Best Wichita, KS Auto Insurance in 2026 (Find the Top 10 Companies Here)

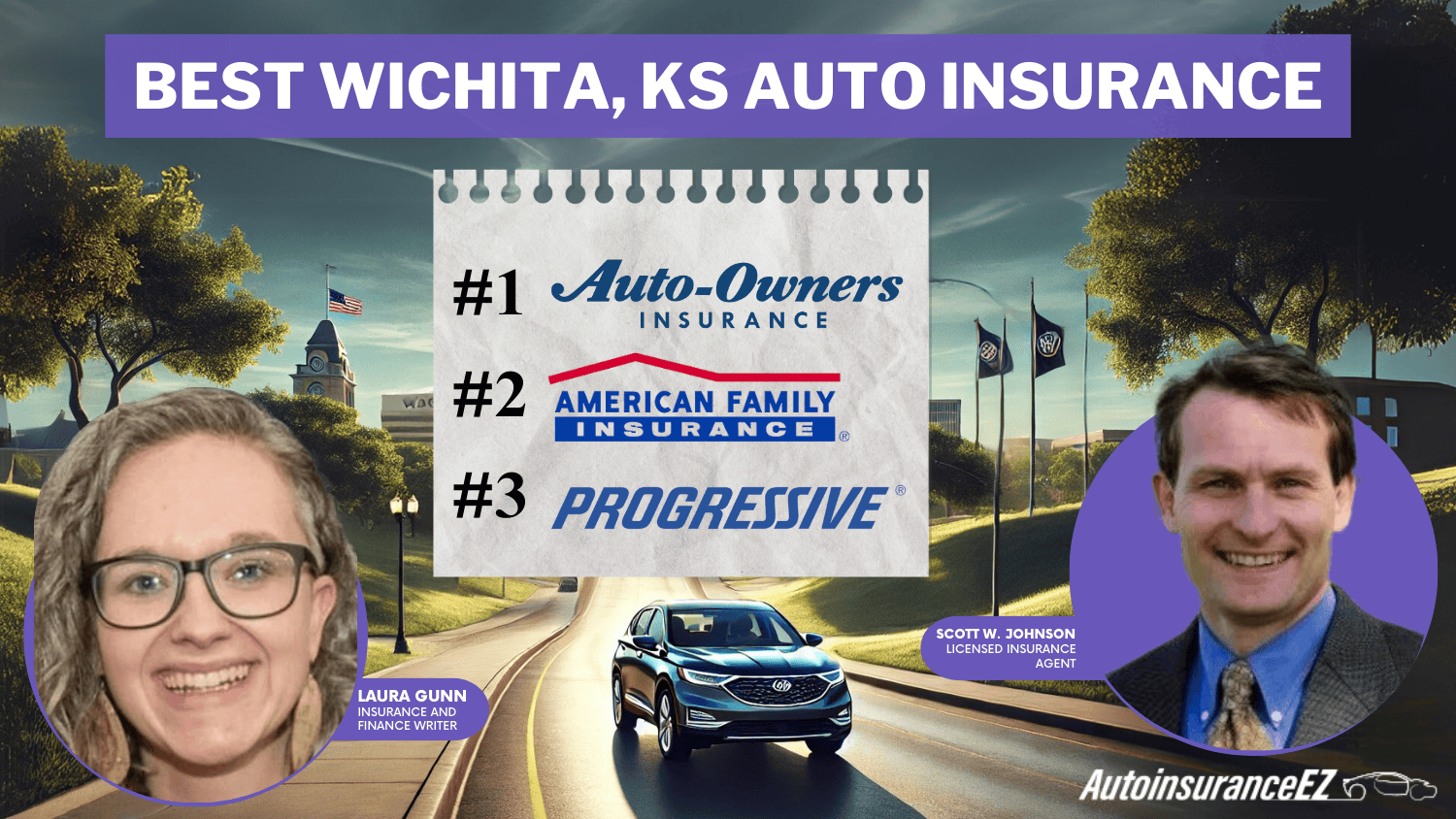

The best Wichita, KS, auto insurance companies are Auto-Owners, American Family, and Progressive. Monthly car insurance rates in Wichita, KS, start at $42. Auto-Owners offers excellent claims service. American Family has solid bundling discounts, and Progressive is known for its customizable coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Updated April 2025

563 reviews

563 reviewsCompany Facts

Full Coverage in Wichita KS

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Wichita KS

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage in Wichita KS

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsAuto-Owners, American Family, and Progressive offer the best Wichita, KS auto insurance, with rates starting at $42 per month, and Auto-Owners is ranked as the top pick overall.

It leads with strong customer service and reliable auto insurance coverage options. American Family provides valuable bundling discounts, while Progressive delivers flexible, affordable plans.

Our Top 10 Company Picks: Best Wichita, KS Auto Insurance

| Company | Rank | A.M. Best | Monthly Rates | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | $115 | Affordable Rates | Auto-Owners | |

| #2 | A | $120 | Comprehensive Coverage | American Family | |

| #3 | A+ | $130 | Competitive Rates | Progressive | |

| #4 | B | $118 | Local Presence | State Farm | |

| #5 | A++ | $125 | Online Claims | Geico | |

| #6 | A | $135 | Customizable Coverage | Liberty Mutual |

| #7 | A | $128 | Affordable Liability | Safeco | |

| #8 | A | $123 | Personal Service | Farmers | |

| #9 | A | $140 | High-Risk Drivers | The General | |

| #10 | A- | $132 | Non-Standard Coverage | Bristol West |

These companies offer the best balance of cost, coverage, and customer satisfaction, making them ideal choices for Wichita drivers looking for both value and dependable protection.

- Auto-Owners is the top pick for excellent service and reliable coverage

- Best Wichita, KS auto insurance meets local needs with trusted, flexible options

- Drivers can get top-rated coverage starting at just $42 a month

Paying more than you should for auto insurance? Just enter your ZIP code to compare top-rated providers in Wichita and see if a better deal is available for you.

#1 – Auto-Owners: Top Overall Pick

Pros

- Affordable Coverage: With premiums starting at as low as $42 a month, Auto-Owners insurance provides one of the better value options for low-cost car insurance in Wichita, Kansas.

- Dependable Service: With a reputation for top-notch customer support, Auto-Owners makes sure Wichita drivers have a seamless time with claims and coverage assistance.

- Variety of Options: With wide policy choices, Auto-Owners is a great option for people seeking individualized coverage. Learn more in our Auto-Owners auto insurance review.

Cons

- Limited Availability: Although affordable, Auto-Owners may not be available everywhere in Wichita.

- Lack of Digital Tools: The insurer’s online tools are less developed compared to others, which might be inconvenient for tech-savvy drivers.

#2 – American Family: Best for Comprehensive Coverage

Pros

- Comprehensive Protection: American Family specializes in high level of content, giving top notch protection for Wichita individuals.

- High Satisfaction: An insurer with a reputation for excellent customer service, American Family offers Wichita drivers a high level of support when picking coverage.

- Bundling Discounts: Wichita homeowners can save money by bundling home and auto policies. For more, read our American Family auto insurance review.

Cons

- Higher Premiums for Low Credit: Premiums can be less affordable for drivers with low credit scores in Wichita.

- Limited Online Resources: American Family’s online tools fall short compared to digital-first providers, which could be a downside for online users.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive features some of the lowest rates compared to insurance carriers in Wichita, while offering customized coverage for all types of needs and budgets.

- Customizable Coverage: Progressive provides many ways to tailor policies around the specific needs of Wichita drivers, making it a great option for personalized protection.

- User-Friendly Technology: Progressive equips Wichita customers with user-friendly digital tools to help you manage your policy and file claims. To learn more Progressive auto insurance review.

Cons

- Potential for Premium Increases: Progressive may increase premiums more significantly than other insurers after an accident, which could impact long-term affordability.

- Mixed Claims Experience: Some drivers report issues with claims processing, which could be a disadvantage for Wichita residents.

#4 – State Farm: Best for Local Presence

Pros

- Strong Local Support: State Farm features a far-reaching network of agents that can offer personalized help to Wichita drivers when they need assistance in person.

- Discounts for Safe Driving: State Farm values safe drivers, making it an affordable choice for Wichita drivers with clean records.

- Wide Range of Coverage: The flexible insurance plan offered by State Farm makes it an exceptional choice for Wichita drivers. Read more our review of State Farm auto insurance.

Cons

- Limited Digital Resources: State Farm’s online tools aren’t as advanced as some other insurers, which might be inconvenient for Wichita drivers preferring digital service.

- Young Drivers pay More on Average: Young drivers in Wichita might pay rates that are higher than older motorists.

#5 – Geico: Best for Online Claims

Pros

- Affordable for Clean Drivers: Geico has one of the cheapest premiums for drivers with clean driving records, which makes it one of the best options for people in Wichita.

- 24/7 Availability: Geico’s round-the-clock service ensures Wichita drivers can get assistance anytime. For more information, browse our Geico auto insurance review.

- Convenient Online Tools: Geico boasts a robust online presence, allowing Wichita drivers to manage their policies and file claims with ease

Cons

- Absence of In-Person Support: Geico functions without a network of agents, which could be detrimental to people in Wichita who prefer to meet in person.

- Limited Discount Opportunities: For Wichita drivers, Geico’s fewer discounts may result in lost savings.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

- Flexible Coverage: Liberty Mutual has flexible coverage options to help you customize the right protection for your needs.

- Great Digital Tools: Liberty Mutual’s app and website are easy to use for Wichita drivers and policyholders. To find out more, check out our Liberty Mutual auto insurance review.

- Eco-Friendly Discounts: With discounts available for electric or hybrid vehicles, Liberty Mutual appeals to those Wichitans who want to save money and treat Mother Earth kindly.

Cons

- Limited Local Agents: Liberty Mutual has fewer in-person agents in Wichita compared to other insurers, which could be inconvenient for those who prefer face-to-face service.

- Claims Process Delays: Some Wichita drivers report longer claims processing times, which could be frustrating in urgent situations.

#7 – Safeco: Best for Affordable Liability

Pros

- Affordable Liability Coverage: If you only need liability coverage, Safeco provides some of the cheapest rates on the market — a great option for Wichita drivers on a budget.

- Great for Drivers with History: Safeco offers strong rates no matter your driving history, so it’s a great option for Wichita drivers who have had an accident or two in the past.

- Payment Flexibility: To help Wichita drivers manage insurance costs, Safeco offers flexible payment plans. See our Safeco auto insurance review for details.

Cons

- Limited Availability: Safeco coverage and insurance products may not provide coverage or be offered in every area of Wichita or Kansas, leading to limited availability.

- Service Issues: Some drivers report slow customer service, which could be frustrating for Wichita residents seeking fast support.

#8 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers offers personalized customer service, making it a great fit for Wichita drivers who want more one-on-one guidance.

- Comprehensive Coverage: Offers flexible protection to ensure Wichita residents receive the coverage they need. For more information, see our Farmers auto insurance review.

- Multi-Policy Discounts: Drivers who bundle home and auto insurance can save with Farmers, which is great for Wichita homeowners.

Cons

- Fewer Discounts Available: Compared to some other insurers, Farmers offers fewer discount opportunities, which might limit potential savings for Wichita residents.

- Value Comes at a Price: While service and coverage are solid, Farmers tends to cost more than some other providers.

#9 – The General: Best for High-Risk Drivers

Pros

- Ideal for High-Risk Drivers: The General focuses on high-risk auto insurance, making it an excellent choice if you don’t have an unimpeachable driving record in Wichita.

- Easy Online Quotes: Wichita drivers can use the General’s quick quote process to begin the search for auto insurance. To find out more, The General auto insurance review.

- Flexible Payment Options: The General also provides Wichita drivers with more than one payment plan, so you can select what payment plan is best for you.

Cons

- Claims Processing Speed: Some Wichita drivers have experienced slower claims handling, causing potential delays in repairs and payouts.

- Limited Discounts: Offers fewer discount options compared to other insurers, which may affect Wichita drivers.

#10 – Bristol West: Best for Non-Standard Coverage

Pros

- Specialized Non-Standard Coverage: Bristol West specializes in non-standard coverage, which makes it a good fit for Wichita drivers with unique needs.

- Low Initial Premiums: Premiums start affordably, making it a great option for drivers in Wichita looking for a cost-effective start.

- Multiple Policy Options: Provides a range of policy options for Wichita drivers, which can help drivers find cheap auto insurance in Kansas.

Cons

- Higher Renewal Rates: After the initial term, Bristol West’s renewal rates tend to rise, which could affect long-term affordability for Wichita drivers.

- Customer Service Delays: Some Wichita drivers report slow service, which could be a drawback when filing claims or seeking support.

Wichita Auto Insurance Rates and Risks

Shopping for car insurance in Wichita means balancing the sticker price in each quote against the local risk factors that drive those numbers. The two tables below lay out both sides of that equation: one ranks monthly premiums by company and coverage level, while the other grades the city’s underlying risk profile.

The first table shows that State Farm and Auto‑Owners lead on affordability, dipping to $42–$44 for minimum liability and staying under $120 for full coverage, whereas The General and Liberty Mutual climb into the $135–$140 range.

Those spreads reflect how each carrier weighs Wichita‑specific exposures—whether steep hail‑repair costs or higher theft claims—when calculating premiums.

Wichita, KS Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $120 | |

| $44 | $115 | |

| $52 | $132 | |

| $46 | $123 | |

| $45 | $125 | |

| $50 | $135 |

| $49 | $130 | |

| $48 | $128 | |

| $42 | $118 | |

| $51 | $140 |

The report‑card table explains why those exposures matter. Kansas’s A grade for uninsured motorists suppresses prices, but three B grades—for weather, traffic congestion, and rising claim sizes—add steady upward pressure.

A C in vehicle theft nudges comprehensive rates even higher, which is why full‑coverage quotes diverge more sharply than minimum‑liability ones.

Wichita, KS Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Drivers Rate | A | Kansas has a low 7.2% uninsured rate, helping lower premiums. |

| Weather-Related Risk | B | Hail and icy weather raise accident and claim risks. |

| Traffic Density | B | Heavy traffic increases accident chances and rates. |

| Average Claim Size | B | High claim amounts raise insurance costs. |

| Vehicle Theft Rate | C | Above-average theft rate pushes premiums higher. |

Taken together, the tables make a simple point: Wichita drivers can still snag sub‑$120 full‑coverage policies, but only if they choose carriers that price conservatively against hail, congestion, and theft risks. How does an insurance company determine my premium? Look right back at those same factors.

Compare at least three companies from the low end of the premium list, adjust deductibles to match your hail‑damage tolerance, and you’ll keep those risk‑based surcharges from overrunning the savings.

Wichita Auto Insurance Savings

Shopping for car insurance in Wichita isn’t just about picking the lowest base premium—it’s about stacking the right discounts to blunt the city’s accident, theft, and weather‑driven risks.

Check what the top carriers will shave off your bill, Liberty Mutual’s 35 % anti‑theft break, American Family’s 25 % across four categories, and the 30 % telematics cuts from Auto‑Owners, Farmers, and State Farm show how aggressively insurers reward defensive‑driving tech, bundles, and mileage‑tracking apps.

Combine even two of those levers and you can often wipe out the surcharge that full coverage usually carries.

Auto Insurance Discounts From the Top Providers in Wichita, KS

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 25% | 25% | 25% | 20% | 30% | |

| 16% | 16% | 25% | 30% | 30% | |

| 10% | 10% | 20% | 10% | 20% | |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 15% | 10% | 10% | 30% | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 18% | 15% | 20% | 10% |

Those savings matter because Wichita logged more than 10,000 crashes and 2,063 vehicle thefts in 2023, with average claims running $6.5 k for property damage and $26.5 k for injuries.

Toss in icy‑road pile‑ups and dense traffic on Kellogg and I‑135, and carriers have every reason to price high—unless you counter with the best‑fit discounts from the table above.

Wichita, KS Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | Over 10,000 crashes reported in 2023. |

| Claims Per Year | 2,418 auto insurance claims filed annually in Wichita. |

| Average Claim Cost | Approximately $6,551 for property damage and $26,501 for bodily injury. |

| Percentage of Uninsured Drivers | 8% of drivers in Kansas are uninsured. |

| Vehicle Theft Rate | 2,063 motor vehicle thefts in 2023; rate of 521.9 per 100,000 residents. |

| Traffic Density | High traffic volumes at major intersections; detailed counts available via Wichita's traffic data portal. |

| Weather-Related Incidents | Icy conditions in early 2024 led to numerous accidents across Wichita. |

Match the risk profile in the second table to the discounts in the first—including any switching‑provider discount—and you’ll insulate your wallet against Wichita’s heavy accident count and theft rate while still securing the robust coverage you need.

Wichita, KS Auto Insurance Coverage Options

Before buying Wichita, KS automobile insurance, it’s important to comprehend your coverage choices. Typical options are liability, collision, comprehensive, uninsured (UM) or under-insured motorist, and/or personal injury protection (PIP). Each offers its own level of protection against risks typical in Wichita, including hailstorms, collisions, and uninsured drivers.

Carefully assess your car’s value and the city’s local risks to select coverage that protects you fully without unnecessary costs. Additionally, consider opportunities to save, such as a forward collision warning discount, which provides a discount for vehicles fitted with advanced safety features.

Minimum Auto Insurance Requirements in Maryland

In Maryland, drivers must meet minimum insurance requirements to stay legal on the road. This coverage provides $30,000 for bodily injury per person, $60,000 per accident, and $15,000 for property damage. Additionally, uninsured motorist coverage and personal injury protection (PIP) are mandatory.

Although these limits meet legal requirements, many experts suggest opting for higher coverage amounts to secure more comprehensive financial protection.

Read more: Auto Insurance Basics: Property Damage Liability

Key Considerations for Affordable Car Insurance in Wichita, KS

There are many factors that affect your rate quotes, some of which you can control. For instance, adjusting your comprehensive and collision coverage can help tailor your policy and possibly lower your premiums.

Here are some elements which can affect your car insurance premium:

Your ZIP Code

Where you park your car each night will have a major impact on your auto insurance rate.

Wichita, KS Auto Insurance by ZIP Code

| ZIP | Rates |

|---|---|

| 66044 | $100 |

| 66102 | $113 |

| 66204 | $117 |

| 66441 | $92 |

| 66614 | $104 |

| 67002 | $88 |

| 67212 | $108 |

| 67401 | $98 |

| 67801 | $91 |

| 67901 | $100 |

Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of Wichita is 386,552 and the median household income is $43,538.

Automotive Accidents

Compared with the national average, Wichita’s rates of car accidents and auto claims are fairly high, as you can see in the chart below.

Fatal Accidents in Wichita, KS

| Statistic | Count |

|---|---|

| Fatal accident count | 29 |

| Vehicles involved in fatal crashes | 48 |

| Fatal crashes involving drunk persons | 8 |

| Fatalities | 33 |

| Persons involved in fatal crashes | 68 |

| Pedestrians involved in fatal accidents | 8 |

Ask your provider about safe‑driver discounts to help lower Wichita, KS auto‑insurance costs.

Auto Thefts in Wichita

Finding cheap auto insurance can be difficult if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities.

The total number of stolen vehicles in Wichita was 1,984 back in 2013. This means that auto thefts are on the rise. Protect your vehicle from theft by making sure you have Comprehensive coverage on your policy.

Your Credit Score

A consumer’s credit score can impact their monthly premiums more than they might think, and the best & worst credit scores by state data make that crystal‑clear.

As the chart shows, drivers with excellent credit often pay 50–75 % less each month than those with poor credit.

Your Age

Cheap car insurance for young drivers can be tricky to find, and there’s a reason why. Young and inexperienced drivers are more prone to crashing, statistically speaking. That’s a big part of why older drivers often pay less each month—insurance companies simply aren’t taking on as much financial risk with them.

Auto Policy Age Comparison in Wichita, KS

| Insurance Company | 34 Year Old | 17 Year Old |

|---|---|---|

| $31 | $131 | |

| $31 | $93 | |

| $30 | $108 |

| $38 | $280 |

| $31 | $112 |

If you’re a young or teen driver, you can still lower your premium by looking into good student discounts or savings for completing Driver’s Ed and defensive driving courses.

Your Driving Record

After your credit score, your driving record is the second most impactful factor when it comes to changing your monthly premiums.

Motorists with clean driving records often qualify for a safe driver discount, allowing them to pay significantly lower rates than drivers with speeding tickets, moving violations, or serious accidents on their record.

Wichita, KS Auto Insurance: Monthly Rates by Vehicle Type

| Insurance Company | Crossover | Minivan | Pickup Truck | Sedan | SUV |

|---|---|---|---|---|---|

| $88 | $90 | $95 | $85 | $92 | |

| $83 | $85 | $88 | $80 | $86 | |

| $132 | $135 | $140 | $130 | $138 | |

| $114 | $117 | $120 | $110 | $115 | |

| $98 | $100 | $105 | $95 | $100 | |

| $135 | $138 | $142 | $130 | $137 |

| $130 | $133 | $137 | $125 | $132 | |

| $128 | $130 | $135 | $120 | $125 | |

| $93 | $95 | $98 | $90 | $95 | |

| $140 | $143 | $148 | $135 | $142 |

Some Wichita, KS auto insurance companies may even refuse coverage altogether if you have major infractions like a DUI.

Your Vehicle

As this chart illustrates, covering a plain sedan versus a fancy sports car is vastly different. A significant part of that increase stems from the fact that a luxury car is going to require more than the most basic insurance coverage.

Car Insurance Rates by Make/Model

| Insurance Company | 2015 Honda Accord | 2012 Porsche Boxster Spyder |

|---|---|---|

| $31 | $73 | |

| $31 | $164 | |

| 30 | $95 |

| 38 | $162 |

| 31 | 123 |

For many insurance companies, many have their trade secrets quickly and easily available to the general public with a search on the internet, unfortunately.

How to Find Affordable Auto Insurance in Wichita, KS

While the average cost of car insurance in Kansas varies depending on personal and location factors, you can most certainly find auto insurance Wichita, KS for a reasonable price. Average cheap car insurance quotes for customers with major companies like Auto-Owners, American Family, and Progressive run around just $42 a month.

The knowledge about your ZIP code and risk profile matters whether you’re searching for affordable auto insurance or using a comparison site to look for affordable auto insurance near me.

Carefully assess your car’s value and Wichita, KS risks to secure cost-effective, comprehensive auto insurance.

Chris Abrams Licensed Insurance Agent

Some examples of key questions you may be asking yourself include will my auto insurance cover non-accident repairs? and how much insurance coverage do I need? These can help guide your decision-making process.

Be sure to apply every discount available. With the right approach, you can find affordable auto coverage at a cost you can manage. Compare quotes today and lock in the cheapest auto insurance in Wichita,

Frequently Asked Questions

What are the top-rated car insurance companies in Wichita, KS?

Some of the best-rated companies in Wichita include Auto-Owners, American Family, Progressive, State Farm, and Geico. These insurers stand out for strong financial stability (A-rated or higher), solid customer satisfaction, and a mix of affordability and coverage options.

Which insurance providers cover the most vehicles in the Wichita area?

Larger, nationally known companies with local offices — like State Farm, Geico, and Progressive — are among the most widely used by Wichita drivers due to their brand recognition and accessible services. Get fast, affordable Wichita auto insurance—start comparing now.

Who offers the best value auto insurance for drivers in Wichita?

Insurers like Auto-Owners and American Family offer a strong balance of price and coverage across the different types of car insurance, making them a top choice for value-conscious drivers.

Which car insurance company is known for being the most reliable in Wichita, Kansas?

Companies with high A.M. Best ratings (like Auto-Owners and Geico) and consistent claims service are viewed as the most reliable by drivers in the area.

Is it better to buy car insurance online or through a local Wichita agent?

Buying online offers speed and convenience, while local agents from companies like State Farm and Farmers provide personalized advice — either option works depending on your preferences.

Who usually has the most affordable car insurance rates in Wichita?

Auto-Owners offers some of the lowest average monthly premiums, with State Farm and American Family also ranking well for affordability, making them smart choices if you’re looking at how to lower your auto insurance premiums.

What type of car insurance coverage is recommended for Wichita drivers?

Full coverage (including liability, comprehensive, and collision) is ideal due to potential weather-related damage and busy traffic areas in the city.

How can I compare quotes to find the best car insurance in Wichita, KS?

Use online tools to compare rates from at least 3–5 insurers and consider speaking with a local agent for personalized recommendations.

What types of drivers tend to pay the most for auto insurance in Wichita?

High risk drivers, including those with past violations, young drivers, or poor credit typically face higher premiums. Companies like The General and Bristol West cater to these profiles.

Are there Wichita-specific discounts or programs available for auto insurance?

Yes, many insurers offer regional deals like safe driver rewards, bundling discounts, and loyalty perks, especially through local agents.

How do weather and road conditions in Wichita impact car insurance rates?

What’s the average cost of car insurance in Wichita compared to the rest of Kansas?

How does your credit score affect your car insurance rates in Wichita, KS?

Are there local insurance agents in Wichita who specialize in high-risk drivers?

What should I look for in an insurance policy if I commute daily within Wichita or to nearby cities?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.