Best Springfield, IL Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, Progressive, and Erie provide the best Springfield, IL auto insurance, offering top-rated coverage with monthly rates starting at $27. These providers have earned residents' trust by offering exclusive discounts to young and safe drivers, making them the top choices for affordable auto insurance in Springfield.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Dec 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Springfield IL

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Springfield IL

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Springfield IL

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsState Farm is the top choice for the best Springfield, IL auto insurance, offering comprehensive coverage and strong customer service. Progressive and Erie follow closely with affordable options and a wide range of Springfield car insurance options suitable for different needs.

This article will help you understand what makes these companies stand out and which may guide you in choosing the right coverage for your needs.

Our Top 10 Company Picks: Best Springfield, IL Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Trusted Service | State Farm | |

| #2 | 10% | A+ | Competitive Rates | Progressive | |

| #3 | 25% | A+ | Youth Discounts | Erie |

| #4 | 25% | A++ | Special Discounts | Geico | |

| #5 | 13% | A++ | Comprehensive Coverage | Travelers | |

| #6 | 25% | A | Personalized Policies | American Family | |

| #7 | 10% | A++ | Military Drivers | USAA | |

| #8 | 15% | A++ | Flexible Options | Safeco | |

| #9 | 20% | A+ | Innovative Technology | Nationwide |

| #10 | 25% | A | Accident Forgiveness | Liberty Mutual |

Compare rates from top insurance providers in Springfield, IL, by entering your Springfield ZIP code using our free quoting tool above.

- State Farm offers affordable auto insurance coverage starting at $27/month

- Compare top companies in Springfield for budget-friendly coverage

- Discounts and online tools simplify policies for Springfield drivers

#1 – State Farm: Top Overall Pick

Pros

- Trusted Service: Springdale drivers can count on State Farm for excellent customer service, backed by decades of experience and a high J.D. Power satisfaction score.

- Discount for Safe Vehicles: For auto insurance in Springfield, State Farm offers discounts to clients with the latest safety features installed, thus encouraging safe-minded people.

- Steer Clear Program: State Farm’s Steer Clear program helps young drivers in Springfield save money by encouraging safe driving and rewarding good insurance records.

Cons

- Fewer Specialized Discounts: State Farm doesn’t offer some of the specialized auto insurance discounts available elsewhere, so savers in Springfield, IL, cannot save as much in these areas.

- Premiums May Be Higher for Younger Drivers: Young drivers in Springfield with limited experience may find auto insurance expensive. Elevate your knowledge with our “State Farm Review.”

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Affordable Pricing: Progressive is one of the providers that offers lower rates. Therefore, this company is a first choice for Springfield car owners seeking affordable auto insurance.

- Multi-Vehicle Discount: Progressive offers discounts on car insurance for households in Springfield, IL, with multiple vehicles. Our “Progressive Auto Insurance Review” provides further insights.

- Snapshot Telematics Program: Progressive’s Snapshot program rewards Springfield drivers with insurance discounts for safe driving, helping to lower costs.

Cons

- Inconsistent Claims Experience: Some claimants find Progressive inconsistent in its response, and their insurance claims may go through a slow-track process or not even reach the processing desks.

- Limited In-Person Support: Progressive’s limited local presence in Springfield, IL, means drivers may rely more on online or phone support, which may not suit everyone.

#3 – Erie: Best for Youth Discounts

Pros

- Youthful Driver Savings: Erie offers car insurance discounts for drivers under 25, making it a great choice in Springfield, IL. For additional information, read our “Erie Auto Insurance Review.”

- Pay-in-Full Discount: Springfield car owners who pay their insurance premiums in full upfront can take advantage of additional savings with Erie, reducing long-term costs.

- Vehicle Safety Discounts: Erie offers lower auto insurance rates to Springfield customers who own cars with safety features.

Cons

- Limited Availability in Some Areas: Erie insurance services are not offered throughout Springfield, IL, which limits their supply for some people.

- Fewer Digital Tools: Erie’s online tools and mobile app aren’t as robust as some insurance competitors, which may disadvantage tech-savvy Springfield car owners.

#4 – Geico: Best for Special Discounts

Pros

- Military and Federal Employee Discounts: Geico provides excellent insurance discounts only for military and federal employees, which puts it at the top of the list of eligible Springfield drivers.

- Multi-Vehicle Savings: Springfield car owners with more than one car through Geico get great savings on car insurance, which makes this a very affordable option for a family with multiple cars.

- Federal Employee Benefits: Geico offers exclusive auto insurance savings for Springfield government employees. For additional insights, refer to our “Geico Auto Insurance Review.”

Cons

- Less Personal Touch: Geico’s largely online operation often reveals a lack of personalized insurance service for its customers, which will not please every vehicle owner in Springfield, IL.

- Claims Processing Delays: Those insured under Geico of Springfield have expressed long waiting times when filling car insurance claims as the major disadvantage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Travelers offers various coverage options, so Springfield, Illinois residents can get the desired automobile insurance.

- Discount for Hybrid Vehicles: Springfield customers who buy hybrid automobiles may qualify for a discount on their automobile insurance to help them save money while maintaining sustainability.

- Early Quote Discount: It offers discounts to Springfield residents who buy their insurance years in advance, helping them save money.

Cons

- Higher Initial Premiums: Some Springfield, IL motorists may find that Travelers’ initial premiums are higher than other providers, though savings may increase over time.

- Limited Discounts for Young Drivers: It offers limited discounts for young drivers in Springfield, IL, making it less accessible. Explore further details in our “Travelers Auto Insurance Review.”

#6 – American Family: Best for Personalized Policies

Pros

- Customizable Coverage: American Family allows customers to pick what they want, and vehicle owners in Springfield, IL, can pick what suits them the best.

- Generational Discount: Its car insurance helps Springfield families save by insuring multiple generations and their vehicles. Read our “American Family Auto Insurance Review” to find out more.

- Defensive Driving Discount: Springfield residents must enroll in a defensive driving lesson for insurance deals to be safe and save their hard-earned cash on insurance.

Cons

- Higher Premiums for High-Risk Drivers: The American Family would charge a higher premium to Springfield’s high-risk users because they have had accidents or committed violations in the past.

- Limited Availability of Discounts for First-Time Policyholders: New customers may not immediately qualify for the full range of discounts, which could increase Springfield customers’ initial costs.

#7 – USAA: Best for Military Drivers

Pros

- Exclusive Military Discounts: USAA offers exclusive deals for military personnel, making it the number one company for Springfield’s veterans who have served in the armed forces.

- Defensive Driving Discount: USAA offers Springfield customers a discount if they take a defensive driving course.

- Bundling Opportunities: USAA offers great savings for Springfield customers who bundle auto and home insurance. For a broader perspective, learn more about our “USAA Auto Insurance Review.”

Cons

- Limited to Military Families: It only specializes in providing car insurance to military families, and by this, the non-military people of Springfield, IL, are automatically ruled out from its list of services.

- Online-Only Claims: USAA primarily handles insurance claims online, which might not be ideal for Springfield, Illinois, drivers who prefer direct, in-person support during the claims process.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Safeco: Best for Flexible Options

Pros

- Flexible Coverage Options: Safeco lets Springfield, IL, customers select coverage tailored to their needs. Read further to discover more about our “Safeco Auto Insurance Review.”

- Teen Safety Discount: The company offers discounts to Springfield families with young drivers after completing a teen safety course to ensure safe driving and, therefore, insurance prices.

- Bundling Discount: Springfield, IL residents can save 15% on auto and home bundles with Safeco’s 15% multi-line discount, which allows them to save money on multiple policies.

Cons

- Higher Premiums for Certain Groups: Springfield customers, especially those with a low credit history, will likely find that their Safeco policies cost them much more.

- Less Availability of Local Offices: With fewer offices in Springfield, Illinois, by Safeco, there is less opportunity to encounter live service providers for car insurance drivers.

#9 – Nationwide: Best for Innovative Technology

Pros

- SmartRide Program: Its SmartRide program tracks driving habits and offers insurance discounts for safe driving, which is ideal for Springfield drivers who want to take benefit of modern technology.

- Telematics Discount: Springfield, IL, Customers who participate in the telematics program provided by Nationwide can save on their car insurance depending on their driving actions.

- Accident-Free Discount: It offers a discount for Springfield drivers without accident records as a reward for safe driving. Discover a wealth of knowledge in our “Nationwide Auto Insurance Review.”

Cons

- Premium Rates Can Be High: Its premium rates are much higher than those of other insurance companies in Springfield, IL, making it hard for those on tight budgets with limited budgets.

- The Claims Process Can Be Slow: Drivers in Springfield have reported delays in the auto insurance claims process, which can frustrate victims during emergencies.

#10 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Springfield, IL, offers accident forgiveness to prevent premium increases after a driver’s first at-fault accident. See complete details in our “Liberty Mutual Review.”

- Discount for Hybrid Vehicles: Liberty Mutual offers discounts to Springfield drivers with hybrid or electric vehicles, helping them save on premiums while supporting sustainability.

- New Car Replacement: It offers Springfield clients a new car replacement option, ensuring they get a new car instead of the depreciated value if their vehicle is totaled for car insurance.

Cons

- Higher Premiums for Certain Drivers: Springfield drivers with low ratings receive higher premiums than Liberty Mutual, which pays other providers for the same type of driver.

- Limited Customization: Residents of Springfield, IL, say Liberty Mutual’s policies are less flexible than those of other major insurance companies, potentially affecting personalized coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Coverage Level of Springfield, IL Auto Insurance Providers

By examining monthly rates by provider and coverage level for drivers in Springfield, IL, one can understand how to get cheap auto insurance rates. With competitive rates from the best providers, residents get options for their various coverage needs, from minimum to full coverage.

Springfield, IL Auto Insurance Monthly Rates by Provider & Coverage Level

In Springfield, IL, drivers can secure affordable rates, with Progressive offering minimum coverage at $27 per month and State Farm leading in full coverage at $56 per month. Competitive options include Erie and American Family, while Liberty Mutual charges the highest rates at $48 for minimum and $84 for full coverage.

If you’re seeking affordable legal compliance, Erie is a great choice, with minimum coverage at just $32. However, American Family offers a full coverage plan for $58 if you’re looking for greater financial protection.

Schimri Yoyo Licensed Agent & Financial Advisor

These options accommodate diversified needs. If minimal protection is required, Progressive ensures minimum cover, State Farm a holistic approach, and Erie consistency across levels. Each provider has the opportunity to afford the residents of Springfield a chance to offer their respective choices with affordable policies.

Online & Digital Processes in Springfield through Auto Insurance Providers

Access to auto insurance has become extremely easy for Springfield, IL citizens, considering the latest powerful internet-based tools developed by top players. These tools allow citizens to acquire quotes, compare prices, and adjust coverage from home with reduced effort and time utilization.

Using such platforms, motorists can seek cheap policies without having to visit an office while having an array of valuable driving tips for road safety to stay well-informed.

Other online facilities for policy management exist, meaning there is 24/7 online access. Drivers from Springfield can file their claims online, make payments, and update coverage; even other insurance dealings can be done without visiting any office. Seamless access helps protect drivers as efficiently as their insurance needs are managed.

Auto Insurance Discounts Offered to Springfield Drivers

Several cheap auto insurance companies in Springfield offer discounts on their premiums. These discounts reward good driving habits, loyalty, and smart choices. Whether you are a safe driver, a student, or a military member, you will have opportunities to lower your monthly auto insurance rates with several discounts available.

Auto Insurance Discounts From the Top Providers in Springfield, IL

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Low Mileage | |

| Multi-Policy, Safe Driver, Good Student, Early Bird |

| Good Student, Multi-Policy, Safe Driver, Military | |

| Multi-Policy, Safe Driver, Early Bird, Good Student |

| Multi-Policy, Safe Driver, Good Student, Early Bird |

| Multi-Policy, Safe Driver, Good Student, Homeowner | |

| Multi-Policy, Safe Driver, Good Student, Early Bird | |

| Multi-Policy, Good Student, Safe Driver, Defensive Driving | |

| Multi-Policy, Good Student, Safe Driver, Low Mileage | |

| Safe Driver, Good Student, Military, Multi-Policy |

As per the table, some of the most common discounts offered by insurance companies in Springfield, IL, include multi-policy discounts, good driver discounts, and student discounts. Companies that allow bundling, safe or hybrid vehicles, and accident-free driving records also offer savings.

Others offer discount facilities to young drivers, military officers, and users of telematics programs that track their driving patterns. With these many options, one must ask the insurer about the discounts that benefit him.

The Impact of Auto Accidents on Insurance Claims in Springfield, IL

Auto accidents have massively impacted insurance claims in Springfield, IL. The frequency of accidents dictates overall rate changes and is a causative link for increases in the claim rate. As the number of accidents increases, the premiums also increase, increasing the cost of claims for repairs or other damages.

Springfield, IL Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 1,500 |

| Total Claims Per Year | 1,200 |

| Average Claim Size | $4,000 |

| Percentage of Uninsured Drivers | 11% |

| Vehicle Theft Rate | 180 thefts/year |

| Traffic Density | Moderate |

| Weather-Related Incidents | High |

The table shows Springfield has about 1,500 accidents yearly, resulting in 1,200 claims. The average claim is $4,000, and 11% of drivers have no coverage. With annual thefts of about 180 vehicles and moderate traffic, weather-related incidents increase claims in the area.

Accidents resulting in insurance claims in Springfield show an increasing need for better coverage and risk management.

Auto Insurance Claim Process in Springfield, IL

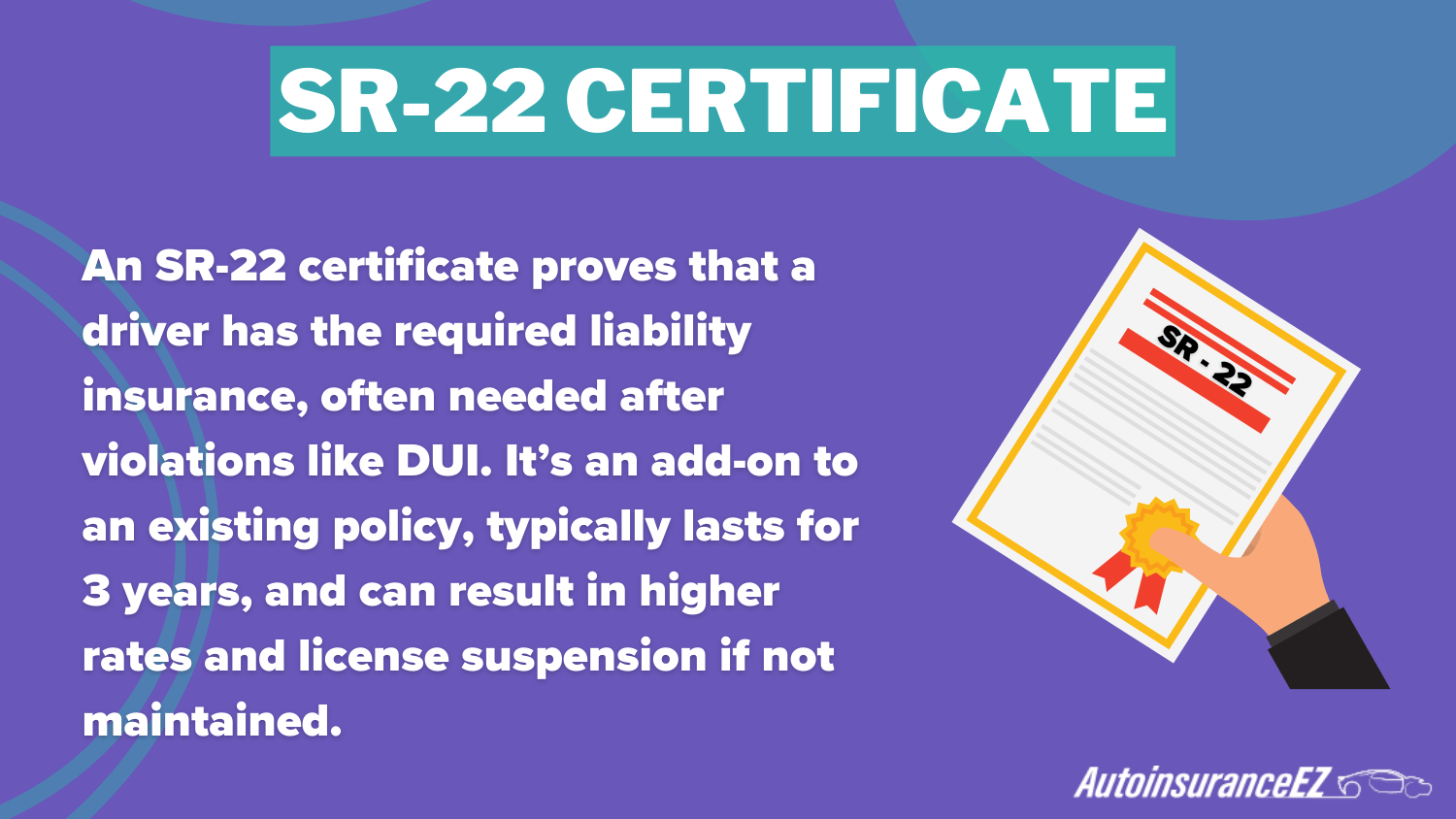

Springfield, IL, auto insurance claims are made by immediately reporting the incident to your insurer. You can submit a claim via an online platform or app or by calling their claims department and providing all the necessary details about the timing, location, and parties involved. An SR-22 certificate may be required to prove financial responsibility for serious violations.

Once an insurance claim is filed, an adjuster inspects the damage done to your vehicle, including the cost of repairs or replacement value, medical expenses, and property damage. If you’re eligible for a claim-free insurance discount, your premiums may be reduced, and the insurance company will process the claim on those terms.

Major Factors in Cheap Car Insurance in Springfield, Illinois

Not only are there many different variables your car insurance company will consider when calculating your premium, but different Springfield, IL, auto insurance companies will assign different levels of importance to each one.

In general, the factors below will have the biggest impact on whether or not you end up getting charged an affordable price for your monthly premium:

Your ZIP Code

Have you ever wondered why your ZIP code is the first thing insurance companies ask for when calculating a quote? It’s because your ZIP code tells the insurance company a mountain of data about your circumstances, such as how likely you are to get into an accident.

It’s the biggest factor in estimating how safe of a driver you will be.

Springfield, Illinois Auto Insurance Monthly Rates by ZIP Code

| ZIP | Minimum Coverage | Full Coverage |

|---|---|---|

| 62701 | $61 | $209 |

| 62702 | $62 | $211 |

| 62703 | $63 | $215 |

| 62704 | $64 | $220 |

| 62707 | $65 | $225 |

| 62711 | $66 | $230 |

The table above outlines the average monthly auto insurance rates for minimum and full coverage in various ZIP codes across Springfield, Illinois. Rates vary slightly depending on the area, with minimum coverage starting at $61 and full coverage reaching up to $230.

Automotive Accidents

The rate of deadly accidents in Springfield isn’t zero; however, given the population, it’s relatively lower than that of comparable-sized cities.

Fatal Accidents in Springfield, IL

| Category | Springfield |

|---|---|

| Fatal Accidents | 12 |

| Vehicles Involved in Fatal Accidents | 16 |

| Fatal Crashes Involving Drunk Persons | 1 |

| Fatalities | 13 |

| Persons Involved in Fatal Crashes | 24 |

| Pedestrians Involved in Fatal Crashes | 3 |

With 12 fatal accidents, 16 vehicles involved, and 13 fatalities, this data influences the way insurers assess risk in the region. Areas with higher accident rates tend to see higher insurance costs as insurers factor in the increased risk to policyholders.

Your Credit Score

Credit score is one of the essential factors influencing auto insurance premiums in Springfield, IL. Insurers adjust rates based on the level of financial responsibility indicated by a person’s credit history.

Springfield, IL Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $165 | $185 | $240 | |

| $160 | $180 | $235 | |

| $155 | $175 | $220 |

| $170 | $195 | $250 | |

| $160 | $180 | $230 | |

| $165 | $190 | $245 |

| $175 | $200 | $260 | |

| $155 | $175 | $225 | |

| $165 | $190 | $240 | |

| $150 | $170 | $215 |

The table shows that drivers with good credit typically pay around $150–$165 per month, while those with bad credit can face premiums as high as $250–$260. It highlights how a lower credit score can lead to significantly higher monthly rates, affecting insurance costs in Springfield, IL.

Your Age

Age is a major factor in determining premiums and the source of the biggest price swings in Springfield. This age-based pricing structure highlights insurance companies’ risk assessments based on a Springfield driver’s experience and risk profile.

Springfield, IL Auto Insurance Monthly Rates by Age

| Insurance Company | Age: 17 | Age: 25 | Age: 35 | Age: 45 | Age: 55 | Age: 65 |

|---|---|---|---|---|---|---|

| $320 | $185 | $165 | $160 | $150 | $140 | |

| $310 | $180 | $160 | $155 | $145 | $135 | |

| $295 | $175 | $155 | $150 | $140 | $130 |

| $330 | $190 | $170 | $165 | $155 | $145 | |

| $300 | $180 | $160 | $155 | $145 | $135 | |

| $310 | $185 | $165 | $160 | $150 | $140 |

| $340 | $195 | $170 | $165 | $155 | $145 | |

| $290 | $170 | $155 | $150 | $140 | $130 | |

| $315 | $185 | $165 | $160 | $150 | $140 | |

| $280 | $165 | $150 | $145 | $135 | $125 |

The data shows that younger drivers, particularly those aged 17, face significantly higher premiums, with Progressive rates reaching as high as $340 monthly. More experienced drivers benefit from lower rates, with USAA offering the cheapest coverage at $125 for those aged 65.

Your Driving Record

Have you ever gotten a speeding ticket only to see your auto insurance bill spike a month or two later? Most of the time, you or your state are legally required to inform your insurance company of any citations you receive.

Springfield, IL Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $168 | $190 | $210 | $250 | |

| $160 | $180 | $200 | $240 | |

| $155 | $175 | $195 | $230 |

| $172 | $200 | $225 | $270 | |

| $165 | $185 | $205 | $245 | |

| $170 | $190 | $215 | $260 |

| $180 | $205 | $230 | $280 | |

| $158 | $175 | $195 | $235 | |

| $175 | $200 | $220 | $265 | |

| $150 | $170 | $190 | $225 |

Rates can increase significantly with one ticket, accident, or DUI, with companies like Progressive and Farmers showing some of the highest premium hikes. As shown in the table, Progressive’s monthly rates can rise to $280 with a DUI, while USAA’s rate increases to only $225 for the same situation.

Your Vehicle

Your vehicle type can also greatly impact your monthly premiums in Springfield. As we discussed earlier, cars, trucks, and SUVs that are more likely to be stolen will cost more to insure.

The more expensive and newer your vehicle—especially if you add gap coverage to your policy—the more it will cost each month.

Springfield, IL Auto Insurance Monthly Rates by Vehicle Type

| Insurance Company | Sedan | SUV | Pickup Truck | Minivan | Electric Vehicle (EV) |

|---|---|---|---|---|---|

| $178 | $170 | $175 | $165 | $185 | |

| $172 | $168 | $174 | $160 | $180 | |

| $165 | $158 | $166 | $155 | $175 |

| $180 | $175 | $182 | $170 | $190 | |

| $170 | $165 | $168 | $160 | $178 | |

| $175 | $168 | $172 | $162 | $185 |

| $185 | $175 | $180 | $170 | $195 | |

| $168 | $160 | $165 | $158 | $178 | |

| $180 | $172 | $178 | $168 | $185 | |

| $160 | $155 | $160 | $150 | $170 |

USAA offers the lowest rates in Springfield, IL, such as $160 for sedans and $150 for minivans, while Progressive has the highest rates, charging $185 for sedans and $195 for electric vehicles. It highlights USAA as the most affordable option for most vehicle types.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Reducing Your Auto Insurance Rates in Springfield, Illinois

To lower your auto insurance rates in Springdale, Illinois, consider personalizing your coverage with options from companies like State Farm and Progressive to meet your needs affordably.

Springfield, IL Report Card: Auto Insurance Premium

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B+ | Slightly above state average |

| Vehicle Theft Rate | B | Low compared to other Illinois cities |

| Weather-Related Risk | B | Occasional snowstorms, manageable risk |

| Traffic Density | B- | Moderate, less than major cities |

| Uninsured Drivers Rate | C+ | Slightly higher than state average |

Another significant factor is understanding your auto insurance premiums compared to state and national averages. The table shows that Springdale’s premiums are relatively affordable, about 16.8% lower than the national average of $2,015, so there are opportunities to look around for even better deals.

To reduce your premiums, consider adjusting your coverage based on local factors such as traffic density, weather risks, and the rate of uninsured drivers in Springfield.

Chris Abrams Licensed Insurance Agent

Finally, consider the importance of claims satisfaction when selecting an insurer. While claims processing in the area is generally satisfactory, comparing customer experiences across providers can help you choose a company with reliable service.

Enter your ZIP code below into our free comparison tool to get Springfield, Illinois’s most affordable auto insurance quotes.

Frequently Asked Questions

Which car insurance companies offer the best rates for seniors in Springfield, IL?

For seniors in Springfield, IL, the cheapest car insurance options are Erie, with rates starting at $130 per month, and Geico, starting at $135 per month. Both providers offer discounts for safe drivers and multi-policy bundling, which can help reduce costs further.

What are the cheapest car insurance quotes in Illinois for 17-year-old Springfield drivers?

For 17-year-old drivers in Springfield, IL, the cheapest car insurance quotes include Erie, with rates starting at $295 per month, and Geico at $300 per month.

How can maintaining a clean driving record lead to lower car insurance rates in Springfield, IL?

Maintaining a clean driving record in Springfield, IL, can lower insurance rates. For a clean record in Springfield, Geico starts at $165 and Erie at $155. This shows how avoiding violations reduces premiums across various types of auto insurance coverage within Springfield, IL.

What makes the lowest car insurance quotes for minimum and full coverage in Springfield, IL, ZIP codes different?

The lowest car insurance quotes for minimum and full coverage in Springfield vary by ZIP code location, risk levels, and local insurance providers. For example, ZIP code 62701 offers minimum coverage at $61 and full coverage at $209, while ZIP code 62707 has a higher rate of $65 for minimum coverage and $225 for full coverage.

Find the most affordable auto insurance quotes for Springfield, IL, by entering your ZIP code into our free comparison tool.

How does my credit score affect cheap car insurance options online in Illinois?

Your credit score is key in determining rates for cheap car insurance options online in Illinois. Drivers with good credit can secure affordable Illinois auto insurance, with companies like USAA offering the lowest premiums at $150. Those with bad credit face higher rates, such as Progressive’s, at $260.

Where can I find auto insurance quotes for high-risk drivers in Springfield?

High-risk drivers can find tailored policies by exploring insurers offering the best car insurance in Springfield, IL, specifically designed for drivers requiring high-risk auto insurance due to past violations.

What are the options for commercial auto insurance in Springfield, IL?

In Springfield, IL, commercial auto insurance options include coverage from providers such as State Farm, Geico, and Progressive, offering different plans for business automobiles. These choices can offer liability, collision, comprehensive, and specialized coverage based on the type of business and vehicle use.

How can I contact State Farm agents in Springfield, IL?

You can contact State Farm agents in Springfield, IL, by visiting a local office, calling their office directly, or reaching out online through the State Farm website. Agents can provide personalized quotes and coverage advice and help you with your insurance needs.

What car insurance companies in Springfield, IL, offer the lowest coverage for drivers with a DUI on their record?

In Springfield, IL, Erie offers the lowest coverage for drivers with a DUI on their record, starting at $230 per month. Other options include Geico at $245 and American Family at $240. Each provider helps reduce premiums with a safe driver insurance discount and bundling options.

What are Springfield, IL’s cheapest car insurance rates for drivers with an SR-22 certificate, based on credit and driving history?

The cheapest car insurance rates for Springfield, IL, drivers with an SR-22 certificate vary by credit and driving history. Erie offers the lowest minimum coverage for clean records at $155, while Geico offers a similar rate at $160. Drivers with a DUI on record may see higher rates, with Erie starting at $230 and Geico at $245 for minimum coverage.