Best Bloomington, MN Auto Insurance in 2025 (See the Top 10 Companies)

The best Bloomington, MN auto insurance comes from State Farm, Allstate, and Farmers, with rates starting at $64/month. State Farm offers excellent value, Allstate gives up to 20% in safe driver discounts, and Farmers excels with local service, making them the best options for Bloomington drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Bloomington MN

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Bloomington MN

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Bloomington MN

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best Bloomington, MN auto insurance providers are State Farm, Allstate, and Farmers; their rates fall starting at $64 a month with up to 20% discount. The best option is State Farm for accessibly priced yet great coverage.

Allstate has several discounts for everybody, while Farmers excels with personalized service through local agents. Whether you’re a safe driver, student, or looking to bundle policies, these companies deliver the best mix of quality, savings, and flexibility for Bloomington drivers.

Our Top 10 Company Picks: Best Bloomington, MN Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Comprehensive Coverage | State Farm | |

| #2 | 25% | A+ | Various Discounts | Allstate | |

| #3 | 20% | A | Local Agent | Farmers | |

| #4 | 25% | A++ | Affordable Rates | Geico | |

| #5 | 25% | A | Customizable Coverage | American Family | |

| #6 | 10% | A+ | Online Tools | Progressive | |

| #7 | 25% | A | Policy Management | Liberty Mutual |

| #8 | 20% | A+ | Loyalty Discount | Nationwide |

| #9 | 13% | A++ | Claims Handling | Travelers | |

| #10 | 15% | A | Affordable Coverage | Safeco |

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

- State Farm offers the best Bloomington, MN, auto insurance with affordable rates

- Bloomington drivers can save with discounts and tailored coverage options

- Local factors like driving record and ZIP code affect Bloomington auto rates

#1 – State Farm: Best Overall Pick

Pros

- Vital Customer Service: According to our State Farm auto insurance review, the company consistently ranks highly for customer satisfaction and offers excellent support in Bloomington.

- Wide Range of Discounts: As one of the largest and most financially stable insurers, State Farm ensures reliable claims payouts for policyholders in Bloomington, MN.

- Financial Stability: State Farm is one of the largest and most financially stable insurers, ensuring reliable claims payouts.

Cons

- Higher Premiums for Younger Drivers: Rates for younger or less experienced Bloomington drivers can be higher.

- Limited Availability of Some Discounts: State Farm offers specific discounts only in select states, including Bloomington, MN.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Various Discounts

Pros

- Great Discounts: In Bloomington, MN, Allstate offers various discounts, including the Drivewise program for safe driving.

- Wide Range of Coverage Options: Bloomington drivers can access add-ons like accident forgiveness and new car replacements.

- 24/7 Customer Service: According to our Allstate auto insurance review, drivers in Bloomington, MN, benefit from round-the-clock customer support.

Cons

- Premiums Can Be Expensive: Allstate’s premiums in Bloomington are higher than those of other providers.

- Claims Process Can Be Slow: Some Bloomington, MN, customers report delays in claims resolution.

#3 – Farmers: Best for Local Agent

Pros

- Excellent Overall: Farmers offers several types of coverage in Bloomington, MN, including rideshare and car rental coverage.

- Robust Claims Handling: According to our Farmers auto insurance review, Bloomington drivers can rely on their efficient and fair claims handling.

- Customizable Policies: Farmers allow Bloomington drivers to tailor their policies based on personal preferences.

Cons

- Higher Costs for Some Drivers: Premiums can be more expensive in Bloomington, particularly for high-risk drivers.

- Limited Online Services: Bloomington, MN’s website and mobile app can be less user-friendly than those of competitors.

#4 – Geico: Best for Affordable Rates

Pros

- Budget-Friendly Offerings: In Bloomington, MN, Geico provides some of the best rates, especially for clear-record drivers.

Easy-to-Use Website and App: Our Geico auto insurance review highlights the simplicity of their digital tools for managing policies and filing claims in Bloomington, MN.

Wide Range of Discounts: Geico offers multiple discounts in Bloomington, MN, including those for good students, military members, and federal employees.

Cons

- Lack of Specialized Coverages: Geico offers a few specialized coverage options that some competitors offer in Bloomington, MN.

- Customer Service Issues: Some Bloomington, MN, customers report less-than-stellar customer support experiences.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Best for Customizable Coverage

Pros

- Excellent Customer Service: American Family receives high customer support and claims handling ratings in Bloomington, MN.

- Substantial Discounts: American Family offers various discounts in Bloomington, MN, including safe driving, bundling, and more.

- Flexible Payment Plans: View our American Family auto insurance review to see how their flexible payment plans in Bloomington add convenience for policyholders.

Cons

- Not Available in All States: American Family policies are unavailable in every state, including Bloomington, MN.

- Higher Premiums: Premiums can be higher for some drivers in Bloomington.

#6 – Progressive: Best for Online Tools

Pros

- Competitive Rates: Progressive often has lower rates than other top insurers in Bloomington, MN, especially for high-risk drivers.

- Snapshot Program: Based on our Progressive auto insurance review, the Snapshot Program in Bloomington, MN, rewards safe driving with potential discounts.

- Broad Coverage Options: Progressive in Bloomington provides a range of coverage options, including rental reimbursement and roadside assistance.

Cons

- Concerns About the Quality of Service: Some clients residing in Bloomington, MN, have claimed that the claims management and support they receive could be better.

- Rates Can Be High for Some Drivers: While rates are competitive for some, they can be higher for other drivers in Bloomington, MN, especially those with poor credit.

#7 – Liberty Mutual: Best for Policy Management

Pros

- Customizable Policies: Liberty Mutual in Bloomington, MN, offers various add-ons, such as new car replacement and accident forgiveness.

- Wide Range of Discounts: See our Liberty Mutual auto insurance review for details on their wide range of discounts in Bloomington, including those for good drivers and hybrid vehicles.

- Well-known for High-Risk Coverage: Liberty Mutual provides coverage for high-risk drivers in Bloomington, MN, that may be hard to insure elsewhere.

Cons

- Higher Premiums for Some Drivers: Liberty Mutual can have higher rates in Bloomington, MN, especially for younger or high-risk drivers.

- Limited Online Tools: Some users in Bloomington find the website and mobile app less intuitive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Loyalty Discount

Pros

- Roadside Services and Disappearing Deductibles: Nationwide offers services such as roadside assistance and disappearing deductibles in Bloomington, MN.

- Robust Financial Strength: Nationwide has high financial strength ratings in Bloomington, which means it can pay claims.

- Straightforward Online Claims: Within our Nationwide auto insurance review, you’ll find that their digital tools make filing claims and managing policies easy in Bloomington, MN.

Cons

- Rates Can Be High: Premiums may be higher in Bloomington, MN, compared to other insurers.

- Limited Discounts: The available discounts in Bloomington may not be as extensive as those offered by other providers.

#9 – Travelers: Best for Claims Handling

Pros

- Customizable Coverage: Read our Travelers auto insurance review to learn how customizable coverage options allow Bloomington, MN, policyholders to tailor their plans.

- Safe Driver Discounts: Travelers incentivize Bloomington drivers with recent claims-free or accident-free histories.

- Robust Financial Strength: They have built a strong reputation for financial stability in Bloomington, MN, which makes them a reliable factor when making claims.

Cons

- Issues with Customer Service: Some Bloomington users need help with customer assistance and receiving timely responses to their online inquiries.

- Limited Discounts for Some Drivers: Certain discount options may only be available to some Bloomington, MN customers.

#10 – Safeco: Best for Affordable Coverage

Pros

- Cost-Effective: Safeco is often the most cost-effective option, especially for low-risk drivers in Bloomington, MN.

- Flexible Policy Options: In Bloomington, Safeco lets you customize your coverage and adjust your deductible to fit your needs.

- Solid Customer Support: Our Safeco auto insurance review highlights Bloomington’s strong customer support and efficient claims handling.

Cons

- Limited National Presence: Safeco is unavailable in all states, which may limit accessibility for some drivers in Bloomington, MN.

- Fewer Discounts: Safeco offers fewer discounts to reduce premiums in Bloomington than other insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Discover the Best Auto Insurance Deals in Bloomington

According to the drivers of Bloomington, MN, Geico offers some of the most competitive charges in the market. The lowest coverage limit has a base rate of $64 per month, while the highest is $150, which makes it ideal for the frugal customer.

Bloomington, MN Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $180 | |

| $71 | $178 | |

| $68 | $170 | |

| $64 | $150 | |

| $72 | $185 |

| $67 | $165 |

| $65 | $160 | |

| $66 | $168 | |

| $70 | $175 | |

| $69 | $172 |

More Farmers and Progressive offer the same equally priced rate range to provide a well-balanced price and quality mix. Liberty Mutual, Travelers, and American Family deliver diverse coverage options at a higher cost.

Because rates change due to other aspects such as driving history and type of car, Bloomington residents are encouraged to check on these top providers to determine the most suitable one. Explore our comprehensive resource titled “How does an auto insurance company determine my premium?”

Save Big: Bloomington, MN Auto Insurance Discounts

Bloomington, MN, drivers can enjoy various discounts with top auto insurance providers. Allstate offers safe driving and multi-policy discounts, while American Family rewards good students and safe drivers. Farmers and Geico provide savings for bundling and using tech like the Signal app or anti-theft devices.

Auto Insurance Discounts From the Top Providers in Bloomington, MN

| Insurance Company | Available Discounts |

|---|---|

| Early Signing, Safe Driving Bonus, New Car, Multi-Policy | |

| Good Student, Multi-Policy, Safe Driver, Paid-in-Full | |

| Signal App, Multi-Policy, Good Student | |

| Good Driver, Multi-Vehicle, Anti-Theft Device, Military | |

| Multi-Policy, New Car, Safe Driver, Claims-Free |

| SmartRide Program, Accident Forgiveness, Family Plan, Good Student |

| Snapshot Program, Continuous Insurance, Multi-Vehicle, Homeowner | |

| Multi-Policy, Claims-Free, Safe Driver, Paid-in-Full | |

| Drive Safe & Save, Multi-Vehicle, Good Student, Steer Clear Program | |

| IntelliDrive Program, Multi-Policy, Safe Driver, Multi-Vehicle |

Liberty Mutual and Nationwide offer discounts for claims-free records and safe driving, and Progressive rewards continuous coverage. Safeco, State Farm, and Travelers provide multi-policy, safe driver discounts, and student savings.

Auto Insurance Coverage Requirements in Minnesota

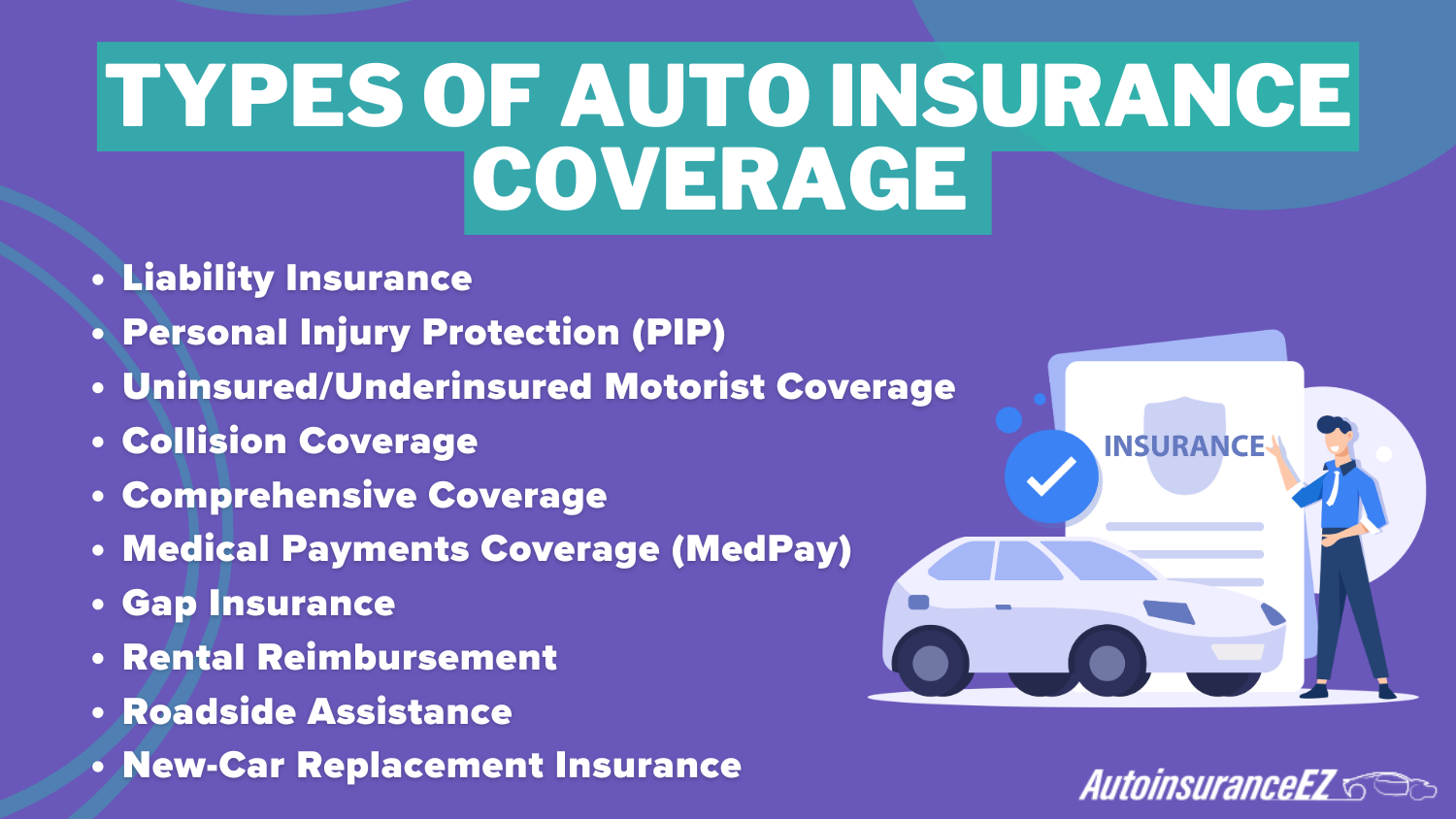

In Bloomington, MN, drivers must meet state-required auto insurance coverage, including Bodily Injury, Property Damage Liability, and Uninsured Motorist coverage. While collision and comprehensive coverage aren’t mandatory, many choose these for added protection.

Minnesota Minimum Auto Insurance Coverage Requirements

| Coverage | Requirements |

|---|---|

| Bodily Injury Liability | $30,000 per person $60,000 per accident |

| Property Damage Liability | $10,000 per accident |

Local motorists can grab competitive deals with companies such as Geico, Farmers, or Allstate. However, when determining the best auto insurance quotes in Bloomington, MN, it would be critical to evaluate the cost and the quality of coverage to provide complete coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Essential Factors for Auto Insurance in Bloomington, MN

When shopping for the best auto insurance in Bloomington, MN, consider the vital factors that can significantly impact the rates you receive. While some aspects are beyond your control, others can be adjusted to help lower your premiums. Here are the most essential elements that influence your Bloomington car insurance costs.

Your ZIP Code

The ZIP code you possess in Bloomington, MN, significantly contributes to formulating your auto insurance costs. With approximately 83,319 residents, factors such as the fact that it is a city cause near urban areas to have higher premiums than their rural counterparts because of traffic congestion and the risks of accidents.

Bloomington, MN Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 55431 | $96 |

| 55420 | $104 |

| 55425 | $115 |

| 55435 | $119 |

| 55437 | $133 |

| 55438 | $163 |

The best auto insurance in Bloomington, MN; it is crucial to compare rates with many insurance companies and consider aspects like state-specific insurance rates to find the cheapest deal. To gain profound insights, consult our extensive guide, “Auto Insurance Rates by State.”

Automotive Accidents

The higher rate of accidents in Bloomington, MN, can lead to increased auto insurance premiums. Your provider may adjust rates based on local risk, but you may qualify for discounts like Safe Driver rewards.

Bloomington, MN Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 3,500 |

| Total Claims Per Year | 2,800 |

| Average Claim Size | $4,500 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 300 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | Medium |

Understanding how accidents affect car insurance rates is critical to finding the best Bloomington, MN, auto insurance and selecting the right coverage, whether primary or comprehensive.

Auto Thefts in Bloomington, MN

In Bloomington, MN, car robbery presents a problem that affects insurance coverage costs in areas with relatively high crime rates, expressing the risk of the threat posed by automobile theft.

Bloomington, MN Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B+ | Slightly above average |

| Traffic Density | B | Moderate congestion |

| Weather-Related Risks | B- | Moderate weather impact |

| Uninsured Drivers Rate | C+ | Moderate uninsured rate |

| Vehicle Theft Rate | C | Average theft risk |

With car thefts peaking at 100 in 2013, residents are likely to experience higher insurance rates due to the particularities of those risks. To reduce costs, consider Comprehensive coverage or inquire about an anti-theft device Discount, which can lower premiums if your vehicle has security features.

Understanding these factors is essential when seeking the best Bloomington, MN, auto insurance to ensure adequate coverage while keeping costs in check.

Your Credit Score

Depending on your automobile insurance, your credit score can have many effects in Bloomington, Minnesota. For instance, customers with low credit scores tend to pay higher premiums. A good credit score is essential to getting better prices, which is important when looking for the best auto insurance in Bloomington, Minnesota.

Bloomington, MN Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $168 | $182 | |

| $105 | $130 | |

| $155 | $185 | |

| $210 | $250 | |

| $160 | $190 |

| $120 | $145 |

| $150 | $170 | |

| $125 | $150 | |

| $160 | $190 | |

| $140 | $160 |

For providers such as Allstate, Farmers, and State Farm, Knowing how your credit rates affect your auto insurance premiums can help you save money.

Your Age

Young drivers, especially teenagers, face higher premiums when searching for the best Bloomington, MN, auto insurance due to their lack of experience and higher accident rates. Insurers view them as higher risk, which leads to increased costs, especially in the first few years of driving.

Bloomington, MN Auto Insurance Rates by Age

| Insurance Company | Age: 17 | Age: 34 |

|---|---|---|

| $243 | $165 | |

| $140 | $140 | |

| $208 | $150 | |

| $181 | $125 | |

| $208 | $150 |

| $117 | $117 |

| $133 | $133 | |

| $136 | $136 | |

| $130 | $130 | |

| $133 | $133 |

For car insurance for teenagers, it is always wise to check how much different companies associated with the likes of Allstate, Farmers, and State Farm charge because age also plays a factor in determining how much one pays in premiums. Age consideration and other aspects of policies may help in selecting the best Bloomington, MN, auto insurance, even for younger drivers.

Your Driving Record

State Farm offers the best combination of affordable rates and reliable coverage for Bloomington drivers.

Dani Best Licensed Insurance Agent

Your driving record is critical in determining your premiums when seeking the best Bloomington, MN, auto insurance. A speeding ticket or minor fender-bender can raise rates, and drivers with violations or accidents on their record are considered high-risk drivers, leading to even higher costs.

Bloomington, MN Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $168 | $188 | $225 | $270 | |

| $111 | $115 | $137 | $140 | |

| $175 | $185 | $200 | $225 | |

| $239 | $250 | $275 | $300 | |

| $175 | $185 | $200 | $225 |

| $117 | $120 | $130 | $140 |

| $158 | $170 | $190 | $210 | |

| $127 | $135 | $150 | $170 | |

| $175 | $185 | $200 | $225 | |

| $133 | $140 | $155 | $170 |

Allstate and State Farm offer Accident Forgiveness discounts for safe drivers. Nonetheless, it is pertinent to comprehend the effects of violations on your driving record and insurance rates since these can appreciably influence the most favorable policies when looking for auto insurance, particularly in Bloomington, MN.

Your Vehicle

The type of vehicle you drive matters when looking for the best Bloomington, MN, auto insurance. Luxury cars, like Porsche cars, are typically among the most expensive to insure due to their higher value and repair costs.

Honda Accord Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Levell

| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Chevrolet Bolt EV | $168 | $220 |

| Ford Escape | $145 | $180 |

| Ford F-150 | $139 | $168 |

| Honda Accord | $165 | $210 |

| Honda CR-V | $128 | $150 |

| Nissan Leaf | $163 | $200 |

| Subaru Outback | $146 | $185 |

| Tesla Model 3 | $240 | $300 |

| Tesla Model Y | $242 | $310 |

| Toyota Tacoma | $143 | $175 |

In comparison, insuring a standard vehicle, such as a 2015 Honda Accord, is typically cheaper. If you own a luxury vehicle, consider comprehensive coverage to ensure adequate protection when searching for the best auto insurance in Bloomington, MN.

Minor Influences on Bloomington, MN Auto Insurance

If you are searching for car insurance in Bloomington, MN, and you plan to do it without spending too much money, there are several factors you can change to lower your monthly premium. Although coverage levels are essential, other aspects of your expenditure are also necessary. Here’s how you can maximize your insurance policy.

Your Marital Status

Some married couples get the best Bloomington, MN auto insurance rates to the greatest extent possible because they bundle policies, thus leading to considerable savings. Combining car insurance after marriage is beneficial in cutting costs, as insurance companies charge comparatively lower rates for married drivers.

Additionally, bundling auto insurance with other policies, like homeowners insurance, can further cut costs, making it an effective strategy for finding the best value on coverage.

Your Gender

When searching for the best Bloomington, MN auto insurance, your gender and personal injuries are less of a factor than they used to be. While historical data once suggested that male and female drivers posed different risks, many insurers no longer evaluate premiums based on gender.

Today, the focus is more on factors like driving history and vehicle type, so finding the best auto insurance rates in Minnesota without regard to gender has become easier. To gain further insights, consult our comprehensive guide, “These Factors Affect Your Auto Insurance Rates.”

Your Driving Distance to Work

When seeking the best Bloomington, MN auto insurance, your commute distance has a minimal impact on premiums. Cutting back on driving for a while may only give a 2-3 % discount. However, vehicles used for business purposes, like commercial auto insurance, can increase premiums by 11% compared to personal vehicles. Other factors tend to influence your rates more significantly.

Your Coverage and Deductibles

To obtain the lowest available car insurance rates in Bloomington, Minnesota, consider modifying the extent of coverage or increasing the deductibles to lower the monthly premiums.

One common way to reduce auto insurance premiums is to raise the deductible, which many people do as they plan to avoid making any claims for a considerable period. However, it is essential to remember that one’s financial capabilities must also be able to cover the increased deductible in the case of an accident so as not to save too much.

Education in Bloomington, MN

In Bloomington, MN, higher education can lead to the best auto insurance rates, with discounts often given to those with a bachelor’s degree. With many residents holding degrees, education can reduce premiums more than job title or salary. Colleges like Bethany College of Missions and Normandale Community College offer opportunities that lower insurance costs—cheap auto insurance rates for Professors with College Degrees.

The Process of Evaluating Auto Insurance in Bloomington

To offer the best auto insurance in Bloomington, MN. One should prioritize price and coverage. State Farm, Allstate, and Farmers have competitively priced plans starting at $64, including some discounts for safe driving and bundling policies.

It is imperative to compare quotes and ascertain the driver’s history, type of vehicle, and credit score. Shopping for a policy with many carriers helps you get an appropriate policy for you and your pocket.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is liability insurance in Bloomington, MN?

Liability insurance covers damages you cause to others, with a minimum limit of 30/60/10 to meet state-mandated coverage requirements. To delve deeper, refer to our in-depth report titled “Automobile Liability Coverage“

Is there a grace period in Minnesota for car insurance?

There is no grace period; continuous coverage is mandatory to avoid fines or license suspension.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Do I need insurance in Minnesota to register a car?

Proof of insurance is required to register a car in Minnesota and must meet the state’s minimum coverage standards.

How long does it take to get insurance on a new car in Minnesota?

You can typically get insurance for a new car within a few hours through online or phone applications with insurers.

What is the required type of auto insurance in Bloomington City?

Drivers must have liability insurance, PIP, and uninsured motorist coverage to meet state requirements and legally drive in Bloomington, MN. For detailed information, refer to our comprehensive report titled “Auto Insurance Coverage Options“

Can I drive in Minnesota with a foreign license?

You can drive in Minnesota with a valid foreign license and an IDP is recommended for easier understanding by law enforcement.

How much is car insurance in Bloomington, MN?

Car insurance in Bloomington typically costs $1,200–$1,500 annually, depending on coverage and personal factors such as age, driving history, and vehicle type.

What is a premium insurance in Bloomington?

A premium in Bloomington is the cost of auto insurance, influenced by factors like driving history and vehicle type.

Can a non-resident register a vehicle in Minnesota?

Non-residents can register a vehicle if they meet specific eligibility requirements such as working or owning property in the state.

Is Bloomington, MN, a no-fault insurance state?

Yes, Minnesota, including Bloomington, is a no-fault insurance state requiring PIP to cover medical expenses regardless of fault.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.