Best Auto Insurance Discounts for Farm Vehicles in 2025 (Save up to 35% With These Companies)

You will find the best auto insurance discounts for farm vehicles at State Farm, Farmers, and Nationwide, with up to 35% savings. Farm vehicle discounts are for customers who combine farm vehicle insurance with auto insurance and have approved agricultural vehicles, such as tractors.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Nov 2, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

State Farm, Farmers, and Nationwide have the best auto insurance discounts for farm vehicles, helping farmers lower their insurance costs.

Depending on what provider you use, you can save at least 15% on your annual premiums with a farm vehicle auto insurance discount.

Our Top 10 Company Picks: Best Farm Vehicle Auto Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 35% | B | Vehicles used primarily for farm operations | |

| #2 | 30% | A | Vehicles used for farm work | |

| #3 | 28% | A+ | Vehicles for daily farm tasks like crop hauling |

| #4 | 25% | A | Farm vehicles for livestock, equipment, or tasks | |

| #5 | 23% | A++ | Vehicles for personal farm or ranch work | |

| #6 | 22% | A+ | Farm trucks and tractors used for agriculture |

| #7 | 20% | A+ | Farm vehicles, excluding commercial use | |

| #8 | 18% | A+ | Farm vehicles used solely on farm property | |

| #9 | 17% | A | Agricultural vehicles insured for farm use only |

| #10 | 15% | A+ | Farm vehicles transporting goods like produce |

Keep reading to discover what providers offer this discount and learn how to get cheap car insurance rates. To compare farm vehicle auto insurance discount rates, enter your ZIP code into our free tool above to immediately receive quotes from the best providers in your region.

- State Farm has the best discount on insurance for farm vehicles

- Farm vehicle auto insurance discounts will vary by company

- You must have an approved farm vehicle to qualify for farm vehicle insurance

How to Get an Auto Insurance Discount for Farm Vehicles

According to DataUSA, there are about 270,000 farmers in America. What is a farm vehicle auto insurance discount?

If you’re a farm owner, you can receive discounted auto insurance rates by bundling your auto and farm vehicle policies through the same provider. This customer loyalty discount works similarly to auto insurance discounts for bundling home and auto policies.

Some companies allow you to bundle your auto, farm vehicle, and home or renters insurance for even more significant savings (Learn More: Bundling Car Insurance and Renters Insurance to Save Money). To qualify, you must purchase an approved policy for a tractor, ATV, UTV, plow truck, seeder, or other specialized farm equipment through the same provider as your auto insurance.

The insurance rate for agricultural vehicles tends to be cheaper than other larger commercial trucks because they aren’t driven as often, reducing the risk of a claim being filed.

Dani Best Licensed Insurance Producer

A farm vehicle auto insurance discount is separate from limited-use agricultural vehicle insurance. The deal only applies to a private passenger auto policy, not a farm owner policy.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies With Farm Vehicle Discounts

What companies offer a farm vehicle auto insurance discount? You’re in the right place to research farm vehicle auto insurance discounts by company.

Currently, only a few major insurance companies offer a farm vehicle discount on truck insurance and other vehicles to customers. However, there may be local agencies near you that also provide this savings opportunity.

If you want to buy farm vehicle discount auto insurance, check out the following providers with the best discounts for farm vehicles.

Top Farm Vehicle Savings: Monthly Min. Coverage Rates After Discount

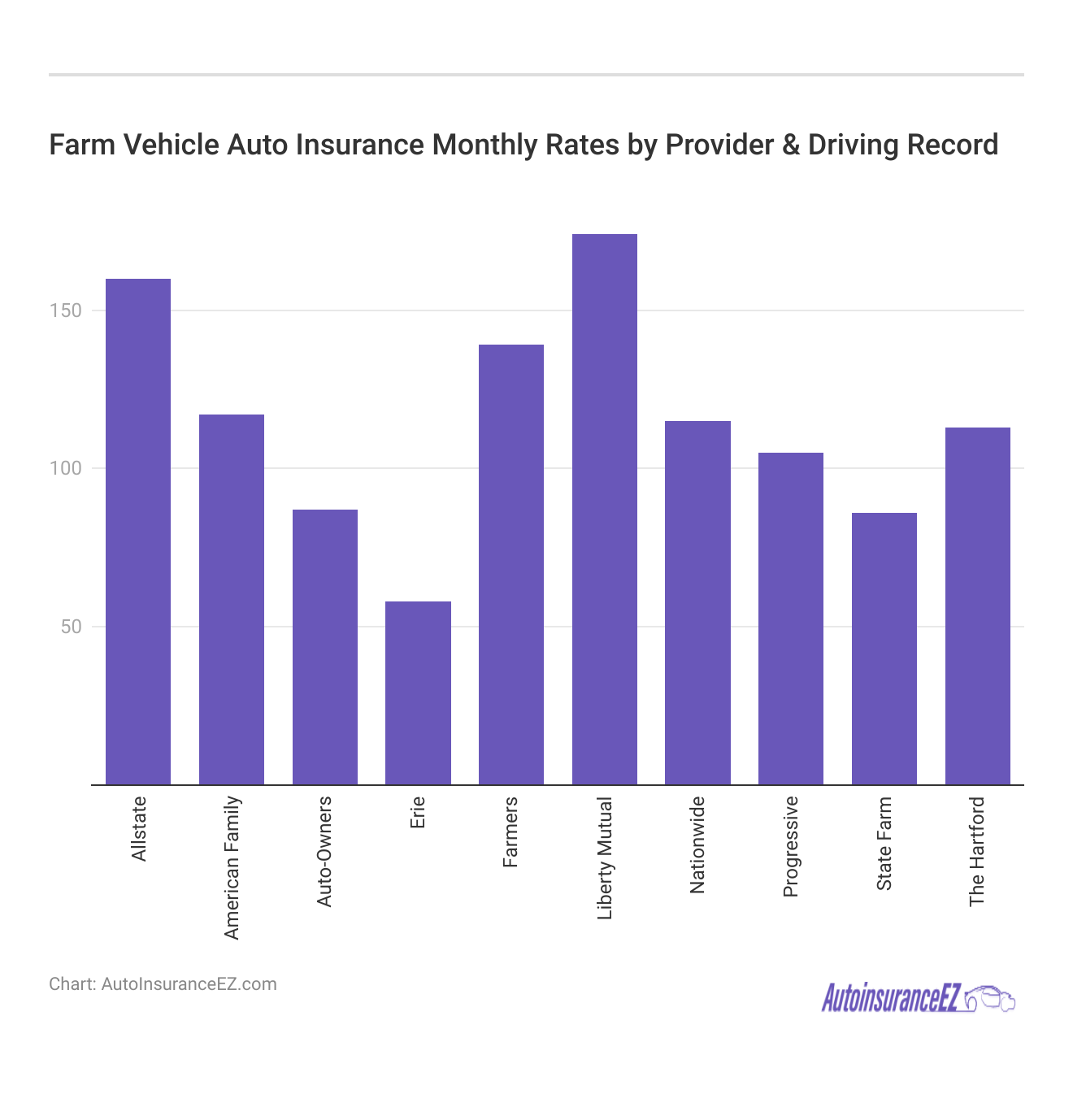

When it comes to auto insurance discounts, each company uses different eligibility rules and provides different levels of saving. It’s important to also look at what an auto insurance company’s rates are on average to determine which is most affordable for your driving record before the farm vehicle discount is applied.

The best farm vehicle auto insurance discount company for one person might not be the same for another person. However, you can expect to save at least 15% on your annual premiums if you earn this discount.

Saving on Your Farm Vehicles With Auto Insurance Discounts

On average, farmers’ rates for farm insurance start at $58/mo, but the best car insurance discounts for farm vehicles can help farmers save.

However, by insuring your farm equipment through the same company as your auto insurance, you can potentially receive up to a 35% annual rate reduction.

Now that you’ve learned about affordable farm vehicle auto insurance discounts, you can enter your ZIP code into our free rate tool below to immediately receive quotes from the top companies near you.

Frequently Asked Questions

What is farm vehicle insurance?

Farm vehicle insurance is auto insurance coverage for farm vehicles. The different types of auto insurance coverage for farm vehicles protect the vehicle and the owner in case of accidents.

What is a farm vehicle?

A farm vehicle is any vehicle used for agricultural use, from tractors to small trucks. If you need to buy farm vehicle insurance, use our free quote tool to find the best deal.

How much does it cost to insure a tractor?

Tractor insurance prices will vary depending on which farm auto insurance company you choose, with State Farm having the biggest discount (Read More: State Farm Auto Insurance Review).

Do farm vehicles need insurance?

Yes, you’ll need to buy a farm vehicle auto policy if you drive your farm vehicle on public roads. If you can afford to do so, paying in full for your policy will lower rates with a discount (Learn More: Is it a bad idea to pay all at once on auto insurance?).

Is Progressive cheaper than State Farm?

If you’re looking for cheap farm vehicle insurance quotes, State Farm is actually cheaper on average than Progressive.

What discounts does Farmers insurance offer?

Farmers offers several discounts on insurance coverage, such as a good driver discount. Read our Farmers auto insurance review to learn more about the company.

Who has the cheapest farm car insurance?

Erie is one of the cheapest insurance for agricultural vehicles. However, Erie is only available in select states.

Is tractor insurance worth it?

Yes, limited-use vehicle insurance for a tractor is usually worth it for most farmers.

Is farm truck insurance cheaper?

Yes, farm truck insurance is usually cheaper due to lower mileage on the truck (Read More: Is it bad to set your auto insurance miles too low?).

Is it better to shop around for insurance?

Yes, it would be best if you shopped around for farm auto insurance quotes to get the best deal. You can also look for discounts like a continuous coverage discount to maximize savings.