists can find affordable coverage nonetheless by taking advantage of discounts and comparing quotes.

Read More: Anti-Theft Device Discount

The following table identifies prominent carriers and the respective discounts they offer, from policy bundles (up to 25% discount) to good driver credits (up to 40% discount).

Auto Insurance Discounts From the Top Providers in Wyoming

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

| 25% | 25% | 25% | 20% | 30% |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 5% | 20% | 40% | 15% | 40% | |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 13% | 10% | 8% | 30% | |

| 15% | 10% | 30% | 10% | 30% |

The state’s low crime rates (Grade A) and light traffic jams (Grade A) keep premiums low. Moderate weather hazards and uninsured motorists (Grade C), though, indicate that shopping around is essential.

Wyoming Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A | Wyoming has one of the lowest vehicle theft rates in the U.S. |

| Traffic Density | A | Low population and rural roads contribute to low traffic congestion. |

| Average Claim Size | B | Claims are moderate due to lower repair costs and less severe collisions. |

| Weather-Related Risk | B | Wyoming experiences moderate snow and hail, but severe weather is infrequent. |

| Uninsured Drivers Rate | C | Moderate uninsured rate compared to the national average. |

Higher-risk drivers might pay more but can shop for specialty insurers. For all others, taking full advantage of discounts (such as anti-theft or usage-based insurance) ensures the lowest prices.

Additional Liability Coverage for Cheap Auto Insurance in Wyoming

You now know the basic Wyoming auto insurance requirements for liability coverage. However, these are only minimums and may not cover all accident costs. Consider higher liability limits. In Wyoming, the at-fault driver covers damages. Extra liability coverage offers added protection.

The insurance industry recommends setting liability limits at $100,000 per person and $300,000 per accident—well above Wyoming’s minimums. For better protection, consider full coverage, uninsured motorist protection, or adding umbrella insurance for extra liability.

Comprehensive and collision coverages pay to repair your auto. While not required in Wyoming, they’re often mandatory if you lease or finance. For cheap auto insurance in Wyoming, check the USAA site for affordable coverage options that fit your situation.

Personal injury protection (PIP) and medical payments coverage pay for medical bills, but are not required in Wyoming. Higher coverage limits with cheap auto insurance in Wyoming can reduce your out-of-pocket costs. You might also consider optional uninsured/underinsured motorist coverage for added protection.

Let’s talk loss ratios.

A loss ratio shows how often insurers pay out claims. When shopping for cheap auto insurance in Wyoming, reviewing a company’s loss ratio helps you gauge its financial health and reliability in covering customer claims.

Companies with loss ratios over 100% are more likely to pay claims but may be less financially stable.

Companies with lower loss ratios may not cover all expenses in an accident. They are financially secure but pay fewer claims. The table below shows the loss ratios for personal injury protection, medical payments, and UUM in Wyoming.

Wyoming Auto Insurance Loss Ratios

| Wyoming Loss Ratio | 2021 | 2022 | 2023 |

|---|---|---|---|

| Net Loss Ratio | 77% | 82.5% | 75% |

| Combined Ratio | 101.5% | 112.2% | 104% |

Learn more about what liability auto insurance is to better understand how it protects you in case of an accident in Wyoming.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Wyoming Car Insurance Laws

Wyoming’s state laws require all drivers to carry minimum liability coverage, making it essential to find cheap auto insurance in Wyoming and compare policies to find the right coverage for your needs.

Penalties for Driving Without Insurance

Despite its legendary frontier spirit, the Cowboy State requires all drivers to carry cheap auto insurance. Proof must be kept in the vehicle or accessible digitally. Failure to comply can result in fines and license suspension.

Read More: Can you get auto insurance without a license?

How State Laws for Insurance Are Determined

Each state’s legislature sets regulations for vehicles and cheap auto insurance, including minimum car insurance requirements. In Wyoming, state law mandates liability insurance with specific minimum limits. The Department of Transportation oversees licensing, vehicle registration, and insurance compliance.

Windshield Coverage

Some states have made laws specific to windshields, regulating broken and cracked windshields, replacements, and insurers’ obligations. However, Wyoming is an outlier. As of 2019, Wyoming does not have any state laws specific to windshields.

Read More: Does auto insurance cover a cracked windshield?

High-Risk Insurance

There is a special category labeled for “high-risk drivers.” Sometimes, drivers have trouble finding cheap auto insurance in Wyoming, even though it’s required in the state. Companies might refuse to insure them due to their “high-risk” status. Younger drivers and those with a DUI are often considered high-risk.

The State of Wyoming has a system that makes insurance accessible to all, and it is called the Wyoming automobile insurance plan (waip). This program helps drivers who can’t find an insurer through the traditional market. Visit the Liberty Mutual site for more options on affordable coverage.

Waip isn’t an insurance provider. It connects drivers with insurance companies willing to insure them. Waip is part of an association that shares the risk among multiple companies.

When applying for Waip, you must prove you can’t obtain insurance through regular channels. You also need a valid driver’s license, funds to pay the premium, and arrangements for any past-due premiums.

Automobile Insurance Fraud in Wyoming

“Insurance Fraud” might sound like a scary phrase, but it doesn’t have to be. Misrepresenting facts on an application or submitting false claims for damage or injuries are examples of fraud. This can impact your ability to get cheap auto insurance in Wyoming.

Other forms of auto insurance fraud include setting fire to your own vehicle, using a false social security number, or providing a fake address to secure cheap auto insurance in Wyoming. Some even stage fake accidents.

Insurance companies can also commit auto insurance fraud by refusing to pay valid claims or selling fraudulent policies. Wyoming is one of ten states without an insurance fraud bureau. However, insurance fraud is still considered a crime in the state.

Read More: Is it bad to use an old address for your auto insurance?

You can contact the Wyoming Department of Insurance if you suspect insurance fraud. However, you will likely be redirected to file a report through the National Association of Insurance Commissioners.

Statute of Limitations

You’ll want to file a claim if you’ve been involved in an automobile accident. In Wyoming, the statute of limitations allows four years to file a claim for personal injury or property damage.

Read More: Property Damage Liability

Driver Safety and Traffic Laws in Wyoming

Wyoming’s driver safety and traffic laws promote responsible driving and reduce accidents. Following these laws can help drivers find cheap auto insurance in Wyoming.

Wyoming Statistics Summary

| Category | Statistic |

|---|---|

| Road & Vehicle Miles | 30K+ miles of roads; 575M miles/month driven |

| Registered Vehicles | ~960,000; ~78 thefts/month |

| Population | ~581,000 |

| Top Vehicle | Ford F-150 |

| Uninsured Rate | ~5.9% (one of the lowest) |

| Fatalities (Monthly) | Speeding: ~4.3 |

| Avg. Premiums | Liability: $30 |

| Cheapest Insurer | American National (~$32 for full coverage) |

Explore different types of car insurance to find affordable coverage that keeps you protected and compliant on the road.

Teen Driver Laws

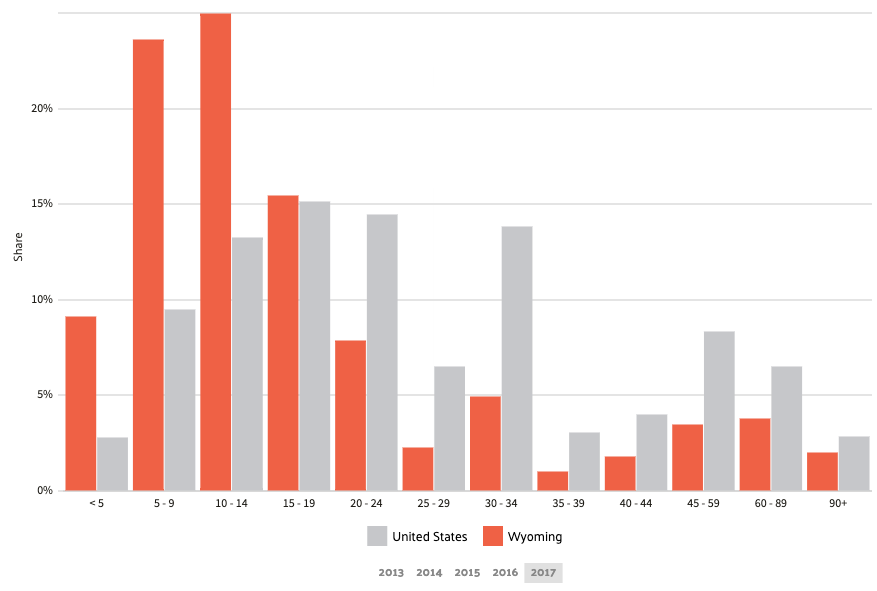

Teen drivers make up a significant part of Wyoming’s driving population. Due to their inexperience, the state requires extensive practice before teens can get a license.

Wyoming Teen Driving Laws & Requirements

| Requirement | Details |

|---|---|

| Minimum Age (Learner’s Permit) | 15 years (written test required) |

| Permit Holding Period | Minimum of 10 days |

| Supervised Driving Hours | 50 total hours (10 at night) |

| Intermediate Permit Age | 16 years (after meeting prior requirements) |

| Unsupervised Driving Ban | 11 p.m. – 5 a.m. (exceptions: work, school, emergencies) |

| Night Restrictions Duration | 6 months or until age 17 |

Wyoming has restrictions to protect young drivers and others on the road, and a parents’ supervised driving program is available at exam stations or online.

Read More: How old do you have to be to drive?

Older Driver License Renewal Procedures

As drivers age, vision and driving skills may decline. Some states have added requirements for older drivers to improve safety. In Wyoming, regulations are the same for all drivers. Licenses must be renewed every five years, with vision proof required every ten years. Renewals must be done in person or by mail—online renewals aren’t available. Mail-in renewal is allowed every other cycle.

Read More: When is it time for elderly drivers to stop driving?

New Residents

Moving to Wyoming? New residents must visit a driver exam station within a year for a Wyoming license. Bring the required documents, pass a vision screening, and surrender your out-of-state license. Active-duty military members and their dependents are exempt from needing a Wyoming license if residing in the state.

Read More: How to Get Insurance on Your Driver’s License

License Renewal Procedures

Wyoming drivers must renew their licenses every five years, with vision proof required every ten years. Most renewals don’t require a written or driving exam. Renewals must be done in person every other cycle, with mail-in options available in between.

Wyoming doesn’t use a formal point system for traffic violations, but all offenses are recorded on your official driving record, and penalties are handled at the county level. Repeated minor violations can lead to license suspension.

Major violations like DUI or serious accidents may result in suspension, fines, or jail. You can check your record online. Understanding how quickly insurance policy changes go into effect is important, especially after a violation that could impact your coverage or premiums.

State Laws

Auto insurance, road safety, and driving laws vary by state, so it’s important to keep this in mind whether you’re planning a road trip or relocating.

Wyoming’s driving and auto insurance laws are similar to those of other states, but with no windshield laws and no insurance fraud bureau, it’s lighter on legislation. A couple of recent laws are worth noting.

In July 2013, a law was signed allowing Wyoming drivers to exceed the speed limit by up to 10 mph on two-lane highways to pass slower vehicles. The posted limit must be 50 mph or higher, and only one vehicle can be passed at a time.

The Wyoming Department of Transportation can charge a $125 fee for drivers applying for an ignition interlock-restricted license. Later, we’ll explore speeding and DUI-related laws in Wyoming.

Read More: Fault vs. No Fault Auto Insurance Laws

Forms of Financial Responsibility

In Wyoming, drivers must provide proof of financial responsibility, typically via insurance. Alternatively, a surety bond or a $25,000 deposit with the state treasurer can be used.Proof must be carried at all times, and electronic proof is acceptable. When choosing auto insurance, consider companies offering both traditional and alternative financial responsibility options that meet state requirements. Additionally, understanding dealing with your insurance company when your car needs repairs can help ensure a smoother claims process when accidents occur.

Vehicle Licensing Laws

In addition to cheap auto insurance in Wyoming and insurance laws, the state has vehicle licensing laws. These laws cover who can obtain a license, the renewal process, and any restrictions on licensed drivers.

The Real ID Act passed in 2005, set federal standards for issuing driver’s licenses. While states have taken time to implement it, it will be applicable nationwide in 2020.

Wyoming is a “compliant state.” Drivers with real IDs can fly or travel across the U.S. without issues. Look for the star in the upper corner of the license. Federal agencies accept Wyoming’s ID cards and driver’s licenses at federal facilities, including nuclear power plants. If you get a new ID in Wyoming soon, it will likely be a real ID.

Fault vs. No-Fault

Wyoming is an at-fault state, not a no-fault state. When an accident occurs, the responsible party is financially liable for damages. This makes carrying auto insurance legally required and a smart choice.

Wyoming’s rural layout means long commutes and heavy reliance on personal vehicles, which impact insurance rates. To find cheap auto insurance in Wyoming, you can use our free online tool to compare quotes and identify the most affordable options.

Car Ownership

Wyomingites typically own two or three vehicles per household. To stay protected, compare providers offering cheap auto insurance with reliable coverage.

Read More: Will my auto insurance cover other cars?

Transportation

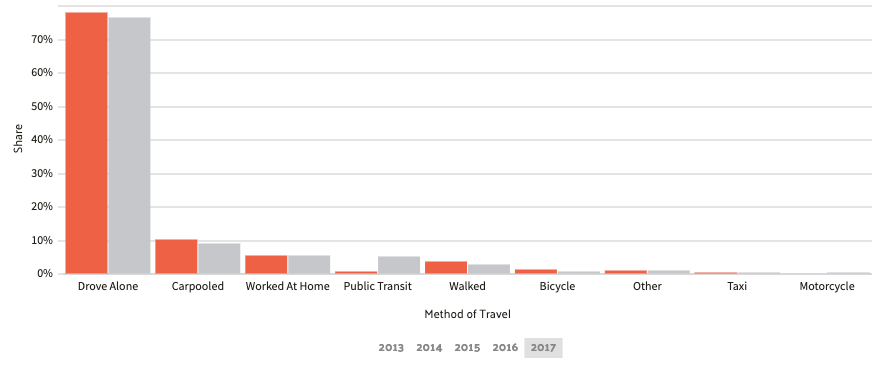

Now that you’re familiar with Wyoming’s insurance rules, here are key Transportation stats on car ownership, commute times, and travel methods.

Wyoming’s commuting culture favors driving alone, with nearly 80% of residents driving alone to work—a trend that has held steady since 2013.

Carpooling occupies only 10% of trips, with alternative modes of transportation such as walking, biking, and public transit seeing limited use. These commuting patterns impact both traffic risks and insurance considerations.

Read More: Green Commuting

EMS Response Time

One factor in accident outcomes is EMS response time. Quick emergency service can reduce injury severity. The table below compares EMS response times in urban and rural Wyoming.

EMS Response Time Intervals in Wyoming

| Time Interval | Rural Areas | Urban Areas |

|---|---|---|

| Time of Crash to EMS Notification | 6.38 minutes | 2.95 minutes |

| EMS Notification to EMS Arrival | 21.04 minutes | 5.83 minutes |

| EMS Arrival at Scene to Hospital Arrival | 42.17 minutes | 24.75 minutes |

| Total Time: Crash to Hospital Arrival | 61.22 minutes | 33.50 minutes |

| Total Fatal Crashes (Sample Size) | 80 | 25 |

Urban areas generally see faster EMS response due to their closer proximity to hospitals and medical services. However, most fatal crashes happen in rural areas, which is notable given Wyoming’s largely rural landscape.

Read More: 6 Events in History that Caused Fatal Crash

Traffic Congestion in Wyoming

Cheyenne, Wyoming’s largest city, has about 66,000 residents. Even though it is the state’s biggest city, it doesn’t have the traffic congestion to appear on national or global traffic databases.

If you’re traveling through Wyoming and need traffic updates, WYDOT provides reliable resources. The 2017 solar eclipse brought record-high traffic to the state, though it’s unclear if that level will happen again.

Read More: Auto Insurance Rates by State

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rules of The Road

Wyoming has laws to promote safe driving, which helps maintain order on the roads and ensures drivers act responsibly. Knowing these laws and how violations are recorded on your driving record is key to avoiding penalties and keeping a clean history.

Seatbelt and Car Seat Laws

Wyoming seatbelt laws became effective on June 8, 1989, under secondary enforcement regulations. This is where police officers may only cite drivers for seatbelt infractions after they have already stopped the car for another offense.

Wyoming Safety Belt Laws

| Category | Details |

|---|---|

| Effective Since | June 8, 1989 |

| Primary Enforcement | No (Secondary Enforcement) |

| Age/Seats Applicable | 9+ years in all seats |

| 1st Offense Maximum Fine | $25 driver / $10 passenger |

| Secondary Enforcement | Officers can only issue a seat belt citation if another violation occurs. |

| Medical Exemptions | Allowed with physician certification. |

| Postal Workers | USPS employees on duty are exempt. |

| Vehicles Without Seat Belts | Exempt if not originally equipped. |

Wyoming’s auto seat laws comply with national safety guidelines. These generally mandate rear-facing seats for infants until age 2, toddler seats with harness systems facing forward, and booster seats for children until the age of 9 or a height of 4 feet 9 inches.

Wyoming Car Seat Requirements

| Age | Type | Requirement |

|---|---|---|

| Under 2 Years | Rear-Facing Car Seat | Must use a rear-facing car seat |

| 2 to 8 Years | Forward-Facing or Booster Seat | Use based on size and manufacturer’s guidelines |

| 9 Years & Older | Vehicle Seat Belt | Allowed if the seat belt fits properly |

Always follow the car seat manufacturer’s guidelines. Proper use helps keep your child safe on the road.

Read More: Does my car’s restraint system matter to my insurance company?

Keep Right and Move Over Laws

Wyoming’s open highways require patience and caution. Drivers must stay right when moving slower than traffic and use the left lane only to pass.

When approaching an official vehicle with lights on, move over or reduce speed by 20 mph below the limit. These laws support safe driving records.

Read More: Safe Driver Discount

Speed Limits

Wyoming speed limits differ depending on road classification, with interstates going up to 80 mph and school areas as low as 20 mph.

Speed Limit Laws in Wyoming

| Road Type | Speed Limit |

|---|---|

| Interstate Highways | Up to 80 mph |

| Urban Areas | 30 mph |

| School Zones | 20 mph |

| Other Paved Roads | 70 mph |

| Unpaved Roads | 55 mph |

Speeding is a risk of penalties and loss of life, drive responsibly at all times. Be safe and save yourself the fine by respecting Wyoming’s speed limit postings.

Read More: Reckless Driving and Auto Insurance Rates

DUI Laws

In 2017, Wyoming recorded 44 alcohol‑impaired driving fatalities—one‑third of All Traffic Deaths—with Four Victims Under Age 21. That year, 3,253 people were arrested in Wyoming for driving under the influence of alcohol, including 28 drivers under 18. The table below outlines the DUI laws in Wyoming.

Wyoming DUI Laws & Penalties

| Category | Details |

|---|---|

| Legal BAC Limit | 0.08% (drivers), 0.04% (CDL), 0.02% (under 21) |

| Implied Consent | Refusing BAC test = license suspension |

| 1st Offense (Misd.) | Up to $750 fine, 6 months jail, 90-day suspension, 6-month IID if BAC ≥ 0.15% |

| 2nd Offense (Misd.) | Up to $750 fine, 7–180 days jail, 1-year suspension, 1-year IID |

| 3rd Offense (Misd.) | Up to $3,000 fine, 30–180 days jail, 3-year suspension, 2-year IID |

| 4th+ Offense (Felony) | Up to $10,000 fine, 7 years prison, permanent revocation, lifetime IID |

| Refusal Penalties | 6-month suspension (1st), 18 months (repeat) |

| Underage DUI | BAC ≥ 0.02% triggers penalties |

| CDL DUI | BAC ≥ 0.04% = 1-year CDL revocation (lifetime for repeats) |

| Enhanced Penalties | Applied for minors in vehicle, high BAC (≥ 0.15%), injury, or death |

Even one fatality from driving under the influence is too many. Many are caught drinking and driving before an accident occurs.

Wyoming DUI Charges

| DUI Charge | Classification |

|---|---|

| First Offense | Misdemeanor |

| Second Offense | Misdemeanor |

| Third Offense | Misdemeanor |

| Fourth Offense & Subsequent | Felony |

| Refusing a BAC Test | Administrative Penalty |

| Underage DUI (Under 21, BAC ≥ 0.02%) | Misdemeanor |

| Commercial DUI (BAC ≥ 0.04%) | Misdemeanor (CDL-specific) |

As shown in the table above. If caught, you can face serious consequences like jail time, license revocation, and fines in Wyoming.

Read More: Car Insurance After A DUI

Marijuana-Impaired Driving Laws

Wyoming bans marijuana for recreational and medical use. Driving under the influence carries the same penalties as alcohol—fines, jail, and license revocation. Knowing what a driving record is and what it tracks is essential to avoid penalties and keep a clean record.

Read More: When is high-risk auto insurance required?

Distracted Driving Laws

Smartphone use while driving poses a serious hazard. Wyoming bans texting for all drivers, but Cheyenne and Green River are the only cities that ban handheld use—other areas have no restrictions.

Read More: Best Cheyenne, WY Auto Insurance

Safety Laws

Even if you follow speed limits, wear seatbelts, and obey traffic laws, you may face hazards from impaired or distracted drivers. Wyoming’s regulations cover impaired driving, distracted driving, and other safety issues. Below, we explore these rules in detail.

Read More: How Traffic Violations Increase Car Insurance Rates

Ridesharing

Whether you’re heading to the airport or returning home from a late-night event in Cheyenne, rideshare services like Lyft and Uber are increasingly popular.

Ridesharing also provides an opportunity for drivers to earn extra income. However, if you plan to drive for Uber or Lyft, ensure you’re protected with cheap auto insurance in Wyoming.

If you’re considering ridesharing, note that only a few of Wyoming’s insurance providers offer cheap rideshare insurance coverage for rideshare drivers.

Some of these coverages are extensions of your regular insurance policy. As with standard auto insurance, it’s helpful to shop around for cheap auto insurance in Wyoming to find an affordable quote.

Automation on The Road

Self‑driving, “autonomous,” and “connected” dominate automotive tech. Wyoming hasn’t passed autonomous vehicle laws but joined a 2015 USDOT pilot for connected vehicles on I-80—snowplows, trucks, and emergency vehicles equipped with advanced sensors (not autonomous).

Read More: Levels of Driving Automation

Vehicle Theft in Wyoming

In 2017, the 2007 full‑size Chevy pickup topped Wyoming’s stolen vehicle list, followed by other truck models. Wyoming auto theft patterns are crystal clear: high-theft-risk, older, full-size pickups are the targets of choice.

Most Stolen Vehicles in Wyoming

| Make/Model | Year of Vehicle | Number of Thefts |

|---|---|---|

| Ford Pick-Up (Full Size) | 2004 | 54 |

| Chevrolet Pick-Up (Full Size) | 2007 | 50 |

| Dodge Pick-Up (Full Size) | 2003/1998 | 26 |

| GMC Pick-Up (Full Size) | 2003 | 21 |

| Toyota Camry | 2005 | 12 |

| Honda Civic | 2007 | 10 |

| Jeep Cherokee/Grand Cherokee | 2005 | 9 |

| Ford Escape | 2017/2012/2009 | 9 |

| GMC Yukon | 2007/2005 | 8 |

| Chevrolet Suburban | 2002/1999 | 8 |

Cheyenne had the most thefts, with Casper second. Understanding the models and spots most at risk empowers motorists to take action in advance to prevent theft.

Worst Cities for Vehicle Theft in Wyoming

| City | Thefts |

|---|---|

| Cheyenne | 411 |

| Casper | 128 |

| Riverton | 28 |

| Gillette | 27 |

| Rock Springs | 25 |

| Laramie | 20 |

| Sheridan | 20 |

| Evanston | 14 |

| Rawlins | 13 |

| Jackson | 12 |

Shield your vehicle with comprehensive and collision auto insurance coverage if you have a high-theft-risk model or drive through theft-target areas.

Road Fatalities in Wyoming

Next, we’ll cover road fatalities. Understanding the statistics can help us make safer choices on the road. We’ll explore key insights into Wyoming’s risks, which also explain why auto insurance is more expensive in higher‑risk areas.

Wyoming’s fatal crash statistics expose sobering trends—single-vehicle crashes, departure from roadways, and rollovers comprise the majority of fatalities.

Wyoming Traffic Fatalities by Crash Type

| Type | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Total Fatalities (All Crashes) | 147 | 127 | 110 | 134 |

| Single Vehicle | 95 | 85 | 69 | 84 |

| Involving a Large Truck | 23 | 22 | 17 | 12 |

| Involving Speeding | 53 | 50 | 42 | 56 |

| Involving a Rollover | 82 | 70 | 55 | 60 |

| Involving a Roadway Departure | 110 | 97 | 78 | 83 |

| Involving an Intersection (or Intersection Related) | 15 | 14 | 11 | 15 |

Large truck involvement is still comparatively low, but speeding is an ongoing contributor to fatal crashes. Knowing these patterns of crashes can assist drivers in being more alert on Wyoming’s roads. Understanding where fatal crashes are most common can further help drivers stay cautious. In Wyoming, the top counties for fatal car crashes include Laramie, Natrona, and Fremont.

Top Ten Counties for Fatal Car Crashes in Wyoming

| Rank | County |

|---|---|

| 1 | Laramie County |

| 2 | Natrona County |

| 3 | Fremont County |

| 4 | Carbon County |

| 5 | Sweetwater County |

| 6 | Albany County |

| 7 | Park County |

| 8 | Big Horn County |

| 9 | Campbell County |

| 10 | Lincoln County |

Drivers traveling through these areas—especially on rural highways—should exercise extra caution, particularly when speeding and driving at night. This concern is supported by data showing consistent speed-related fatalities across several counties. For example, Fremont County has reported some of the highest numbers, with 4 or 5 speed-related deaths each year from 2019 to 2023.

Wyoming Speed-Related Traffic Fatalities by County

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Albany | 2 | 1 | 3 | 2 | 2 |

| Big Horn | 1 | 0 | 1 | 1 | 1 |

| Campbell | 3 | 2 | 4 | 3 | 3 |

| Carbon | 2 | 1 | 2 | 2 | 2 |

| Converse | 1 | 1 | 1 | 1 | 1 |

| Crook | 0 | 0 | 1 | 0 | 1 |

| Fremont | 4 | 3 | 5 | 4 | 4 |

| Goshen | 1 | 1 | 1 | 1 | 1 |

| Hot Springs | 0 | 0 | 0 | 0 | 0 |

| Johnson | 1 | 1 | 1 | 1 | 1 |

| Laramie | 5 | 4 | 6 | 5 | 5 |

| Lincoln | 1 | 1 | 2 | 1 | 2 |

| Natrona | 6 | 5 | 7 | 6 | 6 |

| Niobrara | 0 | 0 | 0 | 0 | 0 |

| Park | 2 | 1 | 2 | 2 | 2 |

| Platte | 1 | 1 | 1 | 1 | 1 |

| Sheridan | 2 | 1 | 2 | 2 | 2 |

| Sublette | 1 | 1 | 1 | 1 | 1 |

| Sweetwater | 3 | 2 | 4 | 3 | 3 |

| Teton | 1 | 1 | 1 | 1 | 1 |

| Uinta | 2 | 1 | 2 | 2 | 2 |

| Washakie | 0 | 0 | 0 | 0 | 0 |

| Weston | 1 | 0 | 1 | 1 | 1 |

Counties like Campbell, Carbon, and Albany have also seen steady incidents, underscoring the persistent danger of speeding on Wyoming’s roads. Alcohol is another major factor in fatal car accidents. The table below shows fatalities from alcohol-impaired driving.

Wyoming Alcohol-Impaired Driving Fatalities by County

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Albany | 2 | 1 | 3 | 2 | 2 |

| Big Horn | 1 | 0 | 1 | 1 | 1 |

| Campbell | 3 | 2 | 4 | 3 | 3 |

| Carbon | 2 | 1 | 2 | 2 | 2 |

| Converse | 1 | 1 | 1 | 1 | 1 |

| Crook | 0 | 0 | 1 | 0 | 1 |

| Fremont | 4 | 3 | 5 | 4 | 4 |

| Goshen | 1 | 1 | 1 | 1 | 1 |

| Hot Springs | 0 | 0 | 0 | 0 | 0 |

| Johnson | 1 | 1 | 1 | 1 | 1 |

| Laramie | 5 | 4 | 6 | 5 | 5 |

| Lincoln | 1 | 1 | 2 | 1 | 2 |

| Natrona | 6 | 5 | 7 | 6 | 6 |

| Niobrara | 0 | 0 | 0 | 0 | 0 |

| Park | 2 | 1 | 2 | 2 | 2 |

| Platte | 1 | 1 | 1 | 1 | 1 |

| Sheridan | 2 | 1 | 2 | 2 | 2 |

| Sublette | 1 | 1 | 1 | 1 | 1 |

| Sweetwater | 3 | 2 | 4 | 3 | 3 |

| Teton | 1 | 1 | 1 | 1 | 1 |

| Uinta | 2 | 1 | 2 | 2 | 2 |

| Washakie | 0 | 0 | 0 | 0 | 0 |

| Weston | 1 | 0 | 1 | 1 |

Insurance companies factor in DUI and reckless driving history when setting rates—higher risk means higher premiums.

Read More: 10 Worst Cities for Rush Hour Fatal Crashes

Teen Drinking and Driving

Drinking and driving is especially dangerous for teens. In Wyoming in 2016, under-21 alcohol-related driving deaths were 1.9 per 100,000—well above the national average of 1.2.

In 2016, Wyoming ranked fourth nationwide for teen DUI arrests per capita, with police making 26 arrests involving individuals under the age of 18. The state also held the third-highest rate of total DUI arrests per capita, with 3,082 individuals arrested for driving under the influence that year.

These alarming statistics highlight the importance of early education and responsible driving habits—making it crucial for parents to focus on how to teach your teen to drive safely and responsibly.

Fatal Crashes by Weather Condition and Light Condition

Weather and light play a significant role in accidents and fatalities. Most fatal crashes occur in normal weather, not icy conditions, and often at night.

Wyoming Traffic Fatalities by Weather Conditions

| Weather Condition | Number of Fatalities |

|---|---|

| Clear | 365 |

| Cloudy/Overcast | 37 |

| Snowing | 31 |

| Blowing Snow | 27 |

| Severe Wind | 13 |

| Not Reported | 24 |

When driving at night, stay in well-lit areas for safety. Here are tips for driving in bad weather:

- Slow down and maintain more space between vehicles.

- Use headlights in low visibility conditions.

- Avoid sudden braking or sharp turns.

- Keep tires well-maintained for better traction.

- Keep an emergency kit in your vehicle.

For coverage in varying conditions, check auto insurance reviews for responsive service and claims assistance in adverse weather.

Read More: 10 States With The Worst Weather-Related Fatal Crashes

Traffic Fatalities

Let’s examine rural and urban traffic fatality rates in Wyoming using data provided by the NHTSA.

Wyoming Traffic Fatalities by Road Type

| Type | Fatalities |

|---|---|

| Interstate | 28 |

| U.S. Highways | 41 |

| State Highways | 17 |

| County Roads | 22 |

| Local Roads | 15 |

| Other/Unknown | 10 |

According to data over nine years, fatal car accidents in Wyoming are more likely to occur in rural areas, as most of the state is considered “rural. ”

Read More: Top 10 Traffic Stop Reasons

Fatalities by Person Type

Fatal accidents in Wyoming can occur on or off the roadway, involving one or multiple vehicles. Due to the high number of trucks on the road, truck accidents are common.

Wyoming Traffic Fatalities by Person Type

| Type | Fatalities |

|---|---|

| Passenger Car Occupants | 103 |

| Light Truck – Pickup | 48 |

| Light Truck – Utility | 15 |

| Light Truck – Van | 9 |

| Large Truck Occupants | 6 |

| Other/Unknown Occupants | 5 |

| Total Occupants | 186 |

| Motorcyclists | 15 |

| Pedestrians | 9 |

| Bicyclists and Other Cyclists | 1 |

| Other/Unknown Nonoccupants | 4 |

| Total Nonoccupants | 29 |

| Total Fatalities | 215 |

Fatal motorcycle crashes are also notable, and lawyers often help families secure insurance for medical costs and damages. Pedestrian and bicycle accidents are rare. Following driving tips for road safety can help reduce these tragic incidents and protect all road users.

Five-Year Trend for The Top 10 Counties

Wyoming traffic fatality patterns demonstrate important county-by-county variation, with Laramie County experiencing a disturbing 60% increase in fatalities since 2019 and Natrona County fatalities decreasing by half.

Top Ten Counties in Wyoming With the Most Traffic Fatalities

| County | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Albany | 6 | 5 | 6 | 8 |

| Big Horn | 4 | 3 | 4 | 5 |

| Campbell | 5 | 4 | 5 | 7 |

| Carbon | 7 | 6 | 7 | 6 |

| Fremont | 9 | 8 | 9 | 10 |

| Laramie | 11 | 10 | 12 | 16 |

| Lincoln | 4 | 3 | 4 | 9 |

| Natrona | 14 | 12 | 13 | 7 |

| Park | 5 | 4 | 5 | 8 |

| Sweetwater | 8 | 7 | 8 | 10 |

The area you travel through in Wyoming matters greatly when it comes to exposing yourself to risk. Study these county-specific patterns when assessing your auto insurance needs.

Read More: 15 Worst U.S. Counties for Drunk Driving

Wyoming Accident and Claim Statistics

The table highlights how different cities in Wyoming experience varying levels of accidents and insurance claims annually. Larger cities tend to have higher numbers, reflecting more traffic and congestion.

Wyoming Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Casper | 1,110 | 960 |

| Cheyenne | 1,240 | 1,050 |

| Evanston | 460 | 400 |

| Gillette | 950 | 800 |

| Green River | 520 | 440 |

| Jackson | 410 | 370 |

| Laramie | 870 | 730 |

| Riverton | 430 | 390 |

| Rock Springs | 790 | 680 |

| Sheridan | 670 | 590 |

Seasonal challenges like winter storms and blizzards significantly impact road safety, often contributing to increased accidents during colder months. Drivers in these areas should be especially cautious and ensure their insurance coverage is adequate to handle the risks posed by harsh weather conditions common in Wyoming.

Finding the Best Cheap Auto Insurance in Wyoming

Three companies lead Wyoming’s affordable insurance market: USAA, at $13 a month, offering exclusive military benefits and 97% claims satisfaction; Liberty Mutual, which provides 17 different discounts, including 10% for the teaching profession; and State Farm, with strong customer support and 37 local agents across the state.

Compare quotes from multiple providers to secure comprehensive protection without compromising your budget. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

What is the cheapest car insurance in Wyoming?

USAA is known for its affordable rates and solid coverage options. USAA provides various discounts, helping drivers in Wyoming secure, reliable coverage at lower costs while maintaining quality service.

What is the minimum car insurance in Wyoming?

The minimum car insurance required in Wyoming includes liability coverage of $25,000 per person for bodily injury, $50,000 per accident, and $20,000 for property damage. Companies like USAA, Liberty Mutual, and State Farm offer policies that meet these state requirements, often with affordable rates and additional coverage options.

Is it a bad idea to insure your car out-of-state for cheap Wyoming auto insurance?

Yes. Insuring your car out-of-state can lead to higher costs, non-compliance with Wyoming laws, and invalid claims. For the cheapest and proper coverage, always get insurance from a Wyoming-licensed provider.

Read More: Is it a bad idea to insure your car in another state?

Are there any discounts available for Wyoming drivers on auto insurance?

Yes, many insurers offer discounts to Wyoming drivers, including safe driver discounts, multi-policy discounts (bundling auto with home insurance), good student discounts, and discounts for vehicles equipped with safety features like anti-theft devices.

Are there insurance companies in Wyoming that don’t consider credit scores?

Some insurers may place less emphasis on credit scores or don’t use them at all. It’s worth shopping around and asking providers about their policies to find cheaper options.

Read More: Best & Worst Credit Scores by State

How does Wyoming’s harsh winter weather impact auto insurance claims?

Wyoming’s snowy and icy winters increase the risk of accidents and vehicle damage, leading to higher claims. Comprehensive and collision coverage becomes especially important to cover damages from weather-related incidents like sliding off roads or hitting wildlife.

Is uninsured motorist coverage mandatory in Wyoming?

Uninsured motorist coverage is not mandatory in Wyoming, but it is highly recommended. It protects you if you are involved in an accident with a driver who does not have insurance, helping cover medical bills and vehicle repairs.

Which insurance company has the highest rates for cheap auto insurance in Wyoming?

Allstate has the highest rates among the listed providers for cheap auto insurance in Wyoming, with premiums starting at $36 per month. However, they offer comprehensive coverage and discounts that may appeal to certain drivers. Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for you.

Can you use digital proof of auto insurance in Wyoming?

Yes, Wyoming allows drivers to use digital proof of insurance. You can present an electronic version on your smartphone or device when requested by law enforcement as long as it clearly displays valid and current coverage information. Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

What happens if you’re caught driving without insurance in Wyoming?

Driving without insurance in Wyoming can result in fines up to $750, a potential six-month jail sentence, and license suspension until proof of insurance is provided. Reinstatement fees and an SR-22 filing may also be required for repeat offenses.

Pros

Pros

Pros

Pros