Best New York, NY Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

The best New York, NY, auto insurance companies are Geico, State Farm, and Progressive, with rates starting as low as $125 a month. Geico is known for its low rates and 25% bundling discount. State Farm offers financial stability with an A++ rating, and Progressive provides flexible coverage options for all drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in New York

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in New York

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in New York

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best New York, NY auto insurance providers are Geico, State Farm, and Progressive, with monthly starting rates of $125. These companies are known for their affordable premiums and big discounts.

Geico’s rating from A.M Best is an A+, suggesting its customer service satisfaction. State Farm’s financial stability offers clients peace of mind, and Progressive offers flexible coverage options

Our Top 10 Company Picks: Best New York, NY Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $145 | A++ | Low Rates | Geico | |

| #2 | $155 | B | Financial Stability | State Farm | |

| #3 | $245 | A+ | Flexible Coverage | Progressive | |

| #4 | $220 | A+ | Innovative Discounts | Allstate | |

| #5 | $347 | A+ | Excellent Service | Erie |

| #6 | $275 | A++ | Claims Satisfaction | Travelers | |

| #7 | $237 | A | Extensive Discounts | Liberty Mutual |

| #8 | $220 | A | Comprehensive Coverage | Farmers | |

| #9 | $210 | A | Customer Focus | American Family | |

| #10 | $230 | A+ | Strong Discounts | Nationwide |

These New York auto insurance providers offer you the quality experience of premium coverage at an affordable rate. See the best auto insurance providers in New York, NY, in the table below.

- Geico, State Farm, and Progressive are the best auto insurance companies in New York

- Geico offers low rates starting at $125 monthly

- State Farm is known for financial stability, and Progressive has flexible coverage

Want to know more about these auto insurance companies? Start comparing total coverage auto insurance rates by entering your ZIP code here.

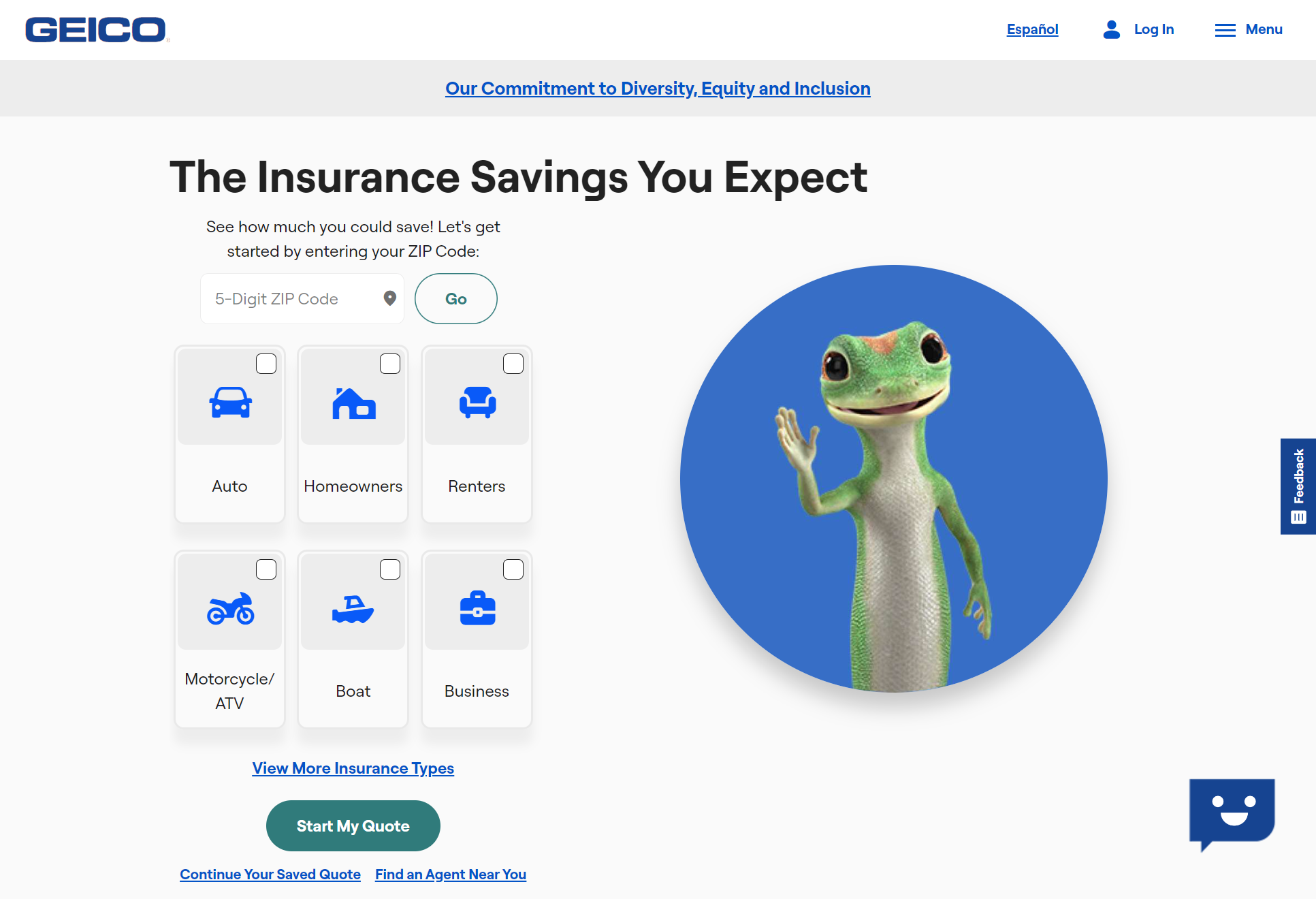

#1 – Geico: Top Overall Pick

Pros

- Affordable Premiums: Geico offers competitive pricing, making it easy to fit auto insurance into your budget.

- Bundling Discounts: Geico’s bundling policies can lead to significant savings and lower overall auto insurance costs. Learn more in our Geico auto insurance review.

- Mobile Convenience: With Geico’s app, you can handle your policy and claims anytime, anywhere, quickly and hassle-free.

Cons

- Limited Local Agent Support: Geico’s focus on online and phone services may limit the personalized help some drivers prefer.

- Limited Coverage Options: Offers a wide range of plans, but may not cover all specialized coverage types.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Financial Stability

Pros

- Financial Strength: The A++ rating indicates that State Farm demonstrates strong financial stability, ensuring you are protected by a reliable and trustworthy insurer.

- Personalized Service: State Farm has an extensive network of local agents that provide expert, tailored support to help with your insurance needs.

- Teen Driver Programs: State Farm provides valuable discounts and educational programs for young drivers, helping them save on premiums.

Cons

- Higher Premiums: State Farm is stable, but its higher premiums may limit affordable options for some drivers. Check more in our State Farm auto insurance review.

- Limited Digital Tools: State Farm’s online and mobile tools are not as comprehensive as those of some competitors, which can make managing your policy more cumbersome.

#3 – Progressive: Best for Flexible Coverage

Pros

- Customizable Pricing: Allows you to get the best plan for your car by tailoring your coverage to your needs and budget. To understand better, read our Progressive auto insurance review.

- Wide Coverage Options: Offers flexible coverage options that allow you to customize your policy with ridesharing insurance or other add-ons.

- Safe Driving Rewards: Progressive’s Snapshot® program rewards safe driving, helping you save on your premiums by maintaining a good driving record.

Cons

- Risk of Rate Increases: The Snapshot program from Progressive may raise your rates if your driving habits are risky, it will resulting in unexpected cost increases.

- Inconsistent Customer Service: In some locations, customers may experience service delays or issues, which can affect satisfaction and make it harder to get timely support when needed.

#4 – Allstate: Best for Innovative Discounts

Pros

- Drivewise App: This app rewards you for safe driving by offering cash back, so you’ll get the chance to reduce your costs while promoting safer habits on the road.

- Accident Forgiveness: Allstate’s policy includes accident forgiveness, which helps prevent premium increases after a first-time accident, ensuring your rates don’t escalate unnecessarily.

- Strong Digital Tools: Online tools provide easy access control for your coverage and simplify policy management.

Cons

- Higher Base Premiums: Based on our Allstate auto insurance review, rates can be higher for some drivers, making it not the best choice for those looking for budget-friendly coverage.

- Slow Claims Process: Policyholders have reported delays in claim processing, which can lead to frustration and longer wait times for resolution.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Erie: Best for Excellent Service

Pros

- Top Customer Satisfaction: Erie is recognized for its excellent customer service, which makes it easy for clients to get help or understand its coverage.

- Rate Lock Feature: Erie’s Rate Lock feature guarantees your premium remains fixed during your policy term, offering peace of mind and consistent budgeting.

- Affordable for Budget-Conscious Drivers: Offers affordable auto insurance rates, making it a great choice for drivers seeking savings with quality coverage.

Cons

- Limited Availability: Erie is not available in all states, so some drivers may not be able to benefit from their services. See our Erie insurance review for more details.

- Regional Limits: Services may not be available, so some drivers may need to look for other providers.

#6 – Travelers: Best for Claims Satisfaction

Pros

- Claims Support: Travelers offers fast, reliable claims support, helping you get the assistance you need quickly after an accident or issue. Discover how it works through our Travelers auto insurance review.

- Variety of Discounts: Travelers provides discounts for safe driving, policy bundling, and helping you save while still getting the coverage you need.

- Accident Forgiveness: Gives you financial comfort following an accident by enabling you to maintain your premiums constant even after a first-time claim.

Cons

- Higher Risk Premiums: Drivers with a history of claims or violations may face higher premiums, making it harder to stay within budget.

- Clunky Digital Experience: Travelers’ digital tools can be less intuitive, sometimes making it harder to manage or update your policy with ease.

#7 – Liberty Mutual: Best for Extensive Discounts

Pros

- Numerous Discounts: Offers various discounts, allowing you to lower your premium by bundling policies, adding anti-theft devices, and taking advantage of other available options.

- Better Car Replacement: Helps you swap it out for a newer one, which is helpful for drivers who want to update after a bad incident. To understand better, read our Liberty Mutual auto insurance review.

- Strong Online Tools: Provides easy-to-use online tools for managing your policy, receiving a quotation, and making changes from your computer or phone.

Cons

- Variable Customer Service: Liberty Mutual receives mixed customer reviews, with some reporting delays or inconsistent service, depending on their location.

- Price Fluctuations: Uncontrollable circumstances, such as changes in your driving behavior or claims history, may cause your premium to increase.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Comprehensive Coverage

Pros

- Wide Coverage Options: Gives you the freedom to select the best protection for your car by offering a variety of coverage options catered to your needs.

- Strong Claims Support: Offers 24/7 claims support, so you can file a claim anytime and get quick assistance to get your car back on the road faster.

- Signal App: Rewards safe driving with potential discounts, allowing you to lower your premiums by improving your driving habits. Explore our Farmers insurance review for more details.

Cons

- More Expensive Premiums: Farmers usually charge higher rates, which might make it more expensive for people on a tight budget.

- Fewer Local Agents: Farmers may have fewer local agents available to provide personalized services, which can be inconvenient for those looking for a local touch.

#9 – American Family: Best for Customer Focus

Pros

- Personalized Service: Offers customized insurance options to protect your car based on your specific needs.

- Great for Young Drivers: Helps young drivers afford insurance and form safe driving habits by offering them great options and discounts. Read our American Family insurance review for more details.

- KnowYourDrive Program: This program allows you to earn rewards for safe driving, which means you can see your premiums decrease as your driving habits improve.

Cons

- Limited Availability: American Family’s coverage is not available in all states, which may be a drawback for drivers in areas where the provider is not operational.

- Fewer Digital Features: While they offer basic online tools, their digital platform is not as advanced as some competitors, making it harder to manage policies efficiently.

#10 – Nationwide: Best for Strong Discounts

Pros

- Vanishing Deductible: Offers a feature that lowers your deductible each year you remain claim-free, helping you save money and making it easier to cover repair costs if needed.

- Accident Forgiveness: With accident forgiveness, you won’t see your rates increase after a first-time incident, which helps you avoid the financial strain of higher premiums.

- Discount Variety: Ensures you receive the best rate by offering a range of discounts tailored to your driving habits and coverage needs.

Cons

- Higher Premiums for Some: Nationwide’s rates may be higher if you have accidents or violations on your record, making it less affordable for high-risk drivers.

- Premium Variability: Rates may change unexpectedly due to factors such as your driving record or location, potentially leading to cost increases over time. To learn more, read our Nationwide insurance review.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Rates and Discounts in New York, NY

New York City, also known as the Big Apple, is the most populous city in the U.S., with 8.6 million people. Despite its large subway system, car insurance is still essential for many residents.

New York, NY Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $180 | $220 | |

| $160 | $210 | |

| $249 | $347 |

| $160 | $220 | |

| $125 | $145 | |

| $162 | $237 |

| $171 | $230 |

| $176 | $245 | |

| $137 | $155 | |

| $201 | $275 |

This table highlights monthly auto insurance rates from multiple providers in Oklahoma City, helping you compare coverage levels and prices at a glance so you can choose the best plan for your needs.

Auto Insurance Discounts From the Top Providers in New York, NY

| Insurance Company | Available Discounts |

|---|---|

| Drivewise Discount, Good Payer Discount, Multi-Vehicle Discount, Anti-Theft Device Discount, New Car Discount, Early Signing Discount | |

| Multi-Policy Discount, Safe Driver Discount, Good Student Discount, Vehicle Safety Discount, Anti-Theft Device Discount, Early-Bird Discount | |

| Multi-Vehicle Discount, Anti-Theft Discount, Defensive Driver Discount, Good Student Discount, Low Mileage Discount, Multi-Policy Discount |

| Multi-Vehicle Discount, Homeowners Discount, Safe Driver Discount, Good Student Discount, Defensive Driver Discount, Early Quote Discount | |

| Safe Driver Discount, Multi-Vehicle Discount, Military Discount, Anti-Theft Device Discount, Good Student Discount, Defensive Driving Course Discount | |

| Multi-Policy Discount, Safe Driver Discount, Pay-in-Full Discount, Vehicle Safety Discount, Defensive Driving Course Discount, New Car Discount |

| Multi-Policy Discount, Safe Driver Discount, Anti-Theft Discount, Good Student Discount, Family Plan Discount, Paperless Discount |

| Multi-Policy Discount, Safe Driver Discount, Snapshot Program, Paperless Discount, Homeowners Discount, Continuous Insurance Discount | |

| Safe Driver Discount, Drive Safe & Save Discount, Multi-Policy Discount, Student Away at School Discount, Anti-Theft Device Discount, Passive Restraint Discount, Good Student Discount | |

| Multi-Policy Discount, Safe Driver Discount, Hybrid & Electric Vehicle Discount, Anti-Theft Discount, New Car Discount, Pay-in-Full Discount |

These tables will give you an idea of what type of car insurance coverage will perfectly match your vehicle requirements and needs, especially when considering New York state car insurance.

New York Auto Insurance Coverage Options

When it’s time to buy or renew auto insurance, cost is usually the biggest concern. Finding the perfect deal can save you money and still keep you protected.

New York, NY Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Drivers Rate | A | Relatively low in NY at approx. 6.1%. |

| Traffic Density | A- | Very high; contributes to frequent minor and major accidents. |

| Average Claim Size | B+ | Higher than national average; driven by repair and labor costs. |

| Weather-Related Risk | B | Moderate risk from snow, ice, and rain causing collisions. |

| Vehicle Theft Rate | B | Slightly elevated; varies by borough (e.g., Bronx, Queens). |

Many people pay too much for coverage that doesn’t truly fit their needs. Unfortunately, many drivers miss out on valuable insurance discounts for which they are actually eligible.

Auto Insurance Discount From Top New York, NY Provider

| Insurance Company | Anti-Theft | Auto-Pay | Bundling | Claims-Free | Good Driver |

|---|---|---|---|---|---|

| 10% | 5% | 25% | 10% | 25% | |

| 25% | 5% | 25% | 15% | 25% | |

| 25% | 15% | 25% | 10% | 23% |

| 10% | 4% | 20% | 9% | 30% | |

| 25% | 3% | 25% | 12% | 26% | |

| 35% | 5% | 25% | 8% | 20% |

| 5% | 5% | 20% | 14% | 40% |

| 25% | 5% | 10% | 10% | 30% | |

| 15% | 4% | 17% | 11% | 25% | |

| 15% | 5% | 13% | 13% | 10% |

This guide covers why car insurance is expensive, how to lower your rate, and what it costs, featuring tables with monthly rates and top discounts from New York, NY providers.

Learn how to save on car insurance and what affects your rates, especially for auto insurance in New York City, NY.

Read more: How to lower your auto insurance premiums for best New York, NY auto insurance

Factors That Affect Auto Insurance Rates in New York, NY

Knowing what factors impact your car insurance rates in best New York, NY auto insurance is one thing. Understanding how those rates are determined is a different and still rather important matter.

New York, NY Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | 307,550 |

| Claims Per Year | ≈ 185,000 |

| Average Claim Cost | $5,484 |

| Percentage of Uninsured Drivers | 6.1% |

| Vehicle Theft Rate | 135.6 per 100,000 |

| Traffic Density | Very High |

| Weather-Related Incidents | Moderate |

When it comes to lowering your car insurance premiums, some factors are out of your control. The key is to stay informed and focus on what matters most when choosing New York car insurance.

Auto Insurance by ZIP Code in NY, New York

| IP Code | Monthly Rate ($) |

|---|---|

| 10001 | $147 |

| 10002 | $209 |

| 10003 | $216 |

| 11201 | $184 |

| 10453 | $204 |

| 11368 | $216 |

| 10314 | $211 |

| 10025 | $190 |

| 11215 | $163 |

| 10463 | $143 |

Where you live in New York City can also affect your rates, as factors like neighborhood crime rates, traffic density, and accident history can significantly impact your premium.

New York, NY Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Bronx | 54,000 | 31,000 |

| Brooklyn | 78,000 | 47,000 |

| New York (Manhattan) | 58,000 | 35,000 |

| Queens | 72,000 | 43,000 |

| Staten Island | 15,600 | 8,900 |

Your deductible might seem like a small detail, but adjusting it could lead to major savings on your monthly car insurance bill. It’s a simple move that can pay off big. It’s a simple move that can pay off big, especially when managing the cost of car insurance in NYC.

The lower your monthly premium, the bigger your deductible, but remember, if you file a claim, you’ll need to cover that amount out of pocket, which applies to car insurance in New York and New Jersey as well.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Top Auto Insurance Companies in New York, NY

This auto insurance guide helps you choose the auto insurance guide for the best New York, NY auto insurance, featuring top options like Geico, State Farm, and Progressive for their excellent coverage and customer satisfaction.

We hope this New York, NY auto insurance guide helps you get the coverage you need for your New York City NY car insurance.

To get the best New York, NY auto insurance, consider how crime, traffic, and accidents affect rates.

Chris Abrams Licensed Insurance Agent

Use these tips and guidelines to find the right auto insurance in New York that fits both your budget and your needs. This will help you get the best coverage at an affordable price. Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget..

Frequently Asked Questions

How much is car insurance in New York City on average compared to other major cities?

The average cost of car insurance in New York City is higher than in most U.S. cities, often starting around $125 a month, depending on coverage and ZIP code.

What factors make Geico the top overall pick for auto insurance in New York, NY?

Geico is the top pick for New York City auto insurance due to its low rates, high customer satisfaction, and up to 25% bundling discount. Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

How do Progressive’s flexible coverage options benefit different drivers?

Progressive offers customizable coverage plans that cater to diverse driver profiles, providing flexible pricing and coverage for both high-risk and first-time drivers, especially New York City, NY auto insurance.

Read more: High risk driver of best New York, NY auto insurance

What unique discounts does Allstate offer that might not be available with other providers in New York?

Allstate offers unique discounts like Drivewise (usage-based tracking) and safe driver rewards, which can significantly lower premiums for car insurance in New York City based on driving behavior

If you want to lower your premium, how much can adjusting your deductible actually save you?

Raising your deductible can lower premiums by up to 20-30%, but it increases your out-of-pocket costs in case of a claim for car insurance in New York State. Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

How does your ZIP code within New York City affect your auto insurance premium?

Factors that affect your best New York, NY auto insurance premium include ZIP codes, as areas with higher crime, accidents, or traffic density lead to higher insurance rates.

How often should you compare auto insurance quotes in New York?

Drivers should compare quotes annually or when their circumstances change, focusing on factors like coverage, discounts, and financial stability when looking for car insurance in New York City, NY.

How can bundling policies lower your NYC car insurance costs?

Bundling your auto and home insurance policies can save you up to 25% on your NYC car insurance with providers like Geico and State Farm. Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget

How does a provider’s financial stability rating impact customer trust and reliability?

A strong financial stability rating reassures customers that their New York City car insurance provider can reliably pay claims and remain dependable over the long term.

Read more: Compare Auto Insurance Companies

What discounts should drivers look for when shopping for auto insurance in New York City?

When shopping for auto insurance in New York City, drivers should look for safe driver discounts, multi-policy savings, and usage-based programs like Drivewise.