Cheap Auto Insurance in Pennsylvania for 2026 (Save Money With These 10 Companies)

Geico, Travelers, and State Farm offer cheap auto insurance in Pennsylvania starting at $36 per month. Geico has the cheapest rates for drivers who need basic coverage. Travelers rewards frequent commuters, while State Farm stands out for its reliable customer service for Pennsylvania drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: May 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe cheapest auto insurance in Pennsylvania comes from Geico, Travelers, and State Farm, with Geico offering the lowest rates starting at just $36 per month. Geico stands out as the top pick overall thanks to its low complaint levels, strong financial stability, and multiple discount opportunities.

Travelers is ideal for frequent commuters because of its IntelliDrive® program, a telematics-based policy that tracks real driving behaviors such as braking, acceleration, and phone use over a 90-day period.

Our Top 10 Company Picks: Cheap Auto Insurance in Pennsylvania

| Company | Rank | A.M. Best | Monthly Rates | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | $36 | Cost Savings | Geico | |

| #2 | A++ | $40 | Frequent Commuters | Travelers | |

| #3 | A++ | $41 | Customer Service | State Farm | |

| #4 | A+ | $46 | Vanishing Deductible | Nationwide | |

| #5 | A | $58 | Claims Service | American Family |

| #6 | A | $70 | Family Plans | Farmers | |

| #7 | A+ | $79 | New Drivers | Allstate | |

| #8 | A+ | $80 | Custom Coverage | Progressive | |

| #9 | A+ | $78 | Local Agent Availability | Erie |

| #10 | A | $117 | Custom Discounts | Liberty Mutual |

While State Farm provides exceptional customer service through its local agent network. Comparing quotes from these companies can help Pennsylvania drivers find the best coverage at the most affordable price.

- Find cheap auto insurance in Pennsylvania starting at just $36 per month

- Compare coverage, discounts, and rates to meet Pennsylvania drivers’ needs

- Geico is the top pick overall for the cheapest rates and strong customer satisfaction

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

#1 – Geico: Top Overall Pick

Pros

- Lowest Starting Rates: Geico offers some of the cheapest auto insurance in Pennsylvania, with rates starting at $23/month, making it ideal for drivers seeking budget-friendly coverage in PA.

- Extensive Discount Program: Geico provides up to 25% in savings for safe driving and vehicle safety features, helping drivers in PA maximize affordability.

- Easy Online Management: Geico’s mobile app allows PA drivers to manage their policies, file claims, and access digital ID cards 24/7. Learn more by reading our Geico insurance review.

Cons

- Higher Rates for Young Drivers: Young drivers in Pennsylvania may face premiums up to 40% higher than older, more experienced drivers.

- Longer Claims Processing Times: Some customers in PA have reported waiting several weeks for Geico to resolve complex claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Travelers: Cheapest for Frequent Commuters

Pros

- IntelliDrive® Telematics Savings: Travelers rewards safe commuting habits in PA with up to 30% off premiums through its driving behavior program.

- Reliable Customer Service: Travelers maintains a strong reputation among Pennsylvania customers for responsive and supportive claims handling.

- Flexible Coverage Options: PA drivers can choose from a wide range of coverage add-ons, including accident forgiveness and gap insurance. Learn more by reading our review of Travelers.

Cons

- Higher Premiums for High-Risk Drivers: Drivers in PA with violations or accidents may face significantly higher rates compared to other providers.

- Limited App Features: Travelers’ digital tools lack the advanced functionality that some PA drivers might expect from a top insurer.

#3 – State Farm: Cheapest for Customer Service

Pros

- Personalized Local Service: With hundreds of agents across Pennsylvania, State Farm offers personal, face-to-face service that PA drivers can rely on.

- Drive Safe & Save™ Discounts: Drivers in PA can earn up to 30% off premiums by participating in State Farm’s safe driving program.

- Financial Strength: State Farm’s A++ rating ensures Pennsylvania drivers can trust the company’s ability to pay claims reliably. Read more in our full review of State Farm’s auto insurance.

Cons

- High Premiums for Teen Drivers: Young drivers in PA may find State Farm’s rates up to $300/month, making it less affordable for new drivers.

- Limited Digital Tools: State Farm’s online features may not meet the expectations of PA drivers seeking modern digital management.

#4 – Nationwide: Cheapest for Vanishing Deductible

Pros

- Vanishing Deductible® Savings: PA drivers can lower their deductible by $100 each claim-free year, making full coverage more affordable in the long term.

- Comprehensive Coverage Options: Nationwide offers a variety of add-ons to help Pennsylvania drivers build the protection they need.

- Strong Local Support: Nationwide’s customer service team is available to assist PA policyholders with claims and policy management. You can learn more in our Nationwide auto insurance review.

Cons

- Variable Pricing Across Locations: Drivers in larger cities like Philadelphia, PA may see premiums 20–30% higher than those in rural areas.

- Reported Claims Delays: Some Pennsylvania customers have noted longer-than-expected claims processing times.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Cheapest for Claims Service

Pros

- Teen Safe Driver Program: Young drivers in PA can save up to 20% through American Family’s telematics program designed for teens.

- High Customer Satisfaction: American Family receives positive reviews from PA customers for agent service and claims support.

- Bundling Discounts: Pennsylvania drivers can save by combining auto and home insurance under one policy. Find out more about American Family in our American Family review.

Cons

- Higher Base Premiums for Young Drivers: Despite available discounts, young drivers in PA may still face rates starting at $200+/month.

- Limited Digital Management Options: PA customers may find American Family’s app lacks some features offered by competitors.

#6 – Farmers: Cheapest for Family Plans

Pros

- Discounts for Eco-Friendly Vehicles: Pennsylvania drivers who own hybrid or electric cars can qualify for special discounts.

- Wide Range of Add-Ons: Farmers offers PA policyholders options like rental car coverage and roadside assistance.

- Personalized Agent Support: Farmers’ local agent network provides in-person service for drivers across PA. Check out our online Farmers review for more information.

Cons

- Limited Discount Availability: Some PA drivers may find fewer savings opportunities compared to competitors like Geico or State Farm.

- Higher Rates for Riskier Drivers: Drivers with traffic violations in Pennsylvania may see rates upwards of $200+/month.

#7 – Allstate: Cheapest for New Drivers

Pros

- Drivewise® Telematics Program: PA drivers can save up to 40% by demonstrating safe driving through Allstate’s app.

- Multi-Policy Bundling Savings: Combining auto and home policies in Pennsylvania can lower overall insurance costs.

- Reliable Agent Network: Allstate’s local agents in PA offer dedicated service for policyholders. Read more about this provider in our Allstate auto insurance review.

Cons

- High Rates for Inexperienced Drivers: New drivers in Pennsylvania often face higher monthly costs, making it less competitive.

- Less Flexible Payment Options: Some PA customers report fewer installment options compared to online-first insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Progressive: Cheapest for Custom Coverage

Pros

- Snapshot® Personalized Pricing: Pennsylvania drivers can reduce rates by participating in Progressive’s Snapshot® program, which monitors driving behavior.

- Customizable Coverage: Progressive offers PA drivers unique options like rideshare coverage and pet injury protection.

- 24/7 Claims Support: Progressive’s round-the-clock claims service is available to all PA policyholders. Our complete Progressive review provides more details.

Cons

- Higher Rates for High-Risk Drivers: PA drivers with DUIs or multiple violations may face significantly higher premiums.

- Unpredictable Renewal Pricing: Some Pennsylvania customers report rate increases at renewal without significant changes in driving behavior.

#9 – Erie: Cheapest for Local Agent Availability

Pros

- Top-Rated Customer Support: Erie’s #1 ranking in customer satisfaction in the Mid-Atlantic region makes it a reliable choice for PA drivers.

- Guaranteed Replacement Cost Coverage: Unique to Pennsylvania drivers, Erie replaces your vehicle without depreciation if it’s totaled.

- Local Agent Network: As per our Erie insurance review, Erie’s PA-based agents provide personalized service tailored to local drivers.

Cons

- Limited Geographic Availability: Erie operates only in select states, limiting availability for PA drivers who may move out-of-state.

- Higher Surcharges for Risky Drivers: High-risk Pennsylvania drivers may face 30% higher premiums than average.

#10 – Liberty Mutual: Cheapest for Custom Discounts

Pros

- Significant Bundling Discounts: Pennsylvania residents can save up to 30% by bundling auto, home, and renters insurance.

- New Car Replacement: Available to PA drivers, this option provides a brand-new vehicle if your car is totaled within the first year.

- Accident Forgiveness: Liberty Mutual company review helps PA policyholders avoid premium increases after their first accident.

Cons

- Fewer Discounts for Low-Risk Drivers: Safe drivers in PA may not find as many discount opportunities as they would with other insurers.

- Higher Youth Premiums: Young drivers in Pennsylvania may face premiums starting at $250+/month.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage and Rates in Pennsylvania

Auto insurance rates in Pennsylvania vary based on several factors, including your driving record, location, and the level of coverage you choose. While minimum coverage keeps you legal on the road, adding comprehensive and collision coverage provides greater financial protection but comes at a higher cost.

Auto Insurance Monthly Rates in Pennsylvania by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $79 | $237 | |

| $58 | $174 |

| $78 | $125 |

| $70 | $210 | |

| $36 | $109 | |

| $117 | $351 |

| $46 | $138 | |

| $80 | $238 | |

| $41 | $122 | |

| $40 | $121 |

However, comparing quotes from multiple providers is the best way to ensure you’re getting the right balance of price and protection based on your personal driving profile.

Cheap auto insurance in Pennsylvania depends on your driving record, location, and coverage—compare quotes to find affordable protection that meets state requirements.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

While it’s tempting to shop based only on price, drivers in Pennsylvania should also consider factors like customer satisfaction and claims handling. Some drivers report frustration with rising premiums, particularly with companies like Progressive, despite having clean records and low mileage.

This highlights why it’s important to regularly compare providers, read customer reviews, and evaluate financial stability to find the best long-term value on cheap auto insurance in Pennsylvania.

Rates by Age and Gender

Age has a significant impact on what you pay for auto insurance in Pennsylvania, with teen drivers facing the highest rates across all providers. While Pennsylvania law prevents gender-based pricing discrimination, comparing quotes by age group can help you find the most affordable policy for your specific driver profile.

Full Coverage Auto Insurance Monthly Rates in Pennsylvania by Provider & Driving Record

| Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $574 | $641 | $196 | $202 | $174 | $172 | $160 | $163 | |

| $296 | $314 | $135 | $139 | $107 | $108 | $102 | $101 |

| $420 | $465 | $150 | $155 | $120 | $125 | $108 | $110 |

| $681 | $743 | $199 | $216 | $157 | $165 | $143 | $158 | |

| $290 | $312 | $112 | $113 | $100 | $104 | $96 | $100 | |

| $455 | $495 | $175 | $182 | $144 | $149 | $130 | $135 |

| $413 | $498 | $144 | $154 | $114 | $118 | $99 | $115 | |

| $646 | $711 | $157 | $160 | $123 | $119 | $104 | $106 | |

| $273 | $335 | $115 | $128 | $104 | $104 | $94 | $94 | |

| $350 | $433 | $121 | $126 | $114 | $118 | $97 | $101 |

Insurers in Pennsylvania don’t differentiate based on gender but consider age when calculating premiums. Teen drivers typically pay the highest premiums, but shopping around can help find the most economical rate

Rates by Zip Code

Your ZIP code plays a major role in determining your premium because insurers in Pennsylvania assess local risks like accident frequency, weather conditions, and vehicle theft rates.

Drivers in cheaper ZIP codes like Bellefonte and State College typically pay lower premiums, while rates are higher in densely populated or high-risk areas.

Rates by City

Auto insurance costs in Pennsylvania can also vary widely depending on your city. Take a look at the tables below to see if your city has expensive or cheap insurance rates.

Full Coverage Auto Insurance Monthly Rates in Pennsylvania by Expensive Cities

| City | Monthly Rate |

|---|---|

| Philadelphia | $290 |

| Chester | $265 |

| Darby | $260 |

| Yeadon | $255 |

| McKeesport | $250 |

| Norristown | $245 |

| Reading | $240 |

| Allentown | $235 |

| Lancaster | $230 |

| Upper Darby | $228 |

Philadelphia ranks as the most expensive city for auto insurance, while State College and surrounding areas offer some of the lowest monthly rates in the state.

Full Coverage Auto Insurance Monthly Rates in Pennsylvania by Least Expensive Cities

| City | Monthly Rate |

|---|---|

| State College | $115 |

| Warren | $118 |

| Dubois | $120 |

| Lewisburg | $122 |

| Bloomsburg | $125 |

| Selinsgrove | $127 |

| Wellsboro | $130 |

| Lock Haven | $132 |

| Towanda | $135 |

| Clarion | $137 |

This means drivers in smaller cities or rural areas often pay significantly less than those in high-traffic urban centers. Comparing rates by city is one of the easiest ways to lower your insurance costs in PA.

Rates by Monthly Commute

The distance you drive daily directly affects how much you pay for auto insurance in Pennsylvania. Many insurers offer lower rates if your commute is shorter, typically around 6,000 miles per year, helping low-mileage drivers save more.

Full Coverage Auto Insurance Monthly Rates in Pennsylvania by Annual Mileage

| Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $325 | $338 | |

| $653 | $653 |

| $250 | $260 |

| $245 | $255 | |

| $214 | $220 | |

| $492 | $518 |

| $233 | $233 | |

| $371 | $371 | |

| $222 | $235 | |

| $653 | $653 |

On the other hand, longer commutes increase your time on the road, which raises your risk of accidents and may lead to higher premiums. To better understand the factors influencing auto insurance costs in Pennsylvania, we’ve summarized key risk factors in the state’s insurance report card.

Pennsylvania Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | B+ | Snow and ice contribute to claims |

| Traffic Density | B | High volume of cars on roads |

| Vehicle Theft Rate | B- | Theft rates slightly above average |

| Average Claim Size | C | Moderate claim amounts on average |

Weather, traffic, theft rates, and average claim costs all play a role in how insurers calculate your rates. Knowing these risks can help you understand why premiums vary and what to watch for when comparing quotes.

Rates by Credit History

In Pennsylvania, drivers with poor credit often pay much higher premiums than those with good or excellent credit.

Full Coverage Auto Insurance Monthly Rates in Pennsylvania by Provider & Credit Score

| Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $170 | $200 | $230 | |

| $160 | $190 | $220 |

| $150 | $180 | $210 |

| $175 | $210 | $240 | |

| $140 | $170 | $200 | |

| $210 | $240 | $280 |

| $165 | $195 | $225 | |

| $180 | $210 | $250 | |

| $150 | $180 | $210 | |

| $220 | $250 | $290 |

USAA and Nationwide tend to offer the best rates for poor credit, while Geico and State Farm provide affordable options for drivers with stronger credit profiles.

Read More: How Your Credit Score Affects Your Auto Insurance Premiums

Rates by Driving Record

Drivers with a clean record pay the lowest rates in Pennsylvania, while those with a DUI or accident history can face significantly higher premiums.

Full Coverage Auto Insurance Monthly Rates in Pennsylvania by Driving Record

| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 |

| $83 | $100 | $118 | $153 |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 | |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 |

Comparing providers and factors that affect your auto insurance is essential since companies like Erie and State Farm tend to offer more forgiving pricing for drivers with past violations.

Pennsylvania laws don’t prohibit drivers from using handheld devices or cellphones. However, you are not allowed to use text messaging while driving.

Distracted driving is a primary offense in Pennsylvania, and you can be stopped and fined. Vehicle safety tips advise staying focused on the road to avoid accidents caused by distractions.

Read More: Auto Insurance After A DUI

Premiums as a Percentage of Income

On average, Pennsylvania drivers spend a smaller portion of their income on auto insurance compared to the national average.

Auto Insurance Percentage of Income in Pennsylvania

| Year | Pennsylvania | National Average |

|---|---|---|

| 2012 | 2.23% | 2.34% |

| 2013 | 2.28% | 2.43% |

| 2014 | 2.24% | 2.40% |

| 2025 | 3.89% | 3.39% |

However, your personal rate may vary, so it’s smart to compare multiple quotes to make sure you’re getting the best value for your budget.

Coverage Options Beyond Pennsylvania’s Minimum Requirements

While Pennsylvania requires only basic liability and medical benefits coverage, adding extra protection can help safeguard your finances after an accident, theft, or weather-related damage. Below are the most valuable coverage types that go beyond state minimums.

- Comprehensive Coverage: Protects your vehicle from non-collision events like theft, vandalism, fire, and weather damage.

- Collision Coverage: Pays for repairs to your vehicle after a collision, regardless of who is at fault.

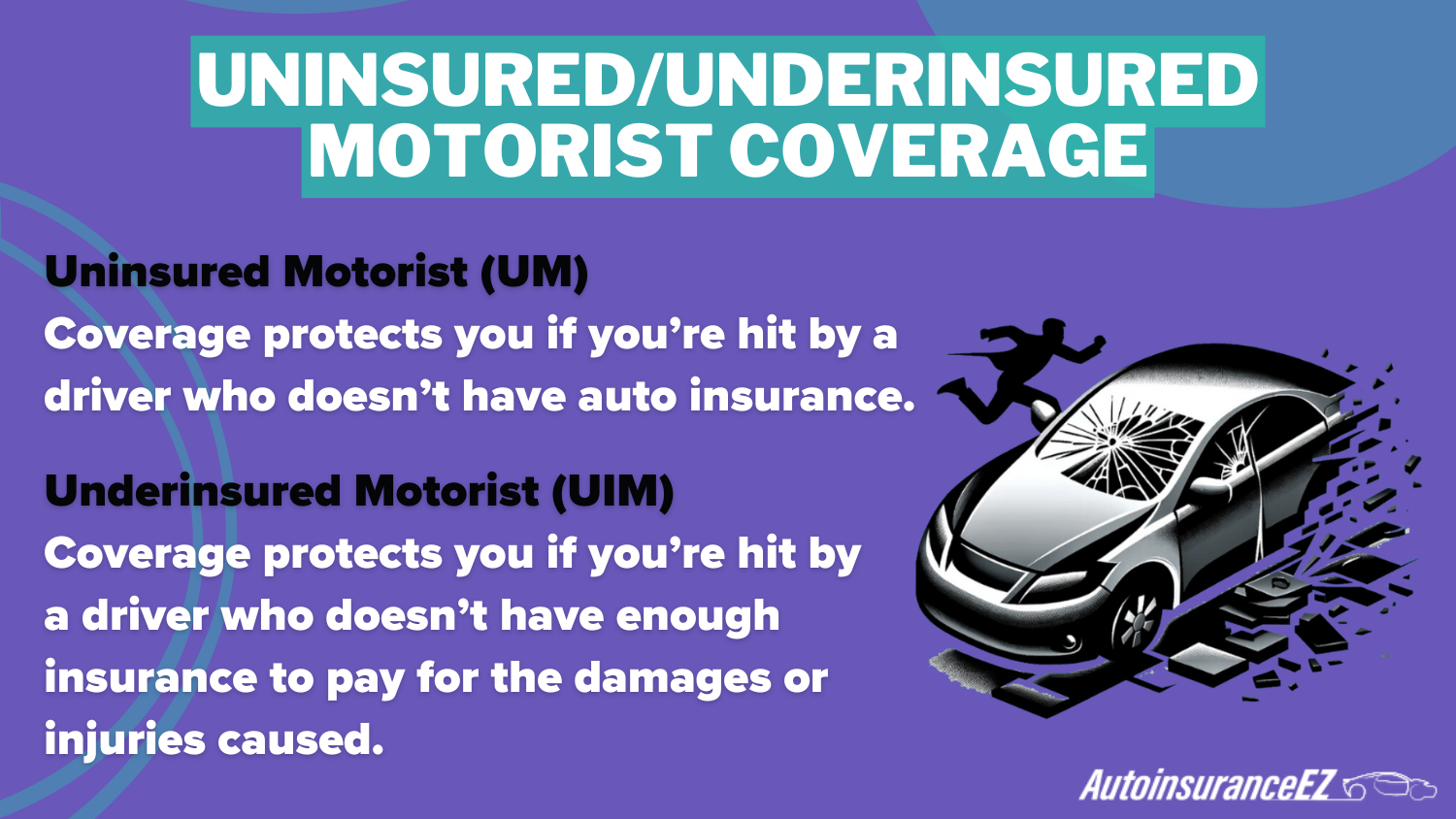

- Uninsured/Underinsured Motorist Coverage: Helps cover your expenses if you’re hit by a driver with little or no insurance.

- Rental Reimbursement Coverage: Covers the cost of a rental car if your vehicle is in the shop for covered repairs.

- Roadside Assistance: Roadside assistance provides services like towing, battery jump-starts, and flat tire changes if you experience a breakdown.

While these add-ons increase your premium slightly, they can save you thousands in unexpected out-of-pocket expenses. Always compare providers and policy options to find the right balance of protection and affordability for your needs.

Tips on Saving Auto Insurance in Pennsylvania

Drivers in Pennsylvania can unlock significant savings by qualifying for common discounts such as safe driver discount, low mileage, and bundling policies. For example, companies like Geico, Erie, and Allstate offer up to 30% off for low-mileage drivers who travel fewer miles each year, reducing their risk of accidents.

Auto Insurance Discounts From Top Providers in Pennsylvania

| Company | Anti-Theft | Bundling | Claims-Free | Good Driver | Low Mileage |

|---|---|---|---|---|---|

| 10% | 25% | 10% | 25% | 30% | |

| 25% | 25% | 15% | 25% | 20% |

| 15% | 25% | 10% | 23% | 30% |

| 10% | 20% | 9% | 30% | 10% | |

| 25% | 25% | 12% | 26% | 30% | |

| 35% | 25% | 8% | 20% | 30% |

| 5% | 20% | 14% | 40% | 20% | |

| 25% | 10% | 10% | 30% | 30% | |

| 15% | 17% | 11% | 25% | 30% | |

| 15% | 13% | 13% | 10% | 20% |

Many providers also reward policyholders with anti-theft device discounts, helping drivers in high-theft areas like Philadelphia lower their premiums by making their vehicles more secure.

Bundle your auto and home insurance with the same provider to unlock up to 25% in savings on your car insurance in Pennsylvania.

Daniel Walker Licensed Insurance Agent

Bundling multiple policies, such as auto and home insurance, can provide savings of up to 25% or more with top companies like Geico, American Family, and Erie. While Pennsylvania does not have a state-sponsored low-cost insurance program, drivers can still find affordable options by comparing multiple providers.

Taking advantage of these discounts—and shopping around regularly—remains one of the best ways to secure cheap auto insurance in Pennsylvania without sacrificing essential coverage.

Read More: How to Lower Your Auto Insurance Premiums

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Largest Auto Insurance Companies in Pennsylvania

Choosing a well-established insurance company can make a difference when it comes to claims reliability, customer support, and competitive pricing. State Farm holds the largest market share in Pennsylvania at 20.35%, making it a top choice for drivers looking for widespread local agent availability and trusted service.

Auto Insurance Companies in Pennsylvania

| Company | Market Share |

|---|---|

| 11.42% | |

| 13.19% |

| 2.20% | |

| 8.08% | |

| 4.85% |

| 8.99% | |

| 10.01% | |

| 20.35% | |

| 3.84% | |

| 3.42% |

Erie Insurance, a regional provider based in Pennsylvania, comes in second with 13.19%, offering personalized service and strong customer satisfaction throughout the state.

While smaller companies like Farmers, with just 2.20% market share, may offer niche benefits, their limited presence could impact agent availability or customer service response times.

By considering both company size and service reputation, Pennsylvania drivers can find the right balance of affordable rates and dependable coverage.

Read More: Driving Tips for Road Safety

Minimum Insurance Coverage Requirements in Pennsylvania

Pennsylvania requires all drivers to carry liability insurance of $15,000 for injury to one person, $30,000 per accident, and $5,000 for property damage, plus $5,000 in medical benefits coverage.

You must also choose between full tort, which allows you to sue for pain and suffering, or limited tort, which restricts lawsuits unless the injury is severe.

Liability Coverage in Pennsylvania

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $15,000 per person, $30,000 per accident |

| Property Damage Liability | $5,000 per accident |

| Uninsured/Underinsured Motorist | Optional |

| Collision Coverage | Optional |

| Comprehensive Coverage | Optional |

Meeting the minimum keeps you legal but may leave you underinsured after a major accident. Higher liability limits and optional coverage like comprehensive and collision can better protect your finances and prevent out-of-pocket costs beyond the state minimum.

Comparing multiple providers can help you find affordable rates while ensuring you’re better protected than the state’s bare minimum car insurance requirements.

Read More: Automobile Liability Coverage

Penalties for Driving Without Insurance in Pennsylvania

Driving without insurance in Pennsylvania puts you at risk of fines, license suspension, and even jail time, but the bigger risk is the financial damage you could face after an accident. Paying out-of-pocket for injuries or property damage can drain your savings and make it harder to find affordable coverage in the future.

Let us review the penalties and challenges you may face if you are caught driving without insurance:

- Financial Penalty: If you are found operating a car without liability insurance, you would have to pay a fine of anywhere between $100 to $500. For repeat occurrences, the penalty can increase to as high as $1,000. You will also have to pay license and registration restoration fees.

- License Suspension: You may face a license suspension of up to three months, which could potentially be extended to six months. However, it can also include registration suspension and vehicle impounding.

- Jail: If you are a repeat offender or caused an accident without insurance, you can be jailed for a period of time.

- Financial Repercussion: Regardless of the penalty, you are putting yourself at substantial financial risk by driving without insurance. If you cause a serious accident, you will have to pay for the damages out of pocket, which can potentially consume your financial assets.

- Impact on Insurance Policy: If you were ever caught driving without insurance, you might find that insurers are not too keen to write you a policy, or your premium rate may increase substantially.

Maintaining at least the state’s required liability insurance protects you from these legal and financial consequences and keeps you eligible for cheap auto insurance in Pennsylvania.

Read more: Can you get auto insurance without a license?

Additional Liability Coverage Options in Pennsylvania

While Pennsylvania only requires basic liability and medical benefits coverage, adding optional protections can help you avoid major financial losses after an accident. These extra types of coverage options are especially important if you want to protect yourself from out-of-pocket expenses not covered by the state minimums.

- Medical Payments (MedPay): Covers your medical bills after an accident, no matter who is at fault, up to your policy’s limit.

- Personal Injury Protection (PIP): Provides broader protection by covering medical expenses, lost wages, funeral costs, and other related expenses.

- Uninsured/Underinsured Motorist Coverage: Pays for your injuries and damages if the at-fault driver has no insurance or insufficient coverage, which affects 7% of drivers in Pennsylvania.

Adding these optional protections gives you stronger financial security and helps ensure you’re covered in high-risk situations, such as getting hit by an uninsured driver or missing work after an injury.

Though not required by Pennsylvania law, these coverages are highly recommended to avoid large personal expenses after serious accidents.

Read more: No-Fault Auto Insurance

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Claims Handling and Loss Ratio in Pennsylvania

When choosing cheap auto insurance in Pennsylvania, it’s not just about finding the lowest price—you also need a company that reliably pays claims. An insurer’s loss ratio—the percentage of premiums paid out in claims—helps gauge this.

To file a claim quickly in Pennsylvania, contact your insurer’s 24/7 claims line or use their mobile app to upload photos and report the accident details immediately.

Chris Abrams Licensed Insurance Agent

A balanced loss ratio, close to the national average, means the company is likely to settle valid claims without excessive premium hikes. Companies with extremely low loss ratios may deny claims to keep profits high, while very high loss ratios could signal future rate increases.

Always check the insurer’s claims reputation and loss ratio to ensure you’re getting affordable and reliable coverage in Pennsylvania.

Read more: How To File An Auto Insurance Claim

Auto Insurance Claims in Pennsylvania

Understanding the most frequent types of auto insurance claims can help Pennsylvania drivers choose coverage that matches real-world risks.

5 Most Common Auto Insurance Claims in Pennsylvania

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collisions | 30% | $3,500 |

| Weather-Related Damage | 25% | $4,000 |

| Parking Lot Damage | 20% | $2,500 |

| Theft or Vandalism | 15% | $6,000 |

| T-Bone Collisions | 10% | $7,500 |

These common claims often result in significant repair or medical costs, making it essential to consider more than just the state’s minimum coverage.

Since these claim types are common across the state, adding comprehensive and collision coverage can protect you from costly out-of-pocket expenses. For example, while minimum liability might cover damage you cause to others, it won’t cover your own vehicle in cases like theft, weather damage, or rear-end collisions.

Pennsylvania Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Allentown | 5,500 | 3,000 |

| Bethlehem | 3,800 | 2,500 |

| Erie | 1,800 | 1,000 |

| Harrisburg | 5,000 | 3,500 |

| Lancaster | 4,500 | 3,000 |

| Philadelphia | 25,000 | 15,000 |

| Pittsburgh | 12,000 | 8,000 |

| Reading | 4,000 | 2,500 |

| Scranton | 3,000 | 2,000 |

| York | 3,500 | 2,500 |

Reviewing these risks can help Pennsylvania drivers make smarter coverage choices that go beyond the legal minimum and provide better long-term financial protection.

Vehicle Theft in Pennsylvania

Vehicle theft continues to be a growing risk in Pennsylvania, with Kia, Hyundai, and Honda topping the list of most stolen vehicles.

Vehicle Theft in Pennsylvania

| Make & Model | Year of Vehicle | Thefts |

|---|---|---|

| Kia | 2021 | 2,124 |

| Hyundai | 2021 | 1,876 |

| Honda | 2020 | 1,343 |

| Toyota | 2019 | 987 |

| Chevrolet | 2021 | 872 |

| Ford | 2021 | 823 |

| Nissan | 2020 | 678 |

| Dodge | 2022 | 512 |

| Subaru | 2021 | 436 |

| RAM | 2022 | 404 |

Major cities like Philadelphia, Pittsburgh, and Allentown have reported significant increases in thefts, driving up insurance risks and premiums for local drivers.

Vehicle Theft by City in Pennsylvania

| City | Motor Vehicle Theft |

|---|---|

| Philadelphia | 92% increase (2022-2023) |

| Lebanon | 178% increase (2020-2022) |

| Pittsburgh | 4,000+ thefts in 2023 |

| Allentown | 1,200+ thefts in 2023 |

| Erie | 600+ thefts in 2023 |

| Reading | 800+ thefts in 2023 |

Adding comprehensive coverage can help protect against these losses, ensuring you’re covered if your vehicle is stolen or damaged. Pennsylvania drivers should also consider anti-theft devices to qualify for additional discounts and reduce theft-related risks.

Finding cheap auto insurance in Pennsylvania requires more than just looking for the lowest price—you need a balance of affordable rates, reliable claims service, and coverage that fits your risk profile.

Limited tort in Pennsylvania saves you money upfront but limits your right to sue for pain and suffering after an accident.

Jeff Root Licensed Insurance Agent

Whether you’re dealing with city-based theft risks, long commutes, or teen driver premiums, comparing providers like Geico, Travelers, and State Farm can help you find the cheap auto insurance.

Take advantage of discounts, review coverage options, and always maintain the required liability insurance to drive confidently and affordably in Pennsylvania. See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

What is the cheapest auto insurance company in Pennsylvania?

Geico offers the cheapest auto insurance in Pennsylvania, with minimum coverage starting at just $23 per month, making it the best choice for budget-conscious drivers.

Read more: How much insurance coverage do I need?

How much is the average cost of car insurance in Pennsylvania?

On average, Pennsylvania drivers pay about $43 per month for minimum coverage and $203 per month for full coverage, but rates can vary based on your driving history, location, and coverage level. Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

Does Pennsylvania require full coverage auto insurance?

No, Pennsylvania only requires liability coverage and medical benefits coverage, but adding full coverage is recommended for better protection against theft, weather damage, and accidents.

What is the difference between full tort and limited tort in Pennsylvania?

Full tort allows you to sue for pain and suffering after an accident, while limited tort restricts your right to sue unless the injury is considered severe, such as permanent impairment or disfigurement.

What discounts are available for cheap auto insurance in Pennsylvania?

Pennsylvania drivers can qualify for car insurance discounts like safe driver, multi-policy bundling, low mileage, anti-theft device, and claims-free savings, depending on the insurer.

Why do auto insurance rates vary by city in Pennsylvania?

Rates vary based on local risks such as traffic density, accident rates, and vehicle theft; cities like Philadelphia tend to have higher premiums, while State College offers some of the lowest rates.

Read More: Average Auto Insurance Cost

Does my commute affect my car insurance rates in Pennsylvania?

Yes, longer daily commutes increase your time on the road and risk of accidents, which can lead to higher premiums, while low-mileage drivers may qualify for discounts.

Is uninsured motorist coverage required in Pennsylvania?

No, it’s not required, but uninsured/underinsured motorist coverage is highly recommended since 7% of Pennsylvania drivers have no or insufficient coverage.

What coverage protects against vehicle theft in Pennsylvania?

Comprehensive coverage protects your vehicle against theft, vandalism, and weather damage, making it a smart choice for drivers in high-risk areas like Philadelphia and Pittsburgh.

How can I lower my auto insurance premium in Pennsylvania?

You can lower your premium by comparing quotes, bundling policies, qualifying for discounts, choosing limited tort, and maintaining a clean driving record. Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.