Best Government-Mandated Auto Insurance Discounts for Seniors in 2025 (Save up to 35% With These Companies)

Geico, Progressive, and Nationwide offer the best government-mandated auto insurance discounts for seniors, with savings up to 35%. To qualify, senior drivers must successfully complete an approved driver safety course and show proof of completion to their auto insurance company.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

If you are a senior citizen, you have the option to save money through the best government-mandated auto insurance discounts for seniors by participating in an approved driving course.

Depending on where you live, you may be able to take advantage of a senior driver discount in order to save money on your monthly car insurance rates. You can always check with your current car insurance company as well to see if they offer any additional discount options for you based on your age.

Our Top 10 Company Picks: Best Government-Mandated Auto Insurance Discount for Seniors

It is a good idea to compare car insurance rates at least once a year to see how much you could potentially save on your car insurance policy. You can use online quote tools to compare multiple companies at once and see which companies offer the best coverage at the most affordable rates.

In fact, you can use our free quote tool to find and compare car insurance rates from top companies in your area today.

- Several states offer seniors discounts for completing driver safety courses

- Government-mandated auto insurance discounts for seniors can help you save

- Always ask your current provider if there’s any way to lower your rates

How to Get a Senior Government-Mandated Discount

Senior drivers must take and pass a safety driving course to qualify for a government-mandated discount, which can result in significant savings on their car insurance rates. These courses are designed to help seniors drive safely and effectively on the road.

If you live in one of the states listed below, you may have the opportunity to receive car insurance discounts after taking a specific driving safety course.

Government-mandated discount states are Alabama, Alaska, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Montana, Nevada, New Jersey, New Mexico, New York, North Dakota, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Virginia, Washington, West Virginia, and Wyoming.

Read more: Government Auto Insurance

You may be able to stay with your current car insurance company and still get a great discount and deal on car insurance rates by taking a safety driving course for seniors, especially since these discounts can help you save anywhere from 10% to 35% on your policy. You can call your company to speak with a representative to ask more about this option.

Even if you do not live in a state that offers government-mandated insurance discounts for seniors, you may find that a safety driving course lowers your rates because your car insurance company offers individual discounts for safe driving.

Dani Best Licensed Insurance Producer

Many senior citizens wonder, “Why did no one tell drivers born between 1936 and 1966 about this new rule?” And the truth is, no one knows. With the potential to save money on car insurance simply for taking a course, these government-mandated discounts should be more popular than they are.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Companies With the Best Senior Government-Mandated Auto Insurance Discounts

Often, even with discounts, car insurance can be expensive. For elderly drivers especially, car insurance rates are likely to increase with age due to age-related driving issues.

So, you may want to know whether there are certain car insurance companies that cater to seniors and offer affordable senior coverage.

While it may be difficult to find car insurance discounts or extremely low rates for someone in their 80s and 90s as they may need high-risk insurance, plenty of senior drivers have favorites when it comes to auto insurance companies that incentivize their policies. Some of the most popular car insurance companies for senior drivers that have great senior discounts include:

Monthly Auto Insurance Rates After Senior Discount

| Insurance Company | Regular Monthly Rate | Senior Discount Applied | Monthly Rate After Discount |

|---|---|---|---|

| $145 | 20% | $116 | |

| $128 | 10% | $115 | |

| $130 | 15% | $111 | |

| $120 | 35% | $78 | |

| $140 | 23% | $108 |

| $130 | 28% | $94 |

| $125 | 30% | $88 | |

| $135 | 25% | $101 | |

| $150 | 18% | $123 |

| $125 | 12% | $110 |

All of the companies listed above offer different reasons for senior drivers to choose them as their insurance carrier. For example, Geico offers very low rates for liability coverage for seniors. Learn more about the company in our Geico auto insurance review.

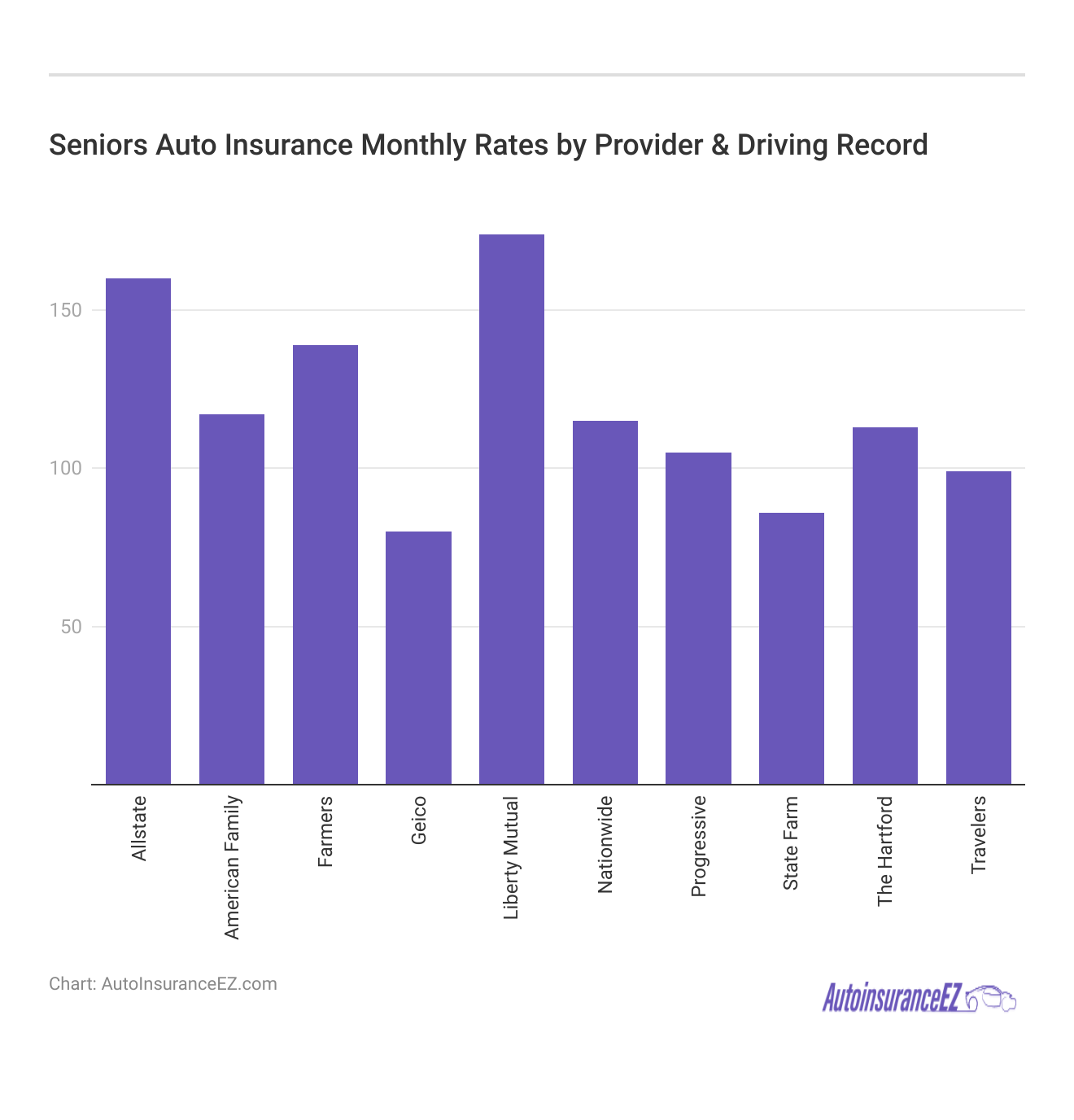

Average Cost of Senior Auto Insurance

You will never know how much you will actually pay for auto insurance until you get a quote from different companies. The table below shows the average monthly car insurance rates for seniors based on age.

As you can see, a senior’s driving record has more potential to make an impact on car insurance rates than that person’s gender or age (Read More: Cheap Auto Insurance for a Bad Driving Record).

This is why it’s very important to shop around for car insurance coverage in order to find the very best deal possible. Otherwise, you run the risk of overpaying for coverage.

It is best if you shop around for car insurance policies from other companies at least once a year. This will help you get specific rates based on your unique situation and give you a better idea of what you’d be paying with a different company.

Getting the Cheapest Senior Auto Insurance Possible

How can seniors get the cheapest auto insurance possible? If you are a senior citizen, taking a driving course and applying for the government-mandated discount will make sure you get cheap auto insurance for seniors in your state.

Seniors should speak to a representative from their car insurance company to see if they are eligible for other car insurance discounts, such as paid-in-full or multi-policy. These discounts could add up to significant savings for seniors.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Be sure to shop around using a quote tool that compares multiple senior auto companies at once to help you save time. You can use our free quote tool today to start your search for cheap senior auto insurance.

Frequently Asked Questions

How can I get government-mandated senior citizen auto insurance discounts?

You will need to take a government-approved driver safety class to qualify for senior car insurance discounts.

What is the cheapest car insurance for senior citizens?

A minimum liability policy is the cheapest car insurance for seniors, but full coverage is the best for senior drivers.

What is the best auto insurance for seniors?

The best senior auto insurance is a full coverage policy, as it includes comprehensive and collision coverage.

How much is a senior discount?

A government-mandated auto insurance discount for seniors can save drivers up to 35% on their policy.

What insurance companies offer senior discounts?

Most insurance companies, such as Geico, Progressive, and Nationwide, offer car insurance discounts for seniors over 65.

Is car insurance higher for seniors?

Due to their driving experience, senior car insurance rates are usually lower than those of adult and teenage drivers, but rates will slightly hike again as seniors reach their 70s and 80s, as age is one of the many factors that affect your car insurance premium.

At what age does car insurance go up for seniors?

Generally, auto insurance companies start charging slightly more at age 70 and up. Auto insurance for seniors over 80 will be the most expensive senior age to purchase insurance, but rates are generally still affordable, especially if seniors apply for discounts.

Do seniors get a discount on auto insurance?

Yes, you can get a discount on seniors’ car insurance by taking a defensive driving course. Other discounts, such as a bundling discount or a good driver discount, can also be applied to senior citizen auto insurance.

Where can I get senior car insurance quotes?

You can get quotes directly from companies or compare auto insurance companies using a quote comparison tool. Enter your ZIP code in our free quote finder to find the cheapest auto insurance for seniors in your area.

Can seniors get free car insurance?

There is no free auto insurance for seniors, but you can find cheap car insurance for senior citizens by shopping around.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.