Best Reno, NV Auto Insurance in 2025 (See the Top 10 Companies Here)

State Farm, Geico, and Progressive are the best Reno, NV, auto insurance, with monthly starting rates of $50. Notable for its 17% bundling discount and accident forgiveness feature, State Farm tops the list, followed by Geico and Progressive, which offers cheap rates, and the Snapshot program, ideal for drivers in Reno, NV.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Apr 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Reno, NV auto insurance providers include State Farm, Geico, and Progressive, with monthly beginning rates of $50 for features like accident forgiveness, snapshot program, and rideshare coverage.

These companies are renowned not only for offering affordable coverage but also for saving programs like roadside assistance, personalized premiums, and family discounts suitable for Reno, NV drivers.

Our Top 10 Company Picks: Best Reno, NV Auto Insurance

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 17% | Accident Forgiveness | State Farm | |

| #2 | A++ | 25% | Various Discounts | Geico | |

| #3 | A+ | 10% | Snapshot Program | Progressive | |

| #4 | A | 20% | Rideshare Coverage | Farmers | |

| #5 | A | 25% | New-Car Replacement | Liberty Mutual |

| #6 | A+ | 20% | Roadside Assistance | Nationwide |

| #7 | NR | 10% | Personalized Premiums | Root | |

| #8 | A | 25% | Family Discounts | American Family | |

| #9 | A++ | 13% | Claims Handling | Travelers | |

| #10 | A+ | 25% | Local Agent | Allstate |

Read more through our car insurance guide to understand what these companies are known for, how to save on your car insurance, and the types of auto insurance coverages.

- The best Reno, NV auto insurance are State Farm, Geico, and Progressive

- State Farm offers the best and most affordable rates at about $53 monthly

- Get competitive rates from Geico and Progressive’s Snapshot program

This guide reviews top auto insurers in Arlington, comparing coverage, pricing, and customer satisfaction to help drivers find the best policy. Begin comparing rates by entering your ZIP code above.

#1 – State Farm: Top Overall Pick

Pros

- Strong Bundling Options: State Farm assists Reno drivers in saving up to 17% when they mix up their auto and home policies.

- Highly Rated Customer Service: Given the wide network of agents in the area of Nevada, it is renowned for providing satisfactory customer assistance.

- Accident Forgiveness Feature: First-time accidents do not need to pay a higher rate compared to other providers in Reno, Nevada.

Cons

- Higher Premiums for Young Drivers: According to our State Farm auto insurance review, young adults and teens in Reno, Nevada, pay more than their expected rate.

- Limited Digital Tools: Despite State Farm’s reliability, customers’ online experience is not as advanced as that of Geico or Progressive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Various Discounts

Pros

- Competitive Low Rates: Geico is one of the best providers in Reno, offering cheap rates for only $60 per month, as per our Geico auto insurance review.

- Extensive Discounts: Geico is known for saving programs, like the 26% safe driving discount to lower Reno driver’s premiums.

- Highly Rated Mobile App: Geico’s mobile app and tool provide a convenient experience for managing your policy in Reno, Nevada.

Cons

- Fewer Local Agents: There is limited in-person support in comparison with other providers in Nevada like State Farm and Farmers.

- Limited Rideshare Coverage: Rideshare policies are less extensive, so it is not the best option for Uber drivers in Reno, Nevada.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program Rewards Safe Drivers: Progressive utilizes telematics to monitor risky driving habits and offer discounts to Reno drivers.

- Strong Online Quoting Tools: This feature helps you decide your customized coverage option in Nevada.

- Competitive Rates for High-Risk Drivers: This feature is most preferred by drivers in Reno with past accidents or violations according to our Progressive auto insurance review.

Cons

- Rates May Increase After Using Snapshot: Premiums could rise as the telematics program identifies risky driving habits.

- Customer Service Inconsistency: Location and complexity are factors identifying claims satisfaction ratings in Nevada.

#4 – Farmers: Best for Rideshare Coverage

Pros

- Comprehensive Rideshare Coverage: Uber and Lyft drivers in Reno, Nevada, find this feature convenient and their best option for car insurance.

- Highly Customizable Coverage: The windshield repair and original equipment manufacturer parts replacement help drivers in Reno to personalize policies.

- Strong Network of Agents: As mentioned in our Farmers auto insurance review, Farmers provide customer service through agents across Reno.

Cons

- Higher-Than-Average Premiums: Basic premiums tend to be higher and more expensive than other providers in Nevada, like Geico and Progressive.

- Fewer Discounts Available: Limited savings programs and discounts are offered in Nevada, unlike Geico and Nationwide.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for New-Car Replacement

Pros

- New-Car Replacement Coverage: This is the best for drivers in Reno with newer cars because it pays for a brand-new vehicle if theirs is totaled.

- Extensive Add-Ons: As we wrote in our Liberty Mutual auto insurance review, gap insurance, accident forgiveness, and better car replacement are being offered for drivers in Reno.

- Strong Claims Handling: Reno, Nevada policyholders prefer Liberty Mutual’s fast and fair claims process.

Cons

- Expensive for High-Risk Drivers: Progressive and USAA offer cheaper options for drivers in Reno with a history of accidents.

- Limited Availability of Local Agents: This feature relies more on phone and digital support than providing personalized assistance.

#6 – Nationwide: Best for Roadside Assistance

Pros

- Strong Roadside Assistance Program: Drivers in Reno who travel most of the time will like this feature as it covers towing, battery jumps, flat tires, and fuel delivery.

- Vanishing Deductible Feature: As mentioned in our Nationwide auto insurance review, deductibles are being reduced over time as a reward for safe driving.

- Multiple Discount Opportunities: Reno drivers, with no record of accidents, bundle policies, and practice safe driving, can save up to 20% discount.

Cons

- Higher Rates for Young Drivers: Teens and young adults may enjoy cheaper and more affordable rates with Geico or Progressive.

- Fewer Local Agents: Nationwide is not all around the area of Reno compared to Farmers and State Farm.

#7 – Root: Best for Personalized Premiums

Pros

- Usage-Based Insurance Model: This feature monitors and determines premiums according to their driving habits and not on their age and credit score.

- Ideal for Safe, Low-Mileage Drivers: Our Root auto insurance review noted that cautious Reno drivers are rewarded with the lowest rates available, proven by its 52% discount.

- Simple and Transparent Pricing: Root is transparent, and no hidden fees or unnecessary policy add-ons.

Cons

- Limited Availability: Root’s availability in the area of Reno, Nevada, is limited, unlike State Farm and Geico.

- Not Ideal for High-Mileage Drivers: Reno drivers who drive frequently may pay higher or more expensive rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Family Discounts

Pros

- Excellent Family and Multi-Car Discounts: This feature is ideal for Reno households with multiple vehicles who want to save for their car insurance.

- Strong Customer Loyalty Perks: Local policyholders in Reno, Nevada, receive significant savings as a reward from the insurer.

- Personalized Service with Local Agents: Agents in Reno provide personal assistance to customers and drivers in Reno.

Cons

- Limited Availability in Some States: As mentioned in our American Family auto insurance review, this feature is not as widely available as it is with other insurance providers in Reno.

- Higher Base Premiums: Unless qualified for multiple discounts, the base premium rate will be more expensive.

#9 – Travelers: Best for Claims Handling

Pros

- Highly Rated Claims Process: Travelers is recognized for efficient claims handling and creating resolution.

- Extensive Coverage Options: As written in our Travelers auto insurance review, this feature includes accident forgiveness, gap insurance, and custom parts coverage.

- Competitive Rates for Low-Risk Drivers: This is ideal for Reno drivers with a clean history and record-seeking stability.

Cons

- Not the Cheapest for High-Risk Drivers: Drivers in Reno, Nevada, with a history of accidents may find better premiums with Progressive or USAA.

- Limited Digital Experience: In comparison with Geico, the mobile app and online tools are not advanced.

#10 – Allstate: Best for Local Agent

Pros

- Strong Local Agent Network: Allstate has many offices in Reno, Nevada, which helps them provide exceptional face-to-face assistance.

- Claim Satisfaction Guarantee: Customers who are unhappy with their claim will have their deductibles credited by Allstate.

- Safe Driving Bonus: Policyholders are being rewarded with a twice-a-year cash back for safe driving habits.

Cons

- Higher Premiums Than Competitors: Drivers in Reno may find other insurers like Geico and Progressive who offer cheaper base rates.

- Discounts Are Limited Compared to Others: According to our Allstate auto insurance review, there is a lower discount program offered than Nationwide or State Farm.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Discounts and Cost of Car Insurance in Reno, Nevada

Paying more for car insurance can motivate you to start comparison shopping. And before you begin comparing, we will help you know the coverage and amount you need.

Reno, NV Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $170 | |

| $63 | $150 | |

| $70 | $165 | |

| $60 | $145 | |

| $77 | $180 |

| $65 | $155 |

| $58 | $140 | |

| $50 | $115 | |

| $53 | $128 | |

| $56 | $130 |

In this section, we’ll go into the major factors car insurers use to set their rates to give you a better understanding of how you can get discounts so that you can have affordable Reno, NV, auto insurance.

To better understand, we will tackle the auto insurance monthly rates by provider & coverage level and auto insurance coverage options and discounts from the top providers in Reno, Nevada.

Top Auto Insurance Discounts in Reno, NV

| Company | Bundling | Good Driver | Good Student | Anti-Theft | Loyalty |

|---|---|---|---|---|---|

| 25% | 25% | 22% | 10% | 15% | |

| 25% | 25% | 20% | 25% | 18% | |

| 20% | 30% | 15% | 10% | 12% | |

| 25% | 26% | 15% | 25% | 10% | |

| 25% | 20% | 12% | 35% | 10% |

| 20% | 40% | 18% | 5% | 8% |

| 10% | 30% | 10% | 25% | 13% | |

| 10% | 52% | 10% | 25% | 6% | |

| 17% | 25% | 35% | 15% | 6% | |

| 13% | 10% | 8% | 15% | 9% |

We’ll explore everything from Reno auto insurance premiums by gender and marital status to your driving record. Keep reading for more info to start comparing rates. To conveniently assist you, enter your ZIP code.

Factors Impacting your Car Insurance in Reno

Gender and age can be significant factors affecting your car insurance rates in Reno, Nevada. Often, based on a driver’s record and length of experience behind the wheel, it’s no surprise that 60-year-olds pay among the lowest prices.

Reno, Nevada Auto Insurance Rates by Age

| Age | Monthly Cost |

|---|---|

| 17 | $772 |

| 25 | $236 |

| 35 | $203 |

| 60 | $193 |

Gender bias in car insurance rates is legal in Nevada. It happens because statistically, males, often younger ones, tend to get into more accidents than females. According to the table, females pay less for premiums than males. Maybe you are wondering about marital status.

From prior claims data, insurers’ statistics show that more single people file claims than married people. So, married people typically pay less for car insurance.

Reno, Nevada Auto Insurance Monthly Rates by Gender

| Male | Female | Cheaper |

|---|---|---|

| $351 | $331 | Female |

Married 60-year-old females pay less than other drivers, while insurers charge inexperienced 17-year-old males the highest rates.

Read more: Factors that Affect your Car Insurance Premium

The Best Car Insurance Options in Reno, Nevada

Car insurance shoppers need to consider many factors when they evaluate an insurer. They include overall premium prices and their coverage needs.

Reno, Nevada Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A | High vehicle theft in cities |

| Average Claim Size | B | Rising repair and medical costs |

| Traffic Density | B | Increasing congestion during peak hours |

| Uninsured Drivers Rate | B | Significant number of uninsured drivers |

| Weather-Related Risks | C | Occasional severe weather incidents |

As you sift through all the measures of a company’s service and performance, the process of finding one of the best Reno, NV, auto insurance companies can become exhausting.

We’re all for helping you save time and keep your sanity. So, in this section, we’ve done all the work for you. We’ll compare how the top car insurance companies in Reno perform for different types of auto insurance rates in Reno, NV, and other states.

Reno, Nevada Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | 1,000 |

| Claims Per Year | 800 |

| Average Claim Size | $5,000 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 464 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Moderate |

Reno car insurance premium rates can be higher or lower than your expected rate. Overall, Progressive and USAA, a niche insurer for the military, offer the lowest prices for drivers of different ages, genders, and marital statuses.

Also, it is a must to consider commute rates. As you might have guessed, how far you commute regularly also influences your car insurance rates. Only a few of the insurers listed factor mileage into their premium costs.

Reno, Nevada Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles | Average |

|---|---|---|---|

| $359 | $359 | $359 | |

| $373 | $383 | $378 | |

| $428 | $428 | $428 | |

| $293 | $302 | $297 | |

| $431 | $431 | $431 |

| $257 | $257 | $257 |

| $303 | $303 | $303 | |

| $411 | $436 | $424 | |

| $402 | $402 | $402 | |

| $226 | $232 | $229 |

Of the companies that use mileage, USAA customers paid the lowest price difference — less than $100 between the two distances. With State Farm. However, the price difference from 10 to 25 miles was the highest, at about $300.

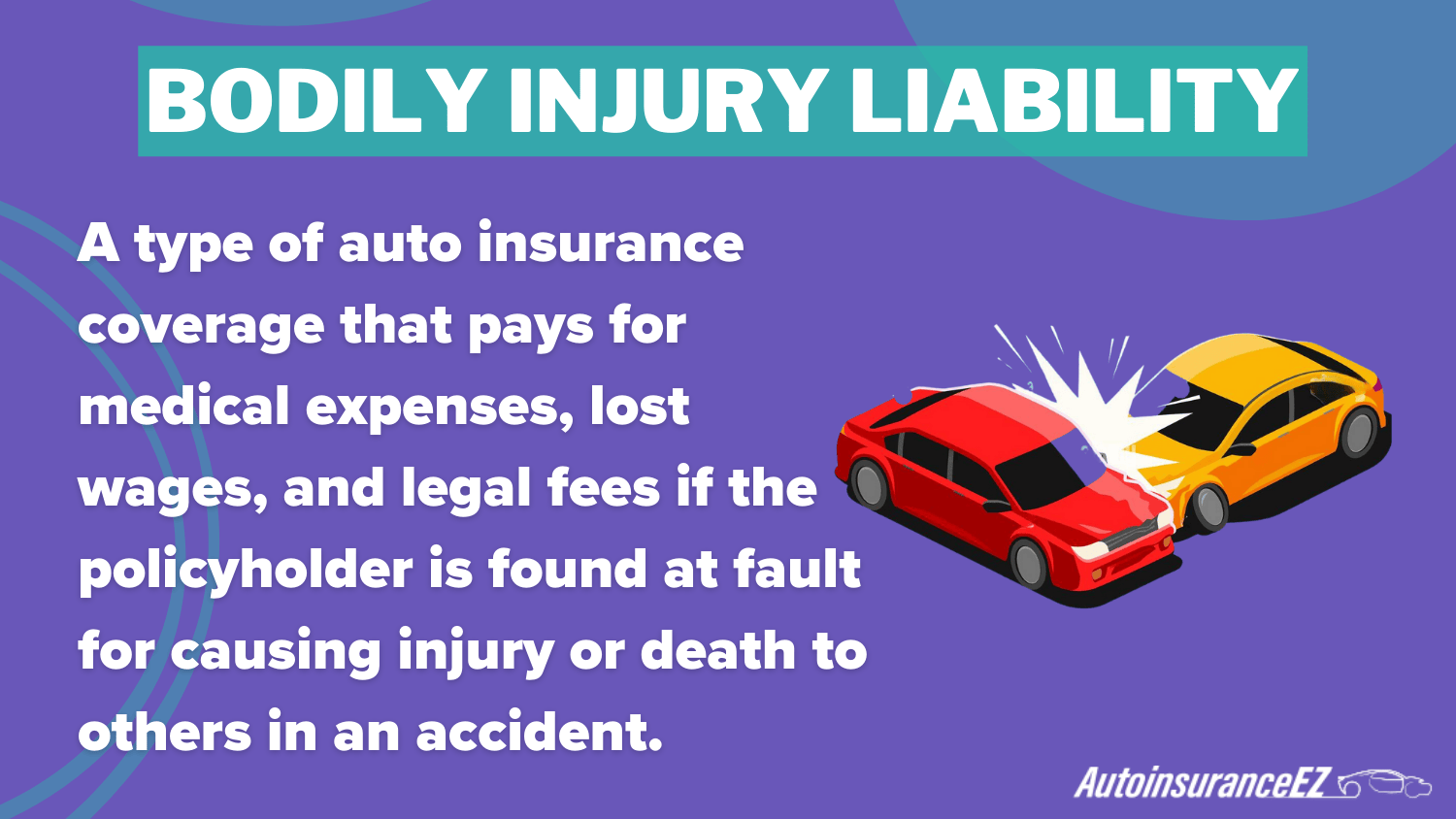

Coverage level rates, on the other hand, also impact your car insurance premium. Whether you buy the state-required minimum liability, collision, comprehensive, or full policy, you want to make sure you buy enough coverage to protect yourself and your loved ones.

Be smart when shopping for your car insurance by reviewing the ratings like A.M. Best and feedback from insurance providers.

Kristine Lee Licensed Insurance Agent

These factors should be considered when shopping for your car insurance premium. These will help you save while getting your vehicle’s needs and requirements. To save more, enter your ZIP code.

Read more: Minimum Car Insurance Requirements

Frequently Asked Questions

How do auto insurance rates in Reno, NV, vary by provider and coverage level?

The auto insurance price Reno drivers pay depends on their provider, with cheap auto insurance in Reno, NV, available from companies like Geico for $60 and Progressive for $58, while full coverage plans cost more.

Which insurance company offers the best bundling discounts?

State Farm provides the best bundling discounts on car insurance in Reno, Nevada, with drivers saving up to 17% when combining policies for cheap auto insurance Reno Nevada and home insurance. Learn more about bundling discounts by entering your ZIP code.

How does mileage impact car insurance premiums in Reno?

Annual mileage affects car insurance rates in Reno, NV, with USAA offering the lowest price difference, making it a good option for those seeking cheap car insurance discounts in Reno, NV.

What makes State Farm the top overall pick for the best auto insurance in Reno, NV?

State Farm is the best provider of auto insurance in Reno, NV, due to its accident forgiveness, strong bundling discounts, and excellent customer service.

How does Geico’s Snapshot program compare to Progressive’s in terms of savings?

Progressive’s Snapshot program personalizes auto insurance quote in Reno rates based on driving habits, but it may increase prices, while Geico’s program is less likely to raise premiums. Personalize your insurance quote by entering your ZIP code.

Why is Farmers considered the best provider for rideshare coverage in Reno?

Farmers offers the most comprehensive rideshare coverage for car insurance in Reno, NV, ensuring drivers are protected while working and during personal use.

Read more: Cheap Rideshare Insurance

Which insurance company offers the best accident forgiveness policy?

State Farm’s accident forgiveness helps maintain cheap auto insurance in Reno, NV, rates by preventing a driver’s first at-fault accident from increasing their premium.

How do gender and marital status affect car insurance rates in Reno?

Married 60-year-old females get the cheapest car insurance in Reno, NV, because they are statistically lower-risk, whereas young male drivers pay higher rates. Know your car insurance rates by entering your ZIP code.

Which insurance companies in Reno provide the most competitive rates for high-risk drivers?

Progressive and USAA specialize in cheap auto insurance in Reno for high-risk drivers, making them ideal for those needing cheap car insurance in Reno, NV, after an accident.

How do the top insurance providers in Reno compare in terms of claims handling?

Travelers and Liberty Mutual offer fast claims processing for car insurance quotes in Reno, NV, while State Farm and Allstate provide the best local agent support for Reno drivers.