Best Lowell, MA Auto Insurance in 2025 (Find the Top 10 Companies Here)

Geico, State Farm, and Progressive offer the best Lowell, MA, auto insurance starting at $45 per month for Massachusetts's 20/40/5 liability coverage limits. Geico rewards safe drivers. State Farm lowers rates with Drive Safe & Save, while Progressive gives Lowell Snapshot users an average discount of $146 yearly.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: May 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGet the best Lowell, MA, auto insurance from Geico, State Farm, and Progressive, each offering standout savings and unique perks for local drivers.

Geico rewards safe habits with an average $112 annual discount through its defensive driving program. State Farm benefits long-term drivers with up to 25% off for staying accident-free and adds extra savings through policy bundling.

Our Top 10 Company Picks: Best Lowell, MA Auto Insurance

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 25% | Cost Savings | Geico | |

| #2 | A++ | 17% | Cheap Rates | State Farm | |

| #3 | A+ | 10% | Biggest Discount | Progressive | |

| #4 | A++ | 13% | Comprehensive Coverage | Travelers | |

| #5 | A+ | 20% | Vanishing Deductible | Nationwide |

| #6 | A+ | 30% | Customer Satisfaction | Amica | |

| #7 | A | 20% | Group Discounts | Farmers | |

| #8 | A | 25% | Diverse Coverage | Liberty Mutual |

| #9 | A | 10% | High-Risk Drivers | The General |

| #10 | A+ | 10% | Infrequent Drivers | Allstate |

Progressive offers a deductible savings bank that reduces out-of-pocket expenses by $50 every six months you’re claim-free.

- Geico offers Lowell drivers added savings through employer affinity plans

- Best Lowell, MA, auto insurance offers savings for hybrid vehicle owners

- Local policies include benefits like accident forgiveness and gap coverage

Are you tired of looking for the best and cheapest car insurance in Massachusetts? Read through our guide below to compare the leading insurance providers. Enter your ZIP code now to begin.

#1 – Geico: Top Overall Pick

Pros

- Affordable Premiums for Lowell Drivers: Geico in Lowell, MA, offers competitive rates, starting as low as $45/month, making it a top choice for budget-conscious car owners.

- Convenient Digital Tools: With easy-to-use apps and online claim management, Geico stands out as a convenient option for Lowell residents looking for efficient service.

- Wide Range of Discounts: From safe drivers to military members, Geico provides numerous ways for Lowell drivers to save on their policies. Elevate your knowledge with our Geico insurance review.

Cons

- Limited Local Agent Support: While Geico excels online, it may not offer the in-person support many Lowell drivers prefer.

- Generic Coverage Options: The broad offerings might not meet the needs of those looking for highly personalized service specific to Lowell’s unique needs.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Cheap Rates

Pros

- Local Agent Accessibility in Lowell: With a robust network of agents in Lowell, State Farm is an ideal choice for drivers who prefer face-to-face service.

- Top-Rated Customer Support: Lowell residents benefit from excellent service with high marks for responsiveness. Check out our State Farm auto insurance review for more.

- Policy Bundling Savings: Lowell drivers can save by combining home and auto insurance, making it a great choice for those looking to secure comprehensive coverage.

Cons

- Higher Rates for Risky Drivers: Lowell drivers with less-than-perfect driving records may find State Farm’s rates more expensive than other providers.

- Inconsistent Mobile Experience: Some customers report glitches in State Farm’s mobile app, affecting the overall experience for tech-savvy Lowell drivers.

#3 – Progressive: Best for Biggest Discount

Pros

- Wide Array of Discounts for Lowell Drivers: From good student to multi-policy discounts, Progressive’s savings options make it a strong contender for those seeking the best deals in Lowell.

- Easy Online Tools for Comparison: Progressive’s quote comparison tool allows Lowell drivers to quickly compare policies and find the best coverage for their needs.

- Rewards for Safe Driving: Lowell drivers who demonstrate safe driving habits can take advantage of the Snapshot program. Explore details in our Progressive auto insurance review.

Cons

- Average Service Quality: While Progressive Insurance in Lowell, MA, offers competitive rates, some drivers may find customer service less responsive than that of other top insurers.

- Rate Increases After Claims: Drivers in Lowell may see higher premiums after an accident, even if it’s their first claim.

#4 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Travelers provides coverages like gap insurance and accident forgiveness, which are essential for Lowell residents who want protection.

- Financial Stability for Peace of Mind: Known for its solid financial backing, Travelers ensures that Lowell drivers can rely on it when it matters most.

- Multi-Policy Discounts: Drivers in Lowell can bundle their auto and home insurance policies, gaining significant savings. Read our Travelers auto insurance review to learn more.

Cons

- Higher Rates for Riskier Drivers: Drivers in Lowell with poor histories may find Travelers’ rates to be on the higher side.

- Fewer Discounts: Unlike some competitors, Travelers doesn’t offer as many discount options, making it less appealing for some Lowell drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Unique Rewards for Lowell Drivers: Nationwide’s vanishing deductible and accident forgiveness options make it a strong choice for Lowell drivers seeking added perks.

- Tailored Coverage Add-Ons: Lowell drivers can customize their policies with a variety of add-ons to meet their specific needs. Discover what lies beyond with our Nationwide auto insurance review.

- Great for Multi-Policy Savings: Bundling policies with Nationwide offers great savings, making it a smart option for Lowell families.

Cons

- Rates Vary by Location: While Nationwide offers competitive rates, premiums can differ significantly depending on the Lowell area, so it’s important to get a personalized quote.

- Limited Agent Availability: Lowell drivers who prefer in-person interactions may find fewer agents in their area. #6 – Amica: Best for Customer Satisfaction

Pros

- Highly Rated for Customer Satisfaction: Amica is consistently ranked highly for customer service, making it one of the top choices for drivers in Lowell who prioritize support.

- Dividend Programs: Amica’s dividend policies give back a portion of premiums, offering financial relief for long-term customers in Lowell. Read more through our Amica insurance review.

- Flexible Coverage for Specific Needs: Whether it’s personal or unique coverage options, Amica allows Lowell drivers to tailor their policies to fit their needs.

Cons

- Higher Premiums: For Lowell drivers looking for budget-friendly options, Amica’s premiums can be higher than those of other providers.

- Limited Availability in Certain Areas: Some Lowell residents may find Amica’s coverage unavailable in certain areas.

#7 – Farmers: Best for Group Discounts

Pros

- Group Discount Opportunities: Lowell residents affiliated with eligible groups or employers can benefit from Farmers’ group discount programs, helping lower premiums.

- Comprehensive Options: Farmers offers a variety of coverage options, making it a good choice for Lowell drivers who need customized insurance. Learn more in our Farmers insurance review.

- Personalized Service Through Local Agents: Farmers has a strong network of local agents in Lowell, offering personalized service that some other insurers may lack.

Cons

- Higher Premiums for Some: Farmers can be more expensive than competitors, making it less ideal for Lowell drivers on a tight budget.

- Inconsistent Digital Experience: Farmers’ app and website may not be as intuitive, affecting Lowell drivers who rely on efficient online tools.

#8 – Liberty Mutual: Best for Diverse Coverage

Pros

- Wide Range of Coverage Options: Liberty Mutual’s diverse coverage offerings, like new car replacement, cater well to Lowell drivers who want flexibility.

- Customizable Policies for Lowell Residents: Liberty Mutual offers tailored options for drivers in Lowell, whether they need liability, collision, or comprehensive coverage.

- Strong Discounts: Lowell drivers can benefit from Liberty Mutual’s savings for good driving habits, bundling, and more. For more, refer to our Liberty Mutual auto insurance review.

Cons

- Higher Premiums Than Competitors: Liberty Mutual’s rates are often higher, which may deter drivers in Lowell seeking more affordable options.

- Variable Customer Service: The quality of service may fluctuate, with some Lowell drivers reporting less-than-ideal experiences.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#9 – The General: Best for High-Risk Drivers

Pros

- High-Risk Driver Coverage in Lowell: The General specializes in offering coverage to drivers with less-than-ideal driving records, making it an ideal choice for some Lowell residents.

- Flexible Payment Plans: Drivers in Lowell who need more flexibility in their payments will appreciate The General’s variety of options. Read more through our The General auto insurance review.

- Quick Online Quotes: The General’s fast and easy online quotes make it simple for Lowell drivers to get an estimate and secure coverage.

Cons

- Limited Coverage Options: Lowell drivers looking for a broader range of policies may find The General’s offerings basic.

- Mixed Customer Reviews: The General’s reputation is somewhat inconsistent, which could be a concern for Lowell drivers prioritizing reliable service.

#10 – Allstate: Best for Infrequent Drivers

Pros

- Low-Mileage Savings for Lowell Drivers: Allstate offers usage-based insurance options that can benefit Lowell drivers who don’t drive often.

- Innovative Programs: With tools like Drivewise, Allstate rewards Lowell drivers for safe driving, offering a way to lower rates.

- Bundle Discounts: Lowell drivers can save by bundling auto and home insurance with Allstate’s flexible options. Read more through our Allstate auto insurance review.

Cons

- Higher Rates for Many Drivers: Allstate may not be the best choice for Lowell drivers looking for the most affordable options.

- Increased Premiums After Claims: Lowell drivers may see their rates go up after an accident, which could impact long-term affordability.

Best Auto Insurance Coverage Rates in Lowell, MA

Ready to secure the best auto insurance in Lowell, MA? Lowell’s average auto insurance cost is $287.50 per month and $3,449.96 annually. Most states allow companies to determine your auto insurance by age and gender.

Lowell, MA Auto Insurance Monthly Rate by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $154 | |

| $62 | $148 | |

| $70 | $150 | |

| $50 | $120 | |

| $67 | $151 |

| $64 | $147 |

| $58 | $142 | |

| $45 | $138 | |

| $68 | $153 |

| $66 | $145 |

Massachusetts auto insurance companies can no longer use gender in rate calculations. Lowell, MA, also does not have varying auto insurance rates by ZIP code. The street you live on does not impact what you pay.

So, how do you get the cheapest rates in Lowell? Prove to insurance companies that you are a low-risk driver for them to insure. Keep reading to find out what we mean.

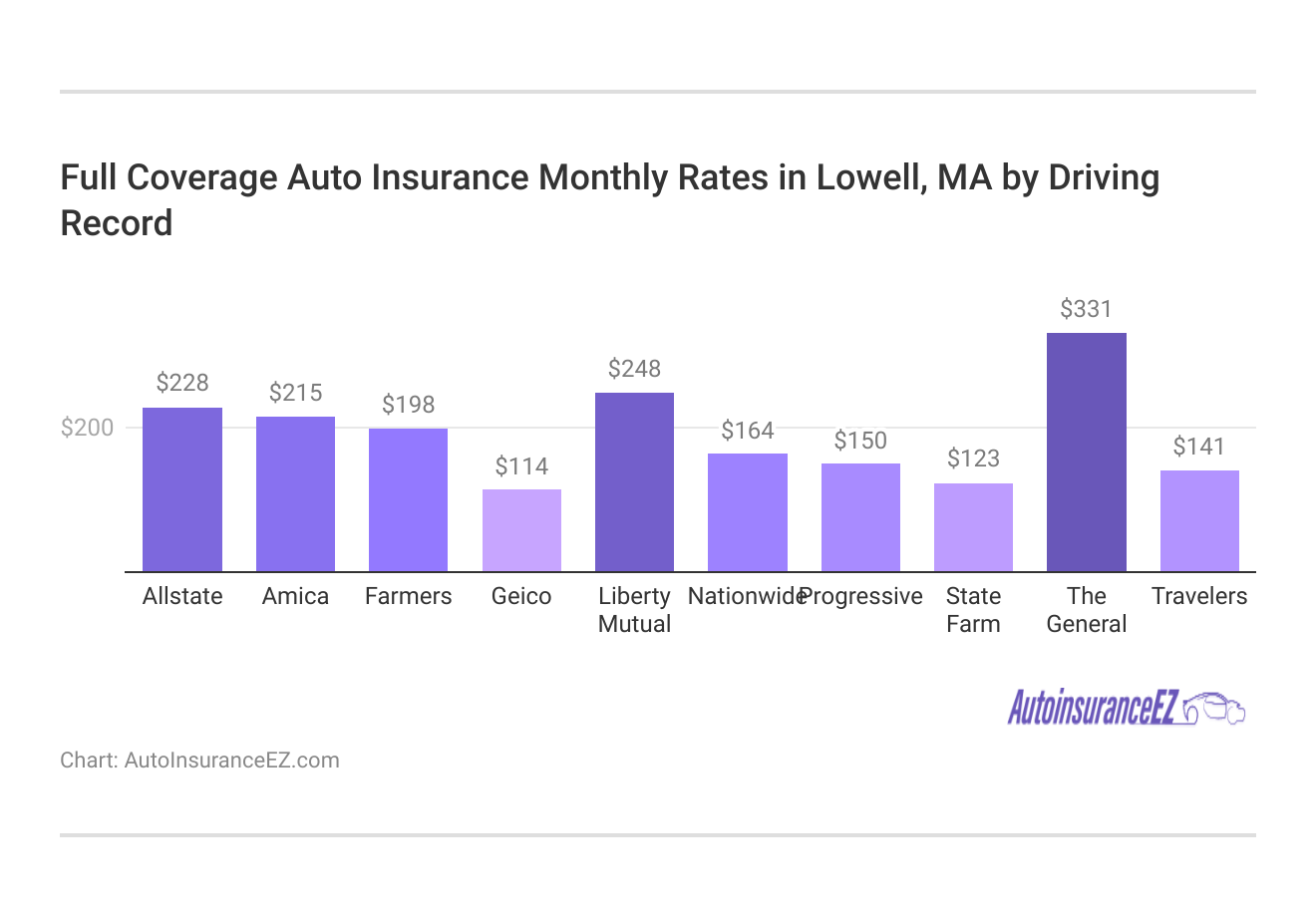

Lowell, MA Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $100 | $120 | $150 | $180 | |

| $95 | $110 | $140 | $170 | |

| $105 | $125 | $155 | $185 | |

| $85 | $105 | $135 | $165 | |

| $110 | $130 | $160 | $190 |

| $98 | $115 | $145 | $175 |

| $92 | $115 | $145 | $175 | |

| $103 | $118 | $148 | $178 | |

| $120 | $140 | $170 | $200 |

| $108 | $128 | $158 | $188 |

This table shows how driving records affect monthly rates in Lowell. Geico always gives the lowest rates for all types of driving histories. DUIs make the biggest increases, with most companies raising rates by about $80. Even one ticket or accident can clearly increase your premium. Clean records lead to the best overall savings.

Lowell, MA Auto Insurance Monthly Rates by Coverage Type

| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $98 | $115 | |

| $90 | $105 | |

| $95 | $113 | |

| $85 | $100 | |

| $105 | $125 |

| $102 | $118 |

| $92 | $110 | |

| $94 | $112 | |

| $110 | $130 |

| $100 | $120 |

This table shows what drivers pay each month for collision and comprehensive coverage in Lowell. Geico has the lowest rates for both categories compared to others.

Liberty Mutual and The General have the most expensive premiums, especially for comprehensive coverage. Amica and Progressive offer more moderate prices in the middle range, with a good balance between collision and comprehensive costs.

Lowell, MA Auto Insurance Monthly Rates by Make & Model

| Insurance Company | 2024 Honda Accord | 2024 Porsche Boxster Spyder |

|---|---|---|

| $95 | $220 | |

| $90 | $215 | |

| $100 | $230 | |

| $85 | $205 | |

| $105 | $240 |

| $98 | $225 |

| $92 | $210 | |

| $98 | $225 | |

| $120 | $250 |

| $110 | $235 |

This table shows monthly premiums for two well-liked vehicles. Geico offers the lowest rate for the Honda Accord and the Porsche Spyder, while The General offers the highest rates.

Hybrid and electric cars often qualify for green discounts, yet battery replacement risks can offset savings. In particular, Teslas carry complex repair costs.

Chris Abrams Licensed Insurance Agent

Expensive models like the Porsche always cost more with every insurance provider. If drivers pick cheaper sedans, they usually pay less for insurance with most companies.

In Lowell, insurers place great importance on driving records when deciding rates. Some companies are more lenient with small mistakes, but others raise premiums significantly even after one incident.

A clean history makes it possible to get the most flexible policies, but drivers who have had past accidents or DUIs sometimes find better offers by changing providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Lowell, MA Auto Insurance Discounts

This table shows the best auto insurance discounts in Lowell, MA. Geico and Liberty Mutual both offer a very good 30% discount for low-mileage drivers, but Nationwide offers an even better 40% discount.

Auto Insurance Discounts From the Top Providers in Lowell, MA

| Insurance Company | Auto-Pay | Bundling | Claims-Free | Loyalty | Low Mileage |

|---|---|---|---|---|---|

| 4% | 25% | 10% | 15% | 30% | |

| 5% | 30% | 20% | 13% | 20% | |

| 5% | 20% | 9% | 12% | 10% | |

| 7% | 25% | 12% | 10% | 30% | |

| 15% | 25% | 8% | 10% | 30% |

| 12% | 10% | 14% | 8% | 40% |

| 13% | 17% | 10% | 13% | 30% | |

| 13% | 17% | 11% | 6% | 30% | |

| 5% | 18% | 10% | 9% | 10% |

| 10% | 13% | 13% | 9% | 20% |

Amica offers the biggest bundling discount at 30%, and Travelers gives strong rewards to drivers who stay claims-free. Each insurance company focuses on different driver habits to help people in Lowell reduce their premiums.

Frequently Asked Questions

What are the average monthly rates for auto insurance in Lowell, MA?

The average rate for auto insurance per month in Lowell is approximately $287.50. This amounts to an annual cost of about $3,449.96.

How do Geico’s rates compare to other providers in Lowell?

Geico is known for providing the most competitive rates in Lowell. With premiums starting at $45 per month, it is considered one of the best options for affordable coverage in the area.

Which insurance company offers the best discounts for Lowell drivers?

Why is State Farm a popular choice for Lowell residents seeking affordable coverage?

State Farm is popular in Lowell due to its competitive rates and large network of local agents offering personalized service. Its policy bundling options also make it an economical choice for many drivers.

What coverage options does Progressive offer to Lowell drivers?

Progressive offers various insurance coverages, including liability, comprehensive, and collision. Additionally, it offers deals, such as the Snapshot program, perfect for safe drivers. Enter your ZIP code now to begin comparing the best car insurance in Lowell, MA.

How does Travelers’ customer service stand out in Lowell?

Aside from avoiding any lapse in insurance coverage and ensuring continuous protection when needed most, Travelers is known for being the best in client service.

Which auto insurance provider in Lowell offers vanishing deductible benefits?

Nationwide offers a unique vanishing deductible program, which reduces your deductible over time as you remain claim-free. This is an appealing option for Lowell drivers looking to reduce their out-of-pocket costs.

How does Nationwide’s multi-policy discount work for Lowell drivers?

Nationwide provides Lowell drivers the chance to bundle their auto insurance with home insurance, which leads to significant discounts. This system can help lower premiums while ensuring complete coverage across policies.

What are the pros and cons of Amica’s customer service for Lowell residents?

Amica is known for excellent customer service, but it also offers higher premiums than some competitors. To make the most of its offerings, check if you qualify for any car insurance discounts. Discover if your clean driving record makes you eligible for a safe driver discount.

How does age influence auto insurance premiums in Lowell, MA?

Young drivers in Lowell face higher auto premiums due to their lack of experience and higher risk of accidents. However, rates tend to decrease significantly as drivers age and gain more experience, especially after 25.

Is Action Auto Insurance a good choice for your monthly coverage needs?

Yes, Action Auto Insurance offers competitive monthly rates and flexible policies, making it a convenient option if you’re looking for localized and affordable coverage.

Can you get affordable protection through auto insurance in Brockton, MA?

Absolutely. Auto insurance in Brockton typically starts around $90 per month, depending on your driving history, age, and coverage level. Compare policies side by side to find the best Brockton, MA auto insurance for your budget.

How does Safety Insurance help you stay protected in Massachusetts?

Safety Insurance is known for offering strong customer service and reasonable monthly premiums, especially if you bundle your policies or maintain a clean driving record.

Should you consider Altai Insurance Services for local policy support?

Yes. Altai Insurance Services provides tailored auto insurance options with competitive monthly rates and local agents who help you compare quotes easily.

Can an insurance agency in Massachusetts help you find the lowest monthly rate?

Definitely. A licensed insurance agency in Massachusetts can shop multiple carriers on your behalf and typically find you monthly premiums below the statewide average of $287.50. See which local factors help you qualify for cheap auto insurance in Massachusetts easily.

Can you compare Massachusetts car insurance rates by town to find cheaper options?

Yes. Massachusetts car insurance rates vary widely by town. Boston averages $310 a month, while towns like Amherst or Andover can be under $210 per month.

Is homeowners insurance in Lowell, MA, affordable for property owners like you?

Yes. Homeowners insurance in Lowell, MA, typically starts at $75 per month, and rates are influenced by your home’s value, location, and claims history. Enter your ZIP code now to begin comparing rates.