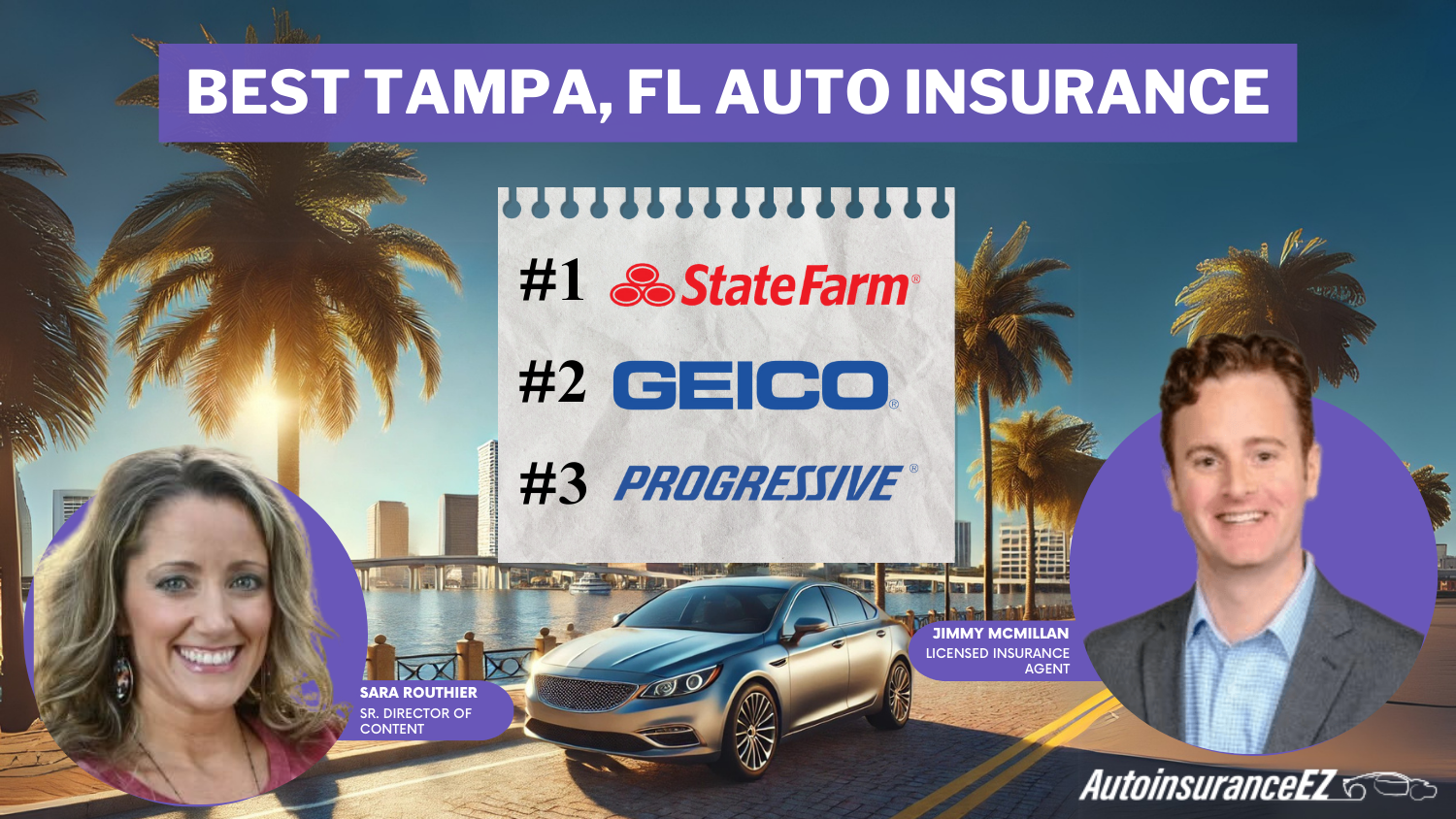

Best Tampa, FL Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Geico, and Progressive offer the best Tampa, FL auto insurance with rates starting as low as $65 per month. These companies lead in affordability, coverage options, and customer satisfaction, making them the top choices for the best Tampa, FL auto insurance and cheap car insurance in Tampa, FL.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jan 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full coverage in Tampa FL

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Tampa FL

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Tampa FL

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive are the best Tampa, FL auto insurance providers. They offer the most affordable rates and comprehensive collision coverage options.

Our Top 10 Company Picks: Best Tampa, FL Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agents | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 12% | A+ | Snapshot Program | Progressive | |

| #4 | 25% | A+ | Drivewise Rewards | Allstate | |

| #5 | 20% | A+ | Roadside Assistance | AAA |

| #6 | 10% | A++ | Customizable Options | Travelers | |

| #7 | 10% | A++ | Military Discounts | USAA | |

| #8 | 15% | A | Comprehensive Coverage | Liberty Mutual |

| #9 | 20% | A | Strong Local Support | Farmers | |

| #10 | 15% | A+ | Senior Benefits | The Hartford |

Curious if another provider offers better rates? Entering your ZIP code into our free comparison tool for the best Tampa, FL auto insurance options.

- State Farm, Geico, and Progressive offer the best Tampa auto insurance

- State Farm is the top pick for auto insurance in Tampa, with great rates

- Monthly rates start as low as $65 with top providers

#1– State Farm: Top Pick Overall

Pros

- Agents Locals: Tampa has a huge network of agents, and personalized service and support match the area’s auto insurance requirements.

- Bundle Discount: A State Farm auto insurance review offers a 17% bundle discount to save money for the top coverages for drivers.

- Reliability of Coverage: It is stable and consistent, always at the top of the auto insurance list.

Cons

- Average Financial Strength: Policyholders might be concerned about their financial strength, which A.M. Best scored at “B.”

- Limited Online Tools: Online management tools are not as broad as competing firms and may be a nuisance for insurance users.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2– Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico has the cheapest rates among the top auto insurance providers.

- Excellent Financial Strength: Geico’s strong financial stability ensures reliable coverage. Check out a Geico auto insurance review to see how this plays out in practice.

- Bundling Discount: A great reason to bundle home and auto policies is the generous 25% discount.

Cons

- Limited Local Agents: Fewer local agents mean customer support is mainly through call centers and online for most clients.

- : Geico offers fewer add-ons and special coverage options than other providers.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: This policy offers use-based discounts to good drivers, making it ideal for auto insurance buyers.

- Superb Financial Strength: With an A+ rating from A.M. Best, it provides sound financial security and helps with claims.

- Flexible Coverage Options:< The company provides many coverage options that enable the policyholder to change their policy as necessary.

Cons

- Limited Local Agent Support: This is primarily an online provider with a limited in-person office in Tampa, Florida. Here’s a Progressive car insurance review to see if it fits your needs.

- Less Bundling Discount: This only provides a 12% discount for bundling, less than most competitors in the most reasonably priced Tampa, Florida, insurance market.

#4– Allstate: Best for Drivewise Rewards

Pros

- Drivewise Rewards Program: An exclusive offer that rewards safe drivers to boast good driving habits for better auto insurance rates.

- Strong Financial Rating: Our A+ rating from A.M. Best signifies financial reliability and a robust claims process, ensuring your peace of mind.

- Generous Bundling Discount: Our 25% discount makes it a perfect choice for insurance seekers.

Cons

- Premiums: Allstate Auto Insurance has higher premiums than other top providers. Read the Allstate auto insurance review for more.

- Mixed Customer Reviews: Some customers complain about the company’s lack of claims handling and customer services

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Known for its excellent roadside assistance, an added comfort for auto insurance customers.

- High Financial Strength: A+ rating from A.M. Best guarantees a robust financial base for policyholders.

- Competitive Bundling Discount: AAA auto insurance review provides a 20% discount for bundling, which is attractive to those seeking competitive auto insurance.

Cons

- Non-Availability of AAA Insurance Products: Not every state is covered by all AAA insurance products so that some insurance choices might be limited.

- Membership Requirement: AAA membership is required, which means residents who are not AAA members will pay an additional cost.

#6 – Travelers: Best for Customizable Options

Pros

- Options: The Traveler’s auto insurance review has flexible coverage options that meet your needs.

- High Financial Rating: The A++ rating from A.M. Best ensures stability and good claims support for policyholders.

- Bundling Discount: This program offers a 10% discount to those who bundle policies with auto insurance.

Cons

- Limited Physical Locations: Fewer offices may mean inadequate insurance service for customers requiring considerable in-person dealings to check on insurance-related documents.

- More Expensive for Youngsters: Higher prices for younger drivers than other companies.

#7 – USAA: Best for Military Discounts

Pros

- Military Discounts: Special discounts specifically for the military, making it perfect for Tampa’s military households.

- Exceptional Financial Rating: A++ rating from A.M. Best, with proven good financial health and security.

- Competitive Premiums: Provides very reasonable pricing, making it a competitive option for auto insurance schemes.

Cons

- Eligibility Restrictions: USAA auto insurance review is only granted to military members and their families in Tampa, Florida, with limited branch offices.

- Limited Local Offices: These are mostly online-based, with fewer local offices where someone can visit.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Extensive Customization Choices: Many choices are available for insurance buyers to tailor.

- Bundle Discount: Allows a 15% discount with bundles, meaning more bang for the buck for policyholders.

- Strong Credit Rating: A.M. Best has assigned the company an “A” rating, which means sound financial support.

Cons

- More Expensive: Liberty Mutual auto insurance premiums are higher than some competitors. Read more on this Liberty Mutual auto insurance review for more details.

- Variable Customer Service: Customer service has mixed reviews, with some policyholders noting longer-than-usual processing times for claims.

#9 – Farmers: Best for Strong Local Support

Pros

- High Local Agent Density: Known for thousands of agents delivering personal service to their insurance customers.

- 20% Bundling Discount: This discount package gives policyholders the highest discount rates over multiple policies for the most inexpensive value.

- Financial Rating:> It has an “A” rating from A.M. Best and excellent financial stability, providing policyholders with adequate financial security.

Cons

- Average Online Tools: Fewer online management tools can be found among tech-savvy competitors who dominate the Tampa, Florida, insurance market.

- Taller Premiums for Young Drivers: According to the review done about Farmer auto insurance review, there are taller premiums for younger Tampa drivers. That alone makes it less attractive to become one of its clients in terms of cost

#10 – The Hartford: Best for Senior Benefits

Pros

- Senior Benefits: The Special Discounts and Benefits designed for senior drivers make it a favorite among older customers.

- Excellent Financial Rating: A.M. Best awarded it an A+ rating, which tests its reliability in providing high-claims support to its customers.

- Bundle Savings: Offers 15% savings and builds value for customers.

Cons

- Restricted Eligibility: This service is mainly available to AARP members, which may limit access for non-seniors.

- Higher Rates: The Hartford premiums are higher, especially for younger drivers. The Hartford company auto insurance review explains if it’s worth the cost.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How to Save on Tampa Auto Insurance Premiums

Many Tampa drivers seek ways to save on auto insurance while maintaining strong coverage. Discounts, such as the safe driver discount, bundling policies, or having specific safety features in your vehicle, are often available.

Tampa, FL Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $84 | $205 |

| $85 | $210 | |

| $88 | $215 | |

| $70 | $180 | |

| $90 | $220 |

| $75 | $190 | |

| $80 | $200 | |

| $82 | $202 |

| $78 | $195 | |

| $65 | $170 |

By shopping for quotes, keeping a clean driving record, and adjusting your coverage, you can lower your premiums while ensuring you get the best protection.

Tampa, FL Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risk | B | High risk of hurricanes and flooding, but coverage options mitigate some impact |

| Average Claim Size | B | Moderate claim amounts compared to other Florida cities |

| Traffic Density | C | Congested city roads lead to frequent minor accidents and increased claims |

| Vehicle Theft Rate | C | Above-average vehicle theft rate due to urban environment |

| Uninsured Drivers Rate | D | High percentage of uninsured drivers increases risks for insured motorists |

These strategies are especially useful for finding affordable auto insurance in Tampa, FL, or Tampa, Florida.

Comprehensive Coverage for Drivers in Tampa

Auto Insurance Discounts From the Top Providers in Tampa, FL

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Senior, Low Mileage |

| Multi-Policy, Safe Driving, Early Signing, Responsible Payer, Student | |

| Multi-Policy, Safe Driver, Good Student, Homeowner, Alternative Fuel Vehicle | |

| Multi-Policy, Safe Driver, Military, Good Student, Federal Employee | |

| Multi-Policy, Safe Driving, Good Student, Homeownership, Vehicle Safety Features |

| Multi-Policy, Continuous Coverage, Good Student, Online Quote, Paperless Documents | |

| Multi-Policy, Safe Driving, Good Student, Vehicle Safety Features, Bundling | |

| Multi-Policy, Safe Driver, Good Student, Homeownership, New Car |

| Multi-Policy, Safe Driving, Good Student, Early Signing, Vehicle Safety Features | |

| Multi-Policy, Safe Driver, Military Affiliation, Good Student, Low Mileage |

If you’re in the market for car insurance in Tampa, FL, it’s crucial to understand how past accidents can affect your rates. Exploring cheap auto insurance companies in Tampa, Florida, might help mitigate some of the increases, but comparing different providers is essential to finding the best deal after an accident.

Key Factors to Consider for Auto Insurance in Tampa

When searching for Affordable car insurance in Tampa, evaluating elements like coverage options, premiums, and customer service is crucial. Residents of Tampa should also consider local driving conditions, weather risks, and their driving history to find the best plan.

Llc insurance in florida (Tampa Bay Area)

byu/Slappy_farts insmallbusiness

Since Tampa faces frequent weather challenges, including the risks mentioned in the states with the worst weather-related fatal crashes, understanding these factors is vital to selecting the right policy.

This will help you make a well-informed decision and secure Affordable car insurance in Tampa, FL, or Affordable insurance in Tampa, FL, that fits your needs and budget.

When searching for the best auto insurance in Tampa, FL, customer satisfaction should be a key factor in your decision-making process. Research providers’ reputations by reviewing reviews and ratings, particularly in customer service, claims handling, and responsiveness.

Tampa, FL Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | 12,500 |

| Claims Per Year | 10,200 |

| Average Claim Cost | $3,800 |

| Percentage of Uninsured Drivers | 20% |

| Vehicle Theft Rate | 8.2 per 1,000 vehicles |

| Traffic Density | High |

| Weather-Related Incidents | Frequent (hurricanes, storms) |

A company that excels in these areas will make a huge difference when you experience car accidents and auto claims, ensuring a smooth process when needed most.

Whether you’re seeking cheap auto insurance in Florida or specifically looking for cheap auto insurance in Tampa, FL, focusing on customer satisfaction can help you find a reliable provider.

Choosing a provider with high service and claims support ratings is crucial, especially when you need to know what to do after your claim has been denied.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Comparing Tampa Auto Insurance Plans Online

In today’s digital age, finding cheap car insurance quotes in Tampa has never been easier. Online comparison tools allow you to quickly gather multiple quotes from top providers such as State Farm, Geico, and Progressive, allowing you to compare rates and coverage options from the comfort of your home.

State Farm offers the best Tampa, FL auto insurance with monthly rates starting at just $65, making it an affordable choice for those comparing Tampa auto insurance plans online.

Michelle Robbins Licensed Insurance Agent

This streamlined process helps you find the most affordable policies, whether you’re looking for cheap car insurance in Tampa, cheap car insurance near me in Tampa, or simply searching for cheap car insurance rates.

By comparing these quotes, you can make an informed decision about the best coverage for your needs and budget without the hassle of visiting individual insurers.

A Look at the Best Auto Insurance in Tampa, FL

When searching for the best auto insurance in Tampa, FL, it is essential to explore all available options to find the best deal. The cheapest car insurance in Tampa can vary depending on factors like your driving record, the coverage you need, and your chosen provider.

Car insurance companies in Tampa, FL, such as State Farm, Geico, and Progressive, offer coverage options that cater to various needs, from basic liability to comprehensive protection. Comparing quotes and considering discounts for safe driving or bundling policies is important when evaluating Tampa car insurance options.

State Farm, one of the Best Auto Insurance Providers in Tampa, FL, offers competitive rates starting at just $65 per month, making it an excellent choice when comparing Tampa auto insurance plans online.

Whether looking for the most affordable rates or specific auto insurance coverage options like roadside assistance or theft protection, shopping around will ensure you find reliable, budget-friendly coverage tailored to your lifestyle.

Frequently Asked Questions

What is the best auto insurance provider in Tampa, FL?

Tampa’s top auto insurance providers are State Farm, Geico, and Progressive. They are known for their competitive rates, excellent coverage, and customer satisfaction. Understanding the types of coverage they offer is key to making the best choice.

How much does auto insurance cost in Tampa, FL?

Auto insurance rates in Tampa can start as low as $65 per month, depending on the provider, coverage level, and individual driving history.

How can I lower my auto insurance premiums in Tampa?

You can lower your premiums by maintaining a clean driving record, bundling insurance policies, utilizing discounts (such as safe driver discounts), and comparing quotes from different providers. Enter your ZIP code below into our free tool to find the best Tampa, FL auto insurance with the most affordable rates in your area.

What factors affect my auto insurance premium in Tampa?

Key factors include your driving history, the type of coverage you choose, vehicle safety features, age, and location. Weather risks and local driving conditions in Tampa also play a role.

What discounts are available for auto insurance in Tampa, FL?

Explore discounts like safe driver savings, bundling car and renters insurance to save money, and vehicle safety features like anti-theft systems. Loyalty discounts for long-term customers can also help. Based on the keyword, bundling car and renters insurance to save money is a smart way to lower your premiums.

Which Tampa auto insurance provider offers the best customer service?

State Farm is known for its excellent customer service and competitive pricing, making it a top choice in Tampa for both service and affordability.

How can I compare auto insurance quotes in Tampa?

You can compare quotes using online comparison tools that allow you to quickly gather multiple quotes from top providers like State Farm, Geico, and Progressive.

What does comprehensive auto insurance coverage include?

Comprehensive and collision coverage protects your car from damage not caused by a collision, such as theft, vandalism, natural disasters, and animal incidents.

What types of coverage are essential for auto insurance in Tampa?

Essential coverage options include liability insurance, collision coverage, and comprehensive coverage. Optional coverage like roadside assistance, theft protection, and medical payments can also provide added peace of mind. Begin seeing quotes for the best Tampa, FL auto insurance today by entering your ZIP code below into our free comparison tool.

Are there specific auto insurance plans for military members in Tampa?

USAA offers the best car insurance discounts for military members in Tampa, with coverage tailored to their needs.