Indiana Auto Insurance Made Easy (Rates + Coverage)

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Indiana Statistics | Details |

|---|---|

| Miles of Roadway | 96,698 |

| Vehicles Registered in State | 5,789,940 |

| Population | 6,691,878 |

| Most Popular Vehicle | Silverado 1500 |

| Uninsured/Underinsured % | 16.70% |

| Total Driving Related Deaths | Speeding: 208 |

| DUI: 220 | |

| Full Coverage Average Premiums | Liability: $382.68 |

| Collision: $250.29 | |

| Comprehensive: $122.06 | |

| Combined: $755.03 | |

| Cheapest Provider | USAA |

Indiana, the 19th state inducted into the union, has a name that strictly means “Land of the Indians”, from a time when Native American tribes, descendants of those traveling south from Alaska, roamed and settled across the large swatches of flat land.

Now, while still predominantly flat, Indiana is the 16th most densely populated state in America, with cultural hubs like Indianapolis and two major professional sports teams: The Indiana Pacers and the Indianapolis Colts.

And it has, since 1911, a relationship with automobiles that few states can match or outreach:

It is simply known as the Brickyard.

In 1911, the winning racer at the Indianapolis Motor Speedway averaged 75 miles per hour. Today, the speed of the winners is roughly between 170 miles per hours.

And we hope all of them had insurance.

Insurance means a lot of things to a lot of people. For some (and for all really) it is a protector against huge financial losses. For others, it’s a way to know the medical bills of their family members are covered in case they are injured in an accident.

For still others, insurance may seem just like something the government demands.

And to many, it is simply confusing.

If you’re on this page, you’re likely looking to purchase insurance in the near future, either for yourself or for a family member.

We’re here to help.

In this guide, you’ll find everything from average collision insurance rates to the state laws that affect that dollar amount of your premium, even if you aren’t the one to break them.

It’s a comprehensive guide, the last one you’ll need about insurance in The Hoosier State.

Searching for cheap auto insurance in Idiana? Whether you reside in Indianapolis, Fort Wayne, Evansville, South Bend, or Gary, you can easily obtain up to ten rate quotes from leading companies near you with AutoInsuranceEZ.com. Try our FREE online comparison tool and enter your zip code.

Indiana Car Insurance Coverage and Rates

Indiana is home to dozens of kinds of wildlife, from black bears to mountain lions, coyotes, and brown recluses. There is even a turtle paradise.

Imagine this.

You’re driving down a road late at night, one of those flat, long highways in Indiana. Suddenly, you make out a shape on the street. It looks at you–rears on its hind legs. It’s a black bear, and you slam on the brakes.

Ouch, right? The questions start:

What do you do if you hit an animal and total your car?

What are the different kinds of insurance that protect you, in this incident and others?

What are their rates?

– Indiana’s Car Culture

16.7 percent. 12. 1977.

This is where you get a glimpse of the car culture through statistics. What are they?

16.7 percent – The number of uninsured motorists on the road in Indiana in 2015. This number ranks in the top 10 in America, a problem for both you and your insurance rates.

12 – The number of factors your insurance company uses to generate rates. Those factors are age, sex, marital status, driver record, car use, place of residence, policy limits, deductibles, type of car, driver training, claims history, and credit scores.

1977 – The year that the Universal Helmet Law was repealed in Indiana. There are a number of specialized laws that affect your insurance rates. You may not drive a motorcycle, but someone riding without a helmet affects your insurance rate.

When it comes to insurance, laws that may not affect you personally may impact your insurance rates. And many other factors too. In the end, there are countless factors, small and large, that impact insurance rates.

That’s why we put together these next few sections. We call them the meat and potatoes of car insurance coverage and rates in Indiana.

– Indiana Minimum Coverage

Minimum coverage is just that: The least amount of insurance coverage you require to drive a car legally in that state.

Minimum insurance coverage is generally aimed for other vehicles and occupants, meaning the damage caused to someone else’s vehicle in an accident or any injuries they (or their passengers) have.

This is called liability insurance.

Here’s the minimum coverage breakdown for Indiana. It’s referred to at the 25/50/25 liability insurance:

- $25,000 to pay for the injuries of one person

- $50,000 to pay for the injuries of more than one person

- $25,000 to pay for property damage

Examples of what this minimum coverage pays for includes car repairs to the other car, medical bills for the occupants if they were injured, or any damage to property other than the car involved in the accident, like a light pole.

Not having the minimum coverage results in penalties:

Every driver and every owner of a motor vehicle must have evidence of continuous financial responsibility. Failure to comply can result in the suspension of the person’s current driver’s license or vehicle registration or both.

These penalties can be severe. The Indiana Bureau of Motor Vehicles is required to verify that a person has minimum insurance if the driver has committed a serious traffic violation or a repeated speeding violation.

That person then may face a driver’s license suspension with a minimum of 90 days, up to one year.

However, if you’re just worried about not having your paper insurance copy on you, you can always use electronic proof of insurance.

Indiana is considered an “at-fault” state, which means that the driver who caused the accident is responsible for the financial damages to the other vehicle and its occupants.

While your insurance company should absorb these damages, it’s only up to the limit stated in your policy.

Anything above that limit, and you’re on the hook.

However, there are additional coverages you can add that will protect you further from paying costs out of your pocket. We’ll talk about these later. For now, let’s take a look at…

– Forms of Financial Responsibility

Forms of financial responsibility for automobiles are a quasi-legal device that proves you have the minimum form of coverage in a state. In Indiana, that section of code is IC 9-25-5 (Chapter 5. Proof of Financial Responsibility).

A couple of snippets are worth noting:

If a person is convicted of a traffic offense that requires a court appearance, the court shall require the person to show proof that financial responsibility was in force on the date of the violation…

And:

If a person fails to provide proof of financial responsibility as

required by this section, the court shall suspend the person’s current driving privileges or motor vehicle registration, or both

According to the section of code IC 9-25-5 (Chapter 4. Financial Responsibility), the documents required to verify are:

- Proof of insurance that meets the minimum requirements

- Proof of a bond executed on the vehicle with respect to section 7

- Certificate of self-insurance under section 11

The Indiana Bureau of Motor Vehicles is required to verify a driver has the minimum coverage in the following situations:

- An auto accident where an accident report is filed

- A pointable moving violation within one year of receiving two others

- A serious traffic violation, such as a misdemeanor or felony

- Any moving violation in which the driver previously failed to show proof

In general, just make sure to keep that proof of insurance handy, whether that’s the paper copy or one stored on your smartphone.

– Premiums as a Percentage of Income

Your premium is based off the 12 factors mentioned above, as well as tertiary factors like the behaviors of other motorists. But how much are you (and your fellow Hoosiers) paying compared to other states?

Premiums fluctuate from state to state. For instance in 2014, in New York, the average full-coverage premium was $1,327.82. While the average premium in Wyoming was $844.33.

That seems like a lot. But the real question is premiums as a percentage of income, which is a more accurate measure of “real” cost.

Here are the costs for the full coverage average premium as a percentage of income in Indiana:

| Year | Full Coverage Premium | Disposable Income | Insurance as % of Income |

|---|---|---|---|

| 2014 | $728.93 | $36,364.00 | 2 |

| 2013 | $704.50 | $35,163.00 | 2 |

| 2012 | $724.44 | $35,125.00 | 2.06 |

As you can see, the full coverage average premium cost is just two percent of the income of the average Hoosier. Let’s see how this compares to other nearby states, just for 2014:

| State | Full Coverage Premium | Disposable Income | Insurance as % of Income |

|---|---|---|---|

| Illinois | $854.10 | $42,256.00 | 2.02% |

| Kentucky | $917.49 | $33,237.00 | 2.76% |

| Michigan | $1,350.58 | $36,419.00 | 3.71% |

| Ohio | $766.66 | $37,490.00 | 2.04% |

As the chart shows, the premiums for all four neighboring states are higher, with Kentucky and Michigan having significantly higher premiums.

As you might expect, the average premium as a percentage of income is significantly higher for Kentucky and Michigan as well.

But while Ohio and Illinois have higher average premiums, the percentage of that premium within income is the same.

Nationwide, the percentages were:

- 2014: 2.37 percent

- 2013: 2.39 percent

- 2012: 2.32 percent

Overall, Hoosiers are paying less for auto insurance compared to residents of other states, and that includes the percentage per income as well.

– Core Coverage in Indiana

The data below comes from the National Association of Insurance Commissioners, a leading source in this subject matter:

| Core Car Insurance Coverage Costs in Indiana | Costs |

|---|---|

| Liability | $382.68 |

| Collision | $250.29 |

| Comprehensive | $122.06 |

| Full Coverage | $755.03 |

Core coverage is cheaper in Indiana than the rest of the country, and having it is the difference between paying just your deductible and thousands of dollars in damage. As we’ll see later, core coverage protects you financially, from a huge loss, at a small cost.

– Additional Liability

| Loss Ratio | 2014 | 2013 | 2012 |

|---|---|---|---|

| Medical Payments (Med Pay) | 83% | 81% | 83% |

| Uninsured/Underinsured Motorist | 64% | 60% | 65% |

To note: Med Pay, Uninsured, and Underinsured Motorist coverage are all optional in Indiana. So why might you need them?

Remember: Indiana ranks 8th in percentage of uninsured or underinsured motorists, with 16.7 percent of people at any given moment behind the wheel not having the minimum coverage.

If they don’t have enough coverage, they’ll have to pay out of pocket, which means you may have to wait a long time for that money, if you see it at all.

The loss ratios, which are defined as the ratio of losses to gains for the insurance companies, are level over time.

Generally, between 60 percent and 80 percent is a sweet spot. Anything over 100 percent and the insurance company is losing money. Anything under 50 percent and they might not be paying claims.

– Add-ons, Endorsements, and Riders

Ever gotten a flat tire in a rainstorm and wanted someone else to fix it?

Or gotten in an accident and had to foot over the rental cost?

Fortunately, insurance companies have a number of more specialized add-ins to your insurance plan. These include:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

– Male vs. Female Rates

Of those 12 factors mentioned earlier that influence car insurance premiums, one of them is—yep, you guessed it—being male or female. Here is a quick list, by age, sex, and company:

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,461.65 | $2,522.04 | $2,161.34 | $2,364.89 | $7,566.53 | $9,542.11 | $2,500.79 | $2,718.57 |

| American Family Mutual | $2,305.56 | $2,305.56 | $2,072.87 | $2,072.87 | $6,342.08 | $9,188.19 | $2,305.56 | $2,839.57 |

| Illinois Farmers Ins 2.0 | $1,558.68 | $1,538.30 | $1,333.35 | $1,497.61 | $8,369.82 | $8,927.88 | $2,053.19 | $2,219.06 |

| Geico Cas | $1,543.08 | $1,533.98 | $1,441.76 | $1,492.21 | $4,534.08 | $4,216.98 | $1,765.37 | $1,558.45 |

| First Liberty Ins Corp | $3,951.85 | $3,951.85 | $3,632.20 | $3,632.20 | $8,652.09 | $13,064.06 | $3,951.85 | $5,418.04 |

| Nationwide Mutual | $1,670.50 | $1,708.99 | $1,463.84 | $1,564.29 | $4,865.35 | $6,323.43 | $1,959.23 | $2,144.10 |

| Progressive Paloverde | $1,659.70 | $1,570.98 | $1,503.23 | $1,513.35 | $9,753.71 | $10,976.02 | $2,081.70 | $2,125.43 |

| State Farm Mutual Auto | $1,480.20 | $1,480.20 | $1,318.52 | $1,318.52 | $4,476.08 | $5,736.50 | $1,637.30 | $1,821.69 |

| Travco Ins Co | $1,225.25 | $1,246.82 | $1,148.12 | $1,147.95 | $7,586.22 | $11,997.40 | $1,295.87 | $1,500.67 |

| USAA | $1,039.00 | $1,023.39 | $966.69 | $974.02 | $2,894.49 | $3,235.29 | $1,404.62 | $1,503.00 |

And a list with the highest to lowest premiums, categorized by age and sex:

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| First Liberty Ins Corp | Single 17-year old male | $13,064.06 | 1 |

| Travco Ins Co | Single 17-year old male | $11,997.40 | 2 |

| Progressive Paloverde | Single 17-year old male | $10,976.02 | 3 |

| Progressive Paloverde | Single 17-year old female | $9,753.71 | 4 |

| Allstate P&C | Single 17-year old male | $9,542.11 | 5 |

| American Family Mutual | Single 17-year old male | $9,188.19 | 6 |

| Illinois Farmers Ins 2.0 | Single 17-year old male | $8,927.88 | 7 |

| First Liberty Ins Corp | Single 17-year old female | $8,652.09 | 8 |

| Illinois Farmers Ins 2.0 | Single 17-year old female | $8,369.82 | 9 |

| Travco Ins Co | Single 17-year old female | $7,586.22 | 10 |

| Allstate P&C | Single 17-year old female | $7,566.53 | 11 |

| American Family Mutual | Single 17-year old female | $6,342.08 | 12 |

| Nationwide Mutual | Single 17-year old male | $6,323.43 | 13 |

| State Farm Mutual Auto | Single 17-year old male | $5,736.50 | 14 |

| First Liberty Ins Corp | Single 25-year old male | $5,418.04 | 15 |

| Nationwide Mutual | Single 17-year old female | $4,865.35 | 16 |

| Geico Cas | Single 17-year old female | $4,534.08 | 17 |

| State Farm Mutual Auto | Single 17-year old female | $4,476.08 | 18 |

| Geico Cas | Single 17-year old male | $4,216.98 | 19 |

| First Liberty Ins Corp | Married 35-year old female | $3,951.85 | 20 |

| First Liberty Ins Corp | Married 35-year old male | $3,951.85 | 20 |

| First Liberty Ins Corp | Single 25-year old female | $3,951.85 | 20 |

| First Liberty Ins Corp | Married 60-year old female | $3,632.20 | 23 |

| First Liberty Ins Corp | Married 60-year old male | $3,632.20 | 23 |

| USAA | Single 17-year old male | $3,235.29 | 25 |

| USAA | Single 17-year old female | $2,894.49 | 26 |

| American Family Mutual | Single 25-year old male | $2,839.57 | 27 |

| Allstate P&C | Single 25-year old male | $2,718.57 | 28 |

| Allstate P&C | Married 35-year old male | $2,522.04 | 29 |

| Allstate P&C | Single 25-year old female | $2,500.79 | 30 |

| Allstate P&C | Married 35-year old female | $2,461.65 | 31 |

| Allstate P&C | Married 60-year old male | $2,364.89 | 32 |

| American Family Mutual | Married 35-year old female | $2,305.56 | 33 |

| American Family Mutual | Married 35-year old male | $2,305.56 | 33 |

| American Family Mutual | Single 25-year old female | $2,305.56 | 33 |

| Illinois Farmers Ins 2.0 | Single 25-year old male | $2,219.06 | 36 |

| Allstate P&C | Married 60-year old female | $2,161.34 | 37 |

| Nationwide Mutual | Single 25-year old male | $2,144.10 | 38 |

| Progressive Paloverde | Single 25-year old male | $2,125.43 | 39 |

| Progressive Paloverde | Single 25-year old female | $2,081.70 | 40 |

| American Family Mutual | Married 60-year old female | $2,072.87 | 41 |

| American Family Mutual | Married 60-year old male | $2,072.87 | 41 |

| Illinois Farmers Ins 2.0 | Single 25-year old female | $2,053.19 | 43 |

| Nationwide Mutual | Single 25-year old female | $1,959.23 | 44 |

| State Farm Mutual Auto | Single 25-year old male | $1,821.69 | 45 |

| Geico Cas | Single 25-year old female | $1,765.37 | 46 |

| Nationwide Mutual | Married 35-year old male | $1,708.99 | 47 |

| Nationwide Mutual | Married 35-year old female | $1,670.50 | 48 |

| Progressive Paloverde | Married 35-year old female | $1,659.70 | 49 |

| State Farm Mutual Auto | Single 25-year old female | $1,637.30 | 50 |

| Progressive Paloverde | Married 35-year old male | $1,570.98 | 51 |

| Nationwide Mutual | Married 60-year old male | $1,564.29 | 52 |

| Illinois Farmers Ins 2.0 | Married 35-year old female | $1,558.68 | 53 |

| Geico Cas | Single 25-year old male | $1,558.45 | 54 |

| Geico Cas | Married 35-year old female | $1,543.08 | 55 |

| Illinois Farmers Ins 2.0 | Married 35-year old male | $1,538.30 | 56 |

| Geico Cas | Married 35-year old male | $1,533.98 | 57 |

| Progressive Paloverde | Married 60-year old male | $1,513.35 | 58 |

| Progressive Paloverde | Married 60-year old female | $1,503.23 | 59 |

On the whole, males have higher premiums than females, and the young do more than the old. The idea is that with more experience, we’re likely to have fewer accidents and tickets.

– Cheapest Insurance Rates by Zip Code

Another one of those 12 factors, where you live, also influences your car insurance premium. We’ve compiled lists that you can search through to find the average premium in your zip code:

| Cheapest ZIP Codes in Indiana | City | Average by ZIP Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 47909 | LAFAYETTE | $2,931.86 | Liberty Mutual | $4,795.80 | Progressive | $3,520.02 | USAA | $1,664.59 | Geico | $1,846.51 |

| 47904 | LAFAYETTE | $2,935.07 | Liberty Mutual | $4,795.80 | Progressive | $3,672.73 | USAA | $1,680.00 | Geico | $1,846.51 |

| 47906 | WEST LAFAYETTE | $2,950.51 | Liberty Mutual | $4,795.80 | Progressive | $3,561.61 | USAA | $1,656.42 | Geico | $1,846.51 |

| 47905 | LAFAYETTE | $2,951.60 | Liberty Mutual | $4,795.80 | Progressive | $3,610.18 | USAA | $1,680.00 | Geico | $1,846.51 |

| 46052 | LEBANON | $2,954.17 | Liberty Mutual | $4,731.27 | Progressive | $3,733.55 | USAA | $1,672.13 | State Farm | $2,025.08 |

| 47304 | MUNCIE | $2,966.03 | Liberty Mutual | $5,135.56 | Progressive | $3,507.11 | USAA | $1,554.19 | Geico | $1,964.87 |

| 47901 | LAFAYETTE | $2,966.62 | Liberty Mutual | $4,795.80 | Progressive | $3,557.08 | USAA | $1,680.00 | Geico | $1,846.51 |

| 47907 | WEST LAFAYETTE | $2,966.92 | Liberty Mutual | $4,795.80 | Progressive | $3,554.69 | USAA | $1,656.42 | Geico | $1,846.51 |

| 47941 | DAYTON | $2,967.67 | Liberty Mutual | $4,795.80 | Progressive | $3,683.95 | USAA | $1,664.59 | Geico | $1,846.51 |

| 47992 | WESTPOINT | $2,979.70 | Liberty Mutual | $4,795.80 | Progressive | $3,619.45 | USAA | $1,664.59 | Geico | $1,846.51 |

| 47320 | ALBANY | $2,992.15 | Liberty Mutual | $5,135.56 | Allstate | $3,790.23 | USAA | $1,557.29 | Geico | $2,086.92 |

| 47303 | MUNCIE | $3,003.06 | Liberty Mutual | $5,135.56 | Allstate | $3,776.91 | USAA | $1,557.29 | Geico | $1,964.87 |

| 47920 | BATTLE GROUND | $3,004.91 | Liberty Mutual | $4,795.80 | Progressive | $3,881.11 | USAA | $1,680.00 | Geico | $1,846.51 |

| 47981 | ROMNEY | $3,009.62 | Liberty Mutual | $4,795.80 | Allstate | $3,828.61 | USAA | $1,664.59 | Geico | $1,846.51 |

| 46733 | DECATUR | $3,011.51 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| 47933 | CRAWFORDSVILLE | $3,016.00 | Liberty Mutual | $4,795.80 | Allstate | $3,810.42 | USAA | $1,751.12 | Geico | $1,846.51 |

| 47305 | MUNCIE | $3,018.08 | Liberty Mutual | $5,135.56 | Allstate | $3,471.39 | USAA | $1,557.29 | Geico | $1,964.87 |

| 47940 | DARLINGTON | $3,019.44 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

| 46711 | BERNE | $3,021.03 | Liberty Mutual | $5,603.67 | Allstate | $3,847.95 | USAA | $1,440.88 | Geico | $1,997.93 |

| 46781 | PONETO | $3,026.33 | Liberty Mutual | $5,603.67 | Allstate | $3,723.28 | USAA | $1,440.88 | Geico | $1,997.93 |

| 46184 | WHITELAND | $3,029.36 | Liberty Mutual | $4,731.27 | Allstate | $3,822.92 | USAA | $1,553.91 | Nationwide | $2,200.66 |

| 46112 | BROWNSBURG | $3,031.44 | Liberty Mutual | $4,731.27 | Progressive | $3,801.39 | USAA | $1,599.04 | Nationwide | $2,168.37 |

| 47302 | MUNCIE | $3,033.48 | Liberty Mutual | $5,135.56 | Progressive | $3,809.05 | USAA | $1,557.29 | Geico | $1,964.87 |

| 46759 | KEYSTONE | $3,034.31 | Liberty Mutual | $5,603.67 | Allstate | $3,893.46 | USAA | $1,440.88 | Geico | $1,997.93 |

| 47955 | LINDEN | $3,047.57 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

As you can see, full coverage car insurance premiums in Indiana generally stay in a $600 range, between $3,000 and $3,600.

| Most Expensive ZIP Codes in Indiana | City | Average by ZIP Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 46402 | GARY | $4,747.17 | Liberty Mutual | $9,628.64 | Travelers | $5,850.12 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46409 | GARY | $4,692.40 | Liberty Mutual | $9,628.64 | Travelers | $5,474.18 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46404 | GARY | $4,666.36 | Liberty Mutual | $9,628.64 | Travelers | $5,474.18 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46406 | GARY | $4,653.94 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,275.82 | State Farm | $3,038.44 |

| 46408 | GARY | $4,643.30 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46407 | GARY | $4,593.71 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46403 | GARY | $4,578.59 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,268.89 | State Farm | $2,999.79 |

| 46312 | EAST CHICAGO | $4,535.08 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46320 | HAMMOND | $4,504.55 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46327 | HAMMOND | $4,484.26 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46323 | HAMMOND | $4,437.39 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46405 | LAKE STATION | $4,429.98 | Liberty Mutual | $9,628.64 | Farmers | $4,942.93 | USAA | $2,268.89 | Geico | $2,701.41 |

| 46394 | WHITING | $4,389.62 | Liberty Mutual | $8,830.37 | Travelers | $5,122.67 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46324 | HAMMOND | $4,283.88 | Liberty Mutual | $8,830.37 | American Family | $4,641.89 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46218 | INDIANAPOLIS | $3,918.34 | Liberty Mutual | $6,988.78 | Progressive | $4,785.22 | USAA | $1,807.48 | Geico | $2,935.62 |

| 46225 | INDIANAPOLIS | $3,911.50 | Liberty Mutual | $6,988.78 | Allstate | $4,556.36 | USAA | $1,921.95 | State Farm | $2,849.34 |

| 46201 | INDIANAPOLIS | $3,903.52 | Liberty Mutual | $6,988.78 | Progressive | $4,737.15 | USAA | $1,807.48 | State Farm | $2,765.34 |

| 46321 | MUNSTER | $3,840.34 | Liberty Mutual | $6,539.56 | Progressive | $4,761.83 | USAA | $1,830.24 | State Farm | $2,634.19 |

| 46202 | INDIANAPOLIS | $3,836.94 | Liberty Mutual | $6,988.78 | Allstate | $4,562.82 | USAA | $1,921.95 | State Farm | $2,734.67 |

| 46205 | INDIANAPOLIS | $3,811.23 | Liberty Mutual | $5,987.84 | Progressive | $4,809.00 | USAA | $1,960.16 | Geico | $2,746.89 |

| 46203 | INDIANAPOLIS | $3,810.17 | Liberty Mutual | $6,988.78 | Progressive | $4,393.59 | USAA | $1,890.04 | State Farm | $2,727.33 |

| 46410 | MERRILLVILLE | $3,807.73 | Liberty Mutual | $6,402.26 | Farmers | $4,942.93 | USAA | $1,941.51 | Nationwide | $2,610.30 |

| 46208 | INDIANAPOLIS | $3,803.31 | Liberty Mutual | $5,987.84 | Allstate | $4,774.63 | USAA | $1,927.91 | Geico | $2,746.89 |

| 46204 | INDIANAPOLIS | $3,795.21 | Liberty Mutual | $6,988.78 | Allstate | $4,562.82 | USAA | $1,921.95 | State Farm | $2,707.44 |

| 46319 | GRIFFITH | $3,791.73 | Liberty Mutual | $6,402.26 | Progressive | $4,788.69 | USAA | $1,830.24 | State Farm | $2,666.18 |

Often, the density of people in a zip code has an impact on car insurance rates. Indianapolis zip codes, for instance, have higher average premiums compared to the rest of the state.

– Cheapest Rates by City

Similar to the analysis of zip codes, none of the top 10 cheapest cities for car insurance have more than 80,000 people. Most have 10,000 or less.

| Cheapest Cities in Indiana | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Lafayette | $2,950.11 | Liberty Mutual | $4,795.80 | Progressive | $3,576.13 | USAA | $1,670.25 | Geico | $1,846.51 |

| Montmorenci | $2,950.51 | Liberty Mutual | $4,795.80 | Progressive | $3,561.61 | USAA | $1,656.42 | Geico | $1,846.51 |

| Americus | $2,951.59 | Liberty Mutual | $4,795.80 | Progressive | $3,610.18 | USAA | $1,680.00 | Geico | $1,846.51 |

| Lebanon | $2,954.16 | Liberty Mutual | $4,731.27 | Progressive | $3,733.55 | USAA | $1,672.13 | State Farm | $2,025.08 |

| Dayton | $2,967.66 | Liberty Mutual | $4,795.80 | Progressive | $3,683.95 | USAA | $1,664.59 | Geico | $1,846.51 |

| Westpoint | $2,979.70 | Liberty Mutual | $4,795.80 | Progressive | $3,619.45 | USAA | $1,664.59 | Geico | $1,846.51 |

| Albany | $2,992.15 | Liberty Mutual | $5,135.56 | Allstate | $3,790.23 | USAA | $1,557.29 | Geico | $2,086.92 |

| Battle Ground | $3,004.91 | Liberty Mutual | $4,795.80 | Progressive | $3,881.11 | USAA | $1,680.00 | Geico | $1,846.51 |

| Romney | $3,009.62 | Liberty Mutual | $4,795.80 | Allstate | $3,828.61 | USAA | $1,664.59 | Geico | $1,846.51 |

| Decatur | $3,011.51 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| Crawfordsville | $3,016.00 | Liberty Mutual | $4,795.80 | Allstate | $3,810.42 | USAA | $1,751.12 | Geico | $1,846.51 |

| Muncie | $3,018.33 | Liberty Mutual | $5,135.56 | Allstate | $3,600.35 | USAA | $1,556.05 | Geico | $1,964.87 |

| Darlington | $3,019.44 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

| Berne | $3,021.03 | Liberty Mutual | $5,603.67 | Allstate | $3,847.95 | USAA | $1,440.88 | Geico | $1,997.93 |

| Poneto | $3,026.33 | Liberty Mutual | $5,603.67 | Allstate | $3,723.28 | USAA | $1,440.88 | Geico | $1,997.93 |

| New Whiteland | $3,029.36 | Liberty Mutual | $4,731.27 | Allstate | $3,822.92 | USAA | $1,553.91 | Nationwide | $2,200.66 |

| Brownsburg | $3,031.44 | Liberty Mutual | $4,731.27 | Progressive | $3,801.39 | USAA | $1,599.04 | Nationwide | $2,168.37 |

| Keystone | $3,034.31 | Liberty Mutual | $5,603.67 | Allstate | $3,893.46 | USAA | $1,440.88 | Geico | $1,997.93 |

| Linden | $3,047.56 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

| Monroe | $3,047.88 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| Bluffton | $3,048.12 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| Winchester | $3,048.99 | Liberty Mutual | $5,603.67 | Allstate | $3,855.97 | USAA | $1,551.34 | Geico | $2,086.92 |

| Gaston | $3,049.64 | Liberty Mutual | $5,135.56 | Progressive | $3,481.03 | USAA | $1,554.19 | Geico | $1,964.87 |

| Waynetown | $3,055.37 | Liberty Mutual | $4,795.80 | Progressive | $3,902.82 | USAA | $1,751.12 | Geico | $1,846.51 |

| Clarks Hill | $3,055.48 | Liberty Mutual | $4,795.80 | Allstate | $4,021.48 | USAA | $1,664.59 | Geico | $1,846.51 |

Lafayette has the cheapest car insurance rates.

| Most Expensive Cities in Indiana | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Gary | $4,653.64 | Liberty Mutual | $9,628.64 | Travelers | $5,300.76 | USAA | $2,269.88 | Geico | $3,059.32 |

| East Chicago | $4,535.08 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,275.82 | Geico | $2,633.18 |

| Lake Station | $4,429.98 | Liberty Mutual | $9,628.64 | Farmers | $4,942.93 | USAA | $2,268.89 | Geico | $2,701.41 |

| Hammond | $4,419.94 | Liberty Mutual | $9,309.33 | American Family | $4,859.78 | USAA | $2,275.82 | Geico | $2,633.18 |

| Munster | $3,840.34 | Liberty Mutual | $6,539.56 | Progressive | $4,761.83 | USAA | $1,830.24 | State Farm | $2,634.19 |

| Griffith | $3,791.73 | Liberty Mutual | $6,402.26 | Progressive | $4,788.69 | USAA | $1,830.24 | State Farm | $2,666.18 |

| Hobart | $3,723.86 | Liberty Mutual | $6,402.26 | Farmers | $4,377.50 | USAA | $1,941.51 | Nationwide | $2,610.30 |

| Highland | $3,696.55 | Liberty Mutual | $6,539.56 | Allstate | $4,381.45 | USAA | $1,830.24 | State Farm | $2,647.19 |

| Schererville | $3,695.41 | Liberty Mutual | $6,402.26 | Progressive | $4,590.37 | USAA | $1,706.16 | State Farm | $2,586.38 |

| Dyer | $3,678.46 | Liberty Mutual | $6,402.26 | American Family | $4,299.79 | USAA | $1,706.16 | State Farm | $2,645.06 |

| St. John | $3,678.32 | Liberty Mutual | $6,402.26 | American Family | $4,299.79 | USAA | $1,706.16 | Geico | $2,701.41 |

| Westville | $3,661.15 | Liberty Mutual | $6,926.39 | American Family | $4,218.96 | USAA | $1,610.51 | Geico | $2,353.77 |

| Beverly Shores | $3,640.46 | Liberty Mutual | $6,926.39 | Progressive | $4,241.52 | USAA | $1,904.61 | Geico | $2,353.77 |

| Borden | $3,625.98 | Liberty Mutual | $5,937.41 | Progressive | $4,459.13 | USAA | $1,897.73 | Geico | $2,437.68 |

| Kingsbury | $3,625.44 | Liberty Mutual | $6,926.39 | Progressive | $4,338.11 | USAA | $1,610.51 | Geico | $2,233.98 |

| Homecroft | $3,623.82 | Liberty Mutual | $5,987.84 | Progressive | $4,872.69 | USAA | $1,771.02 | Geico | $2,369.70 |

| Otisco | $3,614.57 | Liberty Mutual | $5,937.41 | Progressive | $4,528.25 | USAA | $1,897.73 | Geico | $2,437.68 |

| Boone Grove | $3,611.22 | Liberty Mutual | $6,535.71 | Progressive | $4,624.80 | USAA | $1,904.61 | Geico | $2,138.50 |

| Evansville | $3,611.05 | Liberty Mutual | $6,594.45 | Progressive | $4,151.10 | USAA | $1,825.34 | Geico | $2,402.59 |

| Georgetown | $3,606.56 | Liberty Mutual | $5,875.05 | Progressive | $4,388.15 | USAA | $1,734.46 | Geico | $2,556.33 |

| Indianapolis | $3,604.96 | Liberty Mutual | $6,140.11 | Progressive | $4,316.55 | USAA | $1,837.91 | Geico | $2,604.98 |

| Henryville | $3,602.10 | Liberty Mutual | $5,937.41 | Progressive | $4,509.85 | USAA | $1,897.73 | Geico | $2,437.68 |

| Pekin | $3,595.20 | Liberty Mutual | $5,937.41 | Progressive | $4,464.19 | USAA | $1,716.22 | Geico | $2,437.68 |

| Wheeler | $3,593.95 | Liberty Mutual | $6,535.71 | Progressive | $4,392.97 | USAA | $1,760.45 | Nationwide | $2,610.30 |

| Nabb | $3,593.87 | Liberty Mutual | $5,937.41 | Progressive | $4,355.40 | USAA | $1,897.73 | Geico | $2,437.68 |

That closes the section on Indiana’s car insurance coverage and rates. Need a breath? Need to change that set of tires on your racer?

Good. Take it. Because you won’t want to miss the next section. It’s the meat of the meat and potatoes: a section designed to save you a great deal of time in your search for your next car insurance company.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Indiana Car Insurance Companies

Progressive has Flo. Geico had/has the talking gecko. State Farm has half the Houston Rockets NBA team. Their commercials are funny, witty, designed to get you engaged about a topic that’s a little…well, dry.

But how much do you know about them? And the others?

From the previous section, you know about coverages and rates for the state of Indiana, including detailed coverages and zip codes. But it may be confusing—even lurch in the stomach nerves—to sit down and talk to an insurance rep.

– The Largest Companies’ Financial Ratings

You know the situation: That good-for-nothing uncle is coming around asking for money again. You do an assessment of the situation, ask questions: When are you going to pay this back, what is your financial health like, do you have a stream of income?

In your head, you have a rating: His financial strength and the probability he will pay back.

We all have our credit scores, and companies have them too. And while knowing a company’s credit rating is important—no one likes to invest in a company before they go bankrupt—knowing the financial rating is even better.

What follows are ratings from AM Best, a global credit research firm that rates businesses on everything from credit to overall financial rating. These are the latter.

If you want to get a guide for the rating system, click here.

| Company | Rating |

|---|---|

| State Farm | A++ |

| Progressive | A |

| Allstate | A+ |

| Indiana Farm Bureau Group | Not Rated |

| Geico | A++ |

| Liberty Mutual | A |

| American Family Insurance Group | A |

| Erie Insurance Group | A+ |

| USAA | A++ |

| Auto-Owners Insurance Group | A++ |

Nine of the top 10 largest companies are rated A or higher, with the 10th, Indiana Farm Bureau Group, not having a rating listed.

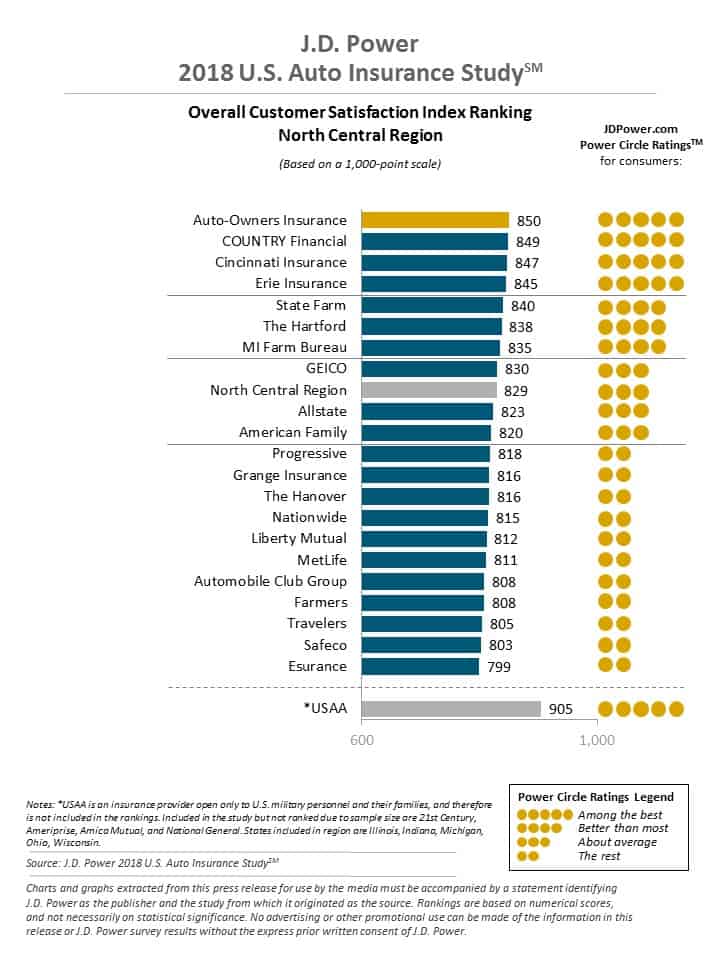

– Companies with the Best Ratings

Here is J.D. Power’s list for customer satisfaction in the mid-Atlantic region, with all but one of our top 10 companies in Indiana there.

The mysterious Indiana Farm Bureau Group is missing again, though it is likely they were just too small of a company to make the AM Best ratings or the J.D. Power list.

It is notable that in its page for this study J.D. Power notes that customer loyalty is at an all-time high, with the increase in digital channels making tasks like paying bills or getting roadside service easier.

– Companies with the Most Complaints

Sure, you’ve filed a complaint. Somewhere, somehow, right?

Did you wonder how that complaint impacted their score (gleefully, I’m guessing?)?

It’s true—complaints do matter. Because of that, we’ve created this list here, drawn from an Indiana Department of Insurance document. It details all the complaints against auto-insurance companies in Indiana for 2018.

Here is a quick hit:

| Company | Number of Complaints | Complaint Index |

|---|---|---|

| State Farm | 24 | 0.41 |

| Indiana Farm Bureau | 4 | 0.56 |

| Auto-Owners Insurance Group | 6 | 0.65 |

A complaint always matters but its impact in terms of the company depends on two factors: the number of complaints already there and how many customers the company has.

That second part is the complaint index, which is a ratio with some fancy math between the number of complaints on how many customers the company has. The lower the index the better.

This number shows that State Farm, while having 24 complaints, has a better complaint index than the Indiana Farm Bureau and the Auto-Owners Insurance Group. They simply do a ton more business.

– Insurance Rates by Company

Here are ten leading insurance company annual averages:

| Company | Average | Compared to State Average | [continued] |

|---|---|---|---|

| Allstate P&C | $3,979.74 | $661.62 | 16.62% |

| American Family Mutual | $3,679.03 | $360.91 | 9.81% |

| Illinois Farmers Ins 2.0 | $3,437.24 | $119.11 | 3.47% |

| Geico Cas | $2,260.74 | -$1,057.38 | -46.77% |

| First Liberty Ins Corp | $5,781.77 | $2,463.65 | 42.61% |

| Nationwide Mutual | $2,712.47 | -$605.66 | -22.33% |

| Progressive Paloverde | $3,898.01 | $579.89 | 14.88% |

| State Farm Mutual Auto | $2,408.63 | -$909.49 | -37.76% |

| Travco Ins Co | $3,393.54 | $75.42 | 2.22% |

| USAA | $1,630.06 | -$1,688.06 | -103.56% |

USAA, Geico, State Farm, and Nationwide all have significantly lower annual averages than the overall average. First Liberty Insurance Corporation is a bit high.

– Commute Rates

For (some) insurance companies, commute length matters. Check out the numbers:

| Company | Commute (in miles) | Annual Mileage | Annual Average |

|---|---|---|---|

| Liberty Mutual | 25 | 12000 | $5,935.42 |

| Liberty Mutual | 10 | 6000 | $5,628.11 |

| Allstate | 10 | 6000 | $3,979.74 |

| Allstate | 25 | 12000 | $3,979.74 |

| Progressive | 10 | 6000 | $3,898.01 |

| Progressive | 25 | 12000 | $3,898.01 |

| American Family | 25 | 12000 | $3,723.40 |

| American Family | 10 | 6000 | $3,634.66 |

| Farmers | 10 | 6000 | $3,437.24 |

| Farmers | 25 | 12000 | $3,437.24 |

| Travelers | 10 | 6000 | $3,393.54 |

| Travelers | 25 | 12000 | $3,393.54 |

| Nationwide | 10 | 6000 | $2,712.47 |

| Nationwide | 25 | 12000 | $2,712.47 |

| State Farm | 25 | 12000 | $2,476.96 |

| State Farm | 10 | 6000 | $2,340.29 |

| Geico | 25 | 12000 | $2,300.89 |

| Geico | 10 | 6000 | $2,220.59 |

| USAA | 25 | 12000 | $1,651.69 |

| USAA | 10 | 6000 | $1,608.43 |

The majority of companies don’t charge a dime extra for a longer commute. But three notable companies—State Farm, Liberty Mutual, and American Family—charge around $100 extra or more.

– Coverage Level Rates

| Company | Coverage Type | Annual Average |

|---|---|---|

| Liberty Mutual | High | $5,985.03 |

| Liberty Mutual | Medium | $5,766.94 |

| Liberty Mutual | Low | $5,593.34 |

| Allstate | High | $4,185.52 |

| Progressive | High | $4,174.68 |

| Allstate | Medium | $3,964.38 |

| Progressive | Medium | $3,837.21 |

| American Family | Medium | $3,800.78 |

| Allstate | Low | $3,789.32 |

| Progressive | Low | $3,682.14 |

| American Family | Low | $3,644.40 |

| American Family | High | $3,591.92 |

| Farmers | High | $3,565.78 |

| Farmers | Medium | $3,430.50 |

| Travelers | High | $3,428.83 |

| Travelers | Medium | $3,425.20 |

| Travelers | Low | $3,326.58 |

| Farmers | Low | $3,315.42 |

| Nationwide | Low | $2,754.80 |

| Nationwide | High | $2,691.75 |

| Nationwide | Medium | $2,690.85 |

| State Farm | High | $2,522.50 |

| State Farm | Medium | $2,407.80 |

| Geico | High | $2,407.42 |

| State Farm | Low | $2,295.59 |

| Geico | Medium | $2,254.59 |

| Geico | Low | $2,120.21 |

| USAA | High | $1,692.31 |

| USAA | Medium | $1,626.02 |

| USAA | Low | $1,571.85 |

Most expensive per coverage: Liberty Mutual, Allstate, Progressive

Least expensive per coverage: USAA, Geico, State Farm

The highest/lowest overall insurance packages: Around $6000 for Liberty Mutual high coverage and around $1600 for USAA low coverage.

– Credit History Rates

Remember those 12 things?

Credit score has a big impact on the rate you’ll get, for better or for worse, as insurance companies will pull your credit history, look at your debt and assess the risk of giving you a plan. For the technically-inclined, the process is called underwriting.

Here is a look at poor to good credit with the companies’ annual averages:

| Company | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $7,698.61 |

| American Family | Poor | $5,032.66 |

| Liberty Mutual | Fair | $5,011.70 |

| Allstate | Poor | $4,935.01 |

| Liberty Mutual | Good | $4,635.00 |

| Progressive | Poor | $4,299.10 |

| Farmers | Poor | $4,010.86 |

| Progressive | Fair | $3,806.34 |

| Travelers | Poor | $3,778.81 |

| Allstate | Fair | $3,670.06 |

| Progressive | Good | $3,588.61 |

| State Farm | Poor | $3,508.97 |

| Allstate | Good | $3,334.15 |

| Farmers | Fair | $3,270.65 |

| American Family | Fair | $3,268.20 |

| Travelers | Fair | $3,202.05 |

| Travelers | Good | $3,199.76 |

| Nationwide | Poor | $3,088.75 |

| Farmers | Good | $3,030.19 |

| American Family | Good | $2,736.23 |

| Geico | Poor | $2,719.94 |

| Nationwide | Fair | $2,608.92 |

| Nationwide | Good | $2,439.73 |

| Geico | Fair | $2,260.74 |

| USAA | Poor | $2,195.89 |

| State Farm | Fair | $2,093.59 |

| Geico | Good | $1,801.53 |

| State Farm | Good | $1,623.32 |

| USAA | Fair | $1,450.78 |

| USAA | Good | $1,243.51 |

If you’re in the poor category, don’t fear. It’s important to note that insurers in Indiana can’t disqualify you solely because of your credit score. As Bulletin 130 reads:

The insurer shall not deny, cancel, decline to renew an insurance policy, or base a renewal rate solely on the basis of credit information

There’s a no-discrimination clause in Bulletin 130 as well, specifying that insurance scores can’t be based on factors like income, gender, address, etc. But credit scores, in general, play significant roles.

– Driving Record Rates

Like your credit score, your driving record can help you or hurt you. Here are some statistics:

| Company | Driving Record | Annual Average |

|---|---|---|

| Liberty Mutual | With 1 DUI | $8,331.91 |

| Liberty Mutual | With 1 accident | $5,317.03 |

| Progressive | With 1 accident | $5,121.94 |

| American Family | With 1 DUI | $5,117.20 |

| Liberty Mutual | With 1 speeding violation | $4,969.05 |

| Allstate | With 1 accident | $4,665.22 |

| Liberty Mutual | Clean record | $4,509.08 |

| Allstate | With 1 DUI | $4,301.12 |

| Progressive | With 1 speeding violation | $4,063.99 |

| American Family | With 1 accident | $4,041.92 |

| Travelers | With 1 DUI | $4,036.63 |

| Allstate | With 1 speeding violation | $3,777.03 |

| Farmers | With 1 DUI | $3,692.93 |

| Farmers | With 1 accident | $3,585.45 |

| Travelers | With 1 accident | $3,562.38 |

| Progressive | With 1 DUI | $3,485.71 |

| Farmers | With 1 speeding violation | $3,395.05 |

| Allstate | Clean record | $3,175.58 |

| Geico | With 1 DUI | $3,162.96 |

| Travelers | With 1 speeding violation | $3,092.54 |

| Farmers | Clean record | $3,075.51 |

| American Family | With 1 speeding violation | $3,020.98 |

| Nationwide | With 1 accident | $3,007.11 |

| Progressive | Clean record | $2,920.42 |

| Nationwide | With 1 DUI | $2,883.35 |

| Travelers | Clean record | $2,882.59 |

| Nationwide | With 1 speeding violation | $2,627.10 |

| State Farm | With 1 accident | $2,578.33 |

| American Family | Clean record | $2,536.03 |

| State Farm | Clean record | $2,352.06 |

| State Farm | With 1 DUI | $2,352.06 |

| State Farm | With 1 speeding violation | $2,352.06 |

| Geico | With 1 accident | $2,335.58 |

| Nationwide | Clean record | $2,332.31 |

| Geico | With 1 speeding violation | $2,060.50 |

| USAA | With 1 DUI | $2,010.62 |

| USAA | With 1 accident | $1,752.37 |

| USAA | With 1 speeding violation | $1,526.13 |

| Geico | Clean record | $1,483.91 |

| USAA | Clean record | $1,231.12 |

Many insurance companies, including Allstate and Geico, offer a Good Driver Plan. It’s on a scale: The more tickets and accidents you accrue, the higher your premium will be. Ditto for the opposite.

– Largest Car Insurance Companies

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $907,710 | 24.05% |

| Progressive Group | $428,466 | 11.35% |

| Allstate Insurance Group | $287,390 | 7.61% |

| Indiana Farm Bureau Group | $277,065 | 7.34% |

| Geico | $233,428 | 6.18% |

| Liberty Mutual Group | $185,530 | 4.92% |

| American Family Insurance Group | $171,186 | 4.54% |

| Erie Insurance Group | $143,261 | 3.80% |

| USAA Group | $98,402 | 2.61% |

| Auto-Owners Group | $91,976 | 2.44% |

As was indicated in the complaints section, State Farm has a huge share of the market, the top two (State Farm and Progressive) make up nearly 35 percent.

The smallest in the group? Auto-Owners Group at 2.4 percent. As shown in the J.D. Power graph, they are also the group with the most satisfied customers.

Find the Cheapest Insurance in Indiana Cities

This section offers a direct comparison of insurance rates in Indiana cities: Evansville, Fort Wayne, Gary, Indianapolis, and South Bend. Securing affordable insurance is essential for optimal coverage. Whether in the capital city of Indianapolis or other cities like Evansville and Fort Wayne, drivers can use this data to find the most economical insurance options, ensuring suitable coverage at competitive rates.

| Find the Cheapest Insurance in Your City |

|---|

| Evansville, IN |

| Fort Wayne, IN |

| Gary, IN |

| Indianapolis, Indiana |

| South Bend, IN |

– Number of Insurers

Indiana has 1,022 insurers, 64 domestic and 958 foreign.

What’s the difference?

Foreign versus domestic might seem more like a country border issue, and it is with insurance—except with state borders.

An insurance company that is based in Indiana and does business in Indiana would be considered a domestic insurer.

An insurance company that is based in Ohio but does business in Indiana would be considered a foreign insurer.

The same “foreign” designation would go for companies that are chains (an Allstate, a Geico) and have offices in other states. However, having insurance from a foreign insurer doesn’t restrict your ability to drive (obviously).

Just make sure you have the minimum coverage; or, perhaps, more.

If you’re ready to get a quote, try our FREE tool:

Enter your ZIP code below to compare auto insurance rates.Free Auto Insurance Comparison

Secured with SHA-256 Encryption

Indiana State Laws

If you’ve ever driven, made an error, and wondered if you had broken a law, this section is for you. We understand that state driving laws can be complicated—and there can be a lot of them.

We understand and are here to help.

– Car Insurance Laws

You’re a newcomer, just passing through, or need to brush up on your car insurance laws. This section is for you. From coverage on your windshield to low-cost insurance, we’ve got you covered in this section, beginning with…

How the Government Regulates Insurance

It may give you a sense of calm to know that it’s not just insurance companies influencing the rates. Like other insurance departments, the Indiana Department of Insurance regulates rates through state laws and procedures. These procedures include:

- Prior approval by the state insurance department

- Modified prior approval

- Flex rating (being a certain percentage above prior rates)

There are some bureaucratic methods as well. If you’d like to learn more, click here and read the document by the National Association of Insurance Commissioners.

– Windshield Coverage

Indiana has no laws specific to windshield coverage. For vehicles less than five years old, you can choose from OEM (parts from an original equipment manufacturer), aftermarket, or used parts.

As this article notes:

Some drivers in Indiana have a special zero-deductible amount established for auto glass repair work, but laws in this state do not necessarily require insurance providers to offer this deductible set-up.

Meaning your windshield repair might be covered for free, or you might have to meet the deductible.

Check with your car insurance company, and if you’re in the process of selecting, ask about it.

– High-Risk Insurance

Sometimes, a person makes a mistake while driving and is sent to court over the violation. If the person’s driving privileges are suspended, in order for them to be reinstated, the Indiana state government may require the person to hold SR-22 insurance.

SR-22 is high-risk insurance filed by the insurance company that proves you meet the requirements for minimum liability insurance (that 25-50-25 number from earlier).

The Indiana Bureau of Motor Vehicles had this to say about the SR-22:

If your driving privileges are suspended upon conviction of certain court-related offenses, or for insurance violations, Indiana law may require you to hold SR22 insurance. Your insurance provider must electronically file proof of future financial responsibility with a SR22 form for you to be reinstated. The SR22 requirement, along with any reinstatement fees, must be satisfied before your driving privileges will be reinstated.

If you can’t get insurance coverage in the voluntary market, you may be eligible for the Indiana Automobile Insurance Plan, or IN AIP. It’s a plan for high-risk drivers.

– Low-Cost Insurance

There are no programs that offer low-cost insurance in Indiana at the moment. Still, if you’re looking for a discount, you can always ask your provider if they offer the following programs:

- Good driver discount

- Student driver discount

- Anti-theft device discount

- Homeowner discount

- Multi-policy discount

- Multi-vehicle discount

- Green vehicle discount

Talk to your agent or provider. There are many more to choose from.

– Automobile Insurance Fraud in Indiana

Indiana has no insurance fraud bureau but has taken steps in recent years to curb fraud. There are now laws against filing false auto insurance applications, criminalizing those who lie on claims, and grant broad immunity to those who report fraud “without malice.”

Insurance fraud amounts to $30 billion per year, so there’s little wonder that it’s taken seriously.

And it’s not worth it: Insurance fraud in Indiana is considered a Level 6 Felony, with between six months and 2.5 years in prison, and that’s just for the first conviction.

– Statute of Limitations

The statute of limitations is more than just prosecuting suspects for a crime; It also dictates how much time you have before you can’t file an auto insurance claim and get the money you’re owed. In Indiana, you have:

Personal injury: Two years

Property damage: Two years

The clock starts on the day of your accident.

– Ride Safe Indiana Program

Indiana experienced a strong increase in motorcycle-related accidents from 2016 to 2017: 17 percent. Since then, the Ride Safe Indiana Program has been initiated, which focused on motorcycle training to reduce accidents, injuries, and fatalities.

Still, there are calls, as in the IndyStar.com, the preeminent newspaper in the state, to reverse the state’s repeal on motorcycle helmets, the lack of which can contribute to fatalities.

– Vehicle Licensing Laws

Like most states in the union, Indiana is compliant with the REAL ID Act, which was passed in Congress in 2005. The Act sets forth the rules regarding the minimum security standards that states have when issuing state-IDs, such as drivers’ licenses.

All new applicants for drivers licenses in Indiana are required to get the new version, and by 2020 everyone will need a REAL ID-complaint license or form of identification to get into commercial planes, enter nuclear facilities, or access federal facilities.

Those who are renewing are not required but are encouraged to do so.

To apply for a REAL ID, you need:

- Proof of identity

- Proof of lawful status

- Proof of social security number

- Two documents to prove Indiana residency

And more. All the documents you need are listed here.

– Penalties for Driving Without Insurance

All drivers in Indiana are required to have insurance. There are stiff penalties for not having it:

- 1st offense: License/registration suspension for 90 days to one year

- 2nd offense: Within three years, license/registration suspension for one year

Cops check for proof of insurance at traffic stops, and a general certificate of compliance is required with all traffic violations and accidents.

If you don’t have coverage and you find yourself pulled over or in an accident, you will likely be out of driving (and your car parked) for a good bit.

– Teen Driver Laws

While you can get a learner’s permit at 15 years old in Indiana, you’ll need to be 16 (and three months) for a driver’s license.

When it comes to restrictions and requirements, here is a short table:

| Minimum Entry Age | 15 |

| Mandatory Holding Period | 6 months |

| Supervised Driving (minimum amount) | 50 hours (10 at night) |

| Minimum Age for DL | 16 (and 3 months) |

Teenagers with a restricted driver’s license can have no passengers except for family members.

Read More: How to Teach Your Teen to Drive

– Older Driver License Renewal Procedures

For older Hoosiers (ages 75 or above), you’ll need to renew your license every four years. There are some commonalities with the general population; You’ll need to have proof of adequate vision with every renewal, for instance.

However, if you’re above 75:

You’re not permitted to have online or mail renewal; instead, you need to do renew in person.

So, if you’re 75 or older: Schedule that eye doctor appointment and head down to the DMV in person.

– New Residents

If you’re a new resident to Indiana, there are some things you need to look out for (not just the black bears). There are certain requirements for new residents, specifically with automobiles.

The first task required is to register your vehicle in Indiana. This must be done in 60 days since becoming a resident. You’ll need:

- Certificate of Title

- Vehicle Inspection

- Proof of Address

- Proof of Social Security Number

You’ll also have 60 days to apply for a new driver’s license. The documents needed will be the same as for the REAL ID license (which is what you’re getting, after all): proof of identity, lawful status, residency, and social security number.

There is just one exception: You’ll need proof that you’ve driven before. This can be with your out-of-state driver’s license, a copy of your official driving record, or a verification letter.

Remember as well: The minimum required insurance coverage in Indiana is that 25/50/25 split. That’s the liability insurance to the tune of:

- $25,000 to pay for the injuries of one person

- $50,000 to pay for the injuries of more than one person

- $25,000 to pay for property damage

Anything less and you run the risk of your license/registration being suspended.

– License Renewal Procedures

License renewal in Indiana is straightforward: All individuals must provide proof of verification of social security number and two proofs of residency. In addition, everyone, regardless of each, must submit proof of adequate vision.

Currently, only those below the age of 75 have the option of renewing online or through mail, and even this, every other time. There are 13 stipulations before being able to renew online, with some such as:

- Your driver’s license is not expired for more than 180 days.

- You do not have six or more active points on your driver record

To make it easier, the Bureau of Motor Vehicles has licenses expire on the birth date of the driver four, five, or six years from the year it was issued if the driver is under 75 years old age.

It is three years for those between 75-84, and two years for those 85 or older.

– Negligent Operator Treatment System (NOTS)

Negligent driving in Indiana is engaging in reckless driving while endangering other people and property. The penalties are harsh for reckless driving, as it’s listed as a Class B misdemeanor. This has the punishments of:

- A fine up to $1,000

- Jail time up to 180 days

Your insurance rates will likely increase as well.

– Rules of the Road

If you don’t know the rules of the road, you will likely break them, leading to fines, possible jail time, and, of course, increased insurance rates. If you want to learn more about avoiding the negative repercussions that come from transgressions, read on.

– Fault vs. No-Fault

Indiana is considered a fault or at-fault state, which means that the person responsible for causing the accident is held liable for the damage to the other person’s vehicle, any injuries that person (or persons) has sustained.

What is liability in a legal sense?

Liability is a duty or obligation, a stipulation that you owe something, monetary or otherwise. If you are found at fault for an accident in Indiana, you owe the other party (or however many parties are involved) reparations for that accident.

That means money, which, hopefully for you, means your car insurance company’s money.

This is part of the reason it’s illegal not to have car insurance. It protects you from going bankrupt in an accident, and the other person as well.

– Seat belt and car seat laws

Seat belts save lives—the National Highway Traffic Safety Administration estimates around 15,000 in 2017 alone—but what are the laws in Indiana?

It comes down to just two:

- Seat belts are required by law for all drivers and passengers age 16 or older

- Riding in the bed of a pickup truck is not permitted

The second part reason being: The 2007 seat belt law that required all passengers in moving vehicles to wear seat belts didn’t mention the beds of pick up trucks; however, as one outlet noted, it is essentially illegal.

The fine for breaking the law: 1st offense, $25.

What about the laws for children riding in vehicles? Just for kids, seven years or younger; they must be in a car seat.

– Keep Right and Move Over Laws

There’s a story from 2018, where a state trooper named Stephen Wheeles pulled over a lady driving on an Indiana highway. The cause? Not speeding for sure. She was driving too slow, and in the left lane on top of it.

In 2015, Indiana had a new law go into effect that required slower drivers not keeping up with traffic to move to the right. This is the general policy with just a few exceptions:

- Bad weather

- Traffic congestion

- When paying a toll

- When exiting on the left

Of course, one major exception is if there’s a stationary vehicle on the right flashing their emergency lights. In these cases, the appropriate response is to vacate the lane closest to the vehicle (if it’s safe) and slow down at least 10 mph below the speed limit.

Speed Limits

Getting a speeding ticket raises your insurance rate. If you don’t want a ticket, get familiar with Indiana’s speed limits:

| Type of Roadway | Speed Limit |

|---|---|

| Rural | 70 (trucks 65) |

| Urban | 55 |

| Limited Access | 60 |

| Other | 55 |

– Ridesharing

Rideshare isn’t going away anytime soon, and many people like to drive for them. You may want to as well. But there’s a part of rideshare driving that many people won’t discuss and that’s the liability.

If you’re working as a ride-share driver in Indiana, you have some options for rideshare insurance.

And you want this, as many insurance companies won’t cover the damages from an accident while you’re ridesharing driving (without special add-ons) and the company insurance (the Uber or Lyft) may not cover as much as you think.

Those options are:

- State Farm

- USAA

- Allstate

- Geico

- Traveler’s

- Farmers

- SafeCo (a subsidiary of Liberty Mutual)

When approaching these companies, ask for what periods they cover, as some only allow for certain conditions, like having the app on but no passengers.

– Automation on the Road

As of now, the state of Indiana has no laws in place to manage autonomous vehicles.

However, they are going to race at the Indianapolis Motor Speedway.

https://www.youtube.com/watch?v=EpFcplu3UIg

– Safety Laws

Knowing the safety laws in Indiana is important for your safety and the safety of others. OWIs, driving under the influence, and texting while driving can all lead to penalties—and for your insurance rate to spike.

Here are a few, in short order.

– OWI Laws

There were 220 alcohol-impaired driving fatalities in 2017 in Indiana, and those fatalities accounted for 24 percent of the total traffic fatalities in the state.

Indiana’s state code is clear on the matter:

A person found with a BAC of .08 or higher can be arrested for a OWI (operating while intoxicated). BACs from .08 to .14 are Class C misdeamenors; .15 and above are Class A misdemeanors.

Any additional offenses within the next five years would be Class D felonies.

In Indiana, there is an Implied Consent Law: Anyone who operates a motor vehicle is giving consent to having a chemical test run of their breath, blood, urine, or other bodily substance.

And, yes, the penalties are steep. Here is a look at DUI sentences, including fines and prison time:

| OWI Penalty | License Revoked | Jail Time | Fines | Additional Information |

|---|---|---|---|---|

| 1st | 30 days - 2 years | up to 1 year | $500 - $5,000 | May be required to attend victim impact counseling |

| 2nd | 180 days - 2 years | 5 days - 3 years | up to $10,000 | Same |

| 3rd | 1 - 10 years | 10 days - 3 years | up to $10,000 | Same |

A fine of up to $5,000, license suspension for up to two years, jail time for up to one year, and that’s just for starters. Never forget the legal and court costs as well.

– Marijuana-Impaired Driving Laws

Indiana has a no tolerance policy for THC and metabolites, agents found in marijuana. Like with OWIs, you have already given your consent to be tested, just by driving.

If a cop smells something or senses something, you could be riding that magic dragon all the way down to jailhouse.

– Distracted Driving Laws

Distracted driving refers to anything we do when we drive that takes our attention from the road.

This can mean fooling with the radio, putting on make-up, and reaching beneath the seat. And according to the NHTSA, it was implicated in over 3,000 car crash fatalities in 2017 alone.

The Indiana Department of Labor has clear words about distracted driving:

Finally, not only is texting while driving dangerous, it is against the law. Effective July 1, 2011, it is unlawful to type, transmit, or read e-mail or text messages on a communication device while driving in Indiana. Violators may face fines of up to $500.

Even further, anyone under 21 is prohibited from handling an electronic device while driving except to make a 911 call. They even made a PSA:

Driving in Indiana

It’s important to know the crimes that affect you and your car. These include theft, fatalities, and drinking and driving.

These statistics help for two reasons: First, they can keep you and your vehicle safe; second, knowing them will help you make a more informed decision about your car insurance.

Here, we start with vehicle theft in Indiana.

– Vehicle Theft in Indiana

Certain cars are stolen more than others in Indiana. Keep in mind that insurance can help. If your car is stolen, certain insurers may cover the cost of your stolen car.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Ford Pickup (Full Size) | 2005 | 659 |

| 2 | Chevrolet Pickup (Full Size) | 1994 | 619 |

| 3 | Chevrolet Impala | 2004 | 423 |

| 4 | Dodge Pickup (Full Size) | 2001 | 263 |

| 5 | Chevrolet Malibu | 2005 | 238 |

| 6 | GMC Pickup (Full Size) | 1995 | 192 |

| 7 | Honda Accord | 1994 | 186 |

| 7 | Chevrolet Pickup (Small Size) | 1998 | 186 |

| 9 | Pontiac Grand Prix | 2004 | 183 |

| 10 | Ford Taurus | 2003 | 182 |

For the table, the year column refers to the most popular year of that vehicle stolen and does not refer to the total thefts that are lifted. In other words, there were 238 Chevy Malibus stolen, with the 2005 model being the most stolen.

Where you live also has an impact on which car is stolen. The FBI has compiled a list of data on vehicle theft in Indiana, which is listed below:

(population is also included)

| City | Population | Motor vehicle theft |

|---|---|---|

| Alexandria | 5,028 | 7 |

| Anderson | 55,134 | 183 |

| Auburn | 13,010 | 13 |

| Aurora | 3,691 | 5 |

| Avon | 17,076 | 30 |

| Bargersville | 7,053 | 10 |

| Batesville | 6,628 | 8 |

| Bedford | 13,335 | 23 |

| Beech Grove | 14,618 | 79 |

| Berne | 4,100 | 1 |

| Bloomington | 84,772 | 146 |

| Bluffton | 10,024 | 11 |

| Bremen | 4,561 | 9 |

| Brownsburg | 25,648 | 21 |

| Brownstown | 2,953 | 10 |

| Carmel | 90,619 | 39 |

| Cedar Lake | 12,085 | 13 |

| Charlestown | 8,189 | 16 |

| Clarksville | 21,888 | 116 |

| Clinton | 4,799 | 4 |

| Columbia City | 8,873 | 6 |

| Columbus | 47,222 | 106 |

| Crawfordsville4 | 16,047 | 17 |

| Crown Point | 29,086 | 11 |

| Cumberland | 5,499 | 19 |

| Danville | 9,729 | 9 |

| Decatur | 9,474 | 8 |

| Dyer | 15,983 | 13 |

| East Chicago | 28,503 | 116 |

| Edinburgh | 4,560 | 5 |

| Elkhart | 52,505 | 239 |

| Ellettsville | 6,607 | 11 |

| Elwood | 8,427 | 10 |

| Evansville | 119,908 | 383 |

| Fairmount | 2,832 | 1 |

| Fishers | 91,100 | 39 |

| Fort Wayne | 261,642 | 414 |

| Frankfort | 15,987 | 22 |

| Franklin | 24,774 | 15 |

| Gary | 76,556 | 398 |

| Gas City | 5,931 | 3 |

| Goshen | 33,166 | 53 |

| Greenfield | 21,653 | 34 |

| Greenwood | 56,502 | 142 |

| Griffith | 16,278 | 34 |

| Hagerstown | 1,717 | 2 |

| Hammond | 77,005 | 278 |

| Hartford City | 5,949 | 0 |

| Hobart | 28,223 | 70 |

| Indianapolis | 866,351 | 4,996 |

| Jasper | 15,530 | 7 |

| Jeffersonville | 47,327 | 149 |

| Kendallville | 9,942 | 15 |

| Kokomo | 57,984 | 88 |

| Lafayette | 71,562 | 187 |

| Lake Station | 11,956 | 45 |

| La Porte | 21,891 | 44 |

| Lawrenceburg | 4,943 | 9 |

| Ligonier | 4,407 | 1 |

| Linton | 5,259 | 17 |

| Logansport | 17,699 | 45 |

| Lowell | 9,476 | 0 |

| Marion | 28,926 | 64 |

| Merrillville | 35,276 | 127 |

| Michigan City | 31,459 | 100 |

| Mishawaka | 48,267 | 206 |

| Mooresville | 9,675 | 29 |

| Muncie | 70,065 | 197 |

| Munster | 22,865 | 12 |

| Nappanee | 6,812 | 4 |

| New Haven | 15,886 | 12 |

| New Whiteland | 5,991 | 2 |

| North Vernon | 6,599 | 0 |

| Peru | 10,998 | 17 |

| Plainfield | 31,198 | 81 |

| Plymouth | 10,037 | 12 |

| Porter | 4,882 | 1 |

| Portland | 6,183 | 3 |

| Scottsburg | 6,655 | 3 |

| Sellersburg | 8,723 | 7 |

| Seymour | 19,762 | 51 |

| Shelbyville | 19,137 | 39 |

| South Bend4 | 101,621 | 566 |

| South Whitley | 1,735 | 5 |

| Speedway | 12,189 | 46 |

| St. John | 16,822 | 3 |

| Tell City | 7,253 | 16 |

| Terre Haute | 60,830 | 347 |

| Tipton | 5,102 | 4 |

| Union City | 3,420 | 1 |

| Vincennes | 17,937 | 54 |

| Warsaw | 14,657 | 17 |

| Westfield | 38,186 | 15 |

| West Lafayette | 46,284 | 21 |

| Whitestown | 6,850 | 3 |

| Whiting | 4,848 | 18 |

| Winchester | 4,732 | 8 |

| Zionsville | 26,877 | 8 |

– Road Fatalities in Indiana

There are many factors that go into road fatalities: risky and harmful behavior, sleep deprivation, dark and windy roads, and weather conditions, to name just a few.

Here are ten sections about road fatalities in Indiana, from fatal crashes by weather condition and light condition to EMS response times.

– Fatal Crashes by Weather Condition and Light Condition

Weather and light conditions play a role. Here are the stats:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 412 | 110 | 203 | 26 | 1 | 752 |

| Rain | 23 | 8 | 23 | 3 | 0 | 57 |

| Snow/Sleet | 10 | 1 | 5 | 0 | 0 | 16 |

| Other | 5 | 0 | 6 | 0 | 0 | 11 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 450 | 119 | 237 | 29 | 1 | 836 |

As you can see, the majority of road fatalities occur in the daylight (when most people drive). But a good portion occurs during periods of darkness or relative darkness, even though fewer people drive during those times.

Also, nighttime driving means dealing with obstacles: Drunk driving, speeding, and riding without seatbelts all happen more at night.

– Fatalities (All Crashes) by County

A general list of fatalities in Indiana, sorted by county:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams County | 2 | 5 | 7 | 2 | 8 |

| Allen County | 31 | 31 | 30 | 36 | 43 |

| Bartholomew County | 6 | 12 | 20 | 14 | 16 |

| Benton County | 1 | 2 | 1 | 2 | 1 |

| Blackford County | 1 | 0 | 1 | 3 | 1 |

| Boone County | 7 | 13 | 12 | 5 | 7 |

| Brown County | 4 | 5 | 2 | 1 | 7 |

| Carroll County | 9 | 6 | 3 | 5 | 2 |

| Cass County | 5 | 6 | 3 | 9 | 8 |

| Clark County | 8 | 11 | 15 | 10 | 15 |

| Clay County | 9 | 1 | 7 | 5 | 5 |

| Clinton County | 7 | 3 | 7 | 4 | 12 |

| Crawford County | 4 | 1 | 7 | 2 | 2 |

| Daviess County | 6 | 8 | 7 | 5 | 7 |

| De Kalb County | 7 | 9 | 7 | 7 | 4 |

| Dearborn County | 8 | 1 | 8 | 5 | 7 |

| Decatur County | 6 | 6 | 0 | 17 | 1 |

| Delaware County | 12 | 15 | 10 | 10 | 8 |

| Dubois County | 10 | 7 | 6 | 3 | 6 |

| Elkhart County | 21 | 20 | 33 | 16 | 26 |

| Fayette County | 2 | 3 | 3 | 3 | 4 |

| Floyd County | 4 | 5 | 8 | 8 | 11 |

| Fountain County | 4 | 4 | 1 | 2 | 1 |

| Franklin County | 4 | 1 | 2 | 3 | 4 |

| Fulton County | 2 | 1 | 3 | 2 | 3 |

| Gibson County | 4 | 6 | 14 | 10 | 19 |

| Grant County | 9 | 7 | 7 | 11 | 9 |

| Greene County | 5 | 9 | 2 | 7 | 11 |

| Hamilton County | 13 | 14 | 14 | 16 | 10 |

| Hancock County | 5 | 5 | 6 | 7 | 16 |

| Harrison County | 16 | 5 | 10 | 13 | 10 |

| Hendricks County | 10 | 7 | 11 | 17 | 8 |

| Henry County | 10 | 7 | 9 | 10 | 4 |

| Howard County | 8 | 10 | 13 | 17 | 12 |

| Huntington County | 5 | 1 | 8 | 5 | 4 |

| Jackson County | 8 | 8 | 7 | 4 | 11 |

| Jasper County | 18 | 13 | 7 | 7 | 7 |

| Jay County | 5 | 8 | 6 | 3 | 3 |

| Jefferson County | 5 | 7 | 4 | 5 | 9 |

| Jennings County | 9 | 5 | 4 | 7 | 11 |

| Johnson County | 12 | 8 | 9 | 6 | 12 |

| Knox County | 7 | 5 | 3 | 3 | 9 |

| Kosciusko County | 6 | 8 | 8 | 17 | 15 |

| La Porte County | 18 | 21 | 10 | 19 | 27 |

| Lagrange County | 10 | 7 | 7 | 6 | 10 |

| Lake County | 47 | 48 | 59 | 50 | 51 |

| Lawrence County | 9 | 8 | 3 | 6 | 13 |

| Madison County | 10 | 23 | 15 | 13 | 17 |

| Marion County | 80 | 83 | 97 | 104 | 102 |

| Marshall County | 12 | 7 | 3 | 9 | 6 |

| Martin County | 1 | 0 | 3 | 2 | 4 |

| Miami County | 8 | 4 | 9 | 4 | 9 |

| Monroe County | 5 | 7 | 6 | 16 | 10 |

| Montgomery County | 5 | 3 | 5 | 6 | 5 |

| Morgan County | 8 | 10 | 17 | 14 | 4 |

| Newton County | 3 | 3 | 4 | 3 | 8 |

| Noble County | 9 | 7 | 5 | 4 | 7 |

| Ohio County | 1 | 1 | 1 | 2 | 1 |

| Orange County | 5 | 1 | 3 | 2 | 3 |

| Owen County | 5 | 3 | 7 | 5 | 6 |

| Parke County | 5 | 4 | 3 | 7 | 3 |

| Perry County | 3 | 4 | 4 | 1 | 1 |

| Pike County | 1 | 1 | 6 | 6 | 1 |

| Porter County | 16 | 13 | 22 | 19 | 28 |

| Posey County | 6 | 4 | 4 | 2 | 3 |

| Pulaski County | 2 | 2 | 1 | 2 | 4 |

| Putnam County | 6 | 11 | 8 | 1 | 9 |

| Randolph County | 2 | 4 | 8 | 8 | 8 |

| Ripley County | 5 | 5 | 1 | 11 | 6 |

| Rush County | 0 | 2 | 3 | 3 | 0 |

| Scott County | 9 | 6 | 1 | 9 | 5 |

| Shelby County | 10 | 6 | 9 | 11 | 7 |

| Spencer County | 5 | 2 | 8 | 3 | 7 |

| St. Joseph County | 20 | 23 | 12 | 22 | 27 |

| Starke County | 2 | 5 | 4 | 5 | 4 |

| Steuben County | 3 | 6 | 5 | 12 | 5 |

| Sullivan County | 5 | 2 | 5 | 4 | 2 |

| Switzerland County | 2 | 4 | 2 | 2 | 2 |

| Tippecanoe County | 24 | 6 | 19 | 7 | 23 |

| Tipton County | 3 | 10 | 2 | 3 | 4 |

| Union County | 2 | 2 | 2 | 0 | 2 |

| Vanderburgh County | 21 | 20 | 15 | 16 | 21 |

| Vermillion County | 2 | 4 | 7 | 4 | 7 |

| Vigo County | 14 | 9 | 12 | 14 | 16 |

| Wabash County | 6 | 7 | 14 | 10 | 1 |

| Warren County | 1 | 1 | 2 | 2 | 3 |

| Warrick County | 3 | 3 | 4 | 8 | 5 |

| Washington County | 12 | 7 | 5 | 3 | 13 |

| Wayne County | 14 | 9 | 7 | 10 | 7 |

| Wells County | 2 | 4 | 6 | 7 | 4 |

| White County | 4 | 7 | 13 | 3 | 6 |

| Whitley County | 3 | 7 | 4 | 5 | 8 |

– Traffic Fatalities

Even though the number of people living in urban settings outnumbers those living in rural settings, fatalities in rural areas are much higher overall than their urban counterparts:

| Geographical Area | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 530 | 418 | 474 | 477 | 524 | 535 | 472 | 521 | 543 | 555 |

| Urban | 290 | 275 | 280 | 274 | 257 | 249 | 273 | 296 | 285 | 357 |

The Indiana State Government lists several factors as to why car crashes in rural areas result in more fatalities and had this to say:

Crashes in rural areas are more likely to result in fatalities largely due to these circumstances, as crashes are more likely to occur at higher speeds, with fixed objects that increase the force of impact, and because of greater distance and longer travel times to and from the crash site by emergency care providers

They also cite driver impairment and reckless driving behaviors as a factor.

– Fatalities by Person Type

Next, whether you’re a pedestrian, occupant, or according to the vehicle you drove:

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 321 | 258 | 326 | 331 | 355 |

| Light Truck - Pickup | 95 | 101 | 88 | 118 | 90 |

| Light Truck - Utility | 84 | 92 | 115 | 98 | 124 |

| Light Truck - Van | 45 | 42 | 41 | 34 | 44 |

| Large Truck | 16 | 15 | 16 | 14 | 17 |

| Bus | 4 | 1 | 0 | 0 | 1 |

| Other/Unknown Occupants | 9 | 11 | 9 | 18 | 14 |

| Total Occupants | 574 | 523 | 596 | 615 | 645 |

| Light Truck - Other | 0 | 3 | 1 | 2 | 0 |

| Total Motorcyclists | 115 | 124 | 108 | 101 | 149 |

| Pedestrian | 76 | 78 | 96 | 87 | 101 |