Auto Insurance in Los Angeles, California [Can’t-Miss Guide]

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Nov 14, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Summary Overview of Los Angeles, CA | |

|---|---|

| Population | 3,976,324 |

| Density | 8,477 people per square mile |

| Average Cost of Insurance in Los Angeles | $7,260.97 |

| Cheapest Car Insurance Company | USAA |

| Road Conditions | Poor: 57% Mediocre: 22% Fair: 11% Good: 10% |

Los Angeles is a city in southern California and is the second-most populous city in the country. LA is home to Hollywood, the nation’s film and television industry.

Los Angeles always has something or other to do in the city. You can take a tour of the many film studios in the city, including Warner Bros, Universal Studios, Paramount Pictures.

Movie fans from the world over come to LA to see the iconic Walk of Fame, Hollywood Boulevard, and the famous TCL Chinese Theater. But nothing says LA more than the famous Hollywood sign.

Los Angeles is a sprawling city with many great things to see and do. Tourists and residents flock to the Rodeo Drive, Venice Beach, the many amusement parks like Disneyland, Six Flags Magic Mountain, and Legoland.

You can also visit one of the many night clubs in the city – who knows you can also see a celebrity while you are partying.

With so many things to do and so many people to share the road with, you should opt for auto insurance coverage that protects you and gives you peace of mind.

We have put together this comprehensive auto insurance guide for the City of Los Angeles so that you have all the information on coverage types, rates, discounts, and factors impacting your car insurance premium.

With this guide, we aim to remove the confusion from the process of buying auto insurance so that you can buy the best coverage you need with confidence.

You can also start comparison shopping today using our FREE online tool. Enter your zip code above to get started.

The Cost of Car Insurance in Los Angeles

To understand the cost of car insurance in LA, you would need to know how auto insurance companies calculate your insurance rate.

There are so many factors that are included in calculating your premium. Your insurance company is taking on a calculated risk by writing you a policy, so they want to make sure to protect themselves from financial risk.

But you can use these factors to your advantage.

You should understand how much you expect to pay for factors that are unique to you. Based on this knowledge, you can negotiate with your insurer for the best possible rate.

To help you achieve this, in this section, we will discuss the factors that car insurance companies deem important for your premium calculation.

Male vs. Female vs. Age

Insurance companies want to lower their risk profile. Since young drivers have little experience, insurers consider them risky.

Practice makes you perfect – this is also relevant for your driving.

As you gain driving experience and maintain a clean driving record, your monthly premium for an auto insurance policy will start to come down.

As a young driver, you are considered a high-risk driver and therefore charged a high rate for coverage.

Many young drivers will get into some sort of accident within the first year of driving. Therefore, insurance companies charge a higher premium in expectation of the eventual claim.

In LA, the median age is 36.6 years.

This means that for many LA residents, insurance premiums may have tapered down to the city average.

And, here are the city averages for different ages:

| AGE | 17 | 25 | 35 | 60 | CHEAPEST AGE |

|---|---|---|---|---|---|

| Average Annual Rate | $10,073.54 | $4,578.97 | $3,562.33 | $3,164.93 | 60 |

However, keep in mind that these are average rates and may differ from your rate.

But, as you can see from the table above, insurance rates decline steadily with age.

On averages, auto insurance rates fall by as much as 54 percent between the age of 17 and 25.

So, a teen driver can save a lot by keeping a clean driving record.

But the good news is that California no longer allows insurance companies to use gender in calculating your auto insurance premium.

According to the ex-California Insurance Commissioner Dave Jones, “These regulations ensure that auto insurance rates are based on factors within a driver’s control, rather than personal characteristics over which drivers have no control.”

California joins six other states that do not allow gender-based auto insurance pricing. The other six states include Hawaii, Massachusetts, Montana, North Carolina, Pennsylvania, and Michigan.

Before the ban, on average, males had to pay a slightly higher premium than females in LA.

Apart from age and gender, your marital status also plays a minor part in your rate calculation.

As per average insurance rates, married drivers tend to pay less on premiums than unmarried drivers. This is because insurance companies believe that married people are less risky compared to an unmarried teenager.

If you look at the average rates by different demographics, a married 35-year old male driver pays a whopping $7,536 less than a 17-year old male teenager.

| DEMOGRAPHIC | RATE (CHEAPEST) |

|---|---|

| Married 60-year old female | $3,162.95 |

| Married 60-year old male | $3,166.90 |

| Married 35-year old male | $3,526.99 |

| Married 35-year old female | $3,597.68 |

| Single 25-year old female | $4,509.64 |

| Single 25-year old male | $4,648.29 |

| Average | $5,344.94 |

| Single 17-year old female | $9,083.26 |

| Single 17-year old male | $11,063.83 |

Cheapest Zip Codes in Los Angeles

Where you live is a major factor in determining your auto insurance rate.

It may be out of your control, but where you live provides a lot of information to an insurance company to determine your risk profile. It helps them with the following essential pieces of information:

- number of accidents reported per year from your neighborhood or zip code

- numbers of claims made

- cost of living

- car thefts in your zip code

- crime rate

Depending on your neighborhood, where you park your car also has a lot of influence on your auto insurance premiums.

To check the average rate in your zip code, use the following table:

| Zipcode | Annual average rate |

|---|---|

| 90732 | $5,443.97 |

| 90248 | $5,547.61 |

| 90022 | $5,659.38 |

| 90731 | $5,785.84 |

| 90045 | $5,866.67 |

| 90023 | $5,961.50 |

| 90063 | $6,112.29 |

| 90032 | $6,257.72 |

| 90066 | $6,263.93 |

| 90042 | $6,342.79 |

| 90041 | $6,408.45 |

| 90073 | $6,442.82 |

| 90031 | $6,574.62 |

| 90065 | $6,606.33 |

| 90059 | $6,638.38 |

| 90292 | $6,639.76 |

| 90033 | $6,641.77 |

| 90039 | $6,666.43 |

| 90001 | $6,668.83 |

| 91342 | $6,669.47 |

| 90061 | $6,680.53 |

| 91345 | $6,711.32 |

| 90064 | $6,790.13 |

| 91311 | $6,856.34 |

| 90002 | $6,880.20 |

| 91307 | $6,911.28 |

| 90034 | $6,938.01 |

| 90047 | $6,990.32 |

| 90011 | $7,015.39 |

| 90025 | $7,018.22 |

| 90058 | $7,034.66 |

| 90043 | $7,151.68 |

| 90044 | $7,199.59 |

| 91304 | $7,210.43 |

| 90003 | $7,216.78 |

| 90071 | $7,263.26 |

| 90089 | $7,299.04 |

| 90021 | $7,317.97 |

| 90049 | $7,318.65 |

| 90008 | $7,324.43 |

| 90079 | $7,356.48 |

| 90026 | $7,407.32 |

| 90037 | $7,442.40 |

| 91330 | $7,471.96 |

| 90013 | $7,484.92 |

| 90062 | $7,554.63 |

| 90012 | $7,585.79 |

| 90016 | $7,666.96 |

| 90018 | $7,691.95 |

| 90035 | $7,723.27 |

| 90007 | $7,804.44 |

| 90036 | $7,859.43 |

| 90024 | $7,859.78 |

| 90019 | $7,892.49 |

| 90068 | $7,907.31 |

| 90067 | $7,924.85 |

| 90015 | $7,984.60 |

| 90014 | $7,996.90 |

| 90006 | $8,008.26 |

| 90048 | $8,094.05 |

| 90077 | $8,095.60 |

| 90057 | $8,100.73 |

| 90027 | $8,112.12 |

| 90017 | $8,115.53 |

| 90004 | $8,152.00 |

| 90029 | $8,166.29 |

| 90005 | $8,303.29 |

| 90046 | $8,322.74 |

| 90038 | $8,323.32 |

| 90028 | $8,339.09 |

| 90020 | $8,434.59 |

| 90010 | $8,529.77 |

What’s the best car insurance company in Los Angeles?

Given that there are so many choices, we understand that it can be overwhelming while choosing the best auto insurance company.

We understand the definition of what constitutes the best car insurance may differ between individuals. Your factors may vary slightly, and therefore your needs might be different.

In this section, we will help you figure out the best car insurance companies for specific factors. You can choose based on your requirements.

Read on to find the best companies – whether you are looking for companies that offer the cheapest rate, or companies that are fine with additional commutes, or may punish you the least for a bad credit score.

Cheapest Car Insurance Rates by Company

Los Angeles is a large city both in terms of size and population.

Therefore, the city offers a plethora of options when it comes to auto insurance. All leading national auto insurance providers are present in the City of Angels.

The competitive market gives us a chance to get some discounts.

But how is an auto insurance company able to give a discount?

Well, insurance is essentially pricing your risk. Auto insurance companies use sophisticated models to calculate risk and, therefore, an appropriate premium.

However, each company may price risks differently.

Here is the table that shows the rates, organized by company and broken down by gender, age, and marital status.

| Insurer | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| USAA | $2,504.85 | $2,368.01 | $2,441.10 | $2,446.92 | $5,806.10 | $5,835.43 | $3,475.77 | $3,280.14 | $3,519.79 |

| Geico | $2,491.48 | $2,490.71 | $2,340.16 | $2,340.16 | $7,615.45 | $7,734.42 | $3,584.13 | $3,653.83 | $4,031.29 |

| Progressive | $2,542.54 | $2,618.94 | $2,173.29 | $2,582.03 | $6,935.09 | $8,359.95 | $3,706.13 | $3,990.25 | $4,113.53 |

| Liberty Mutual | $3,172.36 | $2,975.30 | $2,974.72 | $2,869.00 | $6,853.08 | $7,392.56 | $3,547.93 | $3,615.08 | $4,175.00 |

| Travelers | $3,644.32 | $3,512.51 | $3,208.00 | $3,173.32 | $7,851.28 | $8,932.09 | $4,804.82 | $4,680.00 | $4,975.79 |

| State Farm | $4,591.64 | $4,591.64 | $4,106.31 | $4,106.31 | $8,499.31 | $10,546.13 | $5,085.40 | $5,243.41 | $5,846.27 |

| Allstate | $4,440.80 | $4,431.31 | $3,211.59 | $3,235.18 | $12,526.09 | $15,746.23 | $5,675.19 | $6,203.58 | $6,933.75 |

| Nationwide | $4,984.81 | $4,748.21 | $4,371.12 | $4,108.92 | $12,865.63 | $14,217.34 | $5,955.49 | $5,869.86 | $7,140.17 |

| Farmers | $4,006.28 | $4,006.28 | $3,640.26 | $3,640.26 | $12,797.29 | $20,810.33 | $4,751.88 | $5,298.50 | $7,368.89 |

As we discussed, age and marital status have an impact on your insurance rates.

Also, each insurer may value risk differently. For a single 17-year-old male driver, Farmers Insurance is the most expensive. Farmers charge more than $14,000 over what USAA or Geico may charge the teen driver.

Therefore, it is highly recommended that you shop around to get the best discount.

Also, it is evident that insurance rates decrease by age. A 17-year-old driver with a policy with Farmers Insurance is expected to save more than $5,000 when he is 25 years old. However, he needs to maintain a clean driving record to get that kind of a discount.

Nevertheless, you should not base your purchase decision solely based on the average cheapest price.

Some other insurers might be cheaper for a specific case. In the next section, we will discuss how the annual commute might impact your car insurance rate.

Best Car Insurance for Commute Rates

Los Angeles is a large city, which means you would clock a lot of miles if you regularly traverse the length and breadth of the city.

If you use your car to go to work, read this section carefully as it might help lower your monthly car insurance premium.

According to the Federal Highway Administration, an average driver in Los Angeles drives 13,414 miles per year. It is slightly less than the national average of 14,132 miles.

This might be due to the increased use of public transportation or the fact that there is more congestion on the streets.

To price your premium, insurance companies use the average annual mileage to benchmark against your expected mileage.

We partnered with Quadrant Data Solutions to understand the impact of annual commute on your insurance rate. In the following table, we have insurance organized by the insurer and broken down by annual mileage.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| USAA | $3,240.71 | $3,798.88 | $3,519.80 |

| Geico | $3,661.25 | $4,401.33 | $4,031.29 |

| Progressive | $3,729.65 | $4,497.40 | $4,113.53 |

| Liberty Mutual | $3,826.67 | $4,523.34 | $4,175.01 |

| Travelers | $4,459.95 | $5,491.64 | $4,975.80 |

| State Farm | $5,633.47 | $6,059.06 | $5,846.27 |

| Allstate | $6,239.26 | $7,628.23 | $6,933.75 |

| Nationwide | $6,289.10 | $7,991.24 | $7,140.17 |

| Farmers | $6,682.86 | $8,054.91 | $7,368.89 |

As we discussed earlier, each insurer uses a different model to calculate your premium.

However, almost all insurers in Los Angeles may slightly increase premium rates if you drive a lot.

And it makes sense.

Higher the mileage, the higher is the risk of an accident.

Among the major insurers, USAA and State Farm tend to increase your premium by the least amount.

So, if you know that you are driving more than the city average, remember to get quotes from USAA and State Farm.

On the other hand, Allstate and Nationwide might tend to attach a higher weight your annual commute – both increasing the yearly premium by more than $1,500.

Regardless of which insurer you are with — it is always advisable to shop around in the market.

Best Car Insurance for Coverage Level Rates

Any additional coverage that you buy on your policy increases the risk profile for the insurance company.

Naturally, insurers will charge an additional premium for the new coverage.

However, every company may have slightly different prices for different types of coverage.

First, let us understand some of the different types of coverage that you can purchase from your auto insurer.

Any car insurance policy in Los Angeles can consist of two parts:

- mandatory minimum liability insurance required to drive and

- additional optional coverage that you may purchase

In Los Angeles, you must have the following minimum car insurance:

- $15,000 for bodily injury or death per person

- $30,000 for total bodily injury or death per accident

- $5,000 for damage to property per accident

Remember, this is the lowest coverage that must purchase to be able to drive on the public roads. It is otherwise called a low coverage.

However, the coverage may not be adequate for your needs. You may decide to add on liability coverage on the insurance to safeguard against any financial injury.

Additionally, you can also opt for the following coverages :

- Collision

- Comprehensive

- Med Pay

- Uninsured/Underinsured Motorist

- Personal Injury Protection

If you buy additional coverage and increase the limits, you may end with high coverage.

Remember, you should buy your insurance coverage judiciously, keeping in mind your requirements.

Nevertheless, if you are looking to buy additional coverage, you might be able to save on your premiums by shopping around.

Best Car Insurance for Credit History Rates

In many states, insurance companies refer to credit scores as input while calculating your premium rates.

The good news is that California does not allow auto insurance companies to consider your credit score for your auto insurance rate.

Best Car Insurance for Driving Record Rates

Your driving record is a significant factor in helping insurance companies determine your insurance risk and, therefore, an appropriate premium rate.

Here’s the average premium rate organized by insurance providers and violations.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| USAA | $2,330.45 | $3,485.00 | $5,708.26 | $2,555.44 | $3,841.24 |

| Progressive | $2,674.38 | $4,583.08 | $5,332.27 | $3,864.37 | $4,196.58 |

| Geico | $2,811.80 | $4,369.58 | $5,454.45 | $3,489.34 | $4,211.94 |

| Liberty Mutual | $3,624.85 | $4,850.21 | $4,383.60 | $3,841.35 | $4,286.22 |

| Travelers | $3,235.94 | $5,455.96 | $6,320.04 | $4,891.24 | $5,003.98 |

| State Farm | $4,174.95 | $4,977.11 | $9,389.60 | $4,843.42 | $6,180.55 |

| Farmers | $5,457.32 | $7,424.13 | $9,228.04 | $7,366.05 | $7,369.83 |

| Nationwide | $4,967.15 | $6,379.89 | $10,833.75 | $6,379.89 | $7,393.60 |

| Allstate | $4,149.84 | $7,025.57 | $11,093.95 | $5,465.62 | $7,423.12 |

Insurance companies will pull your full motor vehicle report (MVR) to check your driving record. The MVR will have a summary of your driving record, including:

- Traffic tickets

- Convictions

- Accidents

- Even little things like parking tickets

All insurance companies will penalize you if you are caught speeding, under the influence, or cause an accident.

Speeding and DUI indicate that you are a risky driver and may file a claim in the near future.

An accident also indicates that you are a risky proposition for the company but have already filed a claim. Therefore, your risk profile increases, which in turn will lead to a higher insurance rate.

If you are caught for a DUI charge, your annual insurance premium might increase by around $4,000. On average, Allstate and Nationwide tend to increase the premium to most after a DUI charge.

Car Insurance Factors in Los Angeles

We thus far discussed factors that are specific to your case. You can control your driving record or credit score.

However, some factors are not in your control but yet influence your car insurance rate.

Los Angeles is the second-most populated city in the country and therefore has a significant influence on the local auto insurance rates.

In this section, we will discuss how the city’s prosperity, economy, home-ownership, and income can influence your car insurance rate.

Metro Report – Growth & Prosperity

Los Angeles metropolitan area is the third-largest economic metropolitan area in the world after New York and Tokyo. According to the Bureau of Economic Analysis (BEA), the Los Angeles metropolitan area has a GDP of $1.043 trillion.

As an independent country, LA would have the 17th largest economy in the world.

We know that Los Angeles is the mecca of entertainment.

But other industries drive this huge metropolis?

Well, LA’s economy is driven by healthcare, education, technology, manufacturing, retail, and trade.

In fact, Los Angeles leads the country in many facets of the economy.

LA has the largest retail market, largest manufacturing hub, largest and busiest port, and of course, Hollywood producing the most entertainment products.

Los Angeles has long been the land of opportunities, and it is reflected in the fact that the city is home to 23 of the Fortune 500 companies.

Lately, the city has been experiencing an economic boom, much like the rest of the country.

The economic growth has translated into growth in personal income, jobs, home prices, and corporate equity.

An economic boom is also bound to attract new residents to the city. The rising population and growth are also evident in LA’s national prosperity and growth ranks from 2005 to 2015.

Prosperity (11th)

Productivity: +10.9 percent (10th of 100)

Standard of living: +9.2 percent (9th of 100)

Average annual wage: +8.9 percent (34th of 100)

Growth (49th)

Jobs: +3.2 percent (62nd of 100)

Gross metropolitan product (GMP): +14.5 percent (31st of 100)

Jobs at young firms: -16.3 percent (51st of 100)

According to the Metro Monitor Report by the Brookings Institution, while productivity and standard of living have increased at a faster rate than the national average, the same cannot be said about the job or wage growth.

Regardless, the economic growth and resulting rise in costs are bound to increase your auto insurance rates.

Median Household Income

The economic growth has also increased the median household income.

According to DataUSA, LA County’s median household income is $65,006, whereas the national median household income is $61,338.

However, if you consider the wider Los Angeles-Long Beach-Anaheim metropolitan area, the median household income increase to $69,992.

Nevertheless, the median household income of LA county is considerably less than California’s median household income of $71,805.

But, the auto insurance rate is a different story.

The average annual premium for auto insurance in California is $5,048. In contrast, the same is $7,260 for LA. This means that people in LA are making less on average and paying a higher chunk of their salaries towards maintaining car insurance coverage.

| MEDIAN INCOME LEVEL | AVERAGE CAR INSURANCE PREMIUM | PREMIUM AS A PERCENTAGE OF INCOME | |

|---|---|---|---|

| Los Angeles | $65,006 | $7,260.97 | 11.17% |

| California | $71,805 | $5,048.88 | 7.03% |

You can also calculate how much of your income you are currently spending on car insurance using our free calculator.

CalculatorPro

Homeownership in the Los Angeles

Your homeownership doesn’t automatically lead to lower auto insurance premiums. Although it can help you get some discounts.

Depending on an insurer, homeownership can signify economic stability and, therefore, steady premium payments.

In Los Angeles, it is more difficult to buy a home.

According to DataUSA, LA’s median property value of $588,700 is more than twice the national median property value. It is also around $80,000 more than the median household value in California.

Now, if you consider the wider Los Angeles-Long Beach-Anaheim metropolitan area, the median property value is 2.83 times the national median property value.

Given the absurdly high property value, the homeownership rate is naturally low. The homeownership rate in LA County is only 45.6 percent compared to 63.9 percent for the United States.

However, homeownership is a minor factor in deciding your insurance premium rate, and a steady renting history may also indicate low risk in premium payments.

Education in Los Angeles

Los Angeles is one of the education hubs in the country.

Education is so prominent in the city that the University of California, Los Angeles, is one of the top employers in the city.

Los Angeles has two national-level research universities, The University of California, Los Angeles, and the University of Southern California.

In all, the city has three campuses of the University of California system, seven from the California State University system, and several private universities.

In terms of the number of degrees awarded, the top three universities in Los Angeles are:

- The University of Southern California (15,664 degrees awarded)

- The University of California-Los Angeles (12,961 degrees awarded)

- California State University-Northridge (9,890 degrees awarded)

But, why is education relevant for auto insurance?

Do you remember auto insurers asking about your education level in insurance application?

Well, because insurance companies tend to consider that a good education signifies that you might be a low-risk driver.

However, some people believe that education may not have a high correlation with your driving behavior. Therefore, some organizations are calling for a ban in using education level for your auto insurance rate calculation.

Wage by Race & Ethnicity in Common Jobs

In 2017, Asians were the highest-paid ethnicity in Los Angeles, followed by Whites and people who declare themselves belonging to two or more races.

| RACE & ETHNICITY | AVERAGE SALARIES |

|---|---|

| Asian | $69,782 |

| White | $63,110 |

| Two or More Races | $51,776 |

Wage by Gender in Common Jobs

While gender-based pricing is a norm in the majority of U.S. states, California does not allow insurance companies to consider gender when deciding their policy rates.

However, auto insurance premiums still take a larger share of the income for females.

Why?

Well, because wages differ for genders.

The average salary for males in California is $75,050, which is 1.26 times higher than the average wage for females in California.

This directly translates to females paying a higher percentage of their income towards maintaining their car insurance.

| OCCUPATION | PREMIUM AS A % OF INCOME (MALE) | PREMIUM AS A % OF INCOME (FEMALE) |

|---|---|---|

| Miscellaneous managers | 4.25 | 5.37 |

| Elementary & middle school teachers | 7.77 | 7.99 |

| Retail salespersons | 11.15 | 14.22 |

Poverty by Age and Gender

Los Angeles has some of the richest neighborhoods in the country. The top 10 richest neighborhoods in Los Angeles include:

- Bel Air

- Pacific Palisades

- Brentwood

- Porter Ranch

- West Los Angeles

- Glendale

- Hollywood Hills

- Beverly Glen

- Studio City

- Playa Del Ray

The median income of these neighborhoods is around $1.3 million.

However, Los Angeles also has neighborhoods such as Skid Row, which has the dubious distinction of having the largest amount of homeless people in the United States.

The poverty in Skid Row was so bad that it was part of the report by United Nations Special Rapporteur for extreme poverty.

According to DataUSA, 17 percent of LA residents are living below the national poverty line.

Females are the worst off as the top three demographics living below the poverty line are females.

The US Department of Housing and Urban Development sets income limits that determine the eligibility of applicants for assisted housing programs.

According to HUD, the national poverty level for a family of four is $25,750. However, in the case of Los Angeles, even an income of $52,200 is considered a meager income for a family of four.

Here is a table showing premium as a percentage of income at different income levels.

| Family Size (Persons in Family/Household) | HUD Low Income Level 1 | Premium as a % of income for HUD 1 | HUD Very Low Income Level 2 | Premium as a % of income for HUD 2 | HUD Extremely Low Income Level 3 | Premium as a % of income for HUD 3 | Federal Poverty Level | Premium as a % of income for federal poverty level |

|---|---|---|---|---|---|---|---|---|

| 1 | $58,450 | 9.1 | $36,550 | 14.6 | $21,950 | 24.3 | $12,490 | 42.8 |

| 2 | $66,800 | 8 | $41,800 | 12.8 | $25,050 | 21.3 | $16,910 | 31.6 |

| 3 | $75,150 | 7.1 | $47,000 | 11.4 | $28,200 | 19 | $21,330 | 25.1 |

| 4 | $83,500 | 6.4 | $52,200 | 10.2 | $31,300 | 17.1 | $25,750 | 20.8 |

As we can see, average premiums would potentially take a large share of income from a low-income family in Los Angeles.

Additionally, the calculation assumes the average rate for auto insurance rates. However, low-income drivers may be charged a higher premium, which would make maintaining coverage even more challenging.

Poverty by Race & Ethnicity

Poverty is prevalent among every race and ethnicity.

However, people from Hispanics, Whites, and Others (does not include Black, Asian, Native American, Pacific Islander, or two or more races) ethnicities constitute more than 84 percent of the total people in poverty in LA.

| Race or ethnicity | Share of Poverty in LA (%) |

|---|---|

| Hispanic | 37.8 |

| White | 29.1 |

| Others | 17.4 |

| Black | 6.79 |

| Asian | 6.43 |

| Two or More | 1.82 |

| Native American | 0.52 |

| Pacific Islander | 0.13 |

Employment by Occupations

In 2017, there were 4.97 million people employed in Los Angeles across various occupations.

The three occupations with most professionals are Office & Administrative Support Occupations (649,173 people), Sales & Related Occupations (521,610 people), and Management Occupations (496,987 people).

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Driving in Los Angeles

Whether it is the Rodeo Drive or the Sunset Strip, there are always things to see in the City of Angeles.

The city also boasts of many iconic drives, including the Sunset Boulevard and the Mulholland Scenic Parkway.

However, driving around LA can be tough due to congestion. The traffic snarls can make driving around the city difficult.

In this section, we will cover the speed traps, road conditions, routes, and more to make your drive a little less of a headache.

Roads in Los Angeles

To navigate the sprawling metropolis, you need to know your way around.

In this section, we will discuss major roads, conditions, speed traps, and more.

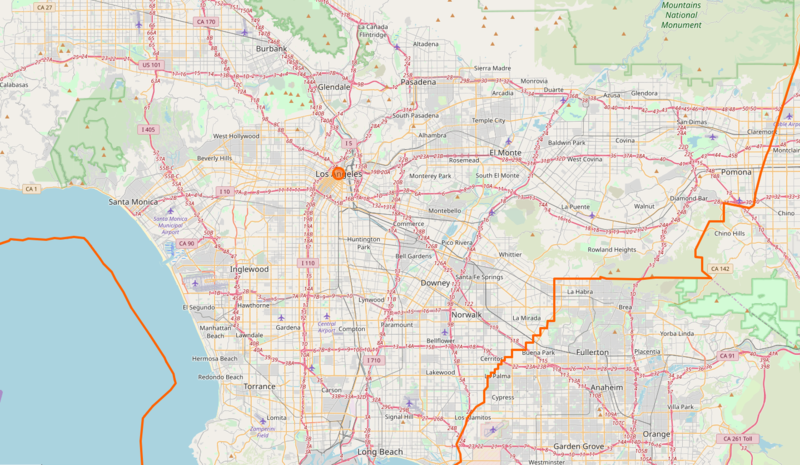

Major Highways in Los Angeles

The City of Los Angeles is spread over 472 square miles.

It is connected through a vast network of freeways and roads.

Here is the map of interstates and highways connecting Los Angeles.

Los Angeles has 515 miles of freeways and expressways, among which the following are the major ones:

I-5, I-10, I-15, I-110, I-405, I-105, I-710, and I-10.

The following table lists down the major freeways and corresponding interstate:

| Highway | Interstate | Miles |

|---|---|---|

| Golden State Freeway/Santa Ana Freeway/San Diego Freeway/Montgomery Freeway | Interstate 5 | 796 |

| Santa Monica Freeway/Rosa Parks Freeway/Golden State Freeway | Interstate 10 | 243 |

| Veteran's Memorial Highway | Interstate 15 | 295 |

| Glenn Anderson Freeway/Century Freeway | Interstate 105 | 19 |

| Harbor Freeway | Interstate 110 | 32 |

| Foothill Freeway | Interstate 210 | 85 |

| San Diego Freeway | Interstate 405 | 72 |

| San Gabriel River Freeway | Interstate 605 | 27 |

| Long Beach Freeway | Interstate 710 | 23 |

| Santa Ana Freeway | part of U.S. Route 101 and I-5 | |

| Hollywood Freeway | part of U.S. Route 101 | 17 |

Popular Road Trips/Sites

The City of Angeles has things to do for everyone. Here are some of the top things that you can do in LA:

Rodeo Drive

Venice Beach

Disneyland

Road Conditions in Los Angeles

Roads in Los Angeles are not in good shape. The public roads seem to be riddled with potholes.

According to TRIP, a national transportation research group, around 57 percent of the public roads are in poor condition.

| Road Condition | Good | Fair | Mediocre | Poor |

|---|---|---|---|---|

| Los Angeles‐‐Long Beach‐‐Anaheim | 10% | 11% | 22% | 57% |

The majority of the funds towards road repair is directed towards maintaining the roads that are in good condition.

The Department of Public Health for the City of Los Angeles has a yearly budget of $150 million to repair roads.

The Department spends around 80 percent of the budget towards maintaining good roads, whereas the remaining 20 percent is spent on improving the roads that are in poor condition.

The State Government is also investing in improving the roads in Southern California. It has declared a significant infrastructure improvement plan. Under the plan, the state government is investing $1.9 billion to improve the I-405.

Other road improvement plans within the state’s infrastructure improvement plan are:

| Project location | Description | Construction period | Total Project Cost ($ million) |

|---|---|---|---|

| I-710 – Port of Long Beach | Gerald Desmond Bridge Replacement | 2012-2021 | 1,200 |

| I-5 (SR-14 Connector to Parker Road) | Construct HOV and Truck Lanes | 2019-2021 | 440 |

| I-5 (Olive Avenue in Burbank to Sheldon St./Laurel Canyon Blvd. in LA) | Widen and realign highway for HOV lanes, realign Metrolink railroad tracks | 2012-2022 | 402 |

| I-5 (Orange County line to Olive Avenue in Burbank) | Widen and realign highway for HOV, general purpose lanes, rehab pavement | 2016-2022 | 3200 |

| 101 (Liberty Canyon Road, Agoura Hills) | Wildlife Habitat Connectivity | TBD | TBD |

| I-10 Puente Avenue to SR-57 | HOV Lanes | 2014-2021 | 343 |

| 71 (SR-60 interchange to I-10) | Upgrade route from 4 lane expressway to 8 lane highway | 2020-2023 | 243 |

| LA-057 (SR-57 connector to Golden Springs Drive) | Reconstruct SR-57 connector to SR-60; construct eastbound SR-60 bypass off-ramp to Grand Avenue; construct southbound Grand Avenue to eastbound SRr-60 loop on-ramp. | 2020-2024 | 263 |

| LA-605-Carson Boulevard to Telegraph Road | Road rehabilitation | 2022-2025 | 81.5 |

| LA-060-I-710 to I-605 | Pavement rehabilitation | 2018-2020 | 75 |

| LA-405-Western Avenue to Crenshaw Boulevard | Construct auxiliary lane, road widening, ramp improvements | 2020-2023 | 68 |

| LA-047-Port of LA | Schulyer Heim Bridge Replacement | 2011-2020 | 247 |

| LA 60 (I-710 to County Line) | Bridge freight corridor improvement | 2021-2024 | 38.6 |

Does Los Angeles use speeding or red light cameras?

According to the Los Angeles Police Department, the city of Los Angeles discontinued the use of red-light cameras in 2011.

Vehicles in Los Angeles

Los Angeles has among the highest vehicle density in the country just behind San Francisco.

The public transportation is available but is not sufficient for the needs. Therefore, a lot of the population use cars for their transportation.

In this section, we will look at cars – the most popular mode of transportation in the city.

Vehicles Most Popular Vehicles Owned

There are a plethora of cars in LA and for good measure.

Cars are the preferred mode of transport for the residents.

But, it is not the cars that you may see in movies and magazines.

Not everyone can afford these cars.

Instead, people look for cars that are easy to maintain and economical to run in this giant metropolis.

Therefore, the car that is most preferred in LA is Honda Civic. The Honda Civic has been in production since 1972 and is known for its reliability and manageable price.

But the great thing about the Civic is that it is also rated as one of the safest cars on the road.

According to the Insurance Institute of Highway Safety, Civic gets a ‘good’ rating for all parameters.

Here is the Civic vehicle test video from IIHS:

The current editions of Civic offer a whole bunch of technology that helps make the car safer on the road.

Civic offers the following safety features:

Dual front air bag, front and rear head air bag, front side air bag, four-wheel ABS brakes, brake assist, electronic stability control, daytime running lights, child safety locks, traction control, lane departure warning, and lane-keeping assist.

How many cars per household

Most of the households in Los Angeles own two cars, which is in line with the national average for a household. The next common count for cars per household is three.

This is understandable given the dependency of residents on cars for transportation needs.

Households without a Car

However, many households do not own a car in Los Angeles.

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | |

|---|---|---|

| Los Angeles, California | 12.10% | 12.20% |

It is interesting to note that the number of households that do not own a car has grown between 2015-16.

Speed traps in Los Angeles

Overspeeding is not only dangerous for you and others on the road, but it can also be dangerous for your driving record as well.

There are many speed traps around the city to catch drivers over speeding on public roads.

As per speedtrap.org, Hacienda Heights and Brea are the worst neighborhoods in the Los Angeles metropolitan area when it comes to speed traps.

Remember, if you are booked for speeding your auto insurance rates might shoot up.

Vehicle Theft in Los Angeles

With such a large population, it always a challenge for the police to maintain law and order.

According to the neighborhoodscout.com crime index, Los Angeles is safer than only 14 percent of U.S. cities.

The high crime rate is also about vehicle theft in the city.

According to the FBI, in 2016, there were 18,591 cases of vehicle theft in Los Angeles.

Car theft can be disturbing. However, the dangerous part is the probability of being a victim of a violent crime.

In Los Angeles, you have one in 130 chances of becoming a victim of a violent crime, compared to the state average of 223.

| MURDER | RAPE | ROBBERY | ASSAULT | |

|---|---|---|---|---|

| LOS ANGELES VIOLENT CRIMES RATES per 1,000 | 0.07 | 0.62 | 2.73 | 4.28 |

| UNITED STATES VIOLENT CRIMES RATES per 1,000 | 0.05 | 0.42 | 0.98 | 2.49 |

However, these are the top ten safe neighborhoods in the city that may reduce the likelihood of being a victim of a crime.

- Victory Blvd / Balboa Blvd

- Topanga Canyon Blvd / S Topanga Canyon Blvd

- Mulholland Dr / Sepulveda Blvd

- Reseda Blvd / Rosita St

- De Soto Ave / Chatsworth St

- Palisades Dr / Ave De Santa Ynez

- W Sunset Blvd / N Kenter Ave

- Riviera

- Sesnon Blvd / Reseda Blvd

- Balboa Blvd / Westbury Dr

Traffic in Los Angeles

Traffic is a big-time productivity killer for not only an individual but also for society as a whole.

Which is why nobody likes to get stuck in traffic.

But in a city as vast as Los Angeles, traffic is something that you have to get used to for your daily commute.

You can better prepare for congestion with the correct information.

Traffic Congestion

Los Angeles has a dubious distinction of having among the worst traffic in the country.

So much so that in a https://losangeles.cbslocal.com/2017/11/06/survey-la-ranks-1-most-stressful-commute-in-us/, Los Angeles was the worst when it comes to the stress of commuting each day.

According to a 2018 traffic study done by INRIX (a team of traffic experts), Los Angeles came out as the fifth most congested city in the US.

The congestion is harming the productivity of individuals, businesses, and companies.

Due to the congestion in 2018, an average driver in Los Angeles spent 128 hours in congestion. This amounted to a loss of $1,788 per driver.

Transportation in Los Angeles

Los Angeles is a city of suburbs, and a lot of people commute long for work.

According to DataUSA, commuters in LA have to spend an average of 30 minutes on their daily commute. The national average is considerably shorter at 25.5 minutes.

However, the alarming stat is that around 25 percent of commuters in LA have to spend more than 45 minutes on their daily commute.

The long commute is probably because around 74.6 percent of people prefer to drive alone to work.

Busiest Highways in Los Angeles

Not all roads are the same.

Some are busier than others, and therefore, this handy guide might help you avoid some of these roads during peak hours.

According to the Federal Highway Administration, highways in LA are among the busiest in the country.

To handle the traffic flow, the Los Angeles metropolitan area has four highways with 12 or more lanes.

| URBAN AREA | ROUTE | LANES |

|---|---|---|

| Los Angeles-Long Beach-Santa Ana | I-405 | 14 |

| Los Angeles-Long Beach-Santa Ana | I-5 | 12 |

| Los Angeles-Long Beach-Santa Ana | 91 | 12 |

| Los Angeles-Long Beach-Santa Ana | I-110 | 12 |

How safe are LA’s streets and roads?

Los Angeles has among the worst accident rates in California.

Sadly, the Los Angeles Country is the worst county in the state for road fatalities.

| California Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|

| 1 | Los Angeles County | 625 | 639 | 651 | 837 | 658 |

| 2 | Riverside County | 228 | 246 | 242 | 297 | 294 |

| 3 | San Bernardino County | 262 | 285 | 260 | 273 | 271 |

| 4 | San Diego County | 198 | 233 | 246 | 243 | 231 |

| 5 | Kern County | 131 | 111 | 138 | 149 | 182 |

| 6 | Orange County | 186 | 173 | 183 | 204 | 178 |

| 7 | Sacramento County | 123 | 114 | 139 | 169 | 172 |

| 8 | Fresno County | 119 | 117 | 102 | 150 | 156 |

| 9 | San Joaquin County | 93 | 83 | 98 | 119 | 116 |

| 10 | Santa Clara County | 95 | 106 | 133 | 114 | 105 |

| Sub Total 1. | Top Ten Counties | 2,060 | 2,107 | 2,192 | 2,555 | 2,363 |

| Sub Total 2. | All Other Counties | 1,047 | 995 | 1,195 | 1,282 | 1,239 |

| Total | All Counties | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

LA County has witnessed an average of 682 traffic-related fatalities each year for the last five years.

Here’s the list of traffic-related fatalities in Los Angeles County along with the biggest reasons:

| 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|

| Fatalities (All Crashes) | 625 | 639 | 651 | 837 | 658 |

| Fatalities in Crashes Involving an Alcohol-Impaired Driver | 187 | 172 | 149 | 240 | 192 |

| Single Vehicle Crash Fatalities | 379 | 359 | 389 | 472 | 368 |

| Fatalities in Crashes Involving a Large Truck by County for 2017 | 51 | 59 | 44 | 63 | 45 |

| Fatalities in Crashes Involving Speeding | 245 | 240 | 231 | 308 | 214 |

| Fatalities in Crashes Involving an Intersection | 218 | 234 | 242 | 307 | 234 |

| Passenger Car Occupant Fatalities | 200 | 200 | 202 | 263 | 183 |

| Pedestrian Fatalities | 209 | 209 | 209 | 278 | 235 |

| Pedalcyclist Fatalities | 30 | 24 | 33 | 37 | 29 |

Single-vehicle crashes are the biggest cause of fatalities in LA. Speeding and crashes at intersections are the next big reasons for the road fatalities in Los Angeles.

However, the second biggest reason is related to crashes involving pedestrians.

According to the National Highway Traffic Safety Administration, principal arterial roads are the most dangerous roads in Los Angeles County.

| Roads | Fatalities |

|---|---|

| RURAL INTERSTATE | 3 |

| URBAN INTERSTATE | 77 |

| FREEWAY/EXPRESSWAY | 47 |

| OTHER | 257 |

| MINOR ARTERIAL | 148 |

| COLLECTOR ARTERIAL | 56 |

| LOCAL | 33 |

| UNKNOWN | 1 |

| TOTAL | 622 |

To understand how NHTSA classifies different types of roads, you can read the definition on their website.

Lastly, according to the data from the Department of Transportation, Los Angeles County saw several rail accidents during the past few years.

Here’s the table on rail accidents in LA County:

| YEAR | COUNTY | RAIL EQUIPMENT | HIGHWAY | HIGHWAY USER TYPE | HIGHWAY USER SPEED | NONSUICIDE FATALITIES | NONSUICIDE INJURIES |

|---|---|---|---|---|---|---|---|

| 2012 | LOS ANGELES | Yard/Switch | DISTRICT BLVD | Truck-trailer | 20 | 0 | 0 |

| 2012 | LOS ANGELES | Yard/Switch | 26TH STREET | Truck-trailer | 20 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | 103 RD STREET | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | Yard/Switch | UP PRI YARD XING | Truck-trailer | 18 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | ELM | Pedestrian | 35 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | 92 ND STREET | Pedestrian | 45 | 0 | 0 |

| 2012 | LOS ANGELES | Psgr Train | IMPERIAL | Pedestrian | 0 | 0 | |

| 2012 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Pedestrian | 0 | 1 | |

| 2012 | LOS ANGELES | B | FRONT STREET | Pick-up truck | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Light Loco(s) | UP PRI YARD XING | Truck-trailer | 5 | 0 | 2 |

| 2012 | LOS ANGELES | Psgr Train | STOCKWELL | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | B | TURNBULL CANYON ROAD | Pedestrian | 0 | 1 | |

| 2012 | LOS ANGELES | Freight Train | PALMDALE BLVD/SR 138 | Pedestrian | 0 | 1 | |

| 2012 | LOS ANGELES | Psgr Train | BELLAIRE AVE | Pedestrian | 0 | 0 | 1 |

| 2012 | LOS ANGELES | Commuter | GLENDORA AVENUE | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | Freight Train | FAIRWAY DRIVE | Truck-trailer | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Light Loco(s) | ROLLING JCT | Automobile | 0 | 0 | 0 |

| 2012 | LOS ANGELES | C | RAMONA BLVD | Pedestrian | 1 | 0 | |

| 2012 | LOS ANGELES | Freight Train | NORWALK BLVD | Automobile | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Commuter | CALEX | Truck-trailer | 0 | 0 | 10 |

| 2012 | LOS ANGELES | C | SAN ANTONIO AVENUE | Automobile | 0 | 0 | 1 |

| 2012 | LOS ANGELES | Freight Train | SOUTH VAIL AVENUE | Truck-trailer | 0 | 0 | 0 |

| 2012 | LOS ANGELES | Freight Train | WESTMONT DR | Truck-trailer | 0 | 1 | |

| 2013 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Automobile | 10 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | NOGALES STREET | Truck-trailer | 0 | 0 | 2 |

| 2013 | LOS ANGELES | Freight Train | SO. GREENWOOD AVE. | Pedestrian | 0 | 1 | |

| 2013 | LOS ANGELES | C | WOLFSKILL STREET | Pedestrian | 0 | 0 | |

| 2013 | LOS ANGELES | Yard/Switch | UP PRIVATE YARD CROS | Automobile | 2 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Pedestrian | 0 | 1 | 0 |

| 2013 | LOS ANGELES | Freight Train | FRIES AVE | Truck-trailer | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Commuter | ARVILLA AVENUE | Pedestrian | 0 | 0 | |

| 2013 | LOS ANGELES | Light Loco(s) | PARK AVE | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | Yard/Switch | E HARCOURT ST. | Automobile | 25 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | VINELAND AVE | Automobile | 5 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | FAIRWAY DRIVE | Automobile | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Commuter | BRAND BLVD. | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | Yard/Switch | PRIVATE | Truck-trailer | 5 | 0 | 1 |

| 2013 | LOS ANGELES | C | INDIAN HILL BLVD. | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | C | VINELAND AVE. | Pedestrian | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | PALOMARES ST | Van | 0 | 0 | 0 |

| 2013 | LOS ANGELES | C | SUNLAND BOULEVARD | Automobile | 0 | 0 | 0 |

| 2013 | LOS ANGELES | Freight Train | NOGALES STREET | Truck-trailer | 0 | 3 | |

| 2013 | LOS ANGELES | Yard/Switch | SLAUSON AVE | Automobile | 30 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | NOGALES STREET | Automobile | 0 | 2 | |

| 2013 | LOS ANGELES | B | HAMILTON BLVD | Pedestrian | 1 | 0 | |

| 2013 | LOS ANGELES | Freight Train | MONTEBELLO BLVD | Automobile | 0 | 0 | 1 |

| 2013 | LOS ANGELES | Freight Train | TROJAN WAY | Van | 10 | 0 | 0 |

| 2013 | LOS ANGELES | Commuter | SAN FERNANDO RD | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | Commuter | PALMDALE BLVD | Pedestrian | 1 | 0 | |

| 2014 | LOS ANGELES | C | DORAN AVENUE | Automobile | 0 | 0 | |

| 2014 | LOS ANGELES | Freight Train | VAN NUYS BLVD. | Pedestrian | 0 | 0 | 0 |

| 2014 | LOS ANGELES | Freight Train | FAIRWAY DRIVE | Truck-trailer | 0 | 0 | 0 |

| 2014 | LOS ANGELES | Light Loco(s) | YARD | Truck-trailer | 5 | 0 | 1 |

| 2014 | LOS ANGELES | Commuter | AVENUE K | Pedestrian | 1 | 0 | |

| 2014 | LOS ANGELES | C | GRAND AVE | Automobile | 5 | 0 | 0 |

| 2014 | LOS ANGELES | Freight Train | UP PRI YARD XING | Truck-trailer | 15 | 0 | 0 |

| 2014 | LOS ANGELES | Yard/Switch | DOWNEY ROAD | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | WALNUT AVENUE | Truck-trailer | 0 | 0 | 1 |

| 2014 | LOS ANGELES | C | BUENA VISTA STREET | Automobile | 5 | 1 | 1 |

| 2014 | LOS ANGELES | C | SIERRA HIGHWAY | Automobile | 5 | 0 | 1 |

| 2014 | LOS ANGELES | Freight Train | RAINBOW GLEN DR | Pedestrian | 0 | 0 | |

| 2014 | LOS ANGELES | B | NORTH MAIN STREET | Automobile | 25 | 0 | 0 |

| 2014 | LOS ANGELES | C | LOS NIETOS ROAD | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | GLENDORA AVENUE | Pedestrian | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | LOS ANGELES AVE | Automobile | 0 | 0 | 0 |

| 2014 | LOS ANGELES | C | N. GAREY AVENUE | Automobile | 0 | 0 | |

| 2014 | LOS ANGELES | Freight Train | WATSON PRIVATE | Truck-trailer | 5 | 0 | 0 |

| 2015 | LOS ANGELES | Freight Train | GAFFEY STREET | Pick-up truck | 15 | 0 | 1 |

| 2015 | LOS ANGELES | Freight Train | FAIRWAY DR | Truck-trailer | 0 | 0 | 0 |

| 2015 | LOS ANGELES | Light Loco(s) | PRIVATE | Truck-trailer | 0 | 0 | 0 |

| 2015 | LOS ANGELES | Freight Train | FAIRWAY AVENUE | Truck-trailer | 0 | 4 | |

| 2015 | LOS ANGELES | Freight Train | ROSECRANS/MARQUAR | Pedestrian | 1 | 0 | |

| 2015 | LOS ANGELES | Commuter | SONORA AVENUE | Pedestrian | 0 | 0 | 0 |

| 2015 | LOS ANGELES | C | COGSWELL ROAD | Pedestrian | 0 | 0 | |

| 2015 | LOS ANGELES | Yard/Switch | ALONDRA ST. | Automobile | 8 | 0 | 1 |

| 2015 | LOS ANGELES | Yard/Switch | ALCOA AVENUE | Automobile | 15 | 0 | 0 |

| 2015 | LOS ANGELES | Freight Train | N. HENRY FORD AVE. | Automobile | 20 | 0 | 0 |

| 2016 | LOS ANGELES | Psgr Train | DE SOTO ST | Automobile | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Yard/Switch | 26TH ST | Pick-up truck | 6 | 0 | 0 |

| 2016 | LOS ANGELES | C | SUN FLOWER AVENUE | Pedestrian | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Commuter | SYCAMORE DRIVE | Pedestrian | 0 | 1 | 0 |

| 2016 | LOS ANGELES | Yard/Switch | 37TH & ALAMEDA ST | Truck-trailer | 30 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | 48TH PLACE | Pedestrian | 1 | 0 | |

| 2016 | LOS ANGELES | Light Loco(s) | LOMITA BLVD. | Truck-trailer | 2 | 0 | 0 |

| 2016 | LOS ANGELES | Commuter | RUETHER ROAD | Pedestrian | 1 | 0 | |

| 2016 | LOS ANGELES | Psgr Train | TAMPA AVE | Pedestrian | 0 | 1 | |

| 2016 | LOS ANGELES | Commuter | CAMBIDGE AVENUE | Pedestrian | 0 | 0 | 0 |

| 2016 | LOS ANGELES | C | JURUPA ROAD | Van | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | LOMITA BLVD | Truck-trailer | 15 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | NADEAU | Automobile | 0 | 0 | 0 |

| 2016 | LOS ANGELES | Freight Train | TEMPLE AVENUE | Automobile | 1 | 0 | 0 |

Allstate America’s Best Drivers Report

To imagine the driving culture of a city, it is beneficial to understand how an average driver behaves.

To understand driver behavior, Allstate conducts a study that covers many cities in the country.

Here’s how Los Angeles performed in the latest Allstate report:

| 2018 Best Drivers Report Ranking | 194 |

|---|---|

| City | Los Angeles |

| Average Years Between Claims | 5.5 |

| Relative Claim Likelihood (Compared to National Average) | 81.40% |

| 2018 Ranking After Controlling for Population Density | 188 |

| 2018 Ranking After Controlling for Average Annual Precipitation | 194 |

Los Angeles fared poorly in the Allstate rankings. LA ranked 194th among 200 cities in the U.S.

The relatively poor driving behavior means that drivers in LA are 81.4 percent more likely to file a claim than the average U.S. driver.

Ridesharing

Ridesharing can be a great alternative to public transportation. It can also help lower traffic congestion in the city.

Here’s the list of ridesharing companies available in Los Angeles:

- Blacklane

- Carmel

- Curb

- Flywheel

- HopSkipDrive

- Jayride

- Kango

- Limos.com

- Lyft

- RideYellow

- SuperShuttle

- Talixo

- Taxi

- Uber

EStar Repair Shops

You need to drive a lot in Los Angeles and, therefore, should be prepared for any contingency.

If your car breaks down, depending on the coverage you have purchased, you can call your insurer for help.

Esurance has also put together a repair shop network called E-star. E-star is a list of reputable and top-quality repair shop near your location.

Here’s the list of top 10 repair shops near sunset strip in Los Angeles:

- Autobahn Collision Studio City

- Harry’s Auto Collision Center

- Western Collision

- All-City Auto Body

- Santa Monica Collision Ctr

- Victory Auto Body

- AGC Collision Center

- Golden Auto Body & Paint

- All-City Collision Burbank

- Auto-tech Collision Center_CF

Weather in Los Angeles

Los Angeles is blessed with mild Mediterranean weather year-round.

The average temperature in LA is between 55-72 degrees all through the year. Here’s the quick summary of the LA weather:

| WEATHER FACTS | DETAILS |

|---|---|

| Annual High Temperature | 71.7°F |

| Annual Low Temperature | 55.9°F |

| Average Temperature | 63.8°F |

| Average Annual Rainfall | 18.67 inches |

On average, LA has dry summers and rainy winters. However, LA has witnessed far more natural disasters than the rest of the country.

So far, LA has witnessed more than 50 natural disasters, whereas the country average is only 13. The most common types of natural hazards in Los Angeles that you should be wary of are fire, flood, storm, landslides, and winter storms.

To protect yourself, check with your auto insurer about comprehensive coverage. You need to make sure that your comprehensive coverage protects against common natural hazards.

Public Transit in Los Angeles

Los Angeles County Metropolitan Transportation Authority (Metro) manages public transportation in LA.

Metro operates buses and trains that you can use to travel within the city.

There are three types of buses plying on the roads along with a rail network with two subway lines and four light-rail lines.

Here’s the quick snapshot of the Metro fares:

| TAP VALIDITY | FARE |

|---|---|

| 1-Way | $1.75 |

| 1-Day Pass | $7 |

| 7-Day Pass | $25 |

| 30-Day Pass | $100 |

However, there is a facility of discounted fares in Metro for senior citizens (62+), people with disabilities, students, and low-income riders.

You can buy TAP cards to pay for the fare and get two hours of unlimited transfers.

Cost of Alternate Transportation in Los Angeles

Los Angeles benefits from being at the forefront of technology innovation. Several options have sprung up in LA that give riders options for transportation within the city.

New options include scooters, bikes, electric bikes, dockless bikes, or smart bikes. Some of the vendors offering such services are:

- Metro Bike Share

- Lime Bikes

- Bird

- Spin (bought by Ford)

- Razor

- Social Bicycles

- Jump (an Uber initiative)

- Lyft

Parking in Los Angeles

Finding parking can be difficult in LA. However, you can use one of the many parking apps to find and reserve parking ahead of time:

- Public Parking – the city of Los Angeles has a public parking locator

- SpotHero

- LA Express Park

- ParkMe

- LA Metered Street Parking

- WhereiPark

Air Quality in Los Angeles

Vehicle emissions contribute to pollution in our cities. LA has a lot of vehicles on the road every day and therefore has a significant role to play in less than adequate air quality in the city.

According to the Environmental Protection Agency (EPA), vehicle emissions include pollutants such as particulate matter (PM), nitrogen oxides (NOx), and volatile organic compounds (VOCs).

55 percent of NOx emissions are due to the transportation sector.

According to EPA, here’s the air quality report card for the city of LA:

| County | # Days with AQI | Good | Moderate | Unhealthy for Sensitive Groups | Unhealthy | Very Unhealthy | AQI Maximum | AQI 90th Percentile | AQI Median | # Days CO | # Days NO2 | # Days O3 | # Days SO2 | # Days PM2.5 | # Days PM10 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Los Angeles County, CA | 365 | 35 | 222 | 89 | 18 | 1 | 201 | 130 | 76 | . | 30 | 173 | . | 161 | 1 |

As you can see in the table, LA breathed “good” quality air for only 35 days a year.

EPA brings vehicular emission checks through various programs to control air pollution. It also brings standards for passenger and commercial vehicles to help control emissions.

Military/Veterans

Los Angeles has a long relationship with the military.

LA has an Air Force Base located close to the Los Angeles International Airport. It also has three other military bases nearby:

- Naval Base in Ventura

- Marine Corps Base Camp Pendleton

- March Air Reserve Base

The majority of the veterans living in LA have seen action during Vietnam and the First Gulf War. We wanted to make auto insurance a tad easier for our heroes.

Be sure to check with the following insurers, as these provide discounts for veterans and active military personnel:

- USAA

- Allstate

- Esurance

- Farmers Insurance

- Geico

- Liberty Mutual

- Metlife

- StateFarm

- The General

On average, USAA may give around 27 percent discount to veterans and military personnel. You may also receive a 21 percent discount from Geico.

Here’s the summary of average insurance rates in LA:

| AVERAGE ANNUAL PREMIUM ($3,688.93) | HIGHER/LOWER (%) | |

|---|---|---|

| Allstate | $4,532.96 | 22.88 |

| Farmers Insurance | $4,998.78 | 35.51 |

| Geico | $2,885.65 | -21.78 |

| Liberty Mutual | $3,034.42 | -17.74 |

| StateFarm | $4,202.28 | 13.92 |

| USAA | $2,693.87 | -26.97 |

Unique City Laws

Every city has some quirky laws that can make us chuckle. They may have been relevant when they were introduced, but now they sound strange. Here are two to of them:

Do you know women are not allowed to drive in their housecoats? Do not wash your neighbor’s car without their permission; it is illegal.

However, there are some unique laws that you must know about LA and are important:

– Handheld Device Laws

It is illegal to text while driving in Los Angeles. You must hands-free devices to talk while driving.

– Food Trucks

LA has a thriving food scene, including many food trucks that you see around the city.

However, you must adhere to some laws to run your food truck business in LA.

You must be aware of the following:

- 2009 California Retail Food Code,

- The Los Angeles Municipal Code 80.73,

- The Los Angeles County Department of Public Health Informational Packet

Here’s the summary of the main provisions:

- Get all the equipment in your food truck certified by an American National Standard Institute (ANSI) accredited certification program

- Obey all posted parking restrictions, including restrictions on stopping, loading, and parking

- Arrange for access to a bathroom within 200 ft travel distance of your truck if you plan to do business at a stop for more than an hour

- Only serve customers on the sidewalk side of your vehicle

- Place a marked trash can outside your food truck

- Must rent a place to park your food truck at a food commissary – do not park your vehicle in your driveway

– Tiny Homes

Los Angeles allows people to build and live in tiny homes. However, you should adhere to local zoning and building laws.

There is no specific definition of a tiny house in LA, but generally, it should be under 500 square feet to qualify as a tiny home.

– Parking Laws

The City of Los Angeles is stringent when it comes to parking violations. To avoid fines or to have your car towed, remember the following:

- Red curb = no parking

- Green curb = parking for a limited time only

- A white or yellow curb = passenger loading and unloading, no parking

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Los Angeles Car Insurance FAQs

Here are some routinely asked questions on car insurance in LA.

What is the minimum amount of coverage required to drive in LA?

The minimum liability coverage that you must have are:

- Bodily injury liability coverage: $15,000 per person / $30,000 per accident

- Property damage liability coverage: $5,000

Who offers the cheapest car insurance in Los Angeles?

According to our calculations, USAA and Geico are the cheapest auto insurance providers in LA.

However, these are average rates and may not apply to you. Some other providers may be able to provide a more affordable rate depending on your circumstances. Get quotes from multiple insurers.

Is there a low-income car insurance program in LA?

Yes, you can get car insurance under California’s Low-Cost Automobile Insurance Program if you meet the low-income requirements. Here are the income requirements organized by family size:

| Family size | Maximum Income |

|---|---|

| 1 | $31,225 |

| 2 | $42,275 |

| 3 | $53,325 |

| 4 | $64,375 |

What if an uninsured driver hits you?

If you carry collision coverage on your car, you may be entitled to the California Deductible Waiver. Under the waiver, if an uninsured driver hits you, your insurance company will foot in the deductible for your car repairs.

Does speeding increase my auto insurance rates?

Yes, if you are caught speeding, your auto insurance rates may increase. Depending on your insurer, you may see your annual car insurance rates increase by anywhere between $200 to $2,000.

Now that you know about car insurance in LA, you can start comparison shopping today using our FREE online tool. Enter your zip code below to get started.