Best Indianapolis, IN Auto Insurance in 2025 (Review the Top 10 Companies Here)

State Farm, Progressive, and Geico provide the best Indianapolis, IN auto insurance, with monthly rates beginning at $36. These top providers are known for their affordable pricing, comprehensive coverage, and high customer satisfaction, making them ideal options for Indianapolis auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Feb 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Indianapolis IN

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Indianapolis IN

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Indianapolis IN

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, Progressive, and Geico offer the best auto insurance in Indianapolis, IN, with rates starting at $36 per month.

State Farm is the top pick for its comprehensive coverage and strong customer satisfaction. View our how accidents change your car insurance rate to find out more.

Our Top 10 Company Picks: Best Indianapolis, IN Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Personalized Service | State Farm | |

| #2 | 10% | A+ | Competitive Rates | Progressive | |

| #3 | 25% | A++ | Discounts Available | Geico | |

| #4 | 20% | A | Comprehensive Coverage | Farmers | |

| #5 | 25% | A+ | Unique Add-Ons | Allstate | |

| #6 | 25% | A+ | Claims Handling | Erie |

| #7 | 25% | A | Online Tools | Liberty Mutual |

| #8 | 20% | A+ | Vanishing Deductible | Nationwide |

| #9 | 25% | A | Customer Service | American Family | |

| #10 | 5% | A+ | Safe-Driving Discount | The Hartford |

Progressive and Geico offer competitive rates and discounts, making them great options. Start saving on the best Indianapolis, IN auto insurance by entering your ZIP code above and comparing quotes.

- Get the best Indianapolis, IN auto insurance starting at $36/month

- State Farm is the top pick for coverage and customer satisfaction

- Compare quotes for the best auto insurance options in Indianapolis, IN

#1 – State Farm: Top Overall Pick

Pros

- Competitive Quotes: State Farm provides some of the most affordable automobile insurance quotes to residents within Indianapolis, IN.

- Local Representatives: Indiana clients get representation from experienced local representatives within Indianapolis.

- Reliable Claim Procedure: State Farm enjoys an excellent rating for handling claims expeditiously throughout Indiana. Find more from our State Farm auto insurance review.

Cons

- Fewer Discounts: Indianapolis drivers will enjoy fewer discounts than their competition.

- No Accident Forgiveness: State Farm does not provide accident forgiveness to Indiana drivers, which means higher insurance premiums over time.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Customized Coverage

Pros

- Customized Policy Options: Progressive offers Indiana policies that can help Indianapolis customize coverage.

- Snapshot Program: Indianapolis drivers may use Snapshot to save by good driving habits.

- Wide Discount Choices: Progressive has several discounts for Indiana customers, such as bundling and multi-car discounts.

Cons

- Higher Premiums for At-Fault Drivers: Indianapolis motorists with accidents or tickets can expect higher rates. For more information, see our Progressive auto insurance review.

- Unpredictable Customer Service: Indiana motorists have mixed reviews regarding Progressive’s customer service quality.

#3 – Geico: Best for Convenient

Pros

- Low Prices: Geico provides some of Indianapolis’s most affordable car insurance rates. Learn more in our Geico auto insurance review.

- Strong Customer Service: Indiana consumers have praised Geico for efficient claims and inquiry processing.

- Ease of Online Platform: Geico’s friendly mobile app and website serve the citizens of Indianapolis easily.

Cons

- Only a Few Local Agents: Indiana’s motorists, who prefer face-to-face services, can be relatively less accessible.

- Limited Specialty Coverage: Geico’s policies may not be sufficient for Indianapolis drivers seeking specialty coverage.

#4 – Farmers: Best for Personalized Service

Pros

- Friendly Agents: Farmers has a strong local presence in Indianapolis for hands-on service in Indiana.

- Solid Discounts: Indianapolis drivers can take advantage of multi-policy and safe-driving discounts. For more details, check out our Farmers auto insurance review.

- Coverage Options: Offers a variety of policies, including comprehensive and specialty coverage for Indiana drivers.

Cons

- High Tariffs: Indianapolis normally charges higher rates than other rivals.

- Fundamental Digital Devices: The digital versions are unlikely to appeal to the technophile driver from Indiana.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Discounts

Pros

- Robust Discount Programs: Allstate offers various savings options for Indianapolis drivers, such as good drivers and multi-policy discounts.

- Local Agents: Indianapolis customers can get local agents to assist them one-on-one.

- Drivewise Program: Indianapolis drivers save with usage-based insurance while proving good driving habits.

Cons

- Average Customer Service: Allstate’s claim satisfaction for Indiana drivers is average. Read our Allstate auto insurance review to find out more.

- Higher Premiums: Indianapolis policyholders will pay more, with no discounts.

#6 – Erie: Best for Comprehensive Coverage

Pros

- Comprehensive Plans: Erie policies offer pet injury cover, making them ideal for Indianapolis.

- Low Premium: Several Indiana buyers can afford coverage from this insurance company. For more information, read the Erie auto insurance review.

- Excellent Customers: These buyers find great claims processing and service.

Cons

- Restricted Geographical Areas: Insurance is sold only in regional areas, which may prevent some Indianapolis citizens from accessing it.

- Minimum Online Resources: Digital solutions may not be as comprehensive as others for highly technological Indiana drivers.

#7 – Liberty Mutual: Best for Add-On Coverage

Pros

- Extensive Add-On Choices: Indianapolis consumers can choose from various benefits, such as accident forgiveness and a new car replacement. For more information, please refer to our Liberty Mutual car insurance review.

- Local Support: Liberty Mutual offers supportive agents in the state of Indiana.

- Multiple Policy Discount: Indiana residents can save money by insuring the house and the car under one policy.

Cons

- Costly Premiums: Liberty Mutual’s prices might be above average for drivers in Indianapolis.

- Irregular Claims Processing: Some Indiana customers experience difficulties with claims processing.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Safe Drivers

Pros

- SmartRide Program: Indianapolis safe drivers can earn through driving behavior.

- Financial Security: Nationwide is also a household name for Hoosiers. See our Nationwide auto insurance review to learn more.

- Complete Policies: Offers complete policies and various kinds of insurance to satisfy the needs of Indianapolis drivers.

Cons

- Few Local Offices: Indianapolis drivers will have fewer in-person services than competitors.

- Average Claims Satisfaction: Indiana policyholders have had mixed experiences with claims handling.

#9 – American Family: Best for Families

Pros

- Family-Oriented Discounts: Indianapolis drivers benefit from teen driver and loyalty savings.

- Local Agents: Indiana customers enjoy accessible support from agents in Indianapolis.

- Generous Coverage Options: American Family offers several types of coverage that can be tailored to fit the needs of Indiana families.

Cons

- Regional Limitations: Not all parts of Indiana may offer policies. For more information, please see our American Family auto insurance review.

- Expensive for First-Time Drivers: Young drivers in Indianapolis could pay through the nose.

#10 – The Hartford: Best for Older Drivers

Pros

- AARP Partnership: Provides personalized policies for older drivers in Indianapolis via AARP. Please read our The Hartford car insurance review for more.

- Best Customer Service: Ranked by Indiana customers as one of the best companies for claims.

- Accident Forgiveness: Indiana drivers will not have their rates raised after a first-time accident.

Cons

- Age Discrimination: Policies are intended for mature Indianapolis drivers, so they are not appealing to others.

- Premium Costs: Hartford’s premium costs may be above the average in Indiana.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Factors That Influence Auto Insurance Rates in Indianapolis

Auto insurance quotes in Indianapolis are not alike for everyone. These variations are due to factors that affect them, such as your driving record, the auto type you own, and sometimes your credit score. Discover everything in our cheap car insurance rates to learn more.

Indianapolis, IN Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $44 | $142 | |

| $46 | $132 | |

| $39 | $130 |

| $39 | $118 | |

| $34 | $129 | |

| $54 | $152 |

| $41 | $129 |

| $36 | $105 | |

| $46 | $150 | |

| $45 | $140 |

Understand how these factors may impact your auto insurance quotes so that you are better prepared to make sound choices when comparing auto insurance quotes in Indianapolis.

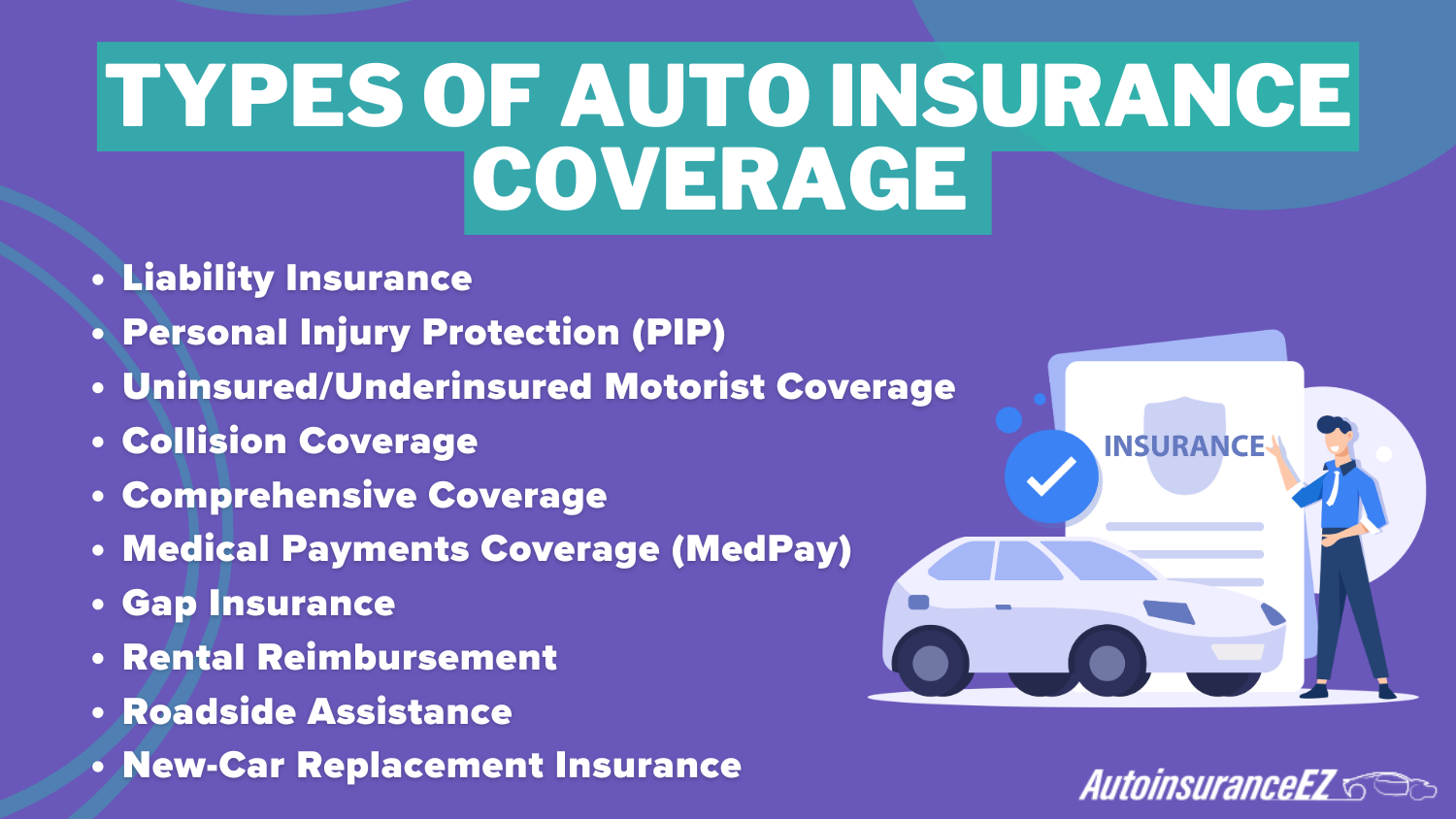

Understanding Coverage Options in Indianapolis

Comparing auto insurance quotes is key when searching for the best car insurance in Indianapolis. To ensure adequate protection, ensure that the policy covers comprehensive and collision coverage.

Auto Insurance Discounts From the Top Providers in Indianapolis, IN

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy Discount, Safe Driving Bonus, Early Signing Discount, New Car Discount | |

| Multi-Policy Discount, Safe Driving Discount, Good Student Discount, Bundling Discounts | |

| Safe Driver Discount, Multi-Policy Discount, Pay-in-Full Discount, First Accident Forgiveness |

| Good Student Discount, Multi-Policy Discount, Homeowner Discount, Youthful Driver Discount | |

| Good Driver Discount, Military Discount, Multi-Vehicle Discount, Federal Employee Discount | |

| Multi-Policy Discount, Vehicle Safety Features Discount, New Customer Discount, Early Signing Discount |

| Multi-Policy Discount, Good Student Discount, Safe Driver Discount, Brand New Car Discount |

| Multi-Policy Discount, Snapshot Program, Continuous Coverage Discount, Homeowner Discount | |

| Safe Driver Discount, Multi-Policy Discount, Good Student Discount, Vehicle Safety Features Discount | |

| AARP Member Discount, Multi-Policy Discount, Safe Driver Discount, Claims-Free Discount |

Knowing these types of coverage is essential to choosing the best car insurance in Indianapolis or Indiana. For more details, check out our types of auto insurance coverage.

Comparing Local Insurance Providers in Indianapolis

Car insurance in Indianapolis, IN, requires comparing local and national providers. Well-known brands such as State Farm, Progressive, and Geico offer less local and regional customization.

Indianapolis, IN Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Discounts Availability | B+ | Insurers offer various discounts, including good student, multi-car, and safe driver discounts. |

| Liability Coverage Cost | B | Liability coverage is reasonably priced with various options available to meet state minimum requirements. |

| Rate Stability | B | Rates are relatively stable, with slight increases associated with statewide claims and inflation trends. |

| Average Premium Cost | B- | Premiums in Indianapolis are moderately priced, though they can vary by neighborhood and driver history. |

| Affordability | C+ | Insurance costs are moderately affordable but can be higher for high-risk drivers or in high-traffic areas. |

| Comprehensive & Collision Rates | C+ | Rates for comprehensive and collision coverage are moderately high, partially due to frequent severe weather. |

While companies like State Farm, Progressive, and Geico are well-known, local insurers often offer more customized policies that cater to regional needs.

State Farm offers some of the best value in Indianapolis, with monthly rates starting at just $36, making it a top choice when comparing local insurance providers in Indianapolis.

Eric Stauffer Licensed Insurance Agent

For Indianapolis’s best car insurance rates, local providers can offer competitive rates and more flexibility, especially if you need cheap, high-risk insurance. Comparing both options ensures you find the best coverage for your needs in Indianapolis car insurance. Learn more by exploring our comprehensive collision coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Benefits of Bundling Insurance Policies in Indianapolis

Bundling your insurance policies in Indianapolis can lead to significant savings. Many insurers offer discounts when you combine auto, home, and renters insurance.

Indianapolis, IN Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Annual Auto Accidents | 12,500 |

| Average Claim Cost | 4,500 |

| Accident Rate (per 1,000 drivers) | $15 |

| Percentage of Accidents with Injuries | 20% |

| Uninsured Motorist Rate | 12% |

| Claims Filed per 1,000 Drivers | 14 |

| Average Time to Settle a Claim | 30 days |

| Most Common Claim Type | Rear-end Collision |

| Average Premium Increase After Claim | 15% |

Bundling will lower the premiums for affordable auto insurance and provide comprehensive coverage to the residents of Indianapolis.

If you’re looking for car insurance discounts, ask your insurer about bundling options to save. This can help you secure affordable and affordable auto insurance in Indianapolis, IN.

How Customer Satisfaction Impacts Your Choice of Auto Insurance

Choose the best Indianapolis car insurance with strong regard to customer satisfaction. That will benefit you to save time and much pressure at times of being in a car accident or doing any claim for your automobiles.

Indiana drivers what’s a good car insurance company to look into?

byu/CurrentlyNa inIndiana

Knowing about previous experience can help you better determine which provider to look after while dealing with its claims and coverage regarding Indiana car insurance or Indianapolis local car insurance when aiming to get cheap Indianapolis car insurance.

The Best Discounts for Indianapolis, IN Drivers

When selecting the best auto insurance, it’s also important to consider how your driving habits can impact your rates. Following road safety tips can help prevent accidents and lower your premiums. Gain deeper insights by reading our automobile liability coverage.

State Farm offers one of the best discounts for Indianapolis, IN drivers, with monthly rates starting at just $36, making it an affordable and reliable choice.

When you choose the best car insurance in Indianapolis, ensure it can meet your needs in a budget-friendly or inexpensive car insurance option.

Do your research, drive safely, and get the best deal without sacrificing coverage. Enter your ZIP code below to use our free quote tool to discover the best auto insurance options in Indianapolis, IN, near you.

Frequently Asked Questions

What are my options for obtaining cheap Indianapolis auto insurance?

Compare policies from multiple companies to find affordable auto insurance in Indianapolis. Look for discounts like bundling home and auto insurance or maintaining a clean driving record. For a complete overview, please read our ultimate road safety guide.

What will influence my Indianapolis auto insurance rate?

Several factors influence Indianapolis auto insurance rates, such as the nature of your record, kind of car, and age or credit profile. Comparing multiple automobile insurance quotes can enable you to get the best insurance rates within Indianapolis. Use our free quote comparison tool below to find the cheapest coverage in your area.

What is the best car insurance in Indianapolis?

Indianapolis’s best car insurance companies offer comprehensive coverage, competitive rates, and excellent customer service. Compare policies to discover the best rates for your needs.

Where is affordable car insurance in Indianapolis, IN?

Cheap car insurance in Indianapolis, IN, can be obtained from local companies with policies designed to meet particular requirements. Finding cheap auto insurance online or through local Indianapolis, IN agents can save you money.

Are there local car insurance options in Indianapolis?

Of course, there are local Indianapolis car insurance providers who care about people’s needs. Look at what the different auto insurance companies around Indianapolis can offer and find one that matches your budget and coverage requirements. See our the most expensive cars to insure to gain more clarity.

What are the requirements for cheap car insurance in Indianapolis?

When looking for cheap car insurance in Indianapolis, consider coverage limits, deductibles, and customer reviews. Many companies offer affordable auto insurance in Indianapolis with discounts for safe drivers.

How do I get the best car insurance in Indiana?

To get the best car insurance in Indiana, compare rates from national and local providers. Many insurers offering car insurance in Indianapolis, IN, extend coverage statewide with excellent benefits.

Is comprehensive yet affordable auto insurance in Indianapolis possible?

Indeed, numerous companies provide comprehensive yet affordable auto insurance in Indianapolis. Evaluate car insurance options in Indianapolis to find the best coverage at an affordable price.

How can the residents of Indianapolis find the best auto insurance rates?

Compare policies from different providers and take advantage of discounts to obtain Indianapolis’s best car insurance rates. Many companies offer personalized coverage plans to suit particular needs. For complete information, please review our high-risk drivers.

What are the benefits of cheap auto insurance in Indianapolis?

By opting for cheap auto insurance in Indianapolis, you can save on premiums while meeting the state’s minimum coverage requirements. Many insurance providers offer basic plans with optional add-ons for better protection. Enter your ZIP codebelow to compare rates from the top providers near you.