Cheap Arizona Auto Insurance Guide (2024)

Arizona auto insurance rates average $81/month. You can buy Arizona auto insurance from the biggest companies in the nation, and Geico has the cheapest rates of the big-name companies. The cheapest Arizona auto insurance company is a smaller company, Western General. Get cheap Arizona auto insurance by shopping around.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Arizona Statistics Summary | |

|---|---|

| Road Miles | Total in State: 65,593 Vehicle Miles Driven: 62.6 Million |

| Vehicles | 5,407,097 |

| Population | 7,016,270 |

| Most Popular Vehicle | Ford F150 |

| Average Premiums (Annual) | Liability: $508.76 Collision: $277.96 Comprehensive: $186.12 Combined Premium: $972.85 |

| Percentage of Motorists Uninsured | 12% State Rank: 24th |

| Cheapest Provider | Civil Service Employees & Western General |

Are you bothered by high car insurance rates? Are you spending your hard-earned money on insurance costs, instead of something fun like that family vacation you’ve always wanted to take? Arizona auto insurance rates are lower on average than the national average, but it’s still a big bill.

Whether it’s monthly, quarterly, or biannually, those letters from the insurance company always seem to fill your inbox or your mailbox. If you’re like us, receiving a letter from your insurance company is never a good thing. Consumers in Arizona pay an average of $972.85/year or $81/month for car insurance.

Are you one of them?

Or do you pay a lot more? Nobody likes to pay too much for anything, let alone, paying too much for car insurance. But how do you get started? What if all of the information you needed to save money on your auto insurance was in one spot?

Would you invest the time? What if it would save you money? A LOT of money. I bet you would.

Everything you need to know about buying cheap auto insurance in Arizona is in the comprehensive guide. We’ll cover Arizona auto insurance requirements and more.

Start comparison shopping for affordable Arizona auto insurance today using our FREE online tool. Enter your zip code below to get multiple Arizona auto insurance quotes.

Arizona Auto Insurance Coverage and Rates

The median household income in Arizona in 2017 was over $56,581. In 2015, drivers, on average paid over $973 for car insurance. Now, we’re no math genius or anything, but however you work it out, consumers in the Copper State are spending way too much money on car insurance.

There has to be a better way.

Below, we have provided information on Arizona auto insurance limits and helpful advice so you can get the best coverage options for your needs.

| Insurance Required | Minimum Limits: 15/30/10 |

|---|---|

| Bodily Injury Liability | $15,000 per person $30,000 per accident |

| Property Damage Liability | $10,000 |

Okay, you’ve read the numbers, but what do they mean?

What is 15/30/10?

Bodily injury?

Accidents?

We hope you never have to deal with any of these situations or end up in one of these:

But if you do, the basic coverage requirements in Arizona which all motorists must have for liability insurance are:

- $15,000 to cover the death or injury of one person

- $30,000 to cover the death or injury of more than one person

- $10,000 to cover property damage

Liability insurance pays all individuals — drivers, passengers, pedestrians, etc. — who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes. If you cause a wreck, liability insurance pays everyone affected by the accident.

– Required Forms of Financial Responsibility in Arizona

What is financial responsibility? Basically, financial responsibility is proof that you have Arizona’s minimum liability coverage. State law requires every driver and owner of a vehicle to have proof of financial security at all times.

Here are a few acceptable forms of proof of financial security in Arizona:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Picture of proof of insurance on your smartphone

– Premiums as Percentage of Income in Arizona

In Arizona, the per capita disposable income is $34,321. On average, residents spend $962 a year on car insurance. To put this amount in perspective, the countrywide, annual average for car insurance is $981. This means people in Arizona pay slightly less than the countrywide average.

Even though folks in Arizona pay slightly less than the national average, overall, compared to states like Michigan and New Jersey, that savings adds up to several hundred dollars.

– Core Coverage in Arizona

| Type of Coverage | Average Cost in Arizona | Average Cost Nationally |

|---|---|---|

| Liability | $508.76 | $538.73 |

| Collision | $277.96 | $322.61 |

| Comprehensive | $186.12 | $148.04 |

| Combined | $972.85 | $1009.38 |

The National Association of Insurance Commissioners, a leading source on insurance coverage, is the source for the above data. Car insurance rates in Arizona will likely be higher for 2019.

– Additional Liability Coverage in Arizona

To gauge the financial health of insurance companies, you should look at its loss ratios. Loss ratios are explained as: the money insurance companies pay out on claims compared to the money they take in on premiums is the loss ratio.

Check out the loss ratio for these two types of coverage in Arizona.

| Loss Ratio | |||

|---|---|---|---|

| Type of Coverage | 2014 | 2013 | 2012 |

| Medical Payments | 69.21% | 77.92% | 83.60% |

| Uninsured/Underinsured Motorist Coverage | 75.40% | 81.35% | 84.52% |

You may want to consider adding additional coverage to your plans, to avoid paying out of pocket in the event of an accident. Without this additional coverage, medical bills and payments could reach well into the thousands of dollars for those affected by an uninsured driver.

– Add-ons, Endorsements, and Riders

Since basic coverage in Arizona only offers $10,000 in case of an accident, have you considered adding extra coverages to your policy? Do you even know what’s out there? Choosing from a list of options can be daunting, and we know you want the best options for your family at the best price.

To help you decide, we’ve made a list of affordable options to add to your policy. Click on the selections below to learn more about them:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Low-Mileage Discount

Any of the above coverages would be great to add to a policy, so make sure to discuss any options you are interested in with your insurance carrier.

– Pay-As-You-Drive Is a Good Option

Not legal in all states, Pay-As-You-Drive insurance bases your rates on how many miles you drive. Similar to Progressive’s Snapshot option, which bases rates on how safely you drive, Usage-Based insurance is a newer option for consumers in certain states.

These types of policies aren’t right for everyone, and certainly not for people who drive a lot of miles.

– Arizona Demographic Rates – Male vs. Female

You may be surprised to learn that gender plays a large role in deciding how much your car insurance rates are? In fact, females typically pay more than males for car insurance, and this is the case in Arizona.

In fact, gender discrimination in car insurance rates is such a problem that California and other states banned gender discrimination and created gender-neutral insurance plans.

https://youtu.be/bZj2y4W-xNg

Below, we show you rates that various folks in Arizona pay for car insurance.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,475.85 | $3,475.85 | $3,384.12 | $3,384.12 | $7,562.62 | $9,796.63 | $3,890.24 | $4,230.29 |

| American Family Mutual | $2,748.94 | $2,748.94 | $2,524.19 | $2,524.19 | $7,241.04 | $9,439.65 | $2,748.94 | $3,227.56 |

| Farmers Ins Co of AZ | $2,679.47 | $2,677.67 | $2,381.02 | $2,534.04 | $11,538.29 | $11,976.04 | $3,034.99 | $3,144.34 |

| Geico Cas | $1,544.04 | $1,721.95 | $1,303.63 | $1,659.36 | $4,418.49 | $4,657.44 | $1,408.73 | $1,388.68 |

| NICOA | $2,354.06 | $2,397.60 | $2,105.21 | $2,230.55 | $5,791.09 | $7,418.71 | $2,714.31 | $2,934.32 |

| Progressive Advance Ins | $1,977.89 | $1,731.84 | $1,776.60 | $1,687.27 | $8,119.66 | $9,061.45 | $2,128.03 | $2,116.05 |

| State Farm Mutual Auto | $2,878.25 | $2,878.25 | $2,538.55 | $2,538.55 | $8,933.99 | $11,220.20 | $3,098.04 | $3,919.15 |

| Travelers Property Casualty | $1,942.75 | $2,042.96 | $1,800.08 | $1,912.79 | $5,643.46 | $7,078.41 | $2,057.04 | $2,162.23 |

| USAA | $1,682.06 | $1,686.88 | $1,569.71 | $1,589.18 | $6,306.70 | $7,232.99 | $2,216.43 | $2,377.31 |

– Cheapest Rates by Zip Code

We’ve collected data on the least and most expensive zip codes, so search to see where your zip code lands on the list. You’ll also see providers’ costs next to your zip code, providing a helpful snapshot into what you should be paying.

| Cheapest ZIP Codes in Arizona | City | Average by ZIP Codes | Most Expensive Company | Most Expensive Rate | Second Most Expensive Company | Second Most Expensive Rate | Cheapest Company | Cheapest Rate | Second Cheapest Company | Second Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 85533 | Clifton | $3,017.43 | State Farm | $3,708.31 | Farmers | $3,639.11 | Geico | $1,884.38 | Travelers | $2,171.74 |

| 85534 | Duncan | $3,049.16 | Farmers | $4,181.09 | Allstate | $3,518.68 | Geico | $1,884.38 | Travelers | $2,402.40 |

| 85540 | Morenci | $3,031.96 | Allstate | $4,179.63 | State Farm | $3,708.31 | Geico | $1,884.38 | Travelers | $2,170.14 |

| 85552 | Thatcher | $3,053.07 | Allstate | $3,836.45 | State Farm | $3,786.48 | Geico | $1,884.38 | Travelers | $2,198.28 |

| 85607 | Douglas | $2,984.01 | Farmers | $3,887.07 | Allstate | $3,550.70 | Geico | $1,877.40 | Travelers | $2,227.10 |

| 85610 | Elfrida | $3,009.40 | Allstate | $3,550.70 | Farmers | $3,530.97 | Geico | $1,877.40 | Travelers | $2,402.45 |

| 85615 | Hereford | $3,057.81 | Allstate | $4,179.63 | State Farm | $3,688.14 | Geico | $1,780.18 | Travelers | $2,279.41 |

| 85616 | Huachuca City | $3,055.06 | Allstate | $3,836.45 | State Farm | $3,693.74 | Geico | $1,794.03 | Travelers | $2,304.77 |

| 85635 | Sierra Vista | $3,048.77 | Farmers | $3,781.88 | State Farm | $3,667.82 | Geico | $1,758.66 | Travelers | $2,342.48 |

| 85643 | Willcox | $3,059.48 | Allstate | $3,836.45 | Farmers | $3,747.77 | Geico | $1,909.88 | Travelers | $2,366.12 |

| 86401 | Kingman | $2,996.32 | Farmers | $4,257.57 | Allstate | $3,518.68 | Geico | $1,828.75 | Travelers | $2,283.42 |

| 86403 | Lake Havasu City | $2,883.46 | Farmers | $3,704.06 | State Farm | $3,552.73 | Geico | $1,828.75 | Travelers | $2,132.47 |

| 86404 | Lake Havasu City | $2,896.40 | Farmers | $3,740.33 | Allstate | $3,518.68 | Geico | $1,828.75 | Travelers | $2,149.26 |

| 86406 | Lake Havasu City | $3,027.98 | Allstate | $4,230.13 | Farmers | $4,158.03 | Geico | $1,828.75 | Travelers | $2,226.06 |

| 86409 | Kingman | $2,949.61 | Farmers | $3,761.07 | Allstate | $3,518.68 | Geico | $1,828.75 | Travelers | $2,399.63 |

| 86411 | Hackberry | $3,049.80 | Farmers | $4,220.95 | State Farm | $3,716.12 | Geico | $1,828.75 | Travelers | $2,315.41 |

| 86413 | Golden Valley | $3,059.25 | Farmers | $4,147.78 | Allstate | $3,862.91 | Geico | $1,828.75 | Travelers | $2,366.31 |

| 86429 | Bullhead City | $3,025.22 | State Farm | $3,896.82 | Allstate | $3,862.91 | Geico | $1,791.37 | Nationwide | $2,459.12 |

| 86431 | Chloride | $2,977.29 | Farmers | $4,214.62 | State Farm | $3,862.46 | Geico | $1,828.75 | Travelers | $2,383.69 |

| 86436 | Topock | $2,951.90 | Allstate | $3,862.91 | State Farm | $3,767.75 | Geico | $1,791.37 | Travelers | $2,475.21 |

| 86437 | Valentine | $3,039.01 | Farmers | $4,753.36 | State Farm | $3,862.46 | Geico | $1,828.75 | Travelers | $2,317.12 |

| 86438 | Yucca | $2,982.40 | State Farm | $3,698.74 | Allstate | $3,518.68 | Geico | $1,828.75 | Travelers | $2,514.20 |

| 86442 | Bullhead City | $3,031.71 | State Farm | $3,878.61 | Farmers | $3,750.98 | Geico | $1,791.37 | Nationwide | $2,520.18 |

| 86443 | Temple Bar Marina | $3,049.56 | Farmers | $4,457.80 | State Farm | $3,862.46 | Geico | $1,828.75 | Travelers | $2,448.01 |

| 86444 | Meadview | $3,013.06 | Farmers | $4,053.91 | Allstate | $3,862.91 | Geico | $1,828.75 | Travelers | $2,356.74 |

The cheapest zip code is 85533 in Clifton, while 23 of the most expensive zip codes can be found in Phoenix.

| Most Expensive ZIP Codes in Arizona | City | Average by ZIP Code | Most Expensive Company | Most Expensive Rate | Second Most Expensive Company | Second Most Expensive Rate | Cheapest Company | Cheapest Rate | Second Cheapest Company | Second Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 85003 | Phoenix | $4,990.72 | Farmers | $7,192.66 | State Farm | $6,711.87 | Geico | $2,928.41 | USAA | $3,451.60 |

| 85004 | Phoenix | $5,011.05 | Farmers | $6,876.61 | Allstate | $6,598.77 | Geico | $3,054.48 | USAA | $3,451.60 |

| 85006 | Phoenix | $5,079.52 | Farmers | $7,241.64 | State Farm | $6,826.70 | Geico | $3,054.48 | USAA | $3,196.00 |

| 85007 | Phoenix | $5,005.43 | Farmers | $7,062.97 | State Farm | $6,629.15 | Geico | $2,959.34 | USAA | $3,451.60 |

| 85009 | Phoenix | $5,479.07 | State Farm | $8,060.87 | Farmers | $7,329.50 | Geico | $3,040.83 | USAA | $4,163.80 |

| 85012 | Phoenix | $5,006.69 | Farmers | $7,060.86 | Allstate | $6,486.07 | Geico | $2,919.43 | USAA | $3,727.96 |

| 85013 | Phoenix | $5,037.15 | Farmers | $7,089.90 | State Farm | $6,701.95 | Geico | $2,928.41 | USAA | $3,580.50 |

| 85015 | Phoenix | $5,176.00 | Farmers | $7,254.03 | State Farm | $6,712.34 | Geico | $2,959.34 | USAA | $3,196.00 |

| 85017 | Phoenix | $5,440.43 | State Farm | $8,143.61 | Farmers | $7,250.93 | Geico | $3,090.57 | USAA | $3,580.63 |

| 85019 | Phoenix | $5,367.13 | State Farm | $7,831.38 | Farmers | $7,250.93 | Geico | $3,085.03 | USAA | $3,231.81 |

| 85020 | Phoenix | $4,842.66 | Allstate | $7,155.38 | Farmers | $6,529.99 | Geico | $3,009.38 | USAA | $3,247.82 |

| 85021 | Phoenix | $5,092.08 | Farmers | $7,201.47 | State Farm | $6,623.96 | Geico | $3,018.39 | USAA | $3,876.59 |

| 85025 | Phoenix | $4,976.47 | Farmers | $7,195.74 | Allstate | $6,486.07 | Geico | $3,054.48 | USAA | $3,339.21 |

| 85029 | Phoenix | $4,978.32 | Farmers | $6,993.32 | Allstate | $6,635.64 | Geico | $3,018.39 | USAA | $3,245.92 |

| 85031 | Phoenix | $5,339.76 | State Farm | $7,703.24 | Farmers | $7,022.49 | Geico | $3,093.67 | USAA | $3,580.50 |

| 85033 | Phoenix | $5,221.61 | State Farm | $7,808.06 | Farmers | $7,066.53 | Geico | $2,961.78 | Travelers | $3,832.41 |

| 85034 | Phoenix | $5,069.47 | Farmers | $6,868.28 | State Farm | $6,857.79 | Geico | $3,067.45 | Travelers | $3,675.82 |

| 85035 | Phoenix | $5,223.71 | Farmers | $7,338.79 | State Farm | $7,254.43 | Geico | $3,069.80 | USAA | $3,786.75 |

| 85040 | Phoenix | $5,115.68 | Allstate | $7,155.38 | Farmers | $7,114.36 | Geico | $3,052.64 | Travelers | $3,703.78 |

| 85041 | Phoenix | $5,101.83 | Farmers | $7,029.64 | State Farm | $6,762.45 | Geico | $3,014.23 | USAA | $3,844.86 |

| 85042 | Phoenix | $4,882.91 | Farmers | $6,876.61 | State Farm | $6,672.68 | Geico | $3,052.64 | USAA | $3,349.11 |

| 85043 | Phoenix | $5,027.59 | Farmers | $7,110.35 | Allstate | $6,486.07 | Geico | $2,966.50 | USAA | $3,540.57 |

| 85051 | Phoenix | $5,127.30 | Farmers | $6,889.00 | State Farm | $6,679.74 | Geico | $3,077.08 | USAA | $3,549.29 |

| 85301 | Glendale | $4,990.47 | Farmers | $7,025.59 | Allstate | $6,635.64 | Geico | $2,967.87 | USAA | $3,063.94 |

| 85303 | Glendale | $4,986.06 | Allstate | $7,155.38 | Farmers | $6,996.99 | Geico | $2,961.78 | USAA | $3,063.94 |

– Cheapest Rates by City

We’ve also collected data on car insurance rates by city. Below is a list of the least expensive and most expensive cities for auto insurance. Simply look for your city in the tables to see your city’s cost.

| Cheapest Cities in Arizona | Average by City | Most Expensive Company | Most Expensive Rate | Second Most Expensive Company | Second Most Expensive Rate | Cheapest Company | Cheapest Rate | Second Cheapest Company | Second Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bullhead City | $3,028.47 | State Farm | $3,887.72 | Allstate | $3,690.80 | Geico | $1,791.37 | Nationwide | $2,489.65 |

| Chloride | $2,977.28 | Farmers | $4,214.62 | State Farm | $3,862.46 | Geico | $1,828.75 | Travelers | $2,383.69 |

| Clifton | $3,024.69 | Allstate | $3,907.09 | State Farm | $3,708.31 | Geico | $1,884.38 | Travelers | $2,170.94 |

| Desert Hills | $2,896.40 | Farmers | $3,740.33 | Allstate | $3,518.68 | Geico | $1,828.75 | Travelers | $2,149.26 |

| Douglas | $2,984.01 | Farmers | $3,887.07 | Allstate | $3,550.70 | Geico | $1,877.40 | Travelers | $2,227.10 |

| Duncan | $3,049.17 | Farmers | $4,181.09 | Allstate | $3,518.68 | Geico | $1,884.38 | Travelers | $2,402.40 |

| Elfrida | $3,009.40 | Allstate | $3,550.70 | Farmers | $3,530.97 | Geico | $1,877.40 | Travelers | $2,402.45 |

| Fort Mohave | $3,066.87 | State Farm | $3,972.37 | Farmers | $3,740.81 | Geico | $1,791.37 | Nationwide | $2,500.77 |

| Golden Valley | $3,059.25 | Farmers | $4,147.78 | Allstate | $3,862.91 | Geico | $1,828.75 | Travelers | $2,366.31 |

| Hackberry | $3,049.80 | Farmers | $4,220.95 | State Farm | $3,716.12 | Geico | $1,828.75 | Travelers | $2,315.41 |

| Hereford | $3,057.81 | Allstate | $4,179.63 | State Farm | $3,688.14 | Geico | $1,780.18 | Travelers | $2,279.41 |

| Huachuca City | $3,055.06 | Allstate | $3,836.45 | State Farm | $3,693.74 | Geico | $1,794.03 | Travelers | $2,304.77 |

| Kingman | $3,019.57 | Farmers | $4,274.45 | State Farm | $3,683.12 | Geico | $1,828.75 | Travelers | $2,340.85 |

| Lake Havasu City | $2,955.72 | Farmers | $3,931.05 | Allstate | $3,890.41 | Geico | $1,828.75 | Travelers | $2,179.26 |

| Meadview | $3,013.06 | Farmers | $4,053.91 | Allstate | $3,862.91 | Geico | $1,828.75 | Travelers | $2,356.74 |

| Pearce | $3,064.05 | Farmers | $3,591.49 | State Farm | $3,526.12 | Geico | $1,847.86 | Travelers | $2,670.48 |

| Pima | $3,092.48 | Farmers | $3,917.67 | Allstate | $3,836.45 | Geico | $1,909.88 | Travelers | $2,193.37 |

| Portal | $3,073.06 | USAA | $3,662.88 | State Farm | $3,637.66 | Geico | $1,884.38 | Travelers | $2,333.77 |

| Sierra Vista | $3,059.15 | Allstate | $3,834.07 | Farmers | $3,742.82 | Geico | $1,758.66 | Travelers | $2,308.60 |

| Temple Bar Marina | $3,049.56 | Farmers | $4,457.80 | State Farm | $3,862.46 | Geico | $1,828.75 | Travelers | $2,448.01 |

| Thatcher | $3,053.07 | Allstate | $3,836.45 | State Farm | $3,786.48 | Geico | $1,884.38 | Travelers | $2,198.28 |

| Tombstone | $3,090.81 | Allstate | $4,191.47 | State Farm | $3,720.71 | Geico | $1,875.67 | Travelers | $2,307.83 |

| Topock | $2,951.90 | Allstate | $3,862.91 | State Farm | $3,767.75 | Geico | $1,791.37 | Travelers | $2,475.21 |

| Willcox | $3,059.48 | Allstate | $3,836.45 | Farmers | $3,747.77 | Geico | $1,909.88 | Travelers | $2,366.12 |

| Yucca | $2,982.40 | State Farm | $3,698.74 | Allstate | $3,518.68 | Geico | $1,828.75 | Travelers | $2,514.20 |

As you can see from the tables, where you live can impact your wallet when purchasing auto insurance from hundreds, and in some cities, like Phoenix, thousands of dollars.

| Most Expensive Cities in Arizona | Average by City | Most Expensive Company | Most Expensive Rate | Second Most Expensive Company | Second Most Expensive Rate | Cheapest Company | Cheapest Rate | Second Cheapest Company | Second Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Avondale | $4,422.01 | State Farm | $6,007.73 | Allstate | $5,930.33 | Geico | $2,699.76 | USAA | $2,710.68 |

| Cashion | $4,082.69 | Farmers | $5,706.74 | Allstate | $5,527.07 | Geico | $2,290.15 | USAA | $2,830.43 |

| Cave Creek | $4,145.70 | Farmers | $5,792.20 | Allstate | $5,203.51 | Geico | $2,419.66 | USAA | $3,293.99 |

| Citrus Park | $4,118.30 | Allstate | $5,330.30 | State Farm | $5,204.20 | Geico | $2,595.96 | USAA | $2,740.85 |

| El Mirage | $4,371.02 | Farmers | $6,050.94 | State Farm | $5,986.88 | Geico | $2,643.88 | USAA | $2,740.85 |

| Flowing Wells | $4,143.15 | Farmers | $6,011.95 | State Farm | $5,994.86 | Geico | $2,312.23 | USAA | $3,119.38 |

| Fort Mcdowell | $4,086.90 | Farmers | $6,614.69 | Allstate | $4,887.66 | Geico | $2,191.11 | Travelers | $3,347.86 |

| Gilbert | $4,123.44 | Allstate | $5,438.87 | State Farm | $5,250.23 | Geico | $2,490.83 | USAA | $3,154.07 |

| Glendale | $4,563.99 | Farmers | $6,326.50 | Allstate | $6,094.75 | Geico | $2,724.34 | USAA | $2,965.88 |

| Guadalupe | $4,348.51 | Farmers | $6,096.00 | Allstate | $5,751.97 | Geico | $2,447.98 | Travelers | $3,442.02 |

| Higley | $4,177.21 | Allstate | $5,422.87 | State Farm | $5,407.93 | Geico | $2,585.36 | USAA | $3,349.11 |

| Laveen | $4,582.09 | State Farm | $6,678.88 | Farmers | $6,129.86 | USAA | $2,781.56 | Geico | $2,910.88 |

| Mesa | $4,198.02 | Allstate | $5,520.31 | Farmers | $5,456.62 | Geico | $2,401.62 | USAA | $3,314.35 |

| New River | $4,110.13 | Allstate | $5,514.75 | Farmers | $5,366.40 | Geico | $2,366.58 | USAA | $2,947.10 |

| Paradise Valley | $4,326.68 | Allstate | $5,751.97 | State Farm | $5,440.05 | Geico | $2,412.91 | Travelers | $3,832.92 |

| Peoria | $4,194.88 | Farmers | $5,960.07 | Allstate | $5,370.79 | Geico | $2,512.41 | USAA | $2,936.83 |

| Phoenix | $4,801.15 | Farmers | $6,609.09 | State Farm | $6,279.06 | Geico | $2,864.68 | USAA | $3,440.60 |

| San Tan Valley | $4,138.35 | Allstate | $5,436.63 | State Farm | $5,308.73 | Geico | $2,246.12 | USAA | $3,153.44 |

| Scottsdale | $4,187.96 | Farmers | $5,498.96 | Allstate | $5,371.35 | Geico | $2,347.23 | Travelers | $3,482.60 |

| Sells | $4,088.89 | Allstate | $5,527.07 | Farmers | $5,492.77 | Geico | $2,103.12 | USAA | $3,032.95 |

| South Tucson | $4,093.28 | State Farm | $5,868.74 | Farmers | $5,746.37 | Geico | $2,290.61 | USAA | $3,023.03 |

| Tempe | $4,203.41 | Farmers | $6,234.44 | Allstate | $5,421.44 | Geico | $2,435.61 | USAA | $3,135.46 |

| Tortilla Flat | $4,092.31 | Farmers | $5,412.36 | State Farm | $5,407.93 | Geico | $2,585.36 | Travelers | $3,212.74 |

| Waddell | $4,243.07 | Allstate | $5,522.20 | Farmers | $5,507.81 | Geico | $2,366.56 | USAA | $3,100.68 |

| Youngtown | $4,176.27 | Farmers | $6,604.03 | Allstate | $5,644.71 | Geico | $2,643.88 | USAA | $2,908.29 |

Enter your ZIP code below to compare auto insurance rates.Free Auto Insurance Comparison

Secured with SHA-256 Encryption

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Arizona Auto Insurance Companies

Mayhem? Flying pigs causing a wreck? We’ve seen it all and covered it. You’ve seen the commercials. You’ve seen the ads. Why are insurance companies trying to be funny? Are they hiding something? What’s really behind the curtain of most insurance companies? Can you really save money with a 10-minute phone call?

But who wants to spend time doing all of that searching? That’s why we’ve researched the best insurance carriers in Arizona, so you can make the best choice for your situation. We’ve looked at companies’ financial ratings, AM’s best ratings, and which companies have the most complaints.

Keep reading to learn about Arizona’s auto insurance providers.

– Ratings of the Largest Car Insurance Companies in Arizona

What does an A.M. Best rating mean? Essentially, an A.M. Best rating measures the financial health of an insurance company.

The table below shows the financial rating of the top auto insurance providers in Arizona.

| Providers by Size | Rating |

|---|---|

| State Farm | A++ |

| Berkshire Hathaway | A++ |

| Progressive | A+ |

| Farmers | A |

| Allstate | A+ |

| USAA | A++ |

| Liberty Mutual | A |

| American Family | A |

| Hartford | A+ |

| CSAA | A |

A good financial rating means the provider has the funds available to pay any claims. But customer service is also an important part of any company, from restaurants to car insurance providers. That’s why we’ve looked at companies with the best customer satisfaction ratings.

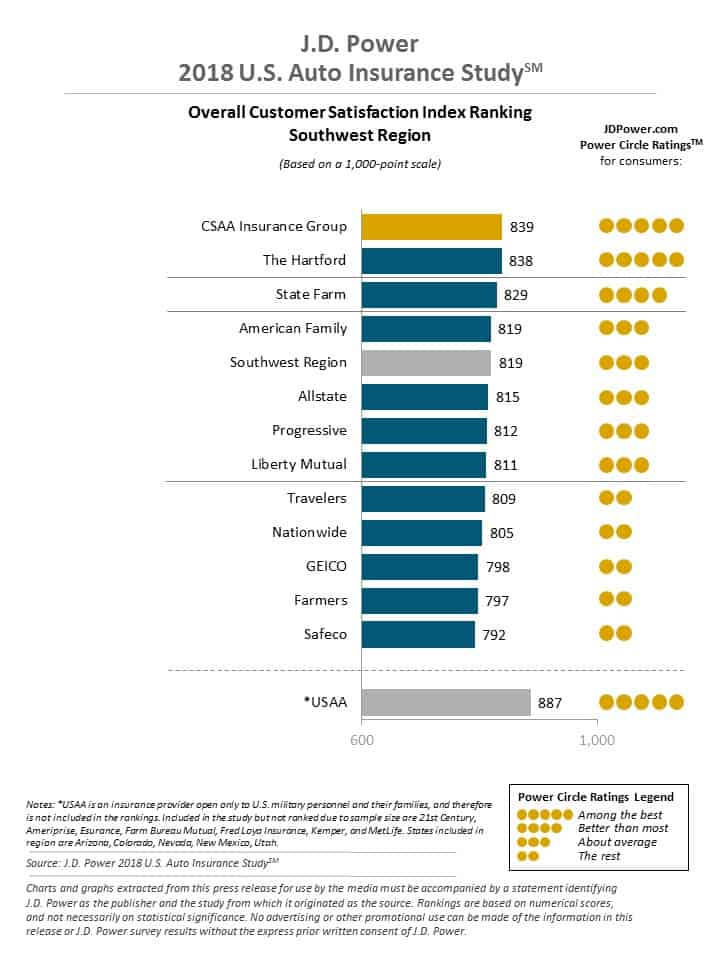

– Arizona’s Insurers with the BEST Ratings

Let’s take a look at J.D. Power ratings for Arizona auto insurance companies.

State Farm ranks near the top of the list — showing that State Farm is great at customer satisfaction. One thing to consider, cost shouldn’t be your only concern when searching for car insurance. You should also be looking at how the insurance provider treats its customers and resolves Arizona auto insurance company claims and complaints.

– Companies with the MOST Complaints in Arizona

The Department of Professional and Financial Regulation collected data on complaint ratios for Arizona’s car insurance companies. The complaint index means the following:

- Average: complaint index of one

- Better than average: complaint index LESS than one

- Worse than average: complaint index GREATER than one

Keep in mind that a high complaint index doesn’t necessarily mean you should avoid a company. Make sure to also look at a company’s customer satisfaction ratings because how a company deals with complaints is also important.

The ratio compares a company’s number of complaints for every 1,000 policies written. The smaller the number, the better the company is performing compared to its competitors.

– Arizona Auto Insurance Rates by Company

In order to save money on car insurance, make sure you are shopping around for rates. Below is information about rates across different companies.

| Company | Average | Compared to State Average | - |

|---|---|---|---|

| Allstate F&C | $4,899.96 | $1,089.94 | 22.24% |

| American Family Mutual | $4,150.43 | $340.40 | 8.20% |

| Farmers Ins Co of AZ | $4,995.73 | $1,185.70 | 23.73% |

| Geico Cas | $2,262.79 | -$1,547.24 | -68.38% |

| NICOA | $3,493.23 | -$316.80 | -9.07% |

| Progressive Advance Ins | $3,574.85 | -$235.18 | -6.58% |

| State Farm Mutual Auto | $4,750.62 | $940.60 | 19.80% |

| Travelers Property Casualty | $3,079.96 | -$730.06 | -23.70% |

| USAA | $3,082.66 | -$727.37 | -23.60% |

| State Average | $3810.03 | - | - |

Looking at different companies can save a lot of money. For example, Travelers is more than $700 BELOW the state average, which, over time, could add up to over several thousand dollars.

– Cost of Different Annual Commutes by Arizona Companies

At some companies, how far you drive each day influences your insurance rates.

| Group | Daily Commute | Annual Mileage | Annual Average |

|---|---|---|---|

| Farmers | 10 miles | 6,000 | $4,995.73 |

| Farmers | 25 miles | 12,000 | $4,995.73 |

| Allstate | 10 miles | 6,000 | $4,899.96 |

| Allstate | 25 miles | 12,000 | $4,899.96 |

| State Farm | 25 miles | 12,000 | $4,870.20 |

| State Farm | 10 miles | 6,000 | $4,631.04 |

| American Family | 25 miles | 12,000 | $4,190.54 |

| American Family | 10 miles | 6,000 | $4,110.32 |

| Progressive | 10 miles | 6,000 | $3,574.85 |

| Progressive | 25 miles | 12,000 | $3,574.85 |

| Nationwide | 10 miles | 6,000 | $3,493.23 |

| Nationwide | 25 miles | 12.000 | $3,493.23 |

| USAA | 25 miles | 12,000 | $3,116.03 |

| Travelers | 10 miles | 6,000 | $3,079.97 |

| Travelers | 25 miles | 12,000 | $3,079.97 |

| USAA | 10 miles | 6,000 | $3,049.29 |

| Geico | 25 miles | 12,000 | $2,301.06 |

| Geico | 10 miles | 6,000 | $2,224.53 |

Most company rates don’t change when the drive is shortened to a 10-mile commute, except for Geico and State Farm, both of whom have rate reductions over a $100.

Up next, a breakdown of coverage level rates in Arizona.

– Coverage Level Rates

The more you pay, the better coverage you will receive. Don’t let higher rates discourage you from purchasing better coverage, as some companies have economical increases in rates. For example, the data below shows Geico has only a $300 increase from low to high coverage.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Farmers | High | $5,680.28 |

| Allstate | High | $5,188.57 |

| State Farm | High | $5,138.26 |

| Farmers | Medium | $5,047.56 |

| Allstate | Medium | $4,926.32 |

| State Farm | Medium | $4,837.71 |

| Allstate | Low | $4,584.99 |

| American Family | Medium | $4,282.99 |

| State Farm | Low | $4,275.90 |

| Farmers | Low | $4,259.36 |

| American Family | High | $4,173.07 |

| American Family | Low | $3,995.23 |

| Progressive | High | $3,929.72 |

| Progressive | Medium | $3,639.87 |

| Nationwide | High | $3,603.30 |

| Nationwide | Medium | $3,529.03 |

| Travelers | High | $3,354.49 |

| Nationwide | Low | $3,347.36 |

| USAA | High | $3,282.03 |

| Progressive | Low | $3,154.96 |

| Travelers | Medium | $3,127.90 |

| USAA | Medium | $3,125.01 |

| USAA | Low | $2,840.93 |

| Travelers | Low | $2,757.50 |

| Geico | High | $2,586.17 |

| Geico | Medium | $2,295.09 |

| Geico | Low | $1,907.11 |

– Credit History Rates

The quality of your credit score impacts your insurance rates. In Arizona, the average credit score is 669, which is slightly below the countrywide average of 675.

Essentially, this means Arizona residents have a smaller chance of getting great rates because of their below-average credit scores.

| Group | Credit History | Annual Average |

|---|---|---|

| State Farm | Poor | $8,740.46 |

| Allstate | Poor | $6,268.01 |

| Farmers | Poor | $5,691.27 |

| American Family | Poor | $5,217.99 |

| Farmers | Fair | $4,764.49 |

| Farmers | Good | $4,531.43 |

| Allstate | Fair | $4,462.15 |

| Nationwide | Poor | $4,203.65 |

| USAA | Poor | $4,057.11 |

| Progressive | Poor | $3,988.93 |

| Allstate | Good | $3,969.73 |

| American Family | Fair | $3,885.37 |

| Travelers | Poor | $3,750.98 |

| Progressive | Fair | $3,482.51 |

| State Farm | Fair | $3,387.26 |

| American Family | Good | $3,347.92 |

| Nationwide | Fair | $3,345.92 |

| Progressive | Good | $3,253.11 |

| Geico | Poor | $3,108.67 |

| Travelers | Fair | $3,058.12 |

| Nationwide | Good | $2,930.12 |

| USAA | Fair | $2,833.38 |

| Travelers | Good | $2,430.80 |

| USAA | Good | $2,357.49 |

| State Farm | Good | $2,124.14 |

| Geico | Fair | $2,039.68 |

| Geico | Good | $1,640.02 |

As you can see from the table above, poor credit scores can add hundreds to your annual cost. A bad credit score at Geico changes your annual cost from $1,640 to $3,109.

– Driving Record Rates

A clean driving record is the EASIEST way to keep rates down. As you can see from the information below, at Progressive, just one speeding violation can raise your rate by over $500.

| Group | Driving Record | Annual Average |

|---|---|---|

| American Family | With 1 DUI | $5,673.56 |

| Allstate | With 1 DUI | $5,631.44 |

| Farmers | With 1 accident | $5,444.19 |

| Farmers | With 1 DUI | $5,312.44 |

| State Farm | With 1 accident | $5,180.16 |

| Allstate | With 1 speeding violation | $5,078.95 |

| Farmers | With 1 speeding violation | $5,006.52 |

| Allstate | With 1 accident | $4,964.56 |

| State Farm | With 1 DUI | $4,750.62 |

| State Farm | With 1 speeding violation | $4,750.62 |

| Nationwide | With 1 DUI | $4,602.36 |

| American Family | With 1 accident | $4,574.11 |

| State Farm | Clean record | $4,321.08 |

| USAA | With 1 DUI | $4,237.25 |

| Farmers | Clean record | $4,219.77 |

| Progressive | With 1 accident | $4,152.77 |

| Allstate | Clean record | $3,924.91 |

| Progressive | With 1 speeding violation | $3,663.97 |

| Travelers | With 1 DUI | $3,572.38 |

| American Family | With 1 speeding violation | $3,414.84 |

| Progressive | With 1 DUI | $3,328.96 |

| Nationwide | With 1 speeding violation | $3,306.90 |

| USAA | With 1 accident | $3,212.15 |

| Travelers | With 1 accident | $3,210.80 |

| Geico | With 1 DUI | $3,170.22 |

| Progressive | Clean record | $3,153.69 |

| Nationwide | With 1 accident | $3,107.91 |

| Travelers | With 1 speeding violation | $3,072.34 |

| Nationwide | Clean record | $2,955.75 |

| American Family | Clean record | $2,939.21 |

| USAA | With 1 speeding violation | $2,639.09 |

| Travelers | Clean record | $2,464.33 |

| Geico | With 1 accident | $2,370.73 |

| USAA | Clean record | $2,242.13 |

| Geico | Clean record | $1,755.11 |

| Geico | With 1 speeding violation | $1,755.11 |

A better record equals better rates. We encourage you to NOT drink and drive.

– The 10 Largest Car Insurance Companies in Arizona

Here’s a look at the top 10 largest insurance companies in Arizona.

| Insurance Company | Premiums Written | Market Share |

|---|---|---|

| State Farm | $818,982 | 16.87 % |

| Berkshire Hathaway | $723,482 | 14.91 % |

| Progressive | $513,333 | 10.58 % |

| Farmers | $393,157 | 8.10 % |

| Allstate | $369,153 | 7.61 % |

| USAA | $362,766 | 7.47 % |

| Liberty Mutual | $279,343 | 5.76 % |

| American Family | $276,833 | 5.70 % |

| Hartford | $109,174 | 2.25 % |

| CSAA Insurance | $100,187 | 2.06 % |

– Number of Property and Casualty Insurance Companies in Arizona

Domestic insurance means a company is formed under Arizona’s state laws, whereas a foreign provider is formed under the laws of any state in the U.S.

| Property and Casualty Insurance | |

|---|---|

| Domestic | 40 |

| Foreign | 943 |

| Total | 983 |

Find the Cheapest Insurance in Arizona Cities

This section provides a brief comparison of insurance rates in key Arizona cities: Gilbert, Scottsdale, Glendale, Tempe, Mesa, and Tucson. Securing affordable insurance is vital for optimal coverage. Whether in urban centers like Scottsdale or cities like Tucson, drivers can use this data to find the most economical insurance options, ensuring suitable coverage at competitive rates.

| Find the Cheapest Insurance in Your City | |

|---|---|

| Gilbert, AZ | Scottsdale, AZ |

| Glendale, AZ | Tempe, AZ |

| Mesa, AZ | Tucson, AZ |

Arizona Laws

Thirsty? If so, you’re in the right state. One of the unusual laws in Arizona states that it is illegal to refuse a person a glass of water.

What about riding a horse off into the sunset? Well, you can do that, too, as long as you don’t ride it up the courthouse steps first.

We know, state laws are confusing and vary from state to state. New residents may sometimes receive tickets for laws they didn’t know existed. We’ve done the work for you to help you discover what the laws are, so check out our roundup of Arizona’s driving laws.

– Arizona’s Auto Insurance Laws

Insurance companies are subject to certain rules and regulations. In Arizona, there is a 30-day waiting period for rate filings.

Let’s look at some of the specific laws for consumers regarding car insurance.

High-Risk Insurance

In Arizona, if you have committed certain infractions such as drug or alcohol offenses, your driver’s license may be revoked. In order to purchase insurance, you will be required to obtain proof of future financial responsibility in the form of an SR-22. You must maintain this proof for three years.

Arizona’s Windshield and Glass Repair Laws

In Arizona, if you have comprehensive coverage for your vehicle, you have the option to get a zero-deductible windshield repair or replacement benefit. The laws for replacement state the consumer may choose the repair facility, and aftermarket parts may be used, however, they must be equal in quality to the manufacturer’s parts.

Compare car insurance rates now and see which company offers you the coverage you want at the best price.

Enter your zip code in our FREE online search tool to get started.

Automobile Insurance Fraud in Arizona

What is automobile insurance fraud?

- Creating a claim for damages or injuries that NEVER occurred (such as faking an accident)

- Adding “extra” costs onto a claim that is legitimate

Committing insurance fraud can result in fines up to $150,000 and/or up to 10 years in jail.

Statute of Limitations

If you are in a car accident in Arizona, there is a statute of limitations if you want to file a claim.

| Arizona Statute of Limitations | Years |

|---|---|

| Personal Injury | 2 Years |

| Property Damage | 2 Years |

Specifically, a statute of limitations is the amount of time you have to file a claim after an accident. The clock starts ticking the day of your accident, so make sure that you are familiar with Arizona’s statute of limitations.

– Arizona’s Vehicle Licensing Laws

We all love the feeling of driving the open road, windows down and the smell of the Mohave and Painted Deserts wafting in on a cool night’s breeze.

But if you’re not careful, that bright glow you see in your rearview mirror won’t be from the nighttime desert sky but a highway patrol officer pulling you over for speeding, or worse, driving while uninsured.

Penalties For Driving Without Insurance

If you are arrested for driving without insurance in Arizona, you can be fined $500 or more, and lose your license and registration for three months or long for the first offense.

On subsequent offenses, penalties can increase to $750 and six months revocation of your license and registration. Don’t risk it, make sure you have the required minimum coverage for your situation.

Arizona is one of the states that now allow drivers to use their smartphone to show proof of insurance. If you are have been involved in an accident or pulled over, law enforcement will ask to see your insurance information.

Here are three acceptable ways:

- Insurance Card

- Electronic Proof of Insurance

- Bond or Certificate of Deposit for $40,000

Any changes in your insurance status must be reported to the Motor Vehicle Department (MVD) of Arizona, including:

- cancellation

- non-renewal

- new policy

If the MVD receives notice that your policy is no longer active, they will send you an inquiry. If you don’t maintain proper coverage, your registration and or driver’s license can be suspended.

Teen Driver Laws

Teenagers in Arizona can apply for a learner’s license (also known as a learner’s permit) at age 15 and a half.

After teenagers have gone through the mandatory learner’s license period and met all the requirements, they can apply for a regular or restricted license.

| Type of License | Age Requirement | Prerequisites | Passenger Restrictions | Driving Restrictions |

|---|---|---|---|---|

| Learner's License | Minimum 15 years six months | Pass vision and written tests | - | Must have a 21-year-old or older licensed driver in the passenger seat |

| Intermediate License | Minimum 16 years | Six months holding period Minimum 30 hours (10 of which at night) supervised driving | Limit of one passenger younger than 18 (except when the passengers are siblings, or when a licensed parent or legal guardian occupies the passenger seat)* | No driving between midnight and five a.m. (Except with a licensed parent or legal guardian in the passenger seat, or when traveling to and from work, school, or religious activities, or for family emergencies)* |

| Unrestricted License | Minimum 18 years | Passing vision, written, and road tests | None | None |

| *Restrictions in place only for the first 6 months receiving the intermediate license. | - | - | - | - |

– Older Driver License Renewal Procedures

All residents in Arizona who maintain a valid driver’s license must renew that license every 12 years up to age 65. Older residents, 65 and over must renew their license every five years.

– New Residents

All applicants must provide adequate proof of vision.

In addition to an eye exam, here are some other things to consider if you want to get an Arizona driver’s license according to the Arizona Department of Transportation:

- You work in Arizona (other than for seasonal agricultural work).

- You are registered to vote in Arizona.

- You place children in school without paying the tuition rate of a nonresident.

- You have a business with an office in Arizona that bases and operates vehicles in this state.

- You obtain a state license or pay school tuition fees at the same rate as an Arizona resident.

- You have a business that operates vehicles to transport goods or passengers within Arizona.

- You remain in Arizona for a total of seven months or more during any calendar year, regardless of your permanent residence.

Also, all license applications and renewals must be done in person at the DMV, or another third party office. Online renewal is NOT permitted.

Arizona Rules of the Road

We all should follow the rules, but if you’re new to the Grand Canyon State, there may be laws you’re unfamiliar with. That’s why we’ve assembled a list of several important laws to keep you in good standing and on the road.

– Fault vs. No-Fault

Arizona is a fault-based state, which means an accident victim has to prove fault on the person that caused an accident and/or their injuries.

Establishing fault includes several elements:

-

- You must prove the other person owed you a duty of reasonable care (ie: if driving, one has a duty to drive carefully and obey traffic laws)

- You must prove the other person breached that duty (ie: they were negligent by running a stop sign or red light)

- You were injured and incurred damages as a result of their negligence.

– Seat Belt and Car Seat Laws

All passengers in the front seat of a vehicle driven in Arizona must be wearing a seat belt. Additionally, children 4 years and younger are required to be in a child safety seat, and children, 5-7 years if under 57 inches.

Currently, there are no restrictions in Arizona regarding the riding in the cargo areas of pickup trucks.

– Keep Right and Move Over Laws

If you’re driving slower than the traffic around you, you must keep in the right lane except when passing another motorist or turning left.

Arizona law states:

If a person driving a vehicle approaches a stationary, authorized emergency vehicle that is giving a signal and displaying alternately flashing red, red and blue lights, the person shall do one of the following:

- If on a highway having at least two lanes proceeding in the same direction as the approaching vehicle, proceed with due caution and if possible, with due regard to safety and traffic conditions, yield the right of way by making a lane change into a lane not adjacent to that of the emergency vehicle.

- If changing lanes would be impossible or unsafe proceed with due caution and reduce speed, maintaining a safe speed for road conditions.

Speed Limits

Every state has different speed limits, and violating Arizona’s speed limits may result in tickets and fines. Below are Arizona’s maximum speed limits for different road types.

| Rural Interstates | Urban Interstates | Other Limited Access Roads | Other Roads |

|---|---|---|---|

| 75 | 65 | 65 | 65 |

– Ridesharing in Arizona

You may be familiar with ridesharing companies like Lyft and Uber. If you want to rideshare, you must purchase ridesharing insurance from one of the following providers in Arizona:

- Allstate

- Geico

- USAA

- State Farm

- Progressive

- Mercury

- American Family Insurance

- Farmers

In addition to the Arisona auto insurance state minimums, Arizona requires, ride-sharing drivers are required to carry $250,000 worth of liability coverage. Ridesharing companies will also require that your vehicle is currently registered/inspected and is safe to drive.

Automation on the Road in Arizona

What is automation? IIHS defines it as the following:

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. One example is adaptive cruise control, which maintains a set speed.”

Arizona does allow for the deployment of autonomous vehicles on their roadways and licensed operators must be in the vehicle during certain levels of automation. Arizona law also requires all autonomous vehicles to have liability insurance.

– Safety Laws

Up next, we take a closer look at the safety laws in Arizona, so you can arrive alive, please don’t drink and drive.

– Impaired-driving Laws in Arizona

Impaired driving has catastrophic results for everyone involved, that’s why tough laws are in place to prevent such tragedies. In Arizona alone, drunk driving caused 278 deaths in 2017. Each state differs in how they address drunk driving and therefore have different penalties.

Below, we’ve listed the details about Arizona’s impaired driving laws.

| Formal Name for Offense | BAC Limit | High BAC Limit | Criminal Status | Look Back Period |

|---|---|---|---|---|

| Driving Under The Influence (DUI) | 0.08 | 0.15-0.2; 0.2+ | 1st-2nd class 1 misdemeanor, 3rd+ class 4 felony | 7 Years |

The penalties get worse with each successive offense. Please don’t drink and drive.

Marijuana Impaired Driving Laws

As for marijuana-impaired driving in the state of Arizona, the state has a ZERO tolerance policy for THC and metabolites.

Distracted Driving Laws in Arizona

Arizona has the following restrictions on hand-held devices and texting while driving.

| Hand-held Ban | Young Driver Cell Phone Ban | Texting Ban | Enforcement |

|---|---|---|---|

| No | Learner's permit holders and intermediate license holders during the first six months after licensing | Learner's permit holders and intermediate license holders during the first six months after licensing | Secondary |

Up next, we delve into some facts about Arizona you might not know.

Arizona Can’t-Miss Facts

Now that you have a good understanding of Arizona state laws, let’s jump into some facts that you might not know. While insurance is important, it’s also crucial to know what to keep your eyes out for on the road.

We’ve laid out everything you need to know about the risk factors in Arizona, from vehicle theft to crash reports, so you can drive safely and enjoy your drive on the road.

– Vehicle Theft in Arizona

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Accord | 1997 | 1,072 |

| Honda Civic | 1998 | 1,016 |

| Chevrolet Pickup (Full Size) | 2004 | 850 |

| Ford Pickup (Full Size) | 2006 | 772 |

| Dodge Pickup (Full Size) | 2001 | 428 |

| Nissan Altima | 2015 | 269 |

| GMC Pickup (Full Size) | 2015 | 246 |

| Toyota Camry | 1999 | 210 |

| Jeep Cherokee/Grand Cherokee | 1994 | 207 |

| Nissan Sentra | 2014 | 200 |

Where you live also plays a role in the number of vehicle thefts. The FBI created a 2013 report on Arizona’s vehicle thefts by cities, which are listed below.

| City | Motor Vehicles Stolen |

|---|---|

| Bisbee | 7 |

| Buckeye | 69 |

| Bullhead City | 101 |

| Camp Verde | 17 |

| Casa Grande | 86 |

| Chandler | 279 |

| Chino Valley | 10 |

| Clarkdale | 0 |

| Clifton | 3 |

| Coolidge | 30 |

| Cottonwood | 15 |

| Eagar | 6 |

| El Mirage | 74 |

| Eloy | 39 |

| Flagstaff | 55 |

| Florence | 1 |

| Fredonia | 0 |

| Gilbert | 153 |

| Glendale | 1,050 |

| Globe | 1 |

| Goodyear | 82 |

| Holbrook | 16 |

| Huachuca City | 1 |

| Jerome | 0 |

| Kearny | 0 |

| Kingman | 64 |

| Lake Havasu City | 68 |

| Mammoth | 1 |

| Marana | 40 |

| Maricopa | 31 |

| Mesa | 952 |

| Miami | 3 |

| Nogales | 57 |

| Page | 28 |

| Paradise Valley | 6 |

| Payson | 21 |

| Peoria | 207 |

| Phoenix | 6,355 |

| Pima | 3 |

| Pinetop-Lakeside | 2 |

| Prescott | 48 |

| Prescott Valley | 30 |

| Quartzsite3 | 4 |

| Sahuarita | 8 |

| San Luis | 55 |

| Scottsdale | 208 |

| Sedona | 5 |

| Show Low | 10 |

| Snowflake-Taylor | 4 |

| Somerton | 20 |

| South Tucson | 31 |

| Springerville | 3 |

| St. Johns | 7 |

| Surprise | 146 |

| Tempe | 487 |

| Thatcher | 0 |

| Tolleson | 41 |

| Tucson | 2,190 |

| Wickenburg | 8 |

| Willcox | 16 |

| Williams | 2 |

| Winslow | 10 |

| Yuma | 222 |

– Dangers on the Road In Arizona

Accidents happen, and up next we’re going to show you statistics for different kinds of accidents in Arizona.

– Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 350 | 191 | 146 | 38 | 1 | 726 |

| Rain | 8 | 9 | 1 | 0 | 0 | 18 |

| Snow/Sleet | 2 | 0 | 1 | 0 | 0 | 3 |

| Other | 2 | 1 | 1 | 1 | 0 | 5 |

| Unknown | 45 | 2 | 68 | 0 | 52 | 167 |

| TOTAL | 407 | 203 | 217 | 39 | 53 | 919 |

As you can see, most accidents occur during daylight hours.

– Fatalities (All Crashes) by County

Here are the 10 counties with the most fatalities over the past five years.

| Rank | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Maricopa County | 398 | 367 | 405 | 478 | 471 |

| 2 | Pima County | 96 | 88 | 93 | 111 | 114 |

| 3 | Pinal County | 59 | 45 | 55 | 62 | 71 |

| 4 | Yavapai County | 41 | 42 | 47 | 41 | 55 |

| 5 | Navajo County | 34 | 39 | 43 | 31 | 48 |

| 6 | Coconino County | 40 | 45 | 58 | 50 | 47 |

| 7 | Mohave County | 55 | 29 | 49 | 53 | 44 |

| 8 | Apache County | 28 | 26 | 49 | 35 | 42 |

| 9 | Gila County | 23 | 17 | 31 | 19 | 27 |

| 10 | Yuma County | 24 | 33 | 16 | 18 | 26 |

| Sub Total 1 | Top Ten Counties | 798 | 731 | 849 | 906 | 945 |

| Sub Total 2 | All Other Counties | 49 | 42 | 46 | 45 | 55 |

| Total | All Counties | 847 | 773 | 895 | 951 | 1,000 |

– Fatalities by Roadway

Ten-year comparison of traffic fatalities on urban vs. rural roadways.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 474 | 419 | 354 | 384 | 375 | 337 | 289 | 343 | 335 | 352 |

| Urban | 464 | 386 | 405 | 439 | 444 | 509 | 482 | 550 | 612 | 647 |

– Fatalities by Person Type

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 209 | 216 | 254 | 265 | 250 |

| Light Truck - Pickup | 116 | 74 | 103 | 101 | 111 |

| Light Truck - Utility | 100 | 81 | 105 | 113 | 105 |

| Light Truck - Van | 24 | 20 | 33 | 30 | 22 |

| Light Truck - Other | 2 | 1 | 0 | 2 | 2 |

| Large Truck | 11 | 9 | 17 | 16 | 19 |

| Other/Unknown Occupants | 46 | 56 | 56 | 55 | 64 |

| Total Occupants | 508 | 458 | 568 | 582 | 575 |

Another factor that shows trends in fatalities is the type of person. We don’t mean demographic information, but rather the type of vehicle that is being driven and if the person is an occupant in the car, a pedestrian, or a cyclist.

The type of crash can also play a role in fatality rates.

– Fatalities by Crash Type

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 849 | 773 | 897 | 952 | 1,000 |

| - (1) Single Vehicle | 506 | 462 | 499 | 542 | 566 |

| - (2) Involving a Large Truck | 63 | 67 | 91 | 83 | 94 |

| - (3) Involving Speeding | 293 | 255 | 315 | 325 | 299 |

| - (4) Involving a Rollover | 259 | 218 | 268 | 294 | 262 |

| - (5) Involving a Roadway Departure | 377 | 301 | 379 | 388 | 371 |

| - (6) Involving an Intersection (or Intersection Related) | 239 | 212 | 248 | 269 | 272 |

Up next, we have a five-year trend for Arizona’s top-10 counties that have the highest fatality rates.

– Five-Year Trend For The Top 10 Counties

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Maricopa County | 398 | 367 | 405 | 478 | 471 |

| Pima County | 96 | 88 | 93 | 111 | 114 |

| Pinal County | 59 | 45 | 55 | 62 | 71 |

| Yavapai County | 41 | 42 | 47 | 41 | 55 |

| Navajo County | 34 | 39 | 43 | 31 | 48 |

| Coconino County | 40 | 45 | 58 | 50 | 47 |

| Mohave County | 55 | 29 | 49 | 53 | 44 |

| Apache County | 28 | 26 | 49 | 35 | 42 |

| Gila County | 23 | 17 | 31 | 19 | 27 |

| Yuma County | 24 | 33 | 16 | 18 | 26 |

| Top Ten Counties | 798 | 731 | 849 | 906 | 945 |

| All Other Counties | 49 | 42 | 46 | 45 | 55 |

| All Counties | 847 | 773 | 895 | 951 | 1,000 |

– Fatalities Involving Speeding by County

Below, are listings by county of the most speed-related fatalities in Arizona.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Apache County | 13 | 3 | 18 | 12 | 6 |

| Conchise County | 9 | 6 | 6 | 11 | 4 |

| Coconino County | 11 | 18 | 17 | 18 | 10 |

| Gila County | 11 | 7 | 13 | 8 | 8 |

| Graham County | 1 | 7 | 2 | 2 | 4 |

| Greenlee County | 2 | 1 | 0 | 1 | 0 |

| La Paz County | 4 | 3 | 12 | 5 | 8 |

| Maricopa County | 111 | 111 | 132 | 148 | 128 |

| Mohave County | 28 | 9 | 26 | 21 | 17 |

| Navajo County | 13 | 15 | 10 | 5 | 21 |

| Pima County | 38 | 27 | 33 | 45 | 36 |

| Pinal County | 24 | 17 | 16 | 24 | 21 |

| Santa Cruz County | 5 | 5 | 0 | 2 | 2 |

| Yavapai County | 14 | 14 | 22 | 17 | 25 |

| Yuma County | 9 | 12 | 8 | 6 | 9 |

– Alcohol-Impaired Fatalities by County

Have you ever wondered about the amount of drunk driving going on in your county? Check out the table below to see fatalities in crashes that involved an alcohol-impaired driver with a BAC over .08.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Apache County | 11 | 7 | 22 | 15 | 14 |

| Cochise County | 6 | 5 | 6 | 5 | 8 |

| Coconino County | 10 | 17 | 15 | 8 | 18 |

| Gila County | 7 | 5 | 11 | 4 | 9 |

| Graham County | 2 | 4 | 2 | 5 | 2 |

| Greenlee County | 2 | 0 | 0 | 1 | 1 |

| La Paz County | 2 | 1 | 2 | 3 | 3 |

| Maricopa County | 97 | 77 | 115 | 128 | 131 |

| Mohave County | 12 | 6 | 12 | 14 | 14 |

| Navajo County | 11 | 10 | 15 | 7 | 14 |

| Pima County | 29 | 25 | 32 | 24 | 33 |

| Pinal County | 14 | 18 | 18 | 16 | 14 |

| Santa Cruz County | 3 | 3 | 1 | 0 | 1 |

| Yavapai County | 10 | 10 | 10 | 5 | 9 |

| Yuma County | 7 | 11 | 5 | 5 | 6 |

– Teen Drinking and Driving

In 2016, Arizona law enforcement arrested 211 teenagers (under the age of 18) for drunk driving.

This number places Arizona as the 14th worst state in the U.S. for underage drinking and driving.

Below are the facts concerning underage (under 21 years old) drinking-related fatalities:

- 1.6 fatalities per 100,000 people in Arizona

- 1.2 fatalities per 100,000 people national average

– EMS Response Time

If you or someone you know is in an accident, you want help to arrive as FAST as possible.

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities |

|---|---|---|---|---|---|

| Rural | 3.96 | 17.4 | 56.80 | 72.01 | 277 |

| Urban | 1.65 | 5.71 | 23.99 | 30.50 | 574 |

Response times in Arizona are longer for those who live in rural areas. It takes less than 30 minutes in an urban setting to arrive at the hospital.

– Transportation in Arizona

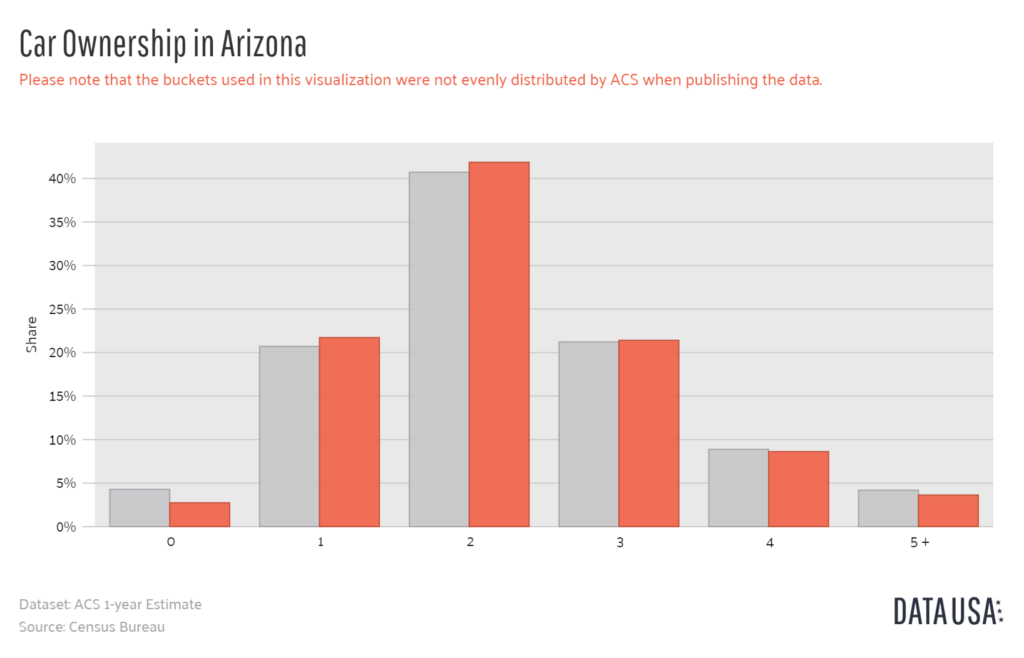

When you drive through your neighborhood, do you ever take note of how many cars are sitting in your neighbors’ driveways? Usually, we can tell if someone is visiting by that extra car parked outside the house.

The average household in Arizona has two cars.

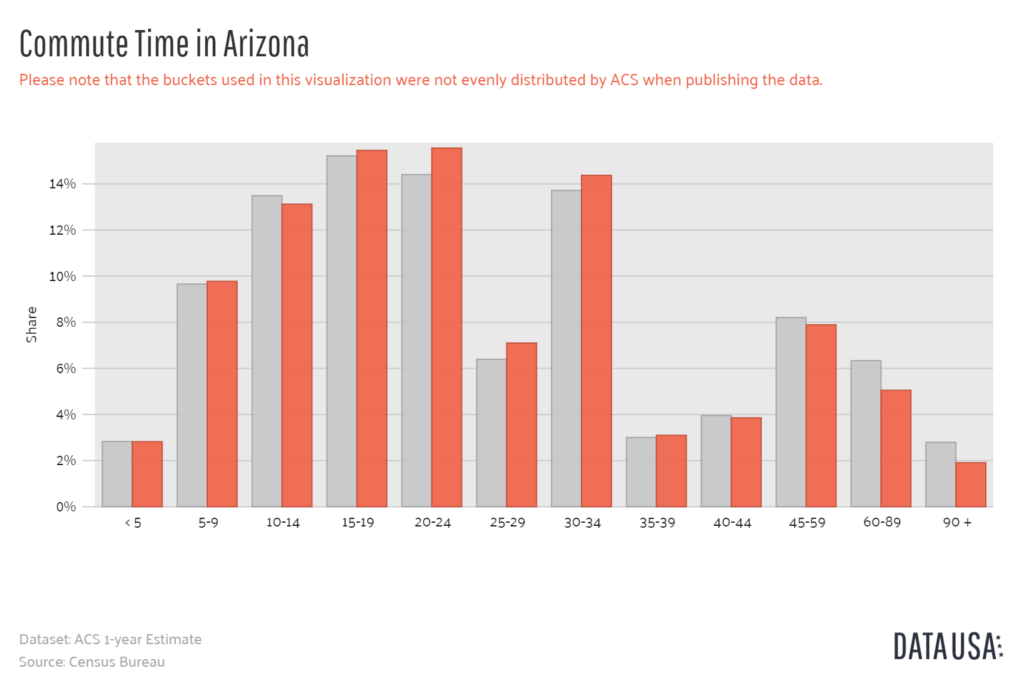

Commute Time

The average commute time in Arizona is 23.7 minutes, which is a bit shorter than the national average of 25.3 minutes. The chart below represents the commute times in Arizona compared to the national average.

Now, let’s take a look at methods of commuter transportation in Arizona.

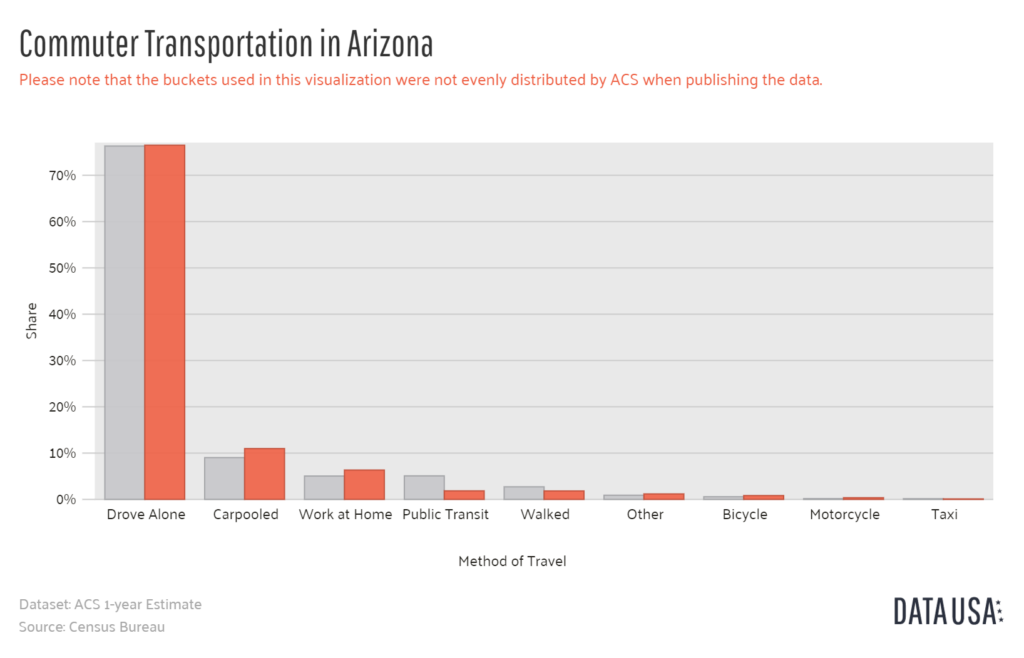

Commuter Transportation

As in most states, the most common transportation method is driving alone to work, followed by carpooling and working from home.

Traffic Congestion

No one likes sitting in traffic. Phoenix is the fifth-largest city in the US and ranks 140th for congestion.

Below is a chart showing how much time commuters spend in traffic in Arizona’s two most populated – and congested – cities.

| City | Hours Spent in Traffic | Peak (Time in Traffic) | Daytime (Time in Traffic) | Overall (Time in Traffic) |

|---|---|---|---|---|

| Phoenix, AZ | 34 | 9% | 4% | 6% |

| Tucson, AZ | 10 | 5% | 4% | 4% |

| Surprise, AZ | 13 | 8% | 8% | 7% |

Now that you’ve read through this comprehensive guide, and know everything there is to know about how to buy Arizona auto, it’s time to hit the road. Enter your zip code below to get a free quote comparison to find affordable Arizona auto insurance for you.