Usage-Based Insurance [How to Save with UBI]

With U.S. household combined debt exceeding $14 trillion, more Americans want to save money on auto insurance. Reports show that 75% of drivers want their insurance rates to be solely based on their driving, which seems only fair. Pay as you drive, behavior-based, or usage-based insurance is a perfect solution for many families. Usage-based insurance, which uses telematics to monitor driving behavior, has been proven to save motorists up to 50% on their auto insurance bills.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

- A recent study reveals 75% of drivers want their premiums to be based on how they drive

- Most of the nation’s top auto insurers offer usage-based insurance (UBI) programs that track driving habits

- Advertised savings are as high as 52% off of standard auto insurance premiums

Car payments, bills, mortgages, and loans. Let’s face it — drivers are looking for financial relief anywhere they can find it. And as the American household debt continues to soar – now at a record $13.95 trillion – every chance to cut costs helps, and every dollar saved matters.

So when you’re looking for cheap auto insurance and several providers are advertising that you can slash your rates by as much as 30, 40, or 50% . . . it’s only natural for you to want to check it out. Hence, the increasing popularity of telematics and usage-based insurance, or UBI.

Known as a form of insurance that tracks your mileage and driving behaviors, UBI is growing steadily — not only in the number of drivers signing up, but also in the number of companies offering programs.

With a growing number of programs, consumers are faced with seemingly endless options. It’s important for drivers who are interested in UBI to get all of the facts, beginning with who offers usage-based insurance, what a usage-based insurance program will do to their rates, and what exactly those devices will be tracking.

For that reason, we’ve reviewed usage-based insurance companies and include usage-based insurance statistics. We add detail on types of usage-based insurance and implicitly show a usage-based insurance comparison.

We’ll give a usage-based insurance definition and look at how different insurance companies are competing in the usage-based insurance market.

Do you feel like you’re being overcharged for your auto insurance? Enter your ZIP code into our free online quote comparison tool. In minutes, you can get several auto insurance quotes from the best providers in your area.

- Buying Auto Insurance

- Usage-Based Auto Insurance

- American Family KnowYourDrive Program Review for 2025

- Allstate Drivewise Program Review for 2025

- Metromile Program Review for 2025

- Tesla Telematics Program Review for 2025

- Safeco RightTrack Program Review for 2025

- USAA SafePilot Program Review for 2025

- Travelers IntelliDrive Program Review in 2025 (Driver Monitoring for Potential Savings)

- State Farm Drive Safe and Save or OnStar Program Review for 2025

- Progressive Snapshot Program Review for 2025

- Nationwide SmartRide Review for 2025

- Liberty Mutual RightTrack Review for 2025

- Farmers Signal App Review for 2025

- Green Commuting in 2025 (Why it Matters)

Now to help you pick the type of insurance that’s best for you, let’s dive in to learn more about the top usage -based options that thousands of Americans are switching to.

Which companies use telematics and usage-based insurance?

Experts with Cambridge Mobile Telematics estimate that roughly eight million North American drivers are taking advantage of usage-based insurance.

Whether they’re insured with major companies like State Farm or Progressive, or newer companies like Root or MetroMile, one thing’s for sure — these drivers are joining the ranks of consumers looking to take an active role in reducing their auto insurance premiums.

And you can too! Get started with our 10-Minute Guide to Auto Insurance.

It’s why we’ve assembled this go-to list of telematics and usage-based insurance programs and providers. You’ll also want to keep reading as we dig deeper into the technology behind usage-based insurance, as well as examine its pros and cons.

Listed in alphabetical order, we’re breaking down each program by how they work, and how much you can save.

AAA Drive™

| AAA Drive™ - Potential Savings | How It Works |

|---|---|

| Enrollment: up to 5% (up to 10% when adding family members) | Powered by a mobile app |

| Safe driving: up to 30% | Tracks mobile phone distraction, smooth driving, speed time of day, and fatigue |

It’s branded as free, fun, and most importantly – a way to save. AAA Drive™ is powered by the AAA Mobile App, which is free to Auto-Club Group (ACG) AAA members and insureds. Once drivers have installed and activated the app, their behaviors will be tracked in order to generate a score.

To qualify for potential discounts, drivers must use the app to record at least 1,000 miles and 25 journeys during a 120-day evaluation period. This breaks down to roughly 250 miles and seven journeys a month.

You Should Know: Drivers with certain driving violations won’t qualify for the AAA™ Drive discount. Be sure to speak with an agent to learn more.

- Allstate Drivewise Program Review

- Can the DriveEasy app save me money?

- State Farm Drive Safe and Save

Allstate Drivewise®

Allstate Drivewise - Savings and How it works

| Drivewise® - Potential Savings | How It Works |

|---|---|

| Enrollment: up to 10% | Powered by app or plug-in device |

| Safe driving: up to 30% with plug-in device; up to 25% with app | Tracks braking, safe speeds, mileage, and time of day |

Allstate promotes Drivewise® as a tool in which customers can drive down insurance costs. In addition to earning as much as 30% in discounts, Allstate Rewards® points are also up for grabs as drivers complete safe-driving challenges.

Drivewise® can be accessed through a mobile app, or through a plug-in device for drivers in Arkansas and Florida. A performance rating is calculated each term, with the potential to earn cash back every six months.

As an added bonus, the app is open to all drivers, whether or not they’re insured with Allstate. However, Drivewise® is not available in every state. Be sure to check with your agent to learn more.

American Family KnowYourDrive

American Family KnowYourDrive - how to save and how it works

| KnowYourDrive - Potential Savings | How It Works |

|---|---|

| Enrollment: 5% | Powered by a mobile app |

| Safe driving: up to 20% | Tracks braking, acceleration, and how often you drive |

It’s a program American Family Insurance says is all about helping customers “protect what matters the most” and can result in big savings – as much as 20%. As participants drive with the app, a score ranging from zero to 100 will be generated.

What score you earn will ultimately determine the type of discount you are eligible for. The good news? American Family promises not to raise your rates as a result of your driving. However, each time your policy renews, your discount may vary. (For more information, read our “American Family KnowYourDrive Program Review“).

Enter your ZIP code below to compare auto insurance rates. Secured with SHA-256 Encryption

Farmers Signal®

Farmers Signal - how to save and how it works

| Signal® - Potential Savings | How It Works |

|---|---|

| Enrollment: 5% | Powered by a mobile app |

| Safe driving: up to 15% | Tracks mileage, braking, location, distracted driving, and speeding |

With the help of Signal®, Farmers auto insurance offers customers the opportunity to “drive toward savings.” Not only can participants earn a discount of up to 15%, but additional savings are possible as more drivers on your policy who are under the age of 25 enroll.

Participating will begin with enrolling with an agent, and downloading the app.

Signal® is not available in all states, and discounts may vary based upon your location, so be sure to speak to an agent to learn more.

Read more:

Geico DriveEasy

Geico DriveEasy - How to save and how it works

| DriveEasy - Potential Savings | How It Works |

|---|---|

| Enrollment: up to 20% | Powered by a mobile app |

| Safe driving: unclear whether savings are offered | Tracks speeding, braking, phone use, time of day, and distance driven |

You can say that Geico’s DriveEasy is one of the newest kids on the UBI block. What was initially revealed as a trial program is now an app with potential savings of up to 20% for signing up. According to Geico’s website, enrolling requires all drivers listed on the policy to participate and download the app.

As your driving behaviors are monitored, a score will be calculated.

So far, DriveEasy is only available to eligible drivers in Connecticut and Pennsylvania, but the site suggests more states will be added in the future.

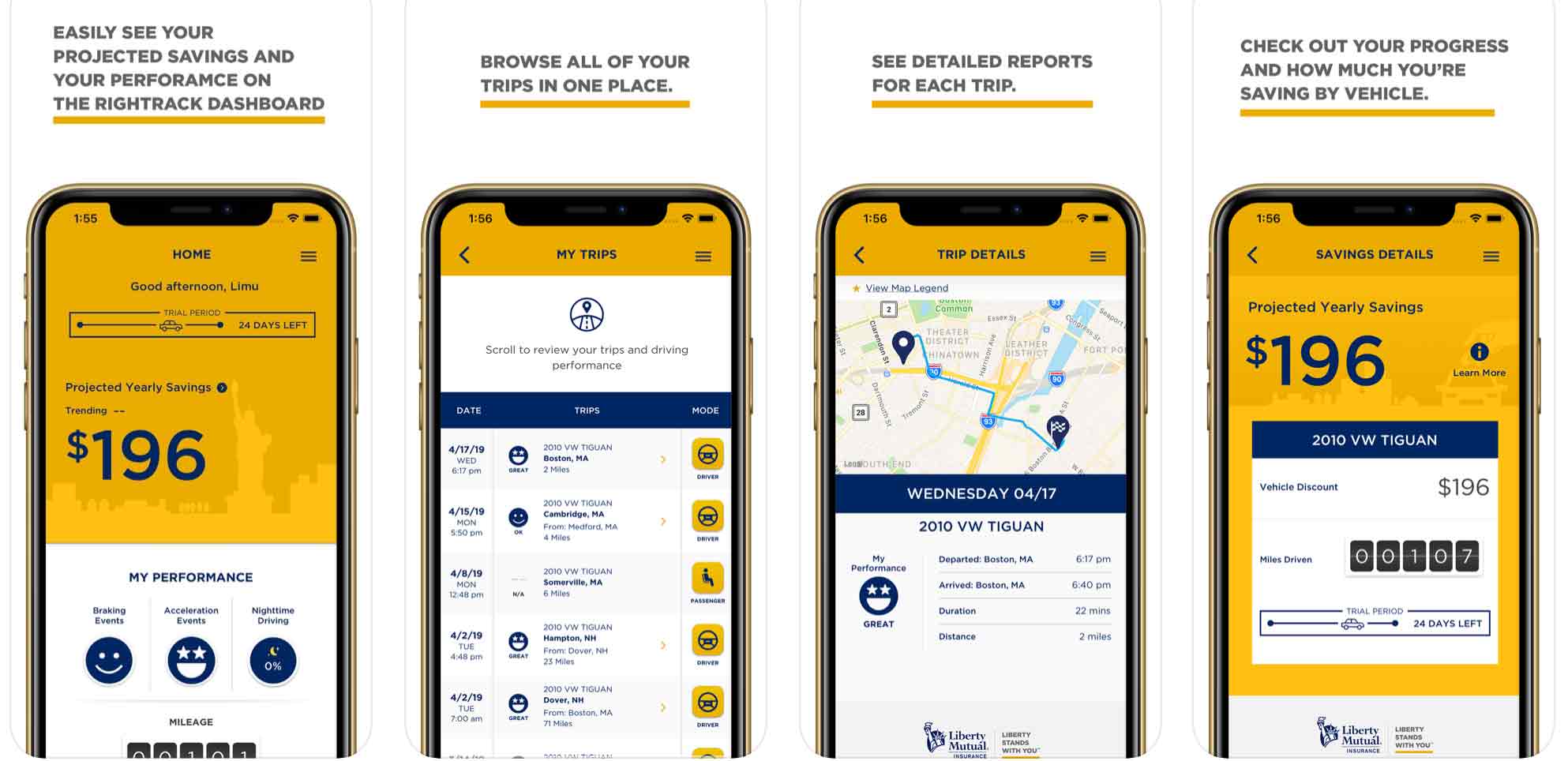

Liberty Mutual RightTrack®

Liberty Mutual RightTrack - How to save and how it works

| RightTrack® - Potential Savings | How It Works |

|---|---|

| Enrollment: unspecified amount | Powered by a mobile app and an accompanying tag |

| Safe driving: up to 30% | Tracks miles, time of day, hard braking, and rapid acceleration |

The premise is simple – Liberty Mutual auto insurance customers can get rewarded with as much as 30% in discounts for safe driving with RightTrack®. Participants will need to drive for 90 days using the app and an accompanying windshield tag before earning a discount.

The insurer promises that once determined, your discount will be applicable for the life of your policy. Program availability and discounts vary by state, so speak to a representative to learn more.

MetLife MyJourney®

MetLife MyJourney - how to save and how it works

| MyJourney® - Potential Savings | How It Works |

|---|---|

| Enrollment: up to 10% | Powered by a mobile app |

| Safe driving: up to 30% | Tracks mileage, time of day, road type and conditions, hard braking, harsh acceleration, and distracted driving |

Those participating in MetLife’s MyJourney® Program can earn discounts as high as 30% for safe driving. Drivers will need to agree to drive with the company’s app for six months as their behaviors are tracked.

MetLife promises that even after the six-month period is over, drivers will be able to maintain their discount for the duration of their policy.

MyJourney® is available in the following states: Connecticut, Delaware, Iowa, Maine, Michigan, Minnesota, North Dakota, New Jersey, Utah, and Wisconsin.

Nationwide SmartRide®

Nationwide SmartDrive - how it works, how much you can save

| SmartRide® - Potential Savings | How It Works |

|---|---|

| Enrollment: 10% | Powered by a plug-in device |

| Safe driving: up to 40% | Tracks mileage, hard braking, acceleration, idle time, and nighttime driving |

Under Nationwide SmartRide® program, the safer you drive, the more you save – by as much as 40%. Under the program’s terms, your discount will be updated weekly based on your driving using a plug-in device.

At the end of the program, which lasts four to six months, a final discount will be calculated and applied at renewal. Nationwide promises drivers they can keep the discount for as long as they’re policyholders.

Progressive Snapshot

Progressive Snapshot - how it works, savings

| Snapshot - Potential Savings | How It Works |

|---|---|

| Enrollment: an average of $26 | Powered by an app or plug-in device |

| Safe driving: an average of $145 | Tracks hard braking, acceleration, time of day, how much you drive, and cell phone use |

“Big discounts for good drivers” is the tagline for Progressive auto insurance’s Snapshot program, as the insurer advertises an average savings of $145 for safe driving.

However, discounts are not available in Alaska, California, Hawaii, North Carolina, or New York Snapshot is powered by a mobile app or by a plug-in device.

If the mobile app isn’t available in your state, you’ll be directed to use the plug-in device. The Snapshot program typically lasts about six months, with the discount being applied at your next renewal.

Read more: Progressive Snapshot Program Review

Beware! Drivers who demonstrate high-risk behaviors can see a rate increase. Progressive claims this only happens to two out of 10 drivers.

Click here to check out our comprehensive review of Progressive auto insurance.

Root Insurance

Root Insurance - Savings and how it works

| Root Insurance - Potential Savings | How It Works |

|---|---|

| Company advertises average savings of 52% off of standard car insurance rates | Powered by a mobile app |

| No savings indicated beyond initial test drive | Tracks time of day, turns, braking, and consistency |

UBI looks a little bit different for customers driving with the relatively new Root Insurance company. Where many insurers offer usage-based insurance as an option, that isn’t the case with Root. Rather,

…any driver interested in being insured with Root must first agree to go through the company’s test drive program.

For drivers who successfully complete the test drive, the company advertises average savings of up to 52% off of standard auto insurance rates.

Prospective customers must download the app, and take a test drive with Root for two to three weeks. Once their test drive is completed, drivers will get a quote based upon how they drive.

Root Insurance is available in the following states: Arizona, Arkansas, California, Colorado, Delaware, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Mississippi, Missouri, Montana, Nebraska, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, and Virginia.

The company has stated they plan to offer insurance in Alaska, Alabama, Massachusetts, New Hampshire, North Carolina, Washington, and West Virginia in the near future.

Safeco RightTrack®

Safeco RightTrack - how to save, how it works

| RightTrack® - Potential Savings | How It Works |

|---|---|

| Enrollment: an unspecified discount | Powered by an app or plug-in device |

| Safe driving: 5% to 30% | Tracks miles you drive, hard braking, time of day, and rapid acceleration |

Safeco’s RightTrack® offers drivers the chance to “take control” of their savings. That includes guaranteed savings of 5-30% upon completion of the program.

Depending on where you live, drivers will be tracked either by an app or with a plug-in device and will need to do so for a 90-day review period. Once a discount is determined, it will be applied to the life of your policy.

Safeco’s RightTrack® is not available in all states. Speak with an agent or check the company’s website to learn more.

Read more: Safeco RightTrack Program Review

State Farm Drive Safe & Save™

State Farm Drive safe and save - how it works and discount

| Drive Safe & Save™ - Potential Savings | How It Works |

|---|---|

| Enrollment: about 5% | Powered by mobile app or elgible cars with OnStar® |

| Safe Driving: up to 50% | Tracks mileage, braking, speed, time of day travel, acceleration, and fast cornering |

It’s a program State Farm says “puts you in control of your car insurance.” Customers participating in State Farm’s Drive Safe & Save™ can do so by either downloading the Drive Safe & Save™ app, or by using their car’s OnStar® system (if it’s eligible).

Discounts will be adjusted at every renewal period, and can change as a result of your driving. You can sign up online, or contact an agent to enroll.

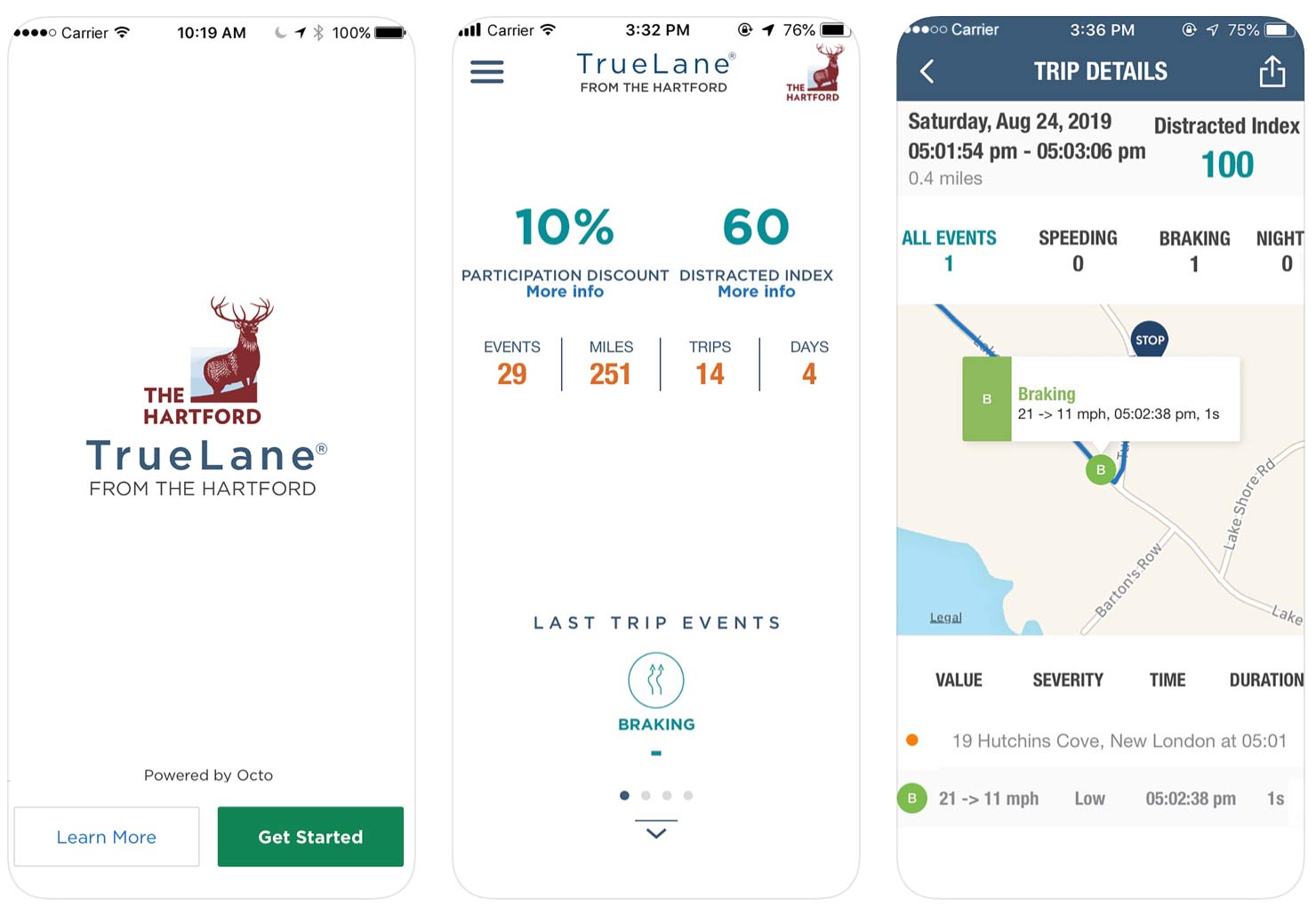

The Hartford TrueLane®

| TrueLane® - Potential Savings | How It Works |

|---|---|

| Enrollment: 5% per vehicle for signing up | Powered by a plug-in device |

| Safe Driving: up to 25% | Tracks behaviors including speeding and braking |

Drivers insured with The Hartford have an opportunity to earn discounts through the provider’s TrueLane® program.

Those enrolled in TrueLane® will receive a free device that plugs into their car’s OBD-II port, and will be able to view their progress online or through the TrueLane® app. Successful participants can earn as much as 25% in savings.

TrueLane® is available in the following states: Arizona, Arkansas, Connecticut, Minnesota, Missouri, Nevada, New Mexico, Oklahoma, Oregon, South Carolina, Virginia, and West Virginia.

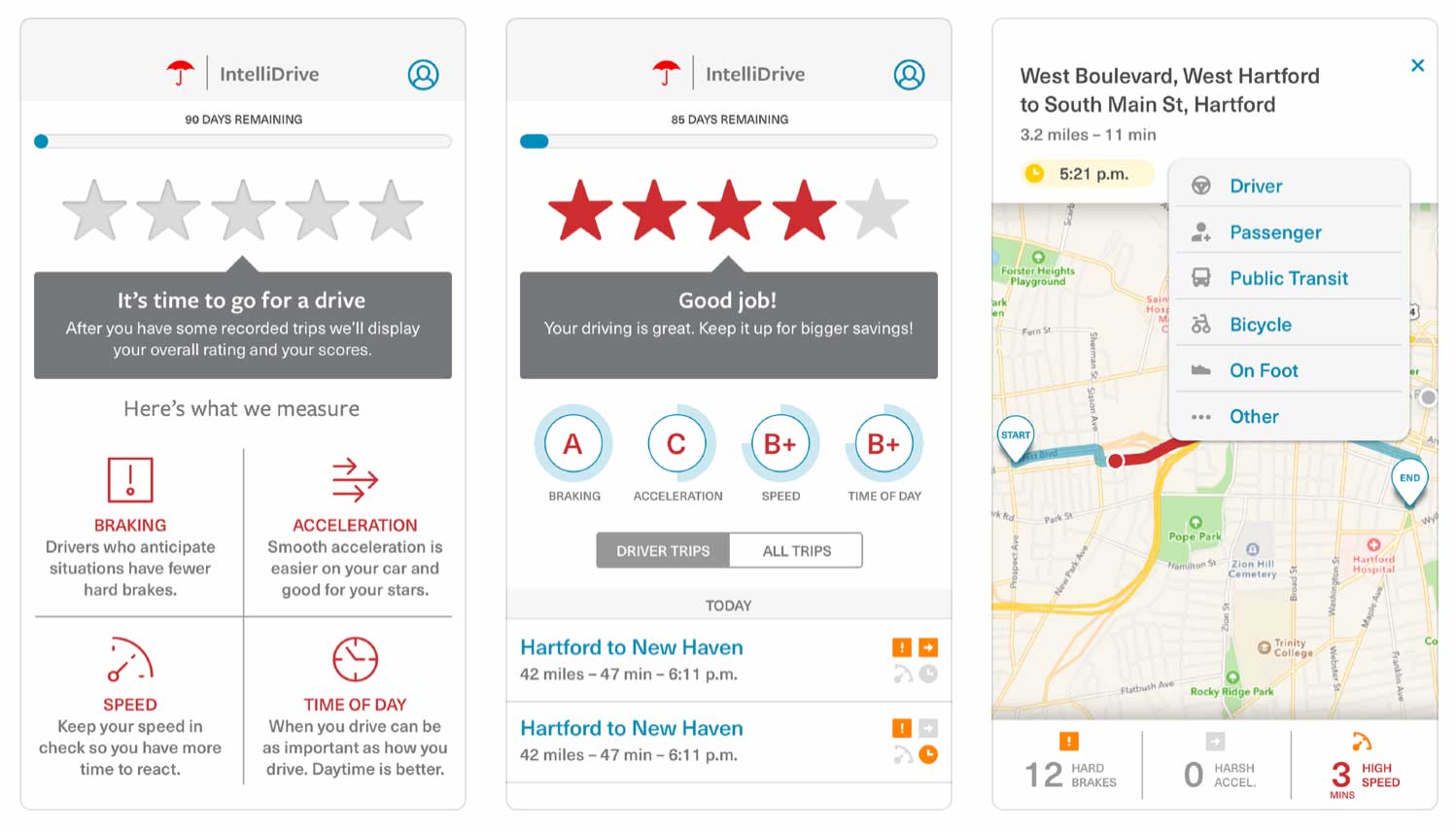

Travelers IntelliDrive®

Travelers Intellidrive - how it works, how to save

| IntelliDrive® - Potential Savings | How It Works |

|---|---|

| Enrollment: discount amount unspecified | Powered by an app |

| Safe Driving: up to 20% | Tracks speed, acceleration, braking, and time of day |

Travelers auto insurance customers looking to save have an option through the Travelers IntelliDrive® program. Depending on where drivers live, they can earn savings as high as 20%.

IntelliDrive® participants will be tracked for 90 days through the app, which will generate a star rating. How many stars you receive (five is the highest) will impact your rate at your next renewal.

Don’t miss it! With the exception of Washington, D.C., Maryland, Montana, Pennsylvania, and Virginia, riskier driving habits can lead to a increased auto insurance rates when using IntelliDrive®.

IntelliDrive is available in the following states: Arizona, Alabama, Colorado, Connecticut, Washington, D.C., Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Maryland, Maine, Minnesota, Missouri, Mississippi, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, Nevada, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, Vermont, Washington, and Wisconsin.

USAA SafePilot

USAA SafePilot - how it works, how to save

| SafePilot - Potential Savings | How It Works |

|---|---|

| Enrollment: 5% | Powered by an app |

| Safe Driving: up to 20% | Tracks time of day, location, driver, phone handling, and harsh Braking |

Safe driving can lead to big rewards — up to 20% — for USAA members participating in the insurer’s SafePilot program. Here’s what you need to know — USAA auto insurance is only open to members of the military and their families.

According to the USAA site, an app will be used to calculate a score, which could lead to potential discounts. The insurer promises your score won’t be used to increase your premium, but your discount can vary from term to term. Right now, USAA SafePilot is only available in Arizona, Ohio, Texas, and Virginia.

If you’re ready to compare rates, check out our free online quote comparison tool. You’ll find rates for your area based on your information and geographical location.

Pay-Per-Mile Usage-Based Auto Insurance Programs

Here’s the deal — some people just don’t drive a lot. Whether they’re stay-at-home moms, work-from-home employees, or carpoolers, they’re putting minimal miles on their vehicles. For these drivers, pay-per-mile auto insurance can present a huge opportunity to save big on their premiums.

This is even more since the COVID-19 pandemic. More and more drivers want to find the cheapest auto insurance and usage-based insurance is one way to go. It is one of the larger changes occuring in the auto insurance industry, one that goes hand-in-hand with autonomous vehicles and driving habits that will push premiums down and force the auto insurance industry to adapt.

Just ask Rick Chen, spokesperson of Metromile Insurance. Chen shares that Metromile customers driving 13,000 miles annually save an average of $500. And get this – for those who drive less than 2,500 miles a year, he says those savings can reach $1,000.

“Traditionally, insurance companies have relied on their customers who do not drive much to subsidize their road warriors, making their model unfair for the majority of drivers who do not drive much and drive safely,” says Chen.

Pay-per-mile auto insurance is exactly what it sounds like – paying a premium based on the number of miles you drive. Below, we’re listing out five pay-per-mile programs, with more on how you can save.

Read more: Cheap Pay-Per-Mile Insurance

Allstate Milewise®

allstate milewise - how it works, how to save

| Milewise® - Potential Savings | How It Works |

|---|---|

| Potential savings of 20% to 39% for customers driving less than 100 miles weekly | Tracks miles with a plug-in device |

Allstate customers who drive less frequently could see significant savings through the “pay-as-you-go” Milewise® program. The program website indicates that those who drive less than 100 miles a week could see weekly savings ranging from 20-39%.

Milewise® is powered by a plug-in device, with customers being charged a daily base rate, plus a per-mile rate. Progress can also be tracked on the Allstate Mobile app.

Milewise® is only available in the following states: Washington, Oregon, Idaho, Arizona, Texas, Illinois, Indiana, Ohio, West Virginia, Virginia, Maryland, Delaware, and New Jersey.

Be sure to speak to an insurance agent to learn more about this specific program.

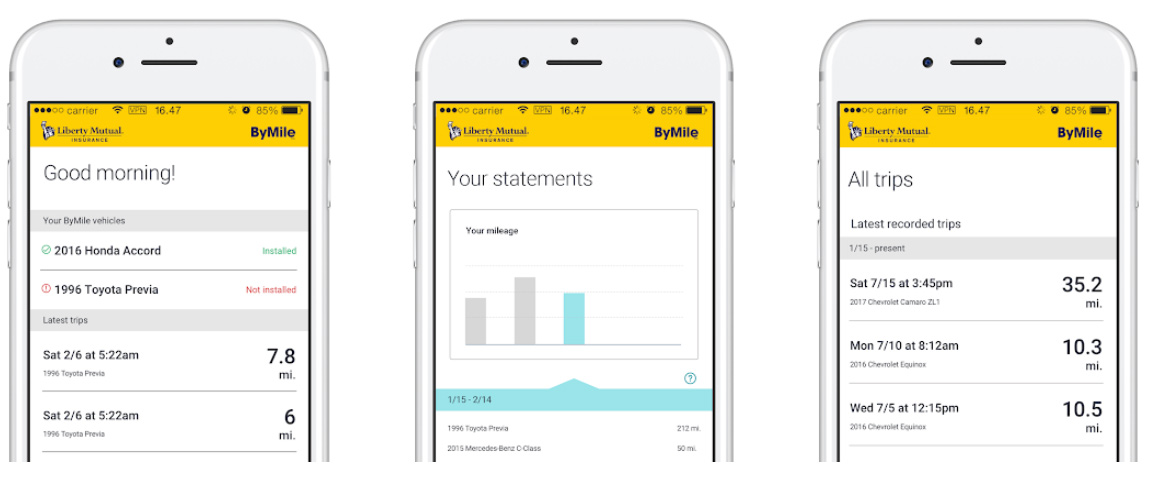

Liberty Mutual ByMile™

Imported from Manual Input

| ByMile™ - Potential Savings | How It Works |

|---|---|

| Potential savings of 25% to 40% | Tracks miles with a plug-in device |

With ByMile™, Liberty Mutual promises customers the opportunity to only pay for what they need. The insurer claims that drivers can save between 25 and 40% off of the cost of a traditional policy.

As drivers are tracked through a plug-in device, they can also monitor their monthly mileage through the ByMile™ app. Right now, ByMile™ is currently available in Connecticut and Virginia.

MetroMile

Imported from Manual Input

| MetroMile - Potential Savings | How It Works |

|---|---|

| Company advertises average savings of $741 | Tracks miles with a plug-in device |

For the relatively new MetroMile, the philosophy is simple – “drive less, save more on car insurance.” Founded in 2011, the company’s website advertises average savings of $741 a year through its pay-per-mile insurance.

MetroMile tracks miles through its MetroMile Pulse, which is the name of the plug-in device. For vehicles that don’t have an OBD-II port – including electric cars and older cars – the company will provide an adapter so that drivers can still use the Pulse and take advantage of its features.

The company advertises monthly base rates as low as $29, plus a per-mile charge. Customers can track their mileage by downloading the MetroMile app. MetroMile is available in Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington.

Mileauto

Imported from Manual Input

| Mileauto - Potential Savings | How It Works |

|---|---|

| Company advertises average savings of 30% to 40% | Customers are asked to take a photo of their odometer |

Straightforward, and easy to use. It’s how Mile Auto describes its pay-per-mile insurance program. According to the company site, low-mileage drivers can save 30 to 40% off of their current rates.

Customers are charged a monthly base rate, and a per-mile rate. But here’s the kicker — Mile Auto doesn’t require a plug-in device. Drivers are simply asked to take a photo of their odometer and send it to the company.

Currently, Mile Auto is available in Georgia, Illinois, and Oregon, with plans to expand.

Nationwide SmartMiles®

Imported from Manual Input

| SmartMiles®- Potential Savings | How It Works |

|---|---|

| Safe driving discount of up to 10% after renewal | Tracks miles with a plug-in device |

SmartMiles® is Nationwide’s pay-per-mile insurance program, and is another relatively new addition to the UBI scene. Savings will vary from month to month, but participants are eligible for a safe driving discount of up to 10% after the first renewal.

Mileage is tracked with a plug-in device, and drivers will be charged a monthly base rate, as well as a per-mile rate. SmartMiles® is currently available in Illinois, with plans to expand into additional states.

Understanding Telematics and Usage-Based Auto Insurance

In a survey that analyzed how consumers feel about telematics and usage-based insurance, experts with Cambridge Mobile Telematics came to this conclusion: 75% of respondents say they want their auto insurance premiums to be based on how they drive.

But there’s more. Respondents also stated that as long as their driving behaviors are being tracked, they want to save big.

Mark Dunford, a licensed agent and owner of the Dunford Insurance Agency, says the good news is that customers are saving big. As an agent who sells Nationwide’s SmartRide® and Progressive’s Snapshot, he says usage-based programs are a win — for both agents and drivers.

“This helps give us a competitive advantage price-wise and helps us retain current clients,” he says. “My clients see an average discount once completing their program of about 22 percent.”

This all begs the question — how do telematics and usage-based insurance programs really work, and are they paying off for consumers?

How do telematics and usage-based auto insurance programs work?

First thing’s first, usage-based auto insurance is powered by a system known as telematics.

Telematics is a combination of the words “telecommunications” and “informatics,” and describes the transmission of data over a cellular network.

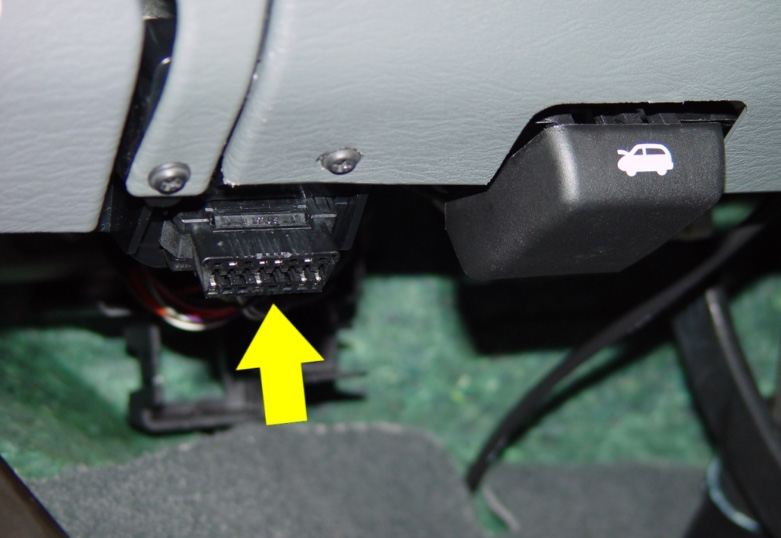

When it comes to usage-based insurance, telematics systems will rely on specific technologies or devices to gather information and transmit it to insurance providers. This usually takes place one of the following ways:

- Through a mobile app

- Through a vehicle-embedded system like OnStar

- Through a company-issued device that plugs into your car’s on-board diagnostics port, also known as an OBD-II port.

As seen in the image below, OBD-II ports are typically located inside a car and under the steering wheel, and they’re used to access a car’s computer. OBD-II ports became standard in cars manufactured after 1996.

Why are auto insurance companies tracking my driving?

The rationale behind auto insurance companies tracking your driving is simple — to more closely tailor your policy to your driving. Think about it.

Most auto insurance providers assess rates based on a variety of different rate factors you can’t control, like your age or gender. This can make it difficult to get the cheapest auto insurance rates.

They’ll also look to other factors that you may not think are fair, like where you live, your marital status, or credit score.

While many of these factors will continue to come into play with usage-based insurance, so will your actual driving. If you can demonstrate safe driving behaviors, insurers will reward you with discounts.

SmartFinancial CEO Lev Barinskiy says this kind of pricing is especially beneficial for young and inexperienced drivers, who tend to face higher-than-normal premiums.

“For many new drivers, car insurance rates are backbreaking,” says Barinskiy. “The use of telematics allows young drivers to get rates based on their driving skills rather than their non-existent driving history, which places them in the highest-rate category of all drivers.”

Have no fear! Here are 10 Auto Insurance Discounts that can Save you Money Fast.

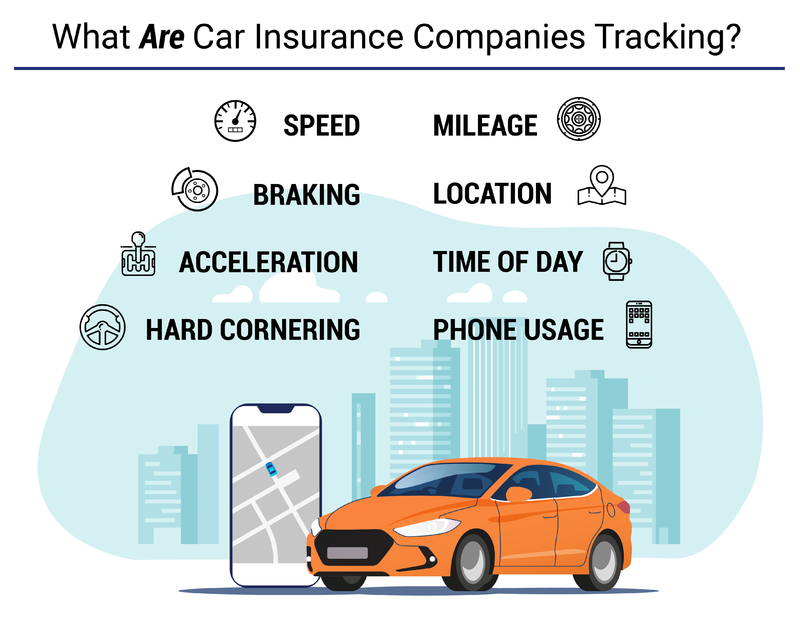

Most usage-based insurance programs will track a combination of the following behaviors to determine if you’re really a safe driver:

- Speed – for some companies, this means speeds in excess of 80 miles per hour.

- Acceleration – how quickly drivers are accelerating.

- Braking – specifically, how hard and quickly drivers are braking.

- Hard cornering – this can be an indicator of the likelihood of your car rolling over.

- Mileage – how many miles you’re putting on your car.

- Location – where you’re most frequently driving, and if it’s an area known for high crime, accidents, etc.

- Time of day – particularly, if you’re driving late at night.

- Phone usage – certain mobile apps will monitor actions such as texting and touching your phone while driving.

When it’s all said and done, the logic is simple: a safer driver will be involved in fewer crashes. And when you consider that motor vehicle crashes are among the top causes of accidental deaths in the country, auto insurers have all the more reason to reward those who steer clear of risky behavior behind the wheel.

Something else to keep in mind? Usage-based insurance programs require an evaluation period. Some can be as short as two or three weeks, and others are as long as six months. In the end, the information gathered during that period will be used to calculate a potential discount.

Pros and Cons of Usage-Based Insurance

For most, the prospect of getting discounts on your auto insurance is pretty much a no brainer. But when it comes to usage-based insurance, not everyone is convinced – particularly when it comes to concerns about the apps tracking your movements.

For those who remain on the fence, we’ve compiled the major pros and cons of this popular insurance program:

Usage-Based Insurance Pros and Cons

| The Pros | The Cons |

|---|---|

| A discounted rate tailored to your driving habits | Your driving behaviors and location are being monitored |

| Drivers are more inclined to adopt safer driving behaviors | For some drivers, rates will increase |

The Good: The majority of usage-based programs will offer some sort of discount, even if it’s simply for enrolling. If you’re a safe driver or a low-mileage driver, these discounts can become even more significant.

Experts also note that drivers participating in usage-based programs are more inclined to drive safely. It turns out that multiple studies confirm those experts opinions:

- One study by INFORMS shows that UBI participants showed a 21% decrease in hard braking.

- A survey reported that 56% of drivers changed their behaviors after installing telematics devices in their cars.

“If this leads to safer roads, then this is a win for everyone,” says Martin.

The Not So Good: There’s no way of getting around the fact that in order to participate in these programs,

. . . your driving behaviors and location will be tracked.

For many, this is is a feature that they simply can’t get past, in spite of assurances from major companies that they aren’t compromising your data. But for Will Ellis, IT Security Consultant and founder of Privacy Australia, these assurances of safety just aren’t enough.

“UBI’s usually deliver savings, but drivers should be concerned about privacy with any UBI unit. Anytime that your information is being stored or transferred wirelessly, there is a chance that the information can be intercepted and used to harm your privacy,” says Ellis.

Ellis goes on to warn that as long as this data can be intercepted, personal information such as your car’s location or your general driving habits can be exposed. Finally, our research revealed that in some cases, drivers who demonstrate riskier driving behaviors can face the dreaded price hike.

Although companies like Progressive assure that this isn’t the norm, it’s still a very real possibility. And it certainly raises questions as to just how risky one’s driving has to be to warrant a rate hike.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions about Telematics and Usage-Based Insurance

Perhaps you still have questions about telematics and usage-based insurance:

Will having a UBI app on my phone use all of my data? What makes someone a low-mileage driver?

We’re tackling these questions and more in our FAQ section:

#1 – Will usage-based auto insurance drain my cell phone data and battery?

Most usage-based apps are designed to transmit information through cellular data or WiFi networks. Any charges stemming from data use will be the responsibility of the driver.

When it comes to battery use, some companies – like Allstate – claim that their app uses battery levels similar to that of a navigational app. Travelers Insurance calls the battery use of its IntelliDrive app “negligible,” to the point drivers where “won’t notice a significant difference” after using the app.

That being said, some insurers recommend drivers charge their phone while driving, especially on long trips. When it comes to data use, AAA claims that an average commute uses the same amount of data as a digital photo.

Progressive claims that their app’s data usage is “very minimal.” Battery and data use will vary from phone to phone. To be safe, drivers will want to check with their mobile phone providers to ensure their phones will be able to handle the activity.

#2 – Do long road trips count against you on a pay per mile program?

The good news is that most pay-per-mile insurance programs we researched provide some sort of leeway for longer road trips.

In fact, if you find that you have an unusual amount of driving to do in one day – let’s say, 300 miles – most programs will stop charging after 250 miles. That being said, you’ll want to double-check with your provider to see whether have a similar policy in place.

#3 – What is considered low-mileage for auto insurance?

Generally speaking, the threshold to be considered a low-mileage driver is someone who drives less than 8,000 miles a year.

#4 – Is my auto insurance company selling my information?

According to the National Association of Insurance Commissioners, most insurers assure customers that they are not selling or disclosing any identifiable information to third parties. In fact, most will also go on to say that your data is collected securely, is used in conjunction with your own policy.

But here’s what you need to know — even if it’s not identifiable, some companies may end up using your data for research. Your data could be requested by police or claims adjusters in the instance of an accident or another legal issue.

Owlcam CEO Gary Clayton, who has experience in the telematics space, encourages drivers who are concerned about privacy to take action.

“Everyone should be concerned with their data privacy. Insurance companies need to communicate clearly what data they’re collecting, how frequently it is collected, how they’re maintaining it and when they delete it,” says Clayton.“Customers should be able to contact their insurers and have their records erased if they so choose.”

We’ve found that each program has a privacy statement or policy, and many are posted online. If you have questions, do your due diligence and read through them carefully.

#5 – What if my car doesn’t have an OBD-II port?

As long as your car was manufactured after 1996, your car will have an OBD-II Port. However, some vehicles – such as hybrids – may not be compatible with the devices issued by your insurer.

Be sure to speak with your agent to make sure your car can take the device. In some cases, you may be able to use a mobile app instead.

#6 – Can I stop participating in a usage-based insurance program?

Yes. Most insurance companies will allow you the option of unenrolling from their UBI programs. However, this may mean that you’ll lose your discount before your term is up. Speak to an agent or representative to learn more.

Usage-Based Auto Insurance and Telematics: Growing Popularity

Usage-based insurance may be relatively new to the insurance game, but it’s working and picking up speed.

The benefit for any driver interested in pursuing UBI program is that their options are plentiful, and you’re bound to get a discount just for trying.

At the end of the day, drivers need to be comfortable knowing that their driving behaviors are being tracked. For many, this will be a deal-breaker, and is worth giving thought to. Conclusion? Telematics and usage-based insurance programs are growing, and fast.

We won’t be surprised to see more and more programs popping up, with even greater potential for savings.

You can begin your search into usage-based programs today by shopping the best rates. Plug your ZIP code into our free quote tool to get started.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.