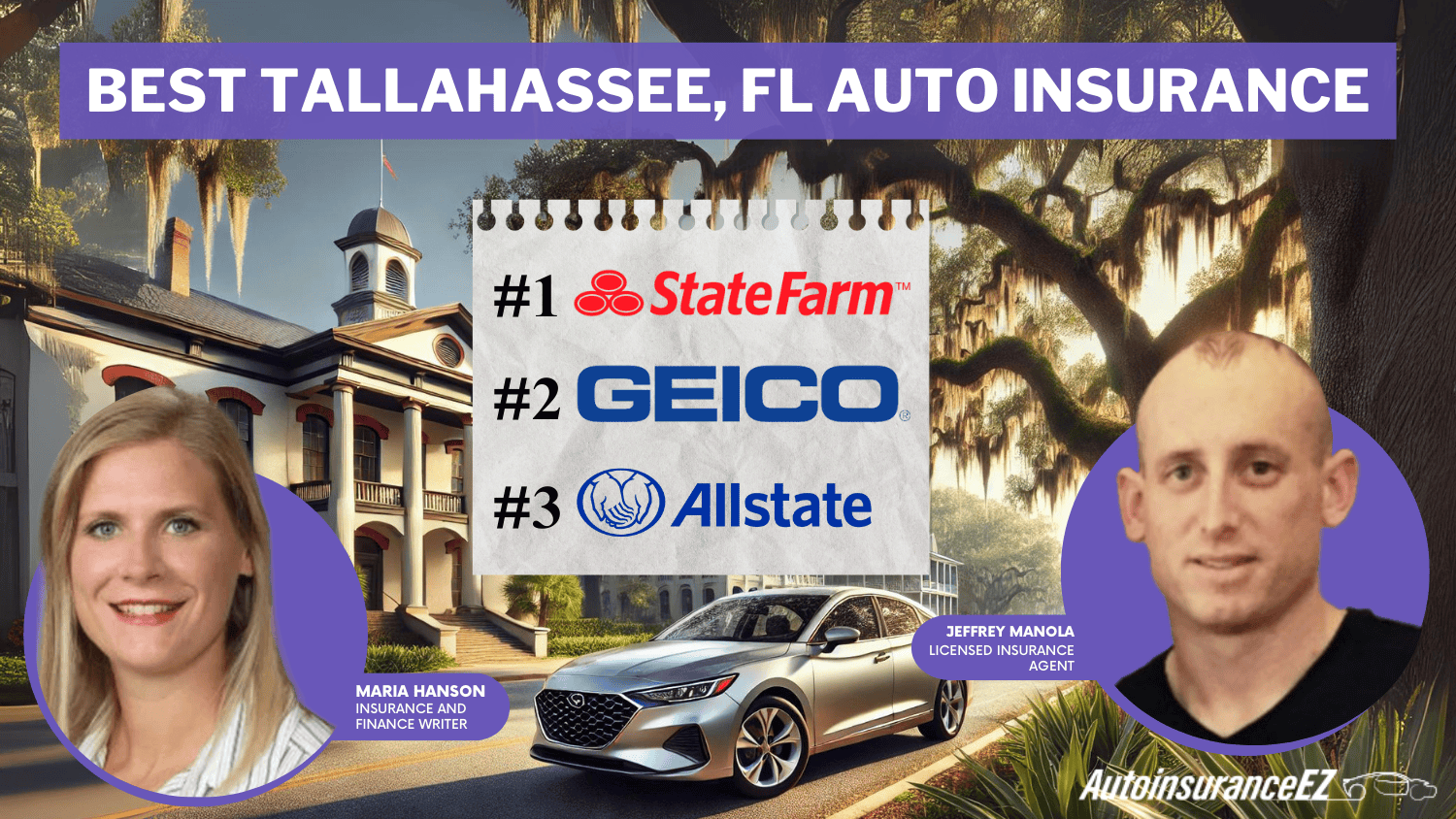

Best Tallahassee, FL Auto Insurance in 2025 (Check Out the Top 10 Companies)

State Farm, Geico, and Allstate have the best Tallahassee, FL auto insurance companies offering rates for as low as $80 monthly. Ranked among the top agencies, they provide reliable customer service, competitive quotes, and flexible coverage that suits various drivers' necessities in Tallahassee, Florida.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Company Facts

Full Coverage in Tallahassee FL

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Tallahassee FL

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Tallahassee FL

A.M. Best

Complaint Level

Pros & Cons

The best Tallahassee, FL auto insurance providers are State Farm, Geico, and Allstate offering high-quality protection and customer support with rates for as low as $80 per month.

Read more below to get ideas on how to find and compare cheap auto insurance companies from our top providers. Consider simple criteria such as coverage provided, customer service, and general affordability among car insurance providers.

Our Top 10 Company Picks: Best Tallahassee, FL Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Local Agents State Farm

#2 25% A++ Affordable Rates Geico

#3 10% A+ Drivewise Program Allstate

#4 10% A+ Flexible Plans Progressive

#5 10% A++ Military Benefits USAA

#6 20% A+ Customizable Coverage Nationwide

#7 13% A++ Safe Driver Travelers

#8 10% A High-Risk Drivers The General

#9 12% A New Car Liberty Mutual

#10 15% A Bundling Discounts Safeco

Understand rate comparisons and find an auto insurance provider that works for you. Enter your ZIP code now.

- There are best choices for optimal auto insurance in Tallahassee, FL

- State Farm provides premium coverage starting around $80 per month

- Receive competitive pricing from leading providers dedicated to local support

#1 – State Farm: Top Overall Pick

Pros

- Exceptional Customer Service: As one of the providers of the best Tallahassee, FL auto insurance, State Farm is praised for its responsive and helpful support team.

- Comprehensive Coverage Options: Known for offering best Florida auto insurance plans, State Farm provides various coverage choices that suit diverse driver needs.

- Efficient Claims Process: Claims process is highly rated, making it a trusted choice for best Florida auto insurance. Read more in our article titled ” State Farm Auto Insurance Review.”

Cons

- Higher Rates for High-Risk Drivers: While considered among the best Tallahassee, FL auto insurance providers, State Farm has higher premiums for high-risk drivers.

- Limited Discount Programs: Despite being a top choice for the best Florida auto insurance, State Farm offers fewer discounts than some competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Low Base Rates: Known for providing affordable rates, Geico is one of the best Florida auto insurance providers with competitive pricing.

- User-Friendly Mobile App: Geico’s easy-to-use app enhances its appeal as one of the best Tallahassee, FL auto insurance providers, allowing quick policy access and claims management.

- Extensive Discount Options: As part of the best Tallahassee, FL auto insurance providers, Geico offers numerous discounts, including multi-policy and safe driver discounts.

Cons

- Limited In-Person Service: While Geico is a best Florida auto insurance provider, it has fewer options for local, in-person assistance. For details, see our “Geico Auto Insurance Review.”

- Higher Rates for Young Drivers: Despite being known for best Tallahassee, FL auto insurance rates, Geico tends to have higher premiums for younger drivers.

#3 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: As a best Tallahassee, FL auto insurance provider, Allstate rewards safe driving through its Drivewise program, offering additional savings for safe behavior.

- Bundling Discounts: Allstate, known for best Tallahassee, FL auto insurance, provides significant savings when bundling auto, home, and other insurance products.

- Specialty Coverage Options: A best Tallahassee, FL auto insurance provider, Allstate offers unique options like gap insurance and accident forgiveness for extra protection.

Cons

- Higher Premiums: Although considered among the best auto insurance provider, Allstate tends to have higher rates compared others. Read “Allstate Auto Insurance Review” for details.

- Drivewise App Limitations: The Drivewise program may be a drawback for those who prefer not to track driving behavior, despite Allstate’s reputation for best Florida auto insurance.

#4 – Progressive: Best for Flexible Plans

Pros

- Flexible Policy Options: Progressive, one of the best Florida auto insurance providers, offers coverage for your needs. Explore details in our “Progressive Auto Insurance Review.”

- Snapshot Program: As a best Tallahassee, FL auto insurance provider, Progressive’s Snapshot program allows safe drivers to earn discounts based on driving habits.

- Affordable High-Risk Coverage: Progressive stands out among the best Florida auto insurance options for offering competitive rates for high-risk drivers.

Cons

- Customer Service Variability: Although a best Tallahassee, FL auto insurance provider, customer service reviews can vary widely depending on the location.

- Limited Local Agents: Progressive, while known for best Tallahassee, FL auto insurance, has fewer in-person agents available compared to some competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Benefits

Pros

- Military-Specific Benefits: As a best Florida auto insurance provider, USAA offers specialized coverage and discounts exclusively for military families.

- High Customer Satisfaction: USAA, known for best Tallahassee, FL auto insurance, consistently ranks high in customer satisfaction due to its dedicated service.

- Comprehensive Bundling Options: Known for best Tallahassee, FL auto insurance, USAA offers substantial savings on bundled policies for auto, home, and life insurance.

Cons

- Eligibility Restrictions: Despite being a top choice for best Florida auto insurance, only military families are eligible for services. Read more through our USAA auto insurance review.

- Limited Physical Branches: Although known for best Tallahassee, FL auto insurance, USAA has limited local branches, making in-person service less accessible.

#6 – Nationwide: Best for Customizable Coverage

Pros

- Customizable Coverage: Known as a best Tallahassee, FL auto insurance provider, Nationwide allows drivers to personalize their policies to meet specific needs.

- Vanishing Deductible: This best Florida auto insurance company rewards safe drivers by reducing deductibles over time. Gain deeper insights by exploring our “Nationwide Review“

- Strong Online and Mobile Tools: Nationwide offers robust digital tools, making it a top choice among best Tallahassee, FL auto insurance providers.

Cons

- Higher Average Premiums: Despite being a best Tallahassee, FL auto insurance option, Nationwide often has higher-than-average premiums.

- Discount Limitations: Nationwide, a best Tallahassee, FL auto insurance provider, has fewer discount options compared to some other major providers.

#7 – Travelers: Best for Safe Driver

Pros

- Safe Driver Discount: Known as a best Tallahassee, FL auto insurance company, Travelers rewards safe driving habits with significant discounts.

- Flexible Payment Options: Travelers, one of the best Florida auto insurance providers, offers multiple options to help with budgeting. Read through our Travelers auto insurance review.

- Robust Customer Support: As a best Tallahassee, FL auto insurance provider, Travelers is known for providing dependable customer service and support.

Cons

- Limited Availability of Local Agents: Despite being a best Florida auto insurance provider, Travelers has fewer local agents, which may limit in-person assistance.

- Higher Rates for Young Drivers: Travelers, while a best Tallahassee, FL auto insurance option, often charges higher rates for young or new drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – The General: Best for High-Risk Drivers

Pros

- High-Risk Driver Friendly: Known as one of the best Tallahassee, FL auto insurance providers, The General specializes in affordable coverage for high-risk drivers.

- Quick Online Quotes: The General, a best Florida auto insurance company, offers fast online quotes for added convenience. Read through our The General auto insurance review.

- Flexible Payment Plans: This best Tallahassee, FL auto insurance provider provides various payment options to meet different financial situations.

Cons

- Basic Coverage Options Only: As a best Tallahassee, FL auto insurance provider, The General mainly offers minimal coverage options without extensive add-ons.

- Higher Premiums for Standard Drivers: The General, while known for best Florida auto insurance, can have higher premiums for those without a high-risk profile.

#9 – Liberty Mutual: Best for New Car

Pros

- New Car Replacement Coverage: Liberty Mutual, a best Tallahassee, FL auto insurance provider, offers new car replacement options for extra peace of mind.

- Strong Bundle Discounts: Known for best auto insurance, it provides discounts when bundling with other types of insurance. Explore details in our “Liberty Mutual Auto Insurance Review.

- Lifetime Repair Guarantee: Liberty Mutual stands out among best Tallahassee, FL auto insurance providers by offering a lifetime repair guarantee at approved repair shops.

Cons

- Higher Premiums for Younger Drivers: While considered among the best Florida auto insurance options, Liberty Mutual tends to be pricier for younger drivers.

- Mixed Customer Service Reviews: Despite being a best Florida auto insurance provider, Liberty Mutual has mixed reviews regarding customer support.

#10 – Safeco: Best for Bundling Discounts

Pros

- Bundling Discounts: Safeco, a best Florida auto insurance provider, offers generous discounts when bundling auto with other policies like home or renters insurance.

- Accident Forgiveness: As one of the best Florida auto insurance companies, Safeco’s accident forgiveness can help keep rates stable after a first accident.

- Comprehensive Coverage Options: Safeco provides a wide range of coverage options, making it a versatile best Tallahassee, FL auto insurance provider.

Cons

- Fewer Online Tools: Safeco, while a best insurance provider, offers limited digital tools compared to other major providers. Read details through our Safeco auto insurance review.

- Limited Availability for Discounts: Although Safeco is a best Tallahassee, FL auto insurance company, it has fewer discounts than some competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tallahassee, FL Auto Insurance Coverage Options

Bear in mind that various kinds of automobiles will need different types of auto insurance coverage. If you’re driving a mature, used vehicle, you may be fine with only the state-required mandatory minimums.

Tallahassee, FL Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$120 $245

$95 $190

$130 $275

$105 $230

$110 $220

$112 $235

$100 $210

$125 $260

$115 $240

$80 $180

However, a luxury vehicle, for example, will need more comprehensive coverage, such as collision and comprehensive insurance, to adequately protect its value and ensure you’re covered for various risks.

Auto Insurance Discounts From the Top Providers in Tallahassee, FL

Insurance Company Available Discounts

Bundling, Safe Driver, Anti-theft Device, New Car, Full Payment, Automatic Payments, Paperless Statements

Bundling, Safe Driver, Good Student, Military, Federal Employee, Emergency Deployment, Anti-theft Device, Defensive Driving

Bundling, Military, New Vehicle, Online Purchase, Hybrid Vehicle, Anti-theft, Early Shopper

Bundling, Defensive Driving, Good Student, Accident-free, Anti-theft, Automatic Payments, Paperless Billing

Bundling, Safe Driver, Good Student, Continuous Insurance, Paperless, Pay in Full, Snapshot (usage-based), Homeowner

Bundling, Safe Driver, Anti-theft, Good Student, Homeowner, Accident Prevention, Pay in Full

Bundling, Safe Driver, Good Student, Accident-free, Anti-theft, Defensive Driving, Multiple Vehicles, Good Driving History

Multi-Vehicle, Full Payment, Continuous Coverage, Good Student, Defensive Driving, Homeowner, Military, Paperless Billing, Senior Driver, Anti-theft

Bundling, Safe Driver, Good Student, Hybrid Vehicle, Continuous Coverage, Automatic Payments, New Car, Homeowner

Bundling, Good Driver, Good Student, Military, Defensive Driving, Automatic Payments, New Vehicle, Length of Membership, Storage Vehicle

Even your average-listed sedan, whether it’s new or a few years old, will require better quality coverage. Most Florida motorists are spending about $153 every month, typically, for his or her automotive insurance plan.

But if you reside in Tallahassee, you will not need to pay such high costs. You are able to get really good coverage for less than $57/mo. Enter your ZIP code now.

Looking for Cheapest Tallahassee, FL Car Insurance

There are a number of cheap auto insurance companies in Tallahassee, Florida who offer rates, including Progressive Insurance Tallahassee, State Farm Tallahassee, and more.

Between Liberty Mutual, Amica, and Allstate, you might have trouble locating affordable Tallahassee, FL auto insurance. But don’t forget: low cost auto insurance in Tallahassee, Florida isn’t everything.

Yes, the savings is great, but what if their customer support stinks? Or let’s say their claims process is tough and time-intensive? They are essential things to research before you decide to switch providers.

Tallahassee, FL Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Discounts Available | A | Multiple discounts offered for safe driving and bundling. |

| Coverage Options | A | Broad range of coverage options to meet various needs. |

| Affordability | B+ | Rates are moderately priced compared to other Florida cities. |

| Customer Service | B | Generally good feedback, with some room for improvement. |

| Claims Process | B- | Processing times vary; can be slow during peak periods. |

However, there are still plenty of ways you can save on Tallahassee, Florida car insurance! Just keep reading.

Those who supply vehicle insurance policies evaluate many variables while figuring out Tallahassee, FL auto insurance rates, particularly driving experience, ZIP code, type of vehicle owned, driving distance to work, and current insurance coverage and limits.

Tallahassee, FL Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Crawfordville | $500 | 400 |

| Havana | $200 | 150 |

| Monticello | $300 | 250 |

| Quincy | $750 | 600 |

| Tallahassee | $1,100 | 850 |

Also remember that affordable car insurance in Tallahassee, Florida will differ from business to business.

To find out if you are still being charged the lowest-cost premium, check cheap Tallahassee, FL auto insurance quotes via the internet. Enter your ZIP code now to begin comparing.

Factors Affecting Cheap Auto Insurance in Tallahassee, Florida

And here are ways you can save, if any of these factors are under your control:

Your Marital Status

If you and your partner aren’t bundled to the same auto policy, you may be flushing money to waste. Insurance providers like to drum up business by providing couples the chance to bundle their guidelines together.

Your Gender

Based on most insurance providers, males are not from Mars and ladies aren’t from Venus with regards to car insurance rates.

Since there is no hard record data to demonstrate that either gender may be the superior driver, a lot of companies have eliminated the concept of charging women and men different premiums.

Your Driving Distance to Work

Commuting through Tallahassee is easier than you might think. Even though more than 2/3rds of drivers depend on their own vehicle for commuting alone, almost 15% will probably carpool.

This means that average commute times usually only last between 15 and 20 minutes, with some as short as 10 minutes.

Your Coverage and Deductibles

If you think you are having to pay an excessive amount of for the payments, ask the local agent about raising your deductible. It’s a terrific way to decrease your costs while still maintaining good coverage.

Just make certain that you could manage to spend the money for greater deductible should you have to file claims.

Education in Tallahassee, FL

The lower rates in Tallahassee might be related to its education level (since the higher your education, the lower your insurance rates will be). More than one quarter of residents have at least a bachelor’s degree, which is almost double the state average.

Just below that are the number of high school graduates, which make up almost 17% of the population.

In summary, factors like bundling policies, adjusting coverage, and your education level can help lower your auto insurance costs in Tallahassee.Jeff Root Licensed Insurance Agent

Additionally, car insurance discounts, such as those for safe driving or multiple vehicles, can further reduce your premiums. By reviewing these aspects, you can find ways to save and ensure you’re getting the best rate for your needs. Enter your ZIP code now.

Frequently Asked Questions

What factors should I consider when choosing the best Tallahassee, FL auto insurance provider?

Key factors include coverage options, customer service, affordability, and available discounts.

How does State Farm compare to other providers for the best Tallahassee, FL auto insurance rates?

State Farm is known for its reliable customer service and competitive rates starting at $80 per month. Enter your ZIP code now to begin comparing rates.

What discounts does Geico offer that make it one of the best Tallahassee, FL auto insurance options?

How can Allstate’s Drivewise program benefit safe drivers in Tallahassee, FL?

Allstate’s Drivewise program rewards safe driving habits with potential premium reductions.

Why is Progressive a good choice for high-risk drivers in Tallahassee looking for auto insurance?

Progressive is well-regarded for providing affordable rates to high-risk drivers in Tallahassee. Enter your ZIP code now to begin comparing rates.

What unique benefits does USAA provide for military families seeking the best Tallahassee, FL auto insurance?

USAA offers exclusive benefits and discounts for military families, making it a top choice for them. Additionally, they provide options for car insurance after a DUI, understanding the unique needs of service members who may face this situation.

Their specialized support can help navigate the challenges of securing affordable coverage following a DUI, offering competitive rates and personalized guidance.

How does Nationwide’s customizable coverage make it one of the best Tallahassee, FL auto insurance providers?

Nationwide’s flexible coverage options allow drivers to customize policies to meet individual needs.

What options does Travelers offer for safe driver discounts on auto insurance in Tallahassee, FL?

Travelers offers discounts for safe drivers, helping them save on auto insurance premiums. Enter your ZIP code now to begin comparing rates.

Why is The General considered a top choice for high-risk drivers in Tallahassee, FL?

The General specializes in affordable coverage for high-risk drivers needing Tallahassee auto insurance, offering cheap auto insurance rates designed to fit within a tight budget while still providing reliable protection.

How can Liberty Mutual’s new car replacement coverage help drivers in Tallahassee find the best auto insurance?

Liberty Mutual’s new car replacement coverage helps protect drivers’ investments in newer vehicles.