Best Grand Rapids, MI Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Grand Rapids, MI auto insurance companies are State Farm, Auto-Owners, and Farmers. Car insurance coverage in Grand Rapids costs only $90/mo. State Farm is known for its excellent customer service. Auto-Owners offers a 25% discount while Farmers has a unique mobile app for Grand Rapids, MI policy management.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Apr 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,157 reviews

18,157 reviewsCompany Facts

Grand Rapids Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 563 reviews

563 reviewsCompany Facts

Grand Rapids Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

563 reviews

563 reviews 3,072 reviews

3,072 reviewsCompany Facts

Grand Rapids Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best Grand Rapids, MI, auto insurance companies are State Farm, Auto-Owners, and Farmers, with starting rates as low as $90 per month. They offer excellent customer service to drivers in Grand Rapids, MI.

These top providers offer significant discounts, affordable rates, and unique savings programs like Snapshot discounts, roadside assistance, and multi-policy discounts.

Our Top 10 Company Picks: Best Grand Rapids, MI Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agents | State Farm | |

| #2 | 25% | A++ | Customer Service | Auto-Owners | |

| #3 | 20% | A | Telematics Programs | Farmers | |

| #4 | 10% | A+ | Snapshot Discounts | Progressive | |

| #5 | 25% | A+ | Multi-Policy Discounts | Allstate | |

| #6 | 25% | A | Flexible Coverage | The Hanover | |

| #7 | 25% | A++ | Affordable Rates | Geico | |

| #8 | 25% | A | High-Risk Drivers | The General | |

| #9 | 20% | A+ | Competitive Rates | Nationwide |

| #10 | 15% | A | Roadside Assistance | AAA |

This car insurance guide will help you detail the factors affecting your car insurance premium, including your age, location, and driving record, to help you meet your car insurance needs.

- State Farm, Auto-Owners, and Farmers offer the best Grand Rapids coverage

- State Farm tops the list for offering affordable rates for only $95 per month

- Get competitive rates from other providers like Auto-Owners and Farmers

Enter your ZIP code into our free online tool if you feel confident in buying your auto insurance in Grand Rapids, MI. We will provide you with instant quotes for cheap car insurance in Grand Rapids, Michigan.

#1 – State Farm: Top Overall Pick

Pros

- Exceptional Local Agent Support: State Farm is known for the guidance and assistance offered by agents in Grand Rapids.

- Affordable and Competitive Rates: State Farm offers cheaper rates and premiums for Grand Rapids, MI drivers.

- Plentiful Discount Options: Grand Rapids residents can access savings opportunities like State Farm’s 17% discount when they bundle policies.

Cons

- Rate Increases After Claims: Our State Farm auto insurance review shows that Grand Rapids policyholders involved in an at-fault accident can pay more.

- Limited Online Customization: State Farm is more traditional and does not provide digital services for Grand Rapids drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Auto-Owners: Best for Customer Service

Pros

- Top-Notch Claims Satisfaction: Auto-Owners provides peace of mind for Grand Rapids drivers because it handles claims efficiently.

- Generous Discount Opportunities: Auto-Owners offers discounts of up to 25%, making it the regional favorite in Grand Rapids, Michigan.

- Superior Financial Strength: Its A++ rating assures Grand Rapids residents that the company is financially stable.

Cons

- Agent-Only Policy Access: According to our Auto-Owners auto insurance review, it has an in-person setup model, which may be a drawback for self-managing drivers in Grand Rapids.

- Higher Rates for Young Drivers: Teen drivers in Grand Rapids may pay a higher premium for their auto insurance.

#3 – Farmers: Best for Telematics Program

Pros

- Innovative Telematics Program: Farmers has a program that benefits safe drivers in Grand Rapids to get affordable auto insurance.

- Extensive Policy Variety: Grand Rapids drivers can enjoy discounts and other savings programs through a variety of flexible plans.

- Local Agency Service: Farmers can be seen everywhere in Grand Rapids, making personalizing your policy convenient.

Cons

- Premiums Without Discounts Can Be High: Without discounts, your auto insurance cost may be steeper, as mentioned in our Farmers auto insurance review.

- ZIP Code Limitations on Discounts: Some Grand Rapids ZIP codes may not be eligible for the full benefits of the offered programs.

#4 – Progressive: Best for Snapshot Discounts

Pros

- Snapshot Program Savings: Progressive has an app that rewards the good driving behavior of Grand Rapids drivers.

- User-Friendly Digital Tools: Progressive provides excellent digital access, helpful for tech-savvy Grand Rapids residents.

- Flexible Pricing Tools: The Name-Your-Price tool gives Grand Rapids drivers control over their pay.

Cons

- Inconsistent Snapshot Outcomes: As mentioned in our Progressive auto insurance review, Snapshot’s outcomes can be frustrating for Grand Rapids drivers.

- Variable Customer Service Quality: Service can range from excellent to lackluster, impacting your experience with this otherwise affordable insurer.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Multi-Policy Discounts

Pros

- Significant Multi-Line Discounts: Grand Rapids drivers can save up to 25% when they bundle their auto, home, and other policies.

- Unique Add-on Features: Accident forgiveness provides local drivers in Grand Rapids peace of mind with their auto insurance.

- Strong Agent Presence: Allstate is everywhere in Grand Rapids, making it convenient to get personalized help from a local agent.

Cons

- Pricier Base Rates: Allstate is not the lowest starting point when shopping for cheap car insurance in Grand Rapids, Michigan.

- Slower Claims Handling Reports: According to our Allstate auto insurance review, local policyholders may face occasional delays.

#6 – The Hanover: Best for Flexible Coverage

Pros

- Highly Customizable Policies: Hanover’s policy structure is ideal for Grand Rapids drivers who want their financial and vehicle needs met.

- Value-Added Coverage Perks: The Hanover is a strong choice for Grand Rapids residents looking for customizable coverage.

- Good Fit for Michigan Market: Hanover’s strong regional roots ensure that its products are well-designed for Michigan drivers.

Cons

- Availability Varies by ZIP Code: As mentioned in our Hanover auto insurance review, some Grand Rapids neighborhoods might not have full access to Hanover programs.

- Outdated Online Experience: Hanover’s digital access is obsolete, making it a drawback for Grand Rapids drivers who prefer online assistance.

#7 – Geico: Best for Affordable Rates

Pros

- Consistently Low Premiums: Geico still provides one of Grand Rapids, Michigan’s best and most affordable auto insurance.

- Strong Digital Experience: In addition to discounts, Geico offers a top-notch mobile app, making it even more convenient for Grand Rapids drivers.

- National Brand Recognition: Geico is recognized for providing excellent service in Grand Rapids, as mentioned in our Geico auto insurance review.

Cons

- Minimal Local Agent Support: Grand Rapids locals looking for in-person interaction may find Geico a drawback.

- Fewer Customizable Features: Geico offers fewer options for policy personalization, which is a drawback for drivers in Grand Rapids.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – The General: Best for High-Risk Drivers

Pros

- High Acceptance Rate: The General is the ideal insurer for drivers in Grand Rapids who have struggled with DUIs or coverage lapses.

- Fast Online Quotes: The General can provide coverage for cheap auto insurance in Grand Rapids, MI, quickly and hassle-free.

- Coverage Available Despite Poor Records: The General serves as a lifeline for high-risk drivers in Grand Rapids to stay on the road legally.

Cons

- Higher Than Average Rates: According to The General auto insurance review, its high-risk focus means some Grand Rapids drivers will pay more.

- Basic Policy Options: The General may not appeal to some Grand Rapids drivers due to limited customization options or perks.

#9 – Nationwide: Best for Competitive Rates

Pros

- Affordable Full Coverage Plans: Nationwide offers robust coverage at a reasonable price for Grand Rapids drivers, striking a balance between protection and affordability.

- Usage-Based Discount Program: The SmartRide program rewards safe driving behaviors, which helps Grand Rapids policyholders save over time.

- Strong Customer Service Reputation: As noted in our Nationwide auto insurance review, it offers reliable support to its Michigan policyholders.

Cons

- Discount Availability May Vary: Some savings programs are not offered in every Grand Rapids area, which impacts the overall monthly rates.

- Less Visible Local Agent Network: Nationwide’s local footprint is smaller than others, which can be a drawback for some Grand Rapids drivers.

#10 – AAA: Best for Roadside Assistance

Pros

- Best-in-Class Emergency Service: AAA’s roadside coverage is ideal for the wintery months in Grand Rapids, Michigan, making it a top pick for drivers in the area.

- Member-Only Discounts: AAA offers exclusive perks for Grand Rapids residents, as mentioned in our AAA auto insurance review.

- Highly Trusted Brand: AAA’s long-standing reputation earns it more trust among Grand Rapids drivers.

Cons

- Membership Fee Required: AAA requires an annual fee, which is not appealing to some Grand Rapids, Michigan drivers.

- Limited Online Features: Some Grand Rapids drivers may be disappointed with AAA’s outdated tech offerings.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Rates and Discounts in Grand Rapids, MI

The best car insurance rates in Michigan vary by state, city, and company. In Grand Rapids, you’ll likely pay much less than Michigan’s average insurance cost. Let’s look at the best auto insurance rates in Michigan, to better understand how much you will pay compared to the national average.

Grand Rapids, MI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $108 | $255 |

| $110 | $250 | |

| $90 | $215 | |

| $100 | $235 | |

| $98 | $230 | |

| $102 | $245 |

| $105 | $240 | |

| $95 | $220 | |

| $92 | $210 | |

| $97 | $225 |

The national average is much cheaper than that of Grand Rapids and Michigan. Although your Grand Rapids auto insurance is more expensive, you can find a company that charges you less monthly for auto insurance.

This section will help you choose the ideal coverage for your financial and vehicle needs by comparing the car insurance discounts offered by top providers in the area.

Auto Insurance Discounts From the Top Providers in Grand Rapids, MI

| Insurance Company | Available Discounts |

|---|---|

| Membership Discount, Multi-Policy Discount, Safe Driver Discount, Good Student Discount |

| Early Signing Discount, Multi-Policy Discount, Safe Driving Bonus, New Car Discount | |

| Multi-Policy Discount, Paid-in-Full Discount, Safe Driver Discount, Good Student Discount | |

| Signal App Discount, Multi-Policy Discount, Good Student Discount, Safe Driver Discount | |

| Defensive Driving Discount, Good Student Discount, Federal Employee Discount, Multi-Vehicle Discount | |

| SmartRide Program, Accident-Free Discount, Family Plan Discount, Good Student Discount |

| Multi-Car Discount, Continuous Insurance Discount, Snapshot Program, Homeowner Discount | |

| Drive Safe & Save, Multi-Car Discount, Steer Clear Program, Defensive Driving Discount | |

| Low-Mileage Discount, Multi-Car Discount, Auto-Pay Discount, Defensive Driving Discount | |

| Anti-Theft Discount, Multi-Policy Discount, Vehicle Safety Discount, Homeowner Discount |

In the sections below, let’s explore more affordable insurance companies in Grand Rapids, MI.

Grand Rapids Auto Insurance Coverage Options

Legal requirements play a vital role in ensuring the cheapest auto insurance in Michigan. This will give you a better idea of what type of policy will work best for you. Let us look at the minimum requirements for driving legally in Grand Rapids.

Grand Rapids, MI Minimum Auto Insurance Coverage Requirements & Limits

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $50,000 per person / $100,000 per accident |

| Property Damage Liability | $10,000 per accident |

| Personal Injury Protection (PIP) | $250,000 per person |

| Uninsured/Underinsured Motorist | $50,000 per person / $100,000 per accident |

| Collision Coverage | Optional, not required by state law |

| Comprehensive Coverage | Optional, not required by state law |

Liability insurance may be a good and economical way to insure an older, easily replaceable vehicle. But if you have a newer automobile, you may want to think about additional coverage. After all, liability won’t pay out on claims for things like weather damage, and it won’t cover damage to your vehicle.

Liability-only insurance can save you money per month. However, getting into an accident where you’re at fault will leave you without a car and a mountain of medical costs. Check out other coverages to learn how they can save you money.

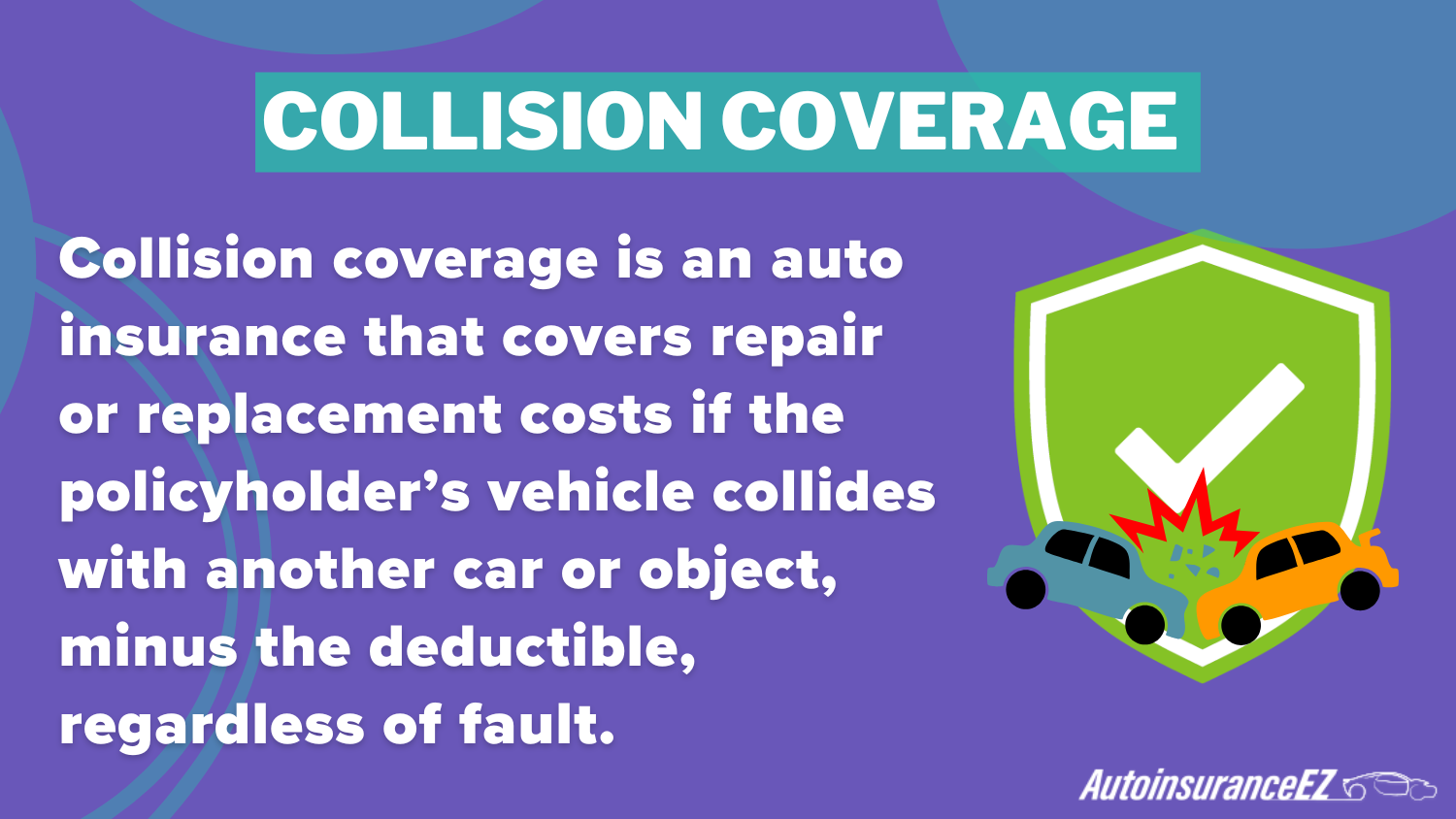

When you add collision auto insurance to your policy, it will cover any damage to your vehicle regardless of fault. If your car is a total loss, your auto insurance company will compensate you for the vehicle’s value.

Auto Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers injury and property damage to others if you’re at fault. |

| Bodily Injury Liability | Pays for injuries to others in an accident you cause. |

| Property Damage Liability | Pays for damage to others' property in an accident. |

| PIP (Personal Injury Protection) | Covers your medical bills and lost wages, regardless of fault. |

| Collision Coverage | Pays for damage to your car in an accident, regardless of fault. |

| Comprehensive Coverage | Covers damage from non-collision events (theft, weather). |

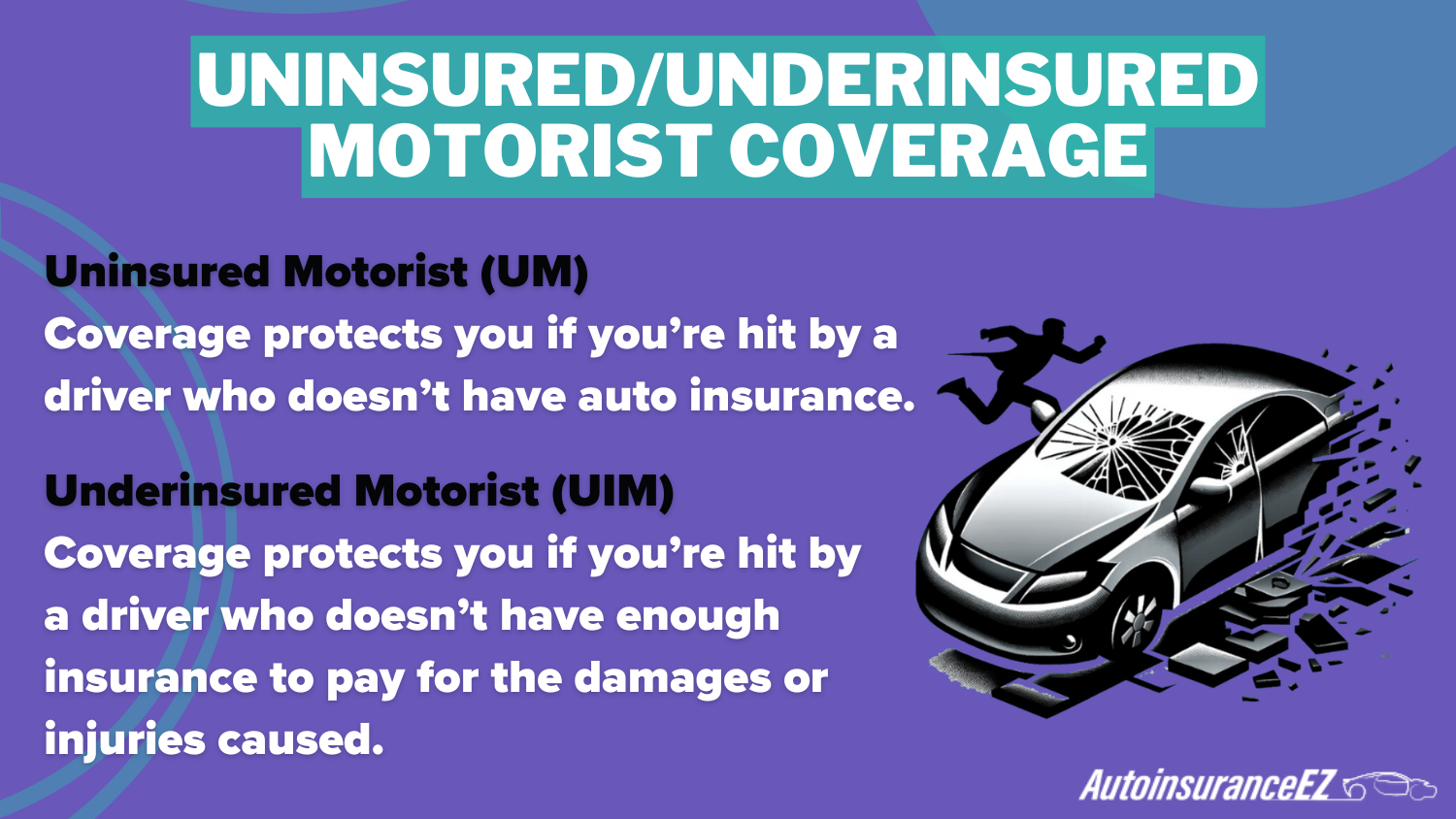

| Uninsured/Underinsured Motorist | Covers you if hit by an uninsured or underinsured driver. |

| Medical Payments (MedPay) | Covers medical expenses for you and passengers. |

| Roadside Assistance | Towing, battery jump, flat tire, etc. |

| Rental Car Coverage | Pays for a rental car if yours is being repaired. |

| Gap Insurance | Covers the difference between your car’s value and loan balance. |

| Glass Coverage | Pays for repairs or replacement of cracked or damaged windows or windshields. |

| Rideshare Coverage | Provides coverage while driving for a rideshare service (Uber, Lyft, etc.). |

| Pet Injury Coverage | Covers veterinary bills if your pet is injured in an accident. |

| Custom Equipment Coverage | Covers aftermarket parts or custom equipment added to your car (e.g., custom wheels). |

| New Car Replacement | Replaces your totaled car with a new one of the same make and model. |

Under comprehensive insurance, you’ll be covered by accidents that don’t involve a collision. Comprehensive auto insurance covers fires, floods, falling objects, and even damage from vehicle theft.

Some accidents can leave you bedridden for weeks. That’s where personal injury protection comes in. PIP pays for injuries, child care, and lost wages after an accident regardless of fault.

Liability-only car insurance only covers the other person. And if all you have is liability-only insurance, you could pay more out-of-pocket expenses. Ask your auto insurance company about MedPay.

This will save you money on medical bills. Healthcare can be expensive. Without health insurance, you could pay hundreds of dollars to recover from an accident. MedPay can save your bank account and increase your savings in the long term.

Grand Rapids, MI Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| State Minimum Coverage Rates | B+ | Minimum coverage is relatively affordable |

| Discounts & Savings Opportunities | B | Good range of discounts available |

| Traffic & Accident Rates | B- | Moderate traffic and accident frequency |

| Rate Trends | C+ | Rates have increased slightly in recent years |

| Credit Score Impact | C | Credit history still affects rates |

If you’re not at fault in an accident, you could save yourself a lot of trouble by having uninsured and underinsured motorist coverage. Uninsured motorist coverage pays for the remaining bodily injury and property damage costs when an at-fault driver doesn’t have car insurance.

You can also be covered if you’re in an accident with a hit-and-run driver. UIM/UM coverage protects you from other drivers who don’t have enough or no insurance. This will guarantee that you can pay for damages and recover.

These are the coverage options you may choose to find the best cheap car insurance in Michigan, that can help you save in the long run.

Factors Affecting Auto Insurance in Grand Rapids, Michigan

You should know that several factors may affect Grand Rapids, MI, auto insurance quotes. ZIP code can be a factor impacting your auto insurance rates. Generally, the most affordable car insurance is usually found in areas with lower population densities.

Grand Rapids, MI Auto Insurance by ZIP Code

| ZIP Code | Monthly Rate |

|---|---|

| 49503 | $151 |

| 49504 | $151 |

| 49505 | $151 |

| 49506 | $151 |

| 49507 | $151 |

| 49508 | $151 |

| 49509 | $151 |

| 49512 | $151 |

| 49525 | $151 |

| 49534 | $151 |

| 49544 | $151 |

| 49546 | $151 |

| 49548 | $151 |

Since fewer vehicles are on the road, the chances of getting into an accident are reduced. Also, Living in a big city increases your potential for being a target of thieves.

Should your general locale have substantial statistics of claims for theft, you’re likely to pay a little more for your auto insurance to attempt to counter the cost of these claims.

Grand Rapids, MI Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Monthly Auto Accidents | $1,200 |

| Fatal Accidents per Month | 4 |

| Injury Accidents per Month | 250 |

| Property Damage Claims per Month | 800 |

| Average Claim Amount | $6,500 |

| Percentage of Uninsured Drivers | 18% |

| Auto Theft Rate (per 100,000) | 200-250 |

| Most Common Accident Cause | Distracted driving & rear-end collisions |

In addition, teenage drivers get charged significantly higher rates. Their youth, as well as their lack of driving experience, makes them much riskier to insure.

Auto-Owners helps teenage drivers save up to 20% on car insurance in Grand Rapids, MI through their good student discount.

Kristine Lee Licensed Insurance Agent

However, teenage drivers can alleviate some of this financial burden by looking into good student discounts or taking additional driver education courses.

Grand Rapids, MI Auto Insurance Monthly Rates by Age and Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $1,032 | $1,032 | $1,481 | $1,481 | $1,481 | $1,481 | $1,481 | $1,481 |

| $3,102 | $3,102 | $1,298 | $1,298 | $1,298 | $1,298 | $1,141 | $1,141 | |

| $2,599 | $2,599 | $1,934 | $1,934 | $1,934 | $1,934 | $1,934 | $1,934 | |

| $5,620 | $5,620 | $3,925 | $3,925 | $3,489 | $3,489 | $3,253 | $3,253 | |

| $1,957 | $1,957 | $1,033 | $1,033 | $1,033 | $1,033 | $1,033 | $1,033 | |

| $3,878 | $3,878 | $4,263 | $4,263 | $3,449 | $3,449 | $3,449 | $3,449 |

| $2,474 | $2,474 | $2,768 | $2,768 | $2,241 | $2,241 | $2,318 | $2,318 | |

| $6,733 | $6,733 | $6,308 | $6,308 | $5,368 | $5,368 | $4,976 | $4,976 | |

| $2,950 | $3,150 | $1,850 | $1,950 | $1,700 | $1,750 | $1,580 | $1,620 | |

| $3,400 | $3,600 | $2,100 | $2,250 | $2,000 | $2,050 | $1,900 | $1,950 |

Aside from these significant factors, some minor factors must be considered, including your gender, marital status, driving distance to work, coverage and deductibles, and even education. Enter your ZIP code to find Grand Rapids, MI, cheap car insurance rates.

Frequently Asked Questions

Which factors have the biggest impact on auto insurance premiums in Grand Rapids, MI?

Age, ZIP code, and driving record influence your car insurance premium in Grand Rapids, Michigan, and are key to finding cheap car insurance in Grand Rapids, Michigan, or even cheap car insurance quotes in Holland, Michigan.

Why is State Farm the top overall pick for auto insurance in Grand Rapids?

State Farm tops the list of car insurance companies in Grand Rapids due to its excellent service and strong reputation in the Grand Rapids, Michigan, car insurance market. Enter your ZIP code to compare rates.

How does Auto-Owners’ 25% discount compare to discounts offered by other top providers?

Auto-Owners offers one of the most generous discounts on car insurance in Grand Rapids, MI, which is why it’s a top choice for those seeking affordable auto insurance near me.

Read more: Auto Insurance Types

What unique features does Farmers’ telematics program offer to Grand Rapids drivers?

Farmers’ telematics program is a standout among Grand Rapids car insurance providers. It rewards safe drivers with lower rates and offers one of the best cheap car insurance options in Michigan.

How much lower are average auto insurance rates in Grand Rapids compared to the statewide average for Michigan?

Drivers looking for Grand Rapids cheap car insurance usually find better deals than the rest of Michigan, especially compared to cities like Sterling Heights. Find the best cheap car insurance in Sterling Heights by entering your ZIP code.

What are the legal minimum auto insurance requirements in Grand Rapids?

Carrying only liability may meet the Grand Rapids, MI, car insurance legal minimums, but you’ll want full coverage on auto insurance Grand Rapids, MI policies for complete protection against theft or weather damage.

Read more: Is Full Coverage Really Full?

How can teen drivers in Grand Rapids reduce their high insurance premiums?

Teen drivers can find cheap car insurance in Grand Rapids, MI, by qualifying for good student discounts and shopping around for car insurance near me.

What types of coverage are most recommended for newer vehicles in Grand Rapids?

A new vehicle in Grand Rapids, MI, should have more than just liability-only car insurance—including comprehensive and collision coverage—to avoid paying out-of-pocket on cheap car insurance Grand Rapids plans. Find cheap car insurance quotes in Holland, Michigan, by entering your ZIP code.

Which companies offer the best auto insurance discounts for bundling home and auto policies?

Multi-policy discounts from companies like Allstate and State Farm are ideal for getting cheap car insurance in Grand Rapids, Michigan, or bundling coverage in nearby cities.

Read more: The Different Types of Car Insurance

How does uninsured/underinsured motorist coverage protect Grand Rapids drivers?

Uninsured motorist coverage is a must-have in your car insurance Grand Rapids policy, especially when seeking cheap Grand Rapids car insurance that also protects you in hit-and-run situations.