Auto Insurance in Houston, Texas [Can’t-Miss Guide]

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Insurance Agent

UPDATED: Nov 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Houston City Statistics | Details |

|---|---|

| City Population | 2,312,717 |

| City Density | 3,991 people per square mile |

| Average Cost of Car Insurance in Dallas | $7,136.56 |

| Cheapest Car Insurance Company | USAA + State Farm |

| Road/Pavement Conditions | Poor Share: 24% Mediocre Share: 28% Fair Share: 11% Good Share: 38% Vehicle Operating Costs: $610 |

Maybe you’ve got a full-time job or you’re a full-time mom or dad. Maybe you’re a full-time student. Maybe you’re just a normal human being who would rather stick a fork in your eye than spend hours scouring the internet for a great car insurance policy.

There are so many different factors that go into a car insurance rate, even if you find the perfect policy, it might not be the perfect amount of money you were hoping to spend.

We totally understand. Finding the perfect car insurance policy that fits your family’s needs and budget isn’t a small order. In fact, it can be quite a dreadful experience.

If this is you, and you’ve just about thrown your fist into a wall out of frustration over a silly thing like car insurance, you’ve come to the right place: we’re here to help.

That’s right — if you have just 15 minutes or less to spare, we’ll clue you in on everything you need to know about auto insurance in Houston, Texas. We did the dirty work, gathered data, and researched all the best car insurance companies out there.

In this complete guide to car insurance in Houston, Texas, we will discuss important factors that can affect your rate, traffic statistics that can help you avoid an accident, and how to save money on your rate.

Do you want to start comparing car insurance rates right now? Use our free tool by entering your zip code in the box above.

Keep reading for more information on how to save 40 percent or more on your car insurance policy.

The Cost of Car Insurance in Houston

It can be so frustrating when you’ve been on the phone with a car insurance company for an hour — you’ve given them all the information they need to put an estimate together for you, you hear the cost of the policy — and it’s way over your budget.

You move onto the next company, but the same thing happens again. Why is car insurance so expensive? How can you lower your rate? How much does car insurance really cost?

We wish we could take on that question with just one simple answer, but unfortunately, it’s just more complicated than that.

Car insurance rates are determined by many different factors. We’ll go over what some of those factors are, up next.

Male vs. Female vs. Age

Let’s start with the basics. Did you know car insurance companies look at your age and gender first when considering your car insurance rate?

Let’s look at some of the data concerning age and gender in Houston, Texas.

Based on a study conducted by Data USA, the median age in Houston, Texas, is 33.1 years.

Usually, car insurance companies will charge inexperienced teenage drivers the most for a policy because they are the most likely age group to cause an accident or to receive a traffic ticket. However, once a young driver turns 25, their rate will likely decrease if they’ve kept a clean driving record.

This table below shows how age can influence your rate.

| Age | 35 | 60 | 17 | 25 | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|---|

| Average Annual Rate | $3,018.83 | $2,876.24 | $9,393.23 | $3,794.62 | $2,876.24 | $60.00 |

As we discussed, there is a significant cost difference between what a 17-year-old might pay for car insurance and what a 60-year-old could pay for the same policy.

Based on this data, 60-year-old drivers pay the least for car insurance. This could be attributed to the fact that they’ve had the most driving experience out of any of the age groups.

But what about gender? Does that influence your car insurance rate?

In Houston, Texas, male drivers are charged approximately $4,770.73 in annual rates, while female drivers pay approximately $4,500.91 per year in policy premiums.

This means male drivers pay out around $270 more annually for coverage than female motorists do.

Now, let’s put all the stats together. The table below indicates how both age and gender, along with the driver’s marital status, affect average auto insurance rates in Houston, Texas.

| Demographic | Rate |

|---|---|

| Married 35-year old female | $2,969.61 |

| Married 35-year old male | $3,068.06 |

| Married 60-year old female | $2,791.00 |

| Married 60-year old male | $2,961.47 |

| Single 17-year old female | $8,559.72 |

| Single 17-year old male | $10,226.74 |

| Single 25-year old female | $3,683.32 |

| Single 25-year old male | $3,905.93 |

| Average | $4,770.73 |

Your marital status can also affect your car insurance rate. Car insurance providers often see married couples as more responsible and less likely to get into a car accident – that’s why their rates are usually cheaper than someone who is single.

So far we’ve talked about age, gender, and marital status, but what other components go into determining a car insurance rate?

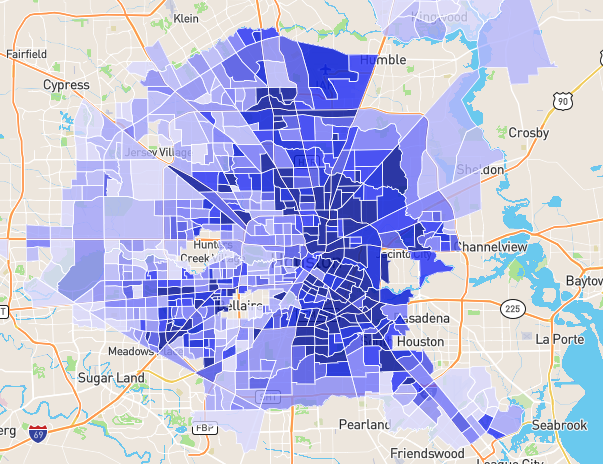

Cheapest Zip Codes in Houston

Did you know that your place of residence can also affect your rate? Even if you live in the same city, some areas might be more vulnerable to crime or natural disasters than others.

Find your zip code in the table below.

| ZIP Code | Average Annual Rate |

|---|---|

| 77059 | $6,254.85 |

| 77062 | $6,263.54 |

| 77058 | $6,308.38 |

| 77339 | $6,351.62 |

| 77079 | $6,441.61 |

| 77005 | $6,459.12 |

| 77094 | $6,513.47 |

| 77598 | $6,523.91 |

| 77336 | $6,538.79 |

| 77006 | $6,550.05 |

| 77098 | $6,594.26 |

| 77069 | $6,608.68 |

| 77046 | $6,623.26 |

| 77070 | $6,655.34 |

| 77025 | $6,664.14 |

| 77089 | $6,714.46 |

| 77007 | $6,724.72 |

| 77027 | $6,740.78 |

| 77056 | $6,743.45 |

| 77030 | $6,751.63 |

| 77024 | $6,766.97 |

| 77018 | $6,787.86 |

| 77489 | $6,794.35 |

| 77064 | $6,795.54 |

| 77068 | $6,797.24 |

| 77096 | $6,824.63 |

| 77095 | $6,824.84 |

| 77043 | $6,824.99 |

| 77015 | $6,843.82 |

| 77054 | $6,843.85 |

| 77338 | $6,847.41 |

| 77077 | $6,852.84 |

| 77019 | $6,856.66 |

| 77049 | $6,872.59 |

| 77008 | $6,881.81 |

| 77009 | $6,915.07 |

| 77055 | $6,931.67 |

| 77031 | $6,939.89 |

| 77080 | $6,946.18 |

| 77092 | $6,950.09 |

| 77063 | $6,965.40 |

| 77034 | $6,970.03 |

| 77041 | $6,970.77 |

| 77002 | $6,994.51 |

| 77057 | $7,042.73 |

| 77065 | $7,044.17 |

| 77029 | $7,052.00 |

| 77035 | $7,053.81 |

| 77085 | $7,102.58 |

| 77084 | $7,112.24 |

| 77042 | $7,117.06 |

| 77021 | $7,149.81 |

| 77075 | $7,189.45 |

| 77044 | $7,214.79 |

| 77010 | $7,224.35 |

| 77082 | $7,227.39 |

| 77013 | $7,229.21 |

| 77032 | $7,242.29 |

| 77066 | $7,257.08 |

| 77011 | $7,286.14 |

| 77003 | $7,313.08 |

| 77071 | $7,325.02 |

| 77073 | $7,327.59 |

| 77087 | $7,329.81 |

| 77074 | $7,337.34 |

| 77040 | $7,345.76 |

| 77012 | $7,347.90 |

| 77047 | $7,389.06 |

| 77023 | $7,399.43 |

| 77014 | $7,408.80 |

| 77045 | $7,420.16 |

| 77017 | $7,427.19 |

| 77090 | $7,441.20 |

| 77086 | $7,471.65 |

| 77061 | $7,479.15 |

| 77048 | $7,486.87 |

| 77051 | $7,489.43 |

| 77201 | $7,492.29 |

| 77204 | $7,496.11 |

| 77004 | $7,497.22 |

| 77050 | $7,505.14 |

| 77020 | $7,514.53 |

| 77026 | $7,553.90 |

| 77038 | $7,567.20 |

| 77028 | $7,579.76 |

| 77093 | $7,592.70 |

| 77099 | $7,600.09 |

| 77039 | $7,601.85 |

| 77022 | $7,605.82 |

| 77081 | $7,609.75 |

| 77088 | $7,612.47 |

| 77067 | $7,613.31 |

| 77016 | $7,629.02 |

| 77091 | $7,644.01 |

| 77060 | $7,664.73 |

| 77037 | $7,670.41 |

| 77083 | $7,670.98 |

| 77076 | $7,684.94 |

| 77078 | $7,700.94 |

| 77053 | $7,747.72 |

| 77033 | $7,840.97 |

| 77072 | $7,909.04 |

| 77036 | $8,150.71 |

According to this table above, there is almost a $2,000 difference in price from the cheapest rate to the most expensive rate. This goes to show that your place of residence has to potential to either raise or decrease your rate.

What’s the best car insurance company in Houston?

By now you should know that not all car insurance companies base a rate off of the same criteria. Some companies might find a person’s credit score is more important than where they live; other companies might charge a person more because they drive a certain type of vehicle.

The point is that not all car insurance companies are equal. But, the question remains: what other factors can affect a car insurance rate?

To save you time, we’ve already gathered some information below to help you make the best choice when searching for a car insurance company.

Let’s get started.

Cheapest Car Insurance Rates by Company

The table below shows the cheapest car insurance rates in Houston, Texas.

| Group | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $3,644.62 | $3,668.74 | $3,595.93 | $3,595.93 | $9,702.39 | $11,687.90 | $4,498.53 | $4,674.05 | $5,633.51 |

| American Family | $3,076.88 | $3,440.54 | $2,918.23 | $3,357.40 | $8,606.74 | $11,338.72 | $4,508.70 | $5,172.72 | $5,302.49 |

| Geico | $2,717.10 | $2,944.34 | $2,638.90 | $3,023.87 | $5,977.56 | $6,157.76 | $2,937.45 | $2,902.58 | $3,662.45 |

| Nationwide | $2,350.64 | $2,387.13 | $2,080.17 | $2,198.96 | $6,664.22 | $8,542.40 | $2,762.74 | $2,985.74 | $3,746.50 |

| Progressive | $2,473.67 | $2,345.40 | $2,202.78 | $2,243.60 | $10,399.12 | $11,605.52 | $2,927.41 | $2,965.04 | $4,645.32 |

| State Farm | $2,223.31 | $2,223.31 | $1,985.80 | $1,985.80 | $5,378.84 | $6,859.94 | $2,421.28 | $2,488.98 | $3,195.91 |

| USAA | $1,683.17 | $1,685.90 | $1,619.86 | $1,600.72 | $4,775.09 | $5,170.04 | $2,235.59 | $2,376.51 | $2,643.36 |

According to our data, USAA and State Farm have the cheapest rates in Houston.

The difference between a 17-year-old’s car insurance rate and a married, 60-year-old’s rate is about $9,000.

What’s the bottom line here? As we discussed above, car insurance rates vary based on many different factors.

Best Car Insurance for Commute Rates

Do you drive a lot? Do you have a longer-than-average commute to work? Car insurance companies know that the more you drive, the more susceptible you are to being involved in a car accident.

According to the most recent 2016 data from the Federal Highway Administration, Texans drove an average of 17,099,340 miles in the state that year.

Check out the table below. Here are some rates based on average commute distances.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Allstate | $6,353.51 | $6,676.06 | $6,514.79 |

| American Family | $6,846.57 | $6,846.57 | $6,846.57 |

| Geico | $3,895.17 | $4,043.38 | $3,969.28 |

| Nationwide | $4,409.62 | $4,409.62 | $4,409.62 |

| Progressive | $5,257.10 | $5,257.10 | $5,257.10 |

| State Farm | $3,466.09 | $3,466.09 | $3,466.09 |

| USAA | $2,894.35 | $2,968.99 | $2,931.67 |

This data is interesting; while some companies leave a rate alone if a person drives more miles per year, other companies increase a rate by a few hundred dollars.

If you drive more than the average person, you might consider State Farm, Progressive, or Nationwide as your new car insurance provider.

Best Car Insurance for Coverage Level Rates

Did you know that your coverage level can also affect the price of your rate?

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $6,747.80 | $6,345.48 | $6,451.07 | $6,514.78 |

| American Family | $7,693.82 | $6,295.82 | $6,550.06 | $6,846.57 |

| Geico | $4,275.87 | $3,723.01 | $3,908.95 | $3,969.28 |

| Nationwide | $4,269.74 | $4,739.31 | $4,219.83 | $4,409.63 |

| Progressive | $5,526.99 | $5,009.56 | $5,234.74 | $5,257.10 |

| State Farm | $3,675.87 | $3,268.93 | $3,453.47 | $3,466.09 |

| USAA | $3,063.36 | $2,814.10 | $2,917.54 | $2,931.67 |

For just a few hundred dollars more per year, you could go from having low coverage insurance to high coverage insurance. If you can afford it now, paying for high coverage insurance could potentially save you thousands of dollars in the long run.

On the other hand, if you have liability insurance or just enough car insurance to get by, car insurance companies might increase your rate because you’re considered to be a high-risk driver.

Even with liability coverage, you might still be stuck paying out of pocket for incidentals after an accident.

So why not save a few thousand dollars? More insurance is always better insurance.

Best Car Insurance for Credit History Rates

Credit history can also affect your car insurance rate. Do you have poor credit? Check out the table below.

| Group | Fair | Good | Poor | Average |

|---|---|---|---|---|

| Allstate | $6,064.69 | $5,193.73 | $8,285.94 | $6,514.79 |

| American Family | $6,015.71 | $5,253.86 | $9,270.13 | $6,846.57 |

| Geico | $3,462.39 | $2,293.67 | $6,151.78 | $3,969.28 |

| Nationwide | $4,248.38 | $3,684.52 | $5,295.97 | $4,409.62 |

| Progressive | $5,113.92 | $4,736.52 | $5,920.85 | $5,257.10 |

| State Farm | $3,057.10 | $2,439.19 | $4,901.97 | $3,466.09 |

| USAA | $2,496.22 | $2,013.20 | $4,285.58 | $2,931.67 |

Except for a few states in the country where the practice is illegal, many car insurance carriers can and will use your credit history as a determining factor when evaluating your annual premiums.

According to the data from the table above, if you have poor credit, you could be paying about $3,000 more per year for your car insurance policy.

Best Car Insurance for Driving Record Rates

The biggest factor that affects your car insurance rate is your driving record. This table below indicates car insurance rates based on various types of driving records.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $5,026.59 | $7,838.42 | $8,167.54 | $5,026.59 | $7,010.85 |

| American Family | $6,204.20 | $7,997.66 | $6,980.21 | $6,204.20 | $7,060.69 |

| Geico | $3,360.70 | $4,480.89 | $3,696.17 | $4,339.34 | $3,845.92 |

| Nationwide | $3,820.09 | $3,820.09 | $5,678.74 | $4,319.57 | $4,439.64 |

| Progressive | $4,576.28 | $5,935.65 | $5,356.54 | $5,159.92 | $5,289.49 |

| State Farm | $3,071.33 | $3,533.51 | $4,188.19 | $3,071.33 | $3,597.68 |

| USAA | $2,174.69 | $3,238.80 | $3,814.31 | $2,498.87 | $3,075.93 |

If you are convicted of a DUI, your rate is likely to increase by $3,000. If you get one traffic ticket, your rate could increase by $1,000.

We understand people make mistakes. If you happen to have a dent in your driving record and you need a car insurance company that might be a little more understanding, try Nationwide or State Farm.

Car Insurance Factors in Houston

Before you make any decisions about which car insurance company to insure you, read on. We still have a few more rate factors to get through.

Below, we have listed some helpful Houston statistics that can also determine a car insurance rate.

Metro Report – Growth & Prosperity

Let’s take a look at the growth and prosperity rate from the Brookings Metro Report in Houston, Texas.

Prosperity:

- Productivity: – .4 percent (86th of 100)

- Standard of Living: – .9 percent (96th of 100)

- Average Annual Wage: – .4 percent (98th of 100)

Growth:

- Jobs: + .9 percent (71st of 100)

- Gross Metropolitan Product (GMP): + .4 percent (91st of 100)

- Jobs at Young Firms: + .8 percent (76th of 100)

While prosperity decreased from 2016-2017 in Houston, Texas, growth increased.

Median Household Income

It’s important to figure out how much of your annual yearly income will be spent on car insurance.

But how much does the average Houston driver make per year?

Households in Houston have a median annual income of $50,896, which is less than the median annual income of $60,336 across the entire United States.

This is in comparison to a median income of $47,793 in 2016, which represents a 6.49 percent annual growth.

The average cost of car insurance in Houston, Texas, is $7,136.56 per year. This means the average driver in Houston, Texas, spends about 14 percent of their yearly salary on car insurance alone.

To find out how much of your income is being spent on car insurance, use our free calculator tool below.

CalculatorPro

Homeownership in Houston

Did you know that owning a home can help you save money on your auto insurance policy? That’s right — car insurance companies believe if a driver owns a home, they are more likely to pay their bills on time and be better drivers.

According to a recent study by Data USA, in 2017, 42.8 percent of the housing units in Houston, Texas, were occupied by their owners. This percentage declined from the previous year’s rate of 43.1 percent.

This percentage of owner-occupation is lower than the national average of 63.9 percent.

In 2017, the median property value in Houston, Texas, grew to $173,600 from the previous year’s value of $163,700.

Education in Houston

The city of Houston is home to several great colleges and universities. In 2016, universities in Houston, Texas, awarded 38,287 degrees.

The student population of Houston is skewed toward women, with 74,034 male students and 90,546 female students.

Based on the 2016 stats acquired by Data USA, the largest universities in Houston in terms of degrees conferred were the University of Houston, Houston Community College, and the University of Houston-Downtown.

The number of graduates, as well as the percentage of total degrees the largest Houston educational institutions conferred in 2016, are as follows:

- University of Houston: Graduates: 9,524. Degrees Conferred: 24.9 percent

- Houston Community College: Graduates: 8,129. Degrees Conferred: 21.2 percent

- University of Houston-Downtown: Graduates: 2,882. Degrees Conferred: 7.53 percent

The most popular majors in Houston by concentration and percentage of degrees awarded are:

- General Studies: 5,127 degrees awarded

- General Business Administration and Management: 2,471 degrees awarded

- Medical Assistant: 1,862 degrees awarded

Other popular degrees include general psychology and multidisciplinary studies.

Wage by Race & Ethnicity in Common Jobs

Let’s look at how race and ethnicity affect the wage rate in Houston, Texas.

Data USA says that in 2017 the highest paid race/ethnicity of Texas workers was Asian. These workers were paid 1.26 times more than White workers, who made the second-highest salary of any race/ethnicity.

The table below shows wages for common jobs based on race and ethnicity in Houston, Texas, along with the percentage of those workers’ incomes going to auto insurance premiums.

Keep in mind that the average cost of car insurance in Houston, Texas, is $7,136.56 per year.

| Ethnicity | Miscellaneous Managers | PERCENTAGE OF INCOME GOING TO CAR INSURANCE | Driver/sales workers & truck drivers | PERCENTAGE OF INCOME GOING TO CAR INSURANCE | Elementary & Middle School Teachers | PERCENTAGE OF INCOME GOING TO CAR INSURANCE | Retail Salespersons | PERCENTAGE OF INCOME GOING TO CAR INSURANCE | Cashiers | PERCENTAGE OF INCOME GOING TO CAR INSURANCE |

|---|---|---|---|---|---|---|---|---|---|---|

| American Indian | 130,996 | 5.40% | 35,400 | 20.10% | 46,914 | 15.20% | 26,122 | 27.30% | 11,054 | 64.50% |

| Asian | 106,579 | 6.60% | 31,556 | 22.60% | 38,661 | 18.40% | 22,273 | 32% | 17,982 | 39.60% |

| White | 103,116 | 6.90% | 43,602 | 16.30% | 43,901 | 16.20% | 29,708 | 24% | 14,254 | 50% |

| Two or More Races | 86,431 | 8.20% | 39,007 | 18.20% | 45,618 | 15.60% | 21,092 | 24.50% | 12,080 | 59% |

| Black | 69,172 | 10.30% | 43,734 | 16.30% | 45,789 | 15.50% | 27,766 | 25.70% | 12,680 | 56.20% |

| Other | 62,098 | 11.50% | 61,135 | 11.60% | 46,177 | 15.40% | 23,078 | 30.90% | 13,980 | 51% |

It’s crazy to see such a difference in salary rate for the same job based on ethnicity.

What’s even more shocking is that some drivers in Houston spend up to 64 percent of their salary on their car insurance policy, while some drivers only spend 6 percent of their salary on car insurance.

Wage by Gender in Common Jobs

The gender pay gap has been a hot topic for quite a while, and though many people might quarrel about the subject, the data doesn’t lie.

Data USA said that in 2017, full-time male employees in Texas made 1.4 times more than female employees.

In 2017, the average male salary was $65,834, while the average female salary was $47,183 in Houston, Texas.

That’s about a $19,000 pay gap between the two genders. Women spend about 15 percent of their average annual income on car insurance, while men spend only 10.8 percent.

It’s important to note that even if male and female employees hold the same job title, the statistics reveal that male workers will still bring home a higher personal income.

Poverty by Age & Gender

Here are some poverty trends in and around the Houston area. This data is brought to you by Data USA.

The largest demographic living in poverty are females ages 25-34, followed by females 35-44 then males 6-11.

Twenty-one percent of the population for whom poverty status is determined in Houston, Texas, (473,000 out of 2.23 million people) live below the poverty line. This number is higher than the national average of 13.4 percent.

Poverty by Race & Ethnicity

The most common racial or ethnic group living below the poverty line in Houston, Texas, is Hispanic, followed by White and Black.

Roughly 266,000 Hispanics live in poverty in Houston, Texas.

The Census Bureau uses a set of money income thresholds that vary by family size and composition to determine who classifies as impoverished.

If a family’s total income is less than the family’s threshold, that family and every individual in it is considered to be living in poverty.

Employment by Occupations

From 2016 to 2017, employment in Houston, Texas, declined at a rate of -1.48 percent, from 1.12 million employees to 1.11 million employees.

The most common job groups, by the number of people living in Houston, Texas, are:

- Office & Administrative Support Occupations: 120,629 people

- Sales & Related Occupations: 109,920 people

- Management Occupations: 104,408 people

Compared to other places, Houston, Texas, has an unusually high number of residents working as Construction & Extraction Occupations (1.81 times higher than expected), Architecture & Engineering Occupations (1.63 times), and Building & Grounds Cleaning & Maintenance Occupations (1.52 times).

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Driving in Houston

Even if you’ve lived in a city for a long time, driving can be a challenge. From traffic jams to unexpected construction, it’s important to know the fastest routes to save you time and money around your city.

Keep scrolling for your complete guide to the best driving routes in Houston, Texas.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

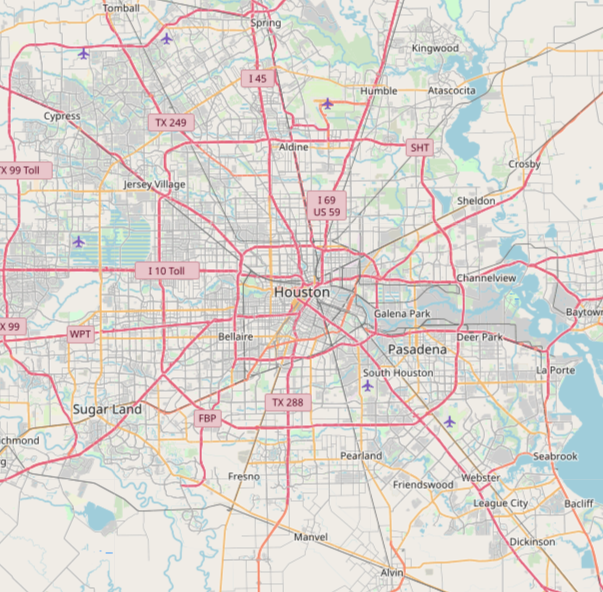

Roads in Houston

In this next section, we’ll discuss road conditions, popular sites, major highways and more.

Let’s get started.

Major Highways

According to Interstate Guide, Texas has 25 active routes running through the state, comprising a total of 3,501.15 miles of roadway. These active interstates include:

- I-2

- I-10

- I-14

- I-20

- I-27

- I-30

- I-35

- I-35E

- I-35W

- I-37

- I-40

- I-44

- I-45

- I-69

- I-110

- I-410

- I-610

- I-820

- I-635

- I-345

- I-69C

- I-69E

- I-69W

- I-169

- I-369

As you can see, I-10, I-69, TX 288, and I-45 all run right through Houston, Texas.

Houston toll roads and metro lanes are operated by Fort Bend County Toll Road Authority (FBCTRA), Harris County Toll Road Authority (HCTRA), Montgomery County Toll Road Authority (MCTRA), and Metropolitan Transit Authority of Harris County (METRO).

Click on the toll roads, tollways, and HOT lanes listed below to see the toll rate charts.

- Westpark Tollway

- Fort Bend Parkway & Extension

- Grand Parkway: Fort Bend County, TxDOT

- Hardy Toll Road

- Hardy Airport Connector

- Sam Houston Ship Channel

- Sam Houston Tollway

- SH 242

- Tomball Tollway

- Katy Freeway Managed lanes I-10 QuickRide and US 290

- US-290 (Northwest Freeway) HOT Lanes

- US-59 North (Eastex Freeway) HOT Lanes

- US-59 South (Southwest Freeway) HOT Lanes

- I-45 North (North Freeway) HOT Lanes

- I-45 South (Gulf Freeway) HOT Lanes

What is TxTag, TollTag, EZ Tag?

All of these tags are tag transponders you can install in your vehicle to pay tolls electronically.

TxTags are good for the whole of Texas at locations where TxTag is acceptable (There are bridges on Mexico-Texas border that only accept cash. At all other places, you can use TxTag).

Alternatively, you can use the NTTA TollTag. The NTTA TollTag is accepted for toll payments in most of Texas, Oklahoma, and Kansas. You can read more about this here.

- TollTag is issued by The North Texas Tollway Authority (NTTA) and allows motorists to pay tolls without stopping at toll booths. Here is detailed information on TollTag.

- TxTag is issued by the Texas Department of Transportation (TxDOT) and allows users to zip through the toll lanes. Here is detailed information on TxTag.

- EZ TAG is used by tolling agencies Houston, Texas, to allow motorists to pay tolls without stopping at toll booths. EZ TAG can also be used on all lanes of tolled roadways in Texas that accommodate electronic toll collection. Here is detailed information on EZ TAG.

Popular Road Trips/Sites

Are you looking for something fun to do in Houston, Texas?

Whether you’re just in town on vacation or you’ve been in Houston for 20 years, Houston’s got it all. From entertainment and dining to shopping and nightlife, you’ll never run out of things to do in this grand Texas city.

This list of fun things to do in Houston is brought to you by Trip Advisor.

- Space Center Houston Admission: Get all-day access to the center and explore the Astronaut and Starship Galleries, take a tram tour of the NASA Johnson Space Center, and more, all at your own pace.

- Houston Zoo: Get a good look at lions and tigers and bears (oh, my!) at the Houston Zoo. The zoo houses over 6,000 animals from 900 species. It receives 2.1 million visitors each year and is the second-most visited zoo in the United States.

- One Fifth Houston Gulf Coast: This restaurant zeroes in on foods from “Texas to Florida, earth to ocean,” offering a bounty of eats like hearth-fired flounder almondine and blackened ribeye, a black lime take on key lime pie, and an entire section just for shellfish: raw, cold, roasted, smoked, cured, and fried.

- 160FT Beerworks: 160ft Beerworks is downtown’s first nano-brewery. The 2,000-square-foot brewery offers four beers on tap at a time, including a stout, blonde, hefeweizen, and imperial IPA. Throughout each year, 160FT will offer 10-12 new styles, always keeping experimental batches on hand.

- The Music Box Theater: The Music Box Theater provides audiences a unique mix of live popular music and original comedy in a relaxing club environment. There are songs you know sung by people you (probably) know, and there is something for everyone. Appropriate for all ages.

Whatever you fancy, you’ll find it in Houston.

Road Conditions

Road construction can put a damper on your day, make you late to work, and put you in a bad mood. Let’s take a look at Houston’s road conditions in the table below.

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Costs (VOC) |

|---|---|---|---|---|

| 24% | 28% | 11% | 38% | $610 |

According to the Trip Net Urban Road Report, vehicle operating costs in Houston are $610.

For more information about road conditions, construction, and live road updates in Houston, Texas, please visit the TxDot Construction Schedule.

Does your city use speeding or red-light cameras?

What is a red-light camera?

According to the IIHS, red-light cameras automatically photograph vehicles that go through red lights. The cameras are connected to the traffic signal and to sensors that monitor traffic flow just before the crosswalk or stop line.

The system continuously monitors the traffic signal, and the camera captures any vehicle that doesn’t stop during the red phase. Many red-light camera programs provide motorists with grace periods of up to half a second after the light switches to red.

Governor Greg Abbott signed legislation on June 1, 2019, banning red-light cameras in Texas, a move proponents say protects drivers’ constitutional rights and might reduce traffic accidents.

The law, which is now in effect, outlaws cameras that take pictures of vehicles that enter intersections while the traffic signal is red.

Vehicles in Houston

In this next section, we will touch on vehicle statistics in Houston, Texas.

These stats will include topics like vehicle theft, speed traps, the most popular vehicles owned in Houston, and more.

Buckle up as we tackle this next section — you don’t want to miss it.

Most Popular Vehicles Owned in Houston

According to Your Mechanic, the most popular vehicle in Houston, Texas, is a Ford F-250 Super Duty.

The National Highway Traffic Safety Administration gave the 2019 Ford F-250 Super Duty a four-out-of-five-star overall rollover safety rating.

Since it is a heavy pickup truck, you can bet that this truck uses a lot of gas.

The Ford F-250 Super Duty showed an average in city driving of 14.6 mpg in stop-and-go-traffic. On the highway, the F-250 averaged 15.5 mpg.

At the end of the trip, the full 48-gallon fuel tank had burned 12.75 gallons of fuel with the publication’s calculations showing 15.7 mpg of combined mileage.

How Many Cars Per Household

A recent study done in 2017 by Data USA showed the average household in Houston, Texas, owns two cars.

The average household in the U.S. also owns two cars.

Households Without a Car

Even though many households own cars in Houston, some households don’t have a vehicle at all.

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Vehicles Per Household |

|---|---|---|---|

| 8.30% | 8.10% | 1.58 | 1.59 |

This table above shows that the number of households that don’t own a car decreased from 2015-2016.

The number of vehicles per household also increased in 2016.

Speed Traps in Houston

Have you ever been driving a little too fast — and then you see it out of nowhere: the flashing blue and red lights behind you, signaling you to pull over.

If you’ve ever been in this situation, you’ve fallen victim to a little thing called a speed trap.

Houston is ranked as the number one city in Texas for speed traps.

There are 32 listed speed traps in Houston, and you can find them all here. Remember to follow posted speed limit signs and always be cautious and courteous when you get pulled over.

Vehicle Theft in Houston

Have you ever wondered if you live in a safe area? According to the FBI, there were 11,949 reported vehicle thefts in the city of Houston.

According to the Neighborhood Scout, these are the top 10 safest cities in Houston:

- Dogwood Acres / Walden Woods

- Westheimer Pky / S Ferry Rd

- Clodine

- Sandtown Cir / Sandtown Ln

- Clodine Reddick Rd / Beechnut Blvd

- Olcott

- Porter Heights

- River Terrace

- Echo Mountain Dr / Mills Branch Dr

- Telge Rd / Northwest Fwy

Take a look at this map below. The light purple areas show the safest areas in Houston, while the darkest color purple shows the most dangerous places.

Neighborhood Scout also revealed that your chances of becoming a victim of violent crime in Houston, Texas, are approximately 11.17 per 1,000 residents. This is lower than the statewide figure, which puts residents at a 4.39 per 1,000 chance of being a victim of violent crime.

Houston is only safer than 4 percent of cities across the country. The city ranks number four in Neighborhood Scout’s crime index, with 100 being the absolute safest.

The table below illustrates the incidents of violent crime in Houston, Texas, in 2017 alone.

| Houston Violent Crimes 2017 | Murder | Rape | Robbery | Assault |

|---|---|---|---|---|

| Report Total | 269 | 1,386 | 9,842 | 14,346 |

| Rate per 1,000 | 0.12 | 0.6 | 4.26 | 6.2 |

Below are Houston’s annual number of crimes for the year 2017.

| Houston Annual Crimes | Violent | Property | Total |

|---|---|---|---|

| Number of Crimes | 25,843 | 98,197 | 124,040 |

| Crime Rate (per 1,000 residents) | 11.17 | 42.46 | 53.63 |

Crime rates are always higher in a bigger city, so don’t be discouraged by these numbers.

Traffic

Now that we’ve talked about road conditions, crime rates, and vehicle theft, let’s go over Houston’s traffic conditions.

Traffic Congestion in Houston

According to Inrix Traffic Scorecard, Houston is ranked as the 77th-most traffic-congested city in the world and the 13th-most traffic-congested city in the U.S.

Take a look at Houston traffic statistics in the table below.

| 2018 U.S. Rank | 2018 World Rank | Hours Lost in Congestion | Cost of Congestion (Per Driver) |

|---|---|---|---|

| 13 | 77 | 98 | $1,365 |

According to Inrix, Houston traffic costs drivers an average of $1,365 per year.

Transportation

We know that Houston drivers spend a lot of time in traffic. But how long is the average Houston driver’s commute?

According to Data USA, using averages, employees in Houston, Texas, have a longer commute time (26.5 minutes) than the normal U.S. worker (25.5 minutes).

Additionally, 1.96 percent of the workforce in Houston, Texas, have “super commutes” in excess of 90 minutes.

What are some common modes of transportation used by Houston residents?

In 2017, the most common method of travel for workers in Houston, Texas, was to drive alone (77 percent), followed by those who carpooled (10.4 percent) and those who worked from home (4.36 percent).

Busiest Highways

According to the Texas A&M Transportation Institute, the 2018 ranking of Texas’s most congested roadways illustrates a familiar theme — growth-induced traffic gridlock is getting worse every year.

The top-five busiest highways in Houston, Texas, are listed below:

- W Loop Fwy / IH 610

- Southwest Fwy / IH 69 /US 59

- Eastex Fwy / IH 69 / US 59

- Katy Fwy / IH 10 / US 90

- North Fwy / IH 45

For more information on the busiest roads in Houston, click here.

How safe are Houston’s streets & roads?

We’ve already talked about the crime rate in Houston, Texas, but now it’s time to give you a few statistics about Houston’s streets and roads. Knowing these important stats can help you avoid an accident, a traffic ticket, and maybe even save your life.

Let’s first take a look at Houston’s fatal crash rate. How did these fatal crashes happen? What caused them to happen?

The National Highway Traffic Safety Administration’s (NHTSA) 2018 study reported the safety conditions and fatal crashes in Houston counties that year.

To begin, let’s take a look at the total fatal crashes in these counties as of 2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 8 | 5 | 10 | 3 | 4 | 27.61 | 16.96 | 33.74 | 10.08 | 13.34 |

| Brazoria | 30 | 42 | 48 | 44 | 31 | 8.88 | 12.15 | 13.57 | 12.13 | 8.37 |

| Chambers | 20 | 15 | 22 | 9 | 20 | 52.23 | 38.39 | 54.66 | 21.74 | 47.11 |

| Fort Bend | 36 | 39 | 37 | 39 | 30 | 5.26 | 5.45 | 4.98 | 5.09 | 3.81 |

| Galveston | 35 | 44 | 45 | 40 | 40 | 11.17 | 13.71 | 13.69 | 11.97 | 11.84 |

| Harris | 417 | 391 | 447 | 458 | 389 | 9.35 | 8.57 | 9.66 | 9.82 | 8.28 |

| Liberty | 16 | 18 | 22 | 39 | 21 | 20.5 | 22.61 | 26.99 | 46.53 | 24.33 |

| Montgomery | 53 | 60 | 76 | 54 | 48 | 10.24 | 11.19 | 13.68 | 9.44 | 8.12 |

| Waller | 11 | 7 | 7 | 24 | 11 | 23.51 | 14.38 | 13.98 | 46.8 | 20.71 |

As you can see, Harris County has the highest fatality rate of all nine counties making up the city of Houston.

Next up, take a look at the fatalities in county crashes in 2018 involving alcohol-impaired drivers with BAC levels of .08 and above.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 4 | 0 | 2 | 1 | 2 | 13.81 | 0 | 6.75 | 3.36 | 6.67 |

| Brazoria | 12 | 18 | 25 | 18 | 10 | 3.55 | 5.21 | 7.07 | 4.96 | 2.7 |

| Chambers | 7 | 3 | 6 | 2 | 10 | 18.28 | 7.68 | 14.91 | 4.83 | 23.55 |

| Fort Bend | 14 | 15 | 15 | 15 | 12 | 2.05 | 2.1 | 2.02 | 1.96 | 1.52 |

| Galveston | 22 | 16 | 20 | 19 | 20 | 7.02 | 4.98 | 6.08 | 5.68 | 5.92 |

| Harris | 210 | 170 | 211 | 202 | 171 | 4.71 | 3.73 | 4.56 | 4.33 | 3.64 |

| Liberty | 6 | 9 | 6 | 14 | 6 | 7.69 | 11.3 | 7.36 | 16.7 | 6.95 |

| Montgomery | 24 | 20 | 25 | 25 | 16 | 4.64 | 3.73 | 4.5 | 4.37 | 2.71 |

| Waller | 4 | 2 | 3 | 8 | 4 | 8.55 | 4.11 | 5.99 | 15.6 | 7.53 |

The data from the table above shows there were 251 alcohol-impaired fatalities in 2018 in the city of Houston.

Here are the total single-vehicle fatality crashes in Houston counties for 2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 5 | 5 | 3 | 0 | 3 | 17.26 | 16.96 | 10.12 | 0 | 10 |

| Brazoria | 15 | 22 | 16 | 20 | 14 | 4.44 | 6.37 | 4.52 | 5.51 | 3.78 |

| Chambers | 7 | 6 | 10 | 5 | 8 | 18.28 | 15.36 | 24.85 | 12.08 | 18.84 |

| Fort Bend | 18 | 22 | 18 | 20 | 14 | 2.63 | 3.08 | 2.42 | 2.61 | 1.78 |

| Galveston | 18 | 25 | 30 | 23 | 20 | 5.74 | 7.79 | 9.12 | 6.88 | 5.92 |

| Harris | 216 | 220 | 263 | 243 | 205 | 4.84 | 4.82 | 5.68 | 5.21 | 4.36 |

| Liberty | 8 | 6 | 11 | 20 | 8 | 10.25 | 7.54 | 13.49 | 23.86 | 9.27 |

| Montgomery | 30 | 34 | 37 | 25 | 28 | 5.8 | 6.34 | 6.66 | 4.37 | 4.74 |

| Waller | 7 | 4 | 5 | 7 | 6 | 14.96 | 8.22 | 9.99 | 13.65 | 11.29 |

Once again, Harris County had the highest number of single-vehicle fatality crashes from 2014-2018.

The table below reveals traffic fatalities involving speeding from 2014-2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Popluation 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 6 | 4 | 0 | 1 | 1 | 20.71 | 13.57 | 0 | 3.36 | 3.33 |

| Brazoria | 12 | 14 | 13 | 19 | 10 | 3.55 | 4.05 | 3.67 | 5.24 | 2.7 |

| Chambers | 8 | 5 | 3 | 0 | 5 | 20.89 | 12.8 | 7.45 | 0 | 11.78 |

| Fort Bend | 11 | 9 | 6 | 6 | 5 | 1.61 | 1.26 | 0.81 | 0.78 | 0.63 |

| Galveston | 17 | 12 | 13 | 10 | 12 | 5.42 | 3.74 | 3.95 | 2.99 | 3.55 |

| Harris | 136 | 107 | 135 | 106 | 87 | 3.05 | 2.35 | 2.92 | 2.27 | 1.85 |

| Liberty | 7 | 5 | 4 | 9 | 2 | 8.97 | 6.28 | 4.91 | 10.74 | 2.32 |

| Montgomery | 25 | 18 | 21 | 12 | 21 | 4.83 | 3.36 | 3.78 | 2.1 | 3.55 |

| Waller | 4 | 1 | 2 | 8 | 3 | 8.55 | 2.05 | 3.99 | 15.6 | 5.65 |

As you can see above, there were 571 speeding-related traffic fatalities from 2014-2018 in Harris County in Houston, Texas.

The table below shows the number of fatalities in Houston counties involving a roadway departure.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 7 | 4 | 3 | 0 | 0 | 24.16 | 13.57 | 10.12 | 0 | 0 |

| Brazoria | 18 | 24 | 24 | 24 | 14 | 5.33 | 6.94 | 6.78 | 6.62 | 3.78 |

| Chambers | 8 | 4 | 9 | 3 | 13 | 20.89 | 10.24 | 22.36 | 7.25 | 30.62 |

| Fort Bend | 18 | 13 | 18 | 13 | 16 | 2.63 | 1.82 | 2.42 | 1.7 | 2.03 |

| Galveston | 18 | 16 | 17 | 15 | 10 | 5.74 | 4.98 | 5.17 | 4.49 | 2.96 |

| Harris | 177 | 166 | 175 | 174 | 138 | 3.97 | 3.64 | 3.78 | 3.73 | 2.94 |

| Liberty | 9 | 8 | 11 | 27 | 10 | 11.53 | 10.05 | 13.49 | 32.22 | 11.58 |

| Montgomery | 35 | 30 | 33 | 29 | 28 | 6.77 | 5.6 | 5.94 | 5.07 | 4.74 |

| Waller | 9 | 2 | 5 | 8 | 7 | 19.23 | 4.11 | 9.99 | 15.6 | 13.18 |

While there weren’t any fatalities involving a roadway departure in Austin County in 2018, there were 138 fatalities in the same year in Harris County.

This table below shows the number of fatalities involving an intersection.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 1 | 0 | 2 | 2 | 1 | 3.45 | 0 | 6.75 | 6.72 | 3.33 |

| Brazoria | 7 | 5 | 10 | 9 | 9 | 2.07 | 1.45 | 2.83 | 2.48 | 2.43 |

| Chambers | 7 | 6 | 1 | 2 | 1 | 18.28 | 15.36 | 2.48 | 4.83 | 2.36 |

| Fort Bend | 5 | 12 | 13 | 15 | 9 | 0.73 | 1.68 | 1.75 | 1.96 | 1.14 |

| Galveston | 9 | 14 | 5 | 8 | 9 | 2.87 | 4.36 | 1.52 | 2.39 | 2.66 |

| Harris | 103 | 89 | 102 | 116 | 116 | 2.31 | 1.95 | 2.2 | 2.49 | 2.47 |

| Liberty | 3 | 5 | 6 | 6 | 3 | 3.84 | 6.28 | 7.36 | 7.16 | 3.48 |

| Montgomery | 8 | 8 | 11 | 9 | 8 | 1.55 | 1.49 | 1.98 | 1.57 | 1.35 |

| Waller | 0 | 2 | 2 | 4 | 0 | 0 | 4.11 | 3.99 | 7.8 | 0 |

Except for Harris County, traffic fatalities involving an intersection in Houston are pretty rare.

These next few tables will show traffic fatalities according to person type. First, we’ll start with passenger car occupant fatalities in Houston.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 4 | 3 | 4 | 2 | 1 | 13.81 | 10.18 | 13.5 | 6.72 | 3.33 |

| Brazoria | 8 | 19 | 22 | 15 | 9 | 2.37 | 5.5 | 6.22 | 4.14 | 2.43 |

| Chambers | 8 | 6 | 6 | 5 | 9 | 20.89 | 15.36 | 14.91 | 12.08 | 21.2 |

| Fort Bend | 19 | 14 | 15 | 12 | 8 | 2.78 | 1.96 | 2.02 | 1.57 | 1.02 |

| Galveston | 9 | 10 | 7 | 7 | 9 | 2.87 | 3.12 | 2.13 | 2.09 | 2.66 |

| Harris | 146 | 124 | 147 | 149 | 134 | 3.27 | 2.72 | 3.18 | 3.19 | 2.85 |

| Liberty | 6 | 5 | 4 | 14 | 7 | 7.69 | 6.28 | 4.91 | 16.7 | 8.11 |

| Montgomery | 18 | 18 | 23 | 23 | 19 | 3.48 | 3.36 | 4.14 | 4.02 | 3.22 |

| Waller | 6 | 2 | 3 | 10 | 2 | 12.82 | 4.11 | 5.99 | 19.5 | 3.76 |

In 2018, there were 198 passenger car occupant fatalities in the city of Houston.

How many pedestrian fatalities were there in Houston, Texas from 2014-2018?

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 0 | 1 | 0 | 0 | 1 | 0 | 3.39 | 0 | 0 | 3.33 |

| Brazoria | 1 | 3 | 8 | 4 | 5 | 0.3 | 0.87 | 2.26 | 1.1 | 1.35 |

| Chambers | 2 | 2 | 4 | 1 | 0 | 5.22 | 5.12 | 9.94 | 2.42 | 0 |

| Fort Bend | 2 | 8 | 5 | 9 | 4 | 0.29 | 1.12 | 0.67 | 1.17 | 0.51 |

| Galveston | 5 | 10 | 14 | 8 | 8 | 1.6 | 3.12 | 4.26 | 2.39 | 2.37 |

| Harris | 90 | 98 | 130 | 109 | 103 | 2.02 | 2.15 | 2.81 | 2.34 | 2.19 |

| Liberty | 1 | 1 | 5 | 4 | 4 | 1.28 | 1.26 | 6.13 | 4.77 | 4.63 |

| Montgomery | 5 | 11 | 9 | 5 | 8 | 0.97 | 2.05 | 1.62 | 0.87 | 1.35 |

| Waller | 0 | 3 | 2 | 4 | 0 | 0 | 6.16 | 3.99 | 7.8 | 0 |

From 2014-2018 there were 697 pedestrian fatalities in Houston.

Lastly, this table shows pedalcyclist fatalities in Houston from 2014-2018.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities Per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Austin | 0 | 1 | 0 | 0 | 1 | 0 | 3.39 | 0 | 0 | 3.33 |

| Brazoria | 1 | 3 | 8 | 4 | 5 | 0.3 | 0.87 | 2.26 | 1.1 | 1.35 |

| Chambers | 2 | 2 | 4 | 1 | 0 | 5.22 | 5.12 | 9.94 | 2.42 | 0 |

| Fort Bend | 2 | 8 | 5 | 9 | 4 | 0.29 | 1.12 | 0.67 | 1.17 | 0.51 |

| Galveston | 5 | 10 | 14 | 8 | 8 | 1.6 | 3.12 | 4.26 | 2.39 | 2.37 |

| Harris | 90 | 98 | 130 | 109 | 103 | 2.02 | 2.15 | 2.81 | 2.34 | 2.19 |

| Liberty | 1 | 1 | 5 | 4 | 4 | 1.28 | 1.26 | 6.13 | 4.77 | 4.63 |

| Montgomery | 5 | 11 | 9 | 5 | 8 | 0.97 | 2.05 | 1.62 | 0.87 | 1.35 |

| Waller | 0 | 3 | 2 | 4 | 0 | 0 | 6.16 | 3.99 | 7.8 | 0 |

Except for Harris County, every county in Houston had eight or fewer pedalcyclist fatalities in 2018.

Let’s take a look at highways with the most fatal crashes. Check out the data below pulled from the FARS Encyclopedia. Note how fatalities in Texas vary based on the road type involved in the collision.

| Rural | Urban | Freeway and Expressway | Other | Minor Arterial | Collector Arterial | Local | Unknown | Total Fatal Crashes |

|---|---|---|---|---|---|---|---|---|

| 176 | 402 | 260 | 982 | 652 | 600 | 261 | 10 | 3,343 |

An arterial road is just a high-capacity urban road. Depending on how much traffic is filtering through a specific area, the road could be categorized as a highway or a minor arterial road.

Most fatal crashes happen on minor arterial roads, collector arterial roads, and urban roads. Many of these crashes fall into the “other” category, as well.

Besides road type fatalities, it is also important to be aware of the high incidence of railroad and highway crashes as they contribute to road dangers in Houston, Texas.

The U.S. Department of Transportation accumulated data indicating the fatalities and injuries in Houston due to highway and railroad crashes in recent years, as listed in the table below.

| Highway User Speed | Calendar Year | County | Highway | Highway User Type | Rail Equipment Type | Non Suicide Fatality | Non Suicide Injury | City | State Name | Latitude | Longitude | GeoLocation |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2012 | HARRIS | CULLEN BLVD | Pick-up truck | Light Loco(s) | 0 | 0 | HOUSTON | Texas | 29.682967 | -95.3559176 | Texas (29.6829670, -95.3559176) |

| 5 | 2012 | HARRIS | BOCARD #2 | Truck-trailer | Freight Train | 0 | 0 | HOUSTON | Texas | 29.7032839 | -95.2726146 | Texas (29.7032839, -95.2726146) |

| 5 | 2012 | HARRIS | COLLINGSWORTH STREET | Truck-trailer | Freight Train | 0 | 1 | HOUSTON | Texas | 29.793664 | -95.346064 | Texas (29.7936640, -95.3460640) |

| 0 | 2012 | HARRIS | HEIGHTS BLVD | Pedestrian | Freight Train | 0 | 0 | HOUSTON | Texas | 29.7714359 | -95.3973231 | Texas (29.7714359, -95.3973231) |

| 5 | 2012 | HARRIS | RAILWOOD | Truck-trailer | Light Loco(s) | 0 | 0 | HOUSTON | Texas | 29.8242536 | -95.2563058 | Texas (29.8242536, -95.2563058) |

| 0 | 2012 | HARRIS | LAURA KOPPE RD | Automobile | Freight Train | 0 | 0 | HOUSTON | Texas | 29.8404085 | -95.3271367 | Texas (29.8404085, -95.3271367) |

| 5 | 2012 | HARRIS | OIL TRAVLING WEST MA | Truck-trailer | Light Loco(s) | 0 | 0 | HOUSTON | Texas | 29.753019 | -95.28746 | Texas (29.7530190, -95.2874600) |

| 20 | 2012 | HARRIS | HOLMES RD | Pick-up truck | Freight Train | 0 | 0 | HOUSTON | Texas | 29.6819275 | -95.3593821 | Texas (29.6819275, -95.3593821) |

| 0 | 2012 | HARRIS | CAMPBELL ROAD | Truck-trailer | Freight Train | 0 | 0 | HOUSTON | Texas | 29.8527614 | -95.5320867 | Texas (29.8527614, -95.5320867) |

| 3 | 2012 | HARRIS | PRIVATE | Truck-trailer | Yard/Switch | 0 | 1 | HOUSTON | Texas | 29.7817514 | -95.2873972 | Texas (29.7817514, -95.2873972) |

| 0 | 2012 | HARRIS | RANKIN ROAD | Truck-trailer | Freight Train | 0 | 2 | HOUSTON | Texas | 29.9659321 | -95.3886698 | Texas (29.9659321, -95.3886698) |

| 15 | 2012 | HARRIS | MARKET STREET ROAD | Truck-trailer | Light Loco(s) | 0 | 0 | HOUSTON | Texas | 29.7683308 | -95.2684282 | Texas (29.7683308, -95.2684282) |

| 10 | 2012 | HARRIS | 66TH ST | Van | Yard/Switch | 0 | 0 | HOUSTON | Texas | 29.7389464 | -95.3099834 | Texas (29.7389464, -95.3099834) |

| 5 | 2012 | HARRIS | PRIVATE | Truck-trailer | Freight Train | 0 | 0 | HOUSTON | Texas | 29.685629 | -95.446693 | Texas (29.6856290, -95.4466930) |

| 5 | 2012 | HARRIS | C. E. KING ROAD | Automobile | Special MOW Eq | 0 | 1 | HOUSTON | Texas | 29.8326089 | -95.2110019 | Texas (29.8326089, -95.2110019) |

| 20 | 2012 | HARRIS | WALTON ROAD | Automobile | Yard/Switch | 0 | 0 | HOUSTON | Texas | 29.8494858 | -95.1178911 | Texas (29.8494858, -95.1178911) |

| 0 | 2012 | HARRIS | SHERWIN STREET | Automobile | Freight Train | 0 | 0 | HOUSTON | Texas | 29.7782062 | -95.4265911 | Texas (29.7782062, -95.4265911) |

| 0 | 2013 | HARRIS | SAND CROSSING/DELTA | Truck-trailer | Freight Train | 0 | 0 | HOUSTON | Texas | 29.7475188 | -95.2788793 | Texas (29.7475188, -95.2788793) |

| 0 | 2013 | HARRIS | PARKER STREET | Automobile | Freight Train | 0 | 0 | HOUSTON | Texas | 29.7726961 | -95.4083913 | Texas (29.7726961, -95.4083913) |

| 0 | 2013 | HARRIS | PRIVATE CROSSING | Truck-trailer | Freight Train | 0 | 0 | HOUSTON | Texas | 29.7321224 | -95.2566235 | Texas (29.7321224, -95.2566235) |

While none of these roads reported fatalities, Collingsworth Street, Private Street, Rankin Road, and C.E. King Road saw a couple of injuries.

Allstate America’s Best Drivers Report

How do Houston drivers compare to drivers nationwide?

According to data collected from Allstate’s Best Drivers in America Report, Houston is the 158th-safest city to drive in the country as of 2019.

In Houston, Texas, the likelihood of a claim being made as compared to the national average is 44.4 percent.

Residents of Houston typically have 6.9 average years between claims.

Seven years might not seem like a long time to go without an accident, but it’s a great number considering all of the traffic congestion in Houston, Texas.

Ridesharing

What ridesharing services are available in Houston, Texas? There are quite a few listed by RideGuru.

- Arro: Hail and pay for a traditional taxi through the Arro app.

- Blacklane: When you order a Blacklane car, a luxury vehicle with seating for one to five people will pick you up.

- Carmel: When you order a Carmel car, you have the choice of riding in a Sedan, Minivan, Stretch Limousine, SUV, and SUV super-stretch limo.

- Jayride: Jayride specializes in airport transfers, meaning you can only use it when scheduling a ride to and from an airport. When you book through Jayride, a vehicle seating one to 20 people will pick you up.

- Lyft

- SuperShuttle: When you order a SuperShuttle, a shuttle or black car (depending on which service you order) will pick you up. SuperShuttle has reservation options for one to 10 passengers.

- Talixo: When you book a Talixo car, you will have the option of choosing an economy, business, or luxury class vehicle for a variety of price points. Talixo’s cars come in various sizes, with their largest size accommodating up to seven passengers.

- Uber

E-star Repair Shops

Are you in need of some repair work for your vehicle but are not sure where to go? E-star is an Esurance-sponsored program that helps drivers find the best repair shops in their area.

Check out the top 10 repair shops in Houston, Texas, according to E-star.

| Shop Name | Address | Contact Information |

|---|---|---|

| RUSSELL & SMITH FORD HONDA | 1109 SOUTH LOOP W HOUSTON TX 77054 | email: [email protected] P: (713) 663-4216 F: (713) 663-4110 |

| MILLER AUTO & BODY REPAIR | 4816 N Shepherd HOUSTON TX 77018 | email: [email protected] P: (713) 864-7820 F: (713) 864-6280 |

| SERVICE KING GALLERIA | 5919 WESTHEIMER ROAD HOUSTON TX 77057 | email: [email protected] P: (713) 243-1400 F: (713) 266-4316 |

| CARSTAR PREMIER | 9520 RICHMOND AVE HOUSTON TX 77063 | email: [email protected] P: (713) 952-3777 |

| SERVICE KING SOUTHWEST FREEWAY | 10475 SOUTHWEST FREEWAY HOUSTON TX 77074 | email: [email protected] P: (713) 773-5000 F: (713) 772-1746 |

| SERVICE KING PEARLAND | 2330 SMITH RANCH ROAD PEARLAND TX 77584 | email: [email protected] P: (713) 795-3100 F: (800) 214-2373 |

| SUNRISE PAINT & BODY INC. | 4211 Cook Rd HOUSTON TX 77072 | email: [email protected] P: (281) 933-7473 F: (281) 933-9426 |

| CHARLTON'S BODY REPAIR_CF | 1131 STAFFORDSHIRE RD STAFFORD TX 77477 | email: [email protected] P: (281) 499-1126 F: (281) 499-1694 |

| SERVICE KING HUMBLE | 450 E FM 1960 HUMBLE TX 77338 | email: [email protected] P: (281) 446-6660 F: (800) 214-2373 |

| GREENFIELD COLLISION CENTER | 15920 KUYKENDAHL HOUSTON TX 77068 | email: [email protected] P: (281) 580-1994 F: (281) 580-3205 |

Weather

According to U.S. Climate Data, the average temperature in Houston, Texas is 69.95 degrees.

| HOUSTON, TEXAS WEATHER | DETAILS |

|---|---|

| Annual High Temperature | 79.7 F |

| Annual Low Temperature | 60.2 F |

| Average Temperature | 69.95 F |

| Average Annual Precipitation (Rainfall) | 49.58 inches |

| Day Per Year with Preciptation - Rainfall | 99 Days |

We’ve talked about the weather, but what about natural disasters?

When you’re looking at a new car insurance policy, it’s important to look at natural disaster statistics because not every type of car insurance policy will cover you if your vehicle is destroyed or damaged during an “act of God.”

The following data is brought to you by CityData.com.

Harris County has experienced 29 total natural disasters, which is significantly higher than the nationwide average of 13. A total of 22 natural disasters in Harris County were declared by the president as major disasters, and six were declared to be emergencies.

The causes of these natural disasters were as follows:

- Storms: 16

- Floods: 15

- Hurricanes: 8

- Tornadoes: 7

- Tropical Storms: 3

- Fires: 2,

- Winds: 2

Remember that some of these incidents may be assigned to more than one category.

What type of insurance will cover you in the event of a natural disaster or storm?

A comprehensive car insurance policy will ensure your vehicle in the event of a natural disaster. Even if your car is totaled because of a storm, a comprehensive policy will cover your vehicle (or replace it) no matter what.

This type of policy could cost you a pretty penny up front but could save you thousands of dollars in the long run — especially if you live in an area where hurricanes and tornadoes happen on a frequent basis.

Public Transit

Greenlink buses operate in Houston on a regular basis.

Multiple buses operate in Downtown Houston from Monday through Friday, 6:30 a.m. to 6:30 p.m., about seven to 10 minutes apart. This Green route spans 2.5 miles with 18 stops and connects Metro transit stops.

Another route, the Orange route, runs Monday through Friday from 6:30 p.m. to midnight, Saturday from 9 a.m. to midnight, and Sunday from 9 a.m. to 6 p.m., with buses every 10 minutes. That route covers more of the historic district, the ballparks, and the Theater District.

Greenlink buses stop at or near popular downtown destinations including the George R. Brown Convention Center, Avenida Houston, Discovery Green, Minute Maid Park, GreenStreet, the Theater District, City Hall, and the Central Library, and connects to Metro Park & Ride services and to the Main Street MetroRail line.

The buses run on Compressed Natural Gas (CNG), making them a cleaner transportation alternative. Features of the buses include a streamlined, modern design, low-floor access, perimeter seating, high-quality air conditioning, 28-seat capacity, a front-mounted bike rack, and they are ADA compliant.

Houston also has a low-cost bike share program called B-Cycle.

The city’s BCycle program is growing and currently consists of 90 stations with 635 bikes available for short-term rentals throughout central Houston.

The bike-share program allows guest users to check out a bike for $3 per 30-minutes from any kiosk. Memberships, available online only, allow you to take unlimited 60-minute trips.

Memberships cost $13 per month or $79 per year, and members can undock one bike at a time for free up to one hour with a $3 usage fee for each additional 1/2 hour on longer trips.

Users can sign up for a membership online at houston.bcycle.com or through the free BCycle mobile app, which also provides a station map on the go. For walk-up guest users, the flat rate is $3 per 30 minutes, paid by credit card at the station kiosk to unlock a bike.

BCycle is ideally suited for those looking for an inexpensive way to tour around the city’s core, along Buffalo Bayou, or around the Museum District. Click here for a map of the station across the area or to sign up.

For more information about Houston’s public transit service, go to the Metro website here.

Alternative Transportation

Currently, Houston, Texas, does not have electric scooter service, but when will Houston decide to implement this new means of transportation?

According to the Houston Public Media, Maria Irshad, assistant director of the City of Houston’s Parking Division, said Houston’s infrastructure has had a lot to do with the lack of scooters.

As for Houston’s timetable for allowing scooter companies to operate, Irshad said there will be more public engagement later this summer. City Council will then have to draft an ordinance regulating scooters, and Irshad estimates we could see them on the streets next year.

Parking in Metro Areas

According to Visit Houston, those looking to avoid the search for parking around Downtown Houston can plan ahead with Parking Panda. The online parking reservation service allows visitors to find and purchase guaranteed parking Downtown, any time.

Parking is 100 percent guaranteed, even if the location otherwise fills up, often at exclusive online discounts. Present the purchase confirmation at the selected location for an easy, turnkey experience.

Parking options are available throughout Houston, including the Convention District, Theater District, NRG Park, Toyota Center, and many other locations.

To view real-time pricing and availability, click here.

Another great option for finding the perfect spot is Parking.com. This company operates more than 69 lots and garages across the city, from NRG Park to Downtown.

Do you have an electric vehicle? According to ChargeHub, within a 10-mile radius, Houston has 264 Level 2 charging stations, 18 Level 3 charging stations, and 120 free charging stations.

Air Quality in Houston

Back in the day, vehicles used to emit fumes and pollution into the air. Today, we don’t have to worry about this issue as much because cars are made a lot differently and much more efficiently.

Let’s take a look at Houston’s air quality.

The following table indicates the air quality in Houston, based on the Environmental Protection Agency’s reports from 2017, 2018, and 2019.

| HOUSTON AIR QUALITY INDEX | 2017 | 2018 | 2019 |

|---|---|---|---|

| Days with AQI | 365 | 365 | 182 |

| Good Days | 184 | 166 | 83 |

| Days Moderate | 156 | 164 | 79 |

| Days Unhealthy for Sensitive Groups | 22 | 26 | 17 |

| Days Unhealthy | 3 | 7 | 3 |

| Days Very Unhealthy | 0 | 2 | 0 |

As you can see from the table above, Houston only has a few days when the air is considered to be unhealthy.

Military/Veterans

If you serve or have served in the military, you could be eligible for a https://www.autoinsuranceez.com/car-insurance-discounts/military-auto-insurance/ discount in the city of Houston, Texas.

Before we talk more about military discounts, let’s take a look at a few military statistics in Houston.

According to a recent study by Data USA, Houston, Texas, has a large population of military personnel who served in the Vietnam War.

Approximately 20,569 veterans who now live in Houston, Texas, served in the Vietnam War. The veteran populace in Houston, Texas, who served in the Vietnam war is 1.17 times greater than the number of residents who served in any other conflict.

In Houston, there are 17,611 veterans who served in the second Gulf War and 10,103 veterans who served in the first Gulf War.

There are 15 military bases in the state of Texas.

The Marines and Coast Guard are the only branches without bases in Texas. While there aren’t any military bases located in Houston, most bases cluster around San Antonio and Corpus Christi.

If you’re looking for a military auto insurance discount in Houston, Texas, try any of these providers listed below.

- Allstate

- Esurance

- Farmers

- Geico

- Liberty Mutual

- Metlife

- Safe Auto

- Safeco

- State Farm

- The General

- USAA

Check out how rates from car insurance companies compare to USAA’s lower average car insurance rate in the table below.

| Group | Average |

|---|---|

| Allstate | $6,514.78 |

| American Family | $6,846.57 |

| Geico | $3,969.28 |

| Nationwide | $4,409.63 |

| Progressive | $5,257.10 |

| State Farm | $3,466.09 |

| USAA | $2,931.67 |

In addition, USAA also offers discounts for military garages to hold vehicles on base.

Unique Houston Laws

Before we let you go, check out these unique laws specific to Houston, Texas.

Hands-Free Law

As of July 1, 2019, texting while driving is against the law in Texas.

Drivers cannot have their hands on their phone while driving through a school zone or a construction zone.

For more information on the hands-free driving law, please visit the Texas Department of Transporation.

Food Truck Law

According to Houstontx.gov, a food truck or a “mobile food unit” is a food service establishment that is vehicle-mounted or wheeled and is capable of being readily moveable.

To use a food truck, a City of Houston Food Service Medallion is required for all mobile food units.

To find basic requirements to own and service a food truck in Houston, please visit Houstontx.gov.

Tiny Home Laws

Code Green Houston says every tiny home dwelling unit shall have at least one habitable room that shall have not less than 120 square feet (11 m2) of gross floor area.

You can find more tiny home codes and regulations here.

Parking Laws

Signage is not normally posted for parking regulations included in the Texas Transportation Code because they are provided in the Texas Department of Public Safety Driver’s Handbook.

The parking regulations included in the Texas Transportation Code are available at Houstontx.gov.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Houston Car Insurance FAQs

Do you have any questions about moving to Houston?

Keep scrolling for a quick car insurance Q&A breakdown that every driver in Houston needs to know before getting back on the road again.

What is the cost of living like in Houston?

According to a study conducted by Sperling’s Best Places, the cost of living in Houston is above the nationwide average. Sperling rated the cost of living at 104.8.

A figure below 100 indicates that a city is cheaper than the U.S. average, while a number exceeding 100 reveals that the city is more expensive. The median home price in Hollywood, Florida, is $185,500.

What do I do if I get into an accident in Houston, Texas?

Texas adheres to the traditional fault system when assessing liability for a collision. This means the at-fault driver is responsible for covering the costs of damages incurred by another party or parties due to an accident they cause.

After a collision, the injured party may opt to file a claim with their insurer and/or the at-fault driver’s carrier.

The injured party may also consider filing a personal injury claim against the at-fault individual to secure compensation for things like property damage, medical bills, pain and suffering, and additional losses.

What are the minimum car insurance requirements?

The minimum liability car insurance requirements in Texas are $30,000 bodily injury liability coverage per person, $60,000 total bodily injury liability coverage per accident, and $25,000 property damage coverage per accident. Remember that driving without insurance is illegal.

Are there any car insurance options for high-risk drivers?

If you have a history of accidents and/or traffic violations on your record and have been unable to secure insurance through the voluntary market, Texas offers a plan for high-risk drivers called the Texas Automobile Insurance Plan Association (TAIPA).

Note that you will not be able to select your own carrier and certain eligibility requirements apply. Visit the TAIPA website for more information.

Is Houston, Texas, safe?

Neighborhood Scout says that Houston, Texas is 4 percent safer than all U.S. cities. The crime rate in Houston is 11.17 per 1,000 residents.

Now that you’ve learned all you need to know about auto insurance in Houston, Texas, it’s time to start comparing rates. All you need to do is use our free tool by entering your zip code in the box below.

Good luck and happy shopping.