Best Lewiston, ME Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Lewiston, ME auto insurance providers are State Farm, Geico, and Allstate. Rates start at $38 per month based on a 50/100/25 coverage plan. State Farm offers up to 30% off via Drive Safe & Save. Geico includes $500 airbag injury benefits, and Allstate forgives one $750+ at-fault accident.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: May 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Lewiston ME

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Lewiston ME

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Lewiston ME

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, Geico, and Allstate are the best auto insurance providers in Lewiston, ME. They offer top-rated protection and deep local discounts for Maine drivers.

State Farm takes the lead with up to 30% off through Drive Safe & Save and added savings for bundling home and auto insurance coverage policies.

Our Top 10 Company Picks: Best Lewiston, ME Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | A++ | Bundling Options | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 25% | A+ | Accident Forgiveness | Allstate | |

| #4 | 10% | A+ | Snapshot Savings | Progressive | |

| #5 | 20% | A+ | Vanishing Deductible | Nationwide |

| #6 | 25% | A | Bundling Discounts | Liberty Mutual |

| #7 | 30% | A+ | Dividend Payments | Amica | |

| #8 | 25% | A | Local Agent | The Hanover | |

| #9 | 15% | A | High-Risk Drivers | Safeco | |

| #10 | 13% | A++ | Comprehensive Coverage | Travelers |

Geico offers premium reductions for vehicles with anti-lock brakes and airbags, especially in low-incident ZIP codes. Allstate ranks high for its $100 accident forgiveness and vanishing deductible, which drops by $100 each year without a claim.

- State Farm offers 30% off plus home-auto bundle deals in Lewiston

- Outskirts of Lewiston report 14% lower accident claim frequency

- Cars valued under $10K in Lewiston see a $19 monthly premium drop

Enter your ZIP code using our free quote comparison tool to discover cheap car insurance in Maine with special offers for local drivers.

#1 – State Farm: Top Pick Overall

Pros

- Bundling Discounts: State Farm offers excellent savings to Lewiston, ME, residents when combining multiple insurance policies. Read our State Farm auto insurance review for details.

- Customer Service: State Farm is well-known for its helpful customer service, making it easy to file claims and providing strong support to policyholders in Lewiston, Maine.

- Affordable Rates for Basic Coverage: State Farm offers competitive pricing for minimum coverage at $28 per month for Lewiston drivers, making it an affordable option for many.

Cons

- Limited Multi-Policy Discounts: State Farm offers bundling discounts to Lewiston, ME, residents, but they might not be as large as those provided by other providers.

- Higher Premiums for Some Drivers: State Farm’s premiums could be higher than those of other insurers, particularly for high-risk drivers, depending on your location or driving record.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Low Premiums: Geico is known for offering some of the cheapest car insurance rates in Lewiston, ME. For many drivers, the minimum coverage is $25 per month.

- Generous Bundling Discounts: Geico offers a 25% discount to Lewiston, Maine, residents who bundle auto insurance with other policies. Learn more in our Geico auto insurance review.

- Strong Financial Stability: Geico is recognized for its financial strength, with an A++ rating from A.M. Best, which ensures it can handle auto insurance claims efficiently.

Cons

- Limited Coverage for High-End Vehicles: Geico may not provide as many auto insurance coverage options for high-performance cars, which could result in higher premiums.

- Less Personalized Customer Service: Geico’s customer service is efficient but primarily online and by phone, which may not suit Lewiston, ME residents who prefer in-person help.

#3 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Allstate offers Lewiston, Me, residents an accident forgiveness program, which is excellent for cautious drivers seeking peace of mind.

- Wide Range of Coverage: Allstate auto insurance offers options like roadside assistance, rental reimbursement, and gap coverage.

- Generous Bundling Discounts: Allstate gives a 25% discount when residents from Lewiston, Maine, bundle their auto insurance with other policies.

Cons

- Higher Premiums: Allstate may charge higher auto insurance premiums for drivers with a poor credit score or a history of accidents than other insurers in Lewiston, ME.

- Complicated Policy Options: Allstate’s offerings can be confusing, with many coverage choices, especially for first-time buyers from Lewiston, ME.

#4 – Progressive: Best for Snapshot Savings

Pros

- Snapshot Program: Progressive offers discounts based on your driving habits, tracking safe driving behaviors through a mobile device.

- Competitive Rates: Progressive auto insurance review shows that Progressive offers competitive rates, with minimum monthly coverage starting at $26.

- Wide Range of Discounts: Progressive offers several discounts to Lewiston, ME, residents, such as for bundling, safe driving, and good student discounts.

Cons

- Premium Increases After Claims: While Progressive is generally affordable, some drivers may experience higher premiums after filing a claim, especially for serious accidents.

- Limited Customer Service Options: Progressive auto insurance customers have trouble getting personalized service or face issues with claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s Vanishing Deductible program rewards safe driving by reducing deductible by $100 yearly, so you remain accident-free.

- Strong Customer Satisfaction: The Nationwide auto insurance review highlights the company’s excellent customer service and claims support, backed by an A+ rating from A.M. Best.

- Competitive Bundling Discounts: Nationwide offers a 20% discount when you bundle auto insurance with other policies, such as home or life insurance.

Cons

- Not the Cheapest Option for Young Drivers: Nationwide may not provide the lowest auto insurance premiums for younger or high-risk drivers in Lewiston.

- Limited Availability of Some Discounts: Some of Nationwide’s best discounts, like the Vanishing Deductible, may not be available in all states or regions.

#6 – Liberty Mutual: Best for Bundling Discounts

Pros

- Strong Bundling Options: Liberty Mutual offers a 25% discount when you bundle auto insurance with other policies, giving multi-policy Lewiston customers significant savings.

- Customizable Coverage Options: Liberty Mutual offers various coverage options, letting you tailor your policy to your needs, including accident forgiveness and new car replacement.

- Competitive Pricing: Liberty Mutual’s auto insurance is affordable, especially when bundled with other types of insurance. Learn more at our Liberty Mutual auto insurance review.

Cons

- Customer Service Complaints: Some customers have complained about Liberty Mutual’s customer service, especially regarding claims and how quickly they are resolved.

- Higher Rates for Drivers with Poor Credit: Like other insurers, Liberty Mutual may charge higher rates for drivers with poor credit, making coverage more expensive.

#7 – Amica: Best for Dividend Payments

Pros

- Dividend Payments: Amica lets policyholders earn dividends, which can help lower premiums or get refunded, saving money in the long run.

- High Customer Satisfaction: The Amica auto insurance review emphasizes the company’s excellent service, making it easy and stress-free for customers to file auto insurance claims.

- Generous Bundling Discounts: Amica gives a 30% discount when you bundle auto insurance with other policies, saving you a lot if you combine your insurance.

Cons

- Limited Coverage for High-Risk Drivers: Amica may not be the best choice for drivers with a history of accidents or violations, as it might not offer the lowest premiums.

- Higher Rates for New Customers: New customers might see higher initial premiums compared to some competitors, but long-term savings through dividends can help offset this.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – The Hanover: Best for Local Agent Support

Pros

- Personalized Service from Local Agents: The Hanover lets you work with local agents who can help you customize your policy and provide personal service.

- Strong Reputation for Claims Handling: The Hanover is known for handling claims well and providing fast and efficient support when needed.

- Competitive Discounts: The Hanover auto insurance review shows The Hanover offers discounts on bundles, loyalty, and safe driver discounts, helping Lewiston, ME, residents save on premiums.

Cons

- Limited National Reach: While The Hanover is great locally, it may not provide as many resources or benefits for policyholders outside certain areas.

- Higher Premiums for Younger Drivers: Like many insurers, The Hanover may charge higher rates for younger drivers, especially those with less driving experience.

#9 – Safeco: Best for High-Risk Drivers

Pros

- Coverage for High-Risk Drivers: Safeco specializes in insuring high-risk drivers, offering competitive rates for those with poor driving records or limited experience.

- Affordable Premiums for Basic Coverage: Safeco offers affordable rates in Lewiston at $31 per month for minimum coverage. Read our Safeco auto insurance review for more details.

- Strong Discount Opportunities: Safeco offers various discounts, including bundling and safe driving, to help customers lower overall costs.

Cons

- Limited High-End Vehicle Coverage: Safeco may not provide as complete coverage for luxury vehicles as some other top insurers.

- Customer Service Issues: Some policyholders have reported problems with Safeco’s customer service, especially during claims or when trying to reach an agent.

#10 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Travelers offers various coverage options, like roadside assistance, rental car reimbursement, and new car replacement.

- Strong Financial Stability: The Travelers auto insurance review examines the company’s financial strength, allowing it to handle claims efficiently and provide reliable service.

- Wide Network of Repair Shops: Travelers work with many auto repair shops so your vehicle can be repaired quickly and affordably.

Cons

- Higher Rates for Certain Demographics: Travelers may have higher premiums for younger drivers or those with a history of accidents.

- Limited Discount Opportunities: Travelers offer discounts, but they may not be as many or as large as those from some competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

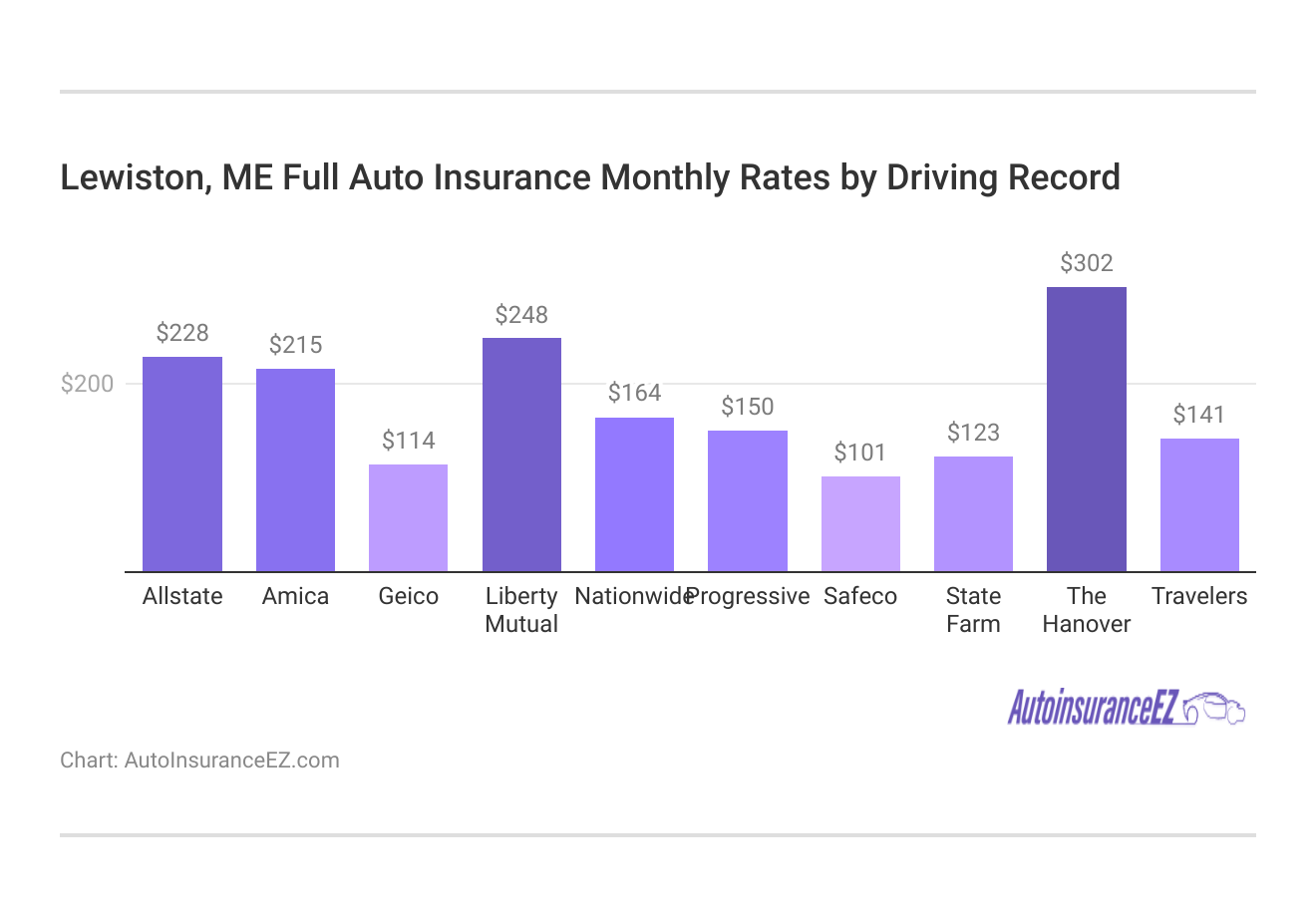

Best Auto Insurance Coverage Rates in Lewiston, ME

When looking for the best auto insurance in Lewiston, Maine, it is essential to compare the minimum and full coverage options. Below is a breakdown of the auto insurance providers and their rates for the area.

Auto Insurance Monthly Rates in Lewiston, ME by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $65 | $215 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $38 | $101 | |

| $47 | $123 | |

| $115 | $302 | |

| $53 | $248 |

Finding the right car insurance in Lewiston, Maine, depends on the coverage you need and how much you’re willing to spend. Geico has the lowest rates for minimum and full coverage, making it an excellent choice for affordable protection.

Nationwide and Progressive also offer reasonable rates, so they’re worth checking out. Determining what coverage works best for you and comparing prices to get the best deal is crucial.

Auto Insurance Coverage Requirements in Lewiston, Maine

Every driver must know Lewiston, Maine’s auto insurance coverage requirements to follow the law and stay protected. Maine law says all drivers must have liability insurance covering injuries and damage during an accident.

Auto Insurance Coverage Requirements in Lewiston, Maine

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $50,000 per person / $100,000 per accident |

| Property Damage Liability | $25,000 per accident |

Uninsured and underinsured auto insurance coverage is required to protect the driver if the other driver doesn’t have enough or no insurance. The minimum limits for this coverage are the same as for liability: $50,000 per person and $100,000 per accident.

Bundle is life! Can’t argue with that logic. + https://t.co/uNYjYTKwoU pic.twitter.com/RRoMMaYbbc

— State Farm (@StateFarm) August 28, 2024

When looking for the best Lewiston, ME, auto insurance, consider getting more than just the basics. Options like comprehensive and collision coverage and medical payment coverage can give you extra protection in case of accidents, theft, or other issues. Many insurance companies offer discounts if you bundle policies or let you customize a plan to fit your budget and needs.

Best Auto Insurance Discounts in Lewiston, ME

In Lewiston, Maine, auto insurance providers offer various discounts to help lower premiums. These include savings for safe driving, multi-policy bundles, good students, multiple vehicles, and eco-friendly cars.

Auto Insurance Discounts From the Top Providers in Lewiston, ME

| Insurance Company | Anti-Theft | Auto-Pay | Bundling | Good Driver | Good Student |

|---|---|---|---|---|---|

| 10% | 9% | 25% | 25% | 25% | |

| 18% | 10% | 30% | 25% | 20% | |

| 25% | 7% | 25% | 26% | 15% | |

| 35% | 15% | 25% | 20% | 12% |

| 5% | 10% | 20% | 40% | 18% |

| 25% | 12% | 10% | 30% | 10% | |

| 20% | 15% | 15% | 20% | 20% | |

| 15% | 13% | 17% | 25% | 35% | |

| 5% | 10% | 25% | 20% | 10% | |

| 10% | 3% | 13% | 10% | 8% |

Providers like Geico, Allstate, Amica, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, The Hanover, and Travelers offer different discounts that can reduce costs based on your driving habits and vehicle features.

Insurers in Lewiston offer rare discounts for paying premiums in full. For instance, upfront payments may slash costs by $40–$60 annually.

Jeff Root Licensed Insurance Agent

Looking into the discounts offered by auto insurance providers in Lewiston, Maine, can help reduce your premiums. You can find a plan that fits your budget by taking advantage of discounts like safe driver discounts or multi-policy savings. Ask your provider about all available discounts to get the best deal.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Major Factors Affecting Auto Insurance in Lewiston, Maine

Several things affect how to get the best auto insurance in Lewiston, Maine. Insurance companies look at your driving record, age, and what kind of car you drive to figure out your rate. Knowing these factors can help you make smarter choices and save money on your auto insurance.

ZIP Code

Areas within Lewiston with higher traffic, greater population density, or a higher likelihood of accidents typically see higher insurance rates. Conversely, ZIP codes in quieter neighborhoods or less densely populated areas may offer lower rates due to a decreased risk of accidents or vehicle theft.

Auto Insurance by ZIP Code in Lewiston, Maine

| ZIP Code | Monthly Rate |

|---|---|

| 4240 | $120 |

| 4241 | $125 |

| 4243 | $130 |

Understanding how ZIP codes impact the best auto insurance in Lewiston helps drivers find cheap auto insurance companies and compare car insurance quotes in Lewiston, ME. This insight also helps them choose cheap auto insurance in Maine that fits their location and needs.

Vehicular Accidents

In Lewiston, some areas may experience more accidents due to high traffic, complex intersections, or winter weather conditions, such as snow and ice. As a result, insurance premiums may be higher in areas with a higher rate of accidents.

Vehicular Accidents in Lewiston, Maine

| Year | Number of Accidents | Number of Injuries | Number of Fatalities |

|---|---|---|---|

| 2020 | 1,250 | 350 | 5 |

| 2021 | 1,300 | 400 | 7 |

| 2022 | 1,400 | 420 | 6 |

The number of vehicular accidents in Lewiston also impacts the type of coverage best suited for drivers. In areas with a higher frequency of accidents, more comprehensive coverage might be recommended to protect against potential costs. Drivers in areas with fewer accidents might choose more basic coverage.

Auto Thefts

In 2013, Lewiston saw a significant rise in stolen cars, with 56 reported thefts, much higher than in previous years. This increase in thefts can make it harder to find the best auto insurance in Lewiston, ME, as insurance companies may raise premiums for vehicles more likely to be stolen.

Basic Coverage vs. Comprehensive Coverage with Auto Theft Coverage in Lewiston, Maine

| Coverage Type | Monthly Rate | Includes Auto Theft Coverage |

|---|---|---|

| Basic Coverage | $120 | ❌ |

| Comprehensive Coverage | $150 | ✅ |

Discussing your comprehensive coverage with your insurance agent is a smart move to ensure complete protection. This coverage can assist if your vehicle is stolen, and exploring options like an anti-theft device discount can help you secure the best auto insurance in Lewiston, ME, while safeguarding your vehicle from theft.

Credit Score

A credit score is a significant factor in determining the best auto insurance in Lewiston, Maine. Insurance companies use credit scores to evaluate financial responsibility, which directly affects their rates.

Auto Insurance Monthly Rates in Lewiston, ME by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $100 | $120 | $150 | |

| $95 | $115 | $145 | |

| $90 | $110 | $140 | |

| $98 | $118 | $148 |

| $94 | $114 | $144 |

| $92 | $112 | $142 | |

| $96 | $116 | $146 | |

| $95 | $115 | $145 | |

| $97 | $117 | $147 | |

| $93 | $113 | $143 |

Drivers with poor credit may pay higher premiums, have fewer coverage options, or have less favorable terms. Conversely, drivers with good credit scores are more likely to receive better rates and discounts.

Understanding how credit score affects car insurance premiums in Lewiston, Maine, helps drivers choose the best car insurance in Lewiston, Maine, or Auburn, Maine. Deciding whether to improve credit or seek affordable coverage is crucial for better financial decisions.

Age

Age is a significant factor in determining the best auto insurance in Lewiston, ME. Insurance companies consider a driver’s age when setting premiums because the level of risk changes at different ages. Younger drivers, particularly those under 25, are typically considered at higher risk due to inexperience, which results in higher premiums.

Auto Insurance Monthly Rates in Lewiston, Maine by Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $320 | $350 | $180 | $200 | $140 | $150 | $110 | $120 | |

| $310 | $340 | $175 | $195 | $135 | $145 | $105 | $115 | |

| $300 | $330 | $170 | $190 | $130 | $140 | $100 | $110 | |

| $315 | $345 | $185 | $205 | $145 | $155 | $115 | $125 |

| $305 | $335 | $180 | $200 | $140 | $150 | $110 | $120 |

| $310 | $340 | $175 | $195 | $135 | $145 | $105 | $115 | |

| $320 | $350 | $180 | $200 | $140 | $150 | $110 | $120 | |

| $300 | $330 | $170 | $190 | $130 | $140 | $100 | $110 | |

| $315 | $345 | $185 | $205 | $145 | $155 | $115 | $125 | |

| $305 | $335 | $180 | $200 | $140 | $150 | $110 | $120 |

In contrast, older drivers, especially those over 50, are generally considered lower risk and may receive lower rates, but these may increase again for seniors due to factors like slower reaction times and potential health concerns.

Driving Record

Drivers with a clean driving record are seen as less risky and may qualify for lower premiums. On the other hand, drivers with a history of accidents, speeding tickets, or DUIs are considered higher risk and usually face higher rates.

Drivers with a poor driving history might need more extensive coverage, like higher liability limits, to qualify for cheap auto insurance for a bad driving record. Those with clean records may only need basic coverage, lowering premiums.

Insurers view past violations as predictors of future claims risk. In particular, one DUI can raise your monthly rate by over $100 in most states.

Dani Best Licensed Insurance Producer

For the cheapest car insurance in Maine, many companies offer discounts for maintaining a clean record, and drivers can easily find motor insurance near them by comparing quotes from local providers.

Vehicle Model

The vehicle model is a major factor in determining the best auto insurance in Lewiston, Maine. Insurance companies consider a car’s make, model, and age when calculating premiums. High-end vehicles or sports cars often come with higher repair and replacement costs, which results in higher insurance premiums.

Auto Insurance Rates by Vehicle Models in Lewiston, Maine

| Vehicle Model | Monthly Rate |

|---|---|

| Honda Civic | $130 |

| Toyota Camry | $125 |

| Ford F-150 | $140 |

| Chevrolet Silverado | $135 |

| Tesla Model 3 | $150 |

| Jeep Grand Cherokee | $145 |

| Hyundai Elantra | $120 |

| Subaru Outback | $125 |

| Nissan Altima | $128 |

| Chevrolet Malibu | $130 |

Understanding how a vehicle model impacts vehicle insurance can help drivers make informed decisions when purchasing coverage based on their car’s type, value, and safety features. Car insurance companies like State Farm in Lewiston, Maine, offer options for low-income car insurance in Maine to provide affordable coverage.

Minor Factors Affecting Auto Insurance in Lewiston, Maine

While several significant factors impact auto insurance premiums in Lewiston, Maine, minor factors can also influence the cost of coverage. These factors affect your auto insurance rates but may not have as significant an impact as age, driving record, or vehicle model. However, they still play a role in determining the best auto insurance in Lewiston, Maine.

Marital Status

Marital status can affect the cost of auto insurance in Lewiston. While it isn’t as important as factors like your driving record or vehicle model, auto insurance companies often offer lower premiums to married drivers. This is because studies show that married drivers are less likely to get into accidents, which makes them less risky for insurers.

Insurance providers may give discounts to married couples, especially when combining car insurance after marriage. Single drivers, on the other hand, tend to face slightly higher premiums because they are statistically more likely to be involved in accidents.

Gender

Statistically, young men are more likely to be involved in accidents and engage in risky driving, which leads to higher premiums for them. As a result, men, especially those under 25, often pay higher rates than women in the same age group. However, once drivers get older, the difference in premiums based on gender becomes less noticeable.

Women may see lower rates when younger, but premiums generally become similar for men and women as they age. Understanding how gender factors into auto insurance rates in Maine, along with safe driver insurance discounts and inexpensive auto insurance near you, can help drivers make more informed choices when selecting their coverage.

Coverage and Deductibles

The amount of coverage you choose and your deductible can impact your premiums. If you choose higher coverage limits or more comprehensive protection, your premiums will likely be higher since the insurance company is taking on more risk.

Selecting lower coverage or a higher deductible can help lower your premium. However, these factors tend to have a minor effect on your rates than more significant factors like your driving record or vehicle type. A higher auto insurance deductible might lower your monthly premium, but you’ll also pay more out of pocket if you file a claim.

Driving Distance to Work

Insurance companies consider how much you drive each day because the more time you spend on the road, the higher your chances of being involved in an accident. Drivers who have longer commutes are statistically at a higher risk of accidents, which can lead to slightly higher premiums.

While driving distance does affect rates, it is generally less important than factors like your driving history or the type of car you drive. Drivers with shorter commutes may enjoy slightly lower rates, but the difference is usually slight. Following driving tips for road safety and exploring cheap vehicle insurance near you can help you make informed decisions when choosing coverage.

Education

In Lewiston, ME, education doesn’t significantly impact auto insurance rates, but it can still play a minor role. While things like your driving record, the car you drive, and where you live matter more, some insurance companies might give you a discount if you have a higher level of education.

Insurers may assume they’re more careful and financially stable. Plus, areas with higher education levels may have fewer accidents, which could help keep rates lower. Knowing how to file an auto insurance claim is essential, as it can affect your rates and overall insurance experience. While education is just a minor factor, it can still make a difference when combined with other factors.

Case Studies: Real-Life Scenarios in Lewiston, Maine Auto Insurance

Understanding how auto insurance premiums are determined can be complex, but real-life examples help simplify the process. Here are three case studies from Lewiston, Maine, showing how various factors influence insurance rates, such as age, driving record, and vehicle type.

- Case Study #1 – Sarah, the Young Driver with a Clean Record: Sarah, a 22-year-old college student, secured affordable auto insurance for her 2015 Toyota Corolla with Liberty Mutual at $95 a month. She benefited from discounts due to her clean driving record and the car’s safety features.

- Case Study #2 – John, the Experienced Driver with a Recent Accident: John, a 38-year-old professional with a recent accident, found a $140 per month premium for his 2019 Honda CR-V. After completing a defensive driving course, he lowered his rate to $120 a month with State Farm.

- Case Study #3 – Tom, the Senior Driver Looking for Low-Cost Coverage: Tom, a 67-year-old retiree, secured a $90 monthly policy for his 2012 Honda Accord with Geico. His low annual mileage and senior discounts helped him find affordable coverage.

Getting the correct type of auto insurance in Lewiston, ME, depends on your driving history, age, and what kind of car you drive. By comparing around and checking for discounts, you can find a policy that works for you and your budget. Take the time to compare your options to make the best choice for you and your vehicle.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How we Conducted our Auto Insurance Analysis in Lewiston, Maine

We figured out the average rate for auto insurance in Lewiston, Maine, based on a few simple factors: a married, 34-year-old male with good credit, a clean driving record, and a history of keeping auto insurance for the last 12 months. This person also owns a home and drives a financed 2015 Honda Accord with a pre-installed anti-theft device.

We factored in garage versus street parking when assessing theft risk. As a case, drivers parking overnight in Mill Street lots saw 12% higher premiums.Jeffrey Manola Licensed Insurance Agent

The miles driven annually were based on the national average. This helps us understand what a typical driver in Lewiston might pay for auto insurance. A clean driving record, good credit, and homeownership often lead to lower auto insurance rates, as insurance companies view these as responsibility indicators. Driving a car with an anti-theft device, like the 2015 Honda Accord, can also help reduce costs.

Considering these factors, we can estimate the average auto insurance cost for someone with this profile in Lewiston, Maine. Please enter your ZIP code into our comparison tool today to find the best auto insurance rates, no matter how much coverage you need.

Frequently Asked Questions

What are the top auto insurance companies in Lewiston, ME?

State Farm, Geico, and Allstate are the best auto insurance companies in Lewiston, ME. These providers offer competitive rates and reliable coverage options to residents.

How much is auto insurance in Lewiston, ME?

In Lewiston, ME, State Farm offers the best rates at approximately $82 a month, followed by Geico at $76 a month and Allstate at $90 per month. Rates can vary based on coverage and individual circumstances.

What auto insurance coverage is required by law in Lewiston, ME?

Maine law requires drivers to have liability insurance, one of the essential types of auto insurance coverage, to cover injuries and damages from accidents. Additionally, uninsured and underinsured motorist coverage is mandatory, with minimum limits of $50,000 per person and $100,000 per accident.

What discounts can I get on auto insurance in Lewiston, ME?

In Lewiston, ME, many providers offer safe driver discounts, multi-policy bundles, good student discounts, and eco-friendly car discounts. Each provider may have specific offers based on your driving habits and vehicle features.

How does your ZIP code affect your auto insurance rate?

Your ZIP code plays a significant role in determining your auto insurance premium. Areas with higher traffic, accidents, or theft rates tend to have higher insurance costs. Conversely, quieter neighborhoods with fewer risks may result in lower rates.

What factors influence my auto insurance rate in Lewiston, ME?

Key factors influencing auto insurance rates include your driving record, vehicle model, age, credit score, and how often you drive. Accidents, traffic violations, and even the car you drive can impact your rates. Access the complete picture in our “Reckless Driving and Auto Insurance Rates.”

Can you lower your auto insurance premiums in Lewiston, ME?

Yes, you can lower your premiums by maintaining a clean driving record, bundling policies, driving fewer miles, and taking advantage of discounts. Adjusting your coverage level or increasing your deductible can help reduce costs.

What type of coverage should you consider in Lewiston, ME?

It’s recommended to have more than just basic liability coverage. Consider adding collision, comprehensive, and medical payment coverage for added protection.

How does my credit score affect my auto insurance rates in Lewiston, ME?

Insurance companies use your credit score to assess risk. Drivers with higher credit scores typically pay lower premiums, while those with lower credit scores may face higher rates. Improving your credit score can help you secure better rates. Gain a deeper understanding through our “Best & Worst Credit Scores by State.”

How does my age impact auto insurance rates in Lewiston, ME?

Age is an important factor in determining auto insurance premiums. Younger drivers, especially those under 25, often face higher rates due to inexperience. Older drivers may qualify for lower rates, but can see an increase if they are over 50.

What is the Cross Insurance phone number you can call for auto insurance help?

You can reach Cross Insurance at 1-800-244-6211 for policy questions, claims, and auto insurance quotes.

How can you find reliable coverage through Cross Insurance in Maine?

Cross Insurance in Maine offers local agents who help you compare policies. Depending on your profile, monthly auto insurance rates start around $39. Find out if your policy meets Maine’s minimum car insurance requirements.

Is Bilodeau Insurance a good option for local auto coverage in Lewiston, ME?

Yes, Bilodeau Insurance is a respected independent agency in Lewiston that partners with multiple carriers to help you find competitive monthly rates and discounts.

Can you get car insurance through Cross Insurance in Massachusetts?

Yes, Cross Insurance provides coverage options in Massachusetts, including multi-policy discounts and teen driver savings to help reduce your monthly auto insurance cost.

Who owns Cross Insurance, and how does that affect your policy?

Cross Insurance is a family-owned agency founded by Woodrow W. Cross. Its independent status means you can choose from various providers for better monthly pricing. Learn how an auto insurance company determines your premium in Maine.

Is Cross Insurance in NH a good place to start your car insurance search?

Cross Insurance in New Hampshire offers local service with customizable policies, including accident forgiveness and safe driver discounts to lower your monthly premiums.

Where is the Cross Insurance headquarters located if you need corporate help?

Cross Insurance Company’s headquarters are in Bangor, Maine, and it supports customers across New England through regional offices and agents offering monthly coverage options.

How can you find the best Auburn, Maine, car insurance for your needs?

You can compare quotes from local and national providers to find Auburn, Maine, car insurance starting as low as $42 per month based on your driving profile and vehicle. Compare quotes now to find the best Auburn, ME auto insurance for less.

Where can you find the cheapest Maine auto insurance for your vehicle?

You can find the cheapest Maine car insurance by comparing quotes online, with monthly rates starting around $36, depending on your driving history and coverage level.

How can you qualify for Maine’s cheap auto insurance discounts?

You can qualify for Maine’s cheap auto insurance by maintaining a clean driving record, opting for higher deductibles, and taking advantage of safe-driver or multi-policy discounts.

Which cheap Maine car insurance companies offer reliable coverage?

Cheap Maine car insurance companies, such as regional mutual insurers and national carriers, often provide dependable service, with monthly premiums as low as $39 for basic liability auto insurance plans.

How do you find motor insurance near you that’s both affordable and local?

You can find motor and auto insurance near you by using a ZIP code quote tool to compare local agents and companies offering monthly rates tailored to your location and risk profile.