Best Santa Ana, CA Auto Insurance in 2025 (Check Out the Top 10 Companies)

The best Santa Ana, CA auto insurance providers are Geico, Progressive, and State Farm. These businesses are the best options for drivers in Santa Ana, California, since they provide competitive prices starting at $35 per month and stand out for their affordability, discounts, and customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Dec 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Santa Ana CA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Santa Ana CA

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Santa Ana CA

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best Santa Ana, CA auto insurance options are offered by Geico, Progressive, and State Farm, known for their competitive rates and excellent coverage.

Geico stands out as the top overall pick, with affordable premiums starting at just $35 per month. Progressive is ideal for budget-conscious drivers, offering low-cost options for those looking to save.

Meanwhile, State Farm shines with a variety of car insurance discounts, making it a great choice for drivers seeking to reduce their premiums further.

Whether you’re looking for basic coverage or comprehensive protection, comparing quotes from these top providers can help you find the best balance of savings.

Our Top 10 Company Picks: Best Santa Ana, CA Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Lowest Rates | Geico | |

| #2 | 10% | A+ | Tight Budgets | Progressive | |

| #3 | 17% | B | Many Discounts | State Farm | |

| #4 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #5 | 10% | A++ | Military Focused | USAA | |

| #6 | 20% | A | Customizable Policies | Farmers | |

| #7 | 25% | A+ | Local Agents | Erie |

| #8 | 15% | A | Flexible Options | Safeco | |

| #9 | 13% | A++ | Diverse Discounts | Travelers | |

| #10 | 20% | A+ | Excellent Service | Nationwide |

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

- Geico stands out as the top choice for affordable and reliable coverage

- Santa Ana drivers can find top coverage options tailored to urban driving risks

- Compare quotes for the best value in auto insurance

#1 – Geico: Top Overall Pick

Pros

- Lowest Rates: Geico provides the most economical premium for the lowest auto insurance rates in Santa Ana. Learn more about Geico’s rates in our Geico auto insurance review.

- Top-Rated Financial Stability: With an A++ rating, Geico’s. A.M. ensures its best financial standing in auto insurance, providing peace of mind for Santa Ana policyholders.

- Bundling Discount: Geico offers a generous 25% bundling discount, helping Santa Ana car owners save when they combine auto insurance with home or other policies.

Cons

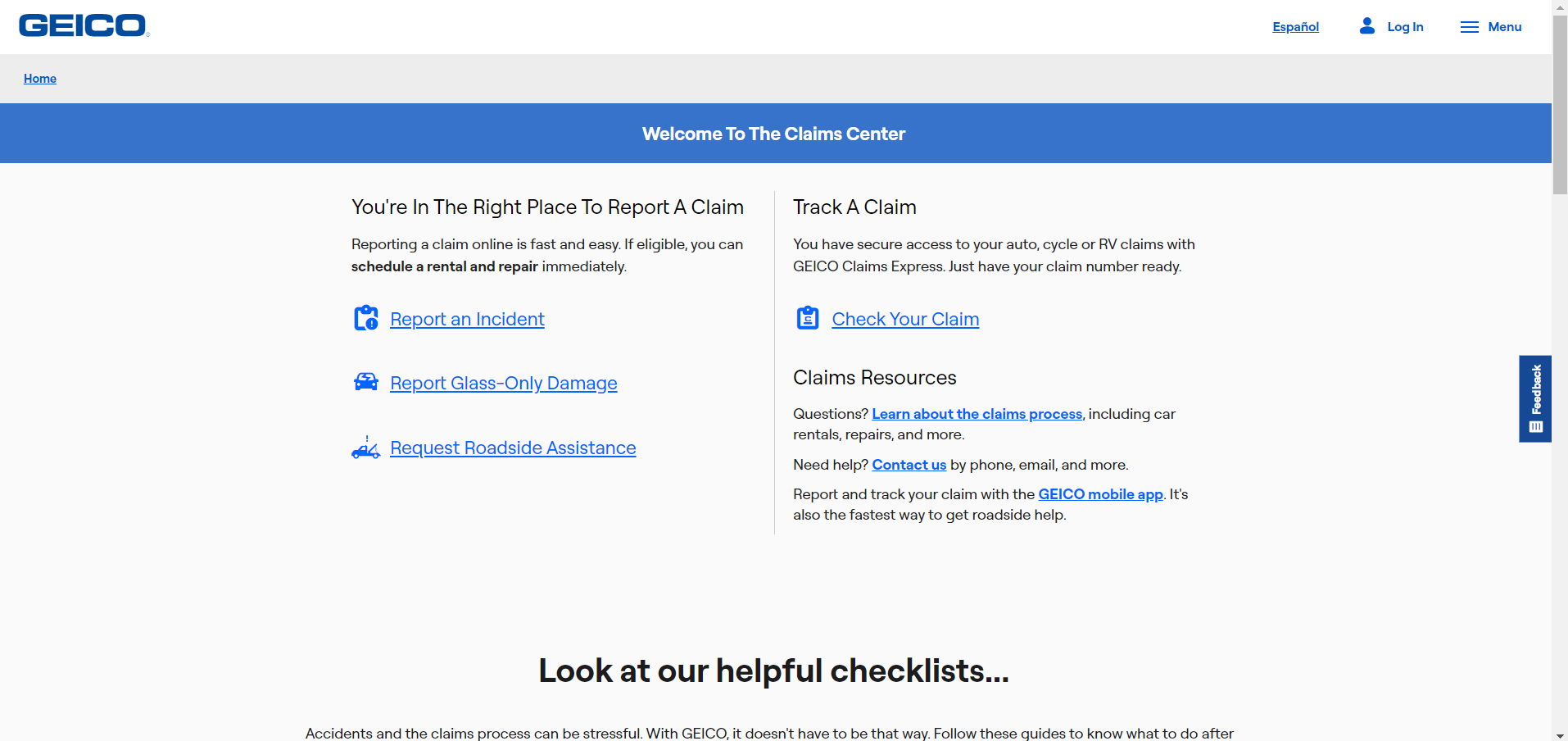

- Customer Service Concerns: Some customers in Santa Ana, CA, have reported delays or challenges in customer service, especially during auto insurance claims.

- Limited Coverage Options: Geico’s offerings to Santa Ana customers regarding customizable policies or auto insurance add-ons may be less comprehensive than those of competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Tight Budgets

Pros

- Affordable for Tight Budgets: Progressive is great for Santa Ana customers looking for affordable and best auto insurance, even with basic coverage options.

- A+ Financial Rating: With an A+ rating from A.M. Best, Progressive is a financially stable, reliable auto insurance provider in Santa Ana, CA. Refer to Progressive auto insurance review for details.

- Unique Coverage Options: Progressive offers specialized auto insurance options like Snapshot, which can help Santa Ana vehicle owners save more based on driving habits.

Cons

- Higher Premiums for Younger Drivers: Progressive’s auto insurance rates can be higher for younger or inexperienced drivers of Santa Ana, despite discounts.

- Customer Service: Many Santa Ana residents have given Progressive mixed reviews, citing slow customer service responses with their auto insurance claim.

#3 – State Farm: Best Discount Options

Pros

- Many Discounts: State Farm offers various auto insurance discounts, making it an excellent option for budget-conscious Santa Ana drivers. For details, read our State Farm auto insurance review

- Flexible Coverage Options: State Farm’s flexible auto insurance options are perfect for Santa Ana residents seeking customization for their vehicles and needs.

- B-rated Financial Stability: Santa Ana policyholders continue to rely on State Farm despite offering cheaper auto insurance than its competitors.

Cons

- Higher Rates for Some Demographics: Despite discounts, auto insurance rates can be higher for some groups, especially new drivers or those with poor records in Santa Ana.

- Limited Digital Features: Compared to its competitors in Santa Ana auto insurance market, State Farm’s digital tools and mobile app can be a bit outdated or less user-friendly.

#4 – Allstate: Best Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Allstate auto insurance offers a range of coverage options, including features like new car replacement. Review our All state auto insurance review for details.

- A+ Financial Rating: Allstate is a stable insurer in Santa Ana, CA, for long-term auto insurance reliability with an A+ rating from A.M. Best.

- Discounts for Bundling: Allstate offers up to a 25% discount to residents of Santa Ana who bundle multiple policies, such as auto insurance and home insurance.

Cons

- Higher Rates for Younger Drivers: Less experienced drivers in Santa Ana may face higher auto insurance rates with Allstate, making it less affordable.

- Claims Process: Customers from Santa Ana often report that Allstate’s process in claiming their auto insurance can be slow or difficult to navigate.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Members

Pros

- Tailored for Military Members: USAA auto insurance tailored its policies catering the needs of an active-duty military members and veterans living in Santa Ana, CA.

- A++ Financial Stability: USAA holds the highest A++ rating from A.M. Best in auto insurance policy, ensuring financial reliability to Santa Ana policyholders.

- Competitive Rates: USAA offers highly competitive military auto insurance rates, including generous discounts to their policies. Please

Cons

- Eligibility Restriction: Compared to other auto insurance provider in Santa Ana, USAA policies is only available to active military, veterans, and their families.

- Limited Physical Locations: USAA offers excellent online auto insurance service but has fewer physical offices for in-person support in Santa Ana.

#6 – Farmers: Best Customizable Policies

Pros

- Highly Customizable Policies: Farmers lets Santa Ana customers customize their policies to suit their needs.

- 20% Bundling Discount: Santa Ana residents can significantly save when they bundle auto insurance with other types, such as home or life insurance.

- A-rated Financial Stability: Farmers auto insurance achieved an A rating from A.M. Best, ensuring solid financial strength and customer security to people of Santa Ana, California.

Cons

- Premiums may be Higher: Santa Ana drivers with Farmers Insurance have reported higher costs for high-risk auto insurance policies.

- Mixed Customer Service: While many customers from Santa Ana praise Farmers for its auto insurance agents, others have had less-than-satisfactory experiences with claims handling.

#7 – Erie: Best Local Agents

Pros

- Personalized Service Through Local Agents: Erie built a strong network of local agents in Santa Ana, CA, providing a more personal and hands-on approach to auto insurance.

- A+ Financial Strength: Erie claimed an A+ rating from A.M. Best, demonstrating solid financial backing for Santa Ana insurers. Find out more about Erie in our Erie auto insurance review.

- 25% Bundling Discount: Up to 25% discount is offered to customers from Santa Ana, CA, who purchase Erie auto insurance bundled with other types of policies.

Cons

- Limited Availability: Erie operates in fewer states than larger insurers like Geico or Progressive, which could be a drawback for Santa Ana residents planning to move.

- Can be Expensive for Younger Drivers: A few of their clients from Santa Ana reported that Erie’s auto insurance premiums may be higher for younger individuals or less-experienced drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Safeco: Best Flexible Options

Pros

- Flexible Coverage Options: Safeco offers various coverage options and flexible payment plans for Santa Ana drivers.

- A-rated Financial Stability: Safeco is rated A by A.M. Best, assuring long-term reliability for auto insurance policyholders residing in Santa Ana, California.

- 15% Bundling Discount: Safeco offers a solid discount for customers from Santa Ana availing their auto insurance and multiple policies together. For details, read our Safeco auto insurance review.

Cons

- Customer Service Issues: Some auto insurance policyholders from Santa Ana, California, report challenges with Safeco’s customer service, particularly with the claims process.

- Not the Cheapest Option: Safeco may not offer the lowest auto insurance rates compared to other insurers like Geico, particularly for high-risk drivers.

#9 – Travelers: Best in Diverse Discounts

Pros

- Diverse Discounts: Travelers auto insurance offers a wide range of safe driver discount, bundling, and hybrid/green vehicle owners of Santa Ana.

- A++ Financial Strength: With the highest rating from A.M. Best, Travelers auto insurance is a reliable and financially stable insurer in Santa Ana, California.

- Good for High-Risk Drivers: Travelers may be a wise choice for Santa Ana high-risk drivers and those with less-than-perfect driving records.

Cons

- Claims Process can be Slow: Some clients from Santa Ana complain that their auto insurance claims are processed more slowly than those of other well regarded insurers.

- Higher Premiums for Younger Drivers: Like many Santa Ana insurers, Travelers may have higher auto insurance premiums for younger drivers or those without a long driving history.

#10 – Nationwide: Best Service

Pros

- Excellent Customer Service: Nationwide is known for its excellent auto insurance customer support in Santa Ana and offers assistance both online and through agents.

- A+ Financial Rating: The company obtained A+ rating from A.M. Best, delivering Santa Ana clients with strong financial security for their auto insurance policies.

- 20% Bundling Discount: Nationwide provides a 20% discount for Santa Ana customers who combine auto and other insurance. Discover more: Nationwide Auto Insurance Review

Cons

- Rates may be Higher for Some Drivers: Nationwide may not always have the lowest rates in their auto insurance policies, especially for Santa Ana drivers with a history of claims or accidents.

- Limited Coverage Add-Ons: While Nationwide offers good auto insurance base coverage, it may lack some specialized add-ons or extras compared to other competitors in Santa Ana, California.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Type of Auto Insurance Coverage Requirements in Santa Ana, California

In Santa Ana, California, drivers are required to carry certain types of auto insurance coverage with a minimum amount to comply with state law and drive legally. The mandatory coverage includes:

Santa Ana, CA Minimum Auto Insurance Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $5,000 per accident |

Even though the state requires basic auto insurance, it may not be enough to cover any losses or damages. Other insurance coverages, such as gap insurance, rental reimbursement, or roadside assistance, could greatly improve your policy and protect your money.

While the minimum coverage satisfies legal requirements, investing in broader coverage ensures more excellent financial protection and security on the road. Always carry proof of insurance to avoid fines and remain compliant with state laws.

Affordable Auto Insurance Available in Santa Ana, California

Those that offer auto insurance plans evaluate several factors when establishing insurance prices, such as marital status, where you live, your credit report, miles driven, and theft protection devices.

Geico’s competitive rates and strong customer service make it the best option for Santa Ana drivers looking for affordability and reliability.

Chris Abrams Licensed Insurance Agent

There are a variety of providers to research, including Geico, Progressive, State Farm Auto Insurance, and more.

Read more: Cheap Auto Insurance in California

Auto Insurance Rate Based on ZIP Code

Auto insurance rates can vary significantly based on your ZIP code, considering factors like local traffic patterns, crime rates, and accident statistics. Understanding how your location impacts premiums is essential to finding the best coverage for your needs.

Usually, auto insurance is cheaper in non-urban regions because fewer vehicles mean a smaller chance that you’ll get into a collision.

| ZIP | Rates |

|---|---|

| 92707 | $144 |

| 92701 | $146 |

| 92704 | $143 |

| 92703 | $149 |

| 92705 | $154 |

| 92706 | $146 |

| 92708 | $157 |

| 92799 | $86 |

| 91701 | $107 |

| 92710 | $95 |

Your ZIP code is vital in determining auto insurance rates, but it’s just one factor that auto insurance providers consider. By comparing options and understanding local risks, you can secure coverage that fits your budget and suits your needs.

Vehicular Accidents in Santa Ana, CA

Santa Ana, CA, also experiences vehicular accidents from time to time. Because of its growing population, the streets became congested, and the chance of being involved in accidents is high. Being mindful of traffic laws and responsible driving can help reduce the risk of accidents.

California Fatal Accidents & Claims Per Year By City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Anaheim | 85 | 128 |

| Bakersfield | 90 | 135 |

| Fresno | 150 | 225 |

| Long Beach | 120 | 180 |

| Los Angeles | 800 | 1,200 |

| Oakland | 100 | 150 |

| Sacramento | 200 | 300 |

| Santa Ana | 100 | 150 |

| San Diego | 600 | 900 |

| San Francisco | 300 | 450 |

| San Jose | 450 | 675 |

Accident statistics, as you can see in the graph above, are relatively low given Santa Ana’s population density. These incidents often lead to 150 auto insurance claims yearly as drivers try to repair damages and address liability.

Read more: How Accidents Change Your Car Insurance Rate

Auto Thefts in Santa Ana, CA and Liability Coverage of Your Auto Insurance

Almost all auto insurance companies are concerned regarding auto theft; this is especially true for vehicle owners who live in big cities. The higher the population, the higher your chance of submitting a theft claim.

Santa Ana, CA Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $105 | $120 | |

| $95 | $110 |

| $110 | $125 | |

| $80 | $95 | |

| $100 | $115 |

| $90 | $105 | |

| $115 | $130 | |

| $85 | $100 | |

| $98 | $115 | |

| $75 | $90 |

Not all states require insurance companies to include auto theft coverage in their policies. However, several state insurance companies include anti-theft device discounts in their policies, given that you purchase and install an anti-theft system in your vehicle.

Auto Insurance Credit Score in Santa Ana, CA

Your ability to get a cheaper auto insurance quote may be severely affected by having a low driving credit score. Since credit history predicts risk, many auto insurance companies consider it when setting rates. A high credit score frequently tells insurance companies that you are a safe and responsible driver, which can result in lower vehicle insurance premium.

The rationale behind this approach is that studies have found a link between credit scores and the likelihood of submitting a claim. Drivers with low credit may be statistically more likely to submit claims or incur losses, causing auto insurance providers to raise prices to compensate for potential risks.

Read more: How Your Credit Score Affects Your Car Insurance Premiums

Age Policy of Auto Insurance in Santa Ana, California

In Santa Ana, age is a key factor in determining auto insurance costs, with younger drivers typically paying more and rates dropping once drivers reach their mid-20s.

Young drivers typically face higher insurance premiums due to inexperience and increased risk of accidents. Drivers under the age of 25 are considered high-risk drivers and are more likely to not secure lower insurance rates from auto insurance companies.

Santa Ana, CA Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $630 | $752 | $225 | $241 | $204 | $204 | $187 | $192 | |

| $650 | $770 | $235 | $250 | $210 | $210 | $190 | $195 |

| $600 | $710 | $220 | $235 | $200 | $200 | $185 | $190 | |

| $453 | $550 | $190 | $205 | $195 | $195 | $180 | $185 | |

| $472 | $560 | $195 | $210 | $190 | $190 | $175 | $180 |

| $664 | $750 | $220 | $235 | $205 | $205 | $195 | $200 | |

| $416 | $520 | $183 | $198 | $175 | $175 | $160 | $165 | |

| $469 | $565 | $198 | $213 | $185 | $185 | $170 | $175 | |

| $528 | $620 | $213 | $228 | $200 | $200 | $185 | $190 | |

| $375 | $460 | $165 | $180 | $162 | $162 | $150 | $155 |

Once drivers reach 25, insurance rates often decrease as they are considered lower risk. Depending on driving history and health, senior drivers may also see rate changes after 60 years.

How Driving Record Affects Auto Insurance in Santa Ana, California

Auto insurance companies operate by assessing risk, and your driving record plays a crucial role in determining how much of a risk you present as a policyholder. Insurers view you as a safer, more responsible driver with a clean driving record—free from accidents, moving violations, or other infractions.

This presumption leads them to believe you are less likely to file claims. As a result, drivers with good driving record are offered lower rates, discounts, or other benefits.

Santa Ana, CA Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $140 | $160 | $180 | $220 | |

| $135 | $155 | $175 | $215 |

| $130 | $150 | $170 | $210 | |

| $120 | $140 | $160 | $200 | |

| $145 | $165 | $185 | $225 |

| $150 | $170 | $190 | $230 | |

| $125 | $145 | $165 | $205 | |

| $115 | $135 | $155 | $195 | |

| $155 | $175 | $195 | $235 | |

| $110 | $130 | $150 | $190 |

Drivers with violation records, such as those with speeding tickets, DUIs, or a history of accidents, are thought to be more likely to be involved in future accidents. To compensate for this perceived risk, insurers frequently offer higher premiums.

Read more: Driving Tips for Road Safety

Vehicle Model and Its Effect on Auto Insurance Policy in Santa Ana, CA

The vehicle you drive plays a significant role in determining your auto insurance rates in Santa Ana. Auto insurance companies assess various factors related to your vehicle model to calculate the potential risk and cost of insuring it.

Drivers should think about how their choice of vehicle influences their insurance premiums. Choosing a dependable, safe, and reasonably priced vehicle will help you get lower insurance premiums. Additionally, discussing potential discounts for safety measures and anti-theft devices with your insurer might help to cut costs.

Santa Ana, CA Auto Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 2024 Buick Envision | $150 | $250 |

| 2024 Chevrolet Trailblazer | $140 | $240 |

| 2024 Ford Bronco Sport | $160 | $270 |

| 2024 Honda Passport | $155 | $260 |

| 2024 Hyundai Venue | $135 | $230 |

| 2024 Kia Soul | $130 | $220 |

| 2024 Mazda CX-5 | $145 | $240 |

| 2024 Nissan Kicks | $125 | $210 |

| 2024 Subaru Crosstrek | $150 | $250 |

| 2024 Toyota Corolla Cross | $140 | $230 |

The age, price tag, and even safety options of the vehicle you own is one of the factors that affect your car insurance premium and will have a significant impact on your monthly premium.

Discount Factors in Auto Insurance in Santa Ana, California

There’s a lot of hard data which clearly shows what you can expect to pay based on your age, credit score, the vehicle you drive, and more. But there are other, easier ways to save money and some overlooked ways which most drivers don’t usually consider. Such as:

Marital Status

Marital status is one of several personal factors auto insurance companies use to determine premiums. Insurers analyze statistical data to assess risk levels and offer discounts or charge higher premiums accordingly. Married individuals often qualify for discounts due to correlations between marital status and lower accident risks.

Progressive is ideal for budget-conscious drivers in Santa Ana, offering low-cost options without compromising coverage.

Kristen Gryglik Licensed Insurance Agent

Some auto insurance carriers offer newlyweds discounts for newly married couples in which you can save 5% on your auto insurance policy. You can save even more money by bundling the two of you together onto the same insurance policy.

Gender

Gender has long been considered a critical factor in determining auto insurance rates. Insurers use statistical models to assess risk, and gender has historically been associated with distinct patterns in driving behavior, accident rates, and claim history.

Altering monthly premiums based on gender has been a controversial business strategy. Different statistical models may show that males are more aggressive and, therefore, more dangerous behind the wheel.

Auto Insurance Discounts From the Top Providers in Santa Ana, CA

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driving, Good Student, Pay in Full, Early Signing | |

| Multi-Policy, Safe Driving, Good Student, Advanced Quote, Paid-in-Full |

| Multi-Policy, Good Student, Safe Driving, Homeownership, Continuous Coverage | |

| Good Driver, Multi-Policy, Military, Federal Employee, Student, Vehicle Safety Features | |

| Multi-Policy, Safe Driving, Good Student, Homeowners, Affinity Group |

| Snapshot (Usage-Based), Multi-Policy, Safe Driver, Good Student, Homeownership |

| Multi-Policy, Safe Driving, Good Student, Homeownership, Vehicle Safety Features | |

| Multi-Policy, Safe Driver, Student, Accident-Free, Vehicle Safety Features | |

| Multi-Policy, Safe Driving, Good Student, Pay in Full, New Car | |

| Military Affiliation, Multi-Policy, Safe Driver, Good Student, Vehicle Safety |

Some insurance companies have given up basing their premium calculations on gender altogether. But if your provider is not one of these companies, rest assured that the monthly charge for your coverage is only about 2-3% different.

Driving Distance to Work

Driving distance matters in auto insurance because longer commutes increase exposure to accidents, which raises the likelihood of collisions. Insurance companies provide incentives for safer, lower-risk behaviors by offering discounts for shorter driving distances. These discounts are typically categorized based on the policyholder’s daily or annual mileage.

- Low Mileage Discount: This discount is offered to drivers who commute less than a specified number of miles per day (e.g., under 10 miles one way).

- Telematics-Based Discounts: Some insurers use telematics devices or mobile apps to monitor actual driving distances and offer discounts in real time.

- Remote Work Discounts: With the rise of remote work, some insurers provide specialized discounts for individuals who no longer commute daily.

By considering driving distance to work, insurers encourage safer habits and ensure that premiums accurately reflect individual driving patterns. Whether you’re a remote worker or have a short commute, understanding how this impacts your policy can help you save on auto insurance costs.

Coverage and Deductibles

Coverage levels and deductibles play a significant role in determining auto insurance costs. While bundled coverage discounts might save money when combining products like auto and house insurance, choosing basic coverage can cut premiums but may leave you under-protected. Reducing collision or comprehensive coverage is another cost-saving option for older vehicles.

Choosing a higher deductible can reduce premiums by 10–30%, making it a smart choice for drivers with good records who rarely file claims. Flexible deductibles, which can be adjusted during policy renewals, also offer opportunities for savings.

To maximize discounts, tailor your policy to balance affordability and protection. For extra savings, combine high deductibles with low-mileage rebates or safety features on your car. Balancing these factors can help you optimize your auto insurance while staying financially secure.

Education Level and Insurance Rates

Factors like age, geography, and driving history affect premium rates in the vehicle insurance market. But one element that has grown in importance is the policyholder’s educational background. Insurance companies often assess a wide range of variables to determine how much risk a driver poses, and education level can be one of these determining elements.

Studies show that individuals with higher education tend to be more responsible drivers, adhering to traffic laws, being informed about safe driving practices, and engaging in less risky behavior. As a result, insurers may offer discounts to policyholders with higher educational attainment, assuming they are less likely to file claims.

Insurance Company Minimum Coverage Full Coverage

$85 $150

$70 $130

$90 $160

$75 $140

$80 $145

$78 $138

$82 $148

$72 $135

$88 $155

$65 $120

Discounts for college graduates, professionals with advanced degrees, or those who complete defensive driving courses are common ways insurers reward higher education. Moreover, educated individuals may also demonstrate better financial management and more significant risk awareness, contributing to safer driving habits.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Auto Insurance Analysis in Santa Ana, California

Santa Ana’s busy streets and diverse drivers make auto insurance a crucial consideration. Our analysis explores affordable, reliable options tailored to local needs, focusing on premiums, customer satisfaction, and coverage flexibility.

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home.

The top 5 commercials have been chosen and the Best of GEICO is almost over. But don’t worry: you could still save money with GEICO. 1. Go here: https://t.co/4vjt0fUfxn 2. Make sure you get a fast, free car insurance quote. #bestofgeico pic.twitter.com/icT1lOiX2u

— GEICO (@GEICO) February 6, 2019

Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

Read more: How does an auto insurance company determine my premium?

Case Studies: Real-Life Scenarios in Santa Ana, CA Auto Insurance

Here are three brief case studies showing how different Santa Ana drivers found the best auto insurance for their needs.

- Case Study #1 – John, the New Driver on a Budget: John, a 22-year-old new driver in Santa Ana, found affordable car insurance for his 2018 Honda Civic with Progressive. By enrolling in their telematics program and demonstrating safe driving, he earned a 10% discount, reducing his premium to $150 per month while still getting solid coverage.

- Case Study #2 – Maria, the Experienced Driver Seeking Comprehensive Coverage: Maria, a 45-year-old driver with a clean record, chose State Farm for her 2015 Toyota Camry. After comparing options, she found a comprehensive policy with accident forgiveness for $230 per month, including discounts for her safe driving history.

- Case Study #3 – Tom, the Senior Driver Looking for Low-Cost Coverage: Tom, a 67-year-old retiree, found affordable auto insurance for his 2012 Honda Accord with Geico. Driving under 8,000 miles annually, he secured a $90/month policy, benefiting from senior discounts and savings for his car’s safety features.

These case studies show that Santa Ana residents, whether new drivers, experienced drivers, or seniors, can find affordable and tailored auto insurance solutions. Comparing multiple quotes from different companies is crucial in finding the right policy that balances coverage and cost.

Geico provides the best value for Santa Ana drivers, with affordable premiums starting at just $35 per month and great coverage options.

Merriya Valleri Insurance and Finance Writer

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Frequently Asked Questions

How much does car insurance cost in Santa Ana, CA?

On average, drivers in Santa Ana pay around $35 monthly for auto insurance. However, rates can vary based on factors like driving record, credit score, vehicle type, and where you live within the city.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

What factors influence my auto insurance premium in Santa Ana?

Several factors can influence your insurance premium, and understanding these factors is crucial to finding the coverage that suits your needs and helps you save by lowering auto insurance premiums costs. Here’s an in-depth look at the elements that can affect your auto insurance premium in Santa Ana:

- Driving record: A clean record can lower premiums

- Age and gender: Younger drivers, especially males, may face higher rates

- Vehicle type: Newer or high-value vehicles tend to have higher premiums

- Credit score: A good credit score can result in lower rates

- Coverage options: Comprehensive coverage generally costs more than basic liability

Keeping a clean driving record, selecting the right coverage, and considering factors like vehicle type and credit score can help lower your auto insurance premium in Santa Ana. Regularly shopping around and updating your policy ensures you get the best deal.

How does my ZIP code affect my auto insurance rates in Santa Ana, California?

In Santa Ana, California, the ZIP code is considered a major factor in determining auto insurance premiums. Insurers consider local risks, such as traffic congestion, crime, and accident-prone areas, when determining rates.

Areas with higher accident rates, heavy traffic, or a high probability of vehicle theft typically lead to higher premiums. ZIP codes in densely populated urban areas have higher auto insurance rates due to more traffic and a greater chance of accidents.

In contrast, customers living in suburban or less congested areas offered lower premiums, as the risk of accidents and theft tends to be lower.

What are the minimum auto insurance requirements in California?

In Santa Ana, California, auto insurance is mandatory and there are several auto insurance types for all drivers. The city follows state-set minimum coverage requirements to protect drivers in the event of an accident. Understanding these requirements is critical to staying compliant and avoiding penalties. Here’s a summary of the coverage drivers must carry:

- $15,000 in bodily injury liability per person

- $30,000 in bodily injury liability per accident

- $5,000 for property damage liability

By maintaining the required coverage, you can drive confidently, knowing you’re protected and compliant with California law. Regularly reviewing your policy to ensure it meets or exceeds these minimum requirements will help you avoid penalties and provide peace of mind in the event of an accident.

How can I lower my auto insurance premiums in Santa Ana, California?

In Santa Ana, auto insurance premiums can vary based on several factors. While minimum coverage is required, there are ways to reduce premiums without sacrificing protection. Here are a few strategies to help you save on auto insurance.

- Increase your deductible

- Bundle policies (e.g., home and auto insurance) with the same provider

- Maintain a clean driving record

- Drive fewer miles each year

- Use available discounts, such as safe driver discount, multi-vehicle, and anti-theft discounts

Following these tips can lower your auto insurance premiums without sacrificing coverage. Shop around for the best rates and ask about available discounts.

Does my credit score affect my car insurance rates?

Yes, your credit score can impact your auto insurance rates in Santa Ana, California. Insurance companies often use credit scores to assess risk, assuming that individuals with higher credit scores are more likely to file fewer claims. Drivers with poor credit may face higher premiums.

What should I do if I’ve had an accident or a traffic ticket in Santa Ana, CA?

If you’ve had an accident or received a traffic ticket in Santa Ana, taking the proper steps is crucial. These issues can affect your record, insurance, and legal standing. Below are the steps essential to do after the incident:

- Notify your insurance company as soon as possible

- Check your policy to see how the incident affects your rates

- Consider taking a defensive driving course to reduce points on your record and potentially lower future premiums

Handling an accident or traffic ticket is crucial to protecting yourself and minimizing future consequences. Stay informed, act quickly, and take the proper steps to avoid penalties and keep your driving record clean.

Is it necessary to have comprehensive coverage in Santa Ana, CA?

While comprehensive coverage is not required by law, purchasing comprehensive and collision auto insurance coverage is often recommended to protect your vehicle from non-collision events like theft, vandalism, or natural disasters. This coverage is especially beneficial for new or high-value vehicles.

How can I compare car insurance rates in Santa Ana?

To compare car insurance rates in Santa Ana, you can use online comparison tools to get quotes from multiple providers. Simply enter your ZIP code and vehicle information, and the tool will provide a list of options.

Make sure to review each policy’s coverage levels and discounts to find the best option for your needs. Use our free comparison tool below to see what auto insurance quotes look like in your area.