Best Kansas City, MO Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, Progressive, and American Family provide the best Kansas City, MO, auto insurance, starting rates as low as $24 per month. These companies are the best Kansas City vehicle insurance options because of their excellent customer service and affordable rates. For dependable coverage, pick them.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Kansas City MO

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Kansas City MO

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Kansas City MO

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsFind the best Kansas City, MO auto insurance with State Farm, Progressive, and American Family, starting at rates of $24 per month.

These top providers offer competitive coverage options tailored for Kansas City drivers, with car insurance discounts and flexible policies to fit varying needs.

Our Top 10 Company Picks: Best Kansas City, MO Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Multi-Policy Discounts | State Farm | |

| #2 | 10% | A+ | Snapshot Program | Progressive | |

| #3 | 25% | A | Local Agent | American Family | |

| #4 | 20% | A | Local Expertise | Farmers | |

| #5 | 25% | A++ | Affordable Rates | Geico | |

| #6 | 25% | A+ | Claims Management | Allstate | |

| #7 | 13% | A++ | Flexible Coverage | Travelers | |

| #8 | 20% | A+ | Safe-Driving Rewards | Nationwide |

| #9 | 25% | A | Family-Friendly Discounts | Liberty Mutual |

| #10 | 5% | A+ | Safe-Driver Discounts | Dairyland |

While State Farm leads in affordability, Progressive and American Family deliver strong value with unique benefits. These companies are the best in the market for drivers seeking quality coverage at low rates.

Start comparing the total coverage of the best Columbia, MO auto insurance rates by entering your ZIP code.

- Find the best Kansas City, MO auto insurance with rates starting at $24 monthly

- Discover coverage options tailored to Kansas City drivers’ unique needs

- State Farm provides top-rated, affordable policies for Kansas City, MO

#1 – State Farm: Top Overall Pick

Pros

- Strong National Presence: Highly reliable Kansas City auto insurance provider with minimum coverage starting at $31 per month.

- Bundle Savings: State Farm auto insurance review offers multiple policy discounts to maximize savings in Kansas City.

- Reputable Claims Handling: State Farm handles Kansas City claims efficiently and effectively.

Cons

- Limited Discount Availability: Fewer discounts are available for specific vehicle types.

- Higher Rates for Young Drivers: Premiums may be higher for younger Kansas City drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Program

Pros

- Affordable Minimum Coverage: Kansas City auto insurance rates start at $36 per month for minimum coverage.

- Snapshot Program: Progressive auto insurance review offers discounts through safe driving tracking in Kansas City.

- High-Risk Support: Tailored options for high-risk Kansas City drivers.

Cons

- Premium Increases: Potential for higher rates with Snapshot program analysis.

- Customer Service Limitations: Reports of mixed service satisfaction in Kansas City.

#3 – American Family: Best for Local Agent

Pros

- Lowest Minimum Coverage Rates: American Family offers Kansas City, MO auto insurance with minimum coverage of $39 per month, making it highly affordable.

- Strong Family Policies: American Family auto insurance review provides unique policy options tailored to family drivers in Kansas City.

- Reliable Claims Process: They process claims quickly and efficiently for local Kansas City residents.

Cons

- Limited Specialty Discounts: Fewer specialty discounts are available for specific demographics.

- Higher Premium Costs: A full coverage cost of $108 may not suit budget-conscious drivers.

#4 – Farmers: Best for Local Expertise

Pros

- Customizable Policies: Farmers Auto Insurance Review offers tailored Kansas City auto insurance policies with minimum coverage starting at $49 per month.

- Strong Local Presence: Farmers has an established presence and support network in Kansas City, MO.

- Specialty Coverages: Add-ons for full coverage are available in Kansas City.

Cons

- High Full Coverage Rates: A full coverage premium of $138/month may be cost-prohibitive for some.

- Limited Online Tools: They have less digital support compared to other insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Geico: Best for Affordable Rates

Pros

- Lowest Rates Available: Minimum coverage for Kansas City, MO auto insurance starts at $33 per month, making it the most affordable option.

- Broad Discount Options: Geico auto insurance review offers various discounts that benefit Kansas City drivers.

- Digital Tools: Convenient apps and web utilities help manage insurance.

Cons

- Customer Service Limitations: They have less personalized support than some Kansas City competitors.

- Limited Coverage Add-ons: They have fewer specialized add-ons compared to other providers.

#6 – Allstate: Best for Claims Management

Pros

- Excellent Customer Support: Allstate auto insurance review excels in customer service for Kansas City, MO auto insurance, enhancing user experience.

- Affordable Rates: It offers its customers minimum coverages starting at $53 per month, which makes it competitive.

- Bundling Discounts: Allstate provides a high savings through bundling packages for Kansas City drivers.

Cons

- Higher Premiums: Compared to others, Allstate’s full coverage costs $150 monthly, which may be high.

- Discount Limitations: Some discounts may not apply to all vehicle types in Kansas City.

#7 – Travelers: Best for Flexible Coverage

Pros

- Variety of Coverage Options: Travelers offers extensive Kansas City, MO auto insurance options with minimum monthly coverage starting at $42.

- Claims Satisfaction: Travelers is known for the efficient claims process in Kansas City.

- Discount Opportunities: Travelers auto insurance review offers a range of discounts that make it affordable for Kansas City motorists.

Cons

- Higher Full Coverage Costs: A full coverage premium of $116 monthly may not suit all budgets.

- Limited Local Agents: Fewer local agents are available in some Kansas City areas.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Safe-Driving Rewards

Pros

- Affordable Full Coverage: Nationwide auto insurance review offers competitive full coverage in Kansas City, MO, starting at $68 per month.

- User-Friendly Digital Tools: Online tools enhance policy management for Kansas City users.

- Accident Forgiveness: They also have accident forgiveness for qualified Kansas City drivers.

Cons

- Limited Coverage Customization: They have fewer Kansas City auto insurance customization options.

- Fewer Discount Types: They have limited discount categories compared to competitors.

#9 – Liberty Mutual: Best for Family-Friendly Discounts

Pros

- Flexible Coverage Options: Liberty Mutual auto insurance review offers customizable policies for Kansas City drivers with minimum coverage at $47 per month.

- Efficient Claims Process: Known for streamlined claims support in Kansas City, MO.

- Extensive Discounts: Various discounts exist that make the price more affordable for the residents of Kansas City.

Cons

- Higher Premiums: A full monthly coverage premium of $130 may not fit every budget.

- Mixed Customer Service Reviews: Some Kansas City customers report inconsistent service experiences.

#10 – Dairyland: Best for Safe-Driver Discounts

Pros

- Flexible Payment Plans: Dairyland offers adaptable payment options for Kansas City auto insurance customers, with minimum monthly coverage starting at $41.

- High-Risk Coverage Options: Supports drivers with difficult records in Kansas City.

- Good Customer Support: Dairyland is responsive and helpful support for drivers from Kansas City.

Cons

- Limited Discount Range: Fewer discount options for specific driver types. Read our relevant guide title, “When is high-risk auto insurance required?“

- Higher Full Coverage Premiums: A monthly full coverage rate of $113 may deter budget-focused drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

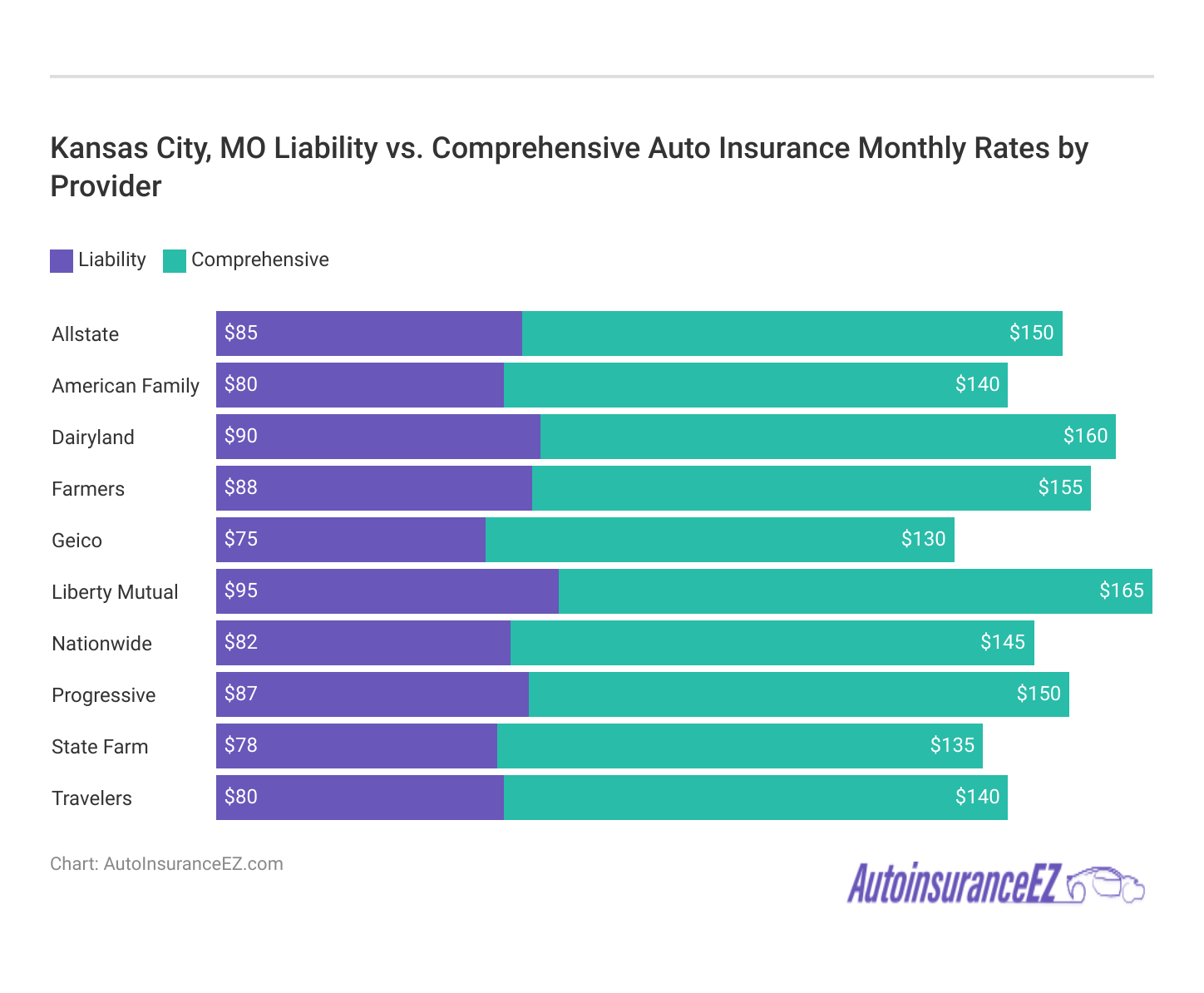

Provider Comparison of Monthly Auto Insurance Rates in Kansas City, MO

Monthly auto insurance rates in Kansas City, MO, vary by provider and coverage level. Nationwide offers the lowest minimum coverage at $24/per month, Geico at $33, and State Farm at $31 monthly. For full coverage, American Family leads at $108 monthly, with Dairyland at $113 monthly. Comparing these rates is highly important when balancing affordability and coverage.

Kansas City, MO Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $53 | $150 | |

| $39 | $108 | |

| $41 | $113 | |

| $49 | $138 | |

| $33 | $91 | |

| $47 | $130 |

| $24 | $68 |

| $36 | $99 | |

| $31 | $87 | |

| $42 | $116 |

In contrast, Allstate and Farmers have higher premiums, with minimum coverage at $53 and $49 per month and full coverage at $150 and $138 monthly, respectively. Liberty Mutual and Progressive offer mid-range options, with minimum coverage at $47 and $36 monthly and full coverage rates at $130 and $99 monthly. Evaluating these factors can help you find the best auto insurance in Kansas City, MO.

Learn More: Is it a bad idea to carry minimum coverage auto insurance?

Top Auto Insurance Discounts in Kansas City, MO

Auto insurance in Kansas City, MO, offers many discounts. Allstate provides savings for students, new cars, and anti-theft devices. American Family rewards early renewals and safe drivers, while Geico gives discounts to military and federal employees. Liberty Mutual and Progressive cater to specific needs like new graduates and eco-conscious drivers.

Auto Insurance Discounts From the Top Providers in Kansas City, MO

| Insurance Company | Available Discounts |

|---|---|

| Smart Student Discount, New Car Discount, Anti-Theft Device Discount, Pay-in-Full Discount | |

| Steer into Savings Discount, Early-Bird Renewal Discount, Auto Safety Equipment Discount, Loyalty Discount | |

| Transfer Discount, Bilingual Support Discount, Homeowner Discount, Safe Driver Discount | |

| Signal Safe Driving Discount, Bundle Discount, Mature Driver Discount, Homeowner Discount | |

| Military Discount, Federal Employee Discount, Good Student Discount, Multi-Vehicle Discount | |

| New Graduate Discount, RightTrack Discount, Early Shopper Discount, Multi-Policy Discount |

| SmartRide Discount, Family Plan Discount, Accident-Free Discount, Automatic Payments Discount |

| Snapshot Discount, Multi-Policy Discount, Continuous Insurance Discount, Teen Driver Discount | |

| Accident-Free Discount, Good Student Discount, Safe Driver Discount, Defensive Driving Discount | |

| Multi-Policy Discount, Hybrid/Electric Car Discount, Continuous Insurance Discount, New Car Discount |

For affordable auto insurance in Kansas City, MO, some providers reward continuous coverage and safe driving after an accident. State Farm and Farmers offer discounts for mature, accident-free drivers, while Nationwide discounts family plans and automatic payments. Comparing auto insurance companies’ options helps drivers find the best rates.

How Much is Kansas City, Missouri, Auto Insurance on Average

Let’s start by looking at Kansas City, Missouri’s average auto insurance rates. The table below shows the average cost of auto insurance in Kansas City, MO, compared to the state and national averages.

Kansas City, MO Average Monthly Auto Insurance Rates vs. Missouri and National Average

| Location | Monthly Rate |

|---|---|

| Kansas City, MO | $180 |

| Missouri | $159 |

| National Average | $124 |

Kansas City’s auto insurance coverage options rate is $317 per month, substantially more than the national average and higher than the Missouri state average.

There are many reasons why Kansas City’s auto insurance is more expensive. Learn how to lower Kansas City, MO’s average auto insurance rate.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Missouri

Auto insurance is available in Missouri, where drivers must carry minimum coverage levels to drive legally. The table below shows Missouri’s required limits compared to common coverage levels chosen by drivers.

Kansas City, MO Minimum Auto Insurance Requirements

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $10,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person / $50,000 per accident |

A basic policy meeting minimum car insurance requirements is affordable but may leave gaps in coverage, especially for liability and uninsured driver injuries. This policy covers only damages to other drivers if you cause an accident or injuries to you if hit by an uninsured driver, leaving you responsible for other expenses.

Missouri drivers pay an average of $317 monthly, though Kansas City residents may find lower rates. USAA, Nationwide, and Travelers offer affordable options nearby, but Geico and Allstate may have better claims processes. Comparing quotes from several providers is critical for determining the best rate and coverage. Major Auto Insurance Factors in Kansas City, Missouri

Auto insurance rates vary widely as each provider calculates premiums differently. In Kansas City, MO, these factors influence your purchase coverage options.

Kansas City, MO Average Monthly Auto Insurance Rates by Company

| Insurance Company | Monthly Rate |

|---|---|

| $245 | |

| $245 |

| $188 | |

| $272 | |

| $170 |

| $125 |

| $173 | |

| $194 | |

| $137 | |

| $92 |

Comparing rates from several firms is critical for determining the best fit for your requirements and budget. Side-by-side comparisons indicate areas where you can economize on coverage.

The table above shows Kansas City, MO’s average monthly auto insurance rates. USAA offers the lowest rates but is limited to military families. Nationwide and State Farm provide affordable options for others.

What ZIP Codes Have the Cheapest Auto Insurance Rates in Kansas City, Missouri

Auto insurance rates in Kansas City, MO, vary depending on age, driving history, and credit score. Each provider uses its formula, so comparing quotes is key to finding the best rate and coverage fit for your needs.

Kansas City, MO Auto Insurance Monthly Rates by Zip Code

| ZIP | Rates |

|---|---|

| 64157 | $225 |

| 64156 | $227 |

| 64164 | $228 |

| 64167 | $229 |

| 64166 | $229 |

| 64155 | $230 |

| 64158 | $232 |

| 64119 | $233 |

| 64165 | $233 |

The table below highlights average auto insurance costs in Kansas City. Comparing these rates can give you an idea of what to expect, helping you choose a policy that aligns with your budget.

USAA has some of the most competitive prices, but it is only available to military families. Non-military residents can get cheap prices and trustworthy coverage from Nationwide and State Farm.

Automotive Accidents in Kansas City, Missouri, and Your Auto Insurance Rates

Insurance companies typically charge higher premiums in locations with high accident rates. The increased premiums mitigate the risks of insuring those who live in areas with risky roads.

Nationwide delivers affordable auto insurance for Kansas City drivers, balancing low rates with solid coverage options.

Heidi Mertlich Licensed Insurance Agent

The table below details the fatal accident statistics for Kansas City, MO.

Kansas City, MO Fatal Accidents

| Category | Count |

|---|---|

| Fatal Accidents | 102 |

| Fatal Crash Vehicles | 160 |

| DUI Fatal Crashes | 35 |

| Fatalities | 102 |

| Fatal Crash Individuals | 150 |

| Fatal Accident Pedestrians | 20 |

These figures may impact Kansas City insurance premiums. If you are concerned about your rates rising due to your city’s crash statistics, consider using public transportation to work to avoid driving during rush hour traffic.

Auto Thefts in Kansas City, Missouri, and Your Auto Insurance Rates

Obtaining low-cost vehicle insurance in Kansas City, MO, can be difficult if you drive a model prone to theft. Trendy cars and trucks are particularly attractive to thieves, especially in larger urban areas like Kansas City, where theft rates are notably higher.

City-Data reports that vehicle theft peaked at 4,287 in Kansas City in 2013, decreased in the following years, and then spiked again in 2017. If you only carry the minimum legal auto insurance in Missouri, your car won’t be protected against theft. Given the high risk of auto theft in the city, investing in comprehensive insurance is advisable.

Comprehensive policies cover theft and damage from weather, flooding, fire, and vandalism. While this coverage can significantly increase your premium, it can be crucial if replacing your vehicle would cause financial hardship. To lower your costs, consider raising your deductible, which can help make comprehensive coverage more affordable.

Best Auto Insurance for Credit History Rates in Kansas City, Missouri

Your credit score can be incredibly influential on your auto insurance premiums. In Kansas City, people with poor credit sometimes pay twice as much as people with good credit.

See what we mean in the table below.

Kansas City, MO Insurance Monthly Auto Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $104 | $125 | $150 | |

| $84 | $100 | $120 | |

| $84 | $105 | $130 | |

| $104 | $125 | $150 | |

| $178 | $200 | $250 | |

| $135 | $155 | $200 |

| $135 | $155 | $200 |

| $136 | $155 | $195 | |

| $79 | $95 | $120 | |

| $80 | $95 | $130 |

Fortunately, negative credit does not stay indefinitely. You can gradually rebuild your credit by paying your monthly car insurance rates on time. You will eventually be able to qualify for better rates.

Does Age Affect my Auto Insurance Rates in Kansas City, Missouri

Insurance companies associate age with driving experience, so older drivers often enjoy lower rates. The more driving years you have, the safer you’re perceived to be.

The table below highlights monthly insurance rate differences between 17- and 34-year-old drivers in Kansas City, MO, with teens typically paying higher premiums due to limited experience.

Kansas City, MO Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $703 | $762 | $234 | $242 | $246 | $238 | $222 | $229 | |

| $569 | $739 | $206 | $240 | $206 | $206 | $184 | $184 | |

| $922 | $954 | $248 | $259 | $217 | $216 | $193 | $205 | |

| $575 | $608 | $160 | $160 | $178 | $201 | $138 | $180 | |

| $938 | $1,041 | $276 | $293 | $262 | $284 | $216 | $242 |

| $387 | $494 | $171 | $184 | $149 | $152 | $134 | $141 |

| $716 | $798 | $256 | $256 | $213 | $193 | $174 | $180 | |

| $501 | $627 | $188 | $215 | $167 | $167 | $151 | $151 | |

| $382 | $467 | $162 | $180 | $129 | $129 | $116 | $118 |

At age 25, rates tend to drop significantly. Until then, Kansas City teens can reduce costs through good student discounts, Drivers Education, and defensive driving courses.

Best Auto Insurance for Driving Record Rates in Kansas City, Missouri

Insurance providers assess your driving history to set your premium rates. They review past violations, accidents, or claims to gauge your risk level, directly impacting your monthly costs.

A clean record typically results in lower premiums. Without any infractions, you present less risk, leading to savings. The table below shows how even one violation raises auto insurance rates in Kansas City.

Kansas City, MO Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $94 | $113 | $141 | $169 | |

| $99 | $119 | $149 | $179 | |

| $115 | $138 | $173 | $208 | |

| $104 | $125 | $156 | $187 | |

| $155 | $186 | $232 | $278 | |

| $105 | $126 | $157 | $188 |

| $87 | $104 | $130 | $156 |

| $155 | $186 | $232 | $278 | |

| $100 | $120 | $150 | $180 | |

| $101 | $121 | $151 | $181 |

For minor infractions, you may still reduce premiums. Ask your insurer about accident forgiveness or discounts to manage increases from small breaches.

Your Vehicle Make and Model and Your Kansas City, Missouri, Auto Insurance Rates

The vehicle you drive has a big impact on your auto insurance costs. Insurers perceive safer, cheaper-to-repair cars as lower risk thus their premiums are often lower. Luxury automobiles, on the other hand, have higher rates since they require more expensive repairs, are more likely to be stolen, and require specialized parts.

The table below compares the monthly auto insurance costs in Kansas City for a basic budget sedan and a luxury vehicle. Another factor driving up luxury vehicle prices is that owners frequently acquire expanded coverage policies to protect their investments.

Kansas City, MO Auto Insurance Monthly Rates by Vehicle Make & Model

| Insurance Company | 2024 Toyota Camry | 2024 BMW 5 Series |

|---|---|---|

| $150 | $200 | |

| $140 | $190 | |

| $160 | $210 | |

| $155 | $205 | |

| $145 | $195 | |

| $170 | $220 |

| $150 | $200 |

| $160 | $210 | |

| $140 | $190 | |

| $150 | $200 |

When shopping for an automobile, look for models with reduced insurance costs to save money on your premiums.

Minor Auto Insurance Factors in Kansas City, Missouri

These factors affect your auto insurance rates in Kansas City, MO; now, let’s look at minor details that can also impact your premiums. Factors like marital status, gender, and commute length play a role in rate calculations. KCTV5 News highlights how these aspects influence local insurance costs. Keep reading to learn how to leverage them for better coverage.

Your Marital Status and Your Kansas City, Missouri, Auto Insurance Rates

If you are part of a couple, there could be some very good news for your vehicle insurance costs. On average, married people in Kansas City pay less for car insurance than single people.

Some companies provide discounts for newlyweds. Other providers see married people as more responsible, and thus lower-risk drivers. The greatest option for married couples to save money on auto insurance is to cover all of their vehicles under the same policy. Multi-car discounts can result in enormous savings.

Progressive consistently delivers affordable premiums and excellent customer service for Kansas City residents.

Michelle Robbins Licensed Insurance Agent

Similarly, if you are a homeowner, bundling your insurance plans with one provider will result in significant savings.

Your Gender and Your Kansas City, Missouri, Auto Insurance Rates

Some states have prohibited the use of gender as a factor in calculating vehicle insurance rates, but not Missouri.

Men often pay significantly more than women for auto insurance in Kansas City. This is because men are statistically more likely than women to cause deadly accidents and get caught driving recklessly.

However, the cost difference between what men and women pay for auto insurance in your location is only about one to two percent, so you shouldn’t be too concerned if you’re a man.

Your Commute Length and your Kansas City, Missouri, Auto Insurance Rates

Driving during peak traffic hours raises your accident risk, which can affect your insurance rates. Insurers may factor in your commute length and timing, especially if you drive more than average.

In Kansas City, the average commute is 21 minutes, below the national average of 25 minutes. About 81% of residents drive to work, while 8% carpool, and 5% work from home—meaning most rely on personal vehicles.

Though many insurers don’t prioritize commute length, some charge higher rates for frequent drivers. If you drive more than average, compare quotes to avoid extra costs. For less frequent drivers, ask about low-mileage discounts or consider public transportation to reduce premiums potentially.

Your Coverage and Deductibles and Your Kansas City, Missouri, Auto Insurance Rates

We covered earlier why a simple Missouri auto insurance policy may not be sufficient for the ordinary Kansas City driver. If you want to get more comprehensive auto insurance but must stay within a specific budget, consider raising the deductibles on your policy.

Both comprehensive and collision coverage comprehensive and collision coverage come with a deductible. The deductible is the amount you will pay out of pocket for damages before your insurance company pays the remainder.

Make sure your deductibles are not too large, as this would defeat the purpose of paying for additional coverage in the first place.

Your Education Level and Your Kansas City, Missouri, Auto Insurance Rates

Education levels once significantly impacted auto insurance rates, but today they play a lesser role. Still, students in Kansas City can find some discounts available for those in higher education, which can help reduce costs.

Read More: Good Student Discount

In Kansas City, over 25% of residents have completed high school, while about 17% hold a bachelor’s degree. Another 17.5% have not completed high school, reflecting varied educational backgrounds across the city.

The University of Missouri at Kansas City is the largest local institution, with over 15,000 students enrolling annually. Some other notable schools include the Kansas City Art Institute and Avila College, plus Research College of Nursing, which serves each with a specific career aspiration in arts, religion, and healthcare.

Case Studies on Top Auto Insurance Providers

These case studies demonstrate how prominent vehicle insurance providers meet various driver demands with unique solutions and competitive pricing.

- Case Study #1 State Farm in Columbia, MO: State Farm provides customizable automobile insurance in Columbia, MO, starting at $34/month. Flexible policies, add-ons such as rental reimbursement, and solid local support make it a first pick for affordable, adaptable coverage.

- Case Study #2—Progressive in Kansas City, MO: Progressive delivers competitive rate quotes to Kansas City, MO, customers for as little as $30/month. Additionally, the company provides Name Your Price and Snapshot to help customers not only save money on auto insurance but also budget for their automotive expenses.

- Case Study #3 — Farmers in New Jersey: Farmers insures high-risk drivers in New Jersey with flexible, comprehensive coverage at competitive rates. Roadside assistance options make farmers an affordable high-risk insurance company to consider.

These case studies exemplify how types of auto insurance coverage address the unique needs of drivers across regions, ensuring tailored coverage options and competitive pricing.

State Farm's competitive pricing and robust coverage make it the top choice for auto insurance in Kansas City.

Ty Stewart Licensed Insurance Agent

Enter your ZIP code into our free quote tool above to find the best Kansas, MO auto insurance providers for your needs and budget.

Frequently Asked Questions

What is the minimum coverage requirement for car insurance in the U.S.?

Each state has specific minimum requirements, usually including liability coverage. Check your state’s department of insurance for exact amounts.

Read More: What is liability auto insurance?

What is liability insurance, and why is it required?

Liability insurance covers damages you cause to others in an accident. It’s required to ensure compensation for injuries and property damage. You can find affordable auto insurance no matter your driving record by entering your ZIP code below in our free quote comparison tool.

How is car insurance priced?

Insurance companies consider factors like age, driving history, location, and vehicle type to set rates.

How can I lower my car insurance premium?

Increase your deductible, bundle policies, maintain a clean driving record, and ask for discounts for safe driving or low mileage.

Read More: What is an auto insurance deductible and how does it work?

What is the difference between comprehensive and collision coverage?

Comprehensive covers non-collision damage (e.g., theft, weather), while collision covers repairs to your car after an accident.

Can I insure a car I don’t own?

In most cases, yes. You can take out a policy if you regularly drive the car, but the owner may need to be listed as an insured party.

What happens if I miss a premium payment?

If you miss a payment, your policy may be canceled after a grace period. It’s best to contact your insurer right away to discuss options.

Read More: How does an auto insurance company determine my premium?

Do I need insurance if my car is parked and not driven?

You may need insurance if the vehicle is financed or leased. Otherwise, comprehensive-only insurance can protect against theft and damages.

What is uninsured motorist coverage, and is it required?

Uninsured motorist coverage protects you if an uninsured driver hits you. It’s required in some states and optional in others.

Read More: UM/UIM Auto Insurance Coverage

Will my insurance rate increase after an accident?

Yes, in most cases, an at-fault accident will lead to a rate increase. Some insurers offer accident forgiveness to prevent this. To protect your vehicle at the best prices, enter your ZIP code into our free auto insurance quote comparison tool below.