The Ultimate New Jersey Car Insurance Guide (Costs + Coverage)

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| New Jersey Statistics Summary | Details |

|---|---|

| Road Miles | Miles Driven: 75,393 millions Miles of Roadway: 39,065 |

| Vehicles | Registered: 5,786,113 Thefts: 11,778 |

| Population | 8,960,001 |

| Most Popular Vehicle in New Jersey | Honda CR-V |

| Uninsured%/Underinsured% | 14.90% |

| Total Driving Related Deaths | Speeding-Related Fatalities: 120 DUI Fatalities: 125 |

| Full Coverage Average Premiums (Annual) | Liability: $869.57 Collision: $381.86 Comprehensive: $131.35 Full Coverage: $1,382.79 |

| Cheapest Provider | Geico |

New Jersey is the most densely populated state in the United States. Over nine million people call New Jersey there home.

If you are a native from New Jersey than you share that with the likes of Jack Nicholson, Judy Blume, Whitney Houston, Frank Sinatra, Bruce Springsteen, Grover Cleveland, and Aaron Burr.

New Jersey holds the title for the longest boardwalk and the first baseball game played in Hoboken. An unfortunate title New Jersey holds is the title of most cars stolen. More cars are stolen in Jew Jersey than Los Angelos and New York City combined.

Yikes, that’s a lot of stolen cars. We will dig into those details a little later and tell you which car is the most popular in the eyes of a car thief and where most of the cars are being stolen.

Don’t worry, it won’t be all bad! We are going to sift through the research and help you with all your New Jersey auto insurance needs.

Finding the right insurance and understand how it works can be tough, and we are going to help you out with it.

Looking for cheap car insurance in New Jersey? If you are living in Newark, Jersey City, Paterson, Elizabeth, or Edison, you can find up to nine rate quotes from first-rate insurers in your area through AutoInsuranceEZ.com.

We make it so easy, you can even get a quote by entering your zip code above.

New Jersey Car Insurance Coverage and Rates

New Jersey is the most expensive state for car insurance. But why?

Due to the density of the state, that leads to more accidents. Drivers also tend to buy more expensive cars since there is a lot of wealth in the state. New Jersey is a high-commuter state, so more drivers are on the road for longer periods of time.

Insurance carriers in New Jersey also have strict personal injury protection guidelines to ensure no one is left liable in an accident where injuries occur.

We are going to to take a look at New Jersey insurance companies, what type of coverages are available, and where the cheapest insurance is in the state.

New Jersey’s Car Culture

New Jersey is known for the number of commuters living in New Jersey. New Jersey drivers hold the second highest percentage on the list for longest commutes. Most commuters drive to New York or Pennsylvania.

Not everyone commutes though. New Jersey, only behind New York, leads the states for most used public transportation.

If you do own a car, how much insurance is required by law? We are hitting that topic next!

New Jersey Minimum Coverage

Car insurance is required for all drivers in the state in New Jersey.

| Requirement | Standard Policy | Basic Policy |

|---|---|---|

| Personal Injury Liability | $15,000 per person/$30,000 per accident | Optional coverage of $10,000/accident |

| Property Damage Liability | $5,000 per accident | $5,000 per accident |

| Personal Injury Protection (PIP) | $15,000 per accident Up to $250,000 for specific injuries | $15,000 per person/$30,000 per accident Up to $250,000 for specific injuries |

You can purchase two types of insurance policies in New Jersey, basic or standard. A basic policy is substantially cheaper than a standard policy.

Forms of Financial Responsibility

Per the New Jersey Motor Vehicle Commission:

“Your insurance company must issue you a paper or electronic New Jersey Insurance Identification Card for each vehicle under your policy. N.J.S.A. 39:3-29. Pursuant to N.J.S.A. 39:3-29.1 and N.J.A.C. 11:3-6.1 – 6.5, New Jersey insurance identification cards must meet the following specifications:

- The dimensions of the paper card must be between three inches by five inches and five and a half inches by eight and a half inches;

- The white cardstock must be at least 20 lbs in weight; and

- The front of the card must contain the insurance company’s name, the insured’s name and address, the policy number, effective date, expiration date, vehicle description (make, model and VIN), the heading “State of New Jersey Insurance Identification Card,” the insurance company code, and the name and address of the insurance company or the office or agency issuing the identification card. The reverse of the card shall include the address established by the insurer for the filing of notification of the commencement of medical treatment by treating medical providers.

In New Jersey, the insurance identification card may be displayed or provided in either paper or electronic form. For these purposes, “electronic form” means the display of images on an electronic device, such as a cellular telephone, tablet or computer. Paper insurance card specifications have not changed.

You must keep the card in the vehicle, or be able to produce the electronic format:

- Before an inspection.

- When involved in an accident.

- When stopped for a traffic violation.

- When you are stopped in a spot check by a police officer.

Failure to present the card or electronic form may result in fines.

Driving an uninsured vehicle may result in fines, community service, license suspension, and insurance surcharges.”

You, as the driver and/or car owner, are responsible for showing proof of your financial responsibility.

Premiums as a Percentage of Income

So how much is this insurance going to take for your income? New Jersey hovers around under three percent of your annual income.

| Details | 2012 | 2013 | 2014 |

|---|---|---|---|

| Full Coverage Premiums (Annual) | $1,334.59 | $1,369.70 | $1,379.20 |

| Personal Disposable Income (Annual) | $48,569 | $47,972 | $49,983 |

| Percentage of Income | 2.75% | 2.86% | 2.76% |

To get a more exact calculation, you can check out this tool.

CalculatorPro

Core Coverage

| New Jersey | Countrywide | |

|---|---|---|

| Liability | $869.57 | $538.73 |

| Collision | $381.86 | $322.61 |

| Comprehensive | $131.35 | $148.04 |

| Full Coverage | $1,382.79 | $1,009.38 |

We already mentioned earlier, New Jersey is the most expensive state for car insurance. The above table shows a breakdown of core coverages and the cost versus the cost countrywide.

Let’s explain some of the core coverages listed above.

- Liability coverage is divided into two types of liability coverages which are bodily injury and property damage for which you are held liable.

- Collision and comprehensive coverage are additional coverages to pay no matter the fault and can cover windshield damage, collision with animals, hit and runs, weather, and theft.

- Full Coverage is the combination of three coverages listed above and in some cases additional coverages depending on the insurance carrier.

Additional Liability

Additional Liability can include personal injury protection, medical payments, and uninsured/underinsured motorist coverage.

Personal injury protection is a required coverage in New Jersey. This coverage is used for any medical expenses that result from a car accident for you or any passengers in your vehicle. This also includes if you were struck while cycling or a pedestrian.

Medical payments are similar to personal injury protection, but the coverage is optional.

Uninsured/underinsured motorist coverage is a required coverage in the state of New Jersey. This coverage is used for when you are in an accident involving someone with not enough or no insurance coverage.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Personal Injury Protection | 75.78% | 70.93% | 72.98% |

| Medical Payments | 80.04% | 58.30% | 66.79% |

| Uninsured/Underinsured Motorist | 56.23% | 57.29% | 68.54% |

The table above shows the loss ratio for these listed liability coverages. Loss ratio is the ratio of claims payments to premium payments.

So, for example, if a customer pays $1000 for premium and the company pays out a $700 claim then the loss ratio would be seventy percent.

Therefore, if the loss ratio is over one hundred percent the company is not making money and spending more on claims than what it is bringing in. The reverse would show a company does not pay out for claims.

Add-ons, Endorsements, and Riders

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

-

– Demographic Rates – Male vs. Female vs. Age

So who pays more for insurance? I think most people know the younger you are the more expensive your insurance is going to be.

Male versus female can be close. Depending on the age and company, it can be a toss-up for who pays more.

| Insurance Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate NJ P&C | $3,436.75 | $3,420.45 | $3,335.46 | $3,335.46 | $10,796.36 | $13,185.02 | $4,043.02 | $4,156.11 |

| Foremost Ins Grand Rapids | $4,830.46 | $4,873.04 | $4,699.01 | $4,594.07 | $14,124.39 | $16,232.62 | $5,737.03 | $5,845.35 |

| Geico Govt Employees | $2,243.42 | $2,201.66 | $2,188.45 | $2,188.45 | $4,064.28 | $4,063.96 | $2,576.09 | $2,513.20 |

| Liberty Mutual Fire | $4,480.25 | $4,480.25 | $4,919.44 | $4,919.44 | $11,601.57 | $13,165.70 | $4,919.44 | $5,646.81 |

| Prog Garden State Ins Co | $2,040.52 | $1,885.91 | $1,841.28 | $1,894.85 | $9,241.04 | $10,160.06 | $2,412.68 | $2,305.40 |

| State Farm Ind | $4,392.28 | $4,392.28 | $3,976.24 | $3,976.24 | $14,395.61 | $18,483.25 | $5,007.86 | $5,593.47 |

| St Paul Protective Ins Co | $3,221.64 | $3,123.67 | $2,982.74 | $3,008.62 | $7,272.20 | $8,195.88 | $3,130.99 | $3,100.17 |

– Cheapest Rates by Zip Code

Which zip codes have the cheapest premium? Take a search and see where your zip code falls on the list.

| Cheapest ZIP Codes in New Jersey | City | Average by ZIP Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 07926 | BROOKSIDE | $4,592.17 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,387.77 | Progressive | $3,160.07 |

| 07046 | MOUNTAIN LAKES | $4,600.78 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07961 | MORRISTOWN | $4,613.10 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,543.78 | Progressive | $3,160.07 |

| 07834 | DENVILLE | $4,613.63 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07878 | MOUNT TABOR | $4,613.63 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07960 | MORRISTOWN | $4,614.46 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,543.78 | Progressive | $3,160.07 |

| 07927 | CEDAR KNOLLS | $4,616.88 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07950 | MORRIS PLAINS | $4,616.88 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07981 | WHIPPANY | $4,616.88 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07999 | WHIPPANY | $4,616.88 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07869 | RANDOLPH | $4,618.98 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,543.78 | Progressive | $3,160.07 |

| 07828 | BUDD LAKE | $4,624.77 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| 07457 | RIVERDALE | $4,630.08 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07837 | GLASSER | $4,641.98 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| 07850 | LANDING | $4,649.92 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| 07857 | NETCONG | $4,649.92 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| 07979 | POTTERSVILLE | $4,660.24 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| 07005 | BOONTON | $4,660.30 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07405 | BUTLER | $4,664.98 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| 07843 | HOPATCONG | $4,667.86 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| 07874 | STANHOPE | $4,667.86 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| 07831 | CHANGEWATER | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| 08801 | ANNANDALE | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| 08802 | ASBURY | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| 08803 | BAPTISTOWN | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

07926 in Brookside has the cheapest car insurance rate in New Jersey.

| Most Expensive ZIP Codes in New Jersey | City | Average by ZIP Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 07102 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07103 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07104 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07105 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07106 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07107 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07108 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07111 | IRVINGTON | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07112 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07114 | NEWARK | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| 07017 | EAST ORANGE | $8,384.68 | Farmers | $12,685.99 | State Farm | $11,824.45 | Geico | $4,150.14 | Travelers | $5,980.16 |

| 07018 | EAST ORANGE | $8,384.68 | Farmers | $12,685.99 | State Farm | $11,824.45 | Geico | $4,150.14 | Travelers | $5,980.16 |

| 07050 | ORANGE | $8,384.68 | Farmers | $12,685.99 | State Farm | $11,824.45 | Geico | $4,150.14 | Travelers | $5,980.16 |

| 07055 | PASSAIC | $8,293.86 | Farmers | $12,398.77 | State Farm | $10,907.42 | Geico | $3,948.66 | Travelers | $6,212.33 |

| 07201 | ELIZABETH | $8,277.10 | Farmers | $12,283.07 | State Farm | $11,789.64 | Geico | $3,798.87 | Travelers | $6,107.40 |

| 07202 | ELIZABETH | $8,277.10 | Farmers | $12,283.07 | State Farm | $11,789.64 | Geico | $3,798.87 | Travelers | $6,107.40 |

| 07206 | ELIZABETHPORT | $8,277.10 | Farmers | $12,283.07 | State Farm | $11,789.64 | Geico | $3,798.87 | Travelers | $6,107.40 |

| 07208 | ELIZABETH | $8,277.10 | Farmers | $12,283.07 | State Farm | $11,789.64 | Geico | $3,798.87 | Travelers | $6,107.40 |

| 07501 | PATERSON | $8,254.80 | Farmers | $12,394.50 | State Farm | $11,353.01 | Geico | $3,909.34 | Travelers | $6,120.50 |

| 07502 | PATERSON | $8,254.80 | Farmers | $12,394.50 | State Farm | $11,353.01 | Geico | $3,909.34 | Travelers | $6,120.50 |

| 07503 | PATERSON | $8,254.80 | Farmers | $12,394.50 | State Farm | $11,353.01 | Geico | $3,909.34 | Travelers | $6,120.50 |

| 07504 | PATERSON | $8,254.80 | Farmers | $12,394.50 | State Farm | $11,353.01 | Geico | $3,909.34 | Travelers | $6,120.50 |

| 07505 | PATERSON | $8,254.80 | Farmers | $12,394.50 | State Farm | $11,353.01 | Geico | $3,909.34 | Travelers | $6,120.50 |

| 07513 | PATERSON | $8,254.80 | Farmers | $12,394.50 | State Farm | $11,353.01 | Geico | $3,909.34 | Travelers | $6,120.50 |

| 07514 | PATERSON | $8,254.80 | Farmers | $12,394.50 | State Farm | $11,353.01 | Geico | $3,909.34 | Travelers | $6,120.50 |

Newark leads the pack with nine out of the top 25 zip codes landing in Newark for the most expensive cities in New Jersey.

– Cheapest Rates by City

The next set of data shows rates by city.

| New Jersey Cheapest Cities | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brookside | $4,592.17 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,387.77 | Progressive | $3,160.07 |

| Mountain Lakes | $4,600.77 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Convent Station | $4,613.10 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,543.78 | Progressive | $3,160.07 |

| Denville | $4,613.63 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Mount Tabor | $4,613.63 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Morristown | $4,614.46 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,543.78 | Progressive | $3,160.07 |

| Cedar Knolls | $4,616.88 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Morris Plains | $4,616.88 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Whippany | $4,616.88 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Randolph | $4,618.98 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,543.78 | Progressive | $3,160.07 |

| Budd Lake | $4,624.77 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| Riverdale | $4,630.07 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Glasser | $4,641.98 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| Landing | $4,649.92 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| Netcong | $4,649.92 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| Pottersville | $4,660.24 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| Boonton | $4,660.30 | State Farm | $6,573.25 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Butler | $4,664.98 | State Farm | $6,156.55 | Farmers | $6,106.07 | Geico | $2,560.75 | Progressive | $3,160.07 |

| Hopatcong | $4,667.85 | Farmers | $6,413.72 | State Farm | $6,156.55 | Geico | $2,427.65 | Progressive | $3,425.84 |

| Annandale | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| Asbury | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| Baptistown | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| Changewater | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| Glen Gardner | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

| Hampton | $4,678.80 | Farmers | $6,764.38 | State Farm | $6,013.78 | Geico | $2,387.77 | Progressive | $3,515.56 |

Brookside has the cheapest car insurance rates in New Jersey, while Irvington and Newark have the most expensive rates.

| New Jersey Most Expensive Cities | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Irvington | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| Newark | $8,512.59 | Farmers | $12,685.99 | State Farm | $11,875.78 | Geico | $4,274.79 | Travelers | $6,159.75 |

| East Orange | $8,384.68 | Farmers | $12,685.99 | State Farm | $11,824.45 | Geico | $4,150.14 | Travelers | $5,980.16 |

| Orange | $8,384.68 | Farmers | $12,685.99 | State Farm | $11,824.45 | Geico | $4,150.14 | Travelers | $5,980.16 |

| Passaic | $8,293.85 | Farmers | $12,398.77 | State Farm | $10,907.42 | Geico | $3,948.66 | Travelers | $6,212.33 |

| Elizabeth | $8,277.10 | Farmers | $12,283.07 | State Farm | $11,789.64 | Geico | $3,798.87 | Travelers | $6,107.40 |

| Elizabethport | $8,277.10 | Farmers | $12,283.07 | State Farm | $11,789.64 | Geico | $3,798.87 | Travelers | $6,107.40 |

| Paterson | $8,228.41 | Farmers | $12,394.50 | State Farm | $11,318.82 | Geico | $3,909.34 | Travelers | $6,129.69 |

| North Bergen | $8,198.85 | Farmers | $12,348.98 | State Farm | $11,146.92 | Geico | $3,777.25 | Progressive | $6,021.03 |

| Guttenberg | $7,929.71 | Farmers | $11,660.42 | State Farm | $11,146.92 | Geico | $3,571.92 | Progressive | $5,657.56 |

| Union City | $7,929.71 | Farmers | $11,660.42 | State Farm | $11,146.92 | Geico | $3,571.92 | Progressive | $5,657.56 |

| Camden | $7,699.21 | Farmers | $11,590.99 | State Farm | $10,324.11 | Geico | $3,635.14 | Travelers | $5,692.37 |

| Perth Amboy | $7,587.46 | Farmers | $11,886.13 | State Farm | $10,195.39 | Geico | $3,241.31 | Travelers | $5,478.47 |

| Atlantic City | $7,564.70 | Farmers | $11,961.16 | Liberty Mutual | $9,785.53 | Geico | $3,635.98 | Travelers | $5,534.72 |

| Linden | $7,501.16 | State Farm | $11,098.56 | Farmers | $10,567.82 | Geico | $3,725.10 | Progressive | $5,175.59 |

| Roselle | $7,501.16 | State Farm | $11,098.56 | Farmers | $10,567.82 | Geico | $3,725.10 | Progressive | $5,175.59 |

| East Newark | $7,467.89 | State Farm | $11,826.73 | Farmers | $9,940.24 | Geico | $3,587.95 | Travelers | $5,258.88 |

| Kearny | $7,467.89 | State Farm | $11,826.73 | Farmers | $9,940.24 | Geico | $3,587.95 | Travelers | $5,258.88 |

| Cliffside Park | $7,392.46 | State Farm | $11,095.37 | Farmers | $10,213.21 | Geico | $3,734.47 | Progressive | $5,233.40 |

| Palisades Park | $7,392.46 | State Farm | $11,095.37 | Farmers | $10,213.21 | Geico | $3,734.47 | Progressive | $5,233.40 |

| Ridgefield | $7,392.46 | State Farm | $11,095.37 | Farmers | $10,213.21 | Geico | $3,734.47 | Progressive | $5,233.40 |

| Hillside | $7,391.94 | Farmers | $10,700.28 | State Farm | $10,295.93 | Geico | $3,532.32 | Travelers | $5,200.76 |

| Union | $7,391.94 | Farmers | $10,700.28 | State Farm | $10,295.93 | Geico | $3,532.32 | Travelers | $5,200.76 |

| Vauxhall | $7,391.94 | Farmers | $10,700.28 | State Farm | $10,295.93 | Geico | $3,532.32 | Travelers | $5,200.76 |

| Jersey City | $7,346.83 | Farmers | $10,415.60 | State Farm | $10,184.76 | Geico | $3,051.71 | Travelers | $5,214.56 |

Find the Cheapest Insurance in Your City: New Jersey Rates Comparison

Discover the most budget-friendly insurance rates in New Jersey’s major cities. Compare now to save!

| Find the Cheapest Insurance in Your City | |

|---|---|

| Clifton, NJ | Newark, NJ |

| Edison, NJ | Paterson, NJ |

| Elizabeth, NJ | Toms River, NJ |

| Jersey City, NJ | Trenton, NJ |

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best New Jersey Car Insurance Companies

So what makes the best insurance company in New Jersey? Well, there are several things that can make a company go from the bottom of the list to the top.

Financial ratings, customer service, and rates are definitely on the top of the list of valuable things to look at in a company.

So let’s take a look at these factors and see which companies land on the top of New Jersey’s best insurance companies.

– The Largest Companies Financial Rating

AM Best rating is a global company focusing on the insurance industry. They rate companies based on financial security and credit.

The table below shows the largest writing companies in New Jersey with their AM Best ratings.

| Insurance Company | A.M.Best Rating |

|---|---|

| Geico | A++ |

| New Jersey Manufacturers Group | A+ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| State Farm Group | A++ |

| Palisades Group | A- |

| Liberty Mutual Group | A |

| USAA Group | A++ |

| Travelers Group | A++ |

| Farmers Insurance Group | A |

None on the list go below an A- rating, so New Jersey drivers have some good choices for insurance companies.

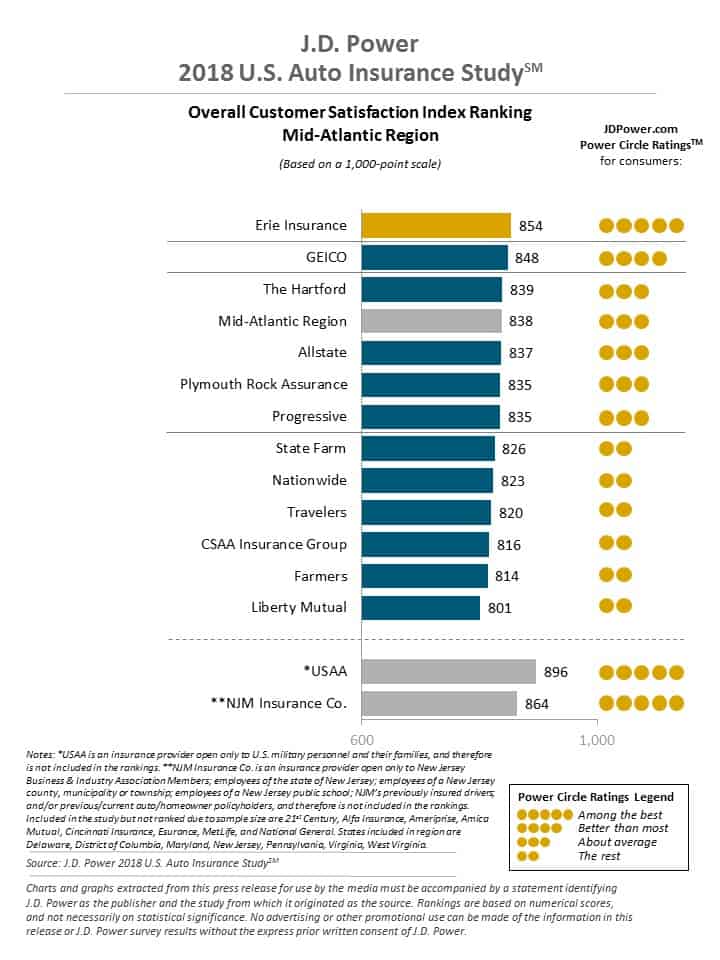

– Companies with Best Ratings

One of the reasons these companies get so big is because of customer service. Good customer service can sometimes make a customer stay with the same company, even with a premium increase.

– Companies with Most Complaints in New Jersey

Every company will eventually get a complaint. You have to remember some of these companies are so large that a high number of complaints are still low considering how many customers they have.

| Insurance Company | Number of Complaints |

|---|---|

| Geico | 333 |

| New Jersey Manufacturers Group | 3 |

| Progressive Group | 120 |

| Allstate Insurance Group | 163 |

| State Farm Group | 1482 |

| Palisades Group | 3 |

| Liberty Mutual Group | 222 |

| USAA Group | 296 |

| Travelers Group | 2 |

| Farmers Insurance Group | 0 |

– Cheapest Companies in New Jersey

Everyone is looking for a good deal on their insurance. We took seven insurance companies and compared average annual rates to the state average.

| Insurance Company | Average Annual Premiums | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allstate NJ P&C | $5,713.58 | $198.37 | 3.47% |

| Foremost Ins Grand Rapids | $7,617.00 | $2,101.79 | 27.59% |

| Geico Govt Employees | $2,754.94 | -$2,760.28 | -100.19% |

| Liberty Mutual Fire | $6,766.61 | $1,251.40 | 18.49% |

| Prog Garden State Ins Co | $3,972.72 | -$1,542.50 | -38.83% |

| State Farm Ind | $7,527.15 | $2,011.94 | 26.73% |

| St Paul Protective Ins Co | $4,254.49 | -$1,260.72 | -29.63% |

– Commute Rates by Companies

New Jersey has a big population of commuters. How much do all the commuting cost New Jersey drivers? Let’s take a look.

| Insurance Company | Commute and Annual Mileage | Annual Average Premiums |

|---|---|---|

| State Farm | 25 miles commute. 12000 annual mileage. | $7,721.28 |

| State Farm | 10 miles commute. 6000 annual mileage. | $7,333.03 |

| Farmers | 25 miles commute. 12000 annual mileage. | $7,617.00 |

| Farmers | 10 miles commute. 6000 annual mileage. | $7,617.00 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $6,832.35 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $6,700.88 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,724.15 |

| Allstate | 10 miles commute. 6000 annual mileage. | $5,703.01 |

| Travelers | 10 miles commute. 6000 annual mileage. | $4,254.49 |

| Travelers | 25 miles commute. 12000 annual mileage. | $4,254.49 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,972.72 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,972.72 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,777.67 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,732.21 |

Commuting is a factor in your premium, but as you can tell from the above chart it does not make a huge impact on your premium.

Coverage Level Rates by Companies

Coverage is one option that most drivers look at and think if they lower it, then their premium will drop significantly.

| Insurance Company | Coverage Type | Annual Average Premiums |

|---|---|---|

| Farmers | High | $8,412.64 |

| Farmers | Medium | $7,577.22 |

| Farmers | Low | $6,861.13 |

| State Farm | High | $7,961.75 |

| State Farm | Medium | $7,625.56 |

| State Farm | Low | $6,994.15 |

| Liberty Mutual | High | $7,274.15 |

| Liberty Mutual | Medium | $6,971.85 |

| Liberty Mutual | Low | $6,053.83 |

| Allstate | High | $6,073.01 |

| Allstate | Medium | $5,797.50 |

| Allstate | Low | $5,270.22 |

| Travelers | High | $4,616.48 |

| Travelers | Medium | $4,254.55 |

| Travelers | Low | $3,892.44 |

| Progressive | High | $4,280.26 |

| Progressive | Medium | $4,034.39 |

| Progressive | Low | $3,603.50 |

| Geico | High | $2,994.20 |

| Geico | Medium | $2,808.31 |

| Geico | Low | $2,462.30 |

Farmers is one company that has a more drastic difference in premium when changing your level of coverage. If you take a look at a company like Geico, for instance, the change isn’t as big.

It is a good idea to quote out your insurance with different levels of coverage. You may be surprised how much a small amount in premium can give you a large payout in coverage.

– Credit History Rates by Companies

Credit history is one of those silent factors that follows you around. It is there for big purchases like cars and homes and can also make or break your interest rate. Credit history also plays a determining factor in your insurance rate.

Companies use your credit history just like we use AM Best rating for insurers. Credit history rates give insurers a look at how a customer pays bills and how timely they are.

| Insurance Company | Credit History | Annual Average Premiums |

|---|---|---|

| State Farm | Poor | $10,892.25 |

| State Farm | Fair | $6,568.67 |

| State Farm | Good | $5,120.55 |

| Farmers | Poor | $9,071.27 |

| Farmers | Fair | $7,090.77 |

| Farmers | Good | $6,688.96 |

| Liberty Mutual | Poor | $8,575.06 |

| Liberty Mutual | Fair | $6,357.77 |

| Liberty Mutual | Good | $5,367.00 |

| Allstate | Poor | $7,965.60 |

| Allstate | Fair | $5,131.18 |

| Allstate | Good | $4,043.95 |

| Travelers | Poor | $5,720.93 |

| Travelers | Fair | $4,186.30 |

| Travelers | Good | $2,856.24 |

| Progressive | Poor | $4,448.52 |

| Progressive | Fair | $3,883.17 |

| Progressive | Good | $3,586.45 |

| Geico | Poor | $4,148.35 |

| Geico | Fair | $2,386.66 |

| Geico | Good | $1,729.80 |

Credit history rates have a significant impact. In some cases, your premium doubles or more from a good rating to a poor rating. Keep a look out at your rating and do your best to keep a good score.

New Jersey does not allow any insurance to be denied, canceled, or non-renewed due to credit history. Companies can not offer unfavorable payments plans due to credit.

Credit is not used for consumers covered by the Special Automobile Insurance Policy or Basic Policy programs which will discuss later in this section.

– Driving Record Rates by Companies

Some are lucky enough to have clean, squeaky driving records; that’s not the case for everyone. Have you ever wondered how much that speeding ticket is costing you with your insurance premium?

| Insurance Company | Driving Record | Annual Average Premiums |

|---|---|---|

| State Farm | With 1 DUI | $11,975.32 |

| State Farm | With 1 speeding violation | $6,597.21 |

| State Farm | With 1 accident | $7,446.84 |

| State Farm | Clean record | $4,089.25 |

| Farmers | With 1 DUI | $8,155.86 |

| Farmers | With 1 speeding violation | $6,395.36 |

| Farmers | With 1 accident | $10,017.70 |

| Farmers | Clean record | $5,899.07 |

| Liberty Mutual | With 1 DUI | $6,632.81 |

| Liberty Mutual | With 1 speeding violation | $6,498.24 |

| Liberty Mutual | With 1 accident | $7,437.18 |

| Liberty Mutual | Clean record | $6,498.24 |

| Allstate | With 1 DUI | $6,227.00 |

| Allstate | With 1 speeding violation | $5,214.06 |

| Allstate | With 1 accident | $7,126.18 |

| Allstate | Clean record | $4,287.07 |

| Travelers | With 1 DUI | $4,697.50 |

| Travelers | With 1 speeding violation | $4,188.00 |

| Travelers | With 1 accident | $4,864.10 |

| Travelers | Clean record | $3,268.35 |

| Progressive | With 1 DUI | $3,906.91 |

| Progressive | With 1 speeding violation | $3,985.79 |

| Progressive | With 1 accident | $4,583.69 |

| Progressive | Clean record | $3,414.48 |

| Geico | With 1 DUI | $3,917.82 |

| Geico | With 1 speeding violation | $2,142.43 |

| Geico | With 1 accident | $2,817.06 |

| Geico | Clean record | $2,142.43 |

A DUI conviction is definitely the violation that will cost you the most. Some companies rate tickets higher than accidents or the other way around. So take a look at the companies and see which one may be better for you if you have any violations listed above.

– Largest Car Insurance Companies in New Jersey

Now, let’s take a look at the largest companies in New Jersey.

| Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| Geico | $1,580,844 | 70.02% | 20.58% |

| New Jersey Manufacturers Group | $993,945 | 66.25% | 12.94% |

| Progressive Group | $856,484 | 59.14% | 11.15% |

| Allstate Insurance Group | $839,883 | 53.02% | 10.93% |

| State Farm Group | $629,485 | 64.66% | 8.19% |

| Palisades Group | $601,852 | 61.30% | 7.83% |

| Liberty Mutual Group | $544,321 | 64.14% | 7.09% |

| USAA Group | $294,678 | 70.79% | 3.84% |

| Travelers Group | $284,191 | 59.53% | 3.70% |

| Farmers Insurance Group | $233,314 | 79.86% | 3.04% |

Geico, by far, has a strong hold on the New Jersey markets. As you can see from the previous tables, their rates are usually on the lower side so you can see why they write so many New Jersey drivers.

Number of Insurers by State

New Jersey has over eight hundred companies to chose from which looking at insurance.

| Type of Insurer | Number |

|---|---|

| Domestic | 66 |

| Foreign | 778 |

The difference between domestic and foreign is where the company originated. A domestic company is local to New Jersey and was started under New Jersey law, while a foreign company was started in another state.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

New Jersey State Laws

We are going to cover a lot of information in this next section. Knowing laws for your state is vital to avoid unnecessary fines, suspensions, and the hassle fixing issues that arise from not knowing simple laws.

We are now going to breakdown some different state laws pertaining to drivers in New Jersey.

Car Insurance Laws

New Jersey car insurance companies must file rate increases with the state and get approval before increases.

Windshield Coverage

There are no unique laws pertaining to windshields in New Jersey. If you have a standard comprehensive deductible is $750.

High-Risk Insurance

The state of New Jersey does not require you to have an SR-22 filing. If you do require this filing from another state and recently moved to New Jersey, you do need to transfer that filing to your New Jersey insurance company.

New Jersey follows insurance eligibility points system. Depending on your amount of points determines which insurance market you can get insurance through. There is the voluntary market and assigned risk market.

The below is a statement from New Jersey Banking and Insurance pamphlet located on their website:

“In accordance with New Jersey regulations for Eligible Person

Qualifications, any driver who has accumulated seven or more insurance eligibility points for the three-year period immediately preceding the application for insurance or the three-year period ending 90 days prior to renewal of a policy may not be considered eligible to purchase coverage

in the voluntary market. As a result, some insurers will direct them to purchase insurance through the Personal Automobile Insurance Plan (PAIP). It is important to note, however, that not all insurers in the voluntary market refuse to cover drivers with seven or more insurance eligibility points. If you have seven or more insurance eligibility points it may be a good idea to shop around and compare your coverage and pricing options.

The PAIP is not an insurance company; instead, it acts as an administrative clearinghouse and assigns each driver to a company for coverage. Therefore, this type of coverage is referred to as “assigned risk.” The state

has standardized the rates for this type of coverage and they do not vary from company to company. The rates may also be substantially higher than rates in the voluntary market. To find PAIP producers in your area, call

1-800-652-2471 or visit the Department’s web site, www.dobi.nj.gov.”

Low-Cost Insurance

New Jersey offers the Special Automobile Insurance Policy initiative to help drivers that would otherwise go without car insurance. This insurance is offered through most insurance providers.

This is offered to drivers enrolled in certain Medicaid programs. Your insurance provider can determine your eligibility.

Automobile Insurance Fraud in New Jersey

Any type of fraud in New Jersey is considered a serious crime. If convicted, punishment can be jail time, fines, and loss of your driver’s license.

There are two types of fraud that can be committed. Soft fraud is when customers pad information whether on the application or when filing a claim.

Hard fraud is the knowing act of staging an accident, or any type of claim, knowing that you are deliberately trying to scam the insurance company.

Statute of Limitations

Statute of limitations is the amount of time you have to file a claim after it has occurred. In New Jersey, you have two years for personal injury and six years for property damage. The best thing to do is file a claim as soon as the claim occurs.

State Specific Laws

Some of these laws may seem a little strange, but nonetheless, they are laws in New Jersey. See if you have broken any of the laws below without knowing them.

- Motorists must honk when passing another vehicle. This law includes skateboarders!

- If you have been convicted of driving under the influence, you can no longer apply for personalized license plates.

- You can not pass horse-drawn carriages on roads

- You can not pump your own gas.

- If you are caught “frowning” at a police officer, you are breaking the law. Make sure you take that ticket with a smile.

- Car dealerships must be closed on Sunday.

Vehicle Licensing Laws

New Jersey is noncompliant for the Real ID Act. They have received an extension for this noncompliance and New Jersey residents can still use their New Jersey license to board commercial airlines and nuclear plants until October 2019.

Penalties for Driving Without Insurance

New Jersey has one of the harshest laws against driving without insurance on the books. The consequence is more severe than being convicted of a DWI charge. The first offense can get you the following:

- Fines ranging from $300-$1000

- Loss of license for one year

- A surcharge of $250 a year for three years

If that did not deter you from ever driving without insurance the second time convicted will. Being convicted for a second offense the following can be imposed:

- Fines up to $5000

- Loss of license for two years

- Mandatory jail time of fourteen days

- Additional 30-days community service

New Jersey wants to instill in all drivers to drive with insurance or suffer harsh consequences. You must carry an insurance ID card with you or have an electronic copy stored on a phone or laptop.

Teen Driver Laws

Teens can obtain their driver’s permit at the age of sixteen in New Jersey. To get their permit, a teen driver must enroll in a licensed driving school.

Once a permit is obtained, pass a road test, and have at least six months of supervised driving you can then get your probationary license.

Once a probationary license is obtained, you must practice unsupervised driving for one year before you can then get your basic driver’s license.

Per the New Jersey Motor Vehicle Commission, supervised driving is as follows:

“Display a reflectorized decal on each license plate (front/back); decals available at motor vehicle agencies, $4 per pair.

No driving after 11:01 p.m. and before 5:00 a.m.

Permit and probationary drivers under 21 may drive outside the prescribed hours for employment or religious reasons.

- Drivers must carry legible documentation on letterhead signed by the employer, organization or religious institution stating the reasons for this request. It must include the title, address and telephone number of designated official.

You must be accompanied in the front seat by an adult supervising driver who is at least 21 years of age, and who possesses a valid New Jersey driver’s license, and has a minimum of three years driving experience.

Parent(s), guardian(s) or dependent(s) are allowed as passengers. A dependent can be the driver’s child, not brother or sister.

Only one additional passenger is allowed unless accompanied by a parent or guardian.

You cannot use cell phones, handheld video games or any other interactive, wireless device, whether it is “hands-free” or not.

Seat belts must be worn at all times.”

Unsupervised driving is as follows:

“Display a reflectorized decal on each license plate (front/back); decals available at motor vehicle agencies, $4 per pair.

No driving after 11:01 p.m. and before 5:00 a.m.

There are no time limits for basic driver’s license holders 18+.

Permit and probationary drivers under 21 may drive outside the prescribed hours for employment or religious reasons.

- Drivers must carry legible documentation on letterhead signed by the employer, organization or religious institution stating the reasons for this request. It must include the title, address and telephone number of designated official.

Parent(s), guardian(s) or dependent(s) are allowed as passengers. A dependent can be the driver’s child, not brother or sister.

Only one additional passenger is allowed unless accompanied by a parent or guardian.

You cannot use cell phones, handheld video games or any other interactive, wireless device, whether it is “hands-free” or not.

Seat belts must be worn at all times.”

Older Driver License Renewal Procedures

Older drivers have the same renewal process as any other drivers. If you are over 70, you have the personal option to shorten your renewal period from four years to two years. We will review the license renewal procedures in a section below.

New Residents

Once you move to New Jersey, you have 60 days or when your current license expires, whichever comes first to update to a New Jersey license.

You must bring your current license, ID, and permit fee to a local motor vehicle agency to get a new license. As long as you are good standing, your road tests will be waived.

If you are under the age of 21, you will need to follow the Graduated Drivers License program.

License Renewal Procedures

Renewal for New Jersey license is every four years. You can renew by mail if you do not need an updated picture. Every ten years, you will need adequate proof of vision.

Rules of the Road

To be safe, all drivers need to familiarize themselves with the rules of the road for the state they are driving.

We have covered the legal aspect of laws and renewal procedure, so now lets switch gears and look at the speed limits, seat belts, and other rules of driving in New Jersey.

Fault vs. No-Fault

New Jersey is a no-fault state. This means in a no-fault state, your medical coverage under your auto policy will pay out no matter who is at fault.

Seat belt and Car Seat laws

Seat belts are required for all passengers in front or rear seats. If convicted, the driver will be subjected to fines and fees.

Children less than 2 years old and under 30 pounds are to be in a rear-facing infant seat. Children younger than four must also be a rear-facing seat until the child is over the guidelines mandated by the car seat manufacturer.

A child younger than 8 years old must be in a front-facing seat or booster seat.

Riding in the cargo of a truck is not permitted.

Keep Right and Move Over Laws

Driving in the left lane is only for turning left and for passing. Cars should slow and move over if possible when emergency vehicles are present.

Speed Limits

| Type of Road | Speed Limit |

|---|---|

| School Zone, Business or Residential Districts | 25 mph |

| Low Density business and Residential Districts | 35 mph |

| All other Roadways | 50 mph |

| Interstates and certain State Highways | 55 mph |

| State Highways | 65 mph |

Ridesharing

Ridesharing is becoming a common way to commute. Whether that is carpooling or using a service like Uber or Lyft, it is always a good idea to check with your insurance company on gaps in coverage. You want to be clear with who you are driving, when, and where.

Automation on the Road

Automated cars are no longer a thing of the future. Cars are parking and now driving with no driver necessary. New Jersey currently has no laws regarding automation, but that doesn’t mean there are no laws under review.

There are several proposed bills under consideration, one offering a one-year pilot program for a fully autonomous car.

Safety Laws

Alcohol and cell phones are two major distractions and impairments causing major safety hazards on that road. Let’s take a look at what laws are in place to keep New Jersey drivers safe.

DUI Laws

As we saw earlier, driving without insurance has a harsh consequence in New Jersey. Driving while intoxicated is no different. The fines are steep, but even worse is the jail time and license suspension.

| Offense | Fine | Imprisonment | License Suspension | Automobile Insurance Surcharge |

|---|---|---|---|---|

| First Offense | $250-$450 | Up to 30 days | 3-months | $1,000/year for 3 years |

| Second Offense | $500-$1,000 | Up to 90 days | 2-years | $1,000/year for 3 years |

| Third Offense | $1,000 | 180 days | 10-years | $1,500/year for 3 years |

If you are caught three times, you lose your license for 10 years.

Distracted Driving Laws

No driver is allowed to use a hand-held device or text while driving. Anyone with a permit or probationary license has a complete ban on any use of a cellular device.

Take these laws seriously, as New Jersey charged a woman in 2019 for vehicular homicide after she was texting and rear-ended another car. Even if you don’t cause a fatality, you could face heavy fines and penalties for driving distracted.

Driving in New Jersey

Lastly, we are going to look at some unfortunate statistics occurring in New Jersey. As mentioned earlier, New Jersey has the highest amount of auto theft.

We will also look at the statistics of traffic fatalities. We will inform you when and where and how most fatalities in New Jersey occur.

Vehicle Theft in New Jersey

This first table is a list of the most stolen vehicles in New Jersey. It will also list the most popular year of each car model of the total amount stolen.

| Make & Model | Most Popular Model Year | Number of Vehicles Stolen |

|---|---|---|

| Honda Accord | 1997 | 844 |

| Honda Civic | 1998 | 753 |

| Dodge Caravan | 2002 | 427 |

| Nissan Sentra | 1998 | 340 |

| Ford Pickup (Full Size) | 2006 | 295 |

| Nissan Altima | 2014 | 291 |

| Jeep Cherokee/Grand Cherokee | 2000 | 286 |

| Toyota Camry | 2014 | 232 |

| Nissan Maxima | 1998 | 195 |

| Ford Econoline E350 | 2003 | 184 |

Second, we break down which cities have the most crime. If you are located in a city with high auto theft, be vigilant. Keep possessions out of sight or not located in the car, try to park near a light, and always keep your car locked.

| City | Motor vehicle theft |

|---|---|

| Aberdeen Township | 10 |

| Absecon | 6 |

| Allendale | 2 |

| Allenhurst | 1 |

| Allentown | 0 |

| Alpha | 1 |

| Alpine | 2 |

| Andover Township | 0 |

| Asbury Park | 30 |

| Atlantic City | 71 |

| Atlantic Highlands | 1 |

| Audubon | 2 |

| Audubon Park | 1 |

| Avalon | 0 |

| Avon-by-the-Sea | 0 |

| Barnegat Light | 0 |

| Barnegat Township | 5 |

| Barrington | 10 |

| Bay Head | 3 |

| Bayonne | 87 |

| Beach Haven | 2 |

| Beachwood | 3 |

| Bedminster Township | 4 |

| Belleville | 164 |

| Bellmawr | 13 |

| Belmar | 3 |

| Belvidere | 1 |

| Bergenfield | 2 |

| Berkeley Heights Township | 3 |

| Berlin | 4 |

| Berlin Township | 4 |

| Bernards Township | 4 |

| Bernardsville | 2 |

| Beverly | 7 |

| Blairstown Township | 0 |

| Bloomfield | 160 |

| Bloomingdale | 0 |

| Bogota | 2 |

| Boonton | 0 |

| Boonton Township | 0 |

| Bordentown | 3 |

| Bordentown Township | 3 |

| Bound Brook | 3 |

| Bradley Beach | 3 |

| Branchburg Township | 3 |

| Brick Township | 20 |

| Bridgeton | 47 |

| Bridgewater Township | 20 |

| Brielle | 3 |

| Brigantine | 0 |

| Brooklawn | 6 |

| Buena | 0 |

| Burlington | 13 |

| Burlington Township | 15 |

| Butler | 2 |

| Byram Township | 3 |

| Caldwell | 2 |

| Califon | 0 |

| Cape May | 2 |

| Cape May Point | 0 |

| Carlstadt | 25 |

| Carney's Point Township | 8 |

| Carteret | 24 |

| Cedar Grove Township | 11 |

| Chatham | 7 |

| Chatham Township | 3 |

| Cherry Hill Township | 57 |

| Chesilhurst | 4 |

| Chester | 1 |

| Chesterfield Township | 0 |

| Chester Township | 0 |

| Cinnaminson Township | 8 |

| Clark Township | 3 |

| Clayton | 6 |

| Clementon | 8 |

| Cliffside Park | 12 |

| Clifton | 103 |

| Clinton | 1 |

| Clinton Township | 5 |

| Closter | 2 |

| Collingswood | 24 |

| Colts Neck Township | 13 |

| Cranbury Township | 3 |

| Cranford Township | 11 |

| Deal | 8 |

| Delanco Township | 3 |

| Delaware Township | 0 |

| Delran Township | 8 |

| Demarest | 1 |

| Denville Township | 7 |

| Deptford Township | 47 |

| Dover | 11 |

| Dumont | 1 |

| Dunellen | 0 |

| Eastampton Township | 0 |

| East Brunswick Township | 16 |

| East Greenwich Township | 6 |

| East Hanover Township | 6 |

| East Newark | 8 |

| East Orange | 270 |

| East Rutherford | 17 |

| Eatontown | 6 |

| Edgewater | 6 |

| Edgewater Park Township | 18 |

| Edison Township | 106 |

| Egg Harbor City | 0 |

| Egg Harbor Township | 29 |

| Elizabeth | 1,001 |

| Elk Township | 2 |

| Elmer | 1 |

| Elmwood Park | 15 |

| Elsinboro Township | 0 |

| Emerson | 1 |

| Englewood | 23 |

| Englewood Cliffs | 1 |

| Englishtown | 1 |

| Essex Fells | 2 |

| Evesham Township | 17 |

| Ewing Township | 72 |

| Fairfield Township, Essex County | 20 |

| Fair Haven | 2 |

| Fair Lawn | 8 |

| Fairview | 10 |

| Fanwood | 2 |

| Far Hills | 0 |

| Flemington | 0 |

| Florence Township | 8 |

| Florham Park | 5 |

| Fort Lee | 16 |

| Franklin | 0 |

| Franklin Lakes | 10 |

| Franklin Township, Gloucester County | 10 |

| Franklin Township, Hunterdon County | 1 |

| Franklin Township, Somerset County | 59 |

| Freehold | 3 |

| Freehold Township | 14 |

| Frenchtown | 0 |

| Galloway Township | 28 |

| Garfield | 26 |

| Garwood | 1 |

| Gibbsboro | 1 |

| Glassboro | 12 |

| Glen Ridge | 9 |

| Glen Rock | 0 |

| Gloucester City | 6 |

| Gloucester Township | 32 |

| Green Brook Township | 6 |

| Greenwich Township, Gloucester County | 1 |

| Greenwich Township, Warren County | 1 |

| Guttenberg | 6 |

| Hackensack | 46 |

| Hackettstown | 12 |

| Haddonfield | 4 |

| Haddon Heights | 1 |

| Haddon Township | 13 |

| Haledon | 8 |

| Hamburg | 0 |

| Hamilton Township, Atlantic County | 23 |

| Hamilton Township, Mercer County | 131 |

| Hammonton | 9 |

| Hanover Township | 4 |

| Harding Township | 0 |

| Hardyston Township | 1 |

| Harrington Park | 0 |

| Harrison | 68 |

| Harrison Township | 6 |

| Harvey Cedars | 1 |

| Hasbrouck Heights | 1 |

| Haworth | 0 |

| Hawthorne | 9 |

| Hazlet Township | 7 |

| Helmetta | 3 |

| High Bridge | 0 |

| Highland Park | 6 |

| Highlands | 1 |

| Hightstown | 4 |

| Hillsborough Township | 4 |

| Hillsdale | 0 |

| Hillside Township | 102 |

| Hi-Nella | 1 |

| Hoboken | 62 |

| Ho-Ho-Kus | 1 |

| Holland Township | 0 |

| Holmdel Township | 7 |

| Hopatcong | 2 |

| Hopewell | 2 |

| Hopewell Township | 3 |

| Howell Township | 21 |

| Independence Township | 2 |

| Interlaken | 0 |

| Irvington | 522 |

| Island Heights | 1 |

| Jackson Township | 13 |

| Jamesburg | 1 |

| Jefferson Township | 2 |

| Jersey City | 738 |

| Keansburg | 3 |

| Kearny | 136 |

| Kenilworth | 9 |

| Keyport | 3 |

| Kinnelon | 2 |

| Lacey Township | 5 |

| Lake Como | 0 |

| Lakehurst | 0 |

| Lakewood Township | 44 |

| Lambertville | 2 |

| Laurel Springs | 1 |

| Lavallette | 0 |

| Lawrence Township, Mercer County | 36 |

| Lebanon Township | 3 |

| Leonia | 0 |

| Lincoln Park | 3 |

| Linden | 131 |

| Lindenwold | 27 |

| Linwood | 1 |

| Little Egg Harbor Township | 11 |

| Little Falls Township | 19 |

| Little Ferry | 13 |

| Little Silver | 3 |

| Livingston Township | 35 |

| Loch Arbour | 1 |

| Lodi | 21 |

| Logan Township | 15 |

| Long Beach Township | 2 |

| Long Branch | 36 |

| Long Hill Township | 0 |

| Longport | 0 |

| Lopatcong Township | 0 |

| Lower Alloways Creek Township | 0 |

| Lower Township | 18 |

| Lumberton Township | 10 |

| Lyndhurst Township | 28 |

| Madison | 3 |

| Magnolia | 11 |

| Manalapan Township | 21 |

| Manasquan | 0 |

| Manchester Township | 7 |

| Mansfield Township, Burlington County | 5 |

| Mansfield Township, Warren County | 4 |

| Mantoloking | 0 |

| Mantua Township | 8 |

| Manville | 15 |

| Maple Shade Township | 29 |

| Maplewood Township | 56 |

| Margate City | 2 |

| Marlboro Township | 22 |

| Matawan | 1 |

| Maywood | 4 |

| Medford Lakes | 0 |

| Medford Township | 2 |

| Mendham | 2 |

| Mendham Township | 0 |

| Merchantville | 4 |

| Metuchen | 4 |

| Middlesex | 2 |

| Middle Township | 15 |

| Middletown Township | 16 |

| Midland Park | 1 |

| Millburn Township | 21 |

| Milltown | 0 |

| Millville | 49 |

| Mine Hill Township | 0 |

| Monmouth Beach | 2 |

| Monroe Township, Gloucester County | 33 |

| Monroe Township, Middlesex County | 13 |

| Montclair | 35 |

| Montgomery Township | 7 |

| Montvale | 2 |

| Montville Township | 8 |

| Moonachie | 3 |

| Moorestown Township | 16 |

| Morris Plains | 0 |

| Morristown | 19 |

| Morris Township | 11 |

| Mountain Lakes | 4 |

| Mountainside | 2 |

| Mount Arlington | 0 |

| Mount Ephraim | 6 |

| Mount Holly Township | 11 |

| Mount Laurel Township | 20 |

| Mount Olive Township | 11 |

| Mullica Township | 2 |

| National Park | 6 |

| Neptune City | 6 |

| Neptune Township | 37 |

| Netcong | 2 |

| Newark | 2,894 |

| New Brunswick | 87 |

| Newfield | 1 |

| New Hanover Township | 0 |

| New Milford | 1 |

| New Providence | 1 |

| Newton | 1 |

| North Arlington | 19 |

| North Bergen Township | 76 |

| North Brunswick Township | 33 |

| North Caldwell | 3 |

| Northfield | 1 |

| North Hanover Township | 2 |

| North Plainfield | 25 |

| Northvale | 1 |

| North Wildwood | 1 |

| Norwood | 0 |

| Nutley Township | 19 |

| Oakland | 3 |

| Oaklyn | 2 |

| Ocean City | 6 |

| Ocean Gate | 0 |

| Oceanport | 2 |

| Ocean Township, Monmouth County | 14 |

| Ocean Township, Ocean County | 4 |

| Ogdensburg | 3 |

| Old Bridge Township | 46 |

| Old Tappan | 0 |

| Oradell | 2 |

| Orange | 225 |

| Oxford Township | 0 |

| Palisades Park | 8 |

| Palmyra | 9 |

| Paramus | 35 |

| Park Ridge | 1 |

| Parsippany-Troy Hills Township | 15 |

| Passaic | 135 |

| Paterson | 749 |

| Paulsboro | 8 |

| Peapack and Gladstone | 2 |

| Pemberton | 0 |

| Pemberton Township | 36 |

| Pennington | 0 |

| Pennsauken Township | 103 |

| Penns Grove | 11 |

| Pennsville Township | 3 |

| Pequannock Township | 2 |

| Perth Amboy | 140 |

| Phillipsburg | 16 |

| Pine Beach | 1 |

| Pine Hill | 12 |

| Pine Valley | 0 |

| Piscataway Township | 27 |

| Pitman | 2 |

| Plainfield | 96 |

| Pleasantville | 26 |

| Plumsted Township | 3 |

| Pohatcong Township | 3 |

| Point Pleasant | 3 |

| Point Pleasant Beach | 3 |

| Pompton Lakes | 4 |

| Princeton | 1 |

| Prospect Park | 20 |

| Rahway | 43 |

| Ramsey | 7 |

| Randolph Township | 4 |

| Raritan | 4 |

| Raritan Township | 4 |

| Readington Township | 4 |

| Red Bank | 3 |

| Ridgefield | 6 |

| Ridgefield Park | 11 |

| Ridgewood | 1 |

| Ringwood | 1 |

| Riverdale | 0 |

| River Edge | 3 |

| Riverside Township | 7 |

| Riverton | 2 |

| River Vale Township | 0 |

| Robbinsville Township | 1 |

| Rochelle Park Township | 2 |

| Rockaway | 4 |

| Rockaway Township | 11 |

| Rockleigh | 0 |

| Roseland | 7 |

| Roselle | 54 |

| Roselle Park | 9 |

| Roxbury Township | 7 |

| Rumson | 3 |

| Runnemede | 13 |

| Rutherford | 11 |

| Saddle Brook Township | 13 |

| Saddle River | 2 |

| Salem | 5 |

| Sayreville | 28 |

| Scotch Plains Township | 4 |

| Sea Bright | 1 |

| Sea Girt | 0 |

| Sea Isle City | 4 |

| Seaside Heights | 2 |

| Seaside Park | 0 |

| Secaucus | 41 |

| Ship Bottom | 2 |

| Shrewsbury | 4 |

| Somerdale | 4 |

| Somers Point | 5 |

| Somerville | 13 |

| South Amboy | 8 |

| South Bound Brook | 3 |

| South Brunswick Township | 28 |

| South Hackensack Township | 2 |

| South Harrison Township | 2 |

| South Orange | 37 |

| South Plainfield | 12 |

| South River | 7 |

| South Toms River | 3 |

| Sparta Township | 1 |

| Spotswood | 0 |

| Springfield | 14 |

| Springfield Township | 1 |

| Spring Lake | 3 |

| Spring Lake Heights | 0 |

| Stafford Township | 8 |

| Stanhope | 1 |

| Stone Harbor | 0 |

| Stratford | 4 |

| Summit | 17 |

| Surf City | 0 |

| Swedesboro | 0 |

| Tavistock | 0 |

| Teaneck Township | 17 |

| Tenafly | 4 |

| Teterboro | 1 |

| Tewksbury Township | 1 |

| Tinton Falls | 6 |

| Toms River Township | 23 |

| Totowa | 17 |

| Trenton | 416 |

| Tuckerton | 2 |

| Union Beach | 0 |

| Union City | 114 |

| Union Township | 130 |

| Upper Saddle River | 3 |

| Ventnor City | 5 |

| Vernon Township | 2 |

| Verona | 14 |

| Vineland | 61 |

| Voorhees Township | 16 |

| Waldwick | 0 |

| Wallington | 2 |

| Wall Township | 15 |

| Wanaque | 1 |

| Warren Township | 2 |

| Washington | 0 |

| Washington Township, Bergen County | 0 |

| Washington Township, Gloucester County | 29 |

| Washington Township, Morris County | 2 |

| Washington Township, Warren County | 1 |

| Watchung | 3 |

| Waterford Township | 7 |

| Wayne Township | 52 |

| Weehawken Township | 18 |

| Wenonah | 3 |

| Westampton Township | 7 |

| West Amwell Township | 0 |

| West Caldwell Township | 12 |

| West Cape May | 1 |

| West Deptford Township | 26 |

| Westfield | 9 |

| West Long Branch | 7 |

| West Milford Township | 5 |

| West New York | 39 |

| West Orange | 52 |

| Westville | 15 |

| West Wildwood | 0 |

| West Windsor Township | 14 |

| Westwood | 1 |

| Wharton | 0 |

| Wildwood | 9 |

| Wildwood Crest | 0 |

| Willingboro Township | 24 |

| Winfield Township | 1 |

| Winslow Township | 22 |

| Woodbridge Township | 124 |

| Woodbury | 13 |

| Woodbury Heights | 3 |

| Woodcliff Lake | 5 |

| Woodland Park | 7 |

| Woodlynne | 9 |

| Wood-Ridge | 2 |

| Woodstown | 2 |

| Woolwich Township | 0 |

| Wyckoff Township | 1 |

Road Fatalities in New Jersey

A sad reality in a world full of drivers and cars is fatalities happen. We are first going to take a look at the weather condition of fatalities.

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 235 | 166 | 86 | 29 | 0 | 516 |

| Rain | 21 | 26 | 8 | 3 | 0 | 58 |

| Snow/Sleet | 3 | 1 | 1 | 0 | 0 | 5 |

| Other | 0 | 4 | 2 | 2 | 0 | 8 |

| Unknown | 1 | 2 | 0 | 0 | 1 | 4 |

| Total | 260 | 199 | 97 | 34 | 1 | 591 |

Most fatalities happen in normal weather conditions and daylight hours.

Fatalities by County

Now let’s look at which counties have the highest amount of auto fatalities.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Atlantic County | 42 | 41 | 29 | 39 | 36 |

| Bergen County | 37 | 39 | 30 | 35 | 27 |

| Burlington County | 35 | 31 | 48 | 50 | 48 |

| Camden County | 31 | 38 | 34 | 39 | 44 |

| Cape May County | 5 | 12 | 12 | 12 | 16 |

| Cumberland County | 24 | 18 | 29 | 32 | 26 |

| Essex County | 40 | 40 | 40 | 46 | 40 |

| Gloucester County | 26 | 31 | 23 | 26 | 44 |

| Hudson County | 15 | 24 | 27 | 24 | 26 |

| Hunterdon County | 9 | 6 | 9 | 11 | 8 |

| Mercer County | 36 | 26 | 19 | 21 | 26 |

| Middlesex County | 52 | 33 | 41 | 46 | 47 |

| Monmouth County | 27 | 47 | 47 | 50 | 43 |

| Morris County | 25 | 14 | 23 | 21 | 29 |

| Ocean County | 49 | 45 | 38 | 41 | 53 |

| Passaic County | 28 | 24 | 32 | 22 | 18 |

| Salem County | 9 | 19 | 11 | 15 | 17 |

| Somerset County | 19 | 25 | 22 | 19 | 24 |

| Sussex County | 6 | 7 | 10 | 12 | 7 |

| Union County | 18 | 30 | 29 | 26 | 34 |

| Warren County | 9 | 6 | 8 | 15 | 11 |

Traffic Fatalities

| Type of Road | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 72 | 71 | 78 | 89 | 71 | 79 | 78 | 67 | 86 | 83 |

| Urban | 515 | 513 | 476 | 537 | 516 | 463 | 475 | 490 | 512 | 532 |

It is not surprising since New Jersey is mostly a metropolitan area, most accidents happen on urban roads.

Fatalities by Person Type

Most fatalities happen to occupants riding or driving passenger cars.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 217 | 202 | 213 | 233 | 213 |

| Light Truck - Pickup | 24 | 23 | 25 | 32 | 22 |

| Light Truck - Utility | 51 | 48 | 49 | 54 | 72 |

| Light Truck - Van | 34 | 21 | 14 | 16 | 24 |

| Light Truck - Other | 3 | 0 | 2 | 2 | 0 |

| Large Truck | 9 | 13 | 10 | 6 | 6 |

| Bus | 1 | 0 | 0 | 3 | 0 |

| Other/Unknown Occupants | 1 | 4 | 8 | 2 | 3 |

| Total Occupants | 340 | 311 | 321 | 348 | 340 |

| Total Motorcyclists | 56 | 62 | 50 | 71 | 83 |

| Pedestrian | 129 | 168 | 170 | 163 | 183 |

| Bicyclist and Other Cyclist | 14 | 11 | 18 | 18 | 17 |

| Other/Unknown Nonoccupants | 3 | 4 | 2 | 2 | 1 |

| Total Nonoccupants | 146 | 183 | 190 | 183 | 201 |

| Total | 542 | 556 | 561 | 602 | 624 |

Fatalities by Crash Type

Most traffic fatalities involve a single vehicle followed by roadway departure.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 542 | 556 | 561 | 602 | 624 |

| Single Vehicle | 325 | 337 | 360 | 371 | 380 |

| Involving a Large Truck | 60 | 74 | 50 | 57 | 54 |

| Involving Speeding | 118 | 99 | 128 | 132 | 120 |

| Involving a Rollover | 77 | 68 | 86 | 83 | 72 |

| Involving a Roadway Departure | 254 | 234 | 242 | 280 | 266 |

| Involving an Intersection (or Intersection Related) | 182 | 185 | 210 | 213 | 197 |

Five-Year Trend For The Top 10 Counties

| Ranking | New Jersey Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Ocean County | 49 | 45 | 38 | 41 | 53 |

| 2 | Burlington County | 35 | 31 | 48 | 50 | 48 |

| 3 | Middlesex County | 52 | 33 | 41 | 46 | 47 |

| 4 | Camden County | 31 | 38 | 34 | 39 | 44 |

| 5 | Gloucester County | 26 | 31 | 23 | 26 | 44 |

| 6 | Monmouth County | 27 | 47 | 47 | 50 | 43 |

| 7 | Essex County | 40 | 40 | 40 | 46 | 40 |

| 8 | Atlantic County | 42 | 41 | 29 | 39 | 36 |

| 9 | Union County | 18 | 30 | 29 | 26 | 34 |

| 10 | Morris County | 25 | 14 | 23 | 21 | 29 |

| Sub Total 1 | Top Ten Counties | 377 | 375 | 368 | 404 | 418 |

| Sub Total 2 | All Other Counties | 165 | 181 | 193 | 198 | 206 |

| Total | All Counties | 542 | 556 | 561 | 602 | 624 |

Fatalities Involving Speeding by County

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Atlantic County | 9 | 9 | 5 | 12 | 9 |

| Bergen County | 4 | 0 | 7 | 6 | 6 |

| Burlington County | 10 | 3 | 8 | 11 | 11 |

| Camden County | 7 | 9 | 13 | 6 | 7 |

| Cape May County | 1 | 4 | 0 | 3 | 2 |

| Cumberland County | 4 | 1 | 13 | 5 | 7 |

| Essex County | 12 | 2 | 8 | 6 | 7 |

| Gloucester County | 5 | 3 | 6 | 6 | 12 |

| Hudson County | 6 | 8 | 6 | 6 | 4 |

| Hunterdon County | 2 | 0 | 0 | 2 | 1 |

| Mercer County | 7 | 5 | 7 | 4 | 7 |

| Middlesex County | 14 | 3 | 4 | 15 | 13 |

| Monmouth County | 7 | 16 | 10 | 17 | 10 |

| Morris County | 5 | 3 | 3 | 5 | 4 |

| Ocean County | 8 | 9 | 3 | 6 | 5 |

| Passaic County | 7 | 7 | 11 | 7 | 4 |

| Salem County | 3 | 6 | 4 | 4 | 3 |

| Somerset County | 3 | 2 | 3 | 0 | 2 |

| Sussex County | 1 | 1 | 5 | 1 | 0 |

| Union County | 2 | 8 | 10 | 10 | 5 |

| Warren County | 1 | 0 | 2 | 0 | 1 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Atlantic County | 10 | 12 | 3 | 12 | 4 |

| Bergen County | 8 | 12 | 3 | 10 | 4 |

| Burlington County | 11 | 9 | 9 | 9 | 8 |

| Camden County | 6 | 9 | 8 | 8 | 13 |

| Cape May County | 2 | 5 | 1 | 5 | 3 |

| Cumberland County | 4 | 4 | 7 | 8 | 6 |

| Essex County | 12 | 13 | 5 | 10 | 11 |

| Gloucester County | 10 | 7 | 5 | 5 | 8 |

| Hudson County | 4 | 11 | 3 | 4 | 3 |

| Hunterdon County | 3 | 3 | 1 | 1 | 1 |

| Mercer County | 8 | 5 | 3 | 3 | 9 |

| Middlesex County | 13 | 8 | 5 | 9 | 15 |

| Monmouth County | 6 | 14 | 11 | 14 | 9 |

| Morris County | 7 | 3 | 4 | 3 | 4 |

| Ocean County | 12 | 8 | 6 | 6 | 6 |

| Passaic County | 13 | 10 | 9 | 9 | 6 |

| Salem County | 4 | 8 | 5 | 1 | 2 |

| Somerset County | 4 | 10 | 5 | 5 | 3 |

| Sussex County | 2 | 2 | 3 | 2 | 1 |

| Union County | 5 | 5 | 10 | 13 | 7 |

| Warren County | 3 | 2 | 2 | 1 | 1 |

Teen Drinking and Driving

New Jersey has a no tolerance law against any teen drinking. If you are caught driving with any alcohol, under the adult blood alcohol level, you can get a license suspension and community service.

If a driver under 21 years of age is found with an alcohol level over the adult level, that driver will be treated as an adult.

EMS Response Time

If you are ever in an accident, you want to know how fast an emergency medical team can get to you and get you to the nearest hospital.

Lucky for New Jersey drivers, whether the accident happens on a rural or urban road from the time of the accident under 60 minutes you will be at a hospital.

| Type of Road | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 4.14 | 13.22 | 36.48 | 53.84 | 77 |

| Urban | 5.14 | 7.82 | 31.62 | 43.70 | 489 |

Transportation

We know New Jersey is a high commuting state. So let’s take a look at how long their commutes are, how they commute, and how many cars most New Jersey families own.

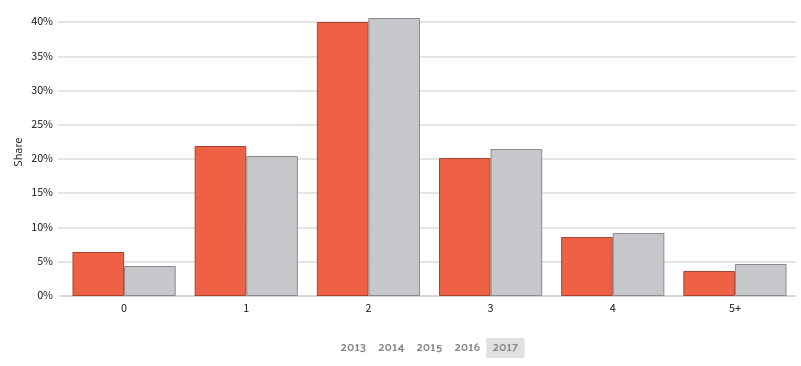

Car Ownership

Commute Time

New Jersey has a large number of drivers that commute to work, including out of state traveling. The average resident living in New Jersey travels over thirty minutes to work. Over five percent of the working population of New Jersey commute over ninety minutes.

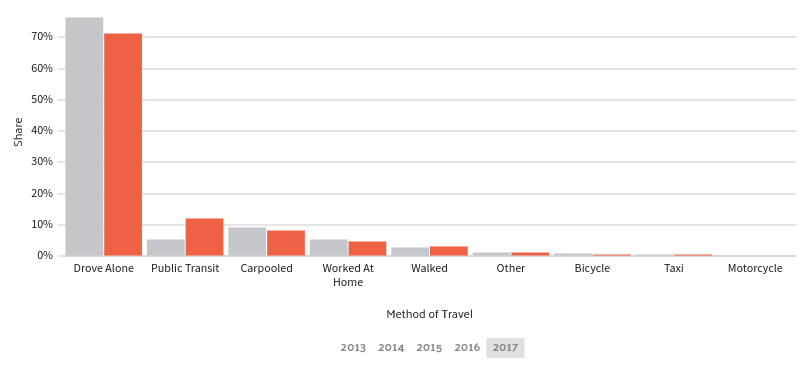

Commuter Transportation

While most drivers still choose to drive to work alone, New Jersey still has a higher use of public transportation than the United States average.

Traffic Congestion in New Jersey

If you look at a traffic report most major roadways in New Jersey have “delayed” as their status.

Holland Tunnel connects Jersey City to Manhattan. Its a huge source of congestion and even more so since New York is proposing a congestion pricing that could cause even more issues. It is no surprise New Jersey residents spend so much time commuting to work.

We have covered a lot of information for this densely populated state of over nine million residents. You have state laws, insurance companies, rates, and coverages. You can now get a free quote here.