Best Warren, MI Auto Insurance in 2026 (Compare the Top 10 Companies)

The top providers of the best Warren, MI auto insurance are State Farm, Progressive, and Allstate. They offer rates from $96 per month for Michigan’s 50/100/10 coverage. State Farm offers up to 30% off with Drive Safe & Save. Progressive’s tool adjusts plans, and Allstate cuts $100 from deductibles in year one.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: May 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Warren MI

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage in Warren MI

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage in Warren MI

A.M. Best Rating

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsState Farm, Progressive, and Allstate have the best Warren, MI auto insurance, each with specific savings and perks for MI drivers.

State Farm offers an average of $134 in bundling discounts and a low 0.67 complaint index, showing strong customer satisfaction. Learn how bundling cuts cheap auto insurance rates in Warren.

Our Top 10 Company Picks: Best Warren, MI Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | A++ | Local Agents | State Farm | |

| #2 | 10% | A+ | Budgeting Tools | Progressive | |

| #3 | 25% | A+ | Multi-Policy Discounts | Allstate | |

| #4 | 20% | A | Customizable Policies | Farmers | |

| #5 | 25% | A | Telematics-Based Discounts | Liberty Mutual |

| #6 | 20% | A+ | Customer Service | Nationwide |

| #7 | 5% | A+ | AARP Members | The Hartford |

| #8 | 25% | A++ | Competitive Rates | Geico | |

| #9 | 25% | A | Family-Focused Discounts | American Family | |

| #10 | 13% | A++ | Bundling Discount | Travelers |

Progressive stands out by offering safe drivers up to 30% off through its Snapshot program, which tracks driving habits. Allstate offers an average of $112 in savings through personalized multi-policy bundles designed for Warren households.

- State Farm offers $250 rates and $134 off with bundling deals

- PIP and PPI are required for all Warren, MI auto insurance plans

- Save up to 30% with telematics and multi-policy discount options

Enter your ZIP code into our free comparison tool to find cheap car insurance in Michigan, compare top providers, uncover discounts, and more.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Discount Value: State Farm provides Warren, MI drivers with up to a $134 savings through its 17% bundling discount.

- Drive Safe & Save Program: Eligible Warren, MI, residents can cut premiums by up to 30% using this telematics-based tool.

- A++ Financial Strength: State Farm’s A.M. Best rating of A++ ensures stability for Warren, MI, policyholders. Please read our article entitled “State Farm Auto Insurance Review.”

Cons

- Limited Custom Add-Ons: Warren, MI drivers may find fewer policy customization options compared to competitors.

- Price Spikes After Claims: A single claim in Warren, MI, can lead to a sharper-than-average premium increase.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Budgeting Tools

Pros

- Snapshot Savings: Progressive offers Warren, MI drivers up to 30% off via Snapshot, plus a flat $231/year telematics reward.

- Name Your Price Tool: This unique feature helps Warren, MI drivers match coverage to budget, down to the dollar. Learn more by reading the Progressive auto insurance review.

- 30% Good Driver Discount: Safe motorists in Warren, MI, benefit from aggressive discounts not easily matched elsewhere.

Cons

- Low Bundling Incentive: At just 10%, the bundling discount available to Warren, MI, residents is one of the lowest.

- High UBI Enrollment Risk: In Warren, MI, poor driving habits tracked through Snapshot may raise premiums.

#3 – Allstate: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discount: Warren, MI drivers bundling home and auto can save up to $112 on their monthly premiums. Click “Allstate Auto Insurance Review” and discover more smart tools.

- Deductible Rewards: Warren, MI residents earn $100 off their collision deductible in year one, plus $100/year for safe driving.

- 25% Good Driver Savings: Clean driving records in Warren, MI, are rewarded with substantial premium reductions.

Cons

- Strict Qualification Criteria: Not all Warren, MI drivers may meet Allstate’s thresholds for discounts.

- Higher Base Rates: Without discounts, Allstate premiums for Warren, MI drivers can be higher than average.

#4 – Farmers Insurance: Best for Customizable Policies

Pros

- 30% Good Driver Discount: Farmers offers Warren, MI, motorists one of the top safe-driving reductions across providers.

- 15% Good Student Perks: Young drivers in Warren, MI, can lower costs significantly with good academic records, as stated in the article “Farmers Auto Insurance Review.”

- Robust Custom Coverage: Farmers lets Warren, MI, residents tailor policy details, from glass repair to rental reimbursement.

Cons

- Limited Anti-Theft Reward: Warren, MI drivers only receive 10% off for anti-theft systems, below market leaders.

- Higher Rates for New Drivers: In Warren, MI, first-time drivers may see inflated starting premiums with Farmers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Telematics-Based Discount

Pros

- 35% Anti-Theft Discount: Liberty Mutual leads the Warren, MI market with deep savings for vehicles equipped with security systems.

- Consistent 25% Bundling Benefit: Warren, MI residents bundling policies get predictable, generous savings. Read more at the Liberty Mutual auto insurance review.

- Strong Telematics Reward: Up to 30% off via RightTrack rewards safe Warren, MI drivers who enroll and perform well.

Cons

- Lower Student Discount: Good student drivers in Warren, MI, receive only 15% off, falling behind top competitors.

- Moderate Complaint Index: Warren, MI, customers have reported moderate dissatisfaction in claims handling per NAIC data.

#6 – Nationwide: Best for Customer Service

Pros

- Exceptional UBI Discount: Nationwide offers Warren, MI drivers up to 40% off through SmartRide, making it the most generous usage-based program on this list.

- Top-Tier Safe Driving Incentive: Warren, MI, policyholders with clean records qualify for a 40% good driver discount—more than most rivals.

- A+ A.M. Best Rating: Nationwide’s strong financial standing ensures claim reliability for Warren, MI, residents. Discover more at “Nationwide Auto Insurance Review.”

Cons

- Minimal Anti-Theft Savings: Only 5% off for anti-theft devices may disappoint safety-conscious Warren, MI, drivers.

- Limited Customization: Warren, MI, customers may find fewer endorsement options than other major carriers.

#7 – The Hartford: Best for AARP Members

Pros

- AARP Exclusive Perks: The Hartford provides Warren, MI AARP members with tailored plans including lifetime renewability and accident forgiveness.

- Strong UBI Participation: With a 20% telematics discount, Warren, MI, seniors who drive less can benefit from significant savings.

- Excellent Customer Service Scores: The Hartford ranks well among Warren, MI, policyholders in post-claim satisfaction. Learn more by reading our article “The Hartford Auto Insurance Review.”

Cons

- Low Bundling Value: Only a 5% off for bundling makes it a weaker choice for Warren, MI, multi-policy households.

- Strict Eligibility: AARP membership is required to access full benefits in Warren, MI, limiting access for younger drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Geico: Best for Competitive Rates

Pros

- 25% Anti-Theft Savings: Geico rewards Warren, MI drivers with one of the largest discounts for vehicle security systems.

- 26% Good Driver Discount: Warren, MI, residents with clean records can access substantial premium reductions.

- Reliable UBI Option: DriveEasy offers up to 25% off for safe habits monitored in Warren, MI, via mobile tracking, according to our article “Geico Auto Insurance Review.”

Cons

- Lackluster Student Discount: Warren, MI, student drivers only receive 15%, which undercuts competitors.

- Basic Add-On Options: Coverage expansion choices for Warren, MI, drivers are more limited than with other top providers.

#9 – American Family: Best for Family-Focused Discounts

Pros

- Uniform 25% Discounts: American Family offers Warren, MI drivers a consistent 25% discount across bundling, safe driving, and anti-theft categories.

- 30% UBI Max Savings: With KnowYourDrive, Warren, MI drivers can reduce premiums substantially by tracking safe driving behaviors. Read more about mobile access at the American Family auto insurance review.

- Solid Academic Incentives: Warren, MI students can claim up to 20% in good student savings, supporting family affordability.

Cons

- A.M. Best Rating of A (Not A+): While stable, American Family’s financial strength ranks slightly below top competitors in Warren, MI.

- Smaller National Presence: Fewer local agents may reduce service access in some Warren, MI zip codes.

#10 – Travelers: Best for Bundling Discounts

Pros

- 30% UBI Incentive: Travelers’ IntelliDrive offers Warren, MI drivers large telematics rewards after 90 days of monitoring.

- Competitive Anti-Theft Discounts: All Warren, MI, customers can enjoy a 15% cut in premiums for vehicle security features.

- 13% Bundling Savings: Home and auto bundles provide moderate but meaningful value for Warren, MI, families. Discover more at “Travelers Auto Insurance Review.”

Cons

- Low Good Student Discount: Travelers offers only 8% off for eligible Warren, MI students, less than half of most rivals.

- Minimal Good Driver Reward: With just a 10% discount, long-term safe drivers in Warren, MI, may find better options elsewhere.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Monthly Auto Insurance Rates in Warren, MI

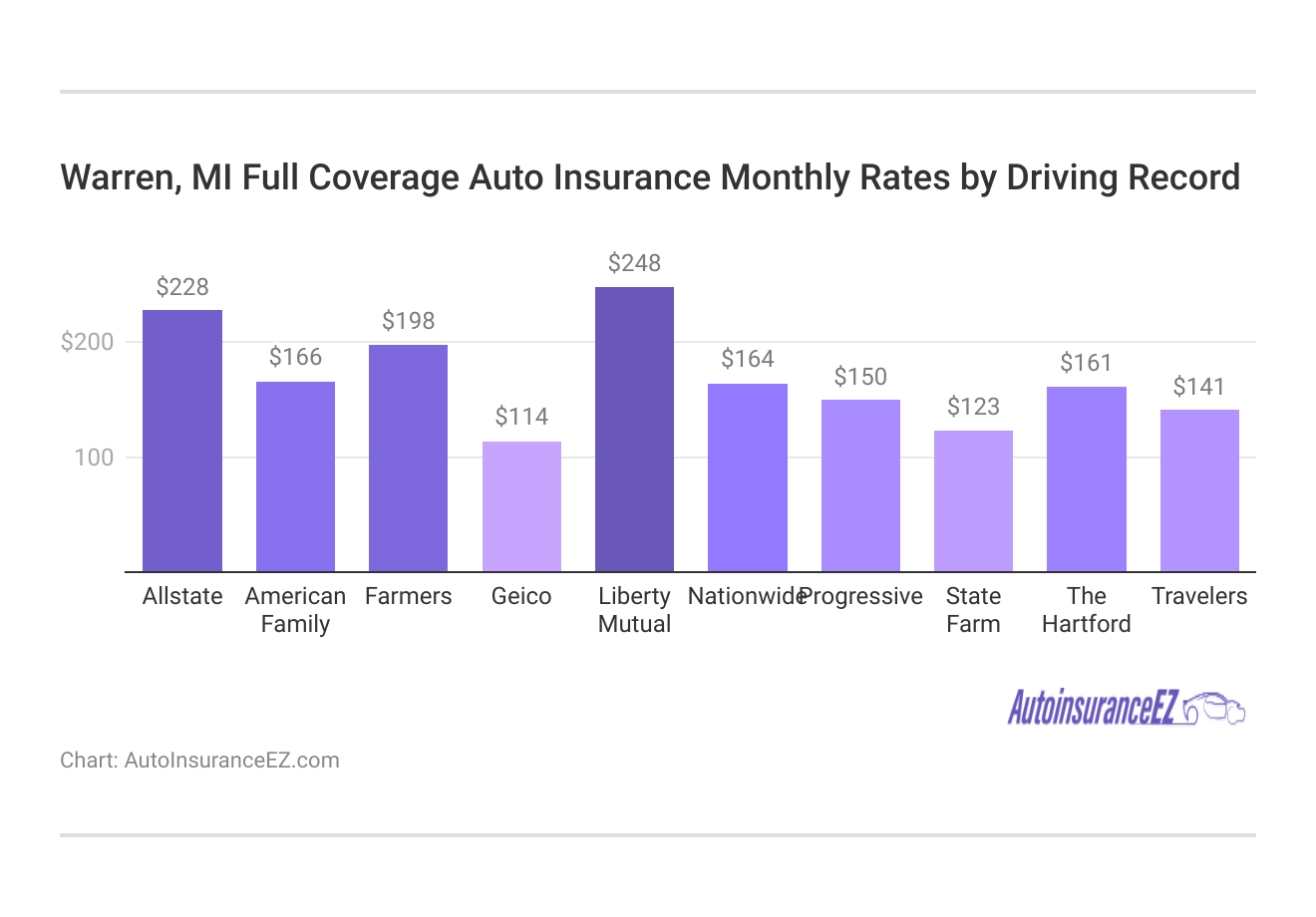

Warren drivers benefit from some of the most competitive auto insurance rates in Michigan. Top providers, such as State Farm, Progressive, and Allstate, offer full coverage options starting at around $243 to $260 per month.

Warren, MI Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $100 | $243 | |

| $104 | $251 | |

| $98 | $235 | |

| $99 | $220 | |

| $107 | $255 |

| $102 | $245 |

| $110 | $260 | |

| $105 | $250 | |

| $96 | $230 |

| $101 | $240 |

Compare providers to find the best coverage and savings for your needs, and take advantage of available discounts to get the most value from your auto insurance in Warren, MI.

In Warren, MI, even the smallest driving mistake tells insurers a lot. Things like not fully stopping at a stop sign or missing a traffic light can often move drivers out of the best pricing categories, even if it is their first time making such an error.

How much you pay for full coverage in Warren, MI, depends a lot on your driving history. If your record is clean, the rates stay low. But if you have even one ticket or accident, your premium can increase quickly.

Factors That Affect Warren, MI Auto Insurance Rates

Knowing the factors that affect your car insurance premium can help you make smarter choices and possibly save more on your Warren, MI, auto insurance. Several personal and other demographic factors impact your auto insurance premiums:

- Age: Young drivers (under 25) often pay higher premiums.

- Driving History: Accidents and tickets raise your rates.

- Credit Score: Insurers use this to determine risk.

- Gender and Marital Status: Married drivers may be eligible for lower rates.

- ZIP Code: Crime rates and population density in your area can influence costs.

- Vehicle Type: New or luxury cars usually cost more to insure.

Many important things affect the cost of auto insurance in Warren, MI. Knowing these can help a lot. Young drivers under 25 usually pay more for their premiums.

Annual mileage directly impacts auto premiums in Warren, MI. In particular, driving over 15,000 miles a year may increase your rate by up to 12%.

Chris Abrams Licensed Insurance Agent

However, people who have clean driving records and high credit scores often get lower rates. Insurers also consider ZIP code information, accident background, and car value to set policy prices.

Auto Insurance Coverage Options in Warren, MI

In Michigan, they have a no-fault system. This means that your insurance pays for your injuries no matter who caused the accident. Key coverage types include:

- Personal Injury Protection (PIP): Required in MI, covers medical expenses.

- Property Protection Insurance (PPI): Required, covers damage to others’ property.

- Residual Liability Insurance: Covers bodily injury and property damage in limited cases.

- Collision: Covers damage to your vehicle after an accident.

- Comprehensive: Covers non-collision-related damage (e.g., theft, fire, vandalism).

- Uninsured/Underinsured Motorist: Optional but recommended.

With the right combination of required and optional coverage, Warren drivers can stay protected on the road without overpaying.

Taking time to compare policies and consider bundling car insurance with home or renters coverage ensures you’re getting the best value for your budget and driving needs.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Discounts in Warren, MI

Warren drivers can cut their auto insurance bills by stacking discounts that reward specific behaviors. Providers like Nationwide give up to 40% off for safe driving, while Liberty Mutual offers 35% just for having anti-theft features installed.

Auto Insurance Discounts From the Top Providers in Warren, MI

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

| 25% | 25% | 25% | 20% | 30% | |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 5% | 20% | 40% | 15% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 5% | 5% | 15% | 12% | 20% |

| 15% | 13% | 10% | 8% | 30% |

Progressive stands apart with a flat $231 annual savings through its usage-based program. Insurers most often offer bundling and loyalty discounts to reduce premiums. For example:

- State Farm offers a 17% bundling discount for combining auto and home insurance.

- Allstate is known for its multi-policy discounts, which are particularly beneficial for residents of Warren.

- Liberty Mutual and Progressive provide telematics and safe driving incentives.

These auto insurance discounts can significantly lower your monthly premium, helping Warren drivers secure high-quality coverage at a more affordable price.

How to Look for the Best Warren, MI Auto Insurance

Warren, MI, drivers have access to some of the most affordable auto insurance options in the state. Top providers like State Farm, Progressive, and Allstate offer full coverage rates starting around $243–$260 per month.

With State Farm’s 17% bundling discount, Progressive’s telematics-based savings, and Allstate’s tailored multi-policy deals, residents can lower their monthly premiums by stacking discounts and selecting the right coverage level.

Essential coverage types in Michigan, such as personal injury protection (PIP) and property protection insurance (PPI), are required by law. Additional options, such as comprehensive and collision coverage, provide extra protection.

When buying auto insurance in Warren, MI, remember it’s a no-fault state. Your policy covers your injuries no matter who caused the accident.

Kristen Gryglik Licensed Insurance Agent

Keep in mind that rates are influenced by personal factors, such as age, driving history, credit score, and even your ZIP code. Whether you’re looking for cheap car insurance in Warren, MI, or comparing rates across the state, understanding your coverage needs and available discounts is key to finding the best policy. Get cheap car insurance in Warren, Michigan, by entering your ZIP code in our free comparison tool.

Frequently Asked Questions

What is the average cost of auto insurance in Warren, MI?

The average full coverage policy under the best Warren, MI auto insurance providers ranges from $243 to $260 per month, placing it among the most affordable car insurance in Michigan.

Who are the best auto insurance providers in Warren, MI?

The best Warren, MI auto insurance companies include State Farm, Progressive, and Allstate, which are recognized as the leading cheap auto insurance companies in Michigan. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

How can I get the cheapest auto insurance in Warren, MI?

To get the cheapest car insurance in Michigan, drivers should explore quotes from the best Warren, MI, auto insurance companies and maximize discounts. They should also understand what automobile liability coverage includes for Michigan drivers.

What discounts are available to Warren drivers?

From bundling to safe driving programs, the best Warren, MI auto insurance providers offer multiple ways to lower rates and secure cheap full coverage car insurance near me.

What coverage is required by law in Michigan?

Michigan law requires PIP and PPI coverage, which even the best Warren, MI auto insurance plans must include. This is important to remember when seeking the cheapest car insurance in Michigan.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Is State Farm a good choice for Warren residents?

State Farm is a top pick for the best Warren, MI auto insurance. It offers low rates and bundle savings for those seeking the most affordable car insurance in Michigan. Explore the benefits of the auto insurance EZ scholarship program for Warren residents.

Do telematics programs help lower rates in Warren?

Yes, many of the best Warren, MI auto insurance companies use telematics to reward safe drivers and help you find low-cost car insurance in Michigan.

How does the car I drive impact my rate?

Driving one of the cheapest cars to insure in Michigan can significantly lower your premium, especially when bundled with the best Warren, MI auto insurance plan.

Can high-risk drivers find affordable coverage in Warren?

Even high-risk drivers can access affordable auto insurance, alternatives in Flint, MI, and the best Warren, MI auto insurance by shopping smart and comparing quotes.

How do I compare auto insurance quotes for Warren?

Use a comparison tool to evaluate the best Warren, MI, auto insurance options and lock in the cheapest car insurance rate in Michigan that fits your profile. Discover if you need extra auto insurance coverage for rental cars.

Who has the cheapest car insurance in Michigan?

You can find the cheapest car insurance in Michigan from companies like Geico and Progressive, with minimum coverage starting at $42 per month.

What is the best cheap car insurance in Sterling Heights, MI?

State Farm offers the best cheap car insurance in Sterling Heights, MI. Its liability plans start at $48 per month and offer safe driver discounts. To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool to instantly compare the cheapest car insurance companies in Michigan.

How can you get low-cost car insurance in Michigan?

To get low-cost car insurance in Michigan, compare quotes from top providers, choose higher deductibles, and look for usage-based programs to cut monthly costs.

Where can you find cheap auto insurance in Flint, MI?

You can find cheap car insurance in Flint, MI, starting at $46 per month from providers like Progressive, especially if you qualify for good driver or multi-policy discounts. Learn which insurers offer the biggest multi-car discount in Michigan.