Cheap Auto Insurance in Utah for 2026 (Lowest Rates With These 10 Companies)

The top providers for cheap auto insurance in Utah are USAA, Geico, and Travelers. Rates start at $22 per month, and coverage meets the 30/65/25 state limits. USAA, exclusive to the military, offers 15% off on garage vehicle on-base. Geico provides DriveEasy savings, and Travelers offers IntelliDrive program.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: May 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsUnlock savings with the top providers for cheap auto insurance in Utah, as USAA, Geico, and Travelers deliver unique features built for Utah drivers.

USAA adds classic car protection, military mileage adjustments, and optional coverage for uniform replacement. Geico stands out with mechanical breakdown insurance, mobile app claims, and up to 23 percent off for consistent seatbelt use.

Our Top 10 Company Picks: Cheap Auto Insurance in Utah

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A++ | Military Discounts | USAA | |

| #2 | $33 | A++ | Low Rates | Geico | |

| #3 | $39 | A++ | Competitive Pricing | Travelers | |

| #4 | $41 | A+ | Good Discounts | Nationwide |

| #5 | $42 | A+ | Snapshot Program | Progressive | |

| #6 | $46 | B | Policy Bundling | State Farm | |

| #7 | $47 | A | Safe Driver | American Family | |

| #8 | $51 | A | Discount Options | Farmers | |

| #9 | $52 | A+ | Drivewise Program | Allstate | |

| #10 | $53 | A | Flexible Plans | Liberty Mutual |

Travelers provides early quote discounts, new car replacement coverage, and diminishing deductible rewards that reduce out-of-pocket expenses.

- USAA offers 90-day storage discounts and specialty vehicle coverage

- Cheap car insurance in Utah requires $25,000 bodily injury per person

- Utah drivers with clean records save up to 40% through usage-based apps

Get matched with the cheapest car insurance in Utah by using our free ZIP code quote tool to compare rates and find the best value coverage in your area.

#1 – USAA: Top Overall Pick

Pros

- Military Housing Discount: Drivers in Utah who garage their cars on base get a 15% rate reduction, making USAA an ideal choice for active-duty military.

- Classic Auto Perks: Coverage for classic vehicles is available in Utah, perfect for those with restored or collector cars that see limited road time, which you can check in the USAA auto insurance review.

- Uniform Protection: USAA includes optional coverage for military uniforms damaged in a Utah auto accident, which sets it apart from most insurers.

Cons

- Membership Limitations: Only military members and their families in Utah can qualify, so civilians won’t have access to these benefits.

- Fewer Add-On Options: Compared to other carriers in Utah, USAA offers a narrower range of policy add-ons, such as rideshare or gap insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

- DriveEasy Rewards: Utah drivers can save up to 23% for safe driving habits tracked through Geico’s DriveEasy app, including seatbelt use and smooth braking.

- Extended Repair Coverage: Mechanical breakdown insurance is available for newer cars in Utah. It covers major repairs at a fraction of dealer warranty costs.

- Mobile-Friendly Claims: Geico’s app allows Utah users to file and track claims easily, with tools like photo uploads and real-time updates. Read more through our Geico auto insurance review.

Cons

- Limited In-Person Access: Drivers in some rural Utah areas may struggle to find nearby Geico offices for face-to-face support.

- Small Bundling Benefits: While bundling home and auto is an option, Utah customers’ savings often fall short of what competitors offer.

#3 – Travelers: Best for Competitive Pricing

Pros

- IntelliDrive Program: Utah drivers who opt in can see lower rates after just 90 days of driving feedback, especially with good habits like gentle acceleration.

- Accident Forgiveness: Travelers won’t raise rates after your first at-fault accident if you’ve had five claim-free years in Utah, a big help for peace of mind.

- Shrinking Deductibles: Drivers in Utah get $50 off their deductible each year they go without a claim, rewarding long-term policyholders. To see more, read our Travelers auto insurance review.

Cons

- Uncertain Upfront Rates: Initial quotes for Utah drivers may be higher until IntelliDrive data kicks in, which can make it harder to compare early pricing.

- Fewer Local Offices: If you prefer in-person service, Travelers might be harder to reach in some Utah cities and smaller towns.

#4 – Nationwide: Best for Good Discounts

Pros

- SmartRide Discounts: Utah drivers can earn up to 40% off by enrolling in SmartRide, which tracks safe habits like braking and mileage, according to our Nationwide auto insurance review.

- Annual Policy Reviews: Nationwide offers Utah customers a yearly On Your Side review to help adjust coverage levels and spot savings opportunities.

- Vanishing Deductibles: For every year of safe driving in Utah, your deductible drops by $100, up to $500, without paying extra for the feature.

Cons

- Not Ideal for Privacy-Minded Drivers: Those in Utah who aren’t comfortable with tracking technology may miss out on SmartRide’s biggest savings.

- Bundling Isn’t Always Better: Some Utah customers report smaller bundling savings compared to providers who heavily reward multi-policyholders.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Program

Pros

- Snapshot Savings Potential: Utah drivers who demonstrate safe habits, like low mileage and smooth braking, can save up to 30%. Check more on our Progressive auto insurance review.

- Flexible Budget Tools: The Name Your Price tool helps Utah drivers match coverage options to their monthly budget without sacrificing key protections.

- Wide Array of Discounts: Progressive stacks multiple discounts in Utah, including ones for continuous coverage, online quotes, and even being a homeowner.

Cons

- Rates May Rise with Snapshot: Unlike some competitors, Progressive could raise your rate in Utah if Snapshot reports high-risk behaviors.

- Can Be Overwhelming to Navigate: With so many options, some Utah drivers find Progressive’s online platform and quote customization a bit confusing.

#6 – State Farm: Best for Policy Bundling

Pros

- Bundled Discount Leverage: Utah drivers can unlock up to 17% off when bundling auto with home or renters insurance under State Farm’s multi-line policy structure.

- High Financial Strength: With an A++ A.M. Best rating, State Farm car insurance in Utah provides policyholders long-term stability and reliability. Discover more in our State Farm auto insurance review.

- Drive Safe & Save Rewards: Utah customers who enroll in this program, especially those with consistent low-mileage use, can benefit from telematics-based savings.

Cons

- Limited Custom Coverage: Some specialized coverages, like gap insurance and rideshare protection, are less comprehensive for Utah drivers compared to newer carriers.

- Fewer Instant Quote Tools: Unlike other providers, Utah customers may face a slower quoting process due to State Farm’s heavier reliance on agent involvement.

#7 – American Family: Best for Safe Driver

Pros

- KnowYourDrive Discounts: Utah drivers can save up to 20% with this telematics program, which tracks behaviors like hard braking and late-night travel.

- Teen Driver Monitoring: Parents in Utah benefit from unique tools like the Teen Safe Driver app, which encourages safer habits, as mentioned in our American Family insurance review.

- Loyalty Rewards: As part of American Family’s commitment to retention, long-term Utah policyholders receive declining deductibles and renewal discounts.

Cons

- Narrow Regional Reach: American Family’s availability is mostly limited to certain parts of Utah, which may limit support or quoting ease statewide.

- Fewer Digital Self-Service Options: Utah drivers looking for robust mobile tools may find the AmFam app less flexible than competitors’ platforms.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Discount Options

Pros

- Signal Telematics Savings: Utah drivers using Signal can save up to 30% for consistently safe driving patterns, including avoiding phone use behind the wheel.

- Affinity Group Perks: Based on our Farmers auto insurance review, occupational group offerings offer discounts for Utah-based professionals like teachers, doctors, and first responders.

- New Car Replacement Add-On: Farmers provides Utah drivers with replacement cost coverage for brand-new vehicles totaled in the first two model years.

Cons

- Above-Average Baseline Rates: Even with discounts, Farmers’ starting premiums in Utah tend to be higher than Geico’s or Progressive’s for comparable coverage.

- Agent-Centric Adjustments: Utah policyholders may need to contact local agents directly to apply certain policy changes, which slows down self-service convenience.

#9 – Allstate: Best for Drivewise Program

Pros

- Drivewise Participation Perks: Utah drivers using Drivewise can earn cashback rewards every six months, along with potential premium discounts for smooth, alert driving.

- Deductible Rewards Program: Allstate gives Utah drivers $100 off their collision deductible the moment they sign up, plus $100 more each claim-free year.

- Claim RateGuard Add-On: This optional benefit prevents Utah premiums from rising after the first accident, even if the driver is at fault. See our Allstate insurance review to check your perks.

Cons

- Higher Entry-Level Pricing: Allstate’s average starting rates for minimum coverage in Utah exceed those of USAA and Geico, even after applying initial discounts.

- Mixed Customer Satisfaction: Some Utah drivers have reported variability in claim resolution times and responsiveness depending on local agent availability.

#10 – Liberty Mutual: Best for Flexible Plans

Pros

- RightTrack Telematics Discounts: Utah drivers who enroll in RightTrack can earn up to 30% off based on driving behavior, including braking, acceleration, and nighttime trips.

- Better Car Replacement Coverage: Liberty Mutual offers Utah customers a total loss settlement upgrade to a newer model year vehicle with fewer miles.

- Optional OEM Part Guarantee: Utah policyholders can select original manufacturer parts for repairs after a collision. For more information, check out our Liberty Mutual auto insurance review.

Cons

- Premium Increases Post-Claim: Liberty Mutual’s pricing structure in Utah may lead to significant premium hikes after just one at-fault accident.

- Less Transparent Quote Flow: Some Utah users report inconsistent online quote results that differ from final premiums once underwriting is complete.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Getting Cheap Auto Insurance Coverage Rates in Utah

How much is car insurance in Utah per month? Monthly rates for car insurance in Utah show that different companies have quite different prices. USAA is the cheapest, with minimum coverage at $22 and full coverage at $50 per month. Geico has the second-lowest rates with $33 for basic coverage and $73 for a more complete option.

Utah Auto Insurance Monthly Rates by Coverage Level

| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $52 | $117 | |

| $47 | $105 | |

| $51 | $115 | |

| $33 | $73 | |

| $53 | $119 |

| $41 | $93 |

| $42 | $95 | |

| $46 | $103 | |

| $39 | $88 | |

| $22 | $50 |

On the other hand, companies like Liberty Mutual and Allstate ask above $50 just to start with their simplest plans. Full coverage increases by as much as $69, depending on which insurance company you choose.

Rural ZIP codes in Utah can lower rates due to fewer claims and accidents. In particular, areas outside Salt Lake City see 15% lower average premiums.

Kristen Gryglik Licensed Insurance Agent

It is essential to know the minimum car insurance requirements in Utah and carefully choose what is suitable for your needs.

A clean record usually shows that the driver is careful and controlled when driving. But if there are any marks on the record, like small tickets or big violations, it affects the cost of insurance.

Each insurance company examines these details using its own method of assessing risk. This can lead to unexpected results that may not really relate to how serious the violation is, but rather how important it is considered by the insurer.

Cheap Auto Insurance Discounts in Utah

Top insurers in Utah offer many important discounts. Nationwide offers a 40% discount to safe drivers and those who use tracking based on how they drive. Liberty Mutual offers a good 35% discount for having anti-theft measures.

Auto Insurance Discounts From the Top Providers in Utah

| Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

| 25% | 25% | 25% | 20% | 30% | |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 5% | 20% | 40% | 15% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 13% | 10% | 8% | 30% | |

| 15% | 10% | 30% | 10% | 30% |

American Family, Geico, and Farmers usually offer 25-30% discounts in the main areas. Progressive’s $231 yearly UBI discount is a notable alternative to percentage-based discounts.

Top providers in Utah offer various discount opportunities. USAA rewards low mileage and military service, while Geico focuses on safe drivers and newer cars. American Family values loyalty, buying insurance early, and using smart technology.

Auto Insurance Discounts From the Top Providers in Utah

| Company | Available Discounts |

|---|---|

| Multi-Policy, Smart Student, Drivewise (Usage-Based), New Car, Anti-Lock Brakes, Safe Driving Club | |

| Multi-Policy, Good Student, Defensive Driver, Loyalty, Early Bird, Low Mileage, Generational, Smart Home | |

| Multi-Policy, Good Student, Signal (Usage-Based), Bundling, Affinity, Homeowner, Senior Driver | |

| Multi-Policy, Good Driver, Good Student, Anti-Theft Device, Military, Emergency Deployment, New Vehicle | |

| Multi-Policy, Good Student, New Car, RightTrack (Usage-Based), Accident-Free, Paperless, Military |

| Multi-Policy, Accident-Free, Good Student, Paperless, SmartRide, Defensive Driving Course, Anti-Theft |

| Multi-Policy, Good Student, Snapshot (Usage-Based), Continuous Insurance, Teen Driver, Online Quote, Homeowner | |

| Multi-Policy, Good Student, Drive Safe & Save (Usage-Based), Steer Clear (Young Driver), Anti-Theft, Passive Restraint | |

| Multi-Policy, Safe Driver, Home Ownership, Hybrid/Electric Vehicle, Good Student, Continuous Insurance | |

| Safe Driver, Good Student, Multi-Policy, Military, Defensive Driving Course, Vehicle Storage, Low Annual Mileage |

Liberty Mutual and State Farm offer programs based on how much you use their services. Multi-policy and student discounts are very common everywhere, helping to reduce monthly costs in Utah.

Utah drivers can use many different auto insurance discounts, but the amount saved is not always the same. Discounts for being a safe driver and having more than one policy are among the best, giving up to 30% off.

Utah Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Safe Driver Discount | A | 30% | Most major insurers |

| Multi-Policy Discount | A- | 25% | State Farm, Allstate, Farmers, Progressive |

| Good Student Discount | B+ | 20% | Geico, State Farm, Progressive |

| Low Mileage Discount | B | 15% | Nationwide, Allstate, USAA |

| Anti-Theft Discount | B- | 10% | Most major insurers |

| Defensive Driving Discount | C+ | 10% | American Family, Farmers |

| Pay-in-Full Discount | C | 10% | Progressive, Liberty Mutual |

Deals for good students and low-mileage drivers usually give around a 15–20% discount. Other options, such as paying in full or having anti-theft devices, offer discounts up to 10%. Participating providers also differ across each discount type.

Read more: Claim-Free Discount: How Much Can You Save?

Auto Insurance Claim Volumes in Utah

In Utah, the number of accidents and claims varies greatly from city to city. Salt Lake City has about 8,500 accidents and 7,000 claims every year, the highest in the region.

Utah Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Logan | 1,200 | 900 |

| Ogden | 3,500 | 2,800 |

| Orem | 2,800 | 2,200 |

| Provo | 3,000 | 2,400 |

| Salt Lake City | 8,500 | 7,000 |

| Sandy | 2,400 | 1,900 |

| South Jordan | 1,800 | 1,400 |

| St. George | 2,000 | 1,600 |

| West Jordan | 3,200 | 2,600 |

| West Valley City | 4,500 | 3,800 |

West Valley City and Ogden also have high traffic incident reports. Smaller cities such as Logan and South Jordan experience fewer than 2,000 accidents each year. This shows that the risk of accidents is quite different depending on where you are located.

Utah drivers submit many different auto insurance claims. Fender benders are the most common, making up 30% of these claims and typically costing about $2,500 to fix.

5 Common Auto Insurance Claims in Utah

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Fender Benders | 30% | $2,500 |

| Windshield Damage | 25% | $400 |

| Rear-End Collisions | 20% | $4,000 |

| Deer-Related Accidents | 15% | $3,500 |

| Theft & Vandalism | 10% | $5,000 |

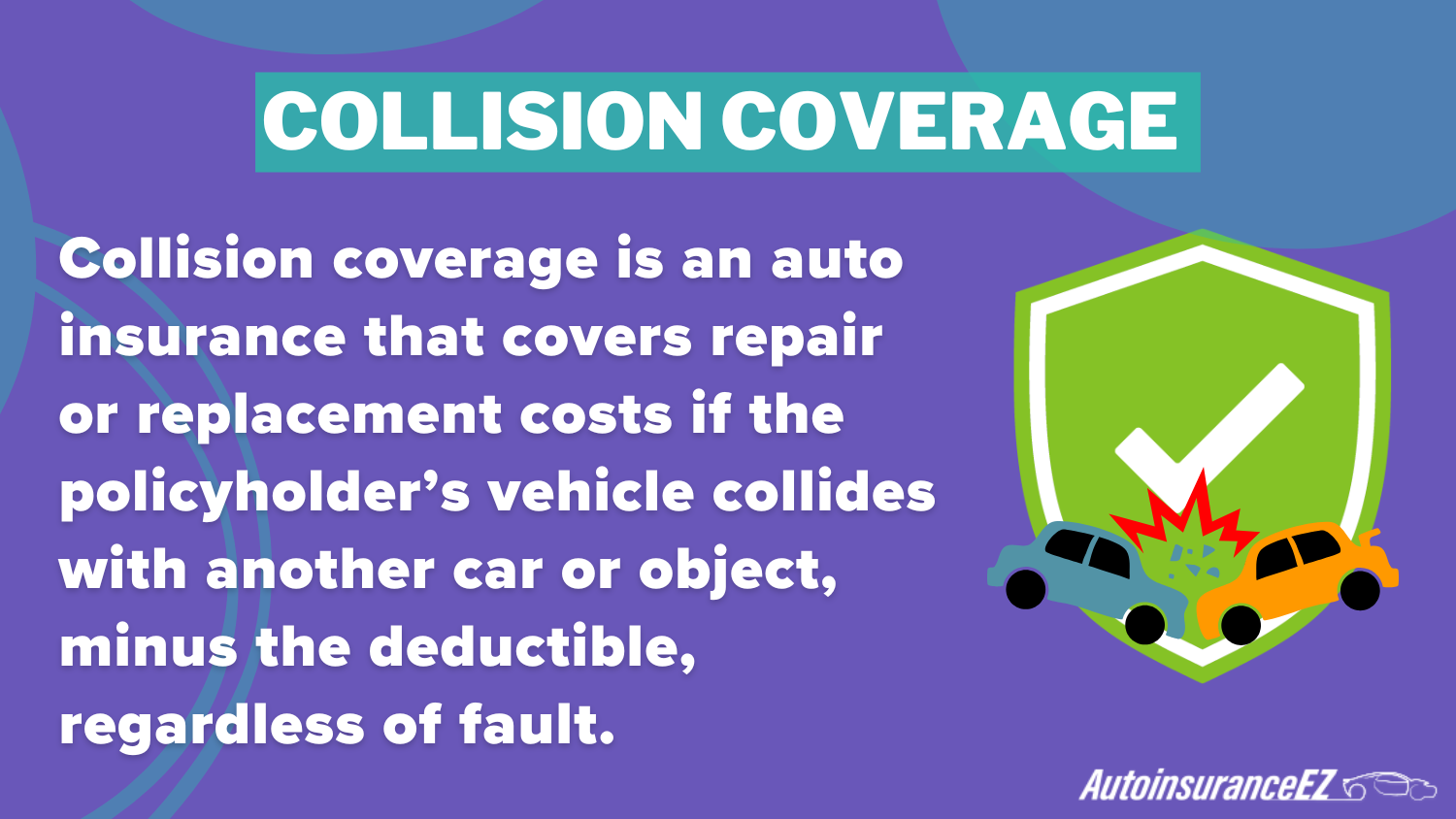

Windshield damage comes second, and it is cheaper, at around $400 per claim. Rear-end collisions and hitting deer happen less often, but they cost more when they do occur. Theft and vandalism are not very common, but they are the most expensive, costing around $5,000 per claim on average. Learn how comprehensive and collision coverage affect what you pay for auto insurance in Utah.

Utah’s auto insurance premiums show mixed results when looking at the main risk factors. The weather is very good, with not many severe events happening often. Traffic density is not too high because there are many rural areas.

Utah Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Minimal weather impacts, rare severe events |

| Traffic Density | B+ | Some congestion in Salt Lake City, but rural areas help |

| Average Claim Size | B- | Moderate claim sizes due to repair costs |

| Vehicle Theft Rate | C | Slightly above-average theft rate in urban areas |

| Uninsured Drivers Rate | D | High rate of uninsured drivers, raising premiums |

However, in cities, car theft rates and repair costs make things worse. Also, many drivers without insurance bring down the overall score even more. These combined factors shape how much drivers in Utah pay each month.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Navigating Cheap Auto Insurance in Utah

Finding cheap auto insurance rates in Utah is not only about picking the lowest cost; it also means choosing a company that fits well with your way of life, how you drive, and the specific risks in your area. Top companies like USAA, Geico, and Travelers are noted for providing useful programs such as discounts based on telematics (tracking driving behavior), rewards for safe drivers, and options for accident forgiveness.

Adding a second car to your Utah policy often unlocks multi-vehicle pricing perks. In particular, this can cut costs by over $150 a year.

Jeffrey Manola Licensed Insurance Agent

With traffic jams mostly in city areas and more drivers without insurance, knowing these risk factors is important to keep your premiums from going up. By looking at quotes, checking discounts, and studying coverage choices, drivers in Utah can choose the best policy that offers good value, flexibility, and dependable protection.

Get access to affordable car insurance in Utah by using our no-cost quote tool and entering your ZIP code to find the best value coverage near you.

Frequently Asked Questions

What are the primary benefits of choosing USAA for auto insurance in Utah?

USAA benefits military members due to its exclusive discounts, which significantly lower premiums for eligible drivers in Utah. See why military auto insurance is ideal for Utah service members with vehicles on base.

How does Geico compare to other providers in terms of offering competitive rates for Utah drivers?

Geico offers competitive rates in Utah by utilizing efficient pricing models and discounts, making it a strong choice for affordable auto insurance.

What factors make Travelers an attractive option for budget-conscious drivers in Utah?

Travelers appeals to budget-conscious drivers because of their competitive pricing and flexible coverage options tailored to various driving needs. Enter your ZIP code to compare the best auto insurance in Utah.

What are the minimum car insurance requirements in Utah?

Utah requires minimum coverage that includes personal injury protection, liability coverage for bodily injury and property damage, and it’s essential to meet these to comply with state law.

How does Utah’s “no-fault” system affect car insurance claims and personal injury protection?

The “no-fault auto insurance” system in Utah ensures that drivers receive compensation for medical expenses and other losses regardless of who caused the accident, but it doesn’t cover non-monetary damages.

How does bundling auto and home insurance with State Farm lead to savings?

Bundling auto and home insurance with State Farm results in discounts, potentially lowering overall premiums for Utah drivers, and is an excellent strategy for saving on car insurance in Utah.

How does Progressive Snapshot lower your auto insurance premiums?

Progressive’s Snapshot Program tracks driving habits and rewards safe driving with potential premium discounts, making it ideal for low-risk drivers.

Does Geico car insurance in Utah offer lower rates for safe drivers?

Geico car insurance in Utah rewards safe driving through its DriveEasy program, helping you lower your monthly rate with consistent, responsible driving behavior.

How much can Utah drivers save by bundling policies with State Farm?

State Farm’s policy bundling allows drivers to combine car and home insurance, resulting in discounts that lower overall premiums for multiple policies

How do Utah’s car accident statistics impact insurance premiums?

Car accident statistics in Utah influence insurance premiums by increasing rates in high-accident areas, emphasizing the need for good coverage to protect against costly claims.

Is QBE car insurance in Utah a good option for reliable monthly rates?

QBE car insurance in Utah may offer competitive monthly pricing, but it’s often limited in availability compared to larger carriers, making it less flexible for most drivers.

Can Root insurance in Utah help you save through driving behavior tracking?

Yes, Root insurance in Utah bases your monthly premium on your driving habits through its mobile app, which can lead to savings if you’re a consistently safe driver.

What are the key differences between liability insurance and other types of coverage?

Liability insurance helps cover the costs of damages or injuries to others when you’re at fault, while additional coverage types like collision or comprehensive insurance cover your own vehicle.

Can Progressive insurance in Utah reduce your monthly cost through Snapshot?

Progressive insurance in Utah offers Snapshot, a telematics tool that tracks how you drive, potentially lowering your monthly premium if your habits are low-risk.

What is the average car insurance in Utah based on monthly rates?

The average car insurance rates in Utah range between $40 and $100 per month, depending on your driving record, coverage level, and ZIP code. Use our free ZIP code tool to discover low monthly rates for the cheapest insurance in Utah.

Is Bear River auto insurance in Herriman, UT, a good choice for local drivers?

Bear River auto insurance in Herriman, UT, offers competitive monthly rates for local residents and is known for favoring safe drivers with clean records. Find out which companies deliver the best Salt Lake City, UT auto insurance for safe drivers.