Best Colorado Springs, CO Auto Insurance in 2025 (Find the Top 10 Companies Here)

Allstate, American Family, and Geico offer the best auto insurance in Colorado Springs, CO, with rates starting at $45 per month. These providers offer reasonably priced coverage alternatives that meet state minimal standards. To get the best rate, compare vehicle insurance Colorado Springs quotes from these top companies.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Colorado Springs CO

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Colorado Springs CO

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Colorado Springs CO

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsFind the best Colorado Springs, CO auto insurance with Allstate, American Family, and Geico, starting at $45 per month.

Allstate offers strong overall coverage, American Family excels in customer service, and Geico provides affordable rates. For more details, check out the guide titled “Safe Driver Discount.”

Our Top 10 Company Picks: Best Colorado Springs, CO Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Drivewise Program | Allstate | |

| #2 | 25% | A | Customer Service | American Family | |

| #3 | 25% | A++ | Affordable Rates | Geico | |

| #4 | 10% | A+ | Snapshot Program | Progressive | |

| #5 | 20% | A | Customizable Policies | Farmers | |

| #6 | 25% | A | Electric Vehicles | Liberty Mutual |

| #7 | 17% | B | Competitive Premiums | State Farm | |

| #8 | 5% | A+ | Older Drivers | The Hartford |

| #9 | 20% | A+ | Coverage Flexibility | Nationwide |

| #10 | 15% | A | Local Claims | AAA |

Compare quotes from these providers to secure the best deal. By enter your ZIP code above to start saving on your auto insurance.

- Find the best Colorado Springs, CO auto insurance starts at $45/month

- Allstate offers top coverage with competitive pricing

- American Family and Geico provide flexible, budget-friendly options

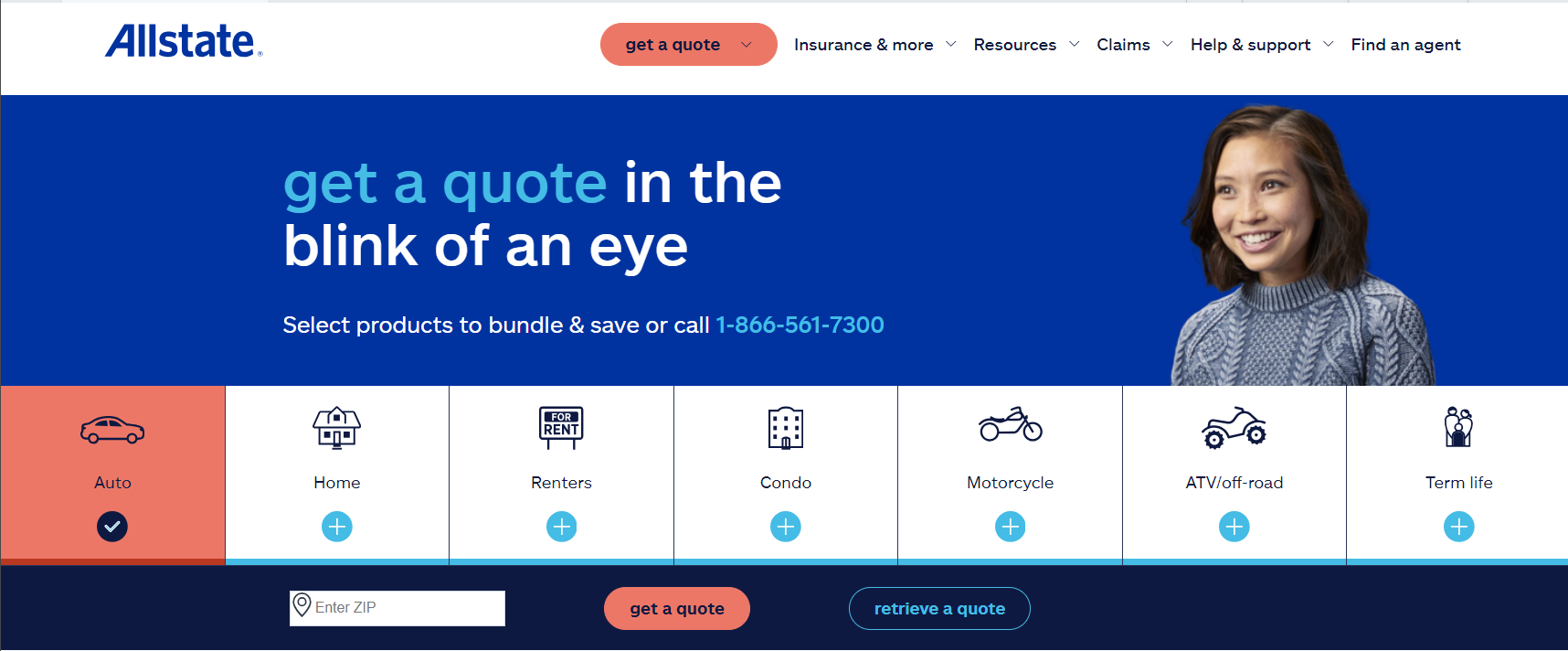

#1 — Allstate: Top Overall Pick

Pros

- Reliable Customer Service: Allstate offers the best Colorado Springs, CO, auto insurance with $57/month minimum coverage rates.

- Accident Forgiveness: Allstate’s accident forgiveness feature provides added peace of mind for drivers in Colorado Springs.

- Safe Driver Discounts: Allstate provides notable savings for safe drivers with its Drivewise program, helping reduce rates.

Cons

- Higher Minimum Coverage Rates: Allstate offers a minimum coverage rates start at $57 per month, which it is higher compared to some competitors in Colorado Springs.

- Limited Customization: Allstate may offer fewer options for customizing policies, affecting coverage flexibility. Find out Allstate auto insurance review for more information.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 — American Family: Best for Customer Service

Pros

- Great for Young Drivers: American Family offers the best Colorado Springs, CO auto insurance for young drivers, with rates starting at $49 per month.

- Generous Discounts: American Family provides numerous discounts, including those for good students, making it an excellent choice for young drivers.

- Innovative Coverage Options: American Family offer a personalize insurance options to help the drivers in Colorado Springs to choose the best coverage for their requirements.

Cons

- Limited Availability: American Family is not available in each zip code of Colorado Springs. See the American Family auto insurance review for more details.

- High Deductibles: Some policyholders might find the deductible levels high, particularly for minimum coverage policies.

#3 — Geico: Best for Affordable Rates

Pros

- Lowest Rates: Geico provides the best vehicle insurance in Colorado Springs, CO, with a monthly minimum coverage rate of $45.

- Digital Tools: The Geico mobile app is easy to use and offers quick access to policy administration.

- Wide Range of Discounts: Geico offers a broad range of discounts, including military and federal employee discounts, further reducing costs.

Cons

- Limited Local Agents: Geico focuses mainly on Internet services and has fewer local agents in Colorado Springs. Discover more in our guide, “Geico Auto Insurance Review.“

- Limited Coverage for High-Risk Drivers: Geico’s low overall rates may not be the greatest option for high-risk drivers.

#4 — Progressive: Best for Snapshot Program

Pros

- Best for High-Risk Drivers: Progressive offers the best Colorado Springs, CO, auto insurance for high-risk drivers, with minimum coverage starting at $53 per month.

- Snapshot Program: Their Snapshot program helps drivers save by monitoring driving habits and rewarding safe driving.

- Wide Range of Coverage Options: Progressive provides the various basic to comprehensive coverage options.

Cons

- Higher Minimum Coverage Rates: Progressive’s minimum coverage rate starts at $53 per month, which is higher than other competitors in Colorado Springs.

- Customer Service Issues: Some customers have reported issues with customer service responsiveness. Learn more in our guide, “Progressive Auto Insurance Review.“

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 — Farmers: Best for Customizable Policies

Pros

- Highly Customizable Plans: Farmers offers the best Colorado Springs, CO, car insurance with customized coverage for a minimum of $51 per month.

- Excellent Claims Support: Farming is great for giving very good claims service to drivers of Colorado Springs.

- Variety of Add-Ons: They offer extended covers, including rideshare, catering to diverse needs.

Cons

- Slightly Higher Premiums: Farmers are more expensive than competitors at each level, beginning with basic coverage at $51 monthly.

- Discount Limitations: Some discounts are more difficult to qualify for, limiting the amount drivers can save. Explore more in our guide titled “Farmers Auto Insurance Review.“

#6 — Liberty Mutual: Best for Electric Vehicles

Pros

- Best for Full Coverage: Liberty Mutual provides the best Colorado Springs, CO, auto insurance for full coverage, starting at $54 per month.

- Accident Forgiveness: They offer accident forgiveness, helping protect drivers from rate increases after an accident. Expand your knowledge in our guide, “Liberty Mutual Auto Insurance Review.“

- New Car Replacement: Liberty Mutual’s new car replacement coverage is ideal for Colorado Springs drivers with newer vehicles.

Cons

- Higher Rates for Minimum Coverage: Liberty Mutual’s $54 per month minimum coverage rate is higher than that of other companies.

- Fewer Discounts for Low-Mileage Drivers: Liberty Mutual offers fewer savings opportunities for drivers who don’t drive often.

#7 — State Farm: Best for Competitive Premiums

Pros

- Best for Customer Loyalty: State Farm provides the best Colorado Springs, CO auto insurance for long-time policyholders, starting at $47 per month for minimum coverage.

- Strong Agent Network: State Farm has a large network of local agents, making it easy to get personalized service in Colorado Springs.

- Great Discounts for Bundling: Their bundling options offer great savings for customers with multiple policies. See more details in our guide, “State Farm Auto Insurance Review.“

Cons

- Higher Premiums for Full Coverage: State Farm’s full coverage premiums may be higher compared to some competitors.

- Limited Online Tools: Their online tools and app could be more comprehensive compared to other providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 — The Hartford: Best for Older Drivers

Pros

- Best for Mature Drivers: The Hartford offers the best Colorado Springs, CO auto insurance for mature drivers, with rates starting at $55 per month for minimum coverage.

- AARP Discounts: Special AARP discounts are great for elderly drivers who want to save more.

- Lifetime Renewability: Hartford offers lifetime renewability for auto policies to ensure the long-term coverage. Read more in our guide, “The Hartford Company Auto Insurance Review.“

Cons

- Higher Minimum Coverage Rates: Hartford’s minimum coverage rates start at $55 per month, higher than others in Colorado Springs.

- Limited Availability for Non-AARP Members: Hartford’s best deals are often only available to AARP members.

#9 — Nationwide: Best for Coverage Flexibility

Pros

- Best for Bundling: Nationwide provides the best Colorado Springs, CO, auto insurance with a $48 per month minimum coverage and offers significant discounts for bundling auto and home insurance.

- Vanishing Deductible: Their vanishing deductible program rewards safe drivers by lowering deductibles over time. Find out more in our guide titled “Nationwide Auto Insurance Review.“

- Wide Range of Discounts: It has numerous discounts, such as safe driving and long-term policy coverage.

Cons

- Higher Rates for High-Risk Drivers: Nationwide may charge more for high-risk drivers than most of its competitors.

- Limited Rideshare Insurance: Nationwide cannot provide the most excellent ridesharing policies for its drivers.

#10 — AAA: Best for Local Claims

Pros

- Affordable Family Rates: AAA provides the best Colorado Springs, CO auto insurance for families, starting at $46 per month for minimum coverage.

- Roadside Assistance Included: Their policies come with roadside assistance, making it more valuable for family vehicles.

- Great Bundle Options: AAA offers significant savings for bundling home and auto insurance, lowering overall costs. Learn AAA Auto insurance review for more details.

Cons

- Slow Claims Process: Some policyholders report a slower claims process, which could impact service satisfaction.

- Limited Online Tools: Their digital tools and mobile app could benefit from more functionality compared to competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Colorado Springs, CO Auto Insurance Monthly Rates by Provider & Coverage Level

In Colorado Springs, Geico offers the lowest minimum coverage rate at $45 per month, followed by AAA at $46 per month and State Farm at $47 per month. Other affordable options include American Family at $49 per month and Nationwide at $48 per month.

Colorado Springs, CO Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $57 | $182 | |

| $49 | $162 | |

| $46 | $158 |

| $51 | $167 | |

| $45 | $150 | |

| $54 | $175 |

| $48 | $160 |

| $53 | $170 | |

| $47 | $155 | |

| $55 | $180 |

Geico remains the most affordable for full coverage at $150 per month, with AAA at $158 per month and State Farm at $155 per month. Progressive and Liberty Mutual have higher rates, starting at $170 and $175 per month, moreovides more comprehensive protection options. For more information, see our guide titled “Types of Auto Insurance Coverage.”

Colorado Springs Auto Insurance Rates

Location is one of the factors that determine auto insurance. The key to cheap car insurance in Colorado Springs, CO, is age, gender, commute, coverage level, credit history, driving record, and the type of vehicle you drive.

Auto Insurance Discounts From the Top Providers in Best Colorado Springs, CO

| Insurance Company | Available Discounts |

|---|---|

| Good Student, Multi-Vehicle, Safe Driver, Vehicle Safety Features, Bundling With Home Insurance | |

| Early Bird, Steer Into Savings, Multi-Vehicle, Low Mileage, Home And Auto Bundling | |

| Snapshot (Telematics), Continuous Coverage, Safe Driver, Bundling Home And Auto |

| New Car Replacement, Accident Forgiveness, Homeowner, Bundling, Vehicle Safety Features | |

| Military, Good Driver, Membership And Employee, New Vehicle, Anti-Theft System | |

| Safe Driving Bonus, Good Student, Bundling, Paperless Billing, New Vehicle |

| Good Student, Loyalty, Bundling, Anti-Theft Features, Pay-In-Full |

| Signal (Telematics), Good Student, Safe Driver, Bundling With Home Insurance | |

| AARP Member, Anti-Lock Brakes, Defensive Driving Course, Bundling | |

| Vanishing Deductible, Accident-Free, Good Student, SmartRide (Telematics), Homeowner |

For this section, we’ll go through each factor that determines auto insurance. You’ll see how factor affects auto insurance and why policy discounts are important.

How Age and Gender Impact Premiums in Colorado Springs

On August 1, 2019, six U.S. states banned the use of gender in setting auto insurance rates. However, Colorado still allows insurers to consider gender when determining premiums.

Colorado, Spring CO Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | Monthly Rates |

|---|---|

| Age: 17 Female | $668 |

| Age: 17 Male | $752 |

| Age: 25 Female | $235 |

| Age: 25 Male | $248 |

| Age: 35 Female | $215 |

| Age: 35 Male | $213 |

| Age: 60 Female | $198 |

| Age: 60 Male | $206 |

| Average | $342 |

Auto insurance quotes in Colorado Springs show that annual rates can vary significantly based on age and gender, as Colorado still permits rates to differ by gender.

Young drivers in Colorado Springs often encounter the highest average car insurance costs, but they may be eligible for discounts, such as good student or driving course discounts. To understand better, look at our detailed guide, “Car Insurance for Students.”

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What ZIP Codes Have the Cheapest Auto Insurance Rates in Colorado Springs

Where you reside directly impacts your affordable auto insurance premium, particularly in cities like Colorado Springs. Rural areas generally have lower rates due to fewer cars and less traffic, which decreases the likelihood of accidents.

Colorado Springs, CO Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 80920 | $299 |

| 80919 | $301 |

| 80921 | $303 |

| 80907 | $305 |

| 80924 | $308 |

| 80923 | $308 |

| 80904 | $310 |

| 80918 | $311 |

| 80922 | $311 |

| 80939 | $315 |

| 80925 | $315 |

| 80906 | $316 |

| 80938 | $316 |

| 80951 | $316 |

| 80946 | $317 |

| 80917 | $317 |

| 80912 | $318 |

| 80926 | $318 |

| 80927 | $319 |

| 80905 | $320 |

| 80902 | $320 |

| 80909 | $321 |

| 80903 | $323 |

| 80928 | $324 |

| 80929 | $325 |

| 80930 | $326 |

| 80910 | $331 |

| 80916 | $336 |

Affordable auto insurance rates in Colorado are influenced by various factors, including the risk of collisions, rates of vehicle theft, and the frequency of claims in each ZIP code. These factors collectively determine the cost of coverage based on your location.

The lowest affordable auto insurance rates can be found in ZIP code 80920, while ZIP code 80916 has the highest rates. This difference reflects the varying risks and claims history in these areas, making certain neighborhoods more expensive to insure than others.

Have you heard of Drivewise? It’s located in our Allstate app. We recently found out that customers who choose to use Drivewise are 25% less likely to have a severe collision than those who don’t. https://t.co/HNMxg3hVAZ

— Allstate (@Allstate) May 13, 2024

If you drive a 4-cylinder vehicle, your insurance costs may be lower due to the typically reduced risk of accidents and repair costs. Explore more in our guide “High Risk Drivers.“

Which Companies Have the Best Auto Insurance Rates in Colorado Springs

We have now reached the section where we will compare cheap auto insurance quotes of various companies in Colorado Springs, CO. The companies included in this section are the top companies based on market share. Let’s find out how much they charge.

Cheapest Colorado Springs, CO Auto Insurance Company Rates

Auto insurance rates in Colorado Springs depend largely on the company you choose. While higher premiums may indicate more coverage or better service, this isn’t always the case. It’s important to carefully review what each provider offers to determine the best value for your needs.

Colorado Springs, CO Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A- | Low severe weather |

| Traffic Density | B | Moderate traffic levels |

| Vehicle Theft Rate | B- | Slightly above average |

| Uninsured Drivers Rate | C+ | Somewhat high rate |

| Average Claim Size | C | Higher-than-average claims |

Currently, Liberty Mutual offers the cheapest rates in the city, making it a popular choice for budget-conscious drivers. USAA comes in second but is only available to military personnel and their immediate families, limiting its accessibility.

Geico and State Farm also offer competitive rates, making them affordable for many residents. By comparing rates and coverage options, drivers in Colorado Springs can find the best auto insurance to suit their specific needs. For more insights, consult our complete guide titled “Car Insurance Discounts.”

Best Auto Insurance for Commute Rates

In Colorado, the average annual mileage is 12,000 miles, slightly exceeding the maximum limit for commute rates. This comparison examines average annual rates from various companies based on different commute distances.

Colorado Springs, CO Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $180 | $200 |

| $210 | $235 | |

| $195 | $220 | |

| $230 | $255 | |

| $175 | $195 | |

| $215 | $240 |

| $190 | $215 |

| $220 | $245 | |

| $200 | $225 | |

| $205 | $230 |

The table below outlines average annual rates in Colorado Springs for different commute distances. For a 10-mile commute with 6,000 annual miles, Geico offers the lowest rate at $175 per month, followed by American Family at $195 per month. For a 25-mile commute with 12,000 annual miles, American Family rate increases to $220 per month, while Geico remains at $195 per month. Other companies, like Allstate and State Farm, have varying rates for both distances.

Some insurers, including AAA, The Hartford, Farmers, Nationwide, and Progressive, charge the same annual rate regardless of miles driven during the policy period. This pricing structure can benefit drivers with longer commutes, providing consistent rates without mileage-related increases.

Best Auto Insurance for Coverage Level Rates

When looking for the best car insurance in Colorado Springs, it’s important to consider the top car insurance companies in Colorado. In Colorado, the minimum auto insurance requirements are $25,000 for bodily injury per person, $50,000 per accident, and $15,000 for property damage, often displayed as 25/50/15. Higher coverage options such as 50/100/50 or 100/300/100 offer more protection but have higher premiums.

Colorado Springs, CO Average Annual Rates by Company Coverage Levels

| Companies | Average Annual Rates with Low Coverage | Average Annual Rates with Medium Coverage | Average Annual Rates with High Coverage |

|---|---|---|---|

| Liberty Mutual | $2,623 | $2,801 | $3,018 |

| Geico | $3,108 | $3,435 | $3,990 |

| USAA | $3,213 | $3,380 | $3,545 |

| State Farm | $3,352 | $3,640 | $3,920 |

| American Family | $3,586 | $3,866 | $3,912 |

| Nationwide | $3,767 | $3,801 | $3,833 |

| Progressive | $4,005 | $4,425 | $4,798 |

| Farmers | $5,037 | $5,710 | $6,646 |

| Allstate | $5,422 | $5,762 | $6,172 |

In Colorado Springs, Geico offers the lowest rates, starting at $2,623 for low coverage and increasing to $3,018 for high coverage. On the other hand, Progressive, Farmers, and Allstate have the highest rates, with Farmers’ low coverage starting at $5,037.

Across all coverage levels in Colorado Springs, Liberty Mutual consistently remains the most affordable, while Progressive, Farmers, and Allstate consistently offer the most expensive plans.

Best Auto Insurance for Credit History Rates

When looking for the best auto insurance companies in Colorado, it’s important to consider how your credit score can impact your rates. In Colorado Springs, CO, the average annual insurance rates can vary significantly based on your credit history.

Colorado Springs, CO Average Annual Rates by Credit History

| Companies | Aveage Annual Rates with Poor Credit | Aveage Annual Rates with Fair Credit | Aveage Annual Rates with Good Credit |

|---|---|---|---|

| Liberty Mutual | $4,010 | $2,470 | $1,963 |

| Geico | $4,226 | $3,511 | $2,796 |

| Nationwide | $4,595 | $3,638 | $3,168 |

| American Family | $4,920 | $3,504 | $2,939 |

| USAA | $4,987 | $2,857 | $2,294 |

| Progressive | $5,017 | $4,283 | $3,929 |

| State Farm | $5,043 | $3,248 | $2,622 |

| Farmers | $6,746 | $5,461 | $5,187 |

| Allstate | $7,394 | $5,682 | $4,281 |

For instance, Liberty Mutual and Geico offer the lowest rates for drivers with poor credit, averaging $4,010 and $4,226, respectively. On the other hand, for those with fair and good credit, Liberty Mutual, USAA, State Farm, and Geico provide more affordable options, with rates dropping considerably as credit scores improve.

The data clearly show that drivers with poor credit pay 25% to 50% more for auto insurance than those with good credit. This highlights the financial implications of credit scores on insurance premiums, emphasizing the importance of maintaining a good credit history for lower rates.

Best Auto Insurance for Driving Record Rates

Auto insurance companies offer “Accident Forgiveness” discounts for minor violations but often exclude serious offenses like DUIs or reckless driving.

In Colorado Springs, CO, the best auto insurance companies offer varying rates based on driving records. USAA provides competitive rates for clean records, while prices rise significantly after a DUI. Liberty Mutual offers the lowest rates for drivers with one DUI, making it one of the best auto insurance options in Colorado Springs. Farmers and Allstate remain the most expensive.

Liberty Mutual stands out as the best auto insurance company for violations, with USAA close behind. Farmers consistently charge the highest rates for speeding violations, accidents, or DUIs. Maintaining a clean record helps avoid premium increases or loss of coverage.

What Affects Auto Insurance Rates in Colorado Springs

Auto insurance rates in Colorado Springs are influenced by several factors, including road conditions, vehicle theft rates, and commute times from work to home, which are often overlooked. Understanding how these elements impact your rates can help you make informed decisions about your coverage. To know more, check out our comprehensive guide titled, “Auto Insurance Coverage Options.”

Colorado Springs Road Conditions

The National Transportation Research Nonprofit (TRIP) evaluates road conditions in U.S. metro areas, highlighting Colorado Springs. The latest report shows that 37% of roads are in poor condition, 25% are mediocre, 16% are fair, and only 21% are good.

Colorado Springs, CO Auto Insurance Monthly Rates by Driving Records

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $280 | $340 | $400 | $490 |

| $411 | $466 | $473 | $578 | |

| $234 | $265 | $331 | $434 | |

| $408 | $482 | $525 | $518 | |

| $206 | $269 | $322 | $374 | |

| $206 | $242 | $241 | $249 |

| $244 | $268 | $333 | $421 |

| $317 | $370 | $449 | $335 | |

| $278 | $303 | $329 | $303 | |

| $300 | $355 | $410 | $500 |

TRIP also assesses vehicle operating costs (VOC), which include repairs, depreciation, maintenance, tires, and fuel. For Colorado Springs, the VOC is reported at $702.

These findings indicate significant challenges for drivers in Colorado Springs, with a substantial portion of the road infrastructure needing improvement and notable costs associated with vehicle operation.

Vehicle Theft in Colorado Springs

In 2018, Colorado Springs reported 2,399 motor vehicle thefts, highlighting the need for vehicle safety awareness and consideration of the best car insurance companies in Colorado.

Colorado Springs, CO Annual Crime Statistics

| Crime Category | Annual Incidents |

|---|---|

| Violent | 4,000 |

| Property | 25,000 |

| Larceny-Theft | 18,000 |

| Burglaries | 3,500 |

| Motor Vehicle Thefts | 3,000 |

| Aggravated Assaults | 2,500 |

| Robberies | 800 |

| Rapes | 450 |

| Arson | 100 |

| Homicides | 40 |

Neighborhood Scout identified ten safe neighborhoods, such as Fort Carson and Black Forest, but the overall crime index is still low at 8. Vehicle theft remains a concern, making it crucial to seek the best car insurance in Colorado Springs.

The annual crime report shows 57,390 total crimes, with a property crime rate of 25 per 1,000 residents. The chance of becoming a victim of violent crime is one in 4,000, while property crime is one in 25,000, indicating the importance of finding the best car insurance rates in Colorado Springs.

Traffic Congestion in Colorado Springs, CO

The advancement of technology has greatly improved traffic tracking. Organizations like Inrix rank metro areas worldwide. According to the latest Inrix traffic report, Colorado Springs is facing significant challenges regarding congestion.

Colorado Springs, CO Inrix Traffic Report

| Metric | Value |

|---|---|

| Average Daily Traffic Delay | 20 minutes |

| Peak Congestion Hours | 7:00 - 9:00 AM, 4:00 - 6:00 PM |

| Annual Traffic Delay per Driver | 70 hours |

| Traffic Incident Count per Year | 1,500 incidents |

| Most Congested Roads | I-25, US-24, Powers Blvd |

| Traffic Density Level | High |

| Average Speed During Peak Hours | 30 mph |

| Cost of Congestion per Driver | $1,200 annually |

Commute times within the urban core are considerably longer due to the increasing population density. As more people move to the area, the strain on roadways intensifies, leading to longer travel times for residents.

In contrast, commute times decrease as one moves further from the city center. Suburban areas experience less congestion, allowing for quicker travel compared to the urban environment.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How is Traffic in Colorado Springs

In Colorado Springs, the average commute time for drivers is between 15 and 23 minutes. Nearly 80 percent of workers choose to drive their own vehicles to work, indicating the city’s reliance on cars for commuting. Explore further in our guide, “How Traffic Violations Increase Car Insurance Rates?”

Colorado Springs, CO Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 10,000 |

| Total Claims Per Year | 7,500 |

| Average Claim Size | $5,500 |

| Percentage of Uninsured Drivers | 18% |

| Vehicle Theft Rate | 2,500 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | Medium |

For those insuring their vehicles as business vehicles, premiums are typically higher. On average, business vehicles cost about 10 to 12 percent more to insure than vehicles used primarily for personal or recreational purposes.

Concerns about high yearly mileage may not significantly impact insurance costs. Even if you drive more than average, your premiums are unlikely to increase by more than 2-3 percent, making it manageable for most drivers.

Case Study: Analyzing Auto Insurance Options in Colorado Springs, CO

Selecting auto insurance in Colorado Springs can be challenging due to many options. This case study reviews three top providers—Allstate, Liberty Mutual, and Geico—focusing on their strengths in coverage, pricing, and customer service to help drivers make informed choices.

- Case Study #1 — Allstate’s Comprehensive Coverage: Allstate is a leading choice in Colorado Springs for its comprehensive coverage and features like accident forgiveness, with policies starting at $45 per month for a clean-record driver. Its strong customer service, including 24/7 claims support, makes it a reliable option.

- Case Study #2 — Liberty Mutual’s Competitive Rates: Liberty Mutual frequently offers the lowest rates in Colorado Springs, with customizable policies that start around $2,623 for low coverage for a clean-record driver. Their “RightTrack” program rewards safe driving, appealing to budget-conscious customers.

- Case Study #3 — Geico’s Affordable Rates and User-Friendly Experience: Geico is known for its competitive rates, starting at $45 per month, and its user-friendly online experience. With discounts for military personnel and students, it stands out for affordability and convenience in Colorado Springs.

Choosing the right auto insurance provider in Colorado Springs involves comparing options. Allstate, Liberty Mutual, and Geico each offer unique strengths in coverage, pricing, and service, helping drivers make informed decisions. For additional information, see our comprehensive guide called “Driving Tips for Road Safety.“

Allstate is the top choice for Colorado Springs drivers, delivering comprehensive coverage at competitive rates.

Scott W. Johnson Licensed Insurance Agent

If you’re looking to compare affordable car insurance in Colorado Springs, CO, use the free comparison tool below by entering your ZIP code now!

Frequently Asked Questions

What are the best auto insurance companies in Colorado Springs?

The top auto insurance companies in Colorado Springs are Allstate, American Family, and Geico, with rates starting at $45 per month. Read more in our guide, “Claim-Free Discount: How Much Can You Save?”

How can I find affordable auto insurance in Colorado Springs?

To find affordable auto insurance, compare quotes from multiple providers, consider your coverage needs, and look for available discounts. Use our free comparison tool below to see what auto insurance quotes look like in your area.

What factors affect auto insurance rates in Colorado Springs?

Factors that affect rates include age, gender, ZIP code, credit history, driving record, and the type of vehicle you drive.

How does my age impact my auto insurance premium?

Younger drivers typically face higher premiums due to their lack of driving experience, while older drivers may qualify for discounts. (Learn more: How does an auto insurance company determine my premium?)

Can my ZIP code affect my auto insurance rates?

Yes, your ZIP code influences rates, as areas with higher crime rates or traffic congestion may lead to increased premiums.

What is the minimum auto insurance coverage required in Colorado?

The minimum coverage requirements in Colorado are $25,000 for bodily injury per person, $50,000 per accident, and $15,000 for property damage (25/50/15).

How does my credit history impact my auto insurance rates?

Drivers with poor credit may pay 25% to 50% more for auto insurance than those with good credit, as insurers often use credit scores to assess risk. View our guide titled “Average Auto Insurance Cost.”

Do auto insurance companies offer discounts for good driving records?

Yes, many insurers provide “Accident Forgiveness” discounts for minor violations, and safe driving can lead to lower rates.

How can I compare auto insurance quotes effectively?

Use online comparison tools to gather quotes from multiple providers, ensuring you consider coverage options and discounts. Find out the 10-minute auto insurance buying guide for more details.

Is it possible to get lower rates for electric vehicles in Colorado Springs?

Yes, some insurers, like Liberty Mutual, offer specialized coverage and discounts for electric vehicles, making them a more affordable option for EV owners. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.