Best Worcester, MA Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Worcester, MA auto insurance providers are State Farm, Allstate, and Progressive, which offer rates from $30/month and valuable discounts. State Farm stands out with a 17% safe driver discount, while Allstate and Progressive deliver flexible policies and significant savings for Worcester, drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Worcester MA

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Worcester MA

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Worcester MA

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Allstate, and Progressive provide the best Worcester, MA auto insurance options. State Farm stands out for its reliable customer service and affordability, making it a popular choice among local drivers.

Allstate offers a variety of coverage plans tailored to individual needs, while Progressive provides a wide range of services and incentives for safe drivers. These providers combine affordability, flexible policy options, and dependable coverage, making them excellent choices for drivers in Worcester.

Our Top 10 Company Picks: Best Worcester, MA Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agents | State Farm | |

| #2 | 25% | A+ | Multi-Policy Discounts | Allstate | |

| #3 | 10% | A+ | Competitive Rates | Progressive | |

| #4 | 25% | A++ | Affordable Premiums | Geico | |

| #5 | 12% | A | Comprehensive Coverage | AIG | |

| #6 | 5% | A+ | Customer Service | The Hartford |

| #7 | 25% | A | Customizable Coverage | Liberty Mutual |

| #8 | 20% | A+ | Discounts Available | Nationwide |

| #9 | 25% | A | Personalized Service | The Hanover | |

| #10 | 13% | A++ | Claims Handling | Travelers |

Enter your ZIP code into our free quote tool above to find the best auto insurance providers for your needs and budget.

- State Farm is the top provider for the best Worcester, MA auto insurance

- Compare coverage options from leading companies to meet your specific needs

- Review discounts and flexible policies to get the most affordable auto insurance

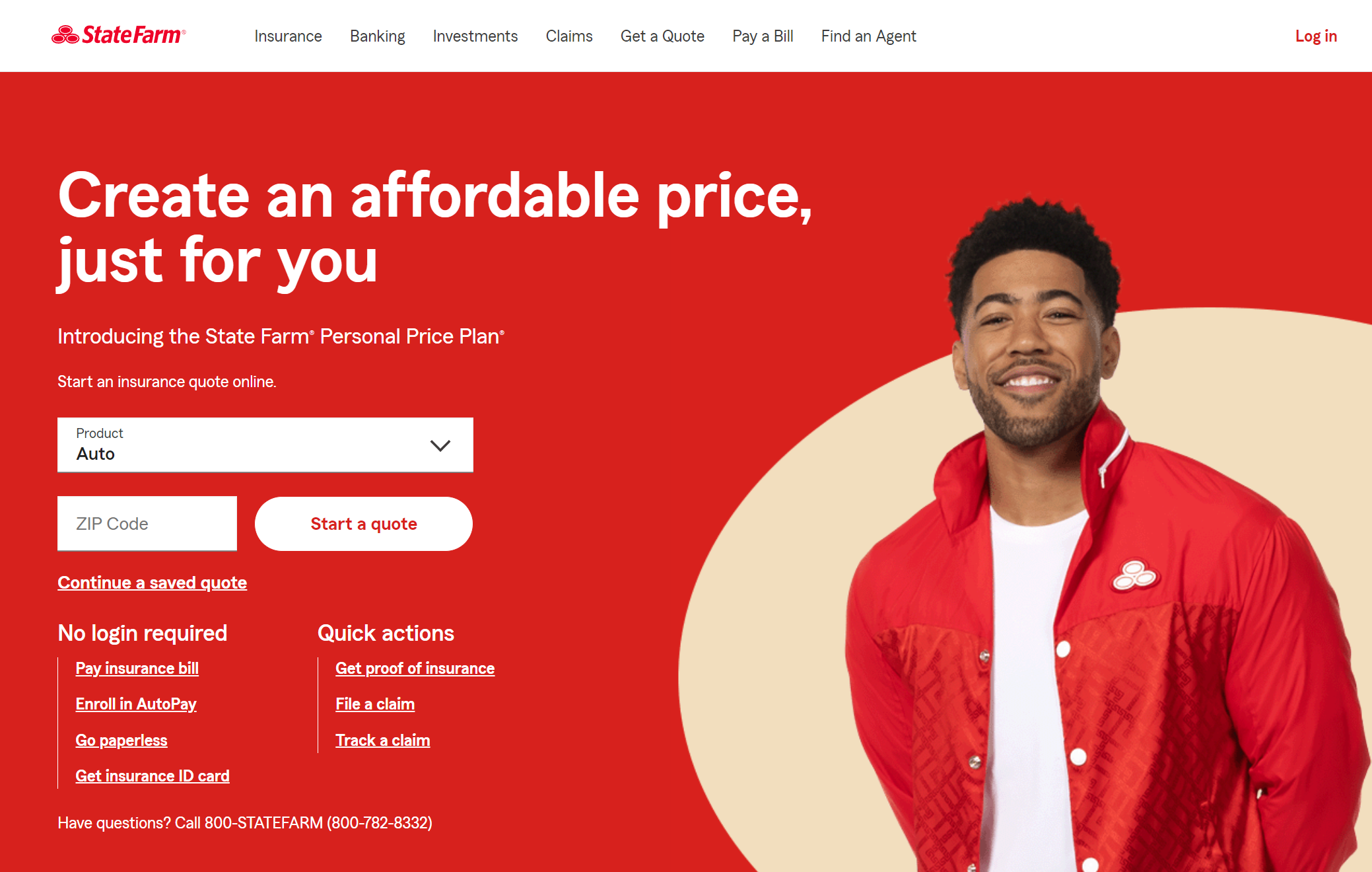

#1 – State Farm: Top Overall Pick

Pros

- Super Availability: State Farm has offices around Worcester, so finding an agent or filing a claim could be easy.

- Exceptional Customer Service: According to our State Farm auto insurance review, the company is known for handling claims quickly and offering responsive customer support.

- Discounts for Safe Driving: Offers numerous discounts for safe driving and good students, which can significantly lower premiums.

Cons

- Higher Rates for Young Drivers: Younger drivers in Worcester may face higher premiums.

- Fewer Digital Tools: While improving, its mobile app and online tools could be more user-friendly compared to competitors like Progressive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Multi-Policy Discounts

Pros

- Customizable Policies: Offers a wide range of options, including coverage for motorcycles and off-road vehicles, which is ideal for diverse driving needs in Worcester.

- Good Driver Discounts: Based on our Allstate auto insurance review, significant discounts are available for safe driving and bundling auto with other types of insurance.

- In-built Familiarity: An extensive and robust association of local agents in Worcester, designing specific insurance needs for personal insurance purposes.

Cons

- More expensive premiums: The rates could be higher than those of other insurance companies, especially for people under 25 or those who have had an accident.

- Claim Processing Delays: Some customers report delays in the claims process, which may be frustrating during urgent situations.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: In our Progressive auto insurance review, the company is known for offering affordable rates in Worcester, especially for those with a clean driving record.

- Excellent Online Tools: Progressive offers easy-to-use online quote tools and a mobile app for managing policies.

- Unique Discounts: Strong discounts for multi-policy bundling, continuous coverage, and safe driving (Snapshot program).

Cons

- Customer Service Variability: Some users need more consistent experiences with claims and support.

- Limited Local Agents: Progressive relies more on online and phone support than a strong network of local agents, which may be inconvenient for some Worcester residents.

#4 – Geico: Best for Affordable Premiums

Pros

- Cheap Insurance: Geico is often a key player in stunning premiums for drivers with good credit and clean driving in Worcester.

- Efficient Claims Process: Our Geico auto insurance review shows how the company offers a fast and convenient online claims process, making it ideal for tech-savvy users.

- Substantial Discounts: Geico provides excellent discounts, especially for military personnel, federal employees, and safe drivers.

Cons

- Limited Personalized Service: While good for self-service online, Geico needs more personalized attention from local agents, which some drivers in Worcester may prefer.

- Lack of Coverage Customization: Fewer options for riders looking for specialized or customized auto coverage plans.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – AIG: Best for Comprehensive Coverage

Pros

- Well-rounded Cash Backing: AIG auto insurance review on how AIG’s robust financing portrays peacefulness about claims and coverage.

- High-Value Coverage Options: AIG offers robust coverage for high-value vehicles and custom insurance plans that may appeal to Worcester residents with luxury or classic cars.

- Global Presence: Valuable coverage for those traveling internationally. For additional details, explore our comprehensive resource titled “Auto Insurance Coverage Options.”

Cons

- Narrower Local Focus: AIG has a relatively weak agent presence in Worcester. Hence, one can expect a lesser degree of personalized service.

- Premiums Can Be High: AIG tends to have higher rates, particularly for standard drivers, which could be a drawback for those in Worcester seeking affordable options.

#6 – The Hartford: Best for Customer Service

Pros

- Excellent for Older Drivers: The Hartford provides great senior driving insurance rates for older drivers in Worcester, including unique coverage options.

- Well-Reviewed Customer Service: Within our Hartford auto insurance review, the company is known for its high customer satisfaction and ease of claims processing.

- AARP Membership: Provides special discounts for the members of AARP, which Worcester seniors can take advantage of.

Cons

- Limited Discounts for Younger Drivers: Rates for younger, less experienced drivers in Worcester may be less competitive than other insurers.

- Higher Minimum Coverage Requirements: Often requires higher minimum coverage limits, which can increase premiums.

#7 – Liberty Mutual: Best for Customizable Coverage

Pros

- Comprehensive Coverage Options: Offers various insurance types and extra protection plans, such as new car replacement and accident forgiveness.

- Discounts for Worcester Residents: View our Liberty Mutual auto insurance review for details on competitive rates for bundling auto with home or renters insurance in Worcester.

- Robust Online Tools: Liberty Mutual provides practical online tools for policy management, quote comparisons, and claims.

Cons

- High Premiums for Young Drivers: Liberty Mutual has higher premiums for younger and less experienced drivers in Worcester, like many larger insurers.

- Mixed Customer Service Reviews: Some customers report issues with claim resolutions and delays in communication.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Discounts Available

Pros

- Affordable Rates for Worcester Drivers: Nationwide often offers some of the lowest rates for drivers with good records.

- Wide Range of Discounts: Discounts for bundling, safe driving, and anti-theft devices help lower overall premiums.

- Solid Reputation: Discover our Nationwide auto insurance review to find out why the company is known for being reliable with claims processing and policy management.

Cons

- Less Coverage Variety: Nationwide’s coverage options may not be as expansive or flexible as other major providers.

- Limited Local Agents: Personal agents are less available than State Farm and Allstate in Worcester.

#9 – The Hanover: Best for Personalized Service

Pros

- Strong Focus on Local Coverage: The Hanover is a terrific choice for Worcester drivers who look for personal service and local know-how, being the community-minded insurer.

- Tailored Policies: This company offers highly customizable auto policies that address specific needs, such as classic car insurance or rideshare coverage.

- Good Customer Service: Read our Hanover auto insurance review to learn how customers report a smooth and efficient claims process and fast resolution times.

Cons

- Higher Rates for Young Drivers: Premiums can be high for younger drivers or those with less driving experience in Worcester.

- Limited National Presence: The Hanover has a more localized focus, meaning it may offer different nationwide support or discounts than larger insurers.

#10 – Travelers: Best for Claims Handling

Pros

- Extensive coverage options: Focuses on offering a broad range of other types of additional coverages, including a new car replacement and rideshare insurance.

- Affordable Options for Worcester Residents: Travelers provide competitive pricing, particularly for drivers with clean driving records in Worcester.

- Good Claims Process: Delve into our Travelers auto insurance review to learn why the company is well-regarded for handling claims efficiently and providing good overall support.

Cons

- Limited Discounts for Younger Drivers: Younger drivers in Worcester may find Travelers’ rates higher than other companies.

- Complicated Online Tools: The website and online tools may not be as user-friendly as those of competitors like Geico or Progressive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Compare the Best Auto Insurance Rates in Worcester, MA

For the best auto insurance options in Worcester, MA, Geico, Progressive, and State Farm are top providers, offering affordable rates and comprehensive coverage. With budget-friendly offers, Geico suits all cost-conscious drivers.

Worcester, MA Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $41 | $116 | |

| $39 | $112 | |

| $30 | $97 | |

| $40 | $114 |

| $33 | $99 |

| $32 | $100 | |

| $34 | $108 | |

| $36 | $106 | |

| $35 | $103 |

| $38 | $110 |

Progressive offers many discounts, especially for persons with no traffic violations, allowing them to save more. Known for personalized services and fast processing under claims, State Farm is recognized as the first choice for consumers who value reliability and service.

Worcester residents have their choice from these three highly trusted companies, each possessing flexible policies and market competitive rate offerings designed for meeting different needs. To further explore auto insurance options, refer to our detailed guide on “Types of Auto Insurance Coverage.”

Maximum Discounts for Auto Insurance in Massachusetts

Searching for the Best Worcester, MA Auto Insurance, knowing how discounts work can significantly lower your premiums while providing the coverage you need. Let’s explore five top Worcester, MA, providers and the benefits their discounts offer.

AIG provides multi-policy discounts, allowing customers to bundle home and auto insurance for streamlined coverage and savings.

The claims-free discount rewards customers for encouraging a safe driving record. One of the characteristics of Geico is its discount offers, such as safe driving discounts for active military personnel or even discounts just for installing increased vehicle security systems.

Auto Insurance Discounts From the Top Providers in Worcester, MA

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Claims-Free, Safe Driver, Personal Auto | |

| Safe Driving Bonus, Multi-Policy, New Car, Early Signing | |

| Good Driver, Military, Multi-Vehicle, Anti-Theft Device | |

| Multi-Policy, Claims-Free, Good Student, Accident-Free |

| Multi-Policy, Safe Driver, Continuous Insurance, Early Quote |

| Snapshot Program, Homeowner, Continuous Insurance, Multi-Vehicle | |

| Drive Safe & Save, Good Student, Multi-Vehicle, Vehicle Safety Feature | |

| Vehicle Safety Features, New Car, Claims-Free, Multi-Policy | |

| AARP Member, Multi-Policy, Claims-Free, Safe Driving |

| SmartRide Program, Family Plan, Good Student, Accident-Free |

Liberty Mutual is an excellent option for accident-free and good student discounts because it caters to families with younger teens who are up to par with driving.

Progressive’s “Snapshot” program personalizes discounts based on real-time driving behavior, incentivizing safe practices and giving drivers control over their savings. By understanding and utilizing these discounts, you can choose an insurer that meets your coverage needs and fits your budget.

Auto Insurance Coverage Requirements in Massachusetts

Understanding the Massachusetts minimum auto insurance coverage requirements is essential when selecting the Best Worcester, MA, Auto Insurance to ensure compliance and financial protection.

The state mandates at least $20,000 in bodily injury liability per person and $40,000 per accident to cover injuries caused to others—minimum amounts of $5,000 property damage liability for damage caused to another person’s property or vehicle.

Massachusetts Minimum Auto Insurance Coverage Requirements

| Coverage | Requirements |

|---|---|

| Bodily Injury Liability | $20,000 per person $40,000 per accident |

| Property Damage Liability | $5,000 per accident |

These minimums provide essential protection but may not fully cover expenses in more severe accidents. When shopping for an auto insurance provider in Worcester, MA, assess how well they meet these minimum requirements and how much more optional coverage they offer.

Balancing mandatory requirements with comprehensive protection is key to securing the Best Worcester, MA Auto Insurance for your needs.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Significant Factors in Best Worcester, MA Auto Insurance

Several factors influence your rates when searching for the best auto insurance in Worcester, MA. While some of these factors are beyond your control, there are actions you can take to secure affordable coverage. Below are key elements that play a major Here are the key factors that significantly impact your auto insurance premiums in Worcester:

Your ZIP Code

When looking for the Best Worcester, MA Auto Insurance, it’s essential to consider how your ZIP code impacts your rates.

Auto insurance premiums in Worcester are directly affected by your location in the city regarding traffic density, accident rates, or how the roads are constructed regarding local driving conditions.

Worcester, MA Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 1602 | $130 |

| 1603 | $135 |

| 1606 | $138 |

| 1604 | $140 |

| 1607 | $142 |

| 1605 | $145 |

| 1609 | $148 |

| 1608 | $150 |

| 1610 | $152 |

For instance, areas with fewer vehicles, such as those in more suburban or rural parts, generally have lower premiums due to a reduced risk of accidents. These rate differences highlight the importance of understanding how your location affects your insurance costs.

To find the Best Worcester, MA Auto Insurance, you should compare rates across ZIP codes to determine where to secure the most affordable coverage. Comparing auto insurance rates by state will further assist you in finding the cheapest coverage in Massachusetts. Doing so can ensure you’re not paying more than necessary for the coverage you need.

Automotive Accidents

Automotive accidents determine the best Worcester, MA, auto insurance rates. With relatively low serious accident rates in Worcester, insurance providers often offer lower premiums, as the town is considered a safer place to drive. Worcester sees around 3,000 accidents and 2,500 claims annually, with an average claim size of $4,000.

Worcester, MA Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 3,000 |

| Total Claims Per Year | 2,500 |

| Average Claim Size | $4,000 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 150 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | Medium |

While uninsured drivers account for about 12% of vehicle thefts and moderate vehicle thefts, any insured mode affects its risk profile. How accidents impact auto insurance rates in Worcester, MA, is a salient inquiry when shopping for affordable auto insurance.

Auto Thefts in Worcester

Auto theft is essential in determining the best Worcester, MA, auto insurance. While Worcester has seen a decline in thefts, with 399 cars stolen in 2013, it remains a concern, especially in urban areas.

If your vehicle is at a higher risk for theft, you may face higher premiums without comprehensive coverage.

For the best auto insurance in Worcester, MA, focus on a provider with strong customer service, flexible coverage options, and affordable rates.

Chris Abrams Licensed Insurance Agent

Many insurers offer discounts for cars equipped with anti-theft devices, which can help lower your insurance costs while providing added protection against theft.

Your Credit Score

In Worcester, MA, your credit score doesn’t directly affect your auto insurance premiums, as Massachusetts is one of the few states where insurers can’t charge different rates based on credit scores.

However, insurance providers may adjust their pricing to offset potential financial risks, so you may still see slightly higher rates than in states that factor in credit scores.

Worcester, MA Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B | Moderate claim cost |

| Traffic Density | B | Moderate congestion |

| Weather-Related Risks | C+ | Moderate to low weather impact |

| Vehicle Theft Rate | C+ | Moderate theft risk |

| Uninsured Drivers Rate | C | Average uninsured rate |

Understanding how your credit score impacts car insurance premium costs is essential when shopping for the best Worcester, MA, auto insurance.

Your Age

Age is key in determining your premiums when searching for the best Worcester, MA, auto insurance. Younger drivers, car insurance for teenagers, typically face higher rates due to their inexperience behind the wheel and a higher likelihood of being involved in accidents.

In Worcester, MA, younger drivers often pay considerably more for coverage than older, more experienced drivers. Premiums are lower for drivers aged 30 and beyond; as such, people generally are considered more professional and have some track record in driving, thus being less risky for the insurance companies to cover.

Worcester, MA Auto Insurance Rates by Age

| Insurance Company | Age: 17 | Age: 34 |

|---|---|---|

| $450 | $180 | |

| $475 | $185 | |

| $420 | $175 | |

| $500 | $190 |

| $460 | $180 |

| $440 | $170 | |

| $430 | $175 | |

| $480 | $185 | |

| $495 | $190 |

| $470 | $180 |

Insurers usually vary their rates; hence, young drivers and their families must compare quotes from all available providers about policies and discounts.

By doing so, you can secure the best Worcester, MA auto insurance rate, whether a new driver or an experienced one, ensuring you’re not overpaying for necessary coverage.

Your Driving Record

Your driving record determines the cost of the best Worcester, MA, auto insurance. A clean driving record is key to low premiums, as insurers view safe drivers as lower risk. However, violations such as traffic tickets, accidents, and DUIs can lead to significantly higher rates.

In Worcester, MA, even a single ticket or accident can raise your premiums, but the impact is especially noticeable after a DUI. Drivers with a DUI on their record may face a substantial increase in their monthly premiums, as insurers view these drivers as high risk.

Car insurance after a DUI can be much more expensive, and shopping around for the best rates is essential. Having a clean driving record or knowing how violations affect your rates is vital to getting the best auto insurance in Worcester, MA.

Worcester, MA Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $130 | $160 | $190 | $300 | |

| $140 | $170 | $200 | $320 | |

| $120 | $150 | $180 | $290 | |

| $145 | $175 | $205 | $330 |

| $135 | $165 | $195 | $310 |

| $125 | $155 | $185 | $295 | |

| $130 | $160 | $190 | $300 | |

| $140 | $170 | $200 | $320 | |

| $150 | $180 | $210 | $335 |

| $140 | $170 | $200 | $320 |

A comparison of several insurers and their rates is necessary because, in most cases, the rates differ significantly, even with reasonably similar driving records.

Your Vehicle

Choosing the best auto insurance in Worcester, MA, and the type of vehicle you drive significantly determines your premiums. High-end cars like the BMW 3 Series often have higher insurance rates due to their higher repair costs and the increased likelihood of theft.

For instance, a BMW 3 Series typically costs more to insure than more affordable vehicles like the Honda Civic or Toyota Corolla. Because luxury vehicles often require specialized repairs and are more attractive to thieves.

BMW 3 Series Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Level

| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $140 | $250 |

| Chevrolet Malibu | $98 | $175 |

| Ford F-150 | $110 | $210 |

| Honda Civic | $90 | $155 |

| Honda CR-V | $105 | $195 |

| Hyundai Elantra | $95 | $160 |

| Nissan Altima | $92 | $165 |

| Subaru Outback | $103 | $190 |

| Toyota Corolla | $85 | $150 |

| Volkswagen Jetta | $100 | $180 |

On the other hand, basic cars such as the Honda Civic and Toyota Corolla tend to have lower insurance rates, as they are less expensive to repair and less likely to be stolen.

You must know how your vehicle influences your premiums to find the best auto insurance policy in Worcester, MA—knowing how the most expensive cars to insure can help you find the best coverage for your vehicle in Worcester.

Comparing rates for different types of cars, you can make a more informed decision and secure the best coverage at the most affordable price for your vehicle.

Minor Elements in Worcester, MA Auto Insurance

Quite a few things are essential in determining your auto insurance premiums, in addition to what you’d seem to be lesser included variables that do not affect much of the monthly costs. Get acquainted with lesser factors to become more informed when selecting suitable auto insurance in Worcester, MA.

Your Marital Status

When searching for the best Worcester, MA auto insurance, Married couples can save by bundling car insurance with other policies, such as renters or the same provider. Combining car insurance after marriage may provide maximum cost-saving benefits.

Ensure that the car insurance company you prefer has a range of covers to maximize these benefits fully. While combining several types of insurance may lead to lower prices, other aspects, such as the driver’s record and vehicle class, are usually more influential in determining providers’ prices.

Your Gender

When looking for the best Worcester, MA, auto insurance, gender typically has little impact on premiums. Most insurers no longer charge different rates based on gender, but those often have inconsistent policies—some may charge more for women, while others may quote higher rates for men.

If you’re looking for reliable auto insurance in Worcester, MA, consider State Farm—its 90% customer satisfaction rating speaks for itself.

Eric Stauffer Licensed Insurance Agent

As such, gender is generally not a significant factor when comparing auto insurance options in Worcester. To expand your knowledge, refer to our comprehensive handbook titled “Compare Auto Insurance Companies.”

Your Driving Distance to Work

When searching for the best Worcester, MA, auto insurance, your driving distance to work has a modest impact on your rates. Commuting in Worcester typically takes about 19-22 minutes, and while reducing your mileage may offer a slight discount of 3-4%, it won’t drastically lower your premiums.

Additionally, if you use your vehicle for business, you may need commercial auto insurance, which can increase your premiums by more than 10% compared to personal use vehicles.

Your Coverage and Deductibles

When acquiring the appropriate car insurance in Worcester, MA, the price and the amounts of coverage are not the only factors to consider. Consider add-ons like roadside assistance or rental car coverage, which can provide extra protection without significantly increasing costs. Your driving habits and the local risk of accidents or severe weather may affect your policy choices.

Discounts may come from safe driving, joining policies, or wearing safety devices. Review what Worcester excludes or the coverage limits; little things can significantly affect the total value of your auto insurance. To gain profound insights, consult our extensive guide titled “What is an auto insurance deductible and how does it work?”

Education in Worcester, MA

When looking for the best Worcester, MA, auto insurance, your level of education can play a role in the discounts you receive. Drivers with higher education tend to qualify for better rates, often saving more than those with higher salaries or job titles. Worcester is home to top universities like UMass Medical Center and Worcester Polytechnic Institute.

It has excellent educational opportunities available to residents. All that is left is for you to compare now because it becomes vital to understanding your risk profile, which will contribute to finding the best car insurance rates possible. For a comprehensive analysis, refer to our detailed guide titled “Car Insurance for Students: Saving 101.”

Evaluating Auto Insurance Options in Worcester

Finding the best Worcester, MA auto insurance depends on your unique needs and driving habits. For drivers with well-rounded experience, State Farm is highly advisable and has a solid claims-handling process.

At the same time, the broad range of coverages and extensive discounts offered by Allstate are among the attributes that set it above the rest. Progressive is an appealing choice for responsible drivers because its Snapshot program provides significant savings to individuals who maintain safe driving habits.

Meanwhile, Geico is a top choice for budget-conscious individuals seeking competitive rates. Residents can maximize savings through discounts like safe driver discounts, anti-theft device discounts, and bundling policies.

By comparing quotes from popular providers, you can ensure that the policy is at its best price and has adequate protection. By researching all options available, you can find a policy that suits your needs and accurately covers you at the best affordable cost.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is comprehensive insurance in Massachusetts?

Comprehensive and collision coverage in Massachusetts protects your vehicle from non-collision damages like theft, vandalism, fire, and natural disasters. Many drivers choose it for protection, especially for newer or financed vehicles.

Can you insure a car in Worcester, MA without a license?

Without a valid driver’s license, you cannot insure a car in Worcester, MA. However, you can list a licensed driver, such as a family member, as the primary driver to meet insurance requirements.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Can I register a car in Worcester without insurance?

No, you cannot register a car in Worcester, MA, without proof of insurance. Massachusetts law requires an active policy and a completed RMV-1 form signed by your insurance agent for registration.

Can I cancel my car insurance at any time in Massachusetts?

Yes, you can cancel your car insurance anytime in Massachusetts, but it’s essential to ensure continuous coverage to avoid penalties or registration suspension.

What is the best car insurance in Massachusetts for new drivers?

Progressive and State Farm are good choices for new drivers, offering discounts and customer service.

What is limited collision coverage in Worcester, MA?

Limited collision coverage only pays for damages to your car after a collision if you are not at fault. It complement no-fault auto insurance by providing an affordable alternative to standard collision coverage.

What happens if an uninsured driver hits you in Worcester?

If an uninsured driver hits you in Worcester, MA, you can use your Uninsured Motorist coverage to pay for damages and injuries, as required by Massachusetts law.

How long does an insurance company have to investigate a claim in Worcester?

In Worcester, MA, insurance companies generally have 30 days to investigate a claim, but this timeline may vary depending on the complexity of the case.

What is full vs basic coverage in Worcester?

Full coverage in Worcester includes liability, comprehensive and collision auto insurance coverage, while basic coverage only includes state-required liability.

Can someone else drive my car in Massachusetts?

Yes, someone else can drive your car in Massachusetts, but they must have your permission, and your insurance policy typically covers them as long as they meet policy requirements.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.