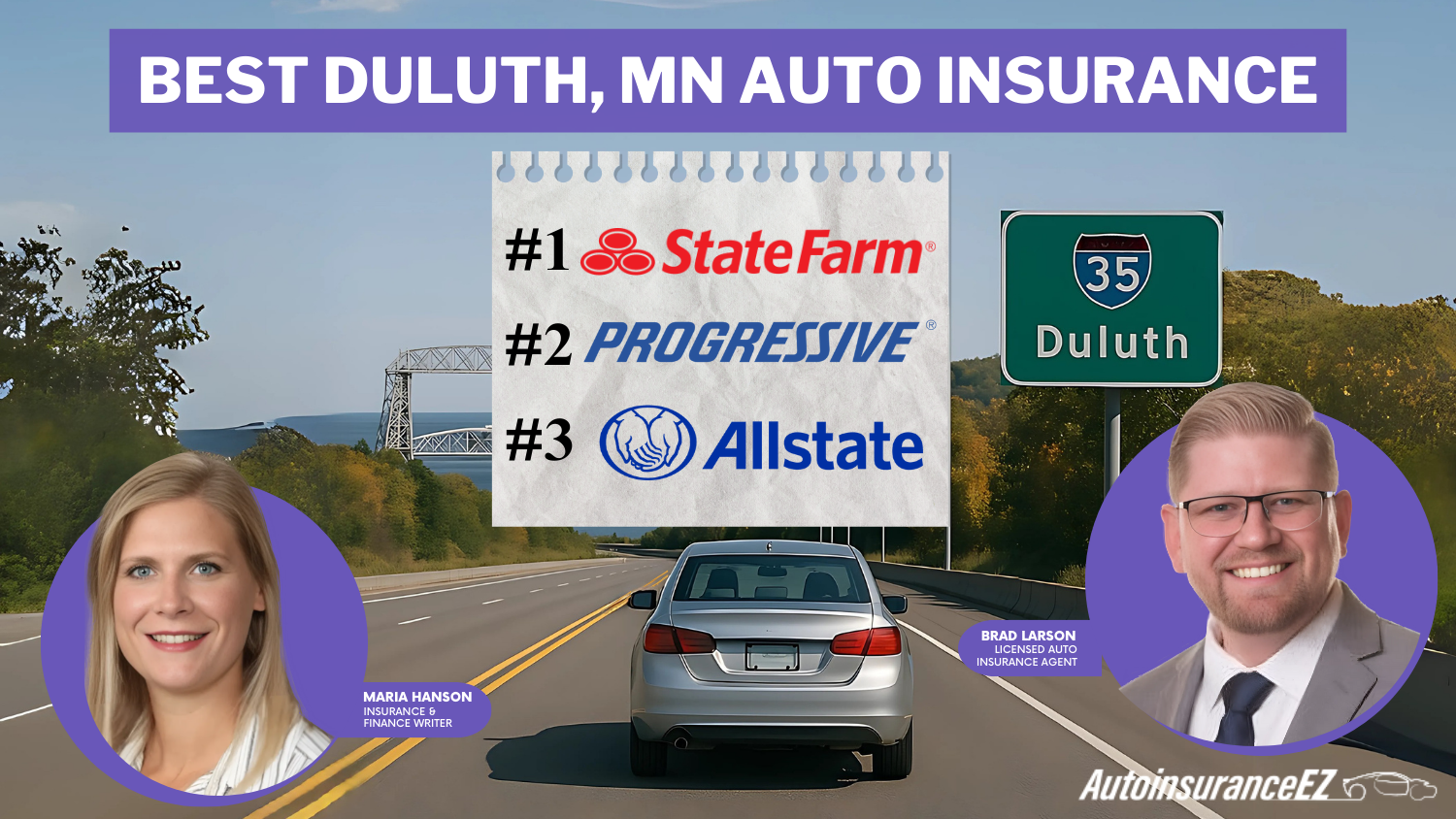

Best Duluth, MN Auto Insurance in 2026 (Top 10 Ranking Companies!)

The top providers of the best Duluth, MN auto insurance are State Farm, Progressive, and Allstate, offering rates from $35 a month. State Farm cuts rates with Drive Safe & Save. Progressive users save on the Snapshot, and Allstate rewards safe drivers with $100 on MN's 30/60/10 liability and no-fault coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: May 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Duluth MN

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage in Duluth MN

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage in Duluth MN

A.M. Best Rating

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsState Farm, Progressive, and Allstate offer the best Duluth, MN auto insurance choices for their practical savings and standout features. Discover how to get cheap auto insurance in MN with real savings.

State Farm stands out with consistently low complaint levels and a 25 percent discount for bundled coverage. Progressive offers tech-savvy drivers up to $145 in savings through its Snapshot program.

Our Top 10 Company Picks: Best Duluth, MN Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | A++ | Multiple Discounts | State Farm | |

| #2 | 10% | A+ | Affordable Rates | Progressive | |

| #3 | 25% | A+ | Personalized Service | Allstate | |

| #4 | 20% | A | Flexible Coverage | Farmers | |

| #5 | 25% | A | Online Tools | Liberty Mutual |

| #6 | 20% | A+ | Vanishing Deductible | Nationwide |

| #7 | 25% | A++ | Competitive Pricing | Geico | |

| #8 | 25% | A | Local Agents | American Family | |

| #9 | 13% | A++ | Claims Handling | Travelers | |

| #10 | 25% | A++ | Customer Service | Auto-Owners |

Allstate supports younger drivers with a 20 percent student discount and sends $100 back each claim-free term, giving Duluth drivers practical ways to save without compromising essential coverage.

- State Farm stands out for offering $70 full coverage in Duluth, MN

- Telematics programs help safe Duluth drivers save up to $145

- Student discounts and $100 bonuses reward low-risk local drivers

Are you interested in the data on the top 10 best Duluth, MN car insurance options? Get free MN auto insurance quotes by using our free comparison tool today.

#1 – State Farm: Top Pick Overall

Pros

- Reliable Full Coverage: State Farm offers Duluth, MN, drivers full coverage at $70 per month, the lowest among top-tier providers.

- Strong Bundling Discounts: Duluth, MN, customers can save up to 25% by combining home and auto insurance. Our State Farm auto insurance review highlights key savings.

- Superior Complaint Record: State Farm maintains one of the lowest complaint ratios in Duluth, MN, indicating consistent service quality.

Cons

- Limited Telematics Flexibility: Drive Safe & Save in Duluth, MN lacks real-time feedback compared to competitors.

- No Vanishing Deductible: Duluth, MN, policyholders don’t get reduced deductibles over time, unlike with other insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Cheap Rates

Pros

- Snapshot Savings: Duluth, MN drivers using Snapshot can save up to $145 annually through safe driving behavior.

- Robust Online Tools: Progressive offers highly rated digital policy management tools for Duluth, MN residents. See what we found in our latest Progressive auto insurance review.

- Continuous Coverage Rewards: Duluth, MN, policyholders get an automatic discount after maintaining coverage without a lapse.

Cons

- Rate Fluctuation Risk: Snapshot users in Duluth, MN, could see higher rates if driving data reflects risky habits.

- Fewer Local Agents: Duluth, MN, customers have fewer in-person service options compared to larger agent networks.

#3 – Allstate: Refined Personalized Service

Pros

- Smart Student Savings: Duluth, MN families receive up to 20% off for students with strong academic performance. See how discounts compare in our Allstate auto insurance review.

- Safe Driving Bonus: Allstate sends Duluth, MN, drivers a $100 reward each claim-free term, ideal for cautious drivers.

- Broad Endorsement Options: Duluth, MN, policyholders can add features like accident forgiveness and new car replacement.

Cons

- Higher Average Premiums: Allstate’s full coverage in Duluth, MN, reaches $162 monthly, above the local average.

- Limited Value for Basic Coverage: Duluth, MN drivers seeking state minimums may find better pricing elsewhere.

#4 – Farmers: Flexible Coverage in Duluth, MN

Pros

- Customizable Packages: Farmers allows Duluth, MN drivers to tailor policies with rare add-ons like glass deductible waivers.

- Extended Coverage Limits: Duluth, MN, customers can increase PIP and liability limits beyond the 30/60/10 baseline. We take a closer look at our latest Farmers auto insurance review.

- 30% Behavior-Based Discounts: Farmers offers Duluth, MN, residents a 30% reduction through Signal, their driving app.

Cons

- Less Competitive Minimum Rates: Farmers’ entry-level premiums in Duluth, MN, start above $45, higher than rivals.

- Slower Claims Response: Duluth, MN reviews indicate occasional delays in Farmers’ claims settlement process.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Its Online Tools

Pros

- 24/7 Digital Access: Liberty Mutual provides Duluth, MN users full access to claims, billing, and policy tools online. Learn what sets policies apart in our Liberty Mutual auto insurance review.

- Wide Range of Discounts: Duluth, MN drivers can stack multiple savings, including multi-car and early shopper discounts.

- Unique Coverage Add-Ons: Duluth, MN, policyholders can add features like original parts replacement or teacher-specific coverage.

Cons

- Most Expensive Full Coverage: Liberty Mutual quotes the highest average monthly rate among the top five in Duluth, MN.

- Telematics Discount Varies: Savings from RightTrack in Duluth, MN range widely, offering less predictable value.

#6 – Nationwide: Vanishing Deductible

Pros

- Vanishing Deductible Perk: Duluth, MN drivers can reduce their deductible by $100 each year without a claim, up to $500.

- Safe Driver Rewards: Duluth, MN policyholders using SmartRide can earn up to 40% off based on real-time driving data. Our Nationwide auto insurance review highlights real Duluth discounts.

- Strong Financial Backing: Nationwide maintains an A+ A.M. Best rating, ensuring stability for Duluth, MN, customers.

Cons

- Higher Initial Premiums: Starting rates for Duluth, MN drivers may be less competitive without qualifying discounts.

- Fewer Local Agencies: Duluth, MN, residents relying on in-person service may find agent availability limited.

#7 – Geico: Competitive Pricing

Pros

- Competitive Base Rates: Geico offers Duluth, MN, some of the most affordable minimum coverage starting near $34 monthly.

- Easy Policy Management: Duluth, MN users benefit from top-rated mobile tools for ID cards, payments, and claims. Find out what we uncovered in our latest Geico auto insurance review.

- Multiple Discount Stacking: Geico allows Duluth, MN drivers to combine safe driver, defensive driving, and multi-car savings.

Cons

- Limited Specialty Coverage: Duluth, MN, policyholders may find fewer add-on options, like new car replacement.

- Less Customization: Policy flexibility in Duluth, MN is more limited compared to competitors offering endorsements.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Trusted Local Agents

Pros

- Strong Local Presence: Duluth, MN drivers have access to a wide network of dedicated American Family agents.

- Teen Driver Discount: American Family Insurance offers Duluth, MN, families a 10–15% discount when adding teen drivers. In our American Family auto insurance review, we explore local savings.

- Loyalty Benefits: Long-term Duluth, MN, policyholders qualify for decreasing deductibles and accident forgiveness.>

Cons

- App Lags Behind Competitors: American Family’s app receives lower usability ratings from Duluth, MN users.

- Fewer National Discounts: Some discount programs are not available to Duluth, MN drivers outside core regions.

#9 – Travelers: Good Claims Handling

Pros

- Strong Claims Reputation: Duluth, MN, customers rate Travelers highly for claims responsiveness and accuracy.

- IntelliDrive Savings: Safe Duluth, MN drivers can earn up to 30% off with behavior tracking over 90 days. Our Travelers auto insurance review highlights IntelliDrive savings.

- Broad Liability Options: Travelers offers Duluth, MN drivers higher-than-average liability limits for added protection.

Cons

- Strict Monitoring with Telematics: IntelliDrive may penalize Duluth, MN drivers for harsh braking or nighttime driving.

- Limited New Driver Discounts: Duluth, MN families adding young drivers may find fewer savings compared to others.

#10 – Auto-Owners: Professional Customer Service

Pros

- Agent-Driven Model: Duluth, MN drivers receive personalized policy support through independent agents. See what we found in the latest Auto-Owners auto insurance review.

- Common Loss Deductible: Auto-Owners waives one deductible if multiple Duluth, MN policies are affected in a single event.

- High Renewal Satisfaction: Duluth, MN, policyholders report strong satisfaction and renewal intent due to local service.

Cons

- No Direct Online Quotes: Duluth, MN, residents must contact an agent for rates and the application process.

- Fewer Digital Features: The mobile app and online tools fall behind Duluth, MN, competitors in functionality.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Coverage Rates in Duluth, MN

This table shows the monthly costs for collision and comprehensive coverage that drivers in Duluth, MN, pay. Nationwide offers the lowest rates at $109 per month for collision and $68 for comprehensive coverage. Farmers is the highest at $282 and $180. Most other companies, such as State Farm and Allstate, are around the $125 mark.

Duluth, MN Auto Insurance Monthly Rates by Coverage Type

| Insurance Company | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| $125 | $78 | |

| $109 | $70 | |

| $131 | $85 | |

| $282 | $180 | |

| $177 | $110 | |

| $245 | $135 |

| $109 | $68 |

| $189 | $120 | |

| $125 | $75 | |

| $132 | $82 |

This table shows minimum and full coverage rates from the main insurers in Duluth, MN. State Farm has the cheapest rates at $48 for minimum coverage and $118 for full coverage.

Auto Insurance Monthly Rates in Duluth, MN by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $115 | $283 | |

| $67 | $165 |

| $60 | $148 | |

| $78 | $191 | |

| $65 | $160 | |

| $270 | $664 |

| $62 | $153 | |

| $73 | $180 | |

| $48 | $118 | |

| $68 | $664 |

Liberty Mutual and Travelers have the highest cost for full coverage at $664. Most other companies keep their charges below $200 for full coverage, which makes State Farm and Auto-Owners notable for being more affordable car insurance in Minnesota.

What’s the cheapest auto insurance in MN? Is it here in MN higher than surrounding states?

byu/jdge90 inminnesota

This table shows how monthly car insurance rates in Duluth, MN, change depending on age and gender. Teenage males have the highest costs, with Farmers charging $290.

Duluth, MN Auto Insurance Monthly Rates by Age and Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $203 | $220 | $203 | $220 | $203 | $220 | $203 | $220 | |

| $131 | $140 | $109 | $115 | $109 | $115 | $109 | $115 | |

| $177 | $185 | $177 | $185 | $177 | $185 | $177 | $185 | |

| $282 | $290 | $282 | $290 | $282 | $290 | $282 | $290 | |

| $177 | $185 | $177 | $185 | $177 | $185 | $177 | $185 | |

| $245 | $250 | $245 | $250 | $245 | $250 | $245 | $250 |

| $109 | $115 | $109 | $115 | $109 | $115 | $109 | $115 |

| $189 | $195 | $189 | $195 | $189 | $195 | $189 | $195 | |

| $125 | $130 | $125 | $130 | $125 | $130 | $125 | $130 | |

| $132 | $135 | $132 | $135 | $132 | $135 | $132 | $135 |

Nationwide is the least expensive for all age groups, with prices averaging from $109 to $115. By age 35, the rates start to become more similar, and most companies keep them stable until age 60.

Insurance rates in Duluth, MN gradually decline after age 30 if drivers remain accident-free. Specifically, premiums can drop by $40 to $60 per decade of clean history.f

Dani Best Licensed Insurance Producer

This table shows how make and model affect monthly insurance costs in Duluth, MN. For example, luxury SUVs like the Cadillac Escalade cost $311 per month for insurance.

Duluth, MN Auto Insurance by Make & Model

| Make and Model | Monthly Rate |

|---|---|

| Audi Q5 | $254 |

| BMW 330i | $273 |

| Cadillac Escalade | $311 |

| Chevrolet Silverado | $222 |

| Dodge Challenger | $305 |

| Dodge Ram 1500 | $227 |

| Ford Escape | $201 |

| Ford F-150 | $246 |

| Honda Odyssey | $132 |

| Honda Pilot | $137 |

| Honda CR-V | $148 |

| Hyundai Tucson | $150 |

| Hyundai Santa Fe | $150 |

| Hyundai Elantra | $150 |

| Jeep Grand Cherokee | $187 |

| Jeep Wrangler | $187 |

| Kia Sorento | $150 |

| Kia Sportage | $150 |

| Mazda CX-5 | $150 |

| Mazda CX-9 | $150 |

| Mazda3 | $150 |

| Nissan Rogue | $150 |

| Nissan Murano | $150 |

| Nissan Altima | $150 |

| Ram 1500 | $227 |

| Subaru Outback | $148 |

| Subaru Forester | $148 |

| Tesla Model 3 | $167 |

| Tesla Model Y | $167 |

| Toyota Tacoma | $148 |

| Toyota Tundra | $148 |

| Toyota Camry | $148 |

| Volkswagen Golf | $150 |

| Volkswagen Jetta | $150 |

Sports cars such as the Dodge Challenger also have high costs, staying above $300. Mid-size trucks like the Ford F-150 cost about $246. The cheapest rates are for the Honda Odyssey, at only $132 each month.

This table shows how various driving records affect full coverage costs for drivers in Duluth, MN. Drivers with clean histories pay the lowest rates with all insurers. One ticket or accident raises monthly premiums. Drivers who have a DUI see the biggest increases, no matter which provider they use.

Read More: Compare Auto Insurance Companies

Get the Best Auto Insurance Discounts in Duluth, MN

This table shows how the best insurance companies give benefits to drivers in Duluth, MN, for stacking discounts. Nationwide gives the biggest discount for good drivers at 40 percent.

Auto Insurance Discounts From the Top Providers in Duluth, MN

| Insurance Company | Bundling | Claims-Free | Good Driver | Multi-Car | Safe Driver |

|---|---|---|---|---|---|

| 25% | 10% | 25% | 25% | 18% | |

| 25% | 15% | 25% | 20% | 18% | |

| 18% | 16% | 25% | 10% | 8% | |

| 20% | 9% | 30% | 20% | 20% | |

| 25% | 12% | 26% | 25% | 15% | |

| 25% | 8% | 20% | 25% | 20% |

| 20% | 14% | 40% | 20% | 12% |

| 10% | 10% | 30% | 12% | 10% | |

| 17% | 11% | 25% | 20% | 20% | |

| 13% | 13% | 10% | 8% | 17% |

Farmers and Progressive give a 30 percent discount for safe driving habits. Geico, Allstate, and Liberty Mutual provide up to 25 percent off if you bundle services or have multiple cars insured with them.

This helps drivers save more money each month. Auto insurance providers offer discounts for safe driving, telematics use, bundling, continuous coverage, and good student status.

How To Find Best Auto Insurance in Duluth, MN

Duluth drivers can reduce full coverage expenses in Minnesota by utilizing specific discounts. Combining policies and participating in safe-driving programs can provide fast benefits.

- Compare Multiple Providers: Rates vary, so shop around for the best deal based on your needs

- Maintain a Clean Driving Record: Safe driving often leads to lower premiums.

- Review Your Coverage Options: Adjust coverage to suit your vehicle’s age and value.

- Consider a Higher Deductible: This can lower your premium if you’re comfortable with more out-of-pocket costs.

- Check for Local Programs: Explore options like low-income insurance or government programs for further savings.

Comparing many insurance companies, changing deductibles, and checking coverage limits based on the vehicle’s worth can help save more money. Local or income-based insurance plans might also offer extra discounts that people do not always know about.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Duluth, MN

This table shows the basic and usual auto insurance coverage in Minnesota. The state requires a minimum bodily injury of $30,000 per person, $60,000 per accident, and $10,000 for property damage.

Auto Insurance Coverage Requirements in Minnesota

| Coverage Type | Minimum Requirement | Most Common Coverage |

|---|---|---|

| Bodily Injury Liability | $30,000 per person, $60,000 per accident | $100,000 per person, $300,000 per accident |

| Property Damage Liability | $10,000 per accident | $50,000 per accident |

| Personal Injury Protection (PIP) | $40,000 (basic PIP) | $50,000 to $100,000 (comprehensive PIP) |

| Uninsured/Underinsured Motorist | $25,000 per person, $50,000 per accident | $100,000 per person, $300,000 per accident |

| Collision Coverage | Not required, but may be added as an option | Often added, typically $500-$1,000 deductible |

| Comprehensive Coverage | Not required, but may be added as an option | Commonly added, with similar deductibles to collision |

However, many drivers in Duluth, MN, choose to have higher limits than this baseline. Usual enhancements include $100,000 in liability coverage and extra protections such as collision and comprehensive coverage with deductibles ranging from $500 to $1,000.

Read More: Minimum Auto Insurance Requirements

Significant Factors Affecting the Best Auto Insurance in Duluth, MN

When auto insurance agents in Duluth, MN, prepare your policy, they consider factors like age, location, driving history, vehicle type, and credit score. While some factors, like age, are fixed, others can be adjusted to lower premiums. Understanding these elements can help you find the best rates.

Your ZIP Code

Auto insurance rates often depend on where you live. Densely populated cities typically have higher rates due to increased accident risk. Duluth has a population of 86,128 and an average household income of $42,176.

Auto Insurance by ZIP Code

| City | ZIP Code | Monthly Rate |

|---|---|---|

| Duluth, MN | 55802–55812 | $136 |

| Proctor, MN | 55810 | $129 |

| Hermantown, MN | 55811 | $127 |

| Cloquet, MN | 55720 | $132 |

| Esko, MN | 55733 | $125 |

| Superior, WI | 54880 | $138 |

| Two Harbors, MN | 55616 | $123 |

| Carlton, MN | 55718 | $124 |

| Wrenshall, MN | 55797 | $120 |

| Saginaw, MN | 55779 | $122 |

To receive auto insurance rates for Duluth, MN, use State Farm’s free tool to get instant rates, compare coverage, and explore affordable options. Higher rates in Duluth may reflect its population density and potential for accidents.

Automotive Accidents

Duluth’s fatal accident rate is low, especially considering its population. Auto insurance providers offer lower rates in areas with fewer accidents, with no effort required on your part.

Fatal Accidents in Duluth, MN

| Year / Date | Location | Vehicles Involved | Fatalities |

|---|---|---|---|

| 2022 (Annual) | Citywide | 6 | 5 |

| March 2024 | I-35 near Duluth | 1 | 1 |

| April 2024 | U.S. Hwy 2, near Brookston (30 mi W) | 3+ | 4 |

By following safe driving practices, such as obeying speed limits, avoiding distractions, and staying alert, you can help keep these rates low and reduce your insurance premiums.

Auto Thefts in Duluth

Low-cost auto insurance can be tough if you’re at risk for auto theft. Specific car models and vehicles left in large cities are often targeted.

In 2013, Duluth had 156 stolen cars, showing a slow decline. If theft isn’t a significant concern, consider raising your comprehensive coverage deductible to save money.

Your Credit Score

If you have an excellent credit score, you’ll likely get a lower rate. However, those with lower credit scores will face higher costs. Your credit score impacts auto insurance premiums, with higher scores leading to lower rates.

Your Age And Gender

Gender has little impact on auto insurance rates in Duluth, MN, with most providers showing only a 2–3% difference. Age plays a more significant role—young drivers pay more due to higher risk, while older drivers often get lower premiums for their experience.

Teens and young adults can lower costs through Driver’s education and Good Student discounts, helping them get the best Duluth, MN auto insurance. Younger individuals can benefit from Driver’s Education and Good Student discounts.

Your Driving Record

Serious violations, like DUIs, can raise your rates or even result in dropped coverage. Minor tickets can also be costly, but some providers offer accident forgiveness for drivers with imperfect records.

There are options for securing coverage after a DUI. Some providers offer specialized policies for high-risk drivers, although these often have significantly higher rates.

Your Vehicle

It is not automatically more expensive to buy insurance for a luxury vehicle. Still, when you add all the different types of coverage you will need and purchase them in high enough amounts to cover the cost of your vehicle, things start getting expensive.

Your Marital Status

Married couples often bundle their vehicle insurance policies to take advantage of the savings that Duluth, MN, auto insurance companies offer for this practice. You can also bundle insurance policies for RVs, motorcycles, or homeowners’ insurance..

Your Driving Distance to Work

Duluth residents’ commutes range from 10 to 23 minutes. About 75% drive to work daily, 4% to 18% carpool, and less than 5% take the bus.

Ensure your vehicle is for personal use, as business vehicles cost at least 10% more to insure. Reducing your annual mileage for discounts requires cutting thousands of miles, offering only a 3-4% reduction.

Your Coverage and Deductibles

The deductible is the amount you pay upfront for your insurance claim. A low deductible increases premiums, but raising it lowers your monthly payment by sharing more financial responsibility. Higher deductibles reduce premiums but increase out-of-pocket costs in case of a claim.

Education in Duluth, MN

Most drivers in Duluth have a high school education, and 20% hold a college degree. This group may qualify for lower auto insurance rates as providers offer discounts for higher education levels. Check Progressive’s site to see if you qualify.

Drivers with post-secondary education in Duluth, MN are seen as lower risk by insurers. One case showed business degree holders paid 12% less annually.

Daniel Walker Licensed Insurance Agent

The largest institution is the University of Minnesota–Duluth, with nearly 12,000 students, while the College of St. Scholastica focuses on physical therapy and nursing. Duluth Business University is also a solid choice for office-oriented careers. Insurance companies have an advantage over shoppers due to their research and experience.

To secure the best auto insurance in Duluth, MN, focus on comparing rates, available car insurance discounts, and your driving record. Compare auto insurance rates from top Duluth, MN, providers by entering your ZIP code to see how much you can save.

Frequently Asked Questions

Who offers the best auto insurance coverage?

Companies like Progressive, State Farm, Allstate, and Farmers consistently rank high for coverage options, customer service, and claims handling. Know your next move by learning how to file an auto insurance claim the right way.

Who has the cheapest car insurance in Minnesota?

Cheap car insurance in the MN market varies, but State Farm, Auto-Owners, and Nationwide often provide the most affordable rates. In areas like Duluth, MN, or the Twin Cities, rates may differ based on driving history, age, and vehicle type.

What is the average cost of auto insurance in Minnesota?

The average cost of cheap car insurance in Minnesota is about $1,400 per year ($117 per month) for complete coverage and around $600 per year ($50 per month) for minimum coverage. Rates vary based on age, credit score, and driving history.

Is Allstate a good insurance company?

Allstate is a reputable insurance company known for offering various coverage options and discounts and having a strong financial standing. However, it is often pricier than competitors, making it less appealing for those seeking cheap car insurance in Duluth, MN.

How do you get the most affordable car insurance?

To get the most affordable car insurance, compare quotes from multiple insurers, maintain a clean driving record, take advantage of discounts (safe driver, multi-policy, good student), raise your deductible (if financially feasible), and drive a car with lower insurance risk.

Is Minnesota a no-fault insurance state?

Yes, Minnesota is a no-fault state, meaning each driver’s insurance covers medical expenses regardless of fault. This requirement influences premium costs, so those searching for affordable auto insurance in MN should compare different providers to find the most budget-friendly option.

What factors affect auto insurance rates in Duluth, MN?

Duluth car insurance rates depend on factors like age, driving history, vehicle type, and credit score. Clean records, newer cars, and higher credit scores often lead to lower premiums. Discounts for bundling or safe driving can also reduce costs.

Why is Minnesota insurance so expensive?

Car insurance in Minnesota is costly due to factors like no-fault insurance laws, which require insurers to cover medical expenses regardless of fault.

Which car insurance is better, State Farm or Allstate?

State Farm Insurance in Duluth, MN, offers lower rates, better customer service, and easier claims processing, while Allstate Insurance provides more coverage options but is often more expensive. See which insurer comes out on top in our Allstate vs. State Farm auto insurance review.

What should you expect when working with health insurance brokers in Duluth, MN?

You’ll get expert guidance comparing multiple carriers and plans, which can help you find monthly premiums as low as $275 based on coverage and needs.

How can health insurance in Duluth, MN, help lower your monthly medical costs?

It provides access to essential benefits like preventive care, prescription coverage, and hospital services, often for monthly rates starting around $240. Enter your ZIP code into our free comparison tool to get started.

How can you find cheap full coverage car insurance in Minnesota?

You can compare quotes online to find full coverage options starting around $95 per month, especially if you qualify for safe driver or bundling discounts.

What should you know about low-income car insurance in Minnesota?

If you meet certain income thresholds, you may qualify for monthly rates as low as $45 through state-approved insurers or usage-based programs. Find out who qualifies for government auto insurance and what it actually covers.