Best Wilmington, DE Auto Insurance in 2025 (Review the Top 10 Companies Here)

State Farm, Progressive, and Allstate provide the best Wilmington, DE auto insurance; minimum coverage is just $70/mo. These three companies offer excellent customer satisfaction, reliable telematics, and essential coverage. Don't just rely on these insurers; Travelers offers minimum coverage at $57/mo.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Wilmington DE

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Wilmington DE

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Wilmington DE

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best Wilmington, DE auto insurance is from State Farm, Progressive, and Allstate, with full minimum coverage starting at $70/mo. Be sure to read further for our top ten list, as other insurers may be more inviting for affordable car insurance in Delaware, such as Travelers, who offer the same coverage at $54/mo.

Delaware auto insurance can vary greatly depending on where you live. This also applies within cities, especially in Wilmington, where ZIP code 19801 has some of the highest average insurance rates in the state.

Our Top 10 Company Picks: Best Wilmington, DE Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Customer Satisfaction | State Farm | |

| #2 | 10% | A+ | Qualifying Coverage | Progressive | |

| #3 | 25% | A+ | Drivewise Programs | Allstate | |

| #4 | 20% | A+ | Strong Reputation | Nationwide |

| #5 | 13% | A++ | Flexible Options | Travelers | |

| #6 | 25% | A++ | Affordable Premiums | Geico |

| #7 | 25% | A | Personal Service | American Family | |

| #8 | 25% | A | Customizable Policies | Liberty Mutual |

| #9 | 10% | A++ | Military Benefits | USAA | |

| #10 | 20% | A | Community Focus | Farmers |

To find cheap car insurance in Delaware, input your ZIP code above to get quick quotes in seconds. This way, you can see the best auto insurance in Wilmington, DE, for your needs.

- Wilmington has the highest auto insurance rates in Delaware

- State Farm has the cheapest rates in the area

- The best insurers are State Farm, Progressive, and Allstate

#1 – State Farm: Best for Customer Satisfaction

Pros

- Good Customer Service: State Farm has positive customer service and claims satisfaction. In Wilmington, the service is quick and easy.

- Reputable Brand: State Farm is a well-established company in Delaware and the USA, known for its strong reputation and financial stability. Check out the State Farm auto insurance review.

- Extensive Agent Network: Wilmington has several local State Farm agents, so policyholders can easily find an agent nearby for in-person support and personalized advice.

- Discounts: State Farm offers discounts for good driving, bundling multiple policies, and using their Drive Safe & Save program, which could lower Wilmington premiums.

Cons

- Higher Premiums: State Farm’s premiums are sometimes higher for younger, high-risk drivers than those of its competitors within the Wilmington area.

- Mixed Claim Processing Times: Some customers report slow claim processing, which can be a significant factor in choosing your car insurance in Wilmington, DE.

- Regional Rate Variation: Delaware has varying insurance rates, and Wilmington has higher rates due to higher accidents and insurance risk factors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Qualifying Coverage

Pros

- Competitive Rates: Progressive offers cheap rates for Wilmington drivers with a clean driving record. For more information, read Progressive’s auto insurance review.

- Range of Discounts: Progressive offers discounts in Wilmington, including good driving, bundling multiple policies, and continuous insurance, helping Wilmington drivers save that vital cash.

- High-Risk Driver Options: Progressive focuses on high-risk drivers, which is helpful considering Wilmington’s accident rates and higher-risk statistics.

Cons

- Higher Rates for High-Mileage Drivers: Progressive’s rates can increase for Wilmington drivers with high annual mileage.

- Inconsistent Rates for Certain Wilmington Drivers: Progressive’s rates vary widely depending on driving history and circumstances, so some drivers may find their premiums higher than expected.

#3 – Allstate: Best for Drivewise Programs

Pros

- Extensive Discounts: Allstate offers various discounts, including safe driving, new car, and loyalty discounts. Their Drivewise program rewards safe driving in Wilmington by lowering premiums.

- Accident Forgiveness: With Allstate’s optional accident forgiveness, your rate won’t go up after your first accident, which can be a nice safety net for Wilmington drivers.

- Claim Satisfaction Guarantee: Allstate offers a unique claim satisfaction guarantee, including a refund if unsatisfied with the claims process. To learn more, read the Allstate auto insurance review.

Cons

- Higher Premiums: Allstate’s premiums are typically higher, especially for younger or high-risk drivers, which may be a drawback for Wilmington drivers looking to save.

- Policy Options May Increase Costs: While accident forgiveness and deductible rewards are beneficial, they come with additional costs that may raise Wilmington’s overall car insurance cost.

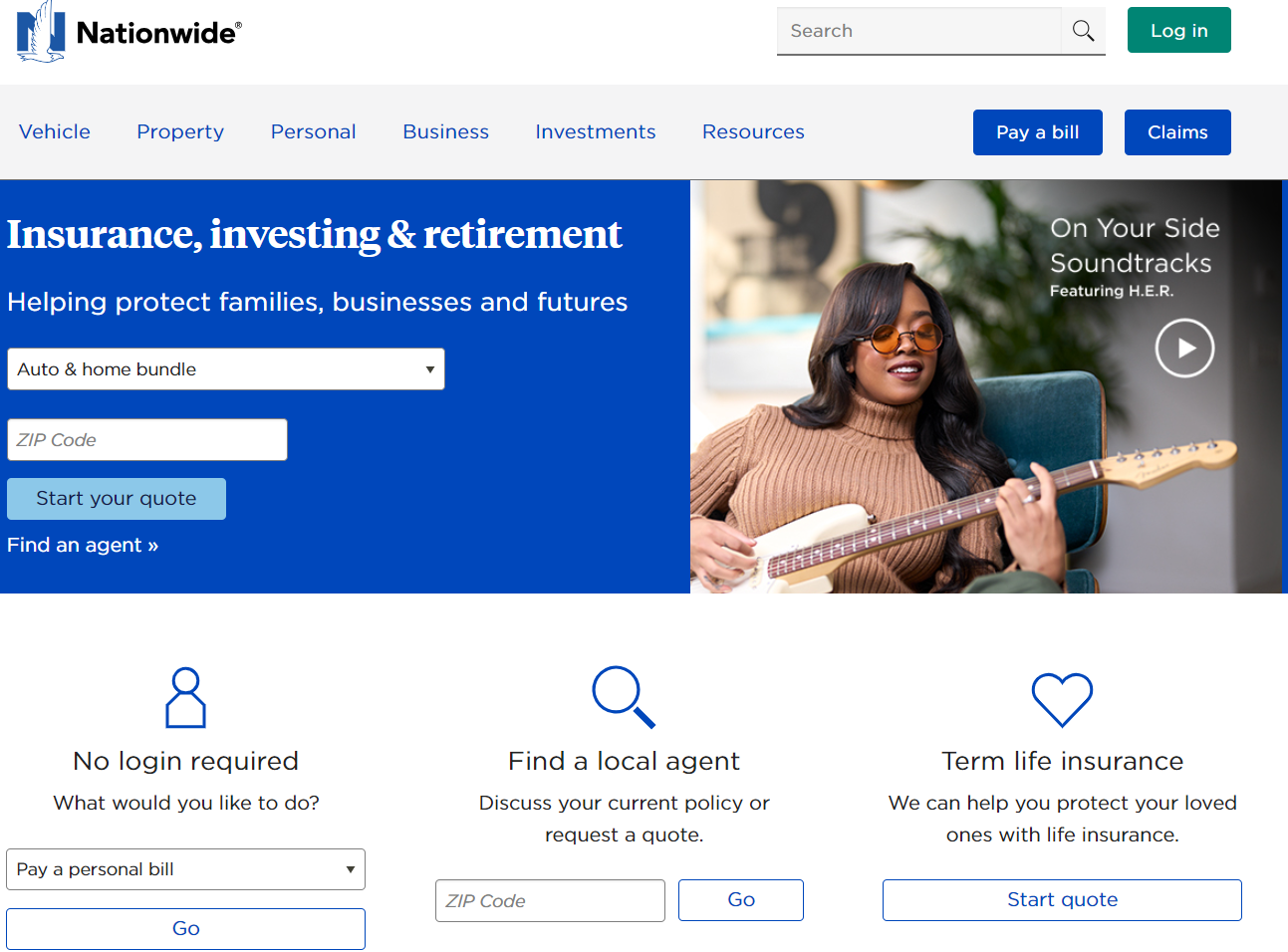

#4 – Nationwide: Best for Strong Reputation

Pros

- Vanishing Deductible: This feature reduces your deductible over time for safe driving, which benefits Wilmington drivers who maintain a clean driving record.

- Strong Financial Stability: Nationwide has a good reputation for financial stability, which gives Wilmington, Delaware, policyholders confidence in the company’s ability to pay out claims.

- Good Customer Service: Nationwide’s responsive customer service and positive claims handling for Wilmington drivers. Read our Nationwide auto insurance review to learn more about their service.

Cons

- Limited Local Agent Presence: Nationwide may have fewer agents in Wilmington. If you prefer face-to-face interaction, Nationwide may not be the right choice.

- Inconsistent Rates Based on Location: Rates can vary significantly based on ZIP code and local factors in Delaware, so some Wilmington drivers may find premiums higher than expected.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Flexible Options

Pros

- Wide Range of Discounts: Travelers offers various discounts, including hybrid/electric vehicle, good student, and safe driver discounts, helping Wilmington drivers save on their premiums.

- IntelliDrive Program: Travelers’ usage-based IntelliDrive program monitors driving habits and can reward safe drivers with additional discounts, which can benefit careful drivers in Wilmington.

- Solid Coverage Options: Wilmington drivers can get flexible options like accident forgiveness and gap insurance. Read more on coverage options with Travelers auto insurance review.

Cons

- IntelliDrive Privacy Concerns: The IntelliDrive app monitors driving habits, which might feel intrusive for some Wilmington drivers concerned about data privacy.

- Potential Rate Increases Post-IntelliDrive: Travelers’ IntelliDrive can lead to rate increases if driving habits are assessed as risky, which might disadvantage some Wilmington drivers.

#6 – Geico: Best for Affordable Premiums

Pros

- Affordable Premiums: Geico is known for competitive pricing, making it one of the cheaper options for Wilmington drivers, especially those with good driving records.

- Wide Range of Discounts: Geico offers discounts for potential savings for cheap Delaware auto insurance, such as multi-policy, good driver, military, federal employee, and student discounts.

- Customer Service: Geico’s fast and efficient 24/7 customer service is a bonus for Wilmington residents. Check out the Geico auto insurance review for more on Geico’s service.

Cons

- Fewer Customization Options: Geico offers fewer add-ons, which might not meet the needs of Wilmington drivers seeking extensive coverage.

- Rate Increases Over Time: Some customers report that Geico’s rates can gradually increase, which may concern Wilmington drivers looking to lock in consistently low rates.

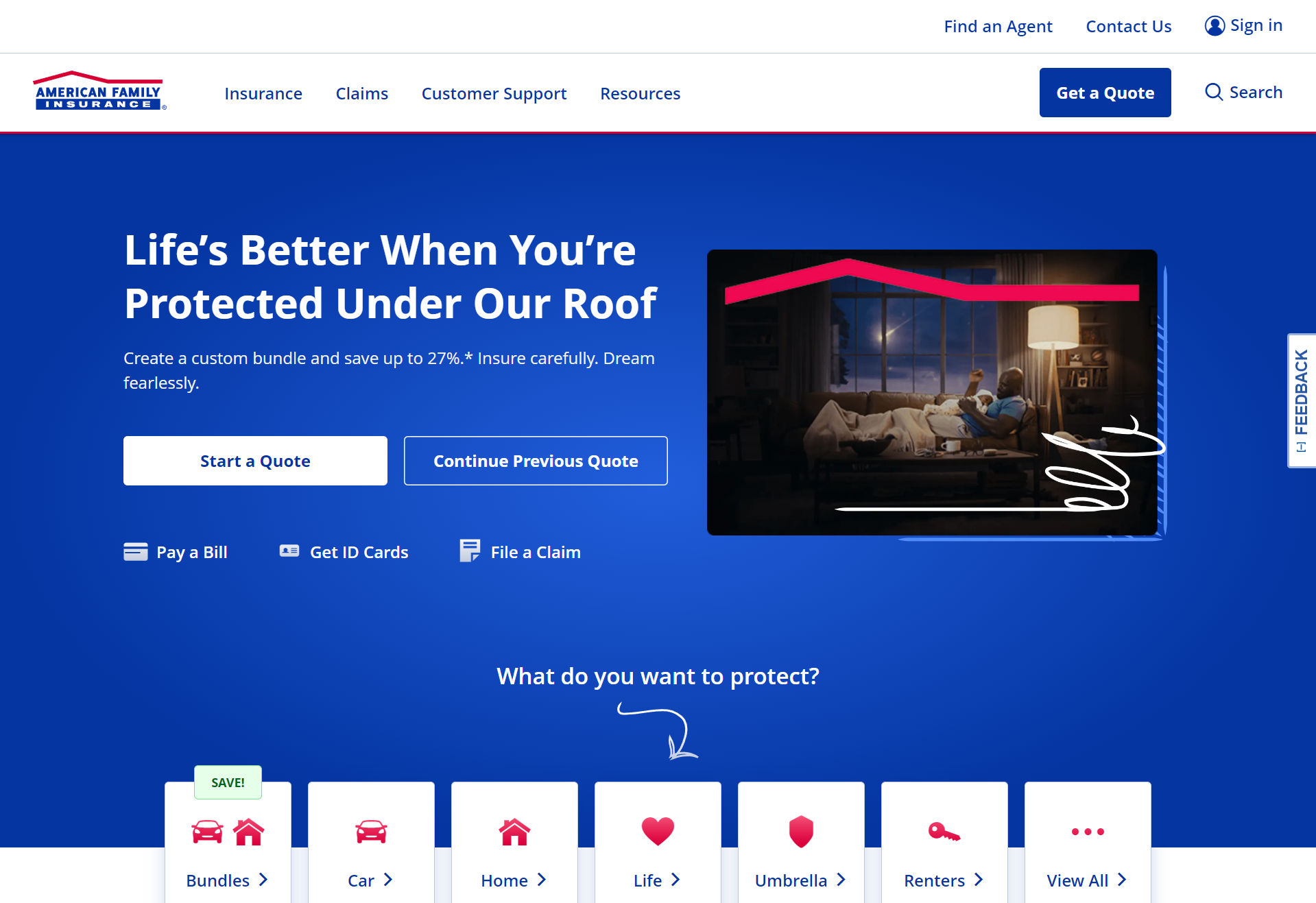

#7 – American Family: Best for Personal Service

Pros

- Comprehensive Discounts: AmFam offers many discounts, including good driver, loyalty, good student, and young volunteer discounts, allowing Wilmington drivers to save in several ways.

- Unique Coverage Options: American Family provides accidental death and disability coverage, gap insurance, and original equipment manufacturer (OEM) coverage in the Wilmington, DE area.

- Flexible Payment Options: AmFam payment plans help Wilmington customers manage their budgets. Read the American Family auto insurance review to understand the options available.

Cons

- Limited Availability: AmFam’s agent network is more limited in the area, which is a problem for Wilmington residents who prefer in-person service.

- Inconsistent Discounts and Coverage Options by State: Some discounts and optional coverages may not be as widely available in Wilmington, Delaware, as in other states.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Coverage Options: Liberty Mutual offers coverage options, including new car replacement and better car replacement, to help Wilmington drivers find policies for their needs.

- Discount Variety: Liberty Mutual provides multiple discounts, such as multi-policy, safe driver, good student, and military discounts, which can help Wilmington residents save on premiums.

- Better Car Replacement Option: A totaled car is replaced with a one-year-old newer model with 15,000 fewer miles, which is especially helpful for Wilmington drivers seeking vehicle protection.

Cons

- Higher Premiums for Some Drivers: Liberty Mutual’s rates can be higher than those of competitors, especially for younger or higher-risk Wilmington drivers.

- Mixed Customer Service Reviews: Liberty Mutual receives mixed reviews for customer service and claims handling. Check Liberty Mutual auto insurance review for their customer service reviews.

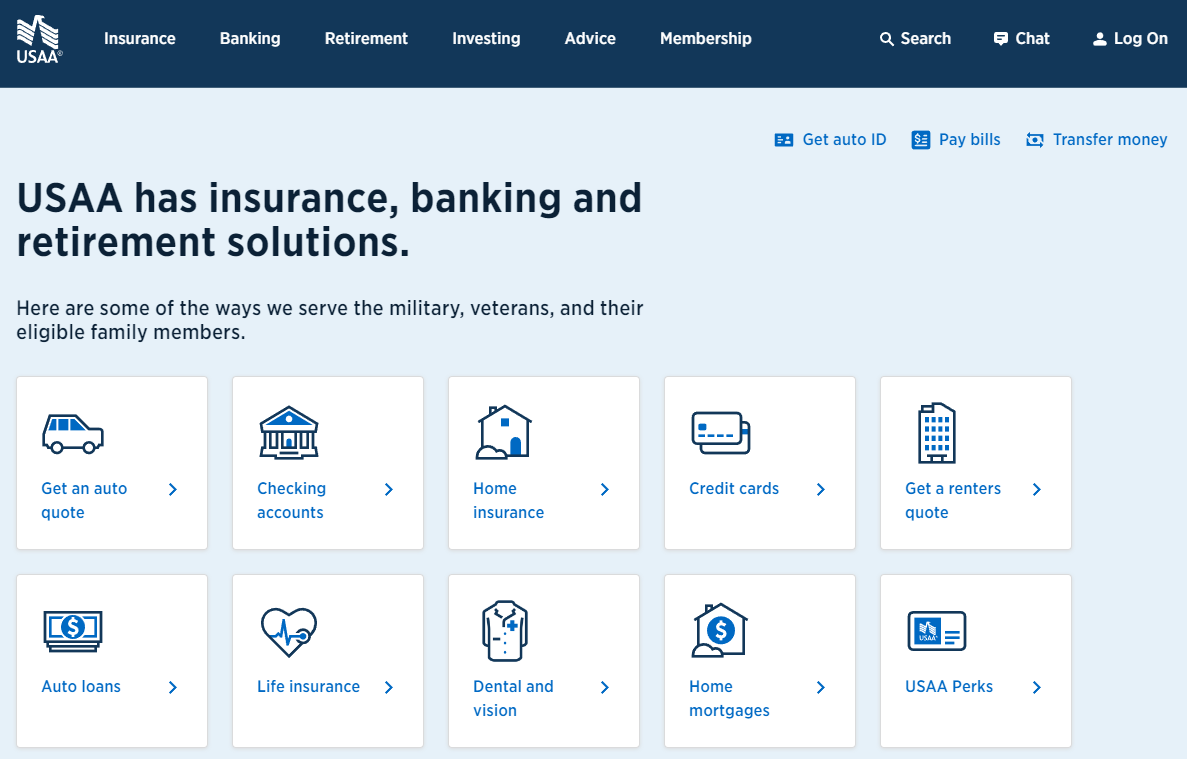

#9 – USAA: Best for Military Benefits

Pros

- Competitive Premiums: USAA is known for affordable rates, particularly for military members and their families. It offers lower premiums for Wilmington drivers eligible for membership.

- Excellent Customer Service: USAA consistently ranks high in customer satisfaction for claims processing, billing, and customer support, providing peace of mind for Wilmington policyholders.

- Broad Range of Discounts: USAA offers several discounts, including safe driver, defensive driving, good student, and military-specific discounts, allowing qualified Wilmington drivers to save more.

Cons

- Membership Restrictions: USAA auto insurance is available only to Wilmington residents who are active military members, veterans, and their families.

- Limited Coverage Options: USAA may lack some specialized coverage options other Wilmington car insurers offer. Check out the USAA auto insurance review to see what is available.

#10 – Farmers: Best for Community Focus

Pros

- Discount Opportunities: Farmers offer many beneficial discounts, considering the relatively high average car insurance costs in Delaware. Check out the Farmers auto insurance review for more.

- Good Customer Support: Farmers is known for its responsive customer service, which includes local agents and online options. This is perfect for Wilmington drivers who need help quickly.

- Claims Forgiveness and Accident Forgiveness Options: Farmers’ add-ons, like claims and accident forgiveness, contribute to its position as the cheapest car insurance in Delaware.

Cons

- Limited Availability of Local Agents in Smaller Towns: If you live in a smaller area near Wilmington or prefer working closely with an agent, you may have fewer options.

- Potential Increases for Minor Violations: Farmers may increase rates following minor violations or claims. Delaware has high insurance rates, so any increase could be substantial.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Monthly Auto Insurance Rates and Coverage Levels in Wilmington, DE

The table below shows the companies’ minimum and full coverage rates on our top ten list of the best Wilmington, DE auto insurance companies. Wilmington drivers can refer to the table below for cheap Delaware car insurance companies.

Wilmington, DE Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $152 | $215 | |

| $83 | $150 | |

| $127 | $224 | |

| $84 | $180 |

| $95 | $191 |

| $59 | $146 |

| $78 | $154 | |

| $70 | $130 | |

| $57 | $168 | |

| $58 | $140 |

If you’re curious about cheap car insurance costs in Wilmington, you’ll find that Travelers and Nationwide have the cheapest minimum coverage at just $57 and $59 monthly. So act fast to get affordable auto insurance now.

Auto Insurance Coverage Requirements in Delaware

Like most states, Delaware requires liability coverage on all auto policies. Unlike most states, however, they also need Personal Injury Protection. This type of insurance covers “no-fault” accidents, especially if you incur medical expenses due to such an accident.

Wilmington, DE Auto Insurance Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $10,000 per accident |

The table above shows what you need to drive legally in Delaware. The average cost of car insurance in Delaware can reach as high as $132 per month for some motorists. However, in Wilmington, you can get a pretty good deal and reduce your rates to $121/mo* or lower if you know what discounts to look for.

Cheapest Auto Insurance Wilmington, Delaware

You may ask, “How much is car insurance in Delaware?” Various companies, including Progressive Insurance, offer car insurance in Wilmington, DE. However, Nationwide, State Farm, and Travelers offer the most competitive rates. These are essential questions when finding the best car insurance in Delaware based on low rates alone.

Wilmington, DE, auto insurance companies contemplate different factors when determining insurance premiums, including driving violations, accident claims, credit score/rating, years of driving experience, and multiple cars and drivers.

Wilmington, DE Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Drivers Rate | B+ | Relatively low compared to national average |

| Weather-Related Risk | B | Moderate impact, with seasonal challenges |

| Average Claim Size | B- | Slightly above the national average |

| Traffic Density | C+ | High congestion increases accident risk |

| Vehicle Theft Rate | C | Above-average theft incidents |

Also, remember that premiums differ among Wilmington, Delaware, car insurance companies. To determine whether you’re still paying the most favorable rate, use our comparison tool below to compare insurer quotes not just in Wilmington but for other areas for the cheapest Delaware auto insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Major Factors in Cheap Car Insurance in Wilmington, Delaware

There are numerous ways in which your car insurance rate might be estimated. But not all of it is out of your control; there are things you can do to influence which discounts you are eligible to acquire. Listed here are some of these factors in greater detail:

Your ZIP Code

Where you park your car each night will significantly impact your auto insurance rate. Your ZIP code is a huge factor, as the area can be much higher due to traffic, accident rates, and crime. ZIP code 19801 has some of the highest average Delaware car insurance costs.

Wilmington, DE Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 19801 | $194 |

| 19802 | $159 |

| 19805 | $148 |

| 19804 | $147 |

| 19806 | $147 |

| 19809 | $140 |

| 19810 | $139 |

| 19803 | $130 |

| 19807 | $119 |

| 19808 | $117 |

Generally, car insurance is cheaper in rural areas because fewer cars mean a smaller chance that you will get into a collision with another vehicle.

Automotive Accidents

If you live in a city where accidents occur frequently, your monthly insurance rates will likely be higher, requiring you to have high-risk coverage.

Wilmington, DE Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | ~1,700 |

| Claims per Year | ~2,500 |

| Average Claim Cost | $2,136 |

| Percentage of Uninsured Drivers | 10% |

| Vehicle Theft Rate | High |

| Traffic Density | Dense |

| Weather-Related Incidents | Moderate |

Luckily for Wilmington drivers, the accident rate is relatively low, even for a city with such a robust population. This can lead to some significant savings towards Wilmington’s car insurance costs.

Auto Thefts in Wilmington

Looking for Delaware’s cheap auto insurance can be difficult if you are at risk for auto theft. Popular vehicle models and vehicles parked often in large cities are attractive to thieves.

The total number of stolen vehicles in Wilmington was 371 back in 2013. This marks a substantial drop in theft from previous years.

Wilmington, DE Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $25 | $70 | |

| $22 | $65 | |

| $24 | $68 | |

| $20 | $60 |

| $26 | $72 |

| $23 | $66 |

| $21 | $64 | |

| $20 | $62 | |

| $24 | $67 | |

| $19 | $58 |

However, if you are still uncertain, you can add Comprehensive coverage to your policy to protect against theft. This way, you will always be covered. Make sure to check out the comparison tool below to compare Delaware car insurance quotes for comprehensive coverage.

Your Credit Score

High or low credit scores can seriously influence your monthly insurance payments. Good credit scores are rewarded with significantly lower Delaware car insurance rates.

Wilmington, DE Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $505 | $570 | $807 | |

| $400 | $450 | $600 | |

| $450 | $500 | $650 | |

| $224 | $327 | $500 |

| $350 | $400 | $550 |

| $280 | $350 | $500 |

| $300 | $375 | $525 | |

| $400 | $450 | $600 | |

| $350 | $425 | $575 | |

| $200 | $250 | $350 |

Poor credit scores, on the other hand, might pay double (or more) for their Wilmington car insurance costs compared to what you would pay with a better credit history. How your credit scores affect insurance premiums can surprise you with the difference it can make.

Your Age

Your automotive insurance gradually gets cheaper over time because your experience behind the wheel makes you less likely to get into an accident.

Wilmington, DE Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $450 | $475 | $160 | $170 | 140 | 150 | 120 | 125 | |

| $440 | $460 | $155 | $165 | 135 | 145 | 115 | 120 | |

| $470 | $495 | $170 | $180 | 150 | 160 | 130 | 135 | |

| $410 | $435 | $150 | $160 | 130 | 140 | 110 | 115 |

| $480 | $510 | $175 | $185 | 155 | 165 | 135 | 140 |

| $430 | $450 | $160 | $165 | 140 | 145 | 120 | 125 |

| $460 | $490 | $165 | $175 | 145 | 155 | 125 | 130 | |

| $420 | $440 | $150 | $160 | 135 | 140 | 115 | 120 | |

| 450 | 470 | 160 | 170 | 140 | 150 | 120 | 125 | |

| 400 | 425 | 145 | 155 | 125 | 135 | 105 | 110 |

However, younger drivers’ lack of experience puts them at a much higher risk. They must pay higher monthly premiums because they are so risky to insure. Therefore, looking for car insurance for teenagers or young adults requires more specialization from insurers who appreciate younger drivers.

Your Driving Record

Your driving record becomes a significant factor when searching for the cheapest auto insurance in Delaware. Accident Forgiveness is a new type of discount that more insurance providers are beginning to offer. It’s an extra safety net for your first offense or violation on the road.

Wilmington, DE Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $529 | $636 | $742 | $1,000 | |

| $500 | $600 | $700 | $900 | |

| $510 | $610 | $710 | $950 | |

| $450 | $550 | $650 | $850 |

| $480 | $580 | $680 | $900 |

| $470 | $570 | $670 | $880 |

| $460 | $560 | $660 | $870 | |

| $490 | $590 | $690 | $900 | |

| $480 | $580 | $680 | $900 | |

| $440 | $540 | $640 | $850 |

It lets you virtually erase a minor traffic citation from your record, lowering your monthly premium. However, it is unlikely to work for more severe violations, such as DUI or reckless driving.

Your Vehicle

Most people don’t realize luxury car insurance costs more than the vehicle. This is because you must purchase numerous types of coverage (and in higher amounts) to protect your investment, which raises the price tag, as the chart shows.

Wilmington, DE Auto Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 2024 BMW 3 Series | $120 | $180 |

| 2024 Chevrolet Silverado | $110 | $170 |

| 2024 Ford F-150 | $105 | $165 |

| 2024 Honda Accord | $95 | $150 |

| 2024 Hyundai Elantra | $90 | $140 |

| 2024 Jeep Grand Cherokee | $115 | $175 |

| 2024 Mercedes-Benz C-Class | $125 | $185 |

| 2024 Nissan Altima | $93 | $145 |

| 2024 Subaru Outback | $100 | $150 |

| 2024 Toyota Camry | $92 | $142 |

A Porsche Spyder and a Honda Accord can be the difference between breaking the bank. You need to be able to afford the car’s running costs and the insurance. Then, there’s the advent of autonomous vehicles, which will change people’s driving habits and insurance prices.

Minor Factors in Cheap Auto Insurance in Wilmington, Delaware

You might want to be mindful of the following factors and how they influence your rate:

Your Marital Status

Married couples can get all sorts of discounts – if they know how to bundle their insurance policies. The most obvious choice is to bundle your and your spouse’s auto policies under the same company. Newlyweds also have discounts that can save 5% from some insurers.

There are a lot of factors that affect your car insurance, especially in a high insurance area such as Wilmington. Talk to your insurance provider to get yourself the best deal possible.

Heidi Mertlich Licensed Insurance Agent

If the company offers other insurance, such as boating, homeowners, or life insurance, you can bundle those for further discounts.

Your Driving Distance to Work

The average commute time for a worker in Wilmington is 17-29 minutes. Of those workers, 60% drive to work in their vehicle; 17% prefer to carpool. If you can help, avoid registering your car as a business vehicle.

Those vehicles are charged 10-12% higher rates than those driven for work, school, or recreation, so you may need to consider comprehensive or collision coverage for what you need. Also, yearly mileage is a reasonably negligible factor—whether you drive above or below the national average, you may only see a 2-3% fluctuation in your rate.

Your Coverage and Deductibles

Do you think you are unlikely to file a claim soon? Then, talk to one of your Wilmington, DE auto insurance agents about raising your deductible.

Auto Insurance Discounts From the Top Providers in Wilmington, DE

| Insurance Company | Available Discounts |

|---|---|

| Bundling, Safe Driver, New Car, Good Student | |

| Bundling, Safe Driver, Good Student, Smart Home | |

| Bundling, Good Student, Groups, Homeowner | |

| Bundling, Good Driver, Military, Federal Employee |

| Bundling, New Car, Homeowner, Military |

| Bundling, Safe Driver, Family Plan, SmartRide |

| Bundling, Continuous Insurance, Snapshot, Homeowner | |

| Bundling, Safety, Defensive Driving, Student | |

| Bundling, Hybrid/Electric, Early Quote, Student Away | |

| Bundling, Military, Vehicle Safety, Good Student | |

It’s a great way to lower your monthly premium and save money. But put a little extra aside—just in case you have to file a claim. Numerous car insurance discounts that can apply to Wilmington can stack together to lower your monthly premiums further.

Education in Wilmington, DE

Most drivers in Wilmington have earned a high school diploma or some other equivalent. A smaller fraction of motorists have yet to complete their high school education. But did you know that pursuing a higher education can save you money on car insurance? It’s a more lucrative discount than you might get from a specific job or even a high-paying salary.

Wilmington has several young universities within driving distance of its residents. More than five of them, including satellite versions of Drexel University and Delaware State University, are less than 25 years old. If you are interested in a legal career, you might want to look into the Delaware Law School.

Unfortunately, for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be difficult for you as an individual to figure out your risk profile and find cheap auto insurance in Delaware. If you need tips as a student, we have car insurance for students savings guide available at your fingertips.

The First State’s Bustling City Needs Great Car Insurance

With the best Wilmington, DE auto insurance list finished, what information can you take away? First is State Farm, which is best on the list for customer satisfaction. Second, whatever insurer you choose, ensure it offers the right vehicle insurance with its available policies.

Third, the cheapest Delaware car insurance doesn’t mean it’s the best. Lower coverage will not save you in a major accident; consider full coverage. Lastly, enter your ZIP code below into our comparison tool to help you find cheap car insurance in Delaware. Use every tool available to you to get the right insurance for your car.

Frequently Asked Questions

What are Delaware’s minimum auto insurance requirements?

In Delaware, the minimum auto insurance coverage required by law is slightly different than most states, as it includes an extra requirement for personal injury. The complete requirements include:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection (PIP): $15,000 per person and $30,000 per accident for bodily injury

However, many drivers in Wilmington opt for higher coverage levels to provide better financial protection in the event of an accident.

How much does auto insurance cost in Wilmington, Delaware?

Auto insurance rates in Wilmington are generally higher than the national average due to several factors, including the higher population density, risk of accidents, and crime rates in certain areas. On average, Wilmington drivers might pay between $130 and $215 monthly for full coverage, although rates vary based on driving history, coverage limits, and vehicle type.

What factors impact car insurance rates in Wilmington?

Many factors, such as your insurance premiums in Wilmington, affect your driving record. Being involved in accidents or violations will increase your rates. The type of vehicle you drive will also change your rates; the bigger or more luxurious the car, the higher your rates. Your credit score in Delaware is also considered, which can impact premiums.

The different coverage levels are also a factor; opting for minimum coverage will cost less than full coverage. Finally, your age and experience are also factors, as younger or new drivers typically pay more.

Can I get discounts on car insurance in Wilmington?

Yes, most insurers offer discounts that Wilmington drivers can qualify for, such as safe driver discounts, multi-policy discounts, good student discounts, low-mileage discounts, and vehicle safety discounts. Discounts and their eligibility vary by provider, so it’s worth comparing quotes with our comparison tool below to find cheap auto insurance in Delaware.

Is Wilmington, DE, considered a high-risk area for auto insurance?

Wilmington has some high-risk areas due to traffic density and accident rates, which can increase premiums. Insurers consider ZIP codes with higher claims rates or incidents of theft and vandalism. However, you can mitigate costs with safe driving, discounts, or usage-based insurance programs.

What is usage-based insurance, and is it available in Wilmington?

Usage-based insurance (UBI) programs use telematics to monitor driving habits and reward safe drivers with discounts. Major insurers offer UBI options in Wilmington, including Progressive’s Snapshot (read more in our Snapshot Program review) and Geico’s DriveEasy. This can be ideal if you’re a safe driver or don’t drive frequently, as it could lower your premiums.

What happens if I’m driving without insurance in Delaware?

Driving without insurance in Delaware is illegal and carries severe penalties if you’re caught, including:

- Fines ranging from $1,500 for a first offense to $3,000 for subsequent offenses

- Potential license suspension

- Fees for reinstatement and proof of insurance are required before driving privileges are restored.

Repeated violations can lead to more severe penalties, so it’s essential to maintain at least the state minimum insurance.

Do I need coverage for uninsured/underinsured motorists in Delaware?

Delaware doesn’t require coverage for uninsured/underinsured motorists (UM/UIM). Still, it’s recommended, as it protects you if an at-fault driver doesn’t have enough insurance to cover damages. Wilmington’s accident rate means UM/UIM can be beneficial for financial protection in case of serious accidents.

Can I switch car insurance providers without penalty?

Yes, you can switch providers in Delaware at any time. Be sure to have new coverage before canceling your current policy to avoid a lapse in insurance. Some insurers charge cancellation fees, so check with your current provider to understand any applicable fees.

How can I reduce my auto insurance premiums in Wilmington?

There are many strategies to lower premiums; some are short-term, and others are more long-term based on your financials or the type of vehicle you’re driving; examples include:

- Improving Your Credit Score: Better credit can lead to lower rates.

- Increasing Your Deductible: Higher deductibles can lower monthly premiums, but only choose this if you can afford it in an accident.

- Reducing Coverage on Older Cars: Consider liability-only or dropping comprehensive and collision for older vehicles.

- Using Usage-Based Insurance: Programs like Snapshot or Signal can offer discounts for safe driving.

So, always take the opportunity to see what you can do to reduce your premiums, as extra savings can be used elsewhere to pay for what you need.