Finding the best auto insurance in Tulsa can be challenging. Most average monthly rates exceed the NAIC’s full coverage projections, influenced by factors such as age, gender, location, and marital status.

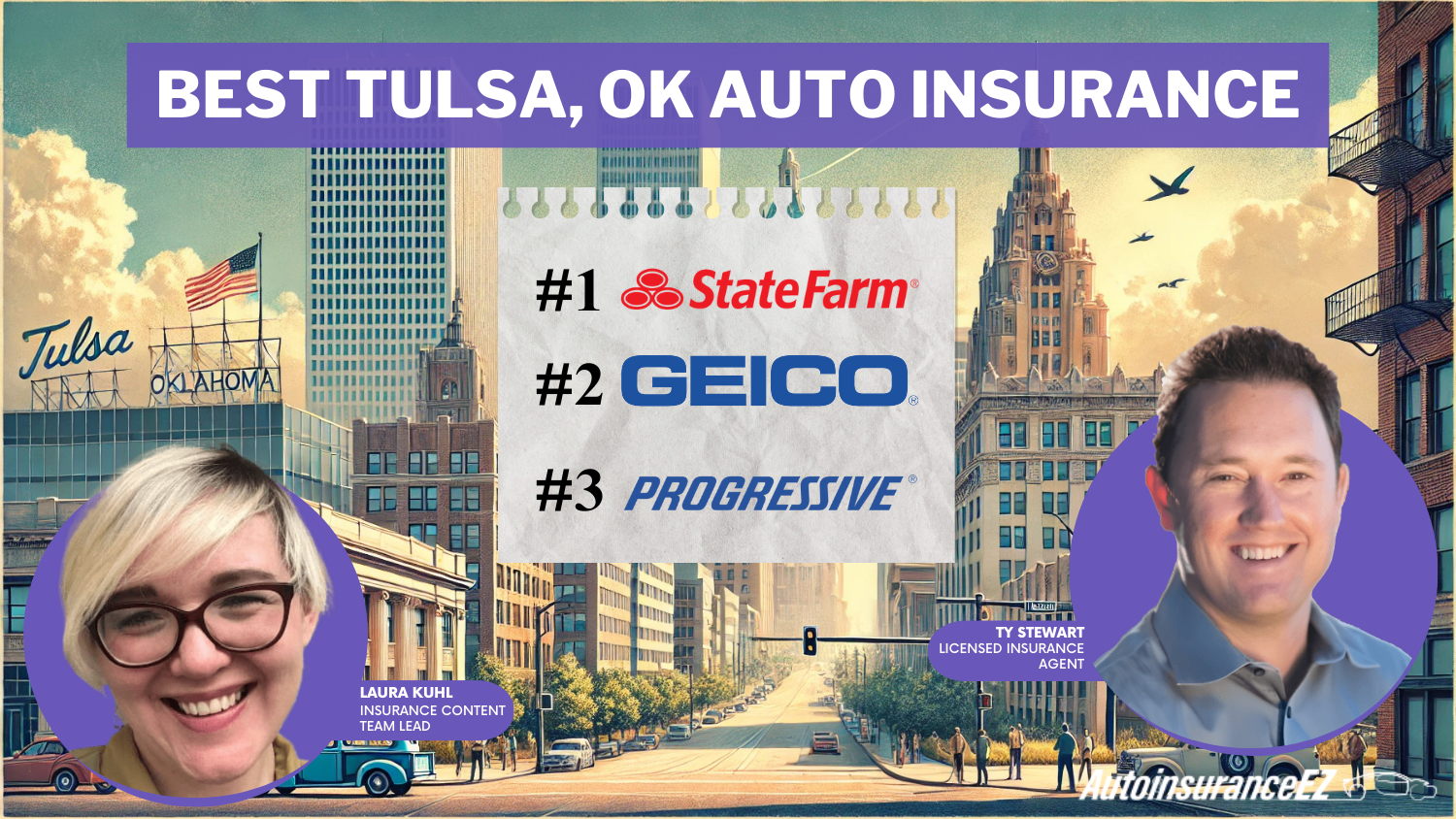

Best Tulsa, OK Auto Insurance in 2026 (Check Out the Top 10 Companies)

State Farm, Geico, and Progressive offer the best Tulsa, OK auto insurance. State Farm is our top pick due to its affordability, especially for Tulsa drivers with a clean driving record, high credit score, or low annual mileage. Tulsa, OK, car insurance rates start at $77 per month.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Apr 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Tulsa OK

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Tulsa OK

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage in Tulsa OK

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsThe best Tulsa, OK, auto insurance rates are offered by State Farm, Geico, and Progressive.

State Farm has the most affordable monthly rate at $77, followed closely by Geico at $74. Progressive comes in higher at $116 per month but may offer more flexibility for drivers with past violations or lower credit scores.

Our Top 10 Company Picks: Best Tulsa, OK Auto Insurance

| Company | Rank | A.M. Best | Monthly Rates | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | $77 | Cheapest Rates | State Farm | |

| #2 | A++ | $74 | Affordable Options | Geico | |

| #3 | A+ | $116 | Customizable Coverage | Progressive | |

| #4 | A | $125 | Local Expertise | Farmers | |

| #5 | A+ | $145 | Strong Reputation | Allstate | |

| #6 | A++ | $75 | Military Discounts | USAA | |

| #7 | A | $162 | Flexible Discounts | Liberty Mutual |

| #8 | A+ | $102 | Customer Satisfaction | Nationwide |

| #9 | A | $109 | Innovative Tools | American Family | |

| #10 | A | $150 | Roadside Assistance | AAA |

State Farm tends to reward drivers with clean records and good credit. Geico is competitive for low-mileage drivers and offers substantial auto insurance discounts. Progressive is often preferred by drivers needing nonstandard coverage.

- Best Tulsa, OK auto insurance rates start at just $77/mo with State Farm

- A clean driving record and good credit unlock the lowest premiums in Tulsa

- Drivers with good credit pay thousands less for auto insurance in Tulsa, OK

Comparing quotes from top insurers is the best way to find cheap auto insurance in Tulsa based on your risk profile. Enter your ZIP code to explore which companies have the best auto insurance quotes for you.

#1 – State Farm: Top Overall Pick

Pros

Pros

- Affordable Rates: State Farm offers some of the lowest rates in Tulsa, starting at $77 per month, making it an excellent choice for budget-conscious drivers. Read more in our full review of State Farm auto insurance

- Multiple Discounts: Offers a range of discounts, including safe driver discounts for accident-free records, good student discounts for maintaining a B average or higher, and multi-policy discounts for bundling auto insurance with home or renters insurance.

- Strong Customer Support: Features 24/7 claims service and an extensive network of local Tulsa agents, ensuring personalized support and faster claim processing.

Cons

- Limited High-Risk Coverage: Higher rates for drivers with DUIs, multiple accidents, or poor credit history.

- Fewer Customization Options: Lacks specialized endorsements, such as rideshare coverage or OEM parts coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

Pros

- Cheapest Rates: Offers the lowest average rates in Tulsa, at $74 per month, making it ideal for drivers focused on affordability. Learn more about their rates in our Geico auto insurance review.

- Discount Variety: Extensive discounts are available, including military discounts for active and retired personnel, federal employee discounts, and vehicle equipment discounts for features like anti-lock brakes and anti-theft systems.

- Efficient Digital Tools: A highly rated mobile app with features like virtual ID cards, claims filing, and roadside assistance requests.

Cons

- Limited Local Agents: Fewer in-person office locations in Tulsa compared to competitors.

- Coverage Gaps: Fewer add-on coverages, like gap insurance and new car replacement.

#3 – Progressive: Best for High-Risk Drivers

Pros

Pros

- Competitive Rates for High-Risk Drivers: Progressive insurance in Tulsa offers competitive rates and accident forgiveness for drivers with past violations or claims. Our complete Progressive review goes into more detail about this.

- Snapshot Program: Usage-based discount that tracks driving behavior through a mobile app or device; safe drivers can save up to 30%.

- Loyalty Rewards: Offers discounts for continuous insurance, multi-policy bundling, and paying premiums in full.

Cons

- Higher Base Rates: Starting rates of $116 are higher than those of State Farm or Geico.

- Customer Service Variability: Some reports of inconsistent claims service experience.

#4 – Farmers: Best for Customized Coverage

Pros

Pros

- Extensive Coverage Options: Offers add-ons like OEM parts coverage, new car replacement, and rideshare insurance. Check out our Farmers review for more information.

- Signal App Discount: A telematics program where safe driving behaviors can earn up to 15% off renewal premiums.

- Good Student Discount: Discounts in Tulsa, OK, are available for full-time students with a GPA of 3.0 or higher.

Cons

- Higher Premiums: The average starting rate is $125 per month.

- Fewer Digital Tools: App features are less comprehensive compared to competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for New Drivers

Pros

Pros

- Drivewise Program: Tracks driving habits and offers discounts for safe driving behaviors. Read more about this provider in our Allstate auto insurance review.

- New Auto Discount: Savings for drivers insuring a brand-new vehicle.

- TeenSMART Discount: Offers education-based discounts for teen drivers who complete defensive driving courses.

Cons

- Expensive Base Rates: The Average rate starts at $145 per month.

- Higher Fees: Additional fees for policy changes and installment payments.

#6 – USAA: Best for Military Families

Pros

Pros

- Lowest Rates for Military: Average rates at $75 per month for active, retired, and eligible family members. More information is available about this provider in our USAA auto insurance review.

- SafePilot Program: A telematics app that rewards safe drivers with up to 30% off premiums.

- Loyalty Discount: Long-term members receive additional savings based on their continuous coverage history.

Cons

- Membership Restrictions: Only available to military members and their families.

- Limited Branch Access: Only a few physical locations in Tulsa.

#7 – Liberty Mutual: Best for Customization

Pros

Pros

- RightTrack Program: Tracks driving habits and offers up to 30% off for safe drivers. To see monthly premiums and honest rankings, read our Liberty Mutual review.

- Bundling Discounts: Save by combining auto insurance with renters, home, or motorcycle insurance.

- New Move Discount: Liberty Mutual in Tulsa offers discounts for drivers who have recently moved to a new residence.

Cons

- Expensive Rates: The average starting premium is $162 per month.

- Mixed Customer Service Reviews: Reports of slow claims processing.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Usage-Based Insurance

Pros

Pros

- SmartRide Program: Rewards safe driving with discounts of up to 40% based on mileage, braking, and speed. Explore more discount options in our Nationwide review.

- Multi-Policy Discount: Savings when bundling auto with renters or homeowners insurance.

- Accident Forgiveness: Helps prevent your premium from increasing after your first at-fault accident.

Cons

- Limited Local Support: Fewer Tulsa offices compared to other top providers.

- Higher Premiums for High-Risk Drivers: Less competitive rates for drivers with past violations.

#9 – American Family: Best for Young Drivers

Pros

Pros

- Teen Safe Driver Program: Monitors driving behavior and offers discounts for safe habits. Find out more about the company in our American Family review.

- Good Student Discount: Savings for students maintaining a grade of B or higher.

- Multi-Vehicle Discount: Lower rates for households insuring more than one vehicle.

Cons

- Limited Availability: Not all discounts or programs may be available in every ZIP code.

- Slower Claims Service: Some customers report delayed claims resolution.

#10 – AAA: Roadside Assistance Benefits

Pros

Pros

- Membership Perks: Includes towing, battery service, lockout assistance, and insurance. Learn more about AAA roadside assistance in our review of AAA insurance.

- Loyalty Discount: Savings for long-term AAA members who bundle insurance.

- Vehicle Safety Discounts: Savings for cars with advanced safety features like lane departure warnings.

Cons

- High Rates: Average premiums around $150 per month.

- Membership Required: Purchasing insurance requires an AAA membership, which adds extra costs.

Auto Insurance Rates in Tulsa, OK

In Tulsa, Oklahoma, basic auto insurance coverage is affordable. Basic coverage includes liability, collision, and comprehensive. The table below shows monthly auto insurance rates in Tulsa, OK, based on provider and coverage level.

Tulsa, OK Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $150 |

| $79 | $145 | |

| $51 | $109 | |

| $57 | $125 | |

| $34 | $74 | |

| $83 | $162 |

| $49 | $102 |

| $65 | $116 | |

| $41 | $77 | |

| $31 | $75 |

Combined, these form full coverage. According to the NAIC, Oklahoma’s average monthly full coverage rate is $85.

Best full coverage auto insurance in Tulsa costs more than basic coverage because it includes additional risk factors.

Rates by Age and Gender

Age and gender significantly impact auto insurance. Younger, single drivers pay more due to inexperience. Parents can secure cheaper auto insurance in Tulsa, OK, by taking advantage of policy discounts.

Teen drivers pay the most. Parents can find the best Tulsa, OK auto insurance using good student, multi-car, and safe driving discounts.

Chris Abrams Licensed Insurance Agent

Let’s look at auto insurance rates based on age and gender to understand why parents should take advantage of discounts for teen drivers.

Tulsa, OK Auto Insurance Monthly Rates by Age, Gender, and Marital Status

| Age, Gender, Marital Status | Monthly Rate |

|---|---|

| Married 60-year-old female | $226 |

| Married 60-year-old male | $241 |

| Married 35-year-old female | $247 |

| Married 35-year-old male | $251 |

| Single 25-year-old female | $268 |

| Single 25-year-old male | $282 |

| Single 17-year-old female | $830 |

| Single 17-year-old male | $924 |

Teen auto insurance in Tulsa, OK, costs between $825 and $925 per month. Older and married drivers pay between $226 and $251 per month.

Rates by ZIP Code

Tulsa has several ZIP codes, and each one has different auto insurance rates. Urban and suburban areas tend to have higher rates, while rural areas have lower rates. Let’s look at some of Tulsa’s ZIP codes to see which areas are the most affordable.

Tulsa, OK Auto Insurance Monthly Rates by ZIP Code

| Tulsa ZIP Code | Monthly Rate |

|---|---|

| 74131 | $387 |

| 74132 | $387 |

| 74107 | $397 |

| 74171 | $397 |

| 74133 | $398 |

| 74117 | $400 |

| 74108 | $402 |

| 74136 | $403 |

| 74137 | $403 |

| 74114 | $406 |

| 74145 | $406 |

| 74127 | $407 |

| 74130 | $408 |

| 74105 | $408 |

| 74135 | $409 |

| 74112 | $410 |

| 74126 | $411 |

| 74104 | $411 |

| 74116 | $411 |

| 74134 | $412 |

| 74172 | $412 |

| 74129 | $413 |

| 74119 | $414 |

| 74128 | $414 |

| 74120 | $415 |

| 74146 | $419 |

| 74103 | $422 |

| 74106 | $428 |

| 74115 | $430 |

| 74110 | $431 |

The most expensive ZIP code in Tulsa is 74110, an urban area with retail businesses and residents. ZIP code 74131 is a rural area where the Turner Turnpike toll road goes right through the city. Campsites, a golf club, and a youth center ranch are in 74131.

You can compare auto insurance quotes by ZIP code to see what fits your budget best. Use our free online comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rates by Company

Monthly auto insurance rates vary by city and state, affecting what drivers pay based on their location. When you move from one city or state to another, your auto insurance might increase. Let’s look at the monthly rates of the best auto insurance companies in Tulsa, OK.

Tulsa, OK Auto Insurance Monthly Rates by Provider

| Insurance Company | 60-Year-Old Female | 60-Year-Old Male | 35-Year-Old Female | 35-Year-Old Male | 25-Year-Old Female | 25-Year-Old Male | 17-Year-Old Female | 17-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| $206 | $216 | $222 | $222 | $238 | $250 | $712 | $839 | |

| $201 | $213 | $224 | $222 | $255 | $265 | $913 | $935 | |

| $231 | $265 | $213 | $236 | $187 | $189 | $660 | $705 | |

| $378 | $414 | $430 | $455 | $447 | $463 | $1,297 | $1,430 |

| $233 | $247 | $283 | $268 | $330 | $344 | $1,132 | $1,268 | |

| $162 | $162 | $182 | $182 | $193 | $218 | $512 | $643 | |

| $170 | $170 | $176 | $175 | $225 | $245 | $586 | $649 |

Liberty Mutual is the most expensive auto insurance company in Tulsa, whereas State Farm is the cheapest. Drivers aged 25 and older spend significantly less on auto insurance. A Redditor pointed out that the Oklahoma Farm Bureau has a good reputation and may offer competitive rates.

They also mentioned that major providers like Progressive, Allstate, and State Farm typically provide strong pricing options worth comparing.

Credit History by Company

According to the Federal Trade Commission, people with excellent credit have a better chance of receiving better deals from lenders, businesses, and auto insurance companies. Therefore, auto insurance companies will issue cheaper auto insurance rates to drivers with good credit and more expensive rates to drivers with fair or poor credit.

Auto insurance statistics show drivers with fair and poor credit have a higher chance of filing a claim than drivers with good credit. Here are the monthly rates based on credit history.

Tulsa, OK Average Annual Auto Insurance Annual Rates by Credit History

| Companies | Average Rates with Good Credit | Average Rates with Fair Credit | Average Rates with Poor Credit |

|---|---|---|---|

| State Farm | $2,414 | $3,008 | $4,715 |

| USAA | $2,444 | $3,050 | $5,283 |

| Geico | $3,199 | $4,030 | $4,860 |

| Allstate | $3,596 | $4,085 | $5,393 |

| Farmers | $4,376 | $4,605 | $5,544 |

| Liberty Mutual | $5,487 | $7,013 | $11,409 |

| Progressive | $5,539 | $5,952 | $6,978 |

See how good credit can save you money and help with affordable auto insurance in Tulsa, OK? Drivers with poor or fair credit have auto insurance rates that are thousands of dollars higher than those with excellent credit. However, you may be eligible for other discounts that can decrease your monthly auto insurance rates.

Commute Rates by Company

Driving your car less can help lower your auto insurance premiums. Licensed drivers in Oklahoma drive about 1,574 miles per month. The more you drive, the higher your risk of an accident.

Auto insurance companies will often ask about the purpose of your vehicle. Pleasure vehicles are usually driven less and produce cheaper rates, while everyday commute vehicles have more expensive rates. The following table shows how much auto insurance companies charge based on monthly mileage for commuting.

Tulsa, OK Auto Monthly Insurance Rates by Commute

| Insurance Company | 10-Mile Commute (6,000 Annual Mileage) | 25-Mile Commute (12,000 Annual Mileage) |

|---|---|---|

| $4,358 | $4,358 | |

| $4,842 | $4,842 | |

| $3,957 | $4,102 | |

| $7,970 | $7,970 |

| $6,156 | $6,156 | |

| $3,322 | $3,436 | |

| $3,549 | $3,635 |

Allstate, Farmers, Liberty Mutual, and Progressive don’t issue higher rates if you drive more or less. Geico, State Farm, and USAA, on the other hand, do offer cheaper rates if you drive your vehicle less.

Low-Cost Insurance in Tulsa, Oklahoma

Many auto insurance companies in Tulsa, Oklahoma, offer discounts for safe driving, low mileage, and more. The table below shows auto insurance discounts from top-rated auto insurance in Tulsa, OK.

Auto Insurance Discounts From the Top Providers in Tulsa, OK

| Insurance Company | Available Discounts |

|---|---|

| Multi-Vehicle, Safe Driver, Good Student, Anti-Theft, Pay-in-Full, Defensive Driving, Bundling |

| Drivewise, Safe Driver, Multi-Policy, Early Signing, Teen Driver, Pay-in-Full, Defensive Driving, New Car, Anti-Theft | |

| KnowYourDrive, Multi-Policy, Safe Driver, Good Student, Anti-Theft Device, Bundling, Pay-in-Full, Vehicle Safety Features | |

| Safe Driver, Multi-Policy, Teen Driver, Good Student, Accident-Free, Anti-Theft Device, Bundling, Homeownership | |

| Military, Federal Employee, Multi-Vehicle, Safe Driver, Good Student, Anti-Theft Device, Defensive Driving, Emergency Deployment | |

| RightTrack, Multi-Policy, Safe Driver, Good Student, Newly Purchased Vehicle, Bundling, Pay-in-Full, Vehicle Safety Features |

| SmartRide, Multi-Policy, Safe Driver, Good Student, Anti-Theft, Pay-in-Full, Vehicle Safety Features, Accident-Free |

| Snapshot Program, Multi-Policy, Multi-Vehicle, Good Student, Safe Driver, Pay-in-Full, Online Quote, Homeowner | |

| Safe Driver, Student, Multi-Policy, Vehicle Safety Features, Defensive Driving, Good Student, Accident-Free, Bundling | |

| Safe Driver, Military, Good Student, Multi-Vehicle, Pay-in-Full, Bundling, Defensive Driving, Vehicle Safety Features |

Compare available discounts to find the best savings on your Tulsa auto insurance policy.

Best Auto Insurance Company for Coverage Level Rates

Oklahoma auto insurance minimum requirements are $25,000 for bodily injury or death of one person per accident, $50,000 for bodily injury or death of multiple people per accident, and $25,000 for property damage per accident.

Coverage rules are abbreviated numbers that represent the coverage limits of insurance.

For example, Oklahoma’s minimum requirements would be written as 25/50/25 as a coverage rule.

The minimum requirements are a low coverage level, but higher policy limits will provide more coverage. Medium coverage levels are typically 50/100/50, while high coverage levels are 100/300/100.

More coverage limits mean you will spend more on auto insurance per year. Let’s examine auto insurance rates based on coverage levels.

Tulsa, OK Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $4,058 | $4,339 | $4,677 | |

| $4,605 | $4,778 | $5,141 | |

| $3,711 | $4,043 | $4,335 | |

| $7,527 | $7,941 | $8,442 |

| $5,673 | $6,114 | $6,683 | |

| $3,155 | $3,359 | $3,623 | |

| $3,419 | $3,580 | $3,778 |

Low coverage rates have the cheapest auto insurance rates per year. If you’re going for higher coverage limits, ask about policy discounts to save money.

Driving Record

Tulsa auto insurance companies will look back 36 months to see if you’ve had any driving violations. Parking violations shouldn’t have any effect on your auto insurance rate, but DUIs and speeding tickets do.

Accidents are reviewed through the claims you’ve made in the past with other insurance companies. Auto insurance companies issue monthly rates based on driving records differently. Take a look at how the top insurance companies in Tulsa issue rates.

Tulsa, OK Auto Insurance Monthly Rates by Driving Records

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $310 | $351 | $366 | $426 | |

| $339 | $407 | $439 | $428 | |

| $242 | $302 | $375 | $425 | |

| $443 | $613 | $752 | $849 |

| $399 | $469 | $744 | $441 | |

| $258 | $282 | $305 | $282 | |

| $220 | $271 | $319 | $387 |

State Farm is lenient on drivers who have a DUI because the increase for speeding violations is the same as the increase for a DUI conviction. All other auto insurance companies increase their rates the most when a driver has a DUI on their driving record.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Read More: Car Insurance After A DUI

Factors That Affect Auto Insurance Rates in Tulsa

We’ve discussed how rural and urban areas have different auto insurance rates, but other factors affect your auto insurance rates. For instance, road conditions and traffic congestion can determine how much you’ll pay for vehicle operating costs. Vehicle thefts in an area can also lead to higher comprehensive coverage rates.

Continue reading to learn more about how these additional factors can affect your auto insurance.

Vehicle Theft

According to the Federal Bureau of Investigation (FBI), Tulsa had 3,259 motor vehicle thefts in 2018.

How safe are vehicles in Tulsa? Neighborhood Scout reports monthly crimes in U.S. cities. Before we look at the crime statistics, let’s take a look at the ten safest neighborhoods in Tulsa, according to NeighborhoodScout.

- S Delaware Ave / E 101st St

- E 111Th St / S Yale Ave

- Oral Roberts U / S Lewis Ave

- E 101st St / S Norwood Ave

- E 81st St / S Harvard Ave

- E 41st St / S 193rd East Ave

- S Harvard Ave / E 36th St

- S Utica Ave / E 31st St

- Gray / Kengle

- E 81st St / S Yale Ave

Crime statistics, especially for property crimes, car accidents, and auto claims, may lead to more comprehensive coverage. Comprehensive coverage pays for damage from vehicle theft. Areas where vehicle theft is likely to occur will have higher auto insurance rates.

Here’s a summary of the crime statistics in Tulsa.

Tulsa, OK Crime Statistics

| Crime Summary | Crime Statistics |

|---|---|

| Number of Violent Crimes | 4,295 |

| Number of Property Crimes | 21,958 |

| Violent Crime Rate Per 1,000 Residents | 10.72 |

| Property Crime Rate Per 1,000 Residents | 54.8 |

| Crime Index | 1 |

| Chances to Become a Victim in a Violent Crime | 1 IN 93 |

| Chances to Become a Victim in a Property Crime | 1 IN 18 |

| Chances to Become a Victim in a Violent Crime in OK | 1 IN 215 |

| Chances to Become a Victim in a Property in OK | 1 IN 35 |

The crime index of Tulsa is 1, where 100 is considered the safest. Neighborhood Scout’s data also shows that you’re more likely to become a victim of property crime than a violent crime.

Is Tulsa, Oklahoma, safe? According to the statistics, it’s not safer than most cities. However, there are indeed safe places to live.

Traffic Congestion

Tulsa is recognized as a central metro area in Oklahoma. Inrix has recorded Tulsa as one of the most congested cities in the United States. Check out Inrix’s stats on Tulsa.

Tulsa, OK Traffic Statistics

| Tulsa Traffic Conditions | Traffic Statistics |

|---|---|

| Most Congested City in the Country | 166th |

| Most Congested City in the World | 788th |

| Driving time spent in congestion in 2019 | 10 Hrs |

| Cost of congestion per driver | $148 |

| Inner-city last-mile speed | 22 MPH |

Inner-city travel appears to be moderate since the speed limit on most residential streets is about 25 miles per hour; knowing how to drive safely in congested areas is essential.

Traffic in Tulsa

Although Tulsa has over 400,000 people living in the city, the commute time is less than the average national commute time.

Tulsa drivers average an 18-minute commute, below the national average, helping residents find affordable Tulsa, OK auto insurance rates.

Daniel Walker Licensed Insurance Agent

According to Data USA, the average commute time for employed drivers in Tulsa is 18 minutes. About 81 percent of working drivers prefer to drive alone. Ten percent of drivers carpool, and three percent work from home.

Road Conditions in Tulsa, Oklahoma

Tripnet reports road conditions in popular metro areas around the United States. Tulsa is one of the popular cities in the western United States. Let’s look at the road shares in Tulsa.

- Poor Share: 36 percent

- Mediocre Share: 37 percent

- Fair Share: 6 percent

- Good Share: 21 percent

The majority of Tulsa’s roads are in poor or mediocre condition. Vehicle operating costs (VOCs) in Tulsa are $898.

VOC is the cost of a driver will spend on vehicles, such as fuel, repairs, maintenance, tires, and other related costs.

Road conditions can be more problematic if the weather conditions are not favorable. Watch this news report on how complicated a drive could be during flooding.

Check your vehicle for Anti-Lock Brake Systems (ABS), which can help reduce insurance costs and assist you in choosing auto insurance coverage options. ABS also helps prevent hydroplaning on wet roads.

If you want to compare Tulsa auto insurance rates now, enter your ZIP code in the FREE comparison tool below!

Frequently Asked Questions

What is the average cost of auto insurance in Tulsa, OK?

The average monthly cost for full coverage auto insurance in Tulsa is approximately $85, according to the National Association of Insurance Commissioners (NAIC).

How do age and gender affect auto insurance rates in Tulsa?

Younger, single drivers typically face higher premiums due to inexperience. Conversely, older and married drivers often benefit from lower rates.

Which auto insurance company offers the lowest rates in Tulsa?

State Farm offers the most affordable full coverage auto insurance in Tulsa, with rates around $142 per month.

Can credit history impact auto insurance premiums in Tulsa?

Yes, drivers with excellent credit often receive lower rates, while those with fair or poor credit may face higher premiums due to the increased risk of claims.

Do ZIP codes affect auto insurance rates in Tulsa?

Yes, urban areas like ZIP code 74110 tend to have higher rates due to factors like traffic congestion and crime, whereas rural regions like 74131 often have lower premiums.

How does a driving record influence auto insurance costs?

A clean driving record typically results in lower premiums. However, drivers with violations such as DUIs or speeding tickets may experience significantly higher rates.

Read More: How to Lower Your Auto Insurance Premiums

What is the difference between basic and full coverage auto insurance?

Basic coverage includes liability insurance, while complete coverage encompasses liability, collision, and comprehensive insurance, offering broader protection.

Are there discounts available for low-mileage drivers?

Yes, some insurers offer lower rates for drivers who use their vehicles less frequently, as reduced driving reduces the risk of accidents.

How can I find the best auto insurance rates in Tulsa?

Comparing auto insurance companies in Tulsa, OK, by considering factors such as coverage options, deductibles, and available discounts can help you find the most competitive rates.

Is it beneficial to bundle auto insurance with other policies?

Yes, bundling auto insurance with other policies, such as home or renter’s insurance, often leads to discounts and makes managing your policies easier.Understanding how insurance works can feel complicated, but finding affordable rates doesn’t have to be. Enter your ZIP code to find the best auto insurance quotes in Tulsa, OK.

Pros

Pros Pros

Pros Pros

Pros

Pros

Pros