Auto Insurance in Philadelphia, Pennsylvania [Can’t-Miss Guide]

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Nov 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| PHILADELPHIA CITY STATISTICS | DETAILS |

|---|---|

| City Population | 1,580,863 |

| City Density | 11,702 people per square mile |

| Average Cost of Car Insurance in Hollywood | $9,302.74 |

| Cheapest Car Insurance Company | USAA + State Farm |

| Road Conditions | Poor Share: 43% Mediocre Share: 28% Fair Share: 11% Good Share: 17% Vehicle Operating Costs: $732 |

It seems like there’s always something going on — your kid’s soccer game, a work party, laundry that’s piled a mile high, grocery shopping, you name it. Maybe you juggle all of those things and work a full-time job at the same time. Maybe you work two or three jobs and you don’t have any time for yourself, ever.

We totally get it. Life is busy, and you don’t want to waste your precious time searching for a great car insurance policy.

You know the drill — you submit your phone number or your email address into a database and suddenly you get a million phone calls.

You answer the phone, spend about an hour and a half talking to a sales agent, and then you find out the cost of the policy is too expensive. So what happens? You do this about 25 more times until you get the price and the policy you’re looking for.

If you’ve been through this cycle, or if you need new car insurance, you’ve come to the right place. If you have 15 minutes or less to read our complete guide to car insurance in Philadelphia, Pennsylvania, you’ll have all the up-to-date and accurate information you need to make a decision about which car insurance company to go with and which policy to buy.

So put on your comfy pants, sit back, and relax, as we explain the fastest and most efficient way to buy a car insurance policy that fits your needs and your budget.

Are you ready? Use our free tool and start comparing car insurance rates in your area right now by entering your ZIP code in the box above.

The Cost of Car Insurance in Philadelphia

People often base their purchasing decisions on the cost of something, so why should car insurance be any different?

How much does car insurance in Philadelphia actually cost?

While we’d love to tackle that question with just one simple answer, there are multiple factors that go into deciding a car insurance rate. Like snowflakes, all car insurance rates are completely unique.

Rates could be based on gender, age, marital status, driving record, credit history and much more. Don’t be overwhelmed, we will explain all of this next.

Male vs. Female vs. Age

While most car insurance companies charge different rates based on gender, the state of Pennsylvania has a law against doing so. That’s right — car insurance companies in Pennsylvania may not use your gender as a reason to increase or decrease your car insurance rate.

However, car insurance companies can use your age to help them determine your rate.

A recent study conducted by Data USA showed that the median age in the city of Philadelphia is 34.4 years of age.

Check out the average costs of insurance in the table below as it relates to a driver’s age.

| Age | 35 | 60 | 17 | 25 | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|---|

| Average Annual Rate | $4,092.17 | $3,856.53 | $17,201.53 | $4,779.13 | $3,856.53 | 60 |

As you can see, car insurance in Philadelphia, Pennsylvania, is extremely expensive for teenage drivers.

Car insurance companies know that drivers with minimal experience are more likely to cause an accident. However, as that teenage driver gets older and more responsible, their rate is likely going to decrease as long as they keep a clean driving record.

The table above also shows us that 60-year-old drivers will most likely have the cheapest car insurance rate. This less expensive rate could be attributed to the years of driving experience they have under their belts.

Did you know that your marital status can also affect your car insurance rate?

Car insurance companies deem married people to be more responsible drivers. Since a married person is committed to their spouse, they are less likely to be reckless drivers and more likely to pay their bills on time. In short, married people are usually safer drivers and responsible clients.

If you’re a little frustrated by these rates, don’t be. There are still many more components that go into determining a car insurance rate.

Cheapest ZIP Codes in Philadelphia

Did you know car insurance companies care about where you live? This is an important factor when determining a car insurance rate because some areas in your city could be more prone to crime and/or natural disasters than others.

Find your ZIP code in the table below.

| Zip Code | Average Annual Rate |

|---|---|

| 19102 | $8,771.34 |

| 19103 | $9,148.09 |

| 19104 | $9,581.50 |

| 19106 | $9,023.19 |

| 19107 | $9,241.41 |

| 19109 | $9,392.81 |

| 19110 | $9,248.59 |

| 19111 | $8,957.91 |

| 19112 | $10,086.22 |

| 19113 | $7,230.41 |

| 19114 | $8,418.71 |

| 19115 | $8,865.96 |

| 19116 | $8,681.96 |

| 19118 | $8,015.18 |

| 19119 | $8,717.53 |

| 19120 | $9,780.21 |

| 19121 | $10,283.48 |

| 19122 | $10,186.97 |

| 19123 | $9,298.94 |

| 19124 | $9,672.32 |

| 19125 | $9,719.20 |

| 19126 | $9,681.59 |

| 19127 | $8,067.84 |

| 19128 | $7,971.25 |

| 19129 | $8,567.87 |

| 19130 | $9,125.87 |

| 19131 | $9,539.80 |

| 19132 | $10,446.90 |

| 19133 | $10,480.35 |

| 19134 | $9,650.55 |

| 19135 | $9,194.67 |

| 19136 | $8,797.21 |

| 19137 | $8,731.85 |

| 19138 | $9,631.63 |

| 19139 | $10,358.57 |

| 19140 | $10,370.26 |

| 19141 | $9,793.33 |

| 19142 | $10,372.77 |

| 19143 | $10,219.59 |

| 19144 | $9,362.74 |

| 19145 | $9,771.21 |

| 19146 | $9,337.55 |

| 19147 | $9,428.07 |

| 19148 | $9,508.89 |

| 19149 | $9,043.03 |

| 19150 | $9,169.50 |

| 19151 | $9,178.22 |

| 19152 | $8,761.68 |

| 19153 | $9,685.55 |

| 19154 | $8,305.29 |

| 19190 | $9,564.29 |

As you probably noticed, there’s about a $3,000 difference from the cheapest rate to the most expensive in this table.

What’s the best car insurance company in Philadelphia?

While the factors we listed above can have a significant impact on your car insurance rate, it is important to note that not all companies work the same way or care about the same things.

For example, your driving record might influence your rate more at State Farm than it would at Progressive. Your credit history might influence your rate more at Progressive than it would at State Farm.

In order to understand the big picture, you need to evaluate and understand car insurance companies as a whole.

To save you time, we’ve already researched all of this valuable information for you.

This next section will take you through a few more factors that can influence your rate, while also showing you the average cost you might pay for a policy based on a certain factor.

Cheapest Car Insurance Rates by Company

The table below shows the car insurance companies that charge the cheapest coverage rates in Philadelphia, Pennsylvania.

| Group | Average |

|---|---|

| Allstate | $7,384.06 |

| Geico | $4,621.12 |

| Liberty Mutual | $12,538.89 |

| Nationwide | $4,996.19 |

| Progressive | $7,433.97 |

| State Farm | $4,804.08 |

| Travelers | $15,126.36 |

| USAA | $2,954.06 |

You’ll notice that USAA has the cheapest car insurance rates, while Travelers has the most expensive.

Keep in mind that USAA only provides insurance for military members, veterans, and their families.

It’s kind of crazy to see such a wide range in rates. It’s important to remember that car insurance companies are like anything else — they might have a higher price tag because of their brand or reputation.

The Best Car Insurance for Your Commute

According to the Federal Highway Administration’s 2014 Licensed Drivers By State report, Pennsylvania drivers drove an average of 11,203 miles in the state that year. The table below indicates the average annual premiums Philadelphia insurers charge based on consumers’ commute rates.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Allstate | $7,221.19 | $7,546.93 | $7,384.06 |

| Geico | $4,547.62 | $4,694.62 | $4,621.12 |

| Liberty Mutual | $12,223.66 | $12,854.12 | $12,538.89 |

| Nationwide | $4,996.18 | $4,996.18 | $4,996.18 |

| Progressive | $7,433.97 | $7,433.97 | $7,433.97 |

| State Farm | $4,648.40 | $4,959.76 | $4,804.08 |

| Travelers | $15,126.36 | $15,126.36 | $15,126.36 |

| USAA | $2,867.82 | $3,040.30 | $2,954.06 |

It’s interesting to note that some companies do not adjust their rates based on how many miles a customer is driving, while other companies raise a driver’s rate for driving more, sometimes by hundreds of dollars.

If you’re someone who drives more than the average person, be sure to check out rates for Nationwide and Progressive.

Best Car Insurance for Coverage Level Rates

We always like to say that the more car insurance you have, the better off you’ll be, and car insurance companies often agree with this statement.

But did you know that a car insurance company could give you a break on your rate if you have more car insurance coverage than what’s required by the state of Pennsylvania?

Take a look at the table below.

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $8,020.68 | $6,663.27 | $7,468.23 | $7,384.06 |

| Geico | $5,246.88 | $3,945.98 | $4,670.50 | $4,621.12 |

| Liberty Mutual | $13,175.96 | $11,792.43 | $12,648.26 | $12,538.88 |

| Nationwide | $5,051.93 | $4,876.19 | $5,060.43 | $4,996.18 |

| Progressive | $8,447.87 | $6,400.45 | $7,453.60 | $7,433.97 |

| State Farm | $5,114.04 | $4,417.09 | $4,881.11 | $4,804.08 |

| Travelers | $15,502.99 | $14,699.01 | $15,177.09 | $15,126.36 |

| USAA | $3,187.90 | $2,686.69 | $2,987.59 | $2,954.06 |

For just a couple hundred dollars more per month, you could go from having liability coverage to high coverage that will protect you no matter what.

If you can afford it now, having higher coverage could save you thousands of dollars in the long run if you’re involved in a serious accident.

Best Car Insurance Rates by Credit History

Did you know that your credit history can affect more than just your interest rates?

That’s right — your credit history is important to car insurance companies because it tells them whether or not you’re faithful in paying your bills every month and on time.

Take a look at the table below to see how credit history influences a car insurance rate.

| Group | Fair | Good | Poor | Average |

|---|---|---|---|---|

| Allstate | $7,048.60 | $5,638.55 | $9,465.03 | $7,384.06 |

| Geico | $3,893.08 | $2,986.78 | $6,983.51 | $4,621.12 |

| Liberty Mutual | $11,494.99 | $10,176.47 | $15,945.20 | $12,538.89 |

| Nationwide | $4,814.49 | $4,279.62 | $5,894.45 | $4,996.19 |

| Progressive | $6,909.76 | $5,513.16 | $9,879.00 | $7,433.97 |

| State Farm | $4,239.43 | $3,356.18 | $6,816.64 | $4,804.08 |

| Travelers | $14,869.14 | $13,999.55 | $16,510.40 | $15,126.36 |

| USAA | $2,724.60 | $2,393.33 | $3,744.26 | $2,954.06 |

As you can see, the difference in rates between a person who has good credit and a person who has poor credit is roughly $3,000-$5,000.

If you keep a clean credit history, you’ll likely be saving yourself thousands of dollars on your car insurance policy.

Best Car Insurance for Driving Record Rates

Probably the most significant factor to influence your car insurance rate is your driving record.

Can you guess why?

If you’re a driver who tends to get into many car accidents, or you’ve been convicted of a DUI or gotten a speeding ticket, you will be stamped as a high-risk driver.

High-risk drivers pay an astronomical amount for car insurance because they cost car insurance companies a lot of money.

Take a closer look at the table below.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $7,045.78 | $8,398.88 | $7,045.78 | $7,045.78 | $7,496.81 |

| Geico | $3,356.70 | $5,913.58 | $4,546.42 | $4,667.79 | $4,605.57 |

| Liberty Mutual | $11,444.01 | $13,109.97 | $12,800.78 | $12,800.78 | $12,451.59 |

| Nationwide | $3,654.90 | $4,841.23 | $6,666.09 | $4,822.52 | $5,054.07 |

| Progressive | $6,727.17 | $9,240.42 | $6,989.74 | $6,778.57 | $7,652.44 |

| State Farm | $4,373.72 | $5,234.44 | $4,804.08 | $4,804.08 | $4,804.08 |

| Travelers | $10,688.46 | $15,238.90 | $19,339.18 | $15,238.90 | $15,088.85 |

| USAA | $2,362.27 | $3,288.44 | $3,518.96 | $2,646.58 | $3,056.56 |

If you get into just one accident, your car insurance rate could increase by $5,000 per year! That is no joke.

You’ll notice that some carriers charge higher rates than others after one DUI, but all insurers listed show a decent increase in premiums for a clean record vs. one DUI.

We know all drivers aren’t perfect, but the longer you drive without getting a ticket or causing an accident, the more likely you are to qualify for good-driver discounts on your car insurance in Philadelphia.

Car Insurance Factors in Philadelphia

Based on what you’ve read above, you’re probably ready to give your money to a company you saw listed that will lower your car insurance rate significantly.

There are even more factors that affect your car insurance rates in Philadelphia, so don’t switch providers before you read these helpful stats.

Here’s what you need to know to pinpoint how much you really ought to be paying for auto coverage in your city.

Metro Report – Growth & Prosperity

Let’s take a look at the growth and prosperity in Philadelphia as shown in the Brookings Metro Report.

Prosperity

- Productivity: + 1 percent (47th of 100)

- Standard of Living: + 2.1 percent (24th of 100)

- Average Annual Wage: + .6 percent (70th of 100)

Growth

- Jobs: + 1.4 percent (51st of 100)

- Gross Metropolitan Product (GMP): + 2.4 percent (44th of 100)

- Jobs at Young Firms: + 7.1 percent (18th of 100)

As you can see, from 2016-2017, Philadelphia improved in both areas of growth and prosperity.

Median Household Income

How much money does the average household make per year in Philadelphia?

According to Data USA, households in Philadelphia, Pennsylvania, have a median annual income of $39,759, which is about $20,000 less than the median annual income of $60,336 across the entire United States.

This is in comparison to a median income of $41,449 in 2016, which represents a -4.08 percent annual growth.

If you’re wondering how much of your yearly salary goes toward your car insurance premium, you’re not alone.

Philadelphia drivers pay an average of $9,302.74 on their car insurance premium per year.

This means that on average, drivers spend roughly 23 percent of their income on car insurance alone.

Homeownership in Philadelphia

Did you know that owning a home could help you save money on your car insurance policy?

Car insurance companies believe that people who own a home are more responsible with their money and are also statistically safer drivers than people who don’t own a home.

Some insurance companies will also give you a discount if you buy homeowners insurance and car insurance at the same time.

In 2017, 49 percent of the housing units in Philadelphia, Pennsylvania, were occupied by their owners. This percentage declined from the previous year’s rate of 52.1 percent.

This percentage of owner-occupation is lower than the national average of 63.9 percent.

In the same year, the median property value in Philadelphia grew to $166,200 from the previous year’s value of $154,000.

Education in Philadelphia

The city of Philadelphia has several notable universities and colleges. In 2016, universities in Philadelphia awarded a total of 42,474 degrees.

According to Data USA, the student population of Philadelphia is skewed toward women, with 63,645 male students and 83,939 female students.

The largest universities in Philadelphia, Pennsylvania, by number of degrees awarded are the University of Pennsylvania, Temple University, and Drexel University.

The number of graduates and the percentage of total degrees the largest Pennsylvania educational institutions conferred in 2016 are as follows:

- University of Pennsylvania: Graduates: 9,053, Degrees Conferred: 21.3 percent

- Temple University: Graduates: 9,017, Degrees Conferred: 21.2 percent

- Drexel University: Graduates: 7,549, Degrees Conferred: 17.8 percent

The most popular majors in Philadelphia by concentration are:

- Registered Nursing: 1,801 degrees awarded

- General Finance: 1,628 degrees awarded

- General Business Administration & Management: 1,247 degrees awarded

General Psychology was also a popular degree program at schools in the city of Philadelphia.

Wage by Race & Ethnicity in Common Jobs

Have you ever wondered how race and ethnicity can affect the wage rate in Philadelphia?

In 2017, Asian people were the highest paid race/ethnicity among Pennsylvania workers. Asians were paid 1.18 times more than White workers, who made the second highest salary of any race/ethnicity.

The table below indicates wages for common jobs based on race and ethnicity in Philadelphia, Pennsylvania, along with the percentage of those workers’ incomes going to auto insurance premiums.

| Ethnicity | Miscellaneous Managers | Percentage of Income Going to Car Insurance | Registered Nurses | Percentage of Income Going to Car Insurance | Elementary & Middle School Teachers | Percentage of Income Going to Car Insurance | Secretaries & Administrative Assistants | Percentage of Income Going to Car Insurance | Driver/Sales Workers & Truck Drivers | Percentage of Income Going to Car Insurance |

|---|---|---|---|---|---|---|---|---|---|---|

| Asian | $114,226 | 8.10% | $70,683 | 13.10% | $60,182 | 15.40% | $47,780 | 19.40% | $23,381 | 39.70% |

| White | $96,999 | 9.50% | $61,142 | 15.20% | $55,189 | 16.80% | $34,610 | 26.80% | $42,090 | 22.10% |

| Two or More Races | $73,230 | 12.70% | $53,525 | 17.30% | $51,564 | 18% | $29,112 | 31.90% | $29,956 | 31% |

| Black | $70,316 | 13.20% | $69,926 | 13.30% | $53,012 | 17.50% | $36,807 | 25.20% | $38,369 | 24.20% |

| Other | $69,194 | 13.40% | $51,155 | 18.10% | $58,301 | 15.90% | $25,558 | 36.30% | $45,519 | 20.40% |

As you can see from the table above, depending on your job role, you could be spending as much as 39 percent of your yearly income on a one-year car insurance policy.

Even the highest-paid workers on this list are paying about 8 percent of their annual income towards a car insurance policy.

Wage by Gender in Common Jobs

The gender pay gap has been disputed for a long time, but the data doesn’t lie.

According to Data USA, in 2017, full-time male employees in Pennsylvania made 1.34 times more than female employees.

The average male salary was $68,603, while the average female salary was $51,375.

That’s more than a $17,000 wage gap between genders. Even if male and female employees hold the exact same job title, the statistics reveal that male workers will still bring home a higher personal income.

The average annual cost of car insurance in Philadelphia, Pennsylvania is $9,302.

This means that while women are paying out approximately 18.1 percent of their annual income to cover the cost of car insurance premiums, men are paying out just over 13.5 percent of their total yearly earnings for coverage.

Poverty by Age & Gender

Let’s look at poverty rates in Philadelphia according to age and gender.

The Census Bureau uses a set of income thresholds that vary by family size and composition to determine who classifies as impoverished. If a family’s total income is less than the family’s threshold, that family and every individual in it is considered to be living in poverty.

According to Data USA, 25.8 percent of the population of Philadelphia, Pennsylvania, (394,000 out of 1.53 million people) live below the poverty line: a number that is higher than the national average of 13.4 percent.

The largest demographic group living in poverty is females age 25-34, followed by females age 18-24, and then males 18-24.

Poverty by Race & Ethnicity

The most common racial or ethnic identity group living below the poverty line in Philadelphia is Black, followed by White, and then Hispanic.

Approximately 197,000 individuals in the Black racial group are categorized as living below the poverty line, with 118,000 Whites meeting poverty standards.

Hispanic ethnic groups make up the smallest proportion of individuals residing below the poverty line with approximately 86,000 individuals as of 2017.

Employment by Occupations

From 2016-2017, employment in Philadelphia, Pennsylvania, declined at a rate of -0.741 percent, from 679,000 employees to 674,000 employees.

The most common positions by the number of residents in Philadelphia are as follows:

- Office & Administrative Support Occupations (83,030 people)

- Sales & Related Occupations (57,331 people)

- Management Occupations (56,671 people)

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Driving in Philadelphia

Whether you’re in the city of Philadelphia for the weekend, or you’re a year-round resident, it’s important to know the best driving routes in the city.

In this next section, we’ll show you how to get around in Philadelphia.

– Roads in Philadelphia

From traffic jams to construction sites and everything in between, we’ve got all your driving needs in the City of Brotherly Love covered.

Buckle up as we trek through roads in Philadelphia.

Major Highways

Pennsylvania has 23 active routes running through the state, comprising a total of 1,862.21 miles of roadway. These active interstates include:

- I-70

- I-76

- I-78

- I-79

- I-80

- I-81

- I-83

- I-84

- I-86

- I-90

- I-95

- I-99

- I-176

- I-276

- I-376

- I-476

- I-576

- I-676

- I-279

- I-579

- I-178

- I-378

- I-180

- I-380

- I-283

- I-295

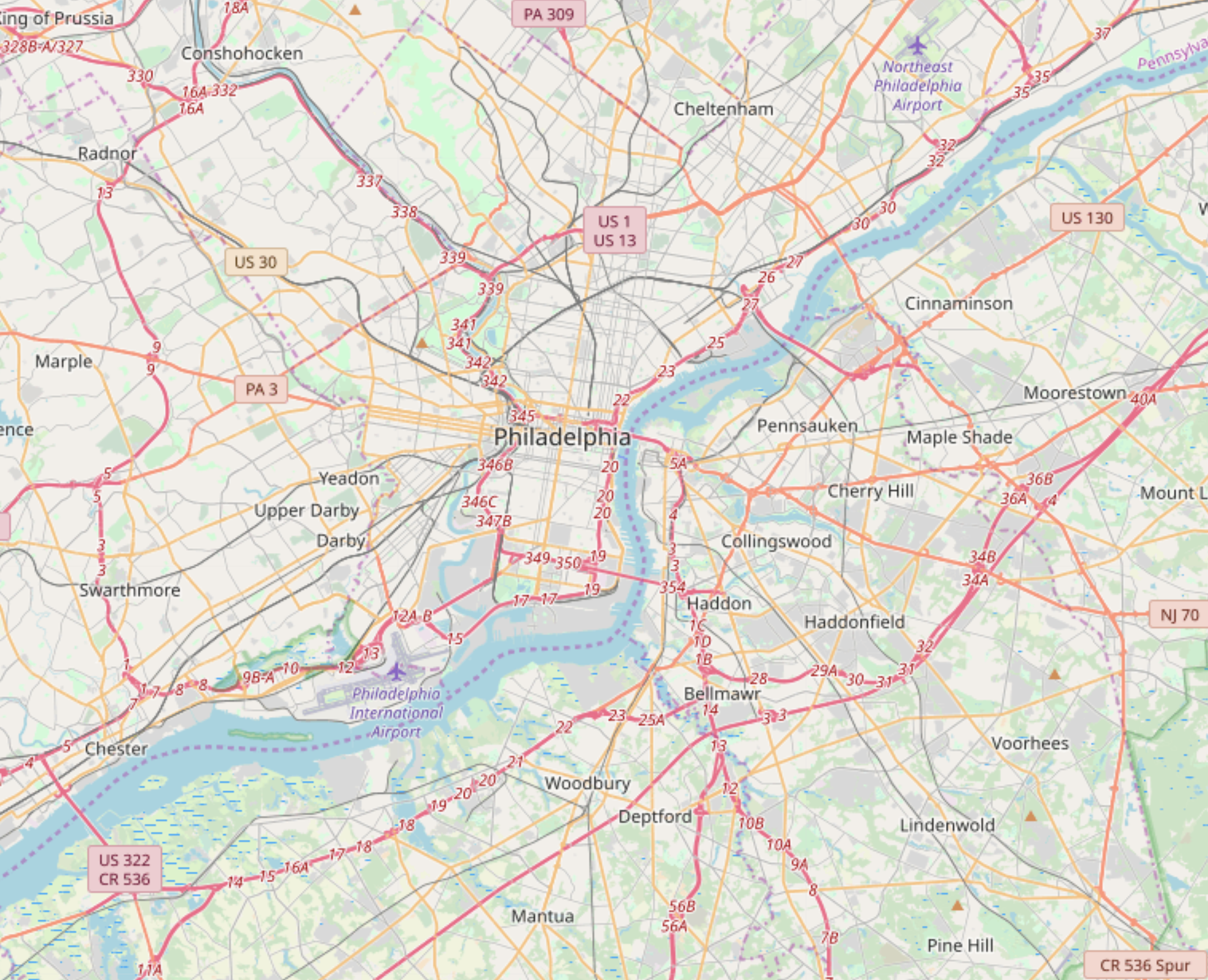

As you can see from the map above, Interstates 76, 95, 276, and 476 are some of the major highways that run through the city of Philadelphia.

According to TollGuru, the Pennsylvania toll calculator calculates tolls for cars, trucks, trailers, buses, RVs, and motorcycles for the entire 360-mile length of the Pennsylvania Turnpike.

The turnpike begins at the Ohio state line in Lawrence County and ends at the New Jersey border at the Delaware River-Turnpike Toll Bridge at the Pearl Harbor Memorial Extension of the New Jersey Turnpike.

The turnpike connects the Pittsburgh, Harrisburg, and Philadelphia areas. It crosses the Appalachian Mountains in central Pennsylvania, passing through four tunnels.

The toll road uses a ticket system of tolling between the Warrendale and Neshaminy Falls toll plazas.

In addition to the east-west Pennsylvania Turnpike, the Pennsylvania Turnpike Commission also operates the Northeast Extension of the Pennsylvania Turnpike (I-476), the Beaver Valley Expressway (I-376), the Mon-Fayette Expressway (PA 43), the Amos K. Hutchinson Bypass (PA 66), and the Southern Beltway (PA 576).

The calculator also provides toll information for both peak and off-peak hours so you can determine exactly how much you’ll pay at your particular travel time.

Popular Road Trips/Sites

Are you looking for a few fun things to do in and around Philadelphia?

You’ve come to the right place. Watch the video above to discover the top places to visit in the city. But don’t take our word for it; check out the list below brought to you by Trip Advisor for more suggestions.

- Explore Philadelphia: Never been to Philadelphia? Jump on a hop-on, hop-off Big Bus to visit major sites or take the constitutional walking tour and get a good history lesson of the city by a friendly guide.

- Food, Wine, and Nightlife: Satisfy your sweet tooth and do an underground donut tour featuring some of the best donut shops in the city. After, you could check out Parc, a Parisian-inspired bistro from prolific and James Beard Award-winning restaurateur Stephen Starr.

- Attractions: Independence Hall, Reading Terminal Market, the Eastern State Penitentiary, and the Philadelphia Museum of Art are just a few of the famous sites in the City of Brotherly Love you won’t want to miss.

- Get Outdoors: Animals are on the move like never before at Philadelphia Zoo, but if you’re not into lions and tigers and bears (oh my!), then grab a bike and helmet and take a ride down the Schuylkill River Trail or Kelly Drive for a fun way to enjoy the outdoors in Philadelphia

Road Conditions

Vehicle operating costs are about $732 per year for a driver in Philadelphia. See the table below.

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Costs (VOC) |

|---|---|---|---|---|

| 43% | 28% | 11% | 17% | $732 |

For information regarding road construction in the city of Philadelphia, please visit the Pennsylvania Department of Transportation. Updates are posted there as needed.

Does your city use speeding or red light cameras?

What is a red light camera?

According to the Insurance Institute for Highway Safety (IIHS), red light cameras automatically photograph vehicles that go through red lights. The cameras are connected to the traffic signal and to sensors that monitor traffic flow just before the crosswalk or stop line.

The system continuously monitors the traffic signal, and the camera captures any vehicle that doesn’t stop during the red phase.

There are 31 red light cameras in the city of Philadelphia. They are permitted by Pennsylvania state law and city ordinance. However, they are only permitted in specific jurisdictions.

Speeding cameras are also permitted in the city.

The cameras are expected to be installed before the end of 2019. Exact dates and locations have yet to be determined. Officials say data will drive the camera locations.

– Vehicles in Philadelphia

In this next section, we’ll talk about popular vehicles driven in Philadelphia, speed traps, vehicle theft, vehicle ownership, and more.

Stay tuned as we cover these important vehicle statistics.

Most Popular Vehicles Owned

According to Your Mechanic, the most popular vehicle owned in the city of Philadelphia is a Nissan Maxima.

The 2019 Nissan Maxima earned good scores in all IIHS physical crash tests, and its standard front crash prevention system earned a superior rating.

The car gets an average of 20 miles per gallon in the city and 30 miles per gallon on the highway.

How many cars per household?

How many cars does the average household own in Philadelphia, Pennsylvania?

According to Data USA, the average household in Philadelphia owns one car, which is lower than the national average of two cars per household.

A smaller portion of residents in Philadelphia own two cars.

Households Without a Car

Although most households own a car in Philadelphia, some do not.

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Vehicles Per Household |

|---|---|---|---|

| 31.10% | 29.50% | 1.03 | 1.05 |

The table above shows that the number of households who did not own a vehicle decreased between 2015-2016.

The number of vehicles owned per household increased from 1.03-1.05 over 2015-2016.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Speed Traps in Your City

There you are, minding your own business, just following the natural speed of traffic and not paying any attention to the fact that you’re actually going over the speed limit.

The blue and red lights come out of nowhere and before you know it, you’re being pulled over. Has this ever happened to you?

Unfortunately, many of us have fallen victim to a speed trap.

Speed traps are designed to stop unsafe driving habits. The good news for residents of Philadelphia is that the city didn’t make it onto the list of The 10 Worst Pennsylvania Speed Trap Cities.

With that being said, please obey the traffic signs and speed limit signs, and always practice safe driving techniques.

Vehicle Theft in Philadelphia

Do you know how safe the city of Philadelphia is? Neighborhood Scout reported 5,486 motor vehicle thefts in 2017.

The safest neighborhoods in Philadelphia, Pennsylvania, per Neighborhood Scout, are as follows:

- Roseglen

- Rhawn St / Rowland Ave

- Stevens Rd / Byberry Rd

- Byberry Rd / Depue Ave

- Ridge Ave / Flamingo St

- Germantown Ave / W Willow Grove Ave

- Chestnut Hill / Chestnut Hill College

- Cherokee St / W Hartwell Ln

- Old Line Rd / Ridge Ave

- Mount Airy

Check out the map below. The light purple areas show the safest places in Philadelphia, while the dark purple areas show the most dangerous places to live in the city.

Neighborhood Scout also revealed that your chances of becoming a victim of violent crime in Philadelphia are one in 106. This is higher than the statewide figure, which puts the chances of residents becoming victims of violent crime at one in 319.

Philadelphia received a score of 10 on Neighborhood Scout’s crime index, where the highest and best score is 100. Based on this rubric, Philadelphia was only deemed safer than 10 percent of cities across the country.

The table below illustrates the incidents of violent crime in Philadelphia, Pennsylvania in 2017 alone.

| PHILADELPHIA VIOLENT CRIMES 2017 | MURDER | RAPE | ROBBERY | ASSAULT |

|---|---|---|---|---|

| Report Total | 316 | 1,182 | 6,028 | 7,417 |

| Rate Per 1,000 People | 0.2 | 0.75 | 3.81 | 4.69 |

According to this table above, there were 316 murders in the city of Philadelphia in 2017.

Below are Philadelphia’s annual number of crimes for the year 2017.

| PHILADELPHIA ANNUAL CRIMES | VIOLENT | PROPERTY | TOTAL |

|---|---|---|---|

| Number of Crimes | 14,943 | 48,276 | 63,219 |

| Crime Rate (Per 1,000 Residents) | 9.45 | 30.54 | 39.99 |

This table above shows that there were almost 15,000 violent crimes in Philadelphia in 2017.

– Traffic

No one likes to sit in traffic. Let’s take a look at how traffic congestion affects drivers in Philadelphia.

Traffic Congestion

According to Inrix’s Scorecard, Philadelphia, Pennsylvania is ranked as the ninth-most traffic-congested city in the U.S.

| 2018 WORLD RANK | HOURS LOST IN CONGESTION | COST OF CONGESTION (PER DRIVER) | U.S. RANK |

|---|---|---|---|

| 69th | 112 | $1,568 | 9th |

Sitting in traffic costs every Philadelphia driver an estimated $1,568 per year.

Transportation

We know that Philadelphia residents spend an outrageous amount of time in traffic, but how long is their average commute?

According to a recent study conducted by Data USA, using averages, employees in this city have a longer commute time (31.7 minutes) than the normal U.S. worker (25.5 minutes). Additionally, 3.93 percent of the workforce in Philadelphia have “super commutes” in excess of 90 minutes.

So now that we know Philadelphia drivers’ average commute time, let’s talk about their preferred transportation methods.

In 2017, the most common method of travel for workers in Philadelphia was driving alone (51.1 percent), followed by those who used public transit (23.8 percent), and those who walked (8.44 percent).

Busiest Highways

According to the Federal Highway Administration, one of the busiest highways in the Philadelphia area is Interstate 95.

You can find more traffic information and statistics at the Pennsylvania Department of Transportation.

How safe are Philadelphia’s streets & roads?

The National Highway Traffic Safety Administration (NHTSA) published a study in 2018 reporting on the safety conditions and fatal crashes in the five counties that make up Philadelphia from 2014-2018.

First, let’s take a look at the total fatal crashes in Philadelphia counties as of 2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 44 | 56 | 52 | 51 | 54 | 7.04 | 8.95 | 8.31 | 8.13 | 8.6 |

| Chester | 34 | 35 | 24 | 35 | 46 | 6.63 | 6.79 | 4.64 | 6.74 | 8.81 |

| Delaware | 26 | 21 | 29 | 25 | 19 | 4.62 | 3.73 | 5.15 | 4.44 | 3.36 |

| Montgomery | 38 | 34 | 32 | 43 | 50 | 4.66 | 4.16 | 3.9 | 5.21 | 6.03 |

| Philadelphia | 97 | 94 | 101 | 94 | 103 | 6.2 | 5.98 | 6.41 | 5.95 | 6.5 |

According to the table above, there were 272 traffic fatalities in Philadelphia in 2018.

This next table shows fatal crashes involving an alcohol-impaired driver.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 12 | 14 | 17 | 16 | 16 | 1.92 | 2.24 | 2.72 | 2.55 | 2.55 |

| Chester | 11 | 14 | 7 | 18 | 12 | 2.14 | 2.72 | 1.35 | 3.47 | 2.3 |

| Chester | 11 | 14 | 7 | 18 | 12 | 2.14 | 2.72 | 1.35 | 3.47 | 2.3 |

| Montgomery | 13 | 4 | 6 | 14 | 9 | 1.59 | 0.49 | 0.73 | 1.7 | 1.09 |

| Philadelphia | 26 | 31 | 23 | 22 | 27 | 1.66 | 1.97 | 1.46 | 1.39 | 1.7 |

This table shows that Montgomery County had the fewest fatal crashes involving an alcohol-impaired driver in 2018.

See below for single-vehicle crash fatalities by county in Philadelphia.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 24 | 26 | 33 | 27 | 33 | 3.84 | 4.16 | 5.27 | 4.31 | 5.25 |

| Chester | 19 | 19 | 11 | 16 | 22 | 3.7 | 3.69 | 2.13 | 3.08 | 4.21 |

| Delaware | 15 | 8 | 14 | 12 | 9 | 2.67 | 1.42 | 2.48 | 2.13 | 1.59 |

| Montgomery | 16 | 18 | 14 | 23 | 32 | 1.96 | 2.2 | 1.71 | 2.79 | 3.86 |

| Philadelphia | 65 | 66 | 57 | 55 | 65 | 4.15 | 4.2 | 3.62 | 3.48 | 4.1 |

Philadelphia County had the most single-vehicle crashes from 2014-2018.

Next, here are crash rates for fatalities involving speeding by county in Philadelphia.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 14 | 22 | 22 | 15 | 14 | 2.24 | 3.52 | 3.51 | 2.39 | 2.23 |

| Chester | 16 | 21 | 13 | 13 | 19 | 3.12 | 4.08 | 2.52 | 2.51 | 3.64 |

| Delaware | 10 | 10 | 9 | 11 | 6 | 1.78 | 1.78 | 1.6 | 1.95 | 1.06 |

| Montgomery | 15 | 13 | 11 | 15 | 19 | 1.84 | 1.59 | 1.34 | 1.82 | 2.29 |

| Philadelphia | 34 | 32 | 22 | 29 | 24 | 2.17 | 2.04 | 1.4 | 1.84 | 1.52 |

There were 82 fatal crashes caused by speeding in the city of Philadelphia in 2018.

The rates in the table below highlight fatal crashes that involved roadway departures. It tells us that Philadelphia County had the most fatal crashes caused by roadway departures in 2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 20 | 31 | 27 | 20 | 28 | 3.2 | 4.96 | 4.31 | 3.19 | 4.46 |

| Chester | 22 | 17 | 11 | 22 | 27 | 4.29 | 3.3 | 2.13 | 4.24 | 5.17 |

| Delaware | 10 | 13 | 11 | 9 | 7 | 1.78 | 2.31 | 1.95 | 1.6 | 1.24 |

| Montgomery | 15 | 16 | 8 | 21 | 23 | 1.84 | 1.96 | 0.98 | 2.55 | 2.78 |

| Philadelphia | 38 | 40 | 23 | 29 | 34 | 2.43 | 2.55 | 1.46 | 1.84 | 2.15 |

The table below shows fatal crashes involving an intersection.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 14 | 14 | 18 | 14 | 9 | 2.24 | 2.24 | 2.88 | 2.23 | 1.43 |

| Chester | 3 | 11 | 5 | 9 | 13 | 0.58 | 2.14 | 0.97 | 1.73 | 2.49 |

| Delaware | 11 | 4 | 10 | 7 | 8 | 1.95 | 0.71 | 1.77 | 1.24 | 1.42 |

| Montgomery | 8 | 8 | 13 | 12 | 13 | 0.98 | 0.98 | 1.59 | 1.46 | 1.57 |

| Philadelphia | 41 | 35 | 50 | 37 | 39 | 2.62 | 2.23 | 3.17 | 2.34 | 2.46 |

Again, Philadelphia County had the highest number of fatal crashes involving an intersection from 2014-2018.

These next few tables will show fatal crash rates by person type: car passenger, pedestrian, and bicyclist. We’ll start with the statistics for passengers.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 20 | 27 | 25 | 20 | 16 | 3.2 | 4.32 | 3.99 | 3.19 | 2.55 |

| Chester | 18 | 11 | 11 | 20 | 24 | 3.51 | 2.14 | 2.13 | 3.85 | 4.6 |

| Delaware | 6 | 14 | 14 | 8 | 10 | 1.07 | 2.49 | 2.48 | 1.42 | 1.77 |

| Montgomery | 24 | 13 | 13 | 21 | 12 | 2.94 | 1.59 | 1.59 | 2.55 | 1.45 |

| Philadelphia | 31 | 28 | 29 | 24 | 35 | 1.98 | 1.78 | 1.84 | 1.52 | 2.21 |

There were 97 fatal crashes involving car passengers in 2018.

Here are pedestrian fatality rates by counties in Philadelphia. Chester County had the fewest number of pedestrian fatalities in 2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 8 | 7 | 8 | 11 | 12 | 1.28 | 1.12 | 1.28 | 1.75 | 1.91 |

| Chester | 5 | 3 | 4 | 2 | 5 | 0.97 | 0.58 | 0.77 | 0.39 | 0.96 |

| Delaware | 8 | 2 | 7 | 7 | 6 | 1.42 | 0.36 | 1.24 | 1.24 | 1.06 |

| Montgomery | 3 | 8 | 5 | 6 | 18 | 0.37 | 0.98 | 0.61 | 0.73 | 2.17 |

| Philadelphia | 38 | 26 | 43 | 37 | 41 | 2.43 | 1.65 | 2.73 | 2.34 | 2.59 |

Lastly, we have bicyclist fatality rates by county.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Bucks | 3 | 1 | 0 | 4 | 2 | 0.48 | 0.16 | 0 | 0.64 | 0.32 |

| Chester | 2 | 1 | 0 | 0 | 0 | 0.39 | 0.19 | 0 | 0 | 0 |

| Delaware | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Montgomery | 1 | 0 | 0 | 0 | 1 | 0.12 | 0 | 0 | 0 | 0.12 |

| Philadelphia | 3 | 7 | 3 | 2 | 4 | 0.19 | 0.45 | 0.19 | 0.13 | 0.25 |

Delaware County didn’t have any bicyclist fatalities from 2014-2018.

Here’s a table highlighting roads with the most fatal crashes by road function class in the state of Pennsylvania.

| Rural | Urban | Freeway + Expressway | Other | Minor Arterial | Collector Arterial | Local | Unknown | Total Fatal Crashes |

|---|---|---|---|---|---|---|---|---|

| 75 | 45 | 40 | 304 | 217 | 198 | 202 | 2 | 1,083 |

An arterial road is just a high-capacity urban road. Depending on how much traffic is filtering through a specific area, the road could be categorized as a highway or a minor arterial road.

You know about road fatality statistics, but it’s important to also be aware of the high incidence of railroad and highway crashes and how they contribute to road dangers in Philadelphia.

| County | Highway | Highway User Type | Rail Equipment Type | Non-Suicide Fatality | Non-Suicide Injury | City | State Name | Latitude | Longitude | GeoLocation |

|---|---|---|---|---|---|---|---|---|---|---|

| Philadelphia | Delaware Avenue | Automobile | Yard/Switch | 0 | 0 | Philadelphia | Pennsylvania | 40.007874 | -75.174515 | Pennsylvania (40.0078740, -75.1745150) |

The table above shows there were zero fatalities on railroads on Delaware Avenue.

Allstate America’s Best Drivers Report

Have you ever wondered how drivers in your city compare to other drivers in the U.S.?

Allstate’s Best Drivers in America Report ranks 200 of the most populous cities in the U.S. based on number of collisions. Philadelphia came in at #190.

Residents of Philadelphia file an insurance claim ever 5.9 years; the national average is every 6.3 years.

The Allstate report also measures how frequently drivers “hard-brake,” or stop suddenly. In Philadelphia, drivers hard-brake 43.9 times every 1,000 miles; the national average is 19 times every 1,000 miles.

Ridesharing

Are you looking for a ridesharing service to pick you up in Philadelphia?

According to RideGuru, these services are available in the city of Philadelphia:

- Blacklane: When you order a Blacklane car, a luxury vehicle with seating for one to five people will pick you up.

- Carmel: When you order a Carmel car you have the choice of riding in a sedan, minivan, stretch limousine, SUV, or SUV super-stretch limo.

- Curb: Hail and pay for a traditional taxi through the Curb app. Curb offers taxi drivers a way to get more business during slower times. Curb was formerly known as TaxiMagic.

- Jayride: Jayide specializes in airport transfers, meaning you can only use Jayride when scheduling a ride to and from an airport. When you book through Jayride, a vehicle seating one to 20 people will pick you up.

- Limos.com

- Lyft

- Talixo: When you book a Talixo car, you will have the option of choosing an economy, business, or luxury class vehicle for a variety of price points. Talixo’s cars come in various sizes, with their largest size accommodating up to seven passengers.

- Taxi

- Uber

E-star Repair Shops

Do you need vehicle repair work done? Look no further, we have the top 10 E-star repair shops in Philadelphia listed below.

E-star is an Esurance-sponsored program that helps drivers find the best repair shops in their area.

| Shop Name | Address | Contact Information |

|---|---|---|

| CALIBER - CLIFTON HEIGHTS | 557-C E BALTIMORE PIKE CLIFTON HEIGHTS PA 19018 | email: [email protected] P: (610) 626-7726 F: (610) 626-7890 |

| CALIBER - CYNWYD | 332 IONA AVENUE NARBERTH PA 19072 | email: [email protected] P: (610) 664-2578 F: (610) 664-8846 |

| CALIBER - LANSDOWNE | 714 EAST BALTIMORE AVE. CLIFTON HEIGHTS PA 19018 | email: [email protected] P: (610) 622-0555 F: (610) 622-0189 |

| CALIBER - PENNSAUKEN | 6900 WESTFIELD AVENUE PENNSAUKEN NJ 08110 | email: [email protected] P: (856) 792-0130 F: (856) 792-1039 |

| CALIBER - WESTMONT | 6 WEST CUTHBERT BLVD HADDON TOWNSHIP NJ 08108 | email: [email protected] P: (856) 854-4888 F: (856) 854-7108 |

| ELMER'S AUTO BODY, INC. | 201-209 route 130 WEST COLLINGSWOOD HEIGHTS NJ 08059 | email: [email protected] P: (856) 456-7018 F: (856) 456-9228 |

| FAULKNER COLLISION OF SOUTH PHILADELPHIA | 6615 Essington Ave. PHILADELPHIA PA 19153 | email: [email protected] P: (215) 863-4100 |

| ROCCO'S COLLISION CENTER, INC. | 806 REED ST PHILADELPHIA PA 19147 | email: [email protected] P: (215) 334-3244 F: (215) 271-3151 |

| ROCCO'S COLLISION CENTER, INC. - SNYDER | 1021 SNYDER AVE. PHILADELPHIA PA 19148 | email: [email protected] P: (215) 334-3244 F: (215) 271-3151 |

| SERVICE KING PHILADELPHIA SOUTH | 7791 Essington Avenue PHILADELPHIA PA 19153 | email: [email protected] P: (215) 365-3513 F: (215) 365-1664 |

– Weather

What is the weather like in Philadelphia, Pennsylvania? The data from the table below is brought to you by U.S. Climate Data. It shows typical average temperatures in Philadelphia.

| PHILADELPHIA, PENNSYLVANIA WEATHER | DETAILS |

|---|---|

| Annual High Temperature | 64.7 F |

| Annual Low Temperature | 47 F |

| Average Temperature | 55.85 F |

| Average Annual Precipitation (Rainfall) | 41.45 inches |

| Average Annual Snowfall | 23 inches |

But what about natural disasters? How many natural disasters happen in Philadelphia, and how do they affect your car insurance rate?

Philadelphia has experienced 21 total natural disasters.

This is significantly higher than the nationwide average of 13. A total of 15 of the natural disasters in Philadelphia were declared major disasters by the president, while the remaining six were classified as emergencies.

The causes of these natural disasters were as follows:

- Hurricanes: 6

- Winter Storms: 5

- Floods: 3

- Snowstorms: 3

- Tropical Storms: 3

- Storms: 2

- Blizzards: 1

- Snowfalls: 1

- Tropical Depressions: 1

- Water Shortages: 1

Some natural disasters may fall into more than one category noted above.

Having a minimum liability car insurance policy will not protect your vehicle if a natural disaster occurs. This is where a comprehensive car insurance policy comes into play.

Comprehensive coverage will protect your vehicle in case of storm damage. If your vehicle needs repairs, comprehensive coverage will help to cover any costs incurred.

Having this kind of coverage could cost you a few hundred dollars more per year. but could save you thousands of dollars in the long run.

– Public Transit

According to VisitPhilly.com, the Southeastern Pennsylvania Transportation Authority (SEPTA) provides public transportation into and within Philadelphia, as well as serving the surrounding Bucks, Chester, Delaware, and Montgomery Counties.

SEPTA is the nation’s sixth-largest public transit system, with train, subway, trolley and bus lines serving 1.3 million customers every day, and giving visitors an easy, affordable way to explore Philly.

SEPTA provides public transportation to Philadelphia and the countryside seven days a week, with rides available as frequently as every few minutes.

Here are SEPTA Key Fares that are Accepted on Regional Rail:

- SEPTA Key Card loaded with a Weekly or Monthly Zone or higher TrailPass or Independence Pass

- SEPTA Key Card loaded with valid TransPass is good for traveling anywhere on weekends and major holidays.

- TransPasses are no longer accepted on the Airport Regional Rail Line for regular Weekday travel. A Zone 1 or higher TrailPass is needed to travel

- SEPTA Key Senior Card

- SEPTA Key Reduced Fare Card

- Quick Trip:

- From Center City Stations: Purchase at Station Fare Kiosk for travel from Center City to an outlying station. Not valid for travel from an outlying station for travel towards Center City (except on Airport Line)

- From Airport Line Stations Terminal A-E/F: Purchase at Terminal platform Fare Kiosks for travel towards Center City

Where Can I Purchase Fares?

- SEPTA Sales Offices: Offer SEPTA Key Cards that can be loaded with a Weekly/Monthly TransPass, Weekly TrailPasses Zones 1,2,3, Anywhere, One Day Convenience Pass, One Day Independence Pass, or Travel Wallet funds (valid on Transit ONLY). Sales Offices also sell Monthly TrailPasses Zone 1,2,3, Anywhere

- Outlying SEPTA Rail Station Ticket Offices: Paper Monthly TrailPasses (Zone 1,2,3, Anywhere), Cross County Pass, One Day Independence Passes, Tickets. SEPTA Key Cards are available for purchase and Pass load/reloads at select outlying Regional Rail Ticket Offices – check individual stations for details

- External Sales Locations: over 500 retail sales locations are available for SEPTA Key Sales.

For more information regarding the public transit service in Philadelphia, please visit SEPTA.org.

– Alternative Transportation

Do you hate taking public transportation but don’t own your own vehicle? Electric scooters might be coming to Philadelphia.

According to a recent article by the Philadelphia Inquirer, electric scooters are still illegal in Philly, but that may be changing very soon.

– Parking in Metro Areas

Visit Philly says Philadelphia has thousands of metered spots throughout the city. Each residential and business area of the city has parking regulations tailored to that neighborhood’s needs; signs indicate the time limit and the hours during which the meter must be paid.

Every metered block also includes one space reserved for people with disabilities.

The Philadelphia Parking Authority also operates off-street parking lots and garages throughout the city.

Can you charge your electric vehicle in Philadelphia?

According to ChargeHub, the city of Philadelphia has 196 public charging station ports (Level 2 and Level 3) within a 10-mile area. Of all the ports, 87 percent are Level 2 charging ports and 30 percent offer free charges for your electric car.

The two main charging networks in operation are Blink and ChargePoint.

– Air Quality in Philadelphia

Cars used to release many toxic fumes into the air, but since regulations and laws have been put into place to curb emissions, this has been less of a problem.

Still, it’s important to know how clean a city’s air is. The following table indicates the air quality in Philadelphia, Pennsylvania based on the Environmental Protection Agency’s reports from 2017, 2018, and 2019.

| PHILADELPHIA AIR QUALITY INDEX | 2017 | 2018 | 2019 |

|---|---|---|---|

| Days with AQI | 365 | 365 | 304 |

| Good Days | 126 | 132 | 171 |

| Days Moderate | 271 | 214 | 123 |

| Days Unhealthy for Sensitive Groups | 20 | 16 | 10 |

| Days Unhealthy | 2 | 3 | 0 |

| Days Very Unhealthy | 0 | 0 | 0 |

As you can see, the data reveals that the days with a good air quality index outweighed moderate or unhealthy days in the period between 2017-2019.

As a whole, this means that Philadelphia has little air pollution.

Military/Veterans

If you currently serve in the military or you are a veteran, you may be eligible for a military car insurance discount.

Before we get into explaining these discounts, we want to point out some important military statistics.

Veterans by Service Period

According to Data USA, Philadelphia has a large population of former military personnel who served in Vietnam.

Approximately 16,527 veterans living in Philadelphia served in the Vietnam War.

The veteran population in Philadelphia who served in the Vietnam War is 2.46 times greater than the population of vets from any other conflict.

The second Gulf War was the second most common veteran service period with a total of 6,722 veterans, followed by the first Gulf War with a total of 5,506 veterans.

Military Bases

According to MilitaryBases.com, there are several military bases in the state of Pennsylvania, but only one is located in the city of Philadelphia.

The Naval Support Academy in Northeast Philadelphia was built in 1942. Most of the base consists of warehouse offices for the Naval supply commands and support services to Navy units that are based at the old Philadelphia Navy Yard.

Military Discounts by Providers

If you’re looking for a military discount, check out any of these providers:

- Allstate

- Esurance

- Farmers

- Geico

- Liberty Mutual

- Metlife

- Safe Auto

- Safeco

- State Farm

- The General

- USAA

USAA usually has the best car insurance rates for veterans across the board. Check out the table below to compare average rates.

| Group | Average |

|---|---|

| Allstate | $7,384.06 |

| Geico | $4,621.12 |

| Liberty Mutual | $12,538.89 |

| Nationwide | $4,996.19 |

| Progressive | $7,433.97 |

| State Farm | $4,804.08 |

| Travelers | $15,126.36 |

| USAA | $2,954.06 |

The total annual cost for car insurance through USAA in Philadelphia, Pennsylvania is $2,954.06. Any other car insurance company on this list will charge you at least a couple of thousand dollars more per year for the same policy — those are some impressive savings.

Unique City Laws

Don’t go away.

Before you get back out there on the road, pay attention to these specific rules and regulations in Philadelphia.

Hands-Free Law

A new law bans the use of handheld cell phones while driving the streets of Philadelphia. The bill signed by Mayor Mike Nutter prohibits talking, dialing, or texting on a handheld device while driving a motor vehicle. It also prohibits these activities while on a bicycle, scooter, in-line skates, or skateboard.

The fine for a first offense is $150; second-time offenders will be fined $300.

Food Truck Law

According to Zac’s Burgers, besides creating a business plan, figuring out your finances, and buying or renting your food truck, you will have a lot of red tape you have to cut through before you can hit the road.

Here is the list of information you need to provide to get things rolling. You can go to the Department of Public Health office at 321 University Avenue, 2nd Floor, Philadelphia, Pennsylvania 19102 during their walk-in hours for help filling out the application.

The list includes a commissary application, a mobile food vending application, a fee assessment, a preliminary sanitation worksheet, and business/liability/fire/auto insurance.

You also need to get your truck inspected and apply for a commercial activity license, a non-permanent retail food license, and a vendor motor vehicle license. Philadelphia requires that all your permits be in order before you can operate your food truck. Contact the Health Department for licensing costs.

Tiny Houses

The City of Philadelphia specifies no minimum house size. However, houses must meet IRC 2009 standards and must have at least one room of 120 square feet or more. In addition, the city requires that row houses (zone RSA5) align with neighboring houses along the front face.

For more information about tiny house laws in Philadelphia, please visit the American Tiny House Association.

Parking Laws

The Philadelphia Parking Authority uses three levels of enforcement for parking regulations: issuing parking tickets to vehicles that violate regulations; applying the boot to vehicles that accumulate unpaid tickets; and, in certain cases, towing and impounding vehicles until outstanding fines and fees are paid.

To request parking enforcement at a location overseen by the Philadelphia Parking Authority patrols, please contact the communications line at 215-683-9775.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Philadelphia Car Insurance FAQs

Before you start comparing car insurance rates on your own, check out this last section on Philadelphia car insurance FAQs.

What questions do you still need answered?

What is the cost of living in Philadelphia?

According to a study by Sperling’s Best Places, the cost of living in Philadelphia is just slightly above the national average. The median home price in the city is $153,400.

What car insurance is required in Philadelphia?

According to Nolo, Pennsylvania is one of a dozen or so states that follow some form of a “no-fault” car insurance system. Under no-fault, after a car accident, your own car insurance coverage (specifically, your “personal injury protection” or “medical benefits” coverage) pays for medical treatment and other out-of-pocket losses.

To drive a motor vehicle in Pennsylvania, vehicle owners must carry certain minimum amounts of insurance on it:

- $5,000 in “medical benefits” coverage, which pays your medical bills (or the medical bills of anyone else who is covered under the terms of your policy) after an accident, regardless of who was at fault

- $15,000 for bodily injury liability per injured person (when you cause an accident)

- $30,000 total bodily injury liability per accident (when you’re at fault), and

- $5,000 per occurrence of property damage protection (when you’re at fault)

Pennsylvania also recognizes certain all-purpose car insurance policies as long as there is a minimum of $35,000 in total coverage.

What do I do if I get into an accident in Philadelphia?

Nolo also says Pennsylvania is one of a few states that follow some version of a “choice” no-fault car insurance scheme.

If no-fault coverage is chosen, injured drivers and passengers must typically turn first to their own personal-injury-protection car insurance coverage to get compensation for medical bills, lost income, and other out-of-pocket losses after a crash, regardless of who might have been at fault.

If the other driver was entirely at fault for your car accident, the result is usually predictable: the other driver (through their insurance carrier) will compensate you for medical bills, lost wages, and other losses you suffered.

Is Philadelphia, Pennsylvania, a good place to live?

Destination Scanner says Philadelphia provides a one-of-a-kind setting for an eclectic blend of different contemporary lifestyles. It is a worthwhile option because of the culinary hotspots, rich history, and affordable housing.

Located close to New York, Philly also has a well-established culture and friendly vibe. It has a great downtown scene, cool restaurants, and waterfront areas.

How are the schools in Philadelphia?

Destination Scanner also notes that Philadelphia has more than 200 elementary, middle, and high schools. There are almost 900 private schools; 59 of the city’s high schools have received recognition from the U.S. News Best High School rankings.

There are also 42 higher education institutions; seven of them have earned spots on the U.S. News Best College rankings.

Well, that’s all for now folks. Now that you’re an expert on all things concerning car insurance in Philadelphia, it’s time to start shopping for your own car insurance policy.

All you have to do is use our free tool by entering your ZIP code in the box below to get started.

Happy shopping!