The Ultimate Georgia Car Insurance Guide (Costs + Coverage)

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Feb 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Georgia Statistics Summary | |

|---|---|

| Road Miles 2014 | Total in State: 127,492 Vehicle Miles Driven: 111,535 Million |

| Vehicles 2014 | Registered: 7,955,532 Total Stolen: 26,854 |

| State Population | 10,519,475 |

| Most Popular Vehicle | F150 |

| Percentage of Motorists Uninsured | 12% State Rank: 25th |

| Driving Deaths | Speeding (2017) Total: 248 Drunk Driving (2017) Total: 366 |

| Average Premiums 2015 (Annual) | Liability: $490.64 Collision: $320.45 Comprehensive: $153.61 Combined Premium: $964.70 |

| Cheapest Provider | State Farm Mutual Auto |

Whether you’re driving into Atlanta or cruising up the coast, the Peach State is a beautiful place for a drive.

When long, flat roads of the coastal plains give way to the spectacular Blue Ridge Mountains, any driver feels lucky to be in Georgia.

A strong auto insurance policy ensures that you can travel up and down the state uninhibited by worries or stress. Just you and the open road.

Unfortunately, it’s often difficult to find straightforward information on car insurance companies.

Who will provide the best coverage? How much will it cost?

That’s why we’ve compiled all the details on Georgia’s numerous auto insurance providers and state laws.

We can help you find the coverage you need at the rates you deserve with transparent, straightforward information. Whether you live in Athens, Savannah, Columbus, Augusta, Atlanta, Roswell, Macon, or Albany, enter your zip code to get up to 10 free car insurance quotes from the leading providers in your area.

Georgia Car Insurance Coverage and Rates

When it comes to car insurance, the options can feel endless. Luckily, you don’t have to go it alone.

Join us as we dive into the coverage, rates, and add-ons available in the great state of Georgia.

Our comprehensive guide to Georgia car insurance options will break everything down into easy-to-understand sections.

We can help you find the coverage that fits your car, lifestyle, and budget, all at once.

Ready to explore? Let’s dig in.

Georgia’s Car Culture

Did you know that Georgia is the biggest state east of the Mississippi? That means there are tons of roads, plenty of drivers, and endless opportunities for road trips. In Georgia, people love their cars.

As a southern state, Georgia enjoys warm winters that are free from harsh weather. That makes it a happy home for classic car collectors. You can glimpse many fine classic cars on the highways, byways, and country roads across the state.

Georgia’s Minimum Coverage

Like other states across the country, Georgia has instituted laws requiring a certain amount of auto insurance coverage for all drivers.

Georgia operates as a “fault” car accident state. What does that look like? In an accident, the at-fault driver is liable for personal injury and property damage resulting from the crash.

The at-fault driver’s liability insurance policy is looked at first to pay for any losses or damages.

The owner of a motor vehicle in Georgia is required to carry liability insurance coverage on his or her vehicle. The minimum amount you are required to carry is:

- $25,000 for the injury or death of one person in one accident

- $50,000 for total injuries or death of two or more persons in one accident

- $25,000 for property damage in one accident

This coverage pays the costs, including medical bills and property damage bills, of drivers, passengers, and pedestrians whose bodies are injured or vehicles are damaged in an accident you cause, up to the coverage limits.

Higher coverage limits can help protect you from paying out-of-pocket for damages and injuries.

Remember: This liability coverage does NOT apply to your own vehicle damage or bodily injury in a car accident you cause.

What the state of Georgia does not require is uninsured/underinsured motorist coverage. UUM coverage protects you, the driver, when an uninsured motorist causes an accident.

Some drivers do not obey the law or unknowingly allow their auto insurance to lapse. That’s where UUM coverage comes in. Policyholders must reject this coverage in writing.

Forms of Financial Responsibility

If you are registering a car in Georgia, you must provide proof of liability insurance when you apply to register.

If you get pulled over while driving through Georgia, you must present proof of minimum insurance coverage.

You are legally permitted to use an electronic copy of your insurance card. If you cannot produce proof of insurance, you are at risk of severe legal consequences.

Insurance companies are required to submit coverage to the Georgia Department of Revenue.

Georgia’s Premiums as a Percentage of Income

The phrase “per capita disposable personal income,” might sound confusing at first, but its definition is simple. Disposable personal income is the money you have available after paying taxes. “Per capita” refers to the amount of money each individual has.

Putting these phrases together, we learn that as of 2014, Georgia residents’ annual per capita disposable personal income is $38,558.

The amount of money each individual driver pays for full coverage comes in at about $991.25, just under $1,000.

So, the average Georgia driver’s car insurance payment would require them to spend 2.87 percent of their total disposable income on coverage each year. This is right in line with other states, where the percentage varies between 1-3 percent.

Core Coverage

Georgia doesn’t have the highest car insurance premiums in the country, nor does it have the lowest. At $991, residents are paying a middle-of-the-road amount. In fact, Georgia has the 16th-highest care insurance payment average in the United States. Not bad.

Notably, the average amount and percentage of income changed very little between 2012 and 2014. Georgia drivers can expect their costs to stay relatively stable over time.

Of course, the $991 statistic pertains only to core coverage. There are many different types of coverage available to Georgia drivers., with varying costs. All are worth considering.

| Georgia Car Insurance Type | Annual Costs in 2015 |

|---|---|

| Liability | $557.38 |

| Collision | $331.83 |

| Comprehensive | $159.18 |

| Combined | $1,048.40 |

The table above gives you an overview of the costs associated with different types of car insurance coverage in Georgia.

These statistics were reported by the National Association of Insurance Commissioners in 2015. Since then, they have likely increased.

Georgia’s Additional Liability Coverage

Though Georgia only requires a minimum amount of liability coverage, you may want to consider add-on coverage in order to fully protect yourself in the case of accidents and other incidents involving your vehicle.

11.7 percent of drivers in Georgia are uninsured or underinsured. That means it is not likely that you’ll be in an accident with an uninsured driver, but it is possible.

For this reason, you may want to consider uninsured/underinsured motorist coverage. This type of coverage is completely optional in Georgia.

– Loss Ratio

What does a loss ratio do? It helps you understand whether or not a car insurance provider is financially secure. When you take a close look at companies’ loss ratios, you can see just how often various insurers pay out claims to their clients.

Companies with higher loss ratios, such as those over 100 percent, are more likely to provide you coverage when you need it. However, they may be less financially secure.

Companies with lower loss ratios won’t necessarily cover all of your expenses should you get into an accident. They are considered more financially secure, but they aren’t paying out claims.

The table below outlines the loss ratios for personal injury protection, medical payments, and UUM in the state of Georgia.

| Georgia Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (MedPay) | 89.06% | 85.66% | 80.33% |

| Personal Injury Protection | N/A | N/A | N/A |

| Uninsured/Underinsured Motorist | 84.16% | 79.73% | 79.31% |

Add-Ons, Endorsements, and Riders

As a driver, you want your insurance coverage to be comprehensive, protecting you and your vehicle. You also want it to be affordable.

Click the links below to explore add-on options:

-

-

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

-

Georgia’s Male vs. Female Rates

There is a commonly-held belief that car insurance rates differ for men and women. Some expect men to be charged more for car insurance premiums.

However, the greatest differences we can see in Georgia have more to do with age than with gender. As you can see in the table below, the biggest gendered price differences occur during the teenage years.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,900.87 | $2,900.87 | $2,779.74 | $2,779.74 | $6,787.85 | $8,744.55 | $3,246.86 | $3,545.10 |

| Geico General | $1,798.00 | $1,774.88 | $1,741.80 | $1,741.80 | $5,405.23 | $6,468.98 | $2,312.93 | $2,573.90 |

| Safeco Ins Co of IL | $5,354.43 | $5,828.62 | $4,383.03 | $4,975.31 | $22,759.67 | $25,413.76 | $5,674.73 | $6,038.00 |

| Nationwide Mutual | $3,767.46 | $3,895.53 | $3,724.66 | $4,094.75 | $11,720.53 | $15,095.77 | $4,594.13 | $4,986.39 |

| Progressive Mountain | $2,842.70 | $2,616.94 | $2,442.41 | $2,567.85 | $8,918.63 | $9,881.25 | $3,285.16 | $3,438.84 |

| State Farm Mutual Auto | $2,211.60 | $2,211.60 | $1,984.58 | $1,984.58 | $5,893.47 | $7,744.68 | $2,426.79 | $2,621.78 |

| USAA | $1,759.52 | $1,757.11 | $1,633.74 | $1,640.04 | $6,343.65 | $7,511.58 | $2,192.11 | $2,421.96 |

Single 17-year-old males tend to be charged more than females of the same age. The gap closes as drivers age into their twenties.

Georgia’s Car Insurance Rates by Zip Code

When it comes to the rate you’ll be charged for car insurance in Georgia, location plays a major role. In the tables below, we’ve broken down average car insurance rates by zip code. You can search for your own zip code to see the average rate for your area.

| 25 Most Expensive Zip Codes in Georgia | City | Average by Zip Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 30314 | ATLANTA | $6,991.02 | Liberty Mutual | $13,795.98 | Nationwide | $9,315.62 | USAA | $3,886.82 | State Farm | $4,776.36 |

| 30021 | CLARKSTON | $6,944.22 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,459.21 | State Farm | $4,616.14 |

| 30088 | STONE MOUNTAIN | $6,913.82 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,574.28 | State Farm | $4,700.44 |

| 30083 | STONE MOUNTAIN | $6,899.09 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,478.91 | State Farm | $4,726.08 |

| 30035 | DECATUR | $6,893.89 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,734.78 | State Farm | $4,756.96 |

| 30334 | ATLANTA | $6,893.38 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | USAA | $3,591.38 | State Farm | $4,528.97 |

| 30315 | ATLANTA | $6,889.33 | Liberty Mutual | $13,795.98 | Nationwide | $8,322.55 | USAA | $3,865.01 | State Farm | $4,645.27 |

| 30310 | ATLANTA | $6,880.31 | Liberty Mutual | $12,863.94 | Nationwide | $9,315.62 | USAA | $3,762.96 | State Farm | $4,665.43 |

| 30304 | ATLANTA | $6,835.84 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | USAA | $3,544.19 | State Farm | $3,655.92 |

| 30303 | ATLANTA | $6,788.76 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | Geico | $3,398.82 | USAA | $3,544.19 |

| 30311 | ATLANTA | $6,750.28 | Liberty Mutual | $12,863.94 | Nationwide | $9,315.62 | USAA | $3,532.72 | State Farm | $4,454.79 |

| 30058 | LITHONIA | $6,733.62 | Liberty Mutual | $12,998.29 | Nationwide | $8,219.53 | USAA | $3,420.60 | State Farm | $4,587.99 |

| 30038 | LITHONIA | $6,730.99 | Liberty Mutual | $12,998.29 | Nationwide | $8,219.53 | USAA | $3,696.02 | State Farm | $4,472.39 |

| 30032 | DECATUR | $6,699.34 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,402.21 | State Farm | $4,352.35 |

| 30034 | DECATUR | $6,694.70 | Liberty Mutual | $12,998.29 | Nationwide | $8,396.55 | USAA | $3,566.58 | State Farm | $4,628.72 |

| 30079 | SCOTTDALE | $6,686.79 | Liberty Mutual | $13,494.47 | Nationwide | $8,219.53 | USAA | $3,131.70 | State Farm | $4,006.43 |

| 30331 | ATLANTA | $6,657.55 | Liberty Mutual | $12,863.94 | Nationwide | $9,315.62 | USAA | $3,550.46 | State Farm | $4,373.39 |

| 30316 | ATLANTA | $6,647.47 | Liberty Mutual | $13,132.24 | Nationwide | $9,431.20 | USAA | $3,773.63 | State Farm | $4,385.74 |

| 30318 | ATLANTA | $6,621.02 | Liberty Mutual | $13,132.24 | Nationwide | $9,315.62 | USAA | $3,886.82 | Geico | $4,476.31 |

| 30312 | ATLANTA | $6,620.73 | Liberty Mutual | $13,132.24 | Nationwide | $9,240.55 | USAA | $3,544.19 | State Farm | $4,376.84 |

| 30313 | ATLANTA | $6,583.09 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | Geico | $3,398.82 | USAA | $3,532.72 |

| 30072 | PINE LAKE | $6,580.33 | Liberty Mutual | $12,395.60 | Nationwide | $9,476.29 | USAA | $3,544.70 | State Farm | $4,294.43 |

| 30349 | ATLANTA | $6,554.04 | Liberty Mutual | $12,648.11 | Nationwide | $8,322.55 | USAA | $3,646.54 | State Farm | $4,334.90 |

| 30291 | UNION CITY | $6,486.71 | Liberty Mutual | $12,648.11 | Nationwide | $8,322.55 | USAA | $3,838.58 | State Farm | $4,415.71 |

| 30087 | STONE MOUNTAIN | $6,469.78 | Liberty Mutual | $13,494.47 | Nationwide | $6,990.93 | USAA | $3,512.50 | State Farm | $4,600.69 |

Expensive zip codes in Georgia are mostly in Atlanta.

| 25 Least Expensive Zip Codes in Georgia | City | Average by Zip Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 31699 | MOODY A F B | $3,976.82 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,101.36 | USAA | $2,430.99 |

| 31605 | VALDOSTA | $3,977.77 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,101.36 | USAA | $2,389.89 |

| 31606 | VALDOSTA | $4,020.26 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,313.11 | USAA | $2,512.28 |

| 31632 | HAHIRA | $4,022.80 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,248.83 | USAA | $2,525.57 |

| 31698 | VALDOSTA | $4,030.81 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,120.11 | USAA | $2,513.70 |

| 31602 | VALDOSTA | $4,044.80 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,120.11 | USAA | $2,525.57 |

| 31601 | VALDOSTA | $4,058.10 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,303.12 | USAA | $2,522.26 |

| 31625 | BARNEY | $4,079.38 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| 31638 | MORVEN | $4,093.21 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| 31643 | QUITMAN | $4,095.02 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| 31750 | FITZGERALD | $4,197.86 | Liberty Mutual | $9,217.46 | Nationwide | $4,957.00 | Geico | $2,580.05 | State Farm | $2,717.52 |

| 31783 | REBECCA | $4,202.67 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,751.23 | Geico | $3,030.56 |

| 31079 | ROCHELLE | $4,205.41 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,868.06 | USAA | $2,921.31 |

| 31629 | DIXIE | $4,206.31 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,727.01 | USAA | $2,777.49 |

| 31626 | BOSTON | $4,210.42 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,456.21 | State Farm | $2,967.64 |

| 31792 | THOMASVILLE | $4,231.02 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,456.21 | State Farm | $2,901.62 |

| 31757 | THOMASVILLE | $4,236.28 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,456.21 | State Farm | $2,946.56 |

| 31627 | CECIL | $4,244.75 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,612.68 | State Farm | $2,715.08 |

| 31620 | ADEL | $4,247.91 | Liberty Mutual | $9,257.13 | Nationwide | $4,819.43 | Geico | $2,612.68 | State Farm | $2,702.55 |

| 31778 | PAVO | $4,284.48 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,613.34 | State Farm | $2,924.94 |

| 31738 | COOLIDGE | $4,289.46 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,613.34 | State Farm | $2,959.80 |

| 31558 | SAINT MARYS | $4,291.24 | Liberty Mutual | $9,023.13 | Nationwide | $5,784.34 | Geico | $2,431.31 | USAA | $2,437.65 |

| 31714 | ASHBURN | $4,295.11 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | Geico | $2,680.97 | USAA | $2,912.71 |

| 31569 | WOODBINE | $4,296.42 | Liberty Mutual | $9,023.13 | Nationwide | $5,550.45 | Geico | $2,431.31 | USAA | $2,518.86 |

| 31793 | TIFTON | $4,300.63 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | State Farm | $2,760.31 | Geico | $2,764.28 |

Moody Air Force Base has the cheapest zip code in Georgia.

Georgia’s Car Insurance Rates by City

It’s also helpful to look at car insurance rates by city. The tables below give you a window into the average rates paid by drivers in cities across Georgia.

| 10 Most Expensive Cities in Georgia | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Clarkston | $6,944.22 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,459.21 | State Farm | $4,616.14 |

| Redan | $6,913.82 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,574.28 | State Farm | $4,700.44 |

| Stone Mountain | $6,899.09 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,478.91 | State Farm | $4,726.08 |

| Lithonia | $6,732.30 | Liberty Mutual | $12,998.29 | Nationwide | $8,219.53 | USAA | $3,558.31 | State Farm | $4,530.19 |

| Scottdale | $6,686.79 | Liberty Mutual | $13,494.47 | Nationwide | $8,219.53 | USAA | $3,131.70 | State Farm | $4,006.43 |

| Pine Lake | $6,580.33 | Liberty Mutual | $12,395.60 | Nationwide | $9,476.29 | USAA | $3,544.70 | State Farm | $4,294.43 |

| Decatur | $6,512.61 | Liberty Mutual | $12,755.96 | Nationwide | $8,274.74 | USAA | $3,491.47 | State Farm | $4,464.04 |

| Union City | $6,486.71 | Liberty Mutual | $12,648.11 | Nationwide | $8,322.55 | USAA | $3,838.58 | State Farm | $4,415.71 |

| Mountain Park | $6,469.78 | Liberty Mutual | $13,494.47 | Nationwide | $6,990.93 | USAA | $3,512.50 | State Farm | $4,600.69 |

| Ellenwood | $6,468.98 | Liberty Mutual | $12,669.13 | Nationwide | $7,813.72 | USAA | $3,739.84 | State Farm | $4,719.07 |

Out of the 600+ cities in the state of Georgia, it is the eastern suburbs of Atlanta that feature the highest insurance rates. Clarkston, Stone Mountain, Lithonia, and Scottdale regularly have higher rates.

Which cities are cheapest for car insurance? Moody Air Force Base comes out on top, with the average resident paying just under $4,000.

| 10 Least Expensive Cities in Georgia | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Moody AFB | $3,976.82 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,101.36 | USAA | $2,430.99 |

| Valdosta | $4,018.41 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,163.67 | USAA | $2,485.36 |

| Hahira | $4,022.80 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,248.83 | USAA | $2,525.57 |

| Barney | $4,079.37 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| Morven | $4,093.21 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| Quitman | $4,095.01 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| Dasher | $4,195.16 | Liberty Mutual | $9,217.46 | Nationwide | $6,001.75 | Geico | $2,290.32 | USAA | $2,522.26 |

| Fitzgerald | $4,197.86 | Liberty Mutual | $9,217.46 | Nationwide | $4,957.00 | Geico | $2,580.05 | State Farm | $2,717.52 |

| Rebecca | $4,202.67 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,751.23 | Geico | $3,030.56 |

| Rochelle | $4,205.41 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,868.06 | USAA | $2,921.31 |

Valdosta, in southern Georgia, as well as many of its surrounding towns, also has cheaper insurance rates. Looking for the lowest rate possible? You may want to move closer to the Florida-Georgia line.

In addition to location, there are a number of other demographic factors that figure into your overall car insurance rate. Don’t worry, we’ll cover those a little later on.

Now that you have a general understanding of rates and demographics, let’s take a look at your car insurance options in the great state of Georgia.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Georgia Car Insurance Companies

These days, it can seem like there are endless car insurance companies competing to be your provider. From funny commercials and memorable characters to sales calls and online ads, companies are trying their darndest to get your attention.

When it comes time to choose a provider, you might feel torn between smaller, locally-owned companies and those with country-wide reach and well-known names. You can ask your friends and family, but everyone has conflicting opinions and experiences.

That’s why we’re here– to provide you with an unbiased, comprehensive, and honest look at all of your options. That way, you can feel calm and confident about choosing an auto insurance provider in Georgia.

– The Largest Companies Financial Rating

For a general understanding of where a car insurance company stands financially, it’s wise to take a look at their financial rating.

We’ve compiled the ratings in an easy-to-read table. Remember: this rating indicates the financial strength and credit-worthiness of each insurer. The table below covers the ten largest auto insurers in Georgia.

| Company | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| State Farm Group | A++ | $1,937,806 | 68.72% | 22.49% |

| Geico | A++ | $1,051,005 | 81.23% | 12.20% |

| Progressive Group | A+ | $1,001,828 | 63.09% | 11.63% |

| Allstate Insurance Group | A+ | $820,479 | 51.96% | 9.52% |

| USAA Group | A++ | $706,276 | 91.01% | 8.20% |

| Liberty Mutual Group | A | $335,540 | 66.84% | 3.89% |

| Nationwide Corp Group | A+ | $267,971 | 77.10% | 3.11% |

| Travelers Group | A++ | $266,864 | 71.60% | 3.10% |

| Georgia Farm Bureau Group | B+ | $261,432 | 64.70% | 3.03% |

| Auto-Owners Group | A++ | $224,705 | 70.36% | 2.61% |

In Georgia, ratings range from A++ to B+. The letter grades follow a traditional scale, wherein A is higher and B is lower.

The plus signs indicate financial strength. The strongest providers, from a financial perspective, are those with the highest letter grades and most plus signs.

– Companies with Best Customer Service Ratings

When choosing a car insurance company, however, financial strength is not the only way to compare options. You also want a company that will provide excellent customer service.

In the Southeast region, which comprises North Carolina, South Carolina, and Georgia, the standout auto insurance company is Farm Bureau Insurance — Tennessee. They are the highest ranked in the region in terms of customer satisfaction.

Read more: Farm Bureau Auto Insurance Review

– Companies with the Most Complaints in Georgia

A company with high customer satisfaction is likely to be a strong candidate for your money. One with a high number of complaints? It might drop to the bottom of your list.

Complaints don’t necessarily paint the clearest picture of every aspect of an insurance company, but they do signal some issues with human resources and perhaps with the size of the company.

Of course, the more customers a company has, the more complaints they are likely to accrue.

| Company | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| State Farm Group | A++ | $1,937,806 | 68.72% | 22.49% |

| Geico | A++ | $1,051,005 | 81.23% | 12.20% |

| Progressive Group | A+ | $1,001,828 | 63.09% | 11.63% |

| Allstate Insurance Group | A+ | $820,479 | 51.96% | 9.52% |

| USAA Group | A++ | $706,276 | 91.01% | 8.20% |

| Liberty Mutual Group | A | $335,540 | 66.84% | 3.89% |

| Nationwide Corp Group | A+ | $267,971 | 77.10% | 3.11% |

| Travelers Group | A++ | $266,864 | 71.60% | 3.10% |

| Georgia Farm Bureau Group | B+ | $261,432 | 64.70% | 3.03% |

| Auto-Owners Group | A++ | $224,705 | 70.36% | 2.61% |

In 2017, State Farm Group led the pack in terms of complaints, followed by Liberty Mutual. It is worth noting that both Geico and USAA did not provide statistics.

Cheapest Car Insurance Companies in Georgia

So, you want a company that is financially stable and helpful to its customers, but there’s another factor that’s probably at the top of your mind: rates.

The table below shows Georgia car insurance companies, along with their average rates. These will help you compare options when it comes to your wallet.

| Company | Average |

|---|---|

| Allstate F&C | $4,210.70 |

| Geico General | $2,977.19 |

| Safeco Ins Co of IL | $10,053.44 |

| Nationwide Mutual | $6,484.90 |

| Progressive Mountain | $4,499.22 |

| State Farm Mutual Auto | $3,384.88 |

| USAA | $3,157.46 |

Commute Rates by Company

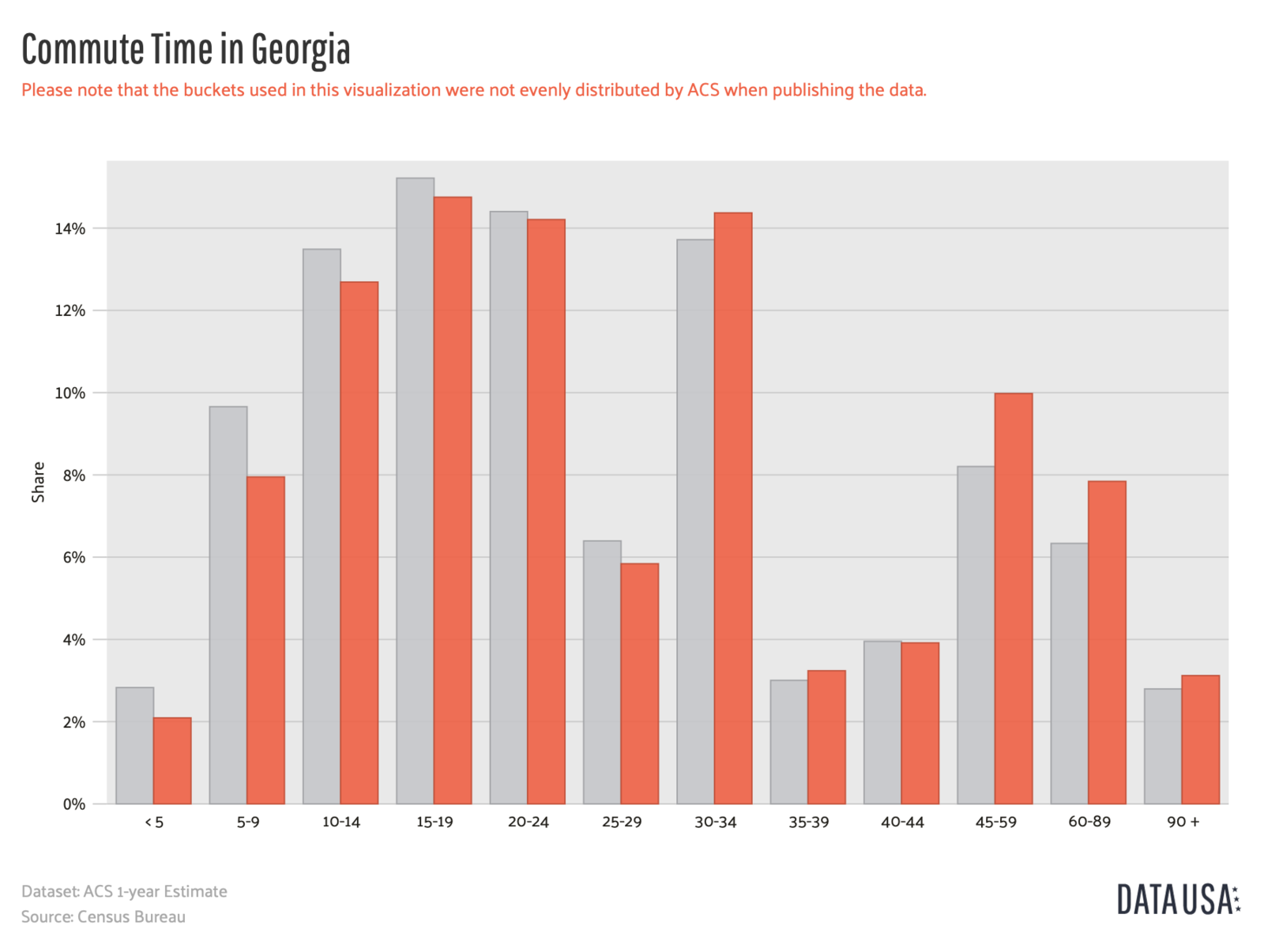

If you live in the big state of Georgia, especially near Atlanta, you probably commute to work. Listening to podcasts, jamming along to music, and indulging in “car breakfast” are just a few of commuters daily rituals.

Did you know that your commute time can affect your auto insurance rate? We’ve compiled the following statistics to give you a window into a commute’s impact on Georgia car insurance rates:

| Companies | Average Annual Rates for 10 Miles Commute 6000 Annual Mileage | Average Annual Rates for 25 Miles Commute 12000 Annual Mileage |

|---|---|---|

| Geico | $2,926.71 | $3,027.68 |

| USAA | $3,013.71 | $3,301.21 |

| State Farm | $3,384.88 | $3,384.88 |

| Allstate | $4,115.26 | $4,306.14 |

| Progressive | $4,499.22 | $4,499.22 |

| Nationwide | $6,484.90 | $6,484.90 |

| Liberty Mutual | $10,053.44 | $10,053.44 |

Coverage Level Rates by Company

The type of coverage you want also has an effect on your rate. If you want high coverage, you will have a higher rate. Low coverage, lower rate.

| Cost by Company with Different Coverage Levels | |||

|---|---|---|---|

| Company | Low Coverage | Medium Coverage | High Coverage |

| Allstate | $3,881.04 | $4,254.86 | $4,496.20 |

| Geico | $2,763.97 | $2,991.78 | $3,175.82 |

| Liberty Mutual | $9,636.66 | $9,998.75 | $10,524.93 |

| Nationwide | $6,334.12 | $6,602.52 | $6,518.06 |

| Progressive | $4,121.20 | $4,426.83 | $4,949.64 |

| State Farm | $3,167.98 | $3,387.35 | $3,599.32 |

| USAA | $3,013.26 | $3,141.23 | $3,317.90 |

Credit History Rates by Companies

If you think car insurance companies consider a number of factors when setting your rate…you’re correct! A lot goes into one number.

In addition to commute times, coverage level, and other factors, insurers also take a look at your credit history. The better your credit history, the less you will have to pay for auto insurance.

As you can see, some companies don’t change rates much for those who hold Good and Fair credit ratings. If you have a Poor credit rating, however, your rate is likely to jump.

Unfortunately, Georgia is at the bottom of the pack when it comes to credit scores, with an average score of 654. Only Mississippi and Louisiana have lower average scores.

| Cost by Company with Different Credit History | |||

|---|---|---|---|

| Company | Good Credit History | Fair Credit History | Poor Credit History |

| Allstate | $3,382.87 | $3,792.84 | $5,456.39 |

| Geico | $2,542.83 | $2,607.81 | $3,780.93 |

| Liberty Mutual | $6,923.06 | $8,834.05 | $14,403.23 |

| Nationwide | $5,476.79 | $6,258.58 | $7,719.34 |

| Progressive | $4,045.92 | $4,376.95 | $5,074.80 |

| State Farm | $2,368.08 | $2,988.35 | $4,798.23 |

| USAA | $2,469.31 | $2,892.23 | $4,110.85 |

Driving Record Rates by Company

It might feel like insurance companies take tons of information into account when setting your rate. It’s true! One of the factors that makes the most economic sense for companies is the driving record.

If you haven’t had many auto accidents, your rate is likely to be lower. If you have a spotty driving record, companies will quote you a higher rate. Speeding violations, accidents, and DUI’s can all make your rate go up.

| Company | Clean Record | With One Speeding Violation | With One Accident | With One DUI |

|---|---|---|---|---|

| Allstate | $3,465.70 | $3,647.83 | $5,365.97 | $4,363.29 |

| Geico | $1,991.22 | $2,244.40 | $2,493.90 | $5,179.25 |

| Liberty Mutual | $7,632.75 | $10,164.83 | $10,428.16 | $11,988.03 |

| Nationwide | $4,993.04 | $6,053.51 | $5,859.64 | $9,033.42 |

| Progressive | $3,524.11 | $4,102.75 | $6,212.74 | $4,157.29 |

| State Farm | $3,084.80 | $3,384.88 | $3,684.98 | $3,384.88 |

| USAA | $2,416.20 | $2,693.63 | $3,058.95 | $4,461.07 |

Largest Car Insurance Companies in Georgia

You can probably already name the top three to five largest car insurance companies in the country, but do you know which ones do the most business in Georgia?

We’ve compiled a list of the top-10 largest auto insurers in the state. You might recognize a few names, but others may surprise you.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $1,937,806 | 68.72% | 22.49% |

| Geico | $1,051,005 | 81.23% | 12.20% |

| Progressive Group | $1,001,828 | 63.09% | 11.63% |

| Allstate Insurance Group | $820,479 | 51.96% | 9.52% |

| USAA Group | $706,276 | 91.01% | 8.20% |

| Liberty Mutual Group | $335,540 | 66.84% | 3.89% |

| Nationwide Corp Group | $267,971 | 77.10% | 3.11% |

| Travelers Group | $266,864 | 71.60% | 3.10% |

| Georgia Farm Bureau Group | $261,432 | 64.70% | 3.03% |

| Auto-Owners Group | $224,705 | 70.36% | 2.61% |

| State Total | $8,614,981 | 71.09% | 100.00% |

Number of Insurers by State

When considering insurance providers, you’ll likely want to think about domestic vs. foreign providers. When shopping around for auto insurance, you’ll be able to choose from both.

Domestic providers are local to the state of Georgia. A so-called “foreign” provider operates on a national level. If you plan to move to a different state in the next couple of years, you may want to choose a foreign provider.

| Georgia Property & Casualty Insurance | |

|---|---|

| Domestic | 23 |

| Foreign | 988 |

| Total | 1011 |

State Laws

Every state in the US has its own laws governing automobiles and driving.

Whether you are moving to Georgia, getting your license in Georgia, or just continuing your everyday life as a Georgia driver, it is extremely important to know the automotive laws in your state.

Car Insurance Laws

Knowing the auto laws helps you to stay safe, keep others safe, and protect yourself against unwanted fines and infractions.

Does the thought of digging through state laws make you nauseous? Have no fear, for we’ve compiled a clear and comprehensive guide to Georgia car insurance laws.

How State Laws for Insurance are Determined

Each state has its own legislative branch that makes laws regarding automobiles and auto insurance. States determine the type of tort law and threshold that applies within their borders, as well as the type and amount of liability insurance required.

The state of Georgia requires liability insurance and sets minimums. Insurance companies operating within Georgia must file insurance rates and forms with the state insurance department.

States also enact laws regarding seat belts, drunk driving, and speed limits.

Windshield Coverage

The windshield is one part of the car that is regulated by various state laws. There are regulations regarding broken and cracked windshields, as well as auto insurers’ obligations to customers’ windshields.

In Georgia, insurers are allowed to use aftermarket parts when repairing and replacing windshields as long as they list the parts and the guarantee on the estimate. Car owners can refuse the parts but must the pay the difference.

Owners can also choose where to have the windshield work done but may have to pay a difference between their chosen location and where the insurer would prefer to have it done.

High-Risk Insurance

Some drivers, especially those considered “high-risk,” may have trouble finding auto insurance coverage.

A driver may be labeled high-risk if he or she has a major traffic infraction or a series of minor infractions.https://www.autoinsuranceez.com/auto-insurance-guide/how-file-claim/

After you have been involved in an at-fault accident or received a ticket for reckless driving, speeding, distracted driving, or racing, you are likely to see your car insurance premiums go up. Sometimes, they increase by hundreds or even thousands of dollars.

It is important to avoid these types of infractions if you want to stay out of the “high-risk” category and keep your insurance costs as low as possible.

Low-Cost Insurance

Car insurance is expensive. It’s also necessary for drivers, especially in states that require certain minimums on liability insurance.

California, New Jersey, and Hawaii all offer state-sponsored programs designed to help lower the costs of car insurance for families with limited incomes.

At this time, Georgia does not offer help for low-income families or individuals who are struggling to pay for car insurance. However, there are other ways to lower your costs.

Some insurers offer discounts for government employees. Others offer savings if you bundle your auto insurance with other types of insurance or if you pay your premium up front.

Of course, the easiest and smartest way to lower your car insurance premium is to shop around. It’s worth it to compare rates and find the best deal.

Automobile Insurance Fraud in Georgia

Insurance fraud can happen across a wide variety of industries. The auto insurance industry is not immune to the problem. Fraud can be committed by policyholders, applicants for insurance, claimants, and even insurance professionals.

Oftentimes, fraud consists of “padding” or inflating claims in order to get more money from insurance companies. Misrepresentation of facts on an insurance application also counts as fraud, as well as submitting claims for damage or injuries that never occurred.

Other examples of auto insurance fraud include setting fire to your own vehicle, using a false Social Security number on an application, or giving a false address in order to secure a cheaper rate. If you can believe it, some people actually stage fake accidents.

Insurance companies themselves can commit auto insurance fraud by refusing to pay valid claims or selling bad insurance policies.

Georgia has its own fraud bureau to deal with situations like these. The state classifies auto insurance fraud as a felony, punishable by up to 10 years in prison and a fine of up to $10,000.

Common auto insurance frauds in Georgia include staged accidents, phony auto theft, auto glass fraud, hail damage, organized group/ring activity, and inflated tow/storage charges.

Statute of Limitations

Now that we’ve covered the heavy stuff, let’s take a look at the statute of limitations, which describes the amount of time you have after a vehicle accident to issue a claim.

In Georgia, you have two years to issue a claim related to personal injury. You have 4 years to issue a claim related to property damage.

That may sound like a long time, but the days and months fly by when you’re dealing with the after-effects of an automobile accident. It is best to file as soon as possible in order to receive support from your insurance company.

State-Specific Laws

In Georgia, there is one way to provide proof of financial responsibility without having car insurance.

Self-insurance is an option for those who can prove that they have the ability to pay the damages an insurer would under a standard insurance policy. AKA: you have enough money to be your own insurance company.

To qualify for self-insurance in Georgia, you have to make a cash deposit of at least $100,000 with the Commissioner and maintain an additional $300,000 in investments.

Investments can include a savings account, government bonds, government loans, or specific stocks.

While self-insurance certainly isn’t an option for most Georgians, it is available for those who would rather pay out of pocket in an auto accident, rather than hand over that responsibility to an insurance company.

Vehicle Licensing Laws

Each state has its own unique vehicle licensing laws. They cover who can obtain a license, what the renewal process looks like, and other restrictions that might be placed on a licensed driver.

One of the most notable licensing laws concerns REAL ID. The REAL ID Act, passed in 2005, set federal standards for the issuance of drivers licenses.

Georgia has been compliant with REAL ID since 2012. Federal agencies accept identification cards and driver’s licenses from Georgia at federal facilities, including nuclear power plants.

Let’s take a look at the vehicle licensing laws in Georgia.

Penalties for Driving Without Insurance

As we’ve seen, the state of Georgia requires all drivers to have auto insurance. Proof of insurance must be in the vehicle or accessed digitally (on a smartphone/tablet).

Proof of insurance must also be on file with the Department of Revenue’s database. It is the insurance company’s responsibility to file that information.

In Georgia, if you are caught driving without insurance, your registration will be suspended.

There is a $25 lapse fee and a $60 reinstatement fee. A “lapse” is a period of 10 days or more in which no liability insurance is on file. These fees occur for a first or second offense.

Drivers who are operating a vehicle without insurance three or more times during a 5-year period will have their registration suspended and be required to pay a $25 lapse fee, as well as a reinstatement fee of $160.

Driving a vehicle with a suspended, revoked, or canceled registration is considered a crime.

Teen Driver Laws

Young drivers are getting their first taste of life on the open road. While driving as a teenager can be fun, it is also a time when drivers should take extra care.

In Georgia, certain restrictions have been put in place to help protect teen drivers and those on the road with them. It’s important to be aware of these restrictions, whether you are a teenager, know a teen, or simply drive on public roadways.

| Requirements for Getting a License in Georgia | |

|---|---|

| Mandatory Holding Period | 12 Months |

| Minimum Supervised Driving TIme | 40 hours, 6 of which must be at night |

| Minimum Age | 16 |

Older Driver License Renewal Procedures

Some states have passed requirements that are specific to older drivers. These rules seek to help older drivers and those that know and love them.

In Georgia, most licensing rules look similar, no matter your age. Both the general population and the older population are required to go through the driver’s license renewal process every eight years. Proof of adequate vision is required at every renewal.

However, those ages 64 years and older are required to complete an in-person renewal, rather than an online or mail renewal.

When a person ceases driving, he or she may voluntarily surrender the driver’s license and purchase an identification card.

New Residents

New residents to Georgia have nothing to fear. The state makes the process for obtaining a driver’s license fairly straightforward.

You must apply for a Georgia driver’s license within 30 days of becoming a resident. Drivers can obtain a transfer at any of Georgia’s customer service facilities.

If you surrender your out-of-state license, you will be exempt from the written and road tests. You will, however, need to take the simple vision exam.

License Renewal Procedures

In Georgia, a driver’s license if good for eight years. You are eligible to start the renewal process 150 days before your license expires.

If your license has been expired for over two years, you will have to restart the application process, including the road test and written test.

Licenses can be renewed in person or online. To renew online, your license must be marked by a gold star or black star in the upper right-hand corner.

– Negligent Operator Treatment System (NOTS)

The state of Georgia works hard to keep its citizens safe. That means that drivers can lose their driving privileges if they engage in dangerous or negligent behavior.

There are three ways to lose driving privileges in Georgia.

- Your license can be canceled if you give incorrect or insufficient information on the application or if you are ineligible.

- Your license can be revoked. When the revocation period is over, you may be able to apply for a driver’s license, provided you have completed all of the requirements. You will have to re-take the driving tests.

- Your license can be temporarily suspended for a period of time. When the suspension period is over, you may be able to apply for a driver’s license, provided you have completed all of the requirements.

Rules of the Road

While it is important to fully understand driver’s licensing laws, one must also have a detailed grasp of the “rules of the road” in Georgia.

These are the laws and regulations that keep traffic moving safely, efficiently, and with respect for everyone on the road. Let’s check out some of the most important rules and laws in the state of Georgia.

Vault vs. No-Fault

States can fall into two camps when it comes to auto accidents. In no-fault states, no blame is assigned for accidents and insurance companies cover drivers’ medical expenses automatically.

Georgia, on the other hand, is an at-fault state. (Most states in the US are at-fault states).

That means when an auto accident occurs in Georgia, the blame will be placed on someone. The party who caused the incident or accident is financially responsible for all damages to other parties.

Georgia also has something called “comparative proportional fault.” That’s a lot of syllables, but all it means is that when two parties get into an accident in Georgia, both of them can carry a percentage of the blame.

If a driver is more than 50 percent at fault in any given accident, he or she cannot seek compensation.

Seat Belt and Car Seat Laws

When it comes to car accidents, seat belts save lives. Below is an overview of seat belt laws in Georgia.

| Safety Belt Laws in Georgia | |

|---|---|

| Effective Since | 09/01/88 |

| Primary Enforcement | yes; effective 07/01/96 |

| Age/Seats Applicable | 8 through 17 years in all seats; 18+ years in front seat |

| 1st Offense Max Fine | $15 |

Car seats are another important aspect of driving in Georgia. Just like seat belts, car seats keep children safe. Below is an overview of car seat laws in Georgia.

| Georgia Car Seat Requirements | |

|---|---|

| Must be in child restraint | 7 years and younger and 57 inches or less |

| Adult safety belt permissible | more than 57 inches |

| Maximum fine 1st offense | $50 |

| Seating preference | 7 years and younger must be in rear seat if available |

Keep Right and Move Over Laws

When you’re driving on a busy highway, it can be tough to know which lane to use. States have varying laws, and they aren’t always followed.

Georgia’s laws are clear. Slower cars should move to the right in order to make way for faster cars to pass on the left. Regardless of your speed, you must move out of the left lane when faster traffic is approaching.

Make sense? The left lane is the “passing” lane. Georgia drivers should always keep right, except to pass. If you remember those simple phrases, you’ll be just fine.

Speed Limits

Accidents are bound to happen when vehicle drivers are not following posted speed limits. Accidents can even be made worse– sometimes much worse– when accidents involve vehicles traveling at high speeds.

It is best to always be on the lookout for speed limit signs, no matter where you are, and to keep each state’s general speed limit laws in mind.

Following the speed limit laws will not only protect your safety, but it will protect your wallet from fines from speeding tickets.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 65 mph |

Ridesharing

Ridesharing has become a popular practice in recent years. It can help save on the cost of gas and vehicle upkeep, it can get you places faster, and it helps the environment by reducing the number of cars on the road.

More drivers are turning to companies like Lyft and Uber in order to make additional income. Everybody needs a side hustle these days, right?

If you or someone you know is considering getting into the ridesharing business, you should note that only a few of Georgia’s insurance providers offer coverage for rideshare drivers.

Those providers are

- Alfa Insurance

- Allstate

- American Family Insurance

- Farmers

- Geico

- Mercury

- State Farm

- USAA.

Additionally, some insurance providers that have long operated in the traditional taxi sphere are now offering insurance specific to ridesharing.

Ethio-American, a company exclusive to Georgia, has provided auto insurance to taxi drivers for many years. They recently began to offer rideshare-friendly policies.

Automation on the Road

Many residents of Georgia and other states are excited about autonomous features and even driverless cars on our roads.

The Georgia state government has proactively signed legislation that allows for autonomous cars within the state. Autonomous vehicles must be registered and must carry liability insurance.

If a car is fully automated, a licensed operator is not required.

With this legislation, Georgia is at the forefront of autonomous-car adoption. When and if self-driving cars become the norm, Georgia will already have laws in place that govern their safe and secure use on public roadways.

Safety Laws

In addition to rules that govern driving in Georgia, there are a number of regulations that cover impaired driving, distracted driving, and other safety issues.

We all want to be as safe as possible while on the road. Let’s take a look at the laws around alcohol, drugs, and other things that can impair driving.

DUI Laws

Driving while intoxicated is one of the most dangerous things a citizen can do. When one’s senses are impaired by alcohol or drugs, driving becomes difficult. Pedestrians, passengers, and other drivers are put at risk.

This video gives an overview of the newest “drunk driving” law in Georgia:

If you are caught drinking and driving (“driving under the influence”) in Georgia, you can get your license revoked, be issued a fine, and even face prison time or community service.

It is best to avoid these consequences altogether by making sure you are always sober when you’re in the driver’s seat.

Check out the table below for an overview of DUI laws in Georgia.

| DUI Laws in Georgia | |

|---|---|

| Name for Offense | Driving Under the Influence (DUI) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | 1st-2nd misdemeanors, 3rd high and aggravated misdemeanor, 4th+ felony |

| Look Back Period | 10 years |

This table outlines the consequences of drinking and driving in Georgia. If you’re going to drink, it is best to set your car keys aside for the time being. Stay safe: Find a sober driver.

| DUI Charges in Georgia | ||||

|---|---|---|---|---|

| 1st Offense | 2nd Offense | 3rd Offense | 4th Offense | |

| License Revoked | 120 days minimum up to 1 year | 3 years | 5 years | |

| Jail Time | 10 days - 12 months, can all be suspended at judge's discretion unless HBAC, then all but 24 hours can be suspended | 90 days - 12 months; mandatory 72 hours for 2nd in 10 years, otherwise can be probated | 120 days - 12 months; sentence can be probated unless 3rd in 10 years, then 15 days mandatory incarceration | 1-5 years, sentence can be probated to 90 days mandatory minimum |

| Fine | $300-$1000 | $600-$1000 | $1000-$5000 | $1000-$5000 |

| Other | 20-40 hours community service | 30 days community service min, IID 6 months min, evaluation and treatment program mandatory, mandatory DUI school, photo of offender must be published in local newspaper | min 30 days community service, 6 months IID, DUI school required, photo of offender must be published in local newspaper | 60 days community service, can be suspended if 3 years jail term served, 6 months IID min |

Marijuana-Impaired Driving Laws

When you see the phrase “driving under the influence,” you probably think of alcohol. But in some states, driving under the influence of marijuana is considered a major offense.

With the legalization and decriminalization of marijuana occurring in many states, it is critical that you know the marijuana-impaired driving laws across the country.

Georgia is a zero-tolerance state when it comes to marijuana. Drivers cannot legally drive with THC or metabolites in their bodies. Actual impairment is not an element of this offense.

Whether or not a driver seems to be impaired, if they have marijuana, a derivative of marijuana, or another controlled substance in his or her body, that driver can be convicted of a DUI.

Remember: You can test positive for marijuana up to a month after you smoke or ingest it. In Georgia, you cannot have any amount of a drug in your system when driving.

Distracted Driving Laws

As smartphones and tablets have become more pervasive across the US, so have the laws that regulate their use while driving, and with good reason.

No one should be https://content.naic.org/cipr_topics/topic_distracted_driving.htm. If your eyes are not on the road, you could be putting yourself at risk of a dangerous accident.

In order to discourage distracted driving, the state of Georgia has instituted a number of laws and regulations.

Hand-held cell phones are banned for all drivers. That means you can use an earpiece, headphones, or a voice-enabled watch, but you cannot hold a phone up to your ear, mouth, or eyes.

Texting is banned for all drivers. For drivers under the age of 18, all cellphone use is banned, including talk-to-text and voice commands.

This video gives a quick look at the newest distracted driving laws in Georgia:

Driving in Georgia

We can all agree: driving is fun. But driving in different states can also be confusing, especially if you’re on a road trip or you just moved to a new place.

We’re here to help make driving in Georgia a breeze. Whether you’re headed to Atlanta or taking a leisurely drive through rural Georgia, you should be able to handle the state’s roads easily and comfortably.

Let’s take an even deeper dive into some facts and figures that impact driving in Georgia.

Vehicle Theft in Georgia

Vehicle theft is something no one wants to experience. You might think it won’t happen to you, especially if you don’t own a particularly sporty or luxurious vehicle. But think again. Many vehicles that are stolen in Georgia are popular, run-of-the-mill makes and models.

These are the top stolen vehicles in the state.

| Top Ten Stolen Vehicles in Georgia | ||

|---|---|---|

| Make/Model | Year of Vehicle | Thefts |

| Honda Accord | 1997 | 1,052 |

| Ford Pickup (Full Size) | 2006 | 954 |

| Chevrolet Pickup (Full Size) | 1999 | 948 |

| Honda Civic | 2000 | 653 |

| Toyota Camry | 2014 | 568 |

| Chevrolet Impala | 2008 | 512 |

| Nissan Altima | 2014 | 484 |

| Dodge Pickup (Full Size) | 2003 | 452 |

| Jeep Cherokee/Grand Cherokee | 2001 | 449 |

| Dodge Caravan | 2002 | 425 |

Honda Accord is the #1 stolen car. The 1997 version was stolen the most, but other years were also stolen. Pickup trucks are commonly stolen too.

If you are concerned about vehicle theft, take a look at the cities where theft is most likely to occur. You may find that you are more or less worried than you really need to be.

| City | Motor vehicle theft |

|---|---|

| Abbeville | 3 |

| Adairsville | 6 |

| Adel | 4 |

| Adrian | 0 |

| Alapaha | 0 |

| Albany | 173 |

| Alma | 5 |

| Alpharetta | 26 |

| Alto | 2 |

| Americus | 28 |

| Aragon | 3 |

| Arcade | 2 |

| Arlington | 1 |

| Ashburn | 8 |

| Athens-Clarke County | 195 |

| Atlanta | 4,432 |

| Attapulgus | 0 |

| Austell | 15 |

| Bainbridge | 10 |

| Baldwin | 5 |

| Ball Ground | 0 |

| Barnesville | 11 |

| Baxley | 4 |

| Berlin | 0 |

| Blackshear | 5 |

| Blairsville | 0 |

| Blakely | 5 |

| Bloomingdale | 5 |

| Blue Ridge | 0 |

| Blythe | 1 |

| Boston | 1 |

| Bowdon | 2 |

| Braselton | 10 |

| Braswell | 0 |

| Bremen | 7 |

| Brooklet | 0 |

| Brunswick | 47 |

| Buchanan | 2 |

| Buena Vista | 2 |

| Butler | 2 |

| Byron | 11 |

| Cairo | 7 |

| Calhoun | 18 |

| Canton | 21 |

| Carrollton | 48 |

| Cartersville | 45 |

| Cave Spring | 3 |

| Cedartown | 20 |

| Centerville | 5 |

| Chatsworth | 8 |

| Chattahoochee Hills | 10 |

| Chickamauga | 4 |

| Clarkston | 27 |

| Claxton | 1 |

| Clayton | 5 |

| Cleveland | 0 |

| Climax | 0 |

| Cochran | 4 |

| College Park | 269 |

| Colquitt | 1 |

| Columbus | 1,108 |

| Commerce | 4 |

| Conyers | 52 |

| Coolidge | 0 |

| Cordele | 14 |

| Cornelia | 7 |

| Covington | 26 |

| Cuthbert | 0 |

| Dalton | 55 |

| Danielsville | 2 |

| Dawson | 0 |

| Decatur | 35 |

| Demorest | 2 |

| Dillard | 0 |

| Doerun | 0 |

| Donalsonville | 1 |

| Doraville | 31 |

| Douglas | 25 |

| Douglasville | 110 |

| Dublin | 36 |

| Duluth | 19 |

| Dunwoody | 68 |

| East Ellijay | 0 |

| Eastman | 9 |

| East Point | 746 |

| Eatonton | 4 |

| Edison | 0 |

| Elberton | 4 |

| Ellaville | 0 |

| Ellijay | 1 |

| Emerson | 4 |

| Ephesus | 0 |

| Eton | 0 |

| Euharlee | 8 |

| Fairburn | 52 |

| Fairmount | 0 |

| Fayetteville | 25 |

| Fitzgerald | 16 |

| Flowery Branch | 5 |

| Folkston | 7 |

| Forsyth | 11 |

| Fort Oglethorpe | 19 |

| Fort Valley | 13 |

| Franklin | 0 |

| Franklin Springs | 0 |

| Gainesville | 66 |

| Garden City | 31 |

| Glennville | 1 |

| Glenwood | 2 |

| Gordon | 1 |

| Gray | 4 |

| Greensboro | 4 |

| Greenville | 3 |

| Griffin | 45 |

| Grovetown | 17 |

| Hahira | 10 |

| Hampton | 5 |

| Hapeville | 88 |

| Harlem | 3 |

| Harrison | 0 |

| Hazlehurst | 3 |

| Helen | 2 |

| Helena | 1 |

| Hinesville | 58 |

| Hiram | 8 |

| Hoboken | 1 |

| Holly Springs | 11 |

| Homeland | 0 |

| Homerville | 7 |

| Jackson | 8 |

| Jefferson | 8 |

| Jeffersonville | 0 |

| Jesup | 15 |

| Johns Creek | 15 |

| Jonesboro | 14 |

| Kennesaw | 16 |

| Kingsland | 15 |

| Lafayette | 14 |

| Lagrange | 80 |

| Lakeland | 10 |

| Lake Park | 1 |

| Lavonia | 2 |

| Lawrenceville | 65 |

| Lilburn | 28 |

| Lincolnton | 1 |

| Locust Grove | 10 |

| Loganville | 16 |

| Lookout Mountain | 1 |

| Lumber City | 1 |

| Lumpkin | 0 |

| Macon | 489 |

| Madison | 5 |

| Manchester | 14 |

| Marietta | 181 |

| McCaysville | 1 |

| McDonough | 42 |

| McIntyre | 0 |

| McRae | 2 |

| Meigs | 0 |

| Midville | 0 |

| Midway | 4 |

| Milledgeville | 28 |

| Milton | 0 |

| Monroe | 37 |

| Montezuma | 7 |

| Morrow | 33 |

| Moultrie | 27 |

| Mount Airy | 0 |

| Nashville | 5 |

| Nelson | 1 |

| Newnan | 39 |

| Newton | 0 |

| Nicholls | 1 |

| Norcross | 59 |

| Oakwood | 9 |

| Ocilla | 10 |

| Oglethorpe | 2 |

| Oxford | 0 |

| Patterson | 0 |

| Pavo | 0 |

| Peachtree City | 39 |

| Pelham | 4 |

| Pembroke | 0 |

| Perry | 14 |

| Pine Mountain | 1 |

| Pooler | 26 |

| Porterdale | 6 |

| Port Wentworth | 13 |

| Poulan | 1 |

| Powder Springs | 21 |

| Quitman | 6 |

| Ray City | 0 |

| Reynolds | 0 |

| Richmond Hill | 9 |

| Ringgold | 8 |

| Riverdale | 66 |

| Rochelle | 0 |

| Rockmart | 7 |

| Rome | 84 |

| Rossville | 66 |

| Roswell | 75 |

| Sandersville | 6 |

| Sandy Springs | 150 |

| Savannah-Chatham Metropolitan | 725 |

| Screven | 2 |

| Senoia | 2 |

| Shiloh | 0 |

| Sky Valley | 0 |

| Smyrna | 145 |

| Snellville | 37 |

| Social Circle | 5 |

| Sparks | 3 |

| Sparta | 4 |

| Springfield | 2 |

| Statesboro | 37 |

| Statham | 33 |

| St. Marys | 10 |

| Summerville | 4 |

| Suwanee | 12 |

| Sylvania | 4 |

| Talbotton | 1 |

| Tallulah Falls | 0 |

| Tennille | 1 |

| Thomasville | 22 |

| Thunderbolt | 9 |

| Tifton | 22 |

| Tignall | 0 |

| Toccoa | 6 |

| Trenton | 4 |

| Trion | 2 |

| Tunnel Hill | 0 |

| Tybee Island | 1 |

| Tyrone | 4 |

| Union City | 211 |

| Union Point | 2 |

| Vidalia | 20 |

| Villa Rica | 25 |

| Walthourville | 5 |

| Warm Springs | 0 |

| Warner Robins | 168 |

| Warrenton | 0 |

| Washington | 8 |

| Watkinsville | 0 |

| Waverly Hall | 1 |

| Waycross | 15 |

| Waynesboro | 12 |

| West Point | 8 |

| Willacoochee | 0 |

| Winder | 39 |

| Winterville | 0 |

| Woodbury | 1 |

| Woodstock | 13 |

| Wrens | 0 |

As you may have guessed, Atlanta, the largest city, is home to the most auto thefts in the state.

Road Fatalities in Georgia

No one likes to think about fatalities due to auto accidents, but it is important to consider the risks. Once we know the stats, we can make choices to keep ourselves safe.

There are many ways to think about road fatalities. We’ll look at a few that might give you insight into where, when, and how fatal road accidents occur.

Fatal Crashes by Weather Condition and Light Condition

Weather and light can contribute to automobile accidents and accident-related deaths.

As you can see here, most fatal car accidents in Georgia occur in normal daylight or dark conditions. If you must drive in the dark, it is best to choose areas that are well-lit.

Some incidents occur under rainy conditions, but snow and sleet rarely play a factor. This might be due to the minimal amount of snow and sleet that Georgia sees in any given year. The winter tends to be mild.

| Fatalities by Weather Condition and Light Condition | ||||||

|---|---|---|---|---|---|---|

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

| Normal | 690 | 140 | 448 | 44 | 1 | 1,323 |

| Rain | 44 | 7 | 39 | 2 | 0 | 92 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 3 | 1 | 14 | 1 | 0 | 19 |

| Unknown | 1 | 0 | 1 | 0 | 0 | 2 |

| TOTAL | 741 | 148 | 503 | 47 | 1 | 1,440 |

Fatalities (All Crashes) by County

Another way we can break down automobile accident fatalities is by looking at the counties where they occur.

This table lists the top-ten counties for fatal car crashes.

| Ten Counties in Georgia with the Most Traffic Fatalities | |||||

|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Fulton County | 85 | 77 | 104 | 130 | 115 |

| Dekalb County | 70 | 55 | 83 | 80 | 95 |

| Gwinnett County | 45 | 55 | 67 | 61 | 66 |

| Cobb County | 59 | 49 | 49 | 59 | 53 |

| Bibb County | 31 | 23 | 21 | 28 | 34 |

| Cherokee County | 16 | 12 | 12 | 7 | 32 |

| Clayton County | 26 | 21 | 26 | 48 | 32 |

| Richmond County | 23 | 27 | 27 | 17 | 32 |

| Hall County | 17 | 21 | 33 | 31 | 31 |

| Chatham County | 44 | 26 | 54 | 44 | 29 |

Fulton County, home to Atlanta and its close suburbs, is home to the highest number of fatal crashes.

This may be due to the high population in Fulton County, as well as the dense, urban, congested traffic patterns you are more likely to see around Atlanta. Dekalb County sits just east of Atlanta.

Traffic Fatalities

Lets now assess the traffic fatality rates in Georgia, using data provided by the NHTSA, for rural and urban areas.

| Georgia Traffic Fatalities by Road Type | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| Rural | 701 | 663 | 655 | 627 | 589 | 557 | 462 | 565 | 603 | 573 |

| Urban | 688 | 629 | 592 | 579 | 603 | 621 | 702 | 867 | 953 | 966 |

| Total | 1,495 | 1,292 | 1,247 | 1,226 | 1,192 | 1,180 | 1,164 | 1,432 | 1,556 | 1,540 |

| Unknown | 106 | 0 | 0 | 20 | 0 | 2 | 0 | 0 | 0 | 1 |

As you can see, traffic fatalities in Georgia are almost evenly split between rural and urban areas, even over a nine-year period.

In the last few years, there have been more deaths in urban areas than in rural ones. Unfortunately, though the total number of fatalities was on the decline for a few years, the numbers have started to increase again.

Fatalities by Person Type

The rate of vehicular accidents in Georgia can also be analyzed by person type. A person might be driving a car or motorcycle, riding a bicycle, or walking.

The table below outlines fatalities by type of vehicle and/or person.

| Georgia Traffic Deaths by Person Type | |||||

|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Passenger Car | 447 | 445 | 561 | 584 | 557 |

| Light Truck - Pickup | 178 | 174 | 213 | 216 | 235 |

| Light Truck - Utility | 138 | 144 | 184 | 210 | 217 |

| Light Truck - Van | 47 | 31 | 50 | 39 | 46 |

| Light Truck - Other | 2 | 1 | 0 | 2 | 2 |

| Large Truck | 26 | 28 | 26 | 33 | 45 |

| Bus | 1 | 0 | 0 | 4 | 3 |

| Other/Unknown Occupants | 16 | 21 | 20 | 31 | 22 |

| Total Occupants | 855 | 844 | 1,054 | 1,119 | 1,127 |

| Total Motorcyclists | 116 | 137 | 152 | 172 | 139 |

| Pedestrian | 176 | 163 | 194 | 232 | 253 |

| Bicyclist and Other Cyclist | 28 | 19 | 23 | 29 | 15 |

| Other/Unknown Nonoccupants | 5 | 1 | 9 | 4 | 6 |

| Total Nonoccupants | 209 | 183 | 226 | 265 | 274 |

| Total | 1,180 | 1,164 | 1,432 | 1,556 | 1,540 |

In Georgia, vehicle occupants make up the majority of traffic deaths. Passenger cars and light trucks are most likely to be involved in fatal accidents, while buses and bicycles are notably less likely to be involved.

That said, anyone operating a vehicle or simply putting their body anywhere near a roadway should be alert and aware of the risk of accidents.

Fatalities by Crash Type

To dive deeper, one can examine fatalities by crash type. Not all crashes involve two cars. There might be just one vehicle involved or many. Incidents occur both on and off the roadway. No two incidents look exactly alike.

| Georgia Fatalities by Crash Type | |||||

|---|---|---|---|---|---|

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

| Total Fatalities (All Crashes) | 1,180 | 1,164 | 1,432 | 1,556 | 1,540 |

| Single Vehicle | 710 | 665 | 777 | 857 | 823 |

| Involving a Large Truck | 163 | 155 | 182 | 179 | 214 |

| Involving Speeding | 197 | 213 | 268 | 266 | 248 |

| Involving a Rollover | 317 | 313 | 336 | 402 | 361 |

| Involving a Roadway Departure | 646 | 624 | 761 | 849 | 769 |

| Involving an Intersection (or Intersection Related) | 272 | 282 | 370 | 363 | 401 |

As we can see from the table, many crashes involve just one vehicle. Road departures are common. And fatal accidents involving large trucks have become more common over time.

Five-Year Trend for the Top 10 Counties

The area of Georgia in which one lives does have an impact on how many fatal crashes one may see. We’ve crunched the numbers to see the five-year trends for Georgia’s counties

| Ten Counties in Georgia with the Most Traffic Fatalities | |||||

|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Fulton County | 85 | 77 | 104 | 130 | 115 |

| Dekalb County | 70 | 55 | 83 | 80 | 95 |

| Gwinnett County | 45 | 55 | 67 | 61 | 66 |

| Cobb County | 59 | 49 | 49 | 59 | 53 |

| Bibb County | 31 | 23 | 21 | 28 | 34 |

| Cherokee County | 16 | 12 | 12 | 7 | 32 |

| Clayton County | 26 | 21 | 26 | 48 | 32 |

| Richmond County | 23 | 27 | 27 | 17 | 32 |

| Hall County | 17 | 21 | 33 | 31 | 31 |

| Chatham County | 44 | 26 | 54 | 44 | 29 |

Fulton, Dekalb, and Gwinnett Counties top the list. All three are located in the Atlanta area. All three have seen upticks in the number of traffic fatalities over the last five years.

Cherokee and Richmond Counties saw big leaps in traffic fatalities between 2016 and 2017, while Chatham County’s number was significantly reduced.

Fatalities Involving Speeding by County

Speeding is a major problem on America’s roads, no matter the state. Over the years, speeding has been a serious factor in many fatal car accidents across Georgia.

In this table, you can see the number of fatalities in crashes that involved speeding, broken down by county.

| Fatalities in Crashes Involving Speeding | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fatalities | Fatalities Per 100k Population | |||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| Appling County | 0 | 0 | 4 | 1 | 0 | 0 | 0 | 21.68 | 5.41 | 0 |

| Atkinson County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 11.94 | 0 | 0 |

| Bacon County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 17.72 | 0 | 0 |

| Baker County | 0 | 0 | 2 | 2 | 2 | 0 | 0 | 62.48 | 62.34 | 62.5 |

| Baldwin County | 0 | 0 | 2 | 3 | 1 | 0 | 0 | 4.39 | 6.64 | 2.23 |

| Banks County | 0 | 1 | 2 | 0 | 0 | 0 | 5.48 | 10.88 | 0 | 0 |

| Barrow County | 1 | 1 | 4 | 1 | 1 | 1.4 | 1.37 | 5.33 | 1.3 | 1.26 |

| Bartow County | 0 | 1 | 3 | 4 | 0 | 0 | 0.99 | 2.94 | 3.87 | 0 |

| Ben Hill County | 0 | 1 | 0 | 0 | 0 | 0 | 5.74 | 0 | 0 | 0 |

| Berrien County | 0 | 2 | 1 | 0 | 0 | 0 | 10.63 | 5.27 | 0 | 0 |

| Bibb County | 6 | 4 | 3 | 7 | 8 | 3.87 | 2.59 | 1.95 | 4.57 | 5.23 |

| Bleckley County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 7.86 | 0 | 7.79 |

| Brantley County | 0 | 1 | 0 | 0 | 0 | 0 | 5.45 | 0 | 0 | 0 |

| Brooks County | 1 | 2 | 0 | 2 | 0 | 6.38 | 12.87 | 0 | 12.74 | 0 |

| Bryan County | 0 | 1 | 0 | 4 | 1 | 0 | 2.97 | 0 | 11.16 | 2.7 |

| Bulloch County | 0 | 1 | 2 | 2 | 2 | 0 | 1.37 | 2.73 | 2.68 | 2.63 |

| Burke County | 3 | 0 | 0 | 0 | 1 | 13.14 | 0 | 0 | 0 | 4.44 |

| Butts County | 0 | 1 | 0 | 0 | 0 | 0 | 4.29 | 0 | 0 | 0 |

| Calhoun County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Camden County | 2 | 4 | 1 | 1 | 2 | 3.89 | 7.7 | 1.91 | 1.91 | 3.77 |

| Candler County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 9.17 | 0 | 0 |

| Carroll County | 3 | 3 | 6 | 2 | 6 | 2.67 | 2.64 | 5.24 | 1.72 | 5.09 |

| Catoosa County | 3 | 2 | 4 | 2 | 1 | 4.6 | 3.05 | 6.08 | 3.02 | 1.5 |

| Charlton County | 1 | 1 | 1 | 0 | 0 | 7.62 | 7.67 | 7.58 | 0 | 0 |

| Chatham County | 13 | 7 | 9 | 9 | 7 | 4.68 | 2.47 | 3.14 | 3.11 | 2.41 |

| Chattahoochee County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Chattooga County | 2 | 1 | 1 | 2 | 0 | 7.99 | 4.02 | 4.02 | 8.05 | 0 |

| Cherokee County | 2 | 5 | 1 | 0 | 8 | 0.89 | 2.17 | 0.42 | 0 | 3.23 |

| Clarke County | 1 | 2 | 4 | 4 | 1 | 0.83 | 1.66 | 3.23 | 3.2 | 0.79 |

| Clay County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Clayton County | 5 | 6 | 3 | 14 | 8 | 1.89 | 2.24 | 1.1 | 5 | 2.81 |

| Clinch County | 1 | 0 | 0 | 1 | 1 | 14.76 | 0 | 0 | 14.73 | 14.87 |

| Cobb County | 16 | 6 | 13 | 19 | 13 | 2.23 | 0.82 | 1.75 | 2.53 | 1.72 |

| Coffee County | 0 | 1 | 3 | 1 | 3 | 0 | 2.33 | 6.96 | 2.32 | 6.97 |

| Colquitt County | 1 | 5 | 0 | 0 | 2 | 2.16 | 10.86 | 0 | 0 | 4.36 |

| Columbia County | 4 | 3 | 3 | 7 | 7 | 2.93 | 2.15 | 2.08 | 4.75 | 4.62 |

| Cook County | 0 | 0 | 2 | 2 | 1 | 0 | 0 | 11.7 | 11.64 | 5.79 |

| Coweta County | 1 | 3 | 7 | 2 | 4 | 0.75 | 2.22 | 5.06 | 1.42 | 2.79 |

| Crawford County | 0 | 1 | 3 | 2 | 1 | 0 | 8.04 | 24.21 | 16.27 | 8.13 |

| Crisp County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Dade County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Dawson County | 2 | 0 | 1 | 1 | 2 | 8.82 | 0 | 4.29 | 4.23 | 8.2 |

| Decatur County | 0 | 0 | 1 | 2 | 2 | 0 | 0 | 3.69 | 7.49 | 7.49 |

| Dekalb County | 11 | 11 | 19 | 17 | 15 | 1.53 | 1.52 | 2.58 | 2.28 | 1.99 |

| Dodge County | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 9.46 | 4.8 | 0 |

| Dooly County | 1 | 0 | 0 | 1 | 0 | 6.96 | 0 | 0 | 7.2 | 0 |

| Dougherty County | 0 | 4 | 3 | 2 | 0 | 0 | 4.31 | 3.28 | 2.21 | 0 |

| Douglas County | 8 | 2 | 6 | 6 | 3 | 5.88 | 1.45 | 4.27 | 4.22 | 2.09 |

| Early County | 0 | 1 | 0 | 1 | 0 | 0 | 9.57 | 0 | 9.71 | 0 |

| Echols County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Effingham County | 1 | 3 | 1 | 1 | 1 | 1.84 | 5.41 | 1.75 | 1.71 | 1.67 |

| Elbert County | 1 | 1 | 0 | 0 | 0 | 5.13 | 5.16 | 0 | 0 | 0 |

| Emanuel County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 8.9 | 0 | 0 |

| Evans County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Fannin County | 1 | 0 | 0 | 0 | 0 | 4.2 | 0 | 0 | 0 | 0 |

| Fayette County | 0 | 4 | 1 | 1 | 1 | 0 | 3.66 | 0.91 | 0.9 | 0.89 |

| Floyd County | 4 | 1 | 5 | 4 | 2 | 4.17 | 1.04 | 5.2 | 4.14 | 2.05 |

| Forsyth County | 3 | 2 | 5 | 2 | 5 | 1.55 | 0.99 | 2.37 | 0.91 | 2.19 |

| Franklin County | 0 | 1 | 1 | 1 | 1 | 0 | 4.51 | 4.49 | 4.48 | 4.38 |

| Fulton County | 17 | 22 | 29 | 26 | 21 | 1.73 | 2.21 | 2.87 | 2.54 | 2.02 |

| Gilmer County | 1 | 0 | 0 | 1 | 0 | 3.48 | 0 | 0 | 3.33 | 0 |

| Glascock County | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 66.84 | 0 |

| Glynn County | 4 | 3 | 0 | 1 | 3 | 4.9 | 3.64 | 0 | 1.18 | 3.52 |

| Gordon County | 4 | 2 | 0 | 2 | 1 | 7.17 | 3.58 | 0 | 3.51 | 1.75 |

| Grady County | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 3.98 | 4.02 | 4.03 |

| Greene County | 1 | 0 | 3 | 0 | 2 | 6.14 | 0 | 17.98 | 0 | 11.57 |

| Gwinnett County | 8 | 18 | 9 | 15 | 16 | 0.93 | 2.06 | 1.01 | 1.65 | 1.74 |

| Habersham County | 1 | 0 | 1 | 2 | 1 | 2.31 | 0 | 2.28 | 4.53 | 2.24 |

| Hall County | 1 | 2 | 6 | 3 | 3 | 0.54 | 1.06 | 3.12 | 1.53 | 1.51 |

| Hancock County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 11.65 | 0 | 0 |

| Haralson County | 2 | 1 | 4 | 0 | 1 | 7.06 | 3.51 | 13.94 | 0 | 3.42 |

| Harris County | 0 | 2 | 1 | 3 | 1 | 0 | 6.11 | 3.02 | 8.92 | 2.95 |

| Hart County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 3.91 | 3.88 |

| Heard County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Henry County | 2 | 9 | 3 | 3 | 4 | 0.95 | 4.22 | 1.38 | 1.36 | 1.77 |

| Houston County | 2 | 1 | 2 | 4 | 1 | 1.35 | 0.67 | 1.34 | 2.63 | 0.65 |

| Irwin County | 1 | 1 | 0 | 0 | 0 | 10.68 | 10.99 | 0 | 0 | 0 |

| Jackson County | 0 | 0 | 0 | 3 | 4 | 0 | 0 | 0 | 4.62 | 5.92 |

| Jasper County | 1 | 0 | 0 | 0 | 0 | 7.35 | 0 | 0 | 0 | 0 |

| Jeff Davis County | 1 | 1 | 0 | 0 | 0 | 6.64 | 6.69 | 0 | 0 | 0 |

| Jefferson County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 6.33 | 0 |

| Jenkins County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Johnson County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Jones County | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 7.02 |

| Lamar County | 0 | 5 | 0 | 0 | 1 | 0 | 27.5 | 0 | 0 | 5.38 |

| Lanier County | 1 | 0 | 0 | 0 | 0 | 9.6 | 0 | 0 | 0 | 0 |

| Laurens County | 3 | 2 | 2 | 0 | 2 | 6.29 | 4.2 | 4.22 | 0 | 4.23 |

| Lee County | 1 | 0 | 0 | 0 | 0 | 3.44 | 0 | 0 | 0 | 0 |

| Liberty County | 1 | 1 | 1 | 3 | 1 | 1.61 | 1.56 | 1.63 | 4.89 | 1.63 |

| Lincoln County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Long County | 0 | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 5.38 | 10.52 |

| Lowndes County | 0 | 3 | 0 | 1 | 2 | 0 | 2.64 | 0 | 0.87 | 1.73 |

| Lumpkin County | 1 | 0 | 4 | 1 | 0 | 3.23 | 0 | 12.76 | 3.17 | 0 |

| Macon County | 1 | 0 | 0 | 0 | 1 | 7.15 | 0 | 0 | 0 | 7.51 |

| Madison County | 1 | 0 | 1 | 0 | 1 | 3.55 | 0 | 3.52 | 0 | 3.41 |

| Marion County | 0 | 1 | 0 | 1 | 0 | 0 | 11.55 | 0 | 11.75 | 0 |

| Mcduffie County | 0 | 4 | 0 | 1 | 1 | 0 | 18.58 | 0 | 4.66 | 4.65 |

| Mcintosh County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 7.09 |

| Meriwether County | 0 | 2 | 2 | 3 | 0 | 0 | 9.42 | 9.44 | 14.24 | 0 |

| Miller County | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 51.01 | 0 |

| Mitchell County | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 8.97 |

| Monroe County | 2 | 4 | 1 | 1 | 2 | 7.51 | 15 | 3.74 | 3.72 | 7.38 |

| Montgomery County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Morgan County | 2 | 0 | 3 | 2 | 1 | 11.31 | 0 | 16.71 | 11.04 | 5.43 |

| Murray County | 6 | 6 | 2 | 1 | 3 | 15.29 | 15.26 | 5.06 | 2.54 | 7.54 |

| Muscogee County | 2 | 3 | 4 | 4 | 7 | 0.98 | 1.49 | 2.01 | 2.04 | 3.61 |

| Newton County | 4 | 1 | 3 | 2 | 2 | 3.92 | 0.97 | 2.86 | 1.88 | 1.85 |

| Oconee County | 1 | 0 | 0 | 0 | 1 | 2.94 | 0 | 0 | 0 | 2.63 |

| Oglethorpe County | 1 | 0 | 0 | 0 | 0 | 6.94 | 0 | 0 | 0 | 0 |

| Paulding County | 0 | 1 | 3 | 2 | 3 | 0 | 0.67 | 1.98 | 1.29 | 1.88 |

| Peach County | 0 | 0 | 4 | 1 | 2 | 0 | 0 | 14.84 | 3.72 | 7.38 |

| Pickens County | 0 | 0 | 2 | 0 | 1 | 0 | 0 | 6.63 | 0 | 3.17 |

| Pierce County | 0 | 1 | 1 | 1 | 0 | 0 | 5.26 | 5.23 | 5.2 | 0 |

| Pike County | 1 | 0 | 3 | 1 | 2 | 5.63 | 0 | 16.74 | 5.58 | 10.98 |