Best Lubbock, TX Auto Insurance in 2025

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Nov 17, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Lubbock City Statistics | Details |

|---|---|

| City Population | 253,888 |

| City Density | 2,211 people per square mile |

| Average Cost of Car Insurance in Lubbock | $5,275.25 |

| Cheapest Car Insurance Company | State Farm and USAA |

| Road Conditions | Poor Share: 39% Mediocre Share: 24% Fair Share: 5% Good Share: 32% VOC: $801 |

In this day and age, finding spare time to sit and search for the best and cheapest car insurance policy out there isn’t at the top of everyone’s to-do list. We get it. You’ve got bills to pay, children to feed, a job to work, a house to run, and a significant other to care for.

Life just never slows down.

But there’s a reason you stumbled along on the interwebs to this page: you need help, and guess what? That’s a good thing.

If you have just 15 minutes or less, we can show you all the information and hard data you need to make an informed decision about buying and saving on car insurance in Lubbock, Texas.

No, we’re not going to ask for your phone number and call you 167 times until you purchase a car insurance policy. We won’t ask for your email address or your physical address to send you tons of junk mail.

We just want to give you the best rate possible by helping you find car insurance discounts, and by showing you the most important factors that can affect your car insurance rate.

We’ve partnered with some of the most trusted insurance sources out there including the Insurance Institute for Highway Safety, the National Highway Traffic Safety Administration, Data USA, and many more.

From learning about carrier costs to road conditions and everything in between, finding car insurance in Lubbock, Texas, has never been easier.

Are you ready to start saving money on your car insurance policy right now? Use our free tool to save by entering your ZIP code in the box above.

Keep reading to learn more about car insurance in Lubbock, Texas.

The Cost of Car Insurance in Lubbock

When searching for a car insurance policy, most people consider the cost to be the most important factor. But how much does car insurance really cost?

We can’t tackle that question with just one, simple answer. The cost of car insurance is affected by many different factors.

Stay tuned as we go over some of the most important factors that can affect your car insurance rate in Lubbock.

Male Versus Female Versus Age

Most people know that your age can affect your car insurance rate, but did you know that your gender and marital status can as well?

What does the data show for your city?

According to a recent article by Data USA, the median age in Lubbock, Texas, is 29.4 years old This is good news for Lubbock drivers because car insurance companies usually give higher rates to cities with a median age of 25 or younger.

Let’s take a closer look at how age can affect car insurance rates.

| 35-year-old | 60-year-old | 17-year-old | 25-year-old | Cheapest Rate | |

|---|---|---|---|---|---|

| Average Annual Rate | $2,560.57 | $2,404.58 | $7,591.97 | $3,184.30 | $2,404.58 |

The table above shows that the older you get, the less you pay for car insurance.

17-year-old drivers pay almost four times what 60-year-old drivers pay for car insurance. This could be attributed to the fact that older drivers are the least likely to be in an accident and young drivers are the most likely to cause an accident.

Let’s see how your gender can also affect your car insurance rate.

According to our data, males pay an average of $3,935.36 for car insurance, while females pay an average of $3,719.53 per year for the same exact policy. This means that men pay a little over $200 more than women pay for car insurance.

Car insurance companies believe that generally, women are more responsible drivers than men, which is why they usually pay less for car insurance.

Now, let’s look at these three statistics — age, gender, and marital status — all together in the table below.

| Demographic | Rate |

|---|---|

| Married 60-year-old female | $2,342.02 |

| Married 60-year-old male | $2,467.15 |

| Married 35-year-old female | $2,523.67 |

| Married 35-year-old male | $2,597.47 |

| Single 25-year-old female | $3,088.20 |

| Single 25-year-old male | $3,280.40 |

| Single 17-year-old female | $6,924.22 |

| Single 17-year-old male | $8,259.71 |

| Average | $3,935.36 |

As you probably noticed, married 60-year-old females pay the cheapest rate for their car insurance policy. Car insurance companies believe that married people are less likely to cause an accident than someone who is single.

If you are discouraged by these statistics, don’t worry. A person’s rate will likely decrease with age if they keep a clean record. Also, we’ve only scratched the surface when it comes to factors that can affect your car insurance rate.

Where you live matters too. Stay tuned to learn more.

Cheapest ZIP Codes in Lubbock

If you live in an area where crime is prevalent in the community or your place of residence is more prone to natural disasters, your car insurance rate might be higher than the average rate in your city.

The table below shows average rates based on ZIP codes in Lubbock.

| ZIP Code | Average Annual Rate |

|---|---|

| 79424 | $5,275.25 |

| 79407 | $5,317.70 |

| 79423 | $5,379.91 |

| 79413 | $5,385.08 |

| 79414 | $5,406.63 |

| 79416 | $5,407.95 |

| 79410 | $5,412.08 |

| 79406 | $5,589.08 |

| 79401 | $5,699.35 |

| 79412 | $5,717.48 |

| 79411 | $5,723.76 |

| 79415 | $5,757.54 |

| 79403 | $5,818.68 |

| 79404 | $5,833.21 |

| 79409 | $5,835.63 |

| 79402 | $6,504.20 |

| 79430 | $7,732.63 |

As you can see, there’s about a $2,500 difference from the cheapest rate to the most expensive rate on this list.

That difference in rates is noteworthy considering there are only 17 different ZIP codes listed in the table above.

What’s the best car insurance company in Lubbock?

When you’re looking for a new car insurance provider, it’s important to know that not all providers are created equal — meaning they don’t all determine car insurance rates the same exact way.

For example, your driving record could influence your car insurance rate more at Company A than it does at Company B. Company B might believe that your rate should be influenced more by your credit score than your driving record.

To find the best possible rate, you will need to look at a company’s big picture. It is key to assess which insurers offer the best rates and which carriers charge steeper premiums based on factors such as your chosen coverage level, credit history, and driving record.

To save you time and a headache, we’ve already collected this information for you. Stick around as we cover all this and more up next.

Cheapest Car Insurance Rates by Company

The table below shows the car insurance companies that charge the cheapest coverage rates in Lubbock, Texas.

| Group | Married 35-year-old Female | Married 35-year-old Male | Married 60-year-old Female | Married 60-year-old Male | Single 17-year-old Female | Single 17-year-old Male | Single 25-year-old Female | Single 25-year-old Male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $3,662.70 | $3,708.56 | $3,620.71 | $3,620.71 | $9,381.13 | $11,363.19 | $4,529.55 | $4,738.59 | $5,578.14 |

| American Family | $2,881.11 | $3,200.74 | $2,654.33 | $3,036.76 | $7,431.57 | $9,743.09 | $4,103.20 | $4,674.33 | $4,715.64 |

| Geico | $2,435.69 | $2,618.02 | $2,321.22 | $2,620.46 | $5,312.09 | $5,511.72 | $2,640.11 | $2,643.49 | $3,262.85 |

| Nationwide | $2,277.85 | $2,321.62 | $2,010.85 | $2,135.08 | $6,342.84 | $8,174.45 | $2,664.09 | $2,888.50 | $3,601.91 |

| Progressive | $2,602.84 | $2,498.85 | $2,290.77 | $2,348.79 | $10,313.39 | $11,498.52 | $3,093.72 | $3,155.13 | $4,725.25 |

| State Farm | $2,032.25 | $2,032.25 | $1,812.00 | $1,812.00 | $4,928.64 | $6,290.66 | $2,213.74 | $2,279.30 | $2,925.11 |

| USAA | $1,773.27 | $1,802.23 | $1,684.26 | $1,696.23 | $4,759.91 | $5,236.36 | $2,373.02 | $2,583.47 | $2,738.59 |

With the exception of USAA (a company that only services military members and their families), the table above shows that State Farm has the cheapest average car insurance rate.

But take a look at State Farm’s rate for single 25-year-old females. State Farm’s rate is actually lower than USAA’s rate for this demographic. The difference is a little more than $150, but it is worth noting.

When searching for a rate in a table like this one, it is important to look for the best rate for your demographic and not just the cheapest one overall.

Best Car Insurance for Commute Rates

According to the Federal Highway Administration’s 2014 Licensed Drivers By State report, Texans drove an average of 15,533 miles in the state that year. The table below indicates the average annual premiums Lubbock, Texas, insurers charge based on consumers’ commute rates.

| Group | 10-mile Commute. 6000 Annual Mileage. | 25-mile Commute. 12000 Annual Mileage. | Average |

|---|---|---|---|

| Allstate | $5,448.80 | $5,707.48 | $5,578.14 |

| American Family | $4,715.64 | $4,715.64 | $4,715.64 |

| Geico | $3,199.98 | $3,325.72 | $3,262.85 |

| Nationwide | $3,601.91 | $3,601.91 | $3,601.91 |

| Progressive | $4,725.25 | $4,725.25 | $4,725.25 |

| State Farm | $2,925.11 | $2,925.11 | $2,925.11 |

| USAA | $2,703.05 | $2,774.14 | $2,738.60 |

Check out the data above. Some car insurance companies like American Family, Nationwide, Progressive, and State Farm will give you the same rate even if you drive more miles than average per year.

However, companies like Allstate charge almost $300 more per year to someone who drives 12,000 miles per year.

In summary, remember that your rate could go up if you tend to put in more miles than the average person.

Best Car Insurance for Coverage Level Rates

You get what you pay for. If you want a lot of coverage, you’re obviously going to pay more for it. But did you know that some car insurance companies might cut you a break on your rate if you have more car insurance than what is required?

Check out the table below.

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $5,760.94 | $5,445.11 | $5,528.38 | $5,578.14 |

| American Family | $5,198.41 | $4,399.83 | $4,548.68 | $4,715.64 |

| Geico | $3,460.62 | $3,100.88 | $3,227.05 | $3,262.85 |

| Nationwide | $3,473.17 | $3,885.79 | $3,446.77 | $3,601.91 |

| Progressive | $4,962.90 | $4,509.49 | $4,703.37 | $4,725.25 |

| State Farm | $3,090.36 | $2,768.08 | $2,916.88 | $2,925.11 |

| USAA | $2,834.13 | $2,653.07 | $2,728.58 | $2,738.59 |

For just a few hundred dollars more per year (that’s less than $30 a month) you could go from having minimum liability insurance to comprehensive coverage.

Check out Allstate’s rates. Low coverage is only about $300 less than the cost of high coverage.

If you can afford it now, having better coverage and paying an extra $30 more per month could save you thousands of dollars on vehicle repairs and replacements in the long run.

Best Car Insurance for Credit History Rates

How can your credit score affect your car insurance rate?

Many car insurance carriers can and will use your credit history as a determining factor when evaluating your annual premiums.

If you have a poor credit score, your rate could increase by thousands of dollars per year.

| Group | Fair | Good | Poor | Average |

|---|---|---|---|---|

| Allstate | $5,188.54 | $4,432.19 | $7,113.70 | $5,578.14 |

| American Family | $4,081.83 | $3,560.80 | $6,504.30 | $4,715.64 |

| Geico | $2,851.13 | $1,901.87 | $5,035.55 | $3,262.85 |

| Nationwide | $3,464.99 | $3,016.76 | $4,323.99 | $3,601.91 |

| Progressive | $4,583.35 | $4,228.21 | $5,364.20 | $4,725.25 |

| State Farm | $2,578.48 | $2,054.78 | $4,142.05 | $2,925.10 |

| USAA | $2,310.50 | $1,849.18 | $4,056.10 | $2,738.59 |

If you have poor credit, you might want to consider going with a company like Nationwide or Progressive, as they have significantly lower rates than many other companies on this list.

Remember that your credit score can affect more than just your future interest rate — poor credit scores can have a huge influence on how much you pay for your car insurance. On the other hand, having great credit can significantly lower your monthly premium or your yearly rate.

Best Car Insurance for Driving Record Rates

Generally, car insurance companies believe that your driving record is the most important factor when it comes to figuring out how much you’re going to pay for car insurance in Lubbock, Texas.

The table below reveals exactly how much your rates could change based on your driving record alone.

| Group | Clean Record | With One Accident | With One DUI | With One Speeding Violation | Average |

|---|---|---|---|---|---|

| Allstate | $4,390.32 | $6,639.59 | $6,892.35 | $4,390.32 | $5,974.09 |

| American Family | $4,303.42 | $5,463.20 | $4,792.52 | $4,303.42 | $4,853.05 |

| Geico | $2,768.38 | $3,643.73 | $3,067.71 | $3,571.58 | $3,159.94 |

| Nationwide | $3,119.72 | $3,119.72 | $4,639.58 | $3,528.62 | $3,626.34 |

| Progressive | $4,123.85 | $5,283.46 | $4,831.42 | $4,662.28 | $4,746.24 |

| State Farm | $2,592.36 | $2,982.09 | $3,533.61 | $2,592.36 | $3,036.02 |

| USAA | $2,053.98 | $3,005.56 | $3,535.49 | $2,359.35 | $2,865.01 |

If you get just one DUI, your rates could increase by thousands of dollars.

As you can see, some carriers have higher rates than others for the same offense.

For example, while American Family will actually leave your rate alone even if you get one speeding ticket, Geico will raise your rate by $700 a year for the same offense.

The moral of the story is to obey the traffic laws. If you don’t speed and you don’t drink and drive, you are less likely to get into an accident, which means your yearly premium should be lower than average.

Car Insurance Factors in Lubbock

Don’t go switching providers just yet; there are many more factors that can influence the cost of car insurance in Lubbock, Texas.

Here’s what you need to know to help you determine what you should be paying for car insurance in your city.

Median Household Income

What does the median household income have to do with your car insurance rate? We want to show you how much of your average yearly income could be eaten up by insurance costs if you live in Lubbock.

According to Data USA, the median household income in Lubbock, Texas, is $47,326.

This number is lower than the median annual income across the U.S., which is $60,336. The previous year, the median income in Lubbock was $45,499, indicating a 4.02 percent annual growth.

The average cost of auto insurance in Lubbock, Texas, is $5,275.25. This means that approximately 11.1 percent of the average worker’s income is going straight to car insurance premiums.

Are you wondering what percentage of your yearly income is spent on your car insurance policy? Use our free calculator tool below to find out.

CalculatorPro

Homeownership in Lubbock

You might not think that owning a home could have anything to do with your car insurance rate, but actually, homeownership could decrease your yearly premium.

Why?

Car insurance companies believe that people who own their homes are usually more responsible and less likely to be high-risk drivers.

Data USA says that in 2017, 52.1 percent of the housing units in Lubbock, Texas, were occupied by their owner. This percentage declined from the previous year’s rate of 52.2 percent.

This percentage of owner-occupation is lower than the national average of 63.9 percent.

In 2017, the median property value in Lubbock grew to $123,800 from the previous year’s value of $118,300.

Education in Lubbock

The city of Lubbock has several noteworthy universities and colleges in the area.

According to Data USA, the student population of Lubbock, Texas, is skewed towards women, with 22,036 male students and 22,378 female students.

The largest universities in Lubbock by number of degrees awarded are Texas Tech University, Texas Tech University Health Sciences Center, and Lubbock Christian University.

The number of graduates and the percentage of total degrees the largest Lubbock educational institutions conferred in 2016 are as follows:

- Texas Tech University – 7,714 graduates and 70.5 percent of degrees conferred

- Texas Tech University Health Sciences Center – 2,157 graduates and 19.7 percent of degrees conferred

- Lubbock Christian University – 519 graduates and 4.74 percent of degrees conferred

Currently, the most popular majors in Lubbock by concentration and percentage of degrees awarded are:

- Registered Nursing Degrees Awarded – 1,201; Percentage of Total Degrees Awarded – 11 percent

- General Business Administration and Management Degrees Awarded – 520; Percentage of Total Degrees Awarded – 4.75 percent

- Other Multidisciplinary Studies Degrees Awarded – 460; Percentage of Total Degrees Awarded – 4.2 percent

The median tuition costs in Lubbock, Texas, are $20,966 for private four-year colleges, and $5,945 and $17,165 respectively for public four-year colleges for in-state students and out-of-state students.

Wage by Race and Ethnicity in Common Jobs

In 2017, the highest paid race/ethnicity of Texas workers was Asian. These workers were paid 1.25 times more than white workers, who made the second highest salary of any race/ethnicity.

This table shows the race and ethnicity-based wage disparities in the five most common occupations in Texas by number of full-time employees.

| Ethnicity | Miscellaneous Managers | Percentage of Income Going to Car Insurance | Driver/Sales Workers and Truck Drivers | Percentage of Income Going to Car Insurance | Elementary and Middle School Teachers | Percentage of Income Going to Car Insurance | Retail Salespersons | Percentage of Income Going to Car Insurance | Cashiers | Percentage of Income Going to Car Insurance |

|---|---|---|---|---|---|---|---|---|---|---|

| American Indian | $74,900 | 7.00% | $41,195 | 12.80% | $42,576 | 12.30% | $23,489 | 22.40% | $14,078 | 37.40% |

| Asian | $107,939 | 4.80% | $32,915 | 16.00% | $38,973 | 13.50% | $24,535 | 21.40% | $17,714 | 29.70% |

| Black | $73,311 | 7.10% | $43,371 | 12.10% | $42,538 | 12.40% | $25,945 | 20.00% | $12,679 | 41.60% |

| White | $103,761 | 5.00% | $43,226 | 12.20% | $44,281 | 11.90% | $30,218 | 17.40% | $14,440 | 36.50% |

| Two or More Races | $89,714 | 5.80% | $40,907 | 13.00% | $44,965 | 11.70% | $24,545 | 21.40% | $11,425 | 46.10% |

| Other | $42,496 | 12.40% | $46,597 | 11.30% | $42,496 | 12.40% | $22,066 | 23.90% | $13,860 | 38.00% |

It’s pretty crazy to see that there are many different salaries for the same jobs. The table above proves that there is a pay gap based on ethnicity.

Wage by Gender in Common Jobs

Gender is another factor that plays a role in how much a person is paid.

Data USA says that in 2017, full-time male employees in Texas made 1.41 times more than female employees.

- Lubbock Average Male Employee Salary – $64,953

- Lubbock Average Female Employee Salary – $45,959

Males in Lubbock, Texas, make, on average, almost $20,000 more than females do working the same exact job.

The average annual cost of car insurance in Lubbock, Texas, is $5,275.25.

This means that while women are paying out approximately 11.4 percent of their annual income to cover the cost of car insurance premiums, while men are paying out just over eight percent of their total yearly earnings.

Poverty by Age and Gender

Nearly 20 percent of the population for whom poverty status has been determined in Lubbock, Texas, (46,000 out of 236,000 people) live below the poverty line, a number that is higher than the national average of 13.4 percent.

The largest demographic living in poverty are males 18–24, followed by females 18–24, and then females 25–34.

Poverty by Race and Ethnicity

The racial or ethnic group with the most individuals living below the poverty line in Lubbock, Texas, is white, followed by Hispanic and black.

The Census Bureau uses a set of money income thresholds that vary by family size and composition to determine who is classified as impoverished. If a family’s total income is below the threshold, then that family and every individual in it is considered to be living in poverty.

Employment by Occupations

From 2016 to 2017, employment in Lubbock, Texas, grew at a rate of 2.33 percent, from 118,000 employees to 121,000 employees.

The most common job groups by number of people living in Lubbock, Texas, are:

- Office and Administrative Support Occupations – 17,048 people

- Sales and Related Occupations – 13,874 people

- Management Occupations – 10,288 people

Driving in Lubbock

Whether you’ve lived in the city for years or you’re just visiting it for the weekend, it’s important to find the very best driving routes to help you avoid traffic jams and road construction.

Keep reading for more information on the best driving routes in Lubbock, Texas.

Roads in Lubbock

From major highways, old back roads, and everything in between, we’ve got all your driving needs covered, right here, right now.

Are you ready? Let’s get started.

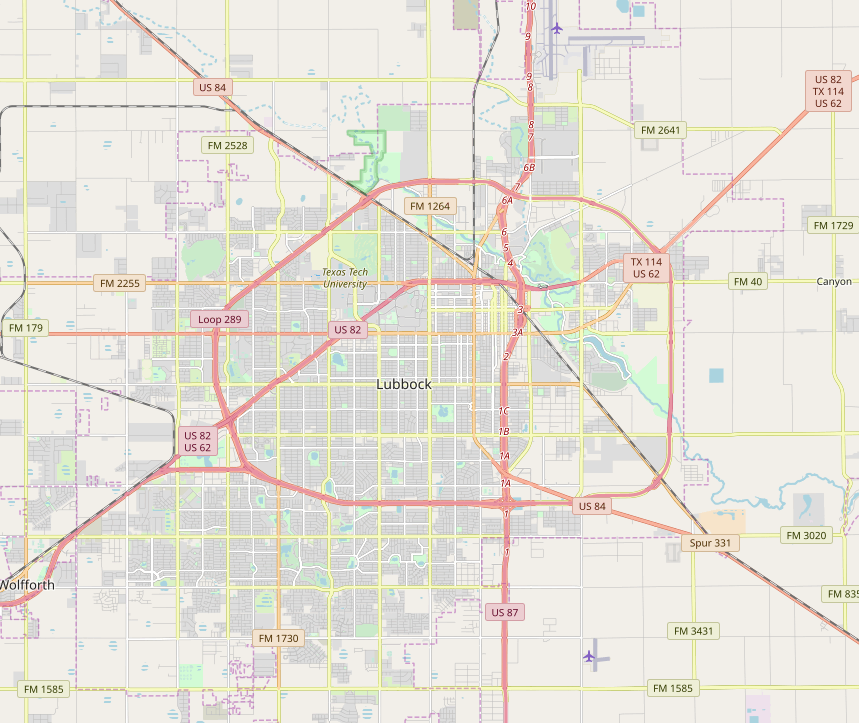

Major Highways

Texas has an astounding 25 active interstates running through its cities. These 25 interstates comprise 3,501.15 miles of roadway. The active interstates are as follows:

| I-2 | I-30 | I-40 | I-69E | I-369 |

| I-10 | I-35 | I-44 | I-69W | I-410 |

| I-14 | I-35E | I-45 | I-110 | I-610 |

| I-20 | I-35W | I-69 | I-169 | I-635 |

| I-27 | I-37 | I-69C | I-345 | I-820 |

As you can see from the map above, US-82, US-87, and US-84 all run through the city of Lubbock.

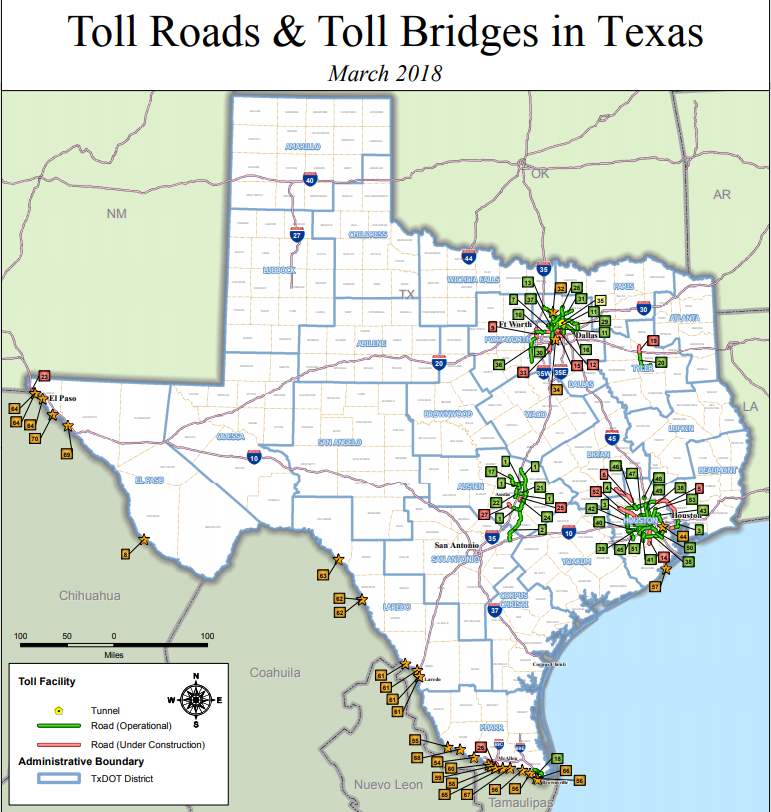

Fortunately for Lubbock drivers, there aren’t any toll roads in the city.

Check out the map below to see the toll roads throughout the state.

For more information on Texas toll roads, please visit the Texas Department of Transportation.

Popular Road Trips/Sites

You might be visiting, or you might live in Lubbock, but either way, there’s always something to do in this great little city in northern Texas.

Watch the video below for a list of things to do and see in Lubbock.

You can also browse through a list of things to do below. This information is brought to you by Trip Advisor.

- The Buddy Holly Center – If you love 1950s rock and roll, this is a must-see. It’s a cute place to learn all about Buddy Holiday and his impact on the music scene.

- Louie Louie’s Piano Bar – If you’re looking for a place with great drinks and great piano music, check out Louie Louie’s. Whether you’re planning a girls’ night out or a birthday party, you’re sure to have a blast at this piano bar.

- Antique Mall of Lubbock – Opened in 1985, the Antique Mall of Lubbock has been one of the best antique malls in the Southwest for almost three decades. They offer a wide variety of quality furniture, primitives, glassware, pottery, art, toys, Western memorabilia, books, costume jewelry, and much more.

- National Ranching Heritage Center – This 19-acre park features authentic ranching structures and a museum housing art and artifacts related to the Western lifestyle.

- The Depot District – Located in the heart of Lubbock, this stretch of businesses and historical sites has a little something for everyone, including bars, restaurants, a movie theater, and a Saturday afternoon Farmer’s Market.

Road Conditions

Let’s take a look at Lubbock’s road conditions in the table below.

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Costs (VOC) |

|---|---|---|---|---|

| 39% | 24% | 5% | 32% | $801 |

As you can see, the road conditions in Lubbock cost each driver a yearly total of $801.

For information regarding road construction, road closures, and more, please visit the Texas Department of Transportation website.

Does your city use speeding or red-light cameras?

According to an article by the Dallas News, on June 1, 2019, Governor Greg Abbott signed House Bill 1631 into law, prohibiting cities in Texas from operating photographic traffic camera systems that catch citizens speeding or running red lights and issue them fines.

The bill prohibits both the use of speeding and red light cameras.

Vehicles in Lubbock

Every city has unique vehicle trends. Keep reading for some interesting statistics on vehicle ownership and how it relates to car insurance in Lubbock, Texas.

How many cars per household?

Have you ever wondered what the average number of cars per household is in Lubbock?

According to Data USA, the average household in Lubbock owns two cars.

Households Without a Car

Even though the average household in Lubbock owns two cars, there are some households that do not own a car at all.

See the table below.

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Vehicles Per Household |

|---|---|---|---|

| 7.30% | 5.60% | 1.67% | 1.74% |

The number of households without a car decreased from 2015 to 2016. The table also shows that the number of vehicles owned per household increased from 1.67 to 1.74 from 2015 to 2016.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Speed Traps in Your City

Have you ever just been driving along, minding your own business, following the speed of traffic, when suddenly you see blue and red lights shining in your rearview mirror? Where did they come from?

You get pulled over, get a speeding ticket, and then the officer sends you on your merry way. If this has ever happened to you, you’ve probably been the victim of a speed trap.

The good news for residents of Lubbock, Texas, is that the city did not make it onto the list of The 10 Worst Texas Speed Trap Cities.

Remember, even if you’re following the speed of traffic, if that speed is over the maximum posted speed limit, you can still be given a traffic citation. Always practice safe driving habits to avoid traffic tickets and accidents.

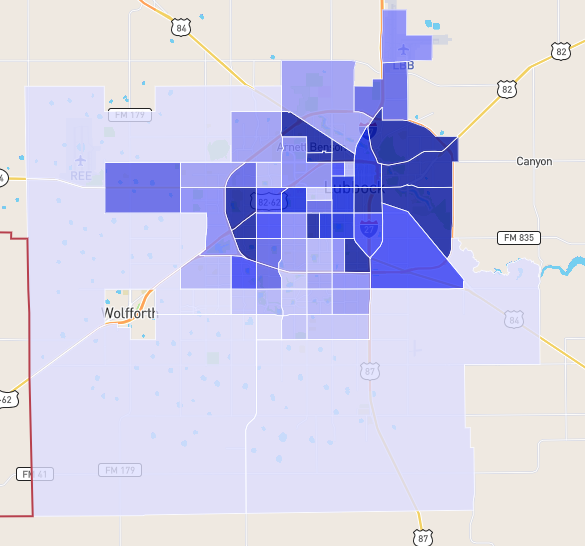

Vehicle Theft in Lubbock

How safe is your vehicle from theft in Lubbock?

In 2018, the FBI reported 1,203 motor vehicle thefts in the city of Lubbock.

The safest neighborhoods in Lubbock, Texas, according to Neighborhood Scout, are as follows:

- Hurlwood

- Slide

- Burris

- Quaker Avenue/98th Street

- Reese Village

- Milwaukee Avenue/98th Street

- 98th Street/Memphis Avenue

- 98th Street/Avenue P

- 19th Street / University Avenue

- 82nd Street/ Louisville Avenue

Check out this map of neighborhoods in Lubbock below.

The light purple areas on the map indicate the safest places to live in Lubbock, while the dark purple areas show the most dangerous neighborhoods in the city.

Neighborhood Scout also revealed that your chances of becoming a victim of violent crime are approximately 10.07 per 1,000 residents. This is much higher than the statewide figure, which puts residents at a 4.11 per 1,000 chance of being a victim of violent crime.

Lubbock is only safer than three percent of cities across the country. The city ranks number three in Neighborhood Scout’s crime index, with 100 being the absolute safest.

The table below illustrates the incidents of violent crime in Lubbock, Texas, in 2017 alone.

| Lubbock Violent Crimes 2017 | Murder | Rape | Robbery | Assault |

|---|---|---|---|---|

| Report Total | 13 | 248 | 444 | 1,873 |

| Rate Per 1,000 | 0.05 | 0.97 | 1.74 | 7.32 |

There were 13 murders in Lubbock in 2017.

Below are Lubbock’s total number of crimes for the same year.

| Lubbock Annual Crimes | Violent | Property | Total |

|---|---|---|---|

| Number of Crimes | 2,578 | 12,036 | 14,614 |

| Crime Rate (Per 1,000 Residents) | 10.07 | 47.04 | 57.11 |

As you can see, there were over 2,500 violent crimes reported in 2017 in the city of Lubbock.

Traffic

Now that we’ve touched on the crime report and road conditions in Lubbock, it’s time to get into the city’s traffic statistics.

Stay tuned for information on transportation, traffic reports, crash reports and more.

Traffic Congestion in Texas

No one ever wants to be stuck in traffic. Luckily for Lubbock drivers, major scorecard studies conducted by research giants like INRIX and TomTom don’t even list traffic congestion rates in Lubbock, Texas.

You still may end up sitting in traffic during peak commute times, but congestion is not a major problem in the city of Lubbock.

Transportation

Speaking of commutes, how long does it take Lubbock residents to get to and from work every day?

Data USA says that the average worker’s commute time in Lubbock (16 minutes) is shorter than the national average (25.1 minutes). Additionally, 1.29 percent of the workforce in Lubbock, Texas, have “super commutes” in excess of 90 minutes.

What is the most common method of transportation in the city?

In 2017, the most common method of travel for workers in Lubbock, Texas, was to drive alone (80.5 percent), followed by those who carpooled (12.8 percent). An additional 2.48 percent work from home in Lubbock.

Busiest Highways

Interstate 27 is the busiest highway in Lubbock. It runs north and south through the city from Lubbock to Interstate 40 in Amarillo.

Heavy traffic congestion is defined as:

- Urban Areas – Traffic is bumper to bumper or moving at a stop-and-go pace

- Rural Areas – It is difficult to change lanes due to the congestion

How safe are Lubbock’s streets and roads?

In this next section, we’ll talk about crash report statistics in the city of Lubbock. The following information is brought to you by the National Highway Traffic Safety Administration.

Let’s start by taking a look at the total number of fatal crashes in Lubbock County from 2014–2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Lubbock | 42 | 40 | 43 | 42 | 24 | 14.26 | 13.41 | 14.23 | 13.78 | 7.81 |

As you can see, there were 24 fatal crashes in this county in 2018.

Next, let’s look at how many of those crashes were caused by an alcohol-impaired driver.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Lubbock | 19 | 17 | 21 | 24 | 13 | 6.45 | 5.7 | 6.95 | 7.87 | 4.23 |

From 2014–2018 there were 94 fatal crashes caused by drinking and driving.

Here are the total number of single-vehicle fatality crashes in Lubbock County from 2014–2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Lubbock | 23 | 23 | 22 | 24 | 18 | 7.81 | 7.71 | 7.28 | 7.87 | 5.86 |

Over the span of these five years, 2017 saw the highest number of single-vehicle fatal crashes.

The table below reveals fatal crashes from 2014–2018 involving speeding, roadway departures, and intersections in Lubbock County.

| Crash Type | Fatalities 2014 | 2015 | 2016 | 2017 | 2918 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Involving a Roadway Departure | 15 | 13 | 12 | 15 | 11 | 5.09 | 4.36 | 3.97 | 4.92 | 3.58 |

| Involving Speeding | 17 | 8 | 11 | 12 | 6 | 5.77 | 2.68 | 3.64 | 3.94 | 1.95 |

| Involving an Intersection | 13 | 15 | 12 | 14 | 2 | 4.41 | 5.03 | 3.97 | 4.59 | 0.65 |

From 2014–2018, there were 176 fatal car crashes that involved speeding, a roadway departure, or an intersection.

The table below illustrates the total number of fatalities in Lubbock County from 2014–2018 by person type.

| Crash Type | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Pedestrian | 9 | 10 | 10 | 10 | 7 | 3.06 | 3.35 | 3.31 | 3.28 | 2.28 |

| Passenger Car Occupant | 9 | 13 | 14 | 11 | 4 | 3.06 | 4.36 | 4.63 | 3.61 | 1.3 |

| Pedalcyclist Fatalities | 1 | 0 | 0 | 2 | 2 | 0.34 | 0 | 0 | 0.66 | 0.65 |

From 2014–2018, there were 102 fatal crashes involving a passenger occupant, a pedestrian, or a pedalcyclist.

Next, let’s look at the types of interstates in the state of Texas with the most fatal crashes according to FARS.

| Texas Road Type | Fatal Crashes |

|---|---|

| Rural | 225 |

| Urban | 469 |

| Local | 232 |

| Freeway and Expressway | 259 |

| Minor Arterial | 717 |

| Collector Arterial | 627 |

| Other | 1108 |

| Unknown | 5 |

| Total Fatal Crashes | 3,642 |

Collector roads gather traffic from local roadways and direct motorists to arterial roadways. As you may have noted from the data above, the most significant proportion of fatal crashes in Texas take place on roads categorized as “other,” with the second-highest number of fatality collisions occurring on minor arterial roads.

An arterial road is just a high-capacity urban road. Depending on how much traffic is filtering through a specific area, the road could be categorized as a highway or a minor arterial road.

It’s also important to be aware of fatal crash numbers on railroads.

The U.S. Department of Transportation accumulated data regarding the fatalities and injuries in Lubbock due to highway and railroad crashes in recent years, as listed in the table below.

| Highway User Speed | Calendar Year | Highway | Highway User Type | Rail Equipment Type | Non-suicide Fatality | Non-suicide Injury |

|---|---|---|---|---|---|---|

| 0 | 2015 | East 38th Street | Automobile | Yard/Switch | 0 | 0 |

| 5 | 2015 | Farmers Coop | Truck-trailer | Freight Train | 0 | 0 |

| 10 | 2013 | FM 179/Inler Avenue | Automobile | Freight Train | 0 | 0 |

| 30 | 2014 | East 40th Street | Pick-up truck | Yard/Switch | 0 | 0 |

| 40 | 2016 | 50th Street East | Truck-trailer | Yard/Switch | 0 | 0 |

| 50 | 2015 | 34th and Alcove | Automobile | Freight Train | 0 | 1 |

| 60 | 2013 | Spur 331/Southeast Drive | Pick-up truck | Yard/Switch | 1 | 0 |

As you can see from the table above, the only railroad fatality that was not a suicide happened on Spur 331/Southeast Drive.

Allstate America’s Best Drivers Report

Have you ever wondered how drivers across the country compare to the drivers in your city?

According to data collected from Allstate’s Best Drivers in America Report, Lubbock is the 49th safest city in the country for driving as of 2019.

In Lubbock, Texas, the likelihood of an insurance claim being made as compared to the national average is 7.40 percent. Residents of Lubbock have 9.3 years on average between claims.

Nine years is a long time to go without getting into an accident.

Ridesharing

What ridesharing services are available in your area?

According to RideGuru, the following ridesharing services are active in Lubbock, Texas:

- Carmel – When you order a Carmel car you have the choice of riding in a sedan, minivan, stretch limousine, SUV, or SUV super-stretch limo.

- Lyft

- Taxi

- Uber

E-star Repair Shops

Are you in need of some vehicle repairs? E-star is here to help. E-star is an Esurance-sponsored program that helps drivers find the best repair shops in their area.

Take a look at the best vehicle repair shop in Lubbock, Texas, listed below.

| Shop Name | Address | Contact Information |

|---|---|---|

| Gerber Collision & Glass - Lubbock/50th Street | 806 50th St. Lubbock, TX 79404 | email: [email protected] P: (806) 747-3459 F: (806) 744-3056 |

Weather

What is the weather usually like in Lubbock, Texas?

The table below shows U.S. Climate Data’s stats for typical temperatures in Lubbock.

| Lubbock, Texas, Weather | Details |

|---|---|

| Annual High Temperature | 74.3° F |

| Annual Low Temperature | 47° F |

| Average Temperature | 60.65° F |

| Average Annual Precipitation (Rainfall) | 19.18 inches |

| Average Annual Snowfall | Nine Inches |

The average weather and climate in your city can affect your car insurance rate. If your area is prone to natural disasters, your rate might be higher than average.

According to City-Data, the city of Lubbock has experienced 13 total natural disasters, which is the same as the nationwide average of 13. A total of six natural disasters in Lubbock County were declared by the president as major disasters, while seven were declared to be emergencies.

The causes of these natural disasters were as follows:

- Hurricanes – Six

- Floods – Four

- Tornadoes – Four

- Fires – Three

- Storms – Three

- Winds – Three

- Winter Storm – One

Note that some of these incidents may be assigned to more than one category.

How do you protect your vehicle in the event of a natural disaster?

Watch the video below.

https://www.youtube.com/watch?v=d3eh4wIuNks

If your vehicle is damaged because of a natural disaster, comprehensive coverage will take care of the repairs and/or replacements for your vehicle.

Comprehensive coverage could cost you as little as $30 more than a low coverage policy. If you can spare the money now, having a comprehensive policy could save you thousands of dollars in the long run.

Public Transit

Sometimes you might not have access to a vehicle, or you might just prefer not to drive. If that’s the case, you’ll probably need to ride public transportation.

Citibus is the public transportation provider for the city of Lubbock. Citibus provides three primary types of service: a Fixed Route Service, CitiAccess (paratransit system), and Special Services.

With the click of a mouse or the tap of your finger, you can check Citibus’ routes wherever you are.

Intercity buses can take you to and from Lubbock, Texas, at ridiculously low prices. CheckMyBus provides you with the means to compare the bus routes to find the one that meets your highest comfort standards. Currently Busbud and Greyhound include Lubbock, TX in their routes. Pick one and see all the bus info at a glance.

Fixed Route service is provided to the public by a set of fixed routes circulating throughout the city on a set schedule.

Buses are fully accessible to persons with disabilities.

- Lubbock System Map (PDF)

- Route 1 – Dunbar Area

- Route 2 – East Broadway

- Route 5 – Boston / South Quaker / South Plains Mall

- Route 6 – Buddy Holly / 50th Street Crosstown

- Route 9 – Avenue Q / South University / S. Quaker

- Route 12 – Arnett Benson / 4th Street

- Route 14 – Cherry Point

- Route 19 – Wayland Plaza / South Plains Mall

- Route 34 – 34th Street / South Plains Mall

- Department of Public Safety Route and Times

Citibus does not operate on the following holidays:

- New Year’s Day

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

NiteRide is a curb-to-curb evening service provided by Citibus to facilitate the needs of passengers who require service within the Lubbock city limits at the conclusion of the day’s fixed route and paratransit services.

Does your student need a way to get to work, school, or summer activities? The CitiKids program offers Lubbock youths ages 6-18 the opportunity to ride the Citibus Fixed Route system.

Passes are available at the main office at 801 Texas Avenue or the Downtown Transfer Plaza at 801 Broadway. For more information call 806-712-2000.

Registration for the program is required, at which time a picture I.D. will be provided by Citibus. Picture I.D. must be carried with CitiKids and CitiSummer passes. Proof of age is required.

Alternate Transportation

According to an article by TechCrunch.com, six months after Lime rolled out its motorized vehicles in Lubbock — the city in Northwest Texas that Texas Tech calls home — the company pulled them from the city streets.

This occurred because overzealous fans who gathered near the school after its win over Michigan State on a Saturday night reportedly began tearing down street signs, throwing glass bottles in the air, tipping over at least one car, and setting scooters on fire.

Parking in Metro Areas

The city of Lubbock has free two-hour parking available on any day of the week. For more information on parking in Lubbock, please visit Parkopedia.

Are you looking for a place to charge your electric vehicle?

ChargeHub says that Lubbock has four public charging station ports (Level 2 and Level 3) within about nine miles. About a quarter of these allow you to charge for free.

The main charging network in operation is ChargePoint. You can find out more about the charging networks (policies, pricing, and registration information) by visiting ChargeHub’s networks section.

With the ChargeHub charging stations map you have all the information you need about Lubbock’s public charging infrastructure. The charging station descriptions give you the address, the type of connector, the network, the price, and a lot more.

Air Quality in Lubbock

Back in the day, cars used to give off a lot of toxic fumes. This isn’t a huge cause for concern today, but it’s still a good idea to know the quality of air in your city.

The next table shows the air quality in Lubbock, based on the Environmental Protection Agency’s reports from 2017–2019.

| Lubbock Air Quality Index | 2017 | 2018 | 2019 |

|---|---|---|---|

| Days with AQI | 340 | 303 | 245 |

| Good Days | 327 | 275 | 233 |

| Days Moderate | 13 | 27 | 11 |

| Days Unhealthy for Sensitive Groups | 0 | 1 | 1 |

| Days Unhealthy | 0 | 0 | 0 |

| Days Very Unhealthy | 0 | 0 | 0 |

As you can see, there weren’t any days where the air quality was considered “unhealthy” in Lubbock from 2017–2019.

Military/Veterans

If you’re active-duty military or a veteran, you might qualify for a discount on your car insurance in Lubbock, Texas.

Before we get into military discounts, let’s take a look at veteran statistics.

Lubbock, Texas, has a large population of military personnel who served in Vietnam, 1.05 times greater than the population of vets from any other conflict.

The second Gulf War was the second most common service period, with 2,937 residents having served in this conflict. The first Gulf War was the third most common service period, with 1,837 veteran residents.

How many bases are within one hour of Lubbock?

According to Military.com, there are 14 military bases in the state of Texas. The US Reese AFB Conversion Agency, the US Naval Reserve Center, and the US Army Department are all located in the city of Lubbock.

To say “thank you” for your service, the following car insurance companies offer all active military personnel and veterans a discount on their car insurance policies.

| Insurer | Percentage Saved with Discount |

|---|---|

| Allstate | N/A |

| Farmers | N/A |

| Geico (Active or Retired Personnel) | 15% |

| Liberty Mutual (Active Duty Only) | 4% |

| MetLife | 15% (Based on Years of Service) |

| Safeco (Active or Retired) | N/A |

| USAA (Policyholder, spouse, or parents must be active or retired) | N/A |

USAA also currently offers a military garage discount for vehicles on a military base. Not every company lists the percentage saved via their discounts, which is why several of the providers have “N/A” listed in the percentage box. However, they do still offer military discounts.

USAA proudly services military members and their families across the U.S. Check out the table below to see USAA’s rates as compared to competitor carriers and the state average (which is approximately $4,043.28).

| Group | Annual Premium | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Allstate | $5,485.44 | $1,442.16 | 26.29% |

| American Family | $4,848.72 | $805.44 | 16.61% |

| Geico | $3,263.28 | -$780.00 | -23.90% |

| Nationwide | $3,867.55 | -$175.73 | -4.54% |

| Progressive | $4,664.69 | $621.41 | 13.32% |

| State Farm | $2,879.94 | -$1,163.34 | -40.39% |

| USAA | $2,487.89 | -$1,555.39 | -62.52% |

As you can see from the table above, USAA has the best rates for military members when compared to the rates of its competitors.

Unique Lubbock Laws

Before we let you go, take a look at these unique Lubbock city laws.

What does the city of Lubbock have to say about driving while using your cellphone?

On September 1, 2017, the Governor of Texas signed a bill into law making it illegal to text while behind the wheel. First-time offenders face fines ranging from $25–$99, while repeat offenders could incur fines from $100 all the way up to $200.

The law pertains specifically to reading, sending, or writing electronic messages.

Can you own and sell food from a food truck in Lubbock?

According to a recent article, in order to be able to operate a food truck, Lubbock city law requires mobile vendors to complete and submit a $250 application for a Mobile Food Vending Permit and also complete all the required inspections through the Fire Marshal’s Office and the Environmental Health Department. The permits are valid for one year.

Can residents of Lubbock live in tiny homes?

https://www.youtube.com/watch?v=7oTSlXI8Xno

According to Lubbock County law, there aren’t any zoning regulations, per se. The County does not require or issue building permits. They do have Subdivision Regulations and other permitting requirements. You may access these at their website under the department’s section.

Lastly, let’s focus on parking laws.

The city of Lubbock does not allow a person’s neighbors to park in front of their homes. This restriction will not override the existing ordinance of the city codes restricting persons from habitually parking adjacent to residential property owned by another.

What costs are associated with the installation of a parking permit area?

The cost of installing this program will be a $50 application fee, plus the cost of all signs. Parking restriction signs are placed approximately every 150 feet and cost $200 each.

Parking permits can be purchased once a year for each vehicle in a household, with a total limit of five parking permits per residence. Parking permits are $5 each and expire annually on July 31.

Lubbock Car Insurance FAQs

If we didn’t quite answer all of your questions about car insurance in Lubbock, Texas, take a quick look at our frequently asked questions section below.

What are the minimum car insurance requirements?

The minimum liability car insurance requirements in Texas are $30,000 bodily injury liability coverage per person, $60,000 total bodily injury liability coverage per accident, and $25,000 property damage coverage per accident.

What happens if I get into a car accident in Lubbock?

Texas adheres to the traditional fault system when assessing liability for a collision. This means that the at-fault driver is responsible for covering the cost of damages incurred by another party or parties due to an accident they cause.

After a collision, the injured party may opt to file a claim with their insurer and/or the at-fault driver’s carrier. The injured party may also consider filing a personal injury claim against the at-fault individual to secure compensation for things like property damage, medical bills, pain and suffering, and additional losses.

Are there any car insurance options for high-risk drivers?

If you have a history of accidents and/or traffic violations on your record and have been unable to secure insurance through in the traditional marketplace, Texas offers a plan for high-risk drivers called the Texas Automobile Insurance Plan Association (TAIPA).

Note, that you will not be able to select your own carrier and certain eligibility requirements apply. Visit the TAIPA website for more information.

What is the cost of living like in Lubbock?

According to a study by Sperling’s Best Places, the cost of living in Lubbock is below the nationwide average. Sperling rated the cost of living at 79.9.

A figure below 100 indicates that a city is cheaper than the U.S. average, while a number exceeding 100 means that the city is more expensive. The median home price in Lubbock, Texas, is $133,200.

How large is Lubbock?

Lubbock is the 79th-largest U.S. city by land area (122.4 sq. mi).

Now that you’ve learned all you need to know about car insurance in Lubbock, Texas, it’s time to start comparing rates on your own. Use our free tool by entering your ZIP code in the box below.

Happy shopping.